Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 12-23-25

Good Afternoon Dinar Recaps,

Major Central Banks Launch Widest Easing Since 2008

Coordinated monetary support sets new macro baseline

Overview:

Central banks globally have initiated the broadest monetary policy easing cycle since the 2008 financial crisis, cutting rates aggressively through 2025 to sustain growth amid slowing economies. Reuters

The coordinated easing spans developed and emerging economies, reflecting widespread concerns over growth, credit conditions, and market stability. Reuters

Actions include policy rate cuts, liquidity injections, and adjustments to reserve requirements aimed at stimulating investment and consumption. Finimize

Key Developments:

The U.S. Federal Reserve, European Central Bank, Bank of England, and several emerging market central banks have collectively slashed interest rates by a significant cumulative margin. Reuters

Central bank balance sheets continue to expand through asset purchases and targeted lending facilities.

Easing measures have been accompanied by assurances that monetary policy will remain accommodative until growth and inflation sustainably align with targets.

Markets reacted with increased risk asset flows, though bond yields and credit spreads remain highly sensitive to macroeconomic signals.

Why It Matters:

Coordinated easing on this scale shifts global financial conditions, lowering borrowing costs worldwide and influencing asset valuations, currency dynamics, and capital allocation strategies across markets.

Why It Matters to Foreign Currency Holders:

Massive monetary easing tends to weaken national currencies over time as money supply grows and interest rate differentials shift. For foreign currency holders, this can impact exchange rates, diminish purchasing power, and alter capital return expectations—particularly if real yields stay negative. Shifts in reserve currency demand and central bank policy direction are crucial signals for strategic currency allocation.

Implications for the Global Reset:

Pillar 1: Monetary Rebalancing — Aggressive easing reshapes risk-free rate benchmarks and alters traditional safe-haven dynamics.

Pillar 2: Capital Flow Volatility — Liquidity-driven asset repricing influences cross-border investment and reserve strategies.

This is not just economics — it’s foundational financial repositioning before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Reuters – “Major central banks deliver biggest easing push in over a decade in 2025”

Finimize Newsroom – “The World’s Central Banks Hit Fast-Forward On Rate Cuts In 2025”

~~~~~~~~~~

Banking & Fintech: Standard Chartered Doubles Down on Fintech Partnerships

Legacy bank embraces digital finance to drive future growth

Overview:

Standard Chartered Australia’s leadership declared that fintech and digital finance represent the future of banking, emphasizing deeper integration with emerging technology firms and digital asset infrastructure.

The bank is expanding services that support institutional digital asset custody, cross-border payments, and blockchain-based solutions.

Strategic partnerships with fintech firms aim to accelerate both innovation and operational efficiency across global markets.

Key Developments:

Standard Chartered’s Australian head publicly framed fintech collaboration as central to the bank’s growth strategy, citing client demand and competitive positioning.

Institutional support infrastructure, including custody services and payment solutions for digital assets and stablecoins, is being prioritized.

The bank is strengthening regional fintech networks across Asia Pacific, the Middle East, and Africa to tap into rising digital finance adoption.

Observers note this signals a broader trend in which traditional banks are partnering with, not competing against, fintech innovators to protect market share and modernize services.

Why It Matters:

Standard Chartered’s shift highlights a growing convergence between traditional finance and digital technology platforms. As banks integrate new payment rails and digital asset services, the financial ecosystem evolves toward faster, more inclusive, and programmable money movement—impacting liquidity, settlement efficiency, and global financial interconnectivity.

Why It Matters to Foreign Currency Holders:

For foreign currency holders, financial institutions that embrace fintech and digital finance can improve cross-border settlement speed and lower transaction costs. Enhanced digital infrastructure can reduce dependency on legacy correspondent banking systems, reshape FX liquidity pools, and provide new avenues for currency conversion and asset management. As banking services modernize, currency holders may benefit from improved access, transparency, and flexibility in global payments.

Implications for the Global Reset:

Pillar 1: Digital Infrastructure Integration — Traditional banks collaborating with fintechs bridge old and new financial rails.

Pillar 2: Payments Modernization — Broader adoption of efficient digital payment networks accelerates settlement innovation.

This is not just finance — it’s systemic evolution before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Australian – “Standard Chartered Australia boss Jacob Berman declares fintech is the future”

Reuters – “Banks ramp up crypto, fintech services amid digital asset drive”

~~~~~~~~~~

Crypto Regulation & Oversight Concerns — Binance Under Scrutiny

Major exchange’s compliance issues highlight regulatory gaps

Overview:

Binance allowed suspicious and potentially illicit accounts to operate even after its 2023 U.S. plea agreement, according to a Financial Times investigation.

The report indicates that weak enforcement and compliance lapses persisted long after Binance agreed to stricter oversight as part of legal settlements.

This development raises renewed concerns from regulators, law enforcement, and market participants about systemic risk and anti–money-laundering (AML) effectiveness in the crypto sector.

Key Developments:

Investigative reporting found that flagged accounts continued to trade and move funds without robust screening or intervention despite prior commitments by Binance.

Regulators in multiple jurisdictions are reassessing oversight frameworks, emphasizing the need for stronger AML and counter-terrorist financing safeguards.

Crypto industry advocates and policymakers are calling for clearer, enforceable standards that apply equally to centralized exchanges and traditional financial institutions.

The episode has reignited debates over whether existing frameworks are sufficient to contain illicit finance risks associated with digital assets.

Why It Matters:

The findings illustrate persistent challenges in supervising digital asset markets where centralized exchanges operate across borders with varying regulatory intensity. Effective oversight is essential to ensure crypto markets contribute to financial stability rather than enabling compliance arbitrage.

Why It Matters to Foreign Currency Holders:

Weak enforcement of AML and compliance standards in major crypto hubs can amplify risk across the global financial system. For foreign currency holders, regulatory uncertainty increases volatility in digital currencies and can indirectly affect FX markets, capital flows, and reserve strategies. Confidence in systematic integrity — whether in traditional finance or digital assets — influences currency trust, investment behavior, and cross-border settlement reliability.

Implications for the Global Reset:

Pillar 1: Regulatory Alignment — Ensuring consistent oversight across digital and traditional finance is critical to systemic stability.

Pillar 2: Institutional Trust — Strengthened enforcement reinforces confidence in modern market architecture.

This is not just enforcement — it’s structural governance evolution before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times – “Binance allowed suspicious accounts to operate even after 2023 US plea agreement”

Reuters – “Regulators step up scrutiny as crypto compliance gaps persist”

~~~~~~~~~~

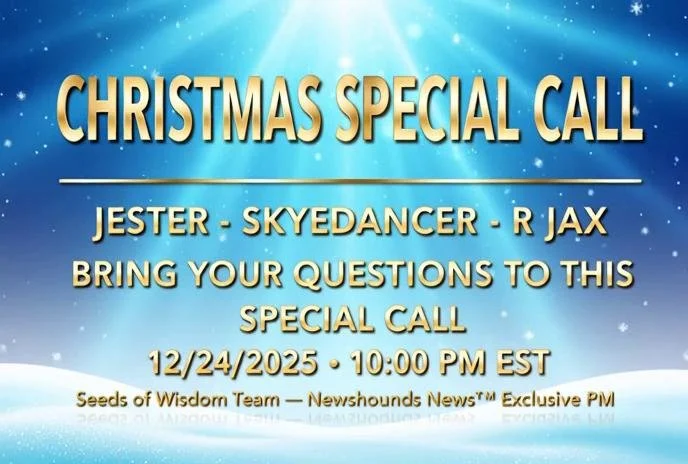

CONFERENCE CALL 12 24 25 10:00 PM EST

Calls will be in the RV Facts with Proof

Join Here

Replay Archive Room

🌱Seeds of Wisdom Team 🌱

Newshounds News™ Exclusive.

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts