Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Tuesday Morning 9-24-24

Good Morning Dinar Recaps,

RIPPLE VS SEC: JOHN DEATON BRINGS SEC MISCONDUCT TO LIGHT – XRP NEWS

▪️Pro-crypto attorney John Deaton has slammed the US SEC over the Ripple lawsuit.

▪️Deaton demanded damages for the XRP community and called for mass layoffs.

Pro-crypto attorney John Deaton has shed more light on the recently concluded case between the US Securities and Exchange Commission (SEC) and Ripple Labs Inc. According to the latest development, Deaton has accused SEC lawyers of intentional misconduct.

Good Morning Dinar Recaps,

RIPPLE VS SEC: JOHN DEATON BRINGS SEC MISCONDUCT TO LIGHT – XRP NEWS

▪️Pro-crypto attorney John Deaton has slammed the US SEC over the Ripple lawsuit.

▪️Deaton demanded damages for the XRP community and called for mass layoffs.

Pro-crypto attorney John Deaton has shed more light on the recently concluded case between the US Securities and Exchange Commission (SEC) and Ripple Labs Inc. According to the latest development, Deaton has accused SEC lawyers of intentional misconduct.

John Deaton Accuses SEC of Misconduct

In a recent YouTube interview, Deaton said the SEC exhibited serious misconduct by claiming that XRP is a security. This take comes as the US SEC recently apologized for the confusion caused by using the term “crypto asset securities.”

However, Deaton says the Ripple vs SEC case wasted money, capital, and energy. He said XRP immediately lost $15 billion, and people were liquidated when the markets regulator initiated the lawsuit.

“You shouldn’t be liquidated because of government overreach because the government and these unelected bureaucrats are doing what they are doing,” says Deaton.

According to him, Ripple spent over $100 million on defense. Deaton stated that he and XRP community members demanded that the SEC remove the “XRP is a security” language to resolve the case. He claims the SEC refused and even attacked him.

As a result, he said the SEC’s apology cannot be accepted and claims the lawsuit was intentional misconduct by its lawyers.

“People should be fired, they should lose their jobs if they were in the decision-making process,” Deaton stated.

He added that Ripple and the XRP community deserve compensation for the extensive litigation and expense over the SEC misconduct. Before the interview, Deaton wrote in an X post that the SEC’s crypto overreach has cost retail investors $15 billion. Deaton’s comments resonated with many XRP investors, even beyond the community, fueling ongoing discussions.

Is an Appeal Imminent?

His comments come as discussion grows over whether the SEC will appeal the Ripple decision. As mentioned in our earlier post, former SEC attorneys Marc Fagel and James Farrell are confident that the SEC will file an appeal. Attorney Fred Rispoli added that the SEC is still undecided and may wait until the last minute to make an appeal announcement.

However, Ripple’s Chief Legal Officer Stuart Alderoty confirmed that Ripple does not intend to appeal. He said Ripple had obtained a stay order on a $125 million penalty pending further proceedings.

Meanwhile, investor caution and market volatility could continue to impact XRP negatively if the case drags on. At press time, XRP is trading at $0.5883, down by 0.71% in the past 24 hours. The 24-hour trading volume decreased by 15.5% to $938 million, indicating reduced investor interest.

Despite current challenges, analysts predict a positive breakthrough for XRP as Ripple prepares for the Ripple Swell 2024 event. Another development that could push XRP higher is Ripple’s participation in Project Agora. As CNF noted earlier, this project, led by the Bank of International Settlements (BIS), will help boost Ripple’s global influence.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

SEC CHAIR GARY GENSLER ADDRESSES CONGRESS ON CRYPTOCURRENCY REGULATION

▪️Gary Gensler will testify before Congress regarding SEC's cryptocurrency policies.

▪️His leadership faces scrutiny from both parties amid upcoming elections.

▪️The SEC's stance on crypto continues to draw significant criticism.

On Thursday at 18:40, Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), will testify before Congress. The cryptocurrency market is focused on Gensler’s upcoming statements and his aggressive stance on altcoins, as the SEC faces increasing scrutiny.

Gensler to Speak Before Committees

On September 24 and 25, Gensler will appear before the Financial Services Committee and the U.S. Senate Banking Committee. His leadership has been under intense review from both partisan and political perspectives, making his statements highly anticipated. Republican committee members have criticized the SEC’s negative stance on cryptocurrencies for years, which has highlighted the Democrats’ anti-crypto position.

As the upcoming presidential elections approach, it is expected that lawmakers will press Gensler on cryptocurrency regulations and the handling of fraud cases such as FTX and Terra. Meanwhile, Coinbase‘s legal counsel received significant backlash for criticizing the SEC’s claims about “crypto asset securities.”

Gensler’s Supporters Decline

Ron Hammond, Director of Government Relations at the Blockchain Association, states that Gensler will face tough questions from both parties. Hammond noted that this session will differ from previous ones.

“Gensler has fewer allies this time; many are dissatisfied with the agency’s recent crypto approach.” – Ron Hammond

This marks the first time Gensler will testify alongside other SEC Commissioners, adding to the significance of the sessions.

While Democratic leaders are expected to defend their policies, Republicans may question the agency’s direction, potentially aiding their electoral efforts by appealing to cryptocurrency investors.

Under Gensler’s leadership, the SEC continues to face heavy criticism from the crypto community and lawmakers. Recent examples include sharp critiques from House Majority Leader Tom Emmer and Financial Services Committee Chairman Patrick McHenry regarding the SEC’s classification of crypto airdrops as securities.

The timing of Gensler’s testimony adds fuel to the debate, as he has faced frequent criticism from courts and Congress over the SEC’s aggressive enforcement tactics. Additionally, former President Donald Trump has stated that he would remove Gensler if he wins the upcoming elections.

Gensler’s testimony in Congress could hold critical importance for cryptocurrency regulations and the SEC’s future policies. Market participants and investors are closely monitoring the outcomes of these sessions.

@ Newshounds News™

Source: Coin-Turk

~~~~~~~~~

TALIBAN INVITE TO BRIC? WHAT? | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Jim Rickards: This is MONUMENTAL! Nobody is PREPARED for What's Coming | Youtube

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Evening 9-23-24

Good Evening Dinar Recaps,

TURKEY TENDS TO VIEW BRICS AS A POLITICAL TRUMP CARD AGAINST THE WEST — EXPERT

Turkish economist Bartu Soral noted that when looking at "the global distribution of power, it is clear that huge changes have occurred since the early 2000s"

ANKARA, September 23. /TASS/. Turkey's interest in BRICS has economic considerations, but purely political motives are also strong, Bartu Soral, one of the country’s leading economists, said in an interview with TASS.

"The decline of the West's dominance in the international system brings BRICS to a leading position in production and export. In this context, Turkey values its relations with the Turkic countries and with Russia, which is active in the region. There are many points of contact here.

Good Evening Dinar Recaps,

TURKEY TENDS TO VIEW BRICS AS A POLITICAL TRUMP CARD AGAINST THE WEST — EXPERT

Turkish economist Bartu Soral noted that when looking at "the global distribution of power, it is clear that huge changes have occurred since the early 2000s"

ANKARA, September 23. /TASS/. Turkey's interest in BRICS has economic considerations, but purely political motives are also strong, Bartu Soral, one of the country’s leading economists, said in an interview with TASS.

"The decline of the West's dominance in the international system brings BRICS to a leading position in production and export. In this context, Turkey values its relations with the Turkic countries and with Russia, which is active in the region. There are many points of contact here.

Nevertheless, I think that the interest in BRICS declared by the Turkish government is an attempt to gain a trump card against the West and has political motives," he believes.

The expert noted that when looking at "the global distribution of power, it is clear that huge changes have occurred since the early 2000s. The G7 countries used to dominate, while today, for example, the EU and Japan have lost power."

"On the contrary, the BRICS countries are leaders in global exports and production. China has acquired significant production and technological power, including thanks to its excellent education system. Russia is strong in the defense industry. Brazil ranks second in the world in food exports. The Anglo-Saxons, who dominated in the 1990s, are losing ground," Soral noted.

Touching upon Turkey's political motives, the economist noted that BRICS is an economic association that needs to be approached in this spirit.

"We need a national program, a roadmap for interaction with BRICS, a production program in various industries in the context of the BRICS economy. Personally, I do not see such plans from the government and I think that Turkey's application does not have a serious economic basis," the economist believes.

Earlier, Turkish Foreign Minister Hakan Fidan said that Ankara was assessing its participation in BRICS from the point of view of economic cooperation opportunities, but said that "the association itself is currently searching for an identity, options for institutionalization" and therefore it is difficult to say to what point the republic's interaction with BRICS may reach.

Nevertheless, Fidan noted that "if Turkey's integration with the EU had ended with full membership in the union, then perhaps Turkey would not be looking for other options on many issues.".

@ Newshounds News™

Source: TASS

~~~~~~~~~

QATAR LAUNCHES DIGITAL ASSETS LAB

Last week the Qatar Financial Centre (QFC) unveiled the first participants in its Digital Assets Lab, “powered” by the Qatar Central Bank. The QFC avoided using the term sandbox, although the Lab’s aims sound similar, but broader.

The goal is to encourage innovation and development in the distributed ledger technology (DLT) space. Plus, it provides regulatory support and is one of the pathways for landing a license to operate in Qatar.

It follows the recent launch of Qatar’s Digital Asset Regulations at the start of the month.

The creation of the Lab involved partnering with Google Cloud, local bank Masraf Al Rayan, The Hashgraph Association (THA) and enterprise blockchan firm R3.

“As the base product for the QFC ecosystem, R3’s Corda will power tokenization projects across Qatar’s financial industry, supporting the issuance, transfer, and redemption of digital assets,” said R3’s CEO David E Rutter.

However, some applications are likely to be deploy on the public Hedera DLT. In May the affiliated Hashgraph Association (THA) announced a $50 million Digital Assets Venture Studio in Qatar which is part of the Lab.

THA is planning to work in five areas:

▪️Equity Tokenization

▪️Sukuk (Islamic Bonds) Tokenization

▪️Real Estate Tokeniszation

▪️Sustainability/ESG – Carbon Credits

▪️Consumer engagement and loyalty programs

The Middle East is becoming a hotbed for tokenization, with multiple regulatory enclaves within the UAE alone, never mind Saudi, Qatar and elsewhere. Qatar’s banking sector is already internationally diversified, with around 30% of deposits from foreigners.

The Qatar Central Bank, which is involved in the Digital Assets Lab, completed its central bank digital currency infrastructure in June.

Digital Assets Lab participants

The Digital Assets Lab isn’t purely for new startups. We’ve regularly covered several of the participants, including Partior, Polygon, Settlemint, Taurus and Citi-backed xalts.

The full list of initial participants are: AISCIA, ALT DRX, arca-x, AssetShare, Audtye, Blade Labs, BlockStead, DMZ, evergon, Finrock, Falcon Nest Labs, itoo technologies, mintus, oori, Partior, Polygon, PropTech, ScieNFT, SettleMint, SidraChain, Skargard, Taurus, xalts, and Verity.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

Telegram may hand over user data of rule violators to authorities

The Telegram team has removed all problematic content from there in recent weeks, Pavel Durov said, without giving any details

MOSCOW, September 23. /TASS/. Telegram co-founder Pavel Durov said that the messenger can disclose user IP addresses and phone numbers in response to legitimate requests from the relevant authorities. He clarified that this measure concerns violators of Telegram rules and is being introduced to deter criminals from abusing the messenger's internal search function.

"We have clarified that the IP addresses and phone numbers of those who violate our rules can be disclosed to the relevant authorities in response to justified legal requests," Durov said, specifying that Telegram has updated its terms of service and privacy policy, bringing them to uniformity worldwide.

As Durov explained, some users were abusing Telegram’s search function to sell illegal goods. The Telegram team has removed all problematic content from there in recent weeks, he said, without giving any details.

"Over the past few weeks, a special team of moderators has used artificial intelligence to make the Telegram search much safer. All problematic content that we identified in search is no longer available," Durov said. He also called on users to report illegal content.

@ Newshounds News™

Source: TASS

~~~~~~~~~

Who Are These Mysterious People? Discover The Power Of Discernment | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Thoughts From DJ “Gold” 9-23-2024

DJ: DID YOU KNOW?

The statutory value of gold refers to the price or value of gold as established or fixed by law or government regulation, rather than being determined by market forces like supply and demand.

Historically, statutory values of gold were set by governments to define the exchange rate of gold with their national currency, often in the context of the gold standard, where currencies were pegged to a specific amount of gold.

This fixed legal value contrasts with the market value of gold, which fluctuates based on trading in the global gold markets. Today, most countries no longer have a statutory value for gold since currencies are not tied to gold, but the concept remains relevant in legal contexts, such as central banks’ gold reserves and specific fiscal policies.

DJ: DID YOU KNOW?

The statutory value of gold refers to the price or value of gold as established or fixed by law or government regulation, rather than being determined by market forces like supply and demand.

Historically, statutory values of gold were set by governments to define the exchange rate of gold with their national currency, often in the context of the gold standard, where currencies were pegged to a specific amount of gold.

This fixed legal value contrasts with the market value of gold, which fluctuates based on trading in the global gold markets. Today, most countries no longer have a statutory value for gold since currencies are not tied to gold, but the concept remains relevant in legal contexts, such as central banks’ gold reserves and specific fiscal policies.

In the context of the U.S. gold reserves, the statutory value of gold is a fixed price set by law, which is significantly lower than the current market value of gold. The U.S. Treasury still maintains this statutory value for accounting purposes, despite the fact that the U.S. dollar is no longer backed by gold (since the U.S. abandoned the gold standard in 1971).

Application to U.S. Gold Reserves:

Statutory Value: The official statutory price of gold in the U.S. is set at $42.22 per troy ounce under the Gold Reserve Act of 1934. This price is used by the U.S. Treasury for accounting and reporting purposes when valuing the gold held in the U.S. Treasury’s reserves. This figure has remained unchanged since 1973, even though the market price of gold has risen significantly.

U.S. Gold Reserves: The U.S. holds a substantial amount of gold (over 8,100 metric tons) in its reserves, primarily stored in locations like Fort Knox and the Federal Reserve Bank of New York. The value of this gold is reported using the statutory price of $42.22 per ounce, which leads to an official accounting value of U.S. gold reserves that is far below its actual market worth.

Difference from Market Value: The market price of gold is determined by global trading on commodities exchanges and typically fluctuates based on supply and demand. As of 2024, the market price of gold is around $2,500 to $2,600 per ounce, much higher than the statutory price. This means that while the gold reserves are valued at billions of dollars under the statutory rate, their true market value is in the hundreds of billions of dollars.

Purpose: The statutory value is a historical relic from when the U.S. dollar was backed by gold, and it now serves primarily for internal accounting within the U.S. Treasury. It simplifies the bookkeeping of the government’s gold holdings but does not reflect the actual economic value of those reserves. While the statutory value of U.S. gold reserves is used for government reporting, it vastly underestimates their real market value.

Title of U.S. Gold Reserves:

The title to the gold in U.S. reserves is held by the U.S. Department of the Treasury, specifically under the legal jurisdiction of the U.S. government. This gold is primarily stored in places like Fort Knox, the U.S. Mint at West Point, and the Federal Reserve Bank of New York. The gold reserves are part of the national assets, managed and accounted for by the Treasury, but owned by the U.S. federal government on behalf of the public.

What Would Happen if the Statutory Value Was Changed to $500 per Ounce:

If the statutory value of gold were changed from the current $42.22 per ounce to $500 per ounce, several significant financial and accounting impacts would occur:

Increase in the Official Valuation of U.S. Gold Reserves:

The U.S. Treasury currently holds over 261 million troy ounces of gold.

At the statutory value of $42.22 per ounce, these gold reserves are valued at approximately $11 billion.

If the statutory value was raised to $500 per ounce, the official accounting value of these reserves would increase to about $130.5 billion (261 million oz × $500).

Impact on the U.S. Federal Balance Sheet:

This change would boost the official assets of the U.S. government by reflecting a closer (though still undervalued) estimate of the gold’s worth. It would improve the appearance of the U.S. Treasury’s balance sheet, reducing the ratio of debt to assets, which might affect perceptions of U.S. fiscal health.

However, since this is an accounting change rather than an actual sale or use of the gold, it wouldn’t directly affect the national debt or reduce federal deficits.

No Immediate Effect on the U.S. Dollar or Monetary Policy:

Since the U.S. no longer operates under the gold standard, the statutory value of gold is primarily an accounting mechanism. A change in this value wouldn’t directly affect the dollar’s value or the Federal Reserve’s monetary policy.

The market price of gold would still be far higher than the new statutory value ($500 per ounce is still below the current market price of ~$2,600 per ounce). The dollar remains a fiat currency, meaning its value is not tied to gold reserves.

Potential Legal or Political Implications:

Increasing the statutory value of gold could spark political debate, especially regarding government transparency and the actual economic utility of the gold reserves.

There may also be calls to further increase the statutory value to align it more closely with the actual market value, though doing so could have broader economic and financial consequences.

Impact on Gold-Backed Securities or International Confidence:

An increase in the statutory value might suggest to some observers that the U.S. is acknowledging the potential for gold to play a larger role in its balance sheet. However, unless there’s a broader shift toward gold-backed currency (which is unlikely under orycurrent economic systems), the change would remain symbolic and largely administrative.

Changing the statutory value of gold to $500 per ounce would increase the U.S. Treasury’s reported assets significantly, but it wouldn’t directly affect the economy, the dollar’s value, or debt levels. The gold reserves would remain an underutilized asset held by the U.S. government unless furthermost.

DJ

Seeds of Wisdom RV and Economic Updates Monday Afternoon 9-23-24

Good Afternoon Dinar Recaps,

HONG KONG MONETARY REGULATOR LAUNCHES SECOND PHASE OF CBDC PROJECT

The HKMA has engaged 11 firms for advanced e-HKD+ digital currency trials, so far.

The Hong Kong Monetary Authority (HKMA) has announced the launch of the second phase of its central bank digital currency (CBDC) pilot program, known as e-HKD, according to a Sept. 23 statement.

The second phase will delve into advanced use cases for digital money, emphasizing e-HKD and tokenized deposits for individuals and businesses. The first phase focused on testing CBDC applications in domestic retail payments, offline transactions, and the settlement of tokenized assets.

Good Afternoon Dinar Recaps,

HONG KONG MONETARY REGULATOR LAUNCHES SECOND PHASE OF CBDC PROJECT

The HKMA has engaged 11 firms for advanced e-HKD+ digital currency trials, so far.

The Hong Kong Monetary Authority (HKMA) has announced the launch of the second phase of its central bank digital currency (CBDC) pilot program, known as e-HKD, according to a Sept. 23 statement.

The second phase will delve into advanced use cases for digital money, emphasizing e-HKD and tokenized deposits for individuals and businesses. The first phase focused on testing CBDC applications in domestic retail payments, offline transactions, and the settlement of tokenized assets.

The HKMA stated that the initiative has evolved from its original e-HKD focus and is now rebranded as Project e-HKD+ to align with the changing fintech landscape.

e-HKD Applications

The HKMA has engaged 11 firms from various sectors to investigate e-HKD applications in three main areas, including tokenized asset settlement, programmability, and offline payments.

Some of the participants reportedly involved in phase 2 include ANZ, Airstar Bank, Aptos Labs, BlackRock, Bank of Communications (Hong Kong), ChinaAMC, China Mobile, DBS, Fidelity International, Kasikornbank, and Sanfield.

The HKMA stated that these firms will evaluate the commercial viability of new digital money forms within real-world settings, aiming to enhance accessibility for individuals and corporations.

The results of Phase 2 will provide insights into the practical challenges of creating a digital money ecosystem that integrates both publicly and privately issued digital currencies. Project e-HKD+ will further develop the necessary technology and legal framework to support potential future issuance of e-HKD for both individuals and businesses.

To foster collaboration, the HKMA will establish the e-HKD Industry Forum. This platform will enable participating institutions to discuss common challenges and explore the scalable implementation of new digital money forms. Industry-led working groups will address specific topics, initially focusing on programmability.

Similar to Phase 1, an e-HKD sandbox will be available for pilot participants to facilitate prototyping, development, and testing of use cases. During Phase 2, the HKMA will collaborate closely with the selected firms over the next 12 months to share key findings with the public by the end of next year.

HKMA chief executive Eddie Yue stated:

“Project e-HKD+ signifies the HKMA’s commitment to digital money innovation. The e-HKD Pilot Programme has provided a valuable opportunity for the HKMA to explore with the industry how new forms of digital money can add unique value to the general public. The HKMA will continue to adopt a use-case driven approach in its exploration of digital money.”

@ Newshounds News™

Source: CryptoSlate

~~~~~~~~~

RIPPLE VS SEC: IS THE SEC PREPARING A LAST-DITCH APPEAL?

▪️Legal experts believe the SEC will file an appeal, but the regulator remains undecided, creating uncertainty for XRP.

▪️Ripple is confident in its legal position, and analysts foresee a potential bullish breakout for XRP despite the looming appeal.

Following the development of the SEC’s appeal against Ripple, CNF highlighted its effect has put the XRP community on edge, current updates in the ongoing Ripple vs. SEC lawsuit suggest that an appeal from the U.S. Securities and Exchange Commission (SEC) is expected. According to legal experts, the SEC seems poised to challenge Judge Torres’ rulings on the XRP case.

As shared on his X account, former SEC attorneys Marc Fagel and James Farrell have expressed confidence that the SEC will file an appeal, emphasizing that not doing so would reflect poorly on the regulator. The SEC has two weeks left before the deadline to submit the appeal.

As the deadline approaches, the XRP community is growing anxious. Attorney Fred Rispoli speculates that the SEC remains undecided about the appeal and could wait until the last minute to make an announcement.

Meanwhile, Ripple’s CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty have confirmed that Ripple does not plan to appeal and has secured a stay order on a $125 million penalty until further proceedings.

Interestingly, recent SEC actions in the Binance case suggest the agency may not appeal Judge Torres’ ruling regarding XRP’s programmatic sales, where the judge stated that buyers in programmatic sales were no different from secondary market purchasers.

XRP Price Surges Despite Legal Uncertainty

However, the trading volume has dropped by 25%, hinting at decreased activity among traders. Analysts are predicting a potential bullish breakout for XRP as Ripple prepares for its Ripple Swell 2024 event. The possibility of an SEC appeal could push XRP beyond its current $0.65 resistance level.

As of today, Ripple (XRP) is trading at $0.5897, with a loss of 1.09% in the past day and a 4.92% increase over the past week. See XRP price chart below.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

CARDANO FOUNDER RESPONDS AS DEVELOPER INTRODUCES BITCOIN TO CARDANO BRIDGE

Cardano’s Charles Hoskinson reacts with surprise as a Bitcoin developer unveils a seamless bridge between Bitcoin and Cardano apps.

A Bitcoin developer, known as elraulito, has announced a breakthrough in blockchain interoperability, revealing a seamless bridge between Bitcoin and Cardano applications.

The developer showcased a smart contract on Plutus V3, allowing Bitcoin wallets to interact directly with Cardano’s ecosystem. This enables users to send ADA, manage tokens, and stake in Cardano pools without requiring a new wallet.

Notably, Cardano founder Charles Hoskinson reacted with surprise as the innovation could mark a new phase in cross-chain connectivity.

Smart Contract Capabilities Explained

The developer detailed how the smart contract was built using a combination of tools and protocols. Notably, the contract employs aiken, a Cardano smart contract language, and CIP69, which enhances the address’s programmability.

A multivalidator enables transactions, delegations, and reward withdrawals, while MeshJS manages off-chain transactions. Mesh, an open-source library, supports Web3 app development and currently offers one of the few implementations compatible with Plutus V3.

This bridge allows Bitcoin users to engage in Cardano’s ecosystem without additional software, providing a straightforward onboarding process. As the developer noted, these capabilities could potentially extend to every EVM chain, broadening blockchain usability and functionality.

Community Reactions and Technical Insights

The announcement generated questions among enthusiasts, eager to understand the mechanics and applications of the new bridge.

One user asked how Cardano actions could be sent from a Bitcoin wallet, to which the developer responded that Bitcoin users can sign Cardano actions from their existing wallets.

If the signature is verified, the action is executed by Cardano nodes. This functionality opens doors to onboarding users from outside the Cardano ecosystem, facilitating interactions like airdrops and liquid staking without changing wallets.

Further discussions focused on the validation process. The contract validates the signature by checking the UTXO, receiver, amount, and asset details against its outputs. This validation ensures that transactions align with predefined rules set within the smart contract, providing secure cross-chain operations.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

BRICS News:

THE TALIBAN MOVEMENT SUBMITS APPLICATION TO ATTEND THE BRICS SUMMIT IN KAZAN

Representatives of the Taliban movement have sent an application to Moscow to attend the BRICS summit which is being held Kazan, the capital of Russia’s Tatarstan Republic on October 22-24, RIA Novosti reported on September 21.

As it has become known, the Taliban want to be represented at the BRICS summit by the acting deputy prime minister of the country, the head of the political wing of the Taliban terrorist movement, Abdullah Ghani Baradar.

"We express our interest in the participation of a high-level delegation in the summit, in particular, Deputy Prime Minister of Afghanistan Abdul Ghani Baradar, as well as myself along with other participants," says an application sent by Nooriddin Azizi, the Taliban’s acting Minister of Commerce and Industry, to Yuri Ushakov, the Aide to Russian President.

BRICS is an intergovernmental organization comprising Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates.

Originally identified to highlight investment opportunities, the grouping evolved into an actual geopolitical bloc, with their governments meeting annually at formal summits and coordinating multilateral policies since 2009. Bilateral relations among BRICS are conducted mainly based on non-interference, equality, and mutual benefit.

The founding countries of Brazil, Russia, India, and China held the first summit in Yekaterinburg in 2009, with South Africa joining the bloc a year later. Iran, Egypt, Ethiopia, and the United Arab Emirates joined the organization on January 1, 2024.

Saudi Arabia is yet to officially join, but participates in the organization's activities as an invited nation. BRICS is an informal group of countries that includes Russia, Brazil, India, China, and South Africa.

@ Newshounds News™

Source: Asia-Plus

~~~~~~~~~

BREAKING NEWS Israel Intercepts Missiles from Iraq | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Morning 9-23-24

Good Morning Dinar Recaps,

Ripple CLO Talks Congress Insights on SEC and XRP

▪️Professor Reiners emphasized the need for Congress to address the regulatory gap in the crypto spot market.

▪️Ripple’s argument against XRP being a security aligns with Reiners’ testimony on investment contracts.

Stuart Alderoty, Ripple’s Chief Legal Officer, has responded to Professor Lee Reiners testifying before Congress, which provided an illuminating viewpoint on the continuing legal dispute between Ripple and the United States Securities and Exchange Commission.

Good Morning Dinar Recaps,

Ripple CLO Talks Congress Insights on SEC and XRP

▪️Professor Reiners emphasized the need for Congress to address the regulatory gap in the crypto spot market.

▪️Ripple’s argument against XRP being a security aligns with Reiners’ testimony on investment contracts.

Stuart Alderoty, Ripple’s Chief Legal Officer, has responded to Professor Lee Reiners testifying before Congress, which provided an illuminating viewpoint on the continuing legal dispute between Ripple and the United States Securities and Exchange Commission.

Reiners, known as both a pro-SEC and anti-crypto advocate, acknowledged the SEC’s recent setback in the Ripple case, underscoring three key factors with substantial significance for the crypto industry and Ripple’s journey.

Questioning the Regulatory Gaps and Decentralization in Crypto Laws

To begin, Reiners identified a significant regulatory gap in the crypto spot market, pointing out that neither the SEC nor the Commodity Futures Trading Commission (CFTC) currently regulate this sector. This observation highlights an obvious flaw in the current regulatory framework for cryptocurrency.

Reiners believes Congress should take a more active role in closing this regulatory hole. Ripple’s Alderoty agreed, emphasizing the importance of legislative action to better address the changing crypto ecosystem.

Another key argument addressed by Reiners was the concept of decentralization in relation to securities legislation. He criticized the idea that securities regulations should be predicated on a “mystical” decentralization threshold, alluding to a 2018 speech by former SEC Director William Hinman.

This statement has sparked debate within the crypto community, particularly because it hinted that certain cryptocurrencies could be immune from securities restrictions if they achieved a sufficient level of decentralization.

Reiners’ stance is consistent with the broader crypto industry, which has long stated that decentralization should not be used to determine whether an asset is a security.

Reiners also addressed the topic of investment contracts, citing analogies to the landmark Howey Test case concerning orange groves. He underlined that the object of an investment contract, such as orange groves, is not a security in and of itself. A management contract must be present when something is considered security.

This viewpoint is consistent with Ripple’s central argument that XRP should not be categorized as a security since it does not meet the criteria for being an investment contract.

The Impact of SEC Changing Leadership on Crypto Regulation

One of Reiners’ most memorable comments was that “SEC chairs come and go,” implying that regulatory landscapes might move dramatically with changes in leadership.

This insight serves as a reminder of the transient nature of regulatory interpretations, implying that Ripple’s case may result in different consequences if future SEC leadership takes a fresh perspective on cryptocurrencies.

While the crypto community eagerly monitors these events, doubt remains over XRP’s future, notably whether the SEC would appeal the Ripple case verdict before the deadline of October 7, 2024.

This lingering uncertainty is currently placing downward pressure on the XRP price, which was $0.5843 at the time of this post, representing a slightly 0.55% fall over the last 24 hours.

On the other hand, Ripple’s partner, SBI Holdings, has made substantial progress in researching the integration of token-based bank deposits with central bank digital currencies. According to a CNF report, SBI Holdings has joined Project Agora, which aims to examine how tokenized commercial bank deposits might be integrated with wholesale CBDCs on a single ledger.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

AUSTRALIA TIGHTENS GRIP ON CRYPTO STARTUPS WITH CORPORATE LAW CHANGES

Key Takeaways

▪️Australia wants all crypto exchanges to hold financial services licenses.

▪️The country has so far had limited success in its crackdown on the crypto industry.

▪️As of 2022, over one million Australians held at least one form of cryptocurrency.

Australia is set to further enhance the regulation of the cryptocurrency industry by requiring all crypto exchanges to hold financial services licenses.

The move will see the country’s corporate watchdog push for updated regulations to be enforced over the next two months, the Australian Financial Review reported.

Australia Tightens Grip on Crypto

The new licensing requirements are required as the Australian Securities and Investments Commission (ASIC) considers most major crypto assets to be relevant under the country’s Corporate Act, according to ASIC commissioner Alan Kirkland.

Crypto developers in the country have been confused about whether or not they should obtain an Australian Financial Services (AFS) license.

An AFS is needed for a “financial product,” which is when an individual takes on a financial risk or makes an investment.

ASIC is currently embroiled in two major court cases involving two crypto startups that have not obtained a license.

“ASIC’s message is that a significant number of crypto-asset firms in the Australian market are likely to need a license under the current law. This is because we think many widely traded crypto assets are a financial product,” Kirkland said.

ASIC Has Had Limited Success

ASIC will update its “Information Paper 225” for a November release. The regulatory paper will clarify how cryptocurrencies and other financial products should be treated.

So far, ASIC has had limited success penalizing crypto exchanges without a license.

Block Earner, an Australian crypto startup founded in 2021, was taken to court by ASIC, which alleged that the company was working unlawfully without a license. The Federal Court sided with Block Earner, claiming the startup had been operating lawfully.

ASIC sued Finder Wallet for not registering as a financial service. The court ultimately ruled that the startup did not need a license to operate.

The Australian watchdog is appealing both court decisions.

Australia and Crypto

Like the rest of the world, Australia has an evolving relationship with cryptocurrency.

In 2022, research firm Roy Morgan found that over one million Australians own at least one form of cryptocurrency, including Bitcoin, Ethereum, and Cardano.

A 2023 study by the Australian Securities Exchange (ASX) found nearly 3 in 10 Aussie investors plan to buy crypto in the next year, with 15% already holding digital assets.

However, While Australia has generally welcomed innovation in the crypto space, a strong emphasis on consumer protection has remained.

According to a Finder report powered by Coinbase, 50% of Australian owners said the security and reputation of an exchange are the most important features to them.

Last month, the Australian Competition and Consumer Commission (ACCC) found that half of crypto-related Facebook ads were scams.

The ACCC alleged that Meta was aware of crypto scams in its ads for the past six years.

“Meta has been aware that a significant proportion of cryptocurrency advertisements on the Facebook platform have used misleading or deceptive promotional practices,” the company said in a court ruling.

@ Newshounds News™

Source: CCN

~~~~~~~~~

GOLD FOLLOWS BITCOIN PRICE RALLY TO NEW RECORD HIGHS, WILL MOMENTUM CONTINUE?

Inflation hedges, such as gold, have emerged as a more attractive option for diversification along with Bitcoin which is nor preparing for a mega rally in Q4.

Key Notes

▪️Gold has surged to a record high of $2,629 per ounce, gaining 5% in the past two weeks, following Fed rate cuts.

▪️Rising geopolitical risks, including conflicts in Ukraine and the Middle East have increased the appeal of gold as a safe-haven asset.

▪️Goldman Sachs forecasts further growth in gold prices, projecting a surge to $2,700 by early 2025.

The gold price has been hitting new highs following the Fed rate cut last week while following the Bitcoin price trajectory recently. Over the past week, the BTC price has surged over 8.5% moving all the way to $64,000.

On the other hand, the gold price touched a record high of $2,629 per ounce on September 23. Within the last 15 days, the yellow metal has registered strong 5% gains. The major boost comes following the 50 bps rate cut by the Federal Reserve which served as the tailwind for the yellow metal.

A decrease in interest rates diminishes the appeal of assets linked to Fed-determined returns, like short-term government bonds, while making inflation hedges, such as gold, a more attractive option for diversification.

Furthermore, the appetite for gold investments has been growing recently amid rising geopolitical risks such as the ongoing wars between Russia and Ukraine, Israel and Hamas. On the other hand, the uncertainty around the 2024 US elections is also another factor contributing to this.

Furthermore, banking giant Goldman Sachs recently reported that the gold purchases by central banks have tripled following the last two years of the Russia-Ukraine war. With more Fed rate cuts expected this year, Goldman Sachs researchers predict that the gold price will surge to $2,700 by early next year.

Gold Rally Isn’t Ending Anytime Soon

Peter Boockvar, chief investment officer at Bleakley Financial Group, noted that gold has yet to surpass its inflation-adjusted peak of $3,200, set in 1980. Meanwhile, gold advocate Peter Schiff took the opportunity to criticize digital assets in a post on X on Sept. 23. Schiff noted:

“Gold just hit another record high, but few investors notice or care. With so much attention focused on Bitcoin, investors are not only missing out on gold’s gains but the significance of the rise.”

On the other hand, Bitcoin is also showing strength gearing up for a mega rally moving ahead in Q4 2024. 10x Research founder and CEO Markus Thielen noted that the chances of a major breakout increase as we approach the October-to-March period.

“Bitcoin’s 2024 performance has once again followed its seasonal pattern – just as it did in 2023. This is why traders should anticipate a major breakout, potentially reaching new all-time highs in Q4 2024,” he added.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

ARE WE THERE YET ROADMAP AND TIMELINE? #rv #gcr #roadmaptosuccess | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 9-22-24

Good Afternoon Dinar Recaps,

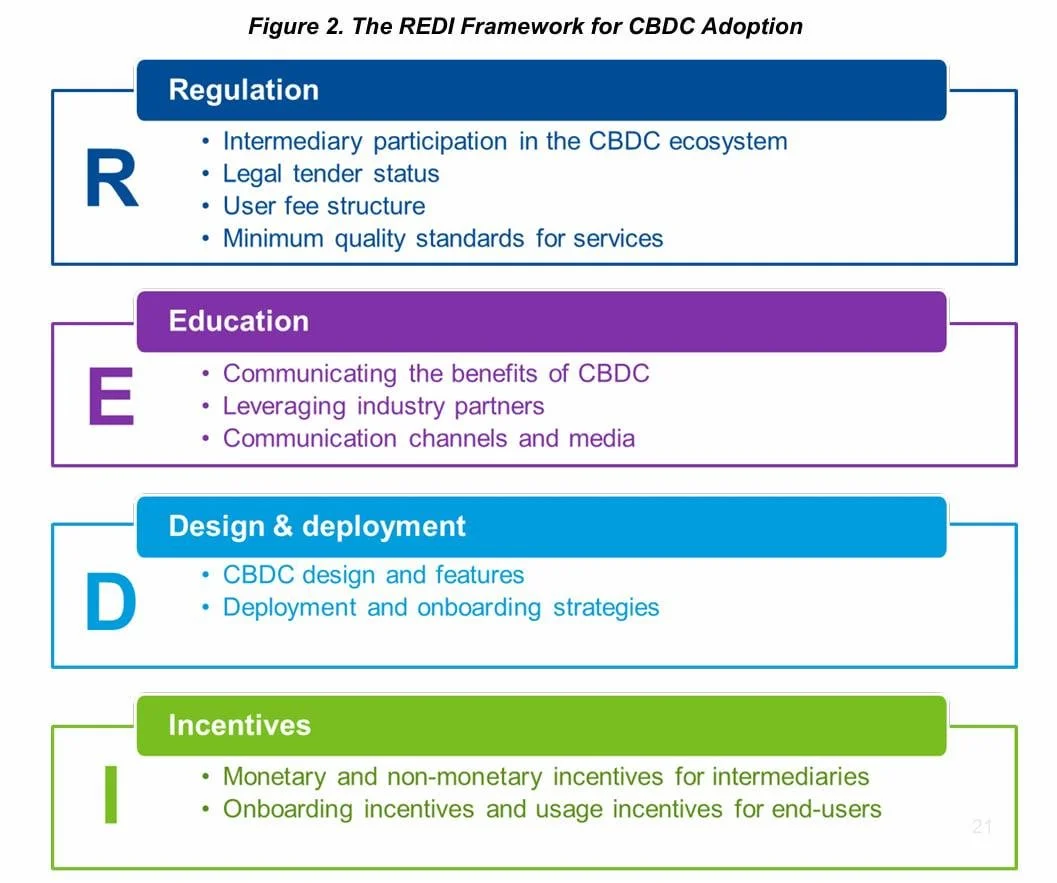

IMF STAFF PROPOSE REDI FRAMEWORK TO CATALYZE CBDC ADOPTION

IMF staff members have introduced a high-level four-stage framework emphasizing regulation, education, design and incentives to enhance CBDC adoption.

International Monetary Fund (IMF) staff members have issued a guide for policymakers and banking institutions on ways to increase the uptake of central bank digital currencies (CBDCs) globally.

The IMF issued the “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users” paper on Sept. 21.

Good Afternoon Dinar Recaps,

IMF STAFF PROPOSE REDI FRAMEWORK TO CATALYZE CBDC ADOPTION

IMF staff members have introduced a high-level four-stage framework emphasizing regulation, education, design and incentives to enhance CBDC adoption.

International Monetary Fund (IMF) staff members have issued a guide for policymakers and banking institutions on ways to increase the uptake of central bank digital currencies (CBDCs) globally.

The IMF issued the “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users” paper on Sept. 21.

The paper recommended implementing inclusive strategies for intermediaries and end-users.

It introduced a high-level framework for regulation, education, design and deployment and incentives (REDI) to help spur CBDC adoption.

According to the IMF staff members, successful CBDC adoption will require proactive strategic policy and design choices that benefit end-users and intermediaries. Therefore, they urged central banks to focus on stakeholder engagement.

The REDI framework is curated by IMF staff members to help central banks improve CBDC adoption in their respective countries.

PIC

REDI framework for central banks to help CBDC adoption. Source: IMF

As shown in the above image, the REDI framework focuses on four key pillars. The first sub-section, regulation, involves policymakers exploring potential regulatory and legislative measures to nurture CBDC adoption.

The education sub-section recommends developing communication strategies to build CBDC awareness, with central banks acting as a central point of communication. Thirdly, the paper highlighted the need for strategies targeting specific user groups and creating an extensive network of intermediaries.

The final sub-section recommended the introduction of monetary and non-monetary incentives to encourage the mass adoption of CBDCs. Subsidizing setup costs, transaction fees and taxes for merchants are some of the recommendations made by the IMF staff.

The paper also encouraged further discussions around pre-existing concerns:

“Certain policy issues, including sustainability of the CBDC system, ensuring integrity of the system, and balancing adoption with financial stability, will need to be explored further.”

In August, two IMF executives said that increasing the average crypto-mining electricity costs globally by as much as 85% through taxes could significantly reduce carbon emissions.

According to IMF Fiscal Affairs Department’s deputy division chief Shafik Hebous and climate policy division economist Nate Vernon-Lin, a tax of $0.047 per kilowatt hour “would drive the crypto mining industry to curb its emissions in line with global goals.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ALGORAND FOUNDATION ANNOUNCES BUILD-A-BULL HACKATHON IN COLLABORATION WITH AWS

NOTE: ALGORAND IS ISO 20022 COMPLIANT

September 20, 2023 – Singapore, Singapore

Registration is now open for global hackathon with $200,000 in prizes across five tracks.

The Algorand Foundation – the organization focused on growing the ecosystem for the world’s most advanced, secure and reliable layer-one blockchain – announces the opening of registration for Build-A-Bull, a global virtual hackathon with $200,000 in prizes.

The hackathon, powered by Algorand Ventures and in collaboration with AWS (Amazon Web Services), will run from October 18 through November 15, 2023. Registration is free and open to anyone.

Build-A-Bull is a hackathon to create consumer-friendly applications using the power and scalability of the Algorand blockchain.

Spanning four weeks, the hackathon offers an opportunity for committed developers and entrepreneurs to conceive a business concept, accelerate it though the development phase and to ultimately present a final product to a panel of expert judges.

Throughout the process, participants will receive matchmaking, tooling, support and mentorship to help bring their ideas to life.

Ryan Terribilini, EVP of Algorand Ventures, said,

“With Build-A-Bull, we expect to attract a new wave of promising builders to come into the Algorand ecosystem.

“We are looking for high-potential, investible startups and founders to bring innovative projects to the Algorand blockchain, and we are confident that the resources and exposure of participating in Build-A-Bull will catalyze this next generation of Algorand builders.”

The hackathon includes five tracks.

▪️DeFi, presented by Circle

▪️Gaming, presented by Unity

▪️Consumer, presented by AWS

▪️Interoperability, presented by Wormhole

▪️Impact, presented by Algorand Foundation

The winner of each track will receive $25,000 and will be invited to pitch to investors on a ‘demo day,’ with a public on-chain vote determining an additional $10,000 grand prize, as well as $25,000 in AWS credits.

The second and third-place winner of each track will receive $10,000 and $5,000 respectively. A bonus ‘university prize’ of $5,000 will be awarded by the judges.

The judging panel is comprised of industry leaders and investors including QCP Capital, DWF Ventures and Blockchain Capital.

Projects will be evaluated by the following criteria – the skillset and strength of the team, the design and interface of the project, the quality of the pitch and the viability of market adoption.

For more information, and to register, please visit here.

About Algorand Foundation

The Algorand Foundation is dedicated to helping fulfill the global promise of the Algorand blockchain by taking responsibility for its sound monetary supply economics, decentralized governance and healthy and prosperous open-source ecosystem.

Designed by MIT professor and Turing Award-winning cryptographer Silvio Micali, Algorand achieves transaction throughputs at the speed of traditional finance – but with immediate finality, near zero transaction costs and on a 24/7 basis.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

CONSUMERS PREFER CASH OVER CBDC: DEUTSCHE BANK SURVEY

Most respondents chose private crypto like BTC over government-backed digital currencies.

While several central banks across the globe are actively exploring the feasibility of launching a Central Bank Digital Currency (CBDC), a recent survey has revealed that cash will not be going away anytime soon as a majority of consumers are not enthusiastic about using those products.

The survey, conducted by Deutsche Bank, Germany’s leading investment bank, polled 4,850 respondents from Europe, the United Kingdom, and the United States. A majority of the respondents stated that they prefer conventional payment methods like cash and debit or credit cards.

Cash Reigns Supreme

According to the study, 59% of the respondents believe cash will always be useful, with 44% stating that they would prefer using cash for payments rather than CBDCs. Only a small percentage of respondents, 16%, expect CBDCs to become mainstream payment options.

Deutsche Bank analysts, Marion Laboure and Sai Ravindran, noted in the report, “While 59% of consumers believe that cash will always be relevant, the COVID-19 pandemic accelerated the shift toward digital payments, particularly among Gen Z.”

Although most of the respondents were hesitant about using a CBDC, about 31% said they would rather use a cryptocurrency managed by the government than one backed by private institutions.

Privacy Concerns Remain

The survey further revealed that privacy concerns significantly affect the adoption of CBDCs. Most of the participants, especially in the U.S., believe that general cryptocurrencies offer better privacy than government-backed digital currencies. About 21% of the respondents said they preferred a private cryptocurrency like Bitcoin.

On the other hand, most European respondents showed stronger preference for cash, due to the anonymity it offers, than those in the U.S. and the U.K.

Per the survey, central banks are increasing exploring wholesale CBDC use cases, however, user skepticism remains a major issue affecting mainstream adoption. A report by the Bank of Canada revealed that 86% of Canadians are opposed to CBDCs, with a whopping 92% preferring cash over a digital Canadian dollar (CAD).

@ Newshounds News™

Source: Crypto Potato

~~~~~~~~~

MANAGING SUDDEN WEALTH THROUGH SMART TEAM BUILDING BOB LOCK | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and RumbleNewshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 9-22-24

Good Morning Dinar Recaps,

Highlights from IOTA Demo Day: Exciting Innovations and Presentations on IOTA EVM

▪️IOTA has shared a highlight of the recent Demo Day program featuring the likes of Qiro Finance, Black Frog, Orobo Finance, Auvo Digital, The Real Lifestyle, and Defa Primitive.

▪️According to the IOTA founder, this program is a huge step towards supporting and mentoring its beneficiaries to impact the ecosystem significantly.

Good Morning Dinar Recaps,

Highlights from IOTA Demo Day: Exciting Innovations and Presentations on IOTA EVM

▪️IOTA has shared a highlight of the recent Demo Day program featuring the likes of Qiro Finance, Black Frog, Orobo Finance, Auvo Digital, The Real Lifestyle, and Defa Primitive.

▪️According to the IOTA founder, this program is a huge step towards supporting and mentoring its beneficiaries to impact the ecosystem significantly.

The much-anticipated Real-World Assets (RWA) Accelerator Demo Day program by IOTA (IOTA) and Tenity was held on September 17 in Singapore with the participation of six finalists selected and supported by the two. As we earlier reported, each finalist got a $50,000 grant as well as mentorship, tools, and networking opportunities.

Soon after the program, IOTA shared a highlight with the community featuring presentations by Qiro Finance, Black Frog, Orobo Finance, Auvo Digital, The Real Lifestyle, and Defa Primitive.

Here’s a recap of the incredible presentations from yesterday’s #IOTA @tenity_global Demo Day! 🌟Let’s dive into the highlights from each team’s journey and the innovations they’re bringing to #IOTAEVM 👇— IOTA (@iota) September 19, 2024

Qiro Finance

According to Qiro Finance’s presentation, it is building an outstanding on-chain private credit marketplace on the IOTA EVM. The idea is to bridge the on-chain investors and the traditional Fintech funding to solve a major problem of rising credit defaults in private credit protocols.

Black Frog

Black Frog’s presentation was centered around the proposal for small-scale miners to capitalize on the mineral market via tokenized assets and provide returns to investors on held commodities.

Researching the background of its provision, CNF observed that the demand for minerals, especially Cobalt, could accelerate considerably with the growing need for a shift to green energy. To enable the industry to meet this need, Black Frog provides financing and credit facilities via loans and bonds on the IOTA platform. Recently, it unveiled a commodity-backed yield-bearing stablecoin to improve the interest offerings on commodities held by small miners.

The Real Lifestyle

According to IOTA, The Real Lifestyle (TRL) provided a comprehensive presentation on its vision of tokenizing and fractionalizing real estate. Fascinatingly, TRL ensures investors are offered fractionalized investment in home ownership and rental properties. In addition to lowering the barrier for real estate investment and triggering financial returns, TRL ensures that liquidity and economic activities are brought to the IOTA EVM.

Orobo Finance

Orobo’s presentation highlighted the importance of digital product passports for the circular economy. It also mentioned several initiatives that have been fully developed and are in the pipeline, ranging from RWA tokenization to sustainability, digital twins, and compliance. Orobo can validate and verify products and materials using the IOTA’s digital product passports.

Auvo Digital

Auvo Digital focuses on digital identity by providing users with a no-code identity management platform to secure on-chain identity. At the program, they displayed their innovative tools for businesses and organizations to enable them to create and manage decentralized identities. According to them, this secures the privacy-focused platform on the IOTA EVM.

Defa Primitive

Defa Primitive spoke about the incredible potential of transforming traditional invoices into RWA tokens. According to them, their initiative unlocks finance for trade logistics, supply chains, and Small and Medium-sized Enterprises (SMEs). On top of that, it provides immeasurable opportunities for on-chain investors to access new opportunities on the IOTA EVM.

Commenting on the initiative for these six finalists, IOTA founder Dom Scheiner disclosed that the support and mentorship provided through the Accelerator Program enhances RWA tokenization growth while ensuring that IOTA EVM users benefit from cutting-edge solutions.

At press time, IOTA (IOTA) was trading at $0.13 after surging by 7.6% in the last 24 hours.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

CARDANO FOUNDER WARNS TRUMP DEFI VENTURE COULD POLITICIZE CRYPTO LANDSCAPE

Cardano and Ethereum co-founder Charles Hoskinson expressed deep concern over the new DeFi platform venture of former President Donald Trump known as World Liberty Financial.

Speaking in interviews, Hoskinson said the venture is likely to turn into a political flashpoint. This might add to the already delicate situation surrounding regulation of cryptocurrencies in the United States.

Through his comments, the executive expressed an emerging discomfort about seeing how politics is penetrating into the digital finance world from the top echelons of the industry.

Trump: Political Polarization And Crypto

The biggest fear Hoskinson has is political polarization due to Trump in crypto. According to him, “Everything Trump does, the left hates with such a passion,” suggesting that Trump’s actions might provoke a backlash from Democrats.

This could result in investigations by regulatory bodies like the Department of Justice or the Securities and Exchange Commission, potentially stifling innovation and growth within the industry.

According to the Cardano founder, although Trump presents himself as a pro-crypto candidate, the history of high staff turnover at the White House raises all kinds of concerns in regards to his ability to create a clear policy for cryptocurrency.

Moreover, Hoskinson criticized both Trump and Vice President Kamala Harris for failing to present a vision for the future of crypto in America. He believes that neither leader demonstrates enough sophistication in understanding the complexity surrounding regulation of cryptocurrency.

This is particularly alarming because both are positioning themselves for positions of leadership in America at a time when adoption of cryptocurrency across the world is increasing geometrically.

Implications For The Crypto Sector

The potential politicization of World Liberty Financial could have far-reaching implications for the entire crypto sector. Hoskinson emphasized that this platform might transform what has traditionally been a bipartisan issue into a divisive one.

Hoskinson warned that if Democrats feel threatened by Trump’s DeFi initiative, they might use governmental powers to choke it. This could make most of the crypto projects go offshore where regulatory environments could be more conducive.

Despite those risks, Hoskinson mentioned a couple of positive aspects to Trump’s approach on crypto. He said that the recent outreach by Trump toward the crypto community attracted influential investors and advocates within the industry. However, he remains cautious about whether this support will translate into effective policies if Trump returns to power.

Future Prospects For Digital Currencies

Looking ahead, Hoskinson said that the key thing is establishing a clear regulatory framework to encourage growth in the US crypto market. He thinks that if America could create an environment conducive to innovation, this could end up adding trillions of dollars to the country’s economy within the next decade.

To the contrary, he says other regions such as Singapore and parts of Europe are moving ahead with crypto-friendly regulations while the US lags behind.

Accordingly, players in the crypto field will need to be very vigilant about the way things progress politically as World Liberty Financial builds up to its launch. Success or failure of this project could set monumental precedent for subsequent crypto projects in America.

The bottom line is going to depend on whether or not both political parties learn to engage with this space of rapid change.

This warning from Charles Hoskinson reflects bigger concerns within the cryptocurrency community that international political affiliations should not influence regulatory policies. As Trump’s DeFi plans take shape, all eyes will be on how they impact not just his political ambitions but also the future viability of cryptocurrencies in America.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

AUDIO - A MUST HEAR! DO YOU WANT TO GO HOME? WHO ARE YOU? | Youtube

Jim educates us on our history and the CONtracts that have been hidden from us to show how we got to where we are since the days of Lincoln and the Civil War. A must to listen to.

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 9-21-24

Good Afternoon Dinar Recaps,

US PAYING $1,157,762,000,000 IN INTEREST ON NATIONAL DEBT IN ONE YEAR, SAYS TREASURY DEPARTMENT, AS ELON MUSK WARNS GOVERNMENT ‘WHISTLING PAST THE GRAVEYARD’

The US Treasury Department says it expects to pay a whopping $1.157762 trillion in interest on the national debt for the fiscal year 2024.

The interest represents the cost of borrowing money, which the government does by issuing Treasury bonds, bills and other securities.

Good Afternoon Dinar Recaps,

US PAYING $1,157,762,000,000 IN INTEREST ON NATIONAL DEBT IN ONE YEAR, SAYS TREASURY DEPARTMENT, AS ELON MUSK WARNS GOVERNMENT ‘WHISTLING PAST THE GRAVEYARD’

The US Treasury Department says it expects to pay a whopping $1.157762 trillion in interest on the national debt for the fiscal year 2024.

The interest represents the cost of borrowing money, which the government does by issuing Treasury bonds, bills and other securities.

*********************************

Interest payments have already totaled $1.05 trillion as of August, and the remaining payments will be added in by the end of the month as the fiscal year comes to a close.

The Treasury Department says interest on the debt is expected to be the country’s third-largest expense this fiscal year just behind the Department of Health and Human Services (Medicare and Medicaid) and Social Security Administration at $1.727 trillion and $1.520 trillion, respectively.

The updated numbers come as billionaire Elon Musk issues a warning on the growing deficit and debt, which has now reached $35.3276 trillion.

In a panel interview at the All-In Summit 2024, Musk said he believes the government is projecting confidence while in a dire situation.

“Everyone seems to be sort of whistling past the graveyard on this one… The Defense Department budget is a very big budget. It’s a trillion dollars a year – DoD (Department of Defense), intel – it’s a trillion dollars. And interest payments on the national debt just exceeded the Defense Department budget. They’re over a trillion dollars a year just in interest and rising.

We’re adding a trillion dollars to our debt, which our kids and grandkids are going to have to pay somehow, every three months. Soon it’s going to be every two months and then every month.

And then the only thing that we’ll be able to pay is interest.”

The national debt jumped by about $1.337 trillion from January 1st until now.

This means the debt has actually increased by around $445.67 billion every three months on average.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

SEC GREENLIGHTS OPTIONS TRADING FOR BLACKROCK’S ISHARES BITCOIN TRUST

The U.S. Securities and Exchange Commission granted approval for Nasdaq to list and trade options on BlackRock’s iShares Bitcoin Trust.

*******************************

Per the details shared in the official filing on Sept. 20, the SEC’s approval comes after a lengthy review process that started on Jan. 9, 2024. That was when Nasdaq initially filed the proposal to trade options on exchange-traded products.

Nasdaq consistently followed up on its proposal with multiple amendments, which began on Jan 11. Over the following months, the exchange submitted additional amendments and information regarding IBIT and other Bitcoin-based ETPs.

SEC’s approval involved multiple stages of review

After almost eight months of review, the SEC finally gave the greenlight for Nasdaq’s proposal. The commission stated that the exchange even proposed to modify its rules to list and trade options on IBIT.

According to the official filing, options on IBIT will be physically settled with American-style exercise. Nasdaq also highlighted that IBIT options will be under the exchange’s continued listing standards.

“Options on IBIT will be subject to the Exchange rules that currently apply to the listing and trading of all ETF options on the Exchange,” the filing reads.

Crypto analysts say decision is bullish

Reacting to the SEC’s decision, several key crypto traders and analysts took to X to share their opinion. Crypto trader Ash Crypto tweeted that this is ultra bullish.

Senior ETF analyst Eric Balchunas also shared details of the approval on X. Balchunas tweeted his assumption that others will be approved in short order.

Balchunas also pinpointed this as a huge win for the Bitcoin ETFs, stating that this will attract more liquidity. However, he highlighted the fact that this is “just one stage of approval.”

The proposal still needs approval from the OCC and CFTC before the official listing.

“I’m assuming others will be approved in short order,” Balchunas added, calling it a “huge win” for Bitcoin ETFs “as it will attract more liquidity which will in turn attract more big fish.”

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

**********************************

TRUMP DEBUTS EXCLUSIVE SILVER COIN—DESIGNED BY TRUMP, MINTED IN AMERICA

Trump's new silver coin is not an investment tool.

Key Takeaways

▪️The Trump commemorative coin is designed by Donald Trump and is not intended for investment purposes.

▪️The coin features high-quality silver with a proof finish and comes with a certificate of authenticity.

Former US President Donald Trump has announced the launch of his first officially authorized commemorative silver coin, named “TRUMP COINS.” Priced at $100, the coin is designed by Trump himself and is minted in the US.

The item features 99.9% purity and a proof finish, marking it as the highest standard in collectible medals. It showcases a portrait of Trump on the front and the White House on the reverse. Each piece is encased in a premium custom felt pouch and includes a certificate of authenticity.

“This is a 1oz .999% silver medallion and struck with a proof finish featuring our 45th President’s profile on the obverse and the White House on the reverse,” as described on the initiative’s official website. RealTrumpCoins . com

The coin will be available for purchase starting September 25 and is not intended as a legal tender or an investment tool.

“The coins are intended as collectible items for individual enjoyment only, and not for investment purposes. The coins are not political and have nothing to do with any political campaign,” as noted in the descriptions.

Enthusiasts can join the waitlist to purchase this exclusive item at the project’s official website.

@ Newshounds News™

Source: Crypto Briefing

~~~~~~~~~

******************************

RIPPLE NEWS: CEO BRAD GARLINGHOUSE ISSUES GRAVE WARNING TO XRP USERS AMID GROWING SCAMS

India’s Supreme Court YouTube channel was hacked on Friday, causing a disruption in its usual livestream of court hearings. Instead of showing the constitutional bench proceedings, the channel showed videos promoting XRP, a cryptocurrency developed by Ripple Labs.

One specific video was titled “Brad Garlinghouse Ripple Responds to SEC’s $2 Billion Fine,” but it only featured a blank screen. This comes as the FBI recently reported that Americans lost approximately $5.6 billion to cryptocurrency scams in 2023.

Ripple CEO Brad Garlinghouse immediately took to his X handle and reacted to the news. The CEO expressed disappointment and wrote, Unfort this feels like my annual PSA (and yes, I sound like a broken record): @Ripple and execs will NEVER ask you to send us XRP.

It’s pathetic to see scammers prey on & exploit innocent crypto users, and the ease at which social media platforms allow it to happen. Stop, spot, avoid – protect yourself.”

Ripple took legal measures to address the increasing number of scams. In April 2020, Ripple filed a lawsuit against YouTube, claiming the platform did not do enough to stop fraudulent cryptocurrency promotions. The case was settled in 2021, but Garlinghouse has remained an advocate for stronger safeguards on social media platforms.

This incident marks the first time the court’s YouTube channel, active since 2018 for broadcasting key hearings, has been compromised. The channel has played a crucial role in live-streaming important cases.

Following the breach, the Supreme Court administration has launched a formal investigation. As a precaution, the YouTube channel was disabled to prevent further unauthorized access and the potential spread of misinformation.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

⚡️BREAKING NEWS:BILLION DOLLAR BANK BNY SET TO CUSTODY BITCOIN (BTC) THE FIRST BANK IN U.S. HISTORY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 9-21-24

Good Morning Dinar Recaps,

BREAKING NEWS: BILLION-DOLLAR BANK BNY SET TO CUSTODY BITCOIN (BTC) AS THE FIRST BANK IN U.S. HISTORY

▪️BNY Mellon becomes the first bank with the SEC exemption from crypto accounting rules.

▪️SEC’s variance for BNY Mellon could open doors for more banks in crypto.

BNY Mellon has emerged as a pioneer in the cryptocurrency custody industry, becoming the first bank to be excluded from the SEC’s Staff Accounting Bulletin No. 121 (SAB 121). This significant development was announced during a public hearing in Wyoming’s Select Committee on Blockchain, Financial Technology, and Digital Innovation Technology.

Good Morning Dinar Recaps,

BREAKING NEWS: BILLION-DOLLAR BANK BNY SET TO CUSTODY BITCOIN (BTC) AS THE FIRST BANK IN U.S. HISTORY

▪️BNY Mellon becomes the first bank with the SEC exemption from crypto accounting rules.

▪️SEC’s variance for BNY Mellon could open doors for more banks in crypto.

BNY Mellon has emerged as a pioneer in the cryptocurrency custody industry, becoming the first bank to be excluded from the SEC’s Staff Accounting Bulletin No. 121 (SAB 121). This significant development was announced during a public hearing in Wyoming’s Select Committee on Blockchain, Financial Technology, and Digital Innovation Technology.

SEC’s Landmark Exception: BNY Mellon Navigates SAB 121 with Ease

The SEC granted BNY Mellon a “variance” from the SAB 121 accounting requirements. This exception allows BNY Mellon to provide institutional crypto custody services, including Bitcoin, as part of its core business activities. Chris Land, general counsel for U.S. Senator Cynthia Lummis (R-WY), testified:

“[BNY] is looking to get more involved in the crypto custody business. They had some problems with Staff Accounting Bulletin (SAB) 121, and the SEC has apparently given them some kind of variance from SAB 121 to move forward.”

This decision marks a watershed moment for the bank and the whole crypto industry, indicating a shift in regulatory views toward traditional financial institutions that engage in digital asset custody.

SAB 121, which has been the subject of discussion in the financial sector, requires banks that hold cryptocurrencies on behalf of clients to register these assets as liabilities on their balance sheets.

Many in the crypto sector regard this rule as cumbersome, as it adds significant financial risk to any institution that engages in crypto custody.

SEC’s Exemption Sparks New Opportunities for Traditional Banks in Crypto

BNY Mellon’s exemption from this legislation might be a game changer, opening the door for other traditional banks to enter the cryptocurrency industry.

This exemption not only represents a watershed moment for BNY Mellon, but it could also dramatically increase institutional participation in the crypto business, lowering entrance barriers for banks that have been cautious owing to regulatory concerns.

The decision may serve as a stimulus for greater acceptance of crypto services by large financial institutions, indicating a mature market in which digital assets are increasingly regarded as viable investment possibilities.

This is not BNY Mellon’s first foray into the crypto and blockchain industry. Last year, in a Swift-led project revealed by CNF, BNY Mellon and Deutsche Bank worked together on the interoperability of electronic Bills of Lading (eBL) on blockchain.

This program sought to improve commercial efficiency by incorporating blockchain technology into traditional financial systems.

Such agreements demonstrate BNY Mellon’s continuous commitment to using blockchain technology to improve financial processes, cementing the company’s position as a pioneer in integrating crypto and blockchain solutions into traditional banking.

While BNY Mellon is making progress in crypto custody, other industry titans are also strengthening their standing in the crypto area. For example, as we previously highlighted, MicroStrategy’s Bitcoin holdings currently total 252,220 BTC after a new 7,420 BTC purchase, confirming its position as a leader in institutional BTC investment.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS NEWS: After Oil, BRICS Accounts for 72% of the World’s Rare-Earth Metals

After the BRICS expansion in 2024, the alliance officially accounts for 42% of the global oil and gas reserves. If that wasn’t enough, BRICS now accounts for the majority of the rare-earth metals reserve totaling to 72%. This gives the alliance an added advantage in global trade in the oil and rare-earth metals sectors.

BRICS countries complement each other for the extraction of critical minerals and production. The cooperation could lead to mutual trade within BRICS members and ensure the continuity of the supply. The alliance can also decide on the stability of the prices and be ahead in decision-making.

Latest reports indicate that the alliance will discuss oil and rare-earth metals trade in the next BRICS summit. The geological trade deals could be rewritten giving the bloc an undue advantage in settling cross-border transactions. “Prospects for cooperation between the BRICS countries in the field of studying, developing and rational use of mineral resources,” is on the cards, read a report.

“One of the possible areas of cooperation in this sphere is to expand the mutual trade in mineral commodities and metals for the purpose of ensuring continuity of supplies and stability of prices,” said Evgeny Petrov, the Head of the Russian Federal Subsoil Resources Management Agency Rosnedra.