US Commercial Real Estate Contagion Spreads to Germany and Japan : Awake-In-3D

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

The Epicenter: The US CRE Crisis

The US CRE sector is currently experiencing unprecedented stress, primarily due to the seismic shifts in work culture brought on by the government’s response to COVID-19.

The transition to remote work has left office buildings vacant, causing a steep decline in rental incomes and property values.

According to a report by Forexlive, Goldman Sachs estimates that $1.2 trillion in mortgages are due by the end of next year, with much of it underwater.

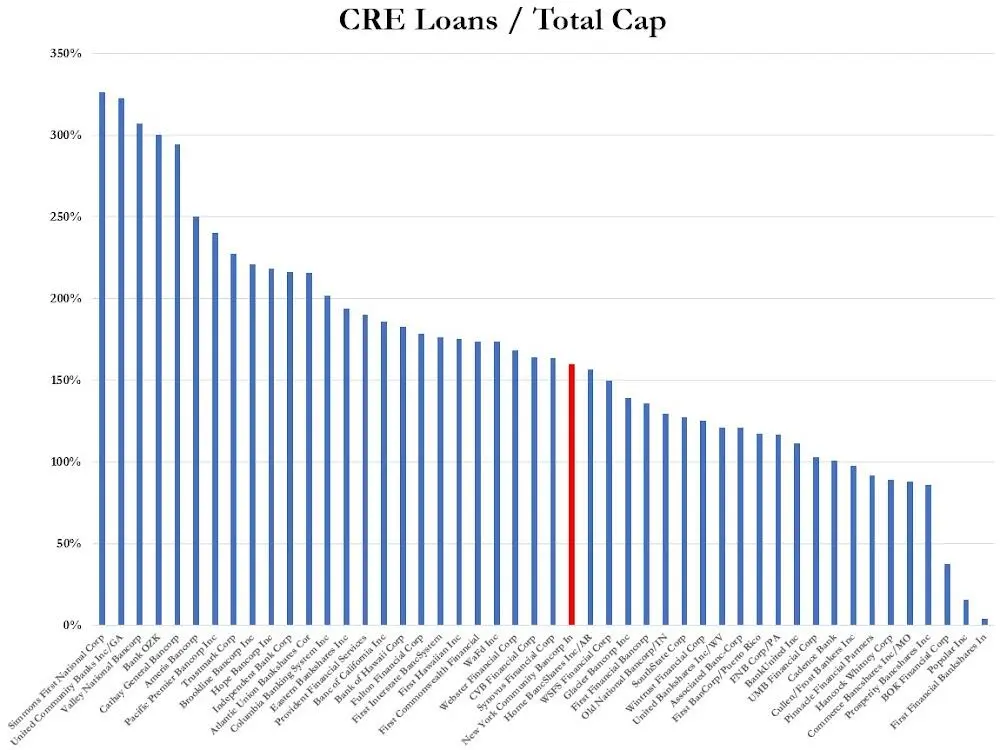

US Regional Banks with the largest CRE loans relative to capital

This situation has led to significant losses for regional banks and financial institutions heavily invested in commercial real estate loans.

More Bad News for Germany: Multiple Banks

Germany, Europe’s largest economy, has not been immune to the repercussions of the US CRE crisis.

Deutsche Pfandbriefbank (PBB), a German lender with a focus on real estate, has had to increase its provisions for bad debts significantly, bracing itself for what it describes as the worst decline in commercial property values in 15 years.

The bank has set aside as much as €215 million ($231.7 million) for potential losses on loans, highlighting the “persistent weakness of the real estate markets”.

Similarly, Deutsche Bank has allocated €123 million ($133 million) to cover potential defaults on its US commercial real estate loans, indicating the far-reaching impact of the US crisis on European banks.

The Situation in Japan: Aozora Bank’s Unexpected Losses

Aozora Bank, based in Tokyo, Japan, has encountered significant financial distress due to its exposure to the U.S. commercial real estate market, marking a dramatic shift in the bank’s balance sheet health.

This situation has led Aozora Bank to report its first annual net loss in 15 years, a stark reversal from its previous net profit projections.

The bank has been compelled to take massive loan-loss provisions for U.S. commercial property as valuations have plummeted in the wake of rising borrowing costs and a decrease in demand exacerbated by the shift to remote work.

This financial turmoil resulted in a projected net loss of 28 billion yen ($190.5 million) for the fiscal year ending March 31, significantly deviating from an initially expected net profit of 24 billion yen. Consequently, Aozora Bank has decided to forgo dividends for the remainder of the financial year.

The ongoing CRE crisis in the US serves as a stark reminder of the global fiat financial system’s interconnectedness and risk of contagions spreading worldwide.

Banks and financial institutions worldwide are now facing the ripple effects of this downturn, with the full extent of potential losses and their distribution across the financial sector still unfolding.

Contributing sources:

https://ai3d.blog/us-commercial-real-estate-contagion-spreads-to-germany-and-japan/

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Fractional Reserve Lending: Massive Leveraging of Your Bank Deposits

Fractional Reserve Lending operates on a principle as simple as it is brilliant.

Banks are required to keep only a fraction of your deposit in reserve, lending out the rest.

With a 10 percent reserve ratio, for example, a $100 deposit can magically transform into $90 of loanable funds.

This leaves us with a peculiar situation: your bank account still shows that you have a $100 balance, yet actually $90 is now elsewhere, in the hands of borrowers.

How?

Through the creation of “bank credit,” a digital mirage replacing real dollars.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through multiplied cycles of bank credit.

Bank Credit: The True Secret of an Invisible Currency

This bank credit, while lacking the tangible form of cash, functions as currency within our economy. It emerges from a simple yet profound act: banks typing numbers into a computer.

This fabricated currency, stemming from your initial deposit, multiplies via loans as it moves through the banking system from one bank, to another and another.

A $100 deposit can balloon into $1,000 of bank credit, all while being backed by a mere $100 from the original deposit.

As loans are made and the currency circulates, each recipient re-deposits the funds, enabling further lending.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting but within the banking system itself.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through this cycle of bank credit.

The Real Cost of These Digital Currency Dollars Numbers

What does this mean for you, the everyday person? Let’s think this through step-by-step.

When you or your business takes out a loan, the proceeds of the loan simply go into another bank account, which creates more deposits (digital numbers) that are then re-loaned out again via fractional reserve lending, and then multiplied via the same process again and again.

This mechanism of currency multiplication underpins a system where the majority of our money supply is not real ‘money’ but a web of IOUs.

Every unit of fiat currency is an IOU created through fraction reserve lending that multiplied and expanded from one loan to the next and one bank to another.

While it fuels economic activity, it also represents a precarious balance, reliant on everyone’s continued faith and participation in the banking system.

The implications become obvious … a system built on fractional reserves is a system built on a foundation of trust, not real, tangible value.

In the next article, I will explain how this fabricated ‘wealth’ affects inflation, interest rates, and ultimately, the transfer of wealth from the many to the few.

Peeling back the layers of the fiat currency system and understanding these unsound mechanisms is the first step toward recognizing the potential true workings of our current financial infrastructure.

The fiat system has a finite self-life leading to an inevitable global financial reset based on more tangible, asset-based systems.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Massive Foreign Demand: Stellar Success in Today’s Record-Breaking US 10-Year Bond Auction

Massive Foreign Demand: Stellar Success in Today’s Record-Breaking US 10-Year Bond Auction

On February 7, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

The global mother of all bonds – the US 10-Year – was in blowout demand today.

There is much confusion out there in GCR Land about US Treasuries. With reports stating there’s no foreign demand and misleading narratives about the meaning of bond prices vs. bond yields, it’s easy to get misinformed.

No worries. After reading this article you will know everything you need to know about bonds in order to accurately discern fact from hype.

Massive Foreign Demand: Stellar Success in Today’s Record-Breaking US 10-Year Bond Auction

On February 7, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

The global mother of all bonds – the US 10-Year – was in blowout demand today.

There is much confusion out there in GCR Land about US Treasuries. With reports stating there’s no foreign demand and misleading narratives about the meaning of bond prices vs. bond yields, it’s easy to get misinformed.

No worries. After reading this article you will know everything you need to know about bonds in order to accurately discern fact from hype.

What Happened in Today’s Bond Auction

Today’s 10-year Treasury bond auction shattered records, both in terms of the amount sold and the robustness of demand. Here’s what made today’s $42 billion auction, aimed at funding government operations through debt maturing on February 15, 2034, not just historic but downright stellar.

Record Auction Size and Demand

Today’s auction was monumental, offering $42 billion in 10-year bonds—the largest amount ever for this maturity.

After a lukewarm reception to a smaller 3-Year Treasury auction yesterday, there were concerns. Would there be enough appetite for such a significant 10-Year offering?

The answer was a resounding YES.

Why Today’s Auction Was Stellar

High Yield: The bonds sold today offered a yield of 4.093%, slightly higher than last month’s 4.024%. This yield is attractive to investors looking for safety, security, and pristine collateral.

Strong Demand: The auction’s “bid to cover” ratio, a key indicator of demand, stood at 2.56. This means there were bids for 2.56 times the amount of bonds available, signaling strong investor interest.

Foreign Demand: A standout aspect was the ultra-strong demand from foreign investors, known as “indirect” bidders. Foreign demand consumed a whopping 70.1% of the auction, showcasing global appetite for safe harbor and to secure collateral. US Treasuries are considered the most pristine form of collateral on earth.

Understanding the Basics of Treasury 10-Year Auctions

Understanding the basics of Treasury 10-year auctions and their impact on bond yields versus bond prices requires a grasp of a few key concepts. Let’s break it down into simpler terms.

The U.S. Department of the Treasury issues bonds to borrow money to fund government spending. A 10-year Treasury bond is a loan to the government that pays back the initial investment plus interest over ten years.

All US Treasuries are sold via regularly scheduled auctions.

The Bond Auction Process

The Treasury sells these bonds through auctions. Investors bid on the bonds, and the yield (interest rate) is determined through this competitive process.

The auction can be of two types: competitive bids, where investors specify the yield they’re willing to accept, and non-competitive bids, where investors accept whatever yield is determined at the auction.

How Bond Yields and Prices Are Related

Bond Yield: This is the return an investor gets on a bond. The yield is inversely related to the bond’s price. When bond prices go up, yields go down, and vice versa.

Bond Price: This is determined by demand and supply in the market. Factors like changes in interest rates, economic outlook, and investor sentiment can affect bond prices.

Impact of the Auction Process on Bond Yields and Prices

Demand at Auction: High demand for bonds at an auction will generally lead to lower yields. This is because investors are willing to pay more for the bonds, which increases the price of the bond and, in turn, lowers the yield.

Supply of Bonds: If the Treasury is selling a large amount of bonds, the increased supply can lead to lower bond prices if demand doesn’t keep pace, which would increase yields.

Market Expectations: Investors’ expectations about future interest rates, economic health and inflation can affect bidding behavior. If investors expect a higher risk environment, they will demand higher yields (during the auction) to compensate for the anticipated risk.

A Practical Example

If a 10-year Treasury bond auction sees higher than expected demand, the price of the bonds will rise because investors are willing to pay more to secure the bonds.

As a result, the yield on those bonds will fall since the fixed interest payments become a smaller percentage of the bond’s higher price.

Conversely, if an auction has weak demand, the Treasury may have to sell the bonds at lower prices to entice buyers, resulting in higher yields.

The auction process for 10-year Treasury bonds is crucial in setting the yields for new bonds entering the market. This process, influenced by investor demand and broader economic factors, directly affects bond prices and yields.

In summary, today’s record-breaking 10-year Treasury auction was a testament to the strength and appeal of U.S. government bonds.

With unprecedented demand, particularly from international markets, this auction underscores the global financial community’s flight to safety and demand for pristine collateral.

Supporting article: Record Large 10Y Auction Sees Stellar Demand, First Stop-Through In 12 Months

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Fiscal Fantasies: Janet Yellen is Living in a Grand Illusion : Awake-In-3D

Fiscal Fantasies: Janet Yellen is Living in a Grand Illusion

On February 6, 2024 By Awake-In-3D

In an era where mainstream media’s economic optimism seems at odds with reality, Treasury Secretary Janet Yellen’s reality-challenged view of the US economy and financial system confirms that she’s living in an alternate reality – a Grand Illusion.

From the precarious state of banking post-Silicon Valley Bank collapse to the looming crisis in commercial real estate and questionable claims of fiscal sustainability, let’s take a look at the stark contrast between official narratives and the underlying economic disaster through the lens of reality.

Fiscal Fantasies: Janet Yellen is Living in a Grand Illusion

On February 6, 2024 By Awake-In-3D

In an era where mainstream media’s economic optimism seems at odds with reality, Treasury Secretary Janet Yellen’s reality-challenged view of the US economy and financial system confirms that she’s living in an alternate reality – a Grand Illusion.

From the precarious state of banking post-Silicon Valley Bank collapse to the looming crisis in commercial real estate and questionable claims of fiscal sustainability, let’s take a look at the stark contrast between official narratives and the underlying economic disaster through the lens of reality.

Banking on Thin Ice

As Silicon Valley Bank’s collapse sent shockwaves through the financial system, Treasury Secretary Janet Yellen’s reassurances seem more like wishful thinking than a realistic appraisal.

Despite a hastily assembled “package of measures,” the specter of a broader banking crisis looms large, raising questions about the efficacy of these interventions.

The admission that some banks remain “quite stressed” only adds to the growing incredulity surrounding the official narrative.

Commercial Real Estate: The Ignored Elephant in the Room

Yellen’s concern over the “nationwide issue” of empty office buildings clashes starkly with her overall positive economic outlook.

Despite regulatory efforts to mitigate risks, the real estate sector’s woes appear to be a ticking time bomb, conveniently downplayed.

Can building reserves and adjusting dividend policies truly stave off the looming crisis, or are these measures just bandaids on a bullet wound?

A Job Market Mirage?

The Treasury Secretary’s confidence in the job market boom and low unemployment rates paints a picture far removed from the daily realities of many Americans.

While boasting of a labor market “at least as strong as it was prior to the pandemic,” the narrative conveniently glosses over the underemployment and job quality issues that plague the workforce.

The Unsustainable Path of Fiscal Health

Perhaps most bewildering is Yellen’s claim of steering the US towards fiscal sustainability. With national debt surging and economic growth being outpaced, her optimism seems misplaced.

The contrast between Yellen’s assurances and her predecessor, Jerome Powell’s stark warning of an “unsustainable fiscal path,” is striking. One can’t help but wonder, where does the truth lie?

Outperforming or Out of Touch?

Yellen’s comparison of the US economy to other advanced countries, touting “the strongest growth” and significant inflation reduction, appears overly simplistic.

Talking up the cleanest dirty shirt in the laundry basket doesn’t inspire confidence in her grasp on the situation every day Americans face.

In a global economy rife with warning signs, such broad strokes seem disconnected from the nuanced realities facing the international community.

A Reality Check Needed

Yellen’s portrayal of the US economy and financial system as robust and on the right path is increasingly hard to reconcile with the underlying challenges.

From banking vulnerabilities to real estate risks and fiscal sustainability concerns, the gap between official statements and the economic realities suggests a narrative deeply infused with fiscal fantasies.

Supporting Article: Janet Yellen: Some banks may be ‘quite stressed’ by empty office building trouble

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/fiscal-fantasies-janet-yellen-is-living-in-a-grand-illusion/

A Lost Republic: The Role of International Bankers in Establishing the ‘United States’ Corporation (Part 2)

A Lost Republic: The Role of International Bankers in Establishing the ‘United States’ Corporation (Part 2)

On February 5, 2024 By Awake-In-3D

Continuing from Part 1 in this article series, this concluding part explains how international bankers emerged as a pivotal force behind the scenes and influenced the financial and political landscape of America, specifically around the period of the District of Columbia Organic Act of 1871.

This era, marked by economic vulnerability and post-Civil War reconstruction challenges, provided a fertile ground for financial maneuvering on an international scale.

Among these financial players were the Rothschilds of London, a legendary banking family synonymous with wealth and power in banking circles for generations.

A Lost Republic: The Role of International Bankers in Establishing the ‘United States’ Corporation (Part 2)

On February 5, 2024 By Awake-In-3D

Continuing from Part 1 in this article series, this concluding part explains how international bankers emerged as a pivotal force behind the scenes and influenced the financial and political landscape of America, specifically around the period of the District of Columbia Organic Act of 1871.

This era, marked by economic vulnerability and post-Civil War reconstruction challenges, provided a fertile ground for financial maneuvering on an international scale.

Among these financial players were the Rothschilds of London, a legendary banking family synonymous with wealth and power in banking circles for generations.

The Civil War, a calamitous period in American history, not only tested the fabric of the nation but also its coffers, leaving the United States in a state of financial exhaustion. It was during this time that international bankers saw an opportunity to extend their influence.

Contrary to accepting direct loans from these international financiers, which would come with strings attached and potentially compromise the nation’s autonomy, the U.S. government sought alternative ways to finance its recovery and reconstruction efforts.

The issuance of Greenbacks (America’s first issuance of a national Fiat Currency) was one such measure, designed to finance the war without succumbing to the pressures and conditions of foreign banks.

However, this move alone was not sufficient to ward off the influence of international banking interests.

Among these financial players were the Rothschilds of London, a legendary family synonymous with wealth and power in banking circles for many generations.

Their relentless pursuit of influence in American finances was not merely opportunistic, but part of a broader strategy to secure a financial stronghold in the burgeoning economic landscape of America.

The establishment of a federal municipal law was a clever mechanism to bind the future economic activities of the nation to the interests of these banking powers.

The Act of 1871, while ostensibly created to provide a governmental framework for the District of Columbia, also opened doors for these bankers to solidify their foothold in American economics.

By establishing a federal municipal law for the newly created federal citizens, the Act inadvertently created a new customer base for the banks and introduced a system wherein the American populace would become increasingly entangled in the financial strategies of both domestic and international bankers.

This new Banking Corporatocracy leveraged the establishment of America’s new National Banking System enacted by President Abraham Lincoln via the National Banking Act and the National Currency Act in 1863 and 1864. This set the legal and structural stage to establish The Federal Reserve Act and Bank in 1913.

This strategic positioning by the bankers was not an act of generosity or a mere financial transaction; it was a calculated move to ensure their dominance in the financial operations of the new, ‘United States’ corporatocracy.

The transformation has led to an environment where the concept of freedom is more myth than reality, as individuals find themselves subject to an ever-expanding array of regulations, statutes, and contractual obligations that dictate their behavior and limit their liberties.

The establishment of a federal municipal law was a clever mechanism to bind the future economic activities of the nation to the interests of these banking powers.

The implications of these developments came swiftly and resolutely.

The shift from a system of rights and liberties under the original Constitutional framework to a regime of privileges under a corporate governance model facilitated by the Act of 1871 marked a significant transformation in the American Republic.

The involvement of international bankers in this transition underscores their role not just as financial entities but as influential actors in the shaping of a nation’s destiny.

Americans Today are Living Under a Corporatocracy – Ignorant and Compliant

The changes initiated by the Act of 1871 continue to resonate in contemporary America.

The corporate governance model affects virtually every aspect of American lives, from the legal system and law enforcement to education, healthcare, and the economy.

This model prioritizes economic interests and efficiency over individual rights and liberties, leading to a society where corporate entities wield significant influence over public policy and decision-making.

The implications for everyday Americans today are profound.

It established a municipal corporation that, over time, has blurred the lines between the sovereign rights of the people and the privileges granted by a corporate state.

The transformation has led to an environment where the concept of freedom is more myth than reality, as individuals find themselves subject to an ever-expanding array of regulations, statutes, and contractual obligations that dictate their behavior and limit their liberties.

The notion of voluntary compliance with the system, driven by a combination of ignorance and apathy, has facilitated the perpetuation of this corporate governance model, further entrenching its influence over American life.

Moreover, the shift from a system based on inherent rights to one governed by statutory privileges has profound implications for the concept of citizenship itself.

Individuals are increasingly treated as customers or subjects within a corporate state, rather than as sovereign citizens of a republic.

This redefinition of the relationship between the individual and the state has led to a gradual but unmistakable dilution of the principles of liberty and self-governance that once defined the American experiment.

Bottom Line: There’s a Profound Difference Between the Original Constitutional Republic ‘United State of America’ vs. The ‘United States’ Corporation

This article outlined a seldom-discussed chapter of American history, uncovering the fundamental transformation of the ‘United States of America’ from the original Constitutional Republic, envisioned by the Founding Fathers, to the ‘United States’ corporate entity shaped by the Act of 1871.

This shift, driven by economic vulnerabilities and the strategic interests of international bankers, has redefined the essence of American governance and the very notion of our individual rights and freedoms within its borders.

The historical backdrop set against the aftermath of the Civil War highlighted the precarious situation America found itself in, leading to the enactment of the Act of 1871. This legislation, while ostensibly aimed at providing a governmental framework for the District of Columbia, effectively ushered in a new era of corporate governance.

It established a municipal corporation that, over time, has blurred the lines between the sovereign rights of the people and the privileges granted by a corporate state.

The role of international bankers in this historical narrative cannot be overstated.

Their influence in shaping the financial destiny of the post-Civil War America has had lasting implications, embedding a commercial ethos at the heart of American governance. This transformation has far-reaching consequences, affecting the daily lives and liberties of American citizens up to the present day.

The shift from tangible freedoms to a system of regulated ‘privileges’ (such as personal driving licenses) underlines the profound impact of the Act of 1871 and international banking interests on the American Republic.

The transition from a system of inalienable rights to one governed by ‘statutes and regulations’ challenges the core principles of freedom and liberty for all Americans.

Read Part 1 of this article series: https://ai3d.blog/a-lost-republic-the-strategic-overthrow-of-american-sovereignty-part-1/

A New Economic Landscape: The Declining Role Of The Petrodollar : Awake-In-3D

A New Economic Landscape: The Declining Role Of The Petrodollar

On February 6, 2024 By Awake-In-3D

The global economic landscape is on the cusp of a monumental shift as key oil-producing nations, including Russia and Saudi Arabia, are increasingly eyeing the Chinese yuan over the US dollar for oil trades.

This has considerably critical implications for not just for the oil market, but for the broader global economy, particularly impacting the US dollar’s global standing.

A New Economic Landscape: The Declining Role Of The Petrodollar

On February 6, 2024 By Awake-In-3D

The global economic landscape is on the cusp of a monumental shift as key oil-producing nations, including Russia and Saudi Arabia, are increasingly eyeing the Chinese yuan over the US dollar for oil trades.

This has considerably critical implications for not just for the oil market, but for the broader global economy, particularly impacting the US dollar’s global standing.

The Dollar’s Diminishing Dominance

The US dollar has long been the core currency of the global oil market, a status that has significantly bolstered its strength and stability on the world stage.

Also see: The Global Financial/Economic Landscape Transforming for a RESET – Here’s Why

However, the shift towards the yuan, and other currencies, for oil trades would trigger a decrease in global reliance on the dollar, which would have severe implications.

Dramatic Economic Consequences for the U.S.

Impact on Dollar Exchange Rates: A decrease in the global demand for the US dollar for oil trades could lead to a depreciation in its value. This devaluation could affect everything from the cost of imports and exports to the financial strategies of multinational corporations.

Reduced Demand for US Treasuries: The US dollar’s strength and stability have traditionally made US Treasury bonds a highly attractive investment for foreign governments and investors. A shift away from the dollar in oil trade could reduce this demand, potentially increasing interest rates in the US as the Treasury may have to offer higher yields to attract buyers.

Escalating US Inflation: The decreased demand for the dollar will lead to increased inflation in the US. As the dollar’s value drops, it would become more expensive to import goods, contributing to rising prices domestically.

Challenges in Exporting US Debt: A significant advantage for the US has been its ability to export its debt, borrowing money at relatively low interest rates due to the high demand for its debt instruments globally. A reduced demand for the dollar will disrupt this ability, leading to higher borrowing costs for the US government.

Global Economic Realignments: This shift might not only affect the US but will also lead to broader economic realignments. As countries adapt to new trading currencies, we will see significant changes in global trade partnerships and financial alliances.

Also see: BRICS Initiates Chinese Yuan’s Rise: JP Morgan Says Potential End for the US Dollar

What Does This Mean for the Average Person?

While these developments might seem distant, they will impact everyday life. From changes in gas prices to fluctuations in the stock market, the ripple effects of a shift in the global oil trade currency will reach the pockets of both consumers and investors alike.

While the full extent of these changes remains to be seen, the growing shift away from the US dollar in global oil trade signifies a major economic realignment with far-reaching implications.

Understanding the dynamics at play and their possible impacts is key to navigating this new economic terrain.

See also: Goodbye PetroDollar: Saudi Arabia’s Plan to Decouple from the Dollar

© GCR Real-Time News

GCR Real-Time News Website: Ai3D.blog

Join my Telegram Channel: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-new-economic-landscape-the-declining-role-of-the-petrodollar/

Surprise! Iraq Climbs to 7th Place in 2023 Global Gold Purchases : Awake-In-3D

Surprise! Iraq Climbs to 7th Place in 2023 Global Gold Purchases

On February 4, 2024 By Awake-In-3D

In RV/GCR

US Treasury Secretary Janet Yellen can’t be very happy with Iraq these days.

In a surprising economic update, the World Gold Council has identified Iraq as the seventh-largest buyer of gold among nations in 2023. This significant acquisition reflects the country’s strategic efforts to bolster its financial stability amidst global economic fluctuations.

Iraq’s move to secure 12.25 tons of gold in 2023, as reported by the Central Bank of Iraq (CBI), positioned the country as a key player in the global gold market.

The 2023 gold buying spree, with Iraq emerging as a significant participant, reflects an ongoing assertive approach by nations to fortify their financial reserves.

Surprise! Iraq Climbs to 7th Place in 2023 Global Gold Purchases

On February 4, 2024 By Awake-In-3D

In RV/GCR

US Treasury Secretary Janet Yellen can’t be very happy with Iraq these days.

In a surprising economic update, the World Gold Council has identified Iraq as the seventh-largest buyer of gold among nations in 2023. This significant acquisition reflects the country’s strategic efforts to bolster its financial stability amidst global economic fluctuations.

Iraq’s move to secure 12.25 tons of gold in 2023, as reported by the Central Bank of Iraq (CBI), positioned the country as a key player in the global gold market.

The 2023 gold buying spree, with Iraq emerging as a significant participant, reflects an ongoing assertive approach by nations to fortify their financial reserves.

This strategic purchase not only highlights Iraq’s growing economic foresight but also underscores its commitment to enhancing its financial security and growing independence on the world stage.

In a year marked by unprecedented geopolitical uncertainties and economic shifts, gold’s allure as a steadfast asset has led countries worldwide to increase their reserves.

According to the World Gold Council, the overall gold purchases by central banks in 2023, though slightly less than the previous year, remained impressively high – the second-highest in nearly 55 years.

The data from the Council highlighted that the total amount of gold bought by central banks was 1,037.4 tons in 2023, a minor decrease from 1,081.9 tons in 2022.

Leading the charge was the People’s Bank of China, with a massive acquisition of 224.88 tons of gold. Following China were Poland with 130.3 tons and Singapore with 76.51 tons. Libya, the Czech Republic, and India also featured prominently in the list, showcasing significant investments in the precious metal.

Interestingly, Iraq wasn’t alone in this pursuit within the Arab world.

Libya and Qatar also ranked amongst the top 10 Arab countries in gold acquisition in 2023. This trend underlines a broader regional approach towards economic stability and diversification of assets.

The 2023 gold buying spree, with Iraq emerging as a significant participant, reflects an ongoing assertive approach by nations to fortify their financial reserves.

This trend will continue to influence global market dynamics and economic strategies in the foreseeable future.

Supporting article: https://www.iraqinews.com/iraq/world-gold-council-reveals-iraq-as-7th-largest-buyer-of-gold-in-2023/

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/surprise-iraq-climbs-to-7th-place-in-2023-global-gold-purchases/

Iraq Confirms Interest in Joining BRICS: Wants Trade in IQD and Russian Ruble : Awake-In-3D

Iraq Confirms Interest in Joining BRICS: Wants Trade in IQD and Russian Ruble

On February 4, 2024

By Awake-In-3D

In RV/GCR

In a significant diplomatic gesture, Iraq has officially expressed its eagerness to become a part of the BRICS consortium, marking a pivotal moment in its foreign policy and economic strategy.

Prime Minister Mohammed Shia Al-Sudani, during last October’s engagement with the Iraqi diaspora in Russia, voiced the nation’s readiness to join the influential group, contingent upon an invitation from its founding members.

Iraq Confirms Interest in Joining BRICS: Wants Trade in IQD and Russian Ruble

On February 4, 2024

By Awake-In-3D

In RV/GCR

In a significant diplomatic gesture, Iraq has officially expressed its eagerness to become a part of the BRICS consortium, marking a pivotal moment in its foreign policy and economic strategy.

Prime Minister Mohammed Shia Al-Sudani, during last October’s engagement with the Iraqi diaspora in Russia, voiced the nation’s readiness to join the influential group, contingent upon an invitation from its founding members.

A Strategic Discussion Amidst Economic Reforms

The revelation came amidst Al-Sudani’s discussions on various economic reforms and bilateral relations during his meeting with Russian President Vladimir Putin.

A notable point of discussion was the potential use of the Iraqi dinar and the Russian ruble in bilateral trade, hinting at Iraq’s intent to diversify its economic partnerships and reduce dependency on traditional trade currencies.

Emphasis on Economic and Administrative Reforms

Al-Sudani underscored the Iraqi government’s commitment to significant economic and administrative reforms aimed at enhancing the living standards of its citizens.

The move towards joining BRICS is seen as part of a broader strategy to integrate Iraq more fully into the global economy through diversified alliances and economic partnerships.

Deepening Iraqi-Russian Relations

The discussions also touched on geopolitical issues, with Al-Sudani commending Russia’s stance on the Palestinian conflict and emphasizing the humanitarian concerns at its core.

Moreover, the Iraqi Prime Minister disclosed plans to establish an Iraqi cultural center in Moscow, symbolizing a deepening of the historical ties between Iraq and Russia.

BRICS: A Gateway to Emerging Economies

Joining BRICS, a coalition of Brazil, Russia, India, China, and South Africa, represents a strategic move for Iraq to align itself with some of the world’s fastest-growing economies.

This association could provide Iraq with a platform to boost its economic profile, attract investments, and play a more influential role in global economic discussions.

Discover More:

The Rising Energy, Gold and Trade Power of the BRICS Alliance

Iraq’s expression of interest in joining BRICS underscores its ambition to pursue a multi-faceted foreign policy and economic strategy.

By strengthening ties with Russia and signaling openness to join economic groups like BRICS, Iraq aims to position itself as a key player in regional and global economic landscapes, fostering growth, stability, and prosperity for its people.

Supporting article: https://www.iraqinews.com/iraq/iraq-expresses-interest-in-joining-brics/

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/iraq-confirms-interest-in-joining-brics-wants-trade-in-iqd-and-russian-ruble/

A Lost Republic: The Strategic Overthrow of American Sovereignty (Part 1) : Awake-In-3D

A Lost Republic: The Strategic Overthrow of American Sovereignty (Part 1)

On February 2, 2024 By Awake-In-3D

How the Act of 1871 and International Bankers Silently Transitioned America from a Constitutional Republic into a Commercial Corporate Entity

Buried deep within the annals of American history, there lies a narrative seldom explored in the classrooms of our nation’s schools or the pages of mainstream historical discourse.

It is a tale that, if known, could fundamentally alter our understanding of the governance and legal foundation upon which the United States operates today.

Every Fourth of July, Americans celebrate their independence with great pomp and patriotism, believing in the freedom and liberty that the Founders fought for. Yet, unbeknownst to the vast majority, the freedoms we cherish and the government we trust to uphold them may not be as secure or as sovereign as we are led to believe.

A Lost Republic: The Strategic Overthrow of American Sovereignty (Part 1)

On February 2, 2024 By Awake-In-3D

How the Act of 1871 and International Bankers Silently Transitioned America from a Constitutional Republic into a Commercial Corporate Entity

Buried deep within the annals of American history, there lies a narrative seldom explored in the classrooms of our nation’s schools or the pages of mainstream historical discourse.

It is a tale that, if known, could fundamentally alter our understanding of the governance and legal foundation upon which the United States operates today.

Every Fourth of July, Americans celebrate their independence with great pomp and patriotism, believing in the freedom and liberty that the Founders fought for. Yet, unbeknownst to the vast majority, the freedoms we cherish and the government we trust to uphold them may not be as secure or as sovereign as we are led to believe.

This narrative revolves around a pivotal yet largely overlooked moment in history—the enactment of the Act of 1871, which established a corporate entity known as the “United States,” distinct from the original Constitutional Republic founded as “The United States of America.”

This act, passed under circumstances of financial desperation and political maneuvering, marked a departure from the principles enshrined by the Founding Fathers and set the stage for a profound transformation in the American political and legal landscape.

Why does this matter?

Every Fourth of July, Americans celebrate their independence with great pomp and patriotism, believing in the freedom and liberty that the Founders fought for. Yet, unbeknownst to the vast majority, the freedoms we cherish and the government we trust to uphold them may not be as secure or as sovereign as we are led to believe.

The distinction between the “United States of America” as a Republic and the “United States” as a corporate entity is not just a matter of semantics; it is a fundamental shift in the nature of governance and the rights of the citizenry.

This article seeks to peel back the layers of history to reveal a forgotten chapter that explains how and why the original Constitutional Republic known as The United States of America has been overshadowed by a corporate, legal construct.

We will delve into the backstory involving international bankers, the role they played in this transformation, and the implications it has for the freedoms and governance of the American people.

By understanding the events surrounding the Act of 1871, the motivations behind its passage, and its subsequent impact on American life, we can gain a clearer insight into the challenges facing our nation’s founding principles today.

Critically, this transition was not merely a legal technicality; it signified a shift towards a system where the federal government assumed greater control over the newly created category of federal citizens.

This hidden history is not merely an academic exercise; it is a quest for truth and understanding. Not just for Americans, but for all of humanity that seeks sovereign individuality.

It is a call to reexamine the foundations upon which our laws and institutions are built and to question the narratives that have been passed down through generations.

We must remember that the real history is far more complex and intriguing than the simplified versions we have been taught.

It is time to uncover why the original Constitutional Republic called The United States of America no longer exists in the form it was intended, and why this matters for every American today.

The Act of 1871: The Beginning of the End of American Self-Governance

At the heart of this exploration is the pivotal year of 1871, a time of profound transformation that redefined the United States’ legal and financial landscape.

This period, situated just after the Civil War, marks a crucial juncture in American history, a moment when the nation found itself grappling with the immense burdens of war debts and the daunting task of reconstruction.

It was against this backdrop of financial desperation and national vulnerability that the Act of 1871 was enacted, laying the groundwork for a seismic shift in the nation’s governance structure.

The post-Civil War era was marked by significant economic pressures and the looming influence of international bankers, notably the Rothschilds of London.

The Civil War, while primarily a battle over the moral and economic fissures created by slavery, also served as a stage for less visible but equally significant conflicts.

Among these were the strategic maneuvers by international banking interests, notably European financiers, who sought to extend their influence over the burgeoning American economy.

The war had left the United States in a precarious financial state, teetering on the brink of bankruptcy, and it was under these dire circumstances that Congress was compelled to act.

The legislation known as the Act of 1871, officially titled “An Act To Provide a Government for the District of Columbia,” was ostensibly passed to create a more efficient governance structure for the nation’s capital. However, the implications of this act were far-reaching, establishing a separate municipal government for the District of Columbia, a federal territory not exceeding ten square miles.

This act was not merely administrative; it represented a fundamental change in the nature of American governance.

The underlying motives for the Act of 1871 were complex. Financially drained and seeking to avoid direct borrowing from international bankers, who were already tightening their grip on global economies, the U.S. government found itself in a quandary.

The act was a strategic response to these pressures, facilitating the creation of a municipal corporation that would operate under a different set of rules than the original constitutional framework.

This new entity, known as the “United States” in a corporate sense, marked a departure from the Republic established by the Founding Fathers.

Critically, this transition was not merely a legal technicality; it signified a shift towards a system where the federal government assumed greater control over the newly created category of federal citizens.

This was not merely an administrative decision; it was a strategic move that laid the groundwork for the creation of a corporate entity known as the “United States.”

These citizens, now subject to the municipal laws of the District of Columbia, found themselves entangled in a web of statutes and regulations that diverged from the freedoms promised by the original Constitution.

The Act of 1871 thus laid the foundation for a dual system of governance, where the principles of the Republic and the dictates of a corporate entity coexisted in an uneasy balance.

The consequences of the Act of 1871 extend beyond the legal realm, touching upon the very identity of the American nation and its citizens. By redefining the framework of governance, the act facilitated a subtle yet profound realignment of power, placing the United States on a path that diverged from its founding ideals. This historical juncture, though often overlooked, is essential for understanding the contemporary challenges and debates surrounding freedom, sovereignty, and governance in the United States.

The Transformation from Republic to Corporate Entity

The United States of America, conceived as a beacon of freedom and democracy, underwent a profound transformation that is neither widely acknowledged nor understood.

This metamorphosis from a Constitutional Republic to a corporate entity was catalyzed by the Act of 1871, a critical yet often overlooked moment in American history.

This act, ostensibly designed to provide a government for the District of Columbia, effectively redefined the very fabric of the nation’s governance and its relationship with its citizens.

The Role of the Act of 1871

The Act of 1871 was passed during a period of vulnerability for the United States, following the devastation of the Civil War.

The nation found itself weakened, financially depleted, and in need of a mechanism to restore its coffers without succumbing to the influence of international bankers. It was within this context that Congress, under its constitutional authority, established a separate municipal government for the District of Columbia.

This was not merely an administrative decision; it was a strategic move that laid the groundwork for the creation of a corporate entity known as the “United States.”

Enter the Rothschilds: Economic Pressures and Foreign Bankster Influence

The post-Civil War era was marked by significant economic pressures and the looming influence of international bankers, notably the Rothschilds of London.

These financial powerhouses sought to extend their reach into the recovering American economy. The United States government, in an attempt to maintain sovereignty and avoid direct borrowing, issued Greenbacks – creating America’s first, official fiat currency.

However, this move was insufficient to fully alleviate the financial strain.

The Act of 1871 represented a compromise of sorts, a way to restructure the nation’s financial system without directly engaging with these international entities.

From Republic to Corporate Governance

This pivotal act signified a departure from the original Constitutional framework envisioned by the Founding Fathers. The creation of a municipal corporation for the District of Columbia introduced a new layer of governance, one that operated under a different set of rules and principles than those of the Republic.

This new government form was not merely a municipal entity; it was a corporate body that held sway over the District of Columbia, and by extension, had implications for the governance of the entire nation.

The Impact on American Freedoms

The transformation from a Republic to a corporate entity had far-reaching implications for the concept of freedom in America. The liberties and rights guaranteed under the original Constitution were gradually supplanted by a system of statutory laws and regulations that favored corporate interests.

The sovereignty of the individual and the state was undermined, replaced by a legal framework that prioritized the interests of the newly established corporate entity.

[To be continued in Part 2: The Role of International Bankers in America’s Incorporation]

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-lost-republic-the-strategic-overthrow-of-american-sovereignty-part-1/

Using Trading Platforms for RV/GCR Bonds and Currencies Explained : Awake-In-3D

Using Trading Platforms for RV/GCR Bonds and Currencies Explained

On January 31, 2024 By Awake-In-3D

In RV/GCR

If you have been around RV/GCR Land for even a short time, it is likely that you have heard the term Platform Trade, or Trading Platforms frequently mentioned. Yet they are never adequately explained regarding their role in the RV/GCR.

This article will get you up to speed.

Private Trading Platforms are a real thing in global finance. Most are not advertised, do not have websites and operate by word-of-mouth between connected businesses and individuals. One cannot get into a PTP by applying as participants are typically approached by private invitation.

I have had the pleasure (and luck) to meet several folks at various levels of PTPs over the years. Yet it’s like the iconic movie where “the first rule of Fight Club is you don’t talk about Fight Club.”

Using Trading Platforms for RV/GCR Bonds and Currencies Explained

On January 31, 2024 By Awake-In-3D

In RV/GCR

If you have been around RV/GCR Land for even a short time, it is likely that you have heard the term Platform Trade, or Trading Platforms frequently mentioned. Yet they are never adequately explained regarding their role in the RV/GCR.

This article will get you up to speed.

Private Trading Platforms are a real thing in global finance. Most are not advertised, do not have websites and operate by word-of-mouth between connected businesses and individuals. One cannot get into a PTP by applying as participants are typically approached by private invitation.

I have had the pleasure (and luck) to meet several folks at various levels of PTPs over the years. Yet it’s like the iconic movie where “the first rule of Fight Club is you don’t talk about Fight Club.”

Yet in the world of the wealthy and connected, private hard assets like fine art, precious metals and rare antiquities are placed into PTPs where they are hypothecated and rehypothecated for substantial financial leverage, arbitrage for various purposes such as raising business capital and even funding economic development or humanitarian projects.

What Exactly are Private Trading Platforms?

PTPs are specialized investment platforms that cater to the trading of a broad spectrum of assets outside the public markets.

These platforms predominantly focus on hard assets, which include tangible assets like real estate, precious metals such as gold and silver, gemstones, fine art, and other physical goods with intrinsic value.

The primary role of PTPs is to offer a secure, regulated space for high-net-worth individuals, institutional investors, and sometimes smaller investors with access, to invest in, sell, or trade these assets.

They provide a level of privacy and exclusivity not commonly found in public markets, thus presenting opportunities for higher returns due to the unique nature of the assets and less volatility compared to mainstream markets.

PTPs leverage their extensive networks, expertise, and exclusive deals to present unique investment opportunities. They often set certain criteria for participants, like minimum investment thresholds, to ensure that all investors are financially robust and comprehend the risks involved in these types of investments.

Access to these platforms is typically limited to investors who meet specific financial qualifications, allowing them to tap into a variety of hard assets and rare or unique investment opportunities not found in traditional markets.

Additionally, PTPs play a crucial role in matching sellers with buyers, facilitating transactions, providing valuation services, and sometimes offering safe storage solutions for the physical assets traded.

The Critical Role of Hypothecation and Rehypothecation in PTPs

When discussing hypothecation and rehypothecation within PTPs, it’s important to understand these as financial processes crucial to the platforms, especially concerning hard assets and securities lending.

Hypothecation happens when an investor pledges collateral (an asset) to secure a debt while maintaining ownership of the collateral, giving the lender the right to seize the asset if the loan isn’t repaid as agreed.

This allows asset owners to gain liquidity without selling, potentially leveraging it for further investments.

Rehypothecation goes a step further by allowing the lender or a financial intermediary to use the pledged collateral (the asset) for its own purposes, like securing its borrowing or obligations.

This process can enhance liquidity and trading efficiency in hard assets by allowing these assets to fulfill multiple financial roles simultaneously.

What Trading Platforms Do

For individuals or entities with valuable physical goods, placing a hard asset into a PTP offers numerous advantages.

It provides an opportunity to leverage these assets as collateral for loans or financing, thus gaining liquidity without selling the asset.

This can be especially appealing for assets anticipated to appreciate or those with sentimental value.

PTPs grant access to unique or exclusive investment opportunities unavailable to the general public, potentially yielding higher returns. They also facilitate the secure and regulated selling or trading of hard assets, reaching a broader audience of buyers or investors than possible through traditional markets.

Moreover, many PTPs provide secure storage solutions for physical assets (such as Safe Keeping Receipts or SKRs), mitigating the risk of theft or damage while the asset is held or traded.

In summary, by placing a hard asset into a PTP, individuals or entities not only secure liquidity but also access a suite of services and opportunities designed to maximize the value and utility of their assets.

It represents a strategic opportunity to enhance potential returns and offer financial flexibility, without the need to sell the asset outright.

How Private Trading Platforms Work

Leveraging hard assets, particularly those anticipated to appreciate significantly over time, in a Private Trading Platform (PTP) is a strategy that involves using these assets as collateral to secure financing or loans. This process allows for the potential appreciation of the asset while maintaining ownership.

Let’s take an an in-depth look at how this process unfolds.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-use-of-trading-platforms-for-rv-gcr-bonds-and-currencies-explained/

Please go to Part 2 and Part 3 for the rest of the article.

Part 2: https://ai3d.blog/how-private-trading-platforms-work-a-simple-example/

Part 3: https://ai3d.blog/how-trading-platforms-apply-to-rv-gcr-redemptions-and-exchanges/

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

On January 23, 2024 By Awake-In-3D

In RV/GCR

I rest my case. There’s frequent member discussion on my Telegram Channel about how US Treasuries are no longer accepted by foreign markets. Yet, the facts indicate exactly the opposite.

Just yesterday, I asked my readers to await the results of several US Treasury auctions this week.

Consequently, today’s 2-Year Treasury auction solidly shows that not only are US Debt instruments being accepted worldwide, foreign demand is at record levels.

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

On January 23, 2024 By Awake-In-3D

In RV/GCR

I rest my case. There’s frequent member discussion on my Telegram Channel about how US Treasuries are no longer accepted by foreign markets. Yet, the facts indicate exactly the opposite.

Just yesterday, I asked my readers to await the results of several US Treasury auctions this week.

Consequently, today’s 2-Year Treasury auction solidly shows that not only are US Debt instruments being accepted worldwide, foreign demand is at record levels.

A notable 65.3% of the auction was bought by foreign investors, termed ‘Indirects’. This is the highest percentage since the previous summer and well above the six-auction average.

So when the Guru News Network tells us that the US is bankrupt and US Treasuries are dead in the water internationally, our first action should be to simply go to the Treasury Auction website and check the facts. Nearly all financial data is publicly available as verification.

Here’s the details of today’s 2-Year Treasury Auction.

Solid Auction Signals Strong International Demand

Today’s 2-year Treasury auction highlighted a significant confidence in the US Treasuries, especially among foreign buyers.

Despite potential concerns regarding the upcoming Federal Open Market Committee (FOMC) meeting and Treasury Refunding, the auction proved successful.

Key Auction Outcomes

Sale Amount: The US sold $60 billion in 2-year notes today (January 23, 2024).

Interest Rate: The notes were sold at an interest rate of 4.365%. This was in line with expectations and slightly higher than last month’s rate.

Demand: The bid-to-cover ratio was 2.571. Although this is a slight decrease from last month and below the recent average, it remains within the healthy range seen over the past decade.

Demand for US Treasury Debt Instruments is at an all time high. Today’s 2-Year auction confirms this fact.

Foreign Interest Peaks

High Foreign Participation: A notable 65.3% of the auction was bought by foreign investors, termed ‘Indirects’. This is the highest percentage since the previous summer and well above the six-auction average.

Implications: Such strong foreign participation indicates a continued trust in the stability and reliability of US Treasury securities.

Domestic Participation and Market Impact

Direct and Dealer Participation: Direct bidders bought 19.9% of the auction, slightly below the average. Dealers took the smallest portion since the previous fall, at 14.8%.

Stable Market Response: The auction did not significantly impact the market. The 10-year Treasury yield remained stable at 4.14% following the auction.

This recent Treasury auction underscores the strong international confidence in US Treasuries (Bills, Notes, and Bonds).

Despite some market uncertainties, the high level of foreign buyer participation reflects the ongoing appeal of US Treasury securities as a stable investment.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D