How Do People Become Wealthy? 2 Case Studies

How Do People Become Wealthy? 2 Case Studies

By Darius Foroux

How do people become wealthy? I was always interested in that question because you can learn from other people’s success. But I don’t want to look at billionaires and no one else. I’m also interested in how “normal” people build wealth. You know, people who live in your city. Why? If anyone from your city can get rich, you can too.

Here’s an idea: Find someone in your network who you want to learn from. It doesn’t necessarily have to be a wealthy person. It could be someone who’s loved in your community. Get close to them and simply observe. Look at what they do and listen to what they say. I’ve done that as well. I wrote about what I learned in an article. It’s really a good way to learn.

How Do People Become Wealthy? 2 Case Studies

By Darius Foroux

How do people become wealthy? I was always interested in that question because you can learn from other people’s success. But I don’t want to look at billionaires and no one else. I’m also interested in how “normal” people build wealth. You know, people who live in your city. Why? If anyone from your city can get rich, you can too.

Here’s an idea: Find someone in your network who you want to learn from. It doesn’t necessarily have to be a wealthy person. It could be someone who’s loved in your community. Get close to them and simply observe. Look at what they do and listen to what they say. I’ve done that as well. I wrote about what I learned in an article. It’s really a good way to learn.

How Do People Become Wealthy? 2 Case Studies

How do people become wealthy? I’ve been interested in that question because you can learn from other people’s success. If you look up that question, you automatically find more information about how people like Jeff Bezos got rich.

But I’m more interested in learning from people that are not covered by the media. “Normal” wealthy people that live in your city—not the billionaires who live on Park Avenue. Why? If anyone from your city can get rich, you can too.

I know two of these wealthy people. I see them as friends and mentors. In this article, I will share their stories, as they’ve told them to me. I’ve only changed their names to protect their privacy, but the rest of the story contains their true path to becoming wealthy.

For the purpose of this article, I’m focusing on acquiring monetary wealth. Obviously, getting rich has very little to do with becoming happy. If you want to read my thoughts on happiness and money, read this article. We can have a good life without being rich. But if you’re interested in learning from people who are wealthy, read on.

Case Study 1: The Enjoyer Of Life

John is in his late sixties, has 3 grown kids, and two grandkids. He’s divorced and lives alone with his dog. He also has a girlfriend who he sees several times a week.

He has a small real estate portfolio (residential only) and spends a few hours a month managing his properties. He has outsourced most of the work, but he enjoys staying in touch with his tenants. So he visits them once a year.

To continue reading, please go to the original article here:

How To Beat Procrastination (backed by science)

How To Beat Procrastination (backed by science)

By Darius Foroux

What’s something you want to do in your life but you’re putting off until later?

“One day I’m going to start with investing.” When is one day? It’s more likely we’re not going to start at all. When you live your life like that, one day you’ll look back and think, “Where did my time go? I haven’t done anything I said I would.” That’s not a good feeling. I was on that path myself. And when I saw my grandmother pass away with many feelings of regret, I decided to change my lifestyle.

I looked at procrastination as my biggest enemy in life. I aimed to become someone who does what they say. I started small and kept living like that. When you never procrastinate on the biggest things in life, you will never feel any regret. It’s a very peaceful way to live.

How To Beat Procrastination (backed by science)

By Darius Foroux

What’s something you want to do in your life but you’re putting off until later?

“One day I’m going to start with investing.” When is one day? It’s more likely we’re not going to start at all. When you live your life like that, one day you’ll look back and think, “Where did my time go? I haven’t done anything I said I would.” That’s not a good feeling. I was on that path myself. And when I saw my grandmother pass away with many feelings of regret, I decided to change my lifestyle.

I looked at procrastination as my biggest enemy in life. I aimed to become someone who does what they say. I started small and kept living like that. When you never procrastinate on the biggest things in life, you will never feel any regret. It’s a very peaceful way to live.

How To Beat Procrastination (backed by science)

https://i0.wp.com/dariusforoux.com/wp-content/uploads/2018/02/the-slope-of-procrastination.png

Do you want to beat procrastination? Join the club. Procrastination has been around since the start of modern civilization.

Historical figures like Herodotus, Leonardo Da Vinci, Pablo Picasso, Benjamin Franklin, Eleanor Roosevelt, and hundreds of others have talked about how procrastination is the enemy of results.

One of my favorite quotes about procrastination is from Abraham Lincoln:

“You cannot escape the responsibility of tomorrow by evading it today.”

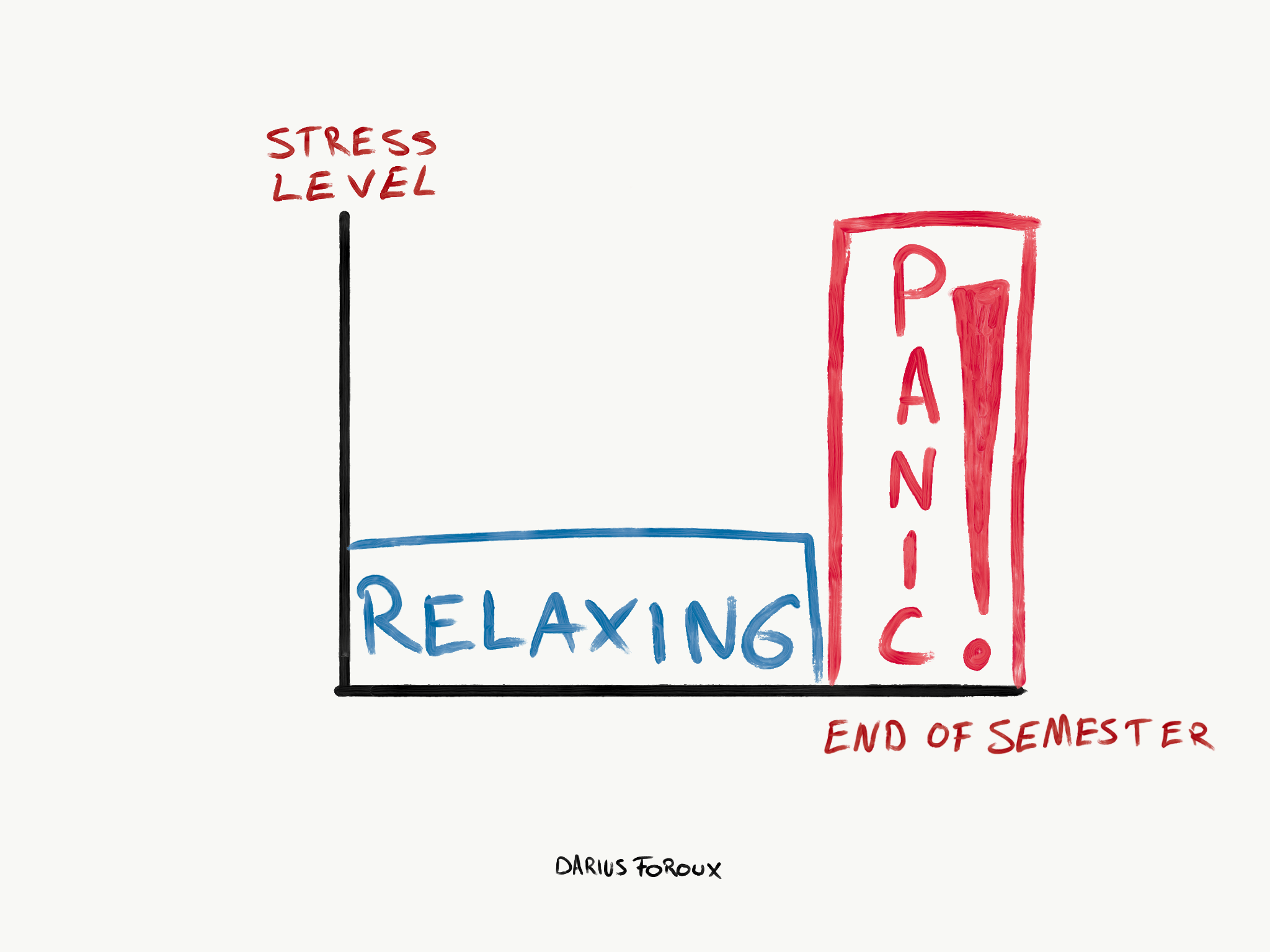

The funny thing about procrastination is that we all know that it’s harmful. Who actually likes to procrastinate? No one enjoys doing that. Me neither. And yet, procrastination was the story of my life. When I was in college, every semester, this would happen:

relaxing and freaking out – procrastination https://i0.wp.com/dariusforoux.com/wp-content/uploads/2018/02/relaxing-and-freaking-out.png

In the beginning of each semester, I was the coolest mofo on the planet. Relaxing, going out, enjoying myself. Big time.

I experienced no stress whatsoever. However, about a week before my exams, I would freak out.

“Dude, why didn’t you begin earlier?” I would tell myself.

And what would follow is an ugly sight of me, with a bunch of Red Bull cans, locked up in my room — freaking out while I was studying.

And research shows exactly that: When you procrastinate, you might feel better in the short-term, but you will suffer in the long-term.

It doesn’t really matter why you procrastinate. Some love the pressure of deadlines. Some are afraid to fail so they put it off until the very last moment. One thing that all procrastinators have in common is that procrastination has a price.

This highly cited study, published in the American Psychological Society journal, by Dianne Tice and Roy Baumeister discusses the cost of procrastination. It is related to:

Depression

Irrational beliefs

Low self-esteem

Anxiety

Stress

Procrastination is not innocent behavior. It’s a sign of poor self-regulation. Researchers even compare procrastination to alcohol and drug abuse.

To continue reading, please go to the original article here:

Impatience: The Pitfall of Every Ambitious Person

Impatience: The Pitfall of Every Ambitious Person

By Darius Foroux

People could talk to me about impatience 24/7 but I would still not act patiently. That’s because I had never seen the power of patience in my own life until a few years ago. At some point, I decided to do one thing for a long time without thinking about the results. I started to write every day. I published a book and articles. Nothing happened for a while. But after several months, I saw some success. Then, some more. And over the years, things kept adding up.

If you’re currently working hard without seeing the results you want, remember to stay focused on the path. Remember that overnight success doesn’t exist. We have to remind ourselves of that whenever we’re impatient. It happens to every ambitious person.

Impatience: The Pitfall of Every Ambitious Person

By Darius Foroux

People could talk to me about impatience 24/7 but I would still not act patiently. That’s because I had never seen the power of patience in my own life until a few years ago. At some point, I decided to do one thing for a long time without thinking about the results. I started to write every day. I published a book and articles. Nothing happened for a while. But after several months, I saw some success. Then, some more. And over the years, things kept adding up.

If you’re currently working hard without seeing the results you want, remember to stay focused on the path. Remember that overnight success doesn’t exist. We have to remind ourselves of that whenever we’re impatient. It happens to every ambitious person.

Impatience: The Pitfall of Every Ambitious Person

One of my mentors, an art dealer, taught me the pitfalls of impatience. He specializes in art from the middle ages. Last time we met, he showed me a part of his personal collection. Impressed by the size of the collection, I asked how long it took to accumulate everything.

He said “45 years,” and then he laughed when I looked surprised. He continued:

“This is not something you can buy in one go. It’s not like going to the IKEA. Accumulating anything worthwhile in life takes time. First, because you don’t have the money to buy everything at once. Second, not everything is always available. You must wait for the right opportunity.”

And waiting is one of the hardest things in life. But if you take a close look around you, you see many examples of people who waited for the right opportunity.

Take all the investors who bought stocks and real estate during the financial crisis that started in 2008. That recession lasted for several years. Recently, I spoke to someone who invested a big chunk of his assets in the stock market between 2009 and 2011.

He saved most of his money in the years that led to the crisis. Not because he predicted the global financial crisis that was sparked by subprime mortgages, but because he simply didn’t know what to do. So he spent his time learning about investing.

He also didn’t follow the market. Instead, he saved his money — and wasn’t tempted to invest it just because “the economy is great.”

But that’s not what most people do in prosperous times. When we see that the economy is growing, we think it’s the right time to invest and spend.

We feel optimistic and we trust the market. So what do we do? We look for “good” investments. All of us turn into part-time investors.

To continue reading, please go to the original article here:

Money Fallacy #1: The Checks Will Not Always Come

Money Fallacy #1: The Checks Will Not Always Come

By Darius Foroux

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns. We also tend to make that same mistake with our income. A lot of people assume their current income level will move in the same direction. If they are earning more every year, they think they will keep earning more. And if they are earning less, they anxiously assume that trend will keep going down.

Both are wrong. A person who earns well today can’t assume the checks will keep coming in (think of all the people who enjoyed 5 minutes of fame). In my latest article, I share how you can avoid this money fallacy.

Money Fallacy #1: The Checks Will Not Always Come

By Darius Foroux

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns. We also tend to make that same mistake with our income. A lot of people assume their current income level will move in the same direction. If they are earning more every year, they think they will keep earning more. And if they are earning less, they anxiously assume that trend will keep going down.

Both are wrong. A person who earns well today can’t assume the checks will keep coming in (think of all the people who enjoyed 5 minutes of fame). In my latest article, I share how you can avoid this money fallacy.

Money Fallacy #1: The Checks Will Not Always Come

Consider two artists: MC Hammer and Chamillionaire. Most people know the former because he famously went broke in the 90s despite earning millions of dollars. It’s a good case of money fallacy that many people who earn well often ignore.

MC Hammer made 37 million dollars. But he spent 50. And when he declared bankruptcy in 1996, he had 13 million dollars of debt.

Now, look at Chamillionaire, who just like Hammer, was popular for a few years. When I was in college, he had a famous song called Ridin Dirty. I was never a fan and never heard about Chamillionaire again until a few years ago.

I read that used the money he made during those few years he was popular to invest. Now, he’s worth at least 50 million dollars.

Enter: The Extrapolation Bias

In the world of behavioral science and finance, there’s a concept called “overextrapolation” or “extrapolation bias” which refers to the assumption that past returns equal returns (the terms are used interchangeably).

According to one paper by Purdue scientists, Cassella and Gulen, “An extrapolative investor believes that recent high returns are more likely to be followed by high returns, and similarly, recent low returns are more likely to be followed by low returns.”1

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise

Too often, ambitious and hard-working people have an urge to pretend that everything is fine.

The house might be burning down, and they’ll say, “It’s fine!” Your house is on fire! How can it be fine?!

Sometimes, we need to admit things are not fine. In his book, Get Out of Your Own Way, the psychiatrist Mark Goulston writes:

“Admitting to yourself that you are upset or in pain can make you feel exposed. You fear that acknowledging a bad feeling gives it more power. The pain might get worse. You might not be able to tolerate it.”

Wise & Wealthy: Pretending You’re Fine And Managing Emotions To Build Wealth

Wise

Too often, ambitious and hard-working people have an urge to pretend that everything is fine.

The house might be burning down, and they’ll say, “It’s fine!” Your house is on fire! How can it be fine?!

Sometimes, we need to admit things are not fine. In his book, Get Out of Your Own Way, the psychiatrist Mark Goulston writes:

“Admitting to yourself that you are upset or in pain can make you feel exposed. You fear that acknowledging a bad feeling gives it more power. The pain might get worse. You might not be able to tolerate it.”

For the past two years, we’ve been dealing with one challenge after the other. Now, it’s inflation. I’m sure something else will come after that. Sometimes it can get a bit too much. And that’s fine. No one can live like a superhuman every day. We must always be aware of the signals our mind and body give us. The key is to acknowledge that you don’t have to be doing well all the time. Sometimes we need to take a step back. And sometimes we need to put our feet on the gas.

What matters is that you always stay connected to body and mind. And never give up.

↳ The Dark Art of Pretending You Are Fine

Wealthy

Whether you’re a seasoned trader or a retail investor who’s just starting out, investing comes with pain. Stocks and other asset prices fluctuate. Growth isn’t linearly. It’s more like a pendulum. It goes up and down. If you’re afraid of the downturns, you won’t be able to keep investing.

https://dariusforoux.com/pretending-you-are-fine-and-managing-emotions-to-build-wealth/

21 Small Actions That Will Make You Richer

21 Small Actions That Will Make You Richer

Small Actions to Get Richer

Despite the “success stories” you might see online, the vast majority of wealthy people got to where they are after many years. But most of us have this idea that getting rich can be easy. “You just need to have the right idea!” Deep down, we know that it’s not that simple. We also know that consistent action over time can lead to big results. As Warren Buffett said:

“It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Whether you’re training for a marathon or working towards financial independence, your best bet is to aim for consistency. What is consistency when it comes to wealth?

21 Small Actions That Will Make You Richer

Small Actions to Get Richer

Despite the “success stories” you might see online, the vast majority of wealthy people got to where they are after many years. But most of us have this idea that getting rich can be easy. “You just need to have the right idea!” Deep down, we know that it’s not that simple. We also know that consistent action over time can lead to big results. As Warren Buffett said:

“It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Whether you’re training for a marathon or working towards financial independence, your best bet is to aim for consistency. What is consistency when it comes to wealth?

Financial consistency is about moderation and perfect execution of your strategy.

A financially consistent person is dedicated to getting richer just a little bit, year after year. It’s about doing the least amount of saving and investing to grow one’s net worth.

If you are financially consistent, it’s a guarantee you will become wealthier over time. It’s all about how well you execute the little things.

Over the years, I’ve identified many small financial actions that sound obvious but few people execute consistently. Here they are.

Reading books — Not only leaders are readers, but so are many wealthy people. Books usually contain quality information and are crafted with care. You usually learn more from books than from other mediums.

Spending time with smart people — Being around smart people gives you an idea of how they think and operate. That’s inspiring.

Asking questions — Being curious leads to new realizations, which in turn leads to better decisions.

Controlling the urge to buy stuff — If you’re on a quest to accumulate nice things, you will never be satisfied. You will only empty your bank account.

Ignoring fake geniuses — There are many people who pretend they are smart. Not only on social media but also in real life. The ability to distinguish the fake from the real will help you avoid stupid things.

Limiting social media consumption — No matter how great social media can be, too much of it will turn you into a mindless consumer. And consumers don’t get rich.

To continue reading, please go to the original article here:

The Art of Money

The Art of Money

Turning financial success into a creative pursuit

Jacob Schroeder Mar 15, 2022

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist.

It’s a shame many famous artists had financial troubles.

Johannes Vermeer is said to have left behind 10 young children, a house full of paintings no one wanted and enormous debts, causing his wife to declare bankruptcy. Mozart wracked up massive amounts of debt, too, to feed an extravagant lifestyle. Not to be out done, Oscar Wilde lived far beyond his means, until he eventually fell into poverty and supposedly spent his last bit of money on booze. When he took his own life, Vincent van Gogh was poor and destitute.

The Art of Money

Turning financial success into a creative pursuit Jacob Schroeder Mar 15, 2022

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist.

It’s a shame many famous artists had financial troubles.

Johannes Vermeer is said to have left behind 10 young children, a house full of paintings no one wanted and enormous debts, causing his wife to declare bankruptcy. Mozart wracked up massive amounts of debt, too, to feed an extravagant lifestyle. Not to be out done, Oscar Wilde lived far beyond his means, until he eventually fell into poverty and supposedly spent his last bit of money on booze. When he took his own life, Vincent van Gogh was poor and destitute.

It’s a shame, because some principles great artists follow to make art could also apply to making money.

Art and money share more similarities than we like to think. Money, like art, is a means of self-expression; it helps you turn the life you imagine into reality. They’re both deeply personal. There is no one right way to sculpt a Greek goddess or invest in stocks. Most of all, money offers a lot of insights into human behaviors and sensations.

It is often those human elements that lead to financial problems, but that also give our financial decisions meaning. Therefore, when trying to create a financially successful future, we may need a little more right-brain than left-brain thinking.

Take it from Andy Warhol, an artist who loved to blur the lines of commerce and culture, who declared:

“Making money is art and working is art and good business is the best art.” Andy Warhol

Why it helps to think of money as more art than science

Is personal finance an art or a science?

The juncture of art and money has gotten most attention as it relates to investing. Investor Howard Marks said: “Investing, like economics, is more art than science.”

Why?

Investing encapsulates the vagaries of human nature in the face of uncertainty. There is an element of personal intuition that guides the algorithms. That element of variance and uncertainty is what Barry Ritholtz expands upon in his definition:

“Investing is the art of using imperfect information to make probabilistic assessments about an inherently unknowable future.”

Perhaps it’s not a coincidence then that some investment charts resemble the art of Piet Mondarian, as if an abstract geometric representation of human behavior, financial enterprise and economic forces.

The art of investing

Retired adviser and author Paul Merriman, meanwhile, advises us not to take the investing-as-art concept too far:

“Follow your own instincts and hunches and amateur research if you want to bet on sports teams. But don't do that with your savings.”

While contemplating risk and return expectations based on intuition and feelings may not be wise, there is a good reason for thinking about money from an artistic point of view.

The art critic Jerry Saltz describes art as “a means of expression that conveys the most primal emotions: lonesomeness, silence, pain, the whole vast array of human sensation.” These primal emotions are often the source of our financial challenges.

More than 80% of Americans have financial regrets, according to a Bankrate survey. Most of these regrets can be attributed to personal attitudes and behaviors, such as spending beyond our means (too much debt), thinking more of the present than the future (not saving) and comparing ourselves to others (too much house).

You can have all the financial data, research and evidence in the world. But what good is it if you never analyze yourself?

As Morgan Housel puts it: “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

Thinking artistically about money – to have deeper awareness of our emotions and behaviors – may not be just an interesting perspective but a necessity. But I’d argue that an artistic mindset can do more than just help us make better financial decisions.

Alain de Botton and John Armstrong in their book, Art as Therapy, describe art as a tool:

“Like other tools, art has the power to extend our capacities beyond those that nature has originally endowed us with…Art can help us identify what is central to ourselves, but hard to put into words.”

Money is also a tool that has the power to extend our capacities beyond our natural abilities. It allows us to buy things we couldn’t create on our own. Investing allows us to grow our money and create a desired lifestyle that most of us couldn’t achieve by saving a portion of our paychecks alone. Money, like art, can help us imagine a better life, whether that means going to college, retiring from work or giving back to our communities.

Further, money can help us identify what is central to ourselves. When thinking about our financial futures we’re forced to determine what needs, wants and values are most important.

Money is one part data and math, two parts imagination and personal awareness. The science is the data and information we gather; the art is what we decide to do with it.

So, how can we think more artistically about money? And, how can it specifically improve our relationship with money? Well, let’s learn from the artists themselves.

Money Lessons From Famous Artists

Here are some words of advice from artists that could double as insight for turning financial success into a creative pursuit.

To continue reading, please go to the original article here:

Don’t Turn Your Hobby Into a Side Hustle

Don’t Turn Your Hobby Into a Side Hustle

Analysis by Erin Lowry | Bloomberg December 26, 2022

During a holiday dinner party, the host suggested we each share a significant moment from the year. As one woman shared how her pottery class had allowed her to explore her creative side, another cheekily said, “Oh, you could totally open up an Etsy shop and sell your work.” Before she even finished the sentence, I exclaimed, “No! Don’t monetize your hobby!”

Don’t Turn Your Hobby Into a Side Hustle

Analysis by Erin Lowry | Bloomberg December 26, 2022

During a holiday dinner party, the host suggested we each share a significant moment from the year. As one woman shared how her pottery class had allowed her to explore her creative side, another cheekily said, “Oh, you could totally open up an Etsy shop and sell your work.” Before she even finished the sentence, I exclaimed, “No! Don’t monetize your hobby!”

It’s advice that perhaps seems heretical in this time of high inflation. After all, it took $107 in November 2022 to buy what $100 bought in November 2021, according to the US Department of Labor. Between 2019 and 2020, the increase was only $1.17. But despite rising prices, it’s important to keep the side-hustle mindset in check.

A hobby, by definition, is supposed to be something you pursue outside of your job for relaxation. Of course, you can have hobbies that are mentally or physically challenging such as chess or hiking. However, a hobby is no longer a hobby once you add a price tag and start to sell your wares to consumers. That’s a job.

Grind culture has faced a modest reckoning in the last few years, with some going so far as to label it toxic. There is certainly a dark underbelly in pushing people to relentlessly consider profitability.

As a recovering member of the constantly-side-hustling community, I can say confidently that respecting the sanctity of at least one or two hobbies for fulfillment does wonders for one’s mental health.

To continue reading, please go to the original article here:

Why It’s Easier Than Ever For Americans To Fall Into This 'Invisible Addiction'

Why It’s Easier Than Ever For Americans To Fall Into This 'Invisible Addiction'

1.9k Serah Louis Sun, January 1, 2023

'I was stealing from Peter to pay Paul': Why it’s easier than ever for Americans to fall into this 'invisible addiction'

Noah Vineberg, a bus driver based in Ottawa, Canada, lost over $1 million to his gambling addiction.

Vineberg traces the roots of his addiction all the way back to elementary school, where he avidly traded marbles and hockey cards on the schoolyard.

“It wasn't until much later — like 16 to 18, 19 — I knew that I was gambling heavier than anybody else. And I knew that I definitely had a problem.”

Why It’s Easier Than Ever For Americans To Fall Into This 'Invisible Addiction'

1.9k Serah Louis Sun, January 1, 2023

'I was stealing from Peter to pay Paul': Why it’s easier than ever for Americans to fall into this 'invisible addiction'

Noah Vineberg, a bus driver based in Ottawa, Canada, lost over $1 million to his gambling addiction.

Vineberg traces the roots of his addiction all the way back to elementary school, where he avidly traded marbles and hockey cards on the schoolyard.

“It wasn't until much later — like 16 to 18, 19 — I knew that I was gambling heavier than anybody else. And I knew that I definitely had a problem.”

It's a problem he grappled with for 48 years. But Vineberg is now in his fourth year free from gambling.

Many others are still struggling to find their way out their addiction. The National Center for Responsible Gambling points to research that indicates 1% of the U.S. population suffers from a severe gambling problem. And young adults are especially vulnerable, with an estimated 6% to 9% of young people experiencing problems related to gambling.

And while not all those problems are financial, they often come with a hefty price tag.

The Pandemic Contributed To the Issue

Gambling has long been one of Americans' favorite pastimes. And access to it has only gotten easier since 2018, when the Supreme Court overturned a decision that limited sports betting to Nevada.

Ads and apps have been popping up everywhere since, even some featuring celebrities like Aaron Paul and Shaquille O'Neal.

But those ads can have a troubling effect, says Vineberg. Because while they may show people winning, “winners” are not who the advertisers are really trying to target.

The client they’re after is the ‘me’ that's going to go to four different check-cashing places … and going to just try and make enough on the weekend in my bets to cover my butt by Monday.”

And it's only going to get more difficult for people like Vineberg. More than two dozen states have legalized sports betting in the past few years. And according to a report by the American Gaming Association, 2022 is on track for another record-setting year. Sports betting and iGaming revenue grew by double digit percentages over the first ten months of the year compared to the same period from the previous year.

“The incidence of online gambling, and the severity of it, have increased considerably,” says Diana Gabriele, a gambling counselor at Hôtel-Dieu Grace Healthcare (HDGH) in Windsor, Ont. in Canada. Ontario is the first province in Canada to regulate sports betting.

Gabriele adds the increased isolation during COVID-19 lockdowns didn't help.

“As a result of that isolation, and the change in lifestyles and loss of employment, people became bored, they became strapped for money, they were looking for ways to make money easily,” she says.

“They were looking for entertainment.”

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/people-six-figure-incomes-living-110000551.html

11 Quick Steps That’ll Have You Managing Your Money Like A Millionaire

11 Quick Steps That’ll Have You Managing Your Money Like A Millionaire

By The Penny Hoarder Staff Updated December 27, 2022

Life would be a whole lot easier if someone would just Venmo us $1 million, but unfortunately the chance of that happening is, well, probably zero. (Venmo doesn’t allow transactions that large anyway.)

But even though our chances of becoming a millionaire are slim, we can still manage our money like one. No, we’re not going to tell you how to buy hundreds of shares of Apple stock. Or how to pick out the perfect yacht. These are simple money moves any normal, non-millionaire person can make today. Each tip can get you closer to achieving your big goals.

11 Quick Steps That’ll Have You Managing Your Money Like A Millionaire

By The Penny Hoarder Staff Updated December 27, 2022

Life would be a whole lot easier if someone would just Venmo us $1 million, but unfortunately the chance of that happening is, well, probably zero. (Venmo doesn’t allow transactions that large anyway.)

But even though our chances of becoming a millionaire are slim, we can still manage our money like one. No, we’re not going to tell you how to buy hundreds of shares of Apple stock. Or how to pick out the perfect yacht. These are simple money moves any normal, non-millionaire person can make today. Each tip can get you closer to achieving your big goals.

Take a look:

1. Cancel Your Car Insurance

Here’s the thing: your current car insurance company is probably overcharging you. But don’t waste your time hopping around to different insurance companies looking for a better deal.

Use a website called EverQuote to see all your options at once.

EverQuote is the largest online marketplace for insurance in the US, so you’ll get the top options from more than 175 different carriers handed right to you.

Take a couple of minutes to answer some questions about yourself and your driving record. With this information, EverQuote will be able to give you the top recommendations for car insurance. In just a few minutes, you could save up to $610 a year.

2. Get a Free $25 to Invest Like an Elite Hedge Fund

Hedge funds feel like an elite, sophisticated way to invest — and out of reach for most of us. Something like a $250,000 minimum makes this kind of investing feel like an exclusive club for the wealthy.

But an app called Titan makes this kind of elite investing strategy accessible to the rest of us — and you can get started with just $100. Plus, they’ll give you $25 for free once you sign up and invest.

Titan is a simple, user-friendly investment app that mirrors the financial moves of top hedge funds. It invests money in top stocks, based on what all those hedge funds have been buying — because it knows those are best set up for growth.

And unlike robo-investing apps, you get access to fund managers and insights into what goes into their recipes. Titan’s portfolio managers and analysts aim to beat the stock market from day one.

All three of Titan’s co-founders are former hedge fund guys who are now heavily invested in their Titan portfolios — the same stocks they’d invest your money in.

More than 50,000 people already use Titan, and it takes just a few minutes to fund your account and get started — and get your free $25 so you can invest even more. Isn’t it time you had access to invest like the elite?

3. You Can Become Debt Free — Without Paying it All Off

To continue reading, please go to the original article here:

https://www.thepennyhoarder.com/budgeting/money-management-in-10-steps/

6 End-of-Year Money Moves to Make Now and Set Yourself Up for 2023

6 End-of-Year Money Moves to Make Now and Set Yourself Up for 2023

By Molly Moorhead, CFP® Assistant Managing Editor Updated December 21, 2022

The year is almost over, and you’re no doubt rushing to wrap up holiday shopping, get ready to travel or meet a final work deadline. The last thing you need is another item on your to-do list, but a little bit of financial reflection and planning is essential before the calendar turns to 2023. Making these end-of-year money moves will help you handle whatever comes your way next year.

6 End-of-Year Money Moves to Make Now and Set Yourself Up for 2023

By Molly Moorhead, CFP® Assistant Managing Editor Updated December 21, 2022

The year is almost over, and you’re no doubt rushing to wrap up holiday shopping, get ready to travel or meet a final work deadline. The last thing you need is another item on your to-do list, but a little bit of financial reflection and planning is essential before the calendar turns to 2023. Making these end-of-year money moves will help you handle whatever comes your way next year.

6 Money Moves to Make Before the End of the Year

1. Set Your Financial Goals for the Coming Year

When you think ahead to the end of 2023, what would make you feel accomplished? What if you cut your credit card debt by half? What if you were able to boost your savings account to four — or even five — figures? Or build up that emergency fund you may have had to dip into this year?

Think about what you want to celebrate at the end of 2022, and then set some goals to help you get there.

We’re fans of the SMART method of goal-setting. A SMART goal is:

Specific

Measureable

Attainable

Realistic

Timely

For instance, “become financially secure” isn’t a SMART goal because it’s ambiguous.

On the other hand, “save $5,000 in my emergency fund by the end of 2023” would be considered SMART because it’s specific, measurable and timely.

By thinking through your financial goals in this way, you’ll have more clarity about what you’re trying to do, and that will give you a better sense of how to allocate your resources and energy in the year to come.

Need a professional checkup? Answer a few questions about yourself to receive a customized financial plan — it's totally free and totally anonymous.

2. Review Your Spending Over the Past Year (and Be Honest About It)

We know this isn’t going to be fun. In fact, it’s probably going to be pretty tedious.

Here’s a shortcut: If you use your bank or credit card app, you likely have access to graphs that show how much of your income went to specific spending categories, like food, entertainment and household expenses.

However, you can reconcile your spending without digital tools.

To continue reading, please go to the original article here:

https://www.thepennyhoarder.com/budgeting/end-of-year-money-moves/