Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Thursday Evening 8-22-24

Good Evening Dinar Recaps,

LIVE: Fed Chair Jerome Powell speaks at the 2024 Jackson Hole Economic Policy Symposium — 8/23/2024 AT 10:00 AM EDT

Federal Reserve Chair Jerome Powell speaks at the central bank’s annual Jackson Hole conference on the economic outlook on Friday. That will follow minutes from the Fed’s July gathering released Wednesday. They indicated that most participants at the central bank’s meeting said it would “likely” be appropriate to lower the fed funds rate from the current range of 5.25% to 5.5% at the September meeting — if data continues to come in as expected.

@ Newshounds News™

Good Evening Dinar Recaps,

LIVE: Fed Chair Jerome Powell speaks at the 2024 Jackson Hole Economic Policy Symposium — 8/23/2024 AT 10:00 AM EDT

Federal Reserve Chair Jerome Powell speaks at the central bank’s annual Jackson Hole conference on the economic outlook on Friday. That will follow minutes from the Fed’s July gathering released Wednesday. They indicated that most participants at the central bank’s meeting said it would “likely” be appropriate to lower the fed funds rate from the current range of 5.25% to 5.5% at the September meeting — if data continues to come in as expected.

@ Newshounds News™

Watch Live Here: BENZINGA

~~~~~~~~~

Jackson Hole Preview: 5 Important Questions Ahead Of Jerome Powell's Fed Speech

Zinger Key Points

Investors anticipate insights on upcoming rate cuts, particularly in Powell’s Friday speech at 10 a.m. ET.

Analysts expect Powell to hint at rate cuts while emphasizing the Fed's data-driven approach to monetary policy.

Traders are anxiously awaiting the Federal Reserve’s annual Jackson Hole Symposium. This highly anticipated event could set the tone for the Fed’s future policy actions, especially as investors anticipate a rate cut at the upcoming September meeting.

All eyes are on Fed Chair Jerome Powell's pivotal speech on Friday at 10 a.m. ET, where he is expected to provide crucial insights into the economic outlook and the central bank’s rate-cut plans.

Here are five important questions answered about this year's Jackson Hole Symposium, scheduled for Thursday and Friday.

1. What Is Jackson Hole?

The Jackson Hole Symposium is a prominent late-summer economic conference hosted by the Federal Reserve Bank of Kansas City.

The event attracts central bankers, policymakers, academics and economists from around the world and takes place in Jackson Hole, Wyoming.

2. Why Should Investors Focus On Jackson Hole?

Generally, the Jackson Hole Symposium holds particular importance for two key reasons: it occurs during the longest gap between Federal Open Market Committee (FOMC) meetings, offering potential clues on future monetary policy. It also takes place in August, when market activity is typically quieter due to summer holidays and a scarcity of other significant events.

Regarding the 2024 event, while a rate cut at the Sept. 18 FOMC meeting is considered as a done deal by markets, investors are keenly focused on how quickly the Fed will proceed with additional cuts and what the economic outlook will be, with a special focus on inflation and the jobs market.

3. How Will Jackson Hole Be Covered?

Powell's speech at 10 a.m. ET Friday will be live-streamed, but the rest of the symposium's speeches will not be televised.

Although there isn't live coverage of the other sessions, major business networks typically feature a series of sideline interviews with key attendees, such as Fed officials, who could provide near-term views on monetary policy.

4. What Do Wall Street Analysts Expect From Jackson Hole This Year?

“The easiest thing for Chair Powell would be to repeat his message from July. An evolution of the July FOMC language would suggest the committee is ‘very close’ or ‘close’ to the point where easing is likely to occur,” noted Bank of America economist Stephen Juneau.

Ed Yardeni, president of Yardeni Research, stated, “He is likely to support market expectations that the Fed will cut the federal funds rate by 25bps in September. But he is also likely to push back on expectations of cuts in November and December. He will repeat that the Fed’s decisions are data dependent.”

Goldman Sachs analysts “expect to hear more comments like those from Goolsbee earlier in August that the Fed’s job is not to react to a single data point.”

However, they also expect the Fed to reassure markets that it stands ready to act swiftly should the economy take a turn for the worse.

Greg Marcus, managing director, UBS Private Wealth Management, expects Jerome Powell “to hint strongly at rate cuts and try to calm the market. He'll make it clear that the Fed will be data dependent and won't commit to any one position but will continue to emphasize the importance of not forgetting that the Fed has a dual mandate.”

5. How Has the Stock Market Performed Historically During Jackson Hole?

Historically, the Jackson Hole Symposium has had a muted impact on the S&P 500's performance.

A Benzinga analysis of the past 10 events shows that the S&P 500 has generally remained flat during the symposium days (Thursday and Friday), with an average decline of 0.4% and a median return of 0%.

When extending the analysis to the entire week, the index shows a slightly better performance, with an average gain of 0.4% and a median return of 0.8%.

Over the past 10 events, the S&P 500 index, as tracked by the SPDR S&P 500 ETF Trust SPY, recorded positive returns in six instances during the symposium days and in seven instances over the entire week.

Notable market reactions to the Jackson Hole events included 2022, 2019 and 2015.

In 2022, Powell’s hawkish remarks at Jackson Hole triggered a 3.4% drop in the S&P 500 over two days, with the index down 4% for the week due to fears of prolonged high interest rates.

In 2019, uncertainty from Powell’s speech amid the U.S.-China trade war led to a 2.9% decline during the symposium days and a 1.4% loss for the week.

In contrast, 2015 saw the S&P 500 rise 2.43% during the symposium and 0.8% for the week, as markets were reassured by the Fed.

@ Newshounds News™

Source: BENZINGA

~~~~~~~~

Latam ecommerce giant Mercado Libre launches MELI dollar stablecoin in Brazil

Mercado Libre, the Latin American ecommerce giant, has launched the MELI dollar stablecoin in Brazil via its digital bank, Mercado Pago. The parent company is the Latin American equivalent of Amazon.com and has the highest market capitalization of any company in the region.

It’s a big deal because the digital bank has 52 million monthly active users across the entire region. While the company doesn’t break out the users by country, its financial report for Q2 2024 said the digital bank users in Brazil had grown 46% year on year.

Users can access the stablecoin via the Mercado Pago app, which also supports cryptocurrencies. The company is currently waving stablecoin transaction fees, whereas other crypto attracts fees of 1.5%. It partnered with crypto firm Ripio, which is providing market making.

Ripio is also a distributor of the Lift stablecoin, a yield bearing dollar token targeted at Argentinians. Paxos issued it out of the Abu Dhabi Global Market (ADGM).

Meanwhile, the MELI stablecoin is issued by Meli Uruguay. Mercado Libre’s headquarters were originally in Argentina but moved to Uruguay, and its holding company is registered in Delaware.

The company has been interested in stablecoins for some time as it was a member of the Facebook-founded Diem stablecoin initiative.

In 2022 Mercado Libre launched the MercadoCoin as part of a loyalty program that started in Brazil.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Thursday 8-22-2024

BRICS Just Stopped Using The Dollar!

Tech Beat: 8-22-2024

In this video, we look at a seismic upheaval in world economics—the BRICS countries have taken a historic step by abandoning the usage of the US dollar in their interactions.

The BRICS group, which includes Brazil, Russia, India, China, and South Africa, has long been regarded as a powerful counterweight to Western economic hegemony.

Now, with this brave step, they are ushering in a new era of international trade and finance.

BRICS Just Stopped Using The Dollar!

Tech Beat: 8-22-2024

In this video, we look at a seismic upheaval in world economics—the BRICS countries have taken a historic step by abandoning the usage of the US dollar in their interactions.

The BRICS group, which includes Brazil, Russia, India, China, and South Africa, has long been regarded as a powerful counterweight to Western economic hegemony.

Now, with this brave step, they are ushering in a new era of international trade and finance.

Join us as we investigate the reasoning behind this decision and its ramifications for the global economy. We'll look at how this move may affect the supremacy of the US dollar, which has been the world's major reserve currency for decades.

From the possible growth of alternative currencies to the problems and opportunities confronting the BRICS nations, we'll examine every aspect of this game-changing development.

We'll also investigate how this decision may affect other countries and global economies, including the impact on commodity pricing, investment flows, and geopolitical alignments.

Is this the end of the dollar's dominance, or merely a transient adjustment in global finance?

Gold as Currency: 20 States Championing Economic Justice and Stability

The Resilient Compass: 8-22-2024

Join Andy Schectman, founder & CEO of @MilesFranklinCo, and Jason Cozens, founder & CEO of @Glint with special guest Mike Carter, as they discuss:

- Impact of national debt and inflation

- Cantillon effect and gold-backed money

- States' rights for gold legal tender

- 'Three T's' of gold currency

- BRICS' challenge to the US dollar

- Using Glint for gold transactions

China Sell-off 39% of US treasury: What's going on?

Fastepo: 8-22-2024

The U.S. government continues to view Treasury securities as reliable and secure investments, especially during times of economic uncertainty.

However, concerns are growing over the nation's expanding debt, which reached about $32.6 trillion by August 2024. Critics warn that this rising debt could pose long-term risks to the economy, potentially leading to inflation and higher borrowing costs.

Another key issue of the US economy is the U.S.'s dependence on foreign investment to help fund its debt. As of August 2024, China remains the second largest foreign holder of U.S. debt. However China has significantly dropped its holding to approximately $770 billion, a 39% decline compared to less than a decade ago.

This shift is tied to broader geopolitical and economic changes, raising concerns about the stability of foreign funding and its potential effects on U.S. economic policy.

This video explores the impact of China's decisions on the U.S. economy, analyzing both historical and current perspectives. It also examines how the outcome of the U.S. election could potentially influence China's approach to its U.S. Treasury holdings.

Seeds of Wisdom RV and Economic Updates Thursday Afternoon/Evening 8-22-24

Good afternoon/evening Dinar Recaps,

XRP Goes Global: Research Reveals Institutional Use Across All 7 Continents

Ripple is rapidly expanding its international footprint through global partnerships and focusing on expanding the use of the XRP Ledger.

Ripple is advancing in South America with its CBDC platform, collaborating with the Bank of Colombia and Brazil’s Fenasbac.

Blockchain startup Ripple has been making every possible effort lately to promote the adoption of its XRP Ledger and the use of XRP in the global financial markets.

Tokenicer, an enterprise blockchain researcher, recently stated that despite Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), the company has been swiftly expanding its global partnerships and services in different regions outside the United States. As reported by Crypto News Flash, Ripple has signed 1,700 agreements with global financial players to boost XRP use.

Good afternoon/evening Dinar Recaps,

XRP Goes Global: Research Reveals Institutional Use Across All 7 Continents

Ripple is rapidly expanding its international footprint through global partnerships and focusing on expanding the use of the XRP Ledger.

Ripple is advancing in South America with its CBDC platform, collaborating with the Bank of Colombia and Brazil’s Fenasbac.

Blockchain startup Ripple has been making every possible effort lately to promote the adoption of its XRP Ledger and the use of XRP in the global financial markets.

Tokenicer, an enterprise blockchain researcher, recently stated that despite Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), the company has been swiftly expanding its global partnerships and services in different regions outside the United States. As reported by Crypto News Flash, Ripple has signed 1,700 agreements with global financial players to boost XRP use.

Although America-based firms have been hesitant to partner with Ripple amid legal considerations, companies overseas have been quite flexible in adopting the Ripple technology. The XRP Ledger facilitates instant cross-border settlements by using Ripple’s native XRP cryptocurrency for settlements. As per the CNF report, Ripple is further expanding the use of XRP Ledger by working on stablecoin integration backed by Gold and Silver, moving beyond the boundaries of fiat settlements on XRPL.

Ripple Eyes Big Opportunity in South America and Europe

Ripple is seeing major advancements in the South American market, particularly with the release of the central bank’s digital currency (CBDC) platform. Last year, Ripple launched its CBDC platform, making it easy for central banks worldwide to quickly launch their CBDC, where Ripple does all the infrastructure-heavy lifting. As a result, the Bank of Colombia has been testing its CBDC on the Ripple platform.

Furthermore, Ripple has joined hands with Brazil’s National Federation of Associations of Central Bank Servers (Fenasbac), which seeks to boost the country’s financial sector through advancements in tokenization, payments, and treasury management.

Europe is another region where Ripple’s influence is growing gradually. Earlier this year, Ripple partnered with Clear Junction to facilitate instant cross-border settlements between the UK and the European Union, per the CNF report. This partnership, regulated by the Financial Conduct Authority (FCA), positions Ripple as a compliant and trustworthy European partner.

On the other hand, the Central Bank of Montenegro is also testing its CBDC on the Ripple platform, while Germany’s DZ bank integrated with Metaco, Ripple’s acquired digital asset custody firm.

Expanding into Asia and the Middle East for XRP Use

Ripple has always maintained a stronghold in the Asian and Middle East markets by working with partners such as SBI Holdings since 2016. This collaboration has led to key advancements for the blockchain startup, such as the use of XRP for cross-border remittances across Vietnam, the Philippines, and Indonesia. These countries are currently the fastest-growing remittance markets globally.

Furthermore, Ripple also secured an MPI license from the Monetary Authority of Singapore (MAS), which allows it to expand its services in the region. Ripple has also expanded its presence in the Middle East through its strong connections in Dubai. The company’s partnership with the Dubai International Financial Centre aims to advance blockchain adoption in the United Arab Emirates (UAE).

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

India’s crypto future hinges on gov’t consultation paper

India’s Department of Economic Affairs’ consultation paper is expected to be a watershed moment for crypto regulation in the country, potentially setting the stage for future legislation.

India’s cryptocurrency landscape could be about to change as the Department of Economic Affairs (DEA) prepares a key consultation paper on cryptocurrency legislation.

According to local media, the paper, which is expected in September or October, will invite feedback from various stakeholders, with the government playing an active role in the direction of digital currencies in India.

India’s crypto conundrum

The paper, led by a panel chaired by the secretary of the DEA, represents a significant step in India’s ongoing effort to balance innovation and regulation in its rapidly evolving crypto sector.

The release comes at a time when global scrutiny of cryptocurrencies is intensifying, particularly in light of the G20 nations’ unified approach to regulation, as highlighted by Indian Finance Minister Nirmala Sitharaman at a meeting of the group of nations in October 2023.

India, which has already implemented a stringent tax regime on cryptocurrency transactions, has taken a cautious approach to regulation. The 30% tax on unrealized crypto gains and a 1% tax deducted at source implemented in April 2022 marked the government’s first major move toward imposing some control over the crypto market.

However, despite the measures, the Indian government has refrained from regulating the sale and purchase of cryptocurrencies, focusing instead on curbing crypto-related money laundering and terrorism financing.

DEA paper to address regulatory concerns

The DEA’s forthcoming paper is expected to address the broader concerns surrounding the regulation of crypto assets, including those raised by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI).

In May, SEBI suggested a multi-regulatory approach, wherein different aspects of cryptocurrency trading would be overseen by various financial authorities. This fragmented approach underscores the complexity of regulating a technology that crosses traditional financial boundaries and poses unique challenges.

On the other hand, the RBI has consistently warned of the macroeconomic risks posed by digital currencies. The central bank’s stance reflects deep concerns about the potential impact of cryptocurrencies on India’s economic stability.

This caution is mirrored in the government’s recent actions against offshore crypto platforms and digital asset service providers, including a high-profile ban on Binance, the world’s largest cryptocurrency exchange.

Despite this, Binance managed to reestablish its presence in India by registering with the Financial Intelligence Unit, even as it faces a hefty $86 million tax demand from Indian authorities.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ICMA updates repo agreement for digital assets

The International Capital Market Association (ICMA) has published a digital assets annex for its Global Master Repurchase (repo) Agreement (GMRA). The Annex follows work by ICMA and ISLA in the Digital Assets Legal Working Group, with Clifford Chance appointed as counsel.

Repo involves the sale of collateral, usually securities, with an agreement to buy them back at a future date for a slightly higher amount representing interest.

There are already two significant intraday repo solutions with a third in progress. JP Morgan has an intraday solution for its clients, and technology firm Broadridge has its Distributed Ledger Repo (DLR) solution that processes $1.5 trillion in transactions monthly.

In Europe, HQLAᵡ has been running a DLT based solution for collateral mobility for a few years. It recently conducted end-to-end repo tests with Fnality, the institutional settlement system where the settlement tokens are backed by cash held in a central bank account. The goal is to support intraday repo for trades on the Eurex Repo F7 system. Fnality is awaiting regulatory approval for its participation and hopes to launch later this year.

By including the ICMA digital assets annex, transactions can include digital cash and/or digital securities.

The digital assets Annex

The GMRA Annex specifies various terms, such as an “Asset-backed Digital Asset” that includes a tokenized traditional security or contractual claim on an underlying asset. Digital cash could be central bank digital currency, tokenized deposits, electronic money tokens or other cryptographically secured representations of a single fiat currency.

If we’re not mistaken, the agreement might also account for HQLAᵡ, where custodians effectively lock conventional assets and DLT is used to transfer ownership. We guessed this from the reference to a “Platform Transferred Security” which is a conventional security that’s capable of being transferred cryptographically.

Support for intraday transactions

Until recently, conventional repo transactions have been constrained by the settlement delays for securities transactions. One of the key innovations of combining DLT with repo is the ability to settle instantly, which enables intraday repo where the repurchase happens at a precise time.

The existing agreement did not account for settlement at specific times, hence the Annex includes wording to support this. Additionally, there are adjustments to interest calculations given they need to account for hours rather than days.

“We hope the Digital Assets Annex will assist the further growth of the market by presenting a common approach that firms can leverage for transactions referencing the relevant categories of digital asset,” said Michael Brown, partner at Clifford Chance.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Thursday Afternoon 8-22-2024

BRICS might go dual currency and the US Dollar isn’t one of them

It’s a one-two punch.

U.S. Treasury Secretary Janet Yellen issued a serious warning over the swelling $34 trillion U.S. debt just as China’s President Xi Jinping returned home after signing 12 contracts with European nations to strengthen their economic ties.

Two facts are emerging:

The US dollar is becoming less and less valuable

Countries are starting to favor their own currency and strengthen their own economy

BRICS might go dual currency and the US Dollar isn’t one of them

It’s a one-two punch.

U.S. Treasury Secretary Janet Yellen issued a serious warning over the swelling $34 trillion U.S. debt just as China’s President Xi Jinping returned home after signing 12 contracts with European nations to strengthen their economic ties.

Two facts are emerging:

The US dollar is becoming less and less valuable

Countries are starting to favor their own currency and strengthen their own economy

BRICS Plus have insisted that they will be using each other’s local currency but there is also the impending need to use one currency that will have a consistent value all the time across different nations. The US dollar is slowly losing its luster. Countries are realizing that supporting the USD means they are betraying their own currency and putting them at the mercy of the US.

Gold is the only feasible and probable candidate as a global currency. Central banks have been buying gold at a record pace for the last several years, with many even remaining unreported.

BRICS Plus could go dual currency. Member nations would use a combination of their local currencies and gold. The first would be for buying goods and services on a daily basis and the second as a permanent asset that has residual value.

Dual currency is not a new concept. El Salvador made history when it adopted bitcoin as its official currency alongside the U.S. dollar in 2021 with mixed success, sparking debate whether other countries would follow suit though no major countries have yet.

However, gold and a local currency make more sense given that most countries already have both. Gold also has an innate value that Bitcoin doesn’t have.

If things get any worse in the US, BRICS Plus could fast-track their plan and officially use gold.

The current gold bull market could just be the beginning. Unfortunately, we won’t know just how far the BRICS Plus Nations are into the plan until it's too late.

So, don’t wait. Before gold goes to $5,000 as predicted by many, invest now and enjoy possible gains.

https://view.info.noblegoldinvestments.com/?qs=0b2a4c087a659430428513a3bc150f864c4b9ddc1ee8a187cd4a2f20720194c5c3047b28aa47affca1c0593c938d1c67cf5d92a1cb89c565c04d86574a5ebf005bd5e17c077c0b24d4f2b63e6ea3fb54

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick [Aki Iraqi bank friend who runs a bank in Michigan] Question: "Have you heard the three zeros will coexist for ten year?" Yes, we have heard about it but we did not hear the number 10. We heard that it would be over a long period of time. Duel pricing in the market would be controlled easier. Also, it would give the CBI longer time frame to collect the citizens 3 zero notes.

Militia Man They were definitely coming after Alaq. Why? Because their cash cow...is getting dried up and obviously they're getting squeezed. You not only have people in Baghdad getting squeezed you got people in Kurdistan area are going to get squeezed as well because they are on the wrong side of the trade. They have different agendas.

************

EXPECT GOLD TO HIT $8,000 AND SILVER TO HIT $800. AND THIS IS HOW IT WILL HAPPEN...

Greg Mannarino: 8-22-2024

Global Gold Repatriation Surge - Why More Nations Are Bringing Gold Home, Why This Is Significant

Kitco News: 8-21-2024

More countries are choosing to repatriate their gold and bring it back to their own borders for storage, Andy Schectman, President and Owner of Miles Franklin Precious Metals, tells Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News.

Schectman adds that this trend is accelerating and breaks down why this is as important as central banks choosing to step up their gold purchases in the last few years.

Bill Holter: Will We Ultimately See A Gold Revaluation?

Bill Holter: Will We Ultimately See A Gold Revaluation?

Arcadia Economics: 8-21-2024

In 2024 alone, we've seen the Philadelphia Federal Reserve publish a study on the effectiveness of a gold standard, confirmations that the BRICS are moving forward plans for a 40% gold-backed settlement currency, and a senator propose revaluing the Fed's gold certificates in order to fund a Strategic Bitcoin Reserve.

Mean while the debts and deficits continue to grow with no end in sight, while the gold price has reached a new all-time high.

And with gold and silver investors wondering for years whether we might ultimately be headed towards a gold revaluation, Bill Holter joins me on the show to talk about what he expects.

Bill Holter: Will We Ultimately See A Gold Revaluation?

Arcadia Economics: 8-21-2024

In 2024 alone, we've seen the Philadelphia Federal Reserve publish a study on the effectiveness of a gold standard, confirmations that the BRICS are moving forward plans for a 40% gold-backed settlement currency, and a senator propose revaluing the Fed's gold certificates in order to fund a Strategic Bitcoin Reserve.

Mean while the debts and deficits continue to grow with no end in sight, while the gold price has reached a new all-time high.

And with gold and silver investors wondering for years whether we might ultimately be headed towards a gold revaluation, Bill Holter joins me on the show to talk about what he expects.

Bill also explains why he continues to feel that the silver is the vulnerable spot in the market. And to find out why, click to watch the video now!

“Tidbits From TNT” Thursday 8-22-2024

TNT:

Tishwash: Saudi Foreign Minister arrives in Baghdad on official visit

Saudi Foreign Minister Faisal bin Farhan arrived in the Iraqi capital, Baghdad, on Thursday, on an official visit.

According to what an informed source told Shafaq News Agency, Bin Farhan is scheduled to hold talks with senior Iraqi officials during the visit, to discuss bilateral relations between the two countries and the latest developments in the region.

The source stated that this visit comes within the framework of enhancing joint cooperation and discussing issues of common interest between the Kingdom of Saudi Arabia and Iraq, especially in light of regional developments that require coordination between the two countries to enhance stability and security in the region. link

************

TNT:

Tishwash: Saudi Foreign Minister arrives in Baghdad on official visit

Saudi Foreign Minister Faisal bin Farhan arrived in the Iraqi capital, Baghdad, on Thursday, on an official visit.

According to what an informed source told Shafaq News Agency, Bin Farhan is scheduled to hold talks with senior Iraqi officials during the visit, to discuss bilateral relations between the two countries and the latest developments in the region.

The source stated that this visit comes within the framework of enhancing joint cooperation and discussing issues of common interest between the Kingdom of Saudi Arabia and Iraq, especially in light of regional developments that require coordination between the two countries to enhance stability and security in the region. link

************

Tishwash: Aircraft Carrier Lincoln Arrives in Middle East with Naval Strike Force

The US military announced that the aircraft carrier USS Abraham Lincoln and its accompanying destroyers arrived in the Middle East after Defense Secretary Lloyd Austin ordered this naval strike group to accelerate its transfer to the region.

This brings to two, at least temporarily, the number of US aircraft carriers currently in the Middle East, where fears of a regional military escalation are growing.

Tensions have been rising in the Middle East since Israel assassinated Hezbollah military leader Fouad Shukr in an airstrike in Beirut's southern suburbs, and Hamas political bureau chief Ismail Haniyeh was killed in an assassination in Tehran, which Iran has accused the Hebrew state of being behind.

The Lincoln is supposed to replace the aircraft carrier USS Theodore Roosevelt.

On Wednesday, the US Central Command (CENTCOM) said in a statement that “the aircraft carrier USS Abraham Lincoln, equipped with F-35C and F/A-18 Block 3 fighters, has entered CENTCOM’s area of responsibility.”

She added that Lincoln "is the lead ship in Carrier Strike Group 3, accompanied by Destroyer Flotilla (Deseron) 21 and Carrier Wing (CVW) 9."

The Pentagon announced on August 11 that Secretary of Defense Lloyd Austin had ordered the carrier Lincoln to "accelerate its transition" to the Middle East, after having ordered it to the region earlier in the month.

Fears of a major military escalation in the region have grown since Hezbollah and its ally Iran threatened to respond to the two assassinations that took place in the southern suburbs of Beirut and Tehran at the end of last July, just a few hours apart. link

************

Tishwash: Iranian-American agreement to keep Iraq away from Middle East events

The Israeli newspaper, The Jerusalem Post, revealed on Wednesday that there is an Iranian-American agreement to keep Iraq away from the current conflict, noting that the Iraqi Prime Minister intervened to prevent the American response to the recent bombing of Ain al-Assad.

The newspaper said in a report, which was followed by Al-Mutalaa, that: “There is news circulating in intelligence circles about instructions reaching armed factions inside Iraq to stop attacks against American forces and their bases to prevent the country from sliding into open war,” indicating that: “The Iranian authorities decided to stop attacks against American bases in Iraq as a result of the escalation of tension to unprecedented levels and the increasing risk of Iraq turning into a war zone.”

She added that: "Prime Minister Mohammed Shia al-Sudani was able to convince the Americans not to respond to the recent targeting of Ain al-Assad base and to cancel any plans to target armed factions inside the country," stressing to the Americans that: "Iraq is committed to maintaining its security and preventing its lands from turning into a battlefield between the American and Iranian parties."

The newspaper pointed out that: "The Iranian instructions do not include any mention of the attacks carried out by the factions inside Iraq against Israeli targets, including the continuous bombing of the port of Eilat," explaining that: "The cessation of attacks is limited so far to American bases and interests only, according to its description." link

************

Tishwash: Iraqi MPs launch campaign to collect signatures to summon Central Bank Governor to Parliament

A number of Iraqi parliament members launched a campaign to collect signatures with the aim of summoning the governor of the Central Bank, Ali Al-Alaq, to the House of Representatives.

This step comes as part of attempts to determine the details of the Central Bank’s performance and raise the level of oversight over monetary policies and economic reforms.

This move reflects the parliament’s desire to follow up on the country’s financial and banking performance and ensure the achievement of the set economic goals.

On August 8, Hadi Al-Salami, a member of the Parliamentary Integrity Committee, revealed that his committee has been following up for more than a year on the file of terminating the assignment of the Central Bank Governor, Ali Al-Alaq, from his position.

Al-Salami stated that "there are many files and violations related to the Central Bank, which were referred to the Integrity Commission and the Public Prosecution," indicating that "these violations include issues related to the lack of control over the exchange rate in the market, in addition to millions of dollars and interest received by Arab and foreign banks, including Jordanian banks."

Jamal Koujar, a member of the Finance Committee of the Iraqi Council of Representatives, said in press statements monitored by (Al-Mada), that: "Seven or eight signatures were collected from within the Finance Committee of the Parliament, and the signatures of members of other parliamentary committees are now being collected to support the campaign.

Koujar added that "the issue of sanctions imposed on Iraqi banks and the issue of dealing with the dollar are not under the control of the governor of the Central Bank, but these representatives have different private interests."

He continued, "If the matter reaches the point of accountability, Ali Al-Alaq will resign from his position, and he has already submitted his resignation." link

************

Mot: .... Soooo Exciting.... More Great Info frum da Net!!!!

Mot .... Hmmmmmmmm - Same List!!!!

News, Rumors and Opinions Thursday AM 8-22-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 22 Aug. 2024

Compiled Thurs. 22 Aug. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors/Opinions)

Wed. 21 Aug. 2024 TNT RayRen: “Get Ready, Get Ready, Get Ready! Congratulatory notices are going out to some SKR Holders telling them to look forward to fully funded accounts tonight into the morning. When they are fully funded, the rates should become fully public instantly in my opinion. If what they are telling me is true, some of you are going to go to bed wealthy.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 22 Aug. 2024

Compiled Thurs. 22 Aug. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors/Opinions)

Wed. 21 Aug. 2024 TNT RayRen: “Get Ready, Get Ready, Get Ready! Congratulatory notices are going out to some SKR Holders telling them to look forward to fully funded accounts tonight into the morning. When they are fully funded, the rates should become fully public instantly in my opinion. If what they are telling me is true, some of you are going to go to bed wealthy.”

Wed. 21 Aug. 2024 Wolverine: “I told you today was going to be an exciting day. People I am close to, people I know received their notifications today.” (It is Thurs. 22 Aug. in Australia where Wolverine is).

Tues. 20 Aug. 2024: MILITARY INTEL! Global Strategic Impact: Starlink’s Military Applications, RVs & GESARA, and the Quantum Financial System – amg-news.com – American Media Group

Wed. 21 Aug. 2024 Ginger’s Liberty Lounge on Telegram: This RV is a Private Exchange, not a public one. The special exchange and/or redemption has special rates for currency – a Contract rate for a couple of currencies. One being the Iraqi Dinar, which is being given as a result of an Oil for Dinar agreement between Iraq and the countries that provided troops during the process to remove Saddam Hussein. The purchase of oil in Dinar from Iraq will start as soon as the Revaluation starts. The Pre-revaluation Dinar will be used to purchase the oil at the new revalued price. For example, the current 25,000 Dinar note has a value against the US Dollar 1,460 dinar to 1 USD. The 25,000 notes we have are those notes. The 25,000 Dinar notes we hold will be exchanged by the US Treasury at a high rate because they in turn will be used to purchase oil from Iraq after revaluation at face value as if they were the new notes. That means that a 25,000 Dinar note can currently buy about $17.00 worth of oil, however after revaluation that same note can buy around $93,000 worth of oil. The Contract rate and the lower International rate are given to us in the Private exchange as a payment for what the US spent in that war. Vietnam holds a very high amount of Dinar and China has put their weight behind the Dongs revalue rate so that they can get the Dong after we exchange it, and the swap it for the Dinar that Vietnam has in order for them to buy oil with those old notes.

~~~~~~~~~~~

Wed. 21 Aug. 2024 RV/GCR, Mr. Pool on Telegram

Deep State Simpsons “predicted” there will be no Internet for a while.

Banking Crisis, Bank Runs: Wells Fargo, Bank of America Ratings Downgraded; Banks Close 100 branches last week; Personal Accounts being closed, or monies withheld without reason

~~~~~~~~~~~~~

Global Financial Crisis:

Wed. 21 Aug. 2024 Over 50 Countries Ready to Accept BRICS Payment System & Ditch SWIFT: https://watcher.guru/news/more-than-50-countries-could-accept-brics-payment-system

Wed. 21 Aug. 2024: Breaking Alert: Protocol 19 Triggers Black Swan Event – NESARA and GESARA – Revolution – Trust the Plan! – amg-news.com – American Media Group

~~~~~~~~~~~~

Wed. 21 Aug. 2024 NESARA/GESARA, (JFK Jr.) on Telegram

NESARA (National Economic Security and Recovery Act) and GESARA (Global Economic Security and Recovery Act) are two proposals for economic reform that have been circulating on the internet for quite some time.

The main goal of these proposals is to make the world a better place by introducing a bunch of changes to the way we handle money. Some of these changes include:

Eliminating debt: Imagine waking up one day and finding out that all your student loans, credit card debt, and mortgage have vanished into thin air. Sounds like a dream, right? Well, that’s what NESARA and GESARA are proposing.

Introducing a new currency: Say goodbye to the good old US dollar and hello to a shiny new currency backed by gold, silver, or some other precious metal. This would make the value of money more stable and less prone to inflation.

Revamping the tax system: No more complicated tax forms or surprise tax bills! NESARA and GESARA want to simplify the tax system and make it more transparent, so you can finally understand what’s going on with your hard-earned cash.

Helping the little guy: These proposals aim to support small businesses and individuals by giving them access to low-interest loans and other financial assistance.

Read full post here: https://dinarchronicles.com/2024/08/22/restored-republic-via-a-gcr-update-as-of-august-22-2024/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Why would somebody bring out an article "Is it time to remove the zeros?" Because we already know they're going to do something like that...Alaq said the project still exists...Alaq has talked about creating value and so has Al Sudani. Sudani has stated more than once that the dinar is stronger the dollar. Why would he lie about that? He might know things about that that you and I don't know...Where we're headed, that is probably a true statement and he's probably not going to be considered a liar. He's probably going to come out in history as one heck of a prime minister.

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

Mr Sammy [his Iraqi bank friend] was explaining how our three zero notes will coexist for 10 years after they drop the three zeros...This is not a LOP...We don't have inflation like other neighboring countries around us that have to lop. We can delete zeros and introduce...the lower notes because of the value that is being added. That's purchasing power. FRANK: That's always been the plan...I can't believe they're going to vie you these 10 years that Dr. Shabibi wanted. That's incredible...Wow!

************

The CBI Makes Economic Roadmap Document Public

Edu Matrix: 8-21-2024

The Central Bank of Iraq makes the Economic Roadmap Document Public. We must translate the entire document to find out what it says. This video shares the basic information.

Seeds of Wisdom RV and Economic Updates Wednesday Evening 8-21-24

Good Evening Dinar Recaps,

El Salvador launches Bitcoin training for 80,000 public servants

Over the years, El Salvador has stepped up efforts to integrate Bitcoin into its educational system.

El Salvador’s National Bitcoin Office (ONBTC) has launched a Bitcoin training and certification program for 80,000 public servants.

In an Aug. 20 statement, ONBTC confirmed that Bitcoin education is now a vital component of a governance initiative designed for public sector employees.

This program is part of the Higher School of Innovation in Public Administration (ESIAP), established by President Nayib Bukele in 2021 to elevate governance standards.

The program features nine training modules covering Bitcoin, Blockchain, Cybersecurity, and Artificial Intelligence, among others. Upon completion, participants will receive certification in these areas.

Good Evening Dinar Recaps,

El Salvador launches Bitcoin training for 80,000 public servants

Over the years, El Salvador has stepped up efforts to integrate Bitcoin into its educational system.

El Salvador’s National Bitcoin Office (ONBTC) has launched a Bitcoin training and certification program for 80,000 public servants.

In an Aug. 20 statement, ONBTC confirmed that Bitcoin education is now a vital component of a governance initiative designed for public sector employees.

This program is part of the Higher School of Innovation in Public Administration (ESIAP), established by President Nayib Bukele in 2021 to elevate governance standards.

The program features nine training modules covering Bitcoin, Blockchain, Cybersecurity, and Artificial Intelligence, among others. Upon completion, participants will receive certification in these areas.

Stacy Herbert, Director of the Bitcoin Office, hinted at a larger announcement on the horizon, noting that this program is just the beginning. She added:

“These education projects are very low time preference commitments to the long term success of El Salvador and its bitcoin (& tech) policy.”

Meanwhile, these trainings are part of El Salvador’s broader effort to advance Bitcoin education nationwide. Since adopting Bitcoin as a legal tender in 2021, the country has introduced three other crypto-focused educational initiatives, including Cuboplus, My First Bitcoin, and Node Nation, which are now part of the public school curriculum.

El Salvador Bitcoin

This move confirms that El Salvador remains steadfast in its Bitcoin strategy despite initially drawing criticism and doubt from international observers.

Indeed, the strategy appears to be finally paying off, as the International Monetary Fund (IMF) recently acknowledged that its anticipated risks of El Salvador adopting Bitcoin as a legal tender have not materialized.

Further, El Salvador’s Bitcoin holdings have yielded a profit of over 35%, largely due to strategic acquisitions made during market downturns. According to Nayibtracker data, the country currently holds 5,848 Bitcoin at an unrealized profit of more than $47 million.

In addition, President Bukele recently announced a $1.6 billion investment by Turkish firm Yilport Holdings to upgrade two ports in the country, one of which will host the proposed Bitcoin City.

The city, envisioned during the 2021 Bitcoin adoption, is expected to be a tax haven powered by geothermal energy for Bitcoin mining and will attract crypto enthusiasts worldwide.

@ Newshounds News™

Read more: CryptoSlate

~~~~~~~~~

Crypto Payment Network for AI Agents Launched by Former Ripple Execs

The company, Skyfire, raised $8.5 million to help AI get things done, even when it involves paying for something.

AI systems can do many things: conjure images and videos, write treatises, synthesize terabytes of information, and even replicate human speech patterns and emulate emotions.

But one thing they cannot yet do, as simple as it sounds, is pay for anything.

Two former Ripple developers now seek to eliminate that barrier by fusing blockchain payments with AI to bring forth what they believe will soon emerge as a new chapter for both technologies.

Their novel service, an open-source payment system called Skyfire, will allow autonomous AI agents to zip around the internet, purchasing whatever goods they need to complete assigned missions—everything from data storage and creative assets to airfare and groceries. All such transactions will be powered by USDC, the popular stablecoin.

The company, which today announced an $8.5 million seed raise, is backed by crypto heavy hitters, including Circle—the issuer of USDC—Ripple, Gemini, and the VC firm of prominent Silicon Valley billionaire and Bitcoin advocate Tim Draper. Skyfire currently runs on Polygon, the Ethereum scaling network, but it says it plans to expand to additional blockchains soon.

@ Newshounds News™

Read more: Decrypt

~~~~~~~~~

Swiss Banks Embrace Instant Payments: Could XRP Become the Go-To Crypto?

▪️Switzerland has taken a step further in embracing crypto with the recent expansion of the instant payment scheme as other banks integrate XRP into their trading platforms.

▪️According to reports, 28% of banks in Switzerland allow or are planning to allow customers to invest in crypto.

According to an announcement by the Swiss National Bank (SNB) and financial infrastructure operator SIX Interbank Clearing Ltd, Switzerland has reached an advanced phase in its effort to leverage the power of instant payment schemes to go cashless.

In the SNB report reviewed by Crypto News Flash, about 60 financial institutions within the country currently can process and receive payment instantly (within 10 seconds). Interestingly, this makes up about 95% of the Swiss retail payment transactions.

The report further discloses that the first institution has launched its retail offering with several others expected to join in the coming months. With this, experts believe that the financial economy could be boosted since private individuals and companies could perform account-to-account transactions around the clock.

This offers significant advantages for individuals, companies and commercial banks. Thanks to shorter settlement chains, risks are reduced and funds received are available immediately. For companies and commercial banks, instant payments expand opportunities for automating processes and linking with other services.

Commenting on this, SNB and SIX disclosed that instant payment could be widely established in Switzerland in the medium term and could be a model for future related innovations.

The technical framework for this new type of payment was put in place with the successful go-live of the new generation of the central Swiss payment system in November 2023.

This market launch represents a further important milestone and reflects the collective stakeholder commitment to the future of cashless payments in Switzerland.

Could XRP be Considered for this Innovation

With the country expected to fully redefine its financial system with the perfect establishment of an instant payment scheme, experts believe that XRP could be integrated in the future.

Fortunately, this possibility is not far-fetched as a Swiss bank fully owned by the government, PostFinance, recently announced the addition of Solana (SOL) and Ripple (XRP) to its trading platform.

According to reports, XRP could get more integration in the future, with 28% of Swiss banks currently allowing clients or planning to enable them to invest in crypto. In addition to PostFinance, the cantonal banks of Zug, St Gallen, and Lucerne have all introduced their crypto offerings.

PostFinance’s history in the crypto industry could be traced beyond 2023, when it partnered with Sygnum Bank to regulate crypto services. The basis of the collaboration was to allow customers to buy, sell, and store cryptos like Bitcoin (BTC), Ethereum (ETH), and now XRP.

Last year, we reported that Swiss banking giant BBVA had expanded its partnership with Ripple-owned Metaco to enable a robust engagement in crypto.

Priding itself as the first tier 1 bank in the Eurozone to combine crypto custodial and trading services alongside traditional assets, BBVA is expected to lead the way for full XRP integration.

Currently, XRP is being set up to lead the new global financial era, which is marked by its recent integration with MasterCard, while Ripple is working to boost Real-World Asset (RWA) tokenization worldwide.

At press time, XRP traded at $0.59 after declining by 0.12% in the last 24 hours.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 8-21-24

Good Afternoon Dinar Recaps,

IOTA Foundation a Winner in EBSI PCP, Demonstrating Scalability and Sustainability

The IOTA Foundation has successfully completed the final phase of the European Blockchain PCP, developing a scalable, energy-efficient, and secure blockchain solution using its Tangle technology.

As part of the European Blockchain PCP, IOTA created prototypes such as Digital Product Passports for electronics and plastics and an Intellectual Property Rights (IPR) Marketplace.

The IOTA Foundation recently announced that it has successfully completed the third and final phase of the European Blockchain Pre-Commercial Procurement (PCP), a big initiative funded by the European Commission. IOTA was one of the seven projects to participate in the European Blockchain PCP which began back in 2020.

Good Afternoon Dinar Recaps,

IOTA Foundation a Winner in EBSI PCP, Demonstrating Scalability and Sustainability

The IOTA Foundation has successfully completed the final phase of the European Blockchain PCP, developing a scalable, energy-efficient, and secure blockchain solution using its Tangle technology.

As part of the European Blockchain PCP, IOTA created prototypes such as Digital Product Passports for electronics and plastics and an Intellectual Property Rights (IPR) Marketplace.

The IOTA Foundation recently announced that it has successfully completed the third and final phase of the European Blockchain Pre-Commercial Procurement (PCP), a big initiative funded by the European Commission. IOTA was one of the seven projects to participate in the European Blockchain PCP which began back in 2020.

The goal of the European Blockchain PCP is to build new Distributed Ledger Technology (DLT) solutions for integration into the European Blockchain Services Infrastructure (EBSI).

As reported by Crypto News Flash, EBSI is an open-source permissioned network supporting cross-border credential attestations across the European continent.

Its long-term vision includes the evolution of the infrastructure into the European Digital Infrastructure Consortium for Blockchain (EUROPEUM-EDIC) which will offer scalability, energy efficiency, and secure blockchain applications.

Throughout the phases of this project, IOTA, along with its partners such as Digimarc, Software AG, Uncommon Digital, etc., developed a solution combining the DAG-based tangle DLT with open-source building blocks and APIs.

This solution includes a core DLT layer built atop the Stardust version of the Tangle protocol, which uses a Decentralized Coordinator with a Proof-of-Authority consensus mechanism involving EU member states and institutions.

It further ensures decentralization, efficiency, interoperability, and scalability, enabled by the “Tangle Tree” data sharding concept and EVM-compatible IOTA Smart Contract Chains.

Now, with the completion of the European Blockchain PCP, IOTA can apply these innovations and prototypes in the market, thereby contributing to future blockchain services in Europe.

IOTA Builds Innovative Prototypes for European Blockchain PCP

As part of its involvement in the European Blockchain Pre-Commercial Procurement (PCP), the IOTA Foundation built innovative solution prototypes. One such prototype focuses on intellectual property rights (IPR) management by leveraging NFTs, smart contracts, and decentralized identities (DIDs). As reported by Crypto News Flash, IOTA has also created an IPR Marketplace that is accessible through an EU Digital Identity-compatible credential wallet.

Similarly, IOTA has also developed Digital Product Passports (DPPs) for both the electronics and the plastic industries. Thus, the Electronics DPP prototype tracks the entire lifecycle of electronic devices, right from manufacturing to recycling. Similarly, the Plastics DPP prototype focuses on the transformation of agricultural plastic waste into bioplastic, while recording each phase of the process, per the CNF report.

IOTA successfully demonstrated its technology in the European Blockchain PCP across multiple areas such as:

▪️Scalability: IOTA’s Tangle technology achieved 90K confirmed transactions per second by using the Tangle Tree sharding concept, thereby supporting exponential scalability with 100 interconnected Tangles.

▪️Sustainability: The energy consumption for IOTA’s Stardust Tangle has scaled logarithmically with transaction volumes. IOTA noted that this makes it more energy-efficient than other solutions, like Hyperledger Besu.

▪️Security and Privacy: IOTA aligned with industry standards, developed quantum-resistant cryptography, and ensured compatibility with European regulations, enhancing both security and privacy in its blockchain solution.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Malaysia’s Anwar Ibrahim visits India to reset ties, boost Brics membership bid

The first visit to India by PM Anwar Ibrahim is timely due to China’s rising dominance of Malaysia’s foreign policy space, analysts say

Malaysia’s Anwar Ibrahim on Monday makes his debut trip to India as prime minister, seeking support for his country’s application to join the Brics bloc and to rekindle a bilateral relationship that was worth over US$16 billion in trade last year.

During its first prime minister-led delegation’s visit to India since 2018, Malaysia hopes to bolster ties with one of Asia’s fastest-growing economies. India is the largest buyer of Malaysian palm oil and a key exporter of rice to the Southeast Asian nation.

The application to join Brics, which was submitted to the current chairman Russia, is aimed at cushioning a potential impact on Malaysia from the escalating US-China trade and tech war, analysts say.

Brics comprises founder members Brazil, Russia, India, China and South Africa, as well as Saudi Arabia, Iran, Ethiopia, Egypt and the United Arab Emirates, offering preferential trade and investment with countries covering 45 per cent of the world’s population.

Anwar’s three-day visit is also a chance to reset Malaysia’s relations with India, analysts say, following a hangover from a spat with New Delhi under a previous Malaysian administration and China increasingly dominating the Southeast Asian nation’s foreign policy space.

During his visit, Anwar is scheduled to hold talks with his counterpart Narendra Modi, Malaysia’s foreign ministry said in a statement on Sunday, as well as meet India’s captains of industry and deliver a lecture on Malaysia-India ties.

The visit marks the first top-level visit by a Malaysian leader since former prime minister Mahathir Mohamad in 2019 accused India of having “invaded and occupied” Kashmir. His comments triggered a limited boycott of Malaysia’s palm oil – one of its biggest exports – by Indian traders.

India has been Malaysia’s top export market for its palm oil for 10 years running, buying 2.84 million tonnes in 2023, or nearly 20 per cent of Malaysia’s total palm oil exports, according to Malaysian government data. In contrast, China bought 1.47 million tonnes of palm oil shipments.

Malaysia is also heavily dependent on India for its domestic food supply.

In March, Malaysia’s government put in a request to import an additional 500,000 metric tonnes of rice from the world’s largest rice exporter, as a prolonged drought crimped domestic output and put pressure on national grain stockpiles. The request was on top of an earlier rice export quota of 170,000 metric tonnes allocated for Malaysia for the year.

India also has deep cultural links with Malaysia, whose minority ethnic Indians make hundreds of thousands of annual visits each year to their ancestral family villages and perform religious pilgrimages in temples, mostly in India’s south.

There is also a burgeoning strategic dimension in the relationship to serve as ballast to counter China’s influence, which looms large over the contested South China Sea, analysts say.

“Beijing’s rapid ascendency in the past three decades has transformed the entire power and economic equation in the region, and until recently, there was no adequate power balancer to this new power dynamic apart from the West,” said Collins Chong Yew Keat, a foreign affairs analyst with the University of Malaya.

The visit presents an opportunity for Malaysia to explore deeper defence cooperation with India, which has been upgrading its security and naval capacities and is carving out an increasingly important role in Asia’s regional maritime resilience, Chong added.

It is a role outlined in Modi’s Indo-Pacific Oceans Initiative launched in 2019, which presents the South Asian power as potentially the “primary power challenger” to China, Chong said.

@ Newshounds News™

Read more: SCMP

~~~~~~~~~

Ripple Enhances XRP Ledger (XRPL) with Launch of New Batch Devnet Servers

▪️Ripple launches Batch-Devnet Servers, boosting XRPL’s development with enhanced testing capabilities.

▪️New Batch Transactions feature on XRPL streamlines complex operations, aiding NFT minting and more.

Ripple Labs developers are taking significant steps to enhance the XRP Ledger (XRPL). Following the new era for XRPL we discussed earlier, Ripple and Archax are working to tokenize millions in real-world assets.

The latest update is the announcement of the availability of Batch-Devnet Servers, which serve as a parallel XRP Ledger test network.

As per a tweet yesterday, RippleX shared that the Batch-Devnet Servers are now available as a parallel XRP Ledger test network.

These test networks provide a platform for testing changes to the XRPL and connecting software without using real funds. It’s important to note that the ledger history and balances on these networks can be reset at any time, and users are advised not to use Testnet or Devnet credentials on the Mainnet.

RippleX also highlighted that users can now explore the new “Batch Transactions” feature. This allows multiple transactions to be bundled and executed as a single unit, enhancing reliability and predictability for complex operations.

All balances and XRP on these networks are separate from the Mainnet. As a precaution, do not use Testnet or Devnet credentials on the Mainnet.

One practical use case for this technology is the minting of non-fungible tokens (NFTs) and creating an offer for them in a single transaction.

Taking into account that the XRP Ledger set a new record with 90 million ledgers closed, as CNF previously highlighted, it was a key achievement highlighting XRPL’s growth and community involvement. According to CoinMarketCap data today, Ripple (XRP) is trading at $0.5946, declined by 1.39% in the past day, and surged by 3.23% in the past week.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

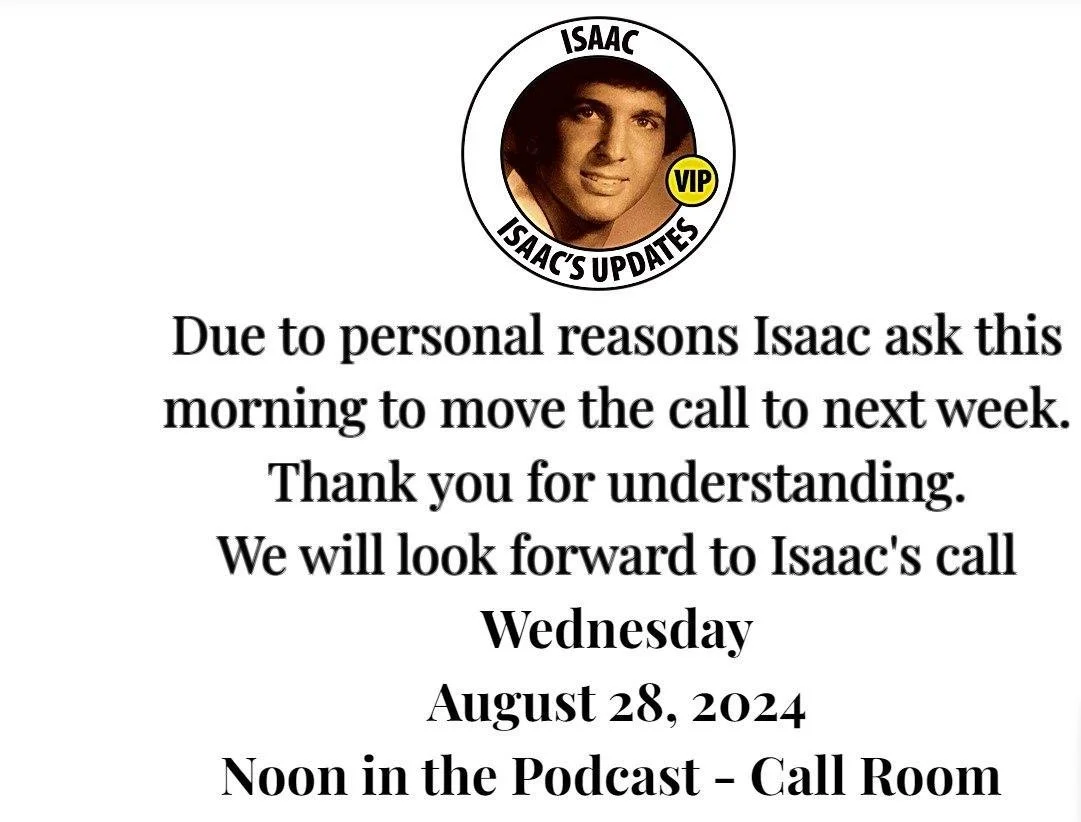

Rescheduled for next week

8 /28/ 2024 Noon Central

Listen Here: Podcast Call Link

Isaac's Room Link

Replay YouTube Link

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Wednesday Afternoon 8-21-2024

TNT:

Tishwash: Iraq pursues his former oil minister via Interpol

ERBIL (Kurdistan 24) – The Federal Commission for Integrity continues to coordinate with Interpol to arrest former Iraqi Oil Minister Ihsan Abdul-Jabbar, who is involved in billions of dollars of corruption.

In mid-August August 2023, the Karkh Investigation Court, which specializes in integrity issues, issued a decision to seize the movable and immovable funds of former Oil Minister Ihsan Abdul Jabbar.

At the time, Iraqi supervisory sources spoke of inflation and extreme wealth in the minister's funds, who, according to the same sources, owns millions of dollars worth of real estate in Iraq and abroad.

TNT:

Tishwash: Iraq pursues his former oil minister via Interpol

ERBIL (Kurdistan 24) – The Federal Commission for Integrity continues to coordinate with Interpol to arrest former Iraqi Oil Minister Ihsan Abdul-Jabbar, who is involved in billions of dollars of corruption.

In mid-August August 2023, the Karkh Investigation Court, which specializes in integrity issues, issued a decision to seize the movable and immovable funds of former Oil Minister Ihsan Abdul Jabbar.

At the time, Iraqi supervisory sources spoke of inflation and extreme wealth in the minister's funds, who, according to the same sources, owns millions of dollars worth of real estate in Iraq and abroad.

Earlier, the head of the transport and communications committee in the Iraqi parliament, Zahra al-Bajari, confirmed that the former minister in the integrity courts has 68 files related to financial and administrative corruption and waste of public money.

At the time, she pointed out that Abdul-Jabbar was involved in damaging public funds within the oil sector worth $ 825 billion.

Al-Bajari said in a press statement on October 18, October, 2022, that the former minister "amended a contract between the Ministry of Oil and two British and Chinese companies related to the Rumaila oil field in a way that causes financial damage to Iraq estimated at more than $ 825 billion over 25 years."

The Iraqi MP said, based on a report of the financial audit, that among the paragraphs affected by the amendment in the contract is a paragraph to reduce oil production and export by 750,000 barrels per day. link

************

Tishwash: Calls to form a parliamentary committee to investigate the discrepancy in the budget tables amounting to 8 trillion

Member of Parliament, Sarwa Abdul Wahid, called on Wednesday for the formation of a parliamentary committee to present its results to the House of Representatives regarding the difference in the budget tables, which amounts to 8 trillion dinars.

Abdul Wahid said in a statement seen by Al-Eqtisad News, "After talking about the difference in the budget tables, which amounts to 8 trillion, it became necessary for the presidency of the council to respond to the letter of the Council of Ministers that was sent on the first of last July, and as a result, the head of the Finance Committee ordered the formation of a committee to find out the facts."

Abdul Wahid explained, "It seems that there is (deception on the issue), so we demand the formation of a parliamentary committee whose results will be presented to the House of Representatives to find out the facts. If the Cabinet's letter is accurate and there is manipulation of the tables, then this is a disaster that must not be ignored, and Parliament must not be allowed to be a bridge for the corrupt." link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Once again, the Project to Delete the Zeros raises its head up. Yes, two more articles on it this period... There are other articles today related to the topic that help us understand and tell us they know what they have to do and its just a matter of time how and when they do it. The clock it ticking… tic, toc, tic, toc.

Militia Man Article Quote: "The Deputy Governor of the Central Bank of Iraq has confirmed work is underway to reduce the price of the dollar against a dinar in the coming days." We've heard this before but we haven't seen the end result yet. Why is that? Could they have been trying to do it before? Sure. Have they tried many times? They could have. Are they trying to do it again? The evidence support that this is what they are telling us - that they're going to try to do it again. Hopefully they get this one done.

************

WARNING! Forget About A STOCK MARKET CRASH! Something MUCH BIGGER Is Coming.

Greg Mannarino: 8-21-2024

Market Needs 40% Correction, GOLD To $6,000? | Michael Pento

Soar Financially: 6-20-2024

Michael Pento discusses his concerns about the current economic landscape, focusing on the risks posed by massive asset bubbles in stocks, real estate, and credit. He outlines his investment strategy and explains why he believes significant market corrections are inevitable. Michael also shares his views on inflation, deflation, and the potential for gold to rise to $5,000 or $6,000 per ounce.

Economist’s “News and Views” Wednesday 8-21-2024

Why Gold Price Ripping is Giving Us Big Clues About Financial System Crashing - Lyn Alden

Daniela Cambone: 8-20-2024

The global financial system is under strain, with currencies around the world failing or on the brink, warns Lyn Alden, founder of Lyn Alden Investment Strategy.

In this interview with Daniela Cambone, Alden explains why there is significant upside for gold in the next five to ten years—and why waiting for small dips could cost you big.

Alden discusses how the U.S. and Europe are sliding toward Japan-style stagnation but without the benefits of a current account surplus or social cohesion.

Why Gold Price Ripping is Giving Us Big Clues About Financial System Crashing - Lyn Alden

Daniela Cambone: 8-20-2024

The global financial system is under strain, with currencies around the world failing or on the brink, warns Lyn Alden, founder of Lyn Alden Investment Strategy.

In this interview with Daniela Cambone, Alden explains why there is significant upside for gold in the next five to ten years—and why waiting for small dips could cost you big.

Alden discusses how the U.S. and Europe are sliding toward Japan-style stagnation but without the benefits of a current account surplus or social cohesion.

As public debt and fiscal deficits surge, Alden predicts a more inflationary future and shares insights on how to navigate these challenging times.

CHAPTERS:

00:00 Fed/Small Rate Cuts

4:21 Gold Price

6:39 U.S. Dollar

9:35 Gold Analysis

11:12 Silver Market

12:24 Wall Street's Interest in Gold

13:57 Carry Trade Impact

18:14 AI Bubble Burst

19:56 Financial System Breakdown

23:34 How to Better Prepare

25:00 CBDCs (Central Bank Digital Currencies)

26:30 U.S. Economy Outlook

28:41 Banking Sector Overview

31:22 U.S. Deficit Concerns

33:10 Lessons from Argentina

BREAKING: A Key Actor in Central Asia Applies to Join BRICS Following Meeting with Russia

Lena Petrova: 8-21-2024

‘Reset Of A Lifetime’; Markets Signal 'Global Deflationary Recession' | Mike McGlone

David Lin: 8-20-2024

0:00 - Intro

1:12 - Bitcoin leading markets

5:38 - Bitcoin vs. stocks

10:45 - 5% unemployment forecast

15:50 – Deflation

18:30 - Gold vs. stocks

24:45 - CPI vs. PPI

30:11 - Bond market outlook

33:30 - Reset of a lifetime

Seeds of Wisdom RV and Economic Updates Wednesday Morning 8-21-24

Good Morning Dinar Recaps,

IOTA Foundation Develops 3 Innovative Solutions for EU_EBSI Funded by European Commission

▪️The IOTA Foundation has introduced three groundbreaking products in collaboration with the European Commission to enhance transparency across various sectors by utilizing blockchain technology.

▪️The new tools include a Digital Product Passport for electronics, a Digital Product Passport for plastics, and an Intellectual Property Rights (IPR) management solution.

Good Morning Dinar Recaps,

IOTA Foundation Develops 3 Innovative Solutions for EU_EBSI Funded by European Commission

▪️The IOTA Foundation has introduced three groundbreaking products in collaboration with the European Commission to enhance transparency across various sectors by utilizing blockchain technology.

▪️The new tools include a Digital Product Passport for electronics, a Digital Product Passport for plastics, and an Intellectual Property Rights (IPR) management solution.

In the latest development, the IOTA Foundation recently developed three revolutionary products, which they launched in association with the European Commission. With these products, IOTA focuses on raising levels of transparency in numerous industries and sectors.

Moreover, these innovations come within the framework of the European Blockchain Pre-Commercial Procurement (PCP). For context, PCP focuses on developing enhanced solutions for blockchain. Let’s take a look at all three products from IOTA.

1. Digital Product Passport For Electronics (H2)

The DPP for electronics manages the lifecycle of electronic goods. The IOTA Foundation built it in collaboration with the Technical University of Catalonia and eReuse. This tool uses blockchain to ensure that all electronics right from manufacturing to its disassembling and recycling are well recorded.

The DPP addresses key stages in an electronic device’s lifecycle: procurement of the raw materials, manufacturing, utilization, and disposal of the product. Also, there is a record of each level of the process, which guarantees proper documentation of all information about the device regarding its chemical content, breakdowns, and recycling procedures.

Furthermore, effective record-keeping also boosts the area of accountability. The DPP prototype uses IOTA Smart Contracts in order to record key information and to easily track and validate the history of electronic products throughout the chain, per the CNF report.

2. Digital Product Passport For Plastics (H2)

To tackle the ecological concern of plastic waste, the IOTA Foundation has developed a DPP prototype designed specifically for agroplastic products like agricultural mulch films. For this initiative, IOTA has partnered with Digimarc and Agro2Circula, and together, they will work on tracing the journey of plastics right from use to reuse, recycling, and reuse as products, reported Crypto News Flash.

However, this operation is rather complex and implies the involvement of many parties, and its specifics depend on national legislation. Nonetheless, the solution gives a comprehensive account of the lifecycle of plastic. It also includes the journey in which the waste is disposed of through recycling and upcycling techniques.

This prototype by the IOTA Foundation provides proof of work in tracking the disposed plastic in a transparent and verifiable manner. As such, it assists in minimizing the effects of plastic waste on the environment.

3. Intellectual Property Rights (IPR) Management Solution (H2)

The third innovation is an identification model created to provide more efficient guidance on Intellectual Property Rights related to the media. IOTA was developed keeping in mind the complexity of the process of licensing music used in films. Thus, this tool uses distributed ledger technology and smart contracts for rights management and royalty payments.

The IPR Marketplace system relies on IOTA Smart Contracts that turn conventional negotiations and paperwork into digital contracts that self-execute and self-enforce. Furthermore, it ensures that rights holders can protect and claim their compensation in an orderly manner, reported CNF.

The system also supports Non-Fungible Tokens (NFTs), designed to ensure timely payment for everyone, from the performer to songwriters and record companies. These NFTs also enhance traceability and reduce disputes.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

Listen and learn from this man. He has facts and shares with us as we all wait. Share with others!

August 21, 2024 12:00 Central Noon, 1 pm ET

Listen Here - Podcast Room https://t.me/+VAm-AlWWqWPzyK8G

Replays - YouTube Currency Facts - YouTube

Directly from Isaac when ask for a bio

“But understand I do not have contacts. Isaac

"I have buyers the us treasury , DOD , Admiral , HSBC several big platforms that I have signed contracts with all and they paid already for the inspection several times" Isaac

See photos of Isaacs bonds here:

https://telegra.ph/Isaacs-Facts-and-Truth-08-03

@ Newshounds News™

~~~~~~~~~

Newshound's Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Wednesday AM 8-21-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 21 Aug. 2024

Compiled Wed. 21 Aug. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors and Opinions )

Mon. 19 Aug. 2024 TNT: “On Fri. 16 Aug. they tested the system. On Sat. 17 Aug. because the system was live, they were paying “Front of the Line” people who wanted to be nameless. They said it has been completed since Thursday. They hope to be done funding all Central Banks today. People are being paid in the US already. It should be international sometime after two o clock am Tues. 20 Aug. I’m hearing people were exchanging at a live rate internationally. ”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 21 Aug. 2024

Compiled Wed. 21 Aug. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors and Opinions )

Mon. 19 Aug. 2024 TNT: “On Fri. 16 Aug. they tested the system. On Sat. 17 Aug. because the system was live, they were paying “Front of the Line” people who wanted to be nameless. They said it has been completed since Thursday. They hope to be done funding all Central Banks today. People are being paid in the US already. It should be international sometime after two o clock am Tues. 20 Aug. I’m hearing people were exchanging at a live rate internationally. ”

~~~~~~~~~~~~~~

Tues. 20 Aug. 2024 Bruce:

Canada may get a different 800# to call that will route you to Redemption Centers in Canada where you will get the best rates. HSBC is the lead bank in Canada.