Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Iraq Economic News and Points To Ponder Thursday Afternoon 1-29-26

Liquidity Shortage Delays Iraqi Salaries: Experts Warn Of Prolonged Financial Strain

2026-01-29 Shafaq News Economic assessments differ over Iraq’s ability to overcome its current liquidity crisis, while concerns grow among public sector employees over delayed salary payments.

As of January 29, government salaries had not been disbursed, despite payments typically being issued between the 20th and 25th of each month, fueling frustration and anxiety among state employees. An informed source attributed the delay to a “shortage of cash,” despite the completion of payroll lists and funding procedures, citing limited liquidity in government banks as the main cause of the disruption.

Liquidity Shortage Delays Iraqi Salaries: Experts Warn Of Prolonged Financial Strain

2026-01-29 Shafaq News Economic assessments differ over Iraq’s ability to overcome its current liquidity crisis, while concerns grow among public sector employees over delayed salary payments.

As of January 29, government salaries had not been disbursed, despite payments typically being issued between the 20th and 25th of each month, fueling frustration and anxiety among state employees. An informed source attributed the delay to a “shortage of cash,” despite the completion of payroll lists and funding procedures, citing limited liquidity in government banks as the main cause of the disruption.

Read more: Iraq can fund salaries, but oil sets the limits

According to an official document from the Finance Ministry, a directive issued by the minister instructs all departments and branches to maintain working hours during and beyond official times until salary distribution is completed. Meanwhile, the federal Finance Ministry announced that it has begun releasing salary funding for state institutions, ordering payments to be made in batches.

Economic analyst Nabil Al-Marsoumi warned of widening financial instability and the persistence of the salary crisis in the absence of a fully empowered government.

Speaking to Shafaq News, he cautioned that a potential US veto over the appointment of Nouri al-Maliki as the next prime minister could delay approval of the 2026 federal budget. “Iraq, in all cases, needs a new government to replace the caretaker cabinet,” he said, warning that continued delays would intensify economic and financial disruption.

Al-Marsoumi noted that failing to form a new government would leave the caretaker administration without legal authority to borrow from state banks, and that recent salary delays could continue in the coming months and may worsen.

On the possibility of resolving the financial crisis without a rise in oil prices, the analyst said, “There is no real hope.”

While prices are currently approaching $70 per barrel, he described the increase as temporary and tied to geopolitical tensions, predicting prices will fall once regional security conditions stabilize. He also stated that any potential boost in oil revenue would not reach Iraq for at least two months, increasing financial risks amid the absence of a fully authorized government.

Read more: Oil revenue volatility exposes Iraq’s budget vulnerabilities

Meanwhile, caretaker Prime Minister’s adviser Muthir Mohammed Saleh told Shafaq News that the government can legally resort to borrowing if the federal budget is not approved and a temporary liquidity shortage occurs, provided the borrowing is limited, short-term, and strictly allocated to essential spending.

“Such borrowing could be used to cover priority obligations, including salaries, pensions, and social welfare payments, under the Federal Financial Management Law No. 6 of 2019, in line with Article 29,” Saleh explained, stressing that borrowing in this context must remain domestic, short-term, and excluded from long-term commitments or new investment spending, with repayment to follow after budget approval.

“Ensuring the continuity of salary and pension payments is vital to economic and social stability and strengthens public confidence in fiscal and monetary policy,” Saleh noted, including that temporary financing tools such as treasury advances or limited domestic borrowing can be used as long as they do not evolve into permanent financial obligations.

Read more: Iraq’s economic “perfect storm”: Experts warn the crisis is structural and social

Written and edited by Shafaq News staff.

Iraq Engages Washington And Tehran To Contain Rising Tensions

2026-01-29 Shafaq News– Baghdad Iraq is continuing dialogue with both the United States and Iran to prevent further escalation and shield the region from war, a senior Foreign Ministry official said on Thursday, as military signaling between Washington and Tehran intensifies.

Foreign Ministry Undersecretary Hisham Al-Alawi told Shafaq News that Iraq maintains strong relations with both the United States and Iran and is using those ties to reduce regional tensions, adding that during Foreign Minister Fuad Hussein's recent visit to Tehran, he stressed Baghdad’s interest in easing military escalation and addressing tensions between Washington and Tehran through dialogue.

“Any escalation would not affect Iraq alone but would have consequences across the region,” Al-Alawi warned, pointing to the impact of the June conflict involving Iran, Israel, and the United States, which lasted 12 days, as an example of how quickly regional instability can spread.

He added that Iraq has a national interest in working with neighboring countries and the United States to strengthen regional stability and address outstanding issues, including Iran’s nuclear file and other disputes, through diplomatic means.

“Iraq, along with other countries, has contributed in recent months to averting a potential military strike on Iran.”

Read more: Escalation without Collapse: Washington’s options against Tehran

In December, caretaker Prime Minister Mohammed Shia Al-Sudani said in a televised interview with Al-Mayadeen TV that efforts were “ongoing” to host negotiations between the United States and Iran in Baghdad, but no steps toward such talks have been announced since then.

The Wall Street Journal reported on Thursday that US President Donald Trump had received full military briefings on possible offensive options against Iran, including a broad bombing campaign targeting Iranian regime facilities and the Islamic Revolutionary Guard Corps, as well as strikes on “symbolic targets,” with the possibility of escalation if Iran does not halt its nuclear program.

Separate disclosures by Western sources cited by Reuters said Trump is also considering options to target Iranian leaders and officials linked to violence, while his aides assess strikes intended to have a lasting impact.

On the Iranian side, senior Iranian military, political, and diplomatic officials have said in recent statements that Tehran is prepared to confront the United States if necessary, stressing readiness to respond to any military action while warning of consequences for regional stability.

Read more:Iraqi factions raise alert levels: Messages to Iran and US

https://www.shafaq.com/en/Iraq/Iraq-engages-Washington-and-Tehran-to-contain-rising-tensions

Iraq Engages Washington And Tehran To Contain Rising Tensions

2026-01-29 Shafaq News– Baghdad Iraq is continuing dialogue with both the United States and Iran to prevent further escalation and shield the region from war, a senior Foreign Ministry official said on Thursday, as military signaling between Washington and Tehran intensifies.

Foreign Ministry Undersecretary Hisham Al-Alawi told Shafaq News that Iraq maintains strong relations with both the United States and Iran and is using those ties to reduce regional tensions, adding that during Foreign Minister Fuad Hussein's recent visit to Tehran, he stressed Baghdad’s interest in easing military escalation and addressing tensions between Washington and Tehran through dialogue.

“Any escalation would not affect Iraq alone but would have consequences across the region,” Al-Alawi warned, pointing to the impact of the June conflict involving Iran, Israel, and the United States, which lasted 12 days, as an example of how quickly regional instability can spread.

He added that Iraq has a national interest in working with neighboring countries and the United States to strengthen regional stability and address outstanding issues, including Iran’s nuclear file and other disputes, through diplomatic means.

“Iraq, along with other countries, has contributed in recent months to averting a potential military strike on Iran.”

Read more: Escalation without Collapse: Washington’s options against Tehran

In December, caretaker Prime Minister Mohammed Shia Al-Sudani said in a televised interview with Al-Mayadeen TV that efforts were “ongoing” to host negotiations between the United States and Iran in Baghdad, but no steps toward such talks have been announced since then.

The Wall Street Journal reported on Thursday that US President Donald Trump had received full military briefings on possible offensive options against Iran, including a broad bombing campaign targeting Iranian regime facilities and the Islamic Revolutionary Guard Corps, as well as strikes on “symbolic targets,” with the possibility of escalation if Iran does not halt its nuclear program.

Separate disclosures by Western sources cited by Reuters said Trump is also considering options to target Iranian leaders and officials linked to violence, while his aides assess strikes intended to have a lasting impact.

On the Iranian side, senior Iranian military, political, and diplomatic officials have said in recent statements that Tehran is prepared to confront the United States if necessary, stressing readiness to respond to any military action while warning of consequences for regional stability.

Read more:Iraqi factions raise alert levels: Messages to Iran and US

https://www.shafaq.com/en/Iraq/Iraq-engages-Washington-and-Tehran-to-contain-rising-tensions

Expert: Salary Payments Delayed Due To Cash Liquidity Crisis... And This Is The Reason For The Dollar's Rise

Time: 2026/01/29 Readings: 255 times {Economic: Al-Furat News} Economic expert, Jalil Al-Lami, confirmed that the delay in paying employee salaries is due to a cash liquidity crisis, while he attributed the reason for the rise in the dollar exchange rate to the law of supply and demand and the increase in speculation in the parallel market.

Al-Lami told Al-Furat News Agency that "the delay in employee salaries is technical due to poor management of transfers between the Ministry of Finance and the banks, in addition to problems with the electronic file and the existence of a liquidity crisis for the Iraqi dinar, which greatly affected the disbursement of salaries, and I believe that the crisis has been overcome after the Ministry of Finance's statement."

He added that "the dollar is subject to the law of supply and demand, and the rise in its prices is due to speculators and demand from small traders in the parallel market to cover their needs. Information also indicates a decline in the value of the dollar globally, which is met with a rise in the prices of goods and services, which has increased the demand for the currency in Iraq."

Al-Lami stressed "the need for the government to work through market and bank monitoring committees to ensure the stability of exchange rates, and for there to be transparency in dealings between the Iraqi bank and importing merchants, especially with the approach of the month of Ramadan."

He explained that "there is a direct relationship between gold and oil on one hand and the dollar on the other, as demand for oil from China has increased from two million barrels per day to three million barrels per day, at a time when OPEC has decided to reduce production by about one million two hundred thousand barrels per day. In addition, most global oil traders are working to raise prices to control the volatility in the markets."

Al-Lami concluded by saying, "The rise in oil prices is yielding positive results for the Iraqi economy and contributing to covering employee salaries."

Global oil prices recorded a significant jump in trading on Thursday, achieving gains of more than 4.3%, pushing Brent crude above the $70 per barrel mark, recording $70.33. Wafaa Al-Fatlawi LINK

Bond Markets Are Breaking and Gold Is Telling You First | Matthew Piepenburg

Bond Markets Are Breaking and Gold Is Telling You First | Matthew Piepenburg

Kitco News: 1-28-2026

Gold has surged past $5,000 and silver is extending its move beyond $100, but Matthew Piepenburg says the real story is not metal prices.

It is the accelerating breakdown of trust across global bond and currency markets.

Bond Markets Are Breaking and Gold Is Telling You First | Matthew Piepenburg

Kitco News: 1-28-2026

Gold has surged past $5,000 and silver is extending its move beyond $100, but Matthew Piepenburg says the real story is not metal prices.

It is the accelerating breakdown of trust across global bond and currency markets.

Speaking with Kitco News at VRIC 2026 in Vancouver, Piepenburg, Partner at Von Greyerz, points to rising yields in Japan, the US, and Europe as a clear warning sign. “The bond market is the thing you have to understand,” he said. “Yields are the cost of debt.”

When yields rise even as central banks step in, Piepenburg argues it shows sovereign IOUs are being repriced and the so-called risk-free asset has become “return-free risk.”

Piepenburg says gold’s move is not speculative excess, but the logical outcome of decades of debt expansion and deliberate currency debasement.

“What should shock you is how bad fiat money has gotten,” he said. As governments rely on negative real rates to manage debt,

Piepenburg argues gold is being repositioned by central banks as a neutral settlement asset in global trade, not something you spend, but something you trust when paper systems falter. Recorded January 25, 2026.

00:13 – Market Volatility, Rising Yields, and Central Bank Stress

01:12 – Japanese Yen Surge and Global Bond Market Dysfunction

03:48 – Trust Breakdown in Sovereign Debt and Fiat Currencies

06:53 – Debt, Politics, and the Limits of Monetary Policy

13:30 – Gold as a Global Settlement and Collateral Asset

16:17 – The US Dollar’s Role in Global Trade and Reserve Systems

18:15 – COMEX, Paper Markets, and Physical Supply Constraints

19:31 – Gold and Silver Price Moves as Warning Signals

21:03 – Historical Parallels in Currency and Debt Crises

23:32 – East vs West Markets and Global Price Discovery

28:15 – Measuring Trust in Modern Financial Systems

32:21 – Wealth Preservation vs Speculation in Volatile Markets

34:28 – Final Thoughts on Gold, Trust, and Systemic Risk

Iraq Economic News and Points To Ponder Thursday Afternoon 1-29-26

Iraq Ranks Among World’s Top Countries For Proven Natural Gas Reserves In 2025

2026-01-29 06:24 Shafaq News Iraq holds 125 trillion cubic feet of proven natural gas reserves, placing it 11th globally in 2025, according to the Energy Institute and the Statistical Review of World Energy.

The data, released on Thursday, showed that Russia topped the list with 1,321 trillion cubic feet, followed by Iran with 1,133 trillion, and Qatar in third place with 871 trillion cubic feet. Turkmenistan ranked fourth with 480 trillion, while the United States came fifth with 446 trillion cubic feet.

Iraq Ranks Among World’s Top Countries For Proven Natural Gas Reserves In 2025

2026-01-29 06:24 Shafaq News Iraq holds 125 trillion cubic feet of proven natural gas reserves, placing it 11th globally in 2025, according to the Energy Institute and the Statistical Review of World Energy.

The data, released on Thursday, showed that Russia topped the list with 1,321 trillion cubic feet, followed by Iran with 1,133 trillion, and Qatar in third place with 871 trillion cubic feet. Turkmenistan ranked fourth with 480 trillion, while the United States came fifth with 446 trillion cubic feet.

China placed sixth with 297 trillion cubic feet, followed by Venezuela (221 trillion), Saudi Arabia (213 trillion), the United Arab Emirates (210 trillion), and Nigeria (193 trillion).

Iraq ranked 11th, ahead of Azerbaijan (88 trillion), Australia (84 trillion), Canada (83 trillion), and Algeria (81 trillion).

Oil Hits Four-Month Peak Following US-Iran Tension

2026-01-29 Shafaq News Oil prices rose more than 1.5% in Asian trade, extending gains for a third day on Thursday, on increasing concerns the U.S. may carry out a military attack on key Middle Eastern producer Iran that could disrupt supply from the region.

Brent crude futures rose 99 cents, or 1.5%, to $69.39 a barrel. U.S. West Texas Intermediate crude climbed $1.06, or 1.7%, to $64.27 a barrel.

Both contracts have climbed about 5% since Monday and are at their highest since September 29.

Prices are rising as U.S. President Donald Trump has increased pressure on Iran to end its nuclear programme with threats of military strikes and as a U.S. naval group has arrived in the region. Iran is the fourth-largest producer among the Organization of the Petroleum Exporting Countries with output of 3.2 million barrels per day.

Trump is considering options to attack Iranian security forces and leaders to inspire protests to potentially topple the current regime, Reuters reported on Thursday, citing U.S. sources familiar with the discussions.

"Despite the Fed holding rates steady and a mild rebound in the US Dollar Index, oil prices remained resilient as escalating US-Iran tensions continued to underpin the supply-risk narrative," said Phillip Nova's senior market analyst Priyanka Sachdeva.

The Federal Reserve held interest rates steady on Wednesday amid signs of a healthy U.S. economy. Lower interest rates typically make it cheaper for consumers to buy oil, encouraging demand and supporting prices.

"Prices also found support from weather-related production losses in parts of the US, alongside a surprise draw in US crude inventories, which temporarily eased concerns of excess supply," Sachdeva added.

An unexpected drop in crude stockpiles in the U.S., the world's biggest oil consumer, also supported prices.

U.S. crude inventories fell by 2.3 million barrels to 423.8 million barrels in the week ended January 23, the Energy Information Administration said on Wednesday, compared with analysts' expectations in a Reuters poll for a 1.8 million-barrel rise.

Some analysts were still forecasting higher prices for the next few months due to geopolitical risk premiums.

"The potential for Iran getting hit has escalated the geopolitical premium of oil prices by potentially $3 to $4 (per barrel)," analysts at Citi said in a note on Wednesday.

They added that further geopolitical escalation could push prices to as high as $72 a barrel for Brent.

(Reuters) https://www.shafaq.com/en/Economy/Oil-hits-four-month-peak-following-US-Iran-tension

Basrah Crudes Rise With A Global Surge

2026-01-29 Shafaq News– Basrah Basra crude prices recorded gains of around 3% on Thursday, moving along the broader trend in global oil markets.

Basra Heavy crude rose by $2.09, or 3.47%, to $62.25 per barrel, while Basra Medium crude increased by $2.09, or 3.34%, to settle at $64.70 per barrel.

In international markets, Brent crude futures rose 99 cents, or 1.5%, to $69.39 a barrel. US West Texas Intermediate crude (WTI) climbed $1.06, or 1.7%, to $64.27 a barrel. https://www.shafaq.com/en/Economy/Basrah-crudes-rise-with-a-global-surge-9-7

Gold Prices Rise In Baghdad And Erbil Markets

2026-01-29 Shafaq News– Baghdad/ Erbil On Thursday, gold prices hovered around 1.11 million IQD per mithqal in Baghdad and Erbil markets, continuing their upward trend, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 1,171,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 1,167,000 IQD. The same gold had sold for 1,141,000 IQD on Wednesday.

The selling price for 21-carat Iraqi gold stood at 1,141,000 IQD, with a buying price of 1,137,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 1,170,000 and 1,180,000 IQD, while Iraqi gold sold for between 1,140,000 and 1,150,000 IQD.

In Erbil, 22-carat gold was sold at 1,235,000 IQD per mithqal, 21-carat gold at 1,180,000 IQD, and 18-carat gold at 1,010,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-rise-in-Baghdad-and-Erbil-markets-2

Gold Nears $5,600 Milestone

2026-01-29 Shafaq News Gold extended its blistering rally on Thursday to hit a record just shy of $5,600 an ounce, as investors sought safety amid geopolitical and economic uncertainties, while silver came within a whisker of breaching $120.

Spot gold shot up 2.6% to $5,538.69 an ounce by 0349 GMT, after hitting a record $5,591.61 earlier in the day.

"Growing U.S. debt and uncertainty created by signs that the global trade system is splintering into regional blocs as opposed to a U.S.-centric model (are leading investors to pile into gold)," said Marex analyst Edward Meir.

The yellow metal jumped past the $5,000 mark for the first time on Monday and has gained more than 10% so far this week, driven by a cocktail of factors including strong safe‑haven demand, firm central bank buying and a weaker dollar.

"Gold is no longer just a crisis hedge or an inflation hedge; it is increasingly viewed as a neutral, and a reliable store of value asset that also provides diversification across a wider range of macro regimes," OCBC analysts said in a note.

Gold has gained more than 27% this year following a 64% jump in 2025.

"Although the parabolic nature of the rally suggests a pullback is not far away, the underlying fundamentals are expected to remain supportive throughout 2026, positioning any dips as attractive buying opportunities," IG market analyst Tony Sycamore said.

In geopolitical news, U.S. President Donald Trump urged Iran on Wednesday to come to the table and strike a deal on nuclear weapons. He warned that any future U.S. attack would be far more severe than the one last year when Iranian nuclear sites were struck.

Tehran responded with a threat to strike back against the U.S., Israel and those who support them.

Meanwhile, the Federal Reserve decided to leave rates unchanged on Wednesday, as widely expected. Fed Chair Jerome Powell said inflation in December was likely still well above the central bank's 2% target.

On Thursday, the precious metal also drew support from crypto group’s plans to allocate 10%–15% of its investment portfolio to physical gold.

Meanwhile, with elevated gold prices, customers have been cramming into stores in Shanghai and Hong Kong that sell the precious metal, with some betting it could rise even further.

Elsewhere, spot silver was up 0.6% at $117.30 an ounce after hitting a record high of $119.34 earlier. Demand from investors looking for cheaper alternatives to gold, along with supply shortages and momentum buying, helped the white metal, which has jumped more than 60% so far this year.

"The silver market is forecast to deliver yet another deficit this year, but the real market tightness stems from the reduced availability of above-ground stocks," analysts at Standard Chartered said in a note.

Spot platinum rose 1.6% to $2,739.48 an ounce, after hitting a record high of $2,918.80 on Monday, while palladium fell 1.3% to $2,047.0. (Reuters) https://www.shafaq.com/en/Economy/Gold-nears-5-600-milestone

Dollar Opens Weak In Baghdad, Erbil

2026-01-29 Shafaq News– Baghdad/ Erbil The US dollar opened Thursday’s trading at a lower rate in Baghdad and Erbil, falling by 3,100 Iraqi dinars compared with the previous session.

According to a Shafaq News market survey, the dollar traded in Baghdad at 149,900 Iraqi dinars per 100 dollars, after closing at 153,000 dinars in the previous session at the Al-Kifah and Al-Harithiya exchanges.

Local exchange shops in the capital sold the dollar at 150,500 dinars per 100 dollars, while buying prices stood at 149,500 dinars.

In Erbil, the selling price reached 150,350 dinars for every 100 dollars, and the buying price was 150,100. https://www.shafaq.com/en/Economy/Dollar-opens-weak-in-Baghdad-Erbil

The Dollar Falls After Trump's Remarks, Boosting The Euro, Yen, And Pound.

Money and Business Economy News — Follow-up The dollar faced a "confidence crisis" as it moved near four-year lows on Wednesday after President Donald Trump ignored its recent decline, triggering a sell-off of the U.S. currency and a rise in the yen, euro and pound sterling.

The euro broke above $1.20 for the first time since 2021 and then fell back slightly during the session to $1.2015, while the pound sterling approached its highest level since 2021, reaching $1.3823 in early Asian trading.

The dollar index, which measures the performance of the US currency against six major currencies, stood at 95.964 after falling more than 1% in the previous session when it hit a four-year low of 95.566.

Trump said on Tuesday that the dollar was "fantastic" when asked if he thought it had fallen too low. Traders interpreted his comments as a signal to sell the currency aggressively.

Trump's comments were not entirely new, but they came at a time when the dollar was under pressure as traders braced for a possible coordinated intervention by U.S. and Japanese authorities to stabilize the yen.

Kyle Rodda, senior market analyst at Capital.com, said: "This shows a crisis of confidence in the US dollar and it appears that as long as the Trump administration sticks to its erratic trade, foreign and economic policies, this weakness may continue."

The dollar fell more than 9% in 2025 and started the new year on a downward trend, having already declined by about 2.3% in January amid Trump’s erratic approach to trade and international diplomacy, concerns about the independence of the Federal Reserve (the US central bank), and massive increases in public spending that have worried investors.

"The weakness of the dollar is at odds with other strong fundamentals," said Roda. "The U.S. economy is still excellent, and the dollar should reflect that. But it isn't because of Trump's approach."

Investors will be focused on the Federal Reserve's monetary policy decision later today.

The Japanese yen received further support from dollar selling, reaching 152.60 against the US currency after rising more than 1% in the previous session. It is hovering near its highest level in three months due to talk of increased US and Japanese exchange rate scrutiny, which is often seen as a prelude to official intervention.

The Australian dollar rose to US$0.70225, its highest level since February 2023, amid widespread weakness in the US currency and after data showed consumer price inflation rose at a faster annual pace in the final quarter of last year, supporting expectations that the Reserve Bank of Australia will raise interest rates in the near term. https://economy-news.net/content.php?id=65060

The Fed Has Only One Way Out — Gold Revaluation Is Coming | Matthew Piepenburg

The Fed Has Only One Way Out — Gold Revaluation Is Coming | Matthew Piepenburg

MacroEdge: 1-29-2026

In this eye-opening analysis, we break down why the Federal Reserve may have only one remaining structural option — a gold revaluation, and what that means for gold, silver, currencies, and investors everywhere.

Based on key insights from Bond Markets Are Breaking and Gold Is Telling You First… partner Matthew Piepenburg explains why record central bank gold buying, historic silver delivery demand, and rising systemic risk are far more than just market noise.

Piepenburg cuts through the headlines to show why gold prices aren’t simply rising — they’re signaling deep instability in global money, trust, and currency systems.

The Fed Has Only One Way Out — Gold Revaluation Is Coming | Matthew Piepenburg

MacroEdge: 1-29-2026

In this eye-opening analysis, we break down why the Federal Reserve may have only one remaining structural option — a gold revaluation, and what that means for gold, silver, currencies, and investors everywhere.

Based on key insights from Bond Markets Are Breaking and Gold Is Telling You First… partner Matthew Piepenburg explains why record central bank gold buying, historic silver delivery demand, and rising systemic risk are far more than just market noise.

Piepenburg cuts through the headlines to show why gold prices aren’t simply rising — they’re signaling deep instability in global money, trust, and currency systems.

In the face of ballooning debt, weakening fiat currencies, and a less trusted dollar, rising gold isn’t a “bubble” — it’s a structural response.

This video covers:

Why the Fed’s traditional tools may be exhausted

What central bank gold buying really signifies

The implications of a possible U.S. gold revaluation

What this means for investors in gold and silver today

TIMESTAMPS (≈ 18 Minutes)

00:00 – Why gold is relevant again and the current market setup

01:50 – The Fed’s problem: debt, liquidity, and eroding tools

04:20 – What central banks are doing in gold — and why it matters

07:10 – Silver markets, delivery demand, and market signals

10:30 – The truth behind potential gold revaluation talk

12:45 – Why transparency and audits are still absent

15:10 – What investors should watch in gold and silver next

17:20 – Key takeaways and preparation mindset

News, Rumors and Opinions Thursday 1-29-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 29 Jan. 2026

Compiled Thurs. 29 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: On Sun. 1 Feb. there was (allegedly) scheduled to be announced that the Quantum Financial System was fully operational and gold/asset-backed currencies now dominated globally, heralding the greatest wealth transfer in history.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 29 Jan. 2026

Compiled Thurs. 29 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: On Sun. 1 Feb. there was (allegedly) scheduled to be announced that the Quantum Financial System was fully operational and gold/asset-backed currencies now dominated globally, heralding the greatest wealth transfer in history.

By February 1, 2026, trillions in prosperity funds were (allegedly) expected to flood into the hands of the people, ending poverty and igniting global renewal under NESARA/GESARA reforms. As the new asset-backed global financial system and Nesara/Gesara detonated — fiat currency (allegedly) dies and rainbow currency floods streets.

Debt forgiveness stands imminent through the Debt Jubilee algorithm, (allegedly) zeroing out mortgages, credit cards, and unlawful burdens as legalized under prior executive actions.

No more fiat taxes or IRS oppression—the new US Treasury, fortified with gold reserves, (allegedly) ensures fair distribution via the QFS.

Redemption centers were on high alert, with Tier 4B notifications (allegedly) flowing through secure channels. This week the RV launch (allegedly) accelerated, with Iraqi Dinar, Vietnamese Dong, and Zim holders poised for historic payouts at contract rates that would empower humanitarian projects and long-term stewards.

Tier 1 payouts load soon — trillions clawed from cabal vaults (allegedly) rerouted to We the People. Humanitarian funds will unleash, RV/GCR hits hard — 209 nations sync to unbreakable QFS grid with the SWIFT buried.

~~~~~~~~~~~~

What to Expect Beginning Sun. 15 Feb. 2026:

A NESARA / GESARA Activation Phase will nullify (allegedly) Global debt and execute a bank fraud reset, with usury termination and illigal interest erased.

Full QFS Implementation: The old financial system was (allegedly) already dead. It just hasn’t been announced yet. From now on there would only be asset-backed ledgers, no money printing, no fraud, no hidden fees, no offshore looting. Every dollar will(allegedly) be traceable, every transaction final.

The Federal Reserve will be(allegedly) dissolved and IRS absorbed into a new US Treasury. There will be no tax on food, medicine, salaries and used goods, including used homes and cars. A 14% sales tax (allegedly) on new items only and tariffs on goods coming into the country will replace the old tax system.

~~~~~~~~~~~~~~~

Possible Timing:

On Tues. 27 Jan. Bruce reported his source said that we are looking for Tier4b (Us, the Internet Group) notification to set exchange appointments over the next three days – Wed, Thurs or Fri. Jan. 28, 29, 30.

Valid sources report that on Sat. 31 Jan. and Sun. 1 Feb. 2026 Global Systems would begin to shift. Banks, Trade Networks and Digital Grids would move toward true transparency with Gold Reserves realigned and Debt frameworks rewritten.

On Sat. 31 Jan. 2026 the QFS (allegedly) goes live using the debt free gold/asset-backed currency of 209 nations and severing all Deepstate control over Global Banking.

On Sun. 1 Feb. 2026 the new gold/asset-backed Quantum Financial System(allegedly) activates.

By Mon. 2 Feb. 2026 Commander in Chief Donald Trump leads. With the fiat US Dollar, (allegedly) dead, Trump brings in the gold/asset-backed US Note in a historic transfer of wealth back to The People. Prepare for a (allegedly) Global 48 Hour communication lockdown.

On Monday 2 Feb. 2026 you’ll (allegedly) see:

• Encrypted alerts tied to your national ID or phone signature

• First wave biometric wallet logins open across verified nations

• Partial debt reconciliations appearing as “system recalculations”

• Global emergency communication drills – disguised as public safety tests

On Fri. 6 Feb. 2026 the public launch of NESARA Tier 1 redemptions would (allegedly) finalize.

By Wed. 11 Feb. 2026 Redemption Centers (allegedly) open worldwide under Military Security to set up the new Global Financial System (GFS) Wallets (formerly known as bank accounts) for the general public on the new and secure Star Link Satellite System. All accounts move to the Quantum Grid.

Read full post here: https://dinarchronicles.com/2026/01/29/restored-republic-via-a-gcr-update-as-of-january-29-2026/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man The news can be charging...disappointing...I know the political scene in Iraq is very volatile at the moment...a lot of negative news...It's intense. But bottom line is who am I watching? I'm watching for the central bank and the gatekeepers...because they have control to be able to take care of the monetary policy...

Mnt Goat This week will be a pivotal week in Iraq. They are supposed to announce their candidate for president. As we know the new president then announces the nominee for prime minister that will then be tasks to form his cabinet...

Clare President Trump X post: "I’m hearing that the Great Country of Iraq might make a very bad choice by reinstalling Nouri al-Maliki as Prime Minister. Last time Maliki was in power, the Country descended into poverty and total chaos. That should not be allowed to happen again. Because of his insane policies and ideologies, if elected, the United States of America will no longer help Iraq and, if we are not there to help, Iraq has ZERO chance of Success, Prosperity, or Freedom. MAKE IRAQ GREAT AGAIN!"

************

Trump Just Signaled a MASSIVE Dollar Debasement—Silver to $170?!

Steven Van Metre: 1-29-2026

President Trump is warning that a massive dollar debasement is coming soon that's going to send the dollar plunging, and safe havens like gold and silver even higher.

Seeds of Wisdom RV and Economics Updates Thursday Morning 1-29-26

Good Morning Dinar Recaps,

Gold Breaks $5,500 as Dollar Weakens and BRICS Shift Accelerates

Precious metals surge signals structural change in global reserves and settlement

Good Morning Dinar Recaps,

Gold Breaks $5,500 as Dollar Weakens and BRICS Shift Accelerates

Precious metals surge signals structural change in global reserves and settlement

Overview (Key Points)

Gold surged above $5,500 per ounce, hitting an intraday record of $5,595.41 on January 29, 2026.

Gold futures are now up more than 20% year-to-date, driven by dollar weakness and central-bank accumulation.

BRICS gold reserves have surpassed U.S. Treasury holdings for the first time since 1996.

Markets are increasingly pricing in a monetary realignment rather than a cyclical rally.

Key Developments

Historic Price Action:

Gold futures rallied sharply as the Federal Reserve held rates steady and the U.S. dollar fell to its lowest level since early 2022. The move reflects intensifying demand for hard assets amid declining confidence in fiat currencies.

Dollar Weakness Fuels Momentum:

Analysts point to sustained dollar depreciation as a key catalyst. As the greenback weakens against major currencies, gold has benefited from both safe-haven demand and debasement hedging.

BRICS Reserves Surpass Treasuries:

Foreign central bank gold holdings are now valued near $4 trillion, exceeding U.S. government bond holdings at approximately $3.9 trillion. BRICS nations collectively control about 50% of global gold production and hold more than 6,000 tonnes in reserves.

Gold-Backed Settlement Takes Shape:

In December 2025, BRICS launched the “Unit”, a pilot gold-backed settlement instrument composed of 40% physical gold and 60% BRICS currencies. The initiative represents the first operational step toward an alternative to dollar-centric settlement systems.

Why It Matters

Gold’s breakout is not being driven by retail speculation alone. Central banks are the dominant buyers, signaling a long-term shift in reserve strategy. The freezing of Russian assets in 2022 fundamentally altered how sovereign nations assess reserve safety, accelerating diversification away from dollar-denominated assets.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation:

Gold strength often precedes currency repricing and settlement reform.

BRICS-aligned currencies tied to commodities and production capacity gain structural leverage.

Reduced dollar weighting in reserves supports multipolar valuation frameworks over time.

Implications for the Global Reset

Pillar 1 — Reserve Reallocation:

Gold replacing Treasuries as a primary reserve anchor reflects declining trust in debt-based instruments.

Pillar 2 — BRICS as Monetary Architects:

By pairing gold accumulation with settlement infrastructure, BRICS is building functionality first, rhetoric second.

This is not a spike — it is a repricing of trust.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “Gold Price Jumps Above $5,500 as Weak Dollar & BRICS Shift Align”

Reuters — “Central banks extend gold buying spree as dollar weakens”

~~~~~~~~~~

Silver & Copper Flash Follow-Up Reset Signal as Metals Reprice Reality

Industrial demand and monetary hedging converge outside the dollar system

Overview (Key Points)

Silver surged above $116 per ounce, up nearly 50% year-to-date, outpacing gold on a percentage basis.

Copper broke above $13,000 per tonne in London trading, a historic high tied to electrification and infrastructure demand.

Both metals are signaling real-economy stress and settlement transition, not speculative excess.

Markets are increasingly using hard assets as proxies for trust amid currency fragmentation.

Key Developments

Silver Reasserts Dual Role:

Silver’s breakout reflects its unique position as both a monetary metal and an industrial input. Rising demand from solar manufacturing, electronics, and military technology coincides with investor hedging against currency debasement.

Copper Sends Infrastructure Signal:

Copper’s surge past $13,000 highlights constraints in mine supply alongside aggressive global build-outs in grids, EVs, and defense infrastructure. Copper is increasingly viewed as a strategic material, not merely a cyclical commodity.

Supply Concentration Risks:

Major copper and silver production remains concentrated in geopolitically sensitive regions, reinforcing concerns over resource nationalism and trade weaponization. These risks are now being priced into futures markets.

Reset Indicator Beyond Gold:

While gold anchors reserves, silver and copper reveal the operational side of the reset — manufacturing capacity, energy systems, and defense readiness. Together, they reflect a system shifting from financial leverage to physical control.

Why It Matters

Silver and copper are not reacting to rate cuts or stimulus expectations alone. Their moves indicate tight physical markets, rising sovereign demand, and the repricing of materials essential to modern economies. These metals expose pressure points where fiat systems meet real-world limits.

Why It Matters to Foreign Currency Holders

For holders awaiting currency revaluation:

Silver often acts as a volatility amplifier during monetary transitions.

Copper reflects industrial backing and productive capacity, a key metric in reset-era valuation.

Rising metals prices support commodity-linked and resource-rich currencies over debt-dependent systems.

Implications for the Global Reset

Pillar 1 — Physical Scarcity Over Paper Claims:

Silver and copper markets are revealing cracks between futures pricing and real-world availability.

Pillar 2 — Infrastructure as Currency Backing:

Control of metals critical to energy, defense, and technology increasingly functions as implicit monetary support.

This is not inflation — it is repricing of the real economy.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Silver jumps as industrial demand tightens global supply”

London Metal Exchange — “Copper prices hit record highs amid supply constraints”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Thursday Morning 1-29-26

Iraq’s Government Formation Enters High-Risk Phase Under US Economic Pressure

2026-01-29 Shafaq News US President Donald Trump’s blunt rejection of Nouri al-Maliki’s return to Iraq’s premiership has pushed government formation into its most precarious phase, transforming what Iraqi factions describe as a constitutional choice into a confrontation shaped by money, leverage, and regional alignment.

Iraq’s Government Formation Enters High-Risk Phase Under US Economic Pressure

2026-01-29 Shafaq News US President Donald Trump’s blunt rejection of Nouri al-Maliki’s return to Iraq’s premiership has pushed government formation into its most precarious phase, transforming what Iraqi factions describe as a constitutional choice into a confrontation shaped by money, leverage, and regional alignment.

The signal from Washington was unambiguous: an al-Maliki-led government would be read not as continuity but as defiance, at a moment when the United States is recalibrating its Middle East posture and narrowing its tolerance for Iranian-aligned power centers inside fragile states.

For Iraq’s Shiite Coordination Framework —the largest parliamentary bloc to which al-Maliki’s State of Law Coalition belongs— the response has been defiant in tone but uncertain in substance. Leaders insist that the premiership is a sovereign Iraqi decision. In practice, however, sovereignty is colliding with a constraint Iraq cannot escape: its economic lifelines remain exposed to US pressure.

Trump’s objection is not rooted solely in al-Maliki’s political past. It reflects a strategic judgment in Washington that Iraq’s next government will either dilute Iran’s grip on the state or formalize it.

Haytham al-Heeti, professor of political science at the University of Exeter, said Washington no longer views Nouri al-Maliki as simply a former prime minister returning to office. “He represents a governing architecture, one that shields Iran-aligned armed groups and embeds their influence within state institutions..”

Previous attempts to reassure US officials were seen, he said, as tactical delays rather than structural change. “This time, the calculation is different,” al-Hiti added. “Washington is no longer managing a balance. It is drawing lines.”

The approach, he argued, has shifted from containment to disruption.

Read more: Nouri Al-Maliki: A name that still divides and tests the politics of memory

Political analyst Omar al-Nasser situates Trump’s stance within a broader realignment of global power, where economics and energy security increasingly dictate political tolerance.

Speaking to Shafaq News, al-Nasser said the aftermath of the Israel–Iran confrontation last June, combined with energy competition and great-power friction, has narrowed Washington’s patience for ambiguous partners. In this environment, “Iraq is no longer a buffer. It is a test case.”

“Trump approaches the region as a marketplace of risk,” al-Nasser said. “Actors are evaluated by cost, not sentiment.”

From that perspective, al-Maliki’s return clashes with a US strategy that prioritizes predictability for markets and leverage over adversaries. Al-Nasser placed responsibility squarely on Iraq’s political class, arguing that its failure to establish firm standards for leadership selection has left the country vulnerable to external vetoes applied through economic pressure.

The tools available to Washington are not theoretical, because Iraq’s financial system remains deeply tied to US-regulated dollar channels, correspondent banking oversight, and oil-revenue mechanisms that pass through international institutions aligned with American compliance standards.

Analyst Ahmed Yousif said Trump’s public stance stripped political cover from those pushing al-Maliki toward a third term. “The problem is not just American opposition,” Yousif told Shafaq News. “It is that al-Maliki carries a record Washington is prepared to weaponize.”

That record —his 2006–2014 tenure— is associated in US policy circles with sectarian polarization, security collapse, and institutional erosion. Combined with his proximity to Tehran, it has turned his candidacy into a pressure point Washington appears willing to exploit.

“These are not abstract threats; they are tools already built into Iraq’s economic structure,” Yousif said.

Within the Shiite Coordination Framework, Trump’s position has sharpened internal strains. Badr Organization MP Mukhtar al-Moussawi acknowledged that al-Maliki’s name has become a liability, not only abroad but at home as well, linking the US objections to corruption, political division, and the cost of reopening old battles.

He argued that realism —rather than concession— requires reassessing a candidacy that risks isolating Iraq at a moment of maximum economic and diplomatic exposure. “The strongest position is avoiding an unnecessary confrontation.”

Attention has shifted to the outcome of the emergency Coordination Framework meeting held on Wednesday, which exposed a substantive rift over both leadership and strategy.

Sources told Shafaq News that discussions revealed two competing parties: one pressing to reaffirm al-Maliki’s candidacy as a matter of authority and resistance to pressure, and another warning that insisting on his nomination risks pushing Iraq into a confrontation it is poorly positioned to absorb.

The divide, according to the sources, is not limited to personalities but centers on risk assessment. One camp fears financial and political repercussions Iraq can ill afford. The other rejects any adjustment as capitulation, insisting that retreat under external pressure would weaken the bloc and set a precedent for future interference.

Amid all of this, endorsing al-Maliki would harden US pressure and test Iraq’s financial resilience. Abandoning him would deepen fractures within the Shiite political house and signal vulnerability.

Either way, the decision will define more than a premiership.

Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

Written and edited by Shafaq News staff.

Iraq Judiciary Warns Of Foreign Interference After US Rejects Al-Maliki

2026-01-29 Shafaq News– Baghdad Iraq’s Supreme Judicial Council on Thursday warned that delays in selecting the country’s top leadership posts could invite foreign interference, after parliament postponed a vote to elect the president and US objections to a potential return of Nouri Al-Maliki to the premiership.

In a statement, the Council stressed the importance of adhering to constitutional deadlines for completing the election of the President of the Republic and appointing the Prime Minister, urging all political parties and forces to “respect these timelines and avoid any violations, to preserve political stability, ensure the democratic process proceeds within constitutional and legal frameworks, and prevent any external interference.”

Earlier, US President Donald Trump said Washington would withdraw support if former prime minister Al-Maliki returned to office. The Shiite Coordination Framework, parliament’s largest bloc, which nominated Al-Maliki, held an emergency meeting that exposed internal divisions over whether to press his candidacy or seek an alternative to avoid escalation, sources told Shafaq News. Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

“Tidbits From TNT” Thursday Morning 1-29-2026

TNT:

Tishwash: Parliament is moving to host the Minister of Finance to follow up on economic issues and enhance financial transparency.

In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures.

This move comes in the context of parliamentary efforts to regulate financial performance and address the country’s economic challenges, in a way that ensures transparency and protects the interests of citizens.

TNT:

Tishwash: Parliament is moving to host the Minister of Finance to follow up on economic issues and enhance financial transparency.

In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures.

This move comes in the context of parliamentary efforts to regulate financial performance and address the country’s economic challenges, in a way that ensures transparency and protects the interests of citizens.

MP Abdul Amir Al-Mayahi confirmed that the House of Representatives is determined to host the Minister of Finance to follow up on financial and economic files, noting that working with the automation system in customs ports would control procedures, without imposing additional burdens on the citizen or the merchant.

Al-Mayahi explained that what is being circulated about imposing taxes or price increases is not based on actual procedures, warning that raising such issues in an inaccurate manner leads to unhealthy uproar and inflames public opinion, stressing that parliamentary hearings are an important oversight tool to address shortcomings and improve financial performance.

Regarding parliamentary procedures related to hosting, Al-Mayahi said: Every deputy works within his jurisdiction to legislate and amend laws in a way that serves the public interest, expressing his hope to develop the mechanisms of hosting and address the problems that it faces, especially in the necessary files that affect the lives of citizens.

In the same context, MP Haider Kadhim stated that 48 MPs had collected official signatures to summon the Minister of Finance, indicating that the First Deputy Speaker of Parliament had referred the request to the Presidency Council for the necessary procedures. These parliamentary actions fall within the framework of the Council's oversight role, aimed at monitoring the financial situation and discussing economic policies to ensure transparency and address issues affecting citizens' living conditions. link

************

Tishwash: Economist: Smuggling and hoarding behind the high demand for dollars in Iraq

Economic expert Duraid Al-Anzi confirmed on Tuesday that the rise in the dollar exchange rate in the local market is no longer linked to the Central Bank's procedures or government policies, noting that the dollar is now mainly affected by the movement of gold and silver prices in global markets.

Al-Anzi told Al-Maalouma News Agency that “the significant rise in gold and silver prices makes it illogical for the dollar to remain in a state of decline,” noting that “the two metals are currently playing a leading role in influencing global currencies, which directly impacts the dollar exchange rate locally.”

He added that "the demand for dollars in the Iraqi market has also increased due to smuggling and hoarding operations," explaining that "the difference between the official price adopted in the budget, the price at which the Central Bank sells to banks, and the market price, has created a large gap that has encouraged citizens and traders to acquire and hold onto dollars."

Al-Anzi pointed out that "this acquisition has begun to shift from mere saving to trading and speculation, especially with the worsening political crises in the region, stressing that the continued political and economic instability in the region prevents any real decline in the price of the dollar."

He pointed out that "a decrease in the price of the dollar will not be achieved without political stability in the region, in addition to global economic stability, especially with regard to gold and silver prices, considering that fluctuations in global currencies are directly reflected in the Iraqi market."

Al-Anzi criticized the caretaker government's handling of the exchange rate issue, arguing that the lack of a clear vision and reliance on fluctuating decisions contributed to deepening the crisis instead of resolving it. link

************

Tishwash: The US Monitor: Sudani is the biggest beneficiary of Trump's criticism of Maliki

A report published by the American newspaper Al-Monitor highlighted the repercussions of the recent statements by US President Donald Trump against former Iraqi Prime Minister Nouri al-Maliki, considering that these statements revived the debate about al-Maliki’s chances of returning to the premiership, and at the same time strengthened the position of the current Prime Minister, Mohammed Shia al-Sudani, as a more balanced and acceptable option locally and internationally.

The report, translated by Iraq Observer, indicated that Maliki still faces widespread rejection inside and outside Iraq, due to his political responsibility during a period that witnessed a major security collapse and the rise of ISIS in 2014, a heavy legacy that still casts a shadow over any attempt to return to the political forefront.

She added: “Trump’s criticism also served as a reminder of the negative role played by Maliki, according to the American perspective, which makes it difficult for him to gain real external or internal support.”

In contrast, the report suggests that “Mohammed Shia al-Sudani appears to be a more likely candidate to lead the next phase, given that he is seen by observers as a less confrontational figure and more balanced in dealing with international parties, especially the United States and Iran.”

According to the report, Al-Sudani is a preferred choice within the coordinating framework forces, and he also enjoys a degree of acceptance at the international level, which makes him a candidate to continue as head of government or to lead the post-election phase.

The report concluded that the balance is gradually shifting in favor of al-Sudani, while al-Maliki's chances remain weak, unless major political developments occur that reshuffle the cards in the Iraqi scene. link

************

Mot: Getting the ole Message Understood is sooooo IMportant!!

Mot: The Seasoned Three !!!!

Seeds of Wisdom RV and Economics Updates Wednesday Evening 1-28-26

Good Evening Dinar Recaps,

China Pushes Back as U.S. Pressures Bolivia Over Iran Ties

Latin America emerges as a new front in the global power and currency realignment

Good Evening Dinar Recaps,

China Pushes Back as U.S. Pressures Bolivia Over Iran Ties

Latin America emerges as a new front in the global power and currency realignment

Overview (Key Points)

China has formally rejected U.S. pressure on Bolivia to designate Iran-linked groups as terrorist organizations.

Beijing framed Washington’s demands as political bullying and interference in sovereign affairs.

The dispute highlights a widening struggle for influence in Latin America, especially following political shifts in Venezuela and Bolivia.

China is reinforcing its presence through economic leverage, yuan settlement, and BRICS alignment, not military force.

Key Developments

China Rejects U.S. Interference:

Beijing reiterated its long-standing principle of non-interference in internal affairs, opposing U.S. demands that Bolivia expel Iranian nationals or designate the IRGC, Hamas, and Hezbollah as terrorist organizations without UN consensus.

Bolivia Becomes Strategic Battleground:

With President Rodrigo Paz taking office in late 2025, Washington sees an opportunity to reposition Bolivia away from the Iran–China–Russia axis. China, however, is moving to protect over $6 billion in investments, particularly in lithium, energy, and infrastructure.

Economic Influence Over Military Presence:

China emphasized that its influence in Bolivia and Latin America is market-driven, relying on trade, lending, and infrastructure under the Belt and Road Initiative rather than military installations. Bolivia has already begun settling imports in Chinese yuan, signaling deeper financial integration.

Latin America “Not Anyone’s Backyard”:

Chinese officials repeated a clear message: Latin America has the sovereign right to choose its partners. Beijing accuses Washington of weaponizing terrorist designations and sanctions to undermine rivals and preserve regional dominance.

Why It Matters

This standoff illustrates how geopolitical competition is shifting away from open conflict toward financial systems, trade alignment, and currency usage. U.S. pressure campaigns now face organized resistance from major powers willing to defend partners diplomatically and economically.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the global reset narrative:

Yuan-based trade and lending in Latin America weaken dollar exclusivity.

BRICS-backed partners gain alternatives to U.S.-controlled financial rails.

Resource-rich nations like Bolivia become key leverage points in future currency and settlement realignments.

Implications for the Global Reset

Pillar 1 — Decline of U.S. Enforcement Power:

When countries resist U.S. pressure without immediate economic collapse, it signals diminishing enforcement reach of dollar-based coercion.

Pillar 2 — BRICS Expansion by Necessity:

China’s support for Bolivia’s BRICS engagement reflects a strategy of insulating partners from Western pressure through alternative financial ecosystems.

This is not ideological alignment — it is survival economics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Brasil de Fato — “China urges U.S. to stop pressuring Latin American nations over ties with Beijing”

~~~~~~~~~~

Europe Confronts a New Reality as U.S. Focus Shifts Elsewhere

EU leaders acknowledge a structural shift in transatlantic priorities

Overview (Key Points)

The European Union has acknowledged that Europe is no longer the primary strategic focus of the United States.

EU foreign policy chief Kaja Kallas described the shift as structural, not temporary.

Europe is being urged to assume greater responsibility for its own defense and security.

NATO remains central, but leaders are calling for a “more European” NATO framework.

Key Developments

U.S. Strategic Priorities Reordered:

Speaking at the European Defence Agency’s annual conference, Kallas stated that Washington’s attention has shifted away from Europe, reflecting long-term changes rather than a passing political phase under the Trump administration.

NATO Must Evolve:

Kallas emphasized that NATO remains vital but warned that continued strength requires greater European leadership, funding, and operational capability, reducing reliance on U.S. decision-making.

Rising Geopolitical Risk Environment:

The EU official cautioned against a return to coercive power politics and spheres of influence, signaling concern about intensifying great-power competition and weakening multilateral norms.

Strategic Autonomy Becomes Mandatory:

From defense and cybersecurity to trade and diplomacy, Europe is now framing strategic autonomy as a necessity, not a policy preference, as U.S. focus shifts toward the Indo-Pacific and other global priorities.

Why It Matters

This marks a pivotal acknowledgment from within the EU: the post-Cold War security model is no longer guaranteed. Europe’s recalibration reflects broader fragmentation in the Western alliance system and accelerates regional self-reliance across defense, energy, and economic policy.

Why It Matters to Foreign Currency Holders

For foreign currency holders monitoring global reset dynamics:

A less U.S.-centric Europe may pursue independent trade, defense spending, and settlement mechanisms.

Strategic autonomy often precedes currency diversification and reserve rebalancing.

A more self-directed Europe adds momentum to a multipolar financial system, reducing dollar exclusivity over time.

Implications for the Global Reset

Pillar 1 — Alliance Reconfiguration:

Acknowledging reduced U.S. focus lowers the psychological barrier to independent regional decision-making.

Pillar 2 — Multipolar Security, Multipolar Finance:

As security responsibilities decentralize, financial systems tend to follow, reinforcing long-term currency realignment trends.

This is not a rift — it is a rebalancing.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy — “Kallas: Europe Is No Longer Washington’s Core Focus”

Reuters — “EU’s Kallas says Europe must take more responsibility as U.S. focus shifts”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Rob Isbitts Barchart Wed, January 28, 2026

If you think the silver (SIH26) market is acting “normal” right now, you haven’t checked the lease rates or the London vaults lately. We are witnessing a historic de-coupling where physical silver is trading at 50% to 80% premiums over the official paper spot price. In early 2026, the metal has already blasted past its 1980 record of $53.40, hitting intraday highs that remind me of that scene from the classic comedy movie Airplane. Silver, now arriving at $80, $90, $100…

But this isn’t just a speculative cornering of the market. This is a structural physical squeeze meeting AI-industrial desperation.

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Rob Isbitts Barchart Wed, January 28, 2026

If you think the silver (SIH26) market is acting “normal” right now, you haven’t checked the lease rates or the London vaults lately. We are witnessing a historic de-coupling where physical silver is trading at 50% to 80% premiums over the official paper spot price. In early 2026, the metal has already blasted past its 1980 record of $53.40, hitting intraday highs that remind me of that scene from the classic comedy movie Airplane. Silver, now arriving at $80, $90, $100…

But this isn’t just a speculative cornering of the market. This is a structural physical squeeze meeting AI-industrial desperation.

What’s Different Now Than in 1980?

When the Hunt brothers tried to corner silver, they were fought by the exchanges and eventually crushed by a wave of new supply. In 2026, the short sellers are the ones getting crushed. Why?

Silver is no longer just “poor man’s gold.” It is an industrial necessity for AI data centers, electric vehicles, and solar panels. Manufacturers must have silver to keep production lines running, regardless of the cost. This is not a luxury now.

The market has been in deep “backwardation,” meaning spot prices were higher than futures. That implies investors and industries are so desperate for the metal, they are willing to pay massively more to bypass the paper contracts.

As of January 2026, China has tightened export licenses for silver, effectively choking off a major global supply artery just as the West needs it most.

How I’m Playing the ‘Silver Bullet’

To Read More: https://www.yahoo.com/finance/news/why-current-silver-mania-wild-140002483.html

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

The shift away from U.S. dollar assets began in 2008, when the Federal Reserve intervened in the housing crisis with unprecedented monetary measures.

The subsequent quantitative easing during the 2020 CoviD-19 lockdowns, which saw the U.S. print massive amounts of money, further solidified this trend.

As a result, institutional investors, particularly in Europe and BRICS countries (Brazil, Russia, India, China, and South Africa), are now divesting from U.S. debt at an accelerating pace.

Europe’s largest pension funds have drastically reduced their holdings in U.S. Treasuries, reflecting a growing mistrust in the dollar’s continued dominance. This move is significant, as it signals a shift away from the traditional safe-haven status of U.S. government bonds.

BRICS nations, once reliant on U.S. bonds, are now either dumping their holdings or allowing them to mature without reinvesting. At the same time, they are increasing their gold reserves as a safer store of value.

India’s sell-off is particularly noteworthy, given its high exposure to Russian oil and the threat of U.S. secondary sanctions. Germany, too, has demanded the repatriation of its gold reserves from the U.S., fearing asset seizure amid rising geopolitical risks. These moves underscore the growing unease among foreign investors about the risks associated with holding U.S. dollar assets.

The U.S. dollar continues to weaken structurally, with the dollar index hitting lows not seen since late 2022. Despite modest gains in U.S. equity markets, foreign investors are effectively losing money due to currency depreciation.

The high cost of hedging against the dollar’s decline further diminishes the appeal of U.S. Treasuries. The Trump Administrtion’s aggressive trade policies and tariff threats, particularly toward South Korea and Europe, are only exacerbating global uncertainties and accelerating the flight from dollar assets.

Central banks now hold more gold reserves globally than U.S. Treasury bonds, signaling a historic shift in reserve asset preferences.

As countries diversify their reserves to mitigate risk, gold is emerging as the primary beneficiary of this trend. The geopolitical and economic instability caused by U.S. policies is prompting a flight to safety, with gold seen as a more reliable store of value.

The decline of the dollar and the exodus from U.S. debt markets are structural shifts that are likely to continue in the coming years. As the global economy becomes increasingly multipolar, the dominance of the U.S. dollar is being challenged.

The implications of this trend are far-reaching, with potential consequences for U.S. interest rates, currency markets, and the global economy as a whole.

In conclusion, the global shift away from U.S. dollar assets is accelerating, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar.

As investors and central banks continue to diversify their reserves, gold is emerging as the primary beneficiary. For further insights and information, watch the full video from Sean Foo, which provides a more in-depth analysis of this trend and its implications for the global economy.

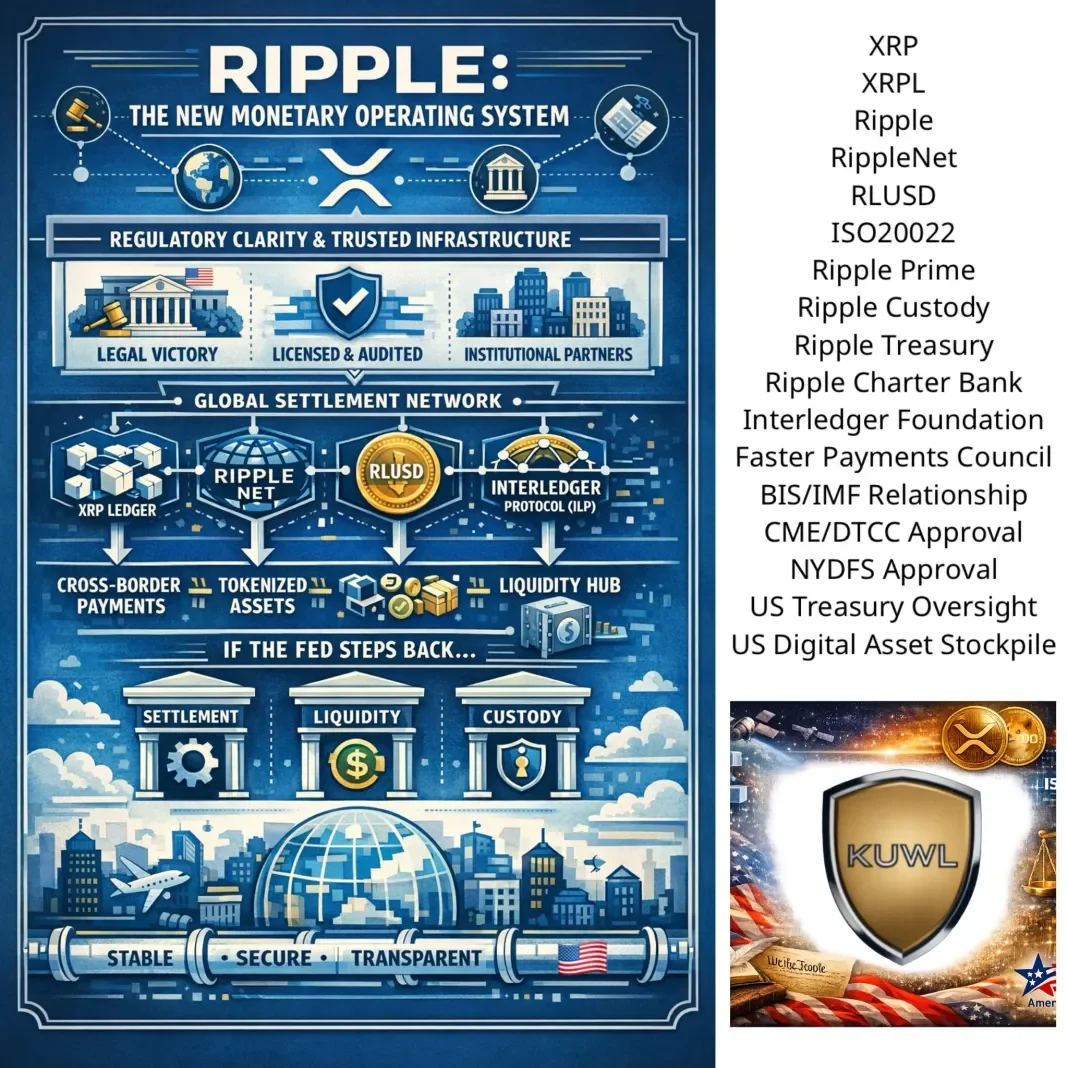

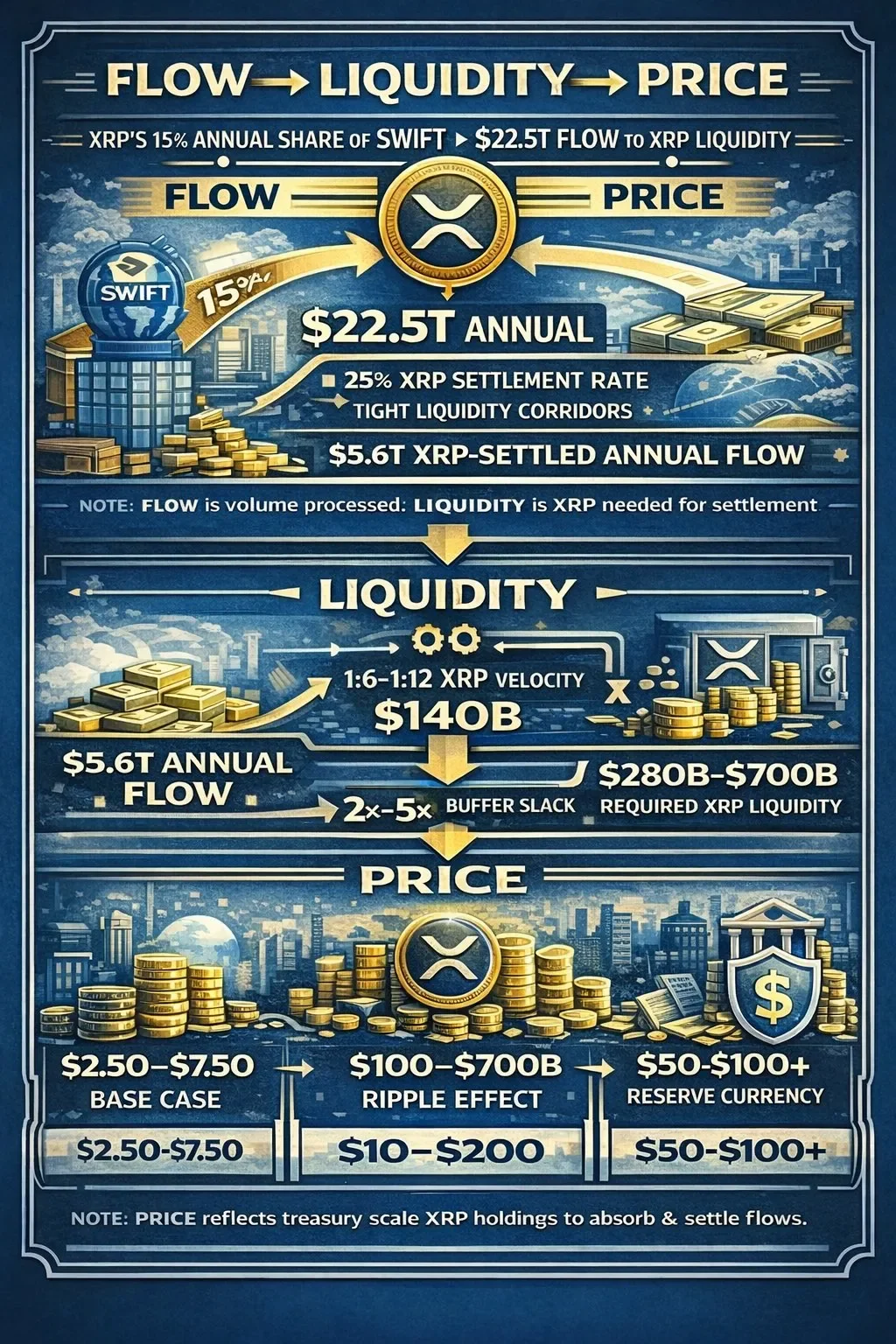

Rob Cunningham: XRP Price is Not a “Crypto” Question

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

This is not a product stack. It’s a monetary operating system in waiting.

And critically, it is being built by Ripple Labs – the only large-scale crypto-native firm that:

Survived full-contact litigation with the U.S. government

Achieved judicial clarity rather than regulatory arbitrage

Maintained institutional relationships through the storm

Never lost operational continuity or balance-sheet solvency

That combination is vanishingly rare.

Regulatory survival has become regulatory advantage

Most actors spent the last decade avoiding clarity. Ripple went through it – and emerged standing.

In any system transition, survivors of the old regime with proof of compliance become default candidates for stewardship in the new one.

That will matter immensely over the next five years.

The XRPL + Interledger + RippleNet triad isn’t just about speed or cost.

It’s about who already sits at the table:

Central banks

Treasury-adjacent institutions

Payment councils

Market infrastructure incumbents

Once a system becomes the meeting place between sovereign rails, private liquidity, and cross-border settlement, replacement becomes politically and operationally expensive.

That’s durable power.

RLUSD quietly solves the “trust gap”

Stablecoins fail when:

Governance is opaque

Custody is unclear

Redemption trust erodes

RLUSD’s design posture – paired with NYDFS discipline – signals something different:

a regulated liquidity instrument meant to be boring, dependable, and invisible.

That’s exactly what large institutions want.

Here’s the subtle but critical insight:

If the Federal Reserve’s role is diluted rather than abolished – through multipolar settlement, bilateral liquidity corridors, and atomic gross settlement – someone still has to run the pipes.

Not policy.

Not discretion.

Pipes.

Ripple’s stack looks increasingly like plumbing, not politics.

So what does this imply for Ripple equity holders?

A casual – but clear-eyed – observer should conclude:

Ripple equity is levered to infrastructure adoption, not token price theatrics

The upside is asymmetric if Ripple becomes:

A settlement backbone

A neutral liquidity intermediary

A custody + compliance hub for tokenized value

The downside is muted relative to peers because:

The company already cleared its largest existential risk

Its customers are institutions, not retail sentiment

In plain language:

If value flows where trust, clarity, and continuity converge, Ripple sits unusually close to the center of that convergence.

the promise to equity owners is not hype-driven upside—but civilizational relevance if the world continues moving toward:

Honest settlement

Atomic reconciliation

Transparent ledgers

Rule-based money instead of discretionary illusion

That’s the long game.

And Ripple appears to be one of the very few still playing it seriously.

XRP price is not a “crypto” question.

It’s a balance-sheet, liquidity, and risk-management question.

Once XRP is treated as:

Plumbing,

Neutral collateral, &

Settlement certainty,

its’ pricing logic will stop looking like Bitcoin and start looking like a Systemically Important Liquidity Asset.

And let’s never forget @JoelKatz’s commentary that the XRP price must be quite high (well above $200 as indicated in image below) to cost-effectively deliver on its’ designed purpose to serve as a neutral liquidity and settlement bridge token the world over.

Strap in. Clarity is guaranteed to come. Adoption after Law. Price after Adoption. Patience is a MAGA-Wealth enhancing virtue, and nothing stops this inevitability. Happy @America250 to all you XRP Fans out there!

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 1-28-26

Good Afternoon Dinar Recaps,

Gold Blasts Into New Territory — All-Time High Above $5,300

Bullion breaks records as markets price uncertainty, weak dollar, and systemic shifts

Good Afternoon Dinar Recaps,

Gold Blasts Into New Territory — All-Time High Above $5,300

Bullion breaks records as markets price uncertainty, weak dollar, and systemic shifts

Overview (Key Points)

Gold futures on the COMEX exchange surpassed $5,300 per troy ounce — the highest price in history for gold contracts.

The surge reflects a combination of weak U.S. dollar dynamics, geopolitical tensions, and safe-haven demand.

Analysts now project potential for even higher prices later in 2026, signaling deep market conviction in the rally.

Key Developments

Historic COMEX Breakthrough: