Seeds of Wisdom RV and Economics Updates Tuesday Evening 12-23-25

Good Evening Dinar Recaps,

Switzerland Faces Strategic and Diplomatic Inflection Point

Neutral financial hub confronts shifting global alignments

Overview:

Switzerland—long regarded as a bastion of neutrality and financial stability—is experiencing political and economic pressures that challenge its traditional global role.

Debates have intensified over the country’s position on international sanctions, banking confidentiality, and financial regulation, raising questions about its long‑standing diplomatic and financial posture.

This introspection comes as global capitals reassess alliances, regulatory standards, and strategic partnerships amid rising geopolitical tension.

Key Developments:

Commentary from major financial outlets highlights Switzerland’s struggle to balance neutrality with evolving global expectations on transparency, sanctions enforcement, and regulatory cooperation.

Pressure from the U.S., EU, and other blocs has pushed Swiss regulators to adapt compliance practices previously protected under strict privacy norms.

Internally, political factions are divided over how actively Switzerland should engage in geopolitical issues versus preserving its historical stance of impartiality.

Changes in policy could affect the Swiss financial sector’s appeal to global investors and alter capital flows that have historically favored Swiss banking and wealth services.

Why It Matters:

Switzerland’s financial sector has been a cornerstone of global liquidity, cross‑border capital flows, and conservative banking practices. Any strategic realignment in policy or diplomatic posture has implications for how wealth is stored, moved, and regulated internationally.

Why It Matters to Foreign Currency Holders:

As Switzerland potentially recalibrates its neutrality and financial policies, foreign currency holders may face shifts in capital movement environments previously viewed as safe and discreet. Changes in regulatory cooperation or sanctions alignment could impact liquidity, settlement routes, and the perceived stability of Swiss‑linked currency and financial services. This signals a broader trend where diplomatic shifts increasingly shape financial landscapes and reserve preferences.

Implications for the Global Reset:

Pillar 1: Financial Transparency Reform — Swiss policy shifts reflect global demands for greater compliance and alignment.

Pillar 2: Diplomatic‑Financial Integration — Financial hubs are now influenced by geopolitical strategy as much as economic pragmatism.

This is not just geopolitics — it’s financial architecture evolution before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times – “Is Switzerland losing its place in the world?”

Reuters – “Switzerland weighs sanctions stance amid global pressure”

~~~~~~~~~~

Part 1: Copper Hits $12,000 for First Time as Tariff Trade Upends Market

Historic surge highlights supply risks and geopolitical trade impacts

Overview:

Copper prices climbed above $12,000 per ton for the first time ever, driven by severe global supply disruptions and trade distortions tied to tariff dynamics. Bloomberg

Prices on the London Metal Exchange rose as much as 2% to $12,159.50 a ton, extending a rally that has lifted copper by more than a third this year. Bloomberg

The rally is linked to mine outages, tariff‑related trade flows, and traders front‑running potential additional U.S. import duties, tightening global availability. FastBull

**********************************

Key Developments:

Severe mine outages across key producing regions have tightened refined supply, adding to upward price pressure. FastBull

Dislocations from tariff signals have shifted copper export flows, with traders moving metal into the U.S. ahead of possible duties, exacerbating shortages elsewhere. FastBull

Analysts and major banks have forecast continued strength in copper markets given structural deficits, industrial demand, and tightening availability. FastBull

Why It Matters:

Copper’s historic breakout beyond $12,000 reflects deeper pressures in global trade and supply chains. As a foundational industrial metal — essential for infrastructure, energy systems, and technology production — copper’s price dynamics can influence broader commodity markets, manufacturing costs, and investment flows tied to the global industrial cycle.

Why It Matters to Foreign Currency Holders:

For foreign currency holders, a dramatic surge in copper prices can signal inflationary pressures, real resource scarcity, and shifts in terms of trade for commodity‑producing nations. Strong commodity prices often influence emerging‑market currency strength, reserve diversification strategies, and capital allocation — particularly for countries reliant on metal exports. Higher copper prices can also affect currency valuations relative to the U.S. dollar, adding another layer to global FX and reserve dynamics in the context of trade policy uncertainty.

Implications for the Global Reset:

Pillar 1: Commodity‑Driven Valuation Realignment — Strategic industrial metals become new benchmarks for national economic resilience.

Pillar 2: Trade Policy as Market Disruptor — Tariff signals and supply disruptions reshape global trade routes and resource allocation.

This is not just price movement — it’s tectonic supply and policy impact before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Bloomberg – “Copper Hits $12,000 for First Time as Tariff Trade Upends Market”

Yahoo Finance – “Copper Hits $12,000 for First Time as Tariff Trade Upends Market”

~~~~~~~~~~

Part 2: Copper Soars as Energy Transition & Geopolitics Reshape Industrial Metals

Strategic resource becomes center of global economic recalibration

Overview:

Copper prices remain elevated, fueled by renewable energy projects, electrification, and industrial demand.

Geopolitical disruptions, including tariffs and supply bottlenecks, tighten availability and highlight copper’s strategic importance.

Analysts view copper as a barometer for industrial and geopolitical stability, connecting commodities to economic reset dynamics.

Key Developments:

Energy transition projects are consuming unprecedented copper volumes.

Tariff-driven trade shifts displace supply, forcing preemptive stockpiling.

Industrialized and emerging economies reassess strategic copper reserves.

Copper increasingly serves as a hedge against supply shocks and geopolitical risk.

Why It Matters:

Copper is now a strategic asset influencing trade, energy policy, and reserve decisions, with supply and price fluctuations affecting industrial planning, inflation, and financial stability.

Why It Matters to Foreign Currency Holders:

Foreign currency holders must account for copper volatility when assessing FX exposure, inflation hedges, and reserve allocations. Exporting nations may see strengthened currencies and trade balances, while import-dependent countries may face currency pressure, highlighting copper’s direct influence on cross-border financial stability.

Implications for the Global Reset:

Pillar 1: Strategic Resource Realignment — Copper serves as industrial and financial leverage in global planning.

Pillar 2: Geopolitical & Trade Sensitivity — Supply and tariff disruptions reshape currency, reserves, and investments.

This is not just commodity volatility — it’s systemic industrial and financial restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Bloomberg – “Copper Hits $12,000 for First Time as Tariff Trade Upends Market”

Reuters – “Global Copper Market Tightens Amid Energy Transition and Trade Tensions”

~~~~~~~~~~

From Treasuries to Gold: BRICS Accelerate Settlement Currency Shift

Reserve diversification moves from strategy to structure

Overview

BRICS nations are accelerating a shift away from U.S. Treasury exposure while simultaneously increasing gold reserves and expanding non-dollar trade settlement mechanisms.

Central bank gold purchases by BRICS members remain near record levels, reinforcing gold’s role as a neutral reserve anchor.

The transition reflects a broader effort to reduce exposure to dollar-centric settlement risk without triggering market disruption.

Key Developments

BRICS central banks have steadily increased gold accumulation as U.S. Treasury holdings decline, signaling a preference for asset-backed reserve stability.

Bilateral and regional trade agreements increasingly rely on local currencies rather than dollar settlement, particularly between China, Russia, India, and energy exporters.

Gold is being positioned as a confidence asset—supporting trade credibility where direct dollar usage is reduced.

These moves align with longer-term initiatives to modernize cross-border payment rails and settlement frameworks outside traditional Western systems.

Why It Matters

The combination of Treasury reductions, gold accumulation, and alternative settlement currencies signals a coordinated evolution in reserve and payment architecture. Rather than abandoning the dollar outright, BRICS nations are building parallel systems designed to function during periods of sanctions risk, liquidity acknowledgment, or geopolitical stress.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the growing linkage between gold reserves and non-dollar settlement frameworks alters how currency strength and credibility are assessed. As gold increasingly underpins confidence in bilateral trade arrangements, currencies associated with commodity production or strong reserve backing may gain relative stability.

At the same time, reduced reliance on dollar settlement could introduce new exchange-rate dynamics, making diversification and awareness of settlement trends critical for preserving value.

Implications for the Global Reset

Pillar 1: Gold as Neutral Collateral — Gold is re-seen as a trust asset supporting trade and reserve confidence without political alignment.

Pillar 2: Settlement Multipolarity — Trade increasingly clears through multiple currencies, reducing single-system dependency.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Central banks on track for massive gold purchases (global shift to gold reserves)

Reuters – Gold’s rise in central bank reserves appears unstoppable

Bank for International Settlements – “Annual Economic Report: Cross-Border Payments”

~~~~~~~~~~

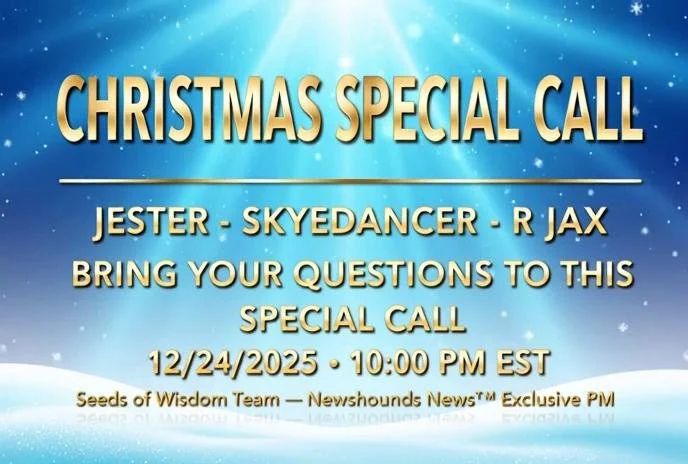

CONFERENCE CALL 12 -24 -25 10:00 PM EST

Calls will be in the RV Facts with Proof

Join Here

Replay Archive Room

🌱Seeds of Wisdom Team 🌱

Newshounds News™ Exclusive.

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps