Ariel: Powerful Post by Mr. Cunningham

Ariel: Powerful Post by Mr. Cunningham

1-15-2026

Let Me Add To This

The Clarity Act isn’t just another regulatory Band-Aid; it’s the kill switch for the old game’s hidden levers.

Once you force atomic settlement, public ledgers, and programmatic supply into law, you don’t merely “regulate” Wall Street you rip out the plumbing that let them rehypothecate, front-run, and manufacture synthetic scarcity for decades.

The same opacity that hid naked short positions, dark-pool manipulation, and off-balance-sheet leverage in stocks is the same fog that let banks pretend stablecoins were just “fun money” while quietly building shadow positions.

When every token move is final, visible, and auditable in real time, the arbitrage between paper promises and on-chain truth collapses.

Institutions don’t get to play both sides anymore. They either adapt to honest rails or bleed out trying to fight them.

And the ripple hits everywhere: tokenized treasuries kill the repo market’s secrecy, on-chain stablecoins gut correspondent banking fees, programmable money makes sanctions enforcement trivial, and fractional-reserve stablecoin issuers suddenly have nowhere to hide.

This isn’t crypto being co-opted by legacy finance. This is legacy finance being forced to run on rails it can no longer secretly bend.

The Fed’s monopoly on settlement dies the day the first major bank is legally required to settle on a public chain. That day is closer than most people think.

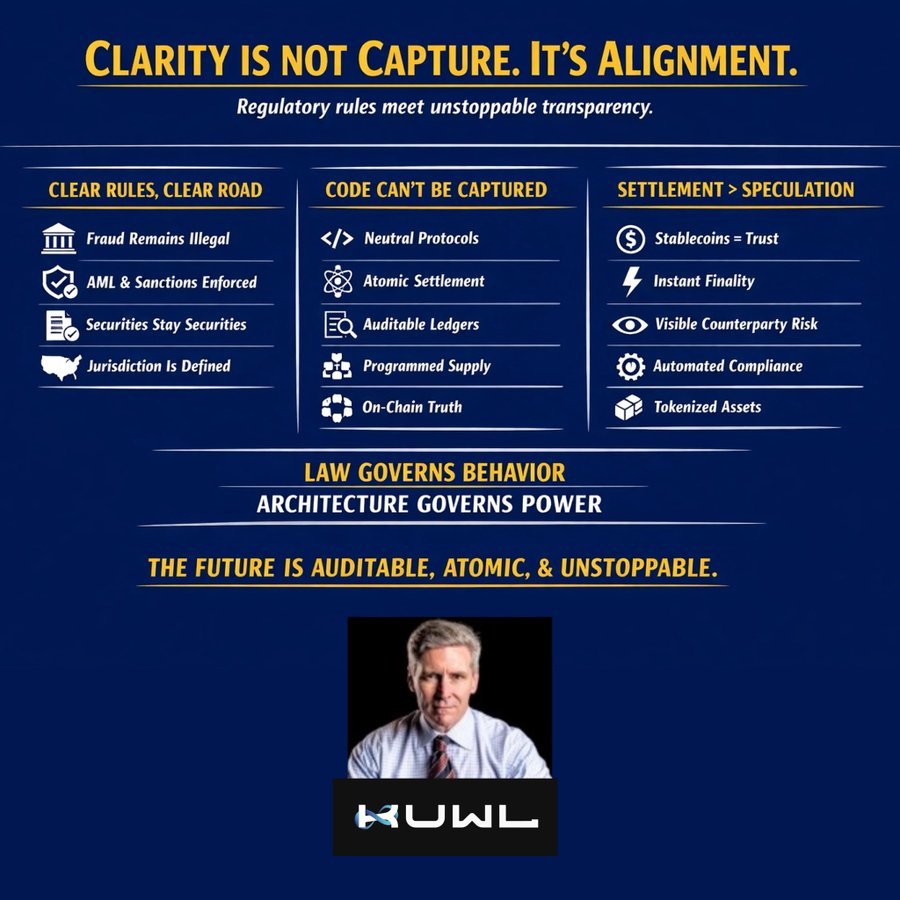

Rob Cunningham: The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior - but the architecture governs power. Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

Digital asset markets don’t fail because of innovation. They fail because of opacity, jurisdictional confusion, and discretionary power.

The CLARITY Act does one simple thing: It replaces uncertainty with enforceable rules.