Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by: * United Kingdom * United States * Italy * Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq.

It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by:

* United Kingdom

* United States

* Italy

* Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq. It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

The UN's involvement with Iraq has been taking place since 2003. It has been a team of leaders from several Nations engaged in helping Iraq "transition" their political and economic economy into a place whereby their contribution to the world is capable of moving to a level of Independence.

Starting early June, Iraq will be gradually moving into their own. These stages of the independence will be monitored, but their control over their own Nation will increase with each passing day. Kurdistan24 Iraq UN

© Goldilocks

~~~~~~~~~

Hong Kong officially launches pilot for digital yuan payments | Business Times

"HONG Kong launched a pilot programme enabling digital yuan payments through major Chinese banks, the first example of China’s currency project being deployed beyond the mainland.

Residents of the city can now open digital yuan wallets with Bank of China, Bank of Communications, China Construction Bank and Industrial and Commercial Bank of China to pay merchants in mainland China directly, Hong Kong’s de facto central bank said in a statement on Friday (May 17)."

Hong Kong has officially launched a pilot program that will allow them to utilize the Yuan as a form of payment.

Users can use the FPS payment system. FPS stands for Faster Payments Service. FPS is a UK banking initiative allowing real-time electronic fund transfers between banks.

© Goldilocks

~~~~~~~~~

Resolution 1770 (2007) / adopted by the Security Council at its 5729th meeting, on 10 August 2007 | United Nations Digital Library System

~~~~~~~~~

Silver Daily Forecast and Technical Analysis for May 17, 2024, by Chris Lewis for FX Empire | Youtube

~~~~~~~~~

The days of shorting the silver market are coming to an end.

~~~~~~~~~

SEC Adopts Rule Amendments to Regulation S-P to Enhance Protection of Customer Information | SEC

~~~~~~~~~

Kraken ‘Actively Reviewing’ Tether’s Status Under New EU Rules | BloombergLaw

New regime for digital assets set to take effect in July

Tether says it plans to continue its dialog with regulators

Kraken is “actively reviewing” plans that may include removing support for the world’s most-traded cryptocurrency on its exchange in the European Union, under a new regime for digital assets that’s set to take effect in the bloc in July.

Tether Holdings Ltd.’s USDT, a stablecoin that aims to maintain a one-to-one value with the dollar, is expected to be impacted by upcoming EU rules known as MiCA.

~~~~~~~~~

Standard Chartered completes first Euro transactions on Partior Platform – Trade Finance Global

~~~~~~~~~

Eurosystem completes first DLT experiment - Central Banking

The Eurosystem completed its first experiment using distributed ledger technology (DLT), the European Central Bank (ECB) announced on May 14.

This is the first of three experiments the ECB plans to carry out. All three experiments will test interoperability-type solutions for central bank money settlement of wholesale financial transactions recorded on DLT platforms.

This experiment covered tokenization and simulated the deliver-versus-payment (DvP) settlement of government bonds in a secondary market transaction against central bank money.

The DLT platform for the experiment was provided by the National Bank of Austria. Other participants include the central banks of Germany, France, Italy and Luxembourg.

👆 Goldilocks pointed to this article

~~~~~~~~~

Is Blockchain the Key to Transforming the Global Tourism Industry? | Analytics Insight

~~~~~~~~~

‘All UAE banks have to launch Jaywan debit cards’: Rollout to happen in phases - News | Khaleej Times

~~~~~~~~~

WATCH & LISTEN HERE Video on XRP

~~~~~~~~~

They Are Dumping Our TREASURIES - The Economic Ninja | Youtube

~~~~~~~~~

Miners Eye Middle East as Next Region for Growth | Coindesk

~~~~~~~~~

Iraq Going for the International Investment Platform? | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

UNDP endorses Iraq’s electronic payment services system | Search4Dinar

Today, the United Nations Development Programme (UNDP) approved the electronic payment system in Iraq.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Good Evening Dinar Recaps,

Iraq: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Iraq

Domestic stability has improved since the new government took office in October 2022. This has facilitated the passage of Iraq’s first three-year budget, which entailed a large fiscal expansion starting in 2023. The non-oil economy has rebounded strongly in 2023 after stalling in 2022 and was largely unaffected by the ongoing conflict in the region.

Nonetheless, Iraq remains highly vulnerable to oil price fluctuations, and private sector activity is hindered by the large state footprint—including as an employer of first resort—corruption, red tape, underdeveloped infrastructure, and poor access to credit.

Goldilocks' Comments and Global Economic News Friday Evening 5-17-24

Good Evening Dinar Recaps,

Iraq: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Iraq

Domestic stability has improved since the new government took office in October 2022. This has facilitated the passage of Iraq’s first three-year budget, which entailed a large fiscal expansion starting in 2023. The non-oil economy has rebounded strongly in 2023 after stalling in 2022 and was largely unaffected by the ongoing conflict in the region.

Nonetheless, Iraq remains highly vulnerable to oil price fluctuations, and private sector activity is hindered by the large state footprint—including as an employer of first resort—corruption, red tape, underdeveloped infrastructure, and poor access to credit. IMF

~~~~~~~~~

DTCC explores posting fund NAV data on blockchain with JPM, BNY Mellon, Chainlink - Ledger Insights

The Depository Trust and Clearing Corporation DTCC just made public the result of a proof of concept (PoC) test exploring the posting of tokenized funds by setting net asset values (NAV) data onto a blockchain.

In order to reach a real value on an asset, the value of an asset is reached by deducting the asset's liabilities from the market value of all of its shares. Then, you divide that number by the number of issued shares.

This is what happens in a reset when values across the board on the market have been inflated beyond their actual worth.

Until these calculations are completed across the board of the markets, it's hard to say we are going to have a crash or a rise in values of these new assets that are being tokenized and supported by gold and other commodities.

Forex will go into these equations as well finding representations of a real value for currencies giving them a Level Playing Field in the purchasing power of Global currencies around the world. This will give us a Global Currency Reset.

These correlated calculations will link themselves to the banking system causing the reformation of new values inside our new digital asset-based trading system.

This is the credit valuation adjustment we spoke of about a month ago that was going to start taking place. We are in the testing phase, but these assets will soon be interfaced onto the QFS reflecting new values in the new Financial System.

"The ten participants in the Smart NAV trial were American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JP Morgan, MFS Investment Management, Mid Atlantic Trust d/b/a American Trust Custody, State Street and U.S. Bank." Ledger Insights

© Goldilocks

~~~~~~~~~

CME Stock Exchange is planning to launch Bitcoin trading. This is currently in the discussion phase, but if it does go any further it will connect CME and the Swiss EBS.

The Chicago Mercantile Exchange is a global derivatives marketplace based in Chicago. The Swiss Electronic Bourse (EBS) is a "computer linking system between the former stock exchange trading floors in Zurich, Geneva, and Basel, Switzerland."

The connection would allow trades to be executed on all three of these trading floors onto Digital Ledger Technologies.

This is why it is so important to complete the MICA regulations. Currently, the integration at the full QFS is being set into motion. Cryptonomist Nasdaq

© Goldilocks

~~~~~~~~~

China Sells Record Sum of US Debt Amid Signs of Diversification | Finance Yahoo

~~~~~~~~~

Rep. Massie Introduces Federal Reserve Board Abolition Act to "End the Fed" | U.S. Representative Thomas Massie

~~~~~~~~~

Trafigura, IXM caught in COMEX copper short squeeze as prices hit record | StreetInsider

~~~~~~~~~

The state of play and what’s to come with CBDCs | London Blockchain Conference | Youtube

~~~~~~~~~

Final Rules on Measuring Domestic Control of REITs | FTI

~~~~~~~~~

Palo Alto Networks and IBM on Wednesday announced a significant partnership in which the two companies will jointly provide cybersecurity solutions, and IBM will deliver consulting services across Palo Alto’s platforms.

Palo Alto Networks is an American multinational cybersecurity company with headquarters in Santa Clara, California. The core product is a platform that includes advanced firewalls and cloud-based offerings that extend those firewalls to cover other aspects of security. The company serves over 70,000 organizations in over 150 countries, including 85 of the Fortune 100. It is home to the Unit 42 threat research team and hosts the Ignite cybersecurity conference. It is a partner organization of the World Economic Forum. SecurityWeek Wikipedia

~~~~~~~~~

World Bank to issue Swiss digital bond settled in wholesale CBDC - Ledger Insights

Yesterday the World Bank announced it has priced a CHF 200 million digital bond to be issued on June 11 on the SIX Digital Exchange (SDX) and settled using the Swiss Franc wholesale central bank digital currency (wholesale CBDC).

The Swiss National Bank (SNB) is currently in pilot mode for its wholesale CBDC on the SDX DLT platform as part of Project Helvetia. Several digital bonds have used it for settlement. However, the World Bank, or rather the International Bank for Reconstruction and Development (IBRD), is the first international issuer to use the wCBDC.

~~~~~~~~~

We are beginning to witness how Digital Ledger Technologies, Tokenized Assets, and Stablecoins are currently being tested and regulated to go into law by the end of June 2024.

Do you see how these three networks work together to complete the functionality of the QFS?

Once these functionalities are complete, we will move into credit valuation adjustments to determine real values going forward.

The system will be tweaked during this time as the rest of the world catches up and interfaces their assets onto the system.

© Goldilocks

~~~~~~~~~

Regulators Preparing to Finalize Basel IV | Insights | Mayer Brown

~~~~~~~~~

Visa Reinvents the Card, Unveils New Products for Digital Age | Visa

~~~~~~~~~

Press release: Basel Committee publishes report on the digitalisation of finance | BIS

~~~~~~~~~

********************************

URGENT NEWS: Emergency Meeting on Iraq 2024 Budget #iqd Rate in Budget | Youtube

~~~~~~~~~

The modern CEO job is completely broken — but AI could make executives useful again | Business Insider

~~~~~~~~~

Overview | World Bank

Iraq has a mixed economic system with some private freedom, but weak centralized economic planning and government regulation. The country's economy is dominated by oil exports, which serve as the basis of its GDP. Successive governments have done little to wean Iraq off this heavy dependency on oil rents and diversify the economy.

However, non-oil growth has rebounded strongly in 2023, while inflation has receded. The World Bank has highlighted the importance of banking reforms and promoting digital financial services to increase financial intermediation and promote financial inclusion.

The Iraq Vision 2030 plan includes diversifying the economy, reducing dependence on oil, promoting innovation, supporting SMEs, and attracting foreign investment. The plan also promotes sectors such as agriculture, tourism, manufacturing, and technology.

~~~~~~~~~

How Gold Affects Currencies | Investopedia

Gold can add value to a country's currency. Gold is used as a standard of value for currencies worldwide, and the price of gold can influence a country's currency value. For example, if a country exports gold, the value of its currency will increase when gold prices increase.

~~~~~~~~~

BIS DROPS A BOMBSHELL! They Referenced Ripple/XRP On Their Panel! You Will Regret Not Owning XRP! | Youtube

~~~~~~~~~

14 Fireside chat - Technological innovation to enhance existing infrastructures | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Good evening Dinar Recaps,

Wirex chooses OpenPayd to launch embedded accounts across UK and EEA | PRN Newswire

"The partnership between the two entities aims to provide named virtual IBANs to Wirex customers across the UK and European Economic Area (EEA), aligning with Wirex's mission to offer secure payment methods to its customers.

Under this partnership, OpenPayd will issue virtual IBANs to Wirex customers in over 30 countries across the UK and EEA. These customers will gain access to the Faster Payments network in the UK and Single Euro Payments Area (SEPA) Instant payments for Euro-denominated deposits and withdrawals."

This service will be interfaced into Wirex's infrastructure using OpenPayd's single API.

Goldilocks' Comments and Global Economic News Thursday Evening 5-16-24

Good evening Dinar Recaps,

Wirex chooses OpenPayd to launch embedded accounts across UK and EEA | PRN Newswire

"The partnership between the two entities aims to provide named virtual IBANs to Wirex customers across the UK and European Economic Area (EEA), aligning with Wirex's mission to offer secure payment methods to its customers.

Under this partnership, OpenPayd will issue virtual IBANs to Wirex customers in over 30 countries across the UK and EEA. These customers will gain access to the Faster Payments network in the UK and Single Euro Payments Area (SEPA) Instant payments for Euro-denominated deposits and withdrawals."

This service will be interfaced into Wirex's infrastructure using OpenPayd's single API.

Banking API is the process of integrating banking functions to a web service. It will decentralize the banking system inside the new QFS. This unique feature will allow access to third-party companies.

Wirex customers will get unique IBANs. IBAN is an International Bank Account Number. It will facilitate transfers of EUR and GBP between Wirex and bank accounts.

OpenPayd's SEPA Instant Payments transactions will occur in real-time. Here we go. The beginning stages of instant payments. PRN Newswire

© Goldilocks

~~~~~~~~~

The integration of Digital Payment Systems, Digital Ledger Technology, and Digital Payment Sources are all in process of being interfaced onto the QFS.

The new rules and regulations to govern them are in process of becoming law by the end of June.

Europe will begin the Global Reset. It will be up to the rest of the world to follow the Regulations they are building at the present time.

The rest of the world will build around these new Banking and Market guidelines. It is a process that begins the end of June 2024.

© Goldilocks

~~~~~~~~~

The Gold Iraqi Dinar | The Economic Ninja | Youtube

~~~~~~~~~

Iraq maintains its 30th rank with the largest gold reserves | Iraqi News

"Iraq's central bank, the Central Bank of Iraq (CBI), has been buying gold since 2022 to diversify its foreign assets."

Every time Iraq buys more gold. They are adding more value to the net worth of their currency.

"When gold is set free, so are we."

© Goldilocks

~~~~~~~~~

"Due diligence procedures in inquiring about customers of exchange companies category (A, B) and brokerage companies that buy and sell foreign currencies."

Brokerage companies that buy and sell foreign currencies with Iraq and their new registered A&B categorization of the Iraqi Dinar have been given due diligence procedures.

Due diligence procedures include information gathered about the clients who are participating in an exchange. It includes background checks, risk assessments, and more. CBI Investopedia Signicat

© Goldilocks

~~~~~~~~~

Mastercard executes first tokenized deposit transactions with StanChart subsidiaries - Ledger Insights

Mastercard has executed its first live test of the Mastercard Multi-Token Network

() (MTN) involving tokenized deposits and tokenized assets in collaboration with Standard Chartered Bank Hong Kong (SCBHK) and subsidiaries. Mastercard introduced MTN in mid-2023.

This proof of concept was completed as part of the Hong Kong Fintech Supervisory Sandbox. It involved a client of Standard Chartered’s Hong Kong digital bank, Mox Bank, buying a carbon credit.

Mox requested SCBHK to tokenize the carbon credit, a task executed by Libeara, the tokenization platform incubated by Standard Chartered’s SC Ventures. Mastercard’s MTN was used to tokenize the deposit and execute an atomic swap between the tokenized deposit and the carbon credit. Ultimately the Mox client received the tokenized carbon credit in their wallet.

~~~~~~~~~

Financial Services and Markets Act 2022 | Monetary Authority of Singapore

~~~~~~~~~

Escobar: De-Dollarization Bombshell - The Coming Of BRICS+ Decentralized Monetary Ecosystem | ZeroHedge

~~~~~~~~~

BIS’ Project Agorá Opens to Private Sector for Tokenised Cross-Border Payments | Fintech Singapore

Project Agorá, an initiative by the Bank for International Settlements (BIS) alongside major central banks and the Institute of International Finance (IIF), is moving forward and inviting private sector involvement.

The project aims to explore how tokenization can improve wholesale cross-border payments. Private sector financial institutions are encouraged to apply for participation in Project Agorá and the application window is open until 31 May 2024.

Project Agorá involves seven central banks, including the Bank of France (Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England, and the Federal Reserve Bank of New York.

The initiative will build on the unified ledger concept proposed by BIS, aiming to integrate tokenized commercial bank deposits with tokenized wholesale central bank money.

~~~~~~~~~

The Rise of Tokenised Economy: Unified Ledger, RLN, RSN & More..| Linkedin

In simple terms, a unified ledger could be considered a “common venue” where money and other tokenized objects come together to enable seamless integration of transactions and open the door to entirely new types of economic arrangement. 3 days ago

EU wholesale DLT settlement trials start - Ledger Insights - blockchain for enterprise | Ledger Insights

Yesterday, the Oesterreichische Nationalbank participated in the first trial of wholesale DLT settlement transactions as part of the Eurosystem experiments.

As reported last month, 16 institutions were onboarded to participate in the first wave of DLT trials, which use real central bank money. In addition, there are experiments involving simulations.

The Oesterreichische National bank example was a simulation involving the tokenization and simulated settlement of government bonds against central bank money – a delivery versus payment (DvP) transaction.

The ECB says upcoming trials and experiments will include

DvP transactions in primary and secondary markets securities lifecycle management automated wholesale payments, and payment-versus-payment transactions.

~~~~~~~~~

Ripple’s Latest Move Bolsters It As A Digital Asset Custody Provider | Mitrade

Ripple is transitioning into a full-service digital asset custody provider, following its acquisition of Metaco, a Swiss-based leader in the sector, for $250 million in May 2023. This development represents a significant expansion of the fintech’s capabilities into the institutional crypto custody market—a segment that is expected to experience substantial growth over the next decade.

~~~~~~~~~

Bankster Boss Christine Lagarde Reveals Plan for Europe’s GREAT RESET | Awake in 3D

“A hotter climate and the degradation of natural capital are forcing change in our economy and financial system. We must understand and keep up with this change to continue to fulfill our mandate.”

Christine Lagarde, President European Central Bank

~~~~~~~~~

I hope the above information gives you a more detailed understanding of what is taking place this month.

~~~~~~~~~

JUST IN: 🇺🇸 Senator Cynthia Lummis calls for Senate approval on bill allowing highly regulated financial firms to hold Bitcoin and crypto. https://t.me/c/1545617426/78718

~~~~~~~~~

DTCC, Chainlink Complete Pilot to Accelerate Fund Tokenization with JPMorgan, Templeton, BNY Mellon Participating | Coindesk

The Depository Trust and Clearing Corporation (DTCC), the world’s largest securities settlement system, completed a pilot project with blockchain oracle Chainlink (LINK) and multiple major U.S. financial institutions, aiming to help accelerate the tokenization of funds, according to a Thursday report published by DTCC.

~~~~~~~~~

Find information in faster & easier ways with AI Overviews in Google Search - Google Search Help

AI Overview

Learn more… Opens in new tab

Yes, due diligence is part of a foreign currency exchange. The Bank Secrecy Act (BSA) regulatory requirements for due diligence programs for foreign financial institutions include detecting and reporting money laundering and any potential suspicious activity.

The goal of section 312 of the USA PATRIOT Act is to help prevent money laundering through accounts that give foreign financial institutions a base for moving funds through the U.S. financial system. U.S. financial institutions covered by the final rule must establish a due diligence program that includes appropriate, specific, risks.

~~~~~~~~~

Iraq repays IMF loans in full | Search 4 Dinar

~~~~~~~~~

U.S. Senate Votes to Kill SEC's Crypto Accounting Policy, Testing Biden's Veto Threat | Coindesk

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Good Evening Dinar Recaps,

"The European Securities and Markets Authority (ESMA) recently revealed that four applications are pending. One of those is from Germany’s 21X (https://www.21x.eu/), the only one of the quartet that has applied for a DLT trading and settlement systems (DLT TSS) license.

If approved, this would allow it to both operate a secondary market (DLT MTF) and run the settlement systems (DLT SS). We were the first DLT TSS applicant in Europe. We do have a first mover advantage that we are hoping to realize,” 21X CEO Max Heinzle told Ledger Insights."

A secondary market allows investors and traders the ability to exchange with each other when a primary Market adds an item for sale. Securities can be directly traded between two entities without having to go through the primary issuer.

This allows the actual price of an item to be driven by supply and demand. An actual value begins to surface over several trades.

Goldilocks' Comments and Global Economic News Wednesday Evening 5-15-24

Good Evening Dinar Recaps,

"The European Securities and Markets Authority (ESMA) recently revealed that four applications are pending. One of those is from Germany’s 21X (https://www.21x.eu/), the only one of the quartet that has applied for a DLT trading and settlement systems (DLT TSS) license.

If approved, this would allow it to both operate a secondary market (DLT MTF) and run the settlement systems (DLT SS). We were the first DLT TSS applicant in Europe. We do have a first mover advantage that we are hoping to realize,” 21X CEO Max Heinzle told Ledger Insights."

A secondary market allows investors and traders the ability to exchange with each other when a primary Market adds an item for sale. Securities can be directly traded between two entities without having to go through the primary issuer.

This allows the actual price of an item to be driven by supply and demand. An actual value begins to surface over several trades.

It is a system that allows large and small traders to invest in Market transactions such as stock markets and over-the-counter markets.

Foreign currency exchanges are traded on the secondary Market. Examples of stock markets (or secondary markets) include:

* the NYSE and Nasdaq in the U.S.

* the London Stock Exchange

* the Hong Kong Stock Exchange

* the Bombay Stock Exchange

* the Frankfurt Stock Exchange

(https://www.ledgerinsights.com/esma-explains-why-dlt-pilot-regime-hasnt-taken-off/)

When Stablecoins and Tokenized Assets become law on June 30th, 2024, we will have a Digital Ledger System capable of recording these transactions going forward. Germany’s 21X (https://www.21x.eu/),

Ledger Insights Investopedia 1 Banking Frontiers Soft Serve Inc Investopedia 2

© Goldilocks

~~~~~~~~~

"Deutsche Bank today announced it has joined the Monetary Authority of Singapore’s (MAS) Project Guardian (as part of the asset and wealth management workstream). The collaborative initiative is dedicated to testing the feasibility of asset tokenization applications in regulated financial markets.

Project Guardian is a multi-year project involving global policymakers (including the United Kingdom’s FCA, Switzerland’s FINMA, and Japan’s FSA) and financial services industry representatives.

As part of the asset and wealth management workstream, the bank will test an open architecture and interoperable blockchain platform to service tokenized and digital funds. It will then propose protocol standards and identify best practice to contribute to industry progress."

The Deutsche Bank connects to all banks around the world, and their proposed "protocol standards" from this project test will move us towards Global unification inside the new digital asset economy. Deutsche Bank The Block Fintech Futures

© Goldilocks

~~~~~~~~~

The Monetary Authority of Singapore is finalizing their rules for their new over-the-counter derivatives reporting regimen.

These final regulations come into operation on October 21, 2024. It will introduce the Unified Payments Interface, Unique Transaction Identifier or swaps transaction identifier, cardholder data environment, and ISO 20022 in reporting.

These new developments just so happen to be taking place in the same month of the next BRICS summit. Exchange Protocols and Regulations are clearly being interfaced onto the QFS during this time. Traction Fintech DowJones

© Goldilocks

~~~~~~~~~

How Trading Works on OTC Markets | Youtube

~~~~~~~~~

What are Secondary Markets? | Youtube

~~~~~~~~~

Philippines Central Bank Launches Peso-Linked Stablecoin Trials | Bitrue FAQ

Philippines Stablecoin Announcement:

The Philippines will now test a peso-backed stablecoin in payments, trading, hedging, and DeFi applications.

~~~~~~~~~

Finastra certifies multiple solutions for ISO 20022 compliance | The Paypers

Tuesday 14 May 2024 15:05 CET | News

Global provider of financial software applications Finastra has announced the completion of testing and certification for ISO 20022. (https://thepaypers.com/search/index.aspx?search=Finastra)

This achievement positions Finastra as one of the early vendors in the industry to complete the certification process for multiple solutions. The certification pertains to four of Finastra’s payment processing solutions, allowing financial institutions across the United States to enhance their innovation capabilities.

The certified solutions include Payments To Go, Global PAYplus, PAYplus USA, and PAYplus Connect, offering a range of options for financial institutions to comply with ISO 20022 standards for FedWire. Financial institutions are required to conduct their own testing to meet ISO 20022 compliance standards by the end of 2024, emphasizing the importance of selecting a suitable payment processor with the necessary technology.

👆 Goldilocks pointed to this article

~~~~~~~~~

Digital ID Regulations Start THIS MONTH mandatory by 2026. | TheNationalPulse

The Digital Identity Regulation (eIDAS 2.0), the European Union’s latest set of digital ID rules, will take effect on May 20. Big Tech firms and EU member nations must now comply in supporting the EU Digital Identity (EUDI) Wallet, though work on the project remains ongoing, with pilot programs scheduled for 2025.

According to recently published standards by the European Council, the EUDI Wallet must be fully implemented across the continent by 2026. Initial usage will encompass scenarios such as accessing government services and age verification.

~~~~~~~~~

Financial Services and Markets Act Announcement:

Singapore has commenced its second phase of implementing the Financial Services and Markets Act (FSMA). The Act was passed into law in April 2022 to give the Monetary Authority of Singapore (MAS) additional powers to address misconduct, technology, and virtual asset risks. 20 hours ago

~~~~~~~~~

Andrei Belousov: The Economist in Charge of Russia’s Army | The Moscow Times

n economist and technocrat with no military background, Russia's new Defense Minister Andrei Belousov has been tasked with deploying his number-crunching skills and bureaucratic oversight to secure Russian victory against Ukraine.

~~~~~~~~~

China considers local government purchases of unsold homes, Bloomberg News says | Yahoo News

~~~~~~~~~

Government Acquisition, Regulation of Private Property. Initiative Constitutional Amendment. | LAO CA Gov

~~~~~~~~~

The Unseen Battles in Iraq USD IQD Ex Rate Value Up | Youtube

~~~~~~~~~

Silver Price Hasn't Done This In Over A Decade ($30 BREAKOUT Imminent) | Youtube

~~~~~~~~~

Yesterday, the Oesterreichische National Bank participated in the first trial of wholesale DLT settlement transactions as part of the Eurosystem experiments. As reported last month, 16 institutions (https://www.ledgerinsights.com/ecb-wholesale-dlt-trials-first-participants/) were onboarded to participate in the first wave of DLT trials, which use real central bank money. In addition, there are experiments involving simulations. LedgerInsights

~~~~~~~~~

09 May 2024 (BIS):

BIS added 37 entities to the Entity List under the destination of the PRC for the following reasons:

Supporting the High Altitude Ballon that overflew the United States in February 2023;

Having connections to companies that provided such support;

Acquiring and attempting to acquire U.S.-origin items, applicable to unmanned aerial vehicles, to be used by Chinese military entities;

Being involved in the shipment of controlled items to Russia since its invasion of Ukraine in February 2022;

Acquiring and attempting to acquire U.S.-origin items in support of advancing China’s quantum technology capabilities; and Being involved in advancing China's nuclear program development. https://overruled.com/china/

~~~~~~~~~

The essential metals for humans: a brief overview - PubMed

~~~~~~~~~

S&P Global Rankings Urges Asset Managers To Embrace Tokenization | TheDefiant

~~~~~~~~~

The DCSA Digital Trade initiative was designed to facilitate universal acceptance and adoption of a standards-based electronic Bill of Lading, applicable to both original Bill of Ladings and Seaway Bills.

Using open source Application Programming Interfaces (APIs), DCSA BL standard enables straight-through processing of BL data, eliminating paper and manual intervention from BL processes.

Standardised digitalisation of BL data and processes will help create a more secure, agile and sustainable supply chain ecosystem. DCSA is also working closely with eBL solution providers on technical and legal interoperability to enable seamless digital transfer of original BLs across different platforms and stakeholders, which will facilitate the global uptake of BL standards. DCSA

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible." It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS © Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Tuesday Evening 5-14-24

Good Evening Dinar Recaps,

Prudential treatment of cryptoasset exposures | BIS

"The Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, met on 13 May 2024."

During this meeting, they set up a new Basel 3 standard timeline for crypto asset implementation.

The new timeline was moved from January 1st, 2025 to January 1st, 2026. It is expected that 2/3s of our crypto assets will be done by the end of this year.

The committee wanted to reiterate that the expectation is for these crypto assets to be implemented into Basel 3 "as soon as possible."

It is important to know that the bank's exposure to tokenized traditional assets, stablecoins, and unbacked cryptoassets is still set for January 1st, 2025.

It is the crypto assets standards that will continue on until January 1st, 2026. BIS

© Goldilocks

~~~~~~~~~

"UAE: Liv Digital Bank enters tokenization deal targeting Gen Zs" | CoinGeek

We are moving at a rapid pace at this point in the tokenization of our assets around the world.

You are going to notice the word digital added to many banking titles and companies going forward. Old traditional assets have been reformed into digital assets.

Hong Kong is leading the way in the digital asset transformation, and the innovation of our new banking system on a global scale is in its final stages there.

Hong Kong is presently finishing up many of their pilot programs, and their movement forward will lead our way into the new digital age.

© Goldilocks

~~~~~~~~~

Franklin Templeton CEO: All Investment Funds Going Blockchain | Crypto Times

"Jenny Johnson, CEO of the $1.6 trillion asset management giant Franklin Templeton, stated that all exchange-traded funds (ETFs) and mutual funds will eventually migrate to blockchain technology."

I know we have gone over this several times, but this gives you an idea of how much money is transferred into blockchain technology.

This is just one of many companies that are doing the same as we speak.

Institutional money and institutional integration are beginning to take place on the blockchain at larger magnitudes indicating that the new digital economy is moving towards mass adoption.

© Goldilocks

~~~~~~~~~

U.S. banks undertake blockchain experiment | Investment Executive

"The U.S. financial sector is exploring the idea of tokenizing various financial instruments, including U.S. Treasuries, wholesale central bank money, and commercial bank money, which would enable transactions in these instruments to settle on a single shared ledger.

Currently, transactions in various components of the wholesale financial system all take place on separate systems. A new project will examine the concept of tokenizing these instruments to facilitate settlement on a single platform, under existing legal frameworks.

SIFMA is serving as project manager, with participation from several large financial institutions including Citi, J.P. Morgan, Mastercard, Swift, TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa, and Zions Bancorp.

Other project contributors include the Bank of New York Mellon, Broadridge, DTCC, the International Swaps and Derivatives Association, Tassat Group, and the MITRE Corp"

I want to point out that this article is sharing with us how this new experiment is being conducted on the Swift System and the new Digital Ledger Transmission System (DLT) Ledger.

This indicates that the movement of foreign currency exchange services is transitioning from wire services that can take days for transmissions to occur to electronic exchange services that are done in a matter of seconds and far more cost-efficient.

This is what my banker friend was referring to yesterday as to why her friend was going through foreign exchange services training.

© Goldilocks

~~~~~~~~~

Tokenizing assets on a scalable blockchain | Naeem Aslam, Antonino Sardegno, Stas Trock | Youtube

~~~~~~~~~

Swarm Markets (SMT) Price Today, News & Live Chart | Forbes Crypto Market Data

~~~~~~~~~

...by the Securities and Exchange Commission

H.J. Res. 109 would invalidate SEC Staff Accounting Bulletin 121 (SAB 121), which reflects considered SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets. 6 days ago

~~~~~~~~~

SEC issues SAB 121 on digital asset custodial obligations | KPMG

~~~~~~~~~

👆The US is still working on who has governing power over these digital assets. This is why many Governments are moving ahead of the United States in the mobilization of the new digital economy.

This is why the MICA regulations are so important for us to finish. It will give more clarity and government power to authentic leaders in government to facilitate the movement of our new digital economy. House Financial Services

© Goldilocks

~~~~~~~~~

US Department of Treasury, Pacific Northwest National Laboratory, and Cloudflare Partner to Share Early Warning Threat | CoudFlare

San Francisco, CA, May 9, 2024 – Cloudflare, Inc (NYSE: NET), the leading connectivity cloud company, today announced a partnership with the United States Department of Treasury and Pacific Northwest National Laboratory (PNNL) under the Department of Energy to improve the cyber resilience of the financial services industry by sharing an advanced threat intelligence feed through Cloudflare. With this new offering, financial services institutions that are using Cloudflare Gateway now have privileged access to Custom Indicator Feeds that share threat indicators and enable direct action to be taken, to better defend against ransomware, phishing, and other threats.

~~~~~~~~~

Ranking Member Waters Statement on Resolution to Overturn SEC’s Guidance on Crypto Assets: H.J. Res. 109 “Would Have Broad and Negative Consequences for All Public Companies and Their Investors, with Implications for the Entire Securities Market, Not Just Crypto.” | U.S. House Committee on Financial Services Democrats

~~~~~~~~~

May 9, 2024

Tokenized Real-World Assets: Pathways to SEC Registration

By: Ryan Mitteness, Ryan M. McRobert, Andrew T. Albertson

What You Need to Know

Global demand for Tokenized Real-World Assets (RWAs) is growing rapidly in the decentralized finance (DeFi) community and traditional finance industry.

Tokenized RWAs allow legal ownership or rights to traditionally illiquid assets to be digitalized and traded on digital platforms, leading to expedited settlements and potentially reduced operating costs.

Regulatory hurdles have slowed adoption in U.S. markets where companies have to navigate existing securities laws and often lengthy review processes by the Securities Exchange Commission (SEC).

While a clear preferred registration pathway through the SEC for tokenized RWAs has yet to emerge, there are various potential approaches issuers of RWAs may explore for broadly marketed offerings in the United States. Fenwick

~~~~~~~~~

ETFs and mutual funds are all going to be on blockchain, says Franklin Templeton CEO - Ledger Insights - blockchain for enterprise | LedgerInsights

~~~~~~~~~

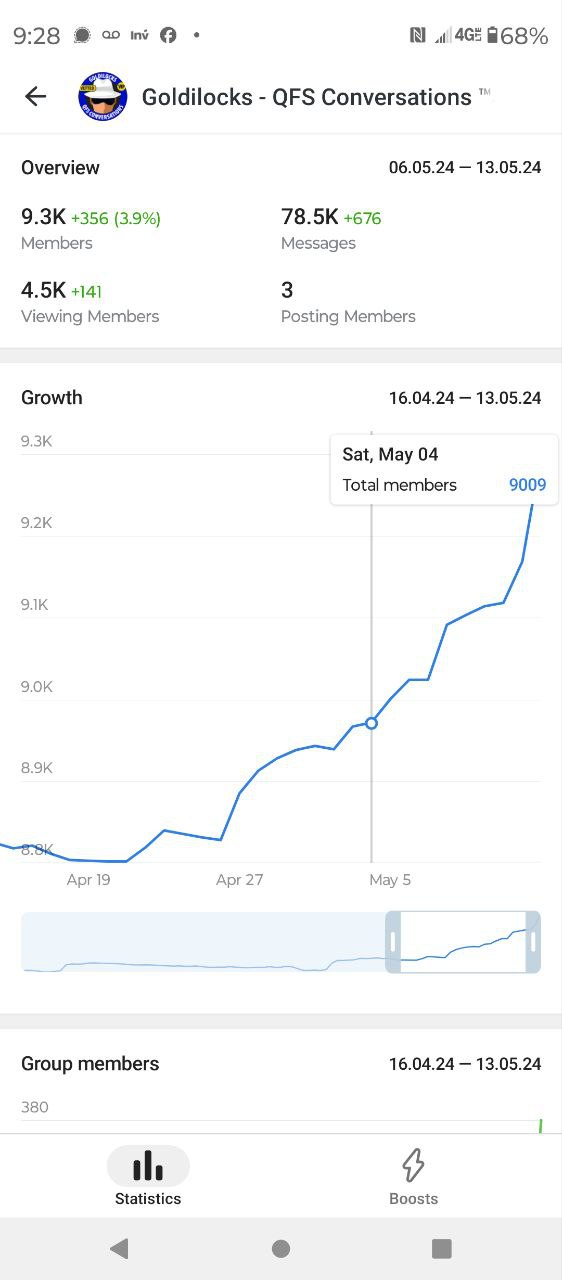

Thank you everyone for your participation in this room. I thought I would give you an idea of the statistics that actually take place in this room. This is the current total.

It is important to note that almost 50% of the people in this room actually come to it every day. This is very rare due to the fact that most people join rooms and then move on to others.

What you are looking at above is an active room where people realize and know that the information being shared is important, and I take this room and the lives of the people within it as an important piece instilled within my heart of prayer each and every day as I write to support and encourage all of us to move forward in faith, hope, and love.

© Goldilocks

~~~~~~~~~

ECB conducts first DLT trials for wholesale central bank money settlement | FinExtra

~~~~~~~~~

Report on OTC derivatives data reporting and aggregation requirements

The final regulations come into operation on 21 October 2024, introducing the UPI, UTI, CDE and ISO 20022 in reporting.10 hours ago

~~~~~~~~~

Miami Federal Court Orders Multiple Individuals and Entities to Pay Over $225 Million for Foreign Currency Fraud and Misappropriation Scheme | CFTC

~~~~~~~~~

May 14, 2024

Washington, D.C. — The Commodity Futures Trading Commission today announced the Honorable Darrin P. Gayles of the U.S. District Court for the Southern District of Florida issued an order of default judgment against four individuals and five companies (nine defendants): Jase Davis of Brandon, Mississippi; Borys Konovalenko of Ukraine; Anna Shymko of Duluth, Georgia; Alla Skala of Grand Island, New York and/or Fort Erie, Canada; Easy Com LLC d/b/a ROFX, a New Hampshire LLC; Global E-Advantages LLC a/k/a Kickmagic LLC d/b/a ROFX, a Delaware LLC and New York foreign LLC; Grovee LLC d/b/a ROFX, a Delaware LLC; Notus LLC d/b/a ROFX, a dissolved Colorado LLC; and Shopostar LLC d/b/a ROFX, a Colorado LLC.

The default judgment order stems from the CFTC’s August 31, 2022 amended complaint charging the nine defendants and defendant Timothy F. Stubbs with fraud, misappropriation, and registration violations in connection with a fraudulent foreign currency (forex) scheme. [See CFTC Press Release Nos. 8486-22 and 8790-23]

~~~~~~~~~

DTCC Comments on Industry’s Affirmation Progress | DTCC

~~~~~~~~~

H.R.4766 - 118th Congress (2023-2024): Clarity for Payment Stablecoins Act of 2023 | Congress Gov

~~~~~~~~~

Using MRI, engineers have found a way to detect light deep in the brain | MIT News | Massachusetts Institute of Technology

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation" Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~

Goldilocks' Comments and Global Economic News Monday Evening 5-13-24

Good Evening Dinar Recaps,

"The End Of The World Order And The Rise Of Trade Regulation"

Throughout the world, the US has been in process of signing Free Trade Agreements with countries.

These FTAs eliminate barriers to trade significantly. This includes tariffs, improving intellectual property rights, and more.

In addition, they improve laws protecting intellectual property rights, open up government procurement opportunities, and easing investment rules.

The world of trade between countries are changing rapidly at this point. These new trade agreements require credit valuation adjustments across the board including foreign currency exchange rates. Mondaq Trade Cornell Law

WATCH THE WATER.

© Goldilocks.

~~~~~~~~~*

"The network value-to-transaction ratio, or NVT ratio, is a proposed approach that is determined by dividing the market capitalization of a digital asset by the transaction value during a certain time period. These are the important metrics that help in the valuation of digital assets."

The above information is exactly what will begin happening at some level when our new regulated digital assets become law on June 30th.

We will go through a process of credit valuation adjustments based on demands for their use and corresponding underlying assets that support what used to stand alone in the traditional markets.

Backing traditional assets with gold and other commodities will change the way we look at the price of these assets going forward.

During this time, we can expect to see caps on gold released for many of these new digital assets to find a real value as we approach January 1st, 2025.

The first of next year is when the expectation for Basel 3 compliant measures to be fully complete. At that time, solid rates will become possible for many of the assets a trader will hold.

Price fluctuations across the board between now and then are expected including Forex. Our markets will be in process of finding real values. Eqvista MoodysAnalytics

© Goldilocks

~~~~~~~~~

Crypto Regulations Act update for the US:

"Today, the House Committee on Rules publicly noticed its intent to consider the Financial Innovation and Technology for the 21st Century (FIT21) Act, clearing a pathway for a floor vote later this month.

The FIT for the 21st Century Act is an important first step towards achieving regulatory clarity for digital assets. FIT21 provides the robust, time-tested consumer protections and regulatory certainty necessary to allow the digital asset ecosystem to flourish in the United States."

After this vote, you can expect movement towards the Senate to come soon after in order to meet those deadlines for June 30th, 2024 for the European Union.

China is already in the regulatory process, and expected to coordinate with a global efforts of Europe and the US. House Financial Services DailyCryptoNews

© Goldilocks

~~~~~~~~~

Global Banking Announcement:

This is a note to follow up on the banker who went into foreign currency exchange training last week.

The banks now have the capability to send wires in every currency around the world with the exception of the Iraqi dinar.

There will be much faster settlement times utilizing a country's own currencies for the exchange.

This makes sense to me due to the fact that Dee and I have been told that the IQD would not float. It will be given a revalued rate.

What is important to take from this piece of Intel is, for this Bank, these new procedures began today.

This does not mean that all Banks have started these protocols yet, but it does mean that expectations are high that they begin.

© Goldilocks

~~~~~~~~~

"Navigating the New Frontier: Updates to Federal Onshore Oil and Gas Leasing Rules and Regulations" | JD Supra

These new rules and regulations for the oil sector have reached their final stages. And now, the transition into the energy sector of our markets that includes solar power and electric cars will proceed.

© Goldilocks

~~~~~~~~~

SAN FRANCISCO, May 9, 2024 — WisdomTree Prime Launches to 41 States, Leveraging Stellar Network for Enhanced Digital Asset Services | Crypto News

WisdomTree, a notable asset management firm, has launched its innovative financial app, WisdomTree Prime, to cover 75% of the U.S. population across 41 states despite shareholder wishes.

This strategic extension is powered by the Stellar Development Foundation, which supports the app’s robust digital asset services. (https://www.crypto-news.net/tokenization-government-money-fund/)

WisdomTree has integrated Stellar’s efficient transaction platform to power WisdomTree Prime, aligning with its goal to streamline financial operations for its users.

~~~~~~~~~

WisdomTree Digital Trust Company, LLC. | Wisdom Tree Inc

~~~~~~~~~

ASEAN - The key Player in the Indo-Pacific Region - Indian Defence Review

~~~~~~~~~

Dow Gold Ratio: Stocks vs Gold Charts | SD Bullion

~~~~~~~~~

Hong Kong and Saudi Arabia Consider Establishing ETF - Claps

~~~~~~~~~

Alternative Trading Systems (ATSs) | Investor Gov

~~~~~~~~~

Zimbabwe set to be invited to join BRICS | The Zimbabwe Mail

👆 Goldilocks pointed to this article

~~~~~~~~~

Currently, indications are pointing at Zimbabwe, together with Argentina and Saudi Arabia, being officially announced as new members of the NDB at the BRICS summit to be held in South Africa this August. | Herald

~~~~~~~~~

Institutions Coming In! Pivotal Moment For XRP! | Youtube

~~~~~~~~~

RIPPLE VS. SEC

Tomorrow on May 13th:

Parties and any third parties file omnibus letter motions and also file proposed redactions to such materials!

As @attorneyjeremy1 said: We‘re just waiting for the judge now! #Ripple Twitter

~~~~~~~~~

BREAKING NEWS Iraq at Odds w/OPEC Over Oil Production Cuts | Youtube

~~~~~~~~~

When You Put Money in the Bank annnddd It's Gone - SOUTH PARK | Youtube

~~~~~~~~~

Crash Landing Ahead? Fed May Cut Rates but We’ve Run Out of Time | Youtube

~~~~~~~~~

The Gold Team Breaking down Goldilocks. Their backgrounds is why Goldilocks gave them all the Gold Seal of approval. Goldilocks QFS Goldilocks Q A Saturday Night Live Call

~~~~~~~~~

The Association of Private Banks praises the direction of the Iraqi Central Bank to establish digital banks | Search 4 Dinar

Economy News – Baghdad

The Executive Director of the Association of Iraqi Private Banks, Ali Tariq, praised the Central Bank’s direction to establish digital banks to keep pace with the great development in the global banking sector.

In an interview with “Economy News”, Tariq said that “the world is moving towards digitizing banking services, and Iraq has started its first steps in establishing digital banks, as so far there is a licensed digital bank inside Iraq, and provides its services naturally to the public.”

~~~~~~~~~

Why is Crude oil price crashing? | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Sunday, 12 May 2024, 21:50 PM

Executive Director of the Sound Money Defense League 5/8/2024 With Gov. Jim Pillen’s recent signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver.

LB 1317 is the fourth major sound money bill to become law this year, as state lawmakers across the nation scramble to protect the public from the ravages of inflation and runaway federal debt.

Under the new Nebraska law, any “gains” or “losses” on precious metal sales reported on federal income tax returns are backed out, thereby removing them from the calculation of a Nebraska taxpayer’s adjusted gross income (AGI).

Nebraska Becomes 12th State to End Taxes on Gold and Silver Sales

Sunday, 12 May 2024, 21:50 PM

Executive Director of the Sound Money Defense League 5/8/2024

With Gov. Jim Pillen’s recent signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver.

LB 1317 is the fourth major sound money bill to become law this year, as state lawmakers across the nation scramble to protect the public from the ravages of inflation and runaway federal debt.

Under the new Nebraska law, any “gains” or “losses” on precious metal sales reported on federal income tax returns are backed out, thereby removing them from the calculation of a Nebraska taxpayer’s adjusted gross income (AGI).

Supported by the Sound Money Defense League, Money Metals Exchange, and in-state advocates, Nebraska’s sound money measure passed out of the unicameral legislature’s Revenue committee unanimously before being amended into a larger bill.

Sponsor Sen. Ben Hansen said upon news of the formal enactment of his legislation:

Gold and silver are the only forms of currency mentioned in our Constitution and with that comes the people’s ability to use it as such without penalty from the government. Saving, and using, gold and silver is our right and one of the only checks and balances to our federal government’s unending devaluation of our paper currency.

Taxpayers often realize ‘gains’ when converting the monetary metals back into Federal Reserve notes even though the ‘gains’ do not reflect an increase in real value but rather reflect the currency’s ongoing devaluation.Despite the lack of “real” gains, the Internal Revenue Service imposes capital gains taxes on such transactions. Nebraska has now opted out at the state level, declining to carry the IRS’s position into the definition of Nebraska income.

Jp Cortez, executive director of the Sound Money Defense League, explained during his testimony before the Revenue Committee that the ferocious wave of inflation facing Nebraskans is largely caused by harmful actions of the Federal Reserve: The state can take a different course and provide Nebraska citizens cleaner access to gold and silver ownership – and these metals are not only a proven inflation hedge but states all over the country are remonetizing constitutional sound money in the form of gold and silver.

Eleven other states already do not charge an income tax on sales of precious metals, with Arkansas, Arizona, and Utah recently enacting such laws. Meanwhile, Iowa, Georgia, Oklahoma, Missouri, West Virginia, and Kansas have been considering similar legislation in 2024.

“Investments in precious metals coins and bullion in Nebraska are now rightly exempt from both sales tax and income tax,” said Stefan Gleason, CEO of Money Metals and Chairman of the Sound Money Defense League.

Neutralizing Nebraska’s income tax treatment of the monetary metals removes significant disincentives in the Cornhusker State against the ownership and use of the monetary metals.

Meanwhile, LB 1317 revises the state’s formal definition of money by adding language that states: “Money does not include central bank digital currency.”

The new law defines central bank digital currency as “a digital medium of exchange, token, or monetary unit of account issued by the United States Federal Reserve System or any analogous federal agency that is made directly available to the consumer by such federal entities. Central bank digital currency (CBDC) includes a digital medium of exchange, token, or monetary unit of account so issued that is processed or validated directly by such federal entities.”

Sen. Hansen said: “I believe we have to be extra vigilant in our assessment and application of a Central bank digital currency to make sure they do not become a danger to our freedom. That’s why we defined in LB 1317 that CBDC’s are not classified as currency in Nebraska, which should help protect against unwarranted mandates for their use in the future.”

Versions of this “anti-CBDC language” have advanced or signed into law in Tennessee, North Carolina, and Florida, South Dakota, and Indiana . Congressman Alex Mooney has also introduced a federal measure to block the Federal Reserve’s digital currency scheme.

In his testimony, Cortez discussed the potential risks of adopting a CBDC, including creating a greater ability to track all financial transactions, disallowing certain types of purchases, or even completely “turning off” a targeted individual’s access to money.

Nebraska joins Utah, Wisconsin, and Kentucky as states to have enacted pro-sound money legislation into law so far in 2024.

Currently ranked 22nd in the 2024 Sound Money Index, Nebraska’s ranking is expected to rise.

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

Goldilocks' Comments and Global Economic News Monday AM 5-13-24

Good Morning Dinar Recaps,

The link below provides information on Vietnam's review by the US Department of Commerce regarding Vietnam's ability to move into a Market Economy.

My understanding from the previous article on Vietnam reviewed is that this is not a graded review. It is simply a valuation of the types of goods and services they can provide comprehensively.

Vietnam is showing steady growth in several areas of their Market. Their potential to increase National Capital Investment opportunities on a Global scale is evident.

Clearly, hurdles are being cleared for Vietnam to move into a Market Economy. A Market Economy will allow them to freely move their money through supply and demand.

******************************

Credit Valuation Adjustments on their currency will be determined by Vietnam's ability to move their goods and services near and far at competitive rates.

© Goldilocks

https://vietnamnet.vn/en/vietnam-business-news-may-12-2024-2279536.html

~~~~~~~~~

Vietnam's Foreign Exchange Rate Review:

HCMC (Saigon) inspects authorized foreign exchange agents.

The State Bank of Vietnam-Ho Chi Minh City Branch (SBV-HCMC) has urged commercial banks to conduct inspections of their authorized foreign exchange agents and submit reports on the findings to the SBV-HCMC no later than June 15, 2024.

The SBV-HCMC has issued a letter requesting commercial banks and branches of foreign banks authorized to engage in foreign exchange activities within the city to conduct inspections of the authorized foreign exchange agents appointed by commercial banks.

Accordingly, commercial banks are required to inspect their authorized foreign exchange agents, covering compliance with legal regulations, adherence to foreign exchange agency contracts, identification of any existing limitations or misconduct, and the outcomes of any corrective actions taken.

The SBV has urged commercial banks to conduct these inspections on authorized foreign exchange agents appointed by banks to ensure compliance with regulations governing foreign currency transactions and the appropriate use of foreign currency, thus contributing to promoting the development of production and business activities, import-export, tourism, and services.

Simultaneously, commercial banks authorized to delegate foreign exchange agents must strictly adhere to all legal regulations regarding the delegation of authority to economic organizations to ensure that the appointed agents comply with legal requirements, adhere to contracts, and play a crucial role in stabilizing foreign exchange rates, the foreign exchange market, and socio-economic development.

VietnamNet

~~~~~~~~~

Peter Schiff: Gold, Silver 'Ready to Explode Higher' — Sees 'Biggest Precious Metals Bull Market in History' – Markets and Prices Bitcoin News

~~~~~~~~~

US Scrutiny of Tether Could Disrupt Crypto Ecosystem, Ripple CEO Warns – News Bytes Bitcoin News

~~~~~~~~~

***********************************

Franklin Templeton CEO says all ETFs and mutual funds will be on blockchain | CoinTelegraph

~~~~~~~~~

JPMorgan’s Onyx to industrialize blockchain PoCs from Project Guardian | CoinTelegraph

~~~~~~~~~

IMF Official: Countries Are Reevaluating Their Reliance on the US Dollar – Economics Bitcoin News

~~~~~~~~~

BRICS joining hands with North Korea to fight against US dollar dominance? | The News

~~~~~~~~~

The Ticking Time Bomb Has Started For Tether! When It Erupts, EVERYTHING WILL FALL Including XRP!! | Youtube

~~~~~~~~~

Recession has begun since October of 2023 | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Good Evening Dinar Recaps,

Breaking: Ripple CEO Brad Garlinghouse on SEC Lawsuit, Crypto Predictions, XRP Victory | CoinGape

If you think that cryptocurrency is not part of the Presidential race this year, you might want to think again. The population is watching very closely on how Congress deals with our new digital economy.

At the end of June, our Markets in Crypto Assets and Stablecoins are about to become law. We have some coins that just simply won't cut the mustard after that date.

These new regulations becoming law will set directives on their use and their value going forward. Gold and other Commodities will back these tokenized assets and stablecoins that are going to be backed with enough gold and other commodities to keep these digital currencies at a stable value to represent their countries' currency.

Quite simply, unless you hold a digital asset that is part of the new QFS, you may find some of your assets being either banned or just simply going away.

Goldilocks' Comments and Global Economic News Sunday Evening 5-12-24

Good Evening Dinar Recaps,

Breaking: Ripple CEO Brad Garlinghouse on SEC Lawsuit, Crypto Predictions, XRP Victory | CoinGape

If you think that cryptocurrency is not part of the Presidential race this year, you might want to think again. The population is watching very closely on how Congress deals with our new digital economy.

At the end of June, our Markets in Crypto Assets and Stablecoins are about to become law. We have some coins that just simply won't cut the mustard after that date.

These new regulations becoming law will set directives on their use and their value going forward. Gold and other Commodities will back these tokenized assets and stablecoins that are going to be backed with enough gold and other commodities to keep these digital currencies at a stable value to represent their countries' currency.

Quite simply, unless you hold a digital asset that is part of the new QFS, you may find some of your assets being either banned or just simply going away.

At the end of June, utility case digital assets will begin to drive the market over speculation, and the cryptocurrencies that survive going forward will have a purpose.

This could cause a Black Swan Event temporarily in the markets as new Tokenized Assets become adopted on a massive scale. Every sector of the market will begin feeling the pressures of movement into a real value in the second half of this year.

Ripple will begin to move assets across borders near and far. It will begin creating a level of competition with the dollar and other currencies, but the ability to level off Currency Market opportunities will commence at that time.

Ripple will be the common currency used to make currencies around the world have a real chance at going to a real value based on demand and supply backed by commodities. CoinGape

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

US House Committee set to address regulatory issues over digital assets through review of FIT21 Act | FX Street

The House Committee on Rules publicly announced intentions to address digital asset regulatory issues.

Financial Innovation and Technology for the 21st Century Act would be reviewed to better address the state of digital assets.

Billionaire Mark Cuban says that crypto is the way to win the votes of younger and independent Americans.

~~~~~~~~~

Vietnam welcomes US consideration of market economy's status for VN | VietnamNet

~~~~~~~~~

Vietnam: Market-economy status shouldn’t require a ‘perfect score’ | InsideTrade

~~~~~~~~~

📈 Facing Today's #stagflation Reality | Youtube

~~~~~~~~~

Uphold CEO On XRP, ODL & Mass Adoption! | Youtube

~~~~~~~~~

FYI: I only post in this room, and people are welcome to take any information out of this room to other places.

I do not post outside of dinar land, but I have seen this information throughout the internet inside professional business venues.

This is a free gift to the group of people that I am a part of and always will be.

© Goldilocks

~~~~~~~~~

Leading European bank to halve oil and gas exposure by 2025 | Offshore Technology

~~~~~~~~~

Standard Chartered Bank to fund green Chinese firms in Africa-Xinhua | English News

~~~~~~~~~

Scaling AML compliance with AI to prepare for the next black swan event | BAI

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Good Evening Dinar Recaps,

EUROPEAN BANKING AUTHORITY MICA ANNOUNCEMENT:

"The EBA publishes final draft technical standards under the Markets in Crypto-Assets Regulation (MICA)"

Specifically, stablecoins and tokenized assets are currently in the comment stage and ready for the white papers.

A white paper is a final document ready for implementation for business owners in an industry to utilize as a reference guideline. In this case, this particular white paper is for countries around the world to use these stablecoin and asset regulations as a guideline for creating a standardized stablecoins and digital assets they can use Globally.

Remember, Stablecoins and Market assets are a digital representation of a country's currency and the assets they pay for going forward. The standardization process of our Global currencies is currently in their final phases. EBA Europa CorporateFinanceInstitute

© Goldilocks ~~~~~~~~~

Goldilocks' Comments and Global Economic News Saturday Evening 5-11-24

Good Evening Dinar Recaps,

EUROPEAN BANKING AUTHORITY MICA ANNOUNCEMENT:

"The EBA publishes final draft technical standards under the Markets in Crypto-Assets Regulation (MICA)"

Specifically, stablecoins and tokenized assets are currently in the comment stage and ready for the white papers.

A white paper is a final document ready for implementation for business owners in an industry to utilize as a reference guideline. In this case, this particular white paper is for countries around the world to use these stablecoin and asset regulations as a guideline for creating a standardized stablecoins and digital assets they can use Globally.

Remember, Stablecoins and Market assets are a digital representation of a country's currency and the assets they pay for going forward. The standardization process of our Global currencies is currently in their final phases. EBA Europa CorporateFinanceInstitute

© Goldilocks

~~~~~~~~~

"On May 7, 2024, the European Banking Authority (EBA) published three final drafts of technical standards developed under Regulation (EU) 2023/1114 on crypto-assets, the so-called Market in Crypto-Assets Regulation (MICA), published in the Official Journal of the European Union on June 9, 2023.

With reference to the timeline for applicability of the MICA Regulation, it will be applicable in its entirety from December 30, 2024; however, the requirements set for asset-referenced tokens and e-money tokens will be applicable starting from June 30, 2024."

I know some of you look for dates and rates only, so I'm going to make the above articles more specific to those looking for important dates.

On June 30th, the digital markets and the e-money used to pay for those assets through the banking system are to be done by June 30th, 2024. PwC TLS

© Goldilocks

~~~~~~~~~

MICA activating new laws on June 30th, 2024 regarding our digital assets and stablecoins will begin the process of institutional money being moved across borders.

This will begin the process of putting price pressures on foreign currency exchange rates going forward. This does not mean we'll see those changes right away, but we will begin seeing movements of money in ways we have not seen before.

Credit valuation adjustments will be happening across the board throughout the second half of this year. Some assets will go up and others will go down. In the end all assets will be in process of finding their equilibrium inside the new digital economy.

© Goldilocks

~~~~~~~~~

5 Major Banks Closing Many Locations in Idaho and Washington State | LiteOnline

~~~~~~~~~

Treasury and IRS Release Final Regulations on Credit Transferability | JD Supra

On April 25, 2024, the U.S. Department of the Treasury (Treasury) and the Internal Revenue Service (IRS) issued final regulations (the Final Regulations) regarding the election to transfer energy tax credits under Section 6418 of the Internal Revenue Code of 1986, as amended (the Code), pursuant to changes authorized by the Inflation Reduction Act of 2022 (IRA). The Final Regulations update the initial proposed regulations issued on June 14, 2023 (the Proposed Regulations), discussed by Wilson Sonsini, relating to the transfer of eligible credits.

~~~~~~~~~

JPMorgan Chase Implements Quantum-Secured Network | IOT World Today

JPMorgan Chase researchers have successfully implemented a high-speed, quantum-secured crypto-agile network (Q-CAN), connecting two data centers over existing fiber optic cables.

The demonstration was conducted in an air-gapped environment over 29 miles of deployed telecom fiber across Singapore and achieved 45 days of continuous operation.

Quantum-safe communication is an increasingly pressing issue as large-scale quantum computers could break the cryptography used to secure transmissions.

~~~~~~~~~

This Week in AI: Digital Agents, Quantum AI and Spy Chatbots | Pymnts

~~~~~~~~~

Banking Giant Wells Fargo Holds Spot Bitcoin ETF on Behalf of Clients, According To New SEC Filing - The Daily Hodl

~~~~~~~~~

Senate Urged to Swiftly Overturn SEC's 'Misguided' Crypto Rules – Regulation | Bitcoin News

~~~~~~~~~

US Elections: Stand With Crypto forms committee to support pro-crypto candidates | FinExtra

~~~~~~~~~

🚨*Ripple CEO Brad Garlinghouse Warns About A Blackswan Coming*🚨 | Twitter

He Discusses How The US Government Is Coming After Tether.

~~~~~~~~~

Goldilocks Posts are Broken Down Weekly on Saturday Nights!

TONIGHT! Saturday Night Live Call with Freedom Fighter breaking down Goldilocks Posts from this Week, with Jester too! Come join the call and learn what is happening with the new QFS!

SNL Call Link Freedom Fighter's Bio

9 pm EDT / 8 pm CDT / 6 pm PDT

The Saturday Night Q & A room will be open an hour before the call and remain open during the call for Questions to be answered during the call at the end!

The calls are recorded and will be posted in the Archive room after the call

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24

Good evening Dinar Recaps,

"The U.S. is in a dilemma about whether to upgrade the non-market economy status of Vietnam to that of a market economy."

The U.S. Department of Commerce has until late July to complete this review and decision. A market economy would bring with it significant trade relationship opportunities.

Vietnam would become a country where supply and demand would determine prices on their goods and services.

A shift in a monetary policy such as this would bring more power back to the people and less to the government.

It would move from government intervention powers for the stabilization of their currency to incentives toward supply and demand determined by the people and the industries they promote.

Goldilocks' Comments and Global Economic News Friday Evening 5-10-24