News, Rumors, and Opinions Tuesday AM 2-27-2024

Awake-in-3D: GCR Purchasing Power vs. Fiat Exchange Rates

Everyone in GCR Land hates the fiat currency system and all it stands for.

Yet, everyone in GCR Land wants to know what their currencies and bonds are going to be worth in fiat currency (RV Exchange rates).

In what universe does that make sense?

We need to start thinking in terms of the “purchasing power” of a tangible asset, instead of prices in fiat currencies.

“Rates” for IQD, VND, ZIM bonds, etc. are an illusion of the fiat currency system we all grew up in.

Ask yourself, exactly what is a “rate” anyway. A rate of what vs. what?

Awake-in-3D: GCR Purchasing Power vs. Fiat Exchange Rates

Everyone in GCR Land hates the fiat currency system and all it stands for.

Yet, everyone in GCR Land wants to know what their currencies and bonds are going to be worth in fiat currency (RV Exchange rates).

In what universe does that make sense?

We need to start thinking in terms of the “purchasing power” of a tangible asset, instead of prices in fiat currencies.

“Rates” for IQD, VND, ZIM bonds, etc. are an illusion of the fiat currency system we all grew up in.

Ask yourself, exactly what is a “rate” anyway. A rate of what vs. what?

We must think outside of the box and the construct of a “fiat” currency to understand what real asset-backed value and purchasing power establishes in order to grasp what our GCR benefit is all about.

The reality of the purchasing power between one store of value vs. another store of value is the key to understanding the GCR.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 27 Feb. 2024

Compiled Tues. 27 Feb. 2024 12:01 am EST by Judy Byington

Global Currency Reset(RUMORS)

Judy Note: A High Up Contact and other valid sources have indicated that the Cabal capitulated Thurs. 22 Feb. On Sat. 24 Feb. Iraq (allegedly) joined the World Trade Organization which required their Dinar to have a market rate. If things went as expected we could have a three day celebration beginning around Thurs. 29 Feb. RV rates have been (allegedly) agreed upon with a goal for the RV to happen by the end of Feb. It remained my personal opinion that Tier4b (Us, the Internet Group) would receive notification for our redemption and exchange appointments right before, during, or directly after the Ten Days of Darkness/ Exposure – which appeared slated to occur around Sun. 3 March through Wed. 13 March 2024.”

Mon. 26 Feb. Hernán Robert Hbravo: “There is radio and TV communication, the latter being more limited about the possible revaluation of our DINAR currency between Thursday, February 29 and Friday March 1, 2024. It is speculative but the media Baghdad Communication is reporting it.”

Sat. 24 MarkZ: “There are a lot of rumors that everything implodes next week. Redemption Center Staff were being told to prepare for a possibly very busy week this week. There were tons of rumors that things have started processing on the group side but I don’t have any group leaders willing to confirm, or deny that.

Sat. 24 Feb. Wolverine: “According to all sources coming in, we are to get ready. People are giving dates, but I am saying it must happen before the end of the month.”

Read full post here: https://dinarchronicles.com/2024/02/27/restored-republic-via-a-gcr-update-as-of-february-27-2024/

****************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Paulette IMSO...now that the Federal Court ruled, the Oil and Gas Law is no longer needed.The court wrote the entire Oil and Gas Law in one decision. All government employee salaries are paid through Baghdad and all oil and non oil revenues of Kurdistan go to the Federal government. Nothing more to say or agree to. "Binding and Compelling".

Militia Man Article: "The Central Banks show that the amount of printed currency decreased by 1trillion between November and December 2023" They've been reducing their money supply for 20 years... They're telling you specifically they have been, in the trillions... Less supply means more value...They've been doing what we said they were doing. They've reduced the note count. We're going to see what the accurate numbers are and we're probably gong to see that in valuation of the Iraqi dinar.

SHOCK THERAPY: CENTRAL BANKERS Should Go to JAIL for PRINTING CASH Says Argentina's Milei

Lena Petrova: 2-26-2024

What's Really Going On With The Stock Market? 5 Minute Sharable Videos Ep. 2

Lynette Zang: 2-26-2024

Lynette Zang has been studying currency lifecycles since 1987 and discovered similar social, economic, and financial patterns that occur throughout the stages of a currency’s lifetime. She believes that recognizing these patterns enables people to see what’s coming and make well-informed choices that put their best interest first.

Billionaire Warns of BRICS Threat to Dollar Dominance: UST Yellen Says Everything is Fine

Billionaire Warns of BRICS Threat to Dollar Dominance: UST Yellen Says Everything is Fine

On February 19, 2024 By Awake-In-3D

Fred Smith, the founder and executive chairman of FedEx, has voiced serious concerns over the United States’ surging public debt, highlighting its potential to precipitate a catastrophic fiscal crisis.

Smith underscored the alarming projections from the Congressional Budget Office (CBO), which forecasts the U.S. federal debt held by the public to escalate from 99 percent of the gross domestic product (GDP) in 2024 to a record 116 percent by 2034, and further exceed 170 percent by mid-century.

Smith also highlighted the risk posed by the BRICS alliance to the U.S. dollar’s status as the world’s primary reserve currency.

Billionaire Warns of BRICS Threat to Dollar Dominance: UST Yellen Says Everything is Fine

On February 19, 2024 By Awake-In-3D

Fred Smith, the founder and executive chairman of FedEx, has voiced serious concerns over the United States’ surging public debt, highlighting its potential to precipitate a catastrophic fiscal crisis.

Smith underscored the alarming projections from the Congressional Budget Office (CBO), which forecasts the U.S. federal debt held by the public to escalate from 99 percent of the gross domestic product (GDP) in 2024 to a record 116 percent by 2034, and further exceed 170 percent by mid-century.

Smith also highlighted the risk posed by the BRICS alliance to the U.S. dollar’s status as the world’s primary reserve currency.

Smith emphasized, “This is unsustainable,” adding to a growing chorus of warnings about the nation’s fiscal health.

Echoing Smith’s concerns, Jamie Dimon, CEO of JPMorgan Chase, recently cautioned that unchecked government spending could lead to a default, potentially sparking a “rebellion.”

Similarly, billionaire investor Ken Griffin warned against printing more dollars to avert default, predicting it would plunge the financial system into a “deep tailspin.”

The national debt has significantly increased under recent administrations, jumping by more than $6.3 trillion during President Joe Biden’s tenure and $7.8 trillion under President Donald Trump.

He warned that efforts by these nations to dethrone the dollar could prevent the U.S. from selling its bonds, dramatically affecting living standards.

Treasury Secretary Janet Yellen, however, has taken a different stance, arguing against the need for the federal government to balance the budget for fiscal sustainability.

Despite a 16 percent increase in the budget deficit, pushing it to $532 billion in the fiscal year’s first four months, Yellen remains optimistic about President Biden’s deficit-reduction policies.

Annual interest payments on the public debt now exceed $1 trillion as the national debt passed the $34 trillion-mark last month.

Supporting article: Epoch Times The founder of FedEx has added his voice to the chorus of views expressing concern about out-of-control spending in Washington

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

De-Dollarization: Will the QFS Replace the All-Powerful Eurodollar System? Awake-In-3D

De-Dollarization: Will the QFS Replace the All-Powerful Eurodollar System?

On February 19, 2024 By Awake-In-3D

In RV/GCR

GCR-Land discussions often circle around de-dollarization and the fall of the U.S. dollar as the world’s reserve currency.

However, a closer examination reveals a more complex and deeply entrenched structure at the heart of global finance: the Eurodollar Shadow Banking System.

This system, often overlooked in Global Currency Reset (GCR) narratives, holds the true reins of financial power and influence, operating behind a veil of secrecy and complexity.

The U.S. dollar is merely an instrument within the global financial system, while the offshore Eurodollar market is the actual financial system itself.

De-Dollarization: Will the QFS Replace the All-Powerful Eurodollar System?

On February 19, 2024 By Awake-In-3D

In RV/GCR

GCR-Land discussions often circle around de-dollarization and the fall of the U.S. dollar as the world’s reserve currency.

However, a closer examination reveals a more complex and deeply entrenched structure at the heart of global finance: the Eurodollar Shadow Banking System.

This system, often overlooked in Global Currency Reset (GCR) narratives, holds the true reins of financial power and influence, operating behind a veil of secrecy and complexity.

The U.S. dollar is merely an instrument within the global financial system, while the offshore Eurodollar market is the actual financial system itself.

What is the Eurodollar System?

The Eurodollar system, fundamentally different from the U.S. dollar, represents dollar-denominated claims outside the United States. It is the backbone of the global financial system, transcending national currencies, borders, and regulatory jurisdictions.

Dollar-denominated claims in global finance refer to financial assets or liabilities that are denominated in U.S. dollars, regardless of the country in which the transaction takes place. These can include bonds, loans, or other financial instruments that are valued in U.S. dollars.

The Eurodollar’s capital structure is broad, deep and larger than the entire GDP of the United States.

The true power of the Eurodollar lies not in its visibility but in its pervasive and hidden influence over global financial operations.

The focus on de-dollarization and the replacement of the dollar as the world’s reserve currency is, in many ways, a distraction from the deeper issue.

The U.S. dollar is merely an instrument within the global financial system, while the secretive Eurodollar Market is the actual financial system itself.

This distinction is crucial in understanding why simply replacing the dollar with another currency does not support a Global Currency Reset (GCR) because it fails to address the inherent problems of the current system.

The Chinese Yuan is Not the Answer

Remember when alternatives such as the Chinese Yuan and the PetroYuan were proclaimed as successors to the dollar’s hegemony? Yet, these much-exaggerated claims fall apart under closer scrutiny.

China’s current economic challenges and the inherent limitations of the Yuan in global trade render it an unlikely candidate for replacing the dollar. Their collapsing stock markets and the ongoing real estate crisis (Evergrande, etc.) present serious obstacles.

The emergence of decentralized crypto currencies offers promise but also faces hurdles in achieving the level of acceptance and proficiency currently held by the supreme Eurodollar system.

The challenge lies in building a new system that can match, or surpass, the Eurodollar system’s capabilities.

A true transformational alternative lies in a global trade currency backed by gold.

This golden medium of exchange would offer stability, efficiency, and equity in foreign exchange rate management and global trade facilitation.

Such a currency, especially in the form of a global digital stablecoin, could provide the necessary attributes to challenge the Eurodollar system’s supremacy.

It would offer a transparent and reliable reserve currency alternative, free from the current manipulation of fractional reserve lending and fiat currency rehypothecation.

This transition, however, is not without its challenges.

The entrenched interests behind the Eurodollar system, with their vast wealth and influence, are unlikely to embrace a shift that threatens their current control over the global fiat currency and financial system.

The bankster cabal won’t simply embrace a digital gold-backed trade currency within the Eurodollar system. The Eurodollar system must be rendered obsolete by an alternative system.

What About the QFS (Quantum Financial System)?

Perhaps the enigmatic and much over-exaggerated Quantum Financial System (QFS) is the alternative that will dethrone the Eurodollar System. It makes far more sense to me that replacing the Eurodollar System is the true purpose and function of the QFS.

`The quest for an alternative is more than just a search for a new currency; it is a quest for a new financial command and control center for global foreign exchange, banking operations, and global commerce.

The potential of a gold-backed common currency, especially in digital form, and combined with a QFS infrastructure offers a view into what such an alternative might look like to challenge the very foundations of the Eurodollar system.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/de-dollarization-why-the-gcr-cant-happen-unless-the-eurodollar-system-falls/

The Role of GCR Elders and Their Humanitarian Cause – Including BRICS : Awake-In-3D

The Role of GCR Elders and Their Humanitarian Cause – Including BRICS

On February 18, 2024 By Awake-In-3D

In RV/GCR

At the core of the Global Currency Reset initiative is a group unlike any other in the financial world: the Elders and strategic allies forming within BRICS.

The Elders, stewarding vast gold reserves intended for the betterment of humanity, represent a stark departure from the typical players in global finance.

Their approach is not driven by profit or power but by a commitment to humanitarian benefit and the spiritual legacies of their families and peoples.

Their plan to use gold reserves for backing currencies and supporting global economic and humanitarian initiatives is underpinned by a philosophy of stewardship rather than financial domination.

The Role of GCR Elders and Their Humanitarian Cause – Including BRICS

On February 18, 2024 By Awake-In-3D

In RV/GCR

At the core of the Global Currency Reset initiative is a group unlike any other in the financial world: the Elders and strategic allies forming within BRICS.

The Elders, stewarding vast gold reserves intended for the betterment of humanity, represent a stark departure from the typical players in global finance.

Their approach is not driven by profit or power but by a commitment to humanitarian benefit and the spiritual legacies of their families and peoples.

Their plan to use gold reserves for backing currencies and supporting global economic and humanitarian initiatives is underpinned by a philosophy of stewardship rather than financial domination.

The Elders’ vision transcends mere economic reform. It is imbued with a spiritual dimension, reflecting a deep understanding of the interconnectedness of all life and the responsibility that comes with great wealth.

Their plan to use gold reserves for backing currencies and supporting global economic and humanitarian initiatives is underpinned by a philosophy of stewardship rather than financial domination. This philosophy acknowledges the historical accumulation of wealth through centuries of conflict and aims to rectify past injustices by redistributing this wealth for the public good.

The Elders’ approach challenges the prevailing economic orthodoxy, advocating for a system that values integrity, transparency, and the welfare of all beings.

This shift represents a significant turning point in human history, offering a path away from greed-driven economics towards a model that honors our collective heritage and responsibility to future generations.

However, the successful implementation of their vision requires vigilance. All of us must endeavor to ensure that the transition to an asset-backed financial system does not replace one form of domination with another.

The Elders’ commitment to using their wealth for humanitarian purposes must be carefully monitored to prevent the emergence of new hierarchies or forms of exploitation.

In embracing the Elders’ proposal, we are not just agreeing to a financial reset; we are endorsing a fundamentally different way of relating to wealth, power, and each other.

This path invites us to imagine a world where financial systems serve the highest good, reflecting the spiritual and ethical values that many of us aspire to live by.

Global Impact, BRICS and What Lies Ahead

The global impact of the Global Currency Reset (GCR) spearheaded by the Elders and their allies is monumental. It signals a shift from a world financial economy dominated by debt and speculative finance (the casino banking structure) to one grounded in real assets and equitable distribution of wealth.

The BRICS alliance represents a significant move towards this new financial paradigm.

This transition is not just about changing the way money is created and valued; it’s about redefining the principles that underpin our global economy.

The BRICS alliance represents a significant move towards this new financial paradigm.

By challenging the dominance of Western financial institutions and proposing alternatives like the New Development Bank, a new cross-border payment system (BRICS PAY), the Shanghai Gold Exchange, non-dollar oil and gas trade, and possibly creating their own common trade currency, the BRICS alliance underscores the growing dissatisfaction with the dominant Western financial system and the desire for economic independence.

Also see: New BRICS PAY System: How BRICS Will Reset Global Currency Power

Moreover, the existence of the Asian gold troves, long sought after and contested by various Western powers, adds a tangible dimension to the GCR.

These gold reserves, real and substantial, offer a stark contrast to the non-tangible nature of fiat currency, illustrating the possibility of a more stable and sustainable economic foundation.

Also see: GCR Origins (Part 2): Project Hammer’s Secret Trading Platforms for WW2 Off-Ledger Gold

However, the transition to a new financial system is fraught with uncertainties. The timing and specifics of such a monumental shift are inherently unpredictable.

The role of individuals and communities in this financial transition cannot be overstated. The ultimate success of the GCR will depend on the engagement and vigilance of the global citizenry.

Yet, the undeniable fact remains that the global fiat currency debt system will collapse with mathematical certainty.

The question to ask is, “what will replace the current system once it reaches its logical conclusion (crash)?”

Also see: The Connection Between Inflation, Financial Collapse and Our GCR

Key developments, such as the introduction of US Treasury gold-backed dollar and the restructuring of banking practices remain in flux. The introduction of Our GCR remains dependent on a complex interplay of geopolitical, economic, and social factors ongoing to this day.

Despite these uncertainties, there is a palpable sense of momentum towards change.

The anecdotal evidence and investigative information that have come to light recently lend credibility to the notion that a global financial reorganization is underway.

Also see: Europe’s Gold Agreement and Plans for a Gold Standard Currency (Part 1)

This reorganization aims to restore balance and integrity to a system long plagued by exploitation and inequality.

The role of individuals and communities in this process cannot be overstated. The ultimate success of the GCR will depend on the engagement and vigilance of the global citizenry.

It is up to us to stay informed, to question the status quo, and to advocate for a financial system that serves the many rather than the few.

The challenges are significant, but so are the opportunities.

To be concluded in Part 4: Final Thoughts on the GCR Today

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

This is the fourth segment of the GCR Origins article series. Previous segments can be found here: Part 1, Part 2, and Part 3.

https://ai3d.blog/the-role-of-gcr-elders-and-their-humanitarian-cause-including-brics/

An Objective Look at Potential Release Scenarios for a GCR : Awake-In-3D

An Objective Look at Potential Release Scenarios for a GCR

On February 17, 2024 By Awake-In-3D

In RV/GCR

The possible scenarios that unfold from the Global Currency Reset (GCR) proposition by the Elder/Royal Trusts (Global Collateral Gold Accounts) and their allies are stark in contrast and critical in their implications for the future.

This is the third installment of the GCR Origins and Grand Plan for Humanity series.

First and foremost, a Global Financial and Currency Reset cannot simply be forced onto the world. Coercion of such a monumental change would very likely foment suspicion, distrust, and civil unrest over such a sudden departure from a financial system that humanity has lived under for generations.

Imagine the reaction of most people and businesses suddenly exposed to strange new currency notes coming out of ATMs and emergency broadcasts telling them that the old banking and monetary systems are gone.

An Objective Look at Potential Release Scenarios for a GCR

On February 17, 2024 By Awake-In-3D

In RV/GCR

The possible scenarios that unfold from the Global Currency Reset (GCR) proposition by the Elder/Royal Trusts (Global Collateral Gold Accounts) and their allies are stark in contrast and critical in their implications for the future.

This is the third installment of the GCR Origins and Grand Plan for Humanity series.

First and foremost, a Global Financial and Currency Reset cannot simply be forced onto the world. Coercion of such a monumental change would very likely foment suspicion, distrust, and civil unrest over such a sudden departure from a financial system that humanity has lived under for generations.

Imagine the reaction of most people and businesses suddenly exposed to strange new currency notes coming out of ATMs and emergency broadcasts telling them that the old banking and monetary systems are gone.

The most beneficial and peaceful way to introduce Our GCR would be to offer the new asset-backed financial system as a significantly superior alternative over the current fiat currency system.

What about stock markets, investment, and retirement accounts? Not to mention the catastrophic impact that such an unforeseen and sudden monetary change would have on local and global trade.

There is simply no rational or plausible way to publicly implement a sweeping financial system change, over a short period of time without serious unintended consequences.

The most beneficial and peaceful way to introduce Our GCR would be to offer the new asset-backed financial system as a significantly superior alternative over the current fiat currency system.

Once the alternative currency system is offered and explained, two scenarios could likely play out.

Scenario 1: Acceptance of the Plan for Cooperative GCR Reform and Stability

In what I hope to be the more likely scenario, the Western banking cabal, albeit reluctantly, accepts the Elders’ and their Allies’ gold collateral GCR offer. Of course, the primary focus would be on the globally ubiquitous US Dollar.

This acceptance paves the way for the release of historic funds, earmarked for asset-backed currencies, debt relief, and extensive humanitarian projects.

The transition would most certainly lead to the significant devaluation of the US dollar (hence the RV of currencies), but this step is seen as a necessary adjustment towards establishing a stable, equitable global monetary system.

The shift involves transitioning from Fiat Federal Reserve Notes, which are essentially debt instruments, to a gold-backed dollar monetary policy. The new Dollar (call it a USTN, USN, TRN or whatever you like). The new Dollar would be both digital and printed notes.

How this new Dollar would connect out to a global gold-backed ‘unit of value’, and/or a global gold ‘stablecoin’ within foreign exchange and trade is beyond the scope of this article.

Acceptance and cooperation in Our GCR would facilitate a peaceful and successful shift towards prosperity grounded in tangible value, marking the end of an era dominated by fiat “fake money” and the Global Domination Agenda.

Certainly, this scenario’s optimistic pathway will not be without its challenges. The interconnected reality of global finance and trade is complex. Additionally, the Western bankster cabal’s cooperation (standing aside) is a major variable and likely why it’s taken so long for Our GCR to manifest.

Scenario 2: A Descent into Chaos

Conversely, Scenario 2 outlines a more challenging future where the U.S. and the banking cabal resist the Elder Alliance’s GCR vision.

By rejecting the shift to an asset-backed system and economic/humanitarian initiatives, the U.S. risks isolation as the rest of the world moves forward.

This scenario forebodes attempts by entrenched powers to maintain control through imperialistic maneuvers and false-flag events, potentially spiraling into global financial and economic conflict.

This could aptly be described as ‘The Bad Guy Reset’ Plan for humanity and introduced during the current financial system’s accelerating downfall and collapse.

The refusal to accept Scenario 1 would likely precipitate the collapse of the dollar, leading to a comprehensive social and economic breakdown within the U.S., and setting the stage for elements like programmed CBDCs, bank bail-ins and the mass confiscation of securitized assets worldwide.

Also see: How the Global Banking Cabal Plans to Take Everything in Their Great Financial Reset and How the DTCC-Cede & Co. Seek to Own Everything in the Next Financial Super Crisis

This worst-case outlook paints a bleak picture of desperation and decay, driven by a refusal to abandon a fundamentally flawed financial model.

In both scenarios, the fundamental choices made by the banking cabal and Humanity (We the People) will dictate the course of history.

Scenario 1 offers a roadmap to a reformed, stable and revitalized global economy, while Scenario 2 serves as a dystopian ‘reset’ extension of the fiat currency debt system reborn.

To be clear, both scenarios lead to Our GCR, I am personally convinced of this.

Scenario 2 would serve to awaken a far greater portion of humanity to the weaponization, loss of freedoms, and the financial slavery of any form of fiat monetary system.

Yet, obviously, the first scenario is preferable for obvious reasons. Given the growing chaos and divisions ongoing in today’s world, it’s simply impossible to predict the path ahead.

The stakes could not be higher, nor could the importance of our participation in standing up for Scenario 1 and resisting Scenario 2 into oblivion.

To be continued in Part 4: The Elder Plan and the BRICS Alliance as a catalyst for Scenario 1

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Also see: Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth and Part 2: Heroes, Banking Cabals and the GCR Revolutionary War

https://ai3d.blog/an-objective-look-at-potential-release-scenarios-for-a-gcr/

The 28 Enlightening Ways to Stay or Become Poor : Awake-In-3D

The 28 Enlightening Ways to Stay or Become Poor

On February 17, 2024 By Awake-In-3D

We all desire success and prosperity along with the ability to sustain or maintain our achievements.

Yet few are able to actually realize their ultimate goals in the process.

Learning from mistakes, both personal and observed, provides valuable insight into the obstacles to avoid along the path to achievement.

To be successful and become one of the few who has weathered the storms of failure, harnessed the power of resilience, and embraced the spirit of continuous improvement, identifying these obstacles creates a roadmap to success.

The 28 Enlightening Ways to Stay or Become Poor

On February 17, 2024 By Awake-In-3D

We all desire success and prosperity along with the ability to sustain or maintain our achievements.

Yet few are able to actually realize their ultimate goals in the process.

Learning from mistakes, both personal and observed, provides valuable insight into the obstacles to avoid along the path to achievement.

To be successful and become one of the few who has weathered the storms of failure, harnessed the power of resilience, and embraced the spirit of continuous improvement, identifying these obstacles creates a roadmap to success.

The 28 ways to stay poor serve as a reverse guide, highlighting common behaviors and mindsets that can block progress, limit potential, and perpetuate (or create) a cycle of poverty.

They are also a guide for what not to do to maintain success and prosperity.

Each point encapsulates a critical mistake to be avoided, a mindset to be shifted, or a behavior to be corrected.

Understanding and internalizing these points allows us to steer clear of self-sabotage, progress towards growth and success, and ultimately build a foundation for lasting prosperity.

1. Start Tomorrow: Delaying action on your goals leads to missed opportunities and perpetual stagnation. Procrastination creates a cycle where tomorrow never comes, resulting in unfulfilled dreams and regrets.

2. Read Books. Do Nothing: While reading is valuable, knowledge without application is futile. Taking no action based on what you learn prevents growth and improvement in your life and endeavors.

3. Take advice from poor people on how to be rich: Seeking financial guidance from those who haven’t achieved success in that area leads you astray, as their advice may not be based on experience or expertise.

4. Be in a relationship that makes you feel guilty about working: A partner who discourages your ambitions or makes you feel bad about pursuing your goals hinders your progress and limit your success.

5. Fail once, quit forever: Viewing failure as a permanent setback rather than a learning opportunity prevents you from trying again and ultimately achieving success.

6. Think the world is fair: Expecting fairness in all aspects of life leads to a sense of entitlement and disillusionment when things don’t go your way, hindering your ability to adapt and overcome challenges.

7. Blame your circumstances: Constantly attributing your lack of progress or success to external factors removes your sense of agency and control over your life, preventing personal growth and improvement.

8. Complain: Focusing on problems without actively seeking solutions wastes time and energy that would be better spent on productive actions towards your goals.

9. Expect the government to save you: Relying solely on external sources, such as government assistance, for financial security limits your independence and personal responsibility in building wealth and stability.

10. Value the opinion of others over your own: Prioritizing external validation and approval over your own beliefs and instincts leads to poor decision-making and a lack of confidence in your own abilities.

11. Avoid Discomfort: Shying away from discomfort and challenges prevents personal growth and development. Growth often occurs outside of your comfort zone, so avoiding discomfort restrains your progress.

12. Tolerate Mediocrity: Settling for average or mediocre results instead of striving for excellence limits your potential and prevent you from standing out in your field.

13. Make promises. Break promises: Being inconsistent and unreliable in keeping your commitments damages trust and relationships, hindering your ability to succeed in various aspects of life.

14. Wait for perfect conditions: Waiting for ideal circumstances before taking action leads to missed opportunities and perpetual inaction, as perfect conditions rarely exist.

15. Prioritize looking rich over being rich: Focusing on appearances and material possessions rather than building genuine wealth and financial stability leads to a cycle of debt and insecurity.

16. Avoid working on what matters most: Engaging in tasks that don’t align with your long-term goals and priorities lead to wasted time and energy on activities that don’t contribute to your success.

17. Say you’re going to do something. Don’t do it: Failing to follow through on your intentions and commitments can damage your credibility and trustworthiness, reducing your relationships and opportunities for growth.

18. Do what everyone else is doing: Following the crowd without critical thinking or independent decision-making leads to mediocrity and missed opportunities for innovation and success.

19. Do “your best” not what it takes: Settling for subpar effort and performance, rather than pushing yourself to excel and go above and beyond, limits your achievements and potential for success.

20. Talk more. Do less: Engaging in empty conversations without taking meaningful action leads to a lack of progress and results in your endeavors.

21. Start something new today. Start something new tomorrow. Repeat: Lack of consistency and focus in pursuing your goals perpetuates scattered efforts and a lack of progress towards achieving success.

22. Believe what other people think of you, more than what you think of you: Prioritizing external opinions and judgments over your own self-awareness and self-belief creates self-doubt and a lack of confidence in your abilities.

23. Make mistake. Repeat mistake: Failing to learn from your mistakes and repeating them extinguishes growth and improvement, leading to recurring setbacks and obstacles in your journey.

24. Be replaceable: Failing to invest in developing unique skills and qualities that set you apart makes you easily replaceable in various aspects of your life, limiting your value and opportunities for success.

25. Find something that works. Stop doing it: Abandoning successful strategies and methods prematurely diverts your progress and prevents you from maximizing your potential and achievements.

26. Hang around dumb people: Surrounding yourself with individuals who don’t challenge or inspire you impedes your personal and professional growth, hindering your ability to innovate and succeed.

27. Assume you’re always right: Failing to consider feedback, alternative perspectives, and opportunities for growth stimulates arrogance and closed-mindedness, blocking your ability to learn and improve.

28. Make money. Spend more than what you made: Living beyond your means and failing to save or invest wisely creates a state of financial instability and a cycle of debt, preventing long-term wealth accumulation and security.

I’ve found these insights personally invaluable.

Alex Hormozi, the author of these 28 points, has faced and overcome each point on his personal path to success.

Want to learn more? Watch Alex personally explain each point here in under 22 minutes:

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-28-enlightening-ways-to-stay-or-become-poor/

Putin Talks U.S. Financial Suicide, De-Dollarization and the Rise of BRICS : Awake-In-3D

Putin Talks U.S. Financial Suicide, De-Dollarization and the Rise of BRICS

On February 13, 2024 By Awake-In-3D

Last week, in a revealing 2-hour interview with Tucker Carlson in Moscow, the subject of geoeconomic shifts was raised. It was a small segment of the interview, yet I was able to read the transcript and summarize the key points of the segment.

Russian President Vladimir Putin, who currently leads the BRICS Alliance, shared his observations on the United States’ current economic and financial strategies, suggesting that America is on the path to self-destruction on the global stage.

Putin noted a shift in global trade practices, with countries increasingly questioning the necessity of using the dollar for transactions. This move, according to him, could lead to a drastic reduction in the use of the dollar, undermining the U.S.’s economic dominance and potentially leading to severe internal financial crises.

Putin Talks U.S. Financial Suicide, De-Dollarization and the Rise of BRICS

On February 13, 2024 By Awake-In-3D

Last week, in a revealing 2-hour interview with Tucker Carlson in Moscow, the subject of geoeconomic shifts was raised. It was a small segment of the interview, yet I was able to read the transcript and summarize the key points of the segment.

Russian President Vladimir Putin, who currently leads the BRICS Alliance, shared his observations on the United States’ current economic and financial strategies, suggesting that America is on the path to self-destruction on the global stage.

Putin noted a shift in global trade practices, with countries increasingly questioning the necessity of using the dollar for transactions. This move, according to him, could lead to a drastic reduction in the use of the dollar, undermining the U.S.’s economic dominance and potentially leading to severe internal financial crises.

Putin portrayed a scenario where the U.S. is unwittingly undermining its own power, particularly through its handling of the dollar as the world’s reserve currency.

The conversation, which began with a question about BRICS quickly expanded to encompass broader issues of global economic stability and the strategic missteps of the United States.

Putin argued that America’s internal policies, especially its weaponization of the dollar, are precipitating its downfall.

The Dollar’s Dominance and Its Self-Destruction

The Russian leader highlighted the dollar’s pivotal role in establishing the United States as a global superpower post-World War II. He pointed out that the U.S.’s control over the world reserve currency has afforded it considerable leverage and political strength, allowing for unprecedented levels of spending and accumulation of over 34 trillion dollars in debt without triggering domestic economic collapse.

Also see: Checkmate (Part 2) – A Global US Dollar Divorce and Re-Monetizing Gold to Support Our RV/GCR

However, Putin warned of the inherent risks in the U.S.’s current approach, particularly its reliance on the dollar for global trade. He criticized the U.S. leadership for using the dollar as a tool in foreign policy, which he views as a strategic error that has started to alienate both allies and adversaries, potentially threatening the dollar’s global status.

The Global Shift Away from the Dollar

Significantly, Putin noted a shift in global trade practices, with countries increasingly questioning the necessity of using the dollar for transactions. This move, according to him, could lead to a drastic reduction in the use of the dollar, undermining the U.S.’s economic dominance and potentially leading to severe internal financial crises.

Also see: The Global Financial/Economic Landscape Transforming for a RESET – Here’s Why

The Russian president also touched upon the response from other nations to the U.S.’s sanctions and restrictive measures, such as asset freezes, which have spurred a reevaluation of the dollar’s indispensability in international trade.

He highlighted Russia’s own shift from dollar and euro transactions to rubles and yuan, portraying it as a defensive measure against U.S. policies.

Global Repercussions: The Rise of BRICS Alternative

Putin’s insights reveal a broader concern about the future of international economic relations and a significant shift in global power dynamics. He implicitly suggested that the U.S.’s actions could pave the way for other currencies and economic blocs, such as the BRICS Alliance, to assume more central roles in global trade and finance.

Also see: New BRICS PAY System: How BRICS Will Reset Global Currency Power

The geoeconomic segment of the interview concluded with Putin reflecting on the consequences of the U.S.’s economic strategies, not just for America but for the global community.

He questioned whether U.S. policymakers fully grasp the long-term implications of their actions, which he believes could lead to diminishing U.S. influence and the emergence of new global powers.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

For full article and to watch this Putin interview go here: https://ai3d.blog/russias-putin-discusses-u-s-financial-suicide-de-dollarization-and-the-rise-of-a-brics-alternative/

Part 2: Heroes, Banking Cabals and the GCR Revolutionary War : Awake-In-3D

Part 2: Heroes, Banking Cabals and the GCR Revolutionary War

On February 12, 2024 By Awake-In-3D

In RV/GCR

As revealed in Part 1 of this article series, a vast amount of historical wealth is prepared to underpin and transform the current global fiat currency debt system into a gold-backed monetary system – a grand plan undertaken and guided by an alliance of guardian Elder/Royal bloodlines spanning centuries.

The Elders’ plan is nothing short of revolutionary. They propose using their immense gold reserves to back currencies, thereby introducing a stable foundation for a new, global monetary system.

The plan garners support from unexpected quarters. Within the armed services and intelligence agencies, individuals dismayed by prevailing financial system practices have established a Resistance, refusing to back further banking cabal agendas.

Part 2: Heroes, Banking Cabals and the GCR Revolutionary War

On February 12, 2024 By Awake-In-3D

In RV/GCR

As revealed in Part 1 of this article series, a vast amount of historical wealth is prepared to underpin and transform the current global fiat currency debt system into a gold-backed monetary system – a grand plan undertaken and guided by an alliance of guardian Elder/Royal bloodlines spanning centuries.

The Elders’ plan is nothing short of revolutionary. They propose using their immense gold reserves to back currencies, thereby introducing a stable foundation for a new, global monetary system.

The plan garners support from unexpected quarters. Within the armed services and intelligence agencies, individuals dismayed by prevailing financial system practices have established a Resistance, refusing to back further banking cabal agendas.

See also: Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth

This initiative extends beyond mere financial restructuring; it encompasses debt relief and the funding of humanitarian projects worldwide. Such a shift would mark a radical departure from the prevalent system of fiat money, where currency value hinges on government decree rather than tangible assets.

The urgency for this transformation stems from the systemic flaws of the current financial model. This model has enabled the creation of money out of thin air, leading to cycles of debt, inflation, and economic crises.

The Elders’ vision counters this by advocating for a transparent, asset-backed system.

Their plan challenges the Western banking cabal’s dominance, which has long relied on fiat currency to exert global financial power and influence.

The Hero Resistance Alliance

Resistance to this monumental financial shift is anticipated, particularly from those who benefit most from the current system.

Yet, the plan garners support from unexpected quarters. Within the armed services and intelligence agencies, individuals dismayed by the prevailing financial practices are voicing their dissent. They refuse to back further banking cabal agendas.

These factions are not just passive critics; they are actively seeking to realign the U.S.’s financial policies with principles of integrity and transparency aligning with the original, organic Constitution of the United States of America – not the usurped constitution of the United States (a corporate entity in the District of Columbia).

See also: A Lost Republic: The Strategic Overthrow of American Sovereignty (Part 1)

This coalition between the Elders and reform-minded individuals within the U.S., and around the world, signifies a potent alliance and force for change. Together, they aspire to dismantle the existing system’s exploitative mechanisms and lay the groundwork for a more equitable financial future.

This would include Allies positioned within the US Treasury, the IMF, the BIS and other agencies worldwide. Yet the battle of resistance is not one of kinetic violence, but of infiltration and forced attrition within the banking cabal ranks. Victory does not come overnight.

This alliance’s efforts underscore a critical message: the path to global financial stability requires unwavering commitment to asset-backed currencies, the eradication of fiat money’s dominance, and the removal of the banking cabal influence.

The Banking Cabal: Power, Greed and Resistance

The roots of today’s financial system reach deep into history, intertwining with tales of power, greed, and resistance.

At the heart of this revolutionary battle is the banking cabal, a network of financial institutions and families that have shaped the global economy for centuries.

Their methods, often controversial, hinge on the creation of fiat currency, money that derives its value not from physical commodities but from government decree.

This backdrop of historical deceit and manipulation sets the stage for the Elders’ intervention, offering a stark contrast between the principles of asset-backed stability and the wealth transfer scam of fiat currencies.

This system traces back to the establishment of the Bank of England and the spread of the Rothschild family’s banking empire across Europe.

In the United States, figures like President Andrew Jackson and Abraham Lincoln clashed with the burgeoning financial powers over the control of money creation. Jackson survived assassination attempts for his efforts, while Lincoln’s attempts to circumvent fiat money led to his demise.

The pivotal year of 1913 saw the creation of the Federal Reserve and the Internal Revenue Service, fundamentally altering the U.S. financial landscape.

This marked the beginning of a century-long devaluation of the dollar, a trend exacerbated by the 1933 gold confiscation by President Roosevelt to repay secret debts to European bankers.

The assassination of President Kennedy, shortly after he sought to issue gold-backed currency outside of the Federal Reserve system using Asian (Indonesian) gold, underscores the peril faced by those challenging the fiat system.

Secret deal to back the USD currency with gold? JFK with Indonesian President Sukarno in 1961. The Grasberg Block Cave Mine (Indonesia) is one of the largest gold resources in the world.

Nixon’s detachment of the dollar from gold in 1971 removed the last vestiges of asset backing, unleashing an era of unrestricted money printing that has led to over $34 trillion in U.S. debt today.

The banking cabal’s influence extends beyond mere financial manipulation. The refusal to audit USA gold reserves, the covert bailout of banks post-2008 financial collapse, and the ongoing practice of quantitative easing, fractional reserve banking and collateral rehypothecation, highlight a system teetering on the brink of moral and economic bankruptcy.

This backdrop of historical deceit and manipulation sets the stage for the Elders’ intervention, offering a stark contrast between the principles of asset-backed stability and the volatility of fiat currency.

To be continued in Part 3: The Strategic Outcomes and Scenarios of Our GCR

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/part-2-heroes-and-cabals-in-the-secret-currency-revolution/

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth : Awake-In-3D

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth

On February 11, 2024 By Awake-In-3D

In RV/GCR

What you are about to read is, by far, not a comprehensive account of the complete RV/GCR

Nor is it intended to be.

While we are accustomed to using the acronym RV/GCR (Revaluations/Global Currency Reset), the acronym is actually backwards. It would be more accurate to type GCR/RV since the revaluations of currencies are a sub-function of the Global Currency Reset itself.

Taken even further, the GCR is a sub-function of a Global Financial Reset (GFR).

The article series to follow is focused on the GFR/GCR and not the Revaluation of Currencies (RV), yet they go hand in hand.

Part 1: The Grand Financial Plan and the Elder Guardians of Historical Wealth

On February 11, 2024 By Awake-In-3D

In RV/GCR

What you are about to read is, by far, not a comprehensive account of the complete RV/GCR

Nor is it intended to be.

While we are accustomed to using the acronym RV/GCR (Revaluations/Global Currency Reset), the acronym is actually backwards. It would be more accurate to type GCR/RV since the revaluations of currencies are a sub-function of the Global Currency Reset itself.

Taken even further, the GCR is a sub-function of a Global Financial Reset (GFR).

The article series to follow is focused on the GFR/GCR and not the Revaluation of Currencies (RV), yet they go hand in hand.

The origins of Our GCR have an interesting, if not compelling story to tell regarding its overall purpose and foundational structure.

At the heart of this epic plan stand the Dynastic Dragon Families, a coalition of Bloodline Principals and Trustees from across Asia. They represent China, Japan, the Philippines, Indonesia, and Vietnam.

While it may come off reading like a creative fiction worthy of an epic, big-budget movie, it also remains logically plausible given the mission, resources, and achievability within today’s financially interconnected world.

Besides, how could the plan and components for a complete makeover of the failing Fiat Currency Debt System not be made of the stuff that stirs our hearts and souls.

So, let’s begin…

The Royal/Dragon Families: Guardians of the World’s Wealth

The revelation of a Global Currency Reset (GCR) emerged at a pivotal time in our financial history.

Across the globe, nations grapple with unprecedented economic challenges. These range from ballooning debts to the instability of fiat currencies, which lack tangible backing.

In response, a transformative proposal surfaces, promising a radical overhaul of the global financial system. This plan, rooted in the wealth of a secretive alliance known as the “Elder/Royal Families,” aims to reset the monetary landscape.

This is a key element of the GCR, setting the stage for an exploration of humanity’s shift towards a more stable and equitable economic framework.

At the heart of this epic plan stand the Dynastic Dragon Families, a coalition of Bloodline Principals and Trustees from across Asia. They represent China, Japan, the Philippines, Indonesia, and Vietnam.

These stewards hold the keys to the largest gold reserves not listed in any public record. Known as “Off-Ledger Gold,” this treasure is more than a myth; it’s a vast repository of wealth, shrouded in secrecy and history.

See also: GCR Origins (Part 2): Project Hammer’s Secret Trading Platforms for WW2 Off-Ledger Gold

It is reported that the foundation of the Elders traces back to The Kong Family Bloodline, and the ancient Chinese philosopher Confucius (Kongzi), born in 551 B.C.

Confucius laid the philosophical foundations for what would become a system of thought and ethics that has profoundly shaped Chinese society and beyond for over two and a half millennia.

Confucius, the progenitor of the Kong family, represents a lineage that has continued unbroken to the present day and recognized as the longest family tree in history.

The King David Trust is said to represent an amalgamation of European Royal Bloodlines (but not all of them) who support the deployment of their inherited wealth for the benefit of humanity and economic prosperity.

On the Royal Families side, the Lurie family, distinguished by its claim to one of the oldest bloodlines in the world, traces its origins back to the biblical King David, who is said to have united the tribes of Israel and ruled in the 10th century BCE.

The Lurie bloodline originated in the ancient Levant area, historically, the region along the eastern Mediterranean shores, roughly corresponding to modern-day Israel, Jordan, Lebanon, Syria, and certain adjacent areas.

The Lurie family’s lineage is well-documented from the 13th century in France, where they emerged as a prominent Ashkenazi Jewish family. The name “Lurie” itself is believed to derive from the town of Loire, situated along the Rhone River, indicating a geographical origin of the family’s prominence.

The King David Trust is said to represent an amalgamation of European Royal Bloodlines (but not all of them) who support the deployment of their inherited wealth for the benefit of humanity and economic prosperity.

The significance of these gold troves cannot be overstated. They embody not just material wealth but a legacy spanning centuries.

The Elder/Royal Families have amassed this gold over generations, with the intent of using it for the greater good. Their proposition?

To back currencies, relieve debt, and fund humanitarian projects on a global scale.

Their role challenges the current financial paradigm, pushing against the tide of fiat money—a system where currency’s value is not backed by physical commodities but rather the government’s declaration. In advocating for a return to asset-backed currencies, the Elder/Royal Families aim to restore stability and trust in global economics.

This bold vision sets the stage for a confrontation with the entrenched interests of the Western banking cabal, marking a crucial juncture in the quest for financial reform.

To be continued in Part 2: The Foundation for Global Financial Reform and the GCR

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/part-1-the-grand-financial-plan-and-the-elder-guardians-of-historical-wealth/

US Commercial Real Estate Contagion Spreads to Germany and Japan : Awake-In-3D

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

US Commercial Real Estate Contagion Spreads to Germany and Japan

On February 8, 2024 By Awake-In-3D

The commercial real estate (CRE) sector in the United States continues facing significant losses, marking a crisis that experts are calling the worst since the financial crisis of 2008.

I don’t believe that the CRE meltdown will be the trigger of the fiat currency debt system collapse, but it will certainly play a role in contributing to the final event.

This downturn has not only destabilized the US regional banking sector but has also spread as a contagion to Europe and Japan, showcasing the interconnected nature and instability risks of global fiat financial markets.

The Epicenter: The US CRE Crisis

The US CRE sector is currently experiencing unprecedented stress, primarily due to the seismic shifts in work culture brought on by the government’s response to COVID-19.

The transition to remote work has left office buildings vacant, causing a steep decline in rental incomes and property values.

According to a report by Forexlive, Goldman Sachs estimates that $1.2 trillion in mortgages are due by the end of next year, with much of it underwater.

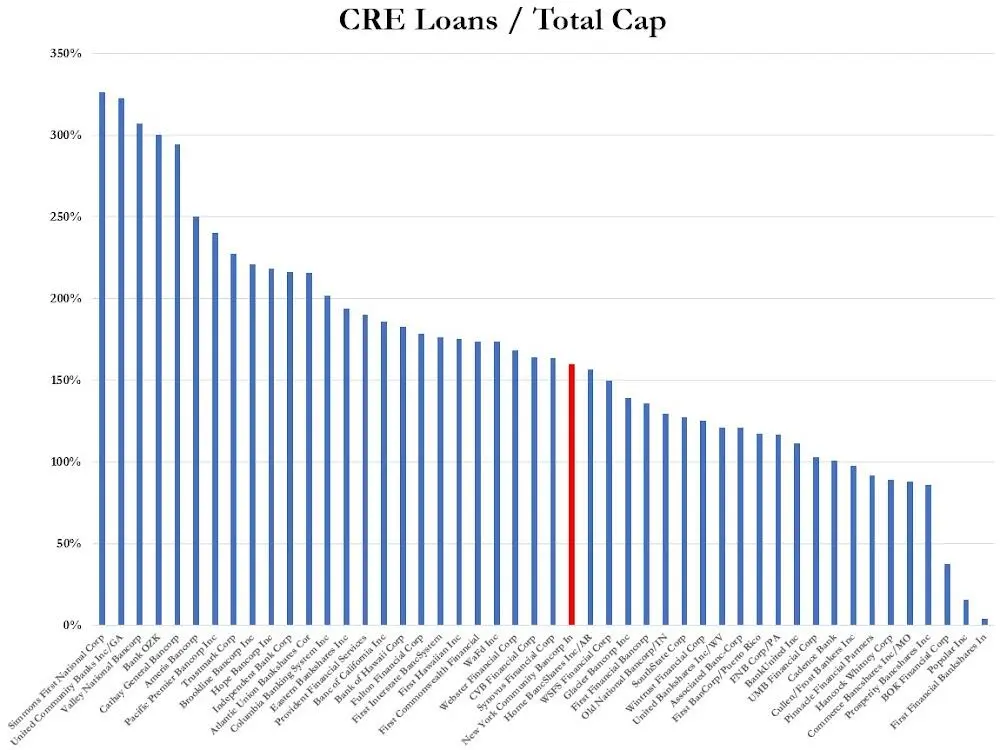

US Regional Banks with the largest CRE loans relative to capital

This situation has led to significant losses for regional banks and financial institutions heavily invested in commercial real estate loans.

More Bad News for Germany: Multiple Banks

Germany, Europe’s largest economy, has not been immune to the repercussions of the US CRE crisis.

Deutsche Pfandbriefbank (PBB), a German lender with a focus on real estate, has had to increase its provisions for bad debts significantly, bracing itself for what it describes as the worst decline in commercial property values in 15 years.

The bank has set aside as much as €215 million ($231.7 million) for potential losses on loans, highlighting the “persistent weakness of the real estate markets”.

Similarly, Deutsche Bank has allocated €123 million ($133 million) to cover potential defaults on its US commercial real estate loans, indicating the far-reaching impact of the US crisis on European banks.

The Situation in Japan: Aozora Bank’s Unexpected Losses

Aozora Bank, based in Tokyo, Japan, has encountered significant financial distress due to its exposure to the U.S. commercial real estate market, marking a dramatic shift in the bank’s balance sheet health.

This situation has led Aozora Bank to report its first annual net loss in 15 years, a stark reversal from its previous net profit projections.

The bank has been compelled to take massive loan-loss provisions for U.S. commercial property as valuations have plummeted in the wake of rising borrowing costs and a decrease in demand exacerbated by the shift to remote work.

This financial turmoil resulted in a projected net loss of 28 billion yen ($190.5 million) for the fiscal year ending March 31, significantly deviating from an initially expected net profit of 24 billion yen. Consequently, Aozora Bank has decided to forgo dividends for the remainder of the financial year.

The ongoing CRE crisis in the US serves as a stark reminder of the global fiat financial system’s interconnectedness and risk of contagions spreading worldwide.

Banks and financial institutions worldwide are now facing the ripple effects of this downturn, with the full extent of potential losses and their distribution across the financial sector still unfolding.

Contributing sources:

https://ai3d.blog/us-commercial-real-estate-contagion-spreads-to-germany-and-japan/

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Banking on Bondage (Part 1): The Brilliant Yet Sinister Scheme of Fractional Reserve Lending Explained

On February 7, 2024 By Awake-In-3D

How to discuss the Fiat Currency System Scam with friends and family without sounding like a conspiracy theory nut.

The lifeblood of the global fiat currency debt system is the powerhouse of currency creation: Fractional Reserve Lending.

This mechanism not only fuels the economy but also amplifies the “Currency Creation Scam” as I will explain in this article.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting, but within the banking system itself.

Fractional Reserve Lending: Massive Leveraging of Your Bank Deposits

Fractional Reserve Lending operates on a principle as simple as it is brilliant.

Banks are required to keep only a fraction of your deposit in reserve, lending out the rest.

With a 10 percent reserve ratio, for example, a $100 deposit can magically transform into $90 of loanable funds.

This leaves us with a peculiar situation: your bank account still shows that you have a $100 balance, yet actually $90 is now elsewhere, in the hands of borrowers.

How?

Through the creation of “bank credit,” a digital mirage replacing real dollars.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through multiplied cycles of bank credit.

Bank Credit: The True Secret of an Invisible Currency

This bank credit, while lacking the tangible form of cash, functions as currency within our economy. It emerges from a simple yet profound act: banks typing numbers into a computer.

This fabricated currency, stemming from your initial deposit, multiplies via loans as it moves through the banking system from one bank, to another and another.

A $100 deposit can balloon into $1,000 of bank credit, all while being backed by a mere $100 from the original deposit.

As loans are made and the currency circulates, each recipient re-deposits the funds, enabling further lending.

This cycle of deposit, lend, and re-deposit can inflate the initial deposit significantly, creating a vast majority of the currency supply not through government minting but within the banking system itself.

Astonishingly, 92 to 96 percent of all fiat currency in existence is created (out of thin air) through this cycle of bank credit.

The Real Cost of These Digital Currency Dollars Numbers

What does this mean for you, the everyday person? Let’s think this through step-by-step.

When you or your business takes out a loan, the proceeds of the loan simply go into another bank account, which creates more deposits (digital numbers) that are then re-loaned out again via fractional reserve lending, and then multiplied via the same process again and again.

This mechanism of currency multiplication underpins a system where the majority of our money supply is not real ‘money’ but a web of IOUs.

Every unit of fiat currency is an IOU created through fraction reserve lending that multiplied and expanded from one loan to the next and one bank to another.

While it fuels economic activity, it also represents a precarious balance, reliant on everyone’s continued faith and participation in the banking system.

The implications become obvious … a system built on fractional reserves is a system built on a foundation of trust, not real, tangible value.

In the next article, I will explain how this fabricated ‘wealth’ affects inflation, interest rates, and ultimately, the transfer of wealth from the many to the few.

Peeling back the layers of the fiat currency system and understanding these unsound mechanisms is the first step toward recognizing the potential true workings of our current financial infrastructure.

The fiat system has a finite self-life leading to an inevitable global financial reset based on more tangible, asset-based systems.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D