Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“The System Is Ending” - Clive Thompson’s Final Warning on Gold & Fiat Collapse

“The System Is Ending” - Clive Thompson’s Final Warning on Gold & Fiat Collapse

ITM Trading: 10-26-2025

Clive Thompson, a former Swiss banker, shares hard-won lessons from decades on the inside: gold carried families through war, preserved wealth through collapse, and shielded everyday people through major crises.

Now, he’s warning that the fiat system is failing, and few are prepared.

“The System Is Ending” - Clive Thompson’s Final Warning on Gold & Fiat Collapse

ITM Trading: 10-26-2025

Clive Thompson, a former Swiss banker, shares hard-won lessons from decades on the inside: gold carried families through war, preserved wealth through collapse, and shielded everyday people through major crises.

Now, he’s warning that the fiat system is failing, and few are prepared.

In a world buzzing with fleeting trends and digital promises, some truths remain constant, shining brighter with each passing year. One such truth, the enduring value of gold, is championed by a man whose life has been inextricably woven with this precious metal for half a century:

Clive Thompson. A seasoned expert whose career has spanned from the trading floors of London to the secure vaults of Swiss private banking, Clive offers insights that are not just theoretical, but forged in the crucible of real-world experience.

Clive’s journey with gold began not in a bustling financial district, but with a simple yet profound lesson from his grandfather. Imagine being a child, presented with a choice: ephemeral paper money, fleeting chocolate, or a gleaming gold sovereign.

This early exercise in discernment laid the foundation for Clive’s lifelong understanding: gold possessed an intrinsic worth that paper currency, a mere promise, could never truly match. It was a tangible asset, a physical representation of value, even then.

From these formative lessons, Clive’s professional life unfurled, cementing his conviction. Decades spent navigating diverse financial landscapes – from the dynamic markets of London to the strategic havens of the Cayman Islands and the meticulous world of Swiss private banking – allowed him to witness firsthand gold’s unparalleled role as a “wealth shield.”

Through crises, wars, economic upheavals, and market volatility, gold consistently acted as an unflinching guardian of wealth, preserving fortunes when other assets faltered.

He recounts stories of clients who, guided by foresight or instinct, chose gold over precarious paper assets. Their enduring legacy often became the preservation of family wealth across generations, a testament to gold’s permanence. Clive vividly remembers the 2008 financial crisis, a pivotal moment when the sudden surge in demand for physical gold overwhelmed supply. This stark reality underscores a critical lesson: the time to own gold is before the panic, not during it.

What makes gold so resilient? Clive emphasizes its fundamental properties: liquidity, portability, and permanence.

Unlike the ephemeral whispers of fiat currencies, which throughout history have collapsed under the weight of their own making, gold remains. It’s a tangible asset that can be easily converted, moved, and, crucially, cannot be printed into oblivion by governments. It holds its value not by decree, but by millennia of human trust and inherent scarcity.

Clive’s insights extend beyond individual portfolios to the precarious state of the global financial system. He points to the staggering realities of soaring government debt, unchecked money printing, and inflating asset bubbles.

The pivotal moment, he argues, was the abandonment of the gold standard in 1971, which unleashed a torrent of unchecked fiat currency inflation, eroding purchasing power at an accelerating rate.

He warns that the current trajectory is unsustainable. The global financial system, built on layers of debt and manufactured money, is nearing a critical juncture.

When fiat currencies inevitably lose all their value – a historical pattern that repeats itself – gold, Clive asserts, will reclaim its rightful role as real money, the bedrock of financial stability.

For Clive Thompson, gold is not merely an investment; it is a permanent, private, and tangible form of wealth. It is protection against systemic risk and a legacy for future generations. It’s about securing what’s truly valuable when the illusion of paper wealth dissipates.

In a world teetering on the edge of a financial reset, Clive’s message is clear and urgent: prepare now. Don’t wait for the inevitable.

Ready to safeguard your future and understand the enduring power of gold? Watch the full video from ITM Trading for further insights from Clive Thompson, a man whose 50 years with gold speak volumes. The wisdom of experience is invaluable – especially when it comes to the future of your wealth.

“Tidbits From TNT” Monday 10-27-2025

TNT:

Tishwash: Expert: Iraqi banks are required to keep pace with cross-border payments

A banking expert confirmed that the recent development in international payment systems using the digital renminbi represents a strategic turning point in global trade, and opens new horizons for import, export and foreign loan settlements.

Expert Faiq Al-Obaidi told (Al-Zaman) yesterday that (this development requires Iraqi banking administrations to quickly keep pace with the new system and provide intensive training on its working mechanisms, to ensure the banks' ability to deal efficiently with cross-border digital payments

TNT:

Tishwash: Expert: Iraqi banks are required to keep pace with cross-border payments

A banking expert confirmed that the recent development in international payment systems using the digital renminbi represents a strategic turning point in global trade, and opens new horizons for import, export and foreign loan settlements.

Expert Faiq Al-Obaidi told (Al-Zaman) yesterday that (this development requires Iraqi banking administrations to quickly keep pace with the new system and provide intensive training on its working mechanisms, to ensure the banks' ability to deal efficiently with cross-border digital payments

Al-Obaidi explained that (the monetary authority is required to issue clear instructions and controls, and grant approvals to banks participating in the new system, especially since most Iraqi banks have taken the initiative to open accounts in Chinese currency Which prepares the financial infrastructure to benefit from this digital revolution).

The People's Bank of China announced that the digital renminbi (Chinese yuan) cross-border settlement system will be fully linked with the ten member states of the Association of Southeast Asian Nations and six countries in the Middle East.Observers believed yesterday that (38 percent of the volume of global trade will exceed the SWIFT system, which is dominated by the United States, and the system will enter directly into what they described as the digital renminbi moment).

For its part, The Economist magazine said yesterday that (this step constitutes a battle for the front bulwark of the Bretton Woods 2.0 system), adding that (blockchain-based technology is rewriting the basic code of the global economy, while increasing settlement speed and reducing costs in an unprecedented way), and explained that (the traditional SWIFT system suffers from a delay of 3 to 5 days in cross-border payments, While the Chinese digital bridge reduced the settlement time to only 7 seconds).

In the first test between Hong Kong and Abu Dhabi, a company paid a supplier in the Middle East using the digital renminbi, and the money did not pass through six intermediary banks, but was received directly through a distributed ledger, reducing processing fees by 98 percent.

In a two-country, two-park project between China and Indonesia, an industrial bank used digital renminbi to complete the first cross-border payment, and the process took just 8 seconds from order confirmation to funds arriving, 100 times faster than traditional methods.

This technical superiority prompted 23 central banks around the world to join the digital bridge test, with energy traders in the Middle East reducing settlement costs by 75 percent.

Experts confirmed yesterday that (this technical superiority made the traditional settlement system dominated by the dollar appear immediately backward, and that the technology not only allows immediate tracking, but also automatically applies anti-money laundering rules), and they pointed out that (China is gradually building its financial sovereignty), and they added (when the United States tried to impose sanctions on Iran through the SWIFT system, China had already established a closed loop of renminbi payments in Southeast Asia.

The volume of cross-border settlement in renminbi in ASEAN countries amounted to more than 5.8 trillion yuan in 2024, an increase of 120 percent compared to 2021, while ix countries, including Malaysia and Singapore, included the renminbi in their foreign currency reserves, and Thailand completed its first oil deal using the digital renminbi.

According to the circulated data, (the wave of eliminating the dominance of the dollar prompted the Bank for International Settlements to say that China is redefining the rules of the game in the era of digital currencies), and the data pointed out that (the digital renminbi is not just a payment tool, but rather carries the Chinese Belt and Road strategy), stressing that (in projects such as the China-Laos Railway and the Jakarta-Bandung Railway, the digital renminbi has been integrated with the navigation system),

Emphasizing that (European car companies use the digital renminbi to settle shipping via the polar route, while China increases trade efficiency by 400 percent), and pointing out that (this strategy makes the dominance of the US dollar systematically threatened for the first time), the data stressed that (87 percent of the world's countries have completed adapting their systems to the digital renminbi, and the volume of cross-border payments has exceeded 1.$2 trillion, and China has built a digital payments network covering 200 countries, concluding that this silent financial revolution is not just monetary sovereignty, but determines who controls the lifeblood of the global economy in the future. link

************

Tishwash: Al-Sudani issues directives to financial and banking institutions

Prime Minister Mohammed Shia al-Sudani directed, on Sunday (October 26, 2025), government and private financial and banking institutions to enhance cooperation with Arab and foreign investors, in a manner that serves Iraq's interests and supports the building of a strong, diversified, and sustainable economy.

Al-Sudani's media office stated in a statement received by "Baghdad Today" that "this came during his attendance at the opening ceremony of the Arab Bank –Iraq, in which Iraqi, Arab and foreign capital contributes," stressing that "the opening of this bank represents an embodiment of investors' confidence in the Iraqi economy and the attractive business environment that has been established during the past period." Pointing out that the bank's presence represents a strategic addition to the national banking sector and a model for modern financial institutions capable of providing advanced services and financing sustainable development projects.

The Prime Minister explained that "the success of this project requires cooperation between Arab Bank–Iraq, national banks, government agencies, and the private sector, in order to employ financial capabilities and banking expertise to support the government's development programs and projects."

He stressed that "the government is continuing to reform the financial and banking system and transform from a single rentier economy to a diversified and sustainable economy that depends on investing in natural resources".

He explained that "these reforms were implemented despite their great social and political costs, and contributed to raising the level of reliability with international financial institutions and creating a safe and attractive financial environment for investment."

He added, "Iraq is witnessing a phase of real development and broad investment opportunities in various sectors, stressing the need for modern digital banking services that meet the needs of individuals and institutions and keep pace with global development in banking".

Al-Sudani concluded by stressing that integration between Iraqi financial institutions and Arab and foreign investors represents a fundamental step towards enhancing economic growth and consolidating financial stability in the country. link

************

Tishwah: Rafidain Bank: Partnership with the Central Bank and the Payments Council is a Successful Model for Managing Financial Transformation

Rafidain Bank announced on Sunday that its partnership with the Central Bank and the Payments Council represents a successful model for managing financial transformation, while indicating its commitment to moving towards an integrated digital financial system.

The bank stated in a statement received by Al-Rabia News Agency: "The bank's Director General, Ali Karim Hussein Al-Fatlawi, participated in the regular meeting of the Iraqi National Payments Council, which was held at the headquarters of the Central Bank of Iraq, headed by the Governor of the Central Bank, Ali Mohsen Al-Allaq, and attended by representatives of ministries, government institutions, and the financial and banking sectors."

According to the statement, Al-Fatlawi said, "The bank is proceeding with confident strides in its strategic partnership with the Central Bank and the National Payments Council to develop the digital payments infrastructure and consolidate the transition towards a national economy based on financial inclusion and technological innovation."

He emphasized that "the bank is working to strengthen its role as a key driver of the digital transformation of the Iraqi banking sector by investing in modern financial technologies and expanding the electronic payment services network, in line with the national vision led by the Central Bank and the Payments Council to build a more efficient and transparent financial system."

He explained that "the bank attaches great importance to developing the technological infrastructure of its banking systems, enhancing cybersecurity and data protection, and spreading the culture of financial awareness among citizens, especially youth and students, as they are the targeted generation for the transition to digital banking services."

He pointed out that "the close partnership between the Central Bank, the Payments Council, and Rafidain Bank represents a successful model of institutional integration in managing financial and digital transformation in Iraq," stressing that "the bank will continue to play its leading role in empowering the national banking sector and expanding the base of financial inclusion, thus enhancing economic stability and serving sustainable development." link

************

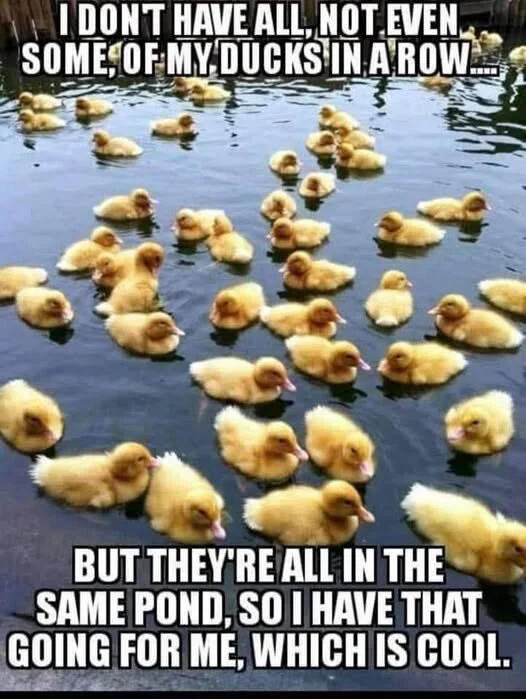

Mot: Things That Make Ya Go -- Hmmmmmmm!!!

Mot: Getting Closer I Is!!!!

Seeds of Wisdom RV and Economics Updates Monday Morning 10-27-25

Good Morning Dinar Recaps,

Global Equities Surge on U.S.–China Trade Optimism

Markets rally worldwide as investors sense a thaw in global tensions

Global markets opened the week with strong momentum as optimism grew over renewed trade cooperation between the United States and China. Hints of a potential trade framework — coupled with encouraging inflation data — have pushed investors back into equities and risk assets.

Good Morning Dinar Recaps,

Global Equities Surge on U.S.–China Trade Optimism

Markets rally worldwide as investors sense a thaw in global tensions

Global markets opened the week with strong momentum as optimism grew over renewed trade cooperation between the United States and China. Hints of a potential trade framework — coupled with encouraging inflation data — have pushed investors back into equities and risk assets.

Key Market Movements

Asia leads the charge: Japan’s Nikkei 225 surged over 2.5%, and South Korea’s KOSPI rose nearly 3%, buoyed by tech-sector strength.

European indexes followed suit, with the FTSE 100 and DAX climbing as investors rotated out of defensive positions.

Gold and bonds declined, signaling a return of risk appetite.

Currencies shifted: the Chinese yuan strengthened, while the U.S. dollar was mixed across major pairs.

Commodities such as copper rose on expectations of increased industrial demand.

Why It Matters

Trade thaw = global growth pulse: Reducing U.S.–China trade risk restores confidence in supply chains, manufacturing, and corporate investment.

Capital flow rotation: Investors are moving from safe havens into growth assets — a structural signal of shifting global sentiment.

Global Financial Reset connection: The emerging trade détente is more than diplomacy — it’s part of a restructuring of the global financial architecture:

“This is not just politics — it’s global finance restructuring before our eyes.”

The Bigger Picture

If sustained, trade normalization could help rebuild global capital flows, re-anchor commodity pricing, and boost confidence in emerging markets. But the rally’s durability hinges on whether promises translate into formal agreements and continued inflation moderation.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times – Global stocks rally on US-China trade optimism

Reuters – Stocks rally, safe-havens retreat on trade deal optimism

Bloomberg Market Wrap – Asia leads risk rally on trade thaw and inflation relief

~~~~~~~~~

Year-End Outlook Brightens: Inflation Eases, Trade Progress Lifts Confidence

Analysts forecast a strong finish to 2025 as twin headwinds subside

After months of uncertainty, two major drivers — softening inflation and trade détente — are reshaping the global outlook. Market sentiment has shifted decisively toward optimism as investors anticipate policy easing and stronger earnings growth heading into year-end.

Key Indicators Supporting the Rally

Inflation cools: U.S. CPI and European inflation prints both came in below forecasts, reinforcing expectations of central bank rate cuts.

Trade relief: U.S.–China negotiations appear to be advancing, calming fears of tariff escalation and supply bottlenecks.

Corporate outlook improves: Multinationals are revising forward guidance upward as input costs decline.

Emerging-market capital inflows are accelerating, reflecting renewed confidence in cross-border growth.

Why It Matters

Policy flexibility returns: Lower inflation gives central banks space to pivot toward growth-supportive stances.

Stronger global linkages: Fewer trade barriers encourage capital mobility and resource reallocation — a hallmark of systemic realignment.

RESET connection: Together, inflation moderation and trade cooperation mark a shift in the monetary order, supporting your consistent theme:

“This is not just politics — it’s global finance restructuring before our eyes.”

Risks to Watch

Persistent services inflation could stall policy easing.

Trade deals may face political delays or reversals ahead of election cycles.

Market optimism may be overextended if corporate earnings fail to justify valuations.

Strategic View

The alignment of easing inflation and improved trade conditions suggests a foundation for a more balanced, multipolar financial system. For investors, it signals a likely shift from defensive strategies toward innovation, infrastructure, and resource assets that benefit from global reintegration.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Australian – Markets to finish 2025 strongly amid US-China trade breakthrough, inflation beat

Reuters – Global markets wrap: Inflation easing boosts risk sentiment

Bloomberg Economics – Inflation trajectory and central-bank signaling

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The System is Blinking Red: Andy Schectman

The System is Blinking Red

VRIC Media: 10-25-2025

In a landscape dominated by shifting geopolitical sands and aggressive monetary policy, understanding the true role of precious metals is more critical than ever.

Andy Schectman, President of Miles Franklin Precious Metals, recently sat down with Darrell Thomas of VRIC Media for a profound, in-depth analysis that goes far beyond simple metal price predictions.

Schectman argues that we are not just in a cyclical bull market for gold and silver, but amidst a fundamental, orchestrated global monetary transition.

The System is Blinking Red

VRIC Media: 10-25-2025

In a landscape dominated by shifting geopolitical sands and aggressive monetary policy, understanding the true role of precious metals is more critical than ever.

Andy Schectman, President of Miles Franklin Precious Metals, recently sat down with Darrell Thomas of VRIC Media for a profound, in-depth analysis that goes far beyond simple metal price predictions.

Schectman argues that we are not just in a cyclical bull market for gold and silver, but amidst a fundamental, orchestrated global monetary transition.

Here are the key takeaways from one of the most comprehensive market interviews of the year, focusing on institutional movement, the “debasement trade,” and the explosive upside potential of physical silver.

The narrative that gold is a “barbarous relic” is officially dead. Schectman points to overwhelming evidence that gold is rapidly being reintegrated into the global monetary framework, driven by overwhelming physical demand from central banks and major financial institutions.

Regarding the recent price pullback, Schectman views it not as a cause for alarm, but as a much-needed correction within a massive bull market. His advice is clear: “Buy the dip” and employ prudent cost-averaging strategies to build a core position during periods of temporary weakness.

Perhaps the most intricate part of the analysis centers on the complex macroeconomic strategy Schectman calls the “debasement trade.” This isn’t just accidental inflation; it is a calculated maneuver by the US government to deliberately devalue the dollar to achieve specific economic goals—primarily supporting the massive reshoring of US manufacturing.

The US is attempting to navigate Triffin’s dilemma—the inherent conflict faced by a world reserve currency where domestic economic needs clash with global monetary obligations.

This monetary maneuver aims to reposition the US economy toward sustainable, manufacturing-led growth while acknowledging that the dollar’s status must evolve. In this environment of controlled currency weakening, physical precious metals become the ultimate defense mechanism.

While gold is the primary monetary asset, Schectman makes a compelling case for silver as the asymmetric wealth asset of this decade. Silver’s value is rooted in its duel nature: it is both a critical industrial metal (essential for solar, EVs, and electronics) and a historical monetary metal.

Schectman emphasizes that the historically wide gold-to-silver ratio (how many ounces of silver it takes to buy one ounce of gold) is a powerful indicator of silver’s current gross undervaluation. Given the persistent supply deficits and surging industrial demand, silver is positioned for potentially explosive upside.

Throughout the discussion, Schectman stresses that official inflation figures are artificially low, and the long-term shifts driven by AI and the hollowing out of US manufacturing capacity mean economic volatility is a certainty.

The global accumulation of physical gold and silver by the world’s most powerful entities—central banks, institutions, and BRICS nations—suggests that the transition to a new monetary standard is not a theory, but an ongoing reality that will profoundly reshape financial markets.

For investors, the conclusion is simple and stark: Owning physical precious metals is the only true hedge against inevitable currency debasement and inflation. While market noise and manipulation exist to distract and disorient, the physical fundamentals are screaming alignment. The time to acquire wealth outside the traditional banking system is now.

To fully grasp the nuanced details of the debasement trade and Schectman’s forecast methodology, we highly recommend watching the full, comprehensive interview hosted by Darrell Thomas on VRIC Media.

https://dinarchronicles.com/2025/10/26/vric-media-the-system-is-blinking-red/

“Vietnam News” Posted by Henig at KTFA 10-26-2025

KTFA:

Henig: Việt Nam, US issue joint statement on reciprocal trade agreement

October 26, 2025 - 19:09

According to the joint statement, Việt Nam will provide preferential market access for substantially all US industrial and agricultural exports to Việt Nam.

HÀ NỘI — Việt Nam and the US on Sunday issued a joint statement outlining a framework for an agreement on reciprocal, fair and balanced trade.

KTFA:

Henig: Việt Nam, US issue joint statement on reciprocal trade agreement

October 26, 2025 - 19:09

According to the joint statement, Việt Nam will provide preferential market access for substantially all US industrial and agricultural exports to Việt Nam.

HÀ NỘI — Việt Nam and the US on Sunday issued a joint statement outlining a framework for an agreement on reciprocal, fair and balanced trade.

Prime Minister Phạm Minh Chính met with US President Donald Trump at the 13th ASEAN-US Summit in Kuala Lumpur on Sunday. VNA/VNS Photo

The statement was released on the occasion of US President Donald Trump and Prime Minister Phạm Minh Chính attending the 47th ASEAN Summit in Kuala Lumpur, Malaysia. The agreement on reciprocal, fair and balanced trade will build upon the longstanding economic relationship between the two countries, including the US-Việt Nam Bilateral Trade Agreement signed in 2000, which entered into force in 2001.

According to the joint statement, Việt Nam will provide preferential market access for substantially all US industrial and agricultural exports to Việt Nam. The US will maintain at 20 per cent the reciprocal tariffs, as outlined in Executive Order 14257 of April 2, 2025, as amended, on originating goods of Việt Nam, and will also identify products from the list set out in Annex III to Executive Order 14346 of September 5, 2025, Potential Tariff Adjustments for Aligned Partners, to receive a zero per cent reciprocal tariff rate.

The US and Việt Nam will work constructively to address both countries’ interests in non-tariff barriers affecting bilateral trade in priority areas. Việt Nam has agreed to address many such barriers, including accepting vehicles built to US motor vehicle safety and emissions standards, addressing import licences for US medical devices, streamlining regulatory requirements and approvals for US pharmaceutical products, fully implementing Việt Nam’s obligations under certain international intellectual property treaties to which it is a party, and addressing US concerns with conformity assessment procedures. The US and Việt Nam have also committed to address and prevent barriers to US agricultural products in the Vietnamese market, including with regard to US regulatory oversight and acceptance of currently agreed certificates issued by US regulatory authorities.

Under the agreement, Vietnam Airlines has agreed to purchase 50 aircraft from Boeing, worth more than US$8 billion.

Vietnamese companies have signed 20 memorandums of understanding with US companies to purchase US agricultural commodities, with a total estimated value of over US$2.9 billion.

In the coming weeks, the US and Việt Nam will work to finalise the agreement, prepare it for signature and undertake domestic formalities in advance of it entering into force. — VNS

************

Henig: Prime Minister Phạm Minh Chính meets US President Donald Trump on sidelines of 47th ASEAN Summit

October 26, 2025 - 20:19

During the meeting, the two leaders agreed to advance the Comprehensive Strategic Partnership for peace, cooperation and sustainable development between Việt Nam and the United States in a deeper, more substantive and effective manner.

Prime Minister Phạm Minh Chính (left) held a brief meeting with US President Donald Trump on the sidelines of the 13th ASEAN–US Summit

KUALA LUMPUR — Prime Minister Phạm Minh Chính held a brief meeting with US President Donald Trump on the sidelines of the 13th ASEAN–US Summit during his attendance at the 47th ASEAN Summit and related meetings in Kuala Lumpur, Malaysia, on Sunday.

During the meeting, the two leaders agreed to advance the Comprehensive Strategic Partnership for peace, cooperation and sustainable development between Việt Nam and the United States in a deeper, more substantive and effective manner.

Both sides expressed a shared commitment to soon conclude a Reciprocal Trade Agreement, ensuring fairness and equality while encouraging greater US investment in Việt Nam.

Following Prime Minister Chính’s proposal, President Trump gave a positive response and took note of Việt Nam’s request for recognition as a market economy, as well as for removal from the US strategic export control lists D1 and D3. President Trump directed senior American officials present at the summit, including the Treasury Secretary and the US Trade Representative, to promptly provide feedback on these matters.

PM Chính commended President Trump’s role in promoting the peaceful settlement of global conflicts in recent times.

The brief ASEAN–US sidelines meeting demonstrated mutual understanding, respect and a shared resolve to further strengthen the Comprehensive Strategic Partnership between the two countries.

On this occasion, PM Chính conveyed an invitation from Party General Secretary Tô Lâm and other senior Vietnamese leaders for President Trump to visit Việt Nam. President Trump warmly accepted, saying he looked forward to and would make time for a visit to Việt Nam in the near future.

PM Chính also proposed that the United States arrange a visit to Washington by Party General Secretary Tô Lâm under the framework of the two countries’ Comprehensive Strategic Partnership. President Trump welcomed the idea, asking that Việt Nam inform the US side at an appropriate time, and also expressed a desire for PM Chính to visit the United States when convenient for both sides.

13th ASEAN–US Summit On Sunday afternoon, PM Chính joined ASEAN leaders and US President Donald Trump at the 13th ASEAN–US Summit, held at the Kuala Lumpur Convention Centre.

In his address, Chính congratulated President Trump on the United States’ recent achievements and praised his diplomatic efforts in promoting dialogue and peaceful conflict resolution worldwide. He particularly acknowledged the President’s cooperation with Malaysia, this year’s ASEAN Chair, and other ASEAN members in facilitating talks between Cambodia and Thailand, leading to the signing of a Joint Declaration of Peace between the two neighbours.

Recognising the US as one of ASEAN’s most comprehensive strategic partners, Chính proposed four major orientations to deepen ASEAN-US cooperation more practically and effectively.

The orientations consist of enhancing economic, trade and investment connectivity towards a balanced, harmonious and sustainable relationship; promoting cooperation in digital transformation, innovation and energy security, including energy infrastructure connectivity and peaceful nuclear energy collaboration; strengthening cybersecurity and the fight against transnational crime, building on US initiatives against online fraud and Việt Nam’s initiative on improving the pursuit of wanted criminals; and maintaining peace, security and stability across the region.

Chính reaffirmed that ASEAN and the US shared common interests and responsibilities in maintaining peace, stability, security and development in the region, including the East Sea (internationally known as the South China Sea). He reiterated ASEAN’s principled position of resolving disputes peacefully and in accordance with international law, particularly the 1982 United Nations Convention on the Law of the Sea (UNCLOS).

For his part, President Trump affirmed that Southeast Asia occupied a central place in the US Indo-Pacific policy, and that the United States remained a steadfast partner and friend to the region.

Washington, he said, would seek to deepen its partnership with ASEAN not only in economics, trade, energy, technology and AI but also in the pursuit of peace, stability and prosperity for all nations and future generations.

The President underscored that the US would be ready to work closely with and support ASEAN in addressing shared challenges, with full respect for ASEAN’s centrality and the legitimate interests of its member states. At the close of the summit, ASEAN and US leaders adopted the 'Joint Vision Statement on a Stronger, Safer and More Prosperous ASEAN-US Partnership,' setting the strategic direction for the next phase of cooperation.

ASEAN leaders commended the United States for its active and constructive contributions to regional cooperation through ASEAN-led mechanisms, particularly in promoting dialogue and confidence-building for peace and stability.

They also highly appreciated President Trump’s personal commitment and role in fostering regional dialogue, including his support for negotiations that helped ease tensions and achieve the Peace Declaration between Thailand and Cambodia in Kuala Lumpur on Sunday.

The leaders noted that ASEAN-US relations continue to grow robustly, comprehensively and effectively across multiple sectors.

The two sides reaffirmed their commitment to effectively implementing existing initiatives and to deepening the ASEAN-US Comprehensive Strategic Partnership, focusing on high-quality trade and investment, finance, infrastructure connectivity, the digital economy, energy and cybersecurity resilience, all aimed at building a peaceful, secure, stable and prosperous region. —VNS

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 10-26-25

Good Afternoon Dinar Recaps,

ASEAN 2025: Malaysia Summit Marks a Turning Point for Global Order

When Southeast Asia convenes, the future of trade, diplomacy and monetary flows is being rewritten../,

Good Afternoon Dinar Recaps,

ASEAN 2025: Malaysia Summit Marks a Turning Point for Global Order

When Southeast Asia convenes, the future of trade, diplomacy and monetary flows is being rewritten../,

Leaders, Expansion & a Crowded Agenda

The Association of Southeast Asian Nations (ASEAN) summit in Kuala Lumpur from October 26–28, 2025 will bring together heavy-weight global figures: Donald Trump (USA), Li Qiang (China), Sanae Takaichi (Japan), Lee Jae‑myung (South Korea), Luiz Inácio Lula da Silva (Brazil) plus others from South Africa, Canada, Australia and New Zealand.

Notably, Timor‑Leste will officially become the bloc’s 11th full member — the first expansion since the 1990s.

The agenda is packed: economic integration, the Myanmar crisis, South China Sea disputes, U.S.–China rivalry, Gaza’s fallout, and a booming online-scam industry.

Why This Matters

● Regional economic architecture in flux – With membership expansion and global leaders present, ASEAN is evolving from a regional forum into a strategic geopolitical player.

● Trade & settlement pathways shifting – As Asia becomes more central, monetary flows and digital-settlement frameworks will increasingly bypass traditional Western hubs.

● Global financial reset underway – The summit’s scale and diversity of issues reflect a transition toward multipolar financial systems, where power is not rooted solely in the West or the dollar.

● Symbolism becoming structure – Timor-Leste’s accession and the presence of global heads signal that the infrastructure of global finance (trade routes, digital rails, reserve assets) is being reconfigured.

The Bigger Picture: Out with the Old, In with the New

The ASEAN 2025 summit isn’t just a diplomatic gathering — it’s a marker of how global economics and finance are morphing:

Legacy settlement systems built around Western-led currency and payment rails face competition from Asia-driven arrangements and digital alternatives.

The inclusion of new members and agendas beyond “just trade” show that alignment is shifting — politics, finance and technology are converging.

Institutions, treaties, and digital platforms being discussed now will underpin tomorrow’s liquidity networks, reserve architectures and financial flows.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “What to expect from Southeast Asian leaders’ summit as Trump attends”

Reuters – “East Timor officially becomes ASEAN’s 11th member”

The Diplomat – “What to Expect From the Upcoming ASEAN Summit in Malaysia”

~~~~~~~~~

BRICS Payment Surge: Yuan-Rails Rewrite the Monetary Map

How the Cross‑Border Interbank Payment System (CIPS) and yuan-lending boom are reshaping global finance.

The Transformation in Motion

The BRICS bloc and China in particular are quietly building a parallel payment and monetary system:

● China’s CIPS now connects 1,700+ banks in over 100 countries, clearing approximately ¥175 trillion (~US $24 trillion) in 2024 — up ~43 % year-on-year.

● China’s overseas renminbi (RMB) lending, deposits and bond investments have surged to over RMB 3.4 trillion (~US $480 billion) in five years — a clear step in de-dollarising trade and financing.

● The Bank for International Settlements (BIS) and others have flagged this trend as a structural shift in global liquidity rather than a transient event.

Why It Matters

• Redesigning the Reserve Architecture:

• The dominance of the U.S. dollar and Western-led rails (e.g., SWIFT) is being challenged by a system that routes value directly through yuan-cleared networks.

• Liquidity Flows Redefined:

• Institutional, trade and sovereign flows are now beginning to respond to networks centred on the yuan and CIPS — not just the dollar-centric system.

• Toward a Global Financial Reset:

• This is more than currency diversification. It’s the creation of an alternative global monetary plumbing, enabling a multipolar value-transfer architecture beyond legacy systems.

• Analogy:

• Just as the internet replaced postal letters, CIPS + yuan-finance may replace correspondent-bank wires — faster, global, programmable.

Key Implications

● Trade-finance realignment: China is settling increasing volumes in yuan — including LNG imports, soybeans and loans in commodity-rich countries — reducing dollar dependency.

● Banking infrastructure on the move: Major global banks (e.g., HSBC Hong Kong) have joined CIPS, signalling institutional support for this rail.

● Emerging-market leverage: BRICS and partner nations see this rail as a way to sidestep sanctions risk and gain greater financial sovereignty.

● Systemic resilience: A diversified global settlement system weakens single-point dependency on the dollar and creates alternatives when geopolitical pressures intensify.

The Bigger Picture: Out with the Old, In with the New

The contours of a new global financial system are emerging:

A shift from fiat-centric, dollar-settlement pipelines toward multi-currency rails under sovereign and institutional control.

Payment networks built on programmable rails, where value moves as instantly and reliably as data.

While the dollar remains dominant for now, the architecture behind it is changing — and these developments mark the inflection point of the global reset.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Grows as 1,700 Banks Process 175 Trillion Chinese Yuan Payments”

FT.com – “Overseas renminbi lending surges as China steps up campaign to de-dollarise”

Reuters – “China central bank urges state-owned businesses to prioritise yuan in overseas expansion”

Reuters – “China talks up digital yuan in push for multi-polar currency system”

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Sunday 10-26-2025

KTFA:

Tishwash: The United Nations renews its support for Iraq in organizing transparent and fair elections.

10/26/2025

The Special Representative of the Secretary-General for Iraq, Mohammed Hassan, reiterated on Sunday the United Nations' support for Iraq in organizing transparent and fair elections, about two weeks before polling stations open to voters.

During his meeting with Iraqi President Abdul Latif Rashid in Baghdad, Al-Hassan affirmed the United Nations' full support for Iraq's efforts to complete the electoral process within the standards of integrity and transparency, commending the steps taken by the Presidency and relevant institutions in creating the appropriate conditions for its conduct.

KTFA:

Tishwash: The United Nations renews its support for Iraq in organizing transparent and fair elections.

10/26/2025

The Special Representative of the Secretary-General for Iraq, Mohammed Hassan, reiterated on Sunday the United Nations' support for Iraq in organizing transparent and fair elections, about two weeks before polling stations open to voters.

During his meeting with Iraqi President Abdul Latif Rashid in Baghdad, Al-Hassan affirmed the United Nations' full support for Iraq's efforts to complete the electoral process within the standards of integrity and transparency, commending the steps taken by the Presidency and relevant institutions in creating the appropriate conditions for its conduct.

According to a statement issued by the President of the Republic, received by Shafaq News Agency, the two sides discussed key regional and international issues, most notably developments in the region and their future impacts, and the role of the United Nations in consolidating dialogue and coordination among countries in the region to ease tensions.

According to the statement, the meeting discussed the country's political developments and situation, ongoing preparations for the upcoming elections, and the need to conduct the elections within controls and standards that ensure their integrity and enhance citizens' confidence in constitutional institutions.

For his part, the Iraqi President affirmed the commitment of constitutional and legal institutions to the success of the upcoming elections by completing the necessary preparations to ensure their efficient and credible organization. He emphasized the importance of the international community and its role in providing technical support and monitoring to ensure they proceed according to transparent and fair principles that reflect the true will of the people.

Parliamentary elections in Iraq will be held on November 11, 2025. Approximately 30 million Iraqis out of a population of 46 million are eligible to vote to elect their representatives in the new House of Representatives. However, approximately seven million of them will be barred from participating due to their lack of voting cards, as their data has not been updated. LINK

************

Clare: Trade: Iraq seeks to open up to the global economy by joining the WTO.

10/26/2025 - Baghdad –

The official spokesperson for the Ministry of Trade, Mohammed Hanoun, confirmed that the Iraqi government continues to implement its reform program aimed at completing the requirements for the Republic of Iraq's accession to the World Trade Organization (WTO), in line with the state's orientations towards openness to the global economy and strengthening Iraq's position within the multilateral trading system.

Hanoun explained in a statement received by Mawazine News that "the ministry, through the National Committee for Iraq's Accession to the Organization, was able, during the years 2023 and 2024, to make tangible progress in completing the basic negotiating documents and updating the required technical files, reflecting Iraq's commitment to international standards and implementing the principles of transparency and economic openness."

He pointed out that "Iraq officially resumed the accession negotiations process after a hiatus of more than 16 years. In July 2024, the third meeting of the working group concerned with Iraq's accession was held at the organization's headquarters in Geneva, headed by the Minister of Trade, who gave a comprehensive presentation on the ongoing economic and legislative reforms. This presentation was widely welcomed by member states, which praised Iraq's commitment to the requirements of full membership."

He added, "The Ministry, in cooperation with relevant government agencies, has completed the update of the customs tariff system to HS2022, in addition to preparing and amending a package of commercial laws and legislation, including intellectual property rights laws, commercial arbitration, technical standards, and regulations related to foreign trade. The Ministry of Finance is also working to complete the stages of approving the new customs system within the national legal framework."

The official spokesman explained that "Iraq participated for the first time in twenty years as an observer" in the 13th Ministerial Conference of the World Trade Organization (MC13), held in Abu Dhabi, stressing that this participation reflects the strong political support for the accession process and the government's will to accelerate structural economic reforms in line with the organization's requirements.

He added that "the National Committee and its subcommittees, after the last meeting, began updating the memorandum on the foreign trade system and submitting detailed answers to 175 questions" submitted by member states, in preparation for holding the fourth meeting of the working group during the next phase."

Hanoun concluded his statement by emphasizing that "the Ministry of Trade, under the direct guidance of the Prime Minister, is proceeding to complete all technical and legal requirements in cooperation with relevant ministries and agencies, with the goal of achieving Iraq's full membership in the World Trade Organization in the coming period, which will contribute to enhancing the competitiveness of the national economy and attracting foreign investment." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Last week, the CBI announced plans to remove zeros from dinar, as part of efforts to strengthen the national currency. Article quote: “The matter of removing zeros from the Iraqi currency is a project that still exists and is ongoing. We are planning for it, and in the future, we will see progress on this matter,”... Can the CBI conduct the project in just a few more months?...I am sure they have a time table...because they told us.

Bruce [via WiserNow] ...we are most likely getting notified Monday or Tuesday of next week. Now we could get something Sunday...I know that’s a little ways off, I know, but you know what? We made it this far, and we're not going to stop now...We're going to... pursue this all the way to its logical conclusion, right? ...and...this is what I've been told...we should get started before the end of October...we are, in a good place...So let's see what happens...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: They come out today and started talking more about the notes. They gave us point by point. First point, security features of the new notes were previously unveiled by the CBI including raised marks for the visually impaired and enhanced anti-counterfeiting measures. They said these notes are designed to circulate alongside existing currency for now... FRANK: None of this can happen at the rate they're at right now. In January they were projecting [In a CBI article] this was going to happen to their currency and this currency would be replaced with lower notes...Every day it gets more and more exciting... Excitement is not even close enough to describe what's happening...

************

FAKE Buffett AI: “DUMP GOLD!” – TIME TO BUY! They Want YOUR Money

Daniela Cambone: 10-25-2025

“The garbage that is out there… all they are trying to do is manipulate the market for their own personal gain,” Todd "Bubba" Horwitz states, referring to the AI-generated deep fake videos that were being used in a coordinated campaign to attack gold.

In today's interview with Daniela Cambone, Bubba breaks down why this desperate attack is a signal of strength for gold, not weakness.

He argues that after a powerful rally, this is exactly the kind of shakeout you should expect. “You get these big dramatic up moves... there's going to be a pullback.

Don't worry about it. Use that as a buying opportunity,” he advises. Find out why the "charlatans" are so desperate to get your gold now and why Bubba believes every portfolio needs this hard asset protection.

Jon Dowling: Weekly RV and Financial Updates for October 24th, 2025

Jon Dowling: Weekly RV and Financial Updates for October 24th, 2025

10-25-2025

Jon Dowling’s latest “RV Report” Friday, October 24th, 2025, update delivered a potent blend of geopolitical, financial, and commodity analyses, with particular emphasis on Iraq’s economic transformation, the unfolding silver crisis, and the dynamic cryptocurrency market.

A significant portion of Dowling’s report focused on Iraq’s ongoing journey toward economic revival and its highly anticipated currency redenomination.

Jon Dowling: Weekly RV and Financial Updates for October 24th, 2025

10-25-2025

Jon Dowling’s latest “RV Report” Friday, October 24th, 2025, update delivered a potent blend of geopolitical, financial, and commodity analyses, with particular emphasis on Iraq’s economic transformation, the unfolding silver crisis, and the dynamic cryptocurrency market.

A significant portion of Dowling’s report focused on Iraq’s ongoing journey toward economic revival and its highly anticipated currency redenomination.

The process of removing zeros from the Iraqi Dinar is indeed underway, a crucial step in normalizing its value and integrating it more fully into the global financial system.

However, Dowling stresses that this is a measured, gradual process, not an overnight event. Its ultimate success and timing are intricately linked to significant political and legislative milestones within Iraq.

Critically, the report highlights the imperative removal of corrupt Iranian proxies embedded within Iraq’s Green Zone Parliament. Until these elements are addressed, the full potential of Iraq’s economic reforms, including the Dinar’s revaluation, will remain constrained. It’s a strategic game of patience, contingent on decisive internal political action.

Moving from geopolitics to precious metals, Dowling paints a stark picture for silver. The market is currently grappling with a severe supply shortage, a situation exacerbated by persistent problematic practices.

The London Bank Metals Exchange (LBME) is reportedly in dire need of over 150 million ounces of physical silver to stabilize its position.

The primary culprit? The pervasive and distorting practice of naked short selling. This manipulation continues to suppress silver’s true market value, creating an increasingly precarious situation.

As demand for physical silver outstrips available supply, especially for industrial and investment purposes, the current market structure appears unsustainable. Dowling’s report underscores the urgent need for transparency and accountability to rectify this imbalance.

On a different digital front, the cryptocurrency landscape is buzzing with anticipation. Dowling dissected the recent guilty plea of Binance’s founder for enabling money laundering. While seemingly a negative development, Dowling interprets this as a crucial precursor to Binance’s potential return and full re-entry into the U.S. market.

He posits that this regulatory cleansing is paving the way for a more compliant and robust crypto ecosystem, signaling a forthcoming “super bull run” for crypto assets. This perspective suggests that the recent regulatory actions, rather than being a hindrance, are essential steps toward mainstream adoption and explosive growth in the digital asset space.

Amidst these larger narratives, the daily market pulse remains dynamic. The report reviewed current market prices for key assets: silver, gold, crude oil, and the dollar index. All showed modest gains, though volatility remained a defining characteristic.

This fluctuation was largely attributed to a combination of profit-taking by investors and short-covering activities, indicating a period of tactical movements rather than clear directional trends.

Beyond the numbers and policies, Dowling often brings a deeper, more reflective dimension to his reports.

He concluded with a poignant and prophetic message from the late Kim Clement, forecasting both turmoil and eventual prosperity for America throughout the fall season.

This serves as a powerful reminder that even in challenging times, a positive outcome is often on the horizon, urging viewers to endure with hope and foresight.

Jon Dowling’s October 24th RV Report is a masterclass in connecting the dots across disparate global events. From the slow grind of Iraqi reconstruction and the silver market’s urgent plea to the burgeoning crypto revolution and overarching spiritual insights, his analysis encourages a comprehensive view of our complex world.

He thanks his viewers and promises further updates as new information emerges.

“Tidbits From TNT” Sunday 10-26-2025

TNT:

Tishwash: US envoy: Iraq is improving day by day and there are no limits to its capabilities

US President Mark Savaya's envoy sent a message to Iraq.

"I want to make Iraq great again," Savaya told the Chaldean Press.

He pointed out that he would like to "achieve peace and stability in the country by building strong bridges with the United States", explaining that "Iraq is improving day by day, without limits to its capabilities".

TNT:

Tishwash: US envoy: Iraq is improving day by day and there are no limits to its capabilities

US President Mark Savaya's envoy sent a message to Iraq.

"I want to make Iraq great again," Savaya told the Chaldean Press.

He pointed out that he would like to "achieve peace and stability in the country by building strong bridges with the United States", explaining that "Iraq is improving day by day, without limits to its capabilities". link

************

Tishwash: Masrour Barzani: Article 140 of the Constitution must be implemented as it is after the elections

#Article 140

The Prime Minister of the Kurdistan Regional Government, Masrour Barzani, confirmed that the Kurdistan Democratic Party is preparing to implement several goals following the parliamentary elections scheduled in Iraq, noting work to implement Article 140 of the Constitution.

Masrour Barzani said in a speech during his participation in an election carnival dedicated by the Kurdistan Democratic Party to candidates from the Kirkuk and Garmian regions, today, Saturday, October 25, 2025, that "Article 140 of the Constitution must be implemented as it is, and the constitutional provisions and articles must be applied as they are," adding: "We will no longer accept injustice." This time we will go to Baghdad to fight for our constitutional rights.

Masrour Barzani stated that "Kirkuk is the heart of Kurdistan", and "we are ready to sacrifice our blood and souls to return them to the embrace of Kurdistan", noting that "the people of Kirkuk must know that the one who sacrificed himself for Kirkuk throughout history is the Kurdistan Democratic Party".

The Prime Minister of the Kurdistan Regional Government and Vice President of the Kurdistan Democratic Party continued, "The injustice practiced against the Kurdistan Region is also practiced against Kirkuk, because Kirkuk is part of Kurdistan", stressing: "Kirkuk must return, and Khanaqin must return, as well as Makhmouz Zammar and Sinjar" to the embrace of Kurdistan.

Masrour Barzani recalled the statement of the President of the Kurdistan Region, Nechirvan Barzani, that "the party will win a million votes in these elections", saying: "We are able to obtain a million votes, and we are able to regain Kirkuk and win as the largest political party in Iraq".

The Prime Minister of the Kurdistan Regional Government touched on the situation in Kirkuk, and the level of services and life there, stressing that "if Kirkuk is run by the Parti, it will become a model of peaceful coexistence on the global level", and "whoever is loyal to Kirkuk must be characterized by actions and not just carrying slogans." He called on the people of the governorate to go to the polls and vote for his party, which bears the symbol 275, in the upcoming elections.

Masrour Barzani stressed that Iraq's stability and development are reflected in Kurdistan, saying: "If security and stability are available in Iraq and its people are able to live in prosperity, Kurdistan will certainly achieve greater progress," stressing that "we will not allow Iraq to return to centralization and dictatorship," and "we must head to Baghdad to stand up to the plans being hatched against the Kurdistan Region." link

************

Tishwash: Iran Declares Major Private Bank Bankrupt Amid Deepening Financial Strain

The collapse of Ayandeh Bank exposes deep cracks in Iran’s financial system, with experts warning more failures could follow amid sanctions and weak oversight.

Iran has declared on Saturday one of its largest private banks, Ayandeh Bank, bankrupt, with its assets absorbed by the state-owned Melli Bank, marking one of the most dramatic collapses in the country’s modern banking history.

The move comes as Tehran grapples with renewed international sanctions and mounting economic instability.

Founded in 2012, Ayandeh Bank once operated 270 branches nationwide—150 of them in Tehran—but had recently been crippled by mounting debt.

According to Iran’s ISNA news agency, the bank’s accumulated losses had reached the equivalent of $5.2 billion, with debts of roughly $2.9 billion.

On Saturday, long lines of anxious depositors formed outside the bank’s shuttered branches in Tehran, with police deployed to maintain order.

State television quoted Melli Bank director Abolfazl Najarzadeh confirming that “the transfer from Ayandeh Bank to Melli Bank is now complete,” assuring customers their deposits would be protected.

Iranian Economy Minister Ali Madanizadeh attempted to calm public fears on Thursday, saying customers “had nothing to worry about.” However, Central Bank officials blamed “bad debts” and risky self-financing projects for the collapse.

Central Bank representative Hamidreza Ghaniabadi told the IRNA news agency that over 90 percent of Ayandeh Bank’s funds were lent to affiliated entities or bank-managed projects that failed to generate returns.

Among its most extravagant ventures was the Iran Mall—one of the world’s largest shopping centers—complete with cinemas, luxury stores, and an ice rink.

The failure of Ayandeh Bank underscores the fragility of Iran’s financial system, heavily burdened by mismanagement, corruption, and years of sanctions that have isolated the country from international markets.

Several other private and semi-state banks—including Sarmayeh, Day, Sepah, Iran Zamin, and Melal—are reportedly facing severe liquidity challenges.

The crisis unfolds against the backdrop of renewed United Nations sanctions, reimposed in September after months of fruitless diplomacy aimed at reviving the 2015 nuclear agreement.

Those sanctions—referred to as a “snapback” mechanism—were reinstated following Israeli and U.S. strikes on Iranian nuclear sites in June, further tightening the economic noose around Tehran.

Economists say the banking sector’s instability reflects broader structural weaknesses in Iran’s economy, where inflation exceeds 40 percent and the national currency continues to plummet against the US dollar.

Observers from the industry warn that more bank failures could follow unless authorities enforce stricter financial oversight and attract foreign investment—both unlikely amid current geopolitical tensions. link

************

Tishwash: Sum Times I Can't Help Meself - I –

Tishwash: . Ripley!!! -- ooooooh Ripley!! -- ""Bath Time""

Seeds of Wisdom RV and Economics Updates Sunday Morning 10-26-25

Good Morning Dinar Recaps,

Ripple Prime: The Quiet Revolution in Global Finance -- The Digital Wall Street Is Here

How Ripple’s strategic acquisition is reshaping cross-border settlements and unlocking digital liquidity.

Good Morning Dinar Recaps,

Ripple Prime: The Quiet Revolution in Global Finance -- The Digital Wall Street Is Here

How Ripple’s strategic acquisition is reshaping cross-border settlements and unlocking digital liquidity.

The Strategic Move

● Ripple Labs, the blockchain giant behind XRP, has officially launched Ripple Prime—a professional-grade liquidity and settlement platform designed for institutional clients. The development follows Ripple’s acquisition of Hidden Road Partners, a global brokerage and prime services firm specializing in digital assets.

● According to reports from Reuters, Coindesk, and The Block, the move gives Ripple direct access to deep institutional liquidity pools, bridging traditional finance and blockchain markets under a single unified settlement rail.

● Garlinghouse’s vision: Ripple CEO Brad Garlinghouse emphasized that Ripple Prime will “unlock enterprise-grade liquidity for tokenized assets and payments”, positioning the firm as a cornerstone of future global finance infrastructure.

Why It Matters

● Institutional On-Ramp to Blockchain Finance

Ripple Prime’s integration with Hidden Road opens the door for major financial institutions to access on-demand liquidity (ODL) directly, without relying on legacy correspondent banking systems.

🌱 This transition signals the gradual migration of settlement infrastructure from centralized banks to blockchain networks.

● Accelerating Tokenized Asset Settlement

The partnership enables near-instant cross-border settlements in any fiat or crypto pair, dramatically reducing the friction and cost of moving value globally.

🌱 This is a critical pillar of the financial reset — instant, trustless settlement across asset classes.

● Bridging Old and New Systems

Ripple’s network now sits at the intersection of central bank digital currency (CBDC) infrastructure and private liquidity platforms.

🌱 Such hybrid models are essential for building a multi-polar financial order that no longer depends solely on the U.S. dollar.

The Bigger Picture: A New Financial Architecture

Ripple Prime’s debut aligns with a broader structural shift:

BRICS nations are advancing gold- and commodity-backed digital trade systems.

The IMF is exploring new settlement architectures using tokenized assets.

Western fintech firms like Ripple are positioning to mediate the convergence between traditional banks, CBDCs, and decentralized networks.

In essence: Ripple Prime represents not just another crypto product — but a core building block of a borderless liquidity layer, paving the way for a new global financial framework.

Ripple Prime is not just a rebrand — it’s a blueprint for a new economic structure.

This is not just politics or crypto hype — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Ripple launches institutional trading platform Ripple Prime

Coindesk – Ripple Expands Institutional Liquidity with Hidden Road Deal

The Block – Ripple’s Next Phase: Ripple Prime and the Institutional Bridge

FX Empire -- XRP News Today: Ripple Prime Launch Ignites XRP Demand Outlook

~~~~~~~~~

Zelle’s Next Leap: Stablecoins Bring Banking Into the Blockchain Era

America’s biggest bank-owned payment network takes its first step toward a borderless digital money system.

The Announcement

Early Warning Services (EWS) — the consortium behind Zelle, jointly owned by major U.S. banks like JPMorgan, Wells Fargo, and Bank of America — announced on October 24, 2025, that it will begin using stablecoins to power international payments.

The goal: bring Zelle’s hallmark speed and convenience in domestic transfers to cross-border money movement, connecting 2,500 financial institutions worldwide under one digital payment rail.

Key Details

● Leveraging stablecoins: EWS will utilize stablecoins to enable instant global transactions, taking advantage of new regulatory clarity provided by the GENIUS Act (July 2025).

● Goal: Build a faster, safer, and cheaper alternative for international remittances, reducing reliance on traditional correspondent banks.

● Network reach: The rollout will cover all 2,500 financial institutions already using the Zelle network.

● Unconfirmed details: It’s still unclear whether EWS will issue its own stablecoin or adopt a regulated third-party token such as USDC or PayPal USD.

● Market disruption: The move positions Zelle to directly compete with Western Union, MoneyGram, and PayPal, potentially redefining the remittance industry.

Industry Implications

This marks a pivotal moment: legacy banks are entering blockchain finance through one of their most successful payment systems.

Analysts note that by integrating stablecoins, Zelle is effectively bridging traditional bank infrastructure with digital settlement networks — the very mechanism driving the new financial architecture envisioned by Ripple, the IMF, and BRICS-aligned systems.

“This is not just about payments — it’s about interoperability between old money and programmable digital cash,” one fintech strategist told Forklog.

Why This Matters

● Out with the Old: Traditional SWIFT-based transfers may soon be replaced by tokenized, instant settlements built on distributed ledger systems.

● In with the New: Stablecoin integration by a U.S. bank consortium shows how regulated digital assets are now being woven into mainstream finance.

● Toward a Financial Reset: When institutions like Zelle’s banking network adopt blockchain rails, it signals the migration of global liquidity into a transparent, programmable system — a key step toward a global financial reset built on digital settlement layers rather than fiat intermediaries.

● Analogy: Much like the telegraph gave way to the internet, this shift represents the “Internet of Value” — money moving at the speed of information.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Ledger Insights – Bank-owned Zelle to launch stablecoin-based cross-border payments

Forklog – Zelle Payment Network Integrates Stablecoins for Cross-Border Transfers

Payments Journal – Zelle’s Stablecoin Could Mark Its Entry to Cross-Border Payments

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Biggest Bubble in History, Only Gold Survives Coming Carnage

Biggest Bubble in History, Only Gold Survives Coming Carnage

Commodity Culture: 19-24-2025

The global financial system is navigating turbulence unlike any seen before. In a recent, must-watch episode of Commodity Culture, host Jesse Day sat down with Alasdair Macleod—a seasoned finance expert with four decades of experience focused on precious metals and macroeconomic trends—to dissect the present dangers.

Macleod’s analysis is sobering: we are in the grip of an unprecedented credit bubble, fueled by decades of low rates and excessive government debt, making physical gold and silver essential stores of value against coming systemic failures.

Biggest Bubble in History, Only Gold Survives Coming Carnage

Commodity Culture: 19-24-2025

The global financial system is navigating turbulence unlike any seen before. In a recent, must-watch episode of Commodity Culture, host Jesse Day sat down with Alasdair Macleod—a seasoned finance expert with four decades of experience focused on precious metals and macroeconomic trends—to dissect the present dangers.

Macleod’s analysis is sobering: we are in the grip of an unprecedented credit bubble, fueled by decades of low rates and excessive government debt, making physical gold and silver essential stores of value against coming systemic failures.

Here is a breakdown of Macleod’s most critical insights from the discussion.

Macleod argues that the primary threat to global wealth isn’t a typical recession—it’s a systemic credit crisis driven by historical failures in monetary policy.

The Scale of Debt: The current credit bubble is deemed “unprecedented,” inflated by historically low interest rates that encouraged massive debt accumulation across governments, corporations, and individuals. This debt is largely unproductive, meaning it hasn’t generated enough economic activity to service itself, a critical vulnerability as interest rates inevitably rise.

Signs of Stress: We are already seeing the consequences. Macleod points to recent corporate collapses in the US automotive sector and failures among regional banks as clear indicators of stress propagating through the credit system.

He warns these are merely the beginning, anticipating more severe failures as rising rates choke off access to cheap capital.

The Margin Debt Vulnerability: A key concern highlighted by Macleod is the massive margin debt currently fueling equity markets. This leverage acts as a tinderbox; should markets begin to correct, forced selling could cascade, precipitating a sharp and violent market crash far beyond typical volatility.

Macleod believes the system is poised for a crisis larger than any historical precedent, demanding vigilance from every investor.Amidst the chaos, Macleod maintains that physical precious metals are critical for preserving purchasing power.

He stresses that short-term price volatility—like the recent corrections in gold and silver—are insignificant distractions compared to the long-term, relentless depreciation of fiat currencies.

The Silver Shortage: Macleod brings specific attention to the silver market, noting pronounced shortages in key inventories, particularly within the LBMA. This physical tightness contrasts sharply with the availability of paper silver.

The Risk of ETFs and Paper Assets: For investors considering paper exposure (such as ETFs), Macleod issues a stark warning about counterparty and jurisdictional risks. When the financial system comes under extreme pressure, the difference between owning physical metal and a paper promise becomes critical.

Mining Stocks: While mining stocks offer a leveraged play on rising metal prices, Macleod cautions that they remain exposed to significant timing risks due to market volatility. The primary focus for true wealth preservation must remain physical metal ownership.

The interview broadened into the global geopolitical arena, where Macleod sees major shifts accelerating financial instability.

Macleod characterizes the ongoing tensions, particularly the US-China trade war, as reflecting the waning of American global dominance. He asserts that China holds a strategic upper hand, largely due to its control over critical rare earth minerals—materials essential for the US military-industrial complex.

A “Wounded Animal”: Macleod uses the compelling analogy of the US acting as a “wounded animal,” lashing out through proxy conflicts and economic sanctions (citing UKraine, Venezuela, and the Middle East). He points to the heightened risk of a full-scale regional conflict, particularly involving Israel and Iran, as a major source of global instability that could rapidly destabilize fragile markets.

Macleod’s overarching message is clear: understanding credit—how bubbles inflate and how they inevitably burst—is the most crucial aspect of investment strategy today.

The combination of systemic credit stress, unprecedented debt levels, and significant geopolitical friction creates a precarious environment where traditional financial assumptions no longer hold true.

For investors seeking to preserve real wealth and navigate this era of extreme risk, the flight to essential, uncompromised value—physical gold and silver—is not merely an option, but a necessity.

The depth of Alasdair Macleod’s analysis—covering everything from the specifics of LBMA inventories to the real economic impact of Artificial Intelligence—is invaluable. To gain the full context and detailed insights into these complex market dynamics, be sure to watch the complete interview on Commodity Culture.

Could Gold ever Become Money again?

Could Gold ever Become Money again?

Heresy Financial: 19-25-2025

In a world increasingly dominated by digital transactions, central bank digital currencies, and instant, borderless payments, the notion of the world reverting to a gold standard often sounds like a historical fantasy.

Critics quickly dismiss the idea, citing the rigidity, impracticality, and inefficiency of tying modern economies to a physical metal.

But what if we are thinking about gold money the wrong way?

Could Gold ever Become Money again?

Heresy Financial: 19-25-2025

In a world increasingly dominated by digital transactions, central bank digital currencies, and instant, borderless payments, the notion of the world reverting to a gold standard often sounds like a historical fantasy.

Critics quickly dismiss the idea, citing the rigidity, impracticality, and inefficiency of tying modern economies to a physical metal.

But what if we are thinking about gold money the wrong way?

A recent deep dive by Heresy Financial suggests that the return of gold as money—not merely as a backing for currency—is not necessarily a return to 19th-century systems. Instead, technology and financial innovation have laid the groundwork for a truly modern, functional, electronic gold standard.

Here is why dismissing the possibility ignores the lessons of history and the realities of modern finance.

The traditional image of gold money involves the physical movement of coins or bullion, which was inherently slow, expensive, and difficult to divide for everyday transactions.

The invention of paper money in the 1600s was a true technological disruption. It separated the transfer of ownership from the movement of the physical asset. Instead of hauling a chest of gold, one simply traded a receipt (a banknote). This made transactions faster, cheaper, and more divisible.

However, this efficiency came at a catastrophic cost: centralization. As paper money became dominant, banks took liberties, leading to fractional reserve banking, inflation, bank runs, and ultimately, the complete abandonment of the gold-backed system in favor of unbacked fiat money.

Today, fiat money serves its purpose—it is an excellent medium of exchange—but lacks gold’s fundamental reliability as a long-term store of value.

If gold were to re-emerge as money, it would not require physical movement. It would leverage the very technology we use today.

The reality is that most gold ownership today is already divorced from its physical location. Billions of dollars worth of gold change hands daily through ETFs, futures contracts, and financial instruments. This ownership is tracked electronically through trusted custodians.

A modern gold standard would function similarly: ownership transfer, not physical movement.

Imagine a system where your digital account represents allocated, segregated, and independently audited gold held in a secure vault. Transactions would involve electronic transfers of ownership, likely batch-settled, much like current inter-bank settlements.

If these safeguards are met, digital gold ownership could provide the divisibility and speed of modern payments while retaining the inherent stability of the metal.

To understand how a monetary transition happens, we must recognize the two critical functions of money: Store of Value and Medium of Exchange.

Historically, during monetary transitions, Gresham’s Law comes into play: Bad money drives out good money. The trusted asset (good money) tends to be hoarded as a store of value, while the less trusted asset (bad money) is used rapidly as the medium of exchange.

This indicates a slow but significant loss of trust in fiat currency among the world’s most powerful financial institutions.