Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Monday Afternoon 7-22-24

Good Afternoon Dinar Recaps,

Seven-State Coalition Opposes SEC’s Cryptocurrency Regulation

The Office of the Attorney General of Iowa announced earlier this month that Iowa Attorney General Brenna Bird led a seven-state coalition in filing an amicus brief opposing the U.S. Securities and Exchange Commission’s (SEC) attempt to regulate cryptocurrencies. The amicus brief, supported by Arkansas, Indiana, Kansas, Montana, Nebraska, and Oklahoma, was filed on July 10 to challenge the SEC’s overreach.

“SEC’s power grab may stop states from protecting their citizens from scams, and it hurts the free market,” the announcement details, adding: SEC’s policing of cryptocurrency will stifle innovation and devastate the cryptocurrency industry.

States like Iowa, which have been at the forefront of protecting scam victims and prosecuting scammers, view the SEC’s actions as a significant overreach.

Good Afternoon Dinar Recaps,

Seven-State Coalition Opposes SEC’s Cryptocurrency Regulation

The Office of the Attorney General of Iowa announced earlier this month that Iowa Attorney General Brenna Bird led a seven-state coalition in filing an amicus brief opposing the U.S. Securities and Exchange Commission’s (SEC) attempt to regulate cryptocurrencies. The amicus brief, supported by Arkansas, Indiana, Kansas, Montana, Nebraska, and Oklahoma, was filed on July 10 to challenge the SEC’s overreach.

“SEC’s power grab may stop states from protecting their citizens from scams, and it hurts the free market,” the announcement details, adding:

SEC’s policing of cryptocurrency will stifle innovation and devastate the cryptocurrency industry.

States like Iowa, which have been at the forefront of protecting scam victims and prosecuting scammers, view the SEC’s actions as a significant overreach.

“The Biden SEC is trying to prevent states like Iowa from doing their job to hold robbers to the law and protect families from the dangers of cryptocurrency scams. This power grab will also hurt the free market and allow the SEC to take the regulatory reins over the cryptocurrency industry with no accountability,” the announcement continues.

Noting that the SEC’s “bypassing Congress to give itself new power is illegal, stifles innovation, and will let scammers off the hook,” the Iowa Attorney General’s Office noted, emphasizing:

The Biden SEC is attempting to abuse its power and put itself in charge of regulating cryptocurrency, bypassing state consumer-protection laws.

“Congress never gave the SEC power to regulate cryptocurrency, and there is no accountability to ensure the actions the SEC takes are legitimate and necessary,” the Iowa Attorney General’s Office stressed.

The amicus brief explains that the SEC is violating the Administrative Procedure Act and the Major Questions Doctrine by bypassing Congress. The states argue that typical cryptocurrencies are not investment contracts under the Securities Act of 1934, urging the court to prevent the SEC from exceeding its authority.

@ Newshounds News™

Read more: Bitcoin

~~~~~~~~~

Japan’s Fast And Early Approach To Crypto Regulation Is Paying Off

Japan was a rare exception when it came to regulating crypto. Following the catastrophic collapse of Mt.Gox in 2014 – a Japan-based company – the government moved fast and early to clamp down on what was seen as an excessively risky industry. It introduced strict rules for operators, putting them under the oversight of the country’s financial regulator.

That decision means that ten years on, Web3 in Japan is evolving quite differently compared to the startup culture that’s characterized the sector in other countries. Instead, we’re seeing a more prevalent trend of large corporations levering their way into Web3 via strategic M&A and investment activities.

To date, banking giant Softbank has been one of the

most active players, acquiring a controlling stake in crypto trading platform BITPoint in 2022 and becoming a key investor in a dedicated Web3 venture fund initially set up by Deutsche Bank.

However, the latest news, that Sony is gearing up to launch a rebranded crypto exchange called. S.BLOX, as a result of a 2023 acquisition of local platform Whalefin, has created a froth in the crypto community.

I recently spoke to Mai Fujimoto, co-founder of INTMAX, who was fresh from the Japan Blockchain Week Summit which she hosted in early July. She confirmed that, based on the lineup of this year’s event, the corporate move into Web3 is becoming a trend:

“This [Sony] is just one such example. We just hosted many speakers from large corporations [at Japan Blockchain Week], which stood out on the Web3 conference circuit. I believe this is unique to Japan. In the United States, Coinbase and Base

Chain have significantly contributed to the penetration of Web3 in the country, so we can expect similar synergies to occur in Japan as well.”

@ Newshounds News™

Read more: Forbes

~~~~~~~~~

IOTA’s Product Passport Could Be Used by Tesla, Audi, Porsche, BMW, and VW After Eviden Partnership

—IOTA’s Product Passport with Eviden enhances transparency for Tesla, Audi, Porsche, BMW, and VW, letting consumers track vehicle history and build trust.

—IOTA’s Digital Product Passports optimize production, maintenance, and recycling, improving supply chains for major automotive brands.

When it comes to cutting-edge data solutions while securing privacy to the highest level, IOTA is at the forefront as highlighted in one of our previous coverages.

According to the latest update from IOTA on the newly established partnership, the IOTA Foundation and Eviden, a subsidiary of Atos, are collaborating on the Eviden Digital Passport Solution (EDPS), which is “Powered by IOTA.”

EDPS is one of the first ready-to-use, DLT-based Digital Product Passports (DPPs) on the market and the first at this scale to utilize IOTA technology.

This upgrade provides detailed lifecycle information about products, enhancing transparency, traceability, and sustainability. Dominik Schiener, Co-Founder and Chair of the IOTA Foundation, stated:

This partnership leverages our unique joint benefits and creates a strong combination of capabilities, ready for the market to use. This is a long-term collaboration between Eviden and the IOTA Foundation, and we will work closely together to explore further use cases in domains such as construction materials, textiles, and consumer electronics, amongst others. We expect millions of passports to be registered on the IOTA network by the end of the decade.

IOTA and Eviden Enhancing Transparency and Traceability for Major Automakers

Eviden, with leading positions in computing, security, AI, and digital platforms, provides expertise across various industries in more than 47 countries. Importantly, the collaboration with the IOTA Foundation is expected to significantly impact major automakers, including Tesla, Audi, Porsche, BMW, and Volkswagen.

This partnership will enhance transparency and traceability throughout their supply chains, allowing consumers to track the origin and history of their vehicles, building trust in these brands. At the same time, manufacturers can optimize production processes, streamline maintenance, and improve recycling efforts.

At the time of writing, IOTA is trading at $0.1769, with a decrease of 0.43% and a surge of 7.48% in the past week.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

WHAT IS A CURRENCY RE-DENOMINATION?

"Redenomination is the recalibration of a country's currency, typically due to hyperinflation and currency devaluation, whereby an old currency is exchanged for a new one at a fixed rate. "

"While significant inflation is the main reason for a country to redenominate its currency, other reasons include decimalization or joining a currency union. When redenomination occurs, old banknotes and coins are typically taken out of circulation and a new currency is issued. Sometimes, the old currency continues to circulate at a fixed value against the new notes. "

"When redenomination occurs, a new value is established for the new banknotes and coins. For example, in 2006, Zimbabwe redenominated its currency at a rate of 1,000 old Zimbabwe dollars to one new Zimbabwe dollar."

"When hyperinflation is involved, redenomination becomes necessary because it requires too many old notes to facilitate commerce. Small bills essentially become useless if you need a wheel barrel of them to buy a loaf of bread. "

" Probably the most famous redenomination has been the Zimbabwean dollar, which circulated in Z$100 trillion bills—the largest denomination of currency ever issued—thanks to an annual inflation rate of more than 231 million percent.

The Zimbabwe government redenominated its currency several times starting in 2006. In that year, the country's first currency reform was launched in an effort to contain inflation. The Zimbabwean dollar was redenominated at a rate of 1,000 to one."

" In August 2008, the government launched another redenomination. Old notes could be exchanged for new ones at a rate of 10 billion to one. Inflation continued unabated, and new issues of currency with staggering face amounts continued to appear. In January 2009, Z$10 trillion, Z$20 trillion, Z$50 trillion, and Z$100 trillion notes were issued.

In February 2009, the government redenominated a third time. Old currency could be exchanged for new currency at a rate of one trillion to one. By then, most people had quit the Zimbabwe dollar in favor of the U.S. dollar and South African rand."

@ Newshounds News™

Read more: Investopedia

~~~~~~~~~

CFTC Chairman Behnam Urges Congress For Increased Crypto Regulation: We Are 'On The Front Lines' | Youtube

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

US Pressure on Latin America to Avoid BRICS: Lost America's Backyard?

US Pressure on Latin America to Avoid BRICS: Lost America's Backyard?

Fastepo: 7-22-2024

Despite the BRICS group's recent pause on accepting new full members, particularly emphasized by the Russian Foreign Minister, Brazil has actively advocated for the bloc's continued expansion.

Brazilian Ambassador to Russia, Rodrigo de Lima Baena Soares, revealed Brazil's proposal of Colombia as a potential new BRICS member, as reported by the Russian News Agency TASS.

This strategic recommendation was underscored by Brazilian President Luiz Inacio Lula da Silva during discussions with Colombian President Gustavo Petro, highlighting Colombia's significance in the expansion plan.

US Pressure on Latin America to Avoid BRICS: Lost America's Backyard?

Fastepo: 7-22-2024

Despite the BRICS group's recent pause on accepting new full members, particularly emphasized by the Russian Foreign Minister, Brazil has actively advocated for the bloc's continued expansion.

Brazilian Ambassador to Russia, Rodrigo de Lima Baena Soares, revealed Brazil's proposal of Colombia as a potential new BRICS member, as reported by the Russian News Agency TASS.

This strategic recommendation was underscored by Brazilian President Luiz Inacio Lula da Silva during discussions with Colombian President Gustavo Petro, highlighting Colombia's significance in the expansion plan.

In addition, Bolivia, under the leadership of President Luis Arce, has formally sought BRICS membership. Bolivia's vast lithium reserves, essential for sustainable energy solutions, make it an attractive candidate for the bloc.

Similarly, Venezuela, led by President Nicolás Maduro, has expressed a strong desire to join BRICS, emphasizing its substantial oil reserves. Venezuela's application has garnered support from China, Russia, and Brazil, underscoring its strategic importance.

The expansion of BRICS into Latin America represents a significant geopolitical shift, diminishing the influence of the United States, which has traditionally viewed the region as its geopolitical "backyard."

By incorporating more Latin American countries, BRICS aims to create a counterbalance to U.S. economic and political dominance. This move is expected to enhance regional integration, reduce dependence on U.S. markets, and promote a more diversified economic base.

In this video, we analyze the significance of Colombia, Bolivia, and Venezuela's potential inclusion in BRICS and its implications for both BRICS and the United States.

This development could potentially reshape the global order, altering economic alliances and geopolitical strategies.

We will explore how this move could challenge U.S. dominance in Latin America and enhance BRICS' influence on the world stage, thereby creating a new dynamic in international relations.

The Rise of the Shanghai Cooperation Organization: A New Geopolitical and Military Force

The Rise of the Shanghai Cooperation Organization: A New Geopolitical and Military Force

On July 20, 2024 By Awake-In-3D

The SCO is reshaping global geopolitics and will independently protect the new GOLD-BACKED Currency and Financial System

In This Article:

Introduction to the SCO’s growing influence

The recent SCO summit in Astana and Western media’s oversight

BRICS’ new financial system and the SCO’s role in securing it

The future of Eurasian alliances and the concept of Rimland

The Rise of the Shanghai Cooperation Organization: A New Geopolitical and Military Force

On July 20, 2024 By Awake-In-3D

The SCO is reshaping global geopolitics and will independently protect the new GOLD-BACKED Currency and Financial System

In This Article:

Introduction to the SCO’s growing influence

The recent SCO summit in Astana and Western media’s oversight

BRICS’ new financial system and the SCO’s role in securing it

The future of Eurasian alliances and the concept of Rimland

The geopolitical landscape is undergoing a significant transformation with the rise of the Shanghai Cooperation Organization (SCO).

Formed initially to combat terrorism and extremism, the SCO has evolved into a formidable economic and geopolitical entity. Its growing influence, alongside BRICS+, signals a shift that Western alliances like NATO and the G7 must acknowledge and adapt to.

Understanding the Shanghai Cooperation Organization Transformation

The Shanghai Cooperation Organization was established just months before the events of 9/11.

Initially known as the Shanghai Five, it included Russia, China, and three Central Asian states. Its primary focus was anti-terrorism, anti-separatism, and anti-extremism. Over the years, the SCO has expanded its scope, now including major Eurasian nations such as India, Pakistan, and Iran, making it a significant player on the global stage.

The recent SCO summit in Astana, Kazakhstan, highlighted this transformation. Despite the event’s importance, Western media largely overlooked it.

This lack of coverage reflects a broader misunderstanding of the SCO’s growing geopolitical influence. The summit underscored the SCO’s role as a key node in a multipolar world, interconnected with various global players.

BRICS’ New Financial System and the SCO’s Role

One of the most significant developments in global finance is BRICS’ move towards a new financial system based on gold-backed currencies.

This initiative aims to create an alternative to the Western-controlled economic mechanisms, providing stability and reducing dependence on the US dollar. However, establishing such a system requires robust geopolitical and military support to ensure its security and legality.

Enter the SCO. With its expanding membership and strategic influence, the SCO is poised to play a crucial role in protecting the integrity of BRICS’ new financial system. The collaboration between these two organizations could ensure the enforcement of economic agreements, protect member states from external threats, and maintain the stability of the new financial system.

The presence of powerful nations like Russia, China, India, and Iran within the SCO enhances its capability to support BRICS in this endeavor.

Potential Impacts on NATO and U.S. Geopolitical Strategies

The strategic significance of Europe and the Mediterranean remains crucial. However, the rise of the SCO and BRICS+ poses a challenge to Western dominance.

If the U.S. and NATO do not recognize and adapt to these shifting alliances, they risk losing influence over Eurasia and the Rimland.

The Rimland, a geopolitical concept introduced by American political scientist Nicholas Spykman, refers to the coastal fringes of Eurasia. This region is strategically vital, serving as a buffer zone between the central Heartland of Eurasia and the world’s oceans.

Controlling the Rimland is essential for global dominance, providing access to crucial maritime routes and Eurasia’s vast resources and markets.

The Future of Eurasian Alliances

The potential unification of the SCO and BRICS+ into a more strategic and possibly military organization could further diminish Western hegemony.

The increasing cooperation among these entities suggests a move towards a unified Eurasian geopolitical landscape. Such a development could redefine global power dynamics, with significant implications for the West.

The SCO’s evolution from an anti-terrorism organization to a geopolitical force underscores the importance of understanding and engaging with emerging multipolar structures. As the SCO and BRICS+ continue to grow, their influence will shape the future of global geopolitics, challenging traditional Western dominance.

The Bottom Line

The Shanghai Cooperation Organization is rapidly becoming a geopolitical force to be reckoned with.

Its growing influence, alongside BRICS+, highlights the need for the U.S. and NATO to recognize and adapt to the shifting global landscape. The recent SCO summit in Astana underscores the organization’s strategic importance in reshaping global geopolitics.

As Eurasian alliances strengthen, the concept of Rimland and its strategic significance will play a crucial role in determining the future of global power dynamics. With BRICS forming a new financial system based on gold-backed currencies, the SCO’s role in securing this system becomes paramount.

The potential unification of the SCO and BRICS+ poses a significant challenge to Western hegemony, signaling the rise of a new, multipolar world order.

Supporting Article: https://strategic-culture.su/news/2024/07/18/the-sco-can-change-the-rules-of-rimland/

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

News, Rumors and Opinions Monday PM 7-22-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 22 July 2024

Compiled Mon. 22 July 2024 12:01 am EST by Judy Byington

Black Swan Events Imminent

Greatest Financial Bubble in Human History About To Pop:

Stocks To Lose Their Value

It’s only wise to have at least a month’s supply of food, water, cash, medicine and essential items on hand for your family and to share with others in case of emergency.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 22 July 2024

Compiled Mon. 22 July 2024 12:01 am EST by Judy Byington

Black Swan Events Imminent

Greatest Financial Bubble in Human History About To Pop:

Stocks To Lose Their Value

It’s only wise to have at least a month’s supply of food, water, cash, medicine and essential items on hand for your family and to share with others in case of emergency.

Judy Note: The greatest Financial Bubble in Human History was about to pop: Stocks to lose over 50% of their value – that would bring in a Global Financial Collapse – something both the Black and White Hats wanted.

With a collapse of the Global Financial System the Deep State Black Hats would bring in their non asset-backed digital currency that could control everyone’s bank accounts, and lives.

The White Hats appeared to have one up on the Cabal as they have already involved over 50% of the World population in their Global Currency Reset to gold/asset-backed currencies that would trade at a 1:1 with each other.

40 Countries Express Interest To Join BRICS Before 2024 Summit: https://watcher.guru/news/40-countries-express-interest-to-join-brics-before-2024-summit

What is Quantum Banking? Quantum Banking is a new type of banking system that makes use of quantum technologies. This system has the potential to revolutionize the banking sector by providing more secure and efficient banking services as it can handle large amounts of data quickly and accurately. https://thequantuminsider.com/2021/06/23/11-global-banks-probing-the-wonderful-world-of-quantum-technologies/

~~~~~~~~~~

Global Financial Crisis:

Black Swan’ investor warns the ‘greatest bubble in human history’ is about to pop and stocks could lose more than half their value. https://fortune.com/2024/07/20/black-swan-investor-mark-spitznagel-greatest-bubble-human-history-stock-market-crash-recession/

Boots to close down 300 stores by the end of summer – full list of axed shops: https://www.mirror.co.uk/news/uk-news/boots-pharmacy-store-closures-list-33286696?utm_source=linkCopy&utm_medium=social&utm_campaign=sharebar

~~~~~~~~~~~

Executive Order 1221 involves:

Economic Collapse and Transition to the Quantum Financial System: A planned economic collapse is a central aspect of Executive Order 1221. This controlled demolition of the current financial system aims to eliminate debt and corruption, paving the way for the introduction of the Quantum Financial System (QFS). The QFS promises unprecedented security, transparency, and efficiency, leveraging advanced technologies to manage financial transactions. The transition to the QFS will involve a Global Currency Reset, reverting to 1950s price levels. This reset will stabilize economies, restore purchasing power, and eliminate the disparities created by inflation and market manipulation. While the immediate impact will be disruptive, the long-term benefits are expected to be transformative.

The removal of Bitcoin (BTC), Ethereum (ETH), and China Coin (CCP) from circulation to stabilize the global economy and prevent the misuse of these digital assets by malicious actors. The eradication of these cryptocurrencies will require coordinated global action, including the seizure of mining operations and the shutdown of trading platforms. This move is expected to cause significant disruption in the financial markets, but it is seen as a necessary step to pave the way for a more secure and regulated financial system.

~~~~~~~~~~

Sun. 21 July 2024 NESARA/GESARA Update, David Wilcock

NESARA implements the following changes:

Zeros out all credit card, mortgage, and other bank debt due to illegal banking and government activities. This is the Federal Reserve’s worst nightmare: a “jubilee” or a forgiveness of debt.

Abolishes the income tax.

Abolishes the IRS. Employees of the IRS will be transferred into the US Treasury national sales tax area.

Creates a 14% flat rate non-essential ‘new items only’ sales tax revenue for the government. In other words, food and medicine will not be taxed; nor will used items such as old homes.

Increases benefits to senior citizens

Creates a new U.S. Treasury, ‘rainbow currency,’ backed by gold, silver, and platinum precious metals, ending the bankruptcy of the United States initiated by Franklin Roosevelt in 1933.

Initiates new U.S. Treasury Bank System in alignment with Constitutional Law

Eliminates the Federal Reserve System. During the transition period the Federal Reserve will be allowed to operate side by side of the U.S. Treasury for one year in order to remove all Federal Reserve notes from the money supply.

Restores financial privacy.

Releases enormous sums of money for humanitarian purposes

Read full post here: https://dinarchronicles.com/2024/07/22/restored-republic-via-a-gcr-update-as-of-july-22-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick Iraq never said they were coming out at 1 to 1...It was actually established during the Paris Club Agreement. That was said to Iraq, Shabibi, at least 1 to 1 with the American dollar.

Frank26 Do they need to have value to their currency in order to join the WTO? No. That's coming...I don't care if they going into the WTO now, tomorrow, next week, whenever. They're probably moving it to the beginning of next year. It's not important. But the evidence of being in the WTO screams what? Monetary reform float.

***********

BREAKING US Okays Iraq Purchase of Electricity from Iran in 120 Degree Temperatures

Edu Matrix: 7-21-2024

BREAKING US Okays Iraq Purchase of Electricity from Iran in 120 Degree Temperatures. The US authorizes the sale of electricity from Iran to Iraq.

PROOF That They are LYING about the Economy!

Atlantis Report: 7-21-2024

There is a common narrative about the state of the economy that's often promoted by mainstream media and political figures, particularly those supporting this current administration.

According to this narrative, everything is going great - the economy is booming, inflation is under control, and the labor market is thriving.

However, many Americans find it hard to believe these optimistic reports because their daily experiences don't align with them.

The stark disparity between official economic accounts and personal experiences has prompted many to doubt the honesty of economic reports. Here's PROOF That They are LYING about the Economy.

“Tidbits From TNT” Monday Morning 7-22-2024

TNT:

Tishwash: US-Iraq Joint Security Dialogue Begins in Washington

US Ambassador to Baghdad Alina Romanowski announced today, Monday (July 22, 2024), the beginning of discussions between Iraq and America regarding the future of the international coalition mission.

Romanowski wrote in a post on the "X" platform, followed by "Mawazine News", saying, "Today, the joint security dialogue between the United States and Iraq begins in Washington, DC." She added, "Security officials from the United States and Iraq will discuss the future of the international coalition mission and strengthening security cooperation between our two countries."

TNT:

Tishwash: US-Iraq Joint Security Dialogue Begins in Washington

US Ambassador to Baghdad Alina Romanowski announced today, Monday (July 22, 2024), the beginning of discussions between Iraq and America regarding the future of the international coalition mission.

Romanowski wrote in a post on the "X" platform, followed by "Mawazine News", saying, "Today, the joint security dialogue between the United States and Iraq begins in Washington, DC."

She added, "Security officials from the United States and Iraq will discuss the future of the international coalition mission and strengthening security cooperation between our two countries."

The US Ambassador to Baghdad, Alina Romanowski, announced the start of the joint security dialogue between the United States of America and Iraq in Washington, today, Monday.

Romanowski said on her account on the "X" platform, "Security officials from the United States and Iraq will discuss the future of the international coalition mission and strengthening security cooperation between our two countries."

Negotiations between Baghdad and Washington resumed last February, with the adoption of a deliberate and gradual reduction, leading to the end of the mission of the international coalition forces to combat ISIS, according to official Iraqi statements, to be followed by two other rounds in March and April.

There are about 2,500 American soldiers in Iraq, as part of the international coalition led by Washington since September 2014. The soldiers are distributed across three main sites in Iraq: Ain al-Assad base in Anbar, Harir base in Erbil, and Camp Victoria adjacent to Baghdad International Airport. In addition to the American forces, there are French, Australian, and British forces operating within the coalition forces, and others within NATO in Iraq. link

************

Tishwash: Al-Nusairi: Implementing banking reform strategies is the main pillar for reforming the national economy

The advisor to the Iraqi Private Banks Association, Samir Al-Nusairi, confirmed today, Monday, that the banking reform and development strategy is the main pillar for reforming the comprehensive national economy.

Al-Nusairi said in a special interview with “Al-Eqtisad News” that “the strategy of banking reform and development is the basic pillar for comprehensive and radical reform of the national economy in line with what is stated in Article Twelve, Paragraph (7) of the government program, which clearly and accurately stated that (banking reform, with what it provides of a real and effective basis for the advancement of the Iraqi economy and the activation of investment through the restructuring and mechanization of government banks, reviewing their work, and stimulating and enabling private banks to be able to support investment and development in a real way).”

Al-Nusairi touched on the "importance of the banking sector, as it occupies a vital position within the financial structure of the economy in mobilizing savings and financing development through its ability to flow money between the categories of the national economy, which is the basic step for economic reform."

He pointed out "the measures currently taken by the Central Bank with the support of the government to launch its new third strategy for reforming and developing the banking sector for the years 2024-2026 according to seven main objectives, 24 sub-objectives and 75 initiatives to implement the objectives focusing on achieving monetary and financial stability, strengthening the banking sector, enhancing digital transformation, activating electronic payment, enhancing financial inclusion, maintaining a sound financial system, developing the organizational structure and human resources, strengthening the internal and external relations of the Central Bank, and the banking sector's compliance with international standards."

Al-Nusairi pointed out that "a national strategy for bank lending in Iraq for the years 2024-2029 was launched, aiming to increase credit granted to the private sector by 4% of the non-oil GDP, which is equivalent to approximately 7 trillion dinars, and the second goal is to increase credit to small and medium enterprises by 3% of the non-oil GDP, which is equivalent to approximately 5 trillion dinars."

He stressed that "the new mechanisms depend on organizing the granting of loans to develop small, medium and micro enterprises by relying on and relying on a new approach to determine the basic objectives of economic development, evaluating the current situation of private sector financing, and benefiting from international experiences in this field, as well as continuing the procedures and using monetary policy applications to control the exchange rate and reduce the gap between the official rate and the parallel rate towards reaching the targeted and balanced exchange rate."

Al-Nusairi explained that, "If it were not for the many services provided by the banking system in developed countries, these countries would not have been able to achieve the progress and economic growth they have achieved."

He explained that "the strength of the banking structure has become a necessity for building a prosperous economy that adopts modern systems and sound sustainable development. The development of banking habits and awareness of the importance of developing banking institutions in a way that ensures the building of a national savings base and develops the financial resources necessary to build the economy have become priorities for decision-makers."

The advisor to the Private Banks Association continued: “The soundness of the banking system and the mobilization of sound decisions in the field of economic policies towards developing and modernizing banking systems ensures the achievement of momentum in the world of real and financial investment, which stimulates financial and monetary markets, which leads to attracting foreign capital seeking profit.

Therefore, the decision-maker should take the necessary measures to fortify and strengthen local banking systems in a way that makes them capable of facing the challenges of transferring capital to and from abroad without causing money laundering or smuggling foreign currency, and then increasing the profitability of financial and banking institutions and strengthening the structure of the gross domestic product, which is what the government and the Central Bank are currently active in.” link

************

Tishwash: The sudden rise of the dollar in Iraq: Does it threaten the stability of the national economy?

Dollar prices exceed their limits: Are we facing an unprecedented cash crisis in Iraq?

Currency exchange markets in Iraq witnessed a significant increase in the exchange rate of the US dollar against the Iraqi dinar this Monday morning. Prices in the markets of Baghdad and Erbil, the capital of the Kurdistan Region, recorded a significant increase, which raises questions about the possible causes and economic impacts of these changes.

Price hike details

t the opening of the two main stock exchanges in Baghdad, Al-Kifah and Al-Harithiya, the dollar rose to 149,250 dinars for every 100 dollars, compared to 149,000 dinars recorded yesterday. In local markets, the selling price of the dollar reached 150,250 dinars, while the buying price recorded 148,250 dinars for every 100 dollars. In Erbil, the dollar also recorded an increase in exchange shops, where the selling price reached 149,400 dinars and the buying price 149,300 dinars for every 100 dollars.

Possible reasons

The rise in the dollar exchange rate is due to several possible factors, including:

Changes in supply and demand: There may be an increase in demand for the US dollar by businesses or individuals, causing the price to rise.

Global economic shifts: Changes in global economic policies and oil prices can affect currency exchange rates.

Local economic conditions: Local economic challenges, such as fiscal deficits or political tensions, may lead to exchange rate fluctuations.

Economic impacts

This increase comes at a sensitive time for the Iraqi economy, as it may lead to several noticeable economic impacts:

Increased import costs: As the dollar rises, the cost of imports will become higher, which may affect domestic prices of goods and services.

Impact on citizens: Citizens who depend on importing goods and products in dollars may be affected by an increase in the cost of living.

Impact on investment: A rise in exchange rates can have negative effects on foreign and domestic investment, as investors may look for more stable markets.

The rise in the US dollar exchange rate against the Iraqi dinar is an important issue that requires close monitoring. It is important for investors and economic decision makers to monitor developments and take the necessary steps to mitigate the potential negative effects on the national economy. link

************

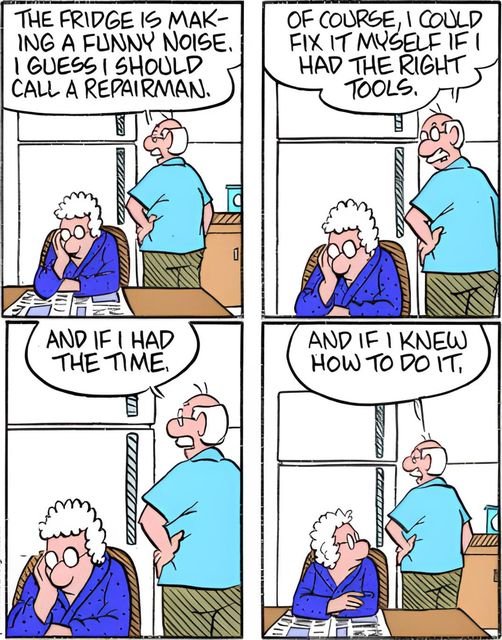

Mot: . WHAT Happened !!!!????

Mot: Important Notice !!!!

Awake-In-3D: New Podcast: Gold-Backed Currency Exchange Rates Revealed

New Podcast: Gold-Backed Currency Exchange Rates Revealed

On July 21, 2024 By Awake-In-3D

In Podcasts

In this unique episode of the Endgame GCR Podcast, Marie G and I break down the details of the new gold-backed financial and currency system soon to be unleashed on the world.

We also discover a very exciting result that fulfills one of the primary goals of the RV/GCR.

New Podcast: Gold-Backed Currency Exchange Rates Revealed

On July 21, 2024 By Awake-In-3D

In Podcasts

In this unique episode of the Endgame GCR Podcast, Marie G and I break down the details of the new gold-backed financial and currency system soon to be unleashed on the world.

We also discover a very exciting result that fulfills one of the primary goals of the RV/GCR.

https://ai3d.blog/new-podcast-gold-backed-currency-exchange-rates-revealed/

More News, Rumors and Opinions Sunday PM 7-21-2024

KTFA:

Clare: The Central Bank of Iraq imposes financial penalties on banks and exchange companies amounting to 43 billion dinars

7/21/2024

The Central Bank of Iraq announced on Sunday that fines imposed on banks and non-banking institutions (exchange companies) amounted to more than 43 billion Iraqi dinars during the past three months.

A table of the bank, which Shafaq News Agency reviewed, showed that the fines imposed on banks and financial companies during the past three months, starting from last April until the end of last June, amounted to 43 billion, 465 million, 532 thousand, and 931 dinars.

KTFA:

Clare: The Central Bank of Iraq imposes financial penalties on banks and exchange companies amounting to 43 billion dinars

7/21/2024

The Central Bank of Iraq announced on Sunday that fines imposed on banks and non-banking institutions (exchange companies) amounted to more than 43 billion Iraqi dinars during the past three months.

A table of the bank, which Shafaq News Agency reviewed, showed that the fines imposed on banks and financial companies during the past three months, starting from last April until the end of last June, amounted to 43 billion, 465 million, 532 thousand, and 931 dinars.

The table showed that “the fines also included 102 administrative penalties for these banks and non-banking institutions, distributed between warnings, alerts, and grace periods.”

The table showed that "May witnessed the highest fines on banks and non-financial institutions, as these fines reached 34 billion, 2 million, 141 thousand, and 100 dinars, with 42 administrative penalties, while June witnessed the lowest fines, reaching 2 billion, 829 million, 157 thousand, and 288 dinars, with 30 administrative penalties."

The table did not show the names of the banks that were fined and subjected to administrative penalties.

The Iraqi Stock Exchange Investors Association had criticised the Central Bank of Iraq’s increase in fines on banks, noting that it would affect the profitability of investors in the shares of these banks. LINK

************

Clare: Iraq intends to connect its electricity with Kuwait and the Gulf at the end of the year, and then with Saudi Arabia

7/21/2024

Prime Minister Mohammed Shia al-Sudani confirmed on Sunday that his government intends to link Iraq's electricity with Kuwait and the Gulf Interconnection Authority at the end of 2024, and then move to link with Saudi Arabia to diversify energy sources when demand increases during peak times in the country.

Al-Sudani said in a speech during the opening of the Iraqi-Turkish electricity linkage project, "The value and importance of this project is that it had been suspended since 2004, and it had been planned since the nineties of the last century, and today it has been completed in coordination with the Turkish Ministry of Energy."

He added, "The value of this project is that for the first time we have an international connection with neighboring Turkey and then to the European Union, and this is an important and strategic factor for energy at the future level."

Al-Sudani added, "After we were able to connect with the Jordanian side, and today with Turkey, and hopefully at the end of this year with Kuwait and the Gulf Interconnection Authority, then we will head to complete our important project with Saudi Arabia so that Iraq can complete its communication with the regional energy system in a way that allows for diversity and exchange in various conditions of peak electrical loads." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Article: "Removing the zeros from the Iraqi currency talks returns and possibility of implementation" How is that possible...without having value? ...When they talk about removing zeros from the Iraqi currency they're talking about returning to a previous era. They're talking about the glory days. I think everybody...knows in the country too, I just can't say we can prove it from a link in print. But the expectation is Iraq is going to bring value to their currency. We know that by Al-Sudan's comments...that the Iraq dinar would be 1 dollar...equal 1.32 dinar.

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

My bank guy said when the zeros come off the exchange rate it's going to change the value of our currency and then your brother who is in the Untied States of America, they can exchange their notes with the 3-zeros after the RI takes action.

************

"There's Nowhere Else To Kick The Can" | Lyn Alden

Liberty and Finance: 7-20-2024

Lyn Alden explores the diminishing impact of interest rate cuts on the U.S. economy

With interest rates now higher than in recent decades, Alden argues that the economy's insensitivity to rate changes stems from the high level of fixed-rate debt held by both consumers and businesses. She explains that, unlike past cycles, current rate cuts may have limited effects on economic activity and housing market dynamics.

She also touches on the broader implications for asset markets, including the potential impact on housing inventory and the comparative experience of Japan's long-term economic challenges.

Rick Rule: $100 Trillion Dollars in Liability; Why This is Far Worse Than Post Vietnam Dollar Crisis

Daniela Cambone: 7-20-2024

"The U.S. dollar will lose substantial purchasing power in the next 10 years," warns Rick Rule, founder and CEO of Rule Investment Media.

During this year's Rule Symposium in Florida, he explained to Daniela Cambone that exploding liabilities, including $100 billion in entitlements such as Medicare, Medicaid, and Social Security, are likely to greatly devalue the U.S. dollar. Rule also emphasized the importance of owning gold to hedge against future uncertainties.

“I own gold because I'm afraid it's going to go to $8,000 or $9,000 or $10,000. I really want to be wrong. And you own gold hoping you'll never have to sell it,” he concludes. Watch the powerful video to learn more about his thoughts.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 7-21-24

Good Afternoon Dinar Recaps,

SOUTH KOREA'S STRICT LAWS ON CRYPTO EXCHANGES COME INTO FORCE

The new regulations issued by South Korea’s watchdog to protect user assets on crypto exchanges went into effect on July 19.

The much-talked-about new regulations from South Korea’s financial security regulator, designed to protect users buying and storing crypto assets with virtual asset service providers (VASPs), came into force on July 19.

Titled the “Virtual Asset User Protection Act,” VASPs must take several steps to ensure the protection of user’s crypto, according to a July 17 statement from South Korea’s Financial Services Commission (FSC).

Good Afternoon Dinar Recaps,

SOUTH KOREA'S STRICT LAWS ON CRYPTO EXCHANGES COME INTO FORCE

The new regulations issued by South Korea’s watchdog to protect user assets on crypto exchanges went into effect on July 19.

The much-talked-about new regulations from South Korea’s financial security regulator, designed to protect users buying and storing crypto assets with virtual asset service providers (VASPs), came into force on July 19.

Titled the “Virtual Asset User Protection Act,” VASPs must take several steps to ensure the protection of user’s crypto, according to a July 17 statement from South Korea’s Financial Services Commission (FSC).

These include:

1. taking out insurance against hacking and malicious attacks against the user’s crypto assets,

2. keeping the customer’s crypto assets separate from the exchange’s assets, and

3. a requirement to keep customer deposits “safely kept in banks.”

VASPs are also required to maintain a certain level of due diligence to prevent money laundering on their platforms and must report any suspicious transactions to the regulator.

“VASPs should maintain a surveillance system for suspicious transactions at all times and immediately report suspicious trading activities to the Financial Supervisory Service (FSS),” it stated.

“After going through investigations by the financial and investigative authorities, those who are found to have engaged in unfair trading activities may be subject to criminal punishment or penalty surcharge,” it added.

Concerns among South Korean crypto exchanges

Crypto exchanges in South Korea have recently voiced concerns that the rules would result in them simultaneously delisting a mass of tokens.

On July 3, Cointelegraph reported that a group of 20 South Korean crypto exchanges will review a total of 1,333 cryptocurrencies over the next six months as part of the new crypto user protection laws, meaning “the possibility of mass delisting occurring all at once is unlikely,” according to the Digital Asset Exchange Alliance (DAXA).

Meanwhile, South Korea’s ruling party, the People’s Power Party, officially proposed delaying the implementation of the country’s tax on crypto trading profits.

On July 12, the party submitted the proposal and noted that current sentiment toward crypto assets was deteriorating. The description stated that rapidly imposing taxes on virtual assets is “not advisable at this time.”

@ Newshounds News™

Read more: Crypto Telegraph

~~~~~~~~~

CDP ISSUES DIGITAL BOND ON POLYGON BLOCKCHAIN USING NEW ITALIAN LAW

Italy’s Cassa Depositi e Prestiti Spa (CDP) issued a €25 million digital bond on the Polygon public blockchain, which was underwritten by Intesa Sanpaolo as the sole investor.

The issuance is part of the European Central Bank’s (ECB’s) wholesale DLT settlement trials.

Hence, the payment was made in central bank money using the Bank of Italy’s TIPS Hash Link solution, which provides connectivity between a DLT and the TARGET2 system for wholesale payments.

CDP is a development bank majority owned by the Ministry of Economy and Finance.

The settlement of a public blockchain bond issuance with central bank money wasn’t the only novel aspect of the digital bond. It is also the first to use Italy’s ‘Fintech decree’ law.

This was Italy’s enactment of the DLT Pilot Regime, but also applies to DLT issuances that are not part of the Pilot Regime (like this one), provided they take some extra steps.

There must be a Digital Register maintained by a Digital Register Manager which is authorized by Consob, Italy’s securities regulator. The Register is a log of the real names and details of the owners of the securities.

“This transaction represents a significant step for CDP in capital market innovation through the pioneering adoption of blockchain technology for bond issues,” said Fabio Massoli, CDP’s Director of Administration, Finance, Control and Sustainability.

“The promotion of a new market ecosystem and the implementation of an innovative, efficient and secure market infrastructure will provide added value to issuers and investors alike, opening up new opportunities for other players, including SMEs.”

Fintech Decree Digital Registers

The Digital Register is similar to Germany’s eWpG law. In both cases they support direct securities issuances and transactions without requiring central securities depositories (CSDs) or bank intermediaries. However, we believe Italy may have gone a step further because it allows issuers to be the Digital Register Manager for their own securities.

That’s the case here – CDP had the role of the Market DLT Operator and also the Consob authorized Digital Register Manager. But we believe this also applies where the issuer/manager is not a bank.

“We are particularly pleased to have been the first in Italy, together with CDP, to carry out an operation that is intended to be the point of reference for future issuers in a totally new legal and regulatory framework,” said Massimo Mocio, Deputy Chief and Head of Global Banking & Markets, IMI CIB Division of Intesa Sanpaolo.

A key goal of the ECB wholesale settlement trials is to test the interoperability between DLT networks and central bank money, both conventional and CBDC. Hence, the transactions involve delivery versus payment in most cases. However, CDP said the settlement for its digital bond was ‘same day’.

Meanwhile, the digital bond has a four month term. It was rated A-2 by S&P, F-2 by Fitch and S-2 by Scope.

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

Silver (XAG) Forecast: Gold Divergence Widens; Is Silver Undervalued or Overextended?

Key Points:

—Silver prices struggle as gold reaches new heights. The widening gold-silver ratio suggests potential undervaluation of the white metal or gold overvaluation.

—Silver's break below the 50-day moving average at $30.19 signals a technical breakdown. Sellers target $28.57, with further decline possible to $27.22-$26.60 zone.

—Weak Chinese manufacturing data raises concerns about silver's industrial demand. This aspect contributes to silver's underperformance compared to gold.

—Fed rate cut expectations drive precious metals. A 98% probability of a September cut may create a buy the rumor, sell the fact scenario for silver and gold.

—Asian physical demand for silver remains sluggish. Customers capitalize on high prices by selling existing holdings rather than making new purchases.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

NIGERIA EMBRACES BLOCKCHAIN NATIONAL INFRASTRUCTURE INITIATIVE GAINS MOMENTUM

Government Pushes for Data Security and Privacy

The Nigerian Federal Government’s initiative to develop an indigenous blockchain infrastructure has garnered substantial support from the National Blockchain Policy Implementation Steering Committee. Two weeks prior, the government revealed its plans to establish a homegrown blockchain, emphasizing the importance of data security and privacy in this endeavor.

Endorsement from Key Stakeholders

Chimezie Chuta, Chairman of the Committee, expressed strong approval of the initiative during a discussion with The PUNCH. He regarded the concept of a national blockchain infrastructure as a significant and positive step forward.

Chuta highlighted that other countries, including India, China, the UAE, South Korea, and Singapore, have already established their blockchain infrastructures, suggesting that Africa’s third-largest economy should not lag behind.

Comparative Analysis and Future Prospects

In comparing Nigeria’s blockchain aspirations to those of other nations, Chuta underscored the potential for significant advancements in data security, economic efficiency, and technological innovation. By establishing a national blockchain, Nigeria aims to join the ranks of countries that have successfully integrated this technology into their national frameworks.

Broader Implications for the Nigerian Economy

The push for a national blockchain infrastructure is a move that could bring benefits to the Nigerian economy. The implementation of such technology promises to streamline various sectors, improve transparency, and foster a more secure and efficient data management system. This could potentially attract foreign investment and bolster confidence in Nigeria’s technological capabilities.

Moreover, the development of a national blockchain could provide a platform for various industries to innovate and collaborate more effectively. By supporting smart contracts and offering a scalable and efficient infrastructure, the blockchain could facilitate new business models and drive economic growth.

Addressing Regulatory and Compliance Challenges

A consortium-based blockchain model, as advocated by Chuta, would also address regulatory and compliance challenges more effectively. By involving multiple stakeholders in governance, this model ensures that the blockchain operates within a framework that supports regulatory oversight and compliance, thereby enhancing its credibility and reliability.

Conclusion: A Strategic Move Towards Technological Advancement

The Nigerian government’s initiative to establish a national blockchain infrastructure represents a strategic move towards embracing advanced technology for national development. With strong backing from key stakeholders and the potential for significant economic and technological benefits, this initiative is poised to position Nigeria as a leader in blockchain technology within Africa and beyond.

As the country moves forward with this ambitious project, the focus will be on ensuring that the infrastructure is robust, secure, and capable of meeting the demands of a modern digital economy.

@ Newshounds News™

Read more: Coin Trust

~~~~~~~~~

PHYSICAL CARDS: The Unexpected Frontier in Digital Security

Dr. Adam Lowe, chief product and innovation officer at CompoSecure, hears it all the time from banking executives when the topic is securing payments: “We cannot introduce friction.” But the balancing act is a tough one. Challenge a user too much and they’ll switch to a competitor. Challenge them too little, and the customer’s financial injury may be calamitous.

In this age of digital attacks and global hacks, banks, FinTechs and platforms face a dilemma. One need only look at the size and scope of the AT&T breach to see that hackers have been able to access, co-opt and use all manner of data to power their scams, and perhaps, cobble together synthetic identities. SMS texts are not as secure as they once were, given the fact that imposters can be the ones behind the SMS missive that seeks user confirmation to complete a transaction.

Among the best lines of defense and security, he said, is something that just about everyone has in their possession: a tangible, physical card. And the card, he said, ticks all the boxes of a robust and usable form of identity protection, as the technology has proven simple enough that even his mother feels comfortable using it, and as tap-to-pay has become a feature ingrained in daily financial life.

CompoSecure’s digital security platform, Arculus, streamlines digital authentication processes and secures digital assets, underpinned by the blockchain. CompoSecure, he said as part of the “What’s Next in Payments” halftime report, “essentially invented the metal card,” and now, with the digital Arculus platform, has extended the capabilities of a payment card.

“We’re seeing more customers rolling out our Arculus technology,” he said, “whether it be the wallet technology, and having digital assets alongside a payment card … or whether it’s the authenticate technology, which is for more traditional banks and for FinTechs.”

A Pocket-Sized Cryptography Engine

With enhanced digital security features, he said, the card “essentially becomes a cryptography engine in your pocket.”

The chip that’s embedded in the card, he said, serves as that aforementioned engine. To enhance the digital experience, he said, the company debuted the Arculus Cold Storage Wallet, which is the digital asset hardware wallet, which puts “keys” on the card for any user to store and use those keys for security to support and pay with crypto assets.

In addition, leveraging similar key technology, Arculus Authenticate allows users to tap their cards to authenticate themselves via a passkey that’s stored on those cards. These cards with Arculus Authenticate can also accept payments, so consumers can login, sign and approve payments.

“Instead of being synched to the cloud,” he said, of the data, “where it can be ‘ripped’ out of the cloud by bad actors, your passkeys are safe in your pocket the same way your keys to the front door of your house are safe in your pocket.”

And, he added, “whether it’s signing Visa transactions, or MasterCard, FIDO 2, or whether it’s signing Bitcoin and Ethereum transactions, that cryptography engine is happy … we can serve whatever market segment needs to be served by design, and we can make it all interoperable.”

That interoperability, he said, is a bit like bridging all the railroads back in the 1890s, as a range of different track gauges knit together to make everything work, east to west and vice versa. In this case, the various parties in a transaction using zero trust architecture standards as transactions move along various conduits.

According to the U.S. Department of Commerce, zero trust architecture is the term for “an evolving set of cybersecurity paradigms that move defenses from static, network-based perimeters to focus on users, assets and resources.” It assumes no implicit trust based on physical or network location.

@ Newshounds News™

Read more: PYMNTS

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Sunday 7-21-2024

Financial System "Revamp" Is Coming | Kerry Lutz

Liberty and Finance: 7-20-2024

Kerry Lutz joins Dunagun Kaiser to discuss the evolution of the financial system and the impact of media on financial discourse. They reflect on how podcasting and independent media have transformed financial discussions compared to a decade ago.

The conversation critiques mainstream media's homogenization and its effect on public understanding of economic issues.

Lutz also explores recent economic crises and the role of new technologies. He offers a forward-looking perspective on how emerging trends could reshape the financial landscape.

Financial System "Revamp" Is Coming | Kerry Lutz

Liberty and Finance: 7-20-2024

Kerry Lutz joins Dunagun Kaiser to discuss the evolution of the financial system and the impact of media on financial discourse. They reflect on how podcasting and independent media have transformed financial discussions compared to a decade ago.

The conversation critiques mainstream media's homogenization and its effect on public understanding of economic issues.

Lutz also explores recent economic crises and the role of new technologies. He offers a forward-looking perspective on how emerging trends could reshape the financial landscape.

INTERVIEW TIMELINE:

0:00 Intro

1:30 LibertyAndFinance & Kerry Lutz

7:00 Financial Survival Network

18:40 The future financial landscape

De-Dollarization Alarms the U.S. Economy: Will BRICS Adopt a New Currency?

Wealth Insights: 7-20-2024

Russia and China have drastically reduced their reliance on the US dollar, with over 90% of their trade now conducted in rubles and yuan. This shift is part of a broader de-dollarization strategy to decrease dependency on the US-led financial system.

Chinese banks in Russia have stopped processing dollar and euro settlements, making the yuan the most traded currency on the Moscow Exchange.

This move aligns with BRICS nations' efforts to establish a new currency to rival the US dollar. Join us as we explore the implications of this significant economic shift.

"All HELL BREAKS LOOSE" (In the Next Few Months) says FED Insider, Danielle DiMartino Booth

Sachs Realty: 7-20-2024

Everyone's getting fired across all industries, says Danielle. U.S. recession is here and the housing market is crashing.

“Tidbits From TNT” Sunday 7-21-2024

TNT:

Tishwash: Angry protesters compare salaries to presidencies, threaten sit-in in Baghdad

Hundreds of employees of Iraqi state departments and institutions demonstrated today, Saturday, in front of the fortified Green Zone in central Baghdad, demanding an amendment to the salary scale.

Employee Wissam Ahmed told Shafak News Agency, "We went out today to demand that the government and parliament amend the salary scale and address the differences in classes for state employees."

TNT:

Tishwash: Angry protesters compare salaries to presidencies, threaten sit-in in Baghdad

Hundreds of employees of Iraqi state departments and institutions demonstrated today, Saturday, in front of the fortified Green Zone in central Baghdad, demanding an amendment to the salary scale.

Employee Wissam Ahmed told Shafak News Agency, "We went out today to demand that the government and parliament amend the salary scale and address the differences in classes for state employees."

He added, "There is inequality and injustice in employees' salaries," indicating that "an employee in the Council of Ministers, Parliament, and the three presidencies receives a salary of 3 million dinars per month, while someone of the same rank in another ministry receives only 500,000 dinars."

For his part, the employee in the Ministry of Education, Ahmed Munim, said in an interview with Shafaq News Agency, "The demonstration is not the first, and it will not be the last for all employees to demand the establishment of a new salary scale based on justice and fairness, in which the amendment of risk allowances is also taken into account," adding that "the demonstration committee met a month ago with Prime Minister Mohammed Shia al-Sudani to amend the salary scale without reaching a solution."

Munim continued, saying, "The demonstration will turn into a comprehensive sit-in if our demands are not met."

Earlier today, Iraqi parliament member Raed Al-Maliki held the Council of Ministers responsible for not amending the salary scale for employees and workers in the public sector, renewing his demand for the federal government to send the Federal Civil Service Council Law for the purpose of legislating it.

Al-Maliki said in a joint press conference held with a number of his colleagues and members of the House of Representatives, "There is another legal path related to the salary scale, which is done through amending the Federal Civil Service Law or legislating a new Civil Service Law."

He explained that "we had in the Iraqi parliament a draft federal civil service law that combines four laws, including the salary scale law," stressing that "the Council of Ministers withdrew this service law, and it was not returned to parliament again despite repeated demands from the representatives."

Al-Maliki pointed out that "the issue of amending the salary scale law is not with the House of Representatives and the delay is not from it, but the entire issue is with the Iraqi government because it has a financial aspect," stressing the parliament's readiness to amend the salary scale if the Council of Ministers sends the Federal Service Law at any time. link

************

Tishwash: Electronic payment products meet the needs of citizens

A responsible source in the global smart card company “Ki” described the current electronic payment products as “acceptable”, but the Iraqi market needs more in a way that makes the citizen’s life easier.

He said: The company realizes the extent of the Iraqi market's need for advanced financial services, especially after Iraqi society opened up to the world and it became easy to communicate and learn about global experiences.

He added that the support of the government and the Central Bank of Iraq represents an incentive to expand the range of products offered to a wide segment of Iraqi society, especially since interaction with electronic payment continues.

He pointed out that being present in all places and providing services to citizens in a manner that suits their needs represents a lofty goal for the company’s management and its work team. link

************

Tishwash: Parliamentary Committee Calls for Substantial Amendments to Investment Law to Attract Foreign Investments

The Iraqi Parliamentary Committee on Economy and Development called on the Iraqi government to make amendments to 12 paragraphs of the current investment law, with the aim of improving the investment environment and attracting foreign investments to the country.

The committee chairman, Hassan Al-Khafaji, explained that the committee discussed with the relevant parties, including university deans and the National Investment Commission, ways to improve the Iraqi investment law.

l-Khafaji stated that the committee was able to obtain the government’s approval to amend 4 out of 12 articles that were proposed, but he considered that the amendments that were approved “are still below the required level.”

Among the most important points discussed by the committee was one related to investment opportunities that investors obtain. Al-Khafaji pointed out that some unsound companies exploit these opportunities, which leads to the flight of capital and the disruption of projects.

Al-Khafaji stressed that the committee is striving to change this paragraph of the law, to ensure that serious investors have real opportunities to invest in Iraq.

In addition to the amendments to the investment law, the committee also discussed several other economic laws, including laws to combat price increases and open new cities.

These efforts by the committee come within the framework of its efforts to improve the Iraqi economy and attract foreign investments, which will create new job opportunities and improve the standard of living of citizens. link

************

Mot: Soooooo Thoughtful!!! -- siigghhhhhh

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 7-20-24

Good Afternoon Dinar Recaps,

JORDAN LAUNCHES NATIONAL TECHNOLOGY NETWORK

The Ministry of Digital Economy and Entrepreneurship in Jordan has launched a national blockchain technology network in partnership with Jordanian blockchain company Blockexe. The implementation of blockchain technology in Jordan’s government sector aligns with the Jordanian Digital Transformation Strategy (2021-2025).

Enhancing Trust in Government Services

On July 17, the Jordanian Ministry of Digital Economy and Entrepreneurship announced its partnership with local blockchain company Blockexe to launch a national blockchain technology network called Modee Dlt. This protocol aims to enhance trust and transparency in government services.

The blockchain network has been integrated with the Jordanian government portal, allowing for decentralized and verifiable digital records of all Sanad transactions. According to a report, this implementation aligns with the Middle Eastern nation’s Digital Transformation Strategy (2021-2025), which focuses on strengthening the country’s digital infrastructure.

Good Afternoon Dinar Recaps,

JORDAN LAUNCHES NATIONAL TECHNOLOGY NETWORK

The Ministry of Digital Economy and Entrepreneurship in Jordan has launched a national blockchain technology network in partnership with Jordanian blockchain company Blockexe. The implementation of blockchain technology in Jordan’s government sector aligns with the Jordanian Digital Transformation Strategy (2021-2025).

Enhancing Trust in Government Services

On July 17, the Jordanian Ministry of Digital Economy and Entrepreneurship announced its partnership with local blockchain company Blockexe to launch a national blockchain technology network called Modee Dlt. This protocol aims to enhance trust and transparency in government services.

The blockchain network has been integrated with the Jordanian government portal, allowing for decentralized and verifiable digital records of all Sanad transactions. According to a report, this implementation aligns with the Middle Eastern nation’s Digital Transformation Strategy (2021-2025), which focuses on strengthening the country’s digital infrastructure.

Under Jordan’s ambitious strategy, innovation, as well as private and public sector partnerships, are seen as key enablers; hence, they are encouraged. Investments in critical information technology infrastructure, including broadband expansion and 5G deployment, are similarly viewed as important enablers. When achieved, these and five other enablers help Jordan improve the quality of life for its citizens.

Meanwhile, the Ministry emphasized that utilizing the blockchain network across various government sectors will create a reliable digital environment, supporting the Kingdom’s broader goals of achieving a robust and trustworthy digital economy.

In addition to enhancing trust in government, this initiative aims to streamline the integration of e-government services, making them more transparent, efficient, and competitive both locally and internationally.

@ Newshounds News™

Read More: Bitcoin News

~~~~~~~~~

BANK OF INTERNATIONAL SETTLEMENTS ISSUE NEW RULES FOR XRP

"The BIS, which positions itself as a bank for central banks globally, has introduced new regulations governing banks’ exposure to Group 2 cryptocurrencies. Notably, the BIS had in the past defined what Group 2 crypto assets are in an effort to separate them from other cryptocurrencies."

"Group 2 assets include unbacked crypto assets such as XRP, Bitcoin (BTC), and Ethereum (ETH). The category also contains stablecoins that lack effective stability mechanisms. According to the BIS’ classifications, these assets are riskier due to their volatility."

"In the latest requirements, the BIS has stipulated that a bank’s total exposure to all these Group 2 assets must not exceed 1% of its Tier 1 capital. For the uninitiated, the Tier 1 Capital represents a bank’s core capital."

"This capital is the primary financial buffer that absorbs losses, ensuring the bank’s stability. Per the BIS requirement, if a bank with $1 trillion in Tier 1 Capital seeks to hold XRP and other assets in Group 2, the combined worth of all assets must not be more than $10 billion."

"Crypto regulations have taken focus in recent times as the industry pushes further into the mainstream scene. For instance, the European Union recently enacted the first part of its MiCA regulations, affecting stablecoins.

"Mainstream banks have begun gaining exposure to crypto assets. Recall that last December the Basel Committee disclosed the crypto holdings of 19 banks across different regions. The disclosure confirmed that these banks held $205 million in XRP at the time.

Despite this, XRP has not commanded as much adoption from banks and financial institutions due to the ongoing SEC lawsuit. Anderson, a crypto researcher, argued in February that XRP might not see increased adoption by banks until the U.S. SEC publicly declares it is not a security."

"Per the publication, the BIS’ recent requirements are set to take effect on JANUARY 1, 2026"

@ Newshounds News™

Read more: Crypto News

~~~~~~~~~

THE CENTRAL BANK OF THE UAE (CBUAE) and NATIONAL BANK OF ETHIOPIA (NBE) have signed an agreement to enhance financial and commercial co-operation between the two nations, in a deal worth AED 3 billion.

"Both parties also entered into two Memorandum of Understanding (MoU) to establish a framework for the use of LOCAL CURRENCIES in settling cross-border transactions and for linking their payment and messaging systems.

The agreement allows the CBUAE and the NBE to SWAP LOCAL CURRENCIES with a nominal value of up to AED 3 billion and ETB 46 billion, supporting the financial and commercial cooperation between the UAE and Ethiopia through the provision of LIQUIDITY IN LOCAL CURRENCIES to financial markets, enabling more effective and efficient settlement of cross-border transactions."

"Both parties will cooperate under the second MoU in the areas of PAYMENT PLATFORM SERVICES and ELECTRONIC SWITCHES, by interlinking their instant payment systems, national card switches UAESWITCH and ETHSWITCH, and messaging systems in accordance with the regulatory requirements of each country, in addition to the cooperation in the field of financial technology and CENTRAL BANK DIGITAL CURRENCIES."

"“The bilateral CURRENCY SWAP AGREEMENT and the MoUs signed today reflect the robust economic cooperation between the UAE and Ethiopia, specifically in the areas of trade and investment. SWAPPING THE CURRENCIES of the two countries and utilizing LOCAL CURRENCIES to settle cross-border transactions and enhancing the cooperation in interlinking instant payment systems, electronic switches and messaging systems will enhance economic, trade, and investment prospects. "

"The currency swap arrangement provides an important funding opportunity for Ethiopia and helps diversify the range of currencies at its disposal to facilitate the growing volume of trade and investment transactions expected over the coming years."

@ Newshounds News™

Read more: ARN News Center

~~~~~~~~~

P

~~~~~~~~~

Currency Swaps: Definition, How and Why They're Done

"A currency swap involves the exchange of interest—and sometimes of principal—in one currency for the same in another currency.

Companies doing business abroad often use currency swaps to get more favorable loan rates in the local currency than if they borrowed money from a local bank.

Considered to be a foreign exchange transaction, currency swaps are not required by law to be shown on a company's balance sheet.

Interest rate variations for currency swaps include fixed rate to fixed rate, floating rate to floating rate, or fixed rate to floating rate."

" Currency swaps were originally done to get around exchange controls, governmental limitations on the purchase and/or sale of currencies. Although nations with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies, most developed economies have eliminated controls nowadays."

"So swaps are now done most commonly to hedge long-term investments and to change the interest rate exposure of the two parties. Companies doing business abroad often use currency swaps to get more favorable loan rates in the local currency than they could if they borrowed money from a bank in that country."

"Currency swaps are important financial instruments used by banks, investors, and multinational corporations."

"In a currency swap, the parties agree in advance whether or not they will exchange the principal amounts of the two currencies at the beginning of the transaction. The two principal amounts create an implied exchange rate. For example, if a swap involves exchanging €10 million versus $12.5 million, that creates an implied EUR/USD exchange rate of 1.25. At maturity, the same two principal amounts must be exchanged, which creates exchange rate risk as the market may have moved far from 1.25 in the intervening years. "

@ Newshounds News™

Read more: Investopedia

~~~~~~~~~

DIGITAL RUSSIAN RUBLE CBDC

"Putin wants to speed up deployment of Russia’s CBDC.

During a meeting on economic issues earlier this week, Vladimir Putin seemed keen for Russia’s central bank digital currency (CBDC) pilots to accelerate, according to Russian news agency TASS.

“Now we need to take the next step, namely to move to a broader, full-scale implementation of the digital ruble in the economy, in economic activity and in the field of finance,” he said. Digital ruble trials started in August last year after months of delays waiting for supporting legislation.

The first wave of tests involved a dozen banks, with a second wave due to start in September with up to 19 additional banks, including Russia’s largest, Sber."

"“It is important for Russia to ‘seize the moment’, as they say, to create the legal framework and regulation in a timely manner, to develop infrastructure, to create conditions for the circulation of digital assets, both within the country and in relations with foreign partners,” he said."

"Russia already has a digital financial asset (DFA) framework for tokenized assets, including commodities such as gold. The usage of DFA such as tokenized gold for payments is banned. However, the country recently passed legislation supporting their use for cross border payments. Plus, Iran said it was working with Russia on CBDC and tokenized asset payments."

"Likewise, the central bank governor recently said that it was acceptable to use cryptocurrencies for international payments if it helps address sanctions"

"This underlines Putin’s desire to accelerate other modes of payment, particularly new digital technologies such as CBDC and digital assets that sidestep the West."

@ Newshounds News™

Read more: Ledger Insights

https://www.ledgerinsights.com/putin-wants-to-speed-up-deployment-of-russias-cbdc/

~~~~~~~~~

CBDC ADOPTION IS A MATTER OF "WHEN" NOT "IF"