Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-8-24

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

Good Afternoon Dinar Recaps,

PRESIDENT TRUMP POSITIONING HIMSELF TO BE A STRONG PROPONENT OF BITCOIN AND TOKENIZED ASSETS

In a Forbes article several lawmakers are described as offering pro-crypto advice to President Trump.

“We want all the remaining Bitcoin to be made in the USA!”

"In a Truth Social post last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he recognized the geopolitical significance of the world’s largest cryptocurrency, warning that any policy that seeks to hamper bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee of a major political party—it also put a spotlight on discussions about classifying bitcoin as a strategic reserve asset. "

"Former presidential candidate Vivek Ramaswamy, for example, has been advising President Trump on bitcoin and digital assets since January. Ramaswamy staked a unique position in the final weeks of his campaign by proposing that the dollar be backed by a basket of commodities that, in time, could include bitcoin."

"Ramaswamy’s plan echoed a similar proposal from Independent presidential candidate Robert F. Kennedy, Jr., in which a small percentage of US Treasury bills 'would be backed by hard currency, by gold, silver, platinum, or bitcoin."

© Newshounds News™

Read more: Forbes

~~~~~~~~~

AN EXCELLENT INTERVIEW ON "Unchained" WITH SENATOR LUMMIS ON WHY CRYPTO HAS BI-PARTISAN SUPPORT

"Show highlights:"

1. Why the SAB 121 approval was bipartisan

2. Whether President Biden will veto the resolution

3. How it’s a “mystery” to Sen. Lummis why the SEC had a change of heart about Ether ETFs

4. How the SEC’s approach to regulating the industry “is not the American way”

5. Whether there is a bipartisan majority in favor of crypto in Congress

6. How bitcoin has come a long way in terms of adoption

7. Sen. Lummis’ thoughts on how to regulate the stablecoin industry and avoid a Terra Luna situation

8. The differences between the Lummis-Gillibrand bill and FIT21

9. How Sen. Lummis feels about the denial of a master account for Custodia Bank

10. Whether there’s a move against Bitcoin mining companies in the US, given the recent ban of an operation in Wyoming

11. What Sen. Lummis would advise for the industry to accomplish its goals

© Newshounds News™

Read more: Unchained Crypto

~~~~~~~~~

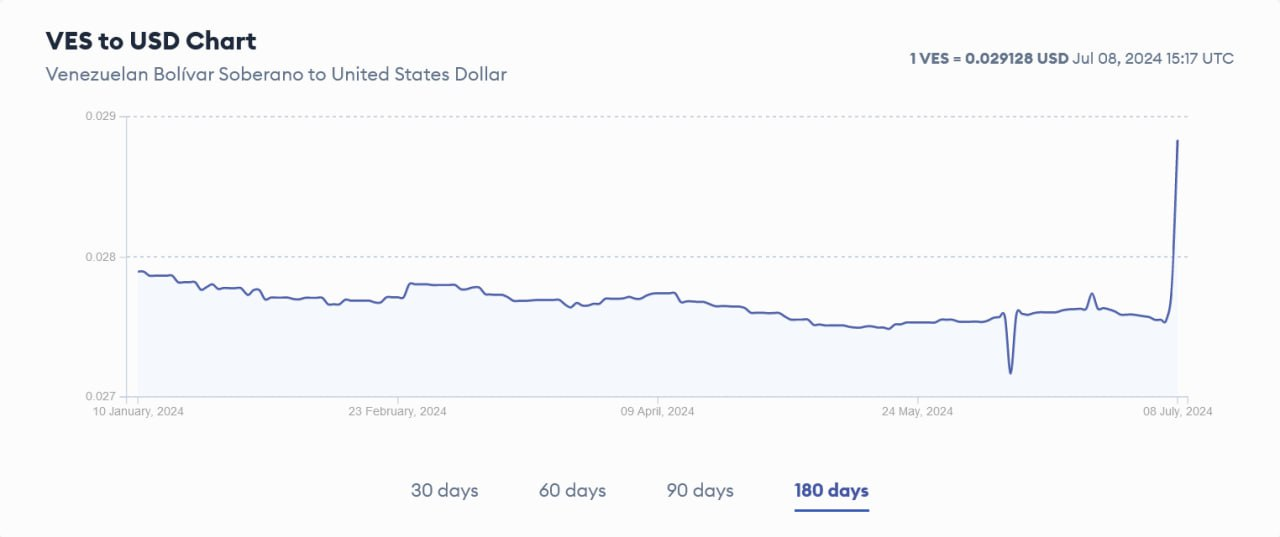

1 VES TO USD

VENEZUELAN BOLIVAR showing a slight strengthening against the US Dollar

Read more: Forbes

~~~~~~~~~

MAJOR DIFFERENCES BETWEEN BASEL CRYPTO RULES AND THE SEC ON BANKS BALANCE SHEETS

The House will seek to overturn the veto possibly later this week with a 2/3rds vote.

"At the end of May President Biden vetoed a bipartisan resolution in the House and Senate that aimed to cancel SEC accounting rule SAB 121, which prevents banks from providing digital asset custody. This week’s House schedule indicates another vote is on the cards.

If lawmakers successfully cancel SAB 121, then the SEC could not provide guidance on crypto custody in the future."

"SAB 121 requires listed firms to show digital assets held in custody as both an asset and liability on their balance sheet, contrary to accounting convention. It particularly impacts banks, because laws require them to set aside risk capital based on their balance sheet. This makes it prohibitively expensive for banks to provide crypto custody and is the reason none provide crypto custody for the Bitcoin ETFs. The SEC did not consult bank regulators before publishing SAB 121.

Firstly, there was the Basel rules for bank treatment of crypto. When the Basel Committee published final rules in late 2022, they did not require crypto held in custody to be shown on the balance sheet. This appeared to be a green light. However, in late March 2022 the SEC had published SAB 121 which meant that international banks could provide custody, but not U.S. ones. The SEC chose not to amend SAB 121 even though it conflicted with the Basel proposals."

Newshounds News will report back on any updates regarding this legislation.

© Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

TAIWAN BUILDS CBDC PROTOTYPE PLATFORM, PLANS HEARINGS FOR NEXT YEAR

"The Block has confirmed that Taiwan’s central bank governor will present a CBDC research report in parliament on Wednesday."

"The central bank started to research a potential central bank digital currency in 2019."

"Taiwan has built a prototype platform for a potential central bank digital currency (CBDC). It plans to hold multiple hearings and forums next year as its central bank continues to study and develop a CBDC."

Taiwan’s Central Bank Governor, Chin-Long Yang, said in a research report on Sunday that building a digital currency isn’t an international competition and that the central bank has yet to set a fixed timeline for CBDC issuance, according to a report from the semi-official Central News Agency.

"The report said the central bank had developed a CBDC prototype platform with a two-tier issuance structure. Initially, the CBDC would be non-interest bearing, and CBDC wallets may come in both anonymous and registered types, according to the report."

"On the retail front, the central bank said that the prototype platform has increased its processing speed to 20,000 transactions per second. The central bank also plans to develop the CBDC at the wholesale level, which could be used as a clearing asset for asset tokenization."

"The central bank stated that cryptocurrency and stablecoins are not part of the CBDC research, as those assets are separate from the digital currency system. The crypto industry remains largely unregulated in Taiwan, with the financial regulator requiring crypto service providers to comply with anti-money laundering laws."

@ Newshounds News™

Source: The Block

~~~~~~~~~

Do US Consumers Underestimate the Potential Of Digital Wallets?

In the United States, digital wallets can be anywhere a smartphone is. In other words, everywhere. Many U.S. consumers are embracing digital wallets, particularly for online shopping. In fact, data shows consumers are 23% more likely to use them for online shopping than in-store purchases. Beyond shopping, PYMNTS Intelligence finds that digital wallets are popular for peer-to-peer payments.

Yet, despite a reputation for tech-savviness, most U.S. consumers are unfamiliar with all these tools could offer. For example, just 8.7% of consumers have used one to store nontransactional credentials. Even fewer have used one of the credentials they have stored.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Sunday Evening 7-7-24

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger? ➖

BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance. ➖RippleNet could replace SWIFT for cross-border transactions. ➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger?

➖BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance.

➖RippleNet could replace SWIFT for cross-border transactions.

➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

The XRP Ledger (XRPL), in particular, provides a potential decentralized platform for quick, safe transactions as a result of the technology developed by Ripple. These features make XRPL a promising foundation for a new asset-backed currency, decreasing reliance on central banks while increasing financial transparency.

RippleNet, Ripple’s payment network, is also key in this potential change. It allows for real-time, cross-border transactions, potentially replacing the traditional SWIFT system. RippleNet uses XRP in conjunction with On-Demand Liquidity (ODL) to eliminate the requirement for pre-funded accounts, simplifying international payments.

A new, more transparent, efficient, and less reliant on the US dollar global financial system may emerge from the BRICS coalition’s interest in cryptocurrencies and Ripple’s technology. By embracing a crypto/Ripple approach, the BRICS nations have the potential to completely reshape the world financial environment, with major effects on commerce and banking across borders.

The possible adoption of a Ripple/crypto strategy by the BRICS coalition represents a major advancement in global financial services. Ripple’s decentralized technology might serve as the basis for a new asset-backed currency. This change would make the banking system more efficient and put the US dollar under more pressure.

Read more Crypto News Land

~~~~~~~~~

US House Considers Overturning Biden’s Crypto Custody Veto — This Could Spark Wide Market Rally

"The US House of Representatives could overturn President Joe Biden’s veto of the crypto custody bill next week, sparking a bold recovery across the recently battered crypto market."

“In May, the US House voted to overturn the Securities and Exchange Commission SAB 121 rule that requires regulated firms custodying cryptocurrencies to record their holdings on balance sheets.”

“However, President Biden later vetoed the bill, saying it could affect the ability of the SEC to set up the much-needed guardrails in the industry. The President also noted it would affect the well-being of investors and customers.”

“The bill is now back in the House of Representatives and has been classified as “legislation that may be considered.” The US House can overturn or uphold the President’s veto.”

A two-thirds majority vote from both the Senate and the House is needed to overturn the veto.

Could A Recovery for the Crypto Market Be Brewing?

With the recent decline in Bitcoin and the cryptocurrency market, an overturn of the bill could be just what the market needs to recover.

“The market has already recorded a bold recovery in the last 24 hours, with the global market cap up by 4.3%. All the top-ten cryptos by market cap are also trading in the green today.”

“Bitcoin and Ether have gained by 4.5% and 5.3%, respectively, in the last 24 hours. XRP and Cardano are among the top gainers, with an 8% and 7% gain, respectively.”

@ Newshound News™

Read more: ZY Crypto

~~~~~~~~~

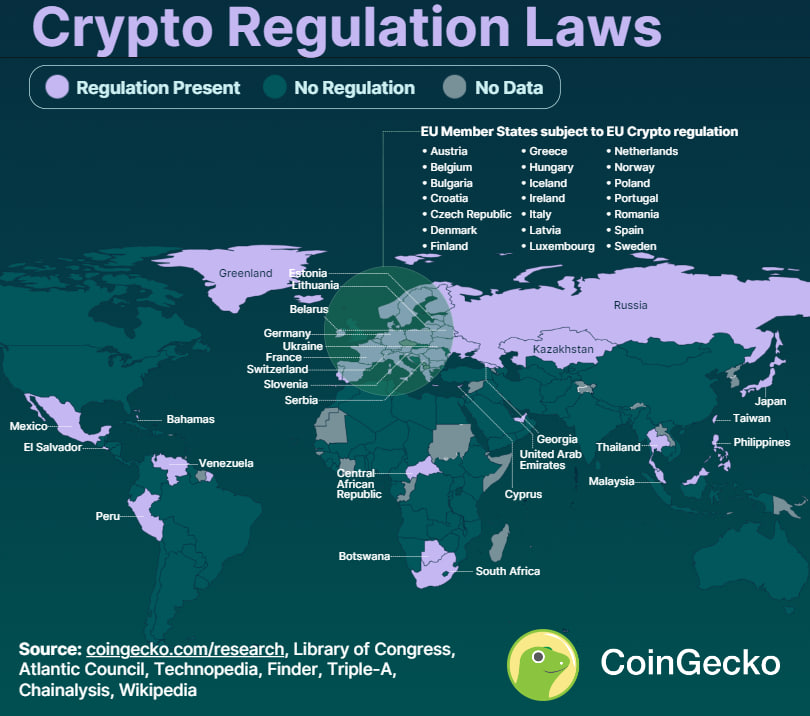

Countries Where Cryptocurrency Is Legal vs Illegal

Where Is Cryptocurrency Legal?

Cryptocurrency is currently legal in 119 countries and four British Overseas Territories. This means more than half of the world's countries have legalized cryptocurrency. 64.7% of countries that have legalized crypto are emerging and developing countries from the Asian and African continents. However, out of the 119 countries that legalized cryptocurrency, 20 (16.8%) have imposed bank bans. These bans restrict financial institutions from interacting with cryptocurrency exchanges or users.

Europe Leads With 39 Countries Recognizing Crypto’s Legitimacy

Europe is at the forefront of global cryptocurrency legalization, with 39 (95.1%) out of 41 analyzed countries acknowledging its legitimacy. North Macedonia is the only European country where cryptocurrency is illegal, while Moldova's status remains unclear.

Out of 31 countries in the Americas, 24 (77.4%) countries recognize cryptocurrency as legal. Bolivia stands as the sole exception, deeming cryptocurrency illegal. Six American countries - Guatemala, Guyana, Haiti, Nicaragua, Paraguay, and Uruguay - have yet to establish their official stance on cryptocurrency.

In Africa, only 17 out of 44 (38.6%) countries have legalized cryptocurrency, while 35 (77.7%) out of 45 countries in Asia recognize cryptocurrency as legal.

How Many Countries Have Defined Crypto Laws?

Only 62 (52.1%) of the 119 countries where cryptocurrency is legal have comprehensive regulations. This number has gone up by 53.2% since 2018 when only 33 jurisdictions had cryptocurrency regulations.

Among the 62 countries with established regulations, 36 (58.0%) are individual countries, 22 (35.5%) are part of the European Union (EU), and 4 (6.5%) are British Overseas Territories. Notably, half of these countries are advanced economies, while the remaining half are emerging and developing economies.

Half of the countries that have legalized cryptocurrency have yet to implement robust regulatory frameworks. This gap between legalization and full regulation raises potential concerns about investor protection and clarity for businesses operating in the cryptocurrency space in those countries.

Instead, several countries have taken the approach of adapting existing regulatory frameworks to encompass cryptocurrencies, rather than establishing entirely new regulations. This approach often involves applying established tax laws and anti-money laundering and counter-financing of terrorism (AML/CFT) laws to cryptocurrency transactions and activities.

Major advanced economies, including France, Japan, and Germany, have successfully established regulatory frameworks for cryptocurrencies.

In contrast, other major advanced economies, such as Italy, the United States, Canada, and the United Kingdom, face challenges in implementing comprehensive cryptocurrency regulations. Multiple governments and financial regulatory bodies in these countries contribute to the complexity of the regulatory process.

EU member states, on the other hand, adhere to EU-wide regulations regarding crypto assets. These regulations provide a more harmonized approach to cryptocurrency regulation within the bloc.

Which Countries Use Cryptocurrency as Legal Tender?

Only two countries, El Salvador and the Central African Republic (CAR), have adopted cryptocurrency as legal tender. Of which, El Salvador remains the only country actively using cryptocurrency as legal tender today.

El Salvador made history in August 2021 by legalizing Bitcoin through the Bitcoin Law. This landmark legislation cemented Bitcoin's acceptance as legal tender with automatic conversion to US dollars. In January 2023, El Salvador took another step towards embracing Bitcoin by passing the Digital Securities Law. This law classifies Bitcoin as a "digital commodity" and all other crypto assets as "securities."

@ Newshound News™

Read more: CoinGecko

~~~~~~~~~

THE UK COULD BE THE FIRST COUNTRY TO DESIGN CBDCs TO HELP THE PEOPLE, NOT THE BANKS

Labour's plan acknowledges the growing case for a state-backed digital pound and emphasizes the need for financial products to reach underserved communities.

"The landslide victory of the UK’s Labour Party in the general election saw little to no mention of Bitcoin, blockchain, or digital assets. However, Labour’s previous statements and plans suggest a cautious yet open stance toward blockchain technology. "

Labour backs Digital Pound, but what could it look like?

“Labour’s financial services plan, “Financing Growth,” acknowledges the growing case for a state-backed digital pound and emphasizes the need for “financial products to reach underserved communities.

“Embrace innovation and fintech as the future of financial services by becoming a global standard-setter for the use of AI in FS, delivering the next phase of Open Banking, defining a roadmap for Open Finance, embracing securities tokenisation and a central bank digital currency, and establishing a regulatory sandbox for financial products to reach underserved communities.”

“The party has fully supported the Bank of England’s ongoing work in this area, indicating a commitment to continue exploring and developing a CBDC.”

The Labour party has “highlighted the importance of addressing key concerns such as privacy, financial inclusion, and stability in designing any potential CBDC.” This indicates Labour “prioritizes public interest and economic stability.”

“Labour’s plan also emphasizes the importance of making the UK a global hub for securities tokenization” and exploring the tokenization of securities. "

"Labour has expressed intentions to advance open banking initiatives, explore the potential of open finance, and establish regulatory sandboxes to test financial products aimed at underserved communities. "

Healthy Skepticism for CBDCs

"As with any attempt to deliver a CBDC, it’s important to remain skeptical due to its potential for governmental overreach and abuse." However, "as one of the few ‘Left Wing’ governments to oversee a CBDC, Labour could offer a unique take on its design."

“Labour’s support for CBDC exploration does not equate to an immediate implementation plan. The party has emphasized the need for thorough consultation and careful consideration of potential impacts” such as privacy concerns associated with CBDCs. “It is clear that FIAT, in its current form, is failing.”

A positive CBDC design would include:

More transparency over government spending

More accessible access to finance for the unbanked

Cheaper and faster international transfers

Reduced costs of Central Bank printing

Increased privacy

A reduction in financial crime

“However, designing a CBDC to offer all these things without the more Orwellian alternatives may require too much of a leap of faith for most. A party with socialist origins, with a forward-thinking and modern technology focus, in the 2024 United Kingdom could theoretically adopt the best of what blockchain offers without overreaching if app priately advised by those in the digital assets industry.”

“We would have one shot at this, and it would have to be designed so that a future government could not alter it to take advantage of its citizens.”

"The coming months and years will be critical in determining whether the UK under Labour leadership can successfully navigate the complex landscape of digital currencies, balancing innovation with stability and public interest. If successful, the UK could emerge as a global leader in the responsible development and implementation of CBDCs, setting a precedent for other nations to follow."

@ Newshound News™

Read more: CryptoSlate

~~~~~~~~~

STABLECOINS AND NATIONAL SECURITY: LEARNING THE LESSONS OF EURODOLLARS

"As Congress struggles to resolve big issues like funding for Ukraine and Israel, the debate over legislation to regulate stablecoins seems like small potatoes. But there is a connection, which is that stablecoins could have national security implications: Unless we strengthen their regulation, they could undermine our ability to use sanctions to advance our national interests.

This was illustrated recently by news that Russian smugglers have used Tether, the largest stablecoin, to avoid Western sanctions and purchase billions of dollars worth of weapons."

"Stablecoins are a type of cryptocurrency that is far more useful as a means of payment than Bitcoin. 1 That is because stablecoins are designed to maintain a constant price in terms of another asset. 2 Stablecoins pegged to the U.S. dollar are more “money-like” than other cryptocurrencies.

They can be used to move value across borders without going through banks, and it is the banking system—and in particular the role of U.S. banks—that is key to the implementation and efficacy of sanctions."

"Stablecoins are in some respects similar to Eurodollars, a financial innovation that helped to create the financial plumbing used to implement sanctions. Both stablecoins and Eurodollars are U.S. dollar-based liabilities that had their origins outside the regulated banking system...

It is the global dominance of the dollar, coupled with the role of U.S. banks in facilitating dollar payments, that gives the U.S. its tremendous financial leverage."

"Could stablecoins undermine that leverage? As with the early days of the Eurodollar market, stablecoin use is minimal today, and so their national security risk may also be minimal. But just as Eurodollar use grew quickly and unexpectedly, stablecoins could also grow.

While they are used principally to trade other crypto assets today, they could become a more widespread means of payment. They have also become popular as a means for people in countries with weak currencies to acquire a dollar substitute.

Moreover, that growth could come even if the U.S. does not take action. That is because many other jurisdictions are creating frameworks to license stablecoins, including Europe, the U.K., Japan, Singapore and the U.A.E. While those frameworks may lead to stablecoins in native currencies, they could also give rise to new dollar-based stablecoins.

@ Newshound News™

Read more: BrookingsEdu

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Saturday Evening 7-6-24

Good Evening Dinar Recaps,

WHAT CAN RLUSD STABLECOIN DO THAT XRP CANT DO?

"Ripple President Monica Long explains the dual role the forthcoming RLUSD stablecoin could play alongside XRP for developers and payment utilities."

1. Some customers will prefer to transact in USD, so the stablecoin is the better method. 2. Sometimes a bridge asset is unnecessary. 3. XRP is a neutral crypto FOR USE as a BRIDGE ASSET. 4. XRP can move more than just currency, RLUSD only moves US dollars.

Good Evening Dinar Recaps,

WHAT CAN RLUSD STABLECOIN DO THAT XRP CANT DO?

"Ripple President Monica Long explains the dual role the forthcoming RLUSD stablecoin could play alongside XRP for developers and payment utilities."

1. Some customers will prefer to transact in USD, so the stablecoin is the better method.

2. Sometimes a bridge asset is unnecessary.

3. XRP is a neutral crypto FOR USE as a BRIDGE ASSET.

4. XRP can move more than just currency, RLUSD only moves US dollars.

"Ripple sees XRP as essential for efficient cross-currency or cross-token settlements, particularly for long-tail assets and currencies. Long cited instances with the sub-Saharan African region, Europe, and the Middle East where costs can be very high amid insufficient liquidity. In these scenarios, fees can exceed 10% of the payment, making XRP crucial for the transactions."

© Newshounds News™

Read more The Crypto Basis

~~~~~~~~~

DONALD TRUMP STATES HE WILL BECOME THE FIRST CRYPTO PRESIDENT

"At a campaign fundraising event in June, former president Donald Trump styled himself as something that would have seemed unlikely not long ago. He said he would be the crypto president," tech executive Trevor Traina, who attended the fundraiser, told Reuters that month."

"By May, he declared that the US should be the industry's global leader in the space."

"The numbers back the point. According to a May report from Public Citizen, the cryptocurrency sector is becoming a titan of political funding that's hard to ignore."

"About half of young voters surveyed by Grayscale said they will consider a candidate's crypto position before voting."

DONALD TRUMP'S STANCE ON CRYPTO SHOULD GET THE ATTENTION OF THE US SENATE WHO HAS YET TO PASS A CRYPTO BILL

© Newshounds News™

Read more: Business Insider

~~~~~~~~~

"Which Banks Are Using Ripple?

Ripple’s network of banking partners has continued to grow as the blockchain expands its global reach and influence. Moreover, the number of potential partners is expected to increase as Ripple Labs tries to move forward from its lengthy legal battle with the U.S. Securities and Exchange Commission (SEC)."

"The following banks are confirmed to have been working with Ripple:

*Santander (USA)

*Canadian Imperial Bank of Commerce (Canada)

*Kotak Mahindra Bank (India)

*Itaú Unibanco (Brazil)

*IndusInd (India)

*InstaReM (Singapore)

*BeeTech (Brazil)

*Zip Remit (Canada)

*LianLian (China)

*RAKBANK (U.A.E.)

*IFX (U.K.)

*TransferGo (U.K.)

*Currencies Direct (U.K.)

*Airwallex (Australia)

*SEB (Sweden)

*SBI Remit (Japan)

*Siam Commercial Bank (Thailand)

*Krungsri (Thailand)

On the flipside Ripple may be a faster and more affordable blockchain network than Bitcoin and Ethereum, but it is outclassed by modern networks like Solana (SOL) regarding speed and efficiency."

© Newshounds News™

Read more: Daily Coin

~~~~~~~~~

VIETNAM INTRODUCES MANDATORY FACIAL RECOGNITION FOR DIGITAL PAYMENTS THAT EXCEED APPROXIMATELY $390

This will be an issue for many US citizens going into the digital age as privacy concerns accompany KYC/AML (know your customer/ anti-money laundering) laws.

"Authorities in Vietnam have introduced a facial recognition requirement for all digital payments of 10 million dong (about $390) or more made in the country. The measure, which has already raised questions about privacy and security, requires all money transfers made through banks or e-wallets to involve face scanning on smartphones via banking applications. According to the State Bank of Vietnam, the obligation aims to “ensure the security of online and bank card payments.”

Newshounds News will be keeping an eye on these new laws and will report on their advancement.

© Newshounds News™

Read more: Agenzia Nova

~~~~~~~~~

BASEL COMMITTEE UPDATE REGARDING CRYPTO RULES FOR BANKS

"The committee is unveiling the standards later in July, culminating a years-long process."

"The Basel Committee met on July 2-3 and made policy decisions on issues that included disclosure of banks’ crypto exposure. A disclosure framework for banks’ crypto assets was proposed in December 2022 and opened for comments in May 2023.

"Updated standards will be published later in July, according to a Bank for International Settlements (BIS) statement."

This article is dated July 3, 2024, up-to-date news regarding BIS and BASEL 3

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Venezuela’s Digital Asset Remittances Hit Yearly $460 Million

"Venezuelans have recorded an increased amount of remittances with crypto numbers surging in the last one year."

HIGHLIGHTS

*"Venezuela recorded $5.4 billion in remittances last year."

*"Out of this number, over $460 million were crypto transactions."

*"Global adoption of crypto assets continues to soar with more use cases."

"Venezuelan citizens have recorded a surging number of cryptocurrency remittances with figures above $460 million in the last 12 months. Generally, remittances in the country have grown due to harsh economic conditions that led to huge numbers of migrants. The figure shows a growth in crypto adoption in the last year in Latin America and other jurisdictions."

"Venezuelans Embrace Crypto Remittances"

"Venezuelans have increased their crypto usage for transactions as general figures have spiked in the last year. According to data from the Inter-American Dialogue, Venezuelans remitted about $5.4 billion contributing 6% to the gross domestic product. To put growth in perspective, the figure is almost a 75% surge from 2021. "

"Crypto remittances were up to $461 million, totaling 9% of numbers per Chainalysis data. Manuel Orozco, director of Migration, Remittances, and Development at the Inter-American Dialogue noted that while the figures are high, a large number of migrants cannot afford to send remittances. “The number of Venezuelan migrants that are sending remittances has jumped 50-60%. It’s not a higher percentage because the rest of the migrants cannot yet afford to send money.”"

"Venezuelan remittances spiked after the country faced an economic crisis leading to migration with about 30% of households receiving money from foreign countries. In the last 10 years, over 7 million Venezuelans have left the country sending money back home through digital methods. While traditional remittance methods appear slower and more expensive, crypto assets provide an easier route. However, crypto users back home face certain regulations on some digital asset exchanges with many calling on pro-industry laws."

Globally, Crypto usage has soared. Traditional means of remittances have huge rates attached, while crypto is a much faster and cheaper way to send remittances.

@ Newshound News™

Read more: CoinGape

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Thursday Evening 7-4-24

Good Evening Dinar Recaps,

WHAT IS A TIER ONE BANK? "Banking regulations known as the Basel Accords require banks to have different types of capital on hand. These liquid and cash assets balance out the risk-weighted assets that banks hold. This increases banks' stability, which increases the stability of the overall financial system. " "Tier 1 capital is the primary funding source of the bank. Typically, it holds nearly all of the bank's accumulated funds. These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down. Under Basel III, the minimum tier 1 capital ratio is 10.5%."

Good Evening Dinar Recaps,

WHAT IS A TIER ONE BANK?

"Banking regulations known as the Basel Accords require banks to have different types of capital on hand. These liquid and cash assets balance out the risk-weighted assets that banks hold. This increases banks' stability, which increases the stability of the overall financial system. "

"Tier 1 capital is the primary funding source of the bank. Typically, it holds nearly all of the bank's accumulated funds. These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down. Under Basel III, the minimum tier 1 capital ratio is 10.5%."

"What Do the Basel Accords Do?"

"The Basel Accords are international banking regulations that ensure banks have enough capital on hand both to meet their obligations and absorb any unexpected losses. They are set by the Basel Committee on Bank Supervision (BCBS)."

© Newshounds News™

Read more: Investopedia

~~~~~~~~~

Crypto Industry Is About to Boom, Is Outperforming the Internet: Architect Partners

The digital asset industry added more than $750 billion in value in the first half of the year, the report said.

—The cryptocurrency industry is starting a major growth phase, the report said.

—Architect Partners said the industry added more than $750 billion in value in the first half of the year.

—Crypto, the stepchild of the internet, is outperforming its predecessor at the same part of their respective life cycles, the advisory firm said.

The digital asset industry is beginning a major growth phase and is in a far better place than it was two years ago, investment bank Architect Partners said in a quarterly report published last week.

© Newshounds News™

Read More: Coin Desk

~~~~~~~~~

"ISO 20022 is an ISO standard for electronic data interchange between financial institutions."

"Over the next four years, ISO will revolutionize the banking sector by improving efficiency, data quality and the ability for organizations to establish enhanced controls."

"Over 70 countries have already adopted ISO 20022 in their payment systems including Switzerland, China, India and Japan. SWIFT, which begins its own migration journey to ISO 20022 in November 2022, estimates 80% of global, high-value payments by volume will be processed through the standard by 2025."

© Newshounds News™

Read more: The Global Treasurer, Wikipedia

~~~~~~~~~

BRICS and XRP

"In its foundational documents, including summit declarations and joint communiqués, BRICS emphasizes key principles like respect for sovereignty, non-interference in the internal affairs of member states, and a commitment to a multipolar world. These documents typically revolve around topics such as trade, investment, technology, and sustainable development."

BRICS and XRPL: A Surprising Convergence

"Surprisingly, within the realm of these documents, a unique convergence with blockchain technology, particularly Ripple’s XRPL, becomes apparent. The mention of XRPL within BRICS documents reflects an acknowledgment of the potential of blockchain technology to reshape the global financial landscape. This recognition indicates that the member nations of BRICS perceive blockchain as a strategic enabler for enhancing financial systems, fostering transparency, and promoting efficient cross-border transactions."

"Ripple’s XRP Ledger (XRPL) stands out in the blockchain space due to its focus on facilitating real-time, cross-border transactions with minimal fees. Unlike traditional financial systems, which can be slow, costly, and subject to intermediaries, XRPL’s decentralized nature allows for seamless peer-to-peer transactions, enabling faster remittances and lower fees. So, the integration of XRPL technology could potentially streamline trade and investment between BRICS member states, promoting economic growth and collaboration."

© Newshounds News™

Read more: All Coin Buzz

~~~~~~~~~

Vietnam's Digital Payments Landscape: A Look at the Emerging Trends

Vietnam's digital payment ecosystem is undergoing a remarkable transformation, driven by a tech-savvy population, government initiatives, and innovative financial solutions. Over the past decade, the country has seen a surge in digital payment adoption, making cashless transactions a way of life for millions of Vietnamese people.

Vietnam's digital payment revolution is marked by a shift away from cash transactions toward convenient, secure, and efficient digital payment methods. E-wallets, QR code payments, contactless cards, and innovative fintech solutions have played a pivotal role in reshaping the country's payments landscape.

Read more: FinExtra

~~~~~~~~~

Japan Is on a Web 3.0 Hot Streak, and the World Should Take Notes

From its cultural heritage to cutting-edge technological advancements, Japan is where ancient customs and modern marvels converge.

The unique blend of tradition and innovation reflects Japan’s strategic positioning within crypto.

Putting regulatory clarity into practice

Despite crypto’s evolution from a speculative investment to an asset class contributing to a balanced portfolio, governments worldwide remain conflicted about how to regulate it.

While it’s not atypical for regulatory bodies to disagree on how to oversee financial instruments, the approach to crypto assets continues to be divisive.

India, for example, has no centralized authority handling crypto regulations and offers no guidelines for settling disputes when dealing with digital assets, leaving investors to trade at their own risk.

The absence of regulations allows unmonitored practices to flourish – and without appropriate safeguards, criminals can and do benefit from the lack of oversight, leaving law-abiding citizens to suffer.

Without laws, there are no legal ramifications, and crypto has magnified this issue before when people or organizations have gotten away with crimes due to legal shortcomings.

{{This is why putting the Regulations into place is so important.}}

Read more: DailyHodl

~~~~~~~~~

CRYPTOCURRENCY EXPLAINED WITH PROS AND CONS FOR INVESTMENT

Learn what you need to know before you invest in a virtual currency | Investopedia

☝An excellent article if you are new to crypto

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 7-3-24

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 7-3-24

Good Afternoon Dinar Recaps

Circle expects MiCA to squeeze other unregulated stablecoins "Circle EU expects a transformative year ahead for the European crypto market. Key implementation dates for MiCA include June 30 for stablecoins and December 30 for crypto asset service providers."

"Circle’s USDC and EURC stablecoins are now fully compliant with the new regulations, alleviating concerns that investors would need to redeem their stablecoins or transfer funds to other digital assets to remain compliant." © Newshounds News™

Good Afternoon Dinar Recaps

Circle expects MiCA to squeeze other unregulated stablecoins

"Circle EU expects a transformative year ahead for the European crypto market. Key implementation dates for MiCA include June 30 for stablecoins and December 30 for crypto asset service providers."

"Circle’s USDC and EURC stablecoins are now fully compliant with the new regulations, alleviating concerns that investors would need to redeem their stablecoins or transfer funds to other digital assets to remain compliant."

© Newshounds News™

Read more: Finance Feeds

~~~~~~~~~

“Will the US set standards for stablecoins, or would we continue down the path of uncertainty?"

"Pointing to clear-cut laws in centralized finance, the company advocated for pro-stablecoin laws giving the country an edge. Describing stablecoins as the foundation for modern commerce, Circle added that it can do for finance what email did for communication. Furthermore, the company noted that stablecoin laws in the United States can help preserve the dollar as the world reserve currency."

"Circle issues the USDC and highlights its pathway to regulations. Per the release, its stablecoin reserves are public on its website calling on authorities to make broader rules to protect investors. The company added that the country is a massive opportunity to lead finance to the next internet wave."

CIRCLE SEEMS TO BE LEADING THE CHARGE IN THE US CALLING FOR CLEAR STABLECOIN REGULATION.

© Newshounds News™

Read more: Coin Gape

~~~~~~~~~

WILL DIGITAL CURRENCIES BECOME THE NORM?

"A CBDC is not a new currency. It is a digital representation of an existing national currency. So an Australian CBDC would have exactly the same value as an Australian dollar. It would be legal tender."

"Like the banknotes in our wallets, the CBDC we could spend using our phones would be issued by the Reserve Bank. But it would enable more sophisticated and innovative types of financial transactions, such as 'smart contracts'. The wholesale version, by contrast, would only be available to financial institutions."

"While the BIS report shows 94% of central banks are considering CBDCs, with about one third running pilot projects, most are being cautious and do not expect to issue their own digital currency in the next few years.'

© Newshounds News™

Read more: Currency Insider

~~~~~~~~~

WHAT ARE SMART CONTRACTS?

"A smart contract involves an instant payment made simultaneously with, and conditional on, the transfer of ownership of an asset."

Why are we discussing smart contracts when we don't even know what they are? Because we WILL be using them in our very near future. TRANSFER OF OWNERSHIP at the same time money changes hands through a digital platform.

"Vending machines provide a good analogy. If you insert $2 and press B4, then the machine dispenses the cookies in the B4 slot. In other words, if (and only if) the vending machine receives the required item of value, then it instantly performs the requested action."

© Newshounds News™

Read more: Currency Insider

~~~~~~~~~

30 TRILLION IN TOKENIZED ASSETS BY 2034?

"A new study released today by Standard Chartered and Synpulse, estimates that the demand for tokenised assets could soar to $30.1 trillion by 2034. Global trade is expected to reach $32.6 trillion by 2030."

"“We see the next three years as a critical junction for tokenisation, with trade finance assets coming to the fore as a new asset class,” said Kai Fehr, Global Head of Trade, Standard Chartered. Banks need to increasingly take on the role of bridging the existing traditional financial markets with a newer and more open token-enabled market infrastructure."

© Newshounds News™

Read more: Trade Finance Global

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Tuesday Evening 7-2-24

Good Evening Dinar Recaps,

WHAT EXACTLY IS A STABLECOIN

"Stablecoins are a type of cryptocurrency that seeks to maintain a stable value by pegging their market value to an external reference. This reference could be a fiat currency like the U.S. dollar, a commodity such as gold, or another financial instrument."

"Stablecoins play a crucial role in the cryptocurrency ecosystem due to their stability."

"They aim to provide the speed and security of a blockchain while eliminating the volatility that most cryptocurrencies endure. Initially used primarily to buy cryptocurrencies on trading platforms that did not offer fiat currency trading pairs, stablecoins have seen their adoption grow. They are now used in several blockchain-based financial services, such as lending platforms, and can even be used to pay for goods and services. © Newshounds News™

Good Evening Dinar Recaps,

WHAT EXACTLY IS A STABLECOIN

"Stablecoins are a type of cryptocurrency that seeks to maintain a stable value by pegging their market value to an external reference. This reference could be a fiat currency like the U.S. dollar, a commodity such as gold, or another financial instrument."

"Stablecoins play a crucial role in the cryptocurrency ecosystem due to their stability."

"They aim to provide the speed and security of a blockchain while eliminating the volatility that most cryptocurrencies endure. Initially used primarily to buy cryptocurrencies on trading platforms that did not offer fiat currency trading pairs, stablecoins have seen their adoption grow. They are now used in several blockchain-based financial services, such as lending platforms, and can even be used to pay for goods and services.

© Newshounds News™

Read more: CoinBase

~~~~~~~~~

DO YOU UNDERSTAND BLOCKCHAINS?

Blockchains are the critical infrastructure underlying cryptocurrencies. The common feature of these distributed ledgers is the sequential updating of a cryptographically secure, verifiable transaction record among a network of peers all operating under a certain set of rules enforced through the software itself. This record is owned and operated in common by anyone anywhere.

While research in shared ledger technology goes back decades, the arrival of the Bitcoin blockchain introduced the first distributed ledger technology that was thoroughly decentralized and resistant to censorship, seizure and collusion.

Blockchain technology, in its various manifestations including the Ethereum blockchain and others, is ultimately a global consensus system — i.e., it allows people to coordinate and cooperate around a neutral source of information without trusting each other or a central administrator. The use cases are wide-ranging, from finance and energy trading to supply chain management.

At Cointelegraph, we are chronicling the evolving blockchain industry. Is it revolutionary or overhyped? Or both? Will it become the solution to securing trust in finance and global trade? What will be the rate of blockchain transactions in the coming years?

Stay tuned to find out.

© Newshounds News™

SOURCE: Coin Telegraph

~~~~~~~~~

Crypto-Friendly Silvergate Bank Pays $63M to Settle Charges With SEC, Fed, California Regulator

Silvergate's executives were aware of 'critical deficiencies' in the bank's anti-money laundering protections, the SEC alleged.

Silvergate Bank's parent company settled charges with the Securities and Exchange Commission, Federal Reserve and California Department of Financial Protection and Innovation alleging it failed to maintain a proper anti-money laundering program and made misleading disclosures about the program's effectiveness.

The SEC also charged Silvergate's former executives. Former CEO Alan Lane and former COO Kathleen Fraher agreed to settlements, while former CFO Antonio Martino denied the charges.

Read more: Coin Desk

~~~~~~~~~

Coinbase files motion to reinforce judge's ruling on Binance case: Secondary market transactions not securities

The SEC is suing Coinbase for selling unregistered securities, but the definition of a security under US law is unclear as applied to crypto, according to Coinbase.

Coinbase uses Judge Jackson's ruling to argue for consistent securities law enforcement in crypto.

The motion calls for clarity in the application of the Howey test to crypto transactions.

Read more: Crypto Briefing

~~~~~~~~~

CFTC Announces Supervisory Stress Test Results

The Commodity Futures Trading Commission today issued Supervisory Stress Test of Derivatives Clearing Organizations: Reverse Stress Test Analysis and Results, a report detailing the results of its fourth Supervisory Stress Test (SST) of derivatives clearing organization (DCO) resources. Among other findings, the 2024 report concluded the DCOs studied hold sufficient financial resources to withstand many extreme and often implausible price shocks.

The Risk Surveillance Branch of the Division of Clearing and Risk conducts periodic SSTs to assess how DCOs might fare under extreme stress. Staff previously conducted SSTs in 2016, 2017, and 2019. The 2019 SST included a reverse stress test component, and this 2024 SST is a major expansion of that, which includes nine DCOs, representing 11 clearing services across four asset classes (futures and options on futures, cleared interest rate swaps, credit default swaps, and foreign exchange products).

The purpose of the analysis was twofold: (1) to identify hypothetical combinations of extreme market shocks, concurrent with varying numbers of clearing member (CM) defaults, that would exhaust prefunded resources (DCO committed capital, and default fund), and unfunded resources available to the DCOs (this represents the reverse stress test component), and (2) to analyze the impacts of DCO use of mutualized resources on non-defaulted CMs.

Read more: CFTC

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 7-2-24

Good afternoon Dinar Recaps,

THE CHEVRON DOCTRINE OVERTURNED BY THE SUPREME COURT

A 40 year PRECEDENT called the Chevron Doctrine WAS OVERTURNED by SCOTUS on June 28th. How could this affect the RV of CURENCY in the U.S.? The overturning of the Chevron Doctrine stripped 3 letter agencies from enacting enforceable policies from ambiguous laws. "

Under that doctrine, if Congress has not directly addressed the question at the center of a dispute, a court was required to uphold the agency’s interpretation of the statute as long as it was reasonable. But in a 35-page ruling by Chief Justice John Roberts, the justices rejected that doctrine, calling it “fundamentally misguided.”

How will this affect the SEC and the CFTC moving forward as they address Crypto and Digital Asset guidelines?

Good afternoon Dinar Recaps,

THE CHEVRON DOCTRINE OVERTURNED BY THE SUPREME COURT

A 40 year PRECEDENT called the Chevron Doctrine WAS OVERTURNED by SCOTUS on June 28th. How could this affect the RV of CURENCY in the U.S.?

The overturning of the Chevron Doctrine stripped 3 letter agencies from enacting enforceable policies from ambiguous laws.

"Under that doctrine, if Congress has not directly addressed the question at the center of a dispute, a court was required to uphold the agency’s interpretation of the statute as long as it was reasonable. But in a 35-page ruling by Chief Justice John Roberts, the justices rejected that doctrine, calling it “fundamentally misguided.”

How will this affect the SEC and the CFTC moving forward as they address Crypto and Digital Asset guidelines?

© Newshounds News™

Read more: SCOTUS Blog

~~~~~~~~~

STOCK MARKET CORRECTION ON THE HORIZON?

"Leading global investment bank JP Morgan has predicted a major US stock market crash. The bank remains cautious on the S&P 500 index noting that a 20% downside could be on the cards. JP Morgan’s doomsday stock market prediction comes when BRICS is looking to uproot the dollar and damage the US economy."

" If the US stock market dips 23% according to JP Morgan, BRICS currencies will gain strength in the forex markets. While the US stock market will look at ways to stop the crash, BRICS could cause further damage by cutting ties with the dollar."

"JP Morgan’s bearish forecast for the US stock market is bullish for BRICS as it wants to pull the dollar down. The weakening of the US dollar is a boon to BRICS which wants to push local currencies ahead for trade."

© Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

DO YOU OWN GOLD?

"The vast majority of professional investors in North America own at least some gold and the number has been growing in recent years. A World Gold Council survey of 525 North American investors found a steadily growing trend of gold ownership. The survey included large institutions, consultants, and financial advisors."

"Over one-quarter of respondents said they plan to increase gold allocations in the next 12 to 18 months. That was more than double the number who said they plan to reduce their exposure to gold."

"In fact, gold has outperformed most asset classes over the last 25 years. In fact, with an average 8 percent return each year, gold has outperformed equities over the last quarter century. "

© Newshounds News™

Read more: ZeroHedge

~~~~~~~~~

U.S. SENATE PICKS UP CRYPTO LEGISLATION

H.R. 4763 passed in the Congress late May giving the U.S. their first look at crypto legislation. The Senate has yet to act upon any Crypto/Digital Asset bill until now as Senator JD Vance (R-OH) is now crafting legislation.

"On June 26, Politico reported that Sen. J.D. Vance (R-OH) has been circulating the draft of a digital assets bill that he hopes to introduce in July. Vance’s bill will reportedly give ‘crypto’ operators even more latitude than the Financial Innovation and Technology for the 21st Century Act (FIT21) approved by the House of Representatives last month."

"And yet Vance’s draft bill reportedly takes “a more industry-friendly approach” than FIT21, which is saying something, given that FIT21’s passage set champagne corks-a-poppin’ within the halls of U.S. digital asset firms. Vance’s bill will reportedly “take a simpler approach to determining which digital assets the SEC would oversee versus the CFTC.”

© Newshounds News™

Read more: Coin Geek

~~~~~~~~~

MiCA AND STABLECOIN RESTRICTIONS

"A few press reports have raised concerns about stablecoin limits under the European Union’s Markets in Crypto Assets Regulation (MiCAR). The stablecoin elements of the regulation came into force at the end of June. The regulation does indeed have some draconian limits, at which point the stablecoin must cease activity. The European Banking Authority has relaxed the rules in its final iteration."

"The EU is saying if you want to use stablecoins to buy crypto and do DeFi stuff, have at it. But if you want to use stablecoins to pay for goods and services like your coffee or your rent, then you need to use Euro (or other EU currency) stablecoins. The limits are really about monetary sovereignty."

© Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Monday Evening 7-1-24

Good evening Dinar Recaps

NEW JAPANESE BANKNOTES TO BE ISSUED FROM JULY 2024

"The banknotes feature as an anti-counterfeiting measure the world’s first three-dimensional holograms that make the portraits on bills appear to rotate when tilted. Tactile marks allow the visually impaired to identify the denominations."

"From the time that they are issued, the new banknotes will be available from financial institutions and ATMs. Currently issued banknotes will continue to be legal tender."

Good Evening Dinar Recaps

NEW JAPANESE BANKNOTES TO BE ISSUED FROM JULY 2024

"The banknotes feature as an anti-counterfeiting measure the world’s first three-dimensional holograms that make the portraits on bills appear to rotate when tilted. Tactile marks allow the visually impaired to identify the denominations."

"From the time that they are issued, the new banknotes will be available from financial institutions and ATMs. Currently issued banknotes will continue to be legal tender."

This ISN'T a revaluation of Japan's currency.

© Newshounds News™

Read more: Nippon

~~~~~~~~~

COMMERCIAL REAL ESTATE FACING UNCERTAIN TIMES

"US Banks Dumping Exposure To $2,500,000,000,000 Market Before ‘Inevitable Losses’ Hammer Balance Sheets: Report"

"Some of the biggest banks in America are quietly selling their exposure to a troubled sector of the US economy, according to a new report.

The banks are beginning to dump commercial real estate loans in a push to “cut their losses,” reports the New York Times."

“…These steps indicate a grudging acceptance by some lenders that the banking industry’s strategy of ‘extend and pretend’ is running out of steam, and that many property owners – especially owners of office buildings – are going to default on mortgages. That means big losses for lenders are inevitable and bank earnings will suffer.”

© Newshounds News™

Read more: Daily Hodl

~~~~~~~~~

WHAT EXACTLY IS FEDNOW?

"The FedNow Service is a new service for instant payments built by the Federal Reserve to help make everyday payments fast and convenient for American households and businesses. Banks and credit unions of all sizes can sign up for the FedNow Service and offer new instant payment services to their customers. In the coming years, customers of banks and credit unions who sign up for the FedNow Service will be able to use their financial institution's app, website, and other interfaces to send instant payments directly from their bank accounts quickly and securely. "

"The FedNow Service enables individuals and businesses to send and receive payments within seconds at any time of the day, on any day of the year, so that the receiver of a payment can use the funds immediately."

Instant payments allow consumers and businesses to send and receive funds from their accounts at banks and credit unions in real-time, any time of day, any day of the year, with immediate funds available to receivers.

© Newshounds News™

Read more: FederalReserve

~~~~~~~~~

IS FEDNOW A CBDC?

"Is the FedNow Service replacing cash? Is it a central bank digital currency?

No. The FedNow Service is not related to a digital currency. The FedNow Service is a payment service the Federal Reserve is making available for banks and credit unions to transfer funds for their customers."

"Does the Fed have access to my bank account with the FedNow Service?

No. The Federal Reserve and the FedNow Service cannot access individuals' bank accounts or control how they choose to spend their money."

© Newshounds News™

Read more: FederalReserve

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-1-2

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-1-24

Good Evening Dinar Recaps,

"Stripe and Coinbase have partnered to expand the global adoption of cryptocurrency and provide faster, cheaper financial infrastructure."

"This collaboration aims to serve businesses and people around the world, Coinbase said in a Thursday (June 27) blog post."

"With this partnership, Stripe will add USDC on Base to its crypto payouts product, according to the post. This will enable Stripe platforms to make “faster, cheaper” money transfers to more than 150 countries."

Good Evening Dinar Recaps,

"Stripe and Coinbase have partnered to expand the global adoption of cryptocurrency and provide faster, cheaper financial infrastructure."

"This collaboration aims to serve businesses and people around the world, Coinbase said in a Thursday (June 27) blog post."

"With this partnership, Stripe will add USDC on Base to its crypto payouts product, according to the post. This will enable Stripe platforms to make “faster, cheaper” money transfers to more than 150 countries."

"In addition, Stripe will add USDC on Base to its fiat-to-crypto onramp, allowing customers in the U.S. to make faster fiat-to-crypto conversions, the post said."

"In a third key integration that’s part of this collaboration, Coinbase will add Stripe’s fiat-to-crypto onramp to Coinbase Wallet. This integration will enable instant purchase of crypto with credit cards and Apple Pay, per the post."

Read more: PYMNTS

~~~~~~~~~

Circle Snags First Stablecoin License Under EU's New MiCA Crypto Rules

Circle Mint France will issue the euro-denominated EURC stablecoin and USDC in the European Union in compliance with MiCA.

Circle is claiming bragging rights as the first global stablecoin issuer to comply with MiCA.

Before the rules took effect on June 30, some exchanges delisted euro-denominated stablecoins, such as Tether’s EURT.

Circle became the first global stablecoin issuer to secure an Electronic Money Institution (EMI) license, a prerequisite to offering dollar- and euro-pegged crypto tokens in the European Union (EU) under the Markets in Crypto Assets (MiCA) regulatory framework.

Read more: CoinDesk

~~~~~~~~~

U.S. Marshals Service Announces Partnership With Coinbase To Manage and Dispose Cryptocurrencies

The US government has announced it is using American crypto exchange Coinbase to custody its digital assets.

The U.S. Marshals Service (USMS), a sub-tier of the Department of Justice (DOJ), has revealed that it is custodying digital assets with Coinbase as part of its program to manage and dispose of large amounts of “Class 1” cryptocurrencies.

“The U.S. Marshals Service (USMS) Department of Justice (DOJ), on behalf of the Asset Forfeiture Division (AFD) has a requirement for managing and disposing of large quantities of popular cryptocurrency assets, known as Class 1 cryptocurrencies. This will require the use of multiple, industry leading, storage and liquidation techniques employed in a manner that is professional, lawful, and consistent with Department and USMS policy.

This contract will also streamline custody, management, and disposal processes for cryptocurrency assets while allowing for the diversification of the type of cryptocurrency assets that can be managed and disposed of under the Government’s forfeiture programs.”

In a blog post, Coinbase says it has a “longstanding history” of working with government agencies.

“Coinbase has a longstanding history of supporting law enforcement agencies, dating back to the founding of our law enforcement program in 2014. Today, Coinbase works with every major U.S. federal, state, and local law enforcement agency, as well as international agencies on every continent.

Read More: Daily Hodl

~~~~~~~~~

DE-DOLLARIZATION

Is Saudi Arabia pulling back from the dollar for oil trade? It appears SA is looking to diversify its oil trade.

"American economic dominance is no longer as stark, with its share of world GDP falling from 40% to 25% since 1960. Moreover, US dependence on Saudi oil has slid considerably, given a historic explosion in US domestic production."

"For instance, Saudi Arabia is among potential BRICS candidates, an economic bloc that has become one of the leading voices against the dollar. It's also linked with China to help establish mBridge, a cross-border payments system that uses central bank digital currencies."

Read more: Markets Business Insider

~~~~~~~~~

WILL CBDC's TURN US INTO A CASHLESS SOCIETY?

"Digital economies require digital currencies."

"Personal, government and business payments shifted away from mainly cash to online and digital payments, embraced FinTech (eg, for financial market transactions, lending, wealth management), with tech companies such as Apple and Alibaba disintermediating banks."

"Retail, wholesale, cross-border and financial payment systems now enable e-commerce and digital finance including digital assets and cryptocurrencies such as Bitcoin and Ethereum. Data suggests there is substantial appetite for cryptocurrencies in the Middle East and North Africa: the region had the sixth largest crypto economy globally, with an estimated $389.8 billion in on-chain value received, in the year ending June 2023 (about 7.2 percent of global transaction volumes)."

"Saudi Arabia reported the highest growth globally in the volume of cryptocurrency transactions during this period."

Read more: Currency Insider

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV And Economics Updates Sunday Afternoon 6-30-24

Seeds of Wisdom RV And Economics Updates Sunday Afternoon 6-30-24

Good Evening Dinar Recaps,

XRP News Today: Did the Binance Ruling Sink SEC Plans to Appeal?

XRP gained 0.28% on Saturday, June 29, closing the session at $0.4722. SEC vs. crypto case-related news drove buyer demand for XRP.

On Sunday, investors should consider the possible influence of the latest court ruling on ongoing SEC vs. crypto cases. Ripple Chief Legal Officer Stuart Alderoty shared the news of the court ruling, saying:

Seeds of Wisdom RV And Economics Updates Sunday Afternoon 6-30-24

Good Evening Dinar Recaps,

XRP News Today: Did the Binance Ruling Sink SEC Plans to Appeal?

XRP gained 0.28% on Saturday, June 29, closing the session at $0.4722.

SEC vs. crypto case-related news drove buyer demand for XRP.

On Sunday, investors should consider the possible influence of the latest court ruling on ongoing SEC vs. crypto cases.

Ripple Chief Legal Officer Stuart Alderoty shared the news of the court ruling, saying:

“For all the SEC has done to muddy the waters with its inconsistent legal theories, the Courts are seeing right through them. The Binance decision last night is long but absolutely worth a read.”

Read more: FX Empire

~~~~~~~~~

Ripple vs SEC Case As of June 30, 2024: Torres’s Verdict On XRP Stands

The legal landscape surrounding cryptocurrencies in the U.S., especially XRP, is gaining much-needed clarity. Two recent court decisions have significantly impacted the ongoing lawsuit between the U.S. Securities and Exchange Commission (SEC) and Ripple and broader industry regulations.

In a significant victory for the crypto industry, District Judge Amy Berman Jackson has bolstered the legal precedent set by Judge Analisa Torres in the SEC vs. Ripple case. Judge Jackson’s decision in the Binance vs. SEC case centered on the classification of Binance’s BNB token.

The SEC argues that secondary sales of BNB by users on crypto exchanges constituted unregistered securities offerings. However, Judge Jackson disagreed, dismissing the SEC’s claim.

This ruling, shared on X by Fox Business journalist Eleanor Terrett, aligns with Judge Torres’ previous decision in the Ripple case.

Read more: Times Tabloid

~~~~~~~~~

XRP Secondary Sales Deemed Non-Securities, Judge Torres’ Doctrine Stands

Judge Jackson’s ruling that XRP secondary sales aren’t securities boosts Ripple and sets a crucial precedent for the entire crypto industry.

Judge Jackson and Torres’ aligned decisions clarify that crypto assets traded by individuals on exchanges do not qualify as securities.

XRP price jumped over 1% after the ruling, aiming to regain $0.50, with increased interest from derivatives traders on OKX and BitMEX.

Judge Amy Berman Jackson has upheld Judge Torres’ doctrine, asserting that XRP’s secondary sales are not securities. This ruling came during the Binance vs. SEC case, where the SEC’s claim regarding secondary sales of Binance’s BNB was dismissed. To that end, the ruling by Judge Jackson, in concurrence with that of Judge Torres on the sale of XRP, sets an example in the crypto industry.

Read more: Crypto News Land

~~~~~~~~~

Pro-XRP Lawyer Sees Binance Ruling as Boost for XRP Non-Security Status

Attorney Bill Morgan says Binance case ruling boosts XRP’s non-security status.

Judge Jackson cited Judge Torres’ Ripple case decision when dismissing parts of the SEC’s case against Binance.

Morgan highlights that the ruling aligns with Judge Torres’ interpretation of the Howey test.

Read more: Coin Edition

~~~~~~~~~

XRP Lawsuit: Ripple Notches Massive Wins as CEO Brad Garlinghouse Clarifies XRP’s Security Status

Ripple Labs CEO Brad Garlinghouse has taken swipes at news outlets over inaccurate reporting of a court decision involving XRP and the US Securities and Exchange Commission (SEC).

The fiasco began following a ruling by Judge Phyllis Hamilton of the US District Court for the Northern District of California, which threw out a class action suit against the issuers of the XRP token. While considered a massive win for Ripple Labs, the judge allowed an individual state law claim to proceed to trial based on alleged “misleading statements” made by Garlinghouse in 2017.

As XRP’s community celebrated the dismissal of securities law violation, CoinDesk and a raft of crypto news outlets reported that Hamilton’s decision could imply that XRP may be a security. The reporting triggered a stir in the ecosystem as XRP enthusiasts believe the question of the asset being a security was finalized in a 2023 decision by District Judge Analisa Torres in New York’s Southern District.

CoinDesk described the ruling as a “fly in the ointment,” but the report elicited fierce kickbacks from XRP’s community, with Garlinghouse leading the charge. According to Garlinghouse on X (formerly Twitter), Garlinghouse described the report as “embarrassing,” noting that Hamilton did not expressly term XRP as a security.

Read more: ZyCrypto

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

The Latest RV And Economics Updates from the Seeds of Wisdom Sunday AM 6-30-24

The Latest RV And Economics Updates from the Seeds of Wisdom Sunday AM 6-30-24

Good Morning Dinar Recaps,

Iraqi Dinar: IBBC ISSUES MAJOR NEW PAPER ON DE-DOLLARISATION OF IRAQ

Professor Frank Gunter publishes a new paper commissioned as part of a series by IBBC's advisory council on the challenges of de-dollarisation for Iraq.

The Advisory Council members and IBBC members have actively contributed to the paper in the past 4 months. It will be presented online on the 18th June in a webinar and in person at the Spring Conference on 2nd July. The Arabic translation will be published soon.

Previous advisory papers include 2020, 'Iraq 2020: Country at the Crossroads', 'Corruption Worse Than ISIS: Causes and Cures Cures for Iraqi Corruption', 'Seaports and Airports of Iraq: Rules Versus Infrastructure' and 'Privatization of State-Owned Enterprises'.

The Latest RV And Economics Updates from the Seeds of Wisdom Sunday AM 6-30-24

Good Morning Dinar Recaps,

Iraqi Dinar: IBBC ISSUES MAJOR NEW PAPER ON DE-DOLLARISATION OF IRAQ

Professor Frank Gunter publishes a new paper commissioned as part of a series by IBBC's advisory council on the challenges of de-dollarisation for Iraq.

The Advisory Council members and IBBC members have actively contributed to the paper in the past 4 months. It will be presented online on the 18th June in a webinar and in person at the Spring Conference on 2nd July. The Arabic translation will be published soon.

Previous advisory papers include 2020, 'Iraq 2020: Country at the Crossroads', 'Corruption Worse Than ISIS: Causes and Cures Cures for Iraqi Corruption', 'Seaports and Airports of Iraq: Rules Versus Infrastructure' and 'Privatization of State-Owned Enterprises'.

Professor Gunter provides an analysis of the drivers of impact on the dinar exchange rate and examines how best to deal with the parallel market of dinars to dollars. He outlines the practical policy initiatives that should reduce the gap between the official and parallel exchange rates in the medium-term.

In particular he lauds the Government of Iraq on its commitment to tackle corruption and to modernise the banking system in one fell swoop but warns of the pressure on the dinar exchange rate as budgets are overstretched and the new banking recipients (state banks) receive the liquidity to enable the economy to perform.

He writes 'All three of these forces - the anti-corruption effort, the banking liberalization, and the lavish 2023-2025 budget - will create challenges for the management of the dinar exchange rate. One could argue that over the last two decades the Government of Iraq (GoI) had little control over its exchange rate; that exchange rate policy was determined by other sectors of the political economy in Iraq.

But even if this is true, the level of the exchange rate and changes in that level are believed by many Iraqis and foreigners as providing valuable insight into the quality of economic management in Iraq.

This importance is exemplified by the current efforts to de-dollarize the Iraqi economy while there is excess demand for dollars. This excess demand is shown by a parallel exchange rate of roughly 1500 dinars per dollar compared to the official exchange rate of 1310 dinars per dollar.

An important cause of this exchange rate gap is that the GoI, with the strong encouragement of the U.S. Federal Reserve, is attempting to reduce the use of the U.S. dollar in both Iraq's internal economy and its external transactions. Since 2003, the U.S. dollar has facilitated economic growth in Iraq by providing a widely accepted medium of exchange for purchases as well as a reliable store of value for savings. In the long run, whether de-dollarization will have a significant adverse impact on the Iraq economy will depend on how rapidly the GoI can increase both the efficiency of alternative mediums of exchange and the perceived security of alternative stores of value.'

© Newshounds News™

Source: Iraq Business News

~~~~~~~~~

To Boost Foreign Investments, Iraq signs Singapore Convention

From the UN Development Programme (UNDP). Any opinions expressed are those of the author(s), and do not necessarily reflect the views of Iraq Business News.

In a landmark move to attract foreign investors to Iraq, the country celebrated its signing of the United Nations Convention on International Settlement Agreements Resulting from Mediation ("Singapore Convention").

Under the patronage of H.E. Prime Minister Mohammed Shia Al-Sudani, the United Nations Development Programme (UNDP) and the National Investment Commission (NIC) of Iraq hosted a high-profile conference on mediation today [Wednesday 26th June, 2o24].

Creating an environment for global investors

Kick-starting the conference on behalf of H.E. the Prime Minister Mohammed Shia` Al-Sudani, the Advisor to the Prime Minister, Nasser Saleh Abdulnabi Al-Asadi reiterated the government's unwavering focus on foreign investment.

"We are steadfast in our progressive reforms, striving to transform Iraq into an inviting and secure investment destination. Iraq's accession to the Singapore Convention is a significant milestone, fortifying our efforts to build a robust business sector. We will persist in our endeavours to bolster investment, combat corruption, and generate employment opportunities for our youth," he said.

On April 17, 2024, Iraq took a significant step by signing the Singapore Convention, as the Convention eases enforcement of mediated settlement agreements, paving the way for enhanced international trade and commerce between countries.

"Iraq is ready to strengthen its collaboration with countries across the globe to foster investment as well as diversify and increase its trade, and the Convention is an important tool for us to operationalize this," ` said Dr. Hayder Makiya [Makiyya], Chairman of the National Investment Commission.

Iraq enters its new chapter

The conference, generously backed by the European Union, was joined by the European Union Ambassador to Iraq, Thomas Seiler.

"We are working hand in hand with the government and UNDP to support the government's ambition to make Iraq a secure and attractive destination for foreign investments, including from the 27 EU Member States. Effective mediation opens a new door for Iraq's international trade and business."

Through its Anti-Corruption and Commercial Dispute Resolution Initiatives funded by the European Union, UNDP has also been working with Iraqi universities to build the capacities of law students in commercial dispute resolution, including mediation.

"With the signing of the Singapore Convention, Iraq is committed to transforming the landscape of commercial cross-border dispute resolution which will significantly impact businesses engaged in international trade and commerce. We will continue supporting the Government in legislation and building the necessary institutional and human capacity to make mediation work." said Auke Lootsma, Resident Representative of UNDP.

The hope is that Iraq's signing of the Singapore Convention is the foundational beginning the country needs in order to attract and instill confidence in investors who wish to do business there - creating a climate that is conducive and safe for foreign investment.

About the Singapore Convention