Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Tuesday 7-9-2024

TNT:

Tishwash: Al-Sudani receives a delegation from the US Department of Defense

The Prime Minister's Media Office stated in a statement that "Prime Minister Mohammed Shia al-Sudani received the US Deputy Assistant Secretary of Defense for Middle Eastern Affairs, Daniel Shapiro, and his accompanying delegation, in the presence of the US Ambassador to Iraq."

He added, "During the meeting, the procedures for proceeding with ending the mission of the international coalition to fight ISIS and activating bilateral relations between Iraq and the United States were discussed," noting that "the meeting witnessed discussion of the situation in the region and the continued aggression on Gaza."

Al-Sudani pointed to "the suffering of the Palestinian people, the difficulty of accessing humanitarian aid and relief supplies under the stifling siege, and the failure of the international community to assume its responsibilities in pressuring the Netanyahu government to stop the genocide."

TNT:

Tishwash: Al-Sudani receives a delegation from the US Department of Defense

The Prime Minister's Media Office stated in a statement that "Prime Minister Mohammed Shia al-Sudani received the US Deputy Assistant Secretary of Defense for Middle Eastern Affairs, Daniel Shapiro, and his accompanying delegation, in the presence of the US Ambassador to Iraq."

He added, "During the meeting, the procedures for proceeding with ending the mission of the international coalition to fight ISIS and activating bilateral relations between Iraq and the United States were discussed," noting that "the meeting witnessed discussion of the situation in the region and the continued aggression on Gaza."

Al-Sudani pointed to "the suffering of the Palestinian people, the difficulty of accessing humanitarian aid and relief supplies under the stifling siege, and the failure of the international community to assume its responsibilities in pressuring the Netanyahu government to stop the genocide."

The Prime Minister stressed "the need for a firm stance against the aggression, and the necessity of preventing escalation that threatens to expand the scope of the conflict."

For his part, the American official pointed out "the importance of Iraq's role in reducing tensions in the region, and the inevitability of continuing the approach of communication and cooperation between the two countries in the areas of armament and security and raising the combat level of the Iraqi forces, in a way that supports Iraq's security and sovereignty, economic development and progress at all levels." link

************

Tishwash: Politician: America is continuing the dollar chaos scenario in Iraq

Today, Monday, the leader in the coordination framework, Jabbar Odeh, accused America of repeating the dollar chaos scenario in Iraq.

Odeh said in an interview with Al-Maalouma, “Since 2003, America has sought to make Iraq's economy hostage to the policies of the White House, and to use the dollar bill as a pressure tool to confront any movement outside the context of its interests in the region.”

He added, "The recent rise in the exchange rate is nothing but a scenario of chaos through pressure on the parallel market and raising exchange rates," stressing that "Iraq's economy will not be safe as long as Washington exploits oil revenues through the Federal Bank."

He pointed out that "the statements of the new American ambassador carried three clear agendas in Baghdad, which are using the economic card, selling oil supplies, and trying to escalate the security situation and interfering in the country's affairs," adding that "Baghdad's exit "From the pressure of the dollar will free the country from dangerous restrictions imposed by the White House administration." For more than 20 years.”

It is noteworthy that the dollar exchange rates witnessed a noticeable increase, raising many question marks amid accusations that an American agenda is behind what is happening. link

************

LouNDebNC: Stocks could fall 30% as US heads for a deep recession, analyst warns

Do you have a lot of your wealth tied in the stock market?

A new analyst note from BCA Research suggests the S&P 500 could slide as much as 30% within the next year as the U.S. economy enters a deep recession.

There may be trouble looming on the horizon for the U.S. stock market, according to BCA Research.

In a note to clients last week, BCA Research chief global strategist Peter Berezin warned that, contrary to popular belief, the economy will fall into a recession either this year or in early 2025.

Should that happen, the S&P 500 could tumble to 3,750, which marks a 30% drop from current levels.

Berezin's prediction hinges on the belief that the labor market will slow notably in coming months, which will weigh heavily on consumer spending – a major driver of economic growth. The relationship between inflation and unemployment is measured by something called the "Phillips curve."

"The reason the U.S. avoided a recession in 2022 and 2023 was because the economy was operating along the steep side of the Phillips curve," he wrote. "When the labor supply curve is nearly vertical, weaker labor demand will mainly lead to lower wage growth and falling job openings. In other words, an immaculate disinflation."

Berezin also foresees widespread economic pain, with growth slowing sharply in Europe and China. This scenario could further weaken global growth and weigh heavily on international stocks.

Stocks notched a new record in mid-May, with the Dow Jones Industrial Average topping 40,000 for the first time ever, but they have since fallen from those highs.

The indexes opened slipped Monday morning as investors await key jobs data from the Labor Department. The S&P benchmark was down about 12 points as of mid-morning.

The forecast from BCA Research – one of the gloomiest on Wall Street – comes after a volatile year for the market.

All three indexes tumbled in mid-2023 amid fears the Federal Reserve would raise interest rates higher than previously expected – and hold them at peak levels for longer. However, they have recouped those losses and more, with the S&P 500 up more than 29% since it hit bottom at the end of October.

Since the start of the year, the benchmark index is up about 15%, while the Dow Jones Industrial Average has climbed 3.7%. The tech-heavy Nasdaq Composite, meanwhile, has increased about 20% year to date.

https://www.foxbusiness.com/markets/stocks-could-fall-30-us-heads-painful-recession-analyst-warns

************

Mot: all that is needed is an Attitude Adjustment - Get a new Doctor!!

Mot . Today's Quote!!! Erma Bombeck

Iraq Economic News and Points To Ponder Late Monday Evening 7-8-24

Excessive Issuance Of New Currency: Will It Push The Iraqi Economy Towards The Abyss?

July 8, 2024 Last updated: July 8, 2024 Hussein Al-Falluji* In light of the economic challenges facing Iraq, the importance of issuing new currency appears as an important tool of monetary policy that can be used to achieve economic growth and financial stability.

Unfortunately, these funds have been ineffectively directed over the past twenty years towards consumer sectors instead of productivity, in addition to using this tool to fill the budget deficit to cover salaries and the operational budget.

This ill-advised directive, coupled with the dominance of the public sector and neglect of the private sector, led to increased inflation and depletion of the hard currency balance.

Excessive Issuance Of New Currency: Will It Push The Iraqi Economy Towards The Abyss?

July 8, 2024 Last updated: July 8, 2024 Hussein Al-Falluji* In light of the economic challenges facing Iraq, the importance of issuing new currency appears as an important tool of monetary policy that can be used to achieve economic growth and financial stability.

Unfortunately, these funds have been ineffectively directed over the past twenty years towards consumer sectors instead of productivity, in addition to using this tool to fill the budget deficit to cover salaries and the operational budget.

This ill-advised directive, coupled with the dominance of the public sector and neglect of the private sector, led to increased inflation and depletion of the hard currency balance.

Hence, there is a need to reconsider the use of this important tool and adopt a new strategy that focuses on directing funds towards productive sectors that generate income in hard currencies and supporting the private sector.

The economic situation in Iraq

According to available statistics, the volume of cash issued at the end of 2017 amounted to more than 44 trillion Iraqi dinars, while the volume of the monetary mass exceeded 103 trillion Iraqi dinars at the end of 2023.

All of this money was directed towards the salaries and subsidies sector instead of being directed towards productive sectors.

If this money had been dealt with wisely and scientifically and pumped into the industrial, agricultural, tourism and mining sectors, the economic situation in Iraq would have been much better than it is now.

Focusing on productive sectors such as tourism, industry, and agriculture can contribute significantly to increasing GDP and improving living standards.

For example, investing in tourism infrastructure development and tourism promotion can attract foreign tourists and increase hard currency revenues.

Likewise, supporting industry and agriculture to meet the needs of the local market contributes to increasing the gross domestic product and preventing the exit of hard currencies by adopting modern technologies and improving the quality of products, which enhances competitiveness in global markets.

Reconsidering and scientifically dealing with the new monetary issuance instrument could help in restructuring the national economy effectively and sustainably.

Improving the balance of payments and reducing inflation

This strategy can contribute to improving the balance of payments by increasing exports and reducing dependence on imports.

Supporting the agricultural sector to meet the needs of the local market and exporting the surplus using advanced technology and developing storage and transportation facilities can improve the quality of crops and increase the volume of exports.

In addition, the development of local industries reduces the need to import goods, which preserves hard currency within the country.

Directing funds towards productive rather than consumer sectors also helps reduce inflation resulting from increased demand without a corresponding increase in production.

Increasing the flow of hard currencies into the economy enhances the stability of the local currency and reduces exchange rate fluctuations.

In this way, sustainable economic stability can be achieved that strengthens the national economy and achieves tangible improvements in the standard of living.

Implementation and monitoring

To ensure the success of this strategy, it is necessary to develop a comprehensive plan and economic feasibility studies to determine priorities and target projects.

There must be a monitoring and evaluation system to ensure that funds are used effectively and that desired objectives are achieved.

Cooperation with international financial institutions and strategic partnerships with the private sector can enhance the effectiveness of implementation.

On this occasion, we demand stopping the issuance of cash for the purposes of filling the deficit in the operating budget, and emphasizing strict commitment to directing any new funds issued towards the productive sectors instead of pumping them into the consumer sectors.

This wise channeling of funds will contribute to achieving sustainable economic development and improving the economic situation in Iraq.

*Independent politician

https://mustaqila.com/الإفراط-في-إصدار-النقد-الجديد-هل-سيدفع/

Mazhar Muhammad Saleh: Our Cash Reserves Are The Highest And There Are No Fears Of The Dollar Rising

Economical 07/09/2024 Baghdad: Al-Sabah Yesterday, Monday, the financial and economic advisor to the Prime Minister, Mazhar Muhammad Saleh, commented on the return of the rise in the exchange rates of the US dollar against the Iraqi dinar in local markets.

Saleh explained, “The fixed exchange rate system in Iraq is based on international reserves, which are the highest in the history of Iraq and its monetary policy, as the foreign currency covers a percentage of more than 100% of the total currency currently exported.”

He added, "In view of the strength of the official central exchange market, the exchange rate of the dollar to the dinar in the parallel market today in the country does not constitute any relative importance in influencing the stability of the general price level, as

that general price level has become stable in its components and trends as a result of the influence of the official exchange rate factor."

Currently, the dominant factor in financing foreign (import) trade, amounting to 1,320 dinars per dollar, is a stable trend in the exchange rate and revolves around the stable external value of the dinar,

which is embodied by the state of stability in the relative prices of goods and services to a large extent, as annual inflation in the country does not exceed only 3%. According to Saleh,

based on the above, and in light of the strength of the foreign reserves supporting the Iraqi dinar, whose value as liquid foreign assets exceeds $100 billion, the official exchange market, as a general trend, will remain dominant in containing any colored noise or ambiguous information that is affected by the parallel exchange market in periods.

Short periods due to urgent international or regional political events here and there or in adapting some instructions regulating the monetary market.

The Sudanese advisor for financial affairs said that after the disappearance of the phenomenon of dollarization in internal transactions, especially in contracts, obligations and payments inside the country since last year and its legal ban, the parallel exchange market has begun to have its general effects today only on a narrow economic scope of prohibited transactions practiced by informal markets. At a rate of 10% of the total supply and demand transactions for the currency. Saleh stressed that

“the stability of the exchange rate of the dinar to the dollar that the country is witnessing, even in the secondary markets mentioned above, is a real and established stability.

Rather, it is derived from the strength of the influence of the price and quantitative factors of the monetary and financial policies and their integration in imposing overall price stability in the country and containing the inflationary expectations that were caused by the forces of The parallel exchange market during the past years.

The financial advisor concluded his speech by pointing out that “the secondary (irregular) market, due to the freedom of external transfer, is under the influence of the official exchange market rate, whose operations are constantly expanding in the interest of dealing with the fixed official exchange rate.” https://alsabaah.iq/99176-.html

Al-Sudani Directs To Reconsider Some Economic Decisions

Economy | 08/07/2024 Baghdad - Mawazine News Prime Minister Mohammed Shia Al-Sudani confirmed today, Monday, that the government has provided the private sector with great supportive opportunities and worked to empower it, while directing a review of some unproductive economic decisions and policies. Al-

Sudani chaired the periodic meeting of the Ministerial Council for the Economy, in which the decisions related to the economic reality and the implementation of the reform aspects included in the government program were followed up, according to a statement received by Mawazine News Agency.

At the beginning of the session, Al-Sudani pointed out "the importance of reviewing the economic decisions and policies that were taken in previous stages, and that the time has come to stand up to a number of unproductive work contexts and practices, and that reform requires strong and correct decisions."

The Prime Minister explained that "the government has provided the private sector with great supportive opportunities, and worked to empower it and launch its projects, and it is closely following up on everything required to continue the pace of growth, and its supportive decisions will not be directed towards the benefit of groups that live on specific outlets, without providing a contribution or returns to the country."

The statement added that "the Council discussed the report of the Diwani Order Committee (24573), headed by the Deputy Prime Minister and Minister of Planning, to follow up on the volume of support directed to petroleum products and fuel supplied to factories and plants and to the Ministry of Electricity."

The statement explained that "the Council also followed up on the issue of taxes due on companies and ways to organize them, and approved the adoption of a clear mechanism for the tax, in addition to approving the work to separate the real operating factories from the fictitious factories and audit the numbers and tables presented in the report and adopt an economic vision that supports the export of factory products and expansion of production."

The statement continued that "on the organizational side, the Council approved the formation of a technical committee from the sectoral bodies in the Ministries of Oil and Trade, in addition to the Council of Ministers' advisors; in order to control roles and resolve loose ends," and directed "to set the next meeting within a week to make final decisions." https://www.mawazin.net/Details.aspx?jimare=250986

Al-Sudani Receives A Delegation From The US Department Of Defense

Political | 08/07/2024 Baghdad - Mawazine News Prime Minister Mohammed Shia al-Sudani stressed, on Monday, the need for a firm stance against the Zionist aggression on the Gaza Strip.

The Prime Minister's Media Office stated in a statement that "Prime Minister Mohammed Shia al-Sudani received the US Deputy Assistant Secretary of Defense for Middle Eastern Affairs, Daniel Shapiro, and his accompanying delegation, in the presence of the US Ambassador to Iraq."

He added, "During the meeting, the procedures for proceeding with ending the mission of the international coalition to fight ISIS and activating bilateral relations between Iraq and the United States were discussed," noting that "the meeting witnessed discussion of the situation in the region and the continued aggression on Gaza."

Al-Sudani pointed to "the suffering of the Palestinian people, the difficulty of accessing humanitarian aid and relief supplies under the stifling siege, and the failure of the international community to assume its responsibilities in pressuring the Netanyahu government to stop the genocide."

The Prime Minister stressed "the need for a firm stance against the aggression, and the necessity of preventing escalation that threatens to expand the scope of the conflict."

For his part, the American official pointed out "the importance of Iraq's role in reducing tensions in the region, and the inevitability of continuing the approach of communication and cooperation between the two countries in the areas of armament and security and raising the combat level of the Iraqi forces, in a way that supports Iraq's security and sovereignty, economic development and progress at all levels." https://www.mawazin.net/Details.aspx?jimare=250976

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

Provoking Thoughts and Points To Ponder On Adversity:

The human race has had long experience and a fine tradition in surviving adversity. But we now face a task for which we have little experience, the task of surviving prosperity. - Alan Gregg

Adversity reveals genius, prosperity conceals it. - Horace

The virtue of prosperity is temperance; the virtue of adversity is fortitude. - Francis Bacon

In the day of prosperity be joyful, but in the day of adversity consider. - Bible

In victory even the cowardly like to boast, while in adverse times even the brave are discredited. - Sallust

Adversity is sometimes hard upon a man; but for one man who can stand prosperity, there are a hundred that will stand adversity. - Thomas Carlyle

http://famousquotesandauthors.com/topics/adversity_quotes.html

Iraq Economic News and Points To Ponder Monday Afternoon 7-8-24

Where Is The Official Position...And What Does The Dollar Hide In The Coming Days?

July 8, 2024 Baghdad/Iraq Observer Yesterday, the Central Bank of Iraq announced that it had submitted the “E-Commerce System Project” paper to the Council of Ministers for review and approval to proceed with work on it.

According to a statement, the Governor of the Central Bank of Iraq, Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate electronic commerce in Iraq with the participation of the concerned authorities.

In detail, during the meeting, a draft system for e-commerce and consumer protection was discussed through the controls discussed by the attendees, through registration procedures and obtaining a license to practice this trade.

Where Is The Official Position...And What Does The Dollar Hide In The Coming Days?

July 8, 2024 Baghdad/Iraq Observer Yesterday, the Central Bank of Iraq announced that it had submitted the “E-Commerce System Project” paper to the Council of Ministers for review and approval to proceed with work on it.

According to a statement, the Governor of the Central Bank of Iraq, Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate electronic commerce in Iraq with the participation of the concerned authorities.

In detail, during the meeting, a draft system for e-commerce and consumer protection was discussed through the controls discussed by the attendees, through registration procedures and obtaining a license to practice this trade.

The committee contributed to identifying the service provider and granting it a license through an electronic platform established by the Ministry of Commerce, and the

members of the committee stressed establishing the controls for granting a license to those wishing to practice electronic commerce in a way that preserves the rights of all parties.

While the attendees agreed to submit the “regulation paper” to the Council of Ministers for review and approval to proceed with work on it.

Realistic reading

Economists believe that the Central Bank does not have a realistic reading of the Iraqi financial situation, while they point out that it is within the powers of Parliament to hold the Central Bank accountable and dismiss those who are negligent.

An economist told the “Iraq Observer” agency, “The Central Bank is living the situation of the Sultanate with itself and does not know about the reality, and it also does not have a realistic reading of the Iraqi financial situation, and

it is required to solve the problem of trade with these two countries, and electronic payment has been stopped for 20 years.” In the drawers of the Central Bank and he did not do it, and

it is within the powers of Parliament to hold the Central Bank accountable and dismiss those who are negligent.”

He said: “The dollar in Iraqi markets is a basic currency like the dinar, and the Iraqi currency is 80% equivalent to the dollar, 10% to gold, and 10% to bonds.”

He pointed out that “Sudani’s visit to Washington previously alleviated the dollar crisis, and that the lack of an agreement with Washington caused the banking sector to be annihilated by sanctions, and some reports against banks came from Facebook and led to sanctions.”

According to the Central Bank’s instructions, “the travelers’ dollar is not sold to them at the present time, and it does not include land trips.”

Plug

Observers considered that the Central Bank of Iraq’s sales, in a month, are sufficient to cover the deficit of delaying salaries and other public needs, from the hard currency auction for the US dollar, which amounted during the month of June to more than 4 billion dollars, while they revealed important statistics about government salaries.

They said: “The allocations for salaries of employees working in the federal government occupy approximately 62 trillion dinars annually of total public spending, and

they constitute a percentage of the total spending ceiling for the fiscal year 2024 of about 30%,” and that “the issue of securing salaries is a top priority in financial and economic policy in the country.”

The country is responsible for securing its expenses.

They stated, “According to the standard of support, which averages 6 people per family in our country, the monthly government salaries are responsible for the livelihood of 24 million Iraqi citizens out of 44 million citizens of the country’s population.”

“Government salaries are considered one of the most important ways to ensure the social and economic well-being of the citizen, with the exception of the category of retirees and social welfare recipients of pensions.”

According to the law, “Based on the provisions of Paragraph II/77 of the Federal General Budget Law No. 13 of 2023 (the tripartite budget), the executive authorities in general and the financial authorities in particular provide due diligence in applying the provisions of the aforementioned article, which concerns the submission of the federal general budget schedules for the year 2025.”.

The file is that the “expenditures, revenues, and hypothetical deficit” tables are “in accordance with the technical and constitutional contexts approved by the table itself for the current fiscal year 2024.”

Salaries Are Late!

Regarding the impact of employee salaries and a possible liquidity crisis: “An observer said: “In all cases, salaries are insured even in the event of a liquidity crisis, but the date of financing and disbursement may be delayed.” He added:

“According to the timings stated in Financial Management Law No. (6) of 2019, the Council of Ministers submits the draft budget before mid-October of each year to the House of Representatives.”

He pointed out that the budget is approved by the House of Representatives in December of each year.

4 Billion Dollars

Yesterday, Sunday, the Central Bank of Iraq’s sales from the hard currency auction for the US dollar during the month of June amounted to more than 4 billion dollars.

During the month of June, during the days in which it opened its auction to buy and sell the US dollar, the Central Bank sold 4 billion and 438 million and 744 thousand and 273 dollars, at a daily rate of 295 million and 916 thousand and 284 dollars.

Foreign remittances amounted to 4 billion 50 million 289 thousand and 273 dollars during the past month, an increase of 90% compared to cash sales that amounted to 388 million and 455 thousand dollars.

The sales were distributed between transfers abroad to finance foreign trade, and cash sales to banks, while the selling price of documentary credits and international settlements for electronic cards reached 1,310 dinars per dollar, while the selling price of transfers abroad and the cash selling price reached 1,305 dinars per dollar. https://observeriraq.net/ما-الموقف-الرسمي-وما-الذي-يخفيه-الدولا/

The Dollar Will Reach 1,600 Dinars.” Exchange Companies Are Moving From Three Axes To Implement Their Demands

Economy 2024-07-08 | 12:55 8,383 views Alsumaria News – Exclusive Today, Monday, the representative of Iraqi exchange companies, Dhia Al-Taie, announced a move on three axes to implement a number of their demands regarding selling the dollar to travelers, while she expected the price of the dollar to reach 1,600 dinars.

Al-Taie told Al-Sumaria News , “The Central Bank approved a new mechanism that harmed exchange companies in general, after selecting only 4 exchange companies to work in Iraqi airports with the aim of selling dollars to travelers,” noting that “the selected companies are the same as the existing categories.”

He added, "More than a year ago, exchange companies proposed a mechanism to the Central Bank to protect them,

but the Central Bank objected to that mechanism, describing it as intrusive, difficult, and causing confusion," pointing out that "the mechanism included the possibility of the traveler obtaining the dollar electronically."

He stated, "There are 1,200 exchange companies, but the Central Bank chose only 7 of them to sell dollars to travelers, 4 of which were at airports, leaving the 1,200 companies that could be outlets for selling dollars to travelers."

He stated, "We have reached the stage of announcing a strike on the platform," pointing out that "this measure will raise the price of the dollar in the coming days to 1,600 dinars and more.

The best evidence of this is that 7 days before the mechanism was implemented, the dollar rose to 1,510 dinars."

He stressed that "there will be a detailed meeting in the presence of a team from the Prime Minister to resolve this issue," pointing out that "the exchange companies have several demands, and

if they are not implemented, we will announce a strike and demonstrate in front of the Central Bank and submit a complaint to the Parliamentary Finance Committee."

Representatives Of Exchange Companies In Iraq Announce The Cancellation Of Their Strike

Sweeteners 2024-07-08 | Source: Alsumaria News 4,142 views Representatives of exchange companies in Iraq announced, on Monday evening, the cancellation of their strike until further notice. A statement said,

“Representatives of exchange companies in Iraq announce the cancellation of their strike until further notice after meeting with the Prime Minister’s Office and advanced staff at the Central Bank of Iraq.” The statement added,

"And agreeing to solve a group of problems related to exchange companies and find the necessary solutions that support the work of these companies, especially those related to organizing the work mechanism at the airport and border crossings and the administrative, organizational and technical procedures related to them."

Today, Monday, the representative of the Iraqi exchange companies, Dhia Al-Tai, announced a move on three axes to implement a number of their demands regarding selling the dollar to travelers, while expecting the price of the dollar to reach 1,600 dinars. Al-Taie told Al-Sumaria News ,

“The Central Bank approved a new mechanism that harmed exchange companies in general, after selecting only 4 exchange companies to work in Iraqi airports with the aim of selling dollars to travelers,” noting that “the selected companies are the same as the existing categories.”

https://www.alsumaria.tv/news/localnews/493281/ممثلو-شركات-الصرافة-في-العراق-يعلنون-الغاء-اضرابهم

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

Provoking Thoughts and Points To Ponder On Adversity:

The human race has had long experience and a fine tradition in surviving adversity. But we now face a task for which we have little experience, the task of surviving prosperity. - Alan Gregg

Adversity reveals genius, prosperity conceals it. - Horace

The virtue of prosperity is temperance; the virtue of adversity is fortitude. - Francis Bacon

In the day of prosperity be joyful, but in the day of adversity consider. - Bible

In victory even the cowardly like to boast, while in adverse times even the brave are discredited. - Sallust

Adversity is sometimes hard upon a man; but for one man who can stand prosperity, there are a hundred that will stand adversity. - Thomas Carlyle

http://famousquotesandauthors.com/topics/adversity_quotes.html

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-8-24

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

"Former presidential candidate Vivek Ramaswamy, for example, has been advising President Trump on bitcoin and digital assets since January. Ramaswamy staked a unique position in the final weeks of his campaign by proposing that the dollar be backed by a basket of commodities that, in time, could include bitcoin."

"Ramaswamy’s plan echoed a similar proposal from Independent presidential candidate Robert F. Kennedy, Jr., in which a small percentage of US Treasury bills 'would be backed by hard currency, by gold, silver, platinum, or bitcoin."

© Newshounds News™

Read more: Forbes

~~~~~~~~~

AN EXCELLENT INTERVIEW ON "Unchained" WITH SENATOR LUMMIS ON WHY CRYPTO HAS BI-PARTISAN SUPPORT

"Show highlights:"

1. Why the SAB 121 approval was bipartisan

2. Whether President Biden will veto the resolution

3. How it’s a “mystery” to Sen. Lummis why the SEC had a change of heart about Ether ETFs

4. How the SEC’s approach to regulating the industry “is not the American way”

5. Whether there is a bipartisan majority in favor of crypto in Congress

6. How bitcoin has come a long way in terms of adoption

7. Sen. Lummis’ thoughts on how to regulate the stablecoin industry and avoid a Terra Luna situation

8. The differences between the Lummis-Gillibrand bill and FIT21

9. How Sen. Lummis feels about the denial of a master account for Custodia Bank

10. Whether there’s a move against Bitcoin mining companies in the US, given the recent ban of an operation in Wyoming

11. What Sen. Lummis would advise for the industry to accomplish its goals

© Newshounds News™

Read more: Unchained Crypto

~~~~~~~~~

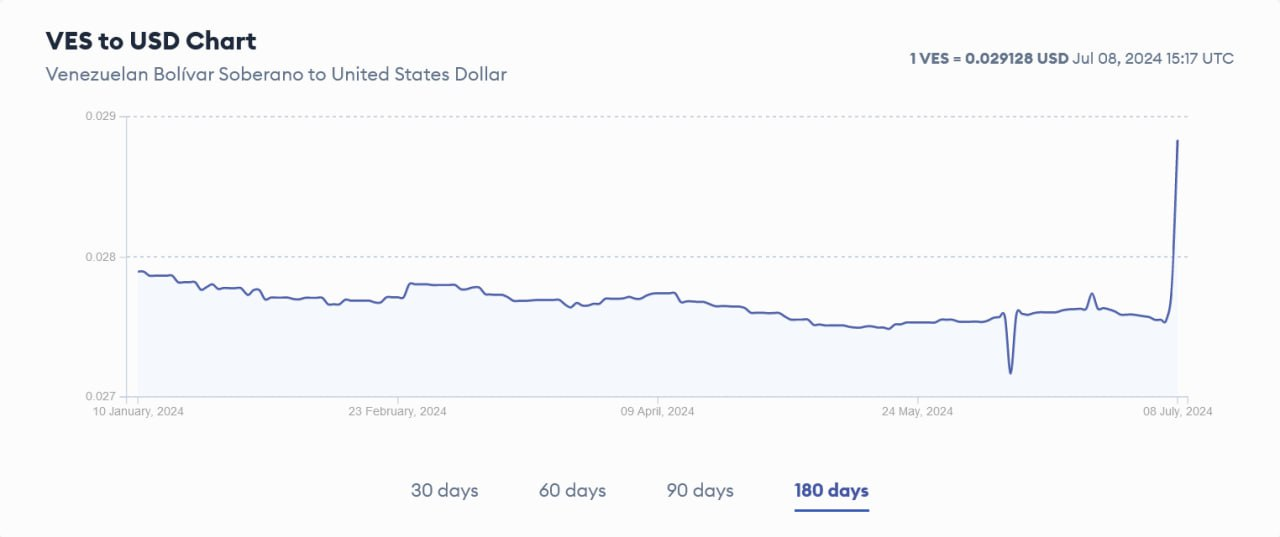

1 VES TO USD

VENEZUELAN BOLIVAR showing a slight strengthening against the US Dollar

Read more: Forbes

~~~~~~~~~

MAJOR DIFFERENCES BETWEEN BASEL CRYPTO RULES AND THE SEC ON BANKS BALANCE SHEETS

The House will seek to overturn the veto possibly later this week with a 2/3rds vote.

"At the end of May President Biden vetoed a bipartisan resolution in the House and Senate that aimed to cancel SEC accounting rule SAB 121, which prevents banks from providing digital asset custody. This week’s House schedule indicates another vote is on the cards.

If lawmakers successfully cancel SAB 121, then the SEC could not provide guidance on crypto custody in the future."

"SAB 121 requires listed firms to show digital assets held in custody as both an asset and liability on their balance sheet, contrary to accounting convention. It particularly impacts banks, because laws require them to set aside risk capital based on their balance sheet. This makes it prohibitively expensive for banks to provide crypto custody and is the reason none provide crypto custody for the Bitcoin ETFs. The SEC did not consult bank regulators before publishing SAB 121.

Firstly, there was the Basel rules for bank treatment of crypto. When the Basel Committee published final rules in late 2022, they did not require crypto held in custody to be shown on the balance sheet. This appeared to be a green light. However, in late March 2022 the SEC had published SAB 121 which meant that international banks could provide custody, but not U.S. ones. The SEC chose not to amend SAB 121 even though it conflicted with the Basel proposals."

Newshounds News will report back on any updates regarding this legislation.

© Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

TAIWAN BUILDS CBDC PROTOTYPE PLATFORM, PLANS HEARINGS FOR NEXT YEAR

"The Block has confirmed that Taiwan’s central bank governor will present a CBDC research report in parliament on Wednesday."

"The central bank started to research a potential central bank digital currency in 2019."

"Taiwan has built a prototype platform for a potential central bank digital currency (CBDC). It plans to hold multiple hearings and forums next year as its central bank continues to study and develop a CBDC."

Taiwan’s Central Bank Governor, Chin-Long Yang, said in a research report on Sunday that building a digital currency isn’t an international competition and that the central bank has yet to set a fixed timeline for CBDC issuance, according to a report from the semi-official Central News Agency.

"The report said the central bank had developed a CBDC prototype platform with a two-tier issuance structure. Initially, the CBDC would be non-interest bearing, and CBDC wallets may come in both anonymous and registered types, according to the report."

"On the retail front, the central bank said that the prototype platform has increased its processing speed to 20,000 transactions per second. The central bank also plans to develop the CBDC at the wholesale level, which could be used as a clearing asset for asset tokenization."

"The central bank stated that cryptocurrency and stablecoins are not part of the CBDC research, as those assets are separate from the digital currency system. The crypto industry remains largely unregulated in Taiwan, with the financial regulator requiring crypto service providers to comply with anti-money laundering laws."

@ Newshounds News™

Source: The Block

~~~~~~~~~

Do US Consumers Underestimate the Potential Of Digital Wallets?

In the United States, digital wallets can be anywhere a smartphone is. In other words, everywhere. Many U.S. consumers are embracing digital wallets, particularly for online shopping. In fact, data shows consumers are 23% more likely to use them for online shopping than in-store purchases. Beyond shopping, PYMNTS Intelligence finds that digital wallets are popular for peer-to-peer payments.

Yet, despite a reputation for tech-savviness, most U.S. consumers are unfamiliar with all these tools could offer. For example, just 8.7% of consumers have used one to store nontransactional credentials. Even fewer have used one of the credentials they have stored.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Monday AM 7-8-2024

TNT:

Harambe: Zimbabwe Has $370 Million in Reserves to Back Currency - Bloomberg (7/7/24)

Cash and mineral reserves backing Zimbabwe’s new currency have risen to approximately $370 million from $285 million over the past three months, the state-run Sunday Mail reported citing central bank governor John Mushayavanhu.

The increase in currency and mineral reserves provides a strong “buffer” for the Zimbabwe Gold, or ZiG, against external forces, according to the report.

Mushayavanhu said the central bank has been accumulating reserves from royalties of gold and conversion in kind of other minerals such as diamonds, lithium and platinum.

TNT:

Harambe: Zimbabwe Has $370 Million in Reserves to Back Currency - Bloomberg (7/7/24)

Cash and mineral reserves backing Zimbabwe’s new currency have risen to approximately $370 million from $285 million over the past three months, the state-run Sunday Mail reported citing central bank governor John Mushayavanhu.

The increase in currency and mineral reserves provides a strong “buffer” for the Zimbabwe Gold, or ZiG, against external forces, according to the report.

Mushayavanhu said the central bank has been accumulating reserves from royalties of gold and conversion in kind of other minerals such as diamonds, lithium and platinum.

“As a result, the total reserves have progressively increased about 30% from $285 million as at ” to above $370 million as at the end of June, he said.

The southern African country introduced the ZiG, which began trading It replaced the Zimbabwe dollar, which had lost 80% of its value against the greenback this year.

In September 2022, Zimbabwe introduced regulations to compel mining firms to pay half of their royalties to the government in the commodities themselves, as part of measures to build up mineral reserves. Zimbabwe has the world’s third-largest reserves of platinum, and also mines nickel, chrome, lithium and coal.

***********

For the first time, Google and Facebook pass their bandwidth through Iraq

The Ministry of Communications revealed, on Monday, that Google and Facebook are passing their capacities through Iraqi territory, confirming that this is happening for the first time, while indicating that the transit projects will provide financial returns to the country.

The ministry's spokesman, Omar Al-Amiri, told the Iraqi News Agency (INA): "The ministry has made great strides in strengthening Iraq's geographical position in the matter of transit and passing communications traffic and Internet capacities across Iraqi territory."

Al-Amiri explained that “the Ministry of Communications signed a new contract a few months ago on the transit level, not by sea but by land,” indicating that “this line passes through the south, then the center, reaching the Kurdistan region, and exits to Turkey and connects Asia to Europe via Iraq.”

He added that "the Ministry of Communications fulfilled its promises regarding transit and exploiting Iraq's location after it was disabled in previous sessions," noting that "Iraq's geographical location and its exploitation in international communications traffic and its return to the International Telecommunication Union in a prestigious manner will provide financial returns, in addition to the fact that many international companies will pass their capacities through Iraqi territory."

He referred to the "Road of Civilizations Transit Contract that was signed months ago," noting that "Google and Facebook passed their capacities through Iraqi territory, for the first time in Iraq."

It is worth noting that the Minister of Communications, Hiyam Al-Yasiri, announced on Friday that the threshold of “one tera” had been exceeded in passing international communications through Iraq, confirming that Iraq possesses a safe, attractive and reliable path for transit communications. link

*************

Parliamentary Finance clarifies.. Will selling dollars at the airport limit its smuggling?

The Parliamentary Finance Committee stated that the Central Bank’s decision to restrict the sale of dollars to citizens at the airport aims to combat currency smuggling and reduce corruption, while it indicated that the increase in its prices in local markets is due to smuggling operations to neighboring countries.

Committee member Jamal Koujar said that the decision will prevent corrupt people from exploiting other sales outlets to smuggle currency, stressing that limiting sales to the airport will ensure that the money reaches the actual travelers.

He pointed out that this decision will not negatively affect citizens, but will besiege smugglers and corrupt people, noting that we discovered that millions of dollars are being stolen due to corruption, and the new decision will create a crisis for thieves and corrupt people who were exploiting the currencies that were supposed to go to travelers.

Koger stressed that the stability of the dollar price in the markets requires strong security action on the borders to pursue smugglers, in addition to facilitating the operations of the Central Bank in disbursing it and increasing the quantities available in the currency auction to meet the needs of the market. link

************

Parliamentary Finance Committee talks about a decision that "created a crisis" for the corrupt and thieves

Iraq is preparing to implement the latest decision of the Central Bank in about 6 days from now, which is to limit the delivery of dollars to travelers inside airports, a decision that the Parliamentary Finance Committee described as "a crisis for the corrupt and thieves."

"The decision will prevent corrupt people from exploiting other sales outlets to smuggle currency," said Jamal Koujar, a member of the Finance Committee, stressing that "limiting sales to the airport will ensure that the money reaches the actual travelers."

He pointed out that "this decision will not negatively affect citizens, but will besiege smugglers and corrupt people, as we discovered that millions of dollars are being stolen due to corruption, and the new decision will create a crisis for thieves and corrupt people who were exploiting the currencies that were supposed to go to travelers."

Koger stressed that stabilizing the dollar price in the markets requires strong security action on the borders to pursue smugglers, in addition to facilitating the Central Bank's exchange operations and increasing the quantities available in the currency auction to meet market needs.

Since Eid al-Adha until now, exchange rates have witnessed a "chronic" rise in dollar exchange rates until the selling prices in exchange offices reached 150,000 dinars for every 100 dollars.

The Financial Supervision Bureau revealed in a report that during the first half of 2023, there were more than 150,000 citizens who bought dollars for the purpose of traveling but did not travel, meaning they obtained 600 million dollars and sold them on the black market and benefited from the currency difference. link

*********

Mot: .. Just Love the Internet.. Sumthun fur All occasions!!!

Mot: .. It's World Chocolate Day

Iraq Economic News and Points To Ponder Sunday Evening 7-7-24

The Parliamentary Economy Reveals The Factors That “Thwart The Iraqi Industry”: Granting What Is Above And Below The Ground For The Benefit Of The Investor

Economy 2024-07-07 | 1,958 views Alsumaria News-Economy Deputy Chairman of the Parliamentary Economy and Industry Committee, Representative Yasser Al-Husseini, considered today, Sunday, that the government and the Ministry of Industry are acting according to the “erroneous belief” that there are no Iraqi competencies to advance the industrial sector in Iraq, which prompted them to offer production lines and factories, as well as underground mineral resources, to invest at high prices. meanness.

Al-Husseini told Al-Sumaria News, “The belief of the government and the Ministry of Industry that Iraqi competencies are unable to advance the industrial sector is completely false, and there are Iraqi experiences and capabilities capable of advancing the sector with the best products and may compete with global industries.”

The Parliamentary Economy Reveals The Factors That “Thwart The Iraqi Industry”: Granting What Is Above And Below The Ground For The Benefit Of The Investor

Economy 2024-07-07 | 1,958 views Alsumaria News-Economy Deputy Chairman of the Parliamentary Economy and Industry Committee, Representative Yasser Al-Husseini, considered today, Sunday, that the government and the Ministry of Industry are acting according to the “erroneous belief” that there are no Iraqi competencies to advance the industrial sector in Iraq, which prompted them to offer production lines and factories, as well as underground mineral resources, to invest at high prices. meanness.

Al-Husseini told Al-Sumaria News, “The belief of the government and the Ministry of Industry that Iraqi competencies are unable to advance the industrial sector is completely false, and there are Iraqi experiences and capabilities capable of advancing the sector with the best products and may compete with global industries.”

He pointed out that "successive mismanagement of the industrial sector led to these bad fateful results for this sensitive, vital and economic sector, and led to the issuance of notorious joint operating contracts, according to which many industrial production lines were sold as piles of scrap."

He stated that "the government agreement not to buy local products from these government factories and not to supply them and to implement the Iraqi Product Protection Law are what led to these fateful and disastrous results for the Iraqi industry."

He pointed out that "the Ministry did not limit itself to offering above-ground factories for investment in the hands of companies,

but rather went underground according to decisions that faced strong opposition in previous years by heading to grant underground resources of precious metals and chemicals, and granting them to Jordanian and American companies at the cheapest prices."

He stated that "one ton of sulfur amounts to $400, while the government granted it to companies for $5 per ton, with quantities in Iraq amounting to more than 500 million tons as explored storage on only 16% of Iraqi territory."

He pointed out that this and other measures and trends cast a shadow over the failure of industry in Iraq and the lack of a true vision, to the point that they became losing companies built on a narrow partisan basis and these companies went on to obtain government contracts outside of what this ministry manufactures.

Parliament Indicates A “Single Way” To Eliminate 95 Percent Of Corruption In State Institutions - Urgent

Politics | Baghdad today - Baghdad Today, Sunday (July 7, 2024), the Integrity Committee in the House of Representatives indicated the only way through which corruption can be eliminated in all state institutions.

Committee member Hadi Al-Salami said in an interview with “Baghdad Today” that

“there is one step that eliminates approximately 95% of the rampant corruption in state institutions, which is the transition towards electronic governance, and although this matter was emphasized in the ministerial curriculum, it was not implemented.” Until now".

He stated, "There is no ministry that has implemented electronic governance so far, despite the importance of this step in fighting corruption and eliminating it once and for all.

This confirms the desire for corruption to continue, and that is why all ministries have not implemented this system, which is the main step in eliminating corruption." Which has been eating away at the body of the Iraqi state for years without any real confrontation with it.

Iraq is considered one of the countries with the highest rates of administrative and financial corruption, and it is noticeably present in several administrative facilities.

Some politicians in Iraq are considered among the first to be besieged by corruption charges.

Because of that, Iraq is considered, along with several countries such as Afghanistan, Somalia, Yemen, Sudan, and Libya, among the countries with the highest rates. Corruption according to the Corruption Barometer.

Because of the massive corruption in Iraq, there is a massive lack of services, deterioration of infrastructure, and deterioration of industrial and agricultural development, among examples of rampant corruption.

A total of $228 billion was wasted on construction and infrastructure projects, on paper only, a value that exceeds three times the national budget and the country's gross domestic product,

despite the enormous funds generated from the sale of oil, as Iraq ranks second among oil-producing countries.

But it remains completely dependent on imports, even for electricity and petroleum products.

Investment Shows The Importance Of The Singapore Agreement.. What Are Its Details?

Money and business Economy News – Baghdad The National Investment Commission confirmed, today, Sunday, that the Singapore agreement will accelerate the increase in Iraq's international classification, while clarifying regarding financing projects of local, Arab and foreign investors in Iraq.

The head of the commission, Haider Makiya, said: “The investment classification of emerging countries in 2024, conducted by FDI Intelligence, ranked Iraq fourth, indicating the confidence provided by investment in Iraq, specifically the National Investment Commission, in providing a safe legislative environment for the investor to settle in Iraq and return large capital to implement infrastructure projects and achieve sustainable development.”

He added, "The Singapore Agreement will accelerate and speed up the increase in Iraq's international rating, which is a sovereign rating for the whole world, and thus Iraq's rating will be known when it is good."

He pointed out that "all investors in the world will come without any restrictions or conditions as long as the legislative environment exists and governs their work in Iraq, and thus the process of attracting money to enter it will proceed easily and smoothly."

He pointed out that "project financing may be internal or external. If Iraq joins the international agreements, the process regarding foreign investors will be governed by the agreements. However, if the investor is local or Arab and wants to take financing, he will be subject to Iraqi laws regarding financing." 47 views 07/07/2024 - https://economy-news.net/content.php?id=44973

Iraqi Oil Exports To America Decline

Economy | 07/07/2024 Baghdad - Mawazine News The US Energy Information Administration announced, today, Sunday, that Iraq's oil exports to America decreased during the past week.

The administration said in a table followed by Mawazine News, "The average US imports of crude oil during the past week from 9 major countries amounted to 5.400 million barrels per day, up by 4 thousand barrels per day from the previous week, which amounted to 5.396 million barrels per day."

It added that "Iraq's oil exports to America amounted to 195 thousand barrels per day last week, up by 4 thousand barrels per day from the previous week, which amounted to 191 thousand barrels per day."

The administration indicated that "the largest oil revenues for America during the past week came from Canada at a rate of 3.918 million barrels per day, followed by Mexico at an average of 332 thousand barrels per day, followed by Colombia at an average of 276 thousand barrels per day, and from Nigeria at an average of 222 thousand barrels per day."

According to the table, "the amount of US imports of crude oil from Ecuador was an average of 152 thousand barrels per day, from Saudi Arabia at an average of 146 thousand barrels per day, from Libya at an average of 98 thousand barrels per day, and from Brazil 74 thousand barrels per day." https://www.mawazin.net/Details.aspx?jimare=250893

Dollar Exchange Rate Against The Dinar After The Stock Exchange Closes

Economy | 04:30 - 07/07/2024 Baghdad - Mawazine News The dollar price rose against the dinar, today, Sunday, in local markets and exchange shops in the capital, Baghdad.

The dollar exchange rate recorded 149,000 dinars for $100 at the close of the two main stock exchanges in Baghdad, Al-Kifah and Al-Harithiya, while this morning it recorded 148,850 dinars for $100.

Selling prices also rose in exchange shops in local markets in Baghdad to 150,000 dinars for $100, while the purchase price reached 148,000 dinars for $100.

https://www.mawazin.net/Details.aspx?jimare=250919

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

Provoking Thoughts and Points To Ponder On Adversity:

Adversity comes with instruction in its hand. - Anonymous

Mistakes are often the best teachers. - James A. Froude

Pain, indolence, sterility, endless ennui have also their lesson for you. - Ralph Waldo Emerson

Prosperity is a great teacher; adversity is a greater. Possession pampers the mind; privation trains and strengthens it. - William Hazlitt

Wisdom comes by disillusionment. - George Santayana

You have learned something. That always feels at first as if you had lost something. - George Bernard Shaw

http://famousquotesandauthors.com/topics/adversity_quotes.html

MilitiaMan: Iraq Dinar-IQD Solid Credit-Strong & Stable Investment Environment-Oil Agreement Reached-SOMO-Kurds

Iraq Dinar-IQD Solid Credit-Strong & Stable Investment Environment-Oil Agreement Reached-SOMO-Kurds

MilitiaMan and Crew: 7-7-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Dinar-IQD Solid Credit-Strong & Stable Investment Environment-Oil Agreement Reached-SOMO-Kurds

MilitiaMan and Crew: 7-7-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Sunday Evening 7-7-24

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger? ➖

BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance. ➖RippleNet could replace SWIFT for cross-border transactions. ➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger?

➖BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance.

➖RippleNet could replace SWIFT for cross-border transactions.

➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

The XRP Ledger (XRPL), in particular, provides a potential decentralized platform for quick, safe transactions as a result of the technology developed by Ripple. These features make XRPL a promising foundation for a new asset-backed currency, decreasing reliance on central banks while increasing financial transparency.

RippleNet, Ripple’s payment network, is also key in this potential change. It allows for real-time, cross-border transactions, potentially replacing the traditional SWIFT system. RippleNet uses XRP in conjunction with On-Demand Liquidity (ODL) to eliminate the requirement for pre-funded accounts, simplifying international payments.

A new, more transparent, efficient, and less reliant on the US dollar global financial system may emerge from the BRICS coalition’s interest in cryptocurrencies and Ripple’s technology. By embracing a crypto/Ripple approach, the BRICS nations have the potential to completely reshape the world financial environment, with major effects on commerce and banking across borders.

The possible adoption of a Ripple/crypto strategy by the BRICS coalition represents a major advancement in global financial services. Ripple’s decentralized technology might serve as the basis for a new asset-backed currency. This change would make the banking system more efficient and put the US dollar under more pressure.

Read more Crypto News Land

~~~~~~~~~

US House Considers Overturning Biden’s Crypto Custody Veto — This Could Spark Wide Market Rally

"The US House of Representatives could overturn President Joe Biden’s veto of the crypto custody bill next week, sparking a bold recovery across the recently battered crypto market."

“In May, the US House voted to overturn the Securities and Exchange Commission SAB 121 rule that requires regulated firms custodying cryptocurrencies to record their holdings on balance sheets.”

“However, President Biden later vetoed the bill, saying it could affect the ability of the SEC to set up the much-needed guardrails in the industry. The President also noted it would affect the well-being of investors and customers.”

“The bill is now back in the House of Representatives and has been classified as “legislation that may be considered.” The US House can overturn or uphold the President’s veto.”

A two-thirds majority vote from both the Senate and the House is needed to overturn the veto.

Could A Recovery for the Crypto Market Be Brewing?

With the recent decline in Bitcoin and the cryptocurrency market, an overturn of the bill could be just what the market needs to recover.

“The market has already recorded a bold recovery in the last 24 hours, with the global market cap up by 4.3%. All the top-ten cryptos by market cap are also trading in the green today.”

“Bitcoin and Ether have gained by 4.5% and 5.3%, respectively, in the last 24 hours. XRP and Cardano are among the top gainers, with an 8% and 7% gain, respectively.”

@ Newshound News™

Read more: ZY Crypto

~~~~~~~~~

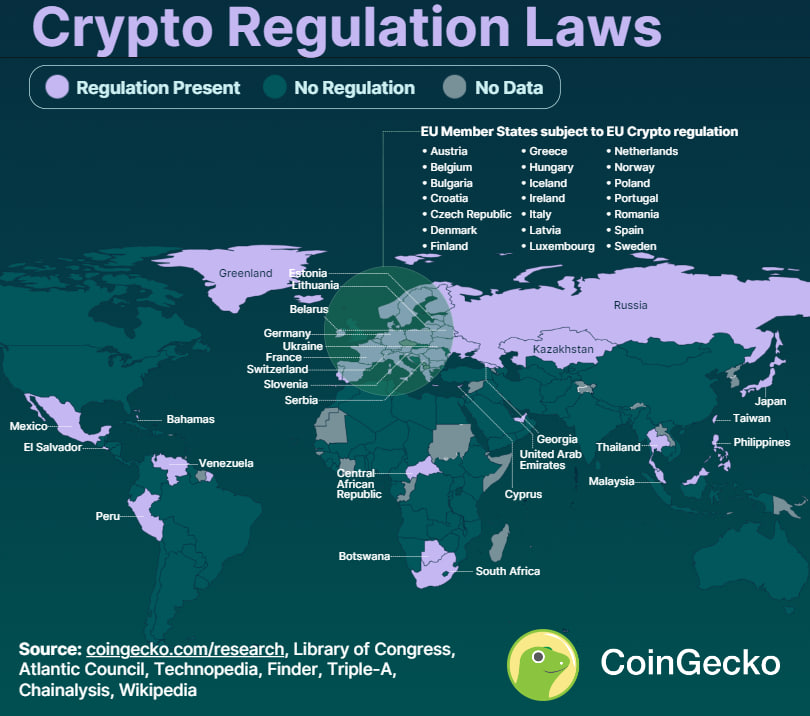

Countries Where Cryptocurrency Is Legal vs Illegal

Where Is Cryptocurrency Legal?

Cryptocurrency is currently legal in 119 countries and four British Overseas Territories. This means more than half of the world's countries have legalized cryptocurrency. 64.7% of countries that have legalized crypto are emerging and developing countries from the Asian and African continents. However, out of the 119 countries that legalized cryptocurrency, 20 (16.8%) have imposed bank bans. These bans restrict financial institutions from interacting with cryptocurrency exchanges or users.

Europe Leads With 39 Countries Recognizing Crypto’s Legitimacy

Europe is at the forefront of global cryptocurrency legalization, with 39 (95.1%) out of 41 analyzed countries acknowledging its legitimacy. North Macedonia is the only European country where cryptocurrency is illegal, while Moldova's status remains unclear.

Out of 31 countries in the Americas, 24 (77.4%) countries recognize cryptocurrency as legal. Bolivia stands as the sole exception, deeming cryptocurrency illegal. Six American countries - Guatemala, Guyana, Haiti, Nicaragua, Paraguay, and Uruguay - have yet to establish their official stance on cryptocurrency.

In Africa, only 17 out of 44 (38.6%) countries have legalized cryptocurrency, while 35 (77.7%) out of 45 countries in Asia recognize cryptocurrency as legal.

How Many Countries Have Defined Crypto Laws?

Only 62 (52.1%) of the 119 countries where cryptocurrency is legal have comprehensive regulations. This number has gone up by 53.2% since 2018 when only 33 jurisdictions had cryptocurrency regulations.

Among the 62 countries with established regulations, 36 (58.0%) are individual countries, 22 (35.5%) are part of the European Union (EU), and 4 (6.5%) are British Overseas Territories. Notably, half of these countries are advanced economies, while the remaining half are emerging and developing economies.

Half of the countries that have legalized cryptocurrency have yet to implement robust regulatory frameworks. This gap between legalization and full regulation raises potential concerns about investor protection and clarity for businesses operating in the cryptocurrency space in those countries.

Instead, several countries have taken the approach of adapting existing regulatory frameworks to encompass cryptocurrencies, rather than establishing entirely new regulations. This approach often involves applying established tax laws and anti-money laundering and counter-financing of terrorism (AML/CFT) laws to cryptocurrency transactions and activities.

Major advanced economies, including France, Japan, and Germany, have successfully established regulatory frameworks for cryptocurrencies.

In contrast, other major advanced economies, such as Italy, the United States, Canada, and the United Kingdom, face challenges in implementing comprehensive cryptocurrency regulations. Multiple governments and financial regulatory bodies in these countries contribute to the complexity of the regulatory process.

EU member states, on the other hand, adhere to EU-wide regulations regarding crypto assets. These regulations provide a more harmonized approach to cryptocurrency regulation within the bloc.

Which Countries Use Cryptocurrency as Legal Tender?

Only two countries, El Salvador and the Central African Republic (CAR), have adopted cryptocurrency as legal tender. Of which, El Salvador remains the only country actively using cryptocurrency as legal tender today.

El Salvador made history in August 2021 by legalizing Bitcoin through the Bitcoin Law. This landmark legislation cemented Bitcoin's acceptance as legal tender with automatic conversion to US dollars. In January 2023, El Salvador took another step towards embracing Bitcoin by passing the Digital Securities Law. This law classifies Bitcoin as a "digital commodity" and all other crypto assets as "securities."

@ Newshound News™

Read more: CoinGecko

~~~~~~~~~

THE UK COULD BE THE FIRST COUNTRY TO DESIGN CBDCs TO HELP THE PEOPLE, NOT THE BANKS

Labour's plan acknowledges the growing case for a state-backed digital pound and emphasizes the need for financial products to reach underserved communities.

"The landslide victory of the UK’s Labour Party in the general election saw little to no mention of Bitcoin, blockchain, or digital assets. However, Labour’s previous statements and plans suggest a cautious yet open stance toward blockchain technology. "

Labour backs Digital Pound, but what could it look like?

“Labour’s financial services plan, “Financing Growth,” acknowledges the growing case for a state-backed digital pound and emphasizes the need for “financial products to reach underserved communities.

“Embrace innovation and fintech as the future of financial services by becoming a global standard-setter for the use of AI in FS, delivering the next phase of Open Banking, defining a roadmap for Open Finance, embracing securities tokenisation and a central bank digital currency, and establishing a regulatory sandbox for financial products to reach underserved communities.”

“The party has fully supported the Bank of England’s ongoing work in this area, indicating a commitment to continue exploring and developing a CBDC.”

The Labour party has “highlighted the importance of addressing key concerns such as privacy, financial inclusion, and stability in designing any potential CBDC.” This indicates Labour “prioritizes public interest and economic stability.”

“Labour’s plan also emphasizes the importance of making the UK a global hub for securities tokenization” and exploring the tokenization of securities. "

"Labour has expressed intentions to advance open banking initiatives, explore the potential of open finance, and establish regulatory sandboxes to test financial products aimed at underserved communities. "

Healthy Skepticism for CBDCs

"As with any attempt to deliver a CBDC, it’s important to remain skeptical due to its potential for governmental overreach and abuse." However, "as one of the few ‘Left Wing’ governments to oversee a CBDC, Labour could offer a unique take on its design."

“Labour’s support for CBDC exploration does not equate to an immediate implementation plan. The party has emphasized the need for thorough consultation and careful consideration of potential impacts” such as privacy concerns associated with CBDCs. “It is clear that FIAT, in its current form, is failing.”

A positive CBDC design would include:

More transparency over government spending

More accessible access to finance for the unbanked

Cheaper and faster international transfers

Reduced costs of Central Bank printing

Increased privacy

A reduction in financial crime

“However, designing a CBDC to offer all these things without the more Orwellian alternatives may require too much of a leap of faith for most. A party with socialist origins, with a forward-thinking and modern technology focus, in the 2024 United Kingdom could theoretically adopt the best of what blockchain offers without overreaching if app priately advised by those in the digital assets industry.”

“We would have one shot at this, and it would have to be designed so that a future government could not alter it to take advantage of its citizens.”

"The coming months and years will be critical in determining whether the UK under Labour leadership can successfully navigate the complex landscape of digital currencies, balancing innovation with stability and public interest. If successful, the UK could emerge as a global leader in the responsible development and implementation of CBDCs, setting a precedent for other nations to follow."

@ Newshound News™

Read more: CryptoSlate

~~~~~~~~~

STABLECOINS AND NATIONAL SECURITY: LEARNING THE LESSONS OF EURODOLLARS

"As Congress struggles to resolve big issues like funding for Ukraine and Israel, the debate over legislation to regulate stablecoins seems like small potatoes. But there is a connection, which is that stablecoins could have national security implications: Unless we strengthen their regulation, they could undermine our ability to use sanctions to advance our national interests.

This was illustrated recently by news that Russian smugglers have used Tether, the largest stablecoin, to avoid Western sanctions and purchase billions of dollars worth of weapons."

"Stablecoins are a type of cryptocurrency that is far more useful as a means of payment than Bitcoin. 1 That is because stablecoins are designed to maintain a constant price in terms of another asset. 2 Stablecoins pegged to the U.S. dollar are more “money-like” than other cryptocurrencies.

They can be used to move value across borders without going through banks, and it is the banking system—and in particular the role of U.S. banks—that is key to the implementation and efficacy of sanctions."

"Stablecoins are in some respects similar to Eurodollars, a financial innovation that helped to create the financial plumbing used to implement sanctions. Both stablecoins and Eurodollars are U.S. dollar-based liabilities that had their origins outside the regulated banking system...

It is the global dominance of the dollar, coupled with the role of U.S. banks in facilitating dollar payments, that gives the U.S. its tremendous financial leverage."

"Could stablecoins undermine that leverage? As with the early days of the Eurodollar market, stablecoin use is minimal today, and so their national security risk may also be minimal. But just as Eurodollar use grew quickly and unexpectedly, stablecoins could also grow.

While they are used principally to trade other crypto assets today, they could become a more widespread means of payment. They have also become popular as a means for people in countries with weak currencies to acquire a dollar substitute.

Moreover, that growth could come even if the U.S. does not take action. That is because many other jurisdictions are creating frameworks to license stablecoins, including Europe, the U.K., Japan, Singapore and the U.A.E. While those frameworks may lead to stablecoins in native currencies, they could also give rise to new dollar-based stablecoins.

@ Newshound News™

Read more: BrookingsEdu

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

BRICS Intra-bank Payment System Launched: What next?

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

This move is seen as a strategic effort by both nations to mitigate the impact of international sanctions and strengthen their economic ties.

Russia, heavily sanctioned due to its invasion of Ukraine, and Iran, facing long-standing sanctions related to its nuclear program and other issues, are increasingly collaborating to build financial infrastructure independent of Western influence.

The first trade transactions using this new system have already taken place, and both countries are optimistic about the potential to significantly increase their annual bilateral trade, aiming to double it from $4 billion to $8 billion.

This integration is part of a broader effort to create a more resilient and self-sufficient economic partnership between Russia and Iran, further solidifying their alliance against Western economic pressures.

Iraq News Highlights and Points To Ponder Sunday AM 7-7-24

Al-Sudani's Advisor Comments On The Fluctuation Of The Dollar Price: It Does Not Suit The Strength Of Iraq's Foreign Reserves

Economy |Today Baghdad Today – Baghdad Mazhar Muhammad Salih, the Prime Minister's economic advisor, confirmed today, Sunday (July 7, 2024), that the fluctuations witnessed by the secondary or parallel dollar exchange market during the past days are not commensurate with the strength of Iraq's international or foreign reserves.

Saleh said in an interview with Baghdad Today, "These are the actions undertaken by speculators looking for emergency profitable opportunities here and there," indicating that "the fixed exchange rate system in Iraq is based on international reserves, which is the highest in the history of Iraq, and its monetary policy, as foreign currency covers a percentage of more than 100% of the total currency currently issued."

Al-Sudani's Advisor Comments On The Fluctuation Of The Dollar Price: It Does Not Suit The Strength Of Iraq's Foreign Reserves

Economy |Today Baghdad Today – Baghdad Mazhar Muhammad Salih, the Prime Minister's economic advisor, confirmed today, Sunday (July 7, 2024), that the fluctuations witnessed by the secondary or parallel dollar exchange market during the past days are not commensurate with the strength of Iraq's international or foreign reserves.

Saleh said in an interview with Baghdad Today, "These are the actions undertaken by speculators looking for emergency profitable opportunities here and there," indicating that "the fixed exchange rate system in Iraq is based on international reserves, which is the highest in the history of Iraq, and its monetary policy, as foreign currency covers a percentage of more than 100% of the total currency currently issued."