Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 10-16-24

Good Afternoon Dinar Recaps,

US CONGRESSMAN BYRON DONALDS PROPOSES CRYPTO REGULATORY SANDBOX

U.S. Rep. Byron Donalds champions regulatory flexibility for cryptocurrency, endorsing a sandbox approach to foster industry growth.

▪️Byron Donalds proposes a regulatory sandbox for crypto, aiming to transform it into a $500B U.S. industry.

▪️Donald Trump's campaign raises $7.5M in crypto donations, signaling a pro-crypto stance for the 2024 election.

▪️U.S. Rep Donalds criticizes Dems' crypto regulation approach as politically motivated amid electoral battles.

Good Afternoon Dinar Recaps,

US CONGRESSMAN BYRON DONALDS PROPOSES CRYPTO REGULATORY SANDBOX

U.S. Rep. Byron Donalds champions regulatory flexibility for cryptocurrency, endorsing a sandbox approach to foster industry growth.

▪️Byron Donalds proposes a regulatory sandbox for crypto, aiming to transform it into a $500B U.S. industry.

▪️Donald Trump's campaign raises $7.5M in crypto donations, signaling a pro-crypto stance for the 2024 election.

▪️U.S. Rep Donalds criticizes Dems' crypto regulation approach as politically motivated amid electoral battles.

In a recent conversation with KMSmithDC, U.S. Congressman Byron Donalds stressed the importance of developing a regulatory sandbox for the crypto industry. Donalds described the industry as a “toddler” that is still young but has a possibility of growing.

He pointed out that the cryptocurrency market has the potential to become a half a trillion dollar industry in the US if there are favorable regulations put in place.

Byron Donalds Advocates for Regulatory Flexibility

Byron Donalds emphasized that the use of a more flexible approach to the regulation of the rapidly developing crypto industry is crucial. He noted that the present model adopted by most regulatory bodies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), is too rigid.

According to US Congressman Donalds, a more adaptive system, like a regulatory sandbox, would allow industry participants to set guidelines as they innovate.

”What the industry really needs is a regulatory sandbox”, Donalds said. “You guys make the rules because the industry is going to change so fast over the next five years.” He pointed out that the current regulatory authorities are “not very innovative enough” to match the advancement of technology hence the need for a shift in the system.

Donald Trump Campaign’s Support for Crypto

US Congressman Donalds, an avid supporter of Donald Trump’s 2024 presidential campaign, also discussed how the Trump campaign has adopted cryptocurrency. Moreover, the PAC supporting Trump has allegedly collected $7.5 million in cryptocurrency contributions during July-September 2024.

These donations in BTC, ETH, XRP, and USD stablecoins reveal that Trump has changed his view about digital currencies. Additionally, the prediction market platform, Polymarket, has given a 59.5% chance of Donald Trump to win the U.S election while 40.3% chance of Kamala Harris.

This is quite a change from Trump’s previous stance on cryptocurrencies during his tenure as president. The fundraising success, garnered from more than 15 US states and Puerto Rico, places Trump as the candidate favorable to cryptocurrencies as the November 2024 elections approach.

In the conversation, Byron Donalds accused the Democratic leadership of not taking the regulation of cryptocurrencies seriously. He also dismissed recent remarks by Democratic politicians, including VP Kamala Harris and Senator Sherrod Brown, on digital assets regulation.

Donalds said that, although some Democrats have lately discussed the need for frameworks, such statements are political. “Vice President Harris is saying it now because there are some issues in her polling,” he said. He also pointed out that the criticism coming from Sherrod Brown could have to do with him being in a tight race in Ohio.

Trump’s Plan to Overhaul Regulatory Agencies

According to the US Congressman Donalds, a potential Trump administration would aim at “cleaning house” in major regulatory bodies such as the US SEC and CFTC. In these talkings, there has been a rumour that Robinhood CLO, Dan Gallagher, may become the new US SEC Chair under the leadership of Donald Trump.

He believes that regulators should focus solely on their assigned missions rather than expanding their roles. “It’s about making sure that regulators simply do the job of carrying out the mission that the agency was given,” Byron Donalds stated.

He reiterated his belief that current regulatory bodies are falling behind in adapting to the fast-paced developments in the crypto industry. According to Donalds, if Trump wins the presidency, the administration will aim to ensure that these agencies better align with the needs of a rapidly evolving digital economy.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

SIAM COMMERCIAL BANK LAUNCHES THAILAND’S FIRST STABLECOIN CROSS-BORDER PAYMENT SYSTEM

Siam Commercial Bank has introduced Thailand’s first stablecoin-powered cross-border payment system.

Partnering with SCB 10X and Lightnet, the bank will use stablecoins—digital assets pegged to gold or the U.S. dollar—to facilitate faster, more efficient international transactions, according to a company release.

This solution is built on a public blockchain network, with Fireblocks providing top-tier custody technology to ensure asset security. The new payment system enables 24/7 cross-border transactions, reducing the need for banks to maintain pre-funded accounts with foreign partners, which improves capital efficiency and lowers operational costs.

By eliminating layers of clearance and currency conversion, the service offers customers a faster, cost-effective way to send and receive funds internationally, per Nikkei. Users can transact using local currencies, further simplifying the process.

Thailand’s regulatory sandbox

In August, Thai financial regulators launched a Digital Asset Regulatory Sandbox to encourage crypto adoption in the country. The initiative, backed by a public hearing in May, allowed participants to test crypto services under flexible regulations to help develop Thailand’s digital asset market.

This SCB stablecoin project successfully graduated from the Bank of Thailand’s regulatory sandbox in October 2024, according to the release, and is now fully commercialized. It sets a new standard for the use of blockchain technology in the financial sector and strengthens SCB’s position as a leader in digital banking.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

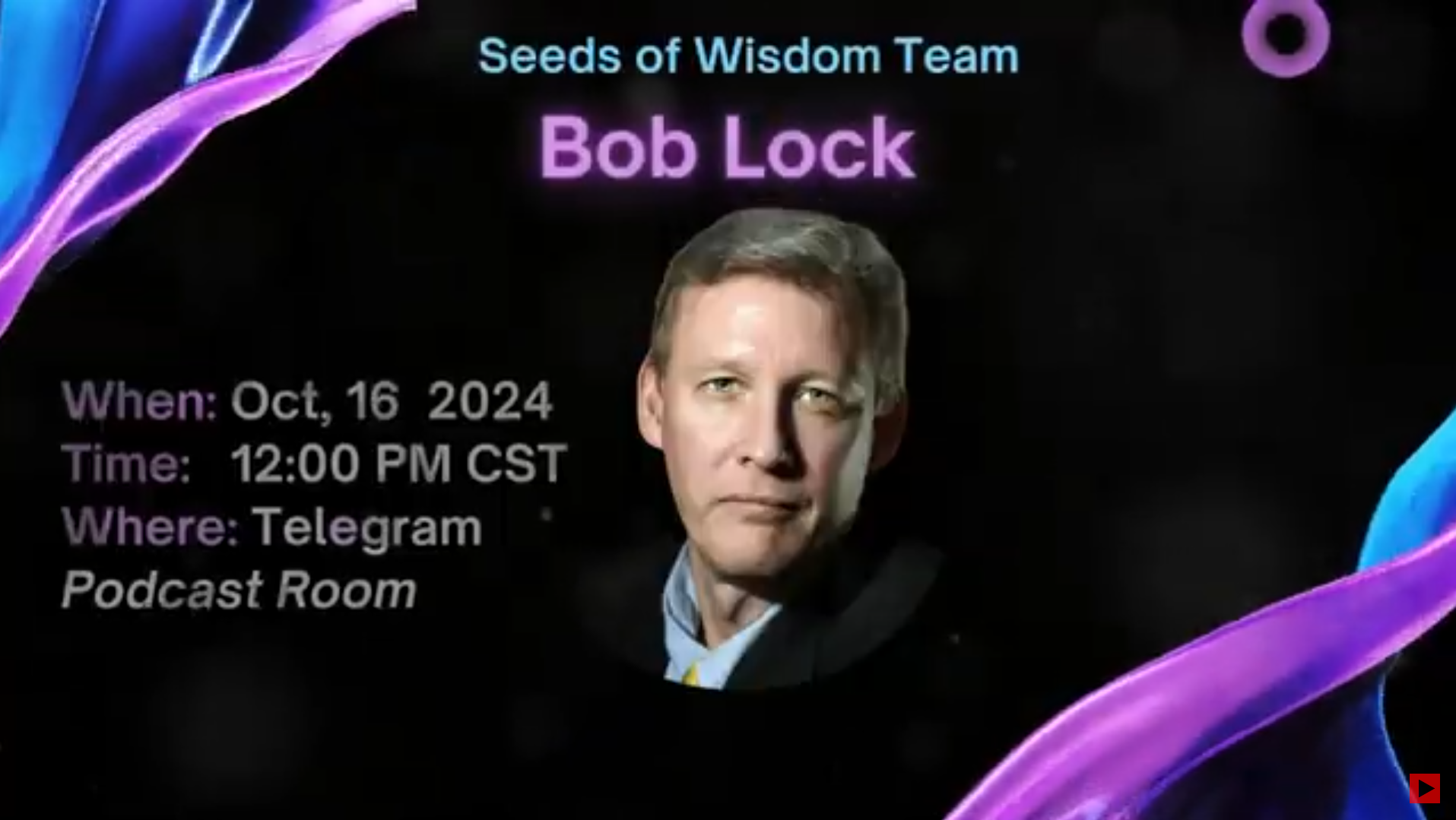

pic

AUDIO REPLAY BOB LOCK: OCT 16, 2024 | Youtube

Bob Lock discusses his new book, "Managing sudden wealth through smart team building" as well as what the future might bring with a new financial system and ways to protect yourself with a possible stock market crash and/or bank failure.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Morning 10-16-24

Good Morning Dinar Recaps,

RIPPLE’S XRP LAWSUIT ENTERS NEW CHAPTER AS BOTH PARTIES FILE APPEALS

The SEC and Ripple are entering the appeals phase of their XRP lawsuit, with both parties preparing to challenge aspects of the initial ruling in a process that could extend into early 2026

▪️SEC appealing Judge Torres’ ruling in Ripple case

▪️Ripple filed cross-appeal on institutional sales decision

▪️Next step: SEC to file Form C detailing appeal scope

▪️Briefing process could last until July 2025

▪️Final appellate court decision possible in early 2026

Good Morning Dinar Recaps,

RIPPLE’S XRP LAWSUIT ENTERS NEW CHAPTER AS BOTH PARTIES FILE APPEALS

The SEC and Ripple are entering the appeals phase of their XRP lawsuit, with both parties preparing to challenge aspects of the initial ruling in a process that could extend into early 2026

▪️SEC appealing Judge Torres’ ruling in Ripple case

▪️Ripple filed cross-appeal on institutional sales decision

▪️Next step: SEC to file Form C detailing appeal scope

▪️Briefing process could last until July 2025

▪️Final appellate court decision possible in early 2026

The Securities and Exchange Commission (SEC) and Ripple Labs are gearing up for the next phase of their legal battle over XRP, as both parties have filed notices to appeal different aspects of Judge Analisa Torres’ ruling from July 2024.

The case, which has significant implications for the cryptocurrency industry, is now moving to the U.S. Court of Appeals for the Second Circuit.

Stuart Alderoty, Ripple’s Chief Legal Officer, expressed confidence in the company’s position as the case moves forward. “I felt good about our case in the Southern District of New York. I feel even better about our case in the Second Circuit,” Alderoty stated in a recent interview.

He believes the SEC’s appeal will ultimately “backfire” and benefit the crypto industry as a whole.

The appeals process is set to begin with both parties filing Form C documents, which will outline the specific aspects of Judge Torres’ ruling they intend to challenge. The SEC is due to file its Form C on October 16, 2024, with Ripple following suit seven days later. These filings will provide clarity on the focus of each party’s appeal.

Following the Form C submissions, a briefing schedule will be established. The SEC will have 90 days to submit its comprehensive legal argument explaining why it believes Judge Torres erred in her decision. Ripple will then have the opportunity to respond to the SEC’s arguments and file its own opening cross-appeal brief.

Alderoty estimates that the briefing process could extend until July 2025, approximately nine months from now. This timeline suggests that a final decision from the appellate court might not come until early 2026, unless the parties reach an agreement to end the legal dispute sooner. ‘

The case has drawn significant attention due to its potential to set precedent for how securities laws are applied to token issuers, particularly within the Southern District of New York, a major financial hub. Judge Torres’ initial ruling found that XRP is “not necessarily a security on its face,” a decision that has been met with both support and skepticism from other judges in similar cases.

While Ripple celebrated aspects of Judge Torres’ ruling, the company was ordered to pay a $125 million fine over XRP transactions that were found to have violated securities laws. The SEC had initially sought a much larger penalty of $2 billion.

As the case moves to the appellate level, both parties are preparing to argue their positions. The SEC maintains that Judge Torres’ ruling “conflicts with decades of Supreme Court precedent and securities laws.”

Ripple, on the other hand, plans to argue that for a digital asset to be considered an investment contract, a contract with rights and obligations is necessary.

@ Newshounds News™

Source: Blockonomi

~~~~~~~~~

MICA-COMPLIANT STABLECOINS TAKE MARKET SHARE OF EURO-STABLECOIN SECTOR: KAIKO RESEARCH

Since the implementation of select provisions of the EU’s Markets in Crypto-Assets (MiCA) regulations in June, MiCA-compliant stablecoins, such as Circle’s EURC and Société Générale’s EURCV, have dominated the euro-stablecoin market, according to a Kaiko Research report.

Circle’s EURC and Société Générale’s EURCV now hold a record 67% market share of the euro-stablecoin market, the report added.

@ Newshounds News™

Read more: The Block

~~~~~~~~~

ITALY PLANS TO RAISE CAPITAL GAINS TAX ON BITCOIN FROM 26% TO 42%: REPORT

The Italian tax authority plans to raise capital gains tax on bitcoin to 42% as part of 2025 budget plans.

Crypto capital gains in Italy have been taxed above €2,000 at 26% from the 2023 tax year.

@ Newshounds News™

Read More: The Block

~~~~~~~~~

RIPPLE PRESIDENT UNVEILS PLANS TO INTEGRATE XRP AND RLUSD INTO PAYMENT SOLUTIONS

▪️Ripple, the company behind cross-border solutions has gained attention from market observers after an announcement of the RLUSD launch.

▪️Ripple is committed to ensuring transparency for both investors and users by releasing monthly reports from independent third parties that verify the reserves backing RLUSD.

On October 15, Ripple’s president Monica Long announced the entry of Ripple into the rapidly expanding stablecoin market, a launch of its new enterprise-grade stablecoin called “Ripple USD”(RLUSD). On the social media platform X, Ripple also announced the development of RLUSD, prompting reactions from notable Monica Long and other figures in the cryptocurrency community.

The president disclosed this on the first day of the Miami Ripple Swell 2024 conference. Once the New York Department of Financial Services (NYDFS) approves the stablecoin’s launch, RLUSD will be accessible on several platforms, including Bitstamp, a European cryptocurrency exchange founded in 2011, The Independent Reserve, Bitso, MoonPay, CoinMENA, Bullish, and Uphold.

Additionally, the firm partnered with B2C2, a global leader in institutional liquidity for digital assets, and Keyrock as market makers to facilitate the creation of liquidity and adoption across global markets. It is worth noting that the former Center Consortium CEO David Puth and Former FDIC Chair Sheila Bair are appointed to the RLUSD advisory board.

Ripple’s RLUSD: Highlighted Features

One of the key features of RLUSD is its compliance-first approach. Ripple emphasizes regulatory adherence in the design of the stablecoin, with plans to publish monthly attestations of its reserves by an independent accounting firm. This is particularly relevant as Ripple has navigated complex legal challenges, including an ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC).

The introduction of RLUSD is seen as a strategic move to bolster Ripple’s position in the market. The stablecoin aims to provide solutions for cross-border payments, on and off-ramps for cryptocurrency exchanges, DeFi, and real-world asset (RWA) tokenization.

Ripple’s CEO, Brad Garlinghous stated that the stablecoin will first be launched on the XRP Ledger and Ethereum networks, enabling real-time transactions and the conversion between fiat and digital currencies.

RLUSD is designed to connect traditional finance with the digital world, offering a secure way for users to trade in and out of cryptocurrency markets without the stress of price fluctuations. It also aims to encourage quicker adoption of digital currencies by creating an entry point into the blockchain ecosystem.

Ripple’s advisory board members have highlighted the critical need for stability and compliance as the digital economy evolves. Sheila Bair remarked that “stablecoins will play a key role in modernizing financial infrastructure.”

As per our data, Ripple’s trading volume has increased by 7.80% over the last 24 hours with a market cap of $ 30.78 billion. Despite its 0.39% price drop in the last 24 hours, XRP is currently trading at $0.5453.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌍 BOB LOCK CALL WED. NOON CENTRAL - PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT 1 PM ET, NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G

Bob Lock Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Wednesday Morning 10-16-2024

TNT:

Tishwash: Foreign Minister begins European tour lasting several days and opens two Iraqi embassies

Foreign Minister Fuad Hussein begins a European tour today, Wednesday, that will last for days and witness the opening of two Iraqi embassies.

Hussein said in a press statement that the tour "begins with a visit to Ireland and ends with a visit to France, passing through the Czech Republic and Croatia to meet with senior officials there," indicating that "this tour aims to strengthen our bilateral relations."

"We will participate in a number of seminars and conferences," he added.

Hussein pointed out that "during his tour, he will open the Iraqi embassies in Dublin and Zagreb." link

TNT:

Tishwash: Foreign Minister begins European tour lasting several days and opens two Iraqi embassies

Foreign Minister Fuad Hussein begins a European tour today, Wednesday, that will last for days and witness the opening of two Iraqi embassies.

Hussein said in a press statement that the tour "begins with a visit to Ireland and ends with a visit to France, passing through the Czech Republic and Croatia to meet with senior officials there," indicating that "this tour aims to strengthen our bilateral relations."

"We will participate in a number of seminars and conferences," he added.

Hussein pointed out that "during his tour, he will open the Iraqi embassies in Dublin and Zagreb." link

************

Tishwash: Iraq Increases Reserves at IMF by 50%

A meeting of the Iraqi Cabinet this evening approved an increase in Iraq's quota at the International Monetary Fund (IMF) by 831.9 million Special Drawing Rights (SDR), equivalent to 1.45 trillion Iraqi dinars [$1.1 billion] based on the exchange rate as of October 8, 2024.

This 50-percet increase in Iraq's previous quota will enhance the country's voting power within the IMF.

The additional allocation will be included in the 2025 budget.

The IMF created SDRs as an international reserve asset to supplement member countries' official reserves; they are not a currency, but rather a claim on freely usable currencies of IMF member countries. They serve as a potential source of liquidity for IMF member nations.

SDRs represent a weighted basket of major international currencies, and can he held as part of a country's foreign exchange reserves. Adding SDRs to a country's international reserves makes it more resilient financially. link

************

Tishwash: Opening of the first center for testing and marking imported gold at Baghdad Airport

The Ministry of Planning opened, today, Tuesday, the first center for examining and marking imported gold jewelry at Baghdad International Airport.

The head of the Central Organization for Standardization and Quality Control, Fayyad Muhammad Abdul, said in a statement received by {Euphrates News} a copy of it, that: “The opening of this center came in implementation of the directives of Prime Minister Muhammad Shia al-Sudani and under the direct supervision and continuous follow-up of the Minister of Planning,” indicating that “it is one of four centers in Iraqi airports to examine and mark gold jewelry imported into Iraq by Iraqi merchants.”

He added, "The Central Organization for Standardization and Quality Control, the Central Bank of Iraq, the Anti-Money Laundering and Terrorism Financing Office, and the Ministry of Trade now have a single database (electronic platform) to know the movement of gold in Iraq," noting that "the opening of the gold testing and marking center at Baghdad Airport was preceded by the opening of a similar center at Najaf Airport, then at Basra Airport, and then its opening at Kirkuk Airport."

Abdul Bin, "These procedures will facilitate the flow of work and shorten the time and date by facilitating the procedures for suppliers of gold bullion and jewelry, as well as activating the supervisory aspect of the device's work in protecting gold, and thus this matter will have a positive impact on the economic movement in the country."

He continued, "The devices used in examining and marking gold, Iraq is one of three countries in the region that possess these devices, which are distributed as (3) devices for examination and (3) devices for marking jewelry in each airport," noting that "the Central Organization for Standardization and Quality Control is working to train Iraqi staff in addition to the staff of the organization so that we have a great technical capacity in order to facilitate procedures and protect citizens from fraud."

For his part, the Assistant Director of Baghdad International Airport, Hussein Ali Hussein, said, "The opening of the jewelry inspection and marking unit came in cooperation between the Central Organization for Standardization and Quality Control and the airport administration and will contribute to facilitating procedures at the airport," indicating that "his administration worked to provide the technical requirements and facilities necessary to complete this technical and technological center and its sustainability, which was recommended by the regulatory authorities." link

************

Tishwash: The Central Bank reveals the percentage of gold in Iraq's foreign currency reserves

The Central Bank of Iraq revealed that the contribution of gold inside and outside the country in 2023 is equal to 8.5% of the country's total foreign currency reserves.

The bank said in a report it recently published and reviewed by "Al-Eqtisad News", that "the total reserves of the Central Bank of hard currency, whether gold, dollars or foreign currency, at the bank in the year 2023 amounted to 145.257 trillion dinars, an increase of 3.50% over the year 2022, which amounted to 140.086 trillion dinars."

He added, "The percentage of gold's contribution to these hard currency reserves amounted to 8.5%, which is equal to 12.293 trillion dinars, an increase of 10.37% compared to the year 2022, which amounted to 11.018 trillion dinars."

According to the report, "the contribution of balances in foreign banks and in New York to the foreign currency reserve amounts to 91.3%, which is equal to 132.641 trillion dinars," noting that "the contribution of foreign currency in the Central Bank's vaults amounts to 0.2%, which is equal to 323 billion dinars." link

************

Mot: . and Yet Another ""Tip"" on Raising the ""Wee Folks""

Mot: Bet You Were Wondering What NOW to Do ---

Seeds of Wisdom RV and Economic Updates Tuesday Evening 10-15-24

Good Evening Dinar Recaps,

RIPPLE’S ISO 20022 COMPLIANCE PAVES WAY FOR XRP IN TRADITIONAL PAYMENT SYSTEMS

▪️Ripple is ISO 20022 compliant, a move many say will benefit XRP.

▪️As a cross-border enabler, Ripple’s success can translate to XRP’s growth.

Market participants believe Ripple’s adoption of ISO 20022 could open the way for XRP’s integration into traditional payment systems. While XRP and ISO 20022 are unrelated, Ripple’s compliance with this industry standard for financial messaging may benefit the coin.

Good Evening Dinar Recaps,

RIPPLE’S ISO 20022 COMPLIANCE PAVES WAY FOR XRP IN TRADITIONAL PAYMENT SYSTEMS

▪️Ripple is ISO 20022 compliant, a move many say will benefit XRP.

▪️As a cross-border enabler, Ripple’s success can translate to XRP’s growth.

Market participants believe Ripple’s adoption of ISO 20022 could open the way for XRP’s integration into traditional payment systems. While XRP and ISO 20022 are unrelated, Ripple’s compliance with this industry standard for financial messaging may benefit the coin.

Ripple’s Connection With ISO 20022

ISO 20022 is a flexible framework that allows users and message development organizations to define information according to an internationally agreed-upon approach. This standard provides a structured and data-rich common language readily exchanged among corporations and banking systems.

This standard, developed by the International Organization for Standardization (ISO), also provides the opportunity for enhanced analytics. This can lead to offering valuable new levels of payment services to financial institutions’ customers.

Approximately 72% of institutions connected to the SWIFT network anticipate switching to ISO 20022 by November 2025. Additionally, over 70 countries, including Switzerland, China, India, and Japan, anticipate adopting ISO 20022 into their payment systems, according to a CNF report. The messaging system is set for smooth harmonization and efficiency in cross-border transactions.

SWIFT, which handles a substantial share of cross-border payments, is leading the transition from its earlier messaging system (MT) to ISO 20022. The move aims to standardize financial communications and streamline payment processes, allowing financial institutions to operate globally.

Ripple, a key player in blockchain-based payments, joined the standards body in 2020.

Ripple’s participation allows its payment network, RippleNet, to integrate with other ISO 20022-compliant institutions. This compliance makes it easier for RippleNet to conduct cross-border transactions through a unified Application Programming Interface (API).

The company’s involvement with ISO 20022 has raised discussions about how it might impact XRP. The token does not comply with the messaging standard despite Ripple’s adherence to ISO 20022. Some crypto community members claim XRP complies with ISO 20022 due to Ripple’s participation in the standard.

Ripple’s Chief Technology Officer, David Schwartz, recently refuted this claim, emphasizing that the token has nothing to do with ISO 20022. He argues that ISO 20022 is a messaging standard, while XRP functions entirely as a cryptocurrency.

Possible Benefits for XRP

Although XRP is not directly compliant with the messaging standard, it can still benefit from Ripple’s alignment with the framework. Ripple’s compliance may facilitate XRP’s integration into established banking institutions.

For instance, Ripple’s payment solutions, especially On-Demand Liquidity (ODL), may gain more popularity as financial institutions switch to ISO 20022.

ODL allows faster, cost-effective cross-border settlements using XRP as a bridge asset between different fiat currencies. XRP’s faster transaction speed could entice financial institutions seeking efficient cross-border payment options to adopt the token.

Furthermore, Ripple’s involvement with ISO 20022 may create new opportunities for XRP to be integrated into the wider financial ecosystem. Overall, this might impact the price of the coin, up 1.25% as of writing to $0.5389.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

UAE STABLECOIN ISSUER GETS NOD FROM CENTRAL BANK

With Tether waiting in the wings, AED Stablecoin becomes the front-runner to launch the United Arab Emirates’ first regulated dirham-pegged token.

The Central Bank of the United Arab Emirates (CBUAE) has granted in-principle approval to AED Stablecoin under its Payment Token Service Regulation framework, the company said in a news release.

AED Stablecoin’s preliminary license approval makes it a frontrunner in the race to become the first issuer of a regulated dirham-pegged stablecoin in the UAE.

This development eases concerns about potential restrictions on crypto payments, which had arisen following the CBUAE’s recent release of its licensing framework, which prohibits crypto for payments unless it involves licensed dirham-pegged tokens.

If fully approved, AED Stablecoin’s AE Coin could serve as a local trading pair for cryptocurrencies in exchanges and decentralized platforms, while allowing merchants to accept it for goods and services.

The central bank’s licensing framework also bars algorithmic stablecoins and privacy tokens, favoring fully cash-backed assets.

Issuers are required to back their stablecoins with cash in a separate escrow fully denominated in dirhams within a UAE bank.

Alternatively, they may hold at least 50% of reserve assets as cash, with the remaining portion invested in UAE government bonds and CBUAE Monetary Bills with an average duration of up to six months.

UAE’s crypto red carpet

AED Stablecoin is expected to face competition from Tether, the issuer of the world’s largest stablecoin by market capitalization, USDt.

Tether recently said that it has partnered with local firms Phoenix Group and Green Acorn Investments to introduce its own dirham-pegged stablecoin.

Meanwhile, the UAE’s crypto-friendly regulatory environment has been attracting major players.

OKX recently launched a retail and institutional trading platform in the UAE after obtaining a full license, which includes derivatives trading for qualified institutional investors.

Additionally, crypto exchange M2 has opened a new system that allows residents to directly convert dirhams into Bitcoin.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🌍 BOB LOCK CALL WED. NOON CENTRAL - PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT 1 PM ET, NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G

Bob Lock Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” 10-15-2024

Will BRICS Make An Announcement About Gold Backed 'Unit' At Next Week's Meeting?

Arcadia Economics: 10-15-2024

We're now one week away from the beginning of the BRICS meeting.

And some of the questions I'm hearing people ask is whether there will be an official announcement, if they might actually launch a gold-backed payment settlement currency next week, and whether that could lead to a substantial move in the gold price.

Will BRICS Make An Announcement About Gold Backed 'Unit' At Next Week's Meeting?

Arcadia Economics: 10-15-2024

We're now one week away from the beginning of the BRICS meeting.

And some of the questions I'm hearing people ask is whether there will be an official announcement, if they might actually launch a gold-backed payment settlement currency next week, and whether that could lead to a substantial move in the gold price.

So in today's video, I share my own thoughts about what I'm expecting heading into the meeting. As well as why.

INFLATED TO DEATH... THE ECONOMY IS DEAD... FOR THE MARKET- WE BUY IT ALL!

Greg Mannarino: 10-15-2024

‘Everything Rally’ Is Here: Markets Repeating 1982’s 100% Bull Run | Eric Jackson

David Lin: 10-15-2024

Eric Jackson, CIO of EMJ Capital, discusses how conditions are ripe for an "everything rally" reminiscent of the bull rally of the early 1980s.

0:00 - "Everything Rally" Is Here

3:13 - Comparing 1982 To Today

7:35 - Bond Yields And Stocks

10:52 - Fed 50 Bps Cuts During Crises

12:48 - What Is "Everything Rally"

14:20 - Conditions For Bull Run Today

17:32 - China's Stimulus

18:40 - Inflation Vs. Tech Stocks

22:00 - Stock Market Ex-Mag 7

26:20 - Capital Rotation Out Of Big Tech

27:45 - NVIDIA

29:20 - Tech Valuations

31:10 - What Could Turn Eric Bearish?

33:00 - Is Tech Recession-Proof?

Iraq Economic News and Points To Ponder Tuesday Afternoon 10-15-24

The Central Bank Of Iraq Sells More Than $ 257 Million

Time: 2024/10/15 15:48:16 Reading: 650 times {Economic: Al Furat News} The Central Bank of Iraq’s dollar sales, on Tuesday, amounted to more than $257 million in the currency auction.

The Central Bank sold in its auction today 257 million, 793 thousand, and 643 dollars, covering it at a basic exchange rate of 1310 dinars per dollar for documentary credits and international settlements for electronic cards, at a rate of 1310 dinars per dollar for foreign transfers, and at a rate of 1305 dinars per dollar in cash. Most of the dollar sales went to boost balances abroad in the form of transfers and credits, which amounted to $252,843,643, an increase of 98% over cash sales of $5,050,000.

The Central Bank Of Iraq Sells More Than $ 257 Million

Time: 2024/10/15 15:48:16 Reading: 650 times {Economic: Al Furat News} The Central Bank of Iraq’s dollar sales, on Tuesday, amounted to more than $257 million in the currency auction.

The Central Bank sold in its auction today 257 million, 793 thousand, and 643 dollars, covering it at a basic exchange rate of 1310 dinars per dollar for documentary credits and international settlements for electronic cards, at a rate of 1310 dinars per dollar for foreign transfers, and at a rate of 1305 dinars per dollar in cash. Most of the dollar sales went to boost balances abroad in the form of transfers and credits, which amounted to $252,843,643, an increase of 98% over cash sales of $5,050,000.

The number of banks that purchased cash dollars was one bank, while the number of banks that met requests to enhance balances abroad was 13 banks, and the total number of exchange companies participating in the auction was 8 companies. LINK

Iraqi Oil Maintains Gains On Second Day Of Trading

Tuesday 15 October 2024 | Economic Number of readings: 245 Baghdad / NINA / Iraqi oil prices stabilized on Tuesday, the second day of trading, after exceeding the $77 per barrel barrier at the end of last week's trading.

Basra Heavy crude recorded $74.10 per barrel during yesterday's trading, while the average recorded $77.25 per barrel, with a change rate of +1.54 and +1.49, respectively.

The data also showed a decrease in global crude prices as well, as British Brent crude recorded $74.57, while US West Texas Intermediate crude recorded $71.05 per barrel, by -2.89 and -2.78. https://ninanews.com/Website/News/Details?key=1162191

Launching Of The Activities Of The International Scientific Conference Under The Slogan "Development And Financial And Economic Stability To Restore Confidence In The Dinar"

Tuesday 15 October 2024 | Economic Number of readings: 345 Mosul/ NINA / The activities of the international scientific conference were launched at the University of Mosul under the slogan "Development and Financial and Economic Stability to Restore Confidence in the Dinar.

Nineveh Governor Abdul Qader Al-Dakhil said during his attendance at the conference that Nineveh Governorate is regaining its health with its universities and scientific expertise."

Al-Dakhil added for the first time, "As a local government, we have implemented major strategic projects such as the Mosul Airport project and other vital development projects. We are working to develop the health sector by establishing many projects, the most important of which is the Ibn Sina Hospital project with a capacity of 600 beds."

He continued, "We are proud of our solid universities and we have an integrated plan that will be launched in the near future that includes all vital sectors, indicating that the city of waterfalls will see the light soon and the mini sports city in the right side of Mosul will join its ranks."

He said, "We have promising investment opportunities in the areas south of Mosul, whether in the oil, energy or sulfur sectors," noting that "the development road is one of the vital projects and will pass through the city of Mosul, in addition to the ring road, which is considered a vital and economic artery that revitalizes the city."

He added, "We promise our people in Nineveh that we are able to make Life again in a manner befitting its Iraqi identity, future and cultural heritage.”/ https://ninanews.com/Website/News/Details?key=1162221

In September, The United States Imported More Than 5 Million Barrels Of Oil From Iraq

10/15/2024 Mawazine News – Economy Iraq's oil exports to the US exceeded 5 million barrels last September. The US Energy Information Administration said, "Iraq exported 5.970 million barrels of crude oil to the US last September, up from 5.741 million barrels in August."

It added, "Iraq exported an average of 222,000 barrels of crude oil to the US during the first week of September, while it exported an average of 155,000 barrels per day in the second week, and exported an average of 265,000 barrels per day in the third week," noting that "the fourth week's exports averaged 152,000 barrels per day."

It continued, "Iraq came in fifth place in its exports to the US last month after Canada, which came in first place as the largest oil exporter to the US, followed by Mexico, Saudi Arabia, and Colombia." https://www.mawazin.net/Details.aspx?jimare=255987

Planning Launches Unified Electronic Platform Services

The Ministry of Planning announced today, Tuesday, the launch and activation of the services of the unified electronic platform for government advertisements and tenders (WWW.ITP.IQ), which is the first of its kind in Iraq.

The ministry said in a statement that "this platform was created under the direct guidance, supervision and follow-up of Deputy Prime Minister and Minister of Planning Mohammed Ali Tamim, and it specializes in tenders, contracts and government procurement affairs, stressing that "it will be applied to the rest of the ministries, agencies and governorates gradually."

The ministry indicated that "the platform will enable all government agencies to manage the activities of contracting procedures represented by publishing tender advertisements and selling their documents electronically and updating their statuses such as extension, re-announcement, cancellation and announcing the winner,

in addition to enabling all agencies to publish government purchase requests and solicit suppliers' offers to meet these requests electronically, leading to the preparation of a database that includes companies, contractors, suppliers and consultants interested in obtaining an opportunity to implement government projects using the method of direct invitations, contracting and direct purchase."

The ministry confirmed, according to the statement, that "the platform will allow commercial entities and businessmen to have immediate access to tenders announced by government contracting agencies and enable them to purchase the documents of these tenders electronically and follow up on the status of the submitted offers and the results of the study and analysis committees using the same mechanism."

The statement pointed out that "launching the electronic platform will contribute to supporting owners of small and medium enterprises, companies and suppliers by enabling them to submit their offers electronically to participate in government purchase request processing activities, in addition to allocating spaces within the platform that allow these commercial entities to promote their products and services electronically through the platform to activate electronic purchasing activity." He

explained that "the platform will enable companies, contractors and consultants to register their data, activities and specialized work within the platform database to enhance their opportunities to implement government projects using the direct invitation method and facilitate their selection processes for this purpose."

According to the statement, the ministry called on "commercial entities interested in implementing government projects, investment opportunities and preparing state purchases to visit the website (WWW.ITP.IQ) to view the platform's services, benefit from them and subscribe to its electronic services." https://www.radionawa.com/all-detail.aspx?jimare=39758

The First Of Its Kind.. Launching The Baghdadna Electronic Service Platform

Baghdad Governorate logo Local Economy News – Baghdad Baghdad Provincial Council announced on Tuesday the establishment of the Governance and Communications Committee to manage digital transformation in the capital, Baghdad, while pointing to the launch of the “Baghdadna” platform to provide more than 25 electronic services to citizens via smart devices.

The head of the e-governance and communications committee in the council, Muthanna Al-Azzawi, said in the first conference to announce the (Baghdadna) platform, which was followed by "Al-Eqtisad News", "We announce the establishment of the Governance and Communications Committee to manage digital transformation in Baghdad Governorate," indicating that "this committee is the first of its kind in the governorate, and aims to adopt and manage digital transformation files and provide electronic services to citizens."

He explained that "the first work of the Governance and Communications Committee is to start announcing the (Baghdadna) platform, which is the official government platform that will represent Baghdad Governorate, to provide all services electronically," stressing that "the platform will provide more than 25 real services to citizens through smart devices."

He added that "the goal of the Governance and Communications Committee is to build a smart local government that provides its services to citizens through smart devices, as citizens will be able to apply for the service through a single platform, and government institutions will complete the rest of the procedures electronically," noting that "the Baghdad local government will undertake the formulation of general policies for the governorate, while exercising its role in planning, monitoring and legislating on sectoral institutions."

Al-Azzawi called on all those interested in the field of digital transformation and information technology, researchers, civil society organizations, and the private sector, who have pioneering experience in this field, to “visit the committee and review the projects and the possibility of providing funds for the purpose of adopting and launching them.” https://economy-news.net/content.php?id=48750

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 10-15-24

Good Afternoon Dinar Recaps,

IOTA UNVEILS IOTA LABS: A NEW ECOSYSTEM ARM TO PROPEL DEFI, WEB3, AND REAL-WORLD SOLUTIONS

▪️IOTA has launched a dedicated outfit to boost innovation in its ecosystem.

▪️The protocol plans to support all projects, irrespective of their technological and ecosystem leaning.

IOTA is advancing its push in the Web3 ecosystem by introducing IOTA Labs. As an independent arm of its broader ecosystem, IOTA Labs will help the protocol turbocharge its growth, drive adoption, and back innovators in Web3.

Good Afternoon Dinar Recaps,

IOTA UNVEILS IOTA LABS: A NEW ECOSYSTEM ARM TO PROPEL DEFI, WEB3, AND REAL-WORLD SOLUTIONS

▪️IOTA has launched a dedicated outfit to boost innovation in its ecosystem.

▪️The protocol plans to support all projects, irrespective of their technological and ecosystem leaning.

IOTA is advancing its push in the Web3 ecosystem by introducing IOTA Labs. As an independent arm of its broader ecosystem, IOTA Labs will help the protocol turbocharge its growth, drive adoption, and back innovators in Web3.

Right Time for IOTA Labs Launch

Almost every blockchain protocol, including Layer-1 and Layer-2 outfits, has a dedicated outfit to support ecosystem growth. This is essential to create useful Decentralized Applications (DApp) for the community.

According to IOTA Labs, its goal with the new outfit is modeled after the concept of Alchemy, which aims to transform the ordinary into something unique. The platform outlined five major elements of a thriving Web3 ecosystem, which will serve as a guide for its mission overall.

🎉 New @iotalabs_ account just launched! 🎉As IOTA’s new independent ecosystem arm, they’re here to fuel growth, drive adoption, and turn bold ideas into real-world solutions.

Be sure to follow them for the latest news #crypto, #DeFi & #Web3 from the #IOTA community https://t.co/VCQ8HIOC5w — IOTA (@iota) October 15, 2024

These elements include Community Building and Relationships, Developer Support and Collaboration, and Incentives to Drive Innovation. Additionally, the firm named Reliable Infrastructure for Seamless Access and Cross-Sector Collaboration to complete the top five elements.

It is worth noting that IOTA has worked effectively across all five elements in the past. As mentioned earlier in a CNF report, one research study from a Turkish University confirmed that the Tangle Protocol from IOTA is superior to other types of DLT, including traditional blockchains, for the Internet of Things (IoT). This is evident from its cross-sector collaboration and usage among innovators.

IOTA has a good track record of offering reliable infrastructure for seamless access. From powering the stablecoin market to facilitating trades across East Africa, the protocol is one of the most used blockchains for building transparent event-tracking databases.

Having played a key role in innovation over the past years, IOTA Labs is emerging to amplify cross-industry adoption. Overall, the essence of this push is to scale the IOTA ecosystem and empower its application to attain true autonomy.

The IOTA Labs Ideals: A Unified Approach

In the Web3 world, there is often fragmented innovation as everyone tries to showcase their uniqueness. As IOTA Labs noted, it is committed to supporting and enhancing every facet of the ecosystem.

Many industry investment funds are generally targeted at a specific niche. In an earlier CNF report, Aethir unveiled a $100 million fund to provide tailored support for AI and cloud gaming developers. With IOTA Labs, the fund allocation will benefit every developer, including those in gaming, Cloud services, AI, Decentralized Finance (DeFi), and driving Real-World solutions.

To begin with, IOTA Labs said it will commit $2 million as incentives in various campaigns over the next six months. As noted, besides developers, the incentive to bootstrap the IOTA Labs will also benefit users within the ecosystem.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

RIPPLE SWELL 2024 LIVE: CLO STUART ALDEROTY AND ADRIENNE HARRIS DISCUSS CRYPTOCURRENCY

Ripple Swell, the annual conference hosted by the payment firm Ripple, begins today in Miami, running from October 15 to 16. This event gathers Ripple’s partners and clients for discussions.

During the conference, Ripple’s General Counsel, Stuart Alderoty, shared the stage with Adrienne Harris, the chief of the New York Department of Financial Services (NYDFS).

Harris announced that the NYDFS has formed a dedicated team of approximately 60 professionals focused specifically on cryptocurrency.

Fox Business journalist Eleanor Terrett wrote on X, “Harris says the NYDFS now has a team of around 60 people focusing specifically on #crypto.”

Social media users noted an interesting coincidence as the company is currently awaiting regulatory approval from the New York Department of Financial Services (NYDFS) for this launch.

Key Insights on Digital Assets and Tokenization

Andrew Czupek, Senior Vice President and Head of Digital Assets at Northern Trust, spoke about the importance of traditional technology infrastructure in unlocking the full potential of digital assets.

He compared the current situation to the electronic trading revolution of the 1980s, explaining that mass adoption of digital assets will take time.

In a panel discussion alongside James Wallis, Graham, CEO of Archax, discussed the impact of digital ETFs on the market. He pointed out that while tokenization took a while to gain traction, it is now evident that real-world use cases are starting to emerge, with users around the globe beginning to experience the benefits.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

RIPPLE REVEALS FIRST PARTNERS FOR RLUSD STABLECOIN WITH TOP EXCHANGES AND PLATFORMS, PLANS LAUNCH ON XRP LEDGER AND ETHEREUM

▪️Ripple aims to position RLUSD as a leading stablecoin in the rapidly growing $170 billion market, focusing on regulatory compliance and utility in cross-border payments.

▪️The RLUSD stablecoin will be backed by short-term U.S. Treasuries and cash equivalents, with testing currently ongoing on the XRP Ledger and Ethereum networks.

In the latest push for its USD-pegged RLUSD stablecoin, blockchain startup Ripple announced its exchange partners and market maker partners during the Ripple Swell 2024 conference in Miami, Florida, on Tuesday.

In its official announcement, Ripple has named exchange partners such as Bitstamp, Uphold, Bitso, Independent Reserve, MoonPay, CoinMENA, and Bullish, for hosting its RLUSD stablecoin.

Similarly, its market maker partners include Keyrock and B2C2 which will provide liquidity support to the RLUSD stablecoin during the launch period.

Moreover, Ripple has appointed former FDIC chair Sheila Bair and David Puth, ex-CEO of Centre, the consortium behind USD Coin (USDC), to the advisory board for its stablecoin. Speaking on this development, Ripple CEO Brad Garlinghouse said:

With our initial exchange partners, clear utility and demand for RLUSD, and a strong focus on regulatory compliance, Ripple’s stablecoin is poised to become the gold standard for enterprise-grade stablecoins. “Our payment solutions will leverage RLUSD, XRP, and other digital assets to enable faster, more reliable, and cost-effective cross-border payments.

Although the official date for the launch of RLUSD stablecoin is not clear, Garlinghouse said last month that it would happen in “weeks, not months” from now. He also warned users to be vigilant about any RLUSD scams and only wait for the official announcement from the firm, reported CNF.

Ripple’s RLUSD Eyes Big Pie of the Stablecoin Market

The announcement follows Ripple’s earlier plans to launch its stablecoin, aiming to capture a share of the rapidly expanding $170 billion stablecoin market.

Stablecoins play a crucial role in the crypto economy, acting as a link between traditional government-issued currencies and blockchain-based digital assets. Also, the stablecoin market is likely to grow to a trillion dollars by 2030. Thus, Ripple’s RLUSD will be pitching direct competition to giants like USDT and USDC through its institution-first approach, reported CNF.

President of Ripple Labs, Monica Long, said that the company is operationally ready from their end. Through the stablecoin, Ripple intends to capitalize on its established role in payments and serve as a crucial bridge for the tokenization of real-world assets, Long stated. In the last 24 hours, Ripple has already minted 4.5 million RLUSD stablecoins, reported CNF. Speaking on the matter, Long said:

For RLUSD and stablecoins generally, we definitely have validated the utility of them with payments. We’re also believers in this broader trend of real-world asset tokenization.

When we think beyond tokenizing money to different instruments and capital markets like securities and bonds, real estate and other assets, you need a stable coin that’s trusted and very reliable, very robustly managed for on and offramps as well.

RLUSD’s value will be supported by short-term U.S. Treasuries, dollar deposits, and cash equivalents. It is currently undergoing testing on the XRP Ledger and Ethereum networks. The company plans to publish independent monthly attestations of its reserves, which will be conducted by the San Francisco-based accounting firm BPM.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌍 NAVIGATING FINANCIAL UNCERTAINTY: PROTECT YOUR 401(K) AND ASSETS! Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits from TNT” Tuesday 10-15-2024

TNT:

Tishwash: Issuance of the first national card outside Iraq

The Ministry of Interior announced the issuance of the first national card outside Iraq.

The ministry said in a statement received by {Euphrates News} a copy of it that "in a step that is considered the first in the history of the Iraqi Ministry of Interior, the first national card was issued at the Embassy of the Republic of Iraq in the British capital, London, after a special office was opened to issue national cards there."

He added, "It is hoped that the Ministry of Interior will open a number of national card issuance offices in a number of countries in succession to provide the best services to Iraqis residing outside the country." link

TNT:

Tishwash: Issuance of the first national card outside Iraq

The Ministry of Interior announced the issuance of the first national card outside Iraq.

The ministry said in a statement received by {Euphrates News} a copy of it that "in a step that is considered the first in the history of the Iraqi Ministry of Interior, the first national card was issued at the Embassy of the Republic of Iraq in the British capital, London, after a special office was opened to issue national cards there."

He added, "It is hoped that the Ministry of Interior will open a number of national card issuance offices in a number of countries in succession to provide the best services to Iraqis residing outside the country." link

***************

Tishwash: Trade Bank of Iraq announces the imminent opening of a cash deposit center in Karkh

The Trade Bank of Iraq announced today, Monday, the imminent opening of the cash deposit center in the Karkh side.

The bank's media advisor, Aqil Al-Shuwaili, said in a statement received by the Iraqi News Agency (INA): "Based on the directives of the respected Prime Minister, Mohammed Shia Al-Sudani, to provide the best services to citizens, the Trade Bank of Iraq announces the imminent opening of the (Cash Deposit Center)."

He explained that "this center receives all cash deposits only for all customers," indicating that "this is a new service that the bank will launch with the aim of providing the best services to customers, and to contribute to reducing the pressure of cash deposits on its other branches in Baghdad link

*************

Tishwash: Government advisor: Tensions and war in the region may lead to a jump in oil prices

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, identified today, Monday, the indicators of the rise in oil prices in global markets, and while he attributed them to two basic variables, he indicated that if tensions and war continue in the region, a jump in prices is expected.

Saleh told the Iraqi News Agency (INA): "The oil asset cycle is subject to accelerated upward volatility across current energy market indicators and two fundamental variables that affect global oil supply and demand: the first is OPEC+'s decisions to reduce oil production on the production of OPEC countries themselves and their allies, as OPEC+ has currently implemented significant oil production cuts of 5.86 million barrels per day."

He added, "These cuts consist of two parts: the first is a reduction of 3.66 million barrels per day extended until the end of 2025, and the other is an additional voluntary reduction of 2.2 million barrels per day that remains in effect until September 2024."

He pointed out that "the cuts come to remove the current oil glut, which is affected by the decline in growth in the world's most important energy-consuming economies, China," noting that "the second variable is the geopolitical situation and the war taking place in the two energy basin regions of the world, namely the Russian-Ukrainian war and the other is the ongoing war in the Middle East, especially the Gaza and Lebanon war with the Zionist entity and its effects on the oil-producing Gulf region, which dominates more than 50% of global oil exports."

He continued, "If military operations or geopolitical tensions continue in the two regions, oil prices are expected to jump." link

****************

Tishwash: Al-Mandlawi: Iraq is making exceptional efforts to prevent the specter of a major war from looming over the region and the world

Acting Speaker of the House of Representatives Mohsen Al Mandalawi warned the international community against the consequences of the conflict in the Middle East region turning into a comprehensive war with a greater impact on global security and peace, while stressing that Iraq is making exceptional efforts to prevent the specter of a major war from the region and the world.

In his speech delivered today, Monday, during his participation in the (149) session of the Inter-Parliamentary Union in Geneva, Al-Mandlawi called for “the formation of an international parliamentary delegation to visit Lebanon and Palestine and investigate the facts about the extent of the Zionist terrorist attacks against civilians,” describing the events taking place as a “major challenge” to the global system and a real threat to international legitimacy, indicating that “the recent attack on the UN peacekeeping forces (UNIFIL) is evidence of the extent of the arrogance of the occupation and its leaders, and has proven that this outcast entity is now outside the legal, humanitarian and international framework.”

Al-Mandlawi said, "International parliamentary bodies are facing a challenge and a test of the usefulness of their existence to express the aspirations of their peoples," calling on them to "take a clear and rapid position to spare the region and the world the dangers of slipping into a large and destructive war," calling on the presidency of the union and representatives of the participating parliaments to "condemn the Zionist practices and serious violations of the charters and legitimate resolutions, and take responsible action to stop the aggression against Palestine, Lebanon and the countries of the region, by demanding that the Security Council take the necessary decisions in this regard, hold the leaders of the entity accountable, prevent humanitarian disasters against civilians, provide urgent humanitarian aid and return the displaced."

He stressed the "necessity for the Union to adopt the signing of an international agreement that criminalizes the use of artificial intelligence technology as a weapon in wars, due to its deadly impact that exceeds the impact of nuclear weapons, and to pay attention to enhancing the parliamentary performance of the legislative bodies of member states and enabling them to perform their duties, in addition to taking the initiative to organize a responsible and serious humanitarian stand to intervene by all means in order to immediately stop the wars of genocide practiced by the Zionist entity, and to save the region and the world from its danger, effects and repercussions, and to exert efforts to raise the levels of cooperation between parliaments to exchange parliamentary expertise, and to emphasize the need to respect international humanitarian law and the rights of peoples to security and stability."

Al-Mandlawi explained that "Iraq is making exceptional parliamentary and governmental diplomatic efforts to prevent the specter of a comprehensive war from the region and the world, and that the Zionist entity is striving to ignite and expand this war by targeting diplomatic missions, leaders and symbols of countries within an aggressive methodology to control and impose wills and drag the region and the world into a comprehensive bloody war,"

Indicating that "Iraq, Yemen, Syria and Iran are at the top of the list of targeted countries, while adding that announcing the name of the highest religious authority, Sayyid Ali al-Sistani, who is a symbol of peace and moderation in the world, within the list of the entity's targets, is nothing but evidence of its arrogance and its lack of consideration for human and heavenly values and international legitimacy." link

******************

Mot: .. making it work

Mot: waiting - waiting –

Iraq News Highlights and Points To Ponder Tuesday AM 10-15-24

Government Advisor: Tensions And War In The Region May Lead To A Jump In Oil Prices

10/14/2024 Mawazine News - Economy The financial advisor to the Prime Minister, Mazhar Muhammad Salih, identified today, Monday, the indicators of the rise in oil prices in global markets, and while he attributed them to two basic variables, he indicated that if tensions and war continue in the region, a jump in prices is expected.

Salih said, according to the official agency: "The oil asset cycle is subject to accelerated upward volatility through current energy market indicators and two basic variables that affect oil supply and demand in the world: the first is OPEC + decisions to reduce oil production on the production of OPEC countries themselves and their allies, as OPEC + has currently implemented large cuts in oil production amounting to 5.86 million barrels per day."

Government Advisor: Tensions And War In The Region May Lead To A Jump In Oil Prices

10/14/2024 Mawazine News - Economy The financial advisor to the Prime Minister, Mazhar Muhammad Salih, identified today, Monday, the indicators of the rise in oil prices in global markets, and while he attributed them to two basic variables, he indicated that if tensions and war continue in the region, a jump in prices is expected.

Salih said, according to the official agency: "The oil asset cycle is subject to accelerated upward volatility through current energy market indicators and two basic variables that affect oil supply and demand in the world: the first is OPEC + decisions to reduce oil production on the production of OPEC countries themselves and their allies, as OPEC + has currently implemented large cuts in oil production amounting to 5.86 million barrels per day."

He added, "These cuts consist of two parts: the first is a reduction of 3.66 million barrels per day extended until the end of 2025, and the other is an additional voluntary reduction of 2.2 million barrels per day that remains in effect until September 2024."

He pointed out that "the cuts come to remove the current oil glut, which is affected by the decline in growth in the world's most important energy-consuming economies, China," noting that "the second variable is the geopolitical situation and the war taking place in the two energy basin regions of the world, namely the Russian-Ukrainian war and the other is the ongoing war in the Middle East, especially the Gaza and Lebanon war with the Zionist entity and its effects on the oil-producing Gulf region, which dominates more than 50% of global oil exports."

He continued, "If military operations or geopolitical tensions continue in the two regions, oil prices are expected to jump." https://www.mawazin.net/Details.aspx?jimare=255968

World Bank Support: Is External Financing Enough To Stabilize Iraq?

October 15, 2024 Baghdad/Al-Masala: The World Bank warns that the poorest countries, where about 40% of the population lives below the poverty line, are facing a significant decline in international aid, with an accelerating economic and social deterioration.

The bank's report indicated that these countries suffer from the highest levels of debt since 2006, which increases the repercussions of climate change, and fuels political instability and wars. These countries have also been severely affected by the Covid-19 pandemic, which led to a 14% decline in per capita GDP between 2020 and 2024.

The World Bank has called for increased external support for these countries through the International Development Association, but bilateral aid has declined significantly, deepening the crisis.

Poor countries must invest 8% of their GDP annually to achieve development goals, a huge challenge given their structural problems and the conflicts that impede control of their territories.

The report indicated that these countries can improve their conditions by increasing tax revenues and improving the effectiveness of public spending, but structural economic conditions and debts constitute a major obstacle.

In the Iraqi case, in terms of the impact of debt and corruption on the country’s economy, Iraq suffers from large debts and a financial system that relies heavily on oil revenues, with low international support and reduced foreign investment.

There are also structural problems such as corruption and political insecurity that hinder necessary economic reforms.

With regional tensions and internal conflicts escalating, Iraq needs massive investments to achieve sustainable development, but without strong international support, Iraq may face a similar path to these poor countries.https://almasalah.com/archives/103288

Government Advisor Prefers Maximizing Non-Oil Revenues By 2024

Information/Baghdad… The Prime Minister's Economic Advisor, Mazhar Muhammad Salih, preferred, on Tuesday, to maximize non-oil revenues for the year 2024 compared to previous years.

Mazhar said in a statement to Al-Maalouma Agency, "Maximizing non-oil revenues stipulated in the government's program for financial reform, which calls for raising the contribution of non-oil revenues to 20% of total annual revenues compared to the previous low rates."

He added, "The development of oil and non-oil revenues (at the semi-annual level) between 2023 and 2024 showed a distinctive growth in revenues in general and non-oil revenues in particular."

He added, "The main objective of this conservative financial planning is to secure spending priorities in the country's general budget, most notably government salaries and wages, retirement pensions, social care, and development projects that are a priority in sustainable development." LINK

Al-Shammari: 757 Billion Dinars In The Ministry Of Interior’s Revenues In 2023

Posted On 2024-10-15 By Sotaliraq Interior Minister Abdul Amir Al-Shammari confirmed that the total revenues for 2023 amounted to 757 billion dinars, which were returned to the state treasury, while he issued strict directives to the Explosives Control Directorate regarding external checkpoints and airports.

The Parliamentary Finance Committee said in a statement: “It hosted, headed by Atwan Al-Atwani, and in the presence of its members and a number of members of other parliamentary committees, the Minister of Interior Abdul Amir Al-Shammari and his accompanying delegation, at the committee’s headquarters to discuss issues related to maximizing revenues and mechanisms for improving the provision of services to citizens.”

Al-Atwani welcomed the Minister of Interior, noting that “the Finance Committee works according to the principle of joint integration to support the government.” He stressed “the need for solidarity in studying the financial and economic situation, and pointed out that relying on oil as a primary resource does not achieve the financial stability required to achieve sustainable development.”

The committee stressed “the importance of forming a committee to study non-oil revenues and monitor their distribution, in addition to analyzing state assets and studying their financial statements. The issue of those whose contracts were terminated and transferring beneficiaries of social protection salaries to the ministry to benefit from their services was also addressed.”

For his part, the Minister of Interior praised the efforts of the Finance Committee and parliamentary committees in supporting the ministry and the government, explaining that “the ministry has received the security file for a number of governorates and is continuing to work on receiving the rest of the governorates, according to the government program.”

He provided an explanation of the ministry’s plan to maximize non-oil revenues, noting that “the total revenues for 2023 amounted to 757 billion dinars, which were returned to the state treasury.”

Discussions between the committee members and the minister touched on many of the ministry’s issues, including the services of issuing electronic passports and unified cards, revenues from the ministry’s fund and other departments, the importance of electronic automation and functional intersection, in addition to discussing the issue of residential complexes.

The committee also inquired about the criteria for distributing job grades according to governorates, stressing “the need for coordination and work to complete the 2025 budget schedules on time.”

In addition, the Minister of Interior, Abdul Amir Al-Shammari, issued directives regarding the Explosives Control Directorate related to external checkpoints and airports.

The ministry said in a statement received by “Al-Zawraa” that “Minister of Interior, Abdul Amir Al-Shammari, visited the Explosives Control Directorate and was briefed on the most important duties and tasks carried out by this directorate.”

According to the statement, the minister stressed “the continuation of training the Explosives Control Directorate’s staff and developing their capabilities,” directing “cooperation with organizations supporting training.” He stressed “the intensification of efforts at external checkpoints and airports, and the rapid response to all calls and work on immediate presence and rapid movement in the event of any emergency, God forbid.”

On the sidelines of this visit, Al-Shammari opened two new buildings in the directorate, and provided support to it by directing the provision of the directorate with juvenile officers and contract police and providing it with various vehicles, including specialized ones, while praising “the work of this directorate and the achievements made by its cadres.” LINK

Seeds of Wisdom RV and Economic Updates Tuesday Morning 10-15-24

Good Morning Dinar Recaps,

SMART CONTRACTS ACHIEVE LEGAL BREAKTHROUGH IN ARGENTINA

Smart contracts, the blockchain-automated programs, are now legal in Argentina after local jurisdiction recognized the enforceability of the first one.

They can now be used to execute rental agreements, purchase payments, and other legal contracts, as cryptocurrency is now approved for use as payment in commercial contracts in the country.

Good Morning Dinar Recaps,

SMART CONTRACTS ACHIEVE LEGAL BREAKTHROUGH IN ARGENTINA

Smart contracts, the blockchain-automated programs, are now legal in Argentina after local jurisdiction recognized the enforceability of the first one.

They can now be used to execute rental agreements, purchase payments, and other legal contracts, as cryptocurrency is now approved for use as payment in commercial contracts in the country.

Smart Contracts Reach Legally Enforceable Status in Argentina

Smart contracts, the automatically executed blockchain-based equivalent of paper contracts, have reached a milestone in Argentina.

According to local reports, the first Cardano-based smart contract was approved to be legally binding by Argentine jurisdiction, which might be the first time this has happened in the country and even the world.

The contract specifies a four-month loan repaid with a 10% interest between Mauro Andreoli and Lucas Macchia, two Cardano ambassadors in Argentina.

The loan was issued for 10,000 ADA (close to $3,430). Andreoli stated that, in practice, this contract formalization means that “any breach can be enforced in court for the performance of the obligation in ADA.”

However, due to the digital nature of smart contracts, the duo had to sign a legal document as a complement. This document specifies the details of the smart contract subscribed loan, the blockchain in which it was built, and the wallet addresses involved with the transaction ID.

As this is the first time this has happened, this kind of document might also be required in other instances to legalize smart contracts.

Andreoli stressed the relevance of the event. He stated:

We did it, we just signed the first legally and judicially binding contract on the Cardano network, in full compliance with the laws of the Argentine Republic.

Andreoli believes the crypto community has to work on educating national judges to be accustomed to this new kind of contract, highlighting this event marked “the initial phase of creating favorable jurisprudence in the country and facilitating commercial transactions.”

Smart contracts are supported by President Milei’s Omnibus Bill, which legalized the use of bitcoin and other cryptocurrencies as part of commercial contracts in Argentina.

Andreoli concluded that smart contracts can now be used to formalize rent or purchase agreements and other legal contracts.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

IOTA HOLDERS BRACE FOR 100% PUMP WITH POTENTIAL RWA REVEAL ON OCTOBER 15

▪️IOTA has teased an announcement on Tuesday, October 15, and the entire ecosystem is holding its breath, waiting for what could be a landmark pivot or partnership.

▪️Many believe that it’s related to the tokenization of real-world assets, which IOTA has been focusing on in recent years, and that the result could be a 100% rally in the token price.

October 15 is a landmark day for the IOTA ecosystem, but few can say with certainty why. IOTA has teased a mega announcement for tomorrow, and the entire space is speculating on how massive it will be and what it will be on.

IOTA teased the announcement two weeks ago, and since then, speculation has been rife over what’s next for the project.

Some believe that it’s most likely related to the tokenization of real-world assets (RWA), a sector that the network has been heavily focused on in recent years.

In an exclusive interview with CNF, founder Dominik Schiener revealed that he believes tokenization “is the silver bullet of cryptocurrencies” and that it’s “what’s missing in our current, highly digitized life.”

This has led some to speculate that the Tuesday announcement will most likely be about tokenization. If this announcement strikes the right chords with investors, the rally that will ensue will be massive, says Bit Whale, a crypto analyst on X.

IOTA: something is brewing and could see a 100% pump out of silence IF their announcement is RWA based on October 15 2024.

The analyst noted that it wouldn’t be the first time that IOTA had recorded a massive surge towards the end of the year. On November 23rd last year, it recorded a 130% rally, a fete that it could repeat tomorrow.

Additionally, the European Blockchain Services Infrastructure is set to make an announcement tomorrow about its verifiable credential service, which could be related to IOTA. After all, IOTA was one of the finalists in the European Blockchain Pre-Commercial Procurement, funded by the European Commission, as we reported.

IOTA’s Big Announcement

And yet, there are others who believe that the announcement will just be a start and that it will be a building block for future success.

This group has called on the community to manage its expectations, with one noting, “I’ve been thinking a lot about what the significance of October 15th might be. My gut feeling tells me that we shouldn’t expect anything major at first.”

He added:

Rather, I believe IOTA will undergo a nearly complete marketing overhaul. New website, new logo, etc. Once this rebranding process is completed, one thing will follow after another…We need traction, and then one thing must follow after another.

IOTA trades at $0.1289, gaining 3.6% in the past day for a $445.8 million market cap as trading volume saw a 20% uptick to start the week.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BOB LOCK CALL WED. NOON CENTRAL - PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G Bob Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

MilitiaMan: Iraq Dinar Update-#iqd news update-#iraqi currency-Attention to Valuation-Revaluation of Currency-IMF

Iraq Dinar Update-#iqd news update-#iraqi currency-Attention to Valuation-Revaluation of Currency-IMF

MilitiaMan and Crew: 10-14-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Dinar Update-#iqd news update-#iraqi currency-Attention to Valuation-Revaluation of Currency-IMF

MilitiaMan and Crew: 10-14-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq News Highlights and Points To Ponder Monday Evening 10-14-24

Currency Auction Likely To Be Cancelled In Response To International Pressure To Combat Financial Smuggling

October 14, 2024 Baghdad/Al-Masala: As part of the efforts made to reform the financial and economic system in Iraq, the Central Bank is moving towards canceling the currency auction, in response to international pressures aimed at regulating the circulation of the dollar and reducing illicit flows.