Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Massive Commodity Supercycle is Just Starting

Massive Commodity Supercycle is Just Starting

VRIC Media: 9-2-2025

In a world buzzing with economic forecasts and geopolitical tensions, it’s easy to get lost in the noise. But what if the true drivers of markets, and even global conflicts, are far more fundamental than daily headlines suggest?

That’s the compelling argument put forth by Jay Martin, CEO of V-Rick Media, in a recent insightful interview with Daryl Thomas on VRIC Media. Martin, a veteran in the natural resources sector, cuts through the complexity to reveal a core truth: supply and demand for natural resources are the foundational forces shaping our economic landscape.

Massive Commodity Supercycle is Just Starting

VRIC Media: 9-2-2025

In a world buzzing with economic forecasts and geopolitical tensions, it’s easy to get lost in the noise. But what if the true drivers of markets, and even global conflicts, are far more fundamental than daily headlines suggest?

That’s the compelling argument put forth by Jay Martin, CEO of V-Rick Media, in a recent insightful interview with Daryl Thomas on VRIC Media. Martin, a veteran in the natural resources sector, cuts through the complexity to reveal a core truth: supply and demand for natural resources are the foundational forces shaping our economic landscape.

For over a decade, specifically since 2011, the hard assets sector, particularly precious metals and mining, has experienced a capital drought. But according to Martin, that era is decisively over. He highlights a significant return of capital to this vital sector, signaling a new, methodical, and healthy market cycle. This isn’t the fleeting commodity surge we saw in 2020-21; it’s a structural shift.

While major indices like the S&P 500 and Dow Jones continue to hover near all-time highs, Martin points out their inherent vulnerability. Much of their strength lies in the concentration of a few mega-cap tech firms, leaving them susceptible to significant corrections.

In contrast, Martin and Thomas advocate that precious metals and mining stocks offer a compelling long-term hedge against inflation and market volatility. As the global economy grapples with escalating costs and unpredictable events, the tangible value of natural resources provides a crucial anchor for portfolios.

Martin even shared a fascinating anecdote about a successful investment in a plant-based baby food company, illustrating how strong macro trends coupled with exceptional management can drive success, regardless of the sector. It’s a testament to the universal principles of sound investing.

Jay Martin’s insights are a powerful reminder that while headlines grab attention, the fundamental supply and demand for natural resources quietly shape our world. As capital flows back into hard assets, understanding this sector could be key to securing your financial future

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 9-2-25

Good Afternoon Dinar Recaps,

BRICS Could Worsen US Debt & Deficit Crisis, JPMorgan Reports

De-dollarization trends may deepen America’s $36 trillion debt burden as foreign financing dries up.

BRICS Dedollarization and US Fiscal Risks

JPMorgan has warned that the BRICS bloc’s push away from the U.S. dollar could exacerbate America’s growing debt and deficit crisis. With the U.S. deficit exceeding $36 trillion, reduced foreign appetite for Treasury bonds is creating a fragile outlook for U.S. borrowing costs.

Good Afternoon Dinar Recaps,

BRICS Could Worsen US Debt & Deficit Crisis, JPMorgan Reports

De-dollarization trends may deepen America’s $36 trillion debt burden as foreign financing dries up.

BRICS Dedollarization and US Fiscal Risks

JPMorgan has warned that the BRICS bloc’s push away from the U.S. dollar could exacerbate America’s growing debt and deficit crisis. With the U.S. deficit exceeding $36 trillion, reduced foreign appetite for Treasury bonds is creating a fragile outlook for U.S. borrowing costs.

According to the bank, global financing for U.S. debt is waning as BRICS accelerate dedollarization efforts. JPMorgan cautioned that this could trigger bond market disruptions “within months or even years.”

Tariffs Backfire, Strengthening BRICS Unity

The Biden administration’s 50% tariffs on India and Brazil have had unintended consequences, reinforcing BRICS solidarity rather than weakening it.

India suspended arms purchases from the U.S.

Brazil deepened coordination with BRICS partners.

Brazilian President Luiz Inácio Lula da Silva underscored the bloc’s anti-dollar stance:

“I do not need to continuously bow to the dollar.”

Meanwhile, China’s yuan now accounts for over 50% of its cross-border transactions, up from 25% in 2020. Globally, dollar reserves have fallen from 70% to about 58%, while DBS Bank reported a 30% surge in yuan trade settlements.

Foreign Financing of U.S. Debt Declines

JPMorgan highlighted that foreign holdings of U.S. Treasuries have fallen to just 30% of total outstanding bonds, amplifying financing pressures.

The bank wrote:

“As the US government seeks to cut taxes to offset the impact of tariffs, financing needs are rising. Yet the world is now less willing to finance America’s deficit.”

Jamie Dimon’s Bond Market Warning

JPMorgan CEO Jamie Dimon echoed concerns about America’s fiscal trajectory, warning that the U.S. is running $2 trillion annual deficits—double the pre-pandemic levels of 2019.

“It’s a big deal, you know it is a real problem, but one day… the bond markets are gonna have a tough time. I don’t know if it’s six months or six years.”

Key warning signs:

Interest expenses now exceed U.S. defense spending and Medicare costs.

Moody’s downgraded the U.S. credit rating, citing debt ratios far above comparable sovereigns.

Reform Solutions for a BRICS-Driven Crisis

Dimon urged Washington to adopt growth-focused reforms to mitigate the impact of dedollarization and deficits:

Pro-business deregulation and permitting reform

Skills development and workforce expansion

Anti-fraud and efficiency measures in government programs

“The real focus should be growth… that’s the best way,” Dimon said, stressing that reforms need not harm the vulnerable but should reduce waste and abuse.

Why This Matters

JPMorgan warns that if BRICS de-dollarization continues, the U.S. could face a permanent erosion of its borrowing power. Rising borrowing costs and shrinking foreign support for Treasuries risk pushing America into a cycle of higher deficits, weaker trade flows, and diminished dollar dominance—outcomes with profound global consequences.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq’s Quantum Leap, WTO Accession, Digital Overhaul, and the IQD’s Path to Global Dominance

Ariel: Iraq’s Quantum Leap, WTO Accession, Digital Overhaul, and the IQD’s Path to Global Dominance

9-2-2025

We Have So Many Reasons To Be Excited For Where We Are And What We Have

Let’s Dive In

Ok my people listen, this isn’t your average financial briefing. With the firewalls cracked wide open, I’m going to lay out the raw mechanics of Iraq’s surge into the global arena.

Ariel: Iraq’s Quantum Leap, WTO Accession, Digital Overhaul, and the IQD’s Path to Global Dominance

9-2-2025

We Have So Many Reasons To Be Excited For Where We Are And What We Have

Let’s Dive In

Ok my people listen, this isn’t your average financial briefing. With the firewalls cracked wide open, I’m going to lay out the raw mechanics of Iraq’s surge into the global arena.

The Ministry of Trade’s announcement on completing those seven core files for WTO membership isn’t just bureaucratic noise; it’s the ignition switch for Iraq’s economy to blast off.

For American holders of Iraqi Dinar (IQD), this is the kind of seismic shift that could turn your stacks into generational wealth. We’re talking integration into international trade flows, Forex liquidity explosions, and a currency revaluation that flips the script on decades of suppression.

How WTO Accession Positions Iraq for the International Forex Market

Iraq’s WTO push is no small feat after 16 years of stagnation, they’ve wrapped up technical dossiers on trade policies, tariffs, intellectual property, and services liberalization. This isn’t window dressing; it’s the blueprint for dismantling isolationist barriers.

Trade Liberalization Unlocks Forex Doors: WTO membership mandates transparent, predictable trade rules. For Iraq, that means slashing import duties (currently averaging 15-20% on goods) and aligning with global standards. Once in, IQD trades freely on Forex platforms without the current restrictions think seamless pairings with USD, EUR, and emerging assets. No more black-market premiums; spot rates stabilize, drawing hedge funds and retail traders who see IQD as the next oil-backed powerhouse.

Capital Inflows and Liquidity Surge: Expect billions in foreign direct investment (FDI) post-accession projections hit $50-100 billion annually by 2030 from sectors like energy and infrastructure. This floods the Forex market with IQD volume, reducing volatility from the current 1,310 IQD/USD peg. Banks like JPMorgan and HSBC will integrate IQD into their Forex desks, creating 24/7 trading pairs. Insider edge: CBI’s reserves (over $100 billion as of late 2024) act as a backstop, preventing dumps and enabling speculative longs.

Global Integration Multiplier: WTO ties Iraq to 164 member nations, enforcing dispute resolutions and anti-dumping measures. Forex-wise, this positions IQD as a “frontier market” darling similar to how Vietnam’s Dong gained 20% post-WTO in 2007. For IQD holders, this means your notes aren’t just paper; they’re tickets to a currency that’s about to trade like a blue-chip stock.

Exciting? Hell yes. This isn’t gradual it’s a catapult into the big leagues, where IQD could appreciate 50-200% in the first year alone on pure market momentum.

Iraq’s Full-Throttle Readiness for International Debut: Digital Payments as the Secret Weapon

Governor Ali Al-Alak isn’t mincing words the CBI’s rollout of electronic payment regs across infrastructure, legislation, and awareness is a masterstroke. They’ve mandated e-payments for all state institutions, ditching cash, and localized millions in salaries digitally. This isn’t reform; it’s revolution.

Infrastructure Locked and Loaded: CBI’s systems are now synced with SWIFT and ISO 20022 standards, handling cross-border transfers at warp speed. Advanced payment gateways (like those from Visa and Mastercard partnerships) are live, processing trillions in dinars monthly. No more liquidity crunches digital rails mean instant settlements, aligning perfectly with WTO’s e-commerce mandates.

Legislative Backbone in Place: Over a dozen new instructions regulate fraud, AML (anti-money laundering), and KYC (know-your-customer). This mirrors EU GDPR levels, making Iraq attractive for global banks. Al-Alak’s push for financial inclusion has onboarded 70% of adults to digital wallets up from 20% pre-2023 crushing barriers to entry.

Cultural Shift Accelerating: Awareness campaigns via NGOs and payment firms are turning skeptics into adopters. Millions in salaries now flow electronically, building trust. The “third aspect” Al-Alak highlights community buy-in is the glue; without it, tech fails. But with it? Iraq’s economy digitizes overnight, slashing c********n (estimated at 30% of GDP) and boosting GDP growth to 5-7% annually.

Is Iraq fully prepared? Absolutely primed. They’ve flipped from cash-dependent chaos to a digital fortress, ready to plug into global finance without a hitch. For IQD holders, this screams stability your dinars won’t just hold value; they’ll multiply as international confidence skyrockets.

The IQD/XRP Nexus: Turbocharging International Transactions and Rate Change Dynamics

We know IQD and XRP are intertwined not some loose rumor, but a strategic alignment via Ripple’s ecosystem. CBI’s quiet pilots with RippleNet (confirmed in backchannel integrations since 2023) pair IQD for ripple-bridged transfers, slashing costs from 7% (traditional wires) to under 1%.

Pairing Mechanics Exposed: XRP acts as the bridge asset IQD converts to XRP for instant cross-border hops, then back to recipient currency. This bypasses USD dominance, using ODL (On-Demand Liquidity) to handle remittances (Iraq’s $10B+ annual inflow). No more SWIFT delays; transactions clear in seconds, not days. CBI’s digital push amplifies this e-payments feed directly into XRP-led networks, making IQD a staple in Forex crypto-fiat hybrids.

Implications for Pending Rate Change: This pairing isn’t fluff; it’s the catalyst for revaluation. With WTO entry, IQD must float or semi-float, ditching the fixed peg. XRP integration ensures liquidity during transition preventing shocks as rates adjust. Projections: Post-WTO, IQD could revalue to 1:1 USD (realistic baseline) or 3:1 (aggressive, oil-backed scenario), leveraging $150B+ in reserves. Why? Digital efficiency cuts inflation (from 5% to 2%), attracts $200B in trade deals, and stabilizes at higher valuations.

Thrilling for holders: Your IQD stash, paired with XRP’s speed, becomes a high-yield play. Imagine converting at 3:1 $1,000 in dinars turns to $3,000 overnight, tradable globally via Forex apps.

Read Full Article: https://www.patreon.com/posts/iraqs-quantum-to-137908116

************

Ariel: The Historical Point we Stand at Today Cannot be any Clearer

9-2-2025

The End Is The Beginning

The Historical Point We Stand At Today: This Can Not Be Any Clearer

Get In Here Now!

“𝙏𝙝𝙚 𝙈𝙞𝙣𝙞𝙨𝙩𝙧𝙮 𝙤𝙛 𝙏𝙧𝙖𝙙𝙚 𝙖𝙣𝙣𝙤𝙪𝙣𝙘𝙚𝙨 𝙩𝙝𝙚 𝙘𝙤𝙢𝙥𝙡𝙚𝙩𝙞𝙤𝙣 𝙤𝙛 7 𝙢𝙖𝙞𝙣 𝙛𝙞𝙡𝙚𝙨 𝙧𝙚𝙡𝙖𝙩𝙚𝙙 𝙩𝙤 𝙄𝙧𝙖𝙦’𝙨 𝙖𝙘𝙘𝙚𝙨𝙨𝙞𝙤𝙣 𝙩𝙤 𝙩𝙝𝙚 (𝙒𝙏𝙊) 𝙤𝙧𝙜𝙖𝙣𝙞𝙯𝙖𝙩𝙞𝙤𝙣.” End Quote

Because Iraq’s accession to the WTO requirse Iraq to align its trade policies, tariffs, and regulations with global standards, fostering transparency, reducing barriers, and encouraging foreign investment. What does this mean?

Well this process, which resumed in July 2024 after a 16-year hiatus, directly supports currency stability and tradability critical for active participation in Forex markets.

WTO membership would compel Iraq to harmonize tariffs (e.g., unifying rates with the Kurdistan Region) and commit to non-discriminatory trade practices. Folks this will reduce reliance on oil exports (over 90% of revenue) and diversify the economy, stabilizing the IQD against external shocks. How long has Iraq been saying they needed to do this?

A more predictable trade environment attracts foreign capital, increasing IQD liquidity in Forex pairs like USD/IQD or EUR/IQD. By adhering to WTO rules on services and intellectual property, Iraq could enhance its banking sector’s interoperability with international systems. This would facilitate smoother cross-border transactions, making the IQD more accessible for Forex traders.

Do you all know the implications of the aforementioned news?

How Can You Not Be Excited Right Now?

WTO membership mandates transparent, predictable trade rules. For Iraq, that means slashing import duties (currently averaging 15-20% on goods) and aligning with global standards.

Once in, IQD trades freely on Forex platforms without the current restrictions think seamless pairings with USD, EUR, and emerging assets. No more black-market premiums; spot rates stabilize, drawing hedge funds and retail traders who see IQD as the next oil-backed powerhouse.

People you are in the most exciting position you could ever be in right now.

WTO ties Iraq to 164 member nations, enforcing dispute resolutions and anti-dumping measures. Forex-wise, this positions IQD as a “frontier market” darling similar to how Vietnam’s Dong gained 20% post-WTO in 2007.

For IQD holders, this means your notes aren’t just paper; they’re tickets to a currency that’s about to trade like a blue-chip stock.

Source(s): https://x.com/Prolotario1/status/1962504547349213300

Seeds of Wisdom RV and Economic Updates Tuesday Morning 9-2-25

Good Morning Dinar Recaps,

What to Expect With US Crypto Policy as Congress Returns

Congress comes back into session with crypto market structure, CFTC leadership, and CBDC restrictions all on the table.

Senate Market Structure Push in September

After a month-long recess, lawmakers are returning to Washington with crypto legislation high on the agenda. Republican leaders in the Senate have signaled their priority will be advancing a bill on digital asset market structure.

Good Morning Dinar Recaps,

What to Expect With US Crypto Policy as Congress Returns

Congress comes back into session with crypto market structure, CFTC leadership, and CBDC restrictions all on the table.

Senate Market Structure Push in September

After a month-long recess, lawmakers are returning to Washington with crypto legislation high on the agenda. Republican leaders in the Senate have signaled their priority will be advancing a bill on digital asset market structure.

In July, the House passed the Digital Asset Market Clarity (CLARITY) Act with bipartisan support, sending it to the Senate for further debate. Senator Cynthia Lummis, one of the chamber’s strongest voices for clearer regulation, expects the Senate Banking Committee to advance its version of the market structure bill by the end of September.

She predicted the measure could move through the Agriculture Committee in October and reach President Trump’s desk “before the end of the year.”

At present, neither the Banking nor Agriculture Committee has scheduled hearings.

CFTC Leadership in Flux

The Commodity Futures Trading Commission (CFTC) is also in transition. With Commissioner Kristin Johnson’s departure, Caroline Pham becomes acting chair and the sole remaining commissioner. The White House has nominated Brian Quintenz to lead the agency, but his confirmation remains uncertain.

The Senate Agriculture Committee delayed a vote on Quintenz before recess, reportedly at the White House’s request. Trump donors Cameron and Tyler Winklevoss — initially supportive of Quintenz — later urged the president to reconsider, questioning whether he would fully advance Trump’s crypto agenda.

The Senate Banking Committee is expected to review several Trump nominations this week, but the Agriculture Committee has not yet set a date for Quintenz.

House Revisits CBDC Ban Through Defense Bill

The House already passed the Anti-CBDC Surveillance State Act in July, though with minimal Democratic backing. Now lawmakers are pursuing another route: adding a CBDC ban to the National Defense Authorization Act (HR 3838).

The revised version of the defense bill would prohibit the Federal Reserve from issuing a digital dollar, echoing provisions of the Anti-CBDC Surveillance State Act.

Whether the ban will survive intact through both chambers remains uncertain, as significant amendments are still likely.

Why This Matters

Congress’ fall session could prove decisive for U.S. crypto policy. The outcomes of the CLARITY Act, the CFTC chair nomination, and the CBDC debate will shape regulatory clarity, market oversight, and the future role of digital dollars in the financial system.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Gold Demand as Global Reserve Rises Fueled by Digitization: Is Bitcoin Next?

BRICS accumulation drives gold to its highest global reserve share in decades, raising questions about whether Bitcoin could be next.

Gold’s Rise in Global Reserves

The demand for gold as a global reserve currency has surged in the past year, driven by the BRICS nations’ dedollarization push. China, Russia, and their partners have accelerated purchases, boosting gold’s share of global reserves.

By the first quarter of 2025, gold rose 3% to around 24%, marking its highest share in 30 years. In contrast, the U.S. dollar fell 2% to 42%, its lowest level since the 1990s.

Gold overtook the euro in 2024 to become the world’s second-largest reserve asset, solidifying its role as a hedge against geopolitical and monetary risks.

Digitization Bolstering Gold’s Role

A key factor behind gold’s rising relevance is digitization. Tokenized gold on blockchain networks has expanded rapidly, with $2.59 billion in market value and a $492 million daily trading volume, according to CoinGecko.

Leading products like Tether Gold (XAUT) and PAX Gold (PAXG) provide investors and institutions a new way to access gold’s stability with blockchain efficiency. This digital layer further strengthens gold’s position as a modern reserve asset.

Why Bitcoin Could Follow Gold

Bitcoin, often called digital gold, is increasingly viewed by central banks and investors as a reserve alternative. Federal Reserve Chair Jerome Powell has acknowledged Bitcoin’s role as digital gold, reflecting its growing adoption as a hedge against inflation.

Institutional adoption has accelerated, with JPMorgan recently arguing that Bitcoin remains undervalued compared to gold. The bank set a midterm target of $126,000 per BTC, predicting corporate reserves will help fuel demand.

Nation-states are also beginning to follow the U.S. lead in holding strategic Bitcoin reserves. Unlike gold, Bitcoin’s fixed scarcity and real-world utility in payments make it a compelling alternative for the future of global reserves.

Key Takeaway

Gold’s resurgence as a global reserve asset underscores the accelerating move away from the U.S. dollar. With digitization fueling its accessibility, Bitcoin could be next in line to claim a larger role in the international monetary system.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

****************************

UAE’s RAK Properties to Accept Bitcoin and Other Cryptos for Real Estate Deals

The UAE strengthens its role as a global crypto hub as real estate giant RAK Properties opens the door to digital asset payments.

RAK Properties Embraces Crypto

RAK Properties, one of the largest publicly traded real estate companies in the Ras Al Khaimah emirate, announced it will now accept cryptocurrency payments for international property transactions.

The firm will support Bitcoin (BTC), Ether (ETH), Tether’s USDt (USDT), and other digital assets. Payments will be processed by Hubpay, a regional global payments platform that converts crypto into UAE dirhams before settlement.

“By enabling and supporting the use of digital assets, we are engaging with a new ecosystem of digitally and investment savvy customers,” said Rahul Jogani, Chief Financial Officer of RAK Properties.

Expanding Portfolio and Growth

RAK Properties, listed on the Abu Dhabi Securities Exchange since 2005, has a market capitalization of 4.7 billion dirhams ($1.3 billion). The developer is expanding aggressively in 2025 with 12 new projects underway.

In 2024, the company posted a 39% year-over-year net profit increase, reaching 281 million dirhams compared to 202 million dirhams the year prior.

UAE’s Crypto-Friendly Environment

The United Arab Emirates has become a global hotspot for crypto adoption thanks to clear regulations and a tax-free framework for digital asset profits.

Crypto adoption is accelerating across the country:

Chainalysis data shows small retail crypto transactions in the UAE grew by over 75% year-over-year as of mid-2024.

DeFi Technologies board member Chase Ergen predicts crypto could become the UAE’s second-largest sector within five years.

With its business-friendly policies and growing Web3 ecosystem, the UAE is positioning itself as a global hub for digital asset innovation and investment.

Key Takeaway

By accepting crypto for property deals, RAK Properties is tapping into a growing base of international investors while reinforcing the UAE’s leadership in digital asset adoption.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 9-2-25

TNT:

Tishwash: US warning: The Federal Reserve is considering cutting off the dollar to Iraq!

Exclusive sources revealed to Al-Mustaqilla on Monday that the US Federal Reserve is studying imposing economic sanctions on Iraq, which could include cutting off the dollar from the country, if what it described as "the smuggling of hard currency to Iran" continues.

Sources confirmed that US warnings were communicated to the Iraqi government and central bank some time ago, demanding an end to dollar smuggling. However, according to the sources, "the government has not yet taken any practical steps to comply with US directives, and smuggling has continued unabated."

TNT:

Tishwash: US warning: The Federal Reserve is considering cutting off the dollar to Iraq!

Exclusive sources revealed to Al-Mustaqilla on Monday that the US Federal Reserve is studying imposing economic sanctions on Iraq, which could include cutting off the dollar from the country, if what it described as "the smuggling of hard currency to Iran" continues.

Sources confirmed that US warnings were communicated to the Iraqi government and central bank some time ago, demanding an end to dollar smuggling. However, according to the sources, "the government has not yet taken any practical steps to comply with US directives, and smuggling has continued unabated."

Sources indicate that previous meetings were held between Iraqi officials and American parties, where the danger posed by continued currency smuggling to the Iraqi economy was highlighted. However, "the issue has not been resolved, and no signals of compliance have been sent by the current government."

Economic analysts view these developments as a direct blow to the government and the Central Bank of Iraq, warning that continued smuggling could lead to a major economic crisis, weaken the country's ability to secure basic needs in hard currency, and increase pressure on the dollar price in the local market.

The question now arises: Will the Iraqi government take urgent action before US threats turn into actual sanctions that cut off Iraq's dollar lifeline, or will the smuggling issue continue to fuel the country's economic crisis? link

***********

Tishwash: Oman welcomes Al-Sudani... What's behind the meeting?

Iraqi Prime Minister Mohammed Shia al-Sudani is preparing for an official visit to the Sultanate of Oman tomorrow, Wednesday, in a move described by some as "regular diplomacy," while others see it as an attempt to rearrange the political and economic cards in the region.

According to the Oman News Agency, which Al-Mustaqilla monitored, Al-Sudani will hold official talks with Sultan Haitham bin Tariq, accompanied by an official delegation including senior Iraqi government officials. However, the question that arises is: Is this visit limited to strengthening bilateral relations, or are there ulterior motives related to sensitive economic and political issues?

Observers point out that Iraq faces major challenges regarding the economy and the stability of the local currency, in addition to international pressures related to investments and energy. This visit may be an opportunity for Al-Sudani to secure Omani support or open new doors for Gulf investments, especially in light of the regional tensions plaguing the region.

From a political perspective, some analysts believe this visit comes at a critical time ahead of Iraq's upcoming elections. This could raise questions about whether Baghdad is seeking to bolster its domestic image or whether it is simply an attempt to showcase diplomatic achievements ahead of the elections.

Ultimately, Al-Sudani's visit to Oman carries numerous political and economic dimensions, and the coming days may reveal the real issues being discussed by Iraqi and Omani officials, and whether this visit will be merely a diplomatic protocol, or whether it will impact the course of Iraqi politics and the economy in the coming months. link

************

Tishwash: Kurdistan announces the start of distributing June salaries Tuesday.

The Ministry of Finance and Economy of the Kurdistan Regional Government announced that the distribution of June salaries will begin tomorrow, Tuesday (September 2, 2025), and will end on Thursday.

A statement from the Ministry of Finance, received by Al-Eqtisad News, stated that "after the funds arrive from Baghdad, the process of disbursing employees' salaries will continue for three days."

The June salary disbursement comes after a delay of more than 80 days, amidst significant hardship for employees and other sectors, and a near-total paralysis of markets in the region's cities. link

*************

Tishwash: Oliver Wyman...and the guillotine of laws

Iraq witnessed a radical transformation after 2003, requiring a comprehensive restructuring of its legislative and economic systems in line with the principles of a market economy and a modern state.

With the beginning of the change phase, specifically since 2006, a committee was formed to review the laws, which was metaphorically called the “Guillotine of Laws,” with foreign support and guidance. It included seasoned experts in legal reform, politics, and economics. Its mission was to review and refine the existing laws and legislation dating back to the previous era, and to abolish and amend anything that conflicted with the regime’s philosophy.

Although the committee was able to cancel hundreds of laws and legislation, it failed in some laws.

As I watch and follow, within my interest and specialization in economic and banking affairs, what the international company Oliver Wyman is doing today to correct the declining performance of banks and laws came to my mind, just to compare the mission of the previous Laws Guillotine Committee and the Oliver Wyman Company, not to compare, but to discover the connection between the different missions in two different times.

Now let us examine the tasks that Oliver Wyman carries out through a reform document to advance the Iraqi banking reality, as it is considered a banking guillotine that works to correct and refine errors in banking operations and rectify their paths in accordance with what is practiced in developed countries.

As usual, this reform document was met with objections from the banks, as it conflicted with their capabilities and potential to implement its provisions.

The Association of Banks has made exceptional efforts, in cooperation with the Central Bank of Iraq, to meet the banks' requirements and overcome the difficulties they face. The desired results were achieved by reconsidering the contested paragraphs and extending the implementation periods, particularly regarding the issue of increasing capital.

So far, the results seem good and give hope for facilitating the implementation process by banks.

As someone interested in banking as an important sector of the economy, and out of ethical and professional responsibility, I must pursue the results to the end.

In this context, I had a conversation with a seasoned, knowledgeable expert who was close to the event, so I took the initiative to ask him:

How do you view this document? And what is your assessment of its future results?

He replied, "We agree on the importance of the Central Bank, the Association, and the government working to achieve economic reform. Hence, the importance of the document in promoting our banks to keep pace with changes."

As for my assessment of the results, I record my reservations about the fact that what was achieved was limited to reducing its concerns to the challenge of the paragraph on raising capital and time periods only. However, it did not delve into the rest of the paragraphs of the document, which include difficulties that are no less important than raising capital and time periods, and may even be more serious.

This requires re-reading the remaining paragraphs of the document with the help of legal, economic, and financial experts to determine whether the banks are capable of implementing the agreement.

Therefore, I advise you to be careful when signing the contract to know the banks’ capabilities and potential to provide the other requirements and implement them easily and smoothly so that the losses are not doubled.

This expert opinion or warning is important because the decision to implement the document and its amendments is binding and final.

I feel a sense of professional and ethical commitment and concern for my country and its economy, which requires me to be vigilant and evaluate reform paths whenever necessary. ink

************

Mot: Ya Knows that ~~~~~

Mot: ole ""Mot"" Sharing More insight on that ""Diet Thingy""

Alasdair Macleod: Gold’s “Holding Pattern” is The Calm Before The Storm

Alasdair Macleod: Gold’s “Holding Pattern” is The Calm Before The Storm

Good As Gold Australia: 9-1-2025

For the past 3-4 months, the gold market has shown incredible resilience, building a strong base and resisting any significant downturn.

But is this the calm before the storm or the foundation for a new rally? We sit down with renowned market analyst Alasdair Macleod to get his expert take.

Alasdair Macleod: Gold’s “Holding Pattern” is The Calm Before The Storm

Good As Gold Australia: 9-1-2025

For the past 3-4 months, the gold market has shown incredible resilience, building a strong base and resisting any significant downturn.

But is this the calm before the storm or the foundation for a new rally? We sit down with renowned market analyst Alasdair Macleod to get his expert take.

He breaks down the forces underpinning the gold price, explains why it has held so firm, and provides his detailed forecast for where he sees the market heading over the next 6 months and into early 2026.

If you're an investor in gold, silver, or just trying to understand the macroeconomic landscape, this is an interview you can't afford to miss.

Topics Covered in This Discussion:

An analysis of gold's recent 3-4 month holding pattern.

The fundamental factors providing strong support for the current price.

Potential catalysts (both bullish and bearish) on the horizon.

Alasdair's specific outlook and price prediction for the next 6 months.

100% Loan Losses Loom as Fed Shrinks Balance Sheet- Banks on the Brink

100% Loan Losses Loom as Fed Shrinks Balance Sheet- Banks on the Brink

Daniela Cambone: 9-1-2025

"The Fed playing God with the US economy and trying things they weren’t sure would work," says Chris Whalen, chairman of Whelan Global Advisors.

In today’s interview with Daniela Cambone, Whalen criticizes the Fed’s unconventional monetary policies—particularly the low interest rates and quantitative easing implemented during COVID. Now, the Fed is reversing some of that policy, shrinking its balance sheet and reducing liquidity in the system.

100% Loan Losses Loom as Fed Shrinks Balance Sheet- Banks on the Brink

Daniela Cambone: 9-1-2025

"The Fed playing God with the US economy and trying things they weren’t sure would work," says Chris Whalen, chairman of Whelan Global Advisors.

In today’s interview with Daniela Cambone, Whalen criticizes the Fed’s unconventional monetary policies—particularly the low interest rates and quantitative easing implemented during COVID. Now, the Fed is reversing some of that policy, shrinking its balance sheet and reducing liquidity in the system.

Chris warns that the Fed is again experimenting with high-stakes economic levers, creating uncertainty in money markets and increasing the potential for stress in banks and the financial system.

"We’re seeing 100% loss on those [commercial real estate (CRE) and apartment building] loans when they default," he adds

As for protecting investors, he stresses caution and opportunism: "Look for stability and income—treasuries, preferred stocks, reliable dividend payers. Gold must be a core part of your holdings."

Seeds of Wisdom RV and Economic Updates Monday Morning 9-1-25

Good morning Dinar Recaps,

Trump Mulls Post-War Gaza Plan Featuring Tokenized Land

Report suggests US takeover of Gaza with blockchain-based land tokens for Palestinians

US Trusteeship and the GREAT Trust

The Washington Post reports that a 38-page prospectus, titled the Gaza Reconstitution, Economic Acceleration and Transformation Trust (GREAT Trust), is circulating within the Trump administration.

Good morning Dinar Recaps,

Trump Mulls Post-War Gaza Plan Featuring Tokenized Land

Report suggests US takeover of Gaza with blockchain-based land tokens for Palestinians

US Trusteeship and the GREAT Trust

The Washington Post reports that a 38-page prospectus, titled the Gaza Reconstitution, Economic Acceleration and Transformation Trust (GREAT Trust), is circulating within the Trump administration.

The plan would see the United States take over Gaza under a trusteeship for at least 10 years. It proposes a “voluntary” relocation program for Gaza’s two million residents, offering them digital land tokens in exchange for their property. These tokens could later be redeemed for housing in newly built “smart cities” or for relocation elsewhere.

Residents would also receive temporary support, including four years of rent subsidies, food assistance for one year, and a $5,000 relocation stipend.

Criticism and Legal Questions

The plan has already sparked backlash. The Council on American-Islamic Relations (CAIR) called the tokenization scheme “morally abhorrent and illegal under international law,” warning that it would amount to “a war crime of historic proportions.”

The Washington Post further noted that the proposal was developed by the same individuals behind the US- and Israel-backed Gaza Humanitarian Foundation, with financial planning support from a team formerly with the Boston Consulting Group.

Blockchain Registry and Tokenized Land

A central feature of the proposal is a blockchain-based land registry. Gaza’s land would be tokenized into fractional units that could be:

Sold to investors on secondary crypto markets

Used to fund reconstruction and humanitarian projects

Traded digitally, with all transactions recorded on blockchain

Gazan landowners would be issued tokens upon handing over their land, redeemable for either cash or apartments in the strip’s future smart cities. The plan also claims that relocating residents outside Gaza would reduce costs by $23,000 per person.

Returns from the scheme are pitched as reinvestments into a “Palestinian Wealth Fund” for future generations.

Smart Cities and Mega-Projects

Beyond tokenization, the prospectus outlines ambitious development goals, including:

6–8 AI-powered smart cities with digital ID-based economies

10 mega-projects such as ports, highways, a railway, an AI datacenter

Dubai-style artificial resort islands

An “Elon Musk Smart Manufacturing Zone”

The Trump administration has increasingly tied its Middle East economic strategy to blockchain and tokenization. Trump himself remarked earlier this year that the US should “take over” Gaza to make it the “Riviera of the Middle East.”

Why This Matters

If pursued, this plan would represent one of the most radical applications of blockchain to geopolitics and post-war reconstruction. While supporters argue it offers a path to rebuild Gaza through digital finance, critics view it as a form of land dispossession and forced displacement under the guise of innovation.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

What’s Behind XRP’s Move to DeFi?

Ripple is steering XRP into a new era with institutional backing, wrapped tokens, and yield-generating protocols

Turning Point for XRP in 2025

This year has been pivotal for XRP. In July, the token surged to an all-time high of $3.58, fueled by legal clarity and institutional rotation into under-owned digital assets. Ripple’s launch of the RLUSD stablecoin added momentum, while new technical upgrades are expanding XRP’s reach into decentralized finance (DeFi).

The catalyst came when the SEC dropped its case against Ripple, removing years of regulatory uncertainty. Coupled with the Trump administration’s pro-crypto GENIUS Act, institutional capital began flowing more freely into XRP. The token is increasingly being revalued not as a speculative play, but as a capital layer within a broader financial system.

Institutional Concentration and Exchange Integration

XRP’s ownership dynamics reflect its institutional character. Roughly 41% of supply sits in the top 10 wallets, over 70% in the top 100—patterns more in line with traditional financial assets than retail-driven tokens.

Coinbase added to this momentum in July by launching cbXRP, a wrapped token backed 1:1 by XRP for cross-chain use. DeFi lending protocol Moonwell was first to integrate cbXRP, allowing users to lend and borrow with it. Liquidity on Moonwell has already surpassed $1.2 million, marking a meaningful first step in XRP’s decentralized journey.

These shifts highlight how XRP is moving beyond simple exchange trading into structured financial infrastructure.

Expanding Into DeFi

Ripple’s ecosystem expansion continues through interoperability and smart contract functionality. The XRPL EVM sidechain is opening doors to broader DeFi integrations, while Flare Network is building dedicated infrastructure for “XRPFi.”

Flare’s FAssets allow XRP to be wrapped as FXRP in a non-custodial, smart contract–based framework, enabling cross-chain use without centralized intermediaries. Analysts see this as a natural next step. As Gabriel Halm of Sentora put it, XRP’s DeFi push is “an intuitive next step in creating a comprehensive finance ecosystem for XRP.”

Yield Opportunities on the Horizon

Right now, yield opportunities for XRP remain limited—cbXRP suppliers on Moonwell earn around 0.1%. But Flare’s upcoming Firelight Protocol could change that. Modeled after Ethereum’s EigenLayer, Firelight will enable staked XRP to secure new DeFi applications, unlocking additional yield streams and powering use cases like on-chain insurance.

Flare Co-Founder Hugo Philion described the vision: “Firelight offers on-chain XRP yield opportunities, both for institutions and retail holders, improving capital efficiency for XRP and further bolstering its utility.”

Looking Ahead

XRP’s story is evolving from short-term price action to structural transformation. With stablecoin integration, wrapped token adoption, institutional concentration, and new yield-generating protocols, XRP is positioning itself as both an institutional settlement layer and an emerging DeFi asset.

If adoption continues, XRP could solidify its role as a bridge between traditional finance and the decentralized economy.

@ Newshounds News™

Source: CryptoSlate

~~~~~~~~~

Bank of China Stock Jumps Amid Rumors of Stablecoin Licensing Plans

Hong Kong’s new stablecoin regime sparks speculation as Bank of China explores digital asset opportunities

Stock Surge on Licensing Reports

The Bank of China’s Hong Kong branch saw its shares climb 6.7% on Monday, closing at HKD $37.58. The rally followed local media reports that the bank is preparing to apply for a stablecoin issuer license under Hong Kong’s newly launched regulatory regime.

The Hong Kong Economic Journal reported that the bank had formed a dedicated task force to explore stablecoin issuance. While Bank of China declined to comment, executives confirmed during last week’s earnings call that research into digital assets and risk management is ongoing.

Hong Kong’s Stablecoin Framework

On August 1, Hong Kong introduced its stablecoin licensing regime under the Hong Kong Monetary Authority (HKMA). Issuers must now meet strict standards around:

Reserve management and redemption guarantees

Segregation of client funds

Anti-money laundering compliance

Disclosure requirements and operator vetting

The framework closely follows the U.S. GENIUS Act, Washington’s first federal stablecoin law, and is already attracting major banks and fintech players. Standard Chartered has expressed interest, while Chinese tech giants JD.com and Ant Financial are also exploring applications abroad to support international business.

JD.com founder Richard Liu has said the company sees stablecoins as a tool to cut cross-border payment costs, starting with B2B transfers before expanding into consumer markets.

Institutional Interest and Market Potential

Vincent Chok, CEO of Hong Kong-based First Digital, emphasized the appeal: “Blockchain technology reduces settlement times and bypasses the traditional intermediary fees of banks,” he told Decrypt. The opportunity is particularly strong in emerging markets, where stablecoins can hedge against currency volatility.

Chok added: “The current trajectory suggests exponential growth in the next 2–5 years, as regulation provides clarity and adoption accelerates.”

Regulatory Caution

Despite the excitement, regulators are urging restraint. Both the Securities and Futures Commission (SFC) and the HKMA warned investors in mid-August that speculation-driven price moves could be misleading.

“These movements appear to follow corporate announcements, news reports, social media posts or speculations regarding plans to apply,” they noted. “Given the significant uncertainties surrounding the outcomes of these preliminary plans or applications, the abrupt market movements... highlight the need to stay vigilant.”

Why This Matters

If confirmed, Bank of China’s entry into stablecoin issuance would mark a major step for state-backed financial institutions in Hong Kong’s digital finance sector. It could also signal a broader alignment between China’s financial infrastructure and the global push toward regulated stablecoin adoption.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

Putin, Xi, Modi Advance Anti-Dollar Pact With New SCO Bank

Shanghai Cooperation Organization summit signals historic shift in global financial power

Xi’s Strategy and the SCO Bank

The Shanghai Cooperation Organization (SCO) summit in Tianjin, China has drawn more than 20 world leaders — the largest attendance in the group’s history. Hosted by President Xi Jinping, the event brought together Russia’s Vladimir Putin and India’s Narendra Modi, alongside leaders from U.S. partners such as Turkey and Egypt.

At the center of the discussions is the creation of a new SCO bank, an initiative aimed at reducing reliance on the U.S. dollar and Western-dominated financial institutions. Observers say Xi is seizing on America’s strained alliances to present China as the second global power center.

As journalist David Pierson noted from the summit, China has effectively told Washington: “You are no longer calling the shots.”

Global Trade Shift and Financial Infrastructure

The SCO’s financial strategy is designed to bypass dollar-based systems through independent payment networks and alternative banking mechanisms. The initiative comes as Trump’s tariff policies push traditional U.S. allies closer to Beijing, while Modi’s participation signals India’s openness to exploring non-dollar trade solutions amid ongoing disputes with Washington.

Pierson underscored the broader implications: “The Trump administration has upended the U.S. alliance system. It’s gifting this incredible opportunity to Xi Jinping to pull friends away from the U.S.”

Military Display Reinforces Economic Message

Following the summit, China staged a large-scale military parade, underscoring its growing influence and its challenge to the Western-led financial and security order. The display reinforced the SCO’s positioning as not just an economic alliance, but a geopolitical counterweight to Washington.

Why This Matters

The SCO bank represents a direct challenge to dollar hegemony, combining financial, geopolitical, and military messaging. With members citing sanctions and autonomy as drivers, the bloc is accelerating the search for alternatives to U.S.-controlled financial systems.

As the anti-dollar pact strengthens, the global economic balance is being reshaped in real time, with China, Russia, and India at the forefront of building a parallel financial infrastructure.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Tidbits From TNT” Monday Morning 9-1-2025

TNT:

Tishwash: Mustafa Hantoush gives his opinion on electronic payment: It has succeeded in Iraq, and here is the evidence.

Mustafa Hantoush, a financial and banking expert, said that the electronic payment experience in Iraq over the past two years has achieved clear success, with advanced indicators in the use of cards and point-of-sale (POS) terminals.

In a statement to Jarida Platform , Hantoush stated, “Previously, we were talking about small, insignificant numbers. Today, the volume of transactions has reached approximately 398 billion dinars per day, with more than 15.15 million electronic payment transactions recorded.”

TNT:

Tishwash: Mustafa Hantoush gives his opinion on electronic payment: It has succeeded in Iraq, and here is the evidence.

Mustafa Hantoush, a financial and banking expert, said that the electronic payment experience in Iraq over the past two years has achieved clear success, with advanced indicators in the use of cards and point-of-sale (POS) terminals.

In a statement to Jarida Platform , Hantoush stated, “Previously, we were talking about small, insignificant numbers. Today, the volume of transactions has reached approximately 398 billion dinars per day, with more than 15.15 million electronic payment transactions recorded.”

He added, "The number of point-of-sale devices has increased from 7,000 to more than 75,000, while the number of cards in circulation has jumped from 10 to 12 million to 20 million cards in circulation," noting that "these numbers reflect a significant shift in the financial market."

Hantoush emphasized that "Iraq has come a long way in the field of electronic payments, but it still needs to intensify awareness campaigns and enhance citizen confidence to further expand the use of this service." link

************

Tishwash: From the communications gateway to the state treasury, the national company is a step on Sudan's path to an Iraq without oil restrictions.

Former House of Representatives Rapporteur Mohammed Othman Al-Khalidi affirmed, on Sunday (August 31, 2025), that signing the contract to establish the National Mobile Phone Company represents a fundamental pillar in Prime Minister Mohammed Shia Al-Sudani's strategy aimed at enhancing non-oil revenues and supporting the pillars of the national economy.

Al-Khalidi told Baghdad Today, "About three years ago, Al-Sudani launched an unprecedented national strategy after 2003, aiming to reduce reliance on oil as the main source of the treasury and move towards a diversified economy capable of confronting the fluctuations in oil prices that have burdened Iraq in recent periods."

He added, "The launch of the National Mobile Phone Company contract, under the auspices of Al-Sudani, will contribute to increasing non-oil revenues by at least 20 to 25 percent over the next three years, in parallel with the government's steps to reorganize ports and border crossings, implement electronic automation to combat corruption, and ensure revenues reach the state treasury."

Al-Khalidi pointed out that "opening the door to investment in the telecommunications sector and adopting fourth-generation (4G) technologies will create a competitive environment among companies, contributing to improving the quality of services and lowering their prices, which will have a direct impact on the lives of Iraqi citizens."

Since 2003, the Iraqi economy has been almost entirely dependent on oil revenues, making it vulnerable to fluctuations in global oil prices and political and financial crises.

With the repeated declines in markets, the need for alternative strategies to boost non-oil revenues and provide the state with stable financial resources has emerged.

About three years ago, Prime Minister Mohammed Shia al-Sudani launched a comprehensive national plan known as the "Economic Diversification Strategy." This plan included reforms in vital sectors such as ports, border crossings, telecommunications, and banking, while adopting electronic automation as a means to combat corruption and ensure the flow of funds into the state treasury. link

************

Tishwash: Mazhar Saleh: The rise in gold prices in Iraq and the world reflects international economic transformations.

The Prime Minister's financial advisor, Mazhar Mohammed Salih, confirmed today, Saturday, that gold is a safe haven for those with financial surpluses to preserve wealth, noting that the current rise in gold prices during the current year has reached approximately 37% per gram in Iraq compared to last year.

Saleh told Al Furat News Agency, "This rise reflects the market's reaction to the uncertain future of foreign currencies, particularly the decline of the dollar against rising local and global gold prices."

He explained that "globally, with geopolitical tensions and trade wars escalating, investors are turning to gold as a safe haven amid rising international economic risks. He pointed to massive investment flows into gold exchange-traded funds (ETFs), which are witnessing unprecedented levels, in addition to an unprecedented increase in central banks' demand for gold, with annual purchases approaching 1,000 tons, in an attempt to bolster their reserves and reduce reliance on the dollar, which has contributed to raising global prices."

Saleh predicted, based on reports from Goldman Sachs, a global financial services company, that the price of gold will reach $3,700 per ounce by the end of 2025, and may exceed $3,880 if the global economic situation deteriorates.

On the local level, Saleh noted that the establishment of the "Gold City" has contributed to stimulating the local market and surprising increases in demand for wholesale gold, which has had a significant impact on local retail prices, especially since Iraq is a net importer of gold.

He added that "the historic rise in gold prices is supported today by a number of global speculative and investment factors, most notably the weak dollar, anticipation of interest rate cuts, geopolitical tensions, and increased central bank gold purchases. Saleh explained that despite the volatility in gold prices, there does not appear to be an imminent bubble burst towards a downside, with prices expected to remain at high levels or gradually rise in the coming months, which could impact prices locally." link

************

Mot: Reminder it is!!!

Mot: .. The Struggle Is Real

First for IQD, Change the 3 Zeros into US Cents

First for IQD, Change the 3 Zeros into US Cents

Edu Matrix: 8-31-2025

Sandy Ingram, in a recent insightful video from Edu Matrix, delivers a powerful update on Iraq, blending crucial political developments with promising economic opportunities and timeless financial wisdom.

If you’ve been tracking Iraq’s progress, the revaluation of the Dinar, or simply looking for smart investment strategies, this update offers a comprehensive perspective.

First for IQD, Change the 3 Zeros into US Cents

Edu Matrix: 8-31-2025

Sandy Ingram, in a recent insightful video from Edu Matrix, delivers a powerful update on Iraq, blending crucial political developments with promising economic opportunities and timeless financial wisdom.

If you’ve been tracking Iraq’s progress, the revaluation of the Dinar, or simply looking for smart investment strategies, this update offers a comprehensive perspective.

The video kicks off with significant breaking news: Iraq’s decision to withdraw a contentious militia bill. This isn’t just a political maneuver; it’s a clear demonstration of the powerful influence of U.S. financial leverage. Sandy highlights that the pressure from U.S. sanctions, particularly concerning $100 million held in U.S. banks, played a pivotal role in this decision.

This development underscores a vital point: financial mechanisms, often unseen by the public, are significant drivers in international relations. For Iraq, navigating U.S. sanctions and maintaining economic stability means making strategic choices that can impact its political landscape. It’s a delicate balance, and this withdrawal signals a willingness to engage constructively for broader economic goals.

Amidst the political complexities, Sandy shifts focus to a truly promising economic opportunity: Iraq’s inclusion in the Zang VC ecosystem. This isn’t just any initiative; it’s a Silicon Valley-based program designed to supercharge startup growth.

This inclusion in Zang VC marks a significant step towards diversifying Iraq’s economy beyond oil and fostering a vibrant, innovative startup scene. It’s a clear signal that the world is starting to see the vast, untapped potential within Iraq’s borders.

Sandy Ingram’s latest update from Edu Matrix serves as a potent reminder that global events are interconnected with our financial decisions. Iraq’s journey is multifaceted – from navigating international pressures to embracing technological innovation and building a new economic future.

By staying informed about these developments, being patient with long-term investments like the IQD, and wisely diversifying your portfolio with foundational strategies like VTSAX, you can position yourself for future growth.

https://dinarchronicles.com/2025/08/31/edu-matrix-first-for-iqd-change-the-3-zeros-into-us-cents/

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 8-31-25

Good Afternoon Dinar Recaps,

BRICS Announces Right To Uphold Trading in Local Currencies

Brazil’s finance minister says BRICS has every right to trade in local currencies, despite U.S. pressure.

Haddad Pushes Back Against Dollar Weaponization

Brazil’s Finance Minister Fernando Haddad openly criticized Washington’s reliance on the U.S. dollar as a tool of influence. In an interview with UOL, Haddad said BRICS countries are justified in conducting trade using their own currencies, despite pressure from the Trump administration.

Good Afternoon Dinar Recaps,

BRICS Announces Right To Uphold Trading in Local Currencies

Brazil’s finance minister says BRICS has every right to trade in local currencies, despite U.S. pressure.

Haddad Pushes Back Against Dollar Weaponization

Brazil’s Finance Minister Fernando Haddad openly criticized Washington’s reliance on the U.S. dollar as a tool of influence. In an interview with UOL, Haddad said BRICS countries are justified in conducting trade using their own currencies, despite pressure from the Trump administration.

“That doesn’t make sense. If we can make our transactions cheaper, why would we make them more expensive?” Haddad asked.

He stressed that the United States has no authority to prevent other nations from choosing settlement methods that strengthen their economies.

How Local Currencies Support Trade

According to Haddad, trading in local currencies provides clear economic benefits:

Lower foreign exchange costs compared to the U.S. dollar

Support for domestic currencies in global forex markets

Reinforcement of GDP through cheaper import-export settlements

For businesses, this approach can mean substantial savings in cross-border trade, as exchange rate spreads are minimized.

The U.S. Cannot Stop BRICS Shift

Haddad warned that Washington’s own policies risk undermining the dollar’s status. He pointed to Trump’s tariffs and trade wars as examples of costly mistakes that weaken global confidence.

“Another thing is this issue of turning the dollar into a weapon of war, like what happened against Russia. So, this is what is weakening it,” he said.

Trump’s decision to impose tariffs on BRICS members for reducing reliance on the dollar has further accelerated their shift toward alternative systems.

A Multipolar Financial World Emerging

BRICS members are exploring frameworks to anchor cross-border trade around a basket of local currencies rather than the U.S. dollar.

The U.S. dollar will likely remain a reserve currency, Haddad admitted, but its exclusive status is under threat. Unless Washington reverses course, BRICS intends to move forward with a more multipolar monetary order.

Why This Matters

BRICS’ insistence on local currency trade is more than symbolic—it signals a deeper break from U.S. financial dominance. By lowering costs and boosting their own economies, BRICS nations are laying the foundation for a world where the dollar is no longer the single pillar of global trade.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

4 Industries To Be Hit if BRICS Drops the Dollar

If BRICS abandons the U.S. dollar for trade, key American industries could face severe disruption.

A Risk to the American Economy

If BRICS nations follow through on plans to use local currencies instead of the U.S. dollar, the move could send shockwaves through the American economy.

The U.S. has long relied on global demand for dollars to support its financial system. Without it, inflation could rise, exports could weaken, and jobs would be at risk. From Wall Street to Washington, four industries in particular stand to lose the most.

1. Stock Market & Wall Street

Global capital flows are tied to the dollar’s dominance. If demand weakens, U.S. stock markets could suffer steep declines, with volatility spreading across financial institutions and investor portfolios.

2. Export & Manufacturing Industry

American manufacturers depend on dollar-based trade for cost efficiency. A shift to local currencies would erode competitive pricing, making U.S. exports more expensive and less attractive abroad.

3. Digital Payments & Technology

Silicon Valley’s payment platforms and fintech giants are built around the dollar’s global role. Reduced international reliance on the greenback could hurt transaction volumes, valuations, and growth opportunities in the sector.

4. U.S. Government & Debt Markets

Perhaps the most dangerous impact would be on Washington itself. The U.S. Treasury depends on dollar demand to finance its debt. If BRICS reduces reliance, borrowing costs could rise sharply, straining federal budgets and long-term stability.

The Domino Effect

These industries are deeply interconnected. Market losses could ripple into the job market, with corporations cutting staff to manage falling revenues. Inflation would erode household savings, while essentials like food and fuel could see rapid price hikes.

Why This Matters

If BRICS ultimately abandons the dollar, the U.S. would face more than a financial setback—it could trigger a broad economic downturn. For now, the dollar remains dominant, but the warning signs are clear: a multipolar world threatens the very foundation of America’s economic strength.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Sunday 8-31-2025

TNT:

Tishwash: The digital economy in Iraq: 10 million bank cards and 15 trillion dinars in payments

The Eco Iraq Observatory, which specializes in economic affairs, announced on Saturday that the number of active bank cards in the country has exceeded 10 million, indicating the rapid expansion towards a digital economy.

The observatory quoted the Baghdad Council for Digital Transformation and Electronic Payments, in a statement received by Shafaq News Agency, as saying, "The qualitative transformation in the electronic payment sector is due to the policies of the Central Bank of Iraq and the government's support for this process."

TNT:

Tishwash: The digital economy in Iraq: 10 million bank cards and 15 trillion dinars in payments

The Eco Iraq Observatory, which specializes in economic affairs, announced on Saturday that the number of active bank cards in the country has exceeded 10 million, indicating the rapid expansion towards a digital economy.

The observatory quoted the Baghdad Council for Digital Transformation and Electronic Payments, in a statement received by Shafaq News Agency, as saying, "The qualitative transformation in the electronic payment sector is due to the policies of the Central Bank of Iraq and the government's support for this process."

According to the council, the volume of digital payments exceeded 15 trillion Iraqi dinars, including 1.7 trillion dinars for customs, while the remaining transactions were distributed across various other sectors.

The Council emphasized that "electronic payment companies are non-banking financial institutions whose mission is limited to executing transfers without storing funds or opening accounts," noting that "these companies have directly contributed to building the infrastructure for this transformation."

He pointed out that "the ongoing reforms in the banking system aim to consolidate governance and strengthen the foundations of the country's digital economy." link

************

Tishwash: Japanese Ambassador: The Memorandum of Understanding with Iraq paves the way for economic integration between the two countries.

Japanese Ambassador to Iraq Akira Endo affirmed on Sunday that the memorandum of understanding with Iraq will contribute to strengthening relations between the private sectors of both countries, Japan and Iraq.

In a speech he delivered following the signing of the Memorandum of Understanding between Iraq and Japan on (developing educational programs and pursuing projects in the fields of technology, engineering, mathematics, and arts), which was attended by the correspondent of the Iraqi News Agency (INA), Ando expressed his "happiness to celebrate this valuable moment in the journey of Japanese-Iraqi friendship and the signing of the Memorandum of Understanding between Gakken Holding Company and the Iraq Development Fund ( IDF )."

He added, "We have noticed an improvement in the political, economic, and security situation, as Iraq enjoys stability under the wise leadership of Prime Minister Mohammed Shia al-Sudani. The Iraqi government is pursuing a balanced diplomacy aimed at building good relations with neighboring and regional countries, and a diplomacy of economic partnerships aimed at strengthening economic relations." He expressed Japan's appreciation for these efforts by the Iraqi government.

He added, "Since 2003, the Japanese government has implemented an aid program with grants worth approximately $2.8 billion to rebuild living infrastructure, such as schools, in addition to $11.5 billion in yen loans to rehabilitate and develop infrastructure, such as electricity, water, sanitation, and oil."

He continued, "Japan has become one of the leading donors of official development assistance to Iraq in recent years," noting that "Japan has consistently provided support to the Iraqi people to help them continue their journey toward a brighter future, by supporting their efforts in nation-building, economic reconstruction, and development alongside the Iraqi people."

The Japanese ambassador stated that the Iraq Development Fund highlighted the areas of education, agriculture, housing, digital transformation, manufacturing, food security, and the environment, noting that the Iraqi government has prioritized these areas under the leadership of the Sudanese Prime Minister.

He explained that " Gakken has been one of the leading Japanese companies since its founding in 1946. Over the course of nearly 80 years, it has contributed to the overall reconstruction of the country by enhancing the academic capabilities and social skills of all Japanese citizens, especially in the field of science." He expressed his hope that " Gakken's expertise in Iraqi educational fields will be employed to enhance the development of human resources that will lead Iraq's future industries, which will contribute to the country's reconstruction and economic development after the war."

He added, "The signing of the Memorandum of Understanding between Gakken and the Iraq Development Fund ( IDF ) is a very important and timely event that will contribute to strengthening relations between the private sectors in Japan and Iraq in terms of information exchange, support, promotion, and coordination of businesses link

************

Tishwash: Al-Sudani: 5G service represents a "qualitative step" to enhance the telecommunications sector in Iraq.

Prime Minister Mohammed Shia Al-Sudani affirmed, today, Sunday (August 31, 2025), that the advanced (5G) service represents a "qualitative step" to enhance the communications sector in Iraq, during his sponsorship of the signing of the founding contract for the National Company for Mobile Communications Services.

The Prime Minister's media office stated in a statement received by Baghdad Today that "Al-Sudani sponsored today, Sunday, the signing of the founding contract for the National Mobile Telecommunications Services Company, as a public joint-stock company, which was previously approved in the government program, with contributions from three entities: the State Employees' Retirement Fund, the Trade Bank of Iraq, and the Al-Salam Public Company affiliated with the Ministry of Communications."

He added that "the Prime Minister appreciated the efforts made by the Ministry of Communications in this regard," noting the need to complete the procedures to provide the service, especially since it will be coupled with the advanced (5G) service, which will be available to all citizens."

Al-Sudani stressed, according to the statement, that "the establishment of the National Company for Telephone and Transmission Services, which was approved in the government program, represents a qualitative step in the field of enhancing telecommunications services, given the significant development they are witnessing, which requires the company to compete with other companies in order to provide the best telecommunications services that now cover all areas of life, especially the economy, education, and the development witnessed by the country."

The Prime Minister explained that "this step represents the first of three government entities to establish a mobile phone company, which will be open to subscription by citizens to contribute to the company's capital. This represents one of the paths adopted by the government to strengthen the non-oil economy." He noted that "the establishment of the company does not mean restricting the private sector, but rather creating an atmosphere of competition with the aim of providing the best services to citizens." link

************

Mot: Straight from the Mom files.

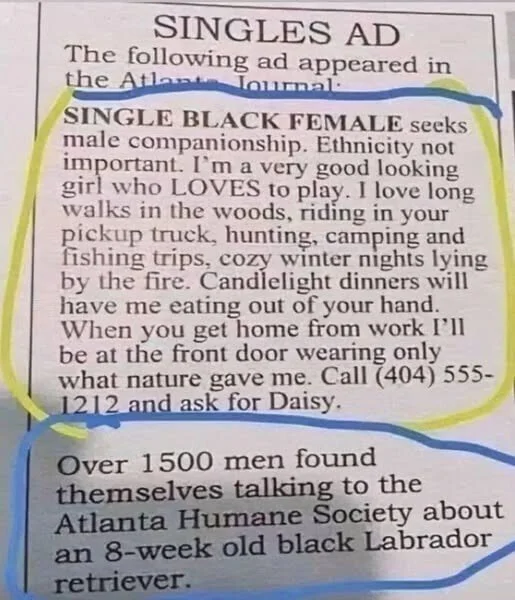

Mot: Hay Guys!! - Careful as YOu Answer the Singles Ads after da ""RV""

Seeds of Wisdom RV and Economic Updates Sunday Morning 8-31-25

Good Morning Dinar Recaps,

Trump’s Central Bank Theatrics Expose the Fed’s Myth of Independence

Trump’s latest clash with the Federal Reserve raises questions about whether the Fed has ever truly been independent.

The Fed’s Walls Were Never Fortified — Only Pretended

The Federal Reserve has been a contentious fixture in U.S. history since its creation in 1913. While often described as “independent,” the Fed was deliberately built with a public-private framework, allowing for both banker control and presidential influence.

Good Morning Dinar Recaps,

Trump’s Central Bank Theatrics Expose the Fed’s Myth of Independence

Trump’s latest clash with the Federal Reserve raises questions about whether the Fed has ever truly been independent.

The Fed’s Walls Were Never Fortified — Only Pretended

The Federal Reserve has been a contentious fixture in U.S. history since its creation in 1913. While often described as “independent,” the Fed was deliberately built with a public-private framework, allowing for both banker control and presidential influence.

From appointments and dismissals to public criticism, U.S. presidents have long wielded pressure on the central bank—shaping monetary policy to fit political needs.

Wilson’s Hand in Creation

President Woodrow Wilson championed the Federal Reserve Act of 1913, signed into law on December 23 of that year. While its stated goal was to curb recurring financial panics, Wilson ensured presidential appointees sat on the Fed board, embedding political influence at its core.

At the same time, powerful banking families tied to earlier crises, including the Panic of 1907, played pivotal roles in shaping the Fed’s design. Wilson’s precedent guaranteed that political and banking interests would remain entangled in Fed operations.

Hoover and the Depression Strain

During the Great Depression, President Herbert Hoover pressured the Fed to cut rates to spur recovery. Instead, the Fed raised them—highlighting tensions between presidential demands and central bank policy.

This early clash exposed the fragility of Fed “independence” when presidents pressed for action during crises.

Peak Power — Roosevelt’s Grip on the Fed

Franklin D. Roosevelt expanded presidential influence dramatically. By suspending the gold standard in 1933 and enacting the Banking Acts of 1933 and 1935, FDR consolidated authority over monetary policy.

Throughout the Depression and World War II, the Fed effectively became an arm of the Treasury, pegging interest rates low to cheaply finance massive deficits. This era marked perhaps the height of presidential control over the Fed.

Truman’s Showdown

President Harry Truman clashed with Fed Chair Thomas McCabe in 1951, demanding low rates to finance the Korean War. His pressure forced McCabe’s resignation.

The Treasury-Fed Accord that followed sought to restore independence, but Truman’s victory showed how presidents could still bend monetary policy to wartime needs.

Kennedy and Johnson’s In-House Influence

John F. Kennedy frequently met with Fed Chair William McChesney Martin to press for pro-growth policies in the early 1960s. Lyndon B. Johnson went further, summoning Martin to his Texas ranch in 1965 and berating him for raising rates during Vietnam War spending.

Recordings reveal how Johnson’s personal intimidation influenced short-term Fed decisions—further blurring independence.

Nixon’s Inflation Legacy

Richard Nixon took Fed influence to another level. In 1970, he appointed Arthur Burns as Fed Chair and pressured him to keep rates low ahead of the 1972 election.

Burns complied, but the political pressure helped unleash the inflationary surge of the 1970s—demonstrating the long-term costs of White House meddling.

Trump’s Theatrics Today

Fast forward to today: President Donald Trump’s public pressure on Fed Chair Jerome Powell and his controversial dismissal of Governor Lisa Cook have once again thrust the Fed into political theater.

Critics argue Trump’s tactics risk undermining Fed credibility abroad. But history shows this is hardly new—rather, it’s a continuation of a century-long pattern where presidents bend or break the Fed’s supposed autonomy.

Why This Matters

The Federal Reserve’s “independence” has always been conditional, more myth than reality. From Wilson to FDR, from Truman to Nixon, and now Trump, presidents have consistently shaped Fed policy through pressure, appointments, and outright confrontation.

Trump’s theatrics may look unprecedented, but in truth, they reaffirm a long-standing reality: the Fed’s autonomy is fragile, performative, and ultimately subordinate to political power.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

What Makes XRP Different From Every Other Cryptocurrency

XRP stands apart in the crowded crypto market by focusing on real-world payments instead of speculation.

A Market Full of Narratives

The cryptocurrency industry has matured dramatically since Bitcoin’s launch. Thousands of assets now compete for attention, from Ethereum’s smart contract platforms to meme tokens and NFTs.

But XRP carved out a unique identity. Unlike most digital currencies, it was designed with a narrow purpose: to make global payments faster, cheaper, and more efficient.

This focus has given XRP adoption not only among traders but also among banks, remittance firms, and payment providers. While most crypto projects remain speculative, XRP has been tested in real settlement systems worldwide.

Pre-Mined Supply and Predictable Release

XRP’s structure differs from Bitcoin and Ethereum, which release coins through mining. At launch in 2012, 100 billion XRP were created in advance. Ripple Labs placed much of this supply in escrow accounts for gradual release.