Experts Say This Is A Key Sign You Have An Unhealthy Relationship With Money

Experts Say This Is A Key Sign You Have An Unhealthy Relationship With Money

By Natalia Lusinski Sep. 17, 2022

When it comes to money and budgeting, it’s often easier said than done. You may have the best of intentions — you’ll eat out less this month and put the money into your savings account instead. But then life happens. Just like working through any other life, fitness, or wellness issue, a little introspection is often the ticket. If you want to get your finances back in order, a financial psychologist or money mindset coach can help. It all starts with getting your head in the right place.

Experts Say This Is A Key Sign You Have An Unhealthy Relationship With Money

By Natalia Lusinski Sep. 17, 2022

When it comes to money and budgeting, it’s often easier said than done. You may have the best of intentions — you’ll eat out less this month and put the money into your savings account instead. But then life happens. Just like working through any other life, fitness, or wellness issue, a little introspection is often the ticket. If you want to get your finances back in order, a financial psychologist or money mindset coach can help. It all starts with getting your head in the right place.

“Whenever things are in order, it brings us a sense of peace,” Severine Bryan, DBA, financial empowerment educator and coach, and founder of Sev Talks Money, tells TZR in an email.

“Having our finances in order doesn't necessarily mean we are debt-free, but it allows us to have a clear picture of where we are at. It is very important to know what is coming in and what is going out so we are not flying blind.”

She says she likes to think of organizing finances like taking a trip to New York City. “I can leave Georgia and end up in California if I don't know the details of the trip and if I don’t put specific plans in place,” she explains. “When I have a plan, I will go directly to NYC. And even if I take a detour, I will know how to get back on track to get there.” Ahead, Bryan and two other financial coaches explain how they help clients get back on track — and why it’s never too late to do so.

What A Financial Coach Does

Whether you consult a financial psychologist, money mindset coach, or similar type of financial expert, they all do variations of the same thing — help you figure out your relationship to money and how your past (upbringing) affects your present spending and saving habits.

“Part of what we're doing in financial therapy is to be able to really look with clarity at our circumstances — and how those circumstances change from moment to moment,” Financial Therapist Amanda Clayman tells TZR. She aims to help clients learn how to use certain strategies to get a money routine or practice in place.

Bryan adds that a financial coach can also help clients set financial goals, create a plan to achieve those goals, and provide accountability to help them follow the plan. “We also help the client dig deep to find what motivates them to achieve certain goals,” she explains.

“Because, many times, the goal is not money, but the things that money provides, such as freedom to make choices.” This can mean anything from wanting to eat out to buying a particular car or taking a certain vacation. “I think of a financial coach similarly to a football coach,” she adds. “The football coach gives the plays during training, but on game day, the quarterback is the one that has to make the calls.”

Finances can be a very difficult topic to discuss, Taryn Bushrod, money mindset coach and founder of Taryn’s World, tells TZR in an email. “Doing so exposes people’s vulnerabilities, and that can be extremely uncomfortable,” she says. “The first thing I do with a new client is build a relationship, so they are comfortable enough to start sharing pertinent information I need in order to help them start seeing results.” She then focuses on behavioral factors that impact spending.

“In doing so, you can identify the root cause of your actions and redirect your spending habits, which, in turn, could result in redirecting your funds.”

To continue reading, please go to the original article here:

You Have “Enough” Money When You Can Afford 2 Needs

You Have “Enough” Money When You Can Afford 2 Needs

By Darius Foroux

Do you have “enough” money? A study found that the ideal income for a typical American family to have “emotional well-being” is around $60,000 to $75,000 annually.1

In an interview, Warren Buffett said he would be “very happy” with $100,000 a year, despite his billionaire net worth.2 Meanwhile, John Bogle, the pioneer of modern index investing and founder of the Vanguard Index Fund, says “enough” is “one dollar more than you need.” Which I think is also a good definition. The truth is that “enough” depends on our personal circumstances.

You Have “Enough” Money When You Can Afford 2 Needs

By Darius Foroux

Do you have “enough” money? A study found that the ideal income for a typical American family to have “emotional well-being” is around $60,000 to $75,000 annually.1

In an interview, Warren Buffett said he would be “very happy” with $100,000 a year, despite his billionaire net worth.2 Meanwhile, John Bogle, the pioneer of modern index investing and founder of the Vanguard Index Fund, says “enough” is “one dollar more than you need.” Which I think is also a good definition. The truth is that “enough” depends on our personal circumstances.

Money is an emotional subject, not a rational one. A multi-six-figure earner can feel they’re overwhelmed with material desires. While someone earning a fraction of that can feel perfectly satisfied with their life.

It’s all about what we think we need.

Here’s a thought experiment for you: Categorize all your needs.

That will help you to improve your relationship with money. There are several ways you can do this. Here’s an example:

Security — Having an emergency fund, a nest egg, and being financially free.

Loved ones — After establishing one’s own financial freedom, some people choose to take financial obligations for their family, sometimes including those in their extended family.

Exploration — traveling to other countries, having new experiences, living a non-traditional lifestyle, and so forth.

Hobbies — Cycling, training for endurance sports, collecting sports cars/luxury watches/ “big person” toys, beauty and fashion, etc. Depending on a person’s immersion in the hobby, these things can cost thousands or millions!

Creative outlet — painting, writing a book, making music, etc. Sometimes, your creative outlet is your full-time career. Other times, it’s a purely artistic endeavor that generates little to no income. Both are fine, depending on you.

You can define these categories any way you like. Then, ask yourself: What are my Top 2 needs?

The reason for choosing only two is that it forces you to think about whether you really want something over another. For most of us, security is always among the top 2.

But that may not be the case for others. Some people come from backgrounds that are financially well-off, for example. Or even if they don’t, they’d rather spend their time exploring and being fully immersed in their creative outlets. So security may not be a priority.

To continue reading, please go to the original article here:

7 Things Rich People Never Do

7 Things Rich People Never Do

By Darius Foroux

I’ve adopted the mental model of Charlie Munger when it comes to living a good life. It’s useful to gain insights into the thought process of certain rich people. Munger was trained as a lawyer, got briefly into real estate development, and built his fortune together with Warren Buffett in Berkshire Hathaway. Munger says:

“My system in life is to figure out what’s really stupid and then avoid it. It doesn’t make me popular, but it prevents a lot of trouble.”

It’s attractive to talk about all the things rich people do and how you can build wealth. A large part of my work focuses on the right actions we should undertake to get wealthy.

7 Things Rich People Never Do

By Darius Foroux

I’ve adopted the mental model of Charlie Munger when it comes to living a good life. It’s useful to gain insights into the thought process of certain rich people. Munger was trained as a lawyer, got briefly into real estate development, and built his fortune together with Warren Buffett in Berkshire Hathaway. Munger says:

“My system in life is to figure out what’s really stupid and then avoid it. It doesn’t make me popular, but it prevents a lot of trouble.”

It’s attractive to talk about all the things rich people do and how you can build wealth. A large part of my work focuses on the right actions we should undertake to get wealthy.

But what I don’t always share is how I figured out the right actions. Most of the time it’s a matter of looking at the wrong options and doing the opposite. In this article, I’m sharing 7 things that you want to avoid if you want to get rich.

These things might sound obvious, but avoiding these types of pitfalls will set you up for success. They should never be overlooked.

1. Using Credit Card Debt

Using credit cards as a payment method is fine. When the full amount is taken out of your checking out every month, you don’t pay interest.

I read somewhere that 77% of U.S. households have some amount of credit card debt.1 To be honest, I was shocked and find it hard to believe. That number just sounds too high to me. Either way, using credit card debt is dumb.

The average credit card interest rate is 18.79 percent right now.2 What?! Forget about how much more expensive it makes your purchases.

With interest rates that high, you’re only paying off interest, and your debt will just remain. This is how people get into debt and never get out of it. My parents still have credit card debt from 20 years ago. I’ve paid some of it off, but they don’t want to accept me paying off everything. I always tell them that’s stupid.

These crooks don’t deserve your interest payments. There are many other good things you can do with that money.

2. Thinking They Know Everything

I have a family member who’s a doctor, lawyer, neuroscientist, politician, engineer, musician, artist, creative, and every other profession in the world.

Every time you talk to him, he pretends he literally knows everything about everything in the world.

To continue reading, please go to the original article here:

Why It’s Time To Be Optimistic About The Future

Why It’s Time To Be Optimistic About The Future

January 9, 2023 Simon Black, Founder Sovereign Research & Advisory Group

Around 23,000 years ago on the southwestern shores of the Sea of Galilee, a small paleolithic tribe of hunter-gatherers made an incredible discovery that would forever alter the course of human history.

They realized that, instead of relying on fishing, hunting, and foraging for edible plants, they could actually grow their own food, right out of the ground. We know this happened because archaeologists have uncovered roughly 90,000 seeds from the site-- including different species of barley, various nuts (almonds, pistachios) and fruits (raspberries, figs). More strikingly, the remains of several small dwellings have been excavated. And a number of stone tools were found on the site, including a grinding stone and several flint blades and sickles.

Why It’s Time To Be Optimistic About The Future

January 9, 2023 Simon Black, Founder Sovereign Research & Advisory Group

Around 23,000 years ago on the southwestern shores of the Sea of Galilee, a small paleolithic tribe of hunter-gatherers made an incredible discovery that would forever alter the course of human history.

They realized that, instead of relying on fishing, hunting, and foraging for edible plants, they could actually grow their own food, right out of the ground. We know this happened because archaeologists have uncovered roughly 90,000 seeds from the site-- including different species of barley, various nuts (almonds, pistachios) and fruits (raspberries, figs). More strikingly, the remains of several small dwellings have been excavated. And a number of stone tools were found on the site, including a grinding stone and several flint blades and sickles.

These findings are clear evidence that the tribe most likely lived on this ancient farm where they planted, harvested, processed, and consumed their own food, making it the world’s first known agricultural settlement.

That was a pivotal moment in human history.

Prior to the development of agriculture, human beings roamed from place to place constantly in search of food. But agriculture meant that, for the first time ever, our ancestors could put down roots and build a real civilization. Permanent construction. Institutions. Structure. Economic activity.

In the paleolithic era prior to agriculture, hunting and gathering food typically required the participation of nearly everyone in the tribe.

But after the development of agriculture and improvement of growing techniques, it only took a few people to grow enough food to feed the rest of the tribe. Everyone else was able to devote their time to other value-creating endeavors, like research, education, construction, defense, etc.

They learned how to store their surplus food production, to create savings and security for the future… as well as to trade with other tribes.

Agriculture also gave them the ability to grow industrial commodities, like cotton, papyrus, and medicinal flowers, which helped create new industries and technologies like writing, textiles, and healthcare.

Eventually their agricultural production grew to such an extent that small settlements like the one near the Sea of Galilee turned into villages, villages into towns, and towns into cities.

It’s difficult to overstate the importance of this development; nearly everything that we enjoy today begins with our ancestors coming out of their caves and planting the seeds of civilization.

For ancient civilizations, agriculture was wealth. Precious metals were well-known to them, but these people understood very well that you couldn’t eat gold and you couldn’t clothe yourself in silver. Gold and silver were simply a medium of exchange used to trade agricultural commodities… but the actual ‘wealth’ was the agriculture itself.

This is one of the common elements of the most advanced civilizations in early history-- the Sumerians, Egyptians, Yangshao, Indus peoples, etc. were all extremely prolific agriculture producers. They recognized that their success depended on their ability to efficiently grow and produce highly-valued products… AND to produce far more than they could consume.

This is what it meant to be ‘wealthy’ in the ancient world, and it remained that way for thousands of years.

(There were obviously many civilizations and kingdoms who attempted to grow wealthier by conquering others. But the basic motivation was the same: conquering more land meant having more production, and hence more wealth.)

But little-by-little the concept of ‘wealth’ started to change. Instead of real, tangible goods and the ability to produce, wealth became defined by the accumulation of money itself.

This change began in earnest in the 1500s, when European rulers began importing enormous quantities of gold and silver from their colonial mines in the Americas; the Spanish, for example, imported thousands of tons of silver just from a single mine in Bolivia.

In this way, they weren’t actually producing anything… other than more money. So they were essentially trying to become wealthier by creating more money, rather than producing valuable goods and services.

(Naturally it didn’t take long for inflation to set in, and Europeans suffered rising prices for more than a century, in part due to the incredible, sudden influx of gold and silver devoid of any increase in the actual production of goods and services.)

This is the view of ‘wealth’ that remains today; it’s no longer about the production of valuable goods and services. Instead, wealth is defined by money. And money has become synonymous with wealth, rather than as a medium of exchange.

In modern times it’s actually even more absurd. In our world, debt is actually wealth… in that the bonds of heavily indebted governments (like the US) are considered a form of money, and hence wealth.

Moreover, the notion that a government should produce more than it consumes and live within its means is viewed as preposterous. No one cares about deficits. Instead, politicians assume there will always be an endless line of willing suckers ready to buy more bonds.

This whole mentality has even given rise to a popular and growing economic theory known as MMT, or Modern Monetary Theory, which contends that government deficits are completely irrelevant. Its most well-known work, in fact, is literally called The Deficit Myth.

In short, MMT says you don’t have to actually do anything to create wealth. Governments can simply conjure infinite quantities of money out of thin air and everyone will live happily ever after.

(Naturally MMT proponents claim their position is grounded in ‘science’ and supported by several complex mathematical models. Therefore they’re right and you’re just an ignorant fool.)

We can even see signs of MMT’s influence in the stock market, where investors developed an ethos that, similar to deficits, profits don’t matter. And businesses with no hope of ever achieving profitability became worth tens of billions of dollars.

Seemingly everything became valuable over the past several years, regardless of productivity, profitability, or practicality.

Perhaps most egregious was back in 2019 when a concept artist sold TWO editions of his ‘work’-- a banana duct-taped to the wall-- for $120,000.

At that point the concept of ‘wealth’ had truly devolved to sheer lunacy.

But that time seems to have come to an end, and I believe we are seeing signs of a shift back to a more traditional view of wealth.

All it took was a devastating war, record-high inflation, unprecedented rate hikes, and an appalling level of government incompetence, to finally realize that a $120,000 banana is just stupid…

And that’s reason enough to be optimistic.

Over the past several years, bad businesses and dumb ideas soared in value because central banks printed gargantuan sums of money, corrupting the very concept of wealth itself.

But people now realize that central bankers are only human. They make mistakes too. They cannot walk across the water and maintain pristine economic conditions forever and ever until the end of time.

Moreover, people are starting to figure out that, while central banks can create trillions of dollars worth of money with the push of a button, they cannot produce a single microchip, a grain of wheat, a drop of oil, a line of code, nor any of the other valuable goods and services that an economy really needs.

And this is why I’m really optimistic.

There’s a whole lot of chatter about recession these days-- whether it’s coming, how bad will it be, how long will it last, etc.

But I think that’s an overly simplified way of looking at it. There’s already a recession-- primarily for $120,000 bananas and other idiotic ideas. Cheers to that.

But for those with a more traditional view-- that wealth is not defined by rapidly depreciating pieces of paper, but rather the ability to efficiently produce highly-valued goods and services-- a new era of opportunity is just beginning.

To your freedom, Simon Black, Founder Sovereign Research & Advisory

https://www.sovereignman.com/trends/why-its-time-to-be-optimistic-about-the-future-145095/

To Build Inevitable Wealth, Simply Avoid Financial Ruin

To Build Inevitable Wealth, Simply Avoid Financial Ruin

By Darius Foroux

In 1942, the world was at war. In December of the previous year, the United States entered WWII when Japan attacked Pearl Harbor. By that time, the US got into a war that started in 1939. While Americans were quick to adjust back at home, by turning factories into manufacturers of weaponry, the war itself didn’t play out well at all. America was struggling in the Pacific. It was a rough first year with many casualties. Some people started to lose faith.

That was the year an 11-year-old boy made his first stock purchase. He bought six shares of Cities Service, an energy company, for $38 per share. He bought three shares for himself and three shares for his sister, Doris Buffett. The boy was of course Warren Buffett, the greatest investor of all time.

To Build Inevitable Wealth, Simply Avoid Financial Ruin

By Darius Foroux

In 1942, the world was at war. In December of the previous year, the United States entered WWII when Japan attacked Pearl Harbor. By that time, the US got into a war that started in 1939. While Americans were quick to adjust back at home, by turning factories into manufacturers of weaponry, the war itself didn’t play out well at all. America was struggling in the Pacific. It was a rough first year with many casualties. Some people started to lose faith.

That was the year an 11-year-old boy made his first stock purchase. He bought six shares of Cities Service, an energy company, for $38 per share. He bought three shares for himself and three shares for his sister, Doris Buffett. The boy was of course Warren Buffett, the greatest investor of all time.

About 1942, he remembers, “We were losing the war in the Pacific.” Buffett learned an important lesson: “Never bet against America.”

That same year, in the midst of the crisis, the Manhattan Project started, which eventually developed into a nuclear weapon that ended the war in 1945.

There’s Always Bad News

When Warren Buffett bought his first stock, it looked like the allied forces were losing the war. But as long as you’re bullish on the future, you must become callous to what’s reported on the news. Buffett says:

“If it’s a good business at a good price, we buy it. There is always going to be bad news out there.”

Buffett and his partner Charlie Munger claim they never allowed macro factors to interfere with their investment process. They have a system for picking stocks and they have a mental model for staying in those stocks.

When you want to make an investment, whether that’s in the stock market, real estate, or in a private business, I bet that you can point to at least a handful of factors and say, “Let’s see how that plays out.”

Maybe you want to see how inflation plays out or whether a geopolitical conflict gets solved, but let’s face it, these are excuses. As Buffett says, there will always be bad news out there.

Instead of focusing on the news or listening to the opinions of people on CNBC, FinTwit, or YouTube, focus on your behavior.

There Are Many Ways To Get Rich; Only A Few Ways To Go Broke

To continue reading, please go to the original article here:

How Do People Become Wealthy? 2 Case Studies

How Do People Become Wealthy? 2 Case Studies

By Darius Foroux

How do people become wealthy? I was always interested in that question because you can learn from other people’s success. But I don’t want to look at billionaires and no one else. I’m also interested in how “normal” people build wealth. You know, people who live in your city. Why? If anyone from your city can get rich, you can too.

Here’s an idea: Find someone in your network who you want to learn from. It doesn’t necessarily have to be a wealthy person. It could be someone who’s loved in your community. Get close to them and simply observe. Look at what they do and listen to what they say. I’ve done that as well. I wrote about what I learned in an article. It’s really a good way to learn.

How Do People Become Wealthy? 2 Case Studies

By Darius Foroux

How do people become wealthy? I was always interested in that question because you can learn from other people’s success. But I don’t want to look at billionaires and no one else. I’m also interested in how “normal” people build wealth. You know, people who live in your city. Why? If anyone from your city can get rich, you can too.

Here’s an idea: Find someone in your network who you want to learn from. It doesn’t necessarily have to be a wealthy person. It could be someone who’s loved in your community. Get close to them and simply observe. Look at what they do and listen to what they say. I’ve done that as well. I wrote about what I learned in an article. It’s really a good way to learn.

How Do People Become Wealthy? 2 Case Studies

How do people become wealthy? I’ve been interested in that question because you can learn from other people’s success. If you look up that question, you automatically find more information about how people like Jeff Bezos got rich.

But I’m more interested in learning from people that are not covered by the media. “Normal” wealthy people that live in your city—not the billionaires who live on Park Avenue. Why? If anyone from your city can get rich, you can too.

I know two of these wealthy people. I see them as friends and mentors. In this article, I will share their stories, as they’ve told them to me. I’ve only changed their names to protect their privacy, but the rest of the story contains their true path to becoming wealthy.

For the purpose of this article, I’m focusing on acquiring monetary wealth. Obviously, getting rich has very little to do with becoming happy. If you want to read my thoughts on happiness and money, read this article. We can have a good life without being rich. But if you’re interested in learning from people who are wealthy, read on.

Case Study 1: The Enjoyer Of Life

John is in his late sixties, has 3 grown kids, and two grandkids. He’s divorced and lives alone with his dog. He also has a girlfriend who he sees several times a week.

He has a small real estate portfolio (residential only) and spends a few hours a month managing his properties. He has outsourced most of the work, but he enjoys staying in touch with his tenants. So he visits them once a year.

To continue reading, please go to the original article here:

How To Beat Procrastination (backed by science)

How To Beat Procrastination (backed by science)

By Darius Foroux

What’s something you want to do in your life but you’re putting off until later?

“One day I’m going to start with investing.” When is one day? It’s more likely we’re not going to start at all. When you live your life like that, one day you’ll look back and think, “Where did my time go? I haven’t done anything I said I would.” That’s not a good feeling. I was on that path myself. And when I saw my grandmother pass away with many feelings of regret, I decided to change my lifestyle.

I looked at procrastination as my biggest enemy in life. I aimed to become someone who does what they say. I started small and kept living like that. When you never procrastinate on the biggest things in life, you will never feel any regret. It’s a very peaceful way to live.

How To Beat Procrastination (backed by science)

By Darius Foroux

What’s something you want to do in your life but you’re putting off until later?

“One day I’m going to start with investing.” When is one day? It’s more likely we’re not going to start at all. When you live your life like that, one day you’ll look back and think, “Where did my time go? I haven’t done anything I said I would.” That’s not a good feeling. I was on that path myself. And when I saw my grandmother pass away with many feelings of regret, I decided to change my lifestyle.

I looked at procrastination as my biggest enemy in life. I aimed to become someone who does what they say. I started small and kept living like that. When you never procrastinate on the biggest things in life, you will never feel any regret. It’s a very peaceful way to live.

How To Beat Procrastination (backed by science)

https://i0.wp.com/dariusforoux.com/wp-content/uploads/2018/02/the-slope-of-procrastination.png

Do you want to beat procrastination? Join the club. Procrastination has been around since the start of modern civilization.

Historical figures like Herodotus, Leonardo Da Vinci, Pablo Picasso, Benjamin Franklin, Eleanor Roosevelt, and hundreds of others have talked about how procrastination is the enemy of results.

One of my favorite quotes about procrastination is from Abraham Lincoln:

“You cannot escape the responsibility of tomorrow by evading it today.”

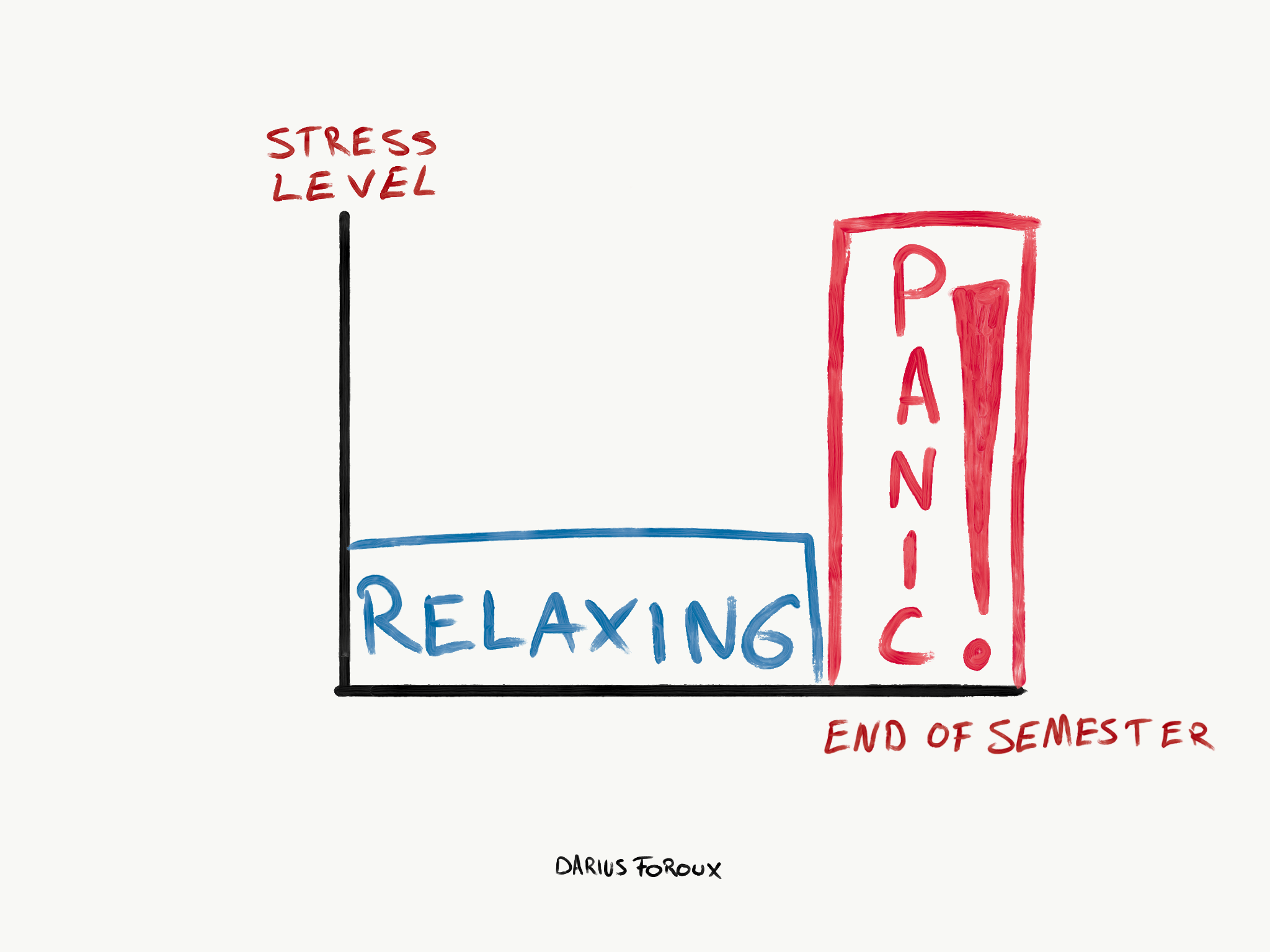

The funny thing about procrastination is that we all know that it’s harmful. Who actually likes to procrastinate? No one enjoys doing that. Me neither. And yet, procrastination was the story of my life. When I was in college, every semester, this would happen:

relaxing and freaking out – procrastination https://i0.wp.com/dariusforoux.com/wp-content/uploads/2018/02/relaxing-and-freaking-out.png

In the beginning of each semester, I was the coolest mofo on the planet. Relaxing, going out, enjoying myself. Big time.

I experienced no stress whatsoever. However, about a week before my exams, I would freak out.

“Dude, why didn’t you begin earlier?” I would tell myself.

And what would follow is an ugly sight of me, with a bunch of Red Bull cans, locked up in my room — freaking out while I was studying.

And research shows exactly that: When you procrastinate, you might feel better in the short-term, but you will suffer in the long-term.

It doesn’t really matter why you procrastinate. Some love the pressure of deadlines. Some are afraid to fail so they put it off until the very last moment. One thing that all procrastinators have in common is that procrastination has a price.

This highly cited study, published in the American Psychological Society journal, by Dianne Tice and Roy Baumeister discusses the cost of procrastination. It is related to:

Depression

Irrational beliefs

Low self-esteem

Anxiety

Stress

Procrastination is not innocent behavior. It’s a sign of poor self-regulation. Researchers even compare procrastination to alcohol and drug abuse.

To continue reading, please go to the original article here:

Impatience: The Pitfall of Every Ambitious Person

Impatience: The Pitfall of Every Ambitious Person

By Darius Foroux

People could talk to me about impatience 24/7 but I would still not act patiently. That’s because I had never seen the power of patience in my own life until a few years ago. At some point, I decided to do one thing for a long time without thinking about the results. I started to write every day. I published a book and articles. Nothing happened for a while. But after several months, I saw some success. Then, some more. And over the years, things kept adding up.

If you’re currently working hard without seeing the results you want, remember to stay focused on the path. Remember that overnight success doesn’t exist. We have to remind ourselves of that whenever we’re impatient. It happens to every ambitious person.

Impatience: The Pitfall of Every Ambitious Person

By Darius Foroux

People could talk to me about impatience 24/7 but I would still not act patiently. That’s because I had never seen the power of patience in my own life until a few years ago. At some point, I decided to do one thing for a long time without thinking about the results. I started to write every day. I published a book and articles. Nothing happened for a while. But after several months, I saw some success. Then, some more. And over the years, things kept adding up.

If you’re currently working hard without seeing the results you want, remember to stay focused on the path. Remember that overnight success doesn’t exist. We have to remind ourselves of that whenever we’re impatient. It happens to every ambitious person.

Impatience: The Pitfall of Every Ambitious Person

One of my mentors, an art dealer, taught me the pitfalls of impatience. He specializes in art from the middle ages. Last time we met, he showed me a part of his personal collection. Impressed by the size of the collection, I asked how long it took to accumulate everything.

He said “45 years,” and then he laughed when I looked surprised. He continued:

“This is not something you can buy in one go. It’s not like going to the IKEA. Accumulating anything worthwhile in life takes time. First, because you don’t have the money to buy everything at once. Second, not everything is always available. You must wait for the right opportunity.”

And waiting is one of the hardest things in life. But if you take a close look around you, you see many examples of people who waited for the right opportunity.

Take all the investors who bought stocks and real estate during the financial crisis that started in 2008. That recession lasted for several years. Recently, I spoke to someone who invested a big chunk of his assets in the stock market between 2009 and 2011.

He saved most of his money in the years that led to the crisis. Not because he predicted the global financial crisis that was sparked by subprime mortgages, but because he simply didn’t know what to do. So he spent his time learning about investing.

He also didn’t follow the market. Instead, he saved his money — and wasn’t tempted to invest it just because “the economy is great.”

But that’s not what most people do in prosperous times. When we see that the economy is growing, we think it’s the right time to invest and spend.

We feel optimistic and we trust the market. So what do we do? We look for “good” investments. All of us turn into part-time investors.

To continue reading, please go to the original article here:

Money Fallacy #1: The Checks Will Not Always Come

Money Fallacy #1: The Checks Will Not Always Come

By Darius Foroux

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns. We also tend to make that same mistake with our income. A lot of people assume their current income level will move in the same direction. If they are earning more every year, they think they will keep earning more. And if they are earning less, they anxiously assume that trend will keep going down.

Both are wrong. A person who earns well today can’t assume the checks will keep coming in (think of all the people who enjoyed 5 minutes of fame). In my latest article, I share how you can avoid this money fallacy.

Money Fallacy #1: The Checks Will Not Always Come

By Darius Foroux

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns. We also tend to make that same mistake with our income. A lot of people assume their current income level will move in the same direction. If they are earning more every year, they think they will keep earning more. And if they are earning less, they anxiously assume that trend will keep going down.

Both are wrong. A person who earns well today can’t assume the checks will keep coming in (think of all the people who enjoyed 5 minutes of fame). In my latest article, I share how you can avoid this money fallacy.

Money Fallacy #1: The Checks Will Not Always Come

Consider two artists: MC Hammer and Chamillionaire. Most people know the former because he famously went broke in the 90s despite earning millions of dollars. It’s a good case of money fallacy that many people who earn well often ignore.

MC Hammer made 37 million dollars. But he spent 50. And when he declared bankruptcy in 1996, he had 13 million dollars of debt.

Now, look at Chamillionaire, who just like Hammer, was popular for a few years. When I was in college, he had a famous song called Ridin Dirty. I was never a fan and never heard about Chamillionaire again until a few years ago.

I read that used the money he made during those few years he was popular to invest. Now, he’s worth at least 50 million dollars.

Enter: The Extrapolation Bias

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns (the terms are used interchangeably).

According to one paper by Purdue scientists, Cassella and Gulen, “An extrapolative investor believes that recent high returns are more likely to be followed by high returns, and similarly, recent low returns are more likely to be followed by low returns.”1

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise

Too often, ambitious and hard-working people have an urge to pretend that everything is fine.

The house might be burning down, and they’ll say, “It’s fine!” Your house is on fire! How can it be fine?!

Sometimes, we need to admit things are not fine. In his book, Get Out of Your Own Way, the psychiatrist Mark Goulston writes:

“Admitting to yourself that you are upset or in pain can make you feel exposed. You fear that acknowledging a bad feeling gives it more power. The pain might get worse. You might not be able to tolerate it.”

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise

Too often, ambitious and hard-working people have an urge to pretend that everything is fine.

The house might be burning down, and they’ll say, “It’s fine!” Your house is on fire! How can it be fine?!

Sometimes, we need to admit things are not fine. In his book, Get Out of Your Own Way, the psychiatrist Mark Goulston writes:

“Admitting to yourself that you are upset or in pain can make you feel exposed. You fear that acknowledging a bad feeling gives it more power. The pain might get worse. You might not be able to tolerate it.”

For the past two years, we’ve been dealing with one challenge after the other. Now, it’s inflation. I’m sure something else will come after that. Sometimes it can get a bit too much. And that’s fine. No one can live like a superhuman every day. We must always be aware of the signals our mind and body give us. The key is to acknowledge that you don’t have to be doing well all the time. Sometimes we need to take a step back. And sometimes we need to put our feet on the gas.

What matters is that you always stay connected to body and mind. And never give up.

↳ The Dark Art of Pretending You Are Fine

Wealthy

Whether you’re a seasoned trader or a retail investor who’s just starting out, investing comes with pain. Stocks and other asset prices fluctuate. Growth isn’t linearly. It’s more like a pendulum. It goes up and down. If you’re afraid of the downturns, you won’t be able to keep investing.

https://dariusforoux.com/pretending-you-are-fine-and-managing-emotions-to-build-wealth/

21 Small Actions That Will Make You Richer

21 Small Actions That Will Make You Richer

Small Actions to Get Richer

Despite the “success stories” you might see online, the vast majority of wealthy people got to where they are after many years. But most of us have this idea that getting rich can be easy. “You just need to have the right idea!” Deep down, we know that it’s not that simple. We also know that consistent action over time can lead to big results. As Warren Buffett said:

“It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Whether you’re training for a marathon or working towards financial independence, your best bet is to aim for consistency. What is consistency when it comes to wealth?

21 Small Actions That Will Make You Richer

Small Actions to Get Richer

Despite the “success stories” you might see online, the vast majority of wealthy people got to where they are after many years. But most of us have this idea that getting rich can be easy. “You just need to have the right idea!” Deep down, we know that it’s not that simple. We also know that consistent action over time can lead to big results. As Warren Buffett said:

“It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Whether you’re training for a marathon or working towards financial independence, your best bet is to aim for consistency. What is consistency when it comes to wealth?

Financial consistency is about moderation and perfect execution of your strategy.

A financially consistent person is dedicated to getting richer just a little bit, year after year. It’s about doing the least amount of saving and investing to grow one’s net worth.

If you are financially consistent, it’s a guarantee you will become wealthier over time. It’s all about how well you execute the little things.

Over the years, I’ve identified many small financial actions that sound obvious but few people execute consistently. Here they are.

Reading books — Not only leaders are readers, but so are many wealthy people. Books usually contain quality information and are crafted with care. You usually learn more from books than from other mediums.

Spending time with smart people — Being around smart people gives you an idea of how they think and operate. That’s inspiring.

Asking questions — Being curious leads to new realizations, which in turn leads to better decisions.

Controlling the urge to buy stuff — If you’re on a quest to accumulate nice things, you will never be satisfied. You will only empty your bank account.

Ignoring fake geniuses — There are many people who pretend they are smart. Not only on social media but also in real life. The ability to distinguish the fake from the real will help you avoid stupid things.

Limiting social media consumption — No matter how great social media can be, too much of it will turn you into a mindless consumer. And consumers don’t get rich.

To continue reading, please go to the original article here: