Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 10-16-24

Good Afternoon Dinar Recaps,

US CONGRESSMAN BYRON DONALDS PROPOSES CRYPTO REGULATORY SANDBOX

U.S. Rep. Byron Donalds champions regulatory flexibility for cryptocurrency, endorsing a sandbox approach to foster industry growth.

▪️Byron Donalds proposes a regulatory sandbox for crypto, aiming to transform it into a $500B U.S. industry.

▪️Donald Trump's campaign raises $7.5M in crypto donations, signaling a pro-crypto stance for the 2024 election.

▪️U.S. Rep Donalds criticizes Dems' crypto regulation approach as politically motivated amid electoral battles.

Good Afternoon Dinar Recaps,

US CONGRESSMAN BYRON DONALDS PROPOSES CRYPTO REGULATORY SANDBOX

U.S. Rep. Byron Donalds champions regulatory flexibility for cryptocurrency, endorsing a sandbox approach to foster industry growth.

▪️Byron Donalds proposes a regulatory sandbox for crypto, aiming to transform it into a $500B U.S. industry.

▪️Donald Trump's campaign raises $7.5M in crypto donations, signaling a pro-crypto stance for the 2024 election.

▪️U.S. Rep Donalds criticizes Dems' crypto regulation approach as politically motivated amid electoral battles.

In a recent conversation with KMSmithDC, U.S. Congressman Byron Donalds stressed the importance of developing a regulatory sandbox for the crypto industry. Donalds described the industry as a “toddler” that is still young but has a possibility of growing.

He pointed out that the cryptocurrency market has the potential to become a half a trillion dollar industry in the US if there are favorable regulations put in place.

Byron Donalds Advocates for Regulatory Flexibility

Byron Donalds emphasized that the use of a more flexible approach to the regulation of the rapidly developing crypto industry is crucial. He noted that the present model adopted by most regulatory bodies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), is too rigid.

According to US Congressman Donalds, a more adaptive system, like a regulatory sandbox, would allow industry participants to set guidelines as they innovate.

”What the industry really needs is a regulatory sandbox”, Donalds said. “You guys make the rules because the industry is going to change so fast over the next five years.” He pointed out that the current regulatory authorities are “not very innovative enough” to match the advancement of technology hence the need for a shift in the system.

Donald Trump Campaign’s Support for Crypto

US Congressman Donalds, an avid supporter of Donald Trump’s 2024 presidential campaign, also discussed how the Trump campaign has adopted cryptocurrency. Moreover, the PAC supporting Trump has allegedly collected $7.5 million in cryptocurrency contributions during July-September 2024.

These donations in BTC, ETH, XRP, and USD stablecoins reveal that Trump has changed his view about digital currencies. Additionally, the prediction market platform, Polymarket, has given a 59.5% chance of Donald Trump to win the U.S election while 40.3% chance of Kamala Harris.

This is quite a change from Trump’s previous stance on cryptocurrencies during his tenure as president. The fundraising success, garnered from more than 15 US states and Puerto Rico, places Trump as the candidate favorable to cryptocurrencies as the November 2024 elections approach.

In the conversation, Byron Donalds accused the Democratic leadership of not taking the regulation of cryptocurrencies seriously. He also dismissed recent remarks by Democratic politicians, including VP Kamala Harris and Senator Sherrod Brown, on digital assets regulation.

Donalds said that, although some Democrats have lately discussed the need for frameworks, such statements are political. “Vice President Harris is saying it now because there are some issues in her polling,” he said. He also pointed out that the criticism coming from Sherrod Brown could have to do with him being in a tight race in Ohio.

Trump’s Plan to Overhaul Regulatory Agencies

According to the US Congressman Donalds, a potential Trump administration would aim at “cleaning house” in major regulatory bodies such as the US SEC and CFTC. In these talkings, there has been a rumour that Robinhood CLO, Dan Gallagher, may become the new US SEC Chair under the leadership of Donald Trump.

He believes that regulators should focus solely on their assigned missions rather than expanding their roles. “It’s about making sure that regulators simply do the job of carrying out the mission that the agency was given,” Byron Donalds stated.

He reiterated his belief that current regulatory bodies are falling behind in adapting to the fast-paced developments in the crypto industry. According to Donalds, if Trump wins the presidency, the administration will aim to ensure that these agencies better align with the needs of a rapidly evolving digital economy.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

SIAM COMMERCIAL BANK LAUNCHES THAILAND’S FIRST STABLECOIN CROSS-BORDER PAYMENT SYSTEM

Siam Commercial Bank has introduced Thailand’s first stablecoin-powered cross-border payment system.

Partnering with SCB 10X and Lightnet, the bank will use stablecoins—digital assets pegged to gold or the U.S. dollar—to facilitate faster, more efficient international transactions, according to a company release.

This solution is built on a public blockchain network, with Fireblocks providing top-tier custody technology to ensure asset security. The new payment system enables 24/7 cross-border transactions, reducing the need for banks to maintain pre-funded accounts with foreign partners, which improves capital efficiency and lowers operational costs.

By eliminating layers of clearance and currency conversion, the service offers customers a faster, cost-effective way to send and receive funds internationally, per Nikkei. Users can transact using local currencies, further simplifying the process.

Thailand’s regulatory sandbox

In August, Thai financial regulators launched a Digital Asset Regulatory Sandbox to encourage crypto adoption in the country. The initiative, backed by a public hearing in May, allowed participants to test crypto services under flexible regulations to help develop Thailand’s digital asset market.

This SCB stablecoin project successfully graduated from the Bank of Thailand’s regulatory sandbox in October 2024, according to the release, and is now fully commercialized. It sets a new standard for the use of blockchain technology in the financial sector and strengthens SCB’s position as a leader in digital banking.

@ Newshounds News™

Source: Crypto News

~~~~~~~~~

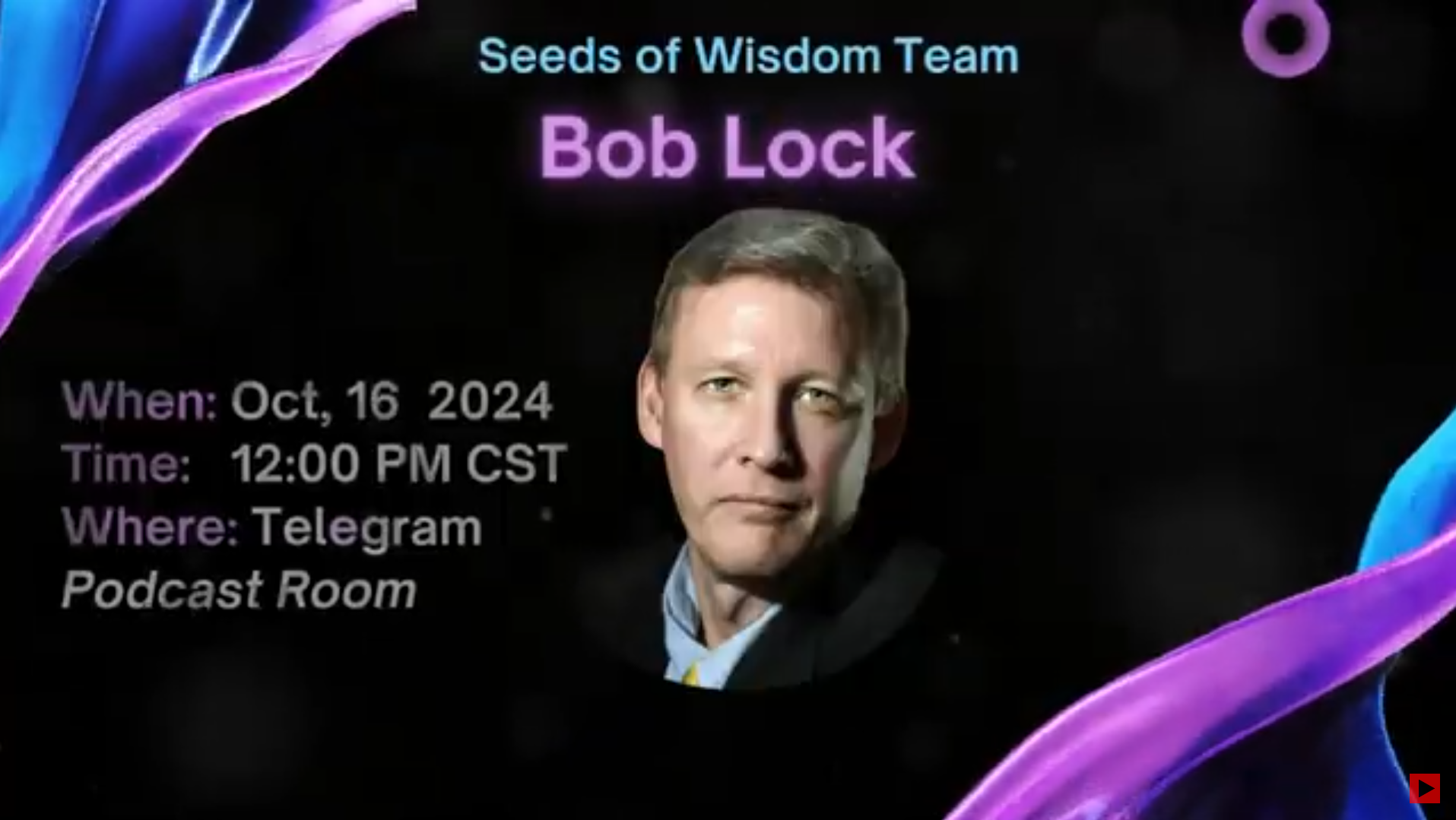

pic

AUDIO REPLAY BOB LOCK: OCT 16, 2024 | Youtube

Bob Lock discusses his new book, "Managing sudden wealth through smart team building" as well as what the future might bring with a new financial system and ways to protect yourself with a possible stock market crash and/or bank failure.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Wed.Afternoon 10-16—2024

KTFA:

Clare: Iraq Increases Reserves at IMF by 50%

15th October 2024 By John Lee.

A meeting of the Iraqi Cabinet this evening approved an increase in Iraq's quota at the International Monetary Fund (IMF) by 831.9 million Special Drawing Rights (SDR), equivalent to 1.45 trillion Iraqi dinars [$1.1 billion] based on the exchange rate as of October 8, 2024.

This 50-percet increase in Iraq's previous quota will enhance the country's voting power within the IMF.

The additional allocation will be included in the 2025 budget.

KTFA:

Clare: Iraq Increases Reserves at IMF by 50%

15th October 2024 By John Lee.

A meeting of the Iraqi Cabinet this evening approved an increase in Iraq's quota at the International Monetary Fund (IMF) by 831.9 million Special Drawing Rights (SDR), equivalent to 1.45 trillion Iraqi dinars [$1.1 billion] based on the exchange rate as of October 8, 2024.

This 50-percet increase in Iraq's previous quota will enhance the country's voting power within the IMF.

The additional allocation will be included in the 2025 budget.

The IMF created SDRs as an international reserve asset to supplement member countries' official reserves; they are not a currency, but rather a claim on freely usable currencies of IMF member countries. They serve as a potential source of liquidity for IMF member nations.

SDRs represent a weighted basket of major international currencies, and can he held as part of a country's foreign exchange reserves. Adding SDRs to a country's international reserves makes it more resilient financially. LINK

************

Alicia2015: Monday is the BRICS summit (22nd - 24th) with word of an introduction to a future cross border currency (the UNIT) backed by 40% gold 60% commodities. We live in interesting times- IMO

**********

Clare: The College of Administration and Economics at the University of Mosul holds its international scientific conference on “Development and financial and economic stability to restore confidence in the Iraqi dinar”

14 October، 2024

Under the patronage of His Excellency the Minister of Higher Education and Scientific Research, Dr. Naim Al-Aboudi, and under the supervision of Prof. Dr. Qusai Kamal Al-Din Al-Ahmadi, President of the University of Mosul, and under the follow-up of the Dean of the College of Administration and Economics, Prof. Dr. Thaeir Ahmed Saadoon Al-Samman, and in cooperation with the Nineveh Future Center for Strategic Studies, the College of Administration and Economics, Department of Banking and Financial Sciences, held in the hall of the University’s Grand Theater on Monday, 14/10/2024 at 10 am its international scientific conference tagged “Development and financial and economic stability to restore confidence in the dinar Iraqi ”

His work lasts for two consecutive days …The opening ceremony of the conference was attended by the respected Governor of Nineveh, Professor Abdul Qader Al-Dakhil, the Chairman of the Parliamentary Education Committee, Prof. Muzahim Al-Khayyat, the Assistant Chairman of the Parliamentary Energy Committee, Mr. Mansour Al-Maraid, the representative of the Nineveh Operations Commander, the representative of the Nineveh Police Commander and the President of the University and the assistants of the President of the University of Mosul for Scientific Administrative Affairs, the Dean of the College, members of the University Council, personalities from the city and a number of faculty and students of the college and the university.

The opening of the conference began with a recitation of verses from the Holy Quran, followed by Prof. Dr. Ali Abdul Sattar Al-Hafiz, followed by the reading of Surat Al-Fatihah on the souls of the martyrs of Iraq, then playing the national anthem, then a speech by the respected Governor of Nineveh, in which he talked about the importance of development and economy in order to restore confidence in the Iraqi currency and about the reconstruction revolution in the province, which was accompanied by the process of reconstruction of Iraqi universities, especially the University of Mosul

Followed by a speech by the Chairman of the Parliamentary Education Committee and a speech by Mr. The Dean of the Faculty welcomed the attendees, as he spoke about the importance of supporting the national economy and the need to support it, the recovery of trade, the fight against corruption and the implementation of the decisions of the monetary authority, then a speech by the Director of the Nineveh Future Center for Strategic Studies in Mosul, the consultant engineer Nabil Al-Youzbeki

Then the start of the work of the conference axes, the first session chaired by Dr. Ahmed Younis Al-Sabawi for the first speaker was Prof. Dr. Dariusz Zarzecki in Financial Management at the University of Zsczecin in Poland, followed by the distribution of shields and certificates to the organizers, supporters of the conference and members of the committees.

The themes of the conference touched on enhancing the challenges and opportunities related to financial and economic stability in Iraq, and working to develop effective strategies to restore confidence in the Iraqi dinar and promote sustainable development.

The conference aimed to highlight the role of economic policies in achieving stability and restoring confidence in the Iraqi dinar, discussing the main challenges affecting the stability of the Iraqi dinar, proposing possible solutions, building cooperation networks based on effective strategies to promote economic development in Iraq, and exchanging knowledge and experiences on strategies to improve economic development in Iraq. LINK

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Concerning the CBI announcing to you Iraqi citizens that they are activating the banking reforms...That means they are activating the monetary reform. They're going to give you your new lower notes. They are going to give you your new exchange rate. They're going to give you the keys to the ATM... You are now going to be receiving your purchasing power not only through the new exchange rate but via the HCL and the jobs the economic reform is about to produce.

Fnu Lnu Reminder...Redemption centers ARE BANKS. They are bank offices designed to be off premises for the purpose of validating and verifying the IQD and accrediting your bank account with the exchange amount deposit. They are banks and you WILL NOT get better rates at a BANK EXCHANGE CENTER. It is AGAINST the LAW to sell a financial instrument for different prices at different places. It is called "THE RULE OF ONE PRICE"...There are laws and they will be followed.

************

Reality to Hit as Historic Bubble Bursts with Michael Oliver

WTFinance: 10-16-2024

This interview was from a WTFinance podcast with Michael Oliver. Michael is a regular guest who is the founder of Momentum Structural Analysis. During our conversation we spoke about how the US is currently the largest market, why the FED won't be able to save it, precious metals and gold, whether silver will outperform this time, a debt crisis and more. I hope you enjoy!

0:00 – Introduction

0:16 - Hell in markets still on the cards in 2024?

4:20 - FED saved the day?

6:40 - Silver to outperform?

8:35 - Extended bond bear market?

11:50 - Flash crashes incoming?

15:30 - Trends keep increasing

18:20 - What is happening in China?

20:25 - Debt crisis?

25:16 - Commodity super cycle?

27:00 - Where does gold and commodities go?

31:10 - Miners to perform?

34:35 - One message to takeaway from conversation?

Awake-In-3D: Trade Wars and Sanctions Now Setting Us Up for the Biggest Collapse in History

Trade Wars and Sanctions Now Setting Us Up for the Biggest Collapse in History

Awake-In-3D October 9, 2024

Are we repeating the mistakes that led to the Great Depression and World War II?

This article explains how past economic disasters, like what happened in Germany after World War I, can help us understand what’s happening in the world today. By looking at how trade issues, financial penalties, and economic crises led to radical political changes back then, we can see similarities with today’s global economy.

The purpose is to show how history is repeating itself and why we may be heading toward the biggest financial collapse in human history if things continue the way they are.

Trade Wars and Sanctions Now Setting Us Up for the Biggest Collapse in History

Awake-In-3D October 9, 2024

Are we repeating the mistakes that led to the Great Depression and World War II?

This article explains how past economic disasters, like what happened in Germany after World War I, can help us understand what’s happening in the world today. By looking at how trade issues, financial penalties, and economic crises led to radical political changes back then, we can see similarities with today’s global economy.

The purpose is to show how history is repeating itself and why we may be heading toward the biggest financial collapse in human history if things continue the way they are.

The study of past economic collapses offers invaluable insights into the forces that drive economies toward disaster. The rise of fascism and Adolf Hitler’s ascent in Germany is a powerful case study, showing how trade disputes, economic sanctions, and financial instability can shape world events.

If we don’t learn from this history, we risk repeating it—and many signs suggest that we are on the brink of another unprecedented financial crisis.

US President Joe Biden recently announced a significant rise in tariffs for Chinese imports, including electric vehicles (EVs) and solar panels. One of the most significant steps is the decision to raise duties on Chinese electric vehicles to 100 percent.

The Role of Economic Sanctions and Trade Disputes in Historical Collapses

Economic sanctions, trade disputes, and punitive measures have long been used to isolate nations. In post-World War I Germany, these tools played a direct role in driving the country to financial ruin.

The Treaty of Versailles demanded massive reparations from Germany, strangling its economy and blocking any real recovery. The inability to trade internationally compounded the problem, leaving Germany cut off from vital markets and resources.

As economic isolation intensified, inflation spiraled out of control, wiping out savings and deepening poverty. Germans faced severe unemployment and social unrest, making them receptive to extremist ideologies.

Hitler seized on these conditions, using the widespread economic misery to gain support. The lesson here is clear: economic collapse can open the door to radicalism, and today’s growing trade wars and sanctions could create similar conditions.

How the Treaty of Versailles Enabled Radicalism in Germany

The Treaty of Versailles humiliated Germany economically, with reparations and territorial losses that crippled the nation’s ability to function. In the years following World War I, Germans watched their currency become worthless.

Children playing with worthless German currency and a cart full of marks could not buy a daily meal in 1930

By the time the Great Depression hit in 1929, Germany was relying on foreign loans—especially from the U.S.—to stabilize its economy. When those loans dried up, Germany’s economy collapsed once again.

The collapse of international trade and financial support left Germany in an even worse position. Mass unemployment and desperation became the norm. In this climate, Hitler’s Nazi Party rose, offering promises to rebuild the economy, restore pride, and make Germany powerful again.

This is eerily similar to the struggles many countries face today, where economic hardship is driving people to seek out extreme solutions and political figures who promise to fix everything.

Parallels Between the Great Depression and Today’s Financial Risks

The Great Depression serves as an important reminder of how quickly global economies can unravel. When the U.S. stock market crashed in 1929, it triggered a worldwide financial collapse.

After 2,000 jobs were made available for park improvements, about 5,000 unemployed people gathered outside City Hall in Cleveland, Ohio, in 1930 during the Great Depression. (AP Photo)

Countries like Germany, already weakened by debt and trade restrictions, plunged into a deeper crisis. Protectionist policies and tariff wars, like the U.S. Smoot-Hawley Tariff, only worsened the situation by choking off global trade.

Fast forward to today, and we see similar warning signs. Global tensions, trade wars, and massive debt levels are putting immense pressure on economies. Inflation is surging, supply chains are breaking down, and many people are struggling to make ends meet.

Just as in the 1930s, these financial pressures are creating a fertile environment for social and political unrest. Many fear that the world is again teetering on the edge of a catastrophic economic collapse.

What History Teaches Us About the Coming Financial Disaster

The history of economic crises shows us that they often follow predictable patterns. Trade disputes, financial isolation, and economic sanctions create the conditions for collapse.

Germany in the 1930s offers a blueprint for what can happen when economic pressure drives a society to desperation. And today’s world looks dangerously similar.

Countries around the globe are facing rising inflation, trade conflicts, and unsustainable levels of debt. The gaps between the wealthy and the poor are widening, and the middle class is being squeezed.

As in the past, when economic conditions deteriorate, people begin searching for drastic solutions, often turning to radical movements or leaders who offer simple answers to complex problems. If the current trends continue, the world could be headed for the greatest financial disaster in history.

The Bottom Line

The economic collapse of post-World War I Germany and the Great Depression offer crucial lessons for understanding the looming financial disaster we face today.

Rising trade tensions, economic sanctions, and the strain on global economies all point to a similar outcome. If we don’t understand the past, we risk repeating it—and this time, the stakes are even higher.

Prepare for the worst, because the next global collapse may be unlike anything the world has ever seen.

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Seeds of Wisdom RV and Economic Updates Wednesday Morning 10-16-24

Good Morning Dinar Recaps,

RIPPLE’S XRP LAWSUIT ENTERS NEW CHAPTER AS BOTH PARTIES FILE APPEALS

The SEC and Ripple are entering the appeals phase of their XRP lawsuit, with both parties preparing to challenge aspects of the initial ruling in a process that could extend into early 2026

▪️SEC appealing Judge Torres’ ruling in Ripple case

▪️Ripple filed cross-appeal on institutional sales decision

▪️Next step: SEC to file Form C detailing appeal scope

▪️Briefing process could last until July 2025

▪️Final appellate court decision possible in early 2026

Good Morning Dinar Recaps,

RIPPLE’S XRP LAWSUIT ENTERS NEW CHAPTER AS BOTH PARTIES FILE APPEALS

The SEC and Ripple are entering the appeals phase of their XRP lawsuit, with both parties preparing to challenge aspects of the initial ruling in a process that could extend into early 2026

▪️SEC appealing Judge Torres’ ruling in Ripple case

▪️Ripple filed cross-appeal on institutional sales decision

▪️Next step: SEC to file Form C detailing appeal scope

▪️Briefing process could last until July 2025

▪️Final appellate court decision possible in early 2026

The Securities and Exchange Commission (SEC) and Ripple Labs are gearing up for the next phase of their legal battle over XRP, as both parties have filed notices to appeal different aspects of Judge Analisa Torres’ ruling from July 2024.

The case, which has significant implications for the cryptocurrency industry, is now moving to the U.S. Court of Appeals for the Second Circuit.

Stuart Alderoty, Ripple’s Chief Legal Officer, expressed confidence in the company’s position as the case moves forward. “I felt good about our case in the Southern District of New York. I feel even better about our case in the Second Circuit,” Alderoty stated in a recent interview.

He believes the SEC’s appeal will ultimately “backfire” and benefit the crypto industry as a whole.

The appeals process is set to begin with both parties filing Form C documents, which will outline the specific aspects of Judge Torres’ ruling they intend to challenge. The SEC is due to file its Form C on October 16, 2024, with Ripple following suit seven days later. These filings will provide clarity on the focus of each party’s appeal.

Following the Form C submissions, a briefing schedule will be established. The SEC will have 90 days to submit its comprehensive legal argument explaining why it believes Judge Torres erred in her decision. Ripple will then have the opportunity to respond to the SEC’s arguments and file its own opening cross-appeal brief.

Alderoty estimates that the briefing process could extend until July 2025, approximately nine months from now. This timeline suggests that a final decision from the appellate court might not come until early 2026, unless the parties reach an agreement to end the legal dispute sooner. ‘

The case has drawn significant attention due to its potential to set precedent for how securities laws are applied to token issuers, particularly within the Southern District of New York, a major financial hub. Judge Torres’ initial ruling found that XRP is “not necessarily a security on its face,” a decision that has been met with both support and skepticism from other judges in similar cases.

While Ripple celebrated aspects of Judge Torres’ ruling, the company was ordered to pay a $125 million fine over XRP transactions that were found to have violated securities laws. The SEC had initially sought a much larger penalty of $2 billion.

As the case moves to the appellate level, both parties are preparing to argue their positions. The SEC maintains that Judge Torres’ ruling “conflicts with decades of Supreme Court precedent and securities laws.”

Ripple, on the other hand, plans to argue that for a digital asset to be considered an investment contract, a contract with rights and obligations is necessary.

@ Newshounds News™

Source: Blockonomi

~~~~~~~~~

MICA-COMPLIANT STABLECOINS TAKE MARKET SHARE OF EURO-STABLECOIN SECTOR: KAIKO RESEARCH

Since the implementation of select provisions of the EU’s Markets in Crypto-Assets (MiCA) regulations in June, MiCA-compliant stablecoins, such as Circle’s EURC and Société Générale’s EURCV, have dominated the euro-stablecoin market, according to a Kaiko Research report.

Circle’s EURC and Société Générale’s EURCV now hold a record 67% market share of the euro-stablecoin market, the report added.

@ Newshounds News™

Read more: The Block

~~~~~~~~~

ITALY PLANS TO RAISE CAPITAL GAINS TAX ON BITCOIN FROM 26% TO 42%: REPORT

The Italian tax authority plans to raise capital gains tax on bitcoin to 42% as part of 2025 budget plans.

Crypto capital gains in Italy have been taxed above €2,000 at 26% from the 2023 tax year.

@ Newshounds News™

Read More: The Block

~~~~~~~~~

RIPPLE PRESIDENT UNVEILS PLANS TO INTEGRATE XRP AND RLUSD INTO PAYMENT SOLUTIONS

▪️Ripple, the company behind cross-border solutions has gained attention from market observers after an announcement of the RLUSD launch.

▪️Ripple is committed to ensuring transparency for both investors and users by releasing monthly reports from independent third parties that verify the reserves backing RLUSD.

On October 15, Ripple’s president Monica Long announced the entry of Ripple into the rapidly expanding stablecoin market, a launch of its new enterprise-grade stablecoin called “Ripple USD”(RLUSD). On the social media platform X, Ripple also announced the development of RLUSD, prompting reactions from notable Monica Long and other figures in the cryptocurrency community.

The president disclosed this on the first day of the Miami Ripple Swell 2024 conference. Once the New York Department of Financial Services (NYDFS) approves the stablecoin’s launch, RLUSD will be accessible on several platforms, including Bitstamp, a European cryptocurrency exchange founded in 2011, The Independent Reserve, Bitso, MoonPay, CoinMENA, Bullish, and Uphold.

Additionally, the firm partnered with B2C2, a global leader in institutional liquidity for digital assets, and Keyrock as market makers to facilitate the creation of liquidity and adoption across global markets. It is worth noting that the former Center Consortium CEO David Puth and Former FDIC Chair Sheila Bair are appointed to the RLUSD advisory board.

Ripple’s RLUSD: Highlighted Features

One of the key features of RLUSD is its compliance-first approach. Ripple emphasizes regulatory adherence in the design of the stablecoin, with plans to publish monthly attestations of its reserves by an independent accounting firm. This is particularly relevant as Ripple has navigated complex legal challenges, including an ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC).

The introduction of RLUSD is seen as a strategic move to bolster Ripple’s position in the market. The stablecoin aims to provide solutions for cross-border payments, on and off-ramps for cryptocurrency exchanges, DeFi, and real-world asset (RWA) tokenization.

Ripple’s CEO, Brad Garlinghous stated that the stablecoin will first be launched on the XRP Ledger and Ethereum networks, enabling real-time transactions and the conversion between fiat and digital currencies.

RLUSD is designed to connect traditional finance with the digital world, offering a secure way for users to trade in and out of cryptocurrency markets without the stress of price fluctuations. It also aims to encourage quicker adoption of digital currencies by creating an entry point into the blockchain ecosystem.

Ripple’s advisory board members have highlighted the critical need for stability and compliance as the digital economy evolves. Sheila Bair remarked that “stablecoins will play a key role in modernizing financial infrastructure.”

As per our data, Ripple’s trading volume has increased by 7.80% over the last 24 hours with a market cap of $ 30.78 billion. Despite its 0.39% price drop in the last 24 hours, XRP is currently trading at $0.5453.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌍 BOB LOCK CALL WED. NOON CENTRAL - PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT 1 PM ET, NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G

Bob Lock Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Wednesday AM 10-16-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 16 Oct. 2024

Compiled Wed. 16 Oct. 2024 12:01 am EST by Judy Byington

Mon. 13 Oct. 2024: It’s a Global Currency Reset! BRICS has struck a deal to settle international trade in sovereign nation’s gold/asset-backed currencies that takes a direct shot at dominance of the US dollar. https://www.cryptopolitan.com/brics-seals-deal-for-international-trade-settlements-in-national-currencies/

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 16 Oct. 2024

Compiled Wed. 16 Oct. 2024 12:01 am EST by Judy Byington

Mon. 13 Oct. 2024: It’s a Global Currency Reset! BRICS has struck a deal to settle international trade in sovereign nation’s gold/asset-backed currencies that takes a direct shot at dominance of the US dollar. https://www.cryptopolitan.com/brics-seals-deal-for-international-trade-settlements-in-national-currencies/

~~~~~~~~~~~~

Global Currency Reset:

Tues. 15 Oct. 2024 Bruce:

Redemption Centers in six different states were affected by the Hurricanes so some weren’t able to respond to the emails that went out on Monday. They went out on time and they are still trying to fix the servers for those few Redemption Centers that didn’t respond.

We could get notified tomorrow and if so, we could start on Thurs. 17 Oct.

Our emails will come from Wells Fargo servers

The Bond Holders are supposed to be notified on Wed. and get access to their funds on Thurs. 17 Oct.

R&R funds are already (allegedly)in your Quantum Account.

Iraqi contractors were to be paid on Wed. 16 Oct. when the new Iraqi Dinar rate is on the bank screens.

~~~~~~~~~~~

Tues. 15 Oct. 2024 Wolverine: “I can assure you that things are happening this week. There is a lot of movement in Reno. Whales are traveling to Reno. A friend got paid. I heard from Zurich that we are going to be paid this week.”

Tues. 15 Oct. 2024 TNT: “There’s a new date and time. I’ll explain tomorrow.”

Tues. 15 Oct. 2024 Anon: “Blockchain went live on Monday (allegedly). They have (allegedly). moved from the SWIFT System to the new Quantum Financial System. That means 200 countries and 11,000 institutions are (allegedly). live on the system. Expect some downtime with banks and ATMs not accessible.

Tues. 15 Oct. 2024 Anon: SSI (Social Security Disability recipients) will (allegedly). receive two checks in November.

Tues. 15 Oct. 2024 Anon: “I received some preliminary information last evening that I couldn’t confirm, then today I was included on an international call from several countries all over the world including US cities of NYC, Reno, Mia, plus Zurich, Hong Kong, and Iraq. The sum and substance of this call was all the in country banking and money reorganization that was to be introduced to the citizens this week and the CBI wanted this nation to announce our new currency in conjunction with them but if not then the CBI and Iraq would RV on their own. Announcement dates are either Monday or Tuesday with effective date to be Wednesday of this coming week. Per several on the call all requirements such as FOREX have been satisfied. Please remember I am just a messenger but they sounded very confident of this info.”

Tues. 15 Oct. 2024 Mike Bara: The Bondholder’s team was told they would be “contacted” about the funds process in the “midnight-to-midnight” window. Turns out they were. They have now been told that funds are good to release starting tomorrow Wed. 16 Oct. 2024. I know the time but can’t say it.

Wed. 16 Oct. is designated as an official celebration Day for Iraq and the day they will (allegedly). pay their contractors in the new Dinar Rate.

~~~~~~~~~~

(Rumor) ON OCTOBER 24 AND 25, every phone on the planet will be hit with a loud, unmistakable alert signal. This will come directly from Star Link satellites, bypassing media channels.

The Earth Alliance, Star Link, and military are ready to execute the final phase. The old world is crumbling, and a new era of freedom is beginning. For years, the Earth Alliance has been preparing, quietly building a secure network of satellites that will make this possible.

The Deep State’s financial institutions will collapse. The Quantum Financial System (QFS) will replace the current system, marking the greatest wealth transfer in history. Banks, stock markets, and fiat currencies will be obliterated, replaced by a fair system that serves the people.

Read full post here: https://dinarchronicles.com/2024/10/16/restored-republic-via-a-gcr-update-as-of-october-16-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

RayRen98 [reference RayRen98 post 10-15-2024] ...OTHER SOURCES ARE "TALKING" ABOUT A DEADLINE DATE AS WELL... BANK FOLKS ARE TALKING, 3 LETTERS ARE TALKING...IT'S A BEAUTIFUL THING!!!... Question: "are the sources in agreement as far as the deadline date is concerned?" YES... TIME WILL TELL...THE CLOCK IS TICKING...

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

The November census starts on the 20th and the 21st, Wednesday and Thursday we will be in curfew...They say will be a 4-day holiday.

Walkingstick [Iraqi bank friend in U.S. Aki update] The next pay period [for Iraqi government salaries] that will follow up after this one will be based on the new exchange rate and so will the HCL payment to the citizens. Both their back pay and the HCL will be presented to the citizens at the same time, not on separate events. Do not look for purchasing power yet.

************

Jim Willie: "They're Selling A Lot Of Treasuries & Buying Gold"

Arcadia Economics: 10-16-2024

As the BRICS meeting and the US elections rapidly approach, while the wars and geopolitical tensions continue to escalate, it's not exactly the most stable time in the world.

Although fortunately to dig into the latest events, including the series of hurricanes that have caused great damage to the affected areas, and FEMA's response, as well as Jerome Powell's aggressive rate cut while he simultaneously claimed that he doesn't see any weakness in the economy,

Dr. Jim Willie of The Hat Trick Letter joins me on the show to discuss all of that and more. As is often the case, Jim had plenty to say about the financial markets, and he shares his latest update regarding the deteriorating situation in the US treasury, and also the gold and silver markets.

So to hear the latest from Dr. Jim Willie, click to watch the video now!

“Tidbits From TNT” Wednesday Morning 10-16-2024

TNT:

Tishwash: Foreign Minister begins European tour lasting several days and opens two Iraqi embassies

Foreign Minister Fuad Hussein begins a European tour today, Wednesday, that will last for days and witness the opening of two Iraqi embassies.

Hussein said in a press statement that the tour "begins with a visit to Ireland and ends with a visit to France, passing through the Czech Republic and Croatia to meet with senior officials there," indicating that "this tour aims to strengthen our bilateral relations."

"We will participate in a number of seminars and conferences," he added.

Hussein pointed out that "during his tour, he will open the Iraqi embassies in Dublin and Zagreb." link

TNT:

Tishwash: Foreign Minister begins European tour lasting several days and opens two Iraqi embassies

Foreign Minister Fuad Hussein begins a European tour today, Wednesday, that will last for days and witness the opening of two Iraqi embassies.

Hussein said in a press statement that the tour "begins with a visit to Ireland and ends with a visit to France, passing through the Czech Republic and Croatia to meet with senior officials there," indicating that "this tour aims to strengthen our bilateral relations."

"We will participate in a number of seminars and conferences," he added.

Hussein pointed out that "during his tour, he will open the Iraqi embassies in Dublin and Zagreb." link

************

Tishwash: Iraq Increases Reserves at IMF by 50%

A meeting of the Iraqi Cabinet this evening approved an increase in Iraq's quota at the International Monetary Fund (IMF) by 831.9 million Special Drawing Rights (SDR), equivalent to 1.45 trillion Iraqi dinars [$1.1 billion] based on the exchange rate as of October 8, 2024.

This 50-percet increase in Iraq's previous quota will enhance the country's voting power within the IMF.

The additional allocation will be included in the 2025 budget.

The IMF created SDRs as an international reserve asset to supplement member countries' official reserves; they are not a currency, but rather a claim on freely usable currencies of IMF member countries. They serve as a potential source of liquidity for IMF member nations.

SDRs represent a weighted basket of major international currencies, and can he held as part of a country's foreign exchange reserves. Adding SDRs to a country's international reserves makes it more resilient financially. link

************

Tishwash: Opening of the first center for testing and marking imported gold at Baghdad Airport

The Ministry of Planning opened, today, Tuesday, the first center for examining and marking imported gold jewelry at Baghdad International Airport.

The head of the Central Organization for Standardization and Quality Control, Fayyad Muhammad Abdul, said in a statement received by {Euphrates News} a copy of it, that: “The opening of this center came in implementation of the directives of Prime Minister Muhammad Shia al-Sudani and under the direct supervision and continuous follow-up of the Minister of Planning,” indicating that “it is one of four centers in Iraqi airports to examine and mark gold jewelry imported into Iraq by Iraqi merchants.”

He added, "The Central Organization for Standardization and Quality Control, the Central Bank of Iraq, the Anti-Money Laundering and Terrorism Financing Office, and the Ministry of Trade now have a single database (electronic platform) to know the movement of gold in Iraq," noting that "the opening of the gold testing and marking center at Baghdad Airport was preceded by the opening of a similar center at Najaf Airport, then at Basra Airport, and then its opening at Kirkuk Airport."

Abdul Bin, "These procedures will facilitate the flow of work and shorten the time and date by facilitating the procedures for suppliers of gold bullion and jewelry, as well as activating the supervisory aspect of the device's work in protecting gold, and thus this matter will have a positive impact on the economic movement in the country."

He continued, "The devices used in examining and marking gold, Iraq is one of three countries in the region that possess these devices, which are distributed as (3) devices for examination and (3) devices for marking jewelry in each airport," noting that "the Central Organization for Standardization and Quality Control is working to train Iraqi staff in addition to the staff of the organization so that we have a great technical capacity in order to facilitate procedures and protect citizens from fraud."

For his part, the Assistant Director of Baghdad International Airport, Hussein Ali Hussein, said, "The opening of the jewelry inspection and marking unit came in cooperation between the Central Organization for Standardization and Quality Control and the airport administration and will contribute to facilitating procedures at the airport," indicating that "his administration worked to provide the technical requirements and facilities necessary to complete this technical and technological center and its sustainability, which was recommended by the regulatory authorities." link

************

Tishwash: The Central Bank reveals the percentage of gold in Iraq's foreign currency reserves

The Central Bank of Iraq revealed that the contribution of gold inside and outside the country in 2023 is equal to 8.5% of the country's total foreign currency reserves.

The bank said in a report it recently published and reviewed by "Al-Eqtisad News", that "the total reserves of the Central Bank of hard currency, whether gold, dollars or foreign currency, at the bank in the year 2023 amounted to 145.257 trillion dinars, an increase of 3.50% over the year 2022, which amounted to 140.086 trillion dinars."

He added, "The percentage of gold's contribution to these hard currency reserves amounted to 8.5%, which is equal to 12.293 trillion dinars, an increase of 10.37% compared to the year 2022, which amounted to 11.018 trillion dinars."

According to the report, "the contribution of balances in foreign banks and in New York to the foreign currency reserve amounts to 91.3%, which is equal to 132.641 trillion dinars," noting that "the contribution of foreign currency in the Central Bank's vaults amounts to 0.2%, which is equal to 323 billion dinars." link

************

Mot: . and Yet Another ""Tip"" on Raising the ""Wee Folks""

Mot: Bet You Were Wondering What NOW to Do ---

Seeds of Wisdom RV and Economic Updates Tuesday Evening 10-15-24

Good Evening Dinar Recaps,

RIPPLE’S ISO 20022 COMPLIANCE PAVES WAY FOR XRP IN TRADITIONAL PAYMENT SYSTEMS

▪️Ripple is ISO 20022 compliant, a move many say will benefit XRP.

▪️As a cross-border enabler, Ripple’s success can translate to XRP’s growth.

Market participants believe Ripple’s adoption of ISO 20022 could open the way for XRP’s integration into traditional payment systems. While XRP and ISO 20022 are unrelated, Ripple’s compliance with this industry standard for financial messaging may benefit the coin.

Good Evening Dinar Recaps,

RIPPLE’S ISO 20022 COMPLIANCE PAVES WAY FOR XRP IN TRADITIONAL PAYMENT SYSTEMS

▪️Ripple is ISO 20022 compliant, a move many say will benefit XRP.

▪️As a cross-border enabler, Ripple’s success can translate to XRP’s growth.

Market participants believe Ripple’s adoption of ISO 20022 could open the way for XRP’s integration into traditional payment systems. While XRP and ISO 20022 are unrelated, Ripple’s compliance with this industry standard for financial messaging may benefit the coin.

Ripple’s Connection With ISO 20022

ISO 20022 is a flexible framework that allows users and message development organizations to define information according to an internationally agreed-upon approach. This standard provides a structured and data-rich common language readily exchanged among corporations and banking systems.

This standard, developed by the International Organization for Standardization (ISO), also provides the opportunity for enhanced analytics. This can lead to offering valuable new levels of payment services to financial institutions’ customers.

Approximately 72% of institutions connected to the SWIFT network anticipate switching to ISO 20022 by November 2025. Additionally, over 70 countries, including Switzerland, China, India, and Japan, anticipate adopting ISO 20022 into their payment systems, according to a CNF report. The messaging system is set for smooth harmonization and efficiency in cross-border transactions.

SWIFT, which handles a substantial share of cross-border payments, is leading the transition from its earlier messaging system (MT) to ISO 20022. The move aims to standardize financial communications and streamline payment processes, allowing financial institutions to operate globally.

Ripple, a key player in blockchain-based payments, joined the standards body in 2020.

Ripple’s participation allows its payment network, RippleNet, to integrate with other ISO 20022-compliant institutions. This compliance makes it easier for RippleNet to conduct cross-border transactions through a unified Application Programming Interface (API).

The company’s involvement with ISO 20022 has raised discussions about how it might impact XRP. The token does not comply with the messaging standard despite Ripple’s adherence to ISO 20022. Some crypto community members claim XRP complies with ISO 20022 due to Ripple’s participation in the standard.

Ripple’s Chief Technology Officer, David Schwartz, recently refuted this claim, emphasizing that the token has nothing to do with ISO 20022. He argues that ISO 20022 is a messaging standard, while XRP functions entirely as a cryptocurrency.

Possible Benefits for XRP

Although XRP is not directly compliant with the messaging standard, it can still benefit from Ripple’s alignment with the framework. Ripple’s compliance may facilitate XRP’s integration into established banking institutions.

For instance, Ripple’s payment solutions, especially On-Demand Liquidity (ODL), may gain more popularity as financial institutions switch to ISO 20022.

ODL allows faster, cost-effective cross-border settlements using XRP as a bridge asset between different fiat currencies. XRP’s faster transaction speed could entice financial institutions seeking efficient cross-border payment options to adopt the token.

Furthermore, Ripple’s involvement with ISO 20022 may create new opportunities for XRP to be integrated into the wider financial ecosystem. Overall, this might impact the price of the coin, up 1.25% as of writing to $0.5389.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

UAE STABLECOIN ISSUER GETS NOD FROM CENTRAL BANK

With Tether waiting in the wings, AED Stablecoin becomes the front-runner to launch the United Arab Emirates’ first regulated dirham-pegged token.

The Central Bank of the United Arab Emirates (CBUAE) has granted in-principle approval to AED Stablecoin under its Payment Token Service Regulation framework, the company said in a news release.

AED Stablecoin’s preliminary license approval makes it a frontrunner in the race to become the first issuer of a regulated dirham-pegged stablecoin in the UAE.

This development eases concerns about potential restrictions on crypto payments, which had arisen following the CBUAE’s recent release of its licensing framework, which prohibits crypto for payments unless it involves licensed dirham-pegged tokens.

If fully approved, AED Stablecoin’s AE Coin could serve as a local trading pair for cryptocurrencies in exchanges and decentralized platforms, while allowing merchants to accept it for goods and services.

The central bank’s licensing framework also bars algorithmic stablecoins and privacy tokens, favoring fully cash-backed assets.

Issuers are required to back their stablecoins with cash in a separate escrow fully denominated in dirhams within a UAE bank.

Alternatively, they may hold at least 50% of reserve assets as cash, with the remaining portion invested in UAE government bonds and CBUAE Monetary Bills with an average duration of up to six months.

UAE’s crypto red carpet

AED Stablecoin is expected to face competition from Tether, the issuer of the world’s largest stablecoin by market capitalization, USDt.

Tether recently said that it has partnered with local firms Phoenix Group and Green Acorn Investments to introduce its own dirham-pegged stablecoin.

Meanwhile, the UAE’s crypto-friendly regulatory environment has been attracting major players.

OKX recently launched a retail and institutional trading platform in the UAE after obtaining a full license, which includes derivatives trading for qualified institutional investors.

Additionally, crypto exchange M2 has opened a new system that allows residents to directly convert dirhams into Bitcoin.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

🌍 BOB LOCK CALL WED. NOON CENTRAL - PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT 1 PM ET, NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G

Bob Lock Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” 10-15-2024

Will BRICS Make An Announcement About Gold Backed 'Unit' At Next Week's Meeting?

Arcadia Economics: 10-15-2024

We're now one week away from the beginning of the BRICS meeting.

And some of the questions I'm hearing people ask is whether there will be an official announcement, if they might actually launch a gold-backed payment settlement currency next week, and whether that could lead to a substantial move in the gold price.

Will BRICS Make An Announcement About Gold Backed 'Unit' At Next Week's Meeting?

Arcadia Economics: 10-15-2024

We're now one week away from the beginning of the BRICS meeting.

And some of the questions I'm hearing people ask is whether there will be an official announcement, if they might actually launch a gold-backed payment settlement currency next week, and whether that could lead to a substantial move in the gold price.

So in today's video, I share my own thoughts about what I'm expecting heading into the meeting. As well as why.

INFLATED TO DEATH... THE ECONOMY IS DEAD... FOR THE MARKET- WE BUY IT ALL!

Greg Mannarino: 10-15-2024

‘Everything Rally’ Is Here: Markets Repeating 1982’s 100% Bull Run | Eric Jackson

David Lin: 10-15-2024

Eric Jackson, CIO of EMJ Capital, discusses how conditions are ripe for an "everything rally" reminiscent of the bull rally of the early 1980s.

0:00 - "Everything Rally" Is Here

3:13 - Comparing 1982 To Today

7:35 - Bond Yields And Stocks

10:52 - Fed 50 Bps Cuts During Crises

12:48 - What Is "Everything Rally"

14:20 - Conditions For Bull Run Today

17:32 - China's Stimulus

18:40 - Inflation Vs. Tech Stocks

22:00 - Stock Market Ex-Mag 7

26:20 - Capital Rotation Out Of Big Tech

27:45 - NVIDIA

29:20 - Tech Valuations

31:10 - What Could Turn Eric Bearish?

33:00 - Is Tech Recession-Proof?

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 10-15-24

Good Afternoon Dinar Recaps,

IOTA UNVEILS IOTA LABS: A NEW ECOSYSTEM ARM TO PROPEL DEFI, WEB3, AND REAL-WORLD SOLUTIONS

▪️IOTA has launched a dedicated outfit to boost innovation in its ecosystem.

▪️The protocol plans to support all projects, irrespective of their technological and ecosystem leaning.

IOTA is advancing its push in the Web3 ecosystem by introducing IOTA Labs. As an independent arm of its broader ecosystem, IOTA Labs will help the protocol turbocharge its growth, drive adoption, and back innovators in Web3.

Good Afternoon Dinar Recaps,

IOTA UNVEILS IOTA LABS: A NEW ECOSYSTEM ARM TO PROPEL DEFI, WEB3, AND REAL-WORLD SOLUTIONS

▪️IOTA has launched a dedicated outfit to boost innovation in its ecosystem.

▪️The protocol plans to support all projects, irrespective of their technological and ecosystem leaning.

IOTA is advancing its push in the Web3 ecosystem by introducing IOTA Labs. As an independent arm of its broader ecosystem, IOTA Labs will help the protocol turbocharge its growth, drive adoption, and back innovators in Web3.

Right Time for IOTA Labs Launch

Almost every blockchain protocol, including Layer-1 and Layer-2 outfits, has a dedicated outfit to support ecosystem growth. This is essential to create useful Decentralized Applications (DApp) for the community.

According to IOTA Labs, its goal with the new outfit is modeled after the concept of Alchemy, which aims to transform the ordinary into something unique. The platform outlined five major elements of a thriving Web3 ecosystem, which will serve as a guide for its mission overall.

🎉 New @iotalabs_ account just launched! 🎉As IOTA’s new independent ecosystem arm, they’re here to fuel growth, drive adoption, and turn bold ideas into real-world solutions.

Be sure to follow them for the latest news #crypto, #DeFi & #Web3 from the #IOTA community https://t.co/VCQ8HIOC5w — IOTA (@iota) October 15, 2024

These elements include Community Building and Relationships, Developer Support and Collaboration, and Incentives to Drive Innovation. Additionally, the firm named Reliable Infrastructure for Seamless Access and Cross-Sector Collaboration to complete the top five elements.

It is worth noting that IOTA has worked effectively across all five elements in the past. As mentioned earlier in a CNF report, one research study from a Turkish University confirmed that the Tangle Protocol from IOTA is superior to other types of DLT, including traditional blockchains, for the Internet of Things (IoT). This is evident from its cross-sector collaboration and usage among innovators.

IOTA has a good track record of offering reliable infrastructure for seamless access. From powering the stablecoin market to facilitating trades across East Africa, the protocol is one of the most used blockchains for building transparent event-tracking databases.

Having played a key role in innovation over the past years, IOTA Labs is emerging to amplify cross-industry adoption. Overall, the essence of this push is to scale the IOTA ecosystem and empower its application to attain true autonomy.

The IOTA Labs Ideals: A Unified Approach

In the Web3 world, there is often fragmented innovation as everyone tries to showcase their uniqueness. As IOTA Labs noted, it is committed to supporting and enhancing every facet of the ecosystem.

Many industry investment funds are generally targeted at a specific niche. In an earlier CNF report, Aethir unveiled a $100 million fund to provide tailored support for AI and cloud gaming developers. With IOTA Labs, the fund allocation will benefit every developer, including those in gaming, Cloud services, AI, Decentralized Finance (DeFi), and driving Real-World solutions.

To begin with, IOTA Labs said it will commit $2 million as incentives in various campaigns over the next six months. As noted, besides developers, the incentive to bootstrap the IOTA Labs will also benefit users within the ecosystem.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

RIPPLE SWELL 2024 LIVE: CLO STUART ALDEROTY AND ADRIENNE HARRIS DISCUSS CRYPTOCURRENCY

Ripple Swell, the annual conference hosted by the payment firm Ripple, begins today in Miami, running from October 15 to 16. This event gathers Ripple’s partners and clients for discussions.

During the conference, Ripple’s General Counsel, Stuart Alderoty, shared the stage with Adrienne Harris, the chief of the New York Department of Financial Services (NYDFS).

Harris announced that the NYDFS has formed a dedicated team of approximately 60 professionals focused specifically on cryptocurrency.

Fox Business journalist Eleanor Terrett wrote on X, “Harris says the NYDFS now has a team of around 60 people focusing specifically on #crypto.”

Social media users noted an interesting coincidence as the company is currently awaiting regulatory approval from the New York Department of Financial Services (NYDFS) for this launch.

Key Insights on Digital Assets and Tokenization

Andrew Czupek, Senior Vice President and Head of Digital Assets at Northern Trust, spoke about the importance of traditional technology infrastructure in unlocking the full potential of digital assets.

He compared the current situation to the electronic trading revolution of the 1980s, explaining that mass adoption of digital assets will take time.

In a panel discussion alongside James Wallis, Graham, CEO of Archax, discussed the impact of digital ETFs on the market. He pointed out that while tokenization took a while to gain traction, it is now evident that real-world use cases are starting to emerge, with users around the globe beginning to experience the benefits.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

RIPPLE REVEALS FIRST PARTNERS FOR RLUSD STABLECOIN WITH TOP EXCHANGES AND PLATFORMS, PLANS LAUNCH ON XRP LEDGER AND ETHEREUM

▪️Ripple aims to position RLUSD as a leading stablecoin in the rapidly growing $170 billion market, focusing on regulatory compliance and utility in cross-border payments.

▪️The RLUSD stablecoin will be backed by short-term U.S. Treasuries and cash equivalents, with testing currently ongoing on the XRP Ledger and Ethereum networks.

In the latest push for its USD-pegged RLUSD stablecoin, blockchain startup Ripple announced its exchange partners and market maker partners during the Ripple Swell 2024 conference in Miami, Florida, on Tuesday.

In its official announcement, Ripple has named exchange partners such as Bitstamp, Uphold, Bitso, Independent Reserve, MoonPay, CoinMENA, and Bullish, for hosting its RLUSD stablecoin.

Similarly, its market maker partners include Keyrock and B2C2 which will provide liquidity support to the RLUSD stablecoin during the launch period.

Moreover, Ripple has appointed former FDIC chair Sheila Bair and David Puth, ex-CEO of Centre, the consortium behind USD Coin (USDC), to the advisory board for its stablecoin. Speaking on this development, Ripple CEO Brad Garlinghouse said:

With our initial exchange partners, clear utility and demand for RLUSD, and a strong focus on regulatory compliance, Ripple’s stablecoin is poised to become the gold standard for enterprise-grade stablecoins. “Our payment solutions will leverage RLUSD, XRP, and other digital assets to enable faster, more reliable, and cost-effective cross-border payments.

Although the official date for the launch of RLUSD stablecoin is not clear, Garlinghouse said last month that it would happen in “weeks, not months” from now. He also warned users to be vigilant about any RLUSD scams and only wait for the official announcement from the firm, reported CNF.

Ripple’s RLUSD Eyes Big Pie of the Stablecoin Market

The announcement follows Ripple’s earlier plans to launch its stablecoin, aiming to capture a share of the rapidly expanding $170 billion stablecoin market.

Stablecoins play a crucial role in the crypto economy, acting as a link between traditional government-issued currencies and blockchain-based digital assets. Also, the stablecoin market is likely to grow to a trillion dollars by 2030. Thus, Ripple’s RLUSD will be pitching direct competition to giants like USDT and USDC through its institution-first approach, reported CNF.

President of Ripple Labs, Monica Long, said that the company is operationally ready from their end. Through the stablecoin, Ripple intends to capitalize on its established role in payments and serve as a crucial bridge for the tokenization of real-world assets, Long stated. In the last 24 hours, Ripple has already minted 4.5 million RLUSD stablecoins, reported CNF. Speaking on the matter, Long said:

For RLUSD and stablecoins generally, we definitely have validated the utility of them with payments. We’re also believers in this broader trend of real-world asset tokenization.

When we think beyond tokenizing money to different instruments and capital markets like securities and bonds, real estate and other assets, you need a stable coin that’s trusted and very reliable, very robustly managed for on and offramps as well.

RLUSD’s value will be supported by short-term U.S. Treasuries, dollar deposits, and cash equivalents. It is currently undergoing testing on the XRP Ledger and Ethereum networks. The company plans to publish independent monthly attestations of its reserves, which will be conducted by the San Francisco-based accounting firm BPM.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌍 NAVIGATING FINANCIAL UNCERTAINTY: PROTECT YOUR 401(K) AND ASSETS! Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Tuesday Afternoon

MikeCristo8: Why the BRICS Currency Matters

10-15-2024

Don’t be surprised if China devalues the yuan against their gold reserves to get a $40 USD oil price.

That will bring down the dollar.

The relationship between gold and oil since 1900 and now, and the relationship between the dollar and oil.

That’s why BRICS is moving to a hard asset backed currency.

MikeCristo8: Why the BRICS Currency Matters

10-15-2024

Don’t be surprised if China devalues the yuan against their gold reserves to get a $40 USD oil price.

That will bring down the dollar.

The relationship between gold and oil since 1900 and now, and the relationship between the dollar and oil.

That’s why BRICS is moving to a hard asset backed currency.

This is why the BRICS currency matters.

The Israel will not attack Iran’s oil is all noise.

They need to distract from the fact that the dollar is no longer pricing oil.

Oil is about to massively crash.

China is manipulating the yuan against their gold reserves to crash oil in USD.

The central planners are doing currency swaps (within the G7) to keep oil from crashing.

Few understand this.

The price of oil is deflationary when measured against gold.

Big if true.

JUST IN: BRICS Advances 'Multicurrency System' To Break US Dollar Dominance

So if BRICS returns the oil price back to the 1971 gold standard

The dollar collapses.

This is what Alasdair Macleod was talking about.

https://dinarchronicles.com/2024/10/15/mikecristo8-why-the-brics-currency-matters/

************

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 15 Oct. 2024

Mon. 14 Oct. 2024 The GLOBAL DE-DOLLARIZATION is happening RIGHT NOW! …Carolyn Bessette Kennedy on Telegram

And what does this BRICS initiative really mean for the world’s economy? This isn’t just another economic move—it’s a direct STRIKE BACK at the weaponization of the U.S. dollar! The elites have long used the dollar as their ultimate tool to CONTROL the global financial system and FORCE their agenda on any nation that doesn’t fall in line with their sinister policies.

Countries like Russia and Iran were the first to see through the lies, and now, more and more nations are WAKING UP to the truth. BRICS isn’t just creating a new system; they’re DESTROYING the old one.

Lavrov has spoken—sanctions are the weapon of the West, but their time is running out. Anyone, any country, could be next in the crosshairs of the globalist agenda. But BRICS is here to change the game. And the real shocker? Even Janet Yellen, the U.S. Secretary of the Treasury, can’t hide it anymore. She KNOWS these sanctions are BACKFIRING and driving the world towards a massive rejection of the U.S. dollar!

The BRICS nations are not just protecting themselves—they’re setting the stage for the collapse of the global dominance of the dollar.

America’s entire system is at RISK. Imagine what happens when the dollar is no longer the king of global trade. The implications are HUGE. The U.S. economy is tightly bound to the dollar’s power—and that power is SLIPPING away. The question is: Are you ready for what comes next?

The elites are scrambling. The system they built is CRUMBLING. The storm is brewing. Are you paying attention?

https://dinarchronicles.com/2024/10/15/restored-republic-via-a-gcr-update-as-of-october-15-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Article: "World Trade Organization in Geneva 2024 was held on July 18th." That's just a few months ago... Quote: "The significance of this is it marked the formal resumption of Iraq's accession process to the WTO after a 6-year hiatus." They have intensified the bilateral negotiations for the accession...There's a push now and they will need to be an internationally accepted currency in place ahead of the accession.

Mnt Goat Article: "IRAQ EXPORTS MORE THAN 54 MILLION BARRELS OF OIL AND ITS DERIVATIVES TO

AMERICA" ...the best part is that Iraq is now refining their own oil and selling not only raw crude oil exports but now running refineries to generate oil products (or derivatives) and exporting them too.

************

IQD VND HTG ARS Exchange Rates The Iraqi PM Delivers Good News

Edu Matrix: 10-15-2024

The Iraqi PM Delivers Good News, IQD VND HTG ARS Exchange Rates –

Not everyone agrees with the Iraqi Prime Ministers assessment. However, it is true, Iraq is doing well in economic progress, and we are hoping for a continuation of this pattern.

There is concern over oil prices decreasing in 2025 and Iraq having to cope with a tight budget due to over 90% of the country's revenue comes from the oil industry.

“Tidbits from TNT” Tuesday 10-15-2024

TNT:

Tishwash: Issuance of the first national card outside Iraq

The Ministry of Interior announced the issuance of the first national card outside Iraq.

The ministry said in a statement received by {Euphrates News} a copy of it that "in a step that is considered the first in the history of the Iraqi Ministry of Interior, the first national card was issued at the Embassy of the Republic of Iraq in the British capital, London, after a special office was opened to issue national cards there."

He added, "It is hoped that the Ministry of Interior will open a number of national card issuance offices in a number of countries in succession to provide the best services to Iraqis residing outside the country." link

TNT:

Tishwash: Issuance of the first national card outside Iraq

The Ministry of Interior announced the issuance of the first national card outside Iraq.

The ministry said in a statement received by {Euphrates News} a copy of it that "in a step that is considered the first in the history of the Iraqi Ministry of Interior, the first national card was issued at the Embassy of the Republic of Iraq in the British capital, London, after a special office was opened to issue national cards there."

He added, "It is hoped that the Ministry of Interior will open a number of national card issuance offices in a number of countries in succession to provide the best services to Iraqis residing outside the country." link

***************

Tishwash: Trade Bank of Iraq announces the imminent opening of a cash deposit center in Karkh

The Trade Bank of Iraq announced today, Monday, the imminent opening of the cash deposit center in the Karkh side.

The bank's media advisor, Aqil Al-Shuwaili, said in a statement received by the Iraqi News Agency (INA): "Based on the directives of the respected Prime Minister, Mohammed Shia Al-Sudani, to provide the best services to citizens, the Trade Bank of Iraq announces the imminent opening of the (Cash Deposit Center)."

He explained that "this center receives all cash deposits only for all customers," indicating that "this is a new service that the bank will launch with the aim of providing the best services to customers, and to contribute to reducing the pressure of cash deposits on its other branches in Baghdad link

*************

Tishwash: Government advisor: Tensions and war in the region may lead to a jump in oil prices

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, identified today, Monday, the indicators of the rise in oil prices in global markets, and while he attributed them to two basic variables, he indicated that if tensions and war continue in the region, a jump in prices is expected.

Saleh told the Iraqi News Agency (INA): "The oil asset cycle is subject to accelerated upward volatility across current energy market indicators and two fundamental variables that affect global oil supply and demand: the first is OPEC+'s decisions to reduce oil production on the production of OPEC countries themselves and their allies, as OPEC+ has currently implemented significant oil production cuts of 5.86 million barrels per day."

He added, "These cuts consist of two parts: the first is a reduction of 3.66 million barrels per day extended until the end of 2025, and the other is an additional voluntary reduction of 2.2 million barrels per day that remains in effect until September 2024."

He pointed out that "the cuts come to remove the current oil glut, which is affected by the decline in growth in the world's most important energy-consuming economies, China," noting that "the second variable is the geopolitical situation and the war taking place in the two energy basin regions of the world, namely the Russian-Ukrainian war and the other is the ongoing war in the Middle East, especially the Gaza and Lebanon war with the Zionist entity and its effects on the oil-producing Gulf region, which dominates more than 50% of global oil exports."

He continued, "If military operations or geopolitical tensions continue in the two regions, oil prices are expected to jump." link

****************

Tishwash: Al-Mandlawi: Iraq is making exceptional efforts to prevent the specter of a major war from looming over the region and the world

Acting Speaker of the House of Representatives Mohsen Al Mandalawi warned the international community against the consequences of the conflict in the Middle East region turning into a comprehensive war with a greater impact on global security and peace, while stressing that Iraq is making exceptional efforts to prevent the specter of a major war from the region and the world.

In his speech delivered today, Monday, during his participation in the (149) session of the Inter-Parliamentary Union in Geneva, Al-Mandlawi called for “the formation of an international parliamentary delegation to visit Lebanon and Palestine and investigate the facts about the extent of the Zionist terrorist attacks against civilians,” describing the events taking place as a “major challenge” to the global system and a real threat to international legitimacy, indicating that “the recent attack on the UN peacekeeping forces (UNIFIL) is evidence of the extent of the arrogance of the occupation and its leaders, and has proven that this outcast entity is now outside the legal, humanitarian and international framework.”

Al-Mandlawi said, "International parliamentary bodies are facing a challenge and a test of the usefulness of their existence to express the aspirations of their peoples," calling on them to "take a clear and rapid position to spare the region and the world the dangers of slipping into a large and destructive war," calling on the presidency of the union and representatives of the participating parliaments to "condemn the Zionist practices and serious violations of the charters and legitimate resolutions, and take responsible action to stop the aggression against Palestine, Lebanon and the countries of the region, by demanding that the Security Council take the necessary decisions in this regard, hold the leaders of the entity accountable, prevent humanitarian disasters against civilians, provide urgent humanitarian aid and return the displaced."

He stressed the "necessity for the Union to adopt the signing of an international agreement that criminalizes the use of artificial intelligence technology as a weapon in wars, due to its deadly impact that exceeds the impact of nuclear weapons, and to pay attention to enhancing the parliamentary performance of the legislative bodies of member states and enabling them to perform their duties, in addition to taking the initiative to organize a responsible and serious humanitarian stand to intervene by all means in order to immediately stop the wars of genocide practiced by the Zionist entity, and to save the region and the world from its danger, effects and repercussions, and to exert efforts to raise the levels of cooperation between parliaments to exchange parliamentary expertise, and to emphasize the need to respect international humanitarian law and the rights of peoples to security and stability."

Al-Mandlawi explained that "Iraq is making exceptional parliamentary and governmental diplomatic efforts to prevent the specter of a comprehensive war from the region and the world, and that the Zionist entity is striving to ignite and expand this war by targeting diplomatic missions, leaders and symbols of countries within an aggressive methodology to control and impose wills and drag the region and the world into a comprehensive bloody war,"

Indicating that "Iraq, Yemen, Syria and Iran are at the top of the list of targeted countries, while adding that announcing the name of the highest religious authority, Sayyid Ali al-Sistani, who is a symbol of peace and moderation in the world, within the list of the entity's targets, is nothing but evidence of its arrogance and its lack of consideration for human and heavenly values and international legitimacy." link

******************

Mot: .. making it work

Mot: waiting - waiting –

Seeds of Wisdom RV and Economic Updates Tuesday Morning 10-15-24

Good Morning Dinar Recaps,

SMART CONTRACTS ACHIEVE LEGAL BREAKTHROUGH IN ARGENTINA

Smart contracts, the blockchain-automated programs, are now legal in Argentina after local jurisdiction recognized the enforceability of the first one.

They can now be used to execute rental agreements, purchase payments, and other legal contracts, as cryptocurrency is now approved for use as payment in commercial contracts in the country.

Good Morning Dinar Recaps,

SMART CONTRACTS ACHIEVE LEGAL BREAKTHROUGH IN ARGENTINA

Smart contracts, the blockchain-automated programs, are now legal in Argentina after local jurisdiction recognized the enforceability of the first one.

They can now be used to execute rental agreements, purchase payments, and other legal contracts, as cryptocurrency is now approved for use as payment in commercial contracts in the country.

Smart Contracts Reach Legally Enforceable Status in Argentina

Smart contracts, the automatically executed blockchain-based equivalent of paper contracts, have reached a milestone in Argentina.

According to local reports, the first Cardano-based smart contract was approved to be legally binding by Argentine jurisdiction, which might be the first time this has happened in the country and even the world.

The contract specifies a four-month loan repaid with a 10% interest between Mauro Andreoli and Lucas Macchia, two Cardano ambassadors in Argentina.