Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Wednesday Morning 12-31-25

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

*********************************************

Overview

Federal Reserve officials are split on whether inflation or unemployment now poses the greater risk.

December 2025 meeting minutes reveal disagreement over the timing and scale of rate cuts in 2026.

Some policymakers warned that inflation progress may have stalled.

Others argued that rising unemployment and economic slowing deserve greater attention.

The divide raises uncertainty about the Fed’s policy path moving forward.

Key Developments

A faction favored holding rates steady, citing concern that inflation is not yet sustainably moving toward the 2% target.

Another group emphasized labor market risks, warning that delayed easing could worsen job losses.

Data dependency was repeatedly emphasized, reflecting uncertainty in economic signals.

No consensus emerged on when rate cuts should begin in 2026.

Market participants are now reassessing expectations for the pace and depth of future easing.

Why It Matters

Central bank unity is a stabilizing force. Division introduces ambiguity into forward guidance, which markets rely on for pricing risk.

The December minutes show a Federal Reserve navigating competing mandates under tightening constraints. When inflation and employment signals diverge, policy decisions become less predictable — increasing volatility across rates, equities, and currencies.

This is not indecision; it is a reflection of a system under structural strain.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Fed clarity directly impacts global exchange rates.

A divided Fed complicates interest rate differentials, capital flows, and carry trades. When markets cannot confidently price U.S. monetary policy, FX volatility rises, particularly for currencies linked to dollar funding, trade settlement, and emerging-market debt.

In reset terms, policy uncertainty accelerates repricing.

Implications for the Global Reset

Pillar: Policy Credibility Requires Cohesion

Fragmented guidance weakens confidence.Pillar: Data Ambiguity Drives Volatility

When signals conflict, markets reprice faster.

************************************

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

New York Times – “Federal Reserve Officials Were Divided Over Inflation and Jobs, Minutes Show”

CNBC – “Fed minutes show officials were in tight split over December rate cut”

Charles Schwab – “Rate Debate: Fed Minutes Today Provide Inside Look”

~~~~~~~~~~

Chinese Oil Tankers Challenge U.S. Blockade off Venezuela

Maritime standoff escalates as China-backed shipments test U.S. enforcement

Overview

Chinese-flagged oil tankers are continuing Venezuela-linked voyages despite a U.S.-declared maritime blockade.

Two unsanctioned VLCCs, Thousand Sunny and Xing Ye, are operating near Venezuelan waters.

The U.S. is escalating tanker seizures and naval pressure to restrict Caracas’ oil revenues.

China and Russia have openly criticized U.S. actions, raising concerns of broader geopolitical confrontation.

Venezuela has begun escorting oil shipments while cutting production as storage fills.

Key Developments

The Thousand Sunny is en route to Venezuela’s Jose Terminal after sailing around the Cape of Good Hope, maintaining course despite the blockade announcement.

The Xing Ye is slow-steaming off French Guiana, awaiting loading at the Jose Terminal, with ownership and destination undisclosed.

U.S. authorities seized multiple tankers, including Centuries and Skipper, while pursuing Bella 1 under a judicial seizure order.

China has opposed the seizures, backing Venezuela during an emergency U.N. Security Council meeting.

PDVSA has begun shutting oil wells in the Orinoco Belt, aiming to cut output by at least 25% as exports are squeezed.

Chevron continues exporting Venezuelan crude under a special U.S. license, highlighting selective enforcement.

***********************************************

Why It Matters

Energy blockades are not just economic tools — they are geopolitical force multipliers. The presence of Chinese-flagged tankers operating near Venezuela tests the limits of U.S. maritime enforcement and exposes fractures in global energy governance.

As sanctions and seizures intensify, oil trade increasingly shifts from commercial rules to power-based navigation, raising risks of escalation, miscalculation, and retaliation.

Why It Matters to Foreign Currency Holders

For currency holders, this standoff underscores how energy flows anchor monetary stability.

Disrupted oil exports weaken reserve inflows, stress balance sheets, and accelerate currency depreciation for producer nations. At the same time, buyers willing to bypass sanctions gain strategic pricing and settlement leverage, reshaping trade flows away from traditional dollar-dominated channels.

In reset terms, energy access increasingly determines currency resilience.

Implications for the Global Reset

Pillar: Energy Control Equals Monetary Power

Disrupted exports destabilize currencies.Pillar: Sanctions Accelerate Fragmentation

Parallel trade routes emerge under pressure.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Oil Tankers Challenge U.S. Blockade off Venezuela”

Bloomberg – “Venezuela Cuts Oil Output as U.S. Blockade Squeezes Exports”

New York Times – “U.S. Escalates Pressure on Venezuela’s Oil Exports”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

12-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

12-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Tuesday Evening 12-30-25

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Dividend: Promise, Process, and Proof

What Americans have been told — and what must still happen

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Dividend: Promise, Process, and Proof

What Americans have been told — and what must still happen

Overview

President Donald Trump has publicly proposed $2,000 payments to Americans, described as “tariff dividends” funded by import tariffs.

No law has been passed authorizing the payments — meaning no checks are approved or scheduled.

The proposal would require Congressional legislation and Treasury implementation before any distribution could occur.

Public confusion has grown as social media claims outpace confirmed policy action.

Key Developments

Trump floated the $2,000 figure publicly in November 2025, framing it as a dividend from tariff revenue.

Administration officials later confirmed that Congressional approval would be required.

Mid-2026 has been mentioned as a possible timeline, but only if enabling legislation passes.

Eligibility has not been defined, beyond statements suggesting “high-income earners” may be excluded.

Economists and budget analysts question feasibility, citing insufficient tariff revenue without deficit funding.

Why It Matters

How Long It Can Take — The 5 Key Factors

1️⃣ It shows Trump is prioritizing direct relief

When he publicly explains what’s needed for the $2,000, it signals he wants money in people’s hands, not trapped in bureaucracy or corporate channels.

2️⃣ The obstacle is procedural — not financial

The holdup isn’t the funds — it’s Congressional voting rules. That puts the pressure on lawmakers, not the Treasury.

3️⃣ It reframes the debate around the Senate

By saying “just the vote,” Trump points to Senate cooperation — or obstruction — as the deciding factor, raising national attention on holdouts.

4️⃣ It reassures people that qualification is simple

His message suggests the $2,000 isn’t means-tested or complicated, easing fear and confusion among seniors and working families.

5️⃣ It confirms the $2,000 is part of the larger economic transition

Direct payments align with the broader shift toward a system built around the people — not big institutions — matching the momentum of debt relief, digital rails, and asset-backed stability.

🌱 Seeds of Wisdom Team 🌱

Newshounds News™ Exclusive.

Currency distributions are not announcements — they are legal, fiscal, and operational events.

Until legislation is passed, funding is appropriated, and Treasury systems are authorized, no payment exists.

This situation highlights a recurring pattern in modern finance: policy signaling often arrives long before legal execution. Markets, households, and currency holders must distinguish between intent, authority, and delivery.

Why It Matters to Foreign Currency Holders

For currency holders, this proposal illustrates how monetary expectations can move faster than monetary reality.

Countries with strong settlement access, legislative clarity, and reserve flexibility can implement stimulus cleanly. Those without legal cohesion or funding clarity risk confidence erosion, volatility, and repricing.

In reset terms, credibility is the currency — not promises.

Implications for the Global Reset

Pillar: Authority Before Liquidity

Money cannot move without legal authorization.Pillar: Confidence Is Built on Execution

Announcements without delivery weaken trust.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

ABC News – “Trump is ‘committed’ to $2,000 tariff dividend payments, White House says”

PBS NewsHour – “Trump floats tariff dividends for Americans, but experts question the math”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Evening 12-30-25

The Iraqi Market Saw Its Name Traded At More Than 57 Billion Dinars In A Week.

Stock Exchange Economy News – Baghdad The Iraq Stock Exchange announced on Tuesday that shares worth more than 57 billion dinars were traded during the past week.

The market said in a report that "the number of companies whose shares were traded during the past week reached 69 joint-stock companies, while the shares of 25 companies were not traded due to the failure of purchase orders to match sale orders, while 10 companies continued to be suspended due to failure to provide disclosure, out of 104 companies listed on the market."

The Iraqi Market Saw Its Name Traded At More Than 57 Billion Dinars In A Week.

Stock Exchange Economy News – Baghdad The Iraq Stock Exchange announced on Tuesday that shares worth more than 57 billion dinars were traded during the past week.

The market said in a report that "the number of companies whose shares were traded during the past week reached 69 joint-stock companies, while the shares of 25 companies were not traded due to the failure of purchase orders to match sale orders, while 10 companies continued to be suspended due to failure to provide disclosure, out of 104 companies listed on the market."

The report added that "the number of shares traded reached 47 billion, 694 million, and 841 thousand shares, an increase of 1075% compared to the previous week, with a financial value of 57 billion, 617 million, and 84 thousand dinars, an increase of 1240% compared to the previous week, through the execution of 4278 transactions."

He noted that "the ISX60 index closed at 988.42 points, recording an increase of 1.95% compared to its closing in the previous session."

The report explained that “the number of shares purchased by non-Iraqi investors last week amounted to 2 billion shares with a financial value of 1 billion dinars through the execution of 71 transactions, while the number of shares sold by them amounted to 53 million shares with a financial value of 240 million dinars through the execution of 35 transactions.”

It is worth noting that the Iraq Stock Exchange holds five trading sessions weekly from Sunday to Thursday, and includes 104 Iraqi joint-stock companies representing the banking, communications, industry, agriculture, insurance, financial investment, tourism, hotels and services sectors. https://economy-news.net/content.php?id=64016

Al-Halbousi: We Are Proceeding With Fulfilling The Constitutional Requirements And Forming A Government That Will Assume Responsibility For Managing The State And Overcoming The Crises

Political | 07:23 - 30/12/2025 Mawazin News – Baghdad The head of the Progress Party, Mohammed al-Halbousi, affirmed on Tuesday the commitment to fulfilling constitutional requirements and forming a government capable of managing the state and overcoming crises.

Speaking to several media outlets from inside the parliament building, al-Halbousi stated that political forces are proceeding with completing constitutional obligations and forming a government able to shoulder the responsibility of governing the country and navigating the crises.

He added that the Iraqi judiciary serves as a safeguard for the political process from a constitutional standpoint, given its role in establishing the legal framework and providing counsel to political forces in accordance with the law and the constitution. https://www.mawazin.net/Details.aspx?jimare=272124

Gold Rebounds After A Two-Week Decline, And Silver Also Recovers

Economy | 30/12/2025 Mawazin News – Baghdad Gold prices rose on Tuesday, recovering from a two-week low hit in Monday's session, following a year-end profit-taking wave that had led to a broad decline in precious metals prices.

Spot gold climbed 1% to $4,374.83 an ounce, after reaching a record high of $4,549.71 last Friday. On Monday, it fell to its lowest level since December 17, 2025, marking its biggest daily loss since October 21 of the same year.

U.S. gold futures for February delivery also rose, gaining 0.8% to $4,377.80 an ounce. The yellow metal performed strongly during 2025, rising by about 66% so far.

This rise was supported by interest rate cuts, market expectations of further monetary easing by the US Federal Reserve, geopolitical tensions, strong demand from central banks, and increased holdings in exchange-traded funds.

Traders expect the US Federal Reserve to cut interest rates at least twice during the next year, as non-yielding assets, such as gold, tend to perform better in a low interest rate environment.

In other metals, silver rose 3% in spot trading to $74.41 an ounce, after recently hitting an all-time high of $83.62. Yesterday, it suffered its biggest daily loss since August 11, 2020.

Silver has risen about 154% since the beginning of the year, outperforming gold, driven by its inclusion on the list of critical metals in the United States, along with supply shortages, declining inventories, and rising industrial and investment demand.

Kelvin Wong, senior market analyst at OANDA, said that the long-term rise for both gold and silver is likely to continue, predicting that prices will reach $5,010 an ounce for gold and $90.90 an ounce for silver within the next six months.

Platinum also rose in spot trading by 1.1% to $2,132.86 an ounce, after recording its biggest daily drop in history yesterday following a record high of $2,478.50.

Palladium also rose by 1.1% to $1,634.29 an ounce, after having lost 16% of its value during yesterday's session.

https://www.mawazin.net/Details.aspx?jimare=272111

The Dollar's Value Fell In Local Markets As The Stock Exchange Closed

Tuesday, December 30, 2025 18:13 | Economy Number of views: 179 Baghdad/ NINA / The exchange rate of the US dollar fell in Baghdad and Erbil on Tuesday evening, coinciding with the closure of the stock exchanges.

The dollar was trading at 143,900 Iraqi dinars per 100 US dollars in Baghdad's Al-Kifah and Al-Harithiya exchanges, down from 144,250 dinars per 100 US dollars earlier in the day.

Exchange rates at local currency exchange shops in Baghdad also declined, with the selling price reaching 144,500 dinars per 100 US dollars and the buying price at 143,500 dinars per 100 US dollars.

In Erbil, the dollar also fell, with the selling price reaching 143,050 dinars per 100 US dollars and the buying price at 143,000 dinars per 100 US dollars. /End https://ninanews.com/Website/News/Details?key=1269320

Saleh's appearance: The Revenue Improvement Is Temporary, And The Solution Lies In Diversifying The Economy And Boosting Productive Spending.

Time: 2025/12/30 Reading: 30 times {Economic: Al-Furat News} Economic expert Mazhar Muhammad Saleh confirmed on Tuesday that the efficiency achieved in managing public liquidity, fulfilling basic obligations, and controlling deficit levels when revenues improve and work to maximize them, is a periodic improvement, not a structural one, due to its direct link to the price cycle of the basic resource, namely oil.

Saleh explained in his interview with Al-Furat News Agency that "this reality constantly calls for a move towards financial strengthening as a preventive option, which is based in essence on examining public spending, analyzing the structure of expenditures, and raising their efficiency to the highest possible level, before thinking about resorting to financing through borrowing."

He explained that “the steps taken to diversify the sources of national income cannot bear fruit through isolated or circumstantial financial measures, but rather require a comprehensive strategy based on an investment budget guided by results and economic impact, not by being satisfied with the logic of allocations, and the transformation from a spending state to a production state, in which public resources are employed to generate sustainable added value, in addition to linking the financial policy with a clear industrial and commercial policy, capable of stimulating the productive sectors and enhancing the competitiveness of the national economy.”

He concluded by saying that "the general budget will remain, otherwise, hostage to the cycle of a single resource, no matter how much its management tools improve in the short term, and no matter how high the level of situational financial discipline." LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 12-30-25

Good Afternoon Dinar Recaps,

Small Island Could Disrupt China’s Rare Earths Supremacy

Japan tests seabed mining to reduce dependence on Chinese minerals

Good Afternoon Dinar Recaps,

Small Island Could Disrupt China’s Rare Earths Supremacy

Japan tests seabed mining to reduce dependence on Chinese minerals

Overview

Japan is preparing to test deep-sea mud near Minamitorishima for rare earth extraction.

Rare earths are essential for EVs, microchips, fighter jets, and advanced radar systems.

China dominates roughly two-thirds of global rare-earth output and has used export restrictions as geopolitical leverage.

The U.S. and Pacific allies are working to diversify supply chains, but progress is expected to take years.

Key Developments

Mining trial scheduled for January 11–February 14, 2026, targeting 350 metric tons of rare-earth-rich mud per day from ~6,000 meters depth.

Seawater separation and continuous environmental assessments will occur on Minamitorishima before transport to Japan’s mainland for refining.

The Japanese government has invested ~40 billion yen ($256 million) since 2018 for seabed mining initiatives.

Chinese navy ships were observed near Minamitorishima, highlighting geopolitical tensions.

If successful, full-scale mining could begin as early as February 2027.

Japan-U.S. agreement on critical minerals extraction and stockpiling strengthens allied supply chain cooperation, though financial details remain unspecified.

Why It Matters

Rare earths are now a strategic resource underpinning technology, military systems, and industrial capacity. Japan’s efforts to secure domestic sources reduce vulnerability to Chinese export controls and strengthen regional supply chain resilience. This initiative signals how control of critical minerals is becoming a decisive factor in global influence, mirroring the leverage once held by oil-producing nations.

Why It Matters to Foreign Currency Holders

Foreign currency holders must pay close attention to rare earth and critical mineral supply chains because these resources are now central to economic resilience and currency stability. Rare earths are indispensable to high-tech industries, including EVs, renewable energy, semiconductors, and defense systems, making them a foundation of global demand.

Because China dominates global refining and processing, any disruptions, export restrictions, or geopolitical leverage can impact global trade balances, inflation expectations, and industrial output, directly affecting currency valuations worldwide.

For holders of foreign currencies, sudden supply shifts can increase market volatility and risk premia, especially for countries heavily dependent on imported minerals. As Japan and the U.S. diversify supply and invest in alternative sources, currencies tied to strategic mineral exporters may fluctuate in value, making awareness of these developments crucial for hedging, reserves management, and long-term risk planning.

Implications for the Global Reset

Pillar: Resource Sovereignty Strengthens Currency Leverage

Nations with domestic control over critical minerals gain influence over trade flows, technological standards, and economic resilience.

Pillar: Critical Minerals as Strategic Infrastructure

Seabed mining and diversification efforts embed rare earths into national industrial and financial planning, shaping future multipolar trade and currency systems.

This is not just environmental policy — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Small Island Could Disrupt China’s Rare Earths Supremacy”

China Briefing – China’s Rare Earth Elements: What Businesses Need to Know

American Geosciences Institute – What are Rare Earth Elements and Why Are They Important?

CSIS – China’s New Rare Earth and Magnet Restrictions Threaten U.S. Defense Supply Chains

~~~~~~~~~~

Commodities Signal Stress as Policy Distorts Price Discovery

Tariffs, rate expectations, and geopolitical risk drive uneven repricing

Overview

Commodity markets experienced heightened volatility as policy uncertainty disrupted pricing signals

Energy, metals, and agricultural commodities reacted unevenly to shifting trade and monetary expectations

Tariff policies and geopolitical tensions continued to distort supply chains and settlement assumptions

Investors increasingly treated commodities as policy hedges rather than pure demand assets

Key Developments

Precious metals retreated sharply from record highs as exchanges raised margin requirements

Energy prices remained volatile amid geopolitical uncertainty and uneven demand expectations

Industrial metals reflected slowing growth signals while supply constraints persisted

Tariff policies and trade restrictions continued to influence commodity flows and pricing

Market participants reduced leverage, amplifying short-term price swings across contracts

Why It Matters

Commodity volatility is signaling policy interference, not demand collapse. When pricing is driven by tariffs, sanctions, and margin adjustments rather than fundamentals alone, markets become less efficient and more reactive.

This environment favors physical control, balance-sheet strength, and strategic reserves. Commodities are increasingly treated as monetary and geopolitical instruments, not just inputs to growth.

Volatility reflects stress in settlement assumptions — a hallmark of systems in transition.

Why It Matters to Foreign Currency Holders

For foreign currency holders, commodity volatility directly impacts inflation expectations, trade balances, and reserve strategy. Sudden price swings complicate fiscal planning and weaken currencies dependent on commodity imports.

Conversely, nations with energy security, domestic resource backing, or diversified reserve assets gain resilience. In reset terms, commodities are reasserting their role in currency credibility, not just economic output.

Implications for the Global Reset

Pillar: Policy Distorts Price Discovery

Intervention-driven markets reprice faster and less predictably.

Pillar: Resources Anchor Monetary Confidence

Control of commodities strengthens currency durability during transition.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Commodities buffeted by policy shifts as markets look toward 2026”

Reuters — “Precious metals slide after margin hikes trigger profit-taking”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Afternoon 12-30-25

Experts: Automation And Fair Tax Collection Are Key To Economic Reform

Baghdad: Shukran Al-Fatlawi Economic experts have praised the Ministerial Council for the Economy's call to enhance electricity collection, review current tariffs, and adopt automation across all government sectors. These experts believe this approach represents a reform path that encourages more efficient consumption. They also described automated bill collection as the cornerstone of any genuine reform, whether in the electricity sector or other sectors, due to its potential for transparency, reduced corruption, and less waste of public funds.

Experts: Automation And Fair Tax Collection Are Key To Economic Reform

Baghdad: Shukran Al-Fatlawi Economic experts have praised the Ministerial Council for the Economy's call to enhance electricity collection, review current tariffs, and adopt automation across all government sectors. These experts believe this approach represents a reform path that encourages more efficient consumption. They also described automated bill collection as the cornerstone of any genuine reform, whether in the electricity sector or other sectors, due to its potential for transparency, reduced corruption, and less waste of public funds.

Economic researcher and academic Dr. Kazem Eidan considered electricity billing to be a social, regulatory, and reformative responsibility that reduces waste, as well as establishing the principle of fairness in the distribution of burdens, to create a state of balance to ensure the continuity of service and improve quality.

Sustainability And Fairness

Eidan added, in an interview with Al-Sabah, that strengthening tax collection, reviewing the current tariff, and adopting automation in all sectors is an interconnected reform path, and none of its elements can be separated from the other, if the services sector is to be sustainable and fair.

It is noted that the Ministerial Council for the Economy called for strengthening electricity collection, reviewing the current tariff, and adopting automation in all government sectors.

Reducing Waste

Eidan continued, saying that the current tariff does not encourage rationalizing consumption, but rather contributes to perpetuating waste. He pointed out the need to adopt the principle of fairness in collection, meaning protecting those with limited income with a tariff that differs from factory and project owners, in a way that ensures that costs are accurately calculated and made closer to reality. He noted that this requires more awareness campaigns about the importance of collection in improving electricity and ensuring sustainability.

The spokesperson stressed the need to avoid imposing financial burdens on citizens without any tangible return, noting that reform requires fairness and transparency, especially for those with limited income, in order to create a state of balance.

Global Procedure

For her part, economic researcher Suhad al-Shammari explained that government taxation is a standard practice in all countries worldwide, based on the services the state provides to its citizens. She pointed out that attempts by some to abolish government taxes and the entire tax collection system do not serve the country's best interests. Speaking to Al-Sabah newspaper, al-Shammari stated that electricity billing is one of the most important sources of budget revenue, expressing her regret that it has not been fully understood and its implications have not been clarified. She emphasized the need to explain the role of electricity billing in bolstering budget funds and increasing revenues to serve the public good.

Dual Payment Mechanism

Al-Shammari stressed the need to eliminate the dual payment system for electricity, which relies on both government-provided power and private generators, to ease the burden on ordinary citizens. She also emphasized the importance of different payment mechanisms for the industrial and public sectors.

It's worth noting that the Ministry of Electricity recently announced that 58% of the supplied power is uncontrolled and uncollected. Ministry spokesperson Ahmed Moussa stated that Prime Minister Mohammed Shia'a al-Sudani and Minister of Electricity Ziad Ali Fadhil are holding ongoing meetings to oversee the electricity sector's preparedness for peak demand periods, both winter and summer.

He explained that these meetings focus on load balancing, addressing the needs of load centers and central and peripheral areas, and resolving bottlenecks in the electricity grid. All of these issues are under continuous review by the Prime Minister, the Minister of Electricity, and ministry staff.

Controlling Losses

He added that "the Prime Minister focused in his continuous meetings on the issue of collecting electricity fees, controlling loads, and regulating violations on distribution networks in agricultural and informal areas in a systematic manner, while reviewing electricity supply hours and energy returns, whether produced, consumed, or distributed," explaining that "the volume of losses in electrical energy is large, and the ministry bears large sums for its production and transmission," noting that "the Prime Minister stressed the need to take measures to limit these losses."https://alsabaah.iq/125680-.html

Graff Gas: A Giant Global Reserve

Walid Khalid Al-Zaidi It is impossible for those in charge of the oil and energy sector to remain detached from the optimal investment of all elements of the national economy, especially in utilizing free gas fields or associated gas from crude oil extraction operations.

This is because our country's energy resources have created a genuine need for this vital strategic element, which the world is currently vying for. For decades, and until recently, this national wealth was unjustifiably neglected in various regions of Iraq's vast and resource-rich land.

The realities of contemporary global crises have demonstrated the importance of exploiting this resource as a national imperative that must be fully utilized through promising plans.

Gas fields are spread across wide areas with varying reserve capacities, including fields in southern Iraq such as the Al-Gharraf oil field, which contains enormous gas reserves. This makes it a crucial starting point for a comprehensive national oil industry, which will positively impact the electricity sector. Furthermore, it is a vital element in Iraq's economic strategy and overall development.

This field possesses exceptional potential that can contribute to boosting national gas production, which is relied upon as fuel to operate various production units and power plants in Iraq.

The Ministry of Oil’s programs for investing in gas and relying on it as fuel for industrial projects are clear, but there are promising opportunities to enhance them, improve their reality, remove all obstacles to their growth, and make them an economy in their own right and an important complement to oil production, and to enter into giant projects with strategic dimensions that would put Iraq at the forefront of the growing international economy map in the foreseeable future, not the distant future.

The economic challenges that Iraq has witnessed over the past two decades have led the government, represented by the Ministry of Oil, to seek to develop the Al-Gharraf field and increase its production to achieve economic stability and energy self-sufficiency by exploiting the associated gas in this field, which was first discovered in (1984) through oil exploration in southern Iraq, specifically northwest of Al-Rifai district in Dhi Qar Governorate, at a distance of (5) kilometers.

It contains huge quantities of associated gas, which has been estimated by experts from giant international companies specializing in the field of gas at approximately (50) trillion cubic feet. If plans to access this quantity are strengthened, it will contribute an important role in covering a large part of the needs of the country's power plants and could save huge sums of money allocated as funds to purchase gas from foreign sources.

Therefore, it has become necessary to expedite the timetables set for the implementation of the project works or at least adhere to them and fully exploit the field and not be satisfied with a modest percentage of work, as well as using horizontal drilling techniques to increase production and develop associated gas processing plants.

It is among the most important projects that the Ministry of Oil announced could be operational at the beginning of the year (2027) as a giant investment project after it entered an advanced and direct implementation stage with the actual installation and installation of specialized equipment as a strategic achievement of the highest priority in the national economy.

It will be invested within the approved designs and enhance fuel supplies to the national grid and stabilize the energy system in all regions of Iraq. https://alsabaah.iq/125761-.html

Intensifying Efforts To Raise Iraq's Credit Rating

Economic 2025/12/30 Baghdad: Hussein Thaghab The government has intensified its efforts to achieve the highest international credit rating, given the importance of this step in gaining the confidence of international investors, facilitating the attraction of foreign investments, reducing borrowing costs, and enhancing confidence in the national economy.

The process of raising the credit rating contributes to supporting structural reforms and enhancing the ability to obtain financing from international institutions. It is an important indicator of the state’s ability to meet its obligations, which encourages sustainable economic development.

A few days ago, Fitch Ratings confirmed in its latest report that it had maintained Iraq’s sovereign rating at “B-” with a stable outlook, reflecting international confidence in the Iraqi economy’s ability to maintain its financial and credit stability despite current global and regional challenges.

In this regard, economic expert Alaa Fahd believes that the country needs investment, especially foreign investment, at the present stage, to carry out infrastructure projects and major projects, stressing the need to create a suitable environment for investment, whether legal, legislative, economic, or financial, by providing financial and banking facilities.

Government Efforts

In an interview with Al-Sabah, Fahd expressed his hope that investment contracts would be free from corruption, as this would raise Iraq’s credit rating. He noted that the country is currently rated B- according to the latest report from the international credit rating agency Fitch, which confirmed that Iraq is a “stable environment.”

He explained that stability paves the way for a higher rating by creating a conducive financial environment, combating corruption, and establishing a suitable legislative framework to support investments. He emphasized that the steps taken by the government and the Central Bank, in cooperation with international financial institutions, to attract investment, particularly in sectors that generate profits and economic savings, such as the Development Road, the Faw Port, and also investment in the oil sector and manufacturing industries, as well as investment in the housing sector, economic cities, smart cities, and the banking sector, have contributed to achieving this rating.

Classification.

Ways Of Cooperation

The spokesperson added that many countries have greatly benefited from foreign investment, emphasizing the importance of providing government support and finding avenues for cooperation to ensure investment becomes a driving force in Iraq, as many other countries have achieved, making the country an attractive investment environment by eliminating bureaucracy.

In this context, Dr. Maitham Adham Al-Zubaidi, Vice President of the Competition and Monopoly Council, stated that attracting investment to Iraq requires addressing the structural factors that influence investor decisions, primarily reforming the banking system, ensuring exchange rate stability, and establishing clear monetary policy. He pointed out that these factors play a crucial role in building confidence and providing a predictable financial environment.

Al-Zubaidi told Al-Sabah that reform remains incomplete unless it is complemented by strengthening governance and transparency, especially in the Iraq Stock Exchange, by protecting shareholders’ rights, ensuring disclosure, and transforming the market into a real tool for financing companies and not just a limited trading platform with an economic concentration in the banking sector to the exclusion of other sectors.

He pointed out that simplifying administrative procedures is a necessity of no less importance, as the multiplicity of granting bodies and licensing committees and the conflict of classifications of economic activities constitute a burden on the investor.

Pivotal Steps

He added that unifying activity classification systems among licensing and business registration bodies and regulatory authorities, such as the ISIC4 system, is a pivotal step toward reducing overlaps, preventing conflicting interpretations, and building a unified government economic data portal accessible to the public.

This portal will accurately serve investors and feasibility study makers. He emphasized that infrastructure, particularly in communications and transportation networks, forms the foundation upon which any economic activity rests, and its development requires liberalizing competition and preventing monopolies, along with effective regulation that ensures a level playing field.

By linking these three paths within a clear governance framework, Iraq can transition from an economy that repels investment to one that is attractive and sustainable. https://alsabaah.iq/125760-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

“Tidbits From TNT” Tuesday 12-30-2025

TNT:

Cutebwoy: The Iraqi Parliament elects Haibet Al-Halbousi as the speaker

Today, INA - BAGHDAD

The Iraqi Parliament elected Haibet Al-Halbousi as its Speaker for the sixth session on Monday.

The Parliament's Media Office stated in a press release received by the Iraqi News Agency - INA that "Parliament elected Haibet Al-Halbousi as its Speaker for its sixth session."

The statement added that "MP Haibet Al-Halbousi received 208 votes, while MP Salim Al-Issawi received 66 votes, and MP Amer Abdul-Jabbar received 9 votes. There were 26 invalid ballots.

TNT:

Cutebwoy: The Iraqi Parliament elects Haibet Al-Halbousi as the speaker

Today, INA - BAGHDAD

The Iraqi Parliament elected Haibet Al-Halbousi as its Speaker for the sixth session on Monday.

The Parliament's Media Office stated in a press release received by the Iraqi News Agency - INA that "Parliament elected Haibet Al-Halbousi as its Speaker for its sixth session."

The statement added that "MP Haibet Al-Halbousi received 208 votes, while MP Salim Al-Issawi received 66 votes, and MP Amer Abdul-Jabbar received 9 votes. There were 26 invalid ballots.

************

Tishwash: Iraq ranks 29th globally and third in the Arab world among the banks with the best reserves.

Iraq ranked 29th globally out of 50 countries, and third in the Arab world, among the best central banks in terms of hard currency reserves, according to Visual Capitalist, a website specializing in markets, technology, energy and the global economy.

The website stated in a report seen by Shafaq News Agency that the central bank's reserves serve as the state's financial shield, as they consist of foreign currencies, gold, and other liquid assets, and play a pivotal role in stabilizing currencies and overcoming financial crises, noting that the size of these reserves determines the extent of the economies' resilience in the face of shocks and their impact on global markets.

According to the report, Iraq ranked 29th globally in terms of the largest reserves of foreign currency and gold, with a total of $100.691 billion.

Globally, China topped the list with reserves of $3.456 trillion, followed by Japan in second place with $1.231 trillion, then the United States in third place with $910.037 billion, Switzerland in fourth place with $909.366 billion, followed by India in fifth place with $643.043 billion, and then Russia in sixth place with $597.217 billion.

In the Arab world, Saudi Arabia ranked first with reserves of $463.870 billion, followed by the UAE in second place with $237.931 billion, then Iraq in third place, Libya in fourth place with $92.894 billion, Algeria in fifth place with $83 billion, Qatar in sixth place with $53.987 billion, Kuwait in seventh place with $50.728 billion, while Egypt ranked eighth with $44.921 billion. link

************

Tishwash: Iranian central bank governor resigns amid currency devaluation

Iran's semi-official news agency Nour News quoted an official in the Iranian president's office on Monday as saying that Central Bank Governor Mohammad Reza Farzin had resigned from his post.

The official added that Iranian President Masoud Pezeshkian is considering Farzin's resignation request.

Iranian traders and shop owners staged protests for the second day in a row on Monday due to the national currency's plunge to a new record low against the US dollar. link

************

Tishwash: Angry protests erupt in central Tehran, with slogans "going beyond the economy".

The Iranian capital, Tehran, witnessed widespread local protests against the sharp and unprecedented decline in the value of the local currency, as the exchange rate of the US dollar exceeded the 1.4 million Iranian rial mark (140,000 tomans).

Iranian media outlets, as reported by Kalemeh News, stated that the increasing pressure on the economic situation of businessmen and traders led to the outbreak of two protests in the heart of the capital, Tehran, specifically in the Shahchar shopping center and Lalehzar Street, where the demands focused on denouncing the sharp fluctuations in the exchange rate and its devastating impact on wholesale and retail prices.

According to the Fars News Agency, which is close to the authorities, the number of protesters reached about 200 people, but it indicated that there were small groups that infiltrated the merchants and chanted slogans that the agency described as going beyond economic demands, in an indication that the chants had turned towards a political direction.

The agency linked these moves to calls by Maryam Rajavi, leader of the opposition group Mujahedin-e Khalq, accusing the organization, which it described as having ties to the United States and Israel, of trying to exploit the economic situation to shake social stability and destabilize the political system in the country, amid the continued suffering of the Iranian economy from the weight of international sanctions. link

**********

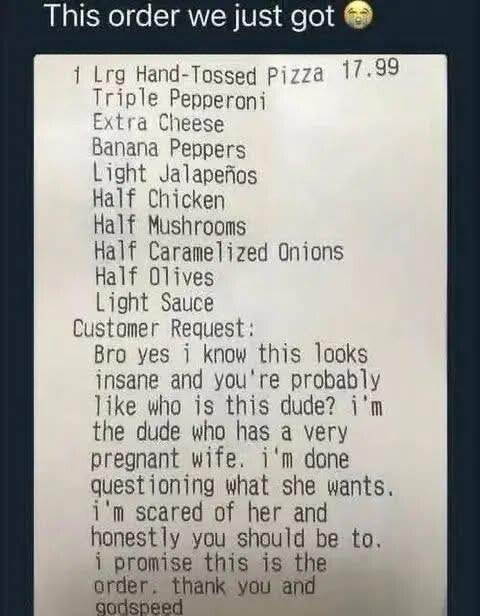

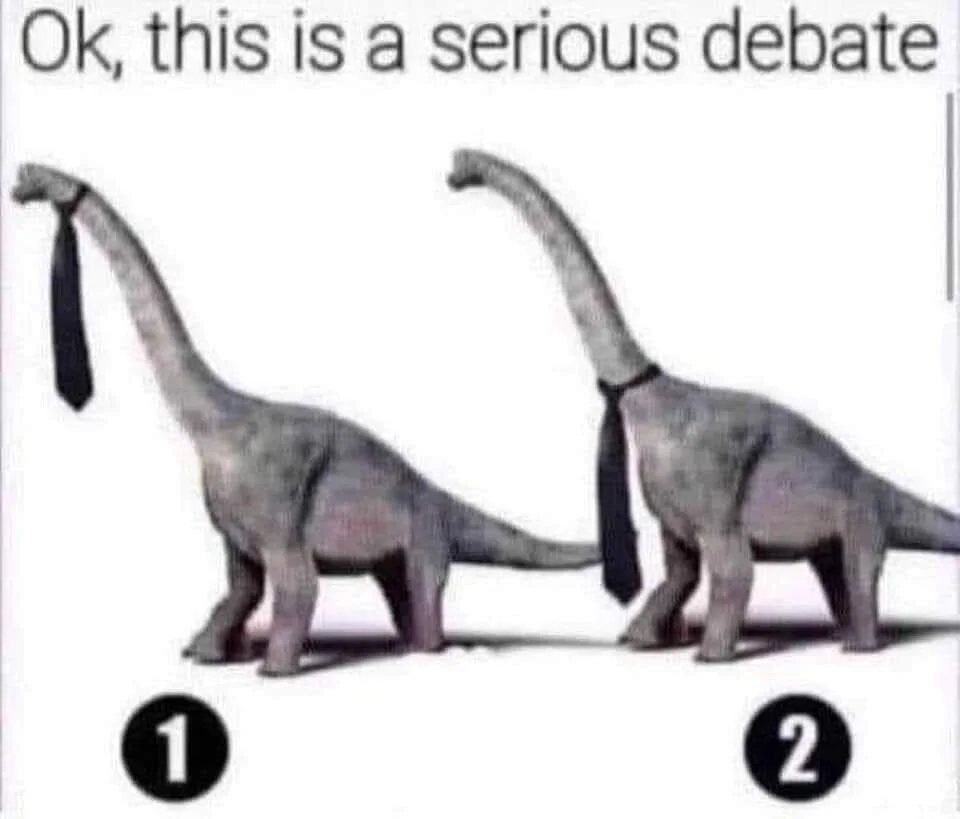

Mot: ... While Waiting for the ""Wee Folks""!!!!

Mot: serious it is….Dino Necktie

Seeds of Wisdom RV and Economics Updates Tuesday Morning 12-30-25

Good Morning Dinar Recaps,

Trump and Netanyahu Signal Strategic Alignment as Middle East Peace Framework Advances

Florida meeting underscores security, disarmament, and regional normalization priorities

Good Morning Dinar Recaps,

Trump and Netanyahu Signal Strategic Alignment as Middle East Peace Framework Advances

Florida meeting underscores security, disarmament, and regional normalization priorities

Overview

U.S. President Donald Trump and Israeli Prime Minister Benjamin Netanyahu signaled near-total strategic alignment following a closed-door meeting in Florida

Both leaders emphasized peace through strength, tying disarmament of militant groups to regional stability

Iran, Hamas, and Hezbollah were identified as remaining destabilizing forces

Expansion of the Abraham Accords was confirmed as an active objective

Netanyahu announced President Trump will receive a prestigious Israeli honor traditionally awarded to Israelis, recognizing his role in advancing peace and security

Key Developments

Trump stated Hamas has been given a short timeline to disarm, warning consequences if commitments are not met

Netanyahu praised Trump’s record as Israel’s strongest ally, crediting joint coordination for regional breakthroughs

Netanyahu confirmed Trump will be awarded a major Israeli honor, typically reserved for Israeli citizens, acknowledging his contributions to Israel’s security and regional diplomacy

Both leaders confirmed ongoing discussions on Gaza governance, West Bank outcomes, and post-conflict security

Trump warned Iran against rebuilding weapons capabilities, signaling readiness to act if red lines are crossed

The Abraham Accords were described as expanding “fairly quickly,” with Saudi normalization still on the table

Trump confirmed openness to bilateral engagement with Iran — conditional on behavior

Why It Matters

The award announcement was not ceremonial — it was symbolic signaling. By granting a traditionally Israeli-only honor to an American president, Israel publicly reinforced long-term strategic alignment and continuity of policy, regardless of political cycles.

This reinforces confidence that the peace framework discussed is not provisional, but intended to be durable. Symbolism matters in diplomacy — especially when it aligns with enforceable commitments.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Middle East stability directly impacts energy pricing, trade routes, sovereign risk premiums, and reserve confidence.

Public recognition of leadership continuity reduces geopolitical uncertainty premiums embedded in currencies. When peace frameworks appear durable — not personality-driven — capital reallocation accelerates and volatility compresses.

In reset terms, symbolic commitments often precede structural ones.

Implications for the Global Reset

Pillar: Diplomatic Continuity Anchors Stability

Stable alliances reduce geopolitical shock risk.

Pillar: Peace Enables Capital Normalization

Durable agreements allow markets to price risk forward instead of defensively.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

YouTube — “President Trump and the Prime Minister of Israel Deliver Remarks”

Reuters — “Trump, Netanyahu signal alignment on Gaza, Iran and regional security”

~~~~~~~~~~

Iran’s Currency Collapse Sparks Protests as Monetary Stress Intensifies

Rial depreciation exposes limits of sanctions resilience and domestic stability

Overview

Iran experienced renewed protests as the national currency fell sharply in value

The Iranian rial’s decline accelerated inflation and reduced household purchasing power

Public unrest highlighted growing stress between monetary instability and social tolerance

Currency weakness reflected sanctions pressure, reserve constraints, and structural imbalances

Key Developments

The Iranian rial slid to new lows against major currencies, triggering street protests

Rising prices for food, fuel, and basic goods intensified public frustration

Authorities cited external sanctions and market speculation as contributing factors

Currency intervention measures failed to restore confidence or stabilize exchange rates

Protests underscored the link between currency credibility and political stability

Why It Matters

Currency collapse is rarely just a financial event — it is a confidence crisis. Iran’s situation illustrates how prolonged sanctions, limited reserve flexibility, and restricted access to global settlement systems eventually surface in domestic instability.

When currencies lose credibility, governments face shrinking policy options. Monetary tools become less effective, capital controls tighten, and social pressure rises. Iran’s experience highlights the cost of isolation in a system increasingly defined by interoperability and trust.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iran’s currency collapse is a cautionary example of how geopolitical isolation accelerates monetary fragility. Currencies dependent on restricted trade, constrained reserves, or politicized settlement systems face amplified repricing risk during stress.

Conversely, currencies supported by diversified reserves, trade access, and functional payment rails retain stability even under pressure. In reset terms, access matters as much as assets.

Implications for the Global Reset

Pillar: Currency Confidence Equals Social Stability

When money fails, unrest follows.

Pillar: Isolation Increases Repricing Risk

Systems outside global settlement frameworks face sharper adjustments.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Iran protests erupt as currency slide fuels inflation anger”

Reuters — “Iran’s rial hits new lows amid sanctions pressure”

~~~~~~~~~~

Critical Minerals: The New Oil of the Global Reset

Green transition accelerates a new era of resource power politics

Overview

Critical minerals are replacing oil as the primary strategic resource in the global economy

China dominates rare earth production and processing, creating geopolitical leverage

Demand for lithium, cobalt, and nickel is accelerating sharply under net-zero mandates

Supply concentration and export controls are emerging as tools of state power

Key Developments

Global demand for lithium is projected to rise more than 400% by 2040, driven by EVs and renewable energy infrastructure

China controls approximately 60% of rare earth production and nearly 90% of global processing capacity

The United States remains fully import-dependent for several critical minerals

Export restrictions on minerals like gallium and germanium have already demonstrated economic shock potential

Australia has positioned itself as a strategic supplier, leveraging lithium and rare earth reserves through new alliances

Calls are growing for new governance frameworks to prevent exploitation, supply coercion, and inequality

Why It Matters

The global shift toward clean energy is not eliminating geopolitical competition — it is relabeling it. Critical minerals now underpin industrial power, military readiness, and technological leadership. Control over extraction and processing is becoming a decisive factor in global influence, echoing the oil-dominated power structures of the 20th century.

Without new governance models, the energy transition risks replicating the same imbalances it claims to solve — substituting carbon dependence with mineral dependence, and emissions inequality with extraction inequality.

Why It Matters to Foreign Currency Holders

Foreign currency holders are increasingly exposed to the geopolitical risks of mineral dependence. Nations controlling critical minerals can influence global trade pricing, reserve currency valuations, and access to high-demand technologies.

A disruption in supply chains—whether through export controls, trade disputes, or production bottlenecks—can ripple through global markets, affecting currency stability, inflation expectations, and purchasing power. Diversification in reserves, awareness of strategic mineral dependencies, and monitoring shifts in resource control are becoming essential for safeguarding value in a multipolar financial landscape.

Implications for the Global Reset

Pillar: Resource Control Drives Currency and Trade Power

Nations controlling strategic inputs gain leverage over settlement, trade terms, and capital flows.

Pillar: Supply Chains Are Becoming Monetary Infrastructure

Critical minerals are no longer commodities — they are embedded in currency stability, industrial policy, and sovereign resilience.

This is not just environmental policy — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy — “How Critical Minerals Became the New Oil”

International Energy Agency — “The Role of Critical Minerals in Clean Energy Transitions”

~~~~~~~~~~

Global Markets Mixed as Stocks Stall and Currency Pressure Builds

Year-end uncertainty exposes fragility beneath surface stability

Overview

Global equity markets ended the session mixed as investors weighed slowing momentum against policy uncertainty

Currency markets reflected ongoing pressure on the U.S. dollar, while risk-sensitive currencies remained volatile

Bond yields stayed elevated, reinforcing concerns over debt sustainability and fiscal stress

Precious metals pulled back from record highs, underscoring liquidity strain rather than demand collapse

Key Developments

U.S. equities softened in holiday-thinned trading as investors reassessed 2026 growth expectations

European and Asian markets showed uneven performance, signaling regional divergence rather than synchronized recovery

The U.S. dollar remained under pressure amid expectations of rate cuts and expanding deficits

Bond markets continued to reflect sensitivity to debt issuance and long-term fiscal positioning

Risk appetite weakened as traders prioritized balance-sheet preservation over upside exposure

Why It Matters

This market behavior reflects transition, not panic. Mixed performance across equities, currencies, and bonds suggests capital is repositioning rather than exiting. Liquidity is becoming selective, favoring assets with structural support while penalizing those dependent on leverage and sentiment.

Markets are no longer reacting to headlines alone — they are responding to policy credibility, debt trajectories, and system readiness. That shift marks a late-stage transition phase rather than a cyclical correction.

Why It Matters to Foreign Currency Holders

For foreign currency holders, mixed markets signal repricing risk, not immediate collapse. When currencies weaken alongside equities and bonds, it reflects uncertainty over long-term purchasing power rather than short-term volatility.

Currencies tied to high debt loads, fiscal expansion, or policy ambiguity face sustained pressure. Those supported by disciplined monetary policy, reserve diversification, and stable trade positioning gain relative durability as capital becomes more selective.

In reset terms, currencies are being evaluated on structure, not momentum.

Implications for the Global Reset

Pillar: Capital Selectivity Increases

Liquidity favors resilience over speculation as systems transition.

Pillar: Currency Credibility Replaces Growth Narratives

Markets price balance-sheet strength ahead of economic optimism.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Global markets slip as investors reassess growth and policy outlook”

Reuters — “Tenuous peace between Trump and $30 trillion U.S. bond market”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Morning 12-30-25

An Economic Expert Identifies 5 Pillars For Strengthening Iraq's Economic Power.

Time: 2025/12/19 21:22:08 Readings: 135 times {Economic: Al-Furat News} On Friday, economist Salah Nouri identified five key pillars for strengthening Iraq's economic power, stressing that the success of economic programs and the path to international development is linked to combating corruption in contracts and implementation.

An Economic Expert Identifies 5 Pillars For Strengthening Iraq's Economic Power.

Time: 2025/12/19 21:22:08 Readings: 135 times {Economic: Al-Furat News} On Friday, economist Salah Nouri identified five key pillars for strengthening Iraq's economic power, stressing that the success of economic programs and the path to international development is linked to combating corruption in contracts and implementation.

Nouri told Al-Furat News Agency that "economic strength lies in local production that competes with imported goods, especially agricultural and animal production," noting that "the Iraqi environment is historically an agricultural country and the elements of agricultural production can be provided, provided that the water problem is solved at the present time."

He added that "the second pillar depends on enhancing industrial production through public-private partnership contracts, as well as encouraging small and medium enterprises by supporting them with soft loans while ensuring the monitoring and regulation of these projects."

Nouri stressed "the importance of accelerating the completion of the electrical power infrastructure and utilizing the natural gas associated with oil extraction," while also calling for "reconsidering the size of the operational budget and streamlining spending, especially unjustified privileges in light of the financial crisis."

The economist stressed that "the success of these programs, in addition to the International Development Road project, depends primarily on combating corruption in contracting and implementation processes."

From... Ragheed https://alforatnews.iq/news/خبير-اقتصادي-يحدد-5-ركائز-لتعزيز-القوة-الاقتصادية-في-العراق

2026...Expectations And Surprises

Yasser Al-Mutawalli In just a few days, the clock will tick away, announcing the end of one year and the beginning of a new one. The year 2026 is just around the corner.

Experts' predictions are often based on indicators and signs of economic phenomena and the changes that occur to them. These predictions are often correct and accurate, and sometimes they intersect with unforeseen surprises.

According to the indicators shown to us, and within the economic framework that constitutes the specialization of this page and my professional interest, the general picture points to a future that promises a real breakthrough in achieving an important aspect of economic reform.

The current government has taken steps and made beginnings with a clear imprint, characterized by particular importance in launching a major development program that will restore the Iraqi economy to its former glory, strength, and status.

In the service sector, any observer can witness the realization of a number of service projects on the ground, without the trouble of evaluation or controversy, forming the nucleus of a primary infrastructure that we desperately need, in support of upcoming strategic projects, such as bridges and overpasses, paving of main and secondary streets, and others.

As for diversifying the economy and sources of funding, actual steps have begun, even if some of them are limited to initialing agreements with major international companies investing in the implementation of strategic projects, most notably the Development Road project, in addition to other promising projects.

Within the sub-sectors of economic reform, the banking sector is witnessing today a tireless effort to correct the course of banks, enabling them to provide the requirements of development, including meeting the needs of investment companies for advanced financial services.

In terms of international, regional and Arab economic relations, Iraq has opened up to extensive exchange and cooperation deals, reflecting the improvement in its economic position and its increasing involvement in its regional and international environment.

The above is but one aspect of many that cannot be fully addressed in this article. However, this achievement provides a solid foundation upon which the next government can build to continue the journey, adopt the important projects whose foundations have been laid, and ultimately achieve the desired economic reform and sustainable development.

I must also mention a crucial indicator upon which we can build a better future: human capital, the cornerstone of development and progress. Alongside this, the health sector has witnessed a significant victory, marked by the successful implementation of the health insurance program for the first time in our country, although we still need more hospitals and advanced medical services.

As for the surprises that may be imposed by international events and changes, they are naturally beyond our control, but the duty remains to deal with them in accordance with the interest of the country and its people.

Beyond that, it is the responsibility of the new and anticipated government to turn expectations into realities on the ground, so that the citizen may enjoy the bounty and wealth of his country. All we need is sound management of public funds, and the rest will happen automatically. https://alsabaah.iq/125679-.html

Experts: Liquidity Is Under Control, Reforms Are Necessary

Baghdad: Hussein Thagab and Imad Al-Imara Economic experts have downplayed concerns about financial risks threatening the reality of public spending in the country, stressing that what the state’s monthly liquidity is witnessing does not amount to a “financial gap” in the scientific and precise sense, but rather reflects mainly the effects of fluctuating crude oil prices in global markets, in addition to the limited non-oil resources.

They pointed out that the financial situation remains within manageable limits, but requires genuine structural reforms to prevent a recurrence of crises and enhance financial stability in the medium and long term. Experts believe that talk of a fiscal gap is often misunderstood, as a gap implies a persistent structural deficit between revenues and expenditures, whereas the current situation is linked to temporary fluctuations in monthly cash flows. These fluctuations stem from the nature of a rentier economy and its near-total dependence on oil, making public finances vulnerable to changes in global markets.

In this context, the Prime Minister's financial advisor, Dr. Mazhar Muhammad Salih, affirmed that the fluctuations in monthly liquidity cannot be classified as a genuine financial gap, but rather reflect temporary imbalances linked to the volatility of oil revenues and the weak contribution of non-oil revenues to financing the general budget.

In an interview with Al-Sabah newspaper, he explained that managing this situation requires a high degree of realism in financial decision-making and swift action, avoiding reactive or temporary solutions that could lead to deeper imbalances in the long run.

The Essence Of Financial Stability

Saleh pointed out that maintaining financial stability at this stage necessitates controlling and prioritizing operational spending to ensure it is directed towards the state's essential obligations, primarily salaries for employees and retirees, social safety nets, and critical service and security sectors. He emphasized that rationalizing or postponing some non-essential expenditures does not mean reducing the state's role, but rather aims to protect financial and social equilibrium and prevent financial pressures from spreading to broader segments of society.

He added that any financial solution must balance the requirements of monetary stability with the social dimension, warning that ill-considered decisions could create inflationary or social effects that would be difficult to contain later.

Maximizing Resources And Improving Tax Collection

The financial advisor emphasized that maximizing financial resources is a complementary approach to controlling spending. This can be achieved by improving the efficiency of tax collection and the collection of outstanding dues, along with developing tax administration and expanding the tax base without overburdening low-income earners. He explained that strengthening non-oil revenues has become a strategic necessity to reduce the vulnerability of public finances to oil price fluctuations.

He also indicated the possibility of resorting to domestic borrowing within carefully considered limits and using short-term instruments, provided that this does not lead to liquidity pressures or create inflationary waves. At the same time, he emphasized the importance of activating the investment of underutilized government assets and transforming them into productive resources, thereby contributing to supporting public finances and achieving sustainable revenues in the medium term.

Diagnosing The Structural Problem

For his part, financial expert Alaa al-Fahd explained that Iraq's financial problem has been identified for years and stems from the rentier nature of its economy and its excessive reliance on oil revenues, making the country highly vulnerable to any rise or fall in crude oil prices on global markets. He emphasized that this structural problem requires reforms that go beyond temporary or patchwork solutions.

Al-Fahd told Al-Sabah: “The current stage calls for adopting urgent and immediate reforms to deal with the current challenges, in addition to future strategic reforms aimed at diversifying the revenue basket and reducing dependence on oil, as well as reducing government spending as much as possible without affecting social or productive investment spending.”

Strategic Projects

As A Safety Valve

Al-Fahad pointed out that the major projects adopted by the government, including the Grand Faw Port and the Development Road project, as well as the revitalization of the agricultural and industrial sectors, represent a crucial pillar for mitigating the impact of any potential financial crisis. He explained that these projects not only provide direct revenues but also contribute to addressing chronic economic bottlenecks, creating job opportunities, and stimulating local production chains that enhance the added value of the national economy.

He added that investing in agriculture and industry represents a strategic option to transform the economy from a rentier, consumer-based economy to a productive one, thus ensuring more stable and less volatile sources of income.

Permanent Sources Of Revenue

The financial expert stressed that the current financial situation does not pose a direct threat to the country’s stability, but that the continuation of the situation as it is without radical treatment may lead to unacceptable confusion, in light of the one-sided economy, weak government coordination, and the disruption of many sectors that are supposed to be key drivers of growth and permanent sources of revenue.

He pointed out that the next government bears a double responsibility in finding real solutions to the problems of the economy, by adopting clear policies to move towards diversifying financial revenues, while avoiding resorting to unstudied internal or external debt, due to the future burdens it places on public finances.

Digital Transformation As A Reform Tool

Al-Fahad pointed out that automating taxes and customs, and transitioning to electronic collection systems, are pivotal reform tools for the next phase, given their role in increasing revenues, reducing waste and corruption, and improving financial transparency. He emphasized that these measures, along with activating productive sectors, can contribute to achieving sustainable financial and economic prosperity.

He concluded by emphasizing that the current financial situation is still under control, but managing the next phase requires courageous decisions and gradual and well-thought-out reforms, stressing that the search for real solutions is no longer an option, but an inevitable necessity to ensure economic and social stability in the country.https://alsabaah.iq/125458-.html

Experts: Iraq Achieves Financial Balance That Boosts Global Market Confidence

Economic Baghdad: Hussein Thagab and Imad Al-Imara Economic experts and specialists have downplayed the risks of Iraq’s internal and external public debt, stressing that its ratio is still within the safe international standard range, and that the strength of the foreign currency reserves has contributed to the stability of Iraq’s financial situation.

The opinions of experts and specialists in economic affairs were consistent with the assurances of the Prime Minister’s financial advisor, Dr. Mazhar Muhammad Saleh, who indicated that “only $3 billion of the remaining debts to the Paris Club will be settled by 2028, and that 47% of the internal debt remains within the investment portfolio of the Central Bank of Iraq, and is covered as cash liquidity or cash liabilities at a rate exceeding 100% in foreign currency thanks to the strength of Iraq’s foreign reserves.”

Debt Repayment Mechanism

Saleh told Al-Sabah: “There is an amount of less than $6 billion of external debt being withdrawn and spent on projects in the liberated areas, from loans provided by international development funds, all of which will also be paid in the current decade, in addition to an external debt of about $9 billion that will be paid gradually in the next decade.”

He explained that the federal general budget sets a precise mechanism for settling external debts and their due dates on an annual level with a high degree of regularity, which has made Iraq’s credit rating more stable at the B level during the last ten years.

He added that the external public debt does not exceed, in all circumstances, between 7 and 8% of the gross domestic product, which is within the safe international standard range that allows the public debt to the output to be 60%, noting that the fluctuations in the price of oil, the main resource for the general budget, between 2014 and recently, and other external factors, led to government borrowing from the local banking market, which led to an increase in the internal public debt to about 92 trillion Iraqi dinars.

Investment Portfolio

The government advisor explained that 47% of the internal debt remains within the investment portfolio of the Central Bank of Iraq, and it is covered as cash liquidity or cash liabilities at a rate of more than 100% in foreign currency thanks to the strength of Iraq’s foreign reserves. He stressed that the total internal and external public debt as a percentage of GDP remains within the safe international standard range and does not exceed 35% to 40% of the country’s GDP under any circumstances.

Saleh emphasized the positive role played by monetary policy in what is called “monetary adjustment”, by facilitating the acceptance of bonds, bills or treasury bills under which public finances borrowed through market operations and absorbing them within the investment portfolio of the Central Bank of Iraq at a rate of approximately 47%, which greatly increased the liquidity of the economy.