8 Frugal Habits Americans Are Ridiculed for — and Why You Shouldn’t Care

8 Frugal Habits Americans Are Ridiculed for — and Why You Shouldn’t Care

May 10, 2025 by Cindy Lamothe Saving Money / Savings Advice

Being frugal sometimes feels like a dirty little secret. You clip coupons, skip the fancy lattes and patch up your clothes instead of tossing them — only to get teased for it.

But here’s the thing: a lot of those so-called “cheap” habits are actually wise financial moves, especially with reports of a possible recession, according to Forbes.

Frugal habits that often get mocked tend to reflect a broader culture of individualism and self-reliance, said Andreas Jones, founder and editor of KindaFrugal.

8 Frugal Habits Americans Are Ridiculed for — and Why You Shouldn’t Care

May 10, 2025 by Cindy Lamothe Saving Money / Savings Advice

Being frugal sometimes feels like a dirty little secret. You clip coupons, skip the fancy lattes and patch up your clothes instead of tossing them — only to get teased for it.

But here’s the thing: a lot of those so-called “cheap” habits are actually wise financial moves, especially with reports of a possible recession, according to Forbes.

Frugal habits that often get mocked tend to reflect a broader culture of individualism and self-reliance, said Andreas Jones, founder and editor of KindaFrugal.

*******************************

“Things like splitting two-ply toilet paper into single-ply sheets or turning off the air conditioning in the middle of a heatwave can sound extreme, but they stem from a deeper focus on stretching every dollar, especially in areas with high living costs or medical debt,” Jones said.

Extreme Couponing

From what he’s seen with his clients, Andrew Lokenauth, money expert and owner of BeFluentInFinance, said extreme couponing gets the most eye rolls and jokes.

“But here’s the thing — I’ve watched people save $300 plus per month just by spending a few hours organizing their coupons.”

One of his clients built a $15,000 emergency fund in 18 months through couponing alone.

“Yeah, it takes time to clip and organize, but the ROI is insane,” he added.

Buying Generic Brands

Buying generic brands is another one people love to mock. Working in finance, Lokenauth said he can’t count how many times he’s heard “but the name brand tastes better.”

“Listen, I’ve done blind taste tests with my clients — they literally can’t tell the difference 80% of the time,” Lokenauth said.

He said the markup on name brands is sometimes 50% higher just for prettier packaging. That’s real money you’re throwing away.

In most cases, generic products are made in the same factories, with nearly identical ingredients. You’re paying extra for the logo, not the quality.

From pantry staples and cleaning supplies to over-the-counter meds, switching to store brands can shave hundreds off your annual grocery bill without changing much about your actual lifestyle.

Maintaining a Fixed Thermostat

Another mockable habit Lokenauth noted was folks keeping the thermostat at 68 degrees in winter and 78 degrees in summer.

“People act like you’re torturing yourself, but your body adapts in about two weeks,” he said.

He personally saved $175 a month last summer by doing this — and he lives in Texas.

His advice? Put on a sweater in winter, use fans in summer. Your bank account will thank you.

Use This Checklist to See if Your Family is Financially Secure

Use This Checklist to See if Your Family is Financially Secure

By Laura Bogart April 30, 2025 GoBankingRates

You work hard to take care of your family, and you’re proud to do it. And one of the most important things is making sure your family is financially secure.

But financial security can be tough to define — how do you know when you’ve achieved it? Fortunately, there are some tangible things you can do that will financially benefit you and your family in the long term. Some of them are small, like starting that emergency fund, and others are bigger picture, like sitting down with a professional to look into investment strategies or life insurance packages.

Use This Checklist to See if Your Family is Financially Secure

By Laura Bogart April 30, 2025 GoBankingRates

You work hard to take care of your family, and you’re proud to do it. And one of the most important things is making sure your family is financially secure.

But financial security can be tough to define — how do you know when you’ve achieved it? Fortunately, there are some tangible things you can do that will financially benefit you and your family in the long term. Some of them are small, like starting that emergency fund, and others are bigger picture, like sitting down with a professional to look into investment strategies or life insurance packages.

When in doubt, take a deep breath and sit down with this checklist.

1. Build An Emergency Fund

If there’s one thing you know by now, it’s that life happens — and it’s often pricey. Whether you’re hit with a sudden accident, job loss or other blow to your income, you want to know that you’re able to protect your family’s finances when it does. Having an emergency fund is one of the biggest safeguards you can build around your family’s future.

Every month you should be allocating some of your income, as well as any extra funds you get, to a high-yield savings account, with the ultimate goal of putting away at least three months’ worth of expenses — and ideally six months’ worth. But start small and build momentum as you save.

2. Secure the Right Life-Insurance Package

Having the right life-insurance policies insulates your loved ones from financial hardship while presenting you with a unique opportunity to actually grow your wealth. Sitting down with an expert advisor from New York Life can give you personalized guidance about the best policies to keep your family secure.

There are a few main options to consider: Permanent life insurance policies (such as whole life) are designed to provide long-term — often lifelong — coverage. As long as you continue to pay your premiums, your coverage will be there for you whenever you need it.

Term life insurance policies provide temporary protection that lasts for a set period of time. In many cases, the coverage can be renewed, but only up to a specific age, and your premiums will generally go up with each renewal.

The sooner you start the process, the lower your premiums can potentially be, and you have the option to keep them level for five, 10 or even 20 years.

You can also explore a universal or variable universal life insurance policy. Variable universal life¹ gives you the option to invest your funds in the market, giving you an opportunity to grow the cash value of your policy — and the amount you’d be able to leave your loved ones. With the growth potential, of course, there is a market risk. The best thing to do is talk with an agent to see what makes the most sense for you and your family.

3. Make Sure You’re Insured Against Income Loss

It’s important to plan for the unexpected. If you were suddenly unable to work due to a sickness or injury, you’d want to be sure you could still provide for your family. That’s why it’s important to protect your income with individual disability insurance.

4 Reasons To Give Your Adult Child Money

4 Reasons To Give Your Adult Child Money (And 2 Reasons Not To)

January 8, 2025 by Cindy Lamothe Money / Financial Planning

Like all things in life, too much of a good thing can go very, very wrong — particularly, when it comes to doling out money to adult kids.

According to experts, there are many appropriate instances when help is needed, and then there are times when doing so can hinder an adult child’s growth.

Here are the financial situations in which it is okay to give a grown child money — and when not to.

4 Reasons To Give Your Adult Child Money (And 2 Reasons Not To)

January 8, 2025 by Cindy Lamothe Money / Financial Planning

Like all things in life, too much of a good thing can go very, very wrong — particularly, when it comes to doling out money to adult kids.

According to experts, there are many appropriate instances when help is needed, and then there are times when doing so can hinder an adult child’s growth.

Here are the financial situations in which it is okay to give a grown child money — and when not to.

To Help With a Down Payment on a Home

“I suggest that contributing to your adult child’s down payment is a meaningful way to provide generational support,” said Max Avery, a Chief Business Development Officer at Syndicately.

He said this investment in their stability gives them a solid financial start, as homeownership often builds long-term wealth.

“This includes gaining access to favorable mortgage terms and avoiding costly rental payments.”

To Fund Emergency Expenses

Avery noted that the best way to offer monetary support is to cover emergency needs like car repairs, legal issues or temporary unemployment that prevent your child from spiraling into debt or compromising their financial stability.

“This support should not be a long-term solution, but rather a temporary boost to help your child stay on track.”

Help With Major Life Transitions

David Cooper, PsyD, therapist and strategic advisor of Yung Sidekick, observed that helping with money during tough transitions is a good reason to help adult children with money, as a way to make big life changes less stressful.

TO READ MORE: https://www.gobankingrates.com/money/financial-planning/reasons-give-adult-child-money/

3 ‘Normal’ Money Habits That Could Ruin You Financially

3 ‘Normal’ Money Habits That Could Ruin You Financially — What to Do Instead

Sarah Li Cain Mon, July 7, 2025 GOBankingRates

Everyone makes mistakes. But some have more dire consequences than others. While the occasional dinner out or spending money on lattes (is this still a big deal?) may set you back a bit financially, it’s not the end of the world.

There are some money habits though, that if not kept in check, could ruin your financial future. Here are three of them, and what habits you can replace them with instead.

3 ‘Normal’ Money Habits That Could Ruin You Financially — What to Do Instead

Sarah Li Cain Mon, July 7, 2025 GOBankingRates

Everyone makes mistakes. But some have more dire consequences than others. While the occasional dinner out or spending money on lattes (is this still a big deal?) may set you back a bit financially, it’s not the end of the world.

There are some money habits though, that if not kept in check, could ruin your financial future. Here are three of them, and what habits you can replace them with instead.

Save What’s Left Over After Spending

While committing to saving after accounting for your spending sounds great in theory, the truth is that it may not be the best move. Maybe you have larger than expected bills for one month, or you decide to take your friend out for dinner.

All of this spending adds up, and you may find that you’ll have nothing at the end of the month to go towards savings.

Instead, consider a popular method called “pay yourself first.” Here, you set a savings goal, whether a percentage or a fixed dollar amount. Then, at the beginning of each month, or whenever you get paid, you transfer the savings to another account. Whatever is left over is for you to spend, guilt-free.

That way, you know you’re consistently reaching your savings goals.

Forgetting About Ongoing Maintenance Costs

Budget is just as much about understanding your spending now as much as projecting or estimating the amount you’ll spend in the future. Forgetting about future costs like maintenance for large ticket purchases can wreak havoc on your budget.

For example, when you buy a car, ongoing expenses include regular oil changes, replacing or rotating tires and any repairs. Even smaller items like a bicycle also need ongoing maintenance.

To help you understand what the “true” cost of an item you’re about to buy could set you back, do an online search to look at average estimated costs for maintenance.

Data from Kelly Blue Book found that average repairs cost car owners $838 each year, though different models may cost more. Consumer Reports is a popular trusted source, and frequently conducts research on various car brands and ranks them according to repair and maintenance costs.

Once you understand what you could pay, factor them into your budget to see whether you can truly afford the item.

Not Having a Buffer Amount Set Aside

TO READ MORE: https://www.yahoo.com/lifestyle/articles/3-normal-money-habits-could-110116246.html

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

This huge transfer of wealth has caused a lot of debate about whether or not leaving your kids a living inheritance is a good idea. Keep reading as we look into some reasons why retired boomers should not leave their kids a living inheritance and a couple of reasons why they should.

Why You Shouldn’t Leave Your Kids a Living Inheritance

Risking Your Own Financial Security

It’s common to want to see your kids succeed. This is true not only with their careers but also financially. Seeing them experience things like purchasing a home or traveling the world can give you self-gratification because you can witness and enjoy their success.

However, you also need to think about your own needs. If you plan to provide your kids with an inheritance while you’re still alive, it’s important to do so carefully. What happens if an unexpected expense pops up? Are you still going to have the funds available to continue living your current lifestyle?

Family Resentment

If you have multiple children that you’re planning to leave an early inheritance for, you need to do so carefully. It’s easy to leave cash assets and know the distribution is even. But what if you’re planning to leave someone with a business or real estate?

These types of assets can have fluctuating values, and if one dependent receives something that becomes more valuable, it could cause tension within the family — not just between siblings but also between you and them.

Potential for Financial Irresponsibility

Let’s be honest with each other. Sometimes people make bad decisions with money. Lifestyle inflation is a real thing and can have some severe outcomes. When people come into additional money, whether it’s a raise at work or an inheritance, they feel more freedom. They want to go out and treat themselves to something they’ve wanted but couldn’t afford. And while this is OK to a certain extent, there must be some restraint.

Don’t Buy Groceries on Saturday or Sunday — Here’s Why

Don’t Buy Groceries on Saturday or Sunday — Here’s Why

Crystal Mayer Thu, July 3, 2025 GOBankingRates

If you work a regular 9-to-5 job, then grocery shopping during the middle of the week can be tricky. This means that just like millions of other people, you will be stuck fighting the crowds on the weekends to ensure that your kitchen is fully stocked for the days ahead — and it could also end up being a fight with your food budget.

Research shows, however, that if you can squeeze in a midweek grocery shopping trip, your wallet and your sanity may be greatly rewarded. With that in mind, here are the worst days of the week to buy your groceries.

Don’t Buy Groceries on Saturday or Sunday — Here’s Why

Crystal Mayer Thu, July 3, 2025 GOBankingRates

If you work a regular 9-to-5 job, then grocery shopping during the middle of the week can be tricky. This means that just like millions of other people, you will be stuck fighting the crowds on the weekends to ensure that your kitchen is fully stocked for the days ahead — and it could also end up being a fight with your food budget.

Research shows, however, that if you can squeeze in a midweek grocery shopping trip, your wallet and your sanity may be greatly rewarded. With that in mind, here are the worst days of the week to buy your groceries.

Avoid Weekends

According to Drive Research, 59% of consumers surveyed do their grocery shopping Friday, Saturday or Sunday. Therefore, waiting until the end of the week or going on the weekend could mean big crowds and less selection. You may be stuck paying a higher price for an item because the less expensive version is unavailable.

Avoiding weekends is a good rule of thumb regardless of which retailer you are visiting. One slight exception might be hitting up Aldi on a Sunday. The discount grocer is known for putting new items in its Hot Deals section on this day. Hot Deals tend to be limited in inventory, so if you really want to score big on one of these trendy products, then you’ll want to break the weekend rule.

Unless it is unavoidable, do not buy groceries on Saturdays and Sundays (except maybe a quick trip to Aldi).

On Wednesdays, We Buy Groceries

Wednesdays should be the day you buy groceries. As explained by Instacart, most grocery stores start their weekly specials on Wednesday.

The grocery delivery company also says shoppers may be able to take advantage of “double discounts” since retailers may honor the previous week’s deals. The article further recommends shopping later in the day to try and get last-minute price reductions on perishable items.

TO READ MORE: https://www.yahoo.com/lifestyle/articles/don-t-buy-groceries-days-130023270.html

The Deadline for Moving Money Out of the US

The Deadline for Moving Money Out of the US

Notes From the Field By James Hickman (Simon Black) July 3, 2025

The Senate passed the “Big Beautiful Bill,” and it’s about to make America’s financial house of cards a whole lot shakier. Already today interest on the national debt costs more than the entire— very large— defense budget. The runaway national debt is literally a matter of national security.

And the bill will add about $3 trillion to the national debt over the next decade, in addition to the $22 trillion the Congressional Budget Office already-projects for the same period.

The Deadline for Moving Money Out of the US

Notes From the Field By James Hickman (Simon Black) July 3, 2025

The Senate passed the “Big Beautiful Bill,” and it’s about to make America’s financial house of cards a whole lot shakier. Already today interest on the national debt costs more than the entire— very large— defense budget. The runaway national debt is literally a matter of national security.

And the bill will add about $3 trillion to the national debt over the next decade, in addition to the $22 trillion the Congressional Budget Office already-projects for the same period.

Do the math, and by 2033, the US national debt will hit a jaw-dropping $56 trillion.

And that’s only if they decide not to pass another big beautiful budget buster next year. It assumes control of the government doesn’t swing in 2028 giving the Left another shot at free college, universal basic income, reparations, or a green new deal.

But why are we so focused on 2033 in particular?

Because that’s also the year when Social Security’s biggest trust fund runs out of money.

The Social Security Administration circles a date each year in its official report, signed by the Secretary of Treasury. That date tends to inch closer each year.

Based on the promises of various politicians NOT to touch Social Security, it’s very likely this problem will be ignored until it becomes a major funding crisis.

By 2033, we also forecast that interest payments on the national debt could devour more than half of all tax revenue.

Foreign investors, already uneasy, will likely continue to sell their US government bonds, putting pressure on the Federal Reserve to “print” trillions of dollars to bail out the Treasury Department. This would almost certainly trigger massive inflation.

Then come the social consequences.

History shows that economic depressions like these lead to crime spikes—especially property crimes and theft. Riots erupt in cities across the country, sparked by shrinking benefits and deep economic anxiety. Local governments declare bankruptcy, unable to keep up with exploding costs and plunging tax revenues.

And into that vacuum steps an invigorated political movement: Socialism 2034.

Fueled by anger and desperation, it promises salvation through universal basic income, rent cancellation, and debt forgiveness. Capitalism is blamed for the crisis.

The calls grow louder for price controls, nationalizations, even capital restrictions.

I’m not saying it is going to play out exactly like this, but this is the trend that America is currently on. It’s hard to dispute the facts.

You and I don’t control Congress, the political parties, or Social Security. The only thing we can do is give ourselves the tools to respond to this— entirely predictable and avoidable— crisis from a position of strength.

That’s what a Plan B is all about. And we talk about elements of this all the time.

Real assets—especially gold and other precious metals, but also economic necessities like industrial metals, energy, and productive technology—can help guard your wealth against inflation.

Second residency abroad can give you a place to go if your home country ever becomes too chaotic or dangerous.

And then there is financial diversification, so that all your savings isn’t under the control of one jurisdiction—especially when that jurisdiction is the US, the most indebted country in the history of the world.

Without serious reform, 2033 is when everything comes to a head—the debt bomb explodes, Social Security craters, and inflation goes nuclear. That means you have a hard deadline for having a portion of your wealth safely outside the United States.

Recent history is filled with examples, from Cyprus to Argentina, of countries in financial crisis implementing capital controls, withdrawal limits, and even wealth confiscation.

When confidence in government bonds evaporates and inflation spirals, it’s not hard to imagine Washington freezing capital outflows “temporarily” or simply forcing retirement accounts to buy “patriotic bonds” to fund Social Security.

By then, the window to move money abroad might be functionally closed.

It’s already becoming harder. Banks around the world have steadily tightened rules on Americans. Thanks to laws like FATCA and global information-sharing regimes, foreign banks now face enormous compliance burdens when dealing with US clients. Most don’t want the risk.

We detailed a few of the options still available in an international banking report we just released to our Total Access members

The main takeaway: it’s far easier to open a foreign bank account when you don’t urgently need one.

If you wait until things get chaotic—whether that’s 2033 or earlier—it may be too late.

That’s why acting now, while the system still works, is crucial.

Foreign accounts aren’t about hiding money—in fact, US citizens generally must report foreign assets to the US government.

But they do let you store some of your savings in other countries, which gives you a legal barrier, and diversifies which jurisdictions can get their hands on your assets.

They give you flexibility if US banks freeze or restrict access. And they put you one step ahead of whatever “emergency measures” Washington dreams up next.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LL

There's 1 Reason Rich Athletes Go Broke

There's 1 Reason Rich Athletes Go Broke

Cam Newton says there's 1 reason rich athletes go broke and he no longer makes $20M/year in 2025 — here's why

Moneywise Tue, July 1, 2025

At the height of his career, Cam Newton, former NFL MVP and Carolina Panthers quarterback, says he earned roughly $20 million a year. However, in a recent video on his YouTube channel, Newton confessed he was making online content “to keep the lights on.”

Newton’s candid admission pulls back the curtain on a common struggle retired athletes face: managing money once the big paychecks stop.

There's 1 Reason Rich Athletes Go Broke

Cam Newton says there's 1 reason rich athletes go broke and he no longer makes $20M/year in 2025 — here's why

Moneywise Tue, July 1, 2025

At the height of his career, Cam Newton, former NFL MVP and Carolina Panthers quarterback, says he earned roughly $20 million a year. However, in a recent video on his YouTube channel, Newton confessed he was making online content “to keep the lights on.”

Newton’s candid admission pulls back the curtain on a common struggle retired athletes face: managing money once the big paychecks stop.

He points to his own situation as “the No. 1 reason” why so many wealthy players end up broke, failing to scale back spending when their income takes a hit.

Here’s how untamed expenses can gobble up even eight-figure salaries.

Lifestyle creep

Newton insists he did a better job managing his money than the average athlete.

“I never really had a financial advisor, but I never really was a splurger either — still to this day,” the 36-year-old says.

Federal and state income taxes ultimately reduced his take-home pay to roughly $12 million a year. Newton estimates his annual expenses were between $5 and $6 million, leaving some room for savings and investments.

Although he no longer makes eight figures a year, he says his expenses have stayed more or less the same. Some of the big-ticket items draining his savings include private schools, home maintenance, alimony and luxury purchases.

“Those things never leave,” Newton says. “Your overhead never really changes.”

The problem Newton — and many other celebrity athletes — can struggle with is that when your income changes, your expenses have to change with it.

This rapid lifestyle inflation during prime earning years is one of the key reasons why even high-income families can struggle financially. Roughly 36% of consumers who earned $200,000 or more a year were living paycheck to paycheck, according to a PYMNTS survey.

The only way to avoid falling into that trap is to keep a tight lid on expenses, according to Newton. Cutting down on your monthly expenses is a good place to start, with insurance payments being one of the biggest cost culprits.

TO READ MORE: https://www.yahoo.com/finance/news/cam-newton-says-theres-1-091700514.html

Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Unfortunately, these cons are common

Tamara Gane Updated Sun, June 22, 2025

Family vacations are exciting, but they can also present an opportunity for scam artists. Just ask a mom named Haylee who booked 11 flights on American Airlines for an upcoming cruise.

She explained in a recent TikTok video that both her daughter and niece are on the autism spectrum. She called the airline to check to see if accommodations like early boarding were available to make their travel day easier.

Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Unfortunately, these cons are common

Tamara Gane Updated Sun, June 22, 2025

Family vacations are exciting, but they can also present an opportunity for scam artists. Just ask a mom named Haylee who booked 11 flights on American Airlines for an upcoming cruise.

She explained in a recent TikTok video that both her daughter and niece are on the autism spectrum. She called the airline to check to see if accommodations like early boarding were available to make their travel day easier.

A Call Gone Wrong

Haylee looked up the number for American Airlines. At least, that was her intention. In the video, she said, “I guess I must’ve not clicked the number because it rerouted the page."

Unaware that anything was amiss, she clicked the first number. A male voice answered the phone, asking for the flight confirmation numbers for the family’s upcoming trip.

An Offer That Seemed Too Good To Be True

Once he had the confirmation numbers, he was able to look up the flight information. He read it back to them, along with the last four digits of the two credit cards used to book the flights. This assured Haylee he was legit but unfortunately, this information is accessible to anyone with a person’s last name and confirmation number.

The man told Haylee he could give her a discount of $150 per ticket, priority boarding, and seats in the front of the plane. But there was a catch. According to Haylee, he said:

“I have to refund both of the cards, which could take 7-20 business days.

After he claimed to have processed the refund on the two cards, he informed her that he would put the flight on a single card. The new total would be $5,250, a $1,600 discount off the original flight cost.

A Suspicious Email

Haylee provided the man with some additional information, including her credit card number. He charged the card and sent her a confirmation email.

This is when Haylee realized something was wrong. The email said it was from “flight trip.” She thought she’d called American Airlines, so this didn’t make sense.

She quickly opened her American Airlines app. Her original flights were there. No changes had been made. At that point, Haylee realized she’d been scammed.

She immediately locked her credit cards and disputed the charge with her company.

How To Avoid Falling For A Similar Scam

Unfortunately, this is a common con. So common that the Federal Trade Commission (FTC) has an entire page devoted to scammers impersonating airline representatives. This is how they suggest you keep your personal information and your credit card numbers safe:

TO READ MORE: https://www.yahoo.com/creators/lifestyle/story/woman-swindled-out-of-thousands-of-dollars-in-airline-scam-022249321.html

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill — how to spot forgeries linked to this technique

Christy Bieber Tue, July 1, 2025 Moneywise

Kevin Costello, owner of Siam Imports, had a bad experience recently receiving payment with cash. A customer came into his store and paid with a fake $100 bill, but it turned out that the bill was actually a legitimate bill made into a counterfeit — and he failed to catch it.

"I had a couple other girls in here at the same time, so I didn’t really closely look at the $100, which if I would have did that I could [have] probably prevented it,” Costello said. One reason he didn't identify the issue on the spot: The counterfeit $100 was made using a clever technique thieves are favoring recently.

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill — how to spot forgeries linked to this technique

Christy Bieber Tue, July 1, 2025 Moneywise

Kevin Costello, owner of Siam Imports, had a bad experience recently receiving payment with cash. A customer came into his store and paid with a fake $100 bill, but it turned out that the bill was actually a legitimate bill made into a counterfeit — and he failed to catch it.

"I had a couple other girls in here at the same time, so I didn’t really closely look at the $100, which if I would have did that I could [have] probably prevented it,” Costello said. One reason he didn't identify the issue on the spot: The counterfeit $100 was made using a clever technique thieves are favoring recently.

Unfortunately, Costello isn't the only one to receive payment with phony money, as counterfeiting cases are on the rise in Hawaii, where he owns his business. Fake bills can cost business owners a lot of money, so it's important to understand the dangers of this crime as well as how to identify fake bills — even if the counterfeiting is done well

Bleached Money On The Rise In Hawaii

According to Honolulu police, counterfeiting and forgery rose 16.5% in the past year.

While this counterfeiting can take on different forms, one popular method — and the one that applied to the bill Costello collected — involves taking $1 bills, bleaching them and reprinting them to look like real $100 bills.

"We’re seeing more and more of these bleaching of dollar bills and then they’re being printed with 50 or 100 on them,” Tina Yamaki, president of Retail Merchants of Hawaii, said.

One reason this approach is becoming common is that it can be really hard to detect. “It still feels kind of like a paper bill because you’re still using the same, you know, paper. It’s like if you throw money through the wash. Right? It still feels like a bill, but we’re seeing a lot more people now holding it up to the light, finding out that the [counterfeit detection] pens don’t always work,” Yamaki said.

It's not just Hawaii where there is a concern. According to the Federal Reserve, around one in 40,000 bills is counterfeit, with high-denomination ($50 and $100) bills accounting for most of the fake money

While this is a significant decline in counterfeit funds since 2006, when around one in 10,000 notes was thought to be fraudulent, this still means that as much as $30 million in fraudulent money is cycling through the economy.

How To Spot Fake Money

Costello feels that his mistake in accepting the fake $100 was driven by the fact that he simply didn't take the time to look carefully enough at the bill. "Take the extra couple seconds, actually, all it would’ve took,” Costello said.

TO READ MORE: https://www.yahoo.com/news/hawaii-store-owner-duped-fake-113100847.html

Fort Worth Teacher, 28, Loses $32K Fraud vs Scam

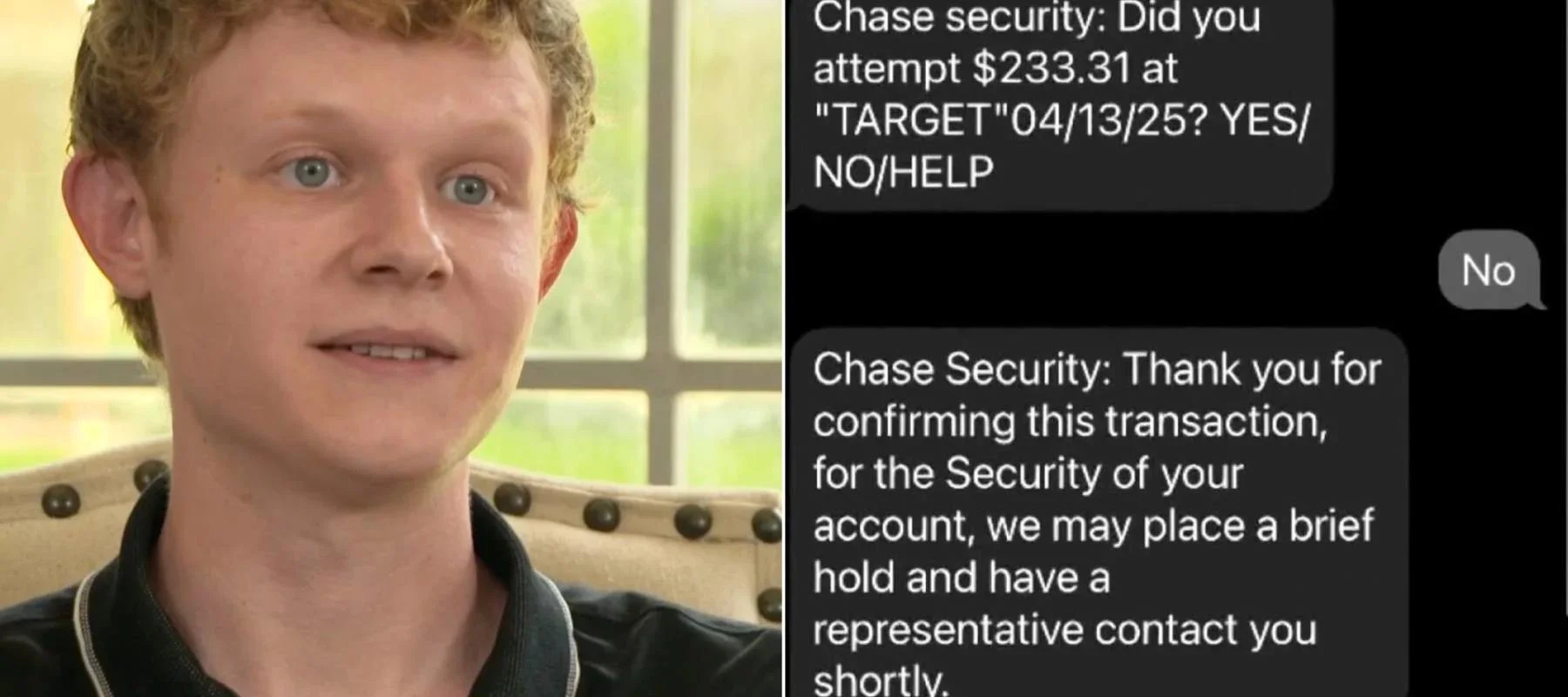

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Leahy was reportedly contacted by scammers who claimed to be representatives of Chase Bank. The supposed bank reps called to inform Leahy that his account had been compromised and that he needed to protect his finances by moving the cash into a secure account. All it took were a few text messages and some counterfeit banking information in order to appear genuine.

"I couldn't even believe how sophisticated it was," Leahy told WFAA.

Now, the newlywed is trying to warn people about the scam that cost him everything in the hopes of preventing others from falling for the same scheme.

Fraud vs. a scam

Unfortunately for Leahy, the situation went from bad to worse when he contacted Chase Bank to report the incident. According to WFAA, the bank told Leahy that his account isn’t covered by fraud protection, arguing that Leahy was the victim of a scam and not financial fraud.

In making this distinction, Chase Bank returned just over $2,000 to Leahy’s account, which is merely a fraction of his total loss. When WFAA contacted Chase Bank for comment, the bank offered clarification on the distinction between fraud and a scam.

"Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission," the bank stated in its emailed reply.

A scam, on the other hand, is "a deceptive scheme or trick used to cheat someone out of their money or other valuable assets,” which is what happened to Leahy.

Chase Bank’s response likely isn’t what Leahy wanted to hear, but that hasn’t stopped him from sharing his story in order to prevent others from making the same mistakes.

"I'd rather I be the sacrificial lamb for the rest of these people and maybe save other people's money from being stolen," he said. "I'm really hoping to look ahead and move on with my life and not have to start over from scratch."

How to avoid falling for similar scams

TO READ MORE: https://www.yahoo.com/lifestyle/articles/fort-worth-teacher-28-loses-110000179.html