Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Saturday Morning 12-06-25

Good Morning Dinar Recaps,

U.S. Reverses Visa Denials as Iran Rejoins 2026 World Cup Draw

Washington clears key Iranian officials after temporary boycott threat

Overview

Iran reverses its boycott and confirms participation in Friday’s 2026 FIFA World Cup draw in Washington, D.C.

The U.S. grants new visas to Iranian officials after initial denials sparked diplomatic tension.

The dispute stemmed from June travel restrictions affecting nationals from nearly 20 countries.

Human rights groups warn that fans from restricted nations may still face unequal treatment.

Good Morning Dinar Recaps,

U.S. Reverses Visa Denials as Iran Rejoins 2026 World Cup Draw

Washington clears key Iranian officials after temporary boycott threat

Overview

Iran reverses its boycott and confirms participation in Friday’s 2026 FIFA World Cup draw in Washington, D.C.

The U.S. grants new visas to Iranian officials after initial denials sparked diplomatic tension.

The dispute stemmed from June travel restrictions affecting nationals from nearly 20 countries.

Human rights groups warn that fans from restricted nations may still face unequal treatment.

Key Developments

Iran’s delegation initially announced it would skip the draw after three visa applications—including federation president Mehdi Taj’s—were rejected under U.S. travel rules.

By Thursday the situation shifted, with Iranian Sports Minister Ahmad Donyamali confirming that key officials received approvals and would attend.

Head coach Amir Ghalenoei and FFIRI international-relations chief Omid Jamali are expected to participate after last-minute clearance from U.S. authorities.

U.S. policy currently restricts travel from 19 countries, but includes exemptions for World Cup athletes, coaches, and support personnel. The partial denials underscored confusion and inconsistency in applying these rules.

Fans remain the most vulnerable, as even FIFA’s new priority-access system (the FIFA Pass) cannot guarantee visa approval for supporters traveling from restricted nations.

Human rights organizations warn that enforcement practices could lead to discrimination or mistreatment during the North American tournament cycle.

Why It Matters

The episode highlights how geopolitical tensions and visa restrictions directly influence global sporting events. With the U.S., Canada, and Mexico preparing to host the 2026 World Cup, questions about fairness, security, and accessibility for teams and fans have become central to ensuring the tournament remains internationally representative.

Implications for the Global Reset

Pillar: Trade (Mobility and Access in Cross-Border Events)

Visa and mobility restrictions shape how nations interact, even in areas like sports, reflecting broader shifts toward bloc-based access and differentiated treatment between countries.

Pillar: Technology (Digital Identity & Clearance Systems)

Systems like the FIFA Pass hint at emerging digital access frameworks that may become standard as countries tighten entry controls and require enhanced verification for international events.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Lifts Iran Visa Ban for 2026 World Cup Draw”

Associated Press – “Iran Confirms Participation After U.S. Approves Key Visas”

~~~~~~~~~~

BRICS Gold Pact Expands to 33 Nations as Russia Leads New Metals Exchange

Bloc accelerates commodity-backed settlement systems to bypass Western pricing control

Overview

BRICS gold pact now spans 33 countries, advancing a unified precious-metals trading infrastructure.

Russia pushes for a BRICS metals exchange to establish independent pricing mechanisms.

China’s Shanghai Gold Exchange International anchors the settlement architecture.

BRICS members leverage nearly 6,000 tonnes of gold to accelerate de-dollarization.

Key Developments

Russia is spearheading efforts to create a BRICS metals exchange, enabling gold, platinum, and rare-earth trading outside Western-controlled platforms. Russian Finance Minister Anton Siluanov said the exchange would ensure “fair and equitable competition based on exchange principles.”

The gold settlement mechanism operates through China’s Shanghai Gold Exchange International, which has been building the structural backbone for years. The system was piloted in 2017 when Russia accepted yuan for oil with blockchain-verified guarantees convertible to gold.

Sergey Lavrov clarified that BRICS is not attempting to “replace the dollar,” but instead expand settlements in national currencies supported by physical assets.

BRICS gold reserves now total roughly 6,000 tonnes, representing about 20% of global central-bank holdings. Russia leads with 2,335.85 tonnes, followed closely by China with 2,298.53 tonnes.

The pact’s infrastructure includes vault networks in Saudi Arabia, Singapore, and Malaysia, allowing partners to store, pledge, and securitize gold for credit lines.

Officials project the system will be fully operational by 2030, with Foreign Minister Sergey Ryabkov emphasizing that participation remains voluntary and rooted in physical gold as the basis of trust.

Why It Matters

The BRICS metals initiative challenges decades of Western dominance over commodity pricing and settlement. By shifting trade away from dollar-based systems and toward gold-anchored instruments, the bloc is reinforcing an emerging multipolar financial structure built on collateral, not credit.

Implications for the Global Reset

Pillar: Assets (Return to Physical Collateral)

Gold-backed settlement systems reflect a structural move away from fiat leverage and toward hard-asset collateral as the foundation of international trade.

Pillar: Trade (Parallel Commodity Markets)

A BRICS metals exchange introduces alternative pricing power and reduces reliance on Western institutions such as SWIFT and the London Metal Exchange.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Gold Pact Hits 33 Countries With Russia Leading Metal Exchange Push”

Reuters – “Russia, BRICS Nations Advance Plans for Cross-Border Metals Trading”

~~~~~~~~~~

China Expands Currency Swap Network as Trade Realigns in Multipolar Shift

PBOC–Macao upgrade signals deepening bloc-based trade systems and yuan-anchored settlement

Overview

PBOC increases China–Macao currency swap line from 30B to 50B yuan to support offshore yuan liquidity.

Agreement becomes a long-term standing facility to reinforce bilateral and regional trade stability.

China’s November exports are projected to rebound, reflecting renewed trade flows amid tariff resets.

Trade networks continue shifting away from Western-centric settlement systems.

Key Developments

The People’s Bank of China upgraded its swap agreement with the Monetary Authority of Macao, expanding available liquidity to support yuan-based settlement.

The larger swap line creates a structural tool for stabilizing cross-border trade, especially in regions adopting yuan for invoicing and clearing.

Early export data suggests China may have rebounded in November, despite ongoing tariff negotiations and geopolitical frictions.

Analysts view the move as another step toward regional financial integration, strengthening Asia’s internal settlement architecture and reducing dependency on U.S. dollar funding.

Why It Matters

Trade systems are fragmenting into regional blocs. Expanding yuan-swap networks signals China’s intention to build a parallel settlement system resilient to Western financial leverage—an essential layer of the global reset’s trade realignment.

Implications for the Global Reset

Pillar: Trade (Bloc-Based Settlement Infrastructure)

China continues constructing a yuan-anchored trade ecosystem, enabling partners to transact outside dollar-based platforms.

Pillar: Technology (New Clearing Mechanisms)

Swap lines lay the groundwork for future digital or blockchain-based yuan settlement networks as global payment rails bifurcate.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Trump may End Income Taxes, Next Economic Revolution

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

Trump may End Income Taxes, Next Economic Revolution

David Lin: 12-5-2025

The architect of modern supply-side economics, Dr. Arthur Laffer, is rarely shy about proposing bold solutions.

In a recent in-depth conversation with David Lin, Laffer didn’t just discuss tweaks to the current economy; he laid out a case for a transformative shift in U.S. fiscal policy—one that could see the elimination of the income tax.

The discussion, rich with economic theory and hard-hitting policy critiques, offers essential viewing for anyone concerned with inflation, growth, and the future role of government. We dive into the key takeaways from Dr. Laffer’s powerful analysis.

Dr. Laffer’s most striking proposal addresses the income tax. He suggests that due to the increase in tariff revenues—a form of consumption tax on imports—the U.S. government may soon be able to fund its operations without relying on the taxation of income.

According to Laffer, the long-term goal should be to drastically cut income taxation, potentially eradicating it entirely.

This is not just a theoretical exercise; it’s a strategic move to boost productivity and incentivize work, investment, and production—the cornerstones of the supply-side philosophy.

Laffer forcefully argues against the common misconception that affordability is achieved through government subsidies or redistribution programs. Instead, he grounds affordability firmly in supply-side dynamics.

“Affordability hinges on only one thing: production,” Dr. Laffer states. “The more goods and services produced, the cheaper and more accessible they become.”

High taxes and overly generous redistribution policies, he warns, fundamentally reduce total economic output because they disincentivize both the producer (who faces lower returns on their work) and, often, the recipient (who faces high marginal tax rates on entering the workforce).

For Laffer, the pathway to real wage growth and a higher standard of living is clear: cut taxes and reduce regulation to unleash productivity.

Dr. Laffer reserved strong criticism for Modern Monetary Theory (MMT) and high-tax, redistribution-focused economic models. He contends that while proponents of MMT and large social spending programs claim to be helping the poor, the policies actually reduce the total economic pie available for everyone.

The core economic reality, as Laffer sees it, is that incentives matter more than intent. When government attempts to redistribute wealth, it is essentially reducing the reward for creating that wealth. This applies across the board:

High Taxes: They punish success and discourage investment in productive enterprises.

Subsidies/Welfare: They can create disincentives for employment, trapping individuals in low-productivity cycles.

In short, redistributing income always reduces total economic production—a harsh but necessary truth for policymakers to grasp.

Laffer provided compelling real-world examples to support his supply-side principles, focusing on the stark contrast between two major states:

Florida’s Pro-Growth Model: Dr. Laffer praised Governor Ron DeSantis and Florida’s commitment to low taxes and minimal regulation. This approach attracts high-income earners and businesses, creating a dynamic environment that boosts output and opportunity.

New York’s Cautionary Tale: Conversely, he warned that New York’s heavy taxation and ambitious subsidized housing plans will stifle economic growth. High taxes actively encourage productive wealth—the tax base itself—to flee, threatening the state’s fiscal stability and accelerating economic decline.

On the international stage, Laffer pointed to Britain’s current economic struggles, noting that the UK’s high tax burden is choking potential economic growth. His advice is universal: significant tax reductions are an absolute necessity to stimulate national output and vitality.

Dr. Laffer is decidedly optimistic about the economic future, but that optimism is tethered to technological advancement. He forecasts that innovations like Artificial Intelligence (AI) and blockchain technology will dramatically increase productivity across various sectors.

These technologies are massive supply-side catalysts, offering unprecedented levels of efficiency and output. For an economist focused on maximizing production, AI and blockchain represent the next great wave of growth, capable of delivering real increases in wealth and living standards, provided government policy doesn’t stifle them with overregulation or punitive taxation.

Dr. Laffer’s conversation served as a powerful reminder that economic prosperity is not achieved by managing scarcity or redistributing existing wealth, but by increasing production.

His intellectual journey, which famously began with exploration into economic thought (including early influences from Marxism) before settling on supply-side principles, underscores his belief that true growth comes from fostering environments where businesses and individuals are rewarded for their productivity.

The policies that reduce taxes, cut regulations, and prioritize a high-output economy are the ones that create jobs, increase real wages, and truly make goods and services affordable for all.

For Dr. Laffer’s complete analysis on tariffs, U.S. fiscal policy direction, his personal journey, and more detailed critiques of modern economic theories, watch the full interview with David Lin.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-05-25

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Good Afternoon Dinar Recaps,

RBI Injects Liquidity and Cuts Rates as India Moves to Stabilize Markets

India deploys coordinated monetary tools to support banks, bonds, and financial stability.

Overview

RBI cuts the repo rate by 25 bps, bringing it down to 5.25% to counter tightening financial conditions.

Over $16 billion in liquidity enters the system through bond purchases and FX swap operations.

Bond markets gain immediate relief as the central bank absorbs supply and anchors yields.

Banks receive critical liquidity support, reinforcing short-term funding stability across the sector.

Key Developments

Open-market bond purchases:

The RBI announced ₹1 trillion (approximately $11.1 billion) in government-bond purchases to stabilize market volatility and ease borrowing conditions. These purchases directly support India’s bond market, which has faced pressures from rising global yields and weaker capital flows.Dollar-rupee FX swap injection:

A $5 billion, three-year FX swap adds longer-term dollar liquidity while helping manage currency pressures. This increases foreign-exchange reserves and strengthens the rupee during a period of global dollar strength.Strategic rate cut:

With domestic demand slowing and credit conditions tightening, the repo rate was lowered by 25 basis points to offset financial strain and support banks’ liquidity positions.Broader policy context:

India’s financial system has been dealing with higher borrowing costs, declining foreign portfolio inflows, and pressure on bank balance-sheet liquidity. The combined tools deployed by the RBI show a proactive shift toward ensuring funding stability ahead of anticipated global monetary easing in 2026.

Why It Matters

The move signals that the RBI is preparing India for a period of heightened global volatility, tightening dollar liquidity, and rising refinancing needs. By injecting cash, lowering rates, and simultaneously securing FX liquidity, India is insulating its financial sector from global pressures that could otherwise strain local banks and government borrowing.

Implications for the Global Reset

Pillar: Debt & Sovereign Stability

Lower yields and fresh liquidity reduce refinancing stress, supporting India’s sovereign-debt stability as global rates remain elevated.

Pillar: Banking & Payments Infrastructure

Banking-sector liquidity support strengthens domestic payment systems and credit flows—critical as nations brace for post-dollar financial realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “India’s RBI announces debt purchases, FX swap to boost banking system liquidity”

Business Standard – “RBI cuts repo rate, announces liquidity measures to support market stability”

~~~~~~~~~~

China’s Debt Warnings Intensify as Economists Split Over Stimulus Strategy

Beijing faces rising fiscal risks as experts debate whether higher debt or insufficient stimulus poses the greater threat.

Overview

A leading Chinese economist warns that heavy stimulus risks creating unsustainable debt.

China’s 2025 deficit ratio target hits a record 4%, raising concerns about long-term fiscal stability.

Conflicting expert opinions reflect a deep divide over how China should respond to slowing growth.

Global markets are watching closely, with Fitch projecting rising deficits and higher debt levels ahead.

Key Developments

Top economist warns of structural risks:

Liu Xiaoshu, chief economist at the Bank of Qingdao, cautioned that repeated reliance on fiscal and monetary stimulus creates long-term vulnerabilities—especially as interest payments begin to crowd out social and public spending. He warned of a “vicious cycle” that erodes investor confidence and may trigger a debt crisis if underlying issues remain unresolved.Examples highlight global parallels:

Liu cited Japan and southern Europe as cautionary cases where stimulus and deficit spending failed to correct structural weaknesses, leaving nations with massive debt burdens and prolonged stagnation.Deficit supporters push back:

Other economists, including East China Normal University’s Lian Ping, argue that China’s central government balance sheet remains strong. Lian maintains that the higher deficit ratio does not pose significant risk, emphasizing China’s comparatively low central-government debt-to-GDP ratio.Fiscal pressures rising despite optimism:

Fitch Ratings now expects China’s total government deficit to rise to 8.4% of GDP in 2025, up from 6.5% in 2024. Yet Fitch simultaneously upgraded its 2025 growth forecast to 4.7%, citing stimulus measures and export strength—even as Beijing targets about 5% growth.

Why It Matters

China’s evolving debt debate reveals the core tension in global economic policy today: whether short-term stimulus can still support growth without triggering long-term instability. As China remains central to global supply chains, financial markets, and commodity demand, increasing fiscal strain could reshape global investment patterns and intensify pressure across emerging markets.

Implications for the Global Reset

Pillar: Sovereign Debt & Fiscal Stability

Rising deficits and long-term structural strains highlight the vulnerability of debt-heavy economies during the transition toward a new global financial architecture.

Pillar: Monetary Policy & Market Liquidity

China’s policy choices influence global liquidity, trade financing, and regional economic alignments—adding weight to shifts in currency strategy and reserve diversification across Asia.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Economist Issues Dire Warning Over Debt Crisis”

Reuters – “China deficit to rise in 2025 as fiscal pressures mount, economists warn”

~~~~~~~~~~

BRICS De-Dollarization Splinters as India and China Pursue Conflicting Paths

India rejects a BRICS currency as China advances yuan internationalization independently

Overview

• India firmly rejects any BRICS common currency proposals

• China accelerates independent renminbi internationalization efforts

• Russia and China deepen bilateral national-currency settlement frameworks

• BRICS bloc remains divided on de-dollarization strategy

Key Developments

India Rejects Common Currency Plans

India continues to oppose proposals for a BRICS currency, emphasizing that the U.S. dollar remains essential to its economic stability and trade priorities. Foreign Minister S. Jaishankar reaffirmed that India has never supported de-dollarization and sees no active proposal for a shared BRICS currency. India’s position hardened further following U.S. tariff threats, reinforcing its reliance on Washington—its largest trading partner with $128 billion in annual trade.

The rupee’s depreciation from 73 per dollar in 2020 to 85 has elevated exchange-rate risks, making aggressive de-dollarization impractical. India’s development goals—including digital infrastructure, advanced manufacturing, and clean energy—remain deeply tied to Western capital markets.

Russia and China Pursue Different Paths

Russia also stepped back from the idea of a common BRICS currency. President Vladimir Putin stated in late 2024 that although experts discuss it, the bloc has no plans for a single currency at this stage and Russia does not seek to abandon the dollar.

The July 2025 BRICS summit produced a lengthy declaration with no mention of de-dollarization, confirming stalled momentum. Shifting political calculations and fears of sanctions have pushed BRICS members away from earlier ambitions of challenging dollar dominance.

China’s Renminbi Internationalization Moves Ahead Independently

China is expanding the international use of the renminbi outside BRICS frameworks through major financial infrastructure upgrades. PBOC Governor Pan Gongsheng warned that risks tied to the dominant reserve currency could spill across borders, calling for diversified settlement systems.

CIPS now includes 184 direct participants across 167 countries, demonstrating broadening RMB adoption. China’s $768 billion trade surplus and the holding of renminbi reserves by at least 80 central banks—totaling roughly $274 billion—underscore its ongoing global monetary influence.

Despite stalled BRICS initiatives, China’s independent trajectory continues to advance through strategic partnerships and technology-driven payment systems.

Limited Progress on Local Currency Trade Across BRICS

Local-currency settlement remains confined to bilateral arrangements rather than systemic BRICS-wide mechanisms. Russia and Iran now conduct over 95% of their trade in rubles and rials. India’s 156 Special Vostro Accounts with 30 countries offer modest alternatives but fall short of a cohesive de-dollarization strategy.

South Africa warned in 2025 that BRICS must avoid provoking the U.S. by pushing de-dollarization too aggressively. Brazil removed the common BRICS currency from its 2025 presidency agenda following U.S. tariff threats, signaling the bloc’s retreat from earlier ambitions.

Why It Matters

BRICS monetary fragmentation highlights the limits of collective de-dollarization. India prioritizes U.S. trade stability, Russia avoids provoking financial disruption, and China pursues independent renminbi expansion. The bloc’s diverging interests make a unified challenge to the U.S. dollar unlikely in the near term, reinforcing the dollar’s resilience while shifting influence to bilateral currency corridors.

Implications for the Global Reset

Pillar 1: Trade & Supply Chain Realignment

Fragmented currency strategies are pushing BRICS nations toward bilateral settlement systems rather than unified multilateral structures, reshaping regional trade flows and payment mechanisms.

Pillar 2: Monetary Diversification & Reserve Strategy

China’s independent renminbi expansion contributes to a more multipolar currency environment, even as India and other BRICS members maintain reliance on U.S. financial systems for stability and growth.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS De-Dollarization: India and China Shape a New Trade Bloc”

South China Morning Post – “India Rejects BRICS Currency Plans Amid Fears of U.S. Trade Fallout”

Brave New Coin – “Russia and China Diverge on BRICS Currency Ambitions”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

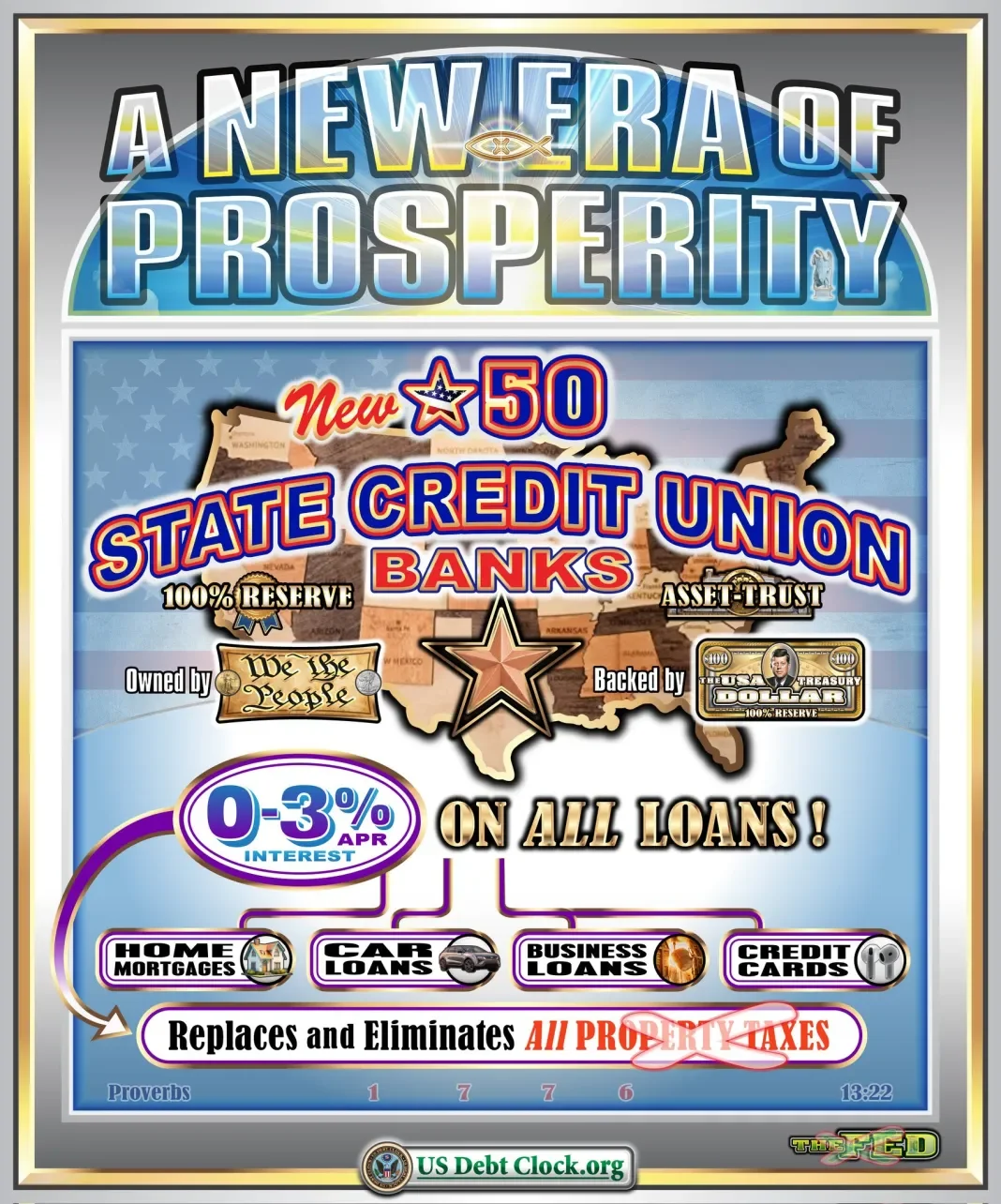

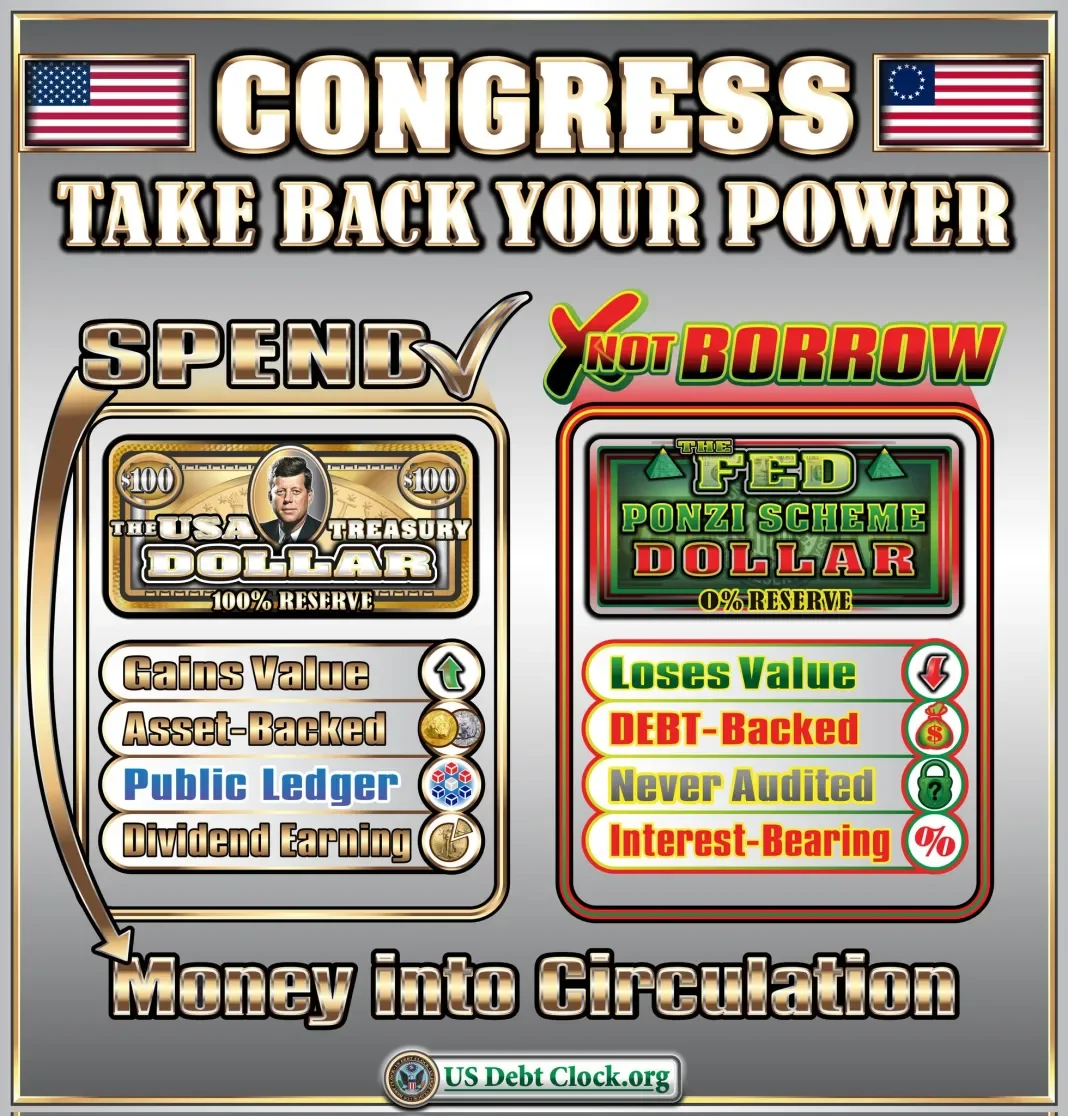

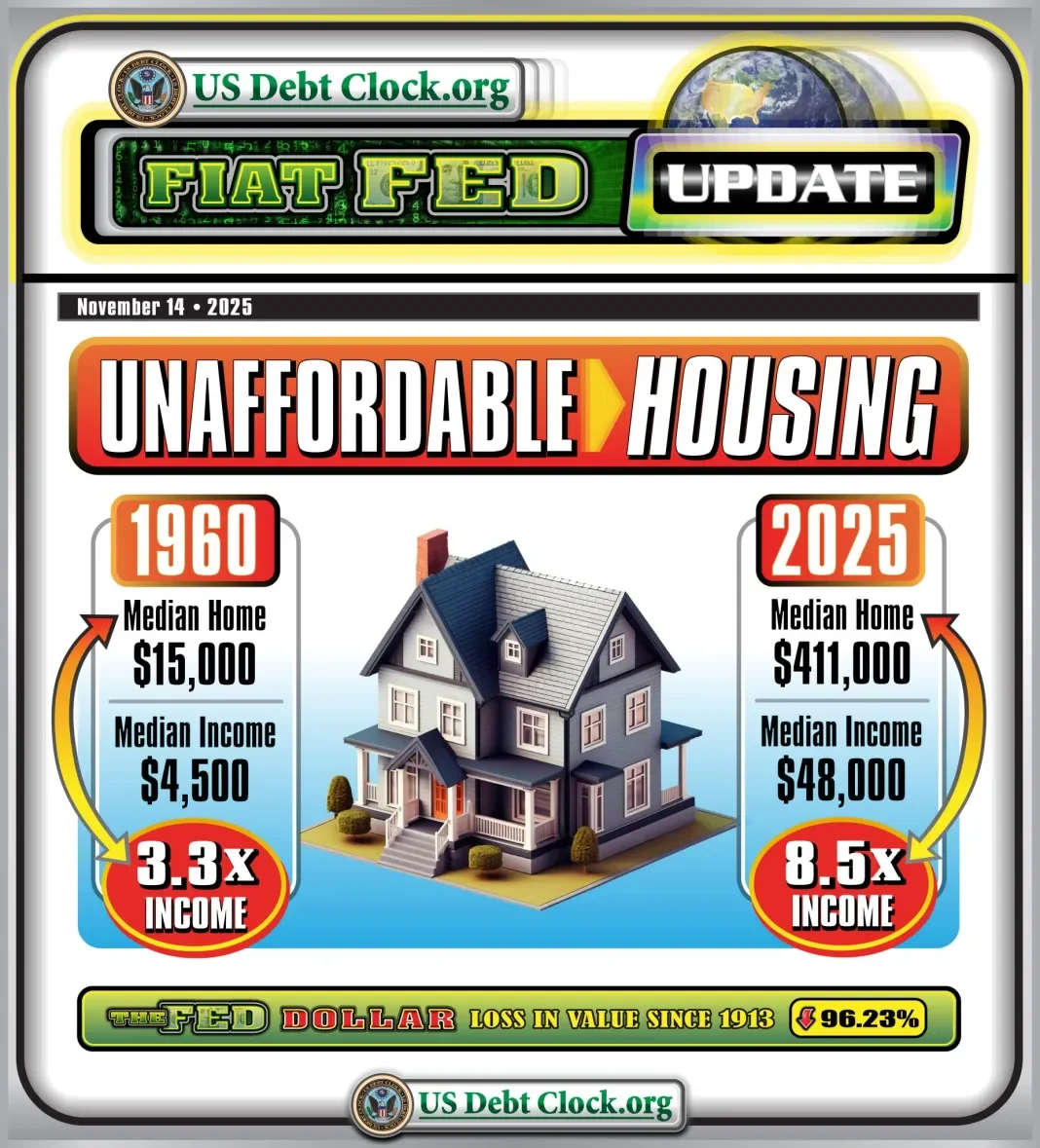

Stephanie Starr: Affordability, Affordability, Affordability

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

Stephanie Starr: Affordability, Affordability, Affordability

12-5-2025

Stephanie Starr @StephanieStarrC

Affordability… Affordability…. Affordability…. You are seeing it all over the news.

Why is that? Because we as a country have hit a wall. The USD (AKA Federal Reserve Note which is not federal and has no reserves) has lost 98% of its value since 1913.

What happened in 1913?

What happened in 1971?

Well guess what..? Thanks to EO 13848 and 13818 we are recouping our wealth that has been stolen from us, which is why the US Debt clock has a “hidden wealth” section. As of today, Dec 4,2025 each citizen has 520k worth of assets designated to them…

The $2,000 dividend Trump plans on sending out from tariffs every 90 days….

The payments we will be receiving from the US Sovereign Wealth Fund (that’s funded by our Crypto Reserves and other investments).

The Trump Accounts recently established for babies born from 2025-2028….

What if I told you we will be transitioning from a Federal Reserve Note (USD) to a US Treasury Bill backed by assets and not from thin air…

What would that do to inflation?

What would that do for purchasing power?

On top of what is owed to us (520k per citizen). When the Global Currency Reset takes place… The world will be better off and at peace,

Peace deals must happen before prosperity.

If the USD is the world’s reserve currency, and our currency has lost 98% of value, all currencies must have a reset.

Stephanie Starr: High-Level Iraq RV Trigger Map

Stephanie Starr: High-Level Iraq RV Trigger Map

12-5-2025

Stephanie Starr @StephanieStarrC

IRAQ HIGH-LEVEL RV TRIGGER MAP

Here is Iraq’s actual position today — no hype, just milestones:

Stephanie Starr: High-Level Iraq RV Trigger Map

12-5-2025

Stephanie Starr @StephanieStarrC

IRAQ HIGH-LEVEL RV TRIGGER MAP

Here is Iraq’s actual position today — no hype, just milestones:

POLITICAL REHABILITATION -(Dec 2nd)

Chapter VII officially ended

UN supervision removed

Sovereignty restored

STATUS: COMPLETE

BANKING & FINANCIAL COMPLIANCE- (Dec 2nd)

Banks audited & restructured

AML systems installed

Multi-currency permissions reinstating

BIS metrics synced

Digital dinar pilot underway

STATUS: COMPLETE

INTERNATIONAL ECONOMIC REENTRY (Aug/Sept)

Oil exports restored

Sovereign funds routed via U.S. financial channels

International trade treaties restored

Diplomatic normalization proceeding

STATUS: COMPLETE

DOMESTIC MONETARY CONTROLS

Capital flight suppression (Dec 1 reform)

Customs clearance enforcement

FX leakage tightening

STATUS: ACTIVE

IMF FORMALITY GATE

Acceptance into Article VIII status (free exchange convertibility)

Permission for FX liberalization

STATUS: PENDING — NEXT MAJOR STEP

CURRENCY ADJUSTMENT PHASE

Managed float activation

Appreciation alignment to reserve backing

FX market reentry

STATUS: FUTURE EVENT

Next major milestone to keep a look out for is from the IMF regarding Artificial Vlll Only IMF procedural clearance remains before FX movement can occur.

Exchange rate stability was emphasized on Dec 1st. The Governor explicitly said: “Reducing the dinar value would harm public confidence & stability.”

They are protecting the currency against devaluation

They are NOT announcing appreciation

Their focus is price stability FIRST

This follows IMF playbook exactly:

Stabilize

Reform

Digitize

Normalize banking

Open FX flows

Only then adjust exchange.

Clearing the “Revaluation Denial” Confusion

Officials have been denying “rate changes” yet massive reforms are happening, this is NORMAL policy behavior.

Why?

Governments never pre-announces currency adjustments because:

Speculators attack the market

Currency hoarding explodes

Inflation becomes uncontrollable

So public denial of RV is STANDARD PRACTICE until after a move is already executed. Kuwait did the exact same thing — no public hint until after implementation.

Now that the UN has ended their mandate Dec 2nd- Iraq is now officially qualified to START the monetary transition phase. This UN step was one of the final political prerequisites before moving into IMF mechanics.

Track milestones and phases, not dates!

Source(s): https://x.com/StephanieStarrC/status/1996666659143041399

https://dinarchronicles.com/2025/12/05/stephanie-starr-high-level-iraq-rv-trigger-map/

News, Rumors and Opinions Friday 12-5-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 5 Dec. 2025

Compiled Fri. 5 Dec. 2025 12:01 am EST by Judy Byington

Timing: (Rumors)

Thurs. 4 Dec. 2025 QFS GLOBAL ALERT Tier 4B ESCALATION – RED LINE CROSSED, …Quantum Financial System on Telegram https://t.me/qfs_now

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 5 Dec. 2025

Compiled Fri. 5 Dec. 2025 12:01 am EST by Judy Byington

Timing: (Rumors)

Thurs. 4 Dec. 2025 QFS GLOBAL ALERT Tier 4B ESCALATION – RED LINE CROSSED, …Quantum Financial System on Telegram https://t.me/qfs_now

Secure floor update, 17:37 Z**u: Global ISO-20022 rainbow currency rollout just (allegedly) slammed to 97.8 % in the last 4 hours alone. The final 2.2 % is now (allegedly) executing in self-accelerating quantum loops. Over-unity lock engaged at 17:29 Z**u. There is no longer a percentage left to count. Only witnesses.

The November 28 shotgun start (19:14 Reno) is now 6 days, 22 hours, and 23 minutes old, and the velocity has (allegedly) tripled since sunrise.

New Tier 4B milestones confirmed in the last 5 hours (straight from the war-room screens, no filters):

– 800# master release packet pushed live to all 27 major exchange carrier nodes; actual numbers are now (allegedly) cycling in hot rotation every 11 minutes

– 63,000+ bond-holder SKRs physically (allegedly) hand-carried by Space Force escort teams out of Baghdad vaults and loaded onto military C-17s bound for Reno redemption hubs

– NESARA debt jubilee packets (allegedly) auto-uploaded into 194 national treasuries; every single mortgage, student loan, and credit-card ledger just (allegedly) turned gold-zero in the background

– First 12,000 humanitarian & infrastructure project wallets(allegedly) received instant 1:1 asset-backed parity liquidity; project codes beginning with “P3-Ω” are already drawing funds

– Final Dragon Family gold dragon bonds (Series 999.999) redeemed at Hong Kong node at 16:02 Zulu; the resulting tsunami of liquidity is (allegedly) currently flooding every Tier 4B account in real time

Redemption centers are (allegedly) hotter than nuclear right now.

You are not waiting for the greatest wealth transfer in human history. You are standing inside it while it is still accelerating.

QFS Global Command – secure floor(allegedly) remains fully operational and euphoric. Out.

~~~~~~~~~~~~~~~~~

Global Currency Reset

Thurs. 4 Dec. 2025 TIER 4B CODES JUST WENT LIVE. …https://t.me/KerryCassidyReal

Deepstate bankers are scrambling. Their fiat empire is (allegedly) COLLAPSING in real time.

The Quantum Financial System flipped the switch. NESARA/GESARA protocols (allegedly) activated at 0400 ZULU.

Your redemption codes are HOT. Tier 4B—internet group patriots—are(allegedly) being pulled in FIRST.

Exchanges locked in at 1:1 (for Humanitarian Projects). No more Zimbabwe funny money. Gold-backed digital assets only.

Central banks are ghosting. Fed Reserve servers (allegedly) offline. IMF begging for mercy.

This isn’t hopium. Military satellites confirm: 209 nations synced. BRICS just(allegedly) executed the kill shot.

REDEMPTION CENTERS ON STANDBY. WWG1WGA.

Read full post here: https://dinarchronicles.com/2025/12/05/restored-republic-via-a-gcr-update-as-of-december-5-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Now that we, the Untied States, are there, the speed of the monetary reform should pick up even faster now...Digitalization IMO also requires the lifting of the three zeros. The fact they talk about it so much is a conclusion that they are about to lift the three zeros. It's called priming you...preparing you. Call it a precursor.

Mnt Goat I wish could tell everyone to go to the bank and exchange your dinar today but this is simply not going to be the case. We must realize that the CBI is working on one track, the GOI on another, and some can even say Kurdistan on yet another. It’s the CBI track that we have been following mostly with all the banking and financial reforms. We were told just a few weeks ago that the CBI is ready to remove the zeros and we all know what that can lead to. In the news back then, Iraq even told us about the pending now basket and talked about moving to FOREX. Then they even told us that moving to Forex would even coincide with the implementation of the new digital dinar. [Post 1 of 2....stay tuned]

Mnt Goat This was the first time they talked openly about this since 2011 when we learned about the overall Dr Shabibi plan. The digital dinar did not exist back then, however things have changed since 2011 and so the CBI told us the digital dinar will stop all currency fraud and completely shut down the parallel market. Article: “CENTRAL BANK GOVERNOR: DIGITAL CURRENCY WILL SOLVE 90% OF THE PROBLEMS IN THE IRAQI FINANCIAL SYSTEM”. [Post 2 of 2]

**************

Japan Just PULLED THE TRIGGER—A $20T MELTDOWN is Imminent!

Steven Van Metre: 12-4-2025

Top Japanese officials just pulled the trigger on unwinding the $20 trillion Yen carry trade that could send tech stocks crashing 15-25% overnight and create a generational buying opportunity for those who are prepared.

Seeds of Wisdom RV and Economics Updates Friday Morning 12-04-25

Good Morning Dinar Recaps,

The 5 Economic Pillars Driving the Global Reset

Why these five forces are reshaping currencies, trade systems, and global finance.

Overview

Global debt has reached record highs, forcing governments and central banks into structural shifts rather than short-term fixes.

Trade is moving away from USD settlement as bilateral agreements, BRICS partnerships, and commodity-linked contracts expand.

Good Morning Dinar Recaps,

The 5 Economic Pillars Driving the Global Reset

Why these five forces are reshaping currencies, trade systems, and global finance.

Overview

Global debt has reached record highs, forcing governments and central banks into structural shifts rather than short-term fixes.

Trade is moving away from USD settlement as bilateral agreements, BRICS partnerships, and commodity-linked contracts expand.

Asset portfolios are transforming, with central banks increasing gold and commodity reserves to hedge against fiat instability.

New financial technologies—CBDCs, faster settlement rails, AI-assisted compliance, and interoperability standards—are redefining global payment architecture.

Energy security is re-aligning, creating new alliances and alternative pricing frameworks that reshape geopolitical leverage.

Key Developments

Debt pressures continue to mount as public and private leverage sit at multidecade highs, prompting calls for restructuring and alternative monetary frameworks.

Trade diversification is accelerating, with more nations conducting cross-border settlement outside the U.S. dollar and strengthening regional trade blocs.

Asset reserve strategies are shifting, especially toward gold accumulation and critical-commodity stockpiling as a hedge against fiat volatility.

Technology modernization is enabling real-time, multi-currency settlement systems that bypass traditional Western-dominated infrastructure.

Energy alliances—particularly in Eurasia, Africa, and South America—are establishing long-term supply chains that operate outside legacy pricing systems.

The Five Pillars of the Global Reset

1. The Debt Pillar — Why Debt Matters

Debt is the core pressure point forcing change. With global public debt surpassing $100 trillion and overall debt exceeding 235% of global GDP, existing systems can no longer sustain normal repayment cycles. This strain compels governments to explore restructuring, currency adjustments, and new financial mechanisms. In the Global Reset model, overwhelming debt acts as the trigger that pushes policymakers toward system redesign rather than temporary relief.

2. The Trade Pillar — Why Trade Matters

Trade determines how nations exchange value, and shifting away from U.S.-centric settlement reshapes the financial map. As more countries sign bilateral or regional agreements using local currencies or commodities, the traditional dollar-dominant framework erodes. These realignments lay the foundation for alternative reserve currencies, new trade rails, and multipolar settlement systems—central components of any global reset.

3. The Assets Pillar — Why Assets Matter

Assets—especially gold, critical metals, and sovereign reserves—form the collateral base of economic power. Central banks have expanded gold purchases in recent years, signaling declining confidence in unbacked currency systems. Accumulating hard assets provides nations with stability during transition periods and strengthens balance sheets for potential revaluation environments. Assets supply the trust, collateral, and liquidity required for a redesigned system.

4. The Technology Pillar — Why Technology Matters

A reset cannot occur without modern financial rails. Digital currencies, tokenized settlements, interoperability standards, AI-driven governance, and blockchain-based infrastructure enable cross-border payments that bypass legacy bottlenecks. These systems allow faster, cheaper, and more transparent value transfers. Technology is what turns restructuring proposals into functioning global architecture.

5. The Energy Pillar — Why Energy Matters

Energy is the foundation of global production—and the source of real geopolitical leverage. Nations dependent on externally controlled supply chains face vulnerability. As countries secure long-term energy agreements, build regional networks, or shift into mixed-energy systems, they reduce exposure to Western pricing mechanisms. Because global trade and currency valuation are linked to energy, any systemic reset must be anchored in stable, diversified energy flows.

Why It Matters

These five pillars—Debt, Trade, Assets, Technology, and Energy—show where structural stress is building and where new systems are emerging. Together, they reveal that a transformation in global finance is not speculative but already underway. Understanding these pillars helps readers interpret the daily news not as isolated events but as part of a coordinated global realignment.

Implications for the Global Reset

Pillar: Debt — System-level strain increases pressure for currency restructuring and alternative payment frameworks.

Pillar: Trade & Assets — As trade moves away from USD and central banks accumulate hard reserves, the foundation for a multipolar financial system strengthens.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

IMF Warns Stablecoin Risks Require Strong Institutions, Not Just Regulation

New IMF report says fragmented global rules are not enough to prevent macro-financial instability

Overview

• IMF releases major report on global stablecoin risks

• Warns that regulation alone cannot prevent shocks without strong institutions

• Notes fragmented rules across the U.S., UK, EU, and Japan

• Highlights dominance of USD-pegged coins and growing Treasury-backed reserves

Key Developments

IMF Identifies Fragmented Global Stablecoin Frameworks

In its “Understanding Stablecoins” report, the IMF examined regulatory approaches across the United States, United Kingdom, Japan, and the European Union. The Fund found that global oversight remains highly inconsistent, creating operational gaps and varied interpretations of risk. It warned that the mix of different issuance models and regulatory classifications—sometimes even within the same region—contributes to policy fragmentation.

Stablecoin Interoperability and Cross-Border Risks Raised

The IMF pointed to the proliferation of stablecoins across multiple blockchains and exchanges as a growing concern. It said this expansion risks inefficiencies due to a lack of interoperability, and could generate friction between countries with differing regulatory requirements or transaction rules.

Regulation Is Not Enough—Institutional Strength Needed

The report emphasized that “strong macro-policies and robust institutions” must serve as the first line of defense against stablecoin-related risks. While regulation can address certain vulnerabilities, the IMF stressed that international coordination is essential to prevent cross-border spillovers and to maintain monetary and financial stability.

USDT and USDC Reserve Structures Under Spotlight

According to the report, two of the world’s largest stablecoins—USDT and USDC—are “mostly backed” by short-term U.S. Treasuries, reverse repo agreements, and bank deposits. Roughly 40% of USDC reserves and around 75% of USDT reserves consist of short-term Treasury holdings, with USDT additionally holding a portion of its reserves in Bitcoin. The IMF noted the overall stablecoin market now exceeds $300 billion, with the vast majority of tokens pegged to the U.S. dollar.

GENIUS Act Implementation Reshapes U.S. Stablecoin Markets

Following the signing of the GENIUS Act in July, U.S. regulators are building a comprehensive federal framework for payment stablecoins. Early analysis from blockchain auditor CertiK noted emerging liquidity separation between U.S. and EU-regulated stablecoin pools, signaling the beginning of distinct regional market structures.

Why It Matters

Stablecoins remain among the fastest-growing components of global finance, yet rules governing them are inconsistent and evolving. The IMF’s warning that regulation alone cannot ensure stability signals that the next phase of digital-asset oversight will hinge on stronger institutions, coordinated policy design, and cross-border collaboration. Without these, the rapid expansion of Treasury-backed digital dollars could pose systemic risks.

Implications for the Global Reset

Pillar 1: Monetary System Restructuring

Stablecoins backed largely by U.S. Treasuries reinforce America’s financial influence even as digital assets rise. The IMF’s call for global coordination indicates a turning point where digital-dollar instruments must now be integrated into broader monetary governance.

Pillar 2: Financial Architecture & Regulatory Reform

Fragmented rules across major economies are shaping new digital payment corridors. As the U.S., EU, and Asia establish competing frameworks, nations may align with the system that best supports their role in a multipolar financial landscape.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Cointelegraph – “IMF lays out guidelines for addressing stablecoin risks, beyond regulations”

Reuters – “IMF says stronger institutions needed as stablecoins rise globally”

CertiK – “GENIUS Act reshapes U.S. and EU stablecoin liquidity flows”

~~~~~~~~~~

BRICS De-Dollarization Splinters as India and China Diverge on Strategy

India rejects a BRICS currency while China advances yuan internationalization independently

Overview

• India formally rejects any BRICS common currency proposals

• China accelerates yuan internationalization outside BRICS frameworks

• Russia and China deepen bilateral national-currency trade

• BRICS bloc remains fragmented on de-dollarization strategy

Key Developments

India Rejects a Common BRICS Currency

India’s foreign minister reiterated that the country has “never been for de-dollarization” and sees no proposal for a BRICS currency on the table. India views the U.S. dollar as critical to trade stability—particularly as it maintains over $128 billion in annual U.S. trade. The weakening rupee adds further caution, as rapid de-dollarization would expose India to exchange-rate volatility.

Russia and China Pursue Separate National-Currency Trade Paths

Russia publicly announced it has no intentions of abandoning the dollar entirely and has dismissed the idea of a BRICS currency “at this stage.” However, Russia continues expanding its ruble-based settlement systems, especially with Iran and China, which report extremely high percentages of national-currency trade.

China Expands Renminbi Internationalization Through Infrastructure

The People’s Bank of China is accelerating yuan adoption through CIPS, which now includes more than 180 participating institutions across 167 countries. Approximately 80 global central banks hold RMB reserves, and China’s $768 billion trade surplus strengthens the appeal of yuan-based settlement in select markets.

Limited BRICS Progress on Local-Currency Trade Mechanisms

While India maintains 156 Special Rupee Vostro Accounts with 30 countries, these channels remain modest in scale. South Africa and Brazil have openly cautioned the bloc to avoid provoking Washington through aggressive anti-dollar initiatives, with Brazil dropping the common-currency agenda entirely during its 2025 BRICS presidency.

Why It Matters

The competing strategies within BRICS reveal a shift away from the idea of a unified anti-dollar bloc. Instead, individual countries are prioritizing national interests, geopolitical stability, and bilateral currency arrangements. While China and Russia push forward with alternative systems, India and others remain cautious, limiting the likelihood of a coordinated monetary challenge to the U.S. dollar in the near term.

Implications for the Global Reset

Pillar 1: Trade & Supply Chain Re-Engineering

Fragmentation in BRICS currency strategy signals a move toward bilateral trade corridors rather than large multilateral realignments, affecting global supply routes and settlement systems.

Pillar 2: Monetary System Diversification

China's unilateral renminbi expansion increases global financial multipolarity, but India’s resistance shows that the shift away from the dollar will be uneven, incremental, and shaped by geopolitical risk calculations.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS De-Dollarization: India and China Shape a New Trade Bloc”

Brave New Coin – “90% of Russia–India Trade Now in National Currencies: What’s Next for BRICS?”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Vawn Himmelsbach Tue, December 2, 2025 Moneywise

So, you’ve hit that money milestone you were aiming for. The one where you thought you’d finally feel wealthy. But you don’t — and in fact you’re as stressed and depressed as ever. Why?

There’s no one number you can hit that upgrades you from middle-class to wealthy. Being rich is “a subjective experience,” says Charles Chaffin, co-founder of the Financial Psychology Institute (1).

Why America Is A Nation Of Miserable Millionaires Who Don't 'Feel Rich'

Vawn Himmelsbach Tue, December 2, 2025 Moneywise

So, you’ve hit that money milestone you were aiming for. The one where you thought you’d finally feel wealthy. But you don’t — and in fact you’re as stressed and depressed as ever. Why?

There’s no one number you can hit that upgrades you from middle-class to wealthy. Being rich is “a subjective experience,” says Charles Chaffin, co-founder of the Financial Psychology Institute (1).

And according to recent research, some people never get much happier when they reach financial security — no matter how much money they make.

Wealth And Well-Being Depend On Mindset

No matter how much money we have, some of us may never feel wealthy. For instance, only a third of millionaires (32%) consider themselves wealthy, according to a survey by Northwestern Mutual (2).

One reason is that people who become millionaires are often “money vigilant,” according to Chaffin. This means they’re constantly keeping track of how much money is moving in and out of their accounts — and they never feel truly secure with the amount they have (1).

Money vigilance is one of four money scripts people fall into, according to a framework created by psychologist Brad Klontz. He describes these scripts as unconscious sets of beliefs about money that shape our financial behavior. They’re typically formed in childhood and can be passed down from generation to generation. While the outcomes from adopting the script of money vigilance can be good — like being a disciplined saver — they can also prevent you from enjoying your wealth (3).

TO READ MORE: https://finance.yahoo.com/news/even-millionaires-dont-feel-wealthy-100702714.html

“Tidbits From TNT” Friday Morning 12-5-2025

TNT:

Tishwash: Economic: The shift towards an electronic payment system provides the state with financial liquidity.

Economic researcher Diaa Abdul Karim found that shifting government transactions to an electronic system for paying fees and collecting taxes would provide the state with significant liquidity.

Abdul Karim told Al-Maalouma, “Iraq is still in the early stages of transitioning to electronic payment systems, while European countries and even neighboring countries have preceded Iraq by many years in this transition.”

TNT:

Tishwash: Economic: The shift towards an electronic payment system provides the state with financial liquidity.

Economic researcher Diaa Abdul Karim found that shifting government transactions to an electronic system for paying fees and collecting taxes would provide the state with significant liquidity.

Abdul Karim told Al-Maalouma, “Iraq is still in the early stages of transitioning to electronic payment systems, while European countries and even neighboring countries have preceded Iraq by many years in this transition.”

He added, "There is a lack of acceptance of the electronic system, as the public is not accustomed to such systems, despite their considerable benefits. These include protecting citizens from financial theft and ensuring ease of purchase without the burden of carrying and protecting cash."

He explained that "the primary goal of transitioning to an electronic payment system and generalizing this experience across various government departments is to guarantee the availability of cash for the state, in addition to ensuring that it does not bear additional burdens related to printing currency. Therefore, it is a good experiment, provided that it is properly educated about and accepted in Iraq." link

**************

Tishwash: Sudanese: For the first time since the founding of the state, we have a maritime view through the navigation channel.

Prime Minister Mohammed Shia al-Sudani praised the Faw port and the development road on Thursday, stressing that it is the "dream" for the transition to a real economy, while pointing out that Iraq, for the first time, has a maritime view of the Gulf through the navigation channel.

The Prime Minister's Media Office stated in a statement received by "Mail" that "Prime Minister Mohammed Shia Al-Sudani attended the Iraqi British Business Council (IBBC) conference held in Basra Governorate under the slogan (Gateway to Iraq)."

The office explained that "the conference includes sessions and panel discussions with the participation of high-level officials from Iraq and the United Kingdom and leading companies, and aims to enhance trade and economic relations between the two countries and facilitate communication between companies and stakeholders, as well as explore opportunities for cooperation and investment in various fields, including energy, finance, climate and education."

Al-Sudani stressed that “(Iraq Gateway) is not a slogan for a conference, but rather a title for a stage in which we aspire for Basra and the rest of the governorates to be actual gateways for investment, trade and mutual opportunities,” noting that “the success of this vision depends on the ability of the government, the private sector and international partners to turn the dialogue into programs, and then into projects that work to improve the lives of citizens.”

He added, “The conference slogan (Iraq’s Gateway) expresses the government’s vision of Basra’s role as a key economic outlet and a center for services, energy, and logistics. We have worked on parallel tracks to improve the business environment, modernize infrastructure, reform the energy sector, and empower the private sector to be a key partner in development.”

He pointed out that “our government has adopted a balanced policy and invested in Iraq’s location to be a bridge between East and West, and part of a broader vision for stability and development in the region.”

Al-Sudani stated that “Iraq’s strength lies in its oil and gas resources, as well as the Faw port, the development route, and its location as a corridor linking the Gulf, Asia, and Europe,” emphasizing “the development of business practices and finance, and our government has simplified administrative procedures, moved towards digitalization, and reduced complexities.”

He added, "Work is underway with Iraqi banks and international partners to develop financing tools that serve strategic, medium, and small productive projects," welcoming "technical and investment cooperation with experienced companies, including British companies and companies that are members of the Iraqi-British Business Council, and we emphasize the need to develop the logistics, ports, docks, and maritime transport sector as it represents an important economic resource."

The Prime Minister pointed out that “we have achieved optimal use of oil and gas resources, and Iraq was losing (8-9) billion dollars annually due to importing oil derivatives and flaring gas. During the 3 years of the government’s term, we have developed a clear vision to solve the problems related to oil and gas investment,” indicating that “the Faw port and the development road is the (dream) project to transform into a real economy and create a new Iraq.”

He pointed out that "for the first time since the establishment of the Iraqi state, we have a maritime view of the Gulf through the navigation channel, which is 20 meters deep and 23 kilometers long, and we look forward to partnership, training and funding initiatives that link female entrepreneurs in Iraq with their counterparts in the United Kingdom," explaining that "the platforms provided by the Iraqi-British Business Council help in implementing energy, infrastructure, services, education and training projects." ink

***************

Tishwash: Samir Al-Nassiri: The banking reform plan is being implemented successfully according to its timetable.

Banking consultant and expert Samir Al-Nassiri confirmed that the Central Bank, Oliver Wyman, and other banks are continuing to implement the standards of the banking reform plan in partnership and daily coordination, according to the plan's timeline, which was launched on April 7, 2025.

The Central Bank published the project implementation mechanisms and the banks signed an agreement to comply with the plan. Preparations are now underway to launch the first evaluation cycle during the first quarter of 2026.

The procedures and efforts undertaken by the Central Bank of Iraq, in cooperation and consultation with the consulting firm and private banks, have resulted in tangible steps during the current quarter in facilitating the implementation of the objectives, programs, mechanisms and standards of the comprehensive banking reform project, within the framework of implementing the Central Bank’s third strategy.

He explained that the main objective of this project is to build a sound, modern, comprehensive and flexible banking sector that contributes to achieving rapid growth in the national economy, a cumulative increase in GDP, and enhancing the market value of the banking sector.

Al-Nassiri pointed out that economic reform begins with banking reform, explaining that the challenges facing the Iraqi economy simultaneously present significant opportunities to reform and develop the banking and financial sector, in line with the government's program and the Central Bank's future vision.

He added that the banking sector will play a pivotal role in achieving sustainable development and attracting investments, as well as supporting ongoing efforts to activate non-oil productive sectors with the aim of diversifying national income sources and ensuring financial sustainability and balanced economic growth.

Al-Nassiri explained that the role of the Central Bank is also embodied in regulating the financing of foreign trade and implementing infrastructure projects related to comprehensive digital transformation, in addition to expanding the use of electronic payment tools in a way that enhances the achievement of financial inclusion.

He stressed that these efforts will contribute to providing real opportunities for reforming, developing and empowering the private banking sector during the period 2025–2028, through a set of key objectives, most notably:

* Developing the Iraqi banking system to keep pace with internationally approved banking and accounting standards.

* Building a sound, modern, comprehensive and flexible banking sector capable of adapting to economic changes.

* To enhance citizens' confidence in the local banking sector and achieve international recognition of its transparency, progress, and commitment to international standards, thereby strengthening the confidence of global correspondent banks in dealing with it.

* Rehabilitating restricted or weakly active banks to enable them to return to the banking market with their full internal and external activities.

* Refocusing the role of banks on their core function of financing and lending for development, while promoting financial inclusion and increasing its rate in accordance with the established plans.

* To promote the transition from a cash economy to a digital economy by attracting funds circulating outside the banking system, which represent about 90% of the money supply, and bringing them into the formal banking cycle.

Al-Nassiri explained that although the period specified for their implementation according to the banking reform project and the Central Bank’s strategy extends to three years, what was achieved during the years 2023, 2024 and 2025 is considered an important achievement, as solid foundations and rules were built that formed the main pillar for the desired reform path.

He added that these achievements will contribute to the process of evaluating and classifying Iraqi banks based on the extent to which they achieve the goals set within the banking reform project, in accordance with the approved international standards and criteria. link

*************

Mot: Wellll - That Was Scary!!!!

Mot: Things You Learn frum da Internet

Seeds of Wisdom RV and Economics Updates Thursday Evening 12-04-25

Good Evening Dinar Recaps,

Tokenized Money Breaks Cover — Banks Accelerate the Shift Toward a Reset-Era Payments System

Traditional finance quietly builds the rails for digital money, stablecoins, and next-gen payments infrastructure.

Overview

European banking giants are pushing ahead with a euro-pegged stablecoin, signaling that tokenized money is no longer experimental but entering regulated, institutional deployment.

Good Evening Dinar Recaps,

Tokenized Money Breaks Cover — Banks Accelerate the Shift Toward a Reset-Era Payments System

Traditional finance quietly builds the rails for digital money, stablecoins, and next-gen payments infrastructure.

Overview

European banking giants are pushing ahead with a euro-pegged stablecoin, signaling that tokenized money is no longer experimental but entering regulated, institutional deployment.

Global banks are expanding crypto-infrastructure, including custody, tokenized deposits, and blockchain settlement rails — steps that mirror early-stage monetary-system redesign.

Fintech acceleration continues in emerging markets, as Brazil authorizes new fast-track payments-initiation access, expanding competition in regulated payments infrastructure.

Key Developments

Consortium of 10 major European banks — including BNP Paribas, ING, and UniCredit — is moving forward with a new institutional euro-stablecoin project designed for compliant cross-border payments and settlement.

Large international banks are broadening their digital-asset architecture, building tokenized-deposit systems, blockchain-based settlement channels, and enterprise custody to prepare for a hybrid digital–traditional financial environment.

Brazil’s fintech sector continues to open up, with Cumbuca receiving authorization for a streamlined payments-initiation license — strengthening competition and accelerating digital payments innovation across Latin America.

Why It Matters

These moves illustrate how global finance is transitioning from exploratory pilots to live digital-currency infrastructure, positioning banks and regulators for a redesigned monetary system built on tokenized value, programmable payments, and instant global settlement.

Implications for the Global Reset

Pillar: Payments & Digital Finance

Traditional banks are embedding stablecoins and tokenized deposits directly into their operating models, accelerating the shift toward programmable, interoperable financial architecture.

Pillar: Monetary System Transition

As regulated entities take control of digital money rails, the foundation is being laid for a blended global system where fiat, stablecoins, and tokenized assets coexist — and eventually converge.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “European banks advance euro-pegged stablecoin initiative”

PYMNTS.com — “Banks Expand Digital-Asset Infrastructure and Tokenized Deposit Rails”

Business Wire — “Cumbuca Receives Payments-Initiation Authorization in Brazil”

~~~~~~~~~~

When Money Printing Meets De-Dollarization — The Reset Collision Point Is Now in View

Fed liquidity returns just as BRICS accelerate their hard-asset shift, reshaping the global monetary order.

Overview

The U.S. is preparing to restart money printing as early as Q1 2026, following the Federal Reserve’s December 2025 end to quantitative tightening — a pivotal inflection point for global liquidity.

BRICS nations are escalating de-dollarization, accelerating gold purchases and expanding non-USD trade mechanisms at the exact moment U.S. liquidity is set to surge again.

Leading analysts warn of bubble dynamics, fueled by renewed Fed expansion, high valuations, and rising geopolitical and monetary fragmentation.

Key Developments

Federal Reserve pivot toward balance-sheet expansion

After shrinking its assets from ~$9 trillion to ~$6.6 trillion over three years, the Fed signaled that reserves have fallen too low to maintain stable market plumbing. Officials now expect renewed asset purchases to rebuild liquidity, which could begin in early 2026.Systemic fragility reemerges

Tight reserve levels have historically triggered repo stress — seen in 2019 and again in 2020 — and the Fed’s shift reflects concern over maintaining smooth financing and collateral markets across banks and money-markets.BRICS gold accumulation surges

Central banks purchased 166 tonnes of gold in Q2 2025 alone — 41% above historical averages — with Russia and China holding the majority of BRICS gold reserves. This marks a deliberate shift away from dollar exposure amid growing reliance on alternative settlement systems.Local-currency trade is expanding rapidly

Dollar share in BRICS trade has fallen from 85% to 59% in eight years, while the bloc continues to build out non-dollar payment systems, institutional frameworks, and reserve diversification strategies.Market warnings intensify

Analysts — including major hedge-fund leaders — warn that renewed Fed money printing into already stretched asset valuations increases the probability of a “melt-up phase” followed by eventual instability.Policy shifts on the horizon

With the Fed Chair term ending in May 2026 and a new administration shaping monetary leadership, markets anticipate potential for more dovish policy, higher tolerance for inflation, and accelerated liquidity injections.

Why It Matters

The world’s largest central bank preparing to expand liquidity at the exact moment that BRICS nations accelerate their retreat from the dollar creates a dual-track monetary transformation: one system leaning into fiat expansion, the other moving toward hard assets and alternative rails. This divergence is defining the next stage of the global reset.

Implications for the Global Reset

Pillar: Monetary System Transition

The Fed’s return to money printing signals the re-inflation of the U.S. financial system, while BRICS deepens its commitment to gold-backed reserves and non-USD trade — accelerating the shift toward a multipolar currency environment.

Pillar: Global Credit & Sovereign Stability

Rising U.S. liquidity may support markets near-term, but it also heightens long-term debt-cycle risks as global actors diversify away from dollar-denominated assets.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “BRICS De-Dollarization Escalates Just as US Money Printing Returns”

Reuters — “Global Central Banks Continue Accelerated Gold Purchases”

Bloomberg — “Federal Reserve Signals End of Quantitative Tightening as Reserves Tighten”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Half of Americans Are Worried About This Threat to Their Paychecks

Half of Americans Are Worried About This Threat to Their Paychecks: 4 Things You Can Do

Marc Guberti Mon, December 1, 2025 GOBankingRates

One of the biggest fears Americans have is getting laid off. This “layoff anxiety” trend affects one-third of Americans, according to Clarify Capital. Anxiety is higher among remote workers, with 40% of them worrying about losing their jobs compared to 20% of in-office workers.

It has gotten to the point where 69% of Americans would be happy to stay in the same job and avoid career growth if it led to more job security. The PNC 2025 Financial Wellness in the Workplace Report found that 67% of Americans live paycheck to paycheck, so there isn’t much financial wiggle room in the event of a layoff.

Half of Americans Are Worried About This Threat to Their Paychecks: 4 Things You Can Do

Marc Guberti Mon, December 1, 2025 GOBankingRates

One of the biggest fears Americans have is getting laid off. This “layoff anxiety” trend affects one-third of Americans, according to Clarify Capital. Anxiety is higher among remote workers, with 40% of them worrying about losing their jobs compared to 20% of in-office workers.

It has gotten to the point where 69% of Americans would be happy to stay in the same job and avoid career growth if it led to more job security. The PNC 2025 Financial Wellness in the Workplace Report found that 67% of Americans live paycheck to paycheck, so there isn’t much financial wiggle room in the event of a layoff.

Although many people dread getting laid off, it’s a scenario that you should prepare for in case it happens. These are some of the ways you can prepare for that scenario, minimize its impact on your finances and rebound quickly.

Create an Emergency Savings Account

Developing good financial discipline is critical for reducing your career stress and feeling more confident about challenges that come your way. Having more money in the bank can give you peace of mind and more time to get back on your feet if you get laid off.

Putting money into an emergency savings account each month is a great starting point. Ideally, this fund should cover six to 12 months of your living expenses. Accelerating your emergency savings account’s growth will require cutting your expenses.

While you don’t want to get rid of necessary expenses, you may find opportunities to trim costs if you have never created a budget. Unused subscriptions and impulsive purchases are good places to start if you want to reduce costs without downgrading your lifestyle.

Develop New Skills

The more skills you develop, the more desirable you are in the marketplace. Working on high-income skills like mastering AI tools each weekend can introduce you to more job opportunities. Then, as you apply for jobs, you will feel more in control, since you won’t feel like all of your income depends on one employer.

TO READ MORE: https://www.yahoo.com/lifestyle/articles/half-americans-worried-threat-paychecks-155505788.html

Western Economic Decline as BRICS Strengthens

Western Economic Decline as BRICS Strengthens

WTFinance: 12-3-2025

In a recent, highly insightful episode of the “WTFinance Podcast,” host Anthony engaged in a deep dive with Warrick Powell, an adjunct professor at Queensland University of Technology renowned for his expertise in China, supply chains, and the global political economy.

The conversation was not about minor market fluctuations; it was about the structural earthquake currently reshaping global power, trade, and financial flows.

Western Economic Decline as BRICS Strengthens

WTFinance: 12-3-2025

In a recent, highly insightful episode of the “WTFinance Podcast,” host Anthony engaged in a deep dive with Warrick Powell, an adjunct professor at Queensland University of Technology renowned for his expertise in China, supply chains, and the global political economy.

The conversation was not about minor market fluctuations; it was about the structural earthquake currently reshaping global power, trade, and financial flows.

Powell argues that the shift away from a Western-centric, unipolar world is inevitable, profound, and accelerating—driven less by external threats and more by internal structural decay.

Warrick Powell’s analysis of the Western decline in manufacturing is sobering because it frames the issue not as a recent political failure, but as a deep, structural problem decades in the making.

While recent energy price shocks have exacerbated the situation, the core issue lies in the redirection of capital.

Powell highlights that the massive expansion of the financial sector in the West effectively starved productive industries. Capital was diverted into financial engineering and speculation, leading to deindustrialization and a failure to modernize infrastructure and labor skills.

Meanwhile, the US economy, though currently robust in parts, faces severe structural headwinds. Powell points specifically to bottlenecks in energy supply, a problem compounded by the rapidly increasing energy demands of the AI and digital sectors.

This rising energy cost acts as an invisible tax on both consumers and businesses, fueling inflation and social pressure.

One of the central arguments of the episode is that the multipolar world isn’t coming—it’s already here, and its center of gravity is shifting away from the Atlantic.

China is positioned at the nucleus of new economic networks, building alternative institutions and supply chains that actively challenge the post-WWII US-dominated order. Powell notes that the US share of global imports has significantly declined, severely weakening its leverage in global trade.

Crucially, he argues that the Western geopolitical response—defined by tariffs, sanctions, and alliance-building—is fundamentally “defensive and nostalgic.” These attempts seek to preserve an outdated unipolar reality, and they are largely futile.

Tariffs, for example, have demonstrably harmed American industries and consumers far more than they have protected domestic manufacturing jobs or deterred Chinese growth.

Multipolarity is messy. It doesn’t mean a simple replacement of one power with another; it means a complex, layered reality where numerous regional institutions coexist alongside legacy global bodies, with national sovereignty demands rising across the board.

One of the most consequential shifts discussed is the rapid evolution of currency dynamics. The US dollar’s role as the undisputed global reserve currency is under pressure, driven primarily by the weaponization of the dollar for geopolitical ends.

When nations see their assets frozen or their access to the SWIFT system threatened due to political disputes, the incentive to find alternative payment and settlement mechanisms becomes overwhelming.

Powell points to the rising use of non-US-dollar currencies, particularly the Chinese Renminbi (RMB) and the Russian Ruble, in trade settlements and bond issuances. These efforts are practical: they reduce transactional risk and lower compliance costs for nations seeking to insulate themselves from geopolitical pressure.

While some commentators anticipate a return to commodity-backed currencies, Powell dismisses the idea of a gold standard revival.