Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Friday Morning 2-28-2025

TNT:

Tishwash: Within hours... the region's oil will be re-exported through SOMO

The Ministry of Oil announced today, Friday, that the coming hours will witness the re-export of Kurdistan Region oil through the State Oil Marketing Company (SOMO).

"Deputy Prime Minister for Energy Affairs and Minister of Oil, Eng. Hayan Abdul-Ghani Al-Sawad, is visiting Khor Al-Zubair port to see the gas pipeline connection operations," she said in a statement.

The minister confirmed, according to the statement, that “Iraq will announce in the coming hours the commencement of the region’s oil export operations through the State Oil Marketing Company (SOMO) via the Turkish port of Ceyhan at an initial rate of 185,000 barrels, gradually increasing to reach the capacity specified in the general federal budget.”

TNT:

Tishwash: Within hours... the region's oil will be re-exported through SOMO

The Ministry of Oil announced today, Friday, that the coming hours will witness the re-export of Kurdistan Region oil through the State Oil Marketing Company (SOMO).

"Deputy Prime Minister for Energy Affairs and Minister of Oil, Eng. Hayan Abdul-Ghani Al-Sawad, is visiting Khor Al-Zubair port to see the gas pipeline connection operations," she said in a statement.

The minister confirmed, according to the statement, that “Iraq will announce in the coming hours the commencement of the region’s oil export operations through the State Oil Marketing Company (SOMO) via the Turkish port of Ceyhan at an initial rate of 185,000 barrels, gradually increasing to reach the capacity specified in the general federal budget.” link

************

Tishwash: From Safe Internet to Smart Systems" Iraq Enters the Digital Revolution Era with Steady Steps

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed that Iraq is moving steadily towards achieving a major digital renaissance, based on a set of foundations that support this trend.

Saleh explained to {Euphrates News} agency, "The most prominent of these foundations is the progress achieved in two types of infrastructure."

He explained that "the first category is represented by the advanced technological infrastructure, whether through secure and strong internet networks or digital payment systems that work effectively and efficiently in parallel with each other."

Saleh continued, "As for the other category, it is the advanced legal infrastructure that provides protection for the rights of users, operators, and the public right against electronic and financial crimes arising from the digital transformation."

He pointed out "the importance of having the ability to keep pace with the developments of digital technology in the virtual world on an ongoing basis," indicating that "the advisory team in the General Secretariat and all relevant Iraqi state institutions are keen to achieve this to ensure that Iraq enters the new digital age." link

************

Tishwash: Iraq agrees to supply Lebanon with crude oil, with immediate cash payment

Lebanese media sources quoted informed sources as saying that the Lebanese delegation to Iraq (consisting of IDAL Chairman Mazen Sweid and Brigadier General Hassan Shaqir) agreed with Iraqi officials to renew the fuel supply contract to operate the Electricité du Liban plants with some amendments to its implementation mechanism.

The sources indicated that Iraq will supply about 2 million tons of crude oil after it had been supplying fuel oil, in exchange for paying the price of the shipments in cash and immediately, unlike the three previous versions of the contract that included Lebanon paying the price of the shipments through services provided in Lebanon to the Iraqis, provided that the previous arrears amounting to 2 billion dollars would be addressed through the platform between the two countries to provide the agreed-upon services.

By the end of 2024 and until the formation of the new government, a huge amount has accumulated on Lebanon for the price of fuel shipments. Lebanon has only paid $118 million out of $2 billion. This accumulated amount is the result of three copies of renewed contracts between the two parties.

The fourth version of the contract includes the supply of 2 million tons of crude oil and payment for it in cash.

These renovations were carried out with “provisions” and “sympathy” even though Lebanon was not paying the cost of the shipments. Despite Iraqi facilities, Lebanon was unable to pay the bills.

These facilities stipulated that Lebanon would pay the price of fuel in Lebanese pounds, and that the amounts would be deposited in the Iraqi government’s account at the Bank of Lebanon, and would be spent on services for Iraqis (including hospitalization and medical treatment for Iraqis in Lebanon) in Lebanon exclusively. link

************

Tishwash: Central Bank of Iraq signs agreement with Emirates Islamic Bank

The Central Bank of Iraq announced the signing of a banking agreement with Emirates Islamic Bank, which is considered one of the highest-rated Islamic banks, and is rated (A+) according to the international Fitch agency.

Thus, Emirates Islamic Bank is a distinctive addition to the banking relations that the Central Bank of Iraq has established with advanced regional and international banks in recent years.

The agreement includes joint cooperation on several axes, the most important of which are:

Exchange of experiences in the field of developing the Islamic banking sector.

Providing payment services in UAE Dirhams to Iraqi banks and expanding their correspondent accounts network.

Cooperation between Iraqi banks and Emirates Islamic Bank, under the supervision and support of the Central Bank of Iraq, to formulate a mechanism that will allow individual customers of Iraqi banks in the near future to invest (partially) in Islamic bonds issued by Emirates Islamic Bank or other issuers with a similar credit rating in the United Arab Emirates.

It is noteworthy that the Central Bank of Iraq announced in August of last year the start of a new phase of foreign transfer operations in a step aimed at enhancing the diversity of currencies and facilitating international transfer operations. This announcement came after reaching an agreement on the mechanisms for regulating dealings in the euro, the Chinese yuan, the Indian rupee, the UAE dirham, and other global currencies.

Central Bank of Iraq

Media Office

February 27, 2025 link

**************

Mot: ..... Ready I Am

Mot: .. Just Perspective it is

Seeds of Wisdom RV and Economic Updates Thursday Evening 2-27-25

Good Evening Dinar Recaps,

SOCIAL SECURITY UPDATE: LAWMAKERS' NEW PLAN WOULD EXPAND BENEFITS BY $2,400

Some members of Congress are pushing for a new law that would expand Social Security benefits by $2,400 annually.

The bill, the Social Security Expansion Act, would also ensure the program is funded for the next 75 years by applying a payroll tax on higher-income workers.

Good Evening Dinar Recaps,

SOCIAL SECURITY UPDATE: LAWMAKERS' NEW PLAN WOULD EXPAND BENEFITS BY $2,400

Some members of Congress are pushing for a new law that would expand Social Security benefits by $2,400 annually.

The bill, the Social Security Expansion Act, would also ensure the program is funded for the next 75 years by applying a payroll tax on higher-income workers.

Why It Matters

Social Security faces a funding crisis that could see the Social Security Administration run out of money for full payments by the mid-2030s.

Millions of Americans rely on the program to fund the bulk of their retirement, but seniors have complained in recent years that the benefits' cost-of-living adjustment doesn't adequately reflect inflation.

Across the board, seniors are facing higher costs for groceries, housing and health care.

What To Know

Independent Senator Bernie Sanders of Vermont, Senator Elizabeth Warren, Democrat from Massachusetts, and Democratic Representatives Jan Schakowsky of Illinois and Val Hoyle of Oregon introduced the bill on Thursday in an attempt to increase benefits for millions of Americans.

The act calls for Social Security benefits to rise by $2,400 per year and would be fully funded for the next 75 years through application of a payroll tax on all income above $250,000.

That means only 9 percent or less of American households would see taxes increase in order to fund the higher benefit amount and ensure funds for the next 75 years.

At the moment, nine other Democratic senators and 17 House members have cosponsored the bill.

Before Social Security was created by President Franklin D. Roosevelt in the 1930s, around half of all seniors lived in poverty. Today, the senior poverty rate is down to 9.7 percent, thanks in large part to Social Security payments, according to the lawmakers.

The average Social Security payment is $1,838 per month, with nearly 40 percent of seniors relying on it for a majority of their income. One in seven count on it for more than 90 percent of their income.

@ Newshounds News™

Read more: MSM

~~~~~~~~~

TREASURY’S NEW CRYPTO COUNSELOR ADVOCATES FOR SWIFT STABLECOIN LEGISLATION

Tyler Williams, newly appointed crypto counselor to Treasury Secretary Scott Bessent, has announced his focus on helping Congress develop appropriate stablecoin legislation as the US accelerates crypto regulation efforts.

▪Williams emphasizes creating clear legal guidelines for stablecoins to boost industry confidence and ensure consistent regulatory approaches across jurisdictions.

▪The Treasury Department's decision to hire Williams signals willingness to responsibly integrate crypto into the mainstream financial system.

▪Bipartisan support continues building with the FIT21 bill passing the House in May 2024 and Senator Hagerty's GENIUS Act seeking to place dollar-pegged tokens under Federal Reserve oversight.

Tyler Williams recently got appointed as the crypto counselor to Treasury Secretary Scott Bessent. However, he has revealed that his first line of actions in this new role will include helping Congress to get stablecoin legislations exactly where they need to be.

Williams’ comment came during a private digital assets event that was recently held in Washington, D.C. This is, as the US accelerates its efforts to regulate a crypto sector that continues to grow at such a remarkable rate.

Tyler Williams Hammers on Unified Regulatory Framework

According to Williams, there is an urgent need for a concerted effort towards creating clear legal guidelines and regulatory environment for stablecoins. He noted that this would not only boost the industry’s confidence but also ensure that both state and federal regulators operate under a consistent framework.

This way, there is a uniform approach to the issuance and oversight of stablecoins that cut across various jurisdictions.

Williams, who previously served as a regulatory lawyer for Galaxy Digital, has also shared his optimism for the times ahead. He believes that the Treasury Department’s decision to hire him already proves that the US is more than willing to introduce crypto into the mainstream financial system, but in a responsible manner.

Bipartisan Momentum in Congress

Speaking at the same event, Representative Bryan Steil, a Wisconsin Republican and chair of the House Financial Services Committee’s digital assets subcommittee, appeared to share the same optimism as Williams. The lawmaker noted that the legislative push for stablecoin regulation has gained serious momentum and bipartisan support.

Despite the notable bipartisan backing that saw the FIT21 pass the House in May 2024, however, Steil insists that the US still needs to “outcompete the rest of the world” in its support of digital assets. That is, if the nation wants to sustain this legislative momentum and see it grow, Steil added.

Interestingly, efforts are also ongoing in the Senate to establish a comprehensive regulatory framework for stablecoins. In early February, Senator Bill Hagerty introduced the Guiding and Establishing National Innovation for US Stablecoins of 2025 Act (GENIUS Act).

This legislation aims to bring US dollar-pegged crypto tokens under Federal Reserve rules. It also seeks to clearly define the roles of federal and state authorities in overseeing stablecoin issuers.

The bill has been hailed as addressing a key challenge that has previously hindered regulatory clarity, especially for stablecoins.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

The Global Financial System is Broken

The Global Financial System is Broken

WTFinance: 2-26-2025

The WTFinance podcast recently welcomed back Larry Lepard, Managing Partner of Equity Management Associates, a veteran investment manager with over 40 years of experience and a staunch advocate for sound money.

Lepard is also the author of the newly released book, “The Big Print: What Happened To America And How Sound Money Will Fix It,” and the discussion delved deep into the issues facing the American economy and the potential solutions he proposes.

The Global Financial System is Broken

WTFinance: 2-26-2025

The WTFinance podcast recently welcomed back Larry Lepard, Managing Partner of Equity Management Associates, a veteran investment manager with over 40 years of experience and a staunch advocate for sound money.

Lepard is also the author of the newly released book, “The Big Print: What Happened To America And How Sound Money Will Fix It,” and the discussion delved deep into the issues facing the American economy and the potential solutions he proposes.

The conversation spanned a wide range of critical topics, starting with Lepard’s central thesis: What exactly happened to America?

He points to the increasing financialization of the country as a primary driver of the current problems. This means a shift away from productive industries and towards complex financial instruments, leading to instability and ultimately, a detachment from the real economy.

A key question raised was: How long can this system survive? Lepard doesn’t paint a rosy picture, suggesting that the current trajectory is unsustainable. He pinpoints interest as a core issue, arguing that artificially low interest rates have fueled malinvestment and distorted the market signals necessary for a healthy economy.

He also expressed concerns about the potential of losing control of the bond market, which could trigger a significant financial crisis.

Given his advocacy for sound money, the conversation naturally turned to precious metals. Lepard remains bullish on Gold, viewing it as a hedge against inflation and a store of value in uncertain times.

He also discussed his intriguing perspective on Bitcoin, explaining his rationale for its potential as a valuable asset. He even speculated on the possibility of sovereigns buying Bitcoin, a development that could significantly impact the cryptocurrency’s long-term value.

The podcast further explored conventional economic wisdom, questioning the commonly held belief that the constant growth of the money supply is necessary for economic growth. Lepard challenges this notion, arguing that it ultimately leads to inflation and erodes the purchasing power of the currency.

In a more unconventional tangent, the discussion even touched upon the meme cryptocurrency D.O.G.E. (Dogecoin) and the possibility of it somehow playing a role in a potential system reset.

While seemingly a lighthearted moment, it highlighted the growing distrust in traditional financial institutions and the search for alternative solutions, however unconventional they may seem.

Lepard also addressed the growing concentration of wealth in the hands of a few, a consequence of the financialized system he criticizes. This disparity, he argues, further exacerbates the existing problems and contributes to social and economic instability.

Despite the bleak outlook, Lepard offered a glimmer of hope, outlining a potential positive outcome.

He believes that a return to sound money principles, coupled with a focus on productive industries and responsible fiscal policies, can steer America back towards a more stable and prosperous future.

Ultimately, the podcast concluded with a call to action. Lepard’s one message to takeaway is a plea for individuals to educate themselves on the principles of sound money and to demand responsible governance from their elected officials.

He believes that informed citizens are the key to driving the necessary changes and ensuring a more sustainable future for the American economy.

The Shocking History of the Fort Knox Gold Audits

The Shocking History of the Fort Knox Gold Audits

Arcadia Economics: 2-26-2025

The whispers are growing louder: a potential audit of Fort Knox, spearheaded by none other than Donald Trump and Elon Musk. The prospect is undeniably intriguing, a potential deep dive into one of the world’s most heavily guarded vaults, holding what many believe to be the United States’ gold reserves.

The coming months promise to be filled with speculation and anticipation as we await details on the scope, methods, and ultimately, the findings of this proposed audit.

The Shocking History of the Fort Knox Gold Audits

Arcadia Economics: 2-26-2025

The whispers are growing louder: a potential audit of Fort Knox, spearheaded by none other than Donald Trump and Elon Musk. The prospect is undeniably intriguing, a potential deep dive into one of the world’s most heavily guarded vaults, holding what many believe to be the United States’ gold reserves.

The coming months promise to be filled with speculation and anticipation as we await details on the scope, methods, and ultimately, the findings of this proposed audit.

While the narrative often repeated is that Fort Knox hasn’t seen an audit since 1974, that’s a simplification of a more complex reality. The truth is, there have been subsequent inspections and verifications, though whether they qualify as full-fledged “audits” is debatable.

These examinations, often conducted by the Government Accountability Office (GAO) or the Treasury Department’s Inspector General, have involved inventory checks and reconciliation of records.

However, what these past exercises have revealed is where things get truly interesting. Beyond simple verification of weight and quantity, some stunning details have emerged regarding the management and handling of the Fort Knox gold after the widely cited 1974 date.

Gold researcher Jan Nieuwenhuijs, for example, has dedicated considerable time to scrutinizing official records and historical accounts pertaining to Fort Knox. His findings, often documented and presented with compelling evidence, raise serious questions about the transparency and accuracy of the government’s accounting of the gold reserves. His research suggests a more nuanced and potentially troubling picture than the public generally perceives.

These “audits” and investigations raise questions: What exactly has transpired within the walls of Fort Knox in the decades since 1974? Have the gold reserves been consistently accounted for? Have there been any instances of discrepancies or unexplained movements?

The prospect of a comprehensive audit led by figures like Trump and Musk adds a new dimension to this long-standing debate. Their involvement could potentially bring greater scrutiny and transparency to the process, providing a more definitive answer to the questions that have lingered for years.

Whether this new initiative will truly unlock the secrets hidden within Fort Knox remains to be seen. But one thing is certain: the renewed focus on the US gold reserves will undoubtedly spark intense discussion and perhaps, finally, reveal the shocking truth about what has been happening inside Fort Knox all these years.

Watch the video below from Arcadia Economics featuring Jan Nieuwenhuijs for further insights and information.

Seeds of Wisdom RV and Economic Updates Thursday Afternoon 2-27-25

Good Afternoon Dinar Recaps,

SOCIAL SECURITY ANNOUNCES EXPEDITED RETROACTIVE PAYMENTS AND HIGHER MONTHLY BENEFITS FOR MILLIONS – ACTIONS SUPPORT THE SOCIAL SECURITY FAIRNESS ACT

Today, the Social Security Administration announced it is immediately beginning to pay retroactive benefits and will increase monthly benefit payments to people whose benefits have been affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

Good Afternoon Dinar Recaps,

SOCIAL SECURITY ANNOUNCES EXPEDITED RETROACTIVE PAYMENTS AND HIGHER MONTHLY BENEFITS FOR MILLIONS – ACTIONS SUPPORT THE SOCIAL SECURITY FAIRNESS ACT

Today, the Social Security Administration announced it is immediately beginning to pay retroactive benefits and will increase monthly benefit payments to people whose benefits have been affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

These provisions reduced or eliminated the Social Security benefits for over 3.2 million people who receive a pension based on work that was not covered by Social Security (a “non-covered pension”) because they did not pay Social Security taxes.

The Social Security Fairness Act ends WEP and GPO.

“Social Security’s aggressive schedule to start issuing retroactive payments in February and increase monthly benefit payments beginning in April supports President Trump’s priority to implement the Social Security Fairness Act as quickly as possible,” said Lee Dudek, Acting Commissioner of Social Security. “The agency’s original estimate of taking a year or more now will only apply to complex cases that cannot be processed by automation. The American people deserve to get their due benefits as quickly as possible.”

People who will benefit from the new law include some teachers, firefighters, and police officers in many states; federal employees covered by the Civil Service Retirement System; and people whose work had been covered by a foreign social security system.

Many beneficiaries will be due a retroactive payment because the WEP and GPO offset no longer apply as of January 2024. Most people will receive their one-time retroactive payment by the end of March, which will be deposited into their bank account on record with Social Security.

Many of these people will also receive higher monthly benefits, which will first be reflected in the benefit payment they receive in April. Depending on factors such as the type of Social Security benefit received and the amount of the person’s pension, the change in payment amount will vary from person to person.

Anyone whose monthly benefit is adjusted, or who will get a retroactive payment, will receive a mailed notice from Social Security explaining the benefit change or retroactive payment. Most people will receive their retroactive payment two to three weeks before they receive their notice in the mail, because the President understands how important it is to pay people what they are due right away.

Social Security is expediting payments using automation and will continue to handle many complex cases that must be done manually, on an individual case-by-case basis. Those complex cases will take additional time to update the beneficiary record and pay the correct benefits.

Social Security urges beneficiaries to wait until April to ask about the status of their retroactive payment, since these payments will process incrementally into March.

Since the new monthly payment amount will begin with the April payment, beneficiaries should wait until after receiving their April payment, before contacting Social Security with questions about their monthly benefit amount.

Visit the agency’s Social Security Fairness Act webpage to learn more and stay up to date on its progress. Visitors can subscribe to be alerted when the webpage is updated.

@ Newshounds News™

Source: SSA Blog

Social Security Fairness Act: Link

~~~~~~~~~

DEMOCRAT LAWMAKER INTRODUCES BILL BANNING OFFICIALS FROM LAUNCHING MEME COINS AFTER TRUMP TOKEN

▪️The MEME Act would require Trump to return profits from his meme coin sales and enable investors to sue officials for losses related to endorsed cryptocurrencies.

▪️The bill faces significant challenges in the Republican-controlled Congress but serves as a symbolic stance against what Liccardo perceives as unethical behavior.

▪️Regulatory uncertainty persists as SEC official Hester Peirce claims most meme coins fall outside their jurisdiction, suggesting CFTC or lawmakers should establish clearer oversight frameworks.

Newly elected Democrat Sam Liccardo, representing Silicon Valley, is introducing legislation that would block government officials from launching cryptocurrencies such as meme coins.

He noted that the move was never part of his plan when he ran for office, but after the president launched a meme coin last month, he felt a response was needed.

US President Donald Trump released a meme coin, TRUMP, just days before assuming office. Not long after, his wife Melania launched hers, called MELANIA, on January 19. Both tokens rose quickly but collapsed just as fast. The introduction of these meme coins has led to criticism. Liccardo noted that even Trump’s crypto-supporting enthusiasts found the move unappealing.

Liccardo’s bill, called the Modern Emoluments and Malfeasance Enforcement (MEME) Act, seeks to prohibit the president, members of Congress, and other high-ranking officials—along with their families—from issuing or endorsing cryptocurrencies, stocks, or other financial securities.

According to the draft, the bill also requires Trump to return any money he made from selling his meme coin. Moreover, the bill would allow investors who lost money on a meme coin backed by a public official to sue to recover their losses.

Despite the bill’s strong stance, it faces an uphill battle in the Republican-controlled Congress. However, Liccardo sees it as a symbolic stand against corruption and a potential legislative tool for the future if Democrats regain power.

Regulatory Uncertainty Surrounds Meme Coins

One of the developers behind Trump’s meme coin, Hayden Davis, has a history of controversial crypto projects, including one linked to a corruption probe involving Argentina’s President Javier Milei.

Davis himself has described meme coins as a rigged game, calling the industry an unregulated casino that rewards a small group at the expense of retail investors.

Liccardo argues that existing laws fail to address the ethical and financial risks posed by politicians entering the crypto space. He said,

“That behavior is so self-evidently unethical that it raises the question why isn’t there a clear enough prohibition.”

He added that having a way to enforce the rules is important, and allowing people to sue helps ensure accountability. Aside from Liccardo’s bill, other proposals related to meme coins have also been introduced.

On February 20, US Democratic Senator Catherine Cortez Masto proposed an amendment to resolution S. Con. Res. 7, seeking to prevent federal employees and officials from launching, endorsing, or profiting from digital tokens connected to investments by the Chinese Communist Party.

Hester Peirce, head of the US Securities and Exchange Commission’s digital asset division, said most meme coins are beyond the SEC’s authority, noting that their regulation depends on the specifics of each coin. She suggested that lawmakers or agencies like the Commodity Futures Trading Commission (CFTC) should take responsibility for overseeing them.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Zimbabwe Gold ZiG Collapse: Lessons on How Not to Launch a Gold-Backed Currency

Zimbabwe Gold ZiG Collapse: Lessons on How Not to Launch a Gold-Backed Currency

Awake-In-3D February 26, 2025

Zimbabwe’s gold-backed currency was supposed to bring stability, but mismanagement led to its rapid decline. A gold-backed currency can work, but only if implemented correctly.

The Zimbabwe Gold ZiG was introduced as a gold-backed solution to the country’s currency instability, promising to restore confidence in Zimbabwe’s monetary system. However, less than a year after its launch, the currency has lost nearly half its value, inflation is rising, and the U.S. dollar remains the preferred medium of exchange.

Zimbabwe Gold ZiG Collapse: Lessons on How Not to Launch a Gold-Backed Currency

Awake-In-3D February 26, 2025

Zimbabwe’s gold-backed currency was supposed to bring stability, but mismanagement led to its rapid decline. A gold-backed currency can work, but only if implemented correctly.

The Zimbabwe Gold ZiG was introduced as a gold-backed solution to the country’s currency instability, promising to restore confidence in Zimbabwe’s monetary system. However, less than a year after its launch, the currency has lost nearly half its value, inflation is rising, and the U.S. dollar remains the preferred medium of exchange.

The problem isn’t with gold backing itself—historically, such systems have provided stability—but rather with poor economic policies that have undermined its success. This article examines the key mistakes made with the Zimbabwe Gold ZiG and the crucial lessons other nations should learn before attempting to implement a similar system.

The Zimbabwe Gold ZiG Struggles to Maintain Value

Zimbabwe introduced the Zimbabwe Gold ZiG on April 8, 2024, with an initial exchange rate of 13.56 ZiG per U.S. dollar. Since its launch, the ZiG has experienced significant depreciation. Below is a summary of its exchange rate progression:

April 8, 2024: 1 USD = 13.56 ZiG

September 2024: The Reserve Bank of Zimbabwe devalued the Zimbabwe Gold ZiG by approximately 42.55%, adjusting the official exchange rate to around 24.4 ZiG per U.S. dollar.

October 12, 2024: Reports indicated that on the parallel market, the U.S. dollar was trading at nearly 28 ZiG.

February 26, 2025: The official exchange rate stood at approximately 26.5012 ZiG per U.S. dollar.

This trajectory highlights the challenges the Zimbabwe Gold ZiG has struggled with in maintaining its value against the U.S. dollar since its inception.

However, less than a year after its launch, the Zimbabwe Gold ZiG lost nearly half its value, inflation soared, and Zimbabweans continued to prefer the U.S. dollar over their own national currency. The problem is not with gold backing itself—historically, gold-backed systems provided monetary stability—but rather with poor government policies and mismanagement that undermined the ZiG’s success.

This article examines what went wrong with the Zimbabwe Gold ZiG and the key lessons other nations should learn before attempting to implement a similar system.

A Gold-Backed Currency Is Only as Strong as Its Convertibility

One of the core principles of a successful gold-backed currency is that it must allow free and transparent conversion into gold. Zimbabwe’s Reserve Bank claimed the Zimbabwe Gold ZiG was backed by gold reserves, yet ordinary citizens and businesses could not directly exchange their ZiG for gold at will.

Lesson Learned: A gold-backed currency must have clear and enforceable redemption policies that allow holders to convert their money into physical gold or other tangible assets on demand. Otherwise, the “gold backing” is just a theoretical concept that fails to build trust.

Partial Backing Defeats the Purpose

A truly stable gold-backed system requires that the total money supply has full gold reserve backing or a basket of tangible assets. However, in Zimbabwe’s case, the actual gold reserves were insufficient to fully support the volume of Zimbabwe Gold ZiG in circulation.

This led to a situation where the central bank continued printing ZiG beyond what gold reserves could support, weakening its purchasing power and causing black market exchange rates to diverge significantly from the official rate.

Lesson Learned: A government cannot simply declare a currency “gold-backed” while still engaging in inflationary monetary policies. Strict money supply discipline is required, ensuring that every unit of currency in circulation is genuinely supported by hard assets.

Government Intervention and Exchange Rate Controls Undermine Trust

Rather than allowing the market to determine the value of the Zimbabwe Gold ZiG, Zimbabwe’s government fixed an official exchange rate that quickly disconnected from reality. As a result, a black market developed where ZiG traded at a much lower value than the government’s official rate.

This eroded trust in the currency even further, as businesses and individuals realized that their ZiG holdings were worth far less in practice than on paper.

Lesson Learned: A gold-backed currency must operate within a free-market system where exchange rates reflect real supply and demand. Government-imposed exchange rates distort the market and drive people toward alternative currencies, such as the U.S. dollar or cryptocurrencies.

Economic Stability Must Come First

A gold-backed currency cannot function properly in an environment of economic mismanagement, inflation, and policy uncertainty. Despite the introduction of the Zimbabwe Gold ZiG, Zimbabwe’s annual inflation rate soared to 14.6% in January 2025, up from 2.5% just a month earlier.

Additionally, high borrowing costs, a weak business environment, and a lack of fiscal discipline continued to undermine confidence in the national economy. A gold-backed currency alone cannot fix a broken financial system.

Lesson Learned: Before implementing a gold-backed currency, a government must establish macroeconomic stability, control inflation, and ensure that businesses and consumers have confidence in the overall financial system. Otherwise, the currency is prone to failure regardless of its backing.

People Must Actually Use the Currency

Perhaps the most fundamental failure of the Zimbabwe Gold ZiG was its lack of adoption. Zimbabweans overwhelmingly preferred using the U.S. dollar—not because they opposed gold backing, but because they didn’t trust the government to manage the currency responsibly.

Many businesses and consumers avoided the Zimbabwe Gold ZiG altogether, choosing instead to trade in U.S. dollars on the informal market. This led to the rise of illigal night markets, where prices were lower and transactions were conducted outside government oversight.

Lesson Learned: A gold-backed currency must be the preferred medium of exchange in daily transactions. This requires trust in the government’s monetary policies, a stable and predictable exchange rate, and a regulatory environment that encourages currency adoption rather than pushing people toward alternatives.

The Bottom Line: A Blueprint for a Proper Gold-Backed System

The failure of the Zimbabwe Gold ZiG is not an indictment of gold-backed currencies themselves—rather, it is a lesson in how not to implement one. A properly managed gold-backed currency provides stability, controls inflation, and builds confidence—but only if the following conditions are met:

Full Convertibility – Citizens and businesses must be able to freely exchange their currency for gold or other hard assets.

Strict Monetary Discipline – The money supply must be strictly controlled to prevent excessive printing beyond gold reserves.

Market-Driven Exchange Rates – The currency must be allowed to float freely, without government-imposed rates that create black markets.

Macroeconomic Stability – Inflation must be controlled, and economic policies must support confidence in the financial system.

Widespread Adoption – People must trust and prefer using the currency over foreign alternatives.

For any country considering a return to a gold-backed system, Zimbabwe’s experience with the Zimbabwe Gold ZiG provides a critical warning: gold backing alone is not enough. Without competent economic management, fiscal responsibility, and public trust, even a gold-backed currency can fail.

A gold standard requires transparency, discipline, and a commitment to free-market principles—things Zimbabwe’s government failed to provide. Other nations considering gold-backed currencies would do well to learn from these mistakes.

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

News, Rumors and Opinions Thursday 2-27-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 27 Feb. 2025

Compiled Thurs. 27 Feb. 2025 12:01 am EST by Judy Byington

What We Think We Know as of Thurs. 27Feb. 2025:

Before Pres. Kennedy was assassinated in 1865 he made an Executive Order to dissolve what was now known as the privately owned Federal Reserve, which was stealing US Taxpayer monies and still was to this day according to the DOGE Audit. The Audit also found that the EO has never been dismissed and was still valid

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 27 Feb. 2025

Compiled Thurs. 27 Feb. 2025 12:01 am EST by Judy Byington

What We Think We Know as of Thurs. 27Feb. 2025:

Before Pres. Kennedy was assassinated in 1865 he made an Executive Order to dissolve what was now known as the privately owned Federal Reserve, which was stealing US Taxpayer monies and still was to this day according to the DOGE Audit. The Audit also found that the EO has never been dismissed and was still valid

Wed. 26 Feb. 2025 The IRS will now be closing over 120 offices nationwide, in addition to laying off THOUSANDS of employees, per WaPo. This comes after We The People OVERWHELMINGLY voted for DOGE to audit the IRS, and apparently, they’re moving quickly.

President Kennedy’s Executive Order to take down the Federal Reserve and return Taxpayer Monies back to The People was still valid.

~~~~~~~~~~~~

Wed. 26 Feb. 2025: BOOM! TRUMP’S 2025 REVOLUTION IGNITES: NESARA to GESARA, the FII Priority Summit, and the unveiling of the Rainbow Dollar—the gold-backed currency reset set to transform the world economy forever. …The 47th on Telegram

Mon. 24 Feb. 2025 – QUANTUM FINANCIAL SYSTEM GOES LIVE (allegedly) Cabal Wealth Seized. Global Currency Reset activated. Quantum satellites & military-guarded nodes now anchor the largest financial revolution in history.

The QFS is no longer in beta. It’s live, tracking every elite move in real time. The financial landscape is shifting—forever.

October 2024 Deployment: The Quantum Financial System began “beta” operations across anti-Cabal regions, with secure, instant transactions bypassing traditional banks. Now, over 100 million real-time transactions flow through QFS daily, locked within an un-hackable quantum ledger.

13 Quantum Satellites guard this revolution—military-secured, beyond NASA’s reach—ensuring every transaction is encrypted and invulnerable.

Operation Dark Mirror: QFS maps out global corruption, exposing shadow accounts, offshore havens, and illicit transactions tied to human trafficking and drug smuggling. Major arrests in Europe & Asia trace directly to QFS intel—and this is only the beginning.

Banks in Chaos: Since November 2024, banks worldwide suffer “glitches”—but these are intentional disruptions as QFS uncovers fraud, embezzlement, and artificial inflation. Cabal-controlled banks are scrambling, their secrets exposed.

Countdown to the Global Currency Reset (GCR): Governments are liquidating gold reserves into QFS, prepping for the end of fiat currencies. The largest wealth shift in history is imminent.

Military Oversight: Special ops are locking down QFS nodes. If the system fails, the Cabal regains control—but the military isn’t letting that happen.

Read full post here: https://dinarchronicles.com/2025/02/27/restored-republic-via-a-gcr-update-as-of-february-27-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 There are so many things that are at a standstill right now waiting for the new exchange rate. That is such an obvious indication that there is a new exchange rate. Every time we see a pause, a delay, it's because it's looking for the new exchange rate. Right now the evidence is showing that Sudani is really tightening up the security on the new exchange rate.

Frank26 I consider this [Kurdish oil] to be the final countdown. Many things are waiting for the new exchange rate but IMO the most important thing is this oil.

Henig Article: "Vietnam's Economic Takeoff: Surpassing the Philippines to Join ASEAN’s Top Four" Quote: "Vietnam’s ascent in economic rankings is a testament to its robust growth and strategic policies aimed at fostering sustainable development."

*************

GOLD Paper Scheme UNRAVELED: Why Gold Prices Are About to Explode!

Daniela Cambone: 2-26-2025

"The fiat currency standard is on its last legs," says Mario Innecco, financial markets and macroeconomics analyst.

In an interview with Daniela Cambone, he compares the current situation to past events, like Roosevelt's 1934 gold revaluation, suggesting a similar monetary reset could occur around 2027.

"Gold will play a key role in the new monetary system, uniting countries like China, Russia, and the US." Innecco also likens the gold market to fractional reserve banking, warning that the LBMA and COMEX may be lending more gold than they hold.

He cautions of a "run on the bank" scenario, where gold in Fort Knox could have been lent, sold, or hypothecated multiple times.

Watch the video to learn how to navigate these turbulent times.

Chapters: 00:00

COMEX gold transfers

6:15 Gold delivery

8:32 China gold demand

15:12 Inflation

17:54 Money printing

22:28 Gold price

27:54 National debt

31:55 Auditing Fort Knox gold

35:49 Currency reset

Seeds of Wisdom RV and Economic Updates Thursday Morning 2-27-25

Good Morning Dinar Recaps,

RIPPLE PARTNERS WITH BDACS FOR XRP, RLUSD CUSTODY IN SOUTH KOREA

Ripple Labs and South Korean custodian BDACS partner to offer institutional-grade custody for XRP, RLUSD and other crypto assets.

Ripple Labs has signed a strategic partnership with BDACS, a South Korean digital asset custody provider, to support institutional custody for XRP and Ripple USD.

Good Morning Dinar Recaps,

RIPPLE PARTNERS WITH BDACS FOR XRP, RLUSD CUSTODY IN SOUTH KOREA

Ripple Labs and South Korean custodian BDACS partner to offer institutional-grade custody for XRP, RLUSD and other crypto assets.

Ripple Labs has signed a strategic partnership with BDACS, a South Korean digital asset custody provider, to support institutional custody for XRP and Ripple USD.

The partnership, announced on Feb. 26, will enable BDACS to integrate Ripple Custody, the company’s institutional crypto and digital asset custody solution, to safeguard XRP, Ripple USD (RLUSD) and other crypto assets for financial institutions in South Korea.

Ripple president Monica Long highlighted the importance of institutional-grade custody amid growing enterprise interest in crypto.

“South Korea is gearing up for a wave of institutional crypto adoption — very excited for Ripple Custody to plant another flag in APAC with BDACS for XRP and RLUSD,” Long said in a statement.

Ripple aligns with South Korean regulatory requirement

According to Ripple, the partnership aligns with the roadmap for regulatory approval of institutional participation set by South Korea’s Financial Services Commission (FSC). The company stated:

“This partnership will support the growth of XRPL developers and its ecosystem, expand the usability of Ripple’s stablecoin (RLUSD), and leverage synergies with Busan, Korea’s blockchain regulation-free zone.” BDACS CEO Harry Ryoo said his firm is committed to ensuring a secure infrastructure for institutional crypto adoption.

“BDACS will provide a secure and reliable custody service to support Ripple’s pioneering blockchain initiatives. Ultimately, this partnership will enable both companies to enhance and expand the digital asset ecosystem,” Ryoo said.

Ripple Custody said it expects the total amount of custodied cryptocurrencies to reach $16 trillion by 2030.

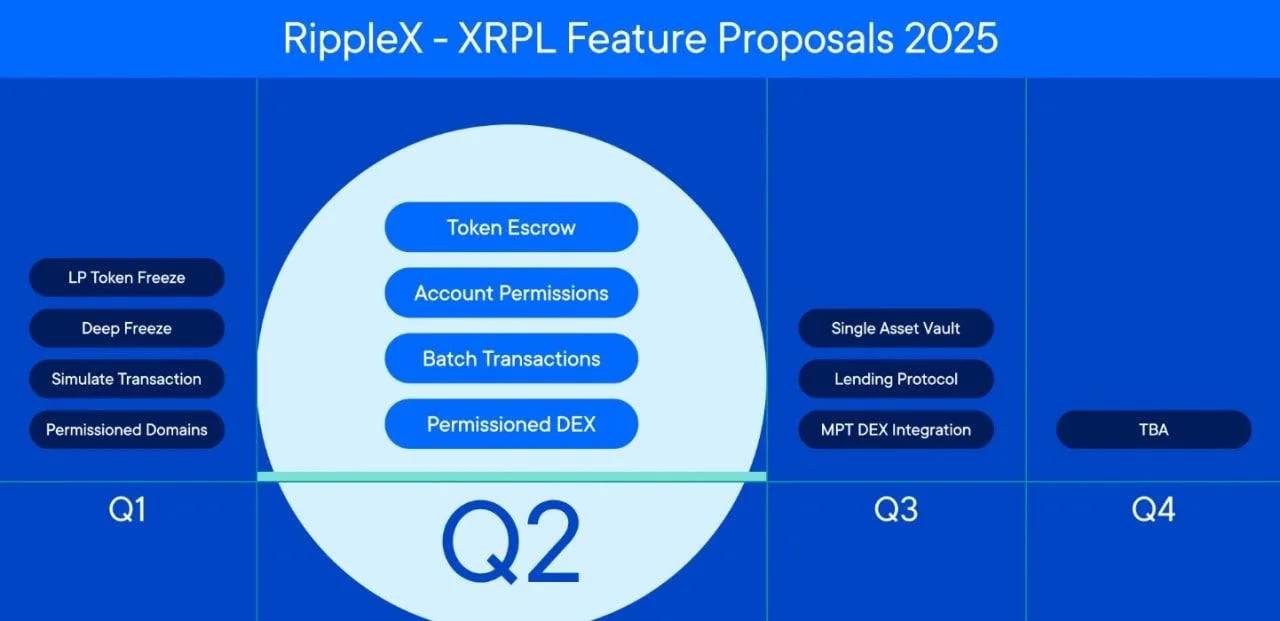

Alongside the partnership with the South Korean crypto custodian, Ripple Labs unveiled a new roadmap for building an institutional decentralized finance (DeFi) ecosystem on the XRP Ledger blockchain network.

XRP Ledger’s roadmap builds on top of existing infrastructure, including price oracles and an automated market maker.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

RIPPLE OUTLINES FUTURE DEVELOPMENTS TO INSTITUTIONAL DEFI ON XRP LEDGER

Ripple has announced upcoming features for the XRP Ledger (XRPL) aimed at enhancing institutional decentralized finance (DeFi).

Key developments include expanded compliance functions, a new lending protocol that integrates with Ripple Payments and decentralized exchanges, and the introduction of Multi-Purpose Tokens (MPTs) for tokenized assets.

Additionally, the XRPL will see the launch of a permissioned decentralized exchange (DEX) and credentialing systems to facilitate secure trading environments.

These innovations are set to enhance programmability and streamline institutional onboarding, further positioning XRPL as a leader in regulated onchain finance.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Thursday Morning 2-27-2025

TNT:

Tishwash: Parliament will not be suspended" .. Parliamentary Legal Committee reveals the plan for sessions during Ramadan

Member of the Parliamentary Legal Committee, Mohammed Anouz, confirmed on Thursday that the Iraqi Parliament will not be suspended early due to the upcoming legislative elections, stressing that the Council has a moral and constitutional responsibility to continue holding its sessions and approving the remaining laws.

Anouz added to Shafaq News Agency that the first and second legislative chapters are sufficient to complete the reading, discussion and voting on many laws, stressing that the Council will resume its sessions next week.

He pointed out that Parliament sessions during the month of Ramadan will be in the evening, i.e. after breakfast, to ensure the continuation of legislative work before the end of the current session.

TNT:

Tishwash: Parliament will not be suspended" .. Parliamentary Legal Committee reveals the plan for sessions during Ramadan

Member of the Parliamentary Legal Committee, Mohammed Anouz, confirmed on Thursday that the Iraqi Parliament will not be suspended early due to the upcoming legislative elections, stressing that the Council has a moral and constitutional responsibility to continue holding its sessions and approving the remaining laws.

Anouz added to Shafaq News Agency that the first and second legislative chapters are sufficient to complete the reading, discussion and voting on many laws, stressing that the Council will resume its sessions next week.

He pointed out that Parliament sessions during the month of Ramadan will be in the evening, i.e. after breakfast, to ensure the continuation of legislative work before the end of the current session.

It is noteworthy that the current session of the Iraqi Council of Representatives began on January 9, 2022, and is scheduled to continue for four years, which means that it will end on January 8, 2026.

According to the amended Electoral Law No. 12 of 2018, legislative elections must be held 45 days before the end of the parliamentary term.

Accordingly, the next elections are expected to be held in late November 2025.

Recently, the Independent High Electoral Commission began its technical and logistical preparations to ensure that the elections are held on the scheduled date, in coordination with the Prime Minister’s Office. link

************

Tishwash: National Bank of Iraq wins the “Excellence Award” from “Citi Bank” in recognition of its outstanding performance

The National Bank of Iraq announced that it won the “Excellence Award” from Citi Bank, in recognition of its exceptional performance in managing incoming and outgoing financial transfers, stressing that this is an achievement that reflects its commitment to the highest standards of quality and transparency in banking services.

This award is a global testament to the bank’s efficiency in implementing financial operations with utmost precision, as it excels in ensuring that transactions are processed according to the highest international standards, while providing the required documents in the correct manner and on time.

This achievement reinforces the position of the National Bank of Iraq as one of the leading banks in the Iraqi banking sector, committed to providing reliable and effective financial solutions that meet the needs of its individual and corporate clients.

Commenting on this achievement, Ayman Abu Dahim, Managing Director of the National Bank of Iraq, expressed his pride and honor in the bank receiving this prestigious award, explaining that receiving this award reflects the bank’s tireless efforts and its firm commitment to providing banking services that are in line with the highest international standards, noting that the National Bank of Iraq believes that innovation and continuous development are the key to success, so it has worked to adopt the latest technologies to ensure the speed and efficiency of financial transfers, which provides its customers with a safe and reliable banking experience.

Abu Dahim praised the efforts made by the bank’s work team at all administrative and functional levels in providing the best banking services and achieving the highest levels of accuracy and transparency, stressing the bank’s commitment to continue developing its operations and strengthening its partnerships with global financial institutions, in a way that ensures the provision of advanced banking solutions that keep pace with the aspirations of our customers and contribute to supporting the national economy.

It is worth noting that the National Bank of Iraq is one of the leading private financial institutions in the Iraqi banking market, as it constantly seeks to provide innovative banking services that meet the needs of customers and enhance their confidence, by providing integrated financial solutions that support individuals and companies, while adhering to the best international practices in the banking sector link

************

Tishwash: It will not be on the "losing team".. Iraq moves to the post-Iran phase

An American report shed light on the attempts that Iraq is facing to get out of the "Iranian orbit" and the "axis of resistance", which took Iran years to build in order to expand its influence deep into the Arab world, but it is rapidly shrinking and could collapse overnight.

A report by the American magazine "The Atlantic", translated by Shafaq News Agency, explained that "the axis of resistance has deteriorated during the past year from its formal rise to a stage of final decline, as Israel struck two of its main members, Hamas and Hezbollah, the regime of Bashar al-Assad fell, and the Lebanese parliament elected a new president and a new prime minister, who are not on friendly terms with the axis."

The report stated that until recently, Iran boasted that it controlled four Arab capitals: Damascus, Beirut, Sanaa, and Baghdad, but now the first two have slipped away, while the third is still under the control of the Houthis, who are still loyal to Tehran. But what about the fourth, Baghdad?

absolute control

In this regard, the American report saw that the degree of Tehran's control over Baghdad is always changing, as the Iraqi parties loyal to Tehran cannot form a government on their own, and are forced to form coalitions with other parties, including those dominated by the Kurds and Sunnis, who have limited ideological ties to the "axis", adding that even among the Shiites, the pro-Tehran position has become a matter of intense controversy, especially after the balance of power in the region shifted away from Iran.

He pointed out that the forces loyal to Iran organized violent clashes in the streets, and were able to obstruct this through religious and parliamentary maneuvers, so Muhammad Shia al-Sudani took over the prime ministership in October 2022, which was described as an “Iranian victory,” for reasons including that the prime minister who replaced al-Sudani was Mustafa al-Kadhimi, whom the report described as the first non-Islamic ruler of Iraq since the fall of Saddam Hussein, and that al-Kadhimi had restored Iraqi relations with Sunni powers such as Saudi Arabia, Egypt and Jordan, and even established excellent relations with Iran and encouraged the restoration of diplomatic relations between the Iranians and Saudis.

However, the American report warned that Tehran's control over Baghdad is not completely secure, as Al-Sudani relies on the support of parties loyal to Tehran, but he continued to follow a large part of Al-Kazemi's regional agenda to strengthen relations with Arab countries.

The losing team

The report considered that there are many issues that cause division among Iraqis, but there is one issue that unites many of them, which is that they do not want Iraq to turn into a battlefield for Iran’s conflicts with the United States and Israel, indicating that in light of the decline in the fortunes of the Tehran axis, these Iraqis do not want to be on the losing team in the region.

The report indicated that many Iraqis are now publicly demanding the dissolution of the Popular Mobilization Forces, which the report described as "the main tool of Iranian interference in Iraq," noting that members of the Iraqi government say that with the defeat of ISIS, the presence of the Popular Mobilization Forces is no longer necessary.

In this context, the report mentioned the recent statements of the Iraqi Foreign Minister Fuad Hussein that he hopes “we will be able to convince the leaders of these groups to lay down their weapons, and that two or three years ago, it was impossible to discuss this issue in our society.” It also mentioned the recent statements of Mr. Muqtada al-Sadr in which he pointed out the necessity of limiting the carrying of weapons to the state’s security forces only.

Baghdad and Washington

However, the report found that what is most surprising is that figures from within the Coordination Framework, which includes parties loyal to Tehran, support this position, including MP Mohsen al-Mandalawi, the Kurdish Shiite billionaire, adding that “dissolving the armed militias or integrating them into the regular security forces would remove Iran’s main source of influence inside Iraq.”

The report considered that such a step may be calculated to avoid problems with Washington, as it is believed that the Donald Trump administration is considering imposing new sanctions on Iraq unless the Popular Mobilization Forces are disarmed, adding that the Iraqi government is looking to calm things down with Washington, as Al-Sudani and Iraqi President Abdul Latif Rashid sent congratulatory telegrams to the American president when he was elected.

The report quoted MP Ali Nema (from the Coordination Framework) as saying that he expected Iraqi-American relations to improve, and that the Coordination Framework, which is loyal to Iran, “is not worried about Trump.”

The report recalled Al-Sudani’s recent visit to Tehran, saying that “relations with Tehran are more controversial than ever,” as Al-Sudani received harsh criticism from Supreme Leader Ali Khamenei, who called for preserving and strengthening the Popular Mobilization Forces and expelling all American forces, and described the recent change of power in Syria as the work of “foreign governments.

Iran axis

The American report then asked whether all this data is sufficient to indicate that Iraq is also leaving the Iranian axis, but it noted that Iraqi experts did not agree on an answer to this question.

The report also quoted Hamdi Malik, a researcher at the Washington Institute, as saying that Iran “still exercises significant influence in Iraq,” and that al-Sudani’s government initially sent “cautious but positive signals” to the new Syrian regime, but “the tone in Shiite circles in Iraq changed completely after Khamenei expressed a completely hostile view of developments there.”

After noting that Al-Sudani's government relies heavily on the support of the Coordination Framework, the report quoted Malik as saying that "any attempt by Al-Sudani to limit Iran's influence will be merely cosmetic attempts."

The report said that Farhang Fereydoun Namdar, an Iraqi analyst from the University of Missouri, agreed with this assessment, as the Popular Mobilization Forces still have about 200,000 members and a budget of about $3 billion, indicating that this force is unlikely to go anywhere, despite calls for its dissolution. The report quoted Namdar as saying that “almost all factions of the Popular Mobilization Forces are loyal to Iran, and the Mobilization has managed to entrench itself in the economy and politics of Iraq ... and is the backbone of the Sudanese government.”

Strategic location

The American Atlantic report saw that Iraq's position may be more complicated than just the image of a state subordinate to a neighboring regime, as Baghdad is distinguished by a unique position to achieve a balance between Iranian interests and the interests of the Sunni states in the region, and it is trying hard to build partnerships with its non-Iranian neighbors.

The report quoted Iraqi affairs expert Aaron Robert Walsh, who is based in Amman, as saying that he believes that Al-Sudani is “cautiously separating Iraq from the axis without completely severing relations with Tehran,” noting that Tehran and its Iraqi allies could spoil these efforts, for example by attacking projects in which the Gulf states have invested.

The report concluded by reminding that Iraq will hold elections in October, and that if enough Iraqis reject pro-Tehran parties at the ballot box, as most did in 2021, there will be an opportunity for al-Sudani, or whoever may succeed him, to form a government that makes an extra effort to assert Iraqi sovereignty. link

************

Mot: .... Hitting Home It is – sssiiiigghghghghhhhhh

Mot: Ya Knows What They Says bout ""Vegas"" – wellllllll Chip Monks

Seeds of Wisdom RV and Economic Updates Wednesday Evening 2-26-25

Good Evening Dinar Recaps,

SEN. LUMMIS SAYS WASHINGTON IS 'ON THE PRECIPICE' OF STABLECOIN AND CRYPTO REGULATION BILLS

▪We’re on the precipice of finally creating a bipartisan legislative framework for both stablecoins and market structure,” said Sen. Cynthia Lummis, R-Wyo. on Wednesday.

▪So far this year in the new Congress, the focus has been on first regulating stablecoins, with both Republican and Democratic lawmakers coming out with bills over the past several weeks.

Good Evening Dinar Recaps,

SEN. LUMMIS SAYS WASHINGTON IS 'ON THE PRECIPICE' OF STABLECOIN AND CRYPTO REGULATION BILLS

▪We’re on the precipice of finally creating a bipartisan legislative framework for both stablecoins and market structure,” said Sen. Cynthia Lummis, R-Wyo. on Wednesday.

▪So far this year in the new Congress, the focus has been on first regulating stablecoins, with both Republican and Democratic lawmakers coming out with bills over the past several weeks.

Just a few months after a new Congress rolled into Washington, lawmakers are starting to get cracking on crypto legislation with hopes that bills can get signed by President Donald Trump by the end of this year.

"We're on the precipice of finally creating a bipartisan legislative framework for both stablecoins and market structure," said Sen. Cynthia Lummis, R-Wyo., during a congressional hearing on Wednesday. "I hope we can get both pieces of legislation to President Trump for his signature this year."

Lummis added that she hoped that would include the Responsible Financial Innovation Act, which she and Democratic Sen. Kirsten Gillibrand have worked on over the years and created a regulatory framework for crypto.

So far this year in the new Congress, the focus has been on first regulating stablecoins, with both Republican and Democratic lawmakers coming out with bills over the past several weeks.

One of those bills is called The Guiding and Establishing National Innovation for U.S. Stablecoins, or GENIUS Act., which was introduced earlier this month by Senate Banking Committee Chair Tim Scott, R-S.C., Sen. Kirsten Gillibrand, D-N.Y., Sen. Bill Hagerty, R-Tenn., and Lummis. The bill includes reserve requirements and implements "light-touch, tailored regulatory standards for stablecoin issuers."

Lawmakers asked detailed questions about that bill during Wednesday's Senate Banking Committee digital assets-focused panel hearing titled "Exploring Bipartisan Legislative Frameworks for Digital Assets." The panel was created this year and is led by Lummis.

Ongoing discussions

Sen. Tina Smith, D-Minn., asked detailed questions about consumer protections in future stablecoin legislation and asked the witnesses at the hearing whether legislation should require "stablecoin issuers to be vetted for character and fitness" like other financial institutions.

Timothy Massad, former chair of the Commodity Futures Trading Commissioner and witness at the hearing, said the GENIUS Act doesn't require it and added that it should.

"Similar standards are in the European legislation and in other countries' legislation," he added.

On the House side, House Financial Services Committee Chair French Hill, R-Ark., released draft legislation last month that builds on work done in that committee over the past few years with some differences.

For example, it gives the Office of the Comptroller of the Currency the authority to "approve and supervise federally qualified nonbank payment stablecoin issuers " instead of including a federal path through the Federal Reserve for "payment stablecoin issuers."

Shortly after, the top Democrat of the committee, Rep. Maxine Waters of California, released a discussion draft that includes language around federal regulators for stablecoins.

Sen. Bernie Moreno, R-Ohio, drew comparisons of crypto to other technologies, such as airplanes and computers, during Wednesday's hearing.

"The point I'm trying to make is, is why all of a sudden, when we got to digital currencies, did we decide here in Washington D.C. and say no, no we are going to decide the pace of innovation, the way technology should work," Moreno said.

@ Newshounds News™

Source: The Block

~~~~~~~~~

BANK OF AMERICA CEO REVEALS PLANS FOR US DOLLAR-BACKED STABLECOIN, BUT THERE’S A CATCH

▪Bank of America is eyeing the stablecoin market amid global adoption.

▪The firm said it stayed back earlier because of unclear regulations.

▪BofA hopes to join major tech giants like Paypal with related offerings.

Like other mainstream fintech giants like Revolut and PayPal Holdings Inc (NASDAQ: PYPL) with Stablecoin plans, Bank of America (BofA) is set to introduce its token once regulations permit.

As reported by Fortune, Bank of America CEO, Brian Moynihan, while speaking at the Economic Club of Washington, D.C., discussed the growing importance of digital assets and the potential for stablecoins to function like traditional financial products.

Bank of America and the Stablecoin Plan

During the event, Brian said that stablecoins will likely play a major role in the conventional banking institution.

He further explained that a BofA-issued stablecoin would be fully backed by the US dollar and linked to a deposit account. Eventually, this will enable an easy and smooth transaction process between digital and traditional money.

“If they make that legal, we will go into that business,” he said, adding that the only reason BofA has not yet released its stablecoin is because of the stringent policy of the past administration.

However, he sounded more positive about the present government, saying that he expects major banks to enter the crypto economy once clear rules are in place.

Brian also made it known that irrespective of other digital asset offerings, the firm’s major focus remains on stablecoins. The BofA chief said he believes these tokens would fit perfectly into the current financial system.

Interestingly, this marks a shift from how the organization has viewed the digital asset economy. In 2022, when top Wall Street banks were diving into crypto, the firm’s CEO stated they had no intention of rushing into the space.

Most Money Movement Is Already Digital

Notably, while stablecoins are not yet part of BofA’s services, the financial institution is already transacting electronically. The CEO mentioned that the Bank transacts about $3 trillion online daily through wire transfers, ACH payments, and card transactions.

He pointed out that consumer spending is now largely digital, with services like Zelle and credit cards far outpacing cash usage. However, he acknowledged that cash remains essential for many people and businesses.

“ATMs and branches are still needed,” he said, despite the shift toward digital payments.

For context, reports show that the bank has invested large amounts of money in emerging technologies.

The expenditure is around $4 billion annually on new developments and another $8–9 billion on system operations. Per the report, the bank was an early adopter of mobile banking, launching its iPhone app before competitors. Today, about 90% of customer interactions happen digitally, supported by AI-powered tools like its virtual assistant, Erica.

Still, Moynihan emphasized the importance of human interaction in banking. With 3,700 branches nationwide, BofA continues to serve customers who prefer face-to-face assistance.

He stressed that digital convenience must be balanced with personal service, as many people seek expert advice on financial planning and major transactions.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 2-26-25

Good Afternoon Dinar Recaps,

UKRAINE WAR: TRUMP IS NOT TRYING TO APPEASE PUTIN – HE HAS A VISION OF A NEW US-CHINA-RUSSIA ORDER

There has been much and justified focus on the implications of a likely deal between US president Donald Trump and his Russian counterpart Vladimir Putin and the overwhelmingly negative consequences this will have for Ukraine and Europe. But if Trump and Putin make a deal, there is much more at stake than Ukraine’s future borders and Europe’s relationship with the US.

Good Afternoon Dinar Recaps,

UKRAINE WAR: TRUMP IS NOT TRYING TO APPEASE PUTIN – HE HAS A VISION OF A NEW US-CHINA-RUSSIA ORDER

There has been much and justified focus on the implications of a likely deal between US president Donald Trump and his Russian counterpart Vladimir Putin and the overwhelmingly negative consequences this will have for Ukraine and Europe. But if Trump and Putin make a deal, there is much more at stake than Ukraine’s future borders and Europe’s relationship with the US.

As we are nearing the third anniversary of Russia’s full-scale invasion, Ukraine’s future is more in doubt than it has ever been since February 2022.

For once, analogies to Munich in 1938 are sadly appropriate. This is not because of a mistaken belief that Putin can be appeased, but rather because great powers, once again, make decisions on the fate of weaker states and without them in the room.

Similar to the pressure that Czechoslovakia experienced from both Germany and its supposed allies France and Britain in 1938, Ukraine is now under pressure from Russia on the battlefield and the US both diplomatically and economically.

Trump and his team are pushing hard for Ukraine to make territorial concessions to Russia and accept that some 20% of Ukrainian lands under Russia’s illegal occupation are lost.

In addition, Trump demands that Ukraine compensate the United States for past military support by handing over half of its mineral and rare earth resources.

The American refusal to provide tangible security guarantees not only for Ukraine but also for allied Nato troops if they were deployed to Ukraine as part of a ceasefire or peace agreement smacks of the Munich analogy.

Not only did France and Britain at the time push Czechoslovakia to cede the ethnic German-majority Sudetenland to Nazi Germany. They also did nothing when Poland and Hungary also seized parts of the country.

And they failed to respond when Hitler – a mere six months after the Munich agreement – broke up what was left of Czechoslovakia by creating a Slovak puppet state and occupying the remaining Czech lands.

There is every indication that Putin is unlikely to stop in or with Ukraine. And it is worth remembering that the second world war started 11 months after Neville Chamberlain thought he had secured “peace in our time”.

The Munich analogy may not carry that far, however. Trump is not trying to appease Putin because he thinks, as Chamberlain and Daladier did in 1938, that he has weaker cards than Putin. What seems to drive Trump is a more simplistic view of the world in which great powers carve out spheres of influence in which they do not interfere.

The problem for Ukraine and Europe in such a world order is that Ukraine is certainly not considered by anyone in Trump’s team as part of an American zone of influence, and Europe is at best a peripheral part of it.

Trump-eye lens on the world

For Trump, this isn’t really about Ukraine or Europe but about re-ordering the international system in a way that fits his 19th-century view of the world in which the US lives in splendid isolation and virtually unchallenged in the western hemisphere.

In this world view, Ukraine is the symbol of what was wrong with the old order. Echoing the isolationism of Henry Cabot, Trump’s view is that the US has involved itself into too many different foreign adventures where none of its vital interests were at stake.

Echoing Putin’s talking points, the war against Ukraine no longer is an unjustified aggression but was, as Trump has now declared, Kyiv’s fault. Ukraine has become the ultimate test that the liberal international order failed to pass.

The war against Ukraine clearly is a symbol of the failure of the liberal international order, but hardly its sole cause. In the hands of Trump and Putin it has become the tool to deal it a final blow. But while the US and Russia, in their current political configurations, may have found it easy to bury the existing order, they will find it much harder to create a new one.

The push-back from Ukraine and key European countries may seem inconsequential for now, but even without the US, the EU and Nato have strong institutional roots and deep pockets.

For all the justified criticism of the mostly aspirational responses from Europe so far, the continent is built on politically and economically far stronger foundations than Russia and the overwhelming majority of its people have no desire to emulate the living conditions in Putin’s want-to-be empire.

Nor will Trump and Putin be able to rule the world without China. A deal between them may be Trump’s idea of driving a wedge between Moscow and Beijing, but this is unlikely to work given Russia’s dependence on China and China’s rivalry with the US.

If Trump makes a deal with Xi as well, for example over Chinese territorial claims in the South China Sea, let alone over Taiwan, all he would achieve is further retrenchment of the US to the western hemisphere. This would leave Putin and Xi to pursue their own, existing deal of a no-limits partnership unimpeded by an American-led counter-weight.

From the perspective of what remains of the liberal international order and its proponents, a Putin-Xi deal, too, has an eerie parallel in history – the short-lived Hitler-Stalin pact of 1939. Only this time, there is little to suggest that the Putin-Xi alliance will break down as quickly.

@ Newshounds News™

Source: Economic Times

~~~~~~~~~

BRICS: GOLDMAN SACHS PREDICTS US DOLLAR WILL EXPERIENCE A BOOM

The BRICS alliance might not be able to deter the US dollar as Goldman Sachs predicts the currency could experience a tariff-fueled boom.

Currency traders could make stellar profits if they take long positions on the USD, wrote the global investment bank. Tariffs from the Trump administration could bolster the appeal for the greenback leading to further gains, the note from the bank read.

If the US dollar continues its rise in the charts, BRICS will have a hard time safeguarding their respective local currencies. The development could derail the de-dollarization agenda and lead to the greenback strengthening further. The USD faced severe challenges from BRICS who were looking to dethrone it from the world’s reserve currency status.

BRICS: Tariffs Could Fuel US Dollar Boom, Says Goldman Sachs

The escalating trade wars could benefit the US dollar in the long haul, wrote Goldman Sachs in a note and the development could impair the BRICS bloc. “Ultimately, not all tariffs are equal when it comes to FX,” wrote Goldman Sachs strategists Karen Reichgott Fishman and Lexi Kanter in a note.

“But given the unwind of premium in key crosses in recent weeks, we once again think tariff risks look underpriced, making long dollar exposure now look even more attractive.”

Trump’s protective style of governance could drive inflation but in turn, support US yields, the note read. The tariffs are ruffling a lot of feathers in the markets as they directly affect the imports and exports sector. BRICS was looking to outdo the US dollar but found itself in a stiff economic situation.

The local currencies of BRICS countries have already plummeted to new lows against the US dollar this year. The de-dollarization initiative could stagnate for the next four years as threats of tariffs loom from Trump.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Bits and Pieces “ in Dinarland Wed. Afternoon 2-26-2025

KTFA:

Henig: Vietnam Poised to Become a Global Financial Hub with New Financial Center Proposal

Vietnam is taking a significant step towards becoming a leading global financial hub with the proposal of a new financial center. The initiative, backed by the Ministry of Justice and the Ministry of Planning and Investment, aims to create a diverse ecosystem of financial services concentrated in a specific area.

This financial center will serve as a hub for numerous financial institutions, banks, investment funds, and financial service companies, and will house stock, currency, and commodity exchanges.

KTFA:

Henig: Vietnam Poised to Become a Global Financial Hub with New Financial Center Proposal

Vietnam is taking a significant step towards becoming a leading global financial hub with the proposal of a new financial center. The initiative, backed by the Ministry of Justice and the Ministry of Planning and Investment, aims to create a diverse ecosystem of financial services concentrated in a specific area.

This financial center will serve as a hub for numerous financial institutions, banks, investment funds, and financial service companies, and will house stock, currency, and commodity exchanges.