Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Gold, Silver, and the Great Financial Reset

Gold, Silver, and the Great Financial Reset

Kinesis Money: 12-6-2024

In a compelling episode of Live from the Vault, Kinesis Money’s Andrew Maguire joins forces with esteemed economist Dr. Stephen Leeb to uncover the seismic shifts occurring within the global financial landscape.

Their insightful dialogue deftly navigates the accelerating decline of the US dollar’s dominance, the resurgent role of gold in contemporary monetary systems, and the significant moves being made by BRICS nations that are catalyzing a transition towards a multipolar world order.

Gold, Silver, and the Great Financial Reset

Kinesis Money: 12-6-2024

In a compelling episode of Live from the Vault, Kinesis Money’s Andrew Maguire joins forces with esteemed economist Dr. Stephen Leeb to uncover the seismic shifts occurring within the global financial landscape.

Their insightful dialogue deftly navigates the accelerating decline of the US dollar’s dominance, the resurgent role of gold in contemporary monetary systems, and the significant moves being made by BRICS nations that are catalyzing a transition towards a multipolar world order.

At the heart of the discussion lies the growing vulnerability of the US dollar, long held as the world’s primary reserve currency. Maguire and Leeb analyze the multifaceted factors contributing to this decline, including rising inflation, expansive monetary policies, and geopolitical tensions.

The dollar’s entrenched status is increasingly at risk as other nations seek alternatives to mitigate their dependence on the dollar. This realignment is not just a financial shift; it represents a profound transformation in global power dynamics.

Amidst this tumult, gold is resurfacing as a form of monetary security. Maguire and Leeb highlight the critical role that gold plays in the evolving landscape, especially as central banks around the world begin to stockpile the precious metal. This strategic move underscores gold’s timeless allure as a reliable store of value and a hedge against fiat currency failures.

Leeb points out that the historical precedence of gold during economic upheaval has led to renewed interest in its intrinsic value.

As nations grapple with the challenges posed by inflationary pressures and the erosion of trust in fiat currencies, gold is being reconsidered not merely as a commodity, but as a cornerstone of sound monetary policy.

This revitalization of gold could reshape not only individual national economies but also the global financial framework.

The discussion also pivots towards the BRICS nations—Brazil, Russia, India, China, and South Africa—whose collective muscle is creating a new paradigm in international finance. These countries are actively working to establish a multipolar world order that diminishes the spotlight on the US dollar.

The implications of their coordinated efforts are profound, signaling a shift toward diversified currencies and transactions that prioritize regional stability over reliance on a single power.

With initiatives such as the BRICS currency discussions and the promotion of trade in local currencies, these nations aim to create more equitable terms of trade that serve their interests. As Maguire suggests, this transition poses both opportunities and challenges, pushing for a recalibration of how financial systems are viewed and operated globally.

A particularly poignant element of the discussion is the dichotomy between spiritual and material perspectives in global economics. Leeb highlights the importance of recognizing the underlying values that drive economic behavior, suggesting that a purely materialistic approach, often seen in the relentless pursuit of GDP growth, is shortsighted.

The co-hosts argue for a shift towards a more holistic view of economics—one that encompasses not just monetary success but also societal well-being and ethical considerations.

Such insights urge policymakers and individuals alike to rethink their relationship with wealth and prosperity. By fostering a balance between spiritual values and material pursuits, it may be possible to create a more sustainable and equitable financial ecosystem.

As Andrew Maguire and Dr. Stephen Leeb so effectively articulate, the current financial landscape is in flux, marked by the decline of the US dollar’s supremacy, the resurgence of gold as a monetary cornerstone, and the transformative ambitions of BRICS nations.

These changes compel us to reconsider our economic paradigms and the values that underpin them. In navigating these uncharted waters, embracing a more holistic view of economics may well equip us to face the future with resilience and integrity.

The implications of their insights are vast and warrant close attention from anyone interested in the dynamics of global finance, as the winds of change continue to shape our monetary future.

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

Awake-In-3D December 6, 2024

Iraq’s blueprint for a $3.00 IQD revaluation combines re-denomination, gold reserves, and sweeping reforms.

Iraq is setting the stage for a transformative economic shift with a $3.00 IQD revaluation—a move rooted in strategic planning and decisive action. By combining a re-denomination of its currency, leveraging vast gold reserves, and implementing sweeping reforms, Iraq is crafting a blueprint that could reshape its economic future. This article walks you through the steps Iraq is taking, so you can clearly see how this bold strategy is turning a monumental vision into an achievable reality.

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

Awake-In-3D December 6, 2024

Iraq’s blueprint for a $3.00 IQD revaluation combines re-denomination, gold reserves, and sweeping reforms.

Iraq is setting the stage for a transformative economic shift with a $3.00 IQD revaluation—a move rooted in strategic planning and decisive action. By combining a re-denomination of its currency, leveraging vast gold reserves, and implementing sweeping reforms, Iraq is crafting a blueprint that could reshape its economic future. This article walks you through the steps Iraq is taking, so you can clearly see how this bold strategy is turning a monumental vision into an achievable reality.

The Current Iraqi Dinar Landscape

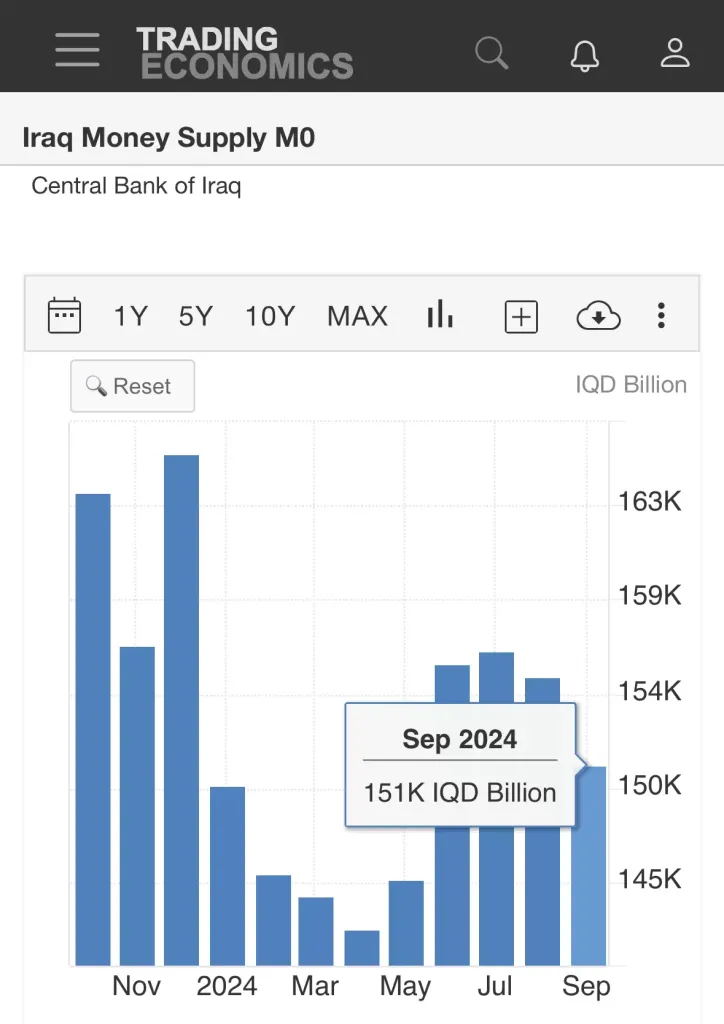

Iraq’s M0 money supply, which measures the total amount of physical currency in circulation, stands at 150,828 billion IQD as of September 2024. To express this figure in trillions, it becomes 150.828 trillion IQD, as one trillion equals 1,000 billion.

Image Source: https://tradingeconomics.com/iraq/money-supply-m0

Additionally, Iraq holds 152.6 metric tons of gold, which equates to approximately 4.9 million troy ounces or 152.6 million grams. At a price of $2,630 per troy ounce, these reserves are valued at around $12.9 billion USD, providing a strong foundation for monetary reform toward a $3.00 IQD.

How a $3.00 IQD Exchange Rate Works

Iraq’s plan to achieve a $3.00 IQD exchange rate relies on two major steps: re-denomination of the currency and backing the new currency with gold reserves. Here’s how these steps would work:

Step 1: Re-denomination

A currency re-denomination means adjusting the value of a currency by removing extra zeros from its face value. For Iraq, this involves removing three zeros from the current IQD notes.

For example:

Today, 1,000 IQD is equal to about $0.76 USD (since 1 IQD is worth roughly $0.00076).

After re-denomination, 1,000 IQD would become 1 new IQD, and that 1 new IQD is targeted to be worth $3.00 USD.

This step simplifies the currency, making it easier for people to use and understand. Instead of needing large numbers (like 1,000 IQD) for small transactions, the new IQD would have a higher value with fewer digits.

Step 2: Backing the New $3.00 IQD with Gold

To support the new value of $3.00 per IQD, Iraq plans to back its currency with its gold reserves. This means each unit of the new IQD would represent a portion of Iraq’s gold. Backing currency with gold provides stability because gold is a tangible, universally valued asset.

Here’s the math behind this:

Iraq’s total money supply after re-denomination would be 150.828 billion new IQD.

To set a value of $3.00 per IQD, the total currency value must equal $452.5 billion USD (calculated as 150.828 billion IQD × $3.00).

Gold is currently valued at $84.58 per gram, so Iraq needs to allocate about 0.0355 grams of gold for every 1 new IQD.

In total, Iraq would need 5.36 metric tons of gold to fully back its new currency at the $3.00 rate. Since Iraq’s reserves are much larger at 152.6 metric tons, the country has more than enough gold to implement this plan.

Why Gold-Backing Matters

By tying the value of the new IQD to gold, Iraq ensures its currency remains stable and valuable. Unlike paper money (fiat currency), which governments can print at will and risk inflation, a gold-backed currency cannot exceed the value of the gold reserves supporting it. This approach boosts confidence in the currency for both Iraqis and international investors.

How a $3.00 IQD Impacts Exports

While a $3.00 IQD delivers many benefits, including increased purchasing power for Iraqi citizens and enhanced international confidence in the currency, it also affects the competitiveness of Iraqi exports.

When a country’s currency strengthens, its goods and services become more expensive for people in other countries. For example, if Iraq exports agricultural products, industrial goods, or locally manufactured items, buyers in other nations need to spend more of their own currency to purchase those items. This higher cost creates challenges in competing with cheaper alternatives from other nations.

For Iraq’s non-oil sectors—such as agriculture, construction materials, and manufacturing—a $3.00 IQD challenges their ability to compete with lower-priced goods from other nations. This slows the development of these industries, which Iraq is keen to grow as part of its economic diversification efforts.

However, Iraq’s primary export—oil—remains unaffected. Oil is priced in USD globally, so its cost doesn’t change regardless of IQD fluctuations. This ensures Iraq’s oil revenue, which makes up the bulk of its economy, remains stable, providing a financial buffer as the country adjusts to a stronger IQD.

A Gold-Backed Currency and Economic Stability

One of the major advantages of a gold-backed currency is its built-in resistance to inflation. Unlike fiat currencies, which can be printed without limit and risk losing value over time, a gold-backed $3.00 IQD derives its value from a tangible asset—gold. This connection to a physical resource ensures monetary stability, as the supply of currency is tied directly to the amount of gold in reserves.

Historically, nations operating on a gold standard experience long periods of price stability, making such a system appealing for Iraq as it restores confidence in its currency.

Economic and Governance Considerations

To sustain the trust of its citizens and international markets, Iraq must address domestic challenges, such as corruption, inefficiency, and political instability. Transparent communication about the redenomination process and its goals is critical in fostering public support and maintaining economic stability.

Iraq has made strides in key areas to support these objectives:

Anti-Corruption Measures

The Iraqi government has intensified efforts to combat corruption, which has long plagued its institutions. The Integrity Commission has launched investigations into high-profile cases, targeting embezzlement and mismanagement of public funds. Recent legislation aims to enhance accountability by streamlining processes for auditing government projects and increasing penalties for financial chaos. These measures are vital for establishing public trust and ensuring that resources are directed toward economic reform.Banking Sector Modernization

Iraq is actively modernizing its banking system to facilitate a stable transition to a stronger IQD. Initiatives include introducing advanced digital banking platforms, improving transparency in financial transactions, and collaborating with international financial institutions for technical assistance. The Central Bank of Iraq (CBI) has also implemented stricter regulations to prevent money laundering and enhance the banking sector’s credibility on the global stage.Political Stability Efforts

Acknowledging the importance of political stability, Iraq’s leaders have focused on fostering unity among its diverse population. Efforts include resolving disputes over revenue sharing between the federal government and the Kurdistan Regional Government (KRG) and strengthening security measures in conflict-prone areas. These steps aim to create a more stable environment conducive to long-term economic growth.Diversification of the Economy

To reduce reliance on oil revenues, Iraq is implementing policies to promote non-oil sectors such as agriculture, manufacturing, and tourism. Programs to provide incentives for small and medium-sized enterprises (SMEs) and attract foreign investors are helping to broaden the economic base. These initiatives are aligned with Iraq’s vision for sustainable development and economic resilience in the face of global market fluctuations.Public Awareness Campaigns

The government has launched public awareness campaigns to educate citizens about the redenomination process and the benefits of a gold-backed $3.00 IQD. These efforts include town hall meetings, media outreach, and collaboration with community leaders to address concerns and misconceptions. By keeping the public informed, Iraq aims to build confidence and minimize resistance to these sweeping monetary changes.

Through these combined efforts, Iraq is positioning itself to implement a strong and sustainable $3.00 IQD exchange rate. Overcoming these challenges is essential to securing the trust of both its citizens and the international community, paving the way for long-term economic stability and growth.

Benefits of a $3.00 IQD

Global Confidence: A gold-backed $3.00 IQD strengthens Iraq’s position in international financial markets and attracts foreign investment.

Increased Purchasing Power: Iraqi citizens benefit from greater purchasing power, making imports more affordable and improving standards of living.

Economic Stability: By tying the IQD to gold, Iraq creates a stable currency, reducing the risk of inflation and promoting long-term trust.

The Bottom Line: A Feasible and Transformative Reform

With gold prices at $2,630 per troy ounce, Iraq’s reserves of 152.6 metric tons are more than sufficient to back a redenominated IQD at $3.00 IQD, requiring only 5.36 metric tons of gold. While this reform is technically feasible and promises significant benefits, Iraq must carefully manage its non-oil export sectors to mitigate the potential downsides of a stronger currency.

If implemented successfully, a $3.00 IQD marks a turning point for Iraq, restoring its currency’s historical strength and securing its place as an economic leader in the region.

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 12-07-24

Good Afternoon Dinar Recaps,

THE QUANTUM FINANCIAL SYSTEM'S NETWORK — ISO 20022 COMPLIANT COINS

▪️Ripple XRP

Institutional coins, network of smart contracts, removes 3rd party verification, reduces fraud and illegal activities.

The digital currency, XRP, acts as a bridge currency to other currencies. It does not discriminate between any fiat/cryptocurrency, which makes it easy for any currency to be exchanged for another. It is scalable. XRP Provides Global Liquidity, backed by gold, part of the ISO20022 ecosystem.

ISO20022 is a worldwide industry standard that has been brought in to regulate the interchange of electronic data between financial institutions.

Good Afternoon Dinar Recaps,

THE QUANTUM FINANCIAL SYSTEM'S NETWORK — ISO 20022 COMPLIANT COINS

▪️Ripple XRP

Institutional coins, network of smart contracts, removes 3rd party verification, reduces fraud and illegal activities.

The digital currency, XRP, acts as a bridge currency to other currencies. It does not discriminate between any fiat/cryptocurrency, which makes it easy for any currency to be exchanged for another. It is scalable. XRP Provides Global Liquidity, backed by gold, part of the ISO20022 ecosystem.

ISO20022 is a worldwide industry standard that has been brought in to regulate the interchange of electronic data between financial institutions.

Ripple works on an open-source and peer-to-peer decentralized platform that helps in easily transferring various forms of fiat money, be it pound, dollars or rupees, or cryptocurrencies, like Ether or Bitcoin.

Its services included being a medium of exchange, international payment settlement and remittance system.

XRP is the digital asset native to the Ripple system. It is touted as being easy to use with almost free, instant transactions. Ripple is built upon distributed open source protocol, a consensus ledger and the aforementioned digital asset known as XRP.

Built for enterprise use, XRP enables real-time global payments anywhere in the world. XRP offers banks and payment providers a reliable, on-demand option to source liquidity for cross-border payments and has been increasingly adopted by banks and payment networks as settlement infrastructure technology.

▪️Stellar XLM

Digital Currency backed by Silver, part of the ISO20022 ecosystem.

XLM/Stellar Network: the people’s coin, people can create/send/trade all forms of money (fiat and digital), undeveloped nations. Partnered with VISA and MoneyGram.

Stellar is a cryptocurrency and open source protocol for value exchange founded in early 2014 with a similar structure to that of the competing blockchain solution, XRP. Stellar claims to be platform that connects banks, payments systems, and people.

Stellar aims to achieve this through its completely decentralized consensus platform. It is designed to support any type of currency and has a built in decentralized exchange that can be used to trade any type of currency or asset.

The Stellar ledger records all the balances and transactions belonging to every account on the network. A complete copy of the Stellar ledger is then hosted on each server that runs the open source Stellar software. These servers form the decentralized Stellar network. To verify the network these servers then sync and validate the ledger through process known as consensus.

▪️Quant QNT

Quant is a versatile plug-and-play solution connecting different blockchains and enterprise software without requiring new infrastructure.

Using distributed ledger technology (DLT) and APIs through the Overledger API gateway, it enables seamless communication between blockchains.

Quant also supports multi-ledger tokens (MLTs) backed by fiat funds held in escrow, serving entities like central banks, banks, fintechs, payment systems, and marketplaces.

These MLTs function as stablecoins, vouchers, loyalty points, and eMoney, facilitating fast and transparent cross-border bank payments.

The union of Quant (QNT) and the ISO 20022 standard signifies a groundbreaking alliance within the Quantum Financial System.

Quant, focused on blockchain interoperability, integrates ISO 20022's universal financial messaging standard to enhance connectivity between diverse networks.

By adhering to ISO 20022, Quant aims for standardized, efficient, and secure transactions, propelling faster speeds, reduced costs, and improved transparency. Moreover, this integration represents a vital step toward leveraging quantum computing in finance.

While promising, challenges like widespread adoption and regulatory alignment must be addressed.

Yet, the amalgamation of Quant QNT with ISO 20022 paints a future where quantum technology and interoperability revolutionize finance.

▪️ XDC/ XinFin Network

Digital Currency backed by Copper, part of the ISO20022 ecosystem.

Fintech coin (VISA/MC), partnered with Flare Network/DeFi (decentralized finance) = bridge between institutional and retail.

XinFin is a Blockchain technology company focused on international trade and finance.

We have developed a highly scalable, secure, permissioned and commercial grade Blockchain architecture.

XinFin blockchain is powered by XDC01 protocol, which is built over the first of its kind Hybrid Blockchain architecture to eliminate the inefficiencies in global trade and financing and to enable institutions provide real time settlement as well as enabling cross border smart contracts.

With an aim to bridge the global infrastructural deficit with their open source marketing platform - TradeFinex, XinFin has created a seamless platform for financiers, suppliers and beneficiaries across industries worldwide.

The primary goal of XinFin is efficiently facilitate capital deployment and minimize pressure on the infrastructural deficit by enabling a peer to peer trade and financing between governments, corporates, communities and suppliers.

They use blockchain and IoT to enable the transaction of community driven digital asset.

▪️Algorand ALGO

Digital Currency backed by precious metal Palladium, part of the ISO20022 ecosystem.

Algorand is an open source, pure proof of stake blockchain protocol.

It requires a negligible amount of computation, and generates a transaction history with low “fork” probability.

This protocol aims to remove technological barriers: decentralization, scalability, and security, that have undermined the acceptance of mainstream blockchain.

Algorand implements a new Byzantine Agreement (BA) protocol to reach consensus among users on the next set of transactions.

To scale the consensus to many users, Algorand uses a novel mechanism based on Verifiable Random Functions. There are two types of smart contracts on the Algorand network:

Layer 1 on-chain, and Layer 2 off-chain, by moving the most computationally intensive smart contracts off-chain, Algorand frees up space on the network for simple transactions, thus reducing congestion to improve processing speed.

▪️Iota MIOTA

Digital Currency backed by precious metal Iridium, part of the ISO20022 ecosystem.

IOTA is an open source, public distributed ledger that is used for providing secure payments and communications between devices on the “Internet of things.

The IOTA ledger stores transactions in a directed acyclic graph structure, called a Tangle.

The Tangle is used instead of the blockchain structure commonly seen in other cryptocurrencies, such as Bitcoin.

This tangle structure is part of what enables IOTA to keep its transactions free, regardless of the size, In addition the confirmations are almost instant and the systems capability is unlimited.

▪️Hedera HBAR

The integration of Hedera HBAR into the ISO 20022 framework within the Quantum Financial System (QFS) marks a significant stride in the evolution of finance.

Hedera Hashgraph's unique consensus algorithm, combined with the standardized messaging of ISO 20022, promises several advantages.

This integration facilitates: Interoperability, Security, Efficiency, Transparency and Auditability, Global Adoption.

These tokens are mainly utilized to power decentralized applications to protect the network from malicious attacks and for paying network services.

While promising, challenges such as regulatory compliance and market acceptance remain.

Nonetheless, this integration paves the way for a more efficient, transparent, and globally accessible financial landscape.

▪️Cardano ADA

Cardano (ADA) is a third-generation blockchain platform built to address the limitations of earlier blockchain systems like scalability, interoperability, and sustainability.

Developed with a strong emphasis on academic research and peer-reviewed protocols, Cardano is known for its innovative approach to decentralization and energy efficiency through its Ouroboros proof-of-stake (PoS) consensus mechanism.

As one of the few cryptocurrencies aligned with the ISO 20022 messaging standard, Cardano is uniquely positioned to integrate seamlessly into the evolving global financial system.

This makes ADA particularly appealing for use cases like cross-border payments, remittances, and other financial services requiring high levels of interoperability and regulatory compatibility.

@ Newshounds News™

Source: https://qfs.live/

~~~~~~~~~

END OF CRYPTO CRACKDOWNS? LAWMAKER SAYS 'REGULATION BY ENFORCEMENT IS OVER'

A top lawmaker says the U.S. is shifting from “regulation by enforcement” to clear oversight, with new leadership poised to boost cryptocurrency and AI innovation.

A New Era for Crypto and AI Regulation

U.S. House Financial Services Committee Chairman Patrick McHenry has highlighted progress in crypto regulation, focusing on new leadership roles and the evolving oversight of cryptocurrencies and artificial intelligence (AI). In a post on social media platform X Friday, McHenry praised the creation of a “crypto and AI czar” as a major development.

“The mere fact that the U.S. now has a crypto and AI ‘czar’ reflects the impact of the Financial Services Committee,” he claimed, emphasizing:

The era of regulation by enforcement is over.

“With folks like David Sacks and Paul Atkins, the future of the digital asset ecosystem in the U.S. is brighter than ever,”the congressman added. “Paul Atkins has the expertise and experience needed to restore faith in the SEC. I’m confident his leadership will lead to clarity for the digital asset ecosystem and ensure U.S. capital markets remain the envy of the world,” the congressman continued.

President-elect Donald Trump recently announced two significant appointments: David Sacks as the White House AI and Cryptocurrency Czar, and Paul Atkins as Chair of the Securities and Exchange Commission (SEC), replacing Chair Gary Gensler.

Sacks, a venture capitalist and former Paypal executive, is tasked with developing a legal framework to bolster the U.S. crypto industry and ensure global competitiveness in artificial intelligence.

Atkins, a former SEC commissioner known for his pro-crypto stance, is expected to shift the agency’s approach towards more lenient regulations, potentially easing enforcement actions against digital asset firms.

These appointments signal the incoming administration’s intent to foster innovation in emerging technologies while reconsidering existing regulatory measures.

McHenry has announced he will retire from Congress at the end of his current term, which concludes in January 2025. As Chairman of the House Financial Services Committee, he has been a leading advocate for clear regulatory frameworks in the digital asset sector.

His comments come amid growing calls for a balanced regulatory approach that fosters innovation while ensuring investor protection. Industry observers have long criticized “regulation by enforcement” for creating uncertainty and stifling growth, making this transition a welcomed change for stakeholders.

The new focus on leadership and structured policies marks a pivotal moment for U.S. cryptocurrency and AI development, with advocates anticipating a more supportive environment for innovation.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

GET READY FOR NESARA GESARA WITH THESE 5 ESSENTIAL QSI TOOLS! Youtube

QUANTUM FUTURE WITH THE QFS

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Saturday 12-7-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 7 Dec. 2024

Compiled Sat. 7 Dec. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

At any moment Tiers 3 and 4a/b (including the Internet Group) were expected to receive notifications to schedule redemption appointments. Bondholders in Tiers 1 and 2 have already (allegedly) received their funds, but are under NDAs. …Gitmo TV on Telegram Tues. 3 Dec. 2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 7 Dec. 2024

Compiled Sat. 7 Dec. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

At any moment Tiers 3 and 4a/b (including the Internet Group) were expected to receive notifications to schedule redemption appointments. Bondholders in Tiers 1 and 2 have already (allegedly) received their funds, but are under NDAs. …Gitmo TV on Telegram Tues. 3 Dec. 2024

On Fri. 6 Dec. 2024 Iraq has (allegedly) passed their HCL Law and it (allegedly) goes into the Gazette in time for the weekend. This means RV! The US Debt Clock gave us a date of Sun. 8 Dec. 2024 just after 9PM (central time). Right after 9:30 PM it gave another message “Revalue Your Thinking.”

Thurs. 5 Dec. 2024 Gingers Liberty Lounge on Telegram: A Report from Jim Willie, stated that an Iraqi citizen he knows has redeemed his currency at the new international rate. Family, this is expected that Iraqi national citizens would have time initially to exchange before the rest of the world’s IQD holders will exchange. This also happened in Kuwait all those years ago with Kuwaiti Dinar RI/RV. Fabulous!

Thurs. 5 Dec. 2024 Bruce: Sources were saying that Tier4b will start this weekend. On Wed. 4 Dec. the screens received new rates for 19 currencies that will move up in value and others that will go down in value. We have been told that the president had to be out of the country in order for this to happen.

Fri. 6 Dec. 2024 TNT Intel Summary: Bank meetings today to discuss final aspects of RV. Three Letter Agencies say “IT’S DONE.” US and Canada (allegedly) started paying VIPs on Wednesday, Thursday, and today. The Iraqi dinar is (allegedly) being paid at $3.49 right now. 800 numbers will be (allegedly) given out tomorrow Sat. 7 Dec. morning at 8:00 am. There will (allegedly) be no 800 numbers in Canada.

Global Financial Crisis:

Fri. 6 Dec. 2024: Breaking: Another Bank Outage Has Just Left Millions Of Americans Without Money! Epic Economist Video – amg-news.com – American Media Group

Fri. 6 Dec. 2024 Another Bank Outage Has Just Left Millions Of Americans Without Money! The catastrophic collapse of Synapse Bank has left millions of Americans penniless! With regulators shrugging off responsibility, over $300 million in deposits have vanished, exposing the dark side of fintech. Trust in the U.S. banking system is crumbling—can it survive? Read the full exposé now! https://amg-news.com/breaking-another-bank-outage-has-just-left-millions-of-americans-without-money-epic-economist-video/

Read full post here: https://dinarchronicles.com/2024/12/07/restored-republic-via-a-gcr-update-as-of-december-7-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Just because you see all the evidence that the monetary reform is already here it doesn't mean that it has to be given to them right now...If you have 95% of the skeleton, that's a lot of information. You can tell if it's a man or a woman...how high they're going to be. You can tell a lot. That's why you can tell a lot about the monetary reform right now because it's 95% completed...What's the 5%? That's what they're doing right now.

Bruce [via WiserNow] There's a flash drive that was sent out for five institutions, three banks and two redemption centers in one case, and those were installed on laptops, and they're using laptops in the redemption centers and the bank...it's a release activation mechanism... like a release activation code key...they are designed to receive a signal in some form of protocol, let's call it - timeline activated - through the Starlink satellite system...So it would be wirelessly activated through Starlink to activate with the codes that are installed to begin what it is we're waiting for...two resources, last night, two more today are saying...that we will start this weekend.

************

The Next Black Swan? Expert Warns of an Economic Crisis that Could Strike Without Warning

Daniela Cambone: 12-6-2024

I think we are at peak dollar... But it’s not something that’s going to happen overnight; it will take decades to unfold,” says Clive Thompson, retired managing director of Union Bancaire Privée in Switzerland.

In an interview with Daniela Cambone, Thompson delves into the dangers of the insurmountable debt burden facing the U.S. economy. “The real debt will be more than double what it is today. And the interest being paid on that debt is probably going to be four or five times what it is today,” he warns, painting a sobering picture of the future.

Thompson also sheds light on the growing crises in Europe, highlighting the fragile state of the eurozone. “If the euro collapses, every country will start pulling in its own direction. It will be chaos.”

Watch the interview now to gain insights into Clive Thompson's perspective and learn how to navigate these turbulent times.

CHAPTERS:

00:00 Insurmountable U.S. debt

12:33 Stock market crashes in history

14:30 U.S. dollar

16:40 European policial chaos

20:39 Gold

26:26 Bitcoin

28:10 Gold performance

29:15 Banking system

Seeds of Wisdom RV and Economic Updates Saturday Morning 12-07-24

Good Morning Dinar Recaps,

FORMER NY FED PRESIDENT ARGUES BITCOIN COULD UNDERMINE USD, SUGGESTS PRIORITIZING REGULATORY FRAMEWORK

Bitcoin has recently surged past $100,000 following Donald Trump‘s election victory. Amidst broader market sentiments, the crypto community eagerly anticipates that Trump administration will prove to be pro-crypto and will stand behind his promise of a strategic BTC reserve for the United States.

Advocates believe it could serve as a hedge against inflation and a diversification tool in portfolios. However, Bill Dudley, former president of the Federal Reserve Bank of New York, has criticized Bitcoin’s role as money, describing its volatility and lack of income generation as its shortcomings.

Good Morning Dinar Recaps,

FORMER NY FED PRESIDENT ARGUES BITCOIN COULD UNDERMINE USD, SUGGESTS PRIORITIZING REGULATORY FRAMEWORK

Bitcoin has recently surged past $100,000 following Donald Trump‘s election victory. Amidst broader market sentiments, the crypto community eagerly anticipates that Trump administration will prove to be pro-crypto and will stand behind his promise of a strategic BTC reserve for the United States.

Advocates believe it could serve as a hedge against inflation and a diversification tool in portfolios. However, Bill Dudley, former president of the Federal Reserve Bank of New York, has criticized Bitcoin’s role as money, describing its volatility and lack of income generation as its shortcomings.

As per a latest Bloomberg report, Bill Dudley, former president of the Federal Reserve Bank of New York, has expressed concerns over the idea of incorporating Bitcoin into the U.S. national reserves and argues that it would not benefit most Americans. He emphasized that such a move might not align with the nation’s best interests and could divert focus from more inclusive economic policies.

Can Bitcoin Undermine USD’s Status?

He noted that incorporating Bitcoin into the US national reserves could undermine the dollar’s status as the global reserve currency and primarily benefit specific interest groups rather than the broader American public.

Notably, Bill Dudley stated that Bitcoin is a weak asset, noting reasons such as price volatility, lack of widespread acceptance as payment, and slow and expensive transaction processes that make BTC a weak asset.

He also noted the risk of individuals losing access to their Bitcoin holdings and that, unlike traditional financial assets, Bitcoin does not generate income through interest or dividends. “Bitcoin is not connected to any cash flows like interest or dividends, and its price is driven purely by speculative demand,” he explained.

The former Fed chair also noted that the absence of an exit strategy for a Bitcoin reserve would make it a liability. “The government would end up holding tokens that produce no income, offering no real value to the majority of Americans,” he said.

Suggests To Focus On Comprehensive Regulations-

Notably, Dudley argued that creating a Bitcoin reserve for the U.S. would require the Treasury to increase borrowing, raising debt servicing costs or requiring the Fed to print more money, ultimately fueling inflation.

Instead of focusing on Bitcoin as a reserve asset, Dudley has called for the Trump administration to prioritize creating a robust regulatory framework for the crypto industry.

He stressed the need for clear rules to protect consumers, regulate stablecoins, and prevent the use of cryptocurrencies in criminal activities. “Crypto technology has the potential to improve the financial system,” Dudley noted. “However, without strong guardrails, fraud and abuse will continue to undermine trust and hinder progress.”

Market Optimism Prevails

Nevertheless, there is market optimism amidst expectations of a more crypto-friendly administration. Also, the nomination of digital asset-friendly Paul Atkins to chair the SEC provided the final boost as bitcoin surpassed $100,000 to record highs.

Recently, Trump nominated venture capitalist David Sacks as the White House AI & Crypto Czar, who is expected to push Trump’s crypto and AI pro-innovation plans forward.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

GARY GENSLER QUIETLY SETS AGGRESSIVE CRYPTO CRACKDOWN IN MOTION BEFORE LEAVING, WARNS FORMER SEC OFFICIAL

SEC Chair Gary Gensler is orchestrating a last-minute push to cement aggressive crypto enforcement, with secret promotions signaling a looming regulatory crackdown despite leadership changes.

Former SEC Official Warns of Crypto Crackdown Despite Incoming Pro-Crypto Chair

John Reed Stark, former head of the U.S. Securities and Exchange Commission’s (SEC) Office of Internet Enforcement, has highlighted significant developments within the agency that he believes could impact the cryptocurrency sector.

“SEC Chair Gensler pulls off the first reverse Saturday Night Massacre,” Stark wrote in a post on social media platform X on Wednesday, referencing Chair Gary Gensler’s recent moves.

Stark addressed the SEC’s leadership transition and the calculated steps Chair Gary Gensler is taking to solidify the agency’s enforcement priorities before leaving office. “It looks like former SEC Commissioner Paul Atkins will be the next SEC Chair. A phenomenal choice,” he wrote.

Known for his pro-business approach, Atkins is expected to bring a different focus to the SEC. However, Stark pointed out that Gensler has been laying the groundwork to ensure the agency’s crypto enforcement efforts remain robust. “Meanwhile, current SEC Chair Gary Gensler is quietly working behind the scenes to lead the SEC from the grave,” he noted, adding:

Along these lines, Gensler just promoted three of the best, brightest, experienced and most dedicated crypto-enforcement lawyers in SEC ranks to senior executive positions—running the SEC’s Trial Unit and running the SEC’s Crypto Unit.

Although the promotions have not been formally disclosed, Stark claimed they are already finalized. He noted the secrecy surrounding the moves, stating: “Interestingly, the SEC has not publicly announced these promotions and seems to be keeping them quiet (which is unprecedented). But these well-deserved promotions are a done deal.”

Crypto firms, Stark warned, should prepare for intensified regulatory pressure even after Gensler leaves office on Jan. 20. He predicted:

The Stark reality is that it looks like the crypto-fight is on post-January 20th. So get ready for World War III on day one Chair Atkins, because these three crypto-enforcement lawyers, who are now in charge, are some of the best in the business and will not roll over easily.

@ Newshounds News™

Source: Bitcoin News

~~~~~~~~~

FINANCIAL REVOLUTION 2024: WHAT YOU NEED TO KNOW! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 12-7-2024

TNT:

Tishwash: The region's salary crisis is worsening again.. Demonstrations return in Sulaymaniyah

Hundreds of teachers and employees demonstrated today, Saturday (December 7, 2024), in front of the Sulaymaniyah Court, protesting the salary crisis, which has been delayed for the past two months.

Baghdad Today correspondent said, "Hundreds of employees, teachers and instructors demonstrated in front of the Sulaymaniyah court due to delayed salaries, while they demanded an end to this crisis and reaching a final agreement that would lead to the delivery of their salaries without delay link

TNT:

Tishwash: The region's salary crisis is worsening again.. Demonstrations return in Sulaymaniyah

Hundreds of teachers and employees demonstrated today, Saturday (December 7, 2024), in front of the Sulaymaniyah Court, protesting the salary crisis, which has been delayed for the past two months.

Baghdad Today correspondent said, "Hundreds of employees, teachers and instructors demonstrated in front of the Sulaymaniyah court due to delayed salaries, while they demanded an end to this crisis and reaching a final agreement that would lead to the delivery of their salaries without delay link

************

Tishwash: Source: Iran resumes gas supply to Central Iraq

On Friday, Iran began gradually resuming gas supplies to power plants in central Iraq following the completion of maintenance work on gas transmission lines, a government source revealed.

The source told Shafaq News that electricity supply is expected to improve in the coming hours in central regions, particularly in Baghdad, Wasit, Diyala, parts of Al-Anbar, and other provinces.

The resumption came after a two-week suspension of Iranian gas supplies for maintenance, which had caused the Iraqi national power grid to lose about 5,500 megawatts of electricity, according to the Ministry of Electricity's announcement on November 24.

Notably, Iraq has relied on scheduled power cuts since the 1990s due to chronic electricity shortages. Residents often turn to private generators to fill the gap.

To supplement its needs, Iraq imports 33-40% of its gas and electricity from Iran. However, US sanctions on Iran have complicated payment for these imports, restricting Iran's access to funds for purchasing non-sanctioned goods like food and medicine.

In light of these challenges, Baghdad has been pursuing alternative energy strategies, including regional grid connections to secure stable electricity supplies without relying on fuel.

Iraq has also sought to diversify its gas imports, signing a preliminary agreement with Turkmenistan in August 2023 to supply gas for its power stations.

On the other hand, the United States continues to pressure Iraq to reduce its reliance on Iranian gas, despite Iraq’s status as the second-largest oil producer in OPEC. link

************

Tishwah: Due to the Kurdish boycott, a representative reveals the reasons for postponing the budget reading

Today, Saturday, the representative of the Al-Fatah Alliance, Walid Al-Sahlani, revealed the reasons for raising the budget paragraph, while pointing out that there are multiple points of view regarding the paragraphs that need to be amended.

Al-Sahlani said in a statement to Al-Maalouma Agency, “The Parliamentary Finance Committee requested to postpone the reading of the budget law for a second reading until the Minister of Finance is hosted.”

He added, "The Kurdish parties refused to enter the session because the budget paragraph was removed from the agenda."

He pointed out that "the Kurdish parties insist on presenting the budget without the need to host the Minister of Finance."

He pointed out that "the majority of the members of the House of Representatives requested to host the Minister of Finance before starting to read the budget amendment." link

************

Tishwash: Mazhar Mohammed Saleh: Iraq's economy, financial flows and trade relations will not be affected by events in Syria

The Iraqi Prime Minister's Advisor for Economic Affairs, Mazhar Mohammed Salih, confirmed the strength of the Iraqi economy, its financial flows, and its trade relations, noting that this economy has not been affected by the tensions taking place in the Syrian arena.

Mazhar Muhammad Salih said in a press statement, “The Syrian economy is an economy sanctioned by countries, such as the United States and some other European countries, and therefore all banking relations (for Iraq) with Syria are basically unavailable.”

He explained that “trade with Syria is mostly border trade and consists of simple, natural civilian goods such as agricultural crops or something like that.”

Regarding the impact of the events in Syria on the exchange rate of the dollar in Iraq, Mazhar Muhammad Salih stated that “the current events are in Syria, not Iraq,” adding that “the problems in Syria may affect some of the simple border trade known, or which is civil or related to the tourism sector, and some simple problems and disturbances may occur, but they are not major disturbances.”

The Iraqi Prime Minister's advisor for economic affairs pointed out that "the Iraqi economy, by nature, has high cash flows from its oil trade and global trade with large trade sources, while the minor fluctuations that are taking place are nothing but colorful noise."

He explained that “the parallel markets usually benefit from any political event in neighboring countries, for example, to raise the price, and for speculators to benefit, so this is a temporary speculation that leads to very simple price disturbances, and has no relation to the Iraqi economy, and is called information markets, so what is happening in Syria at the present time will not affect the Iraqi economy, and our economy is completely isolated from the Syrian issue.”

Mazhar Mohammed Saleh stressed that “the country is immune and there is no fear for our trade because it is governed by the central policies of the state,” noting that “Iraq obtains its budget from major oil revenues, which strengthen the banks’ finances and finance Iraq’s foreign trade, not the domestic market,” adding that “the parallel market is a completely superficial market and does not indicate anything in reality about the Iraqi economy at the present time.”

The Iraqi Prime Minister’s advisor for economic affairs stated that “the parallel market benefits from the neighboring unrest and does not pose any threat to the Iraqi economy and does not represent anything, and we are immune to what is happening in Syria,” explaining that “the problems in Syria are not new to it and have existed since 2011, so there is no fear for the Iraqi economy, which is immune and neutral from the problems of others.”

Mazhar Muhammad Salih stressed that “our policies are disciplined, so what is happening in Syria does not affect the overall economic situation, and an increase in the exchange rate of the currency by one or two dollars could return to its previous state quickly, perhaps through a single statement.”

He believed that “Iraq’s economic situation is secure, its oil policies are calm, its trade relations with the outside world are going well, and its cash flows from cash revenues are good and beyond reproach, and thus the economic situation is stable.” link

************

Mot: .. Guess What a Parents Fav Holiday is ~~~~

Mot: . Maybe if Ya Starts Now - You can Convince um!!!

More News, Rumors and Opinions Friday PM 12-6-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 6 Dec. 2024

Compiled Friday 6, Dec. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Thurs. 5 Dec. 2024 Gingers Liberty Lounge on Telegram: A Report from Jim Willie, stated that an Iraqi citizen he knows has redeemed his currency at the new international rate. Family, this is expected that Iraqi national citizens would have time initially to exchange before the rest of the world’s IQD holders will exchange. This also happened in Kuwait all those years ago with Kuwaiti Dinar RI/RV. Fabulous!

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 6 Dec. 2024

Compiled Friday 6, Dec. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Thurs. 5 Dec. 2024 Gingers Liberty Lounge on Telegram: A Report from Jim Willie, stated that an Iraqi citizen he knows has redeemed his currency at the new international rate. Family, this is expected that Iraqi national citizens would have time initially to exchange before the rest of the world’s IQD holders will exchange. This also happened in Kuwait all those years ago with Kuwaiti Dinar RI/RV. Fabulous!

~~~~~~~~~~~

Thurs. 5 Dec. 2024 Bruce:

On Wed. 4 Dec. three different sources indicated something was going to happen tonight that would make Tier4b move forward with notification.

Wells Fargo and HSBC have sent out to certain individuals in Redemption Centers a flash drive that releases the activation code. Those flash drives have been installed and will receive the activation codes from the Star Link System to begin the redemption process.

Redemption Center people were having to sign brand new NDAs every time they go into the Redemption Center.

Sources were saying that Tier4b will start this weekend.

On Wed. 4 Dec. the screens received new rates for 19 currencies that will move up in value and others that will go down in value.

We were told that the president had to be out of the country in order for this to happen. On Fri. 6 Dec. President Trump will be leaving for France and will be there over the weekend.

Read full post here: https://dinarchronicles.com/2024/12/06/restored-republic-via-a-gcr-update-as-of-december-6-2024/

************

TNT:

Tishwash: UN: Iraq today is more secure and stable and its government has succeeded in keeping it away from conflict

The UN Secretary-General's Representative in Iraq, Mohammed Al-Hassan, confirmed today, Friday, December 6, 2024, that "Iraq today is more secure and stable."

Al-Hassan said in a briefing to the UN Security Council: "Iraq, a country of civilizations, is capable of overcoming crises towards a more stable and brighter future."

He added, "Iraq succeeded in conducting the important population census, and I followed up on this with the Prime Minister."

He stressed that "the Iraqi government succeeded in keeping Iraq away from the conflict."

Al-Hassan pointed out that "Prime Minister Mohammed Shia al-Sudani worked to invest in multiple projects in Iraq to develop bridges, schools, and transportation networks." link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Someone right now can buy 1 million [dinars] …for $1,200, $1,300 but when the blessing occurs you’re going to end up spending a million to buy a million dinars. No, I don’t think so. But the whales and sharks will. They’ll buy 1 million dinar for $1 million because they know as it floats it’ll go to $3 million and they made a killing. That’s when the sharks make their money. They smell the chum right now and some of them are moving but not as much as they will when it happens. When it happens big boys play with big money.

Militia Man Article quote: “The fiscal year of government banks in Iraq ends the end of December each year where some financial operations are temporarily suspended to conduct annual settlements and close accounts.” Those that think Iraq is on a different system and different time frames for their end of year…those that were saying April or March are wrong. Fiscal year of the government bank ends at the end of December each year.

************

Markets At Risk Of Serious Correction, Valuations ‘Out Of Whack’ | Moody’s Mark Zandi

David Lin: 12-6-2024

Mark Zandi, Chief Economist of Moody's Analytics, discusses the prospects for economic growth, the Fed's likely next move, and how financial markets are getting "off kilter".

0:00 – Intro

0:35 - Fed’s next move

3:00 - Recession in 2025?

4:10 - Earnings outlook

4:40 - Asset prices getting overvalued

7:00 - Tax cuts and stocks

9:40 - 100% tariffs on BRICS countries?

13:00 - Markets are “increasingly off kilter”

15:00 - Stocks vs. bond yields

17:00 - Long-term equities returns

18:30 - Valuations are “out of whack”

19:40 - Policies that can trigger correction

21:30 - Real wages rising

22:30 - Credit card spending

24:00 - Quits rate

25:17 - Scott Bessent’s 3-3-3 policy

28:00 - Tariffs and deficit

29:33 - Housing market

31:30 - How to avoid the next financial crisis

Seeds of Wisdom RV and Economic Updates Friday Afternoon 12-06-24

Good Afternoon Dinar Recaps,

XRP LAWSUIT NEWS: ATKINS WON’T DISMISS THE RIPPLE CASE, SEC VS XRP TO CONTINUE

Gary Gensler's departure in January 2025 could leave the SEC’s stance on Ripple unchanged, with Jorge Tenreiro playing a key role in the ongoing case.

As the SEC’s appeal deadline for Ripple approaches in January 2025, the transition in leadership raises questions about the future of crypto regulations.

Good Afternoon Dinar Recaps,

XRP LAWSUIT NEWS: ATKINS WON’T DISMISS THE RIPPLE CASE, SEC VS XRP TO CONTINUE

Gary Gensler's departure in January 2025 could leave the SEC’s stance on Ripple unchanged, with Jorge Tenreiro playing a key role in the ongoing case.

As the SEC’s appeal deadline for Ripple approaches in January 2025, the transition in leadership raises questions about the future of crypto regulations.

Gary Gensler, the controversial head of the U.S. Securities and Exchange Commission (SEC), will step down on January 20, 2025, as announced by the agency recently. Gensler, who was widely criticized by crypto investors during his tenure, will leave just days before a major decision in the SEC’s ongoing legal battle with Ripple, set for January 25, 2025.

What Gary Gensler’s Departure Means for the SEC’s Ripple Lawsuit

However, despite Gensler’s departure, the future of the SEC’s approach to crypto remains uncertain. Bill Morgan, an attorney closely following the case, pointed out that the SEC’s new chief litigation counsel, Jorge Tenreiro, is deeply involved in the Ripple litigation.

Tenreiro, who will be the key lawyer in the SEC v. Ripple case, may continue in this role even after the confirmation of the new SEC commissioner, Paul Atkins. Morgan expressed skepticism about any significant shift in the SEC’s stance on crypto if Tenreiro remains in charge of the litigation.

Morgan warned against assuming that the SEC’s decision not to file its brief in the Ripple case by January 15, 2025, signals a change in approach. He said that Tenreiro would still be handling it.

Morgan wrote, “If Tenreiro stays in the new role it will not signal a big change in SEC enforcement policy towards crypto. Even if there is a change the SEC v Ripple Appeal may continue.”

Jorge Tenreiro’s Role: Will the SEC’s Stance on XRP Change?

In response, Marc Fagel, a former SEC lawyer, clarified that trial counsel like Tenreiro do not make policy decisions; they handle enforcement actions approved by the SEC’s Commissioners.

Fagel asked whether there was any example of a new SEC administration dismissing a pending enforcement action, though he acknowledged that future changes could deviate from past norms.

As the January 2025 appeal deadline approaches, it remains to be seen how the SEC’s leadership transition will impact the outcome of the Ripple case and the agency’s overall approach to the cryptocurrency market.

FAQs

What impact will Gensler’s departure have on the Ripple lawsuit?

Despite Gensler’s exit, the SEC’s approach may remain the same, with Jorge Tenreiro continuing to handle the Ripple case.

Will the SEC’s stance on crypto change after Gary Gensler leaves?

Legal experts suggest the SEC’s crypto policy may not change significantly, even with a leadership transition and Tenreiro in charge.

What is the significance of the January 2025 Ripple case appeal deadline?

The Ripple appeal deadline in January 2025 is pivotal for the future of crypto regulation, potentially shaping the SEC’s approach.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

RIPPLE TARGETING YEAR-END RLUSD STABLECOIN LAUNCH: REPORT

Ripple is pushing to launch its U.S. dollar-pegged stablecoin, RLUSD, by the end of 2024, though regulatory approvals and the holiday season could cause delays.

This sentiment comes from Ripple CTO David Schwartz. Speaking at The Block’s Emergence conference in Prague, Schwartz expressed optimism despite challenges.

“I’m very hopeful it will happen this year, but once you start running into Christmas and New Year’s, people are gone,” he said, according to The Block.

RLUSD was initially announced in April and will operate on both the XRP Ledger and Ethereum. Testing began in August, and Ripple has partnered with exchanges Uphold, Bitstamp, and Bitso, alongside market makers B2C2 and Keyrock, to ensure liquidity.

No release on December 4

One of the main obstacles is obtaining regulatory approval from the New York State Department of Financial Services

There was speculation that Ripple’s stablecoin would be released on December 4. However, the company addressed this speculation on X, stating, “Despite some rumors, RLUSD isn’t launching today. We’re working closely with the NYDFS on final approval and will share updates as soon as possible.”

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

HOW TO OPEN A XAMAN WALLET: THE EASIEST STEP-BY-STEP GUIDE | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

I SPENT YEARS RESEARCHING THE RV AND HERE'S WHAT I FOUND! Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

David Morgan: Gold - The Monetary Hitching Post of the Universe

David Morgan: Gold - The Monetary Hitching Post of the Universe

Palisades Gold Radio: 12-6-2024

Tom Bodrovics, welcomes back David Morgan, founder of The Morgan Report, for a discussion centered around their recent interviews with Dr. Judy Shelton.

They highlight her advocacy for the moral obligation of money and her belief in an honest monetary system that fosters freedom and stability.

David Morgan: Gold - The Monetary Hitching Post of the Universe

Palisades Gold Radio: 12-6-2024

Tom Bodrovics, welcomes back David Morgan, founder of The Morgan Report, for a discussion centered around their recent interviews with Dr. Judy Shelton.

They highlight her advocacy for the moral obligation of money and her belief in an honest monetary system that fosters freedom and stability.

Morgan believes these views align with his life's work. The conversation touches upon potential solutions for imposing monetary discipline on the government, including the idea of long-term gold bonds and a bimetallic standard consisting of both gold and silver.

The benefits of a bimetallic system include regulation of inflation, but its practicality is questioned due to the current market values of gold and silver.

Morgan also discusses the role of the Federal Reserve in the US monetary system, suggesting that commercial banks create most of the money through loans and advocating for the Treasury to manage monetary policy according to the Constitution.

He expresses skepticism towards Central Bank Digital Currencies due to concerns over privacy and potential loss of control by individuals.

David Morgan shares his long-term perspective on investing in silver, emphasizing its importance as a form of financial security and potential return to being a monetary asset.

He also discusses the industrial uses of platinum and palladium and expresses his bullish sentiment towards these metals.

In conclusion, Morgan advocates for self-reliance, fundamental human values, and focuses on the human spirit despite skepticism towards politics.

David Morgan is working on a documentary called "Silver Sunrise" that explores the monetary system, stress, fear, and control related to money, featuring interviews from renowned figures like G. Edwin Griffin, Ron Paul, Ellen Brown, and Mark Passio, set for release early next year.

Time Stamp References:

0:00 - Introduction

0:30 - Dr. Judy Shelton

6:47 - Silver Standard?

10:07 - Fed's Role & Ron Paul

13:48 - CBDC Concerns

16:35 - Trumps Cabinet Picks

22:54 - Silver Expectations

25:48 - China, Russia, & India

29:06 - Platinum & Palladium

31:07 - Sentiment in Metals

33:42 - Silver Sunrise Documentary

38:15 - Holiday Wrap Up

Missouri Currency Reform: A New Move Toward Gold and Silver Economy

Missouri Currency Reform: A New Move Toward Gold and Silver Economy

Awake-In-3D December 5, 2024

Missouri takes a groundbreaking step toward financial sovereignty with its push for gold and silver as legal tender, challenging centralized control and advancing the currency revaluation debate.

In the latest move reshaping the future of state monetary policy, Missouri currency reform has emerged as a powerful response to the challenges of centralized financial control. By rejecting Central Bank Digital Currencies (CBDCs) and advocating for gold and silver as legal tender, Missouri is positioning itself at the forefront of the currency revaluation debate.

Missouri Currency Reform: A New Move Toward Gold and Silver Economy

Awake-In-3D December 5, 2024

Missouri takes a groundbreaking step toward financial sovereignty with its push for gold and silver as legal tender, challenging centralized control and advancing the currency revaluation debate.

In the latest move reshaping the future of state monetary policy, Missouri currency reform has emerged as a powerful response to the challenges of centralized financial control. By rejecting Central Bank Digital Currencies (CBDCs) and advocating for gold and silver as legal tender, Missouri is positioning itself at the forefront of the currency revaluation debate.

This legislative push not only strengthens financial sovereignty but also aligns with broader global trends favoring tangible assets over fiat systems.

Legislative Push: The Basics of the Missouri Currency Reform

Republican Senator Rick Brattin’s pre-filing of SB 194 on December 1 signifies the latest in a series of legislative efforts to define the state’s monetary future. The bill explicitly prohibits public entities from accepting or testing CBDCs, a move designed to curtail the influence of centralized digital currencies that many argue lead to increased government surveillance and control.

Moreover, the bill redefines the state’s Uniform Commercial Code (UCC) to exclude CBDCs from its definition of money.

Perhaps most notably, SB 194 advocates for alternative monetary systems by mandating that the state treasurer allocate at least 1% of state funds to gold and silver holdings. This provision underscores a commitment around a Missouri currency reform to precious metals as a hedge against currency devaluation and economic instability. The bill also exempts gold and silver transactions from state capital gains taxes and recognizes these metals as legal tender, providing citizens with a tangible alternative to fiat currencies.

The Broader Context: State-Level Resistance to CBDCs

Missouri’s legislative moves come at a time when resistance to CBDCs is gaining traction across the United States. States like Louisiana and North Carolina have already passed laws to prohibit CBDC adoption, and similar efforts are underway at the federal level, including the CBDC Anti-Surveillance State Act passed by the U.S. House of Representatives in May.

For Missouri, however, the legislative battle has been particularly robust. Earlier this year, multiple bills addressing CBDCs and precious metals were introduced, though not all succeeded. SB 1352 sought to overhaul the state’s UCC to block CBDCs and passed a House vote before stalling in the Senate. Other bills, like SB 736 and its companion House legislation, attempted to tie CBDC prohibition to the promotion of gold and silver but failed to pass. Despite these setbacks, SB 194 marks a significant initiative to realign the state’s monetary policy with principles of sovereignty and decentralization.

Precious Metals vs. CBDCs: Competing Visions of Monetary Policy

Missouri’s legislative efforts center on a fundamental conflict between two competing visions of the future of money. On one hand, CBDCs represent a digital extension of fiat currencies, offering increased efficiency and integration with modern payment systems. However, critics argue that CBDCs concentrate monetary power in the hands of central banks and governments, enabling unprecedented levels of financial surveillance and control.

On the other hand, gold and silver symbolize a return to monetary systems grounded in tangible value and historical precedent. By recognizing these metals as legal tender, this Missouri currency reform aims to provide its citizens with a form of money that is immune to inflationary pressures and independent of centralized control. This approach resonates with the principles underlying the GCR and RV, which emphasize the restoration of equitable value in global currencies and a move away from excessive reliance on fiat systems.

Implications for the Global Currency Reset

Missouri’s legislative actions reflect broader trends associated with the GCR. The inclusion of gold and silver in state monetary policy aligns with efforts to stabilize currencies through tangible assets, a key tenet of the reset. Additionally, the rejection of CBDCs reflects growing skepticism about the role of centralized institutions in shaping the future of money.

While the GCR is often discussed in terms of international agreements and global economic shifts, state-level actions like those in Missouri highlight the importance of grassroots movements in driving monetary reform. By taking a stand against CBDCs and embracing precious metals, Missouri is not only asserting its own financial sovereignty but also contributing to a larger conversation about the balance between centralized and decentralized monetary systems.

Potential Barriers and Strategic Opportunities for a Missouri Currency Reform

Despite its ambitious goals, Missouri’s legislative agenda faces significant challenges. The failure of earlier bills to pass demonstrates the difficulty of achieving consensus on complex monetary issues. Furthermore, the implementation of gold and silver as legal tender raises practical questions about verification processes, transaction logistics, and public acceptance.

However, these challenges also present opportunities for innovation and leadership. If successful, Missouri’s policies inspire similar initiatives at the national level, influencing the direction of the GCR and RV.

The Bottom Line

Missouri’s efforts to ban CBDCs and promote gold and silver as legal tender reflect a growing desire for financial autonomy and a rejection of centralized monetary control. In the context of the GCR and RV, these actions represent a significant step toward a more equitable and decentralized global economy.

As the debate over the future of money continues, Missouri’s legislative push serves as both a challenge to the status quo and a driving force behind financial reform. Whether or not SB 194 ultimately passes, it shapes state sovereignty, monetary policy, and the broader global currency landscape.

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Seeds of Wisdom RV and Economic Updates Friday Morning 12-06-24

Good Morning Dinar Recaps,

WHO IS DAVID SACKS? AND WHY HAS DONALD TRUMP MADE HIM CRYPTO CZAR?

▪️David O. Sacks Becomes White House AI & Crypto Czar Under Trump's Administration.

▪️Former PayPal COO Brings Expertise in Tech and Venture Capital to Federal Leadership.

▪️Close Ties to Trump and Musk May Boost Fresh AI-Crypto Strategies for U.S. Leadership.

Good Morning Dinar Recaps,

WHO IS DAVID SACKS? AND WHY HAS DONALD TRUMP MADE HIM CRYPTO CZAR?

▪️David O. Sacks Becomes White House AI & Crypto Czar Under Trump's Administration.

▪️Former PayPal COO Brings Expertise in Tech and Venture Capital to Federal Leadership.

▪️Close Ties to Trump and Musk May Boost Fresh AI-Crypto Strategies for U.S. Leadership.

Former PayPal executive and renowned venture capitalist David O. Sacks has been appointed by Donald Trump as the White House’s first “AI & Crypto Czar.” This new role is part of Trump’s plan to position America as a global leader in artificial intelligence (AI) and cryptocurrency, two rapidly growing fields shaping the future. The announcement came shortly after Bitcoin reached its $100k milestone.

Why Trump Appointed David Sacks Only?

In a post on Truth Social, Trump announced Sacks’ appointment and highlighted his mission to create a clear legal framework for the cryptocurrency sector. However, Trump’s decision to appoint Sacks arose from his impressive track record as a tech entrepreneur and investor.

Sacks, a founding-era COO of PayPal and a key member of the “PayPal Mafia,” has built and supported some of Silicon Valley’s most successful ventures. His expertise in technology and finance makes him tackle the challenges and opportunities in AI and crypto effectively.

Meanwhile, some experts even hint that Trump’s decision to appoint Sacks is seen as a reward for his loyal support during the campaign. Sacks played a pivotal role in fundraising for Trump, helping to raise $12 million during a high-profile event earlier this year.

What Changes Could Sacks Bring?

David Sacks will focus on creating clear rules for cryptocurrencies to remove confusion and help the U.S. digital asset industry grow. His goal is to support crypto businesses and position the United States as a global leader in digital innovation.

According to Trump, he will “steer us away from Big Tech bias and censorship,” ensuring a balanced digital landscape that supports open discourse. Sacks will also focus on safeguarding free speech in the online space

Additionally, Sacks will chair the Presidential Council of Advisors for Science and Technology, guiding the administration’s policies on emerging technologies.

Sacks Close Ties to Trump and Musk

Sacks has been a strong Trump supporter of Trump, hosting fundraisers and rallying tech industry donors. He also shares close ties with Elon Musk, who has made waves in AI through his company xAI and chatbot Grok. This connection could bring fresh ideas and partnerships to the administration’s tech strategy.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

PHILIPPINES COMPLETES WHOLESALE CBDC TRIAL

Today Bangko Sentral ng Pilipinas (BSP) said it completed Proof of Concept trials for its Project Agila wholesale central bank digital currency (wCBDC) along with participating financial institutions.

Specifically, the latest trial tested whether banks in the Philippines can pay each other outside of bank operating hours during evenings, weekends and holidays.

“Wholesale CBDCs are expected to enhance liquidity management, reduce settlement risks, and support financial stability,” said BSP Governor Eli M. Remolona, Jr.

“Insights from this project will guide the BSP’s CBDC roadmap. Our goal is to leverage new technologies to further enhance the efficiency and resilience of the national payment system.”

While the bank hasn’t yet released a report about specific findings, the central bank shared its plans earlier in the year. Many wCBDC trials are quite speculative, but this one is less so.

The central bank plans to launch a wCBDC during Mr Remolona’s term, which ends in 2029. It is expected to be sooner rather than later, with 2025 or 2026 previously floated as potential timeframes.

Apart from out of hours payments, the wCBDC will potentially be used for securities settlement and cross border payments. The central bank is an observer in the mBridge DLT cross border payment system used by the central banks of China, Hong Kong, Saudi Arabia, Thailand and the UAE.

During 2023 the BSP assessed various blockchain technologies, selecting Hyperledger Fabric.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

HOW TO OPEN A XAMAN WALLET: THE EASIEST STEP-BY-STEP GUIDE | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Friday AM 12-6-2024

Ariel (@Prolotario1): Iraq and XRP, Exciting Times for us all

Dec. 5, 2024

2025 Budget

Oil & Gas

International Market

New Exchange Rate

Purchasing Power

Victory Day

Ariel (@Prolotario1): Iraq and XRP, Exciting Times for us all

Dec. 5, 2024

2025 Budget

Oil & Gas

International Market

New Exchange Rate

Purchasing Power

Victory Day

Today THURSDAY session finishing what the PM ordered “ finishing the budget amendment “ pic.twitter.com/y4jLnize0A

— Majeed KSA (@majeed66224499) December 5, 2024

Home Plate Ladies & Gentlemen

“the few days remaining of the legislative term of parliament can be ratified the budget law – Article 12 – amended by the government and submitted to parliament,"

Already submitted to parliament to finish it today as what PM ordered them to do… pic.twitter.com/QMmeIo1aCH

— Majeed KSA (@majeed66224499) December 5, 2024

Breaking News…

Do you all know how epic this is?

This is akin to the parting of the Red Sea. Just as Moses stretched out his hand, and the waters of the Red Sea divided, allowing the Israelites to pass on dry ground, Ripple has now stretched forth its digital hand, creating a trustline of such magnitude that it shall lead the way for digital currency in a manner unprecedented.

Imagine, if you will, the walls of water held back by divine will, and now see this trustline as those walls, holding back the chaos of financial instability, providing a path of liquidity through which the future of transactions might safely traverse.

This act by Ripple could be seen as a modern-day covenant, a promise of prosperity and security in the blockchain realm, much like the covenant made with Noah after the flood, marking the end of one era and the beginning of another.

In this new era, 10,000 trillion RLUSD stands as a testament, a beacon of financial innovation, where the old ways of currency are washed away, and in its stead, a new foundation is laid for economic interactions worldwide. As the Israelites looked upon the Promised Land, so too might we look upon this financial landscape with hope and anticipation for what is to come.

10,000 TRILLION RLUSD TRUSTLINE CREATED BY RIPPLE JUST NOW

https://t.co/Le27ztWQ7I pic.twitter.com/FODtb9JT27

— SIRTRADESALOT (@COOLBREEZE_____) December 5, 2024