Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Wednesday Evening 8-7-24

Good Evening Dinar Recaps,

India has no plans to regulate crypto sales and purchases

Despite tightening measures against money laundering and terror financing, India has no immediate plans to regulate cryptocurrency transactions.

The Indian government revealed no immediate plans to regulate the sales and purchase of cryptocurrencies as it continues to tighten oversight on crypto-related money laundering and terror financing.

During a parliamentary meeting on Aug. 5, Pankaj Chaudhary, the Minister of State in India’s Ministry of Finance, responded to several questions detailing the nation’s current stance on crypto regulations.

Good Evening Dinar Recaps,

India has no plans to regulate crypto sales and purchases

Despite tightening measures against money laundering and terror financing, India has no immediate plans to regulate cryptocurrency transactions.

The Indian government revealed no immediate plans to regulate the sales and purchase of cryptocurrencies as it continues to tighten oversight on crypto-related money laundering and terror financing.

During a parliamentary meeting on Aug. 5, Pankaj Chaudhary, the Minister of State in India’s Ministry of Finance, responded to several questions detailing the nation’s current stance on crypto regulations.

Chaudhary said that India has not conducted any study or research to understand the adoption level of cryptocurrencies among its citizens. He responded by saying that:

“Crypto assets or Virtual Digital Assets (VDAs) are unregulated in India and the government does not collect data on these assets.”

India will tax crypto, not regulate it

Although India officially implemented a tax system for cryptocurrency transfers and profits on April 1, 2022, the government has no plans to regulate the sale and purchase of cryptocurrencies. Under India’s crypto law, citizens are required to pay a 30% tax on unrealized crypto gains and a 1% tax deducted at source (TDS).

Chaudhary highlighted India’s ongoing efforts toward Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) in crypto. Earlier in January, India banned several offshore crypto exchanges for noncompliance with local regulations, including Binance, KuCoin, Bitget, Huobi, OKX, Gate.io and MEXC.

However, the nation has no plans to regulate crypto purchases and sales. Chaudhary added:

“Currently, there is no proposal to bring legislation for regulating the sales and purchase of virtual digital assets in the country.”

Ongoing efforts to curb illicit crypto activities

He also reminded that India had pushed for a coordinated effort from all G20 nations to curb the illicit use of cryptocurrencies globally during its 2023 presidency.

Binance’s plan to reenter India after paying a $2 million fine for noncompliance was recently met with a roadblock.

On Aug. 6, the Directorate General of Goods and Service Tax Intelligence (DGGI) — an Indian law enforcement agency — demanded 722 crore Indian rupees ($86 million) in unpaid taxes from Binance.

Indian authorities had sent email notices to Binance offices in Seychelles, the Cayman Islands and Switzerland, which the crypto exchange ignored. However, Binance later appointed a local counsel to officially resolve its tax obligations.

@ Newshounds News™

Read: Coin Telegraph

~~~~~~~~~

HOW TO BUY XRP

"XRP is one of the largest cryptocurrencies by market capitalization, starting the year with a value of more than $30 billion. XRP’s origins date back to 2012 when the company now known as Ripple was founded and the XRP Ledger launched."

"Unlike bitcoin (BTC) and ethereum (ETH), the Ripple network and its XRP native cryptocurrency were designed to facilitate financial transfers among banks and other global financial institutions.

The goal of the project was to create a cheaper, faster and more secure alternative to the Society for Worldwide Interbank Financial Telecommunications, or SWIFT, which executes financial transfers."

WHAT IS XRP?

"While investors sometimes refer to the XRP cryptocurrency as Ripple, in fact Ripple is the technology company backing XRP and the XRP ledger blockchain.

The XRP blockchain itself is decentralized and public. The Ripple transaction protocol facilitates XRP network transactions, a set of rules governing RippleNet. RippleNet is a network of payment facilitators and banks worldwide that helps participants send and receive payments seamlessly, reducing transaction bottlenecks."

"Unlike bitcoin, dogecoin (DOGE) and other cryptocurrencies mined using a proof-of-work consensus mechanism, XRP is pre-mined and has a maximum total supply of 100 billion tokens. "

1. Decide if you want to buy XRP.

"XRP has advantages over bitcoin, ethereum and other leading cryptocurrencies, but it may only be right for some investors. "

2. Find a place to buy XRP.

"Once you have decided to buy XRP, you must find a cryptocurrency exchange or investing app that supports XRP trading. Exchanges are online platforms where users trade cryptocurrencies, and XRP is supported on a large number of markets and exchanges. "

Centralized exchanges

"A centralized crypto exchange is similar to a traditional financial institution in which a centralized company acts as an intermediary between transaction participants. Leading centralized crypto exchanges that support XRP trading include Binance, Coinbase, Kraken and Bybit."

Decentralized exchanges

"A decentralized crypto exchange allows users to make direct transactions through blockchain technology to complete trades without needing a centralized intermediary. Leading decentralized crypto exchanges that support XRP trading include PancakeSwap, SimpleSwap and onXRP."

3. Choose a form of payment.

Once you open an account on your preferred exchange, you must decide which payment methods are compatible with your exchange and convenient for you.

Fiat currency

"Many centralized exchanges allow the U.S. dollar or other fiat currencies for payment. Fiat currencies are government-supported currencies that are not backed by physical assets. Examples include the U.S. dollar, Japanese yen and euro."

Cryptocurrency

"Crypto exchanges often allow users to buy and sell one cryptocurrency using other cryptocurrencies. It’s common for crypto traders to buy and sell altcoins like XRP using bitcoin."

Stablecoins

"Stablecoins are cryptocurrencies designed to have stable prices, typically by pegging them to the price of a fiat currency or other commodity. Popular stablecoins include tether (USDT), USDC (USDC) and Dai (DAI), which are all pegged to the U.S. dollar."

4. Store your XRP.

"You will need a digital wallet compatible with XRP to store your crypto. Digital wallets are hardware or software that store a user’s private keys and are used to send and receive crypto. Some cryptocurrency exchanges provide custodial wallets to their customers.

But others require noncustodial wallets that leave the user responsible for securing private keys. Centralized exchanges such as Kraken and Coinbase offer users custodian wallets.

XRP is also supported on noncustodial software wallets such as GateHub, Xumm and Trust Wallet, as well as noncustodial hardware wallets such as Ledger, Keystone and Trezor."

@ Newshounds News™

Read more: USA Today

~~~~~~~~~

De-Dollarization Faltering in Africa Because Citizens Lack Confidence in Their National Currencies

HOW LONG WILL IT TAKE TO DE-DOLLARIZE THE WORLD WHEN WE HAVE REAL-WORLD PROBLEMS SUCH AS THIS ARTICLE PRESENTS STILL EXIST

"Sometime in 2023, during the peak of anti-dollar hype, Kenyan President William Ruto questioned why his country and Djibouti still had to settle trade in U.S. dollars when they had their currencies."

" The U.S. dollar hegemony was never widely seen as a threat, even as a few small countries were highlighting Washington’s apparent use of the currency’s dominance to achieve political goals.

However, when the U.S. took the bold step of using the dollar’s dominance to punish Russia after its invasion of Ukraine, suddenly there seemed to be a consensus among countries that Washington was weaponizing its currency.

For countries fearing they might be the next target, advocating for an alternative to the dollar or de-dollarization became the logical course of action."

"Clearly, the process or task of establishing a currency that eats into the greenback’s dominance is a mammoth one. But why is it difficult to create or launch a currency that can challenge the U.S. dollar? Alternatively, what has enabled the dollar to remain the most preferred reserve currency, even among those bitterly opposed to the U.S.?"

U.S. Dollar as a Store of Value

"Well, a lot may have nothing to do with what the U.S. is doing right but rather with what its opponents are doing. A good example exists in Africa, where persistently high inflation rates have convinced citizens that holding onto a local currency is unwise."

"Injecting money that does not correspond with an economy’s production usually results in one thing: runaway inflation. Unfortunately, this is precisely what many central banks, including those in Africa, have been doing, leading to currency crises and eventual dollarization."

"So, to answer the Kenyan President and those asking a similar question, traders between two African countries demand payment in U.S. dollars because they lack confidence in their own or their counterpart’s national currency.

It does not matter how far away they are from the United States; the two traders prefer this because it has a stable value, at least when compared with their respective national currencies."

"While the Kenyan leader has gone as far as to plead with traders to use local currencies, several African countries have banned the use of foreign currency in domestic transactions. However, this approach has often not translated into the increased local currency use. Instead, it has driven traders underground, harming local economies."

@ Newshounds News™

Read more: Bitcoin

~~~~~~~~~

Judge Fines Ripple $125M, Bans Future Securities Law Violations in Long-Running SEC Case

"A federal judge ordered Ripple to pay $125 million in civil penalties and imposed an injunction against future securities law violations on Wednesday."

"District Judge Analisa Torres, of the Southern District of New York, imposed the fine after finding that 1,278 institutional sale transactions by Ripple violated securities law, leading to the fine.

The $125.035 million fine is well below the $1 billion in disgorgement and prejudgment interest and $900 million in civil penalty the SEC sought."

"The SEC tried unsuccessfully to appeal that portion of the ruling while the case was ongoing."

"The injunction document requires Ripple to file a registration statement if it intends to sell any securities. The SEC is likely to appeal the July 2023 ruling now that the judge has imposed a sentence, after the same judge denied the SEC's motion for an interlocutory appeal last year."

"The SEC and Ripple settled charges tied to CEO Brad Garlinghouse and other executives after that interlocutory appeal was denied.

The price of XRP rose 3 cents, or around 2%, after the judgement was published."

@ Newshounds News™

Read more: CoinDesk

~~~~~~~~~

Fed Data Shows 9.1% of Credit Card Balances Hit Delinquency Status This Year | PYMNTS

@ Newshounds News™

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Evening 8-6-24

Good evening Dinar Recaps,

Google Pay, Walmart-backed PhonePe to join India’s CBDC pilot

In April, Reserve Bank of India Governor Shri Shaktikanta Das announced plans to expand its retail central bank digital currency (CBDC) pilot beyond banks. Last month the central bank said payment providers would join the digital rupee pilot this quarter.

Now Reuters reported that five payment providers have applied, citing sources. They are Google Pay, Walmart-backed PhonePe, Cred, Amazon Pay and Mobikwik.

PhonePe is India’s leading payments app, followed by GooglePay. Together they make up 85% of transactions and value for UPI, India’s successful instant payment solution, which processes almost 14 billion transactions monthly.

Not mentioned among the digital rupee applicants is third ranked player PayTM, which has a 6% UPI market share. Cred is fourth, AmazonPay is sixth and Mobikwik is sixteenth, but the UPI figures drop off significantly beyond the big three.

Good Evening Dinar Recaps,

Google Pay, Walmart-backed PhonePe to join India’s CBDC pilot

In April, Reserve Bank of India Governor Shri Shaktikanta Das announced plans to expand its retail central bank digital currency (CBDC) pilot beyond banks. Last month the central bank said payment providers would join the digital rupee pilot this quarter.

Now Reuters reported that five payment providers have applied, citing sources. They are Google Pay, Walmart-backed PhonePe, Cred, Amazon Pay and Mobikwik.

PhonePe is India’s leading payments app, followed by GooglePay. Together they make up 85% of transactions and value for UPI, India’s successful instant payment solution, which processes almost 14 billion transactions monthly.

Not mentioned among the digital rupee applicants is third ranked player PayTM, which has a 6% UPI market share. Cred is fourth, AmazonPay is sixth and Mobikwik is sixteenth, but the UPI figures drop off significantly beyond the big three.

If the CBDC follows UPI, then banks might end up playing second fiddle to the payment apps. Three banks rank in the top ten for UPI apps – Axis, ICICI and Kotak Mahindra – with the largest in the fifth spot. However, the three banks combined have a market share of less than one percent.

The percentages reference the user interface used to initiate payments. UPI is for interbank payments, so the money comes from bank accounts.

A Reuters source also stated that the erupee pilots are likely to stay in the pilot stage for a couple of years, which makes sense.

Advanced CBDC functionality takes time

From the early days, the central bank managed expectations, noting that the CBDC was unlikely to compete with the well-established UPI payment infrastructure.

Without more advanced functionality, there’s no incentive for consumers to switch. And if providers offer cash incentives, the switch could be temporary, as has happened in China with its digital yuan red envelope incentives.

Some of the distinguishing functionalities of India’s CBDC include offline payments and programmable payments, which are still in the early stages. Unlike rolling out the app, both may take a little time to come to fruition.

Plus, both the Ministry of Finance and central bank believe that the CBDC killer app will be cross border payments, especially for remittances. Even more so than the other two features, cross border payments take time to develop through collaboration with other jurisdictions.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

Euro stablecoin market surges under MiCA

French and Irish fintech companies have partnered to introduce a euro-backed stablecoin. The coin will launch on the Stellar blockchain a month after MiCA stablecoin laws came into force.

The European Union’s Markets in Crypto-Assets Regulation (MiCA) framework is gradually coming into effect in line with its planned implementation timeline. The initial set of regulations, which took effect on July 1, focused on stablecoins and their issuers.

These clear guidelines have both cleaned out the market of players not able to meet regulatory requirements and created a favorable environment for stablecoins pegged to local currency.

One example is a new partnership between the France-based fintech company Next Generation and Ireland-based electronic money institution (EMI) Decta, which announced a plan to reintroduce a euro-pegged stablecoin, EURT, on the Stellar blockchain.

According to the involved parties, the initiative, which launched on Aug. 5, is fully MiCA compliant.

MiCA rebirth

Next Generation has strong ties to the renowned fintech player Tempo France. This company initially launched EURT in 2017 in collaboration with the Stellar Foundation, pioneering one of the first euro-pegged stablecoins.

However, the absence of a regulatory framework then led to the project’s suspension. However, under MiCA, stablecoins are classified as electronic money tokens (EMTs), aligning them with traditional e-money and necessitating that issuers possess an EMI license or be a credit institution.

This regulatory clarity has transformed the euro-backed stablecoin market, making it more predictable and attractive to investors.

Circle became the first global stablecoin issuer to comply with MiCA and chose France as its European headquarters, citing the country’s “forward-looking” stance on digital asset regulation.

The activation of MiCA is expected to drive substantial growth in the euro-backed stablecoin sector. Market predictions forecast a minimum market capitalization of 15 euros by 2025, reaching 70 billion euros by 2026 and potentially surpassing 2 trillion euros by 2028.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

UBS says ‘going into Japan now is like catching a falling knife,’ warns stock sell-off will continue

“The only reason why the Japanese market is up so strongly in the last two years is because the Japanese yen has been very, very weak.

Once it reverses, you got to get out right and I think they’re all getting out right now as a result of that,” Tay said.

"The yen, which weakened to a 38-year low of 161.99 against the U.S. dollar in June, reversed course during the run-up to the Bank of Japan’s policy meeting."

"It strengthened sharply after the BOJ raised its benchmark interest rate last week to around 0.25% and decided to trim its purchases of Japanese government bonds."

"Currently, the yen was last trading at 144.82, its lowest level against the greenback since January.

A stronger yen pressurizes Japanese stock markets, which are heavily dominated by trading houses and export-oriented firms by eroding their competitiveness."

"Tay said the yen can indicate whether the Japanese market will do well. As the yen has strengthened, stocks have declined, “there is still a lot more pressure on the Japanese stock market, unfortunately,” he said.

"While Tay acknowledged that some gains made by the market were due to corporate restructuring efforts by the Tokyo Stock Exchange, “the main driver was the Japanese yen.”

"Now, with the U.S. Federal Reserve signaling rate cuts are on the table and the Bank of Japan raising rates, the interest differential between the two central banks will narrow, making a “carry trade” less attractive, potentially setting the stage for the yen to strengthen further."

EVERYONE IS WONDERING WHY DID THE MARKETS CRASH ON 8/5 AND THEN REBOUND.

JAPAN SET THE STAGE WITH A WEAKING NIKKEI. THIS ARTICLE SHEDS LIGHT ON THE CURRENCY SIDE OF THIS EVENT AND HOW THE YEN NEEDS TO STRENGTHEN AGAINST THE DOLLAR

@ Newshounds News™

Read more: CNBC

~~~~~~~~~

Morgan Stanley, one of the most important financial institutions in the world, has stated that CRYPTOCURRENCIES WILL DISRUPT THE GLOBAL FINANCIAL SYSTEM IN 2024.

In a Banking And Financial Law Journal, it is documented that Morgan Stanley has also stated that Ripple is a LEADING PAYMENT ALTERNATIVE TO SWIFT.

And their own research reports, Morgan Stanley notes that XRP is more efficient than BTC and is closer to what traditional banks do today.

@ Newshounds News™

https://x.com/SMQKEDQG/status/1820783189197017134

@ Newshounds News™

Read more:

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-6-24

Good Morning Dinar Recaps,

STELLAR Blockchain Chosen for New EURT Euro-Pegged STABLECOIN Initiative

"Ireland-based electronic money institution (EMI) DECTA is partnering with French fintech company Next Generation to introduce a new Euro-pegged stablecoin, ‘EURT’.

The collaboration aims to create a fully compliant stablecoin that adheres to the Markets in Crypto-Assets (MiCA) regulations and operates on the Stellar blockchain, alongside three additional platforms."

Good Morning Dinar Recaps,

STELLAR Blockchain Chosen for New EURT Euro-Pegged STABLECOIN Initiative

"Ireland-based electronic money institution (EMI) DECTA is partnering with French fintech company Next Generation to introduce a new Euro-pegged stablecoin, ‘EURT’.

The collaboration aims to create a fully compliant stablecoin that adheres to the Markets in Crypto-Assets (MiCA) regulations and operates on the Stellar blockchain, alongside three additional platforms."

"Next Generation, which has close ties with Tempo France, previously launched EURT with the Stellar Foundation as one of the first stablecoins in 2017.

However, the project was suspended due to the lack of a regulatory framework. The implementation of MiCA now provides a structured environment, facilitating the relaunch of this project."

"As of 1 July 2024, the new MiCA regulations permit the issuance of Euro-pegged stablecoins exclusively by credit institutions or EMIs within the EU. With its EMI license from the Central Bank of Ireland, DECTA is well-positioned to be a pioneering issuer under these new regulations."

“The implementation of MiCA has ushered in a new era in the history of modern digital finance in Europe,” said Suren Hayriyan, president of Next Generation. “The demand for Euro stablecoins is extremely high. Companies, entrepreneurs, and private users today lose a lot on forced conversions.

"The firms plan to launch EURT in October, aligning with strategic goals and regulatory milestones. The partners emphasize the SIGNIFICANCE OF REGULATION, indicating that UNREGULATED Euro-denominated stablecoins will no longer have a place in the market"

@ Newshounds News™

Read more: Digital Pound Foundation

~~~~~~~~~

We’re excited to announce that #Hedera has officially joined the @IIF

(Institute of International Finance), joining the likes of @circle @coinbase, and @BlackRock, and other leading institutions to collaboratively foster global financial stability and sustainable economic growth.

@ Newshounds News™

Read more: Twitter, IIF

~~~~~~~~~

Hedera - HBAR

@ Newshounds News™

~~~~~~~~~

JUST IN: El Salvador bought more #Bitcoin today while everyone else is selling.

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

ARE CBDC'S A FORM OF CRYPTOCURRENCY?

THIS ARTICLE IS VERY COMPREHENSIVE AND WE HIGHLY RECOMMEND CLICKING THE LINK TO THE FULL ARTICLE FOR REVIEW

"Although CBDCs are a form of digital currency, they are not a cryptocurrency. Compared to cryptocurrencies, CBDCs are centralized, meaning they’re issued and regulated by a monetary authority — in this case, a country’s government.

They’re also considered legal tender and hold the same status as any traditional fiat currency issued by a central bank. Finally, by virtue of the fact that CBDCs are based on fiat currency, they’re far less volatile than cryptocurrencies, whose value is determined by market forces and speculative activity."

"While both CBDCs and cryptocurrencies have their advantages and disadvantages, the general consensus is that they are two very different things, with different implications for the economy and society at large."

"The decentralized nature of cryptocurrencies has also accelerated innovation in cross-border payments — for example, RIPPLE, a Real-Time Gross Settlement system, has successfully built a global payment ecosystem with the XRP cryptocurrency at its core."

"The growing popularity of cryptocurrencies has created increased competition for central banks, which have realized that they need to offer instant, electronic payments to stay current and maintain market share."

"There’s been some confusion recently around the relationship between FedNow and CBDCs, with some wondering whether FedNow is a CBDC. To cut right to the chase: No, it is not, and the two are fundamentally different.

CBDCs are not a payment mechanism, but rather a form of currency and a digital means of storing value. FedNow, however, is a payment mechanism — in other words, it’s a means of moving funds from one bank account to another.

"To put things into perspective, the FedNow Service can be likened to a highway system, providing a fast and efficient infrastructure for the movement of payments between financial institutions.

CBDCs enable central banks to compete with private-sector offerings by providing a wider array of services to consumers, including a more stable, secure alternative to cryptocurrencies.

There’s also a cost-saving incentive to CBDCs, as electronic payments are less expensive to process — both for governments and financial institutions — than paper-based payments."

"Looking to the future, FedNow, digital payments, ISO 20022, and CBDCs will be transformational not only for businesses within the financial services industry but for anyone who uses financial services. In the long run, they will coexist with cryptocurrencies, providing consumers and businesses with a wide range of complementary mechanisms for the digital transfer of value."

@ Newshounds News™

Read more: Volantetech

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Evening 8-5-24

Good Evening Dinar Recaps,

Three-Quarters of Banks Face Digital Banking Infrastructure Issues The banking industry is experiencing a seismic shift as agile, digital-native FinTechs capture an ever-growing share of the market.

Burdened by outdated technology, traditional financial institutions face mounting challenges in delivering modern digital services.

The growing dominance of FinTechs — securing nearly half of all new account openings — highlights the urgency for banks to modernize their infrastructure.

Good Evening Dinar Recaps,

Three-Quarters of Banks Face Digital Banking Infrastructure Issues

The banking industry is experiencing a seismic shift as agile, digital-native FinTechs capture an ever-growing share of the market.

Burdened by outdated technology, traditional financial institutions face mounting challenges in delivering modern digital services.

The growing dominance of FinTechs — securing nearly half of all new account openings — highlights the urgency for banks to modernize their infrastructure.

With consumer expectations rapidly evolving toward seamless digital experiences, banks must navigate the high costs and complexities of updating their core systems.

Exploring incremental modernization through application programming interfaces (APIs) may offer a viable path forward, enabling banks to enhance their digital capabilities and remain relevant in an increasingly competitive landscape.

A recent PYMNTS Intelligence Report, “Core Strength: FIs Must Modernize to Meet the FinTech Challenge,” in collaboration with Galileo, highlights the urgent need for traditional financial institutions to overhaul their outdated systems to keep pace with digital-native competitors.

The report reveals that 75% of banks struggle with implementing new digital solutions due to their legacy infrastructure, underscoring the critical nature of modernization efforts.

As FinTechs continue to capture a growing market share, banks face mounting pressure to adopt agile technologies and innovative approaches.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

The crypto market has just witnessed its largest three-day sell-off in 12 months amid weak jobs data in the US and revived fears of a recession.

The crypto market has just clocked its most significant three-day sell-off in almost a year, shedding as much as $510 billion from its total market capitalization since Aug. 2.

The sharp crypto sell-off arrived amid faltering equities performance, with the S&P 500 falling as much as 4.4% in the same time frame.

The market stumble has been led by weak employment data, slowed growth among major tech stocks and revived fears of a recession.

Several major companies, including Microsoft and Intel, posted lower-than-expected second-quarter results, and market leader Nvidia was battered by expectations of impending rate cuts in September, which has seen capital flow back into smaller, lagging companies.

The total crypto market capitalization fell by $314 billion on Aug. 5. Source: TradingView

The last time crypto sold off this sharply over a three-day period was in mid-August of 2023.

BTC and ETH are down 20% and 28%, respectively, in the last seven days.

Layer-1 network Solana’s has been the hardest-hit cryptocurrency among the top 10 largest tokens by market cap, falling 30.6% since July 30.

The Crypto Fear & Greed Index — an indicator that tracks market sentiment toward Bitcoin and crypto — has fallen back into “fear” and currently displays a score of 26 at the time of publication, according to Alternative.me.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

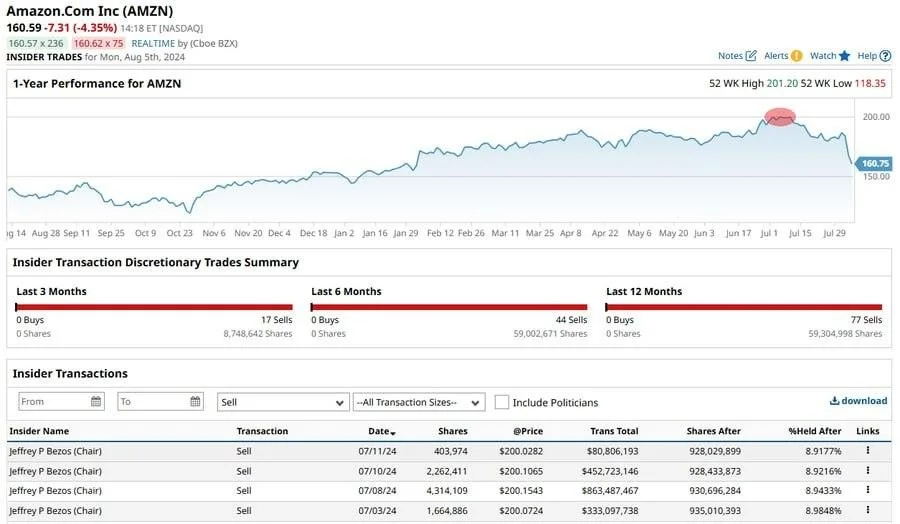

Bezos sold $1.65 billion worth of $AMZN at the exact top - man deserves a round of applause for these trades!

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Why do I hold $XRP? This video should make it clear.

WATCH THE VIDEO IMBEDDED IN THIS TWEET. WORTH 2 MINUTES.

@ Newshounds News™

Listen Here: Twitter

~~~~~~~~~

Japan's three largest financial companies have lost $85 billion in market value over the past two trading days.

Read that again.

History…

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-5-24

Good Afternoon Dinar Recaps,

Blockchain and Nation-State Infrastructure: Why Bother? " Financial titans like JP Morgan, Standard Chartered, HSBC, and Goldman Sachs are diving deep into blockchain, spurred on by the SEC’s approval of spot Bitcoin and Ether ETFs and BlackRock’s tokenization initiatives.

However, participation from legacy organizations brings with it a growing risk of reproducing the same kinds of centralized structures that blockchain set out to dismantle.

Additionally, greater involvement from traditional finance attracts stronger regulatory frameworks and more regimented policy structures from nation-state institutions, which risks stifling innovation and limiting the autonomy of our blockchain networks. So, why bother?"

"Not long ago, these financial giants were the loudest critics of crypto’s credibility and efficacy. For context, in 2017, the CEO of JPMorgan Chase famously declared, “BITCOIN IS A FRAUD”.

Good Afternoon Dinar Recaps,

Blockchain and Nation-State Infrastructure: Why Bother?

" Financial titans like JP Morgan, Standard Chartered, HSBC, and Goldman Sachs are diving deep into blockchain, spurred on by the SEC’s approval of spot Bitcoin and Ether ETFs and BlackRock’s tokenization initiatives.

However, participation from legacy organizations brings with it a growing risk of reproducing the same kinds of centralized structures that blockchain set out to dismantle.

Additionally, greater involvement from traditional finance attracts stronger regulatory frameworks and more regimented policy structures from nation-state institutions, which risks stifling innovation and limiting the autonomy of our blockchain networks. So, why bother?"

"Not long ago, these financial giants were the loudest critics of crypto’s credibility and efficacy. For context, in 2017, the CEO of JPMorgan Chase famously declared, “BITCOIN IS A FRAUD”.

In this era of heavy skepticism, financial governance in the U.S. looked down its nose at this whole ecosystem—if it even dared to look at all.

Yet now, as the two start to realize the potential upside of Wall Street ETFs, we seem incredibly eager to shine a light on their arrival.

We need to ask ourselves if these major private and public players can be trusted with the future of blockchain ecosystems when they have, for years, continued to struggle with the provision of clear and feasible regulatory frameworks."

"It’s still unclear if digital assets are SECURITIES or COMMODITIES, leading to endless lawsuits and regulatory headaches for major exchanges in the US. These opaque rules and guidelines have fostered a mass jurisdictional exodus, as companies look for legal respite to innovate in other places. "

"To circumvent these centralized points of failure, we need to continue building permissionless and trustless systems that can’t be taken down by the state, regulator, or any one owner.

Decentralized, open-source zero-knowledge (zk) bridges may not be a silver bullet, but they offer a more promising and equitable future.

Distributed, anonymous, and autonomous, these bridges can operate with minimum governmental interference and therefore maximum freedom, empowering participants to move assets freely and generate proofs locally and economically."

"This allows for true interoperability, giving protocols sovereign control without the heavy hand of regulatory requirements. It also makes these bridges nation-state-resistant: if a given bridge provider is regulated out of existence or prosecuted, users can continue bridging using the decentralized infrastructure."

"In this vision, protocols would enjoy greater freedom, with no unnecessary requirements, no user flow restrictions, and no extra security vulnerabilities. Crypto would again become a space where no single country, company, or party has an unfair advantage, effectively returning to the decentralized spirit at the heart of blockchain."

"Imagine instead a world where thousands of blockchains communicate seamlessly—a future where fragmented liquidity becomes a cohesive, high-performance ecosystem.

This vision is within reach. We are on the cusp of making blockchain as efficient and interconnected as the internet itself.

Decentralized, horizontal scalability is the only way forward, making crypto truly useful for the wider global community."

@ Newshounds News™

Read more: Bitcoin

~~~~~~~~~

Cambodia’s Bakong DIGITAL CURRENCY helps address DOLLARIZATION

ANOTHER ARTICLE HIGHLIGHTING THE FACT THAT COUNTRIES ARE CONTINUING DOWN THE PATH TO DE-DOLLARIZE AND RETURN TO LOCAL CURRENCIES.

THIS TREND IS HAPPENING ALL AROUND THE WORLD AND SEEMS TO BE A STRATEGIC PLAN TO BRING IN A GLOBAL FINANCIAL SYSTEM.

"Cambodia has been a heavily dollarized country since it returned to civilian rule in the early nineties. Roughly 80% of transactions are in US dollars. Prior to becoming the Governor of the National Bank of Cambodia, Chea Serey spearheaded the launch of the Bakong digital currency payment system in 2020.

A key aim was to encourage a higher proportion of transactions in the local riel rather than dollars. Based on figures for the first half of 2024, that strategy looks like it’s working."

"Bakong has been a huge success. By the end of last year, the central bank said there were ten million wallets out of a 17 million population. While often described as a central bank digital currency (CBDC), Bakong is closer to a tokenized deposit initiative with the Bakong currency backed by balances at commercial banks."

"One of the key tactics to encourage use of the LOCAL CURRENCY is to only support cross border payments using riel. Bakong has existing cross border payment arrangements for Bakong with Thailand, Laos and Vietnam and is expanding its collaborations with China, Japan, India, Korea, Singapore and Malaysia.

Late last year it partnered with Alipay+, the international arm of the dominant Chinese wallet. Additionally, it’s encouraging local retailers to quote prices in riel."

"There’s another reason the strategy is working. With a prudently managed economy, the riel can hold its own in the foreign exchange markets. It has an unofficial peg of 4000 riel to the dollar, which it has managed to more or less hold for the past 20 years.

During the past ten years it has varied by less than 5%. Given the decline in the US dollar in the last few days, the riel has now slightly appreciated against the dollar over the past year. Other currencies in the region such as the Thai Baht, have depreciated a little."

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

USD/JPY Forecast – US Dollar Continues to Drop Against The Yen

The USD/JPY pair fell hard in the early hours on Monday, as the trading world continues to unwind the overall carry trade, and the Fed is looking more and more likely to cut rates later this year. Ultimately, this is a market that I think will continue to see more and more volatility.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

IMPORTANT RIPPLE (XRP) UPDATE

“Ripple USD will be fully backed by a segregated reserve of cash and cash equivalents and redeemable 1:1 for US dollars,” the announcement reads.

▪️Ripple plans to launch a stablecoin called Ripple USD (RLUSD) by the end of 2024, available on XRP Ledger and Ethereum. It promises benefits like deep liquidity for certain trading pairs, instant settlements, and programmable finance.

▪️The SEC has criticized RLUSD as an “unregistered crypto asset,” continuing its ongoing legal battle with Ripple since 2020.

More Attention to RLUSD

Ripple made waves earlier this year when it revealed that it would introduce a stablecoin pegged to the American dollar. At the time, CEO Brad Garlinghouse stated that the product would serve as a bridge between traditional finance and the cryptocurrency industry.

Ripple’s team has still not provided an exact date for the stablecoin’s official release. However, they explained it will be available on the XRP Ledger and Ethereum and should go live before the end of 2024. The team also revealed that the stablecoin will be called Ripple USD (ticker RLUSD).

Most recently, the product was added to the company’s official website, meaning its launch could be just around the corner. “

Ripple USD (RLUSD) is being designed to maintain a constant value of one US dollar. Issued on XRP Ledger and Ethereum blockchains, Ripple USD will be fully backed by a segregated reserve of cash and cash equivalents and redeemable 1:1 for US dollars,” the section reads.

Ripple’s team argued that RLUSD would provide certain benefits, such as deep liquidity for selected trading pairs on centralized exchanges, instant settlements, and programmable finance.

The Clash With the SEC

The upcoming stablecoin has already become a subject of controversy, receiving criticism from the US Securities and Exchange Commission (SEC). Several months ago, the regulator labeled it an “unregistered crypto asset.”

This is not the first confrontation between Ripple and the SEC. The agency sued the firm in December 2020, accusing it and some of its executives of illegally raising more than $1.3 billion by selling XRP in an unregistered security offering.

The legal battle passed through multiple developments in the following years, becoming one of the hottest topics in the crypto space. It reached its trial stage in April 2024, meaning a resolution could be announced anytime.

Some industry participants view the SEC as the underdog in the dispute, pointing to Ripple’s three partial court wins secured throughout 2023. XRP’s price reacted positively to each of those, and it will be interesting to see how it performs once the case is officially closed.

@ Newshounds News™

Read more: Crypto Potato

~~~~~~~~~

Crypto Market Crash Aside: 3 Things to Watch This Week

Things couldn’t get much worse for crypto markets following their largest retreat for more than a year. However, this week’s economic calendar in the US is slow which could limit further volatility.

Crypto markets have fallen below $2 trillion total capitalization in a massive double-digit crash, the likes of which have not been seen for at least a year.

Stock markets in Asia are also reeling this Monday morning following a tech stock rout in the United States late last week.

Economic Calendar August 5 to 9

Monday, we will see July’s final S&P services PMI (purchasing managers index), which provides a snapshot of business conditions in the services sector in the United States.

The ISM services report is also due, which will provide economic indicators for service based on surveys of supply management professionals. Changes in ISM and PMI reports often precede changes in the wider economy.

Thursday has initial jobless claims data, which indicate employment and labor markets in the United States and have a wider impact on the economy.

This week’s light economic events calendar will not have much impact on markets as they are already in freefall.

Economists are forecasting more economic doom and gloom. “All in, we have an economic slowdown for sure, with a high probability that a recession is approaching,” reported Forbes over the weekend.

Crypto Markets Bleed $280B

Crypto markets have dumped a further $280 billion over the past 12 hours resulting in a daily slump of around 13%.

This has dropped total market capitalization back to $1.94 trillion, its lowest level since February. Digital asset markets have dumped more than 20% over the past week as sentiment shifts to bearish.

Bitcoin led the declines with a slump to under $50,000 during the Monday morning Asian trading session. The asset has lost 13% over the past 24 hours in its largest and fastest fall for more than a year.

Ethereum fared even worse, tanking a whopping 21% on the day to $2,200, its lowest level since January.

The altcoins are a sea of red this morning, with most dumping double digits as crypto markets wipe out nearly all gains made in 2024 in the space of a couple of days.

@ Newshounds News™

Read more: Crypto Potato

~~~~~~~~~

IRAQ Central Bank Governor comments on DOLLAR EXCHANGE and FOREIGN REMITTANCES

"Ali Al-Alaq, governor of the Central Bank, discussed the value of remittances sent abroad and the value of the dollar."

"Al-Alaq said in a proclamation got uninvolved of his facilitating in the Place of Delegates that “our unfamiliar cash holds are adequate to make balance on the lookout,” demonstrating that “the National Bank offers in excess of 250 million bucks everyday to meet the necessities of unfamiliar exchange.”

He added, “85% of unfamiliar exchanges are as of now occurring between Iraqi banks and reporter banks WITHOUT GOING THROUGH the US Central bank,” making sense of that “the lodging drive is vital to the bank.”

He explained that “the Central Bank is now heading to cover the financing of the construction of 32 thousand housing units” and that “the volume of loans granted within the real estate initiative amounts to 10 trillion dinars.”

@ Newshounds News™

Read more: Dinar Opinions

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Monday AM 8-5-24

Good Morning Dinar Recaps,

Warren Buffett and Berkshire Hathaway now own 4% of all T-Bills issued to the public…

Buffett has ~$277 Billion. The Fed has $195 Billion.

Good Morning Dinar Recaps,

Warren Buffett and Berkshire Hathaway now own 4% of all T-Bills issued to the public…

Buffett has ~$277 Billion.

The Fed has $195 Billion.

Warren Buffett is now a larger holder of US Treasury Bills than the Federal Reserve.

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

JUST IN: 🇺🇸 The Strategic #Bitcoin Reserve bill has been officially introduced.

@ Newshounds News™

Read more: Bitcoin Magazine, Congress-Gov

~~~~~~~~~

So if it’s subject to REGULATORY APPROVAL and it’s supposed to come out in Q4 this YEAR, then REGULATIONS are COMING OUT before THEN.

@ Newshounds News™

Twitter

THIS IS AN OPINION PIECE BUT WORTH CONSIDERING

~~~~~~~~~

US Stocks tanking. Japanese stocks tanking. Cryptos tanking

@ Newshounds News™

Twitter

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 8-4-24

Good Afternoon Dinar Recaps,

Gold (XAU) Forecast: Dollar Weakness and Falling Yields Set Stage for Continued Rally

Key Points: ▪️ Gold surges 2.32% weekly despite Friday pullback, settling at $2442.50 amid geopolitical tensions and Fed rate cut expectations. ▪️ Middle East conflicts, including Hamas leader assassinations, boost safe-haven demand for gold as geopolitical hedge. ▪️ Powell's comments spark surge in trader bets for September rate cut, CME FedWatch tool shows 28.5% chance of 50-basis-point cut. ▪️ Weaker-than-expected U.S. jobs report strengthens case for gold: Only 114,000 jobs added, unemployment rises to 4.3% ▪️ Analysts eye $2,500 year-end target for gold, potentially arriving sooner if current bullish trends persist in the market.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

Good Afternoon Dinar Recaps,

Gold (XAU) Forecast: Dollar Weakness and Falling Yields Set Stage for Continued Rally

Key Points:

▪️ Gold surges 2.32% weekly despite Friday pullback, settling at $2442.50 amid geopolitical tensions and Fed rate cut expectations.

▪️ Middle East conflicts, including Hamas leader assassinations, boost safe-haven demand for gold as geopolitical hedge.

▪️ Powell's comments spark surge in trader bets for September rate cut, CME FedWatch tool shows 28.5% chance of 50-basis-point cut.

▪️ Weaker-than-expected U.S. jobs report strengthens case for gold: Only 114,000 jobs added, unemployment rises to 4.3%

▪️ Analysts eye $2,500 year-end target for gold, potentially arriving sooner if current bullish trends persist in the market.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

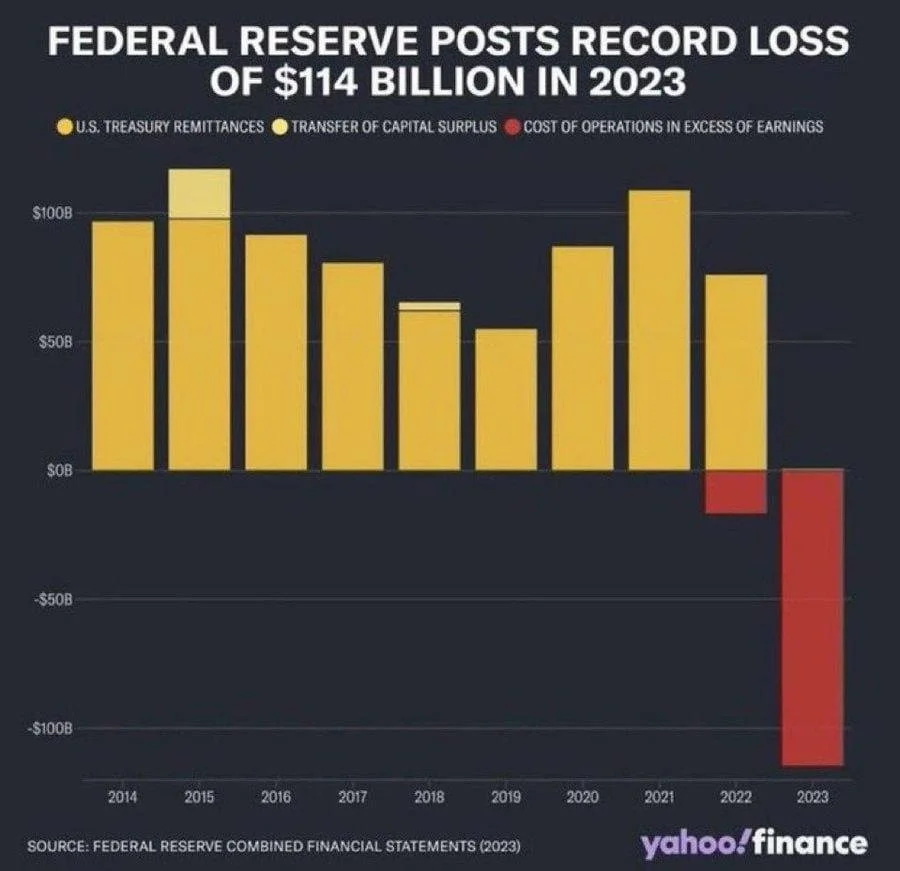

Federal Reserve posted its biggest loss in history last year of $114 Billion

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Ripple Unveils RLUSD Webpage: Set to Compete with Tether and USDC

▪️RLUSD aims to compete with major stablecoins like Tether and USD Coin.

▪️Ripple’s strategic initiatives enhance the interoperability and utility of RLUSD.

Ripple Labs Inc. has developed a new webpage for its next stablecoin, RLUSD. The release has aroused widespread interest, with blockchain researcher Collin Brown noting that RLUSD intends to compete with big players Tether (USDT) and USD Coin.

This step demonstrates Ripple’s determination to increase its presence in the stablecoin sector, despite the changing regulatory landscape.

RLUSD Stablecoin to Leverage Ripple’s Cross-Border Network and XRP Ledger

The RLUSD stablecoin is expected to improve Ripple’s business operations by leveraging its current cross-border settlement network and the well-known Layer 1 protocol, XRP Ledger.

The stablecoin will be released on both the XRP Ledger and Ethereum, providing access to different ecosystems. This dual issuance adds significant liquidity to important trading pairs on certain centralized exchanges, increasing its utility and adoption.

The publication of the RLUSD webpage has fueled this enthusiasm, despite the fact that the stablecoin’s release date remains unknown.

On the other hand, as we previously reported, Monica Long, Ripple’s President, stressed the company’s focus on the XRPL EVM sidechain in their Q2 report, citing a collaboration with Axelar to improve interoperability. This strategic move is intended to improve the sidechain’s functioning and expand its use cases.

Also, according to a prior CNF report, Ripple has released 500 million XRP from escrow to an unnamed wallet, reportedly to assist liquidity and potential future initiatives.

Beside that, El Salvador is investigating the usage of XRP and Bitcoin for international trade with Russia, demonstrating the growing interest in Ripple’s solutions. This exploration is consistent with Ripple’s objective of improving cross-border transactions and providing more efficient financial services.

Meanwhile, according to CoinMarketCap, the XRP price is currently around $0.5458, down 4.47% over the last 24 hours. This also reflects a bearish position of 9.58% for the last 7 days.

@ Newshounds News™

Read more: Crypto News Flash, XLRP-Sidechains, U Today, TimesTabloid

~~~~~~~~~

Nizhny Novgorod to Host 8th BRICS Industry Ministers’ Meeting

The BRICS Industry Ministers’ Meeting will take place on 16 August 2024 as part of Russia’s BRICS Chairship in 2024. The event will focus on the development of industrial cooperation between BRICS countries.

The programme will include a BRICS–EAEU–UNIDO roundtable devoted to the synergy of developing economies and international organizations in order to accelerate industrial development and improve competitiveness.

Russian Minister of Industry and Trade Anton Alikhanov will also be available to the media.

The meeting will take place at the Nizhny Novgorod Fair. There will be a press centre for media representatives with a broadcast of the main programme events.

@ Newshounds News™

Read more: BRICs-Rissia 2024

~~~~~~~~~

Important Cardano Update Related to the Network’s Security: Details

“The alpha v1 release is just the beginning of the journey,” the team stated.

▪️Input Output launched the alpha v1 release of the partner chains toolkit for Cardano to enhance network security by leveraging stake pool operators (SPOs).

▪️Despite the disclosure, Cardano’s native token ADA remained around $0.38, with no significant price change.

The Alpha V1 Release

Input Output – a technology company responsible for the research and development of the Cardano blockchain – launched the alpha v1 release of the partner chains toolkit.

The move aims to strengthen the network’s security by enabling developers to leverage Cardano’s extensive network of stake pool operators (SPOs).

“By leveraging SPOs, both new and existing networks can quickly increase their number of validators for a more robust and efficient security paradigm,” the announcement reads.

The process includes a toolkit that offers numerous innovations for developers, such as mixed validator committee, consensus model flexibility, SPO participation, opt-out capability, and more.

At the core of the initiative is “a unique committee selection algorithm” that uses Cardano data to create trusted committees. These innovations are responsible for generating a specified percentage of blocks, thereby improving security for new protocols.

The Input Output team added that the alpha v1 release is just the beginning of a long journey aimed at receiving feedback from the community.

“Stay tuned for some exciting new developments over the coming months, along with a detailed roadmap,” the team concluded.

@ Newshounds News™

Read more: CryptoPotato

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 8-4-24

Good Morning Dinar Recaps,

OpenEden Introduces Tokenized US Treasury Bills onto the XRP Ledger

"Tokenization platform OpenEden has announced that it will bring tokenized US Treasury bills (T-bills), a short-term US government debt obligation backed by the US Department of the Treasury, to the XRP Ledger (XRPL) and its users for the first time."

"The tokenization of T-bills onto the XRPL is a demonstration of how institutional access to decentralized finance (DeFi) is being driven by the tokenization of traditional real-world assets (RWAs).

The assets backing OpenEden’s TBILL tokens are invested in short-dated US T-bills and reverse repurchase agreements collateralized by US Treasuries. Minters are subject to stringent KYC and AML screening to ensure the highest security and regulatory compliance standards."

Good Morning Dinar Recaps,

OpenEden Introduces Tokenized US Treasury Bills onto the XRP Ledger

"Tokenization platform OpenEden has announced that it will bring tokenized US Treasury bills (T-bills), a short-term US government debt obligation backed by the US Department of the Treasury, to the XRP Ledger (XRPL) and its users for the first time."

"The tokenization of T-bills onto the XRPL is a demonstration of how institutional access to decentralized finance (DeFi) is being driven by the tokenization of traditional real-world assets (RWAs).

The assets backing OpenEden’s TBILL tokens are invested in short-dated US T-bills and reverse repurchase agreements collateralized by US Treasuries. Minters are subject to stringent KYC and AML screening to ensure the highest security and regulatory compliance standards."

"Ripple, the leader in enterprise blockchain and crypto solutions, will also allocate USD$10 million into OpenEden’s TBILL tokens. This is part of a larger fund that Ripple will allocate to tokenized T-bills provided by OpenEden and other issuers."

"OpenEden’s tokenized US Treasury bills represent another exciting example of how all types of real-world assets are being tokenized to drive utility and new opportunities," said Markus Infanger, Senior Vice President, RippleX.

"Institutions are increasingly looking at where to tokenize their real-world assets and the arrival of T-bills on the XRPL powered by OpenEden reinforces the decentralized Layer 1 blockchain as one of the leading blockchains for real-world asset tokenization.”

"Bringing tokenized T-bills to the XRP Ledger is the next step in our exciting journey. Purchasers will be able to mint our TBILL tokens via STABLECOINS, including Ripple USD when it launches later this year.”

"Ripple also recently announced its work with Archax, the UK’s first Financial Conduct Authority regulated digital asset exchange, broker and custodian, that plans to bring hundreds of millions of dollars of tokenized real world assets (RWAs) onto the XRPL over the coming year."

@ Newshounds News™

Read more: Ripple

~~~~~~~~~

Earn 4.97%* U.S. Treasury yields on-chain

"The only tokenized U.S. Treasury product with an “A” rating from Moody’s."

Moody’s Credit Rating

OpenEden’s TBILL is the first and only tokenized product to receive an “investment grade” rating by Moody’s.

"Gain exposure to U.S. Treasuries without the constraints of U.S. trading hours. TBILL token holders enjoy 24/7 minting & redemption, thanks to smart contracts. DeFi projects can build on TBILL's ERC-20 tokens."

TBILL tokens are audited, transparent, and verifiable

"Like you, we live by “don’t trust, verify”. Which is why we launched the market’s first proof-of-reserves that combines off-chain and on-chain auditability. Here is how we open the books."

@ Newshounds News™

Read more: Open Eden

~~~~~~~~~

The OpenEden TBILL tokens are ETHEREUM-BASED ERC-20 standards that are TRANSFERABLE between different blockchain wallets.

"Former senior officials at the Gemini crypto exchange announced that OpenEden, a decentralized finance (DeFi) platform, had launched the first smart contract vault to offer access to US Treasury Bills (T-Bills). According to the announcement, OpenEden will enable stablecoins holders to mint Treasury Bills (T-BILL) tokens through the OpenEden T-BILL Vaul. "

"According to OpenEden, the TBILL tokens are Ethereum-based ERC-20 standards that are transferable between different blockchain wallets."

"There is around $130 billion worth of stablecoins sitting on the sidelines and not generating any meaningful yield. As DeFi yields continue to lag further behind traditional financial asset yields, there is a growing demand for institutional-grade DeFi products that offer low-risk, liquid, and transparent returns to stablecoin holders.”

"By tokenizing real-world assets, OpenEden hopes to open up the blockchain industry to a $300 trillion market that is yet to be tapped on a global scale. Moreover, the cryptocurrency market is about $1 trillion despite being in existence for the past 14 years."

@ Newshounds News™

Read more: Coin Speaker

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 8-3-24

Good Afternoon Dinar Recaps,

WHAT IS THE STRATEGIC BITCOIN RESERVE?

"THE BITCOIN ACT of 2024, introduced by Senator Cynthia Lummis of Wyoming, seeks to firmly establish Bitcoin as a strategic asset in the United States’ financial arsenal. At its core, the Act proposes the creation of a Strategic Bitcoin Reserve (SBR) and a structured Bitcoin Purchase Program, and comprehensive national custody policy."

The Strategic Bitcoin Reserve (SBR) "The establishment of the SBR signifies a paradigm shift in how the United States government manages and custodies Bitcoin at the Federal level. The SBR creates a decentralized network of secure Bitcoin storage facilities across the United States."

Good Afternoon Dinar Recaps,

WHAT IS THE STRATEGIC BITCOIN RESERVE?

"THE BITCOIN ACT of 2024, introduced by Senator Cynthia Lummis of Wyoming, seeks to firmly establish Bitcoin as a strategic asset in the United States’ financial arsenal. At its core, the Act proposes the creation of a Strategic Bitcoin Reserve (SBR) and a structured Bitcoin Purchase Program, and comprehensive national custody policy."

The Strategic Bitcoin Reserve (SBR)

"The establishment of the SBR signifies a paradigm shift in how the United States government manages and custodies Bitcoin at the Federal level. The SBR creates a decentralized network of secure Bitcoin storage facilities across the United States."

Bitcoin Purchase Program

"The Act lays out a plan to acquire up to 1,000,000 Bitcoins over a five-year period, capping purchases at 200,000 Bitcoins annually, and then holding such reserves for twenty years. Furthermore, the Act places limits on the use and sale of the reserve following the holding period.

During the minimum holding period, no Bitcoin held by the Federal government in the SBR may be sold, swapped, auctioned, encumbered, or otherwise disposed of for any purpose other than retiring outstanding Federal debt instruments."

RE-READ THAT LAST STATEMENT- " or otherwise disposed of for any purpose other than retiring outstanding Federal debt instruments."

"It first proposes an amendment to the Federal Reserve Act to reallocate discretionary surplus funds from the Federal Reserve Banks. This reduces the discretionary surplus funds from $6.825 billion to $2.4 billion. The Federal Reserve is then required to remit net earnings to the Treasury, and the Act redirects the first $6 billion towards purchasing Bitcoin."

"Furthermore, the Act also involves an adjustment in the valuation of gold certificates held by the Federal Reserve. Currently, the Federal Reserve holds gold certificates which are marked at $42.22/oz, while the market price of gold is closer to $2,400 today.

Essentially, this forces the Federal Reserve to mark-to-market the gold certificates, then remit the gain on the gold to the Treasury for the purpose of funding the initial acquisition."

COULD THIS BE THE REVALUATION OF GOLD THAT WE HAVE BEEN LOOKING FOR?

REPRICING THE GOLD CERTIFICATES HELD BY THE US TREASURY AT THE NEW PRICE OF $2400/OZ

State Participation

The Act contemplates accepting State-level Bitcoin holdings into the national framework through voluntary participation. This aspect allows individual states to store their Bitcoin holdings within the SBR in segregated accounts.

By offering this option, the Federal government allows (but does not require) States to add Bitcoin to their own treasuries, without having to reinvent and reimplement a robust security plan.

States participating in the program maintain exclusive and segregated title to their Bitcoin, and the right to withdraw or transfer their Bitcoin holdings from the SBR, subject to the terms of their contractual agreement and any applicable Federal regulations, but are not subject to the Federal restrictions otherwise applicable to the SBR.

This flexibility ensures that States can manage their Bitcoin treasuries in accordance with their specific financial strategies and needs.

Implications & Next Steps

"By tapping into existing financial resources and leveraging the economic value of gold, the BITCOIN Act aims to acquire Bitcoin without directly burdening taxpayers or increasing federal debt. This multifaceted approach underscores the innovative financial strategies the Act employs to integrate Bitcoin into the national reserve system, setting the stage for a comprehensive Bitcoin policy throughout all levels of the United States government."

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

Bank of England looks to update RTGS by exploring wholesale CBDC, synchronization

The central bank of the United Kingdom is proposing experimenting with a wholesale central bank digital currency (wCBDC) as it seeks to update its Real-Time Gross Settlement (RTGS) system.

Bank of England (BoE) announced the move in a discussion paper, titled “The Bank of England’s Approach to Innovation in Money and Payments.”

Under this, the BoE promised to undertake a series of experiments within the next six months to examine wCBDC settlement compared to the “synchronization” of non-CBDC central bank money using the existing RTGS system.

RTGS is a fund transfer system that allows for the instantaneous transfer of money and/or securities between banks. In the U.K., the RTGS system is called the Clearing House Automated Payment System (CHAPS). It’s operated by the BoE and used for high-value transactions.

The BoE has been consulting on an update to CHAPS since 2022. In February 2023, in its Roadmap for the Real-Time Gross Settlement Service Beyond 2024, the bank proposed “synchronization” as a possible solution to updating its RTGS system, which suffered a well-publicized crash earlier in July.

“We proposed to create a generic interface into RTGS which would allow a wider range of ledgers to connect to RTGS to synchronize transactions. Synchronization enables ‘atomic settlement’, which means linking the transfer of two assets in a way that one asset moves if and only if the other asset moves,” said the roadmap.

Wholesale CBDCs—digital versions of a country’s currency used by banks and financial institutions for large-scale transactions and settlements—offer another alternative to the current RTGS system, with 19 countries already piloting one.

Both synchronization and wCBDC depend on distributed ledger technology (DLT), a system that records transactions across multiple computers or locations.

In its July 30 discussion paper, the BoE argued that “further work is required to consider the respective roles these innovations might play in the Bank’s future toolkit. To inform this work, the Bank proposes a program of experiments to test the use cases, functionalities and prospective designs of both wCBDC and synchronization, and their relative merits.”

It added that these experiments would ideally assess the relative operational risk and complexity involved in using the two technologies and how different types of financial assets can best be represented on a digital ledger.

“This would help identify important ledger design considerations and inform later workaround interoperability,” said the discussion paper. “The experiments should also allow us to assess the scalability of the different approaches.”

In terms of its ultimate goal, the BoE set out three main outcomes it hopes to achieve from the experiments:

1. Central bank money must keep pace with technological advances in financial markets and must be equipped with the functionality to support central bank money settlement of tokenized wholesale transactions;

2. Innovations in financial markets must be harnessed in a way that supports financial stability and monetary policy objectives. “If tokenization increases the efficiency and speed of post-trade processes, this could release liquidity and reduce settlement risk and cost in wholesale financial markets,” said the BoE;

3. The U.K.’s financial market infrastructure must remain at the forefront of developments in finance, including maintaining an appropriate level of interoperability with new DLT-based infrastructure.

@ Newshounds News™

Read more: Coin Geek

~~~~~~~~~

2,200 letters of support for ‘Bitcoin Strategic Reserve’ bill sent to US senators

Senator Cynthia Lummis introduced the bill on July 31, which would direct the US government to start a reserve Bitcoin fund.

Over 2,200 letters were sent to United States senators in 48 hours urging them to co-sponsor and support Senator Cynthia Lummis’s newly proposed Strategic Bitcoin Reserve bill.

In a post on X, Lummis expressed gratitude for the support given to the Strategic Bitcoin Reserve bill.

Lummis, a prominent advocate for the crypto industry, introduced the Bitcoin Strategic Reserve bill on July 31. The bill aims to establish a national reserve of Bitcoin and position the US as a leader in the adoption and secure management of the world’s first cryptocurrency.

The proposed legislation would direct the US government to create a decentralized network of secure Bitcoin vaults managed by the US Treasury, ensuring strict cyber and physical security measures.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Peru inaugurates first CBDC pilot

Peru’s central bank has launched its first central bank digital currency (CBDC) pilot, selecting local telecom operator Viettel Peru as its partner.

The Central Reserve Bank of Peru announced the partnership recently but didn’t disclose any details about the pilot. Viettel is the local subsidiary of Vietnam’s state-owned multinational telecom operator Viettel Group, which started operating in Peru in 2014.

For Peru, a digital sol is the country’s attempt to digitize payments to enhance efficiency and cut costs. The government is also seeking to boost financial inclusion; according to the latest studies conducted two years ago, only half of Peruvians had access to formal financial accounts.

While this was a significant growth from 2014, when the World Bank revealed that only two in ten Peruvians were banked, it’s still relatively low for a country with a $242 billion gross domestic product (GDP). In stark contrast, 85% of neighboring Chile’s population is banked.

With close to half its population unbanked, Peru is heavily reliant on cash. According to the International Monetary Fund (IMF), high costs and insufficient digital infrastructure remain vital impediments.

IMF believes that a CBDC could eliminate many of the barriers to digital payments. However, the Latin American country would have to make some critical considerations, such as offering the digital solution via USSD, as a large portion of the population doesn’t own a smartphone.

It would also need to dissociate CBDC from the banking system, as the people who need it most don’t have bank accounts. In most countries, the CBDC wallet is linked to a bank account, allowing convenience, as customers can switch between the two easily. This allows the regulators to impose a holding cap—once a customer hits this threshold, the rest is converted to conventional bank deposits.

@ Newshounds News™

Read more: Coin Geek

~~~~~~~~~

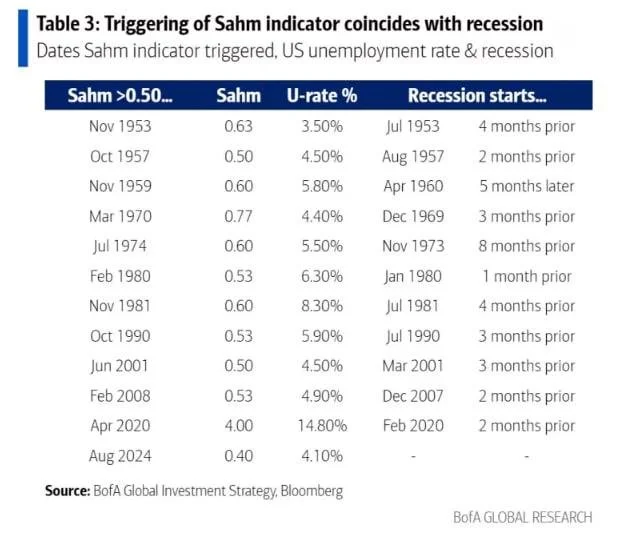

Sahm Recession Rule Trigger Alert 🚨

The Sahm Rule that is designed to signal the start of a recession has officially been triggered. Since 1953, the Sahm Rule has NEVER been wrong!

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 8-3-24

Good Morning Dinar Recaps,

US REJECTS VIETNAM'S Request to Lift ‘Non-Market Economy’ Tag

THE QUESTION REMAINS HOW WILL THIS NEWS AFFECT THE VALUE OF THE VIETNAMESE DONG

" The Biden administration rejected Vietnam’s request to be classified officially as a “market economy,” a setback for the country’s efforts to boost exports to its most important market."

"The trade-dependent Southeast Asian economy has pressed the administration to revise the status since the upgrade in diplomatic ties during a visit by President Joe Biden to Vietnam in September last year."

Good Morning Dinar Recaps,

US REJECTS VIETNAM'S Request to Lift ‘Non-Market Economy’ Tag

THE QUESTION REMAINS HOW WILL THIS NEWS AFFECT THE VALUE OF THE VIETNAMESE DONG

" The Biden administration rejected Vietnam’s request to be classified officially as a “market economy,” a setback for the country’s efforts to boost exports to its most important market."

"The trade-dependent Southeast Asian economy has pressed the administration to revise the status since the upgrade in diplomatic ties during a visit by President Joe Biden to Vietnam in September last year."

"The “non-market” economy label mainly works against Vietnam when the US applies anti-dumping complaints. A change would have been a signal of closer ties at a time when the US is seeking to bolster relationships in the region as a counterweight to China. "

"Vietnam, which has signed numerous free trade agreements, is making greater access to the US market a priority. Its total trade — exports and imports — is equivalent to about twice the size of its economy."

@ Newshounds News™

Read more: MSN

~~~~~~~~~

Bitcoin: El Salvador makes CRYPTOCURRENCY LEGAL TENDER

"Congress approved President Nayib Bukele's proposal to embrace the cryptocurrency, with 62 out of 84 possible votes on Tuesday night.

The president said the government had made history, and that the move would make it easier for Salvadoreans living abroad to send money home.

Bitcoin will become legal tender, alongside the US dollar, in 90 days.

The new law means every business must accept Bitcoin as legal tender for goods or services, unless it is unable to provide the technology needed to do the transaction."

""It will bring financial inclusion, investment, tourism, innovation and economic development for our country," President Bukele said in a tweet shortly before the vote.

He has previously said the move will open up financial services to the 70% of Salvadoreans who do not have bank accounts."

NOTE: THIS ARTICLE IS FROM 2021. BITCOIN IS BEING USED AROUND THE WORLD TO BRIDGE THE GAP WHERE LOCAL CURRENCIES ARE SEVERELY DEPRESSED

@ Newshounds News™

Read more: BBC

~~~~~~~~~

Indonesia preps second stage of wholesale CBDC trials

Today Bank Indonesia published its Indonesian Payment System Blueprint (BSPI) 2030. One of the five major initiatives is its central bank digital currency (CBDC) work, THE DIGITAL RUPIAH.

It previously announced three stages of its proof of concept CBDC work. The first is the basic issuance and redemption of a wholesale CBDC (wCBDC) using DLT, which was completed during the first half of 2024. Secondly, it plans to explore the integration of a wCBDC with a digital securities ledger. Thirdly, it will use the wCBDC as a foundation for a retail CBDC.

While today’s paper provides an update, and reiterates the three phases first outlined in 2022, there is a subtle change in emphasis towards the wCBDC. For example, now the third phase following the wCBDC digital securities work will focus on wCBDC for cross border payments.

Notably, Bank Indonesia is an observer on the mBridge cross border CBDC initiative that uses wCBDC. mBridge recently entered the minimum viable product (MVP) phase with its initial participants, including the BIS Innovation Hub and the central banks of China, Hong Kong, Thailand and the UAE. Saudi Arabia recently joined and there are at least 22 observer banks.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

The Philippines chooses Venom for a groundbreaking national blockchain initiative

Manilla, Philippines, 1 August, Chainwire – Venom Foundation is proud to announce a historic agreement with the government of the Republic of the Philippines to digitize billions of accountable forms using its advanced blockchain technology.

Landmark opportunity and global significance

This initiative represents a pivotal milestone for Venom and the broader crypto industry. In what could end up as the world’s largest blockchain use case, this project underscores Venom’s leadership and innovation in the blockchain space.

By betting on Venom, the Philippine government demonstrates unprecedented trust and confidence in blockchain as a secure, scalable, and efficient solution for national-level operations.

This move is poised to revolutionize the way governments and large institutions handle data, transactions, and record-keeping, setting a new standard for transparency and efficiency.

This breakthrough project not only elevates Venom's standing but also sets the stage for other governments and sovereign nations to adopt the same kind of forward-thinking.

Project scope and impact

The Philippines is making a significant leap forward by launching an ambitious project to use Venom technology to digitize approximately ten billion accountable forms such as but not limited to invoices or receipts, cash tickets, documentary stamps, and special bank receipts, individually identified, accounted for, and afforded appropriate security.

This initiative marks a new phase in the country's digitalization journey and promises to revolutionize financial operations.

The project is expected to significantly enhance transparency, reduce costs, and improve the efficiency and security of financial transactions across the nation. With a population of approximately 115 million, the impact of this digitization effort will be far-reaching, touching every aspect of daily life and commerce in the Philippines.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Russia approves law on legalizing cryptocurrency mining

Requirements for the activities of individuals and legal entities mining digital currency, including participants in mining pools, as well as for individuals organizing their activities, will be established by the Russian Government in coordination with the Bank of Russia

Only Russian legal entities and individual entrepreneurs included in a register will have the right to mine. Individuals who do not exceed the energy consumption limits set by the Russian government will have the right to mine digital currency without being included in the register.

@ Newshounds News™

Read more: TASS

~~~~~~~~~

WHO SETS THE RATES? Common questions about CURRENCY EXCHANGE RATES

"Who's in charge of setting currency exchange rates? If you've ever sent money overseas or checked the rates, this is a question that may have definitely crossed your mind. Who decides what is the value of money, and why do rates fluctuate that much during the day?"

"Every country in the world has its own currency, and each of these currencies is valued differently. When you exchange one currency for another, you're actually buying money, just in a different currency than the one used in your country."

"The exchange rate tells you how much the currency used in your country is worth in foreign currency. The rates CONSTANTLY CHANGE for some countries, whereas others use FIXED exchange rates.

As a rule of thumb, a country's social and economic outlook is the main factor that influences the currency exchange rate."