Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

More News, Rumors and Opinions Monday PM 9-23-2024

TNT:

Tishwash: Iraq Plans Currency Redenomination Amid Economic Challenges

The Central Bank of Iraq (CBI) has announced that discussions regarding the project to remove zeros from the Iraqi dinar are ongoing, with assessments continuing. The bank also noted a reduction in reliance on the US dollar for trade transactions.

Ali Mohsen al-Alaq, Governor of Iraq's Central Bank, stated that the bank is facing global economic challenges, such as rising energy and raw material prices.

To address these issues, it has amended some monetary policies in line with the international situation, aiming to increase confidence in the Iraqi dinar and prevent a significant decline in its value.

TNT:

Tishwash: Iraq Plans Currency Redenomination Amid Economic Challenges

The Central Bank of Iraq (CBI) has announced that discussions regarding the project to remove zeros from the Iraqi dinar are ongoing, with assessments continuing. The bank also noted a reduction in reliance on the US dollar for trade transactions.

Ali Mohsen al-Alaq, Governor of Iraq's Central Bank, stated that the bank is facing global economic challenges, such as rising energy and raw material prices.

To address these issues, it has amended some monetary policies in line with the international situation, aiming to increase confidence in the Iraqi dinar and prevent a significant decline in its value.

The central bank has also increased its holdings of foreign currency and gold reserves to enhance the country's financial stability and its ability to cope with economic crises in any situation, he added.

Many countries remove zeros from their currencies to revalue the national currency and facilitate financial transactions. This process involves eliminating a certain number of zeros from the nominal value of the currency, making it less inflationary and more stable.

Earlier this year, the Iraqi federal government decided to postpone a plan to remove three zeros from the nominal value of its currency notes, citing that the current economic climate is not suitable.

Last year, the central bank indicated plans to redenominate the Iraqi dinar to simplify financial transactions in an economy that remains heavily centralized and oil-dominated, where deals are often conducted in cash. link

************

Tishwash: Nokia signs contract with Zain Iraq to improve the company’s network in the southern governorates

Nokia has announced a 3-year deal with Zain Iraq to upgrade the company’s network in the southern region by applying the latest microwave technologies, including E-band solutions, which will help increase network capacity. The deal includes replacing competitors’ equipment and providing versions that provide the highest transmission power in the market. Nokia considered this partnership to be its first entry into the microwave field with Zain Iraq.

The three-year deal represents Nokia’s first foray into microwave with Zain Iraq, boosting network capacity and upgrading infrastructure to support future growth and increased traffic demand.

The deployment will begin immediately, with a focus on improving network performance and ensuring scalability to accommodate future growth. Nokia’s solutions will help Zain Iraq expand network capacity and improve customer experience while paving the way for future innovations in the region.

Zain Iraq is experiencing increasing demand for its data services and expansion is essential to provide the best service to its customers. Nokia will apply the latest microwave technologies, including the latest E-band solutions, to upgrade Zain Iraq’s microwave backbone. This upgrade will increase network capacity and prepare it for the expected increase in data due to higher customer usage.

The deal includes the replacement of competitor equipment and the introduction of Nokia’s high-capacity microwave solutions. A key component of this deployment is the UBT-T XP, which offers the highest transmit power on the market. This technology reduces antenna sizes and tower loads, saving significant capital and operational costs.

“This deal underscores our strong local capabilities and expertise. By deploying our advanced microwave solutions, Zain Iraq will benefit from an enhanced network that is ready to handle the demands of the future, including meeting the needs of its growing customer base,” said Mikko Lavanti, Senior Vice President, Mobile Networks, Nokia Middle East and Africa.

“Our partnership with Nokia enables us to overcome capacity constraints and modernize our network infrastructure. With Nokia’s advanced microwave technology and E-band solutions, we are not only solving current challenges, but also securing our network for future growth,” said Emre Gurkan, CEO of Zain Iraq. link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

Mr Sammy says they are way ahead of what they are telling us but they can't tell you everything. It's all for safety of our country...markets... speculators... FRANK: There are many things happening right now that are extremely good for our investment. It may seem like it's so far away but it's actually right in front of us. It's not a mirage and you are already touching it.

Mnt Goat Here is the process of the reinstatement...: Institute the reforms the “Pillars of Financial Reform” – Banking, Insurance, Stock Market; Get rid of the parallel market and demand for the dollar through the black market; Realize the Central Bank “official” rate of the dinar and overcome the dollar crisis.; Be able to raise the “official” rate of the dinar against to dollar to a sustainable, realistic rate that reflects the true economy of Iraq (just over a dollar in-country); Conduct the Project to Delete the Zeros: decrease the monetary mass by collecting these large three zero notes,stashes/hoards of dinars and dollars. Swap out the currency; Watch/monitor for inflationary pressures on the process; Reinstate the IQD back to the global currency exchanges ie. FOREX. Not just a placeholder on FOREX pointing to ISX but the ability of tradable buy and sell options.

************

(Alert!) THE WORLD ECONOMY IS IN COLLAPSE! WAR IS EXPANDING... STOCK MARKETS TO GO HIGHER!

Greg Mannarino: 9-23-2024

As Saudi Arabia Sells USD For Gold, US Spends Record $1.2 Trillion On Debt Interest Payments

Sean Foo: 9-23-2024

Saudi Arabia is buying gold, in fact, they could have accumulated over 150 tonnes since 2022. This is devastating for the Petrodollar and it shows trust in Treasury bonds is collapsing.

And it's not a surprise when you realize interest payments on the US debt itself hit a record $1.2 Trillion dollars!

Timestamps & Chapters:

0:00 Saudi Dumps Dollars For Gold

2:29 Saudi & China Drives De-Dollarization

5:23 Massive $1.2 Trillion Interest Payments

7:46 Sponsor: Indigo Precious Metals

9:11 Yellen Denies Urgent Debt Crisis

Seeds of Wisdom RV and Economic Updates Monday Afternoon 9-23-24

Good Afternoon Dinar Recaps,

HONG KONG MONETARY REGULATOR LAUNCHES SECOND PHASE OF CBDC PROJECT

The HKMA has engaged 11 firms for advanced e-HKD+ digital currency trials, so far.

The Hong Kong Monetary Authority (HKMA) has announced the launch of the second phase of its central bank digital currency (CBDC) pilot program, known as e-HKD, according to a Sept. 23 statement.

The second phase will delve into advanced use cases for digital money, emphasizing e-HKD and tokenized deposits for individuals and businesses. The first phase focused on testing CBDC applications in domestic retail payments, offline transactions, and the settlement of tokenized assets.

Good Afternoon Dinar Recaps,

HONG KONG MONETARY REGULATOR LAUNCHES SECOND PHASE OF CBDC PROJECT

The HKMA has engaged 11 firms for advanced e-HKD+ digital currency trials, so far.

The Hong Kong Monetary Authority (HKMA) has announced the launch of the second phase of its central bank digital currency (CBDC) pilot program, known as e-HKD, according to a Sept. 23 statement.

The second phase will delve into advanced use cases for digital money, emphasizing e-HKD and tokenized deposits for individuals and businesses. The first phase focused on testing CBDC applications in domestic retail payments, offline transactions, and the settlement of tokenized assets.

The HKMA stated that the initiative has evolved from its original e-HKD focus and is now rebranded as Project e-HKD+ to align with the changing fintech landscape.

e-HKD Applications

The HKMA has engaged 11 firms from various sectors to investigate e-HKD applications in three main areas, including tokenized asset settlement, programmability, and offline payments.

Some of the participants reportedly involved in phase 2 include ANZ, Airstar Bank, Aptos Labs, BlackRock, Bank of Communications (Hong Kong), ChinaAMC, China Mobile, DBS, Fidelity International, Kasikornbank, and Sanfield.

The HKMA stated that these firms will evaluate the commercial viability of new digital money forms within real-world settings, aiming to enhance accessibility for individuals and corporations.

The results of Phase 2 will provide insights into the practical challenges of creating a digital money ecosystem that integrates both publicly and privately issued digital currencies. Project e-HKD+ will further develop the necessary technology and legal framework to support potential future issuance of e-HKD for both individuals and businesses.

To foster collaboration, the HKMA will establish the e-HKD Industry Forum. This platform will enable participating institutions to discuss common challenges and explore the scalable implementation of new digital money forms. Industry-led working groups will address specific topics, initially focusing on programmability.

Similar to Phase 1, an e-HKD sandbox will be available for pilot participants to facilitate prototyping, development, and testing of use cases. During Phase 2, the HKMA will collaborate closely with the selected firms over the next 12 months to share key findings with the public by the end of next year.

HKMA chief executive Eddie Yue stated:

“Project e-HKD+ signifies the HKMA’s commitment to digital money innovation. The e-HKD Pilot Programme has provided a valuable opportunity for the HKMA to explore with the industry how new forms of digital money can add unique value to the general public. The HKMA will continue to adopt a use-case driven approach in its exploration of digital money.”

@ Newshounds News™

Source: CryptoSlate

~~~~~~~~~

RIPPLE VS SEC: IS THE SEC PREPARING A LAST-DITCH APPEAL?

▪️Legal experts believe the SEC will file an appeal, but the regulator remains undecided, creating uncertainty for XRP.

▪️Ripple is confident in its legal position, and analysts foresee a potential bullish breakout for XRP despite the looming appeal.

Following the development of the SEC’s appeal against Ripple, CNF highlighted its effect has put the XRP community on edge, current updates in the ongoing Ripple vs. SEC lawsuit suggest that an appeal from the U.S. Securities and Exchange Commission (SEC) is expected. According to legal experts, the SEC seems poised to challenge Judge Torres’ rulings on the XRP case.

As shared on his X account, former SEC attorneys Marc Fagel and James Farrell have expressed confidence that the SEC will file an appeal, emphasizing that not doing so would reflect poorly on the regulator. The SEC has two weeks left before the deadline to submit the appeal.

As the deadline approaches, the XRP community is growing anxious. Attorney Fred Rispoli speculates that the SEC remains undecided about the appeal and could wait until the last minute to make an announcement.

Meanwhile, Ripple’s CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty have confirmed that Ripple does not plan to appeal and has secured a stay order on a $125 million penalty until further proceedings.

Interestingly, recent SEC actions in the Binance case suggest the agency may not appeal Judge Torres’ ruling regarding XRP’s programmatic sales, where the judge stated that buyers in programmatic sales were no different from secondary market purchasers.

XRP Price Surges Despite Legal Uncertainty

However, the trading volume has dropped by 25%, hinting at decreased activity among traders. Analysts are predicting a potential bullish breakout for XRP as Ripple prepares for its Ripple Swell 2024 event. The possibility of an SEC appeal could push XRP beyond its current $0.65 resistance level.

As of today, Ripple (XRP) is trading at $0.5897, with a loss of 1.09% in the past day and a 4.92% increase over the past week. See XRP price chart below.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

CARDANO FOUNDER RESPONDS AS DEVELOPER INTRODUCES BITCOIN TO CARDANO BRIDGE

Cardano’s Charles Hoskinson reacts with surprise as a Bitcoin developer unveils a seamless bridge between Bitcoin and Cardano apps.

A Bitcoin developer, known as elraulito, has announced a breakthrough in blockchain interoperability, revealing a seamless bridge between Bitcoin and Cardano applications.

The developer showcased a smart contract on Plutus V3, allowing Bitcoin wallets to interact directly with Cardano’s ecosystem. This enables users to send ADA, manage tokens, and stake in Cardano pools without requiring a new wallet.

Notably, Cardano founder Charles Hoskinson reacted with surprise as the innovation could mark a new phase in cross-chain connectivity.

Smart Contract Capabilities Explained

The developer detailed how the smart contract was built using a combination of tools and protocols. Notably, the contract employs aiken, a Cardano smart contract language, and CIP69, which enhances the address’s programmability.

A multivalidator enables transactions, delegations, and reward withdrawals, while MeshJS manages off-chain transactions. Mesh, an open-source library, supports Web3 app development and currently offers one of the few implementations compatible with Plutus V3.

This bridge allows Bitcoin users to engage in Cardano’s ecosystem without additional software, providing a straightforward onboarding process. As the developer noted, these capabilities could potentially extend to every EVM chain, broadening blockchain usability and functionality.

Community Reactions and Technical Insights

The announcement generated questions among enthusiasts, eager to understand the mechanics and applications of the new bridge.

One user asked how Cardano actions could be sent from a Bitcoin wallet, to which the developer responded that Bitcoin users can sign Cardano actions from their existing wallets.

If the signature is verified, the action is executed by Cardano nodes. This functionality opens doors to onboarding users from outside the Cardano ecosystem, facilitating interactions like airdrops and liquid staking without changing wallets.

Further discussions focused on the validation process. The contract validates the signature by checking the UTXO, receiver, amount, and asset details against its outputs. This validation ensures that transactions align with predefined rules set within the smart contract, providing secure cross-chain operations.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

BRICS News:

THE TALIBAN MOVEMENT SUBMITS APPLICATION TO ATTEND THE BRICS SUMMIT IN KAZAN

Representatives of the Taliban movement have sent an application to Moscow to attend the BRICS summit which is being held Kazan, the capital of Russia’s Tatarstan Republic on October 22-24, RIA Novosti reported on September 21.

As it has become known, the Taliban want to be represented at the BRICS summit by the acting deputy prime minister of the country, the head of the political wing of the Taliban terrorist movement, Abdullah Ghani Baradar.

"We express our interest in the participation of a high-level delegation in the summit, in particular, Deputy Prime Minister of Afghanistan Abdul Ghani Baradar, as well as myself along with other participants," says an application sent by Nooriddin Azizi, the Taliban’s acting Minister of Commerce and Industry, to Yuri Ushakov, the Aide to Russian President.

BRICS is an intergovernmental organization comprising Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates.

Originally identified to highlight investment opportunities, the grouping evolved into an actual geopolitical bloc, with their governments meeting annually at formal summits and coordinating multilateral policies since 2009. Bilateral relations among BRICS are conducted mainly based on non-interference, equality, and mutual benefit.

The founding countries of Brazil, Russia, India, and China held the first summit in Yekaterinburg in 2009, with South Africa joining the bloc a year later. Iran, Egypt, Ethiopia, and the United Arab Emirates joined the organization on January 1, 2024.

Saudi Arabia is yet to officially join, but participates in the organization's activities as an invited nation. BRICS is an informal group of countries that includes Russia, Brazil, India, China, and South Africa.

@ Newshounds News™

Source: Asia-Plus

~~~~~~~~~

BREAKING NEWS Israel Intercepts Missiles from Iraq | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Monday 9-23-2024

Last Time Fed Cut 50 bps Was The Start Of The Great Financial Crisis

Arcadia Economics: 9-23-2024

The markets are cheering that the Federal Reserve is once again back to lowering interests rates, and at a faster than expected pace.

But the history of the beginning of new rate cutting cycles shows that all might not be so easily fixed. Especially when we look back to the last 50 basis point cut, which was delivered right as the Great Financial Crisis really began to accelerate.

So Vince Lanci looks through what's happened in the past, and compares that to the situation we face today.

Last Time Fed Cut 50 bps Was The Start Of The Great Financial Crisis

Arcadia Economics: 9-23-2024

The markets are cheering that the Federal Reserve is once again back to lowering interests rates, and at a faster than expected pace.

But the history of the beginning of new rate cutting cycles shows that all might not be so easily fixed. Especially when we look back to the last 50 basis point cut, which was delivered right as the Great Financial Crisis really began to accelerate.

So Vince Lanci looks through what's happened in the past, and compares that to the situation we face today. And to find out more, click to watch the video now!

U.S. Can ‘No Longer Afford Debt’, Only Way To Avoid Biggest Default In History | Luke Gromen

David Lin: 9-21-2024

Luke Gromen, Founder & President of Forest For The Trees, discusses the insurmountable amounts of debt the U.S. now faces, and what must be done to avoid a sovereign debt default.

0:00 - Intro

1:20 - Dollar crisis

5:53 - Sovereign debt crisis

9:35 - Rising U.S. debt

9:30 - Dollar outlook

13:30 - Fed funding deficits?

18:45 - Causes of inflation

25:00 - Tariffs

27:35 - Anti-price gouging

30:18 - Inflation/interest rate outlook

33:00 - Gold and Bitcoin

42:00 - National security

45:00 - Recession signs

Global War To DISTRACT From Currency Crisis - "I Hope I'm Wrong" | Matthew Piepenburg

Liberty and Finance: 9-21-2024

Matthew Piepenburg discusses the alarming state of the global financial system, arguing that it is caught in a cycle of excessive debt and centralization.

He highlights his forthcoming article titled "Global Snapshot: Stupid, Broken, and Evil," emphasizing that the current system is unsustainable, with war serving as a convenient distraction for politicians.

Piepenburg expresses concern over the Federal Reserve's recent emergency rate cut, suggesting it signifies a desperate attempt to manage an inevitable crisis rather than a sign of economic strength.

He points out that inflation is a persistent issue, exacerbated by poor fiscal policies and a political unwillingness to make necessary reforms.

Finally, he notes a growing global trend away from reliance on the U.S. dollar as countries seek to protect their wealth through hard assets, indicating a significant shift in the financial landscape.

INTERVIEW TIMELINE:

0:00 Intro

1:44 Fed rate cut

13:50 Economic reality

19:03 Holding hard assets

34:13 War as a distraction

48:15 Von Greyerz

News, Rumors and Opinions Monday AM 9-23-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 23 Sept. 2024

Compiled Mon. 23 Sept. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

“On Tues. 1 Oct. 2024 Corp. Dissolves – Ends Fiat Monetary System Experiment. Gold/Asset-Backed Quantum Financial System Locked, Loaded & Taking Over.” on Telegram Sat. 21 Sept. 2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 23 Sept. 2024

Compiled Mon. 23 Sept. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

“On Tues. 1 Oct. 2024 Corp. Dissolves – Ends Fiat Monetary System Experiment. Gold/Asset-Backed Quantum Financial System Locked, Loaded & Taking Over.” on Telegram Sat. 21 Sept. 2024

“The first week in October over the Emergency Broadcast System, the military will reveal all. Also, in the first week of October, we expect to see various countries adopting and rolling out a valid QFS. Military reserves and armies are expected to be activated in the US, Canada, UK, EU, Iceland, South America, Mexico, African regions, Malaysia and over 80 other countries.” … (JFK Jr.) on Telegram Sat. 21 Sept. 2024

Judy Note: Tues. 1 Oct. is the date the new United States of America Restored Republic and Global Currency Reset begin and when the Cabal’s fiscal year ends. Most important, Tues. 1 Oct. is the deadline for banks to be Basel III Compliant (monies backed by gold) or they will be closed. The banks will be taking on a different role as service-only centers. In other words, after Tues. 1 Oct. the Caball which has been officially bankrupt since 2008, will no longer have access to US Taxpayer dollars.

Sun. 22 Sept. 2024 Zimbabwe GESARA: Six million rural Zimbabweans to receive Title Deeds in rural areas. Did Zimbabwe just get liberated? Title deeds to land being given out to humanity, along with trust funds set up for the people!

~~~~~~~~~~

BRICS Alliance; Chinese Elders:

BRICS was an Alliance of the nations of Brazil, Russia, India, China and South Africa formed in 2008 after the so-called US “Mortgage Crisis.” In reality the crisis happened when the C***l continued to print fiat US Dollars while bankrupt and unable to even pay interest on gold borrowed from the Chinese Elders which backed that US Dollar, the basis for international trade. In the ensuing years since BRICS formed, they evaluated gold and resources of 209 nations in preparation for a Global Currency Reset. After the GCR all countries currencies would be at a 1:1 with each other instead of relying on the fiat US Dollar for international trade.

The Chinese Elders were composed of different multigenerational Chinese families living in the Philippines who over centuries, owned and held responsibility for around 90% of the world’s gold, lending it out to countries for establishment of their financial systems. There were five top Chinese Elders who were responsible for the Global Currency Reset and RV release of funds.

Read full post here: https://dinarchronicles.com/2024/09/23/restored-republic-via-a-gcr-update-as-of-september-23-2024/

************

Ariel: IQD Holders What would you do if you woke up tomorrow morning and suddenly realize you are a multi millionaire 3 times over?

Are you all ready for that type of money? Because at this point I am expecting the rate change at any moment.

When you exchange don’t act like you don’t know how to log on to X and speak. Because a lot of you all about to start acting bad & bougie.

Anyway I hope you all bought all you need. The rate release is but a glance away. Ariel

Source(s):

https://x.com/Prolotario1/status/1838040718201295114

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY:The crooks are also talking on TV. Every time a commercial comes out...They're saying changing the rate will be a disaster. FRANK: The crooks are Iran/parliament...The only reason they're saying this is because they know very well the rate is about to change. It's no secret. Sudani is preparing the whole Middle East and all his people for the change this year.

Nader From The Mid East They're going to remove the 3 zeros soon... In 1990 Kuwait did the same thing...If you go back in that time and you find the article, you can read it, it's the same article come out, the big bills are going to be the same than the small bills...25,000 dinars they're going to count like 25. What they did was the opposite, the whole opposite, the 25,000 become 25,000. They stayed 25,000. When you go change your money [Iraqi dinars] this is what's going to having...You'll have three weeks to find a way to exchange your money to small category dinar. Once you change your money to small categories you guys safe. That's how it's going to work...

************

Alak speak about banking sector Iqd

Nader: 9-23-2024

Seeds of Wisdom RV and Economic Updates Monday Morning 9-23-24

Good Morning Dinar Recaps,

Ripple CLO Talks Congress Insights on SEC and XRP

▪️Professor Reiners emphasized the need for Congress to address the regulatory gap in the crypto spot market.

▪️Ripple’s argument against XRP being a security aligns with Reiners’ testimony on investment contracts.

Stuart Alderoty, Ripple’s Chief Legal Officer, has responded to Professor Lee Reiners testifying before Congress, which provided an illuminating viewpoint on the continuing legal dispute between Ripple and the United States Securities and Exchange Commission.

Good Morning Dinar Recaps,

Ripple CLO Talks Congress Insights on SEC and XRP

▪️Professor Reiners emphasized the need for Congress to address the regulatory gap in the crypto spot market.

▪️Ripple’s argument against XRP being a security aligns with Reiners’ testimony on investment contracts.

Stuart Alderoty, Ripple’s Chief Legal Officer, has responded to Professor Lee Reiners testifying before Congress, which provided an illuminating viewpoint on the continuing legal dispute between Ripple and the United States Securities and Exchange Commission.

Reiners, known as both a pro-SEC and anti-crypto advocate, acknowledged the SEC’s recent setback in the Ripple case, underscoring three key factors with substantial significance for the crypto industry and Ripple’s journey.

Questioning the Regulatory Gaps and Decentralization in Crypto Laws

To begin, Reiners identified a significant regulatory gap in the crypto spot market, pointing out that neither the SEC nor the Commodity Futures Trading Commission (CFTC) currently regulate this sector. This observation highlights an obvious flaw in the current regulatory framework for cryptocurrency.

Reiners believes Congress should take a more active role in closing this regulatory hole. Ripple’s Alderoty agreed, emphasizing the importance of legislative action to better address the changing crypto ecosystem.

Another key argument addressed by Reiners was the concept of decentralization in relation to securities legislation. He criticized the idea that securities regulations should be predicated on a “mystical” decentralization threshold, alluding to a 2018 speech by former SEC Director William Hinman.

This statement has sparked debate within the crypto community, particularly because it hinted that certain cryptocurrencies could be immune from securities restrictions if they achieved a sufficient level of decentralization.

Reiners’ stance is consistent with the broader crypto industry, which has long stated that decentralization should not be used to determine whether an asset is a security.

Reiners also addressed the topic of investment contracts, citing analogies to the landmark Howey Test case concerning orange groves. He underlined that the object of an investment contract, such as orange groves, is not a security in and of itself. A management contract must be present when something is considered security.

This viewpoint is consistent with Ripple’s central argument that XRP should not be categorized as a security since it does not meet the criteria for being an investment contract.

The Impact of SEC Changing Leadership on Crypto Regulation

One of Reiners’ most memorable comments was that “SEC chairs come and go,” implying that regulatory landscapes might move dramatically with changes in leadership.

This insight serves as a reminder of the transient nature of regulatory interpretations, implying that Ripple’s case may result in different consequences if future SEC leadership takes a fresh perspective on cryptocurrencies.

While the crypto community eagerly monitors these events, doubt remains over XRP’s future, notably whether the SEC would appeal the Ripple case verdict before the deadline of October 7, 2024.

This lingering uncertainty is currently placing downward pressure on the XRP price, which was $0.5843 at the time of this post, representing a slightly 0.55% fall over the last 24 hours.

On the other hand, Ripple’s partner, SBI Holdings, has made substantial progress in researching the integration of token-based bank deposits with central bank digital currencies. According to a CNF report, SBI Holdings has joined Project Agora, which aims to examine how tokenized commercial bank deposits might be integrated with wholesale CBDCs on a single ledger.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

AUSTRALIA TIGHTENS GRIP ON CRYPTO STARTUPS WITH CORPORATE LAW CHANGES

Key Takeaways

▪️Australia wants all crypto exchanges to hold financial services licenses.

▪️The country has so far had limited success in its crackdown on the crypto industry.

▪️As of 2022, over one million Australians held at least one form of cryptocurrency.

Australia is set to further enhance the regulation of the cryptocurrency industry by requiring all crypto exchanges to hold financial services licenses.

The move will see the country’s corporate watchdog push for updated regulations to be enforced over the next two months, the Australian Financial Review reported.

Australia Tightens Grip on Crypto

The new licensing requirements are required as the Australian Securities and Investments Commission (ASIC) considers most major crypto assets to be relevant under the country’s Corporate Act, according to ASIC commissioner Alan Kirkland.

Crypto developers in the country have been confused about whether or not they should obtain an Australian Financial Services (AFS) license.

An AFS is needed for a “financial product,” which is when an individual takes on a financial risk or makes an investment.

ASIC is currently embroiled in two major court cases involving two crypto startups that have not obtained a license.

“ASIC’s message is that a significant number of crypto-asset firms in the Australian market are likely to need a license under the current law. This is because we think many widely traded crypto assets are a financial product,” Kirkland said.

ASIC Has Had Limited Success

ASIC will update its “Information Paper 225” for a November release. The regulatory paper will clarify how cryptocurrencies and other financial products should be treated.

So far, ASIC has had limited success penalizing crypto exchanges without a license.

Block Earner, an Australian crypto startup founded in 2021, was taken to court by ASIC, which alleged that the company was working unlawfully without a license. The Federal Court sided with Block Earner, claiming the startup had been operating lawfully.

ASIC sued Finder Wallet for not registering as a financial service. The court ultimately ruled that the startup did not need a license to operate.

The Australian watchdog is appealing both court decisions.

Australia and Crypto

Like the rest of the world, Australia has an evolving relationship with cryptocurrency.

In 2022, research firm Roy Morgan found that over one million Australians own at least one form of cryptocurrency, including Bitcoin, Ethereum, and Cardano.

A 2023 study by the Australian Securities Exchange (ASX) found nearly 3 in 10 Aussie investors plan to buy crypto in the next year, with 15% already holding digital assets.

However, While Australia has generally welcomed innovation in the crypto space, a strong emphasis on consumer protection has remained.

According to a Finder report powered by Coinbase, 50% of Australian owners said the security and reputation of an exchange are the most important features to them.

Last month, the Australian Competition and Consumer Commission (ACCC) found that half of crypto-related Facebook ads were scams.

The ACCC alleged that Meta was aware of crypto scams in its ads for the past six years.

“Meta has been aware that a significant proportion of cryptocurrency advertisements on the Facebook platform have used misleading or deceptive promotional practices,” the company said in a court ruling.

@ Newshounds News™

Source: CCN

~~~~~~~~~

GOLD FOLLOWS BITCOIN PRICE RALLY TO NEW RECORD HIGHS, WILL MOMENTUM CONTINUE?

Inflation hedges, such as gold, have emerged as a more attractive option for diversification along with Bitcoin which is nor preparing for a mega rally in Q4.

Key Notes

▪️Gold has surged to a record high of $2,629 per ounce, gaining 5% in the past two weeks, following Fed rate cuts.

▪️Rising geopolitical risks, including conflicts in Ukraine and the Middle East have increased the appeal of gold as a safe-haven asset.

▪️Goldman Sachs forecasts further growth in gold prices, projecting a surge to $2,700 by early 2025.

The gold price has been hitting new highs following the Fed rate cut last week while following the Bitcoin price trajectory recently. Over the past week, the BTC price has surged over 8.5% moving all the way to $64,000.

On the other hand, the gold price touched a record high of $2,629 per ounce on September 23. Within the last 15 days, the yellow metal has registered strong 5% gains. The major boost comes following the 50 bps rate cut by the Federal Reserve which served as the tailwind for the yellow metal.

A decrease in interest rates diminishes the appeal of assets linked to Fed-determined returns, like short-term government bonds, while making inflation hedges, such as gold, a more attractive option for diversification.

Furthermore, the appetite for gold investments has been growing recently amid rising geopolitical risks such as the ongoing wars between Russia and Ukraine, Israel and Hamas. On the other hand, the uncertainty around the 2024 US elections is also another factor contributing to this.

Furthermore, banking giant Goldman Sachs recently reported that the gold purchases by central banks have tripled following the last two years of the Russia-Ukraine war. With more Fed rate cuts expected this year, Goldman Sachs researchers predict that the gold price will surge to $2,700 by early next year.

Gold Rally Isn’t Ending Anytime Soon

Peter Boockvar, chief investment officer at Bleakley Financial Group, noted that gold has yet to surpass its inflation-adjusted peak of $3,200, set in 1980. Meanwhile, gold advocate Peter Schiff took the opportunity to criticize digital assets in a post on X on Sept. 23. Schiff noted:

“Gold just hit another record high, but few investors notice or care. With so much attention focused on Bitcoin, investors are not only missing out on gold’s gains but the significance of the rise.”

On the other hand, Bitcoin is also showing strength gearing up for a mega rally moving ahead in Q4 2024. 10x Research founder and CEO Markus Thielen noted that the chances of a major breakout increase as we approach the October-to-March period.

“Bitcoin’s 2024 performance has once again followed its seasonal pattern – just as it did in 2023. This is why traders should anticipate a major breakout, potentially reaching new all-time highs in Q4 2024,” he added.

@ Newshounds News™

Source: CoinSpeaker

~~~~~~~~~

ARE WE THERE YET ROADMAP AND TIMELINE? #rv #gcr #roadmaptosuccess | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Monday Morning 9-23-2024

TNT:

Tishwash: Al-Sudani meets in New York with the Yemeni President and the Kuwaiti Crown Prince, stressing the depth of relations

Prime Minister Mohammed Shia al-Sudani stressed, on Sunday, when he received Yemeni President Rashad Mohammed al-Alimi in New York, Iraq's keenness to support Yemen's stability.

The Prime Minister's media office said in a statement received by Shafak News Agency, "Prime Minister Mohammed Shia al-Sudani received this evening, Sunday, Baghdad time, the Chairman of the Presidential Leadership Council of the Republic of Yemen, Rashad Mohammed al-Alimi, on the sidelines of his participation in New York in the meetings of the 79th session of the United Nations General Assembly."

TNT:

Tishwash: Al-Sudani meets in New York with the Yemeni President and the Kuwaiti Crown Prince, stressing the depth of relations

Prime Minister Mohammed Shia al-Sudani stressed, on Sunday, when he received Yemeni President Rashad Mohammed al-Alimi in New York, Iraq's keenness to support Yemen's stability.

The Prime Minister's media office said in a statement received by Shafak News Agency, "Prime Minister Mohammed Shia al-Sudani received this evening, Sunday, Baghdad time, the Chairman of the Presidential Leadership Council of the Republic of Yemen, Rashad Mohammed al-Alimi, on the sidelines of his participation in New York in the meetings of the 79th session of the United Nations General Assembly."

The office pointed out that "the meeting reviewed the overall internal situation in Yemen, the surrounding regional situation, its developments and its impact on the region." According to the office's statement, Al-Sudani pointed to "the depth of the historical and fraternal ties that unite Iraq and Yemen," stressing "Iraq's keenness to support Yemen's stability, the importance of finding solutions through internal dialogue, and providing appropriate conditions for the brotherly Yemeni people to enjoy prosperity and development."

For his part, Al-Alimi welcomed the "reopening of embassies between the two countries, and considered it a supportive step to strengthen fraternal relations and support communication between the two brotherly peoples."

In addition, the media office noted that "Prime Minister Mohammed Shia al-Sudani received this evening, Sunday, Baghdad time, the Crown Prince of the State of Kuwait, Sheikh Sabah Khaled Al-Hamad Al-Sabah, in New York, on the sidelines of his participation in the meetings of the 79th session of the United Nations General Assembly."

Al-Sudani stressed, "The depth of the fraternal relations between Iraq and Kuwait, which the government has established in its program that includes strengthening relations with sister Arab countries, and strengthening the bonds of cooperation with them in various fields." The Prime Minister stressed "Iraq's keenness to advance cooperation with Kuwait, and develop it in a way that achieves bilateral interests."

According to the statement, the two sides stressed "the resumption of the work of the joint technical committees between the two countries."

Prime Minister Mohammed Shia al-Sudani also met, this evening, Sunday, Baghdad time, at the United Nations headquarters in New York, with the United Nations High Commissioner for Human Rights, Volk Türk.

A statement from Al-Sudani's office received by Shafaq News Agency stated that the meeting discussed the qualitative development witnessed by the human rights file in Iraq, as Al-Sudani confirmed that the government views the Universal Periodic Review as an essential mechanism in promoting and protecting human rights, noting that Iraq will discuss its fourth periodic report in January of next year after it voted on it in the last cabinet meeting.

According to the statement, Al-Sudani stressed Iraq's commitment to human rights standards, as a party to international agreements and the International Covenant on Civil and Political Rights, appreciating the efforts of the human rights team working within the UNAMI mission in Iraq, and the breadth of measures implemented by the Iraqi government to preserve the rights of minorities and spectrums of the components of the Iraqi people, and to provide assistance to victims of terrorism and the dictatorial regime.

The Prime Minister stated that Iraq has succeeded in establishing a successful experience in the field of transitional justice, and the government has proceeded with the legal and executive framework for all human rights principles, in accordance with the Iraqi constitution and approved international standards.

For his part, the High Commissioner indicated the Commission's desire to open a representative office in Iraq, in order to raise the level of cooperation in the field of capacity development, technical, economic and social cooperation, and in the field of the environment, according to the statement. link

************

Tishwash: International Finance: The Central Bank of Iraq is a model for developing strategies that serve the development of the banking sector

The Regional Director for the Kingdom of Saudi Arabia, Lebanon and Iraq at the International Finance Corporation (IFC) , Fawaz Al-Balbeisi, confirmed today, Monday, that Iraq is one of the first countries to adopt a comprehensive approach to governance and environmental and social accountability, noting that the Central Bank of Iraq is a model for developing strategies that serve the development of the banking sector.

Al-Balbeisi said in a speech during the launch ceremony of the Financial Sustainability Map Project and the Environmental, Social and Corporate Governance Standards Guide for Banks, which was attended by the correspondent of the Iraqi News Agency (INA): “Iraq has provided humanity with justice and law, and it is not strange that it is one of the first countries to adopt a comprehensive approach to governance and environmental and social accountability,” indicating that “this new achievement comes as a result of the strategic partnership between the International Finance Corporation and the Central Bank of Iraq in cooperation with the Kingdom of the Netherlands and our joint efforts to develop an advanced Iraqi banking sector that contributes to Iraq’s sustainable future.”

He added that “the achievements that we celebrate today are a very important step for the Iraqi banking sector towards establishing sound practices of environmental, social and corporate governance standards that are consistent with international standards and rules, where they are not just a reference framework for celebration, but rather a systematic approach achieved by the banking sector,” noting that “environmental and governance standards have changed the environment and governance of the institution, and are a standard for professional excellence and have become a basic requirement for managing and reducing risks and thus financial sustainability and business prosperity.”

He continued: "Today, this event gains great importance in light of Iraq's confrontation with the challenges led by climate change, which requires approximately $233 billion until 2040 to respond to the development gaps necessary to move towards sustainable economic paths."

He continued, "Environmental, social and corporate governance responsibility is not only a statement of transparency, accountability and fairness, but also essential components of responsible investment strategies committed to sustainable practices and ethical standards in all financing and investment decisions. The Iraqi banking sector represents the provision of the necessary financing to meet its nationally defined goals in Iraq, and all of this highlights the importance of the role of the Central Bank, led by Ali Al-Alaq, in achieving this goal."

He pointed out that "with the development of the banking, financial and operational sector's capabilities over the past years, this achievement is complementary to other initiatives led by the Central Bank, the latest of which was the launch of the national strategy last May."

He pointed out that "the Central Bank is a model in developing strategies that serve the development of the banking sector in a way that reflects positively on the external view of the banking system and makes it a tributary that enhances sustainable development in Iraq," expressing his "thanks to the government of the Kingdom of the Netherlands for their support in reaching this achievement and to the Central Bank team and the International Finance Corporation whose tireless work enabled us to reach this achievement link

************

Tishwash: Al-Alaq announces a roadmap for financial sustainability for the Iraqi banking sector

The Governor of the Central Bank, Ali Al-Alaq, announced today, Monday, a roadmap for the financial sustainability of the Iraqi banking sector, while indicating that this map is part of the efforts to upgrade the banking sector.

Al-Alaq said in a speech during the launch ceremony of the Financial Sustainability Map Project and the Environmental, Social and Governance Standards Guide for Banks, “Today we are addressing an important and fundamental aspect in developing the banking sector in Iraq, as the term environmental, social and governance standards has witnessed turbulent growth since its first launch in 2005,” indicating that “the environmental aspects and the response related to climate change are major factors driving the development of environmental, social and governance standards, in addition to the growing importance of other essential elements, especially social ones.”

He added, "If these standards are important for any economic entity or company, regardless of its activity, mission and products, then their importance to the financial sector is a matter of utmost importance, given the significant impact that social and environmental changes have on the reality of this sector and what is required to manage it according to regulatory, supervisory and technical rules that avert risks to guarantee the rights of shareholders and stakeholders within a framework of transparency and disclosure, and above all, to contribute to achieving financial stability, the repercussions of which are reflected in the economic and social environment and general stability, just as the environmental and social repercussions are reflected in stability."

He stated, "We are pleased to announce a roadmap for the financial sustainability of the banking sector in Iraq for the years 2023 to 2029 and social and institutional standards," noting that "this project is part of the ongoing efforts made by the Central Bank of Iraq to advance the banking sector based on international best practices as well as keeping pace with developments in the banking industry."

He stated that "with this announcement, the Central Bank of Iraq is the first in the region to implement this guide."

Al-Alaq praised "the role played by international experts at the International Finance Corporation, affiliated with the World Bank Group, and their effective contribution in preparing the roadmap for financial sustainability for the banking sector in Iraq," appreciating "the effective and ongoing partnership and fruitful cooperation with the institution."

He thanked "the fruitful and distinguished efforts of the Central Bank's work team, as well as the support provided by the Kingdom of the Netherlands in this context to push towards helping Iraq implement these important and necessary programs link

************

Mot: .... Been quite a Week you seeeee....

Mot: figured out Why the RV keeps stopping !!!!......((( Get A Hammer )))......

News, Rumors and Opinions Sunday PM 9-22-2024

TNT:

Tishwash: Iraq Discusses 5G Internet in New York

The Chairman of the Communications and Media Commission, Ali Al-Muayyad, discussed today, Sunday, in New York, the future of the fifth generation and satellite internet in Iraq with the CEO of the Samina Council, Bukar Ba.

A statement by the Authority received by Shafaq News Agency stated that Al-Muayyad met with the CEO of SAMENA Council on the sidelines of the Future Summit held in New York, where a number of technical topics related to developing the communications sector in Iraq were discussed.

TNT:

Tishwash: Iraq Discusses 5G Internet in New York

The Chairman of the Communications and Media Commission, Ali Al-Muayyad, discussed today, Sunday, in New York, the future of the fifth generation and satellite internet in Iraq with the CEO of the Samina Council, Bukar Ba.

A statement by the Authority received by Shafaq News Agency stated that Al-Muayyad met with the CEO of SAMENA Council on the sidelines of the Future Summit held in New York, where a number of technical topics related to developing the communications sector in Iraq were discussed.

The statement added that the meeting focused mainly on the mechanisms for providing 5G services in Iraq, stressing the importance of adopting the latest technical practices and infrastructure that allow for improving communication speed, reducing response time, and supporting the digital economy in line with global technology developments.

He pointed out that the meeting addressed the issue of satellite Internet services, as the two sides discussed the best global practices for licensing these services, focusing on the benefits and harms resulting from using this technology, and studying potential challenges, such as interference with the terrestrial frequency spectrum, and its impact on the environment and users.

In the context of talking about developing the communications sector, he stressed the importance of supporting Iraq by holding global and regional workshops and conferences that address the latest innovations in the fields of communications and information technology, including artificial intelligence, big data, and advanced infrastructure technologies.

SAMENA is one of the world’s leading technology alliances and leads a consortium of telecom companies in South Asia, the Middle East and North Africa. link

************

Tishwash: PM's Advisor: Government Takes 8 Steps to Improve Technology Sector

The Prime Minister's Advisor for Banking Affairs, Saleh Mahoud, stressed on Sunday the importance of cooperation between the public and private sectors to develop the technological infrastructure in Iraq, while pointing out that the Iraqi government has taken 8 strategic steps to improve the technology sector in the country, stressing the existence of serious government efforts to achieve leadership in the field of digital innovation.

"We are pleased to represent the Prime Minister in attending the conference, and we convey his greetings and high appreciation, as he commends this conference and blesses its efforts," Mahoud said in his speech during the opening of the Iraq International Information and Communications Technology Exhibition and Conference (ITEX), which was followed by "Economy News."

He added that "the conference provides an opportunity for cooperation between the public and private sectors, which encourages the establishment of strategic companies that contribute to the development of a strong technological infrastructure."

He pointed out that "organizing and activating such conferences is an urgent necessity, as the Iraqi government, led by Prime Minister Mohammed Shia al-Sudani, looks forward to the importance of this event being an appropriate opportunity to discuss the exchange of experiences and ideas to achieve sustainable development and prosperity for our great people, which enhances Iraq's position as a leading country in the field of digital innovation."

He stressed that "digital transformation has become an inevitable necessity in recent years in the governmental and private sectors and even in our daily lives."

He added that "this conference comes at an important time, as the Iraqi government seeks to achieve a clear vision on how to use technology to improve the quality of services and enhance transparency and community participation."

He explained that "the current Iraqi government, since the start of its duties at the end of 2022, has worked to develop the information and communications technology sector, in coordination with relevant local and international sectors."

He pointed out that "the Iraqi government has taken a set of important steps in the field of developing information and communications technology, including:

1- Establishing laws and legislation to provide an appropriate environment for investment in information and communications technology, aiming to encourage innovation and protect the rights of investors.

2- Improving infrastructure, including supporting efforts to increase internet speed and expand networks in all regions of Iraq.

3- Achieving investment, as the Iraqi government encourages local and foreign investment in the information technology sector by providing banking incentives, including financial support for emerging projects in this field.

4- Partnerships with the private sector to accelerate technological development.

5- Implementing a national digitization plan to improve digital transformation in government institutions. This includes digital platforms for providing government services to citizens, such as registering documents, paying taxes, and submitting complaints, with the aim of facilitating procedures and reducing the time and effort expended, which facilitates the services provided to citizens and increases the efficiency of government performance.

6- Training and rehabilitation programs for youth and professionals in the fields of information technology, in addition to holding workshops and lectures to enhance digital skills.

7- Supporting emerging companies, by providing financial support to encourage entrepreneurs to innovate and expand.

8- Cooperating with international companies to bring new expertise and technology to Iraq.

Mahoud explained that "the above-mentioned steps are important indicators of the trend towards sustainable economic and social development."

He stressed "the government's readiness to make every effort to provide support to all local and international entities, institutions and companies in order to develop the information and communications technology sector."

He concluded by saying: “We urge all institutions and the private sector organizing the conference to exploit all challenges as an opportunity to achieve success in future plans.” link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY:They talked more about the Article 140. They had a big meeting yesterday. Sudani saying it's in the completion stages. FRANK: You have a 3-year budget...salaries...HCL rights...new census...lower denominations with purchasing power coming to you that they have promised to you this year. All these things require a new exchange rate...It's very obvious they are preparing you Iraqi citizens for all of this!

Mnt Goat Ali Al-Alaq is still the acting Director of the CBI just as we were told by my CBI contact the GOI never did accept his resignation. The goals are still the same as they want to eliminate this Black Market corruption with the dollar and set the rate first at par with the official CBI rate. Then once this is in control, they intend to change the official rate and the rest is history as the saga of the currency swap out can then occur.

************

MARKETS A LOOK AHEAD: A "SHOCKTOBER" STOCK MARKET CRASH???

Greg Mannarino: 9-22-2024

US Is Really Shocked with This Decision: Is It the End of Their Presence in Middle East?

US Is Really Shocked with This Decision: Is It the End of Their Presence in Middle East?

Fastepo: 9-22-2024

The human cost of the U.S. involvement in Iraq has been staggering. Between 2003 and 2011, around 4,487 American soldiers were killed, and approximately 31,900 were wounded, many with life-changing injuries.

On the Iraqi side, estimates of civilian casualties vary significantly, but figures suggest between 200,000 and 300,000 civilians died during the conflict, with total deaths—including combatants—ranging between 500,000 and over a million.

US Is Really Shocked with This Decision: Is It the End of Their Presence in Middle East?

Fastepo: 9-22-2024

The human cost of the U.S. involvement in Iraq has been staggering. Between 2003 and 2011, around 4,487 American soldiers were killed, and approximately 31,900 were wounded, many with life-changing injuries.

On the Iraqi side, estimates of civilian casualties vary significantly, but figures suggest between 200,000 and 300,000 civilians died during the conflict, with total deaths—including combatants—ranging between 500,000 and over a million.

The Iraq Body Count project, which tracks civilian deaths, estimated between 183,000 and 210,000 civilian fatalities as of 2019. The financial burden of the Iraq War is similarly immense, with estimates placing the total cost at between $1.7 trillion and $3 trillion.

When long-term costs, such as veterans' care and war-related debt, are included, some estimates push this figure as high as $6 trillion—far exceeding early projections of $50 billion to $60 billion.

In Iraq, the conflict also devastated infrastructure, including the healthcare system, which saw over half of the country's doctors flee. Despite the U.S. spending $60 billion on reconstruction, these efforts largely failed to rebuild essential infrastructure, exacerbating the instability and suffering felt by Iraq's population.

Recently, the Iraqi government has asked the US to leave the country.

The planned withdrawal of U.S. forces from Iraq, slated for 2024 to 2026, signals the end of a protracted engagement marked by setbacks and miscalculations. This departure, structured in two phases, highlights the challenges the U.S. has faced in maintaining a stable foothold in a nation it once invaded with overwhelming force.

The drawdown, particularly after 2024, will mark the closing chapter of U.S. military involvement, which began with the 2003 invasion aimed at toppling Saddam Hussein under the premise of dismantling weapons of mass destruction—an assertion later proven false.

At the height of the Iraq War in 2007, U.S. troop levels peaked at over 170,000, struggling to contain a civil war and insurgency sparked by the invasion. A surge in forces temporarily reduced violence but failed to bring lasting peace or stability.

Although the U.S. officially withdrew in 2011, the rise of ISIS in 2014 prompted a return under Operation Inherent Resolve, aimed at curbing the extremist group. However, this intervention further exposed the limitations of American military power, as U.S. forces found themselves navigating an increasingly hostile environment.

The U.S. appears determined to maintain its presence in Iraq and the broader Middle East.

Washington is actively pursuing a new agreement with Iraq that would extend the stationing of American troops, even though Baghdad has declared that the mission to defeat ISIS has been accomplished.

U.S. officials are currently in talks with Prime Minister Mohammed Shia Al-Sudani's government to establish a broader bilateral partnership, with plans to announce the agreement as early as next week, according to two senior officials involved in the discussions.

This new agreement would replace the U.S.-led international coalition that has operated in Iraq since 2014.

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 9-22-24

Good Afternoon Dinar Recaps,

IMF STAFF PROPOSE REDI FRAMEWORK TO CATALYZE CBDC ADOPTION

IMF staff members have introduced a high-level four-stage framework emphasizing regulation, education, design and incentives to enhance CBDC adoption.

International Monetary Fund (IMF) staff members have issued a guide for policymakers and banking institutions on ways to increase the uptake of central bank digital currencies (CBDCs) globally.

The IMF issued the “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users” paper on Sept. 21.

Good Afternoon Dinar Recaps,

IMF STAFF PROPOSE REDI FRAMEWORK TO CATALYZE CBDC ADOPTION

IMF staff members have introduced a high-level four-stage framework emphasizing regulation, education, design and incentives to enhance CBDC adoption.

International Monetary Fund (IMF) staff members have issued a guide for policymakers and banking institutions on ways to increase the uptake of central bank digital currencies (CBDCs) globally.

The IMF issued the “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users” paper on Sept. 21.

The paper recommended implementing inclusive strategies for intermediaries and end-users.

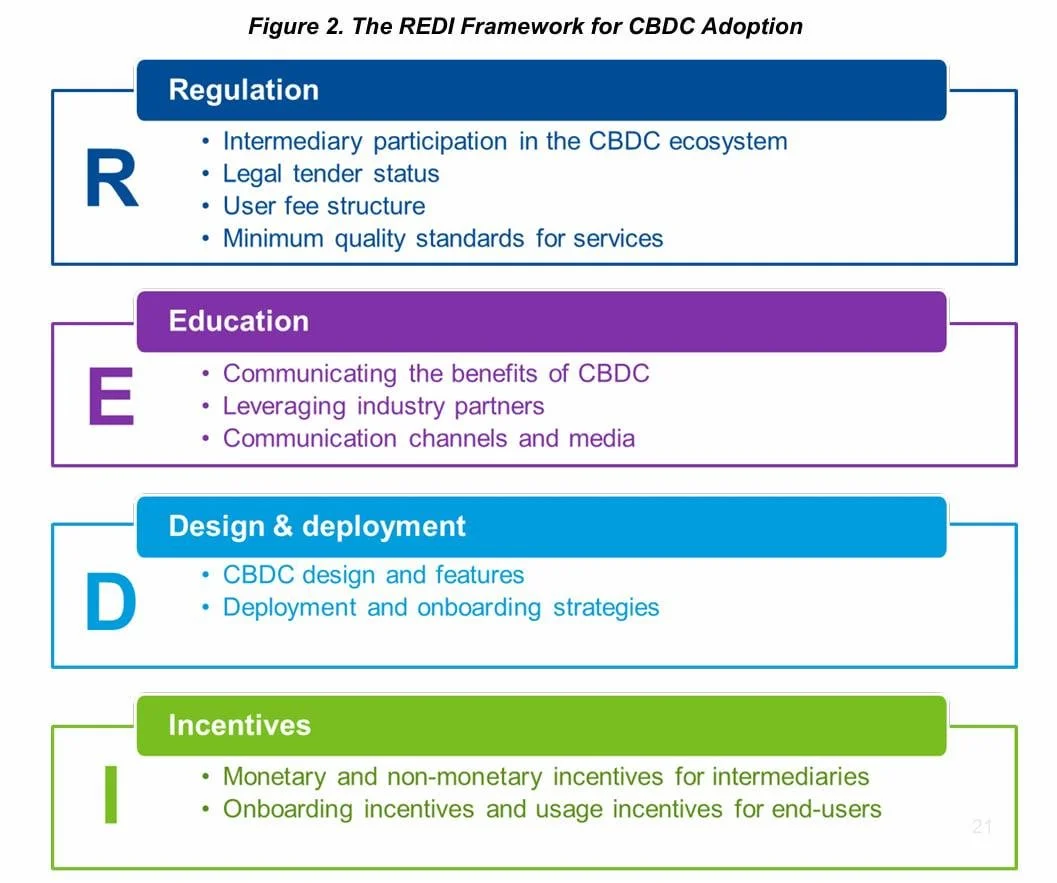

It introduced a high-level framework for regulation, education, design and deployment and incentives (REDI) to help spur CBDC adoption.

According to the IMF staff members, successful CBDC adoption will require proactive strategic policy and design choices that benefit end-users and intermediaries. Therefore, they urged central banks to focus on stakeholder engagement.

The REDI framework is curated by IMF staff members to help central banks improve CBDC adoption in their respective countries.

PIC

REDI framework for central banks to help CBDC adoption. Source: IMF

As shown in the above image, the REDI framework focuses on four key pillars. The first sub-section, regulation, involves policymakers exploring potential regulatory and legislative measures to nurture CBDC adoption.

The education sub-section recommends developing communication strategies to build CBDC awareness, with central banks acting as a central point of communication. Thirdly, the paper highlighted the need for strategies targeting specific user groups and creating an extensive network of intermediaries.

The final sub-section recommended the introduction of monetary and non-monetary incentives to encourage the mass adoption of CBDCs. Subsidizing setup costs, transaction fees and taxes for merchants are some of the recommendations made by the IMF staff.

The paper also encouraged further discussions around pre-existing concerns:

“Certain policy issues, including sustainability of the CBDC system, ensuring integrity of the system, and balancing adoption with financial stability, will need to be explored further.”

In August, two IMF executives said that increasing the average crypto-mining electricity costs globally by as much as 85% through taxes could significantly reduce carbon emissions.

According to IMF Fiscal Affairs Department’s deputy division chief Shafik Hebous and climate policy division economist Nate Vernon-Lin, a tax of $0.047 per kilowatt hour “would drive the crypto mining industry to curb its emissions in line with global goals.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ALGORAND FOUNDATION ANNOUNCES BUILD-A-BULL HACKATHON IN COLLABORATION WITH AWS

NOTE: ALGORAND IS ISO 20022 COMPLIANT

September 20, 2023 – Singapore, Singapore

Registration is now open for global hackathon with $200,000 in prizes across five tracks.

The Algorand Foundation – the organization focused on growing the ecosystem for the world’s most advanced, secure and reliable layer-one blockchain – announces the opening of registration for Build-A-Bull, a global virtual hackathon with $200,000 in prizes.

The hackathon, powered by Algorand Ventures and in collaboration with AWS (Amazon Web Services), will run from October 18 through November 15, 2023. Registration is free and open to anyone.

Build-A-Bull is a hackathon to create consumer-friendly applications using the power and scalability of the Algorand blockchain.

Spanning four weeks, the hackathon offers an opportunity for committed developers and entrepreneurs to conceive a business concept, accelerate it though the development phase and to ultimately present a final product to a panel of expert judges.

Throughout the process, participants will receive matchmaking, tooling, support and mentorship to help bring their ideas to life.

Ryan Terribilini, EVP of Algorand Ventures, said,

“With Build-A-Bull, we expect to attract a new wave of promising builders to come into the Algorand ecosystem.

“We are looking for high-potential, investible startups and founders to bring innovative projects to the Algorand blockchain, and we are confident that the resources and exposure of participating in Build-A-Bull will catalyze this next generation of Algorand builders.”

The hackathon includes five tracks.

▪️DeFi, presented by Circle

▪️Gaming, presented by Unity

▪️Consumer, presented by AWS

▪️Interoperability, presented by Wormhole

▪️Impact, presented by Algorand Foundation

The winner of each track will receive $25,000 and will be invited to pitch to investors on a ‘demo day,’ with a public on-chain vote determining an additional $10,000 grand prize, as well as $25,000 in AWS credits.

The second and third-place winner of each track will receive $10,000 and $5,000 respectively. A bonus ‘university prize’ of $5,000 will be awarded by the judges.

The judging panel is comprised of industry leaders and investors including QCP Capital, DWF Ventures and Blockchain Capital.

Projects will be evaluated by the following criteria – the skillset and strength of the team, the design and interface of the project, the quality of the pitch and the viability of market adoption.

For more information, and to register, please visit here.

About Algorand Foundation

The Algorand Foundation is dedicated to helping fulfill the global promise of the Algorand blockchain by taking responsibility for its sound monetary supply economics, decentralized governance and healthy and prosperous open-source ecosystem.

Designed by MIT professor and Turing Award-winning cryptographer Silvio Micali, Algorand achieves transaction throughputs at the speed of traditional finance – but with immediate finality, near zero transaction costs and on a 24/7 basis.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

CONSUMERS PREFER CASH OVER CBDC: DEUTSCHE BANK SURVEY

Most respondents chose private crypto like BTC over government-backed digital currencies.

While several central banks across the globe are actively exploring the feasibility of launching a Central Bank Digital Currency (CBDC), a recent survey has revealed that cash will not be going away anytime soon as a majority of consumers are not enthusiastic about using those products.

The survey, conducted by Deutsche Bank, Germany’s leading investment bank, polled 4,850 respondents from Europe, the United Kingdom, and the United States. A majority of the respondents stated that they prefer conventional payment methods like cash and debit or credit cards.

Cash Reigns Supreme

According to the study, 59% of the respondents believe cash will always be useful, with 44% stating that they would prefer using cash for payments rather than CBDCs. Only a small percentage of respondents, 16%, expect CBDCs to become mainstream payment options.

Deutsche Bank analysts, Marion Laboure and Sai Ravindran, noted in the report, “While 59% of consumers believe that cash will always be relevant, the COVID-19 pandemic accelerated the shift toward digital payments, particularly among Gen Z.”

Although most of the respondents were hesitant about using a CBDC, about 31% said they would rather use a cryptocurrency managed by the government than one backed by private institutions.

Privacy Concerns Remain

The survey further revealed that privacy concerns significantly affect the adoption of CBDCs. Most of the participants, especially in the U.S., believe that general cryptocurrencies offer better privacy than government-backed digital currencies. About 21% of the respondents said they preferred a private cryptocurrency like Bitcoin.

On the other hand, most European respondents showed stronger preference for cash, due to the anonymity it offers, than those in the U.S. and the U.K.

Per the survey, central banks are increasing exploring wholesale CBDC use cases, however, user skepticism remains a major issue affecting mainstream adoption. A report by the Bank of Canada revealed that 86% of Canadians are opposed to CBDCs, with a whopping 92% preferring cash over a digital Canadian dollar (CAD).

@ Newshounds News™

Source: Crypto Potato

~~~~~~~~~

MANAGING SUDDEN WEALTH THROUGH SMART TEAM BUILDING BOB LOCK | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Newshound's Currency Facts Youtube and RumbleNewshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Sunday 9-22-2024

TNT:

Tishwash: Kurdistan deposits about 100 billion dinars of non-oil revenues into the Iraqi state treasury

The Ministry of Finance and Economy in the Kurdistan Region announced on Sunday the deposit of an amount of money amounting to about 100 billion dinars in financial revenues for non-oil revenues for last May.

The ministry said in a statement today that it deposited an amount of 91 billion, 151 million, and 784 thousand Iraqi dinars to the federal government as the federal treasury's share of the non-oil revenues of the Kurdistan Region for the month of May of this year. link

TNT:

Tishwash: Kurdistan deposits about 100 billion dinars of non-oil revenues into the Iraqi state treasury

The Ministry of Finance and Economy in the Kurdistan Region announced on Sunday the deposit of an amount of money amounting to about 100 billion dinars in financial revenues for non-oil revenues for last May.

The ministry said in a statement today that it deposited an amount of 91 billion, 151 million, and 784 thousand Iraqi dinars to the federal government as the federal treasury's share of the non-oil revenues of the Kurdistan Region for the month of May of this year. link

************

Tishwash: yet another article about removing the 3 zeros? hmm

What does it mean to reduce dependence on the dollar and remove zeros from the dinar?

Countries remove zeros from their currency to revalue the national currency and simplify financial transactions. This is done by removing a specific number of zeros from the nominal value of the currency, making it appear less inflationary and more stable. This is how the Governor of the Central Bank of Iraq, Ali Al-Alaq, summarized the issue.

Al-Alaq confirmed yesterday the reduction of reliance on the US dollar in commercial transactions, adding that the project to delete zeros in Iraq is subject to continuous review and study at the bank.

Al-Alaq said, in a statement followed by the “Iraq Observer” agency, that “the Central Bank responded to global economic challenges such as rising energy and raw material prices, by amending some monetary policies in line with the international situation and to enhance confidence in the Iraqi dinar and prevent a sharp decline in its value.”

He added, "The Central Bank of Iraq has increased its holdings of foreign exchange and gold reserves to strengthen the country's financial position and financial stability in order to enhance its ability to confront potential economic crises."

Local bank accounts

Regarding the steps taken to address the dollar’s rising crisis, Al-Alaq said, “The Central Bank of Iraq has created new mechanisms to cover local banks’ accounts with their senders in other currencies (Chinese yuan, Indian rupee, euro, and UAE dirham) in addition to the dollar, which has reduced reliance on the US currency in commercial transactions for these banks’ clients, while the Central Bank seeks to withdraw excess liquidity in the economy that puts pressure on the exchange rate and to prevent the exported currency from growing in an undesirable manner.”

Regarding the country's foreign reserves, the Central Bank Governor explained that "foreign exchange reserves are the tool used by all central banks to maintain the stability of the local currency exchange rate against foreign currencies, as well as to reduce exposure to external crises by maintaining liquidity in foreign currency to absorb shocks in times of crisis."

“According to the latest data on the level of foreign reserves adequacy, the Central Bank of Iraq’s foreign reserves cover 83.62% of the broad money supply, i.e. covering the cost of importing 15 months, while the global standard rate is 20%, covering 6 months of importing,” according to Al-Alaq.

He pointed out that "the sanctions imposed on banks are related to the decision to ban dealing in dollars, as the banks were not included in the sanctions list issued by the Office of Foreign Assets Control, and therefore the banks' activities continue, according to the applicable procedures and in all currencies except the dollar."

Regarding the situation of the Iraqi banking sector, Al-Alaq said that it “is experiencing a state of stability, as government banks still control approximately 79% of the assets of the total banking sector, compared to 21% for private banks.”

Private sector

While observers believe that the development road project needs 5 years to complete, they pointed out that Iraq will end the unemployment problem and provide jobs for graduates and the unemployed alike.

They said: “The most important thing is for Iraq to move away from the rentier economy that has frozen other sectors despite the abundance of local production and the wheel of reconstruction turning in all of Iraq, which means that the government is taking the right step in diversifying sources of income.”

Economic expert Abdul Rahman Al-Shaikhli said: “Our economy will not see the light of day as long as its two components, “oil and monetary,” are held hostage by the US Treasury and the Federal Reserve Bank. He considered that in order not to jump over the reality, we must look at things as they are, without hanging them on any scapegoat of truth.”

Al-Sheikhly told the “Iraq Observer” agency: “In order to get rid of this dominance, we must work on diversifying the sources of funding for the budget, giving free rein to the “clean” private sector, and limiting economic activities “financial and monetary” to honest hands under strict supervision, especially Iraq’s revenues from customs, taxes and fees, and preventing their exploitation by the corrupt.”

The financial and economic expert explained: “All of this is possible and it is possible to reform our economic system naturally if we can get rid of foreign hegemony.”

Keeping up with developments

On the sidelines of the electronic payment conference in the middle of this month: “The Governor of the Central Bank, Ali Al-Alaq, confirmed that the number of applicants to establish digital banks “exceeded 70 banks,” noting that “digital banks are widely spread in the world and the volume of financial transactions in them is around 5 trillion dollars annually.”

Al-Alaq said: “Digital banks are widespread in the world, and their volume of funds ranges from 5 to 7 trillion annually.”

He added: “We conducted in-depth studies until we reached the point of setting rules for licensing these digital banks.”

He pointed out: “We were surprised by the number of applicants to digital banks, which reached 60 to 70 banks, and we are in the process of studying the applicants’ requests.”

He continued: “We are keeping up with developments and moving towards progress, and there is communication with many external and internal parties, and it is on two levels that depend on the banking sector and the capabilities of the Central Bank to keep up with development and contribute to developing various programs and applications,” stressing that “the Iraqi cadre is distinguished by its ability to adapt and develop.”