Seeds of Wisdom RV and Economic Updates Wednesday Evening 7-24-24

Good Evening Dinar Recaps,

XRP WHALES Go On $84 MILLION Buying Spree To Lock Down 140 Million Tokens "XRP whales look to have regained their confidence in the XRP token, with recent data showing an accumulation trend among these investors. This is significant as XRP eyes the $1 mark and as these XRP whales could play a role in facilitating such a price rally. "

"Crypto analyst Ali Martinez recently shared data from the on-chain analytics platform Santiment, which shows that XRP whales bought over 140 million XRP ($84 million) this past week."

"This increase in whale accumulation is also a factor that could contribute to such a rally, as these investors could use their market influence to push XRP’s price to new highs. Santiment recently noted that XRP’s impressive rebound is supported by the rising level of coins held by xrp whales and sharks with over 100,000 tokens. According to Santiment, this category of investors now holds over 51 billion XRP tokens, a new all-time high (ATH). "

Good Evening Dinar Recaps,

XRP WHALES Go On $84 MILLION Buying Spree To Lock Down 140 Million Tokens

"XRP whales look to have regained their confidence in the XRP token, with recent data showing an accumulation trend among these investors. This is significant as XRP eyes the $1 mark and as these XRP whales could play a role in facilitating such a price rally. "

"Crypto analyst Ali Martinez recently shared data from the on-chain analytics platform Santiment, which shows that XRP whales bought over 140 million XRP ($84 million) this past week."

"This increase in whale accumulation is also a factor that could contribute to such a rally, as these investors could use their market influence to push XRP’s price to new highs. Santiment recently noted that XRP’s impressive rebound is supported by the rising level of coins held by xrp whales and sharks with over 100,000 tokens. According to Santiment, this category of investors now holds over 51 billion XRP tokens, a new all-time high (ATH).

"n addition to this significant whale accumulation, network activity on the XRP ledger (XRPL) also paints a bullish picture for XRP. Santiment revealed that the XRPL is witnessing a notable increase in new addresses created and total addresses interacting on the network. Both metrics are at their highest levels since March.

"Specifically, data from Santiment shows that 1,721 new XRP wallets were created on July 18 and that 47,363 individual addresses interacted on the network that day. This is also a bullish signal as it suggests that retail investors are also flocking into the XRP ecosystem in anticipation of higher prices from the crypto token. XRP’s technicals also suggest that a significant price rally is on the horizon. "

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

South African Startup Neonomad to Launch Rand-Backed STABLECOIN

"South African fintech startup Neonomad, a hybrid exchange platform, is set to launch Zarcoin (ZARC), a rand-backed stablecoin. The goal of Zarcoin is to bridge the gap between traditional and crypto finance while enabling seamless local and cross-border transactions."

"According to a report, the STABLECOIN is set to cater to both unbanked and banked South Africans, utilizing Solana Pay for instant and low-cost transactions."

"For his part, Devon Krantz, COO of Neonomad, stated that the STABLECOIN and the firm’s app are intended to facilitate multiple offerings, even in the decentralized finance (defi) space. He added that Neonomad’s platform is specially designed to transition users from traditional banking platforms to the startup’s “secure STABLECOIN ecosystem.”

"Meanwhile, the report revealed that the hybrid exchange platform also plans to launch an educational program to boost cryptocurrency usage among South Africans. Neonomad aims to achieve this by launching a coworking space for crypto enthusiasts in Cape Town sometime during the last quarter of 2024."

@ Newshounds News™

Read more: Bitcoin

~~~~~~~~~

TWO CALLS COMING SOON

1. A call from ISAAC - WHO IS ISSAC - BIO

Isaac has SKRs, buyers, and contact with the Paymasters' Paymaster and Chinese Dragons.

2. A call with BOB LOCK - COMMON LAW - TRUSTS - ZIM

Read more: Isaac

Read more: Bob Lock

Calls are recorded and in the archive room.

When we have the details they will be shared all over. Stay tuned.

Let's cover the questions you might have.

Where are we with the RV in News?

▪️ Join: Newshounds News

▪️ Join: QA RV Classroom

▪️ Listen: Podcast

What about trust, Zim to RV updates?

▪️Join: Bob Lock RV - Trust - New Book

What are the updates on crypto and more?

▪️Join: Start Here

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Evening 7-24-24

Iraq, US Agree To Reach Understanding On Concept Of New Phase Of Security Relationship

Wednesday 24 July 2024 | Politics Number of readings: 192 Baghdad / NINA / Iraq and the United States of America agreed to reach an understanding on the concept of a new phase of the bilateral security relationship, which includes cooperation through liaison officers, training, and traditional security cooperation programs.

The two sides agreed, in a joint statement issued after the second round of talks in Washington, to commit to developing Iraq's security and defense capabilities and their determination to deepen security cooperation across a full range of issues to advance the common interest of both countries in the security and sovereignty of Iraq, and in the stability of the region.

The 2024 Joint Security Cooperation Dialogue builds on the discussions held during the visit of the Iraqi-Sudanese Prime Minister to Washington, DC, in April of this year and the inaugural Joint Security Cooperation Dialogue last summer.

Iraq, US Agree To Reach Understanding On Concept Of New Phase Of Security Relationship

Wednesday 24 July 2024 | Politics Number of readings: 192 Baghdad / NINA / Iraq and the United States of America agreed to reach an understanding on the concept of a new phase of the bilateral security relationship, which includes cooperation through liaison officers, training, and traditional security cooperation programs.

The two sides agreed, in a joint statement issued after the second round of talks in Washington, to commit to developing Iraq's security and defense capabilities and their determination to deepen security cooperation across a full range of issues to advance the common interest of both countries in the security and sovereignty of Iraq, and in the stability of the region.

The 2024 Joint Security Cooperation Dialogue builds on the discussions held during the visit of the Iraqi-Sudanese Prime Minister to Washington, DC, in April of this year and the inaugural Joint Security Cooperation Dialogue last summer.

They agreed to establish a bilateral High Military Committee to analyze three factors, the threat from ISIS, operational requirements, and the capability levels of the Iraqi security forces, in addition to continuing consultations on enhancing bilateral cooperation to ensure the lasting defeat of ISIS after more than a decade of cooperation between the international coalition and Iraq.

The Joint Security Cooperation Dialogue continued on the basis of the work of the High Military Committee over the past six months and in recognition of the upcoming tenth anniversary of the Global Coalition to Defeat ISIS military mission in Iraq.

A detailed joint statement on the future of the Global Coalition’s mission and presence in Iraq is scheduled to be issued shortly after the conclusion of the Higher Military Committee.

The two sides affirmed the importance of Iraq’s continued support for the Global Coalition to Defeat ISIS in Syria and around the world.

In addition, the delegations reached an understanding on the concept of a new phase in the bilateral security relationship, which includes cooperation through liaison officers, training, and traditional security cooperation programs.

The delegations also discussed efforts to build the operational capacity of Iraqi security forces through U.S. military assistance and security cooperation programs, including through Foreign Military Sales and Foreign Military Financing.

The two sides emphasized the importance of continued cooperation to ensure the sustainability of U.S. military equipment used by Iraqi security forces. The delegations emphasized the value of professional military education and technical training programs and decided to enhance both.

In support of Iraq’s sovereignty and security, the delegations emphasized that the advisory mission is in Iraq at the invitation of the Iraqi government to support Iraqi security forces in the fight against ISIS and to support and develop Iraqi security forces, including Kurdish security forces.

The Iraqi representatives affirmed their absolute commitment to protect U.S. and Coalition personnel, advisors, convoys, and diplomatic facilities.

Delegations discussed the continued urgent need to return displaced persons and detainees currently in northeastern Syria to their countries of origin and to support reintegration efforts into local communities in Iraq. Repatriations represent an important line of effort in the ongoing fight against ISIS./ End https://ninanews.com/Website/News/Details?Key=1143380

Iraqi Banking System.. A Significant Increase In The Number Of Bank Accounts And The Volume Of Deposits For Citizens

Time: 2024/07/24 13:01:43 Read: 1,716 times {Economic: Al Furat News} The banking system in Iraq is gradually regaining citizens’ confidence with the increase in the number of bank accounts in the country.

Banking systems around the world are facing increasing challenges in light of rapid economic and financial changes. To ensure the stability of these systems and protect depositors’ funds, many countries are moving towards joining the International Association of Deposit Insurers. This membership is not just a formality, but a strategic step that carries significant benefits for member countries and their banking systems.

In Iraq, economic and political challenges over the decades have provided a strong justification for keeping money at home rather than in banks. However, the accession of the Iraqi Deposit Insurance Corporation (ICDI) to the International Association of Deposit Insurers was a decisive step in improving confidence in the banking system.

Since its accession, Iraq has witnessed a significant increase in the number of bank accounts and the volume of deposits, reflecting a significant improvement in citizens’ confidence in banks. This development enhances Iraq’s ability to attract investment and support economic growth by converting savings into productive investments.

In a world characterized by increasing economic and financial interdependence, countries cannot operate in isolation from each other. Membership in international deposit insurance bodies reflects countries’ commitment to international cooperation and exchange of expertise, and confirms their relentless pursuit of financial stability and the protection of depositors’ funds.

This membership is not just a formality, but a strategic investment in the future of the banking system and the national economy as a whole.

International cooperation: the cornerstone of deposit insurance

International bodies provide a unique platform for the exchange of expertise and knowledge between member states. National financial institutions can benefit from the successful experiences of other countries in the field of deposit insurance, and avoid the mistakes made by some countries.

This ongoing exchange contributes to the development and modernization of deposit insurance policies and procedures in line with international best practices. Joining the International Association of Deposit Insurers (IADI) enhances the transparency and credibility of the national banking system.

A country’s commitment to strict international standards in the field of deposit insurance sends a positive message to citizens and investors, stating that their deposits with banks that are members of the deposit insurance system are in safe hands and that the banking system is subject to effective local monitoring and supervision.

International bodies do not only provide a platform for the exchange of expertise, but also provide technical and advisory support to their members.

National institutions can benefit from the expertise of international specialists in developing and implementing effective deposit insurance policies, assessing potential risks, and preparing for financial crises.

By adhering to international standards and implementing best practices, national institutions can reduce the risk of financial crises and enhance the stability of the banking system.

This stability is not an end in itself, but rather a means to achieve broader economic and social goals, such as increasing economic growth rates and creating job opportunities. When citizens and investors trust the banking system, they are more willing to deposit their money in banks.

This increased confidence leads to an increase in the volume of deposits available for investment, which supports economic activity and contributes to achieving sustainable development.

The impact of membership in international bodies is not limited to enhancing financial stability and confidence in the banking system, but extends to supporting economic development. Increasing the volume of deposits available for investment can contribute to financing development projects, providing loans to small and medium enterprises, and creating new job opportunities.

Malaysia:

Malaysia joined the International Association of Deposit Insurers, which helped improve deposit insurance policies and increase confidence in the banking system.

This accession led to an increase in the volume of bank deposits and greater financial stability, which contributed to supporting economic growth in the country.

South Korea:

After the Asian financial crisis in the late 1990s, South Korea joined the International Association of Deposit Insurers. International membership helped restore confidence in the banking system and stabilise the national economy, allowing South Korea to achieve a rapid economic recovery. LINK

"Vigilant Guardian"... Harmonious Supervisory Cooperation To Guarantee Citizens' Deposits In Iraqi Banks

Time: 2024/07/24 Reading: 923 times {Economic: Al Furat News} At the heart of the Iraqi financial system, the harmonious cooperation between the Banking Control Department and the Iraqi Deposit Insurance Corporation (ICDI) is evident as two fundamental pillars in the edifice of financial stability.

Despite the apparent overlap in their duties, a deeper look into the details of their roles reveals a precise functional integration that ensures the safety and strength of the country’s banking sector.

The Banking Control Department’s mission is to supervise and closely monitor banking institutions operating in Iraq. It acts as a vigilant guardian that ensures strict adherence to applicable financial and accounting standards.

The department’s responsibilities extend to assessing banks’ financial performance and ensuring their compliance with relevant banking laws and regulations, particularly with regard to liquidity and solvency requirements. In times of crisis, the department intervenes decisively to contain the repercussions and provide the necessary support to maintain the stability of the banking system and prevent its collapse.

On the other hand, the Iraqi Deposit Insurance Corporation (ICDI) plays a pivotal role in protecting and ensuring the safety of public deposits. It is a safety net that protects savings from loss in the event of a bank going bankrupt.

By providing guarantees on bank deposits up to a certain limit, ICDI instills confidence in depositors and encourages them to save and invest in banks instead of hoarding, which contributes to increasing the liquidity available to the national economy, thus driving growth and development.

The integration between the Banking Supervision Department and the ICDI lies in the harmonious distribution of roles and tasks that ensures the achievement of the ultimate goal, which is to preserve the banking system and enhance its stability.

While the Department plays the role of the “guardian” that monitors and guides, the ICDI plays the role of the “safe haven” that protects and provides reassurance. This precise functional integration reflects the close cooperation between the two institutions, and demonstrates that their roles are not conflicting, but rather complementary and harmonious to achieve a common goal, which is to protect deposits and ensure their successful and safe use by banks.

The Iraqi experience is the best evidence of the effectiveness of this integration. Following Iraq’s accession to the International Association of Deposit Insurers, the country witnessed a significant improvement in the stability of its financial system, and a significant increase in the volume of bank deposits, indicating the growing confidence of citizens in the banking system.

These positive results confirm that close cooperation between the Banking Supervision Department and the ICDI plays a crucial role in achieving the desired financial stability.

In conclusion, there is no doubt that the integration between the Banking Control Department and the Iraqi Deposit Insurance Corporation constitutes a model to be emulated for constructive cooperation between state institutions.

This integration contributes to achieving the common goals of protecting depositors’ funds, enhancing financial stability, and driving sustainable economic development in Iraq. LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 7-24-24

Good Afternoon Dinar Recaps,

PUTIN WANTS RUSSIA TO EMBRACE THE DIGITAL RUBLE "The digital ruble has proven its viability and it is time to move on to a wider use of the currency, Russian President Vladimir Putin said at a meeting about the economy." "Digital currency works much the same way as national currencies used by central banks of various countries, making transactions more transparent and easier to track.

Russia is not the first country to think about going digital; the leader in this sphere is China, which was among the first nations to widely introduce digital currency with the digital yuan, Natalya Milchakova, lead analyst at Freedom Finance Global, explained to Izvestia. Only a few countries have fully switched over to using digital currencies, mostly countries in the Caribbean, such as the Bahamas and Jamaica."

""Russia wants to be at the cutting edge of modern technologies, including financial services. The DFA (tokens) market is already taking off in the country, including those issued by major industrial enterprises in order to inject money into promising projects," Milchakova explained.

Good Afternoon Dinar Recaps,

PUTIN WANTS RUSSIA TO EMBRACE THE DIGITAL RUBLE

"The digital ruble has proven its viability and it is time to move on to a wider use of the currency, Russian President Vladimir Putin said at a meeting about the economy."

"Digital currency works much the same way as national currencies used by central banks of various countries, making transactions more transparent and easier to track.

Russia is not the first country to think about going digital; the leader in this sphere is China, which was among the first nations to widely introduce digital currency with the digital yuan, Natalya Milchakova, lead analyst at Freedom Finance Global, explained to Izvestia. Only a few countries have fully switched over to using digital currencies, mostly countries in the Caribbean, such as the Bahamas and Jamaica."

""Russia wants to be at the cutting edge of modern technologies, including financial services. The DFA (tokens) market is already taking off in the country, including those issued by major industrial enterprises in order to inject money into promising projects," Milchakova explained.

Putin wants to take this a step further: to move on to a wider large-scale implementation of the digital ruble in the economy, business and finance. This may help the government in terms of controlling the budget, cutting the cost of budget payments and easing trans-border transactions."

"The digital ruble has a chance to become a full-fledged payment instrument for individuals and companies but to make this a reality, the government has a lot of work to do, and it must learn from past mistakes made by other countries when implementing such currencies.

There, people saw certain risks for financial confidentiality or restrictions of financial freedom," the legislator noted in a conversation with Izvestia."

@ Newshounds News™

Read more: TASS

~~~~~~~~~

WHAT IS "JUNK SILVER?"

"United States 90% silver coins were minted to be used as money, were used as money, and could be used as money again. Minted before 1965, they are called junk silver coins because they have no collector or numismatic value. The coins are bought and sold for the value of their silver content."

"When minted, a bag of 90% junk silver coins contained 723 ounces of silver, but because of wear a smelted bag of dimes or quarters will net about 715 ounces. A bag of half-dollars will net a little more, maybe 718-720 ounces because half-dollars did not circulate as much as dimes and quarters, and, therefore, did not suffer as much wear."

"Because a “bag” ($1000 face) contains approximately 715 ounces of silver, it tracks the spot price of silver. If silver goes up ten cents, a bag of US silver coins rises $70 or so; however, when junk silver coins are in short supply their premiums can increase."

"Although many investors buy junk silver coins as bullion investments, other investors buy junk US silver coins for “survival purposes.” These buyers fear the worst for the dollar, that it will be printed until it becomes worthless. If this “worst-case scenario” were to become reality, US silver coins would be used for the purpose they were originally minted: as money."

@ Newshounds News™

Read more: CMI Gold & Silver

~~~~~~~~~

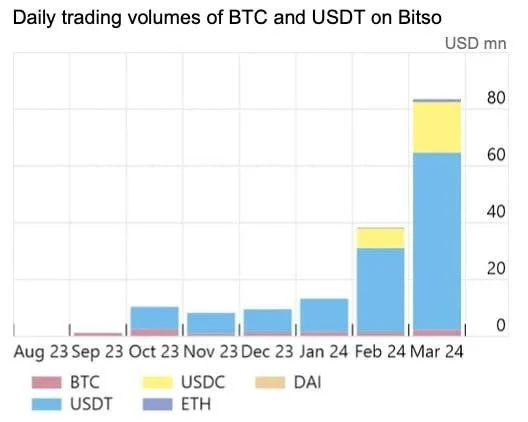

STABLECOIN ACTIVITY IN ARGENTINA

"A graph of Bitso crypto exchange activity in Argentina demonstrates the high level interest in stablecoins. Stablecoins entirely dominate the daily volumes as opposed to other cryptocurrencies. It would be easy to assume that Argentinians are not interested in Bitcoin, but that’s not quite true."

"At first we thought there might be a mistake. However, there are several rationales for both these graphs to be accurate.

Take the scenario of someone who lives in Argentina. When they receive their wages they convert them to dollar stablecoins. Then whenever they want to spend money, they draw down dollars. That would create a lot of stablecoin activity. The same person could still have their savings in Bitcoin. Hence. the daily transactions could be evidence of everyday spending."

@ Newshounds News™

Read more: Ledger Insights

~~~~~~~~~

What’s keeping silver down while gold hold above $2,400?

"(Kitco News) - Gold has been able to maintain a solid uptrend, building a new base with each rally; however, this momentum has not filtered through the entire sector as silver struggles to find its footing."

"While gold is fighting for support at higher lows around $2,400 an ounce, silver is struggling around $29 an ounce. Silver's underperformance compared to the yellow metal has pushed the gold/silver ratio to its highest level in two months, back above 82 points."

"Some analysts have said that gold is benefiting as a safe-haven asset because of rising geopolitical uncertainty, fueled by the U.S. elections in November."

“Silver usually follows the price movements of gold disproportionately. However, this has recently only applied to the downside. The previous upward movement in gold following the US inflation figures was more or less ignored by silver,” said Carsten Fritsch, Commodity Analyst at Commerzbank.

“The relative weakness in silver is likely due to the weakness in base metals. This is because industrial applications are expected to account for almost 60% of silver demand this year.”

"Although silver continues to struggle, many investors are still not ready to give up on the precious metal. In a recent interview with Kitco News, Robert Minter, Director Of Investment Strategy at abrdn, said that he expects silver to eventually outperform gold as the Federal Reserve starts to cut interest rates."

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

SENATOR CYNTHIA LUMMIS RELEASES REPORT ATTACKING BIDEN'S MINING TAX

The pro-crypto senator claimed that Bitcoin mining consumes as much energy as household appliances such as tumble dryers.

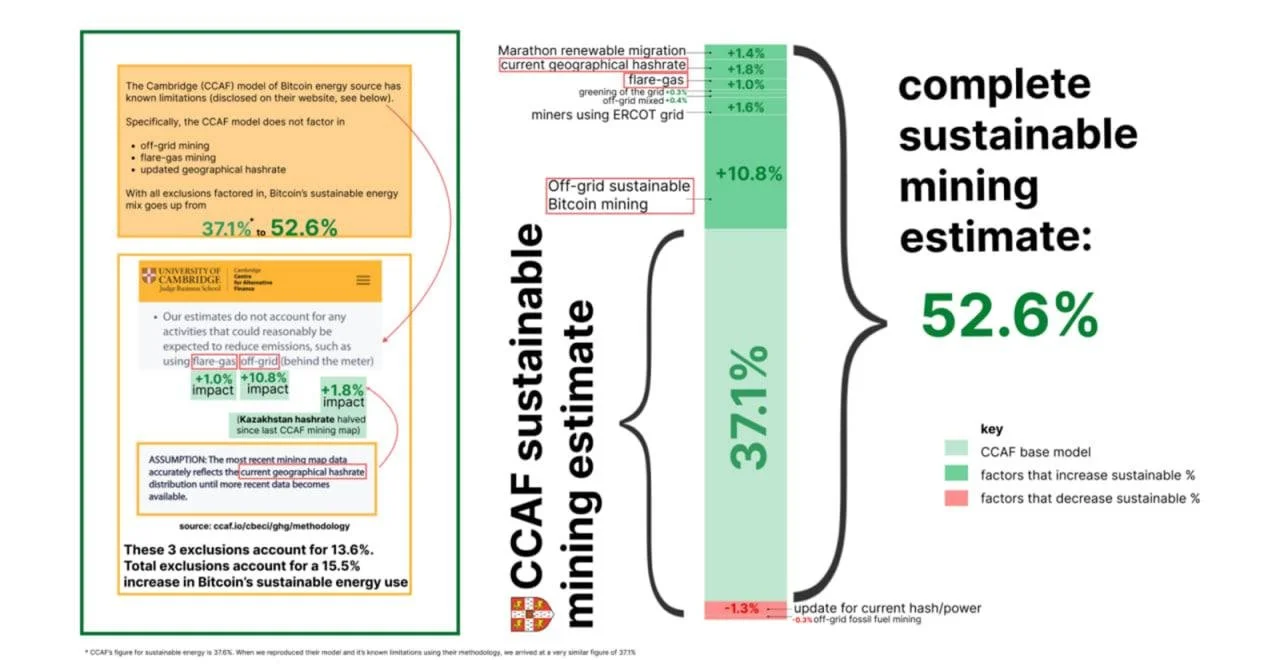

On July 23, Senator Cynthia Lummis released a report arguing against the Biden administration’s proposed 30% excise tax on the energy consumed by Bitcoin miners.

The report, titled "Powering Down Progress: Why A Bitcoin Mining Tax Hurts America", put the Bitcoin

BTC mining industry into sharper focus, highlighting the benefits of the critical mining infrastructure to the United States' energy grid.

Lummis cited the Bitcoin Energy and Emissions Sustainability Tracker as evidence that Bitcoin mining is cleaner than is commonly imagined, noting that up to 52.6% of BTC mining might be emissions-free.

A breakdown of sustainable Bitcoin mining. Source: Batcoinz

The pro-crypto senator then turned her attention to the increasing role of Bitcoin mining facilities in securing the energy grid. Mining facilities represent large, dynamic electrical loads that can be used to balance and redistribute energy to electrical grids during times of need.

Perhaps no other example illustrates this more than the ongoing efforts between the Electrical Reliability Council of Texas (ERCOT) and Bitcoin miners to stabilize electrical grids. The GOP lawmaker explained that in 2022, Bitcoin miners were able to sell 1500 megawatts of energy back to the grid during peak demand. A similar pattern played out in 2024, with Bitcoin mining infrastructure acting as a Controllable Load Resource for Texas’ grid during winter storm Heather.

A 30% tax would hurt the environment that regulators claim to protect

The Wyoming senator explained that levying a 30% excise tax on Bitcoin miners would disincentivize them from seeking sustainable forms of energy and novel energy recycling techniques. Although Lummis gave the example of sequestering methane from trash dumps to mine Bitcoin, similar examples can be seen in El Salvador, where the government mined 474 Bitcoin using volcanic energy.

Another example of the energy efficiencies introduced by Bitcoin mining can be found in the Satakunta region of Finland, where an entire community of 11,000 individuals is warmed by excess heat produced by a Marathon Digital mining facility.

The mining giant also signed an agreement with Kenya’s government earlier this year to further develop the country’s renewable energy sector, a thriving industry already delivering up to 80% of the country’s energy needs.

The Laffer Curve will get the final laugh

Lummis concluded her report by arguing that increasing taxes on Bitcoin miners will lead to the industry leaving the United States, reducing the sought-after tax revenues. This inverse relationship between tax rates and tax revenue is known as the Laffer Curve.

A chart highlighting Bitcoin hashrate dominance between global powers from 2019-2022. Source: Powering Down Progress by Senator Cynthia Lummis

The senator pointed out that this has already happened in China, where the 2021 mining ban drove out the once-thriving mining industry.

Before the ban, Chinese miners controlled a majority of the Bitcoin network’s hashrate.

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

What are the strongest currencies in the world? (2024)

Ever wondered which is the strongest currency in the world? There are lots of factors which can push a currency up the global rankings, from low inflation to a strong economy, to interest rates or oil and gas exports.

What is currency strength?

According to Nasdaq a strong currency is:

“A currency whose value compared to other currencies is improving, as indicated by a decrease in the direct >exchange rates for the currency”.

Put simply, the definition of a ‘strong currency’ is when a currency is worth more than another country's currency. ‘Currency strength’ refers to how strong or weak a currency is at any given time.

What are the top 10 strongest currencies?

1. Kuwaiti dinar

The Kuwaiti dinar (KWD) is the world’s strongest currency, and this is for a number of reasons. For starters, Kuwait has one of the largest oil reserves in the world.

It’s also a wealthy country, whose government has prioritised the growth of the country’s private sector, the diversification of the economy and responsible budgetary policies. All of these factors have contributed to the stability and resilience of the Kuwaiti dinar.

Today 1 USD = 0.305640 KWD

2. Bahraini dinar

The second most valuable global currency is the Bahraini dinar (BHD). Oil and gas again play a part in the Bahraini dinar’s strength, as a major part of the country’s income derives from exports of gas and oil.

Bahrain has also become a regional financial hub, which has attracted international capital and helped to expand the country’s economy.

Today 1 USD = 0.377000 BHD

3. Omani rial

The Omani rial (OMR) is another of the world’s strongest currencies, again thanks to exports of oil and gas. However, the government in Oman is working on lessening the country’s dependence on oil markets. It has taken steps to support other industries in order to diversify the economy, which should help to sustain the resilience of the rial.

Today 1 USD = 0.385015 OMR

4. Jordanian dinar

The Jordanian dinar (JOD) is high up the list of the world’s strongest currencies for a combination of reasons. It is an oil and gas exporting nation, but is less dependent on this than some of its neighbours.

Other factors contributing to the dinar’s success include the actions of Jordan’s central bank, which has taken a cautious approach to monetary and fiscal policy. It is dedicated to price stability and exchange rate flexibility, as well as keeping ample foreign exchange reserves to protect against external shocks.

Today 1 USD = 0.708500 JOD

5. British pound

Now we come to a familiar currency - the British pound sterling or GBP. The pound is the fifth-strongest world currency in 2024, despite the turbulence of Brexit and uncertainty surrounding ties between the UK and the EU. The UK has also experienced political upheaval, such as the ‘mini budget’ by then-PM Liz Truss which triggered a major drop in the value of the pound.

While the pound may have experienced volatility over the last few years, it remains one of the most popularly traded currencies. Its strength and resilience is partly down to the UK’s reputation as one of the world’s biggest countries by Gross Domestic Product (GDP).

Today 1 USD = 0.773784 GBP

*️⃣NOTE: Since this article was published the British pound has moved to 6th place and the Gibraltar pound has move up to the 5th position.

6. Gibraltar pound

In the sixth spot on our list is the Gibraltar pound (GIP). The driving force behind its stability and strength is its relationship to the British pound (GBP). The GIP is pegged to the GBP, and the two countries maintain a close relationship.

Today 1 USD = 0.773754 GIP

7. Cayman Islands dollar

The Cayman Islands dollar (KYD) derives its strength and stability due to the territory’s status as a leading global financial hub. The islands are home to a wide range of financial institutions, enterprises and investment funds, all attracted by a robust regulatory system, advanced banking infrastructure and advantageous tax policies.

Today 1 USD = 0.820000 KYD

8. Swiss franc

The 8th strongest global currency is the Swiss franc (CHF). The Swiss National Bank (SNB) ensures the stability of the currency with a range of crucial measures. This includes implementing monetary policy, maintaining price stability and supervising banks and the financial sector in Switzerland. All of this bolsters investor confidence in the Swiss franc.

Today 1 USD = 0.884350 CHF

9. Euro

The euro (EUR) is one of the world’s major reserve currencies, whose value is influenced by a large number of variable factors. This is because it is the currency of 20 EU member countries, all with their own economic policies.

However, monetary policy and price stability within the region is overseen by the European Central Bank (ECB). The bank has taken steps to maintain the stability and reliability of the euro, primarily by careful management of inflation.

Today 1 USD = 0.921700 EUR

10. US dollar

Last, we have the US dollar (USD) - the world’s 10th strongest currency. You might be surprised not to see the dollar higher up the list, as it is by far the most traded currency on the planet. Plus, the US economy is the biggest in the world in terms of GDP. The dollar is used to price commodities, and it’s also one of the world’s largest reserve currencies. Major US banks are also global leaders.

However, the strength of a currency is determined by complex factors, including supply and demand in the foreign exchange market.

What is the weakest currency in the world?

The Iranian rial (IRR) is the weakest currency in the world.5

What is the most traded currency in the world?

The US dollar is the world’s most traded currency.²

How is foreign currency priced?

There are two main ways that foreign currency is priced. The first uses a floating rate, which is determined by the open market through global supply and demand. If the currency is in demand, its value usually increases.

The second pricing method is a fixed rate, also known as a pegged rate. This is determined by the government through its central bank, and is set against another major global currency (such as USD or EUR, for example).

What is the most stable global currency?

The Swiss franc (CHF) is generally considered to be the most stable currency in the world in 2024.6

What is the strongest currency pair?

The strongest currency pair is the euro (EUR) and US dollar (USD),7 as it is one of the most commonly traded and both locations have large and strong economies.

How do I know which currency is stronger?

One of the easiest ways to work out which currency is stronger is to compare one currency to another, using exchange rates. A higher exchange rate suggests that a currency is stronger compared to the other.

In what country is GBP worth the most?

To determine where GBP is worth the most, you would typically look at exchange rates against other currencies. But remember that exchange rates fluctuate constantly based on factors such as economic conditions, interest rates and geopolitical events.

This means you’ll need to look at exchange rate data to see which country's currency offers the most favourable exchange rate against the British pound at any given time. When researching, watch out for hidden fees to make sure you’re getting the fairest price. At Wise, we’re transparent and upfront about the cost, we use the mid-market rate, and never hide fees*.

@ Newshounds News™

Read more: Wise

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Chris Macintosh: We are Facing a 1 in 100-Year Financial Rebalancing

Chris Macintosh: We are Facing a 1 in 100-Year Financial Rebalancing

Palisades Gold Radio: 7-24-2024

Tom Bodrovics welcomes a new guest to the show Chris Macintosh. Chris is the founder of CapitalistExploits and a seasoned hedge fund manager with experience in seven countries.

They engage in a discussion revolving around ongoing recalibrations and rotations in capital markets, focusing primarily on the deindustrialization of the West and financialization as significant shifts over the last few decades.

Chris underlines the disconnect between Western nations' massive market caps and their actual production capabilities. He also discusses short-term changes such as the increasing dominance of few companies in the S&P 500, accounting for a substantial percentage of market capitalization, and passive capital flows from Western economies affecting investing, particularly smaller companies.

Chris Macintosh: We are Facing a 1 in 100-Year Financial Rebalancing

Palisades Gold Radio: 7-24-2024

Tom Bodrovics welcomes a new guest to the show Chris Macintosh. Chris is the founder of CapitalistExploits and a seasoned hedge fund manager with experience in seven countries.

They engage in a discussion revolving around ongoing recalibrations and rotations in capital markets, focusing primarily on the deindustrialization of the West and financialization as significant shifts over the last few decades.

Chris underlines the disconnect between Western nations' massive market caps and their actual production capabilities. He also discusses short-term changes such as the increasing dominance of few companies in the S&P 500, accounting for a substantial percentage of market capitalization, and passive capital flows from Western economies affecting investing, particularly smaller companies.

Chris expands on the potential consequences of a mere 10% rebalance in Western markets, emphasizing instability arising from massive sovereign debts, derivative markets, and potential debt cycle inflation. He highlights the anomaly of passive capital flows toward large cap stocks and the importance of asymmetry in investing for low downside risk with significant upside potential.

Chris mentions automation selling during a downturn and seeking contrarian sectors as an alternative investment strategy. The conversation shifts to cover geopolitical risks, including the possibility of 'great taking' or conflict, having assets outside the financial system in counter-cyclical, counter-jurisdictional asset classes like food, shelter, agriculture, precious metals, and maintaining a long-term perspective.

Chris discusses the importance of education, problem-solving skills, diversification, and taking action to deal with fear. He prefers Latin and South America for living and investing.

He advocates for banking in multiple jurisdictions and investing in cash-flowing businesses.

Time Stamp References:

0:00 – Introduction

1:07 - Economic Overview & Trends

14:30 - Derivatives & Rebalancing

24:14 - A Silent Bull Market

27:59 - Liquidity Analysis

31:30 - Great Taking & Risks

36:05 - Cloudstrike & Russia

39:08 - War & Capital Shifts

42:57 - Politics Stability & Capital

49:07 - Interesting Jurisdictions

54:19 - Banking & Diversification

58:24 - Fear, Volatility & Action

1:04:13 - Wrap Up

Talking Points From This Episode

- The West's massive market caps vs production capabilities create instability due to debt and derivative risks.

- The impact of passive capital flows on investing, with unloved sectors offering potential protection.

– Preparing for a rotation away from overvalued equities and towards undervalued sectors.

Iraq News Highlights and Points To Ponder Wednesday AM 7-24-24

Causing A Huge Financial Inflation.. Al-Saadi Identifies A Parliamentary "Point Of Contention" Regarding The Drug Law

Policy 2024-07-24 |404 views Alsumaria News - Special: Today, Wednesday, the Deputy Chairman of the Parliamentary Legal Committee, Murtada Al-Saadi, revealed the most prominent differences with the Parliamentary Health Committee regarding the Drug Law, while he pointed out the position of the Ministry of Interior regarding the naming of the law.

Al-Saadi told Sumaria News: "I submitted the drug law proposal at the beginning of the session and we worked on it for more than a year. There were many hostings and its first reading was completed after our efforts with the parliamentary health committee"

He added that "there is a point of disagreement about naming the site and whether it will be an agency, a commission or a directorate," indicating that "the legal committee stresses that it should remain a general directorate for drugs and this is an important part."

Causing A Huge Financial Inflation.. Al-Saadi Identifies A Parliamentary "Point Of Contention" Regarding The Drug Law

Policy 2024-07-24 |404 views Alsumaria News - Special: Today, Wednesday, the Deputy Chairman of the Parliamentary Legal Committee, Murtada Al-Saadi, revealed the most prominent differences with the Parliamentary Health Committee regarding the Drug Law, while he pointed out the position of the Ministry of Interior regarding the naming of the law.

Al-Saadi told Sumaria News: "I submitted the drug law proposal at the beginning of the session and we worked on it for more than a year. There were many hostings and its first reading was completed after our efforts with the parliamentary health committee"

He added that "there is a point of disagreement about naming the site and whether it will be an agency, a commission or a directorate," indicating that "the legal committee stresses that it should remain a general directorate for drugs and this is an important part."

He pointed out that "parties in the Ministry of Interior are working hard to make it a body, and we objected to it because it will cause significant inflation and save huge sums of money, which will result in flabbiness like the rest of the bodies."

He explained that "the committee is now with the Ministry of Health and the vision is one to proceed with preparing the report and working to complete this important law and withdraw all the observations submitted by the representatives."

Earlier this month, the head of the Parliamentary Health Committee, Majid Shankali, said that "the committee will work during the current legislative session on the first amendment to the Narcotics Law of 2017." LINK

President Of The Republic: Iraq Is Politically, Security-Wise And Economically Stable And Supports Human Rights

Time: 2024/07/23 Reading: 169 times

President of the Republic: Iraq is politically, security-wise and economically stable and supports h Screenshot-gallery-97

{Politics: Al Furat News} President of the Republic Abdul Latif Jamal Rashid confirmed today, Tuesday, that Iraq seeks to develop its relations positively with various countries of the world, based on the stability it is witnessing on the security, political and economic levels.

The Presidency of the Republic stated in a statement received by {Al Furat News}, that "Rashid received at the Baghdad Palace, the German Federal Ambassador Christine Hohmann, the Chargé d'Affairs of the Kingdom of the Netherlands Laetitia Van Asch, the Canadian Chargé d'Affairs Marie Therese Hilal, in addition to the Political Advisor to the Embassy of the United Kingdom Angus Clarkson."

The President of the Republic pointed out that "the Iraqi government is working on developing comprehensive plans to rehabilitate and operate factories and plants, and attract investors due to the existence of equal and promising opportunities for companies to invest in Iraq through vital and developmental projects, especially since Iraq today enjoys political, security and economic stability."

He stressed, "Iraq's efforts in combating violence against women and children, finding solutions to the issues of displaced persons, supporting human rights in general, and the means to activate joint international cooperation in this field,"

noting that "Iraq cares about and supports human rights in a distinctive way, and supports its principles and adopts them as a basis for legislating its laws and organizing community work, as all complaints in this regard receive attention and follow-up from the Presidency of the Republic and the relevant authorities."

In turn, representatives of diplomatic missions expressed their happiness with the "development taking place in Iraq," stressing "their countries' keenness to support Iraq's stability and expand the horizons of cooperation with it in various fields." LINK

Parliamentary Investment: Approval Of The Arbitration Law Will Protect Foreign Capital From Sanction

Economy Information / Baghdad .. Member of the Parliamentary Economic and Investment Committee, MP Mohammed Al-Ziyadi, confirmed today, Tuesday, that the approval of the arbitration law will protect foreign capital from international financial sanctions.

Al-Ziyadi said in a statement to / Al-Maalouma / agency, "Tomorrow's session will witness the first reading of the arbitration law, which is a step towards activating commercial investment in Iraq."

He pointed out that "Iraq is in dire need of approving this law because it will open up horizons for commercial cooperation and investment of funds, in addition to thinking about ways that help attract investors and capital."

Al-Ziyadi stressed the "necessity of not touching the foundations of the state and the integration of government institutions."

It is noteworthy that the Presidency of the Iraqi Council of Representatives included the first reading paragraph of the draft arbitration law in its session that will be held tomorrow, Wednesday. LINK

The Government Approves A Package Of New Decisions

Economy , 07/24/2024 10:23 , Number of readings: 162 Baghdad - Iraq Today: The Iraqi Council of Ministers approved a package of decisions in various economic and service sectors, most notably the construction of dozens of schools in a number of governorates.

The Prime Minister's Media Office stated in a statement that the Council held its thirtieth regular session chaired by Muhammad Shiaa Al-Sudani, during which the general situation in the country was discussed, and the implementation of the government program priorities was followed up. The session reviewed the most important files related to development and economic aspects, as well as considering the topics on the agenda, and making decisions about it.

Al-Sudani stressed that the ministries and security agencies must rely on what is available at the Military Industrialization Authority, especially since the equipment and products it produces conform to standards and at an appropriate cost, which represents an essential factor in achieving autonomy.

He stressed that these industries could be a base for developing multiple civil industries, because part of the factories serve civil ministries, including the electrical transformer rehabilitation factory.

1- Increasing the total cost of the project (acquisition of the plot of land numbered (5686/1) m 43, Yaramjah al-Sharqiya/Mosul, Nineveh Governorate)/Ministry of Justice.

2- Approval of the amount of the increase due on undisbursed dues, within Cabinet Resolution 301 of 2021, in (Contract 1 Direct Invitation/2012), a project to build (251) school buildings, using the prefabricated concrete construction method, in the governorates except Baghdad.

In the project contract (4/assignment/2012), which includes the construction of (73) schools using the prefabricated concrete construction method in the governorates of Baghdad and Babylon, with (60) schools in Baghdad and (13) in Babylon. In the draft contract (1/assignment/2012), the construction of (65) schools in place of those in danger of collapse, of various capacities, using the prefabricated concrete construction method, with (20) in Babylon, (41) in Muthanna, and (4) in Diwaniyah.

3- Approving the amount of the increase in the total costs and the reserve percentage for the projects recorded in the letter of the Ministry of Planning, dated July 8, 2024, which includes the previously executed spare orders, which are required to be implemented ( the second phase), and the spare orders resulting from the amount of uncompleted works in accordance with the decision of the Council of Ministers (301 For the year 2021).

4- Increasing the amount of reserve for the contract (construction of the North Tikrit Bridge) and its approaches (first phase) within the project (construction of the Tikrit Concrete Bridge (North Tikrit Bridge) and its approaches).

8- Increasing the amount of reserve and the total cost of the main project (paving streets in the center of Basra Governorate with sidewalks, number 7).

In the course of treatments for the electric power sector, the Council of Ministers approved the recommendation of the Central Committee for Review and Approval of Referral in the Ministry of Electricity, regarding the signing of a contract addendum with BFT Company within the investment plan, which Includes the design, equipping and implementation of electric power transmission lines by the concerned company, according to the following: 1-

Adopting the prevailing standard costs that serve the interest of the Ministry of Electricity.

2- Determine the lines that will be implemented within the contract, after obtaining the necessary approvals, provided that they do not exceed the contractual financial ceiling specified in the contract annex, and only mention the total lengths of the lines.

3- BFT Company shall bear the previous bank commissions, while the General Company for Electricity Transmission/Central Region shall bear the integrity and accuracy of contractual procedures, in accordance with laws, regulations and instructions.

Within the framework of developing and supporting the national industry, the Council approved the recommendations of the minutes of the meeting of the Dry Gas Committee for Investment Projects, regarding (Khor Al-Zubair Fertilizer Factory/ Southern Fertilizers General Company, Abu Al-Khaseeb Fertilizer Project/ Under Referral Procedures, and New Projects), taking into account the comments of the Minister of Industry and Minerals at the minutes, including:

1- Determining the price of dry gas supplied to the Southern Fertilizers Factory: 50 dinars/mqm, for the General Company line, and the partnership line with the private sector, and the price of gas for the attached projects shall be 75 dinars/mqm, and the new projects that are announced shall be according to a price equation agreed upon between the Ministries of Oil and Industry, and with the approval of the Ministerial Council for the Economy.

2- The Ministry of Oil is committed to allocating and equipping new industrial projects planned to be established in partnership with the private sector, by public companies in the Ministry of Industry and Minerals, with quantities of dry gas, according to the need of those projects for quantities, and according to a timetable for equipping, and at prices that achieve the economic feasibility of establishing those projects, and the quantities and prices are regulated through an agreement between the Ministries of Oil and Industry, and with the approval of the Ministerial Council for the Economy.

3- The Ministry of Industry and Minerals shall restore the economic balance of the partnership contracts that have been concluded, or that are under contract to establish new industrial projects, by renegotiating with the companies participating with it, to reach an economically feasible formula that ensures the continuation and continuation of implementation, in a manner that does not harm the interests of both parties.

The Council of Ministers approved the recommendations of the competent authority in the Ministry of Industry and Minerals (Industrial Development and Organization Department), based on the Iraqi Products Protection Law (11 of 2010) amended, as follows:

1- Extending the imposition of an additional customs duty of 65% of the unit of measurement of the product (plastic ampoules), imported to Iraq from all countries of origin, for a period of 4 years and without reduction.

2- Imposing an additional customs duty of 30% of the unit of measurement of a product (aluminum cans for soft drinks, juices and energy drinks).

3- The Ministry of Finance/General Authority of Customs shall apply the customs duty on the aforementioned products and notify the Ministry of Industry and Minerals/Department of Industrial Development and Organization, with a periodic notification about the imported quantities, the value of the additional duties on the imported foreign product, the exporting countries and the importing entities.

In the oil sector file, the Council of Ministers approved the recommendation of the Ministerial Council for Energy (24062 T) for the year 2024 regarding the authority to purchase and implement, which includes raising the authority to purchase and implement the Oil Projects Company for the project (the connecting pipeline network for the unit/FCC, in the Basra refinery), from 100 million dinars to 500 million dinars, based on the instructions to facilitate the implementation of the Federal General Budget Law of the Republic of Iraq (1 of 2023 ).

The Council approved the recommendation of the Ministerial Council for the Economy (24225 Q), regarding the approval of the report of the committee formed in accordance with the Diwani Order (24573 of 2024), issued by the Office of the Prime Minister, regarding studying the economics of the oil and gas sector in Iraq, leading to approving and showing the real costs along the way. The value chain, according to economic principles.

In the process of developing the infrastructure of border crossings to receive visitors and expatriates, the Council of Ministers approved the Ministry of Finance allocating an amount of (5) billion dinars to Wasit Governorate from the emergency reserve, based on the provisions of the Federal General Budget Law (13 of 2023), for the rehabilitation and establishment of a “transport square.”

Visitors at the Zurbatiyah border crossing with its annexes, in a regular, geometric manner befitting the status of Iraq and the reception of visitors.

The Council also approved the Ministry of Finance allocating an amount of (7) billion dinars to Maysan Governorate from the emergency reserve, in accordance with the provisions of the General Budget Law, for the purpose of urgent rehabilitation of the Al-Shayb border crossing, Including the establishment of 3 squares, in preparation for the influx of visitors to the holy shrines on the fortieth anniversary of Imam Hussein. ‘

Maysan Governorate should follow the direct invitation method, as an exception to the instructions for implementing government contracts (2 of 2014) for the purpose of implementation, and assigning Maysan Governorate to implement the project (establishing the new Al-Shayb border crossing) in a turnkey format, as an exception to the controls attached to the instructions for implementing government contracts.

The Council also approved the Ministry of Finance allocating an amount of (3.5) billion dinars to Diyala Governorate from the emergency reserve, based on the Federal General Budget Law, for the purpose of rehabilitating the Al-Mundhiriya border crossing, in preparation for receiving visitors , and authorizing Diyala Governorate to have direct implementation authority for the purpose of implementing the project, and it includes (Project Establishment of the new Al-Mundhiriya border crossing) within Diyala Governorate's allocations from the Liberated Governorates Reconstruction Fund.

In this regard, and in order to benefit from the experience of the Supreme Authority for Hajj and Umrah in the processes of delegation and reverse delegation; The Council approved the following:

1. Authorizing the Authority to contract with private transport companies for the purpose of renting (2000) buses, as an exception to the Government Contracts Implementation Instructions No. (2) of 2014, and the controls attached there for the purpose of transporting visitors to Imam Hussein (peace be upon him) during the fortieth visit. The Ministry of Finance allocates the required amount from the budget of the Prime Minister's Office.

2. Reducing the percentage of tax withheld from contracted transport companies on contracts concluded from (3%) to (1%), according to the authority vested in the Ministry of Finance.

3. Approval of the guarantees submitted to the Supreme Authority for Hajj and Umrah by the companies to be contracted with, in accordance with the fundamental mechanisms and procedures followed by the Authority for contracting purposes.

4. Approval of subscription receipts for companies to be contracted with in the Department of Labor and Social Security.

5. The Supreme Authority for Hajj and Umrah is responsible for the validity and safety of contractual procedures, and the Prime Minister’s Office forms committees to follow up and monitor the work mechanism.

In order to develop the work of the Iraqi air system and raise its level of efficiency, the Council agreed to exempt the General Company for Airport and Air Navigation Management from contracting methods and instructions for implementing government contracts (2 of 2014), in implementing projects related to developing the infrastructure for special devices and equipment for air traffic management systems.

Navigation, radars, air guidance and automated landing systems, communications for air navigation and cybersecurity systems, as well as what is related to restructuring Iraqi air routes,

linking them to the global network of neighboring countries, transforming the navigation system in Iraq, and reducing the longitudinal separation between aircraft, which contributes to increasing the density of aircraft movement. In the Iraqi airspace, it maximizes the company's resources.

It was approved to authorize the Ministry of Education to contract, in a direct referral manner, with the Iraqi Media Network and the House of Cultural Affairs in the Ministry of Culture, to complete the printing of school curricula.

The Council authorized the Ministry of Construction, Housing, Municipalities and Public Works to choose the appropriate agreement method, as an exception to Government Contracts Implementation Instructions No. (2 of 2014) for the purpose of repairing the minaret of the Al-Khalifa Mosque.

It was also approved to exempt the Central Agency for Standardization and Quality Control from the provisions of Article Seven of Instructions No. (1 of 2023), the provisions to facilitate the implementation of the Federal General Budget Law, with regard to purchasing and equipping laboratories with the devices, equipment, and laboratory supplies necessary for the work of the device, based on the aforementioned instructions. LINK

Iraq Economic News and Points To Ponder Tuesday Evening 7-23-24

Two Reasons Behind The Rise In The Dollar Exchange Rates In Iraq.. What Are The Expectations About Its Fate?

Economy/Localities | Today, 16:42 |Baghdad today – Baghdad Today, Tuesday (July 23, 2024), economic expert Alaa Al-Fahd revealed that

there are two reasons behind the return of the dollar exchange rates against the Iraqi dinar in the local market, while

he expected it to gradually decline. Al-Fahd told "Baghdad Today",

"The rise in the price of the dollar in the parallel market came due to the

Central Bank of Iraq implementing a new mechanism, selling dollars to travelers, in addition to the presence of a crisis in

checking remittances in the Chinese yuan, and this matter was quickly resolved by the Central Bank of Iraq."".

Two Reasons Behind The Rise In The Dollar Exchange Rates In Iraq.. What Are The Expectations About Its Fate?

Economy/Localities | Today, 16:42 |Baghdad today – Baghdad Today, Tuesday (July 23, 2024), economic expert Alaa Al-Fahd revealed that

there are two reasons behind the return of the dollar exchange rates against the Iraqi dinar in the local market, while

he expected it to gradually decline. Al-Fahd told "Baghdad Today",

"The rise in the price of the dollar in the parallel market came due to the

Central Bank of Iraq implementing a new mechanism, selling dollars to travelers, in addition to the presence of a crisis in

checking remittances in the Chinese yuan, and

this matter was quickly resolved by the Central Bank of Iraq."".

Al-Fahd stated, "We expect that there will be a gradual decline in the dollar exchange rate in the coming days.

This rise is common with the implementation of any new policy by the Central Bank of Iraq, as speculators try to exploit this in order to increase their profits." He added,

"The Central Bank of Iraq has discussions and procedures with the US Federal Bank in order to control the exchange rate in the parallel market, and

this rise is due to the rise in illicit trade, but the

Central Bank of Iraq emphasized control over the dollar file and

there are positive discussions with the American side."".

Since Eid al-Adha, the exchange rate of the dollar has risen to more than 152 thousand dinars in the parallel market and money exchangers, after hovering around 145 thousand dinars for every 100 dollars.

Prices returned to decline last week, with the dollar now hovering around 149 thousand dinars for every 100 dollars.

The Central Bank imposed a mechanism that prevents the delivery of dollars to travelers except at airports, which increased the demand for dollars in the parallel market after illicit trade was financed through the parallel market via travelers’ dollars.

https://baghdadtoday.news/254073-سببان-وراء-ارتفاع-أسعار-صرف-الدولار-في-العراق.-ما-التوقعات-حول-مصيره؟.html

The Role Of The Iraq Stock Exchange In Supporting Monetary Policy In Iraq

July 23, 2024 Last updated: July 23, 2024 Lawyer and banking expert Saif Al-Halafi

The world is now moving with rapid steps, racing with the wind, in the role of stocks supporting monetary policies, especially since the old classical theories considered that stock markets were not among the tools of monetary policy.

This concept reflected a traditional understanding, where monetary policy was focused on tools such as interest rates, monetary facilities, and monetary reserves. For banks

The development of theories and the different models of economic studies vary with the development of research, studies, and the financial market from one country to another.

It is difficult to make a theory apply to all different countries and economies, from emerging economies to more complex economies, and because of this dialectic based on trying to understand and establish the nature of the relationship between financial markets and politics.

Cash is becoming more evident in many countries

Stock markets have become part of the general economic strategy of governments and central banks, especially after the introduction of the idea of cryptocurrencies and digital banks, as they directly affect consumption, investment, and economic confidence.

Iraqi market

In the case of the Iraqi model and the long years of economic stagnation in that it is a rentier economy that relies mainly on oil to finance its annual budgets and the case of price speculation on the stability of the dollar exchange rate in local markets or what is known as the parallel dollar situation, we can look at the Iraqi market Securities as a supportive tool for monetary policy and influential in the case of a rentier economy.

This is done through:

1- Encouraging local and foreign investment.

The stock market can be a quick and important means of bringing in local capital, especially cash in circulation, and trying to return it to banking incubators and putting it into short-term investments through price maneuvers on the shares of emerging companies listed on the Iraq Stock Exchange for securities or investments. Long-term by pumping these cash blocks into the shares of profit generating companies, which are companies that regularly achieve lucrative annual financial profits,

thus reinforcing the idea of withdrawing the hoarded liquidity and returning it to bank incubators in a way that reduces immediate and temporary speculation on the parallel dollar in the local market.

It also creates real opportunities for the entry of foreign capital that moves between emerging markets, which provides them with the opportunity for quick entry, profitable investment, and safe exit.

2- Diversification of the economy indicates severe over-reliance on oil.

The stock market can be used to encourage local and international investments in sectors that create greater economic diversification than usual and a state of rapid price sales and maneuvers for shares of promising companies in Iraq

3- Absorption of liquidity

The stock market can play an important role in absorbing excess liquidity in the economy, which helps in controlling inflation, and

this depends on the ability of the Iraqi market to be quick in price deliberations of buying and selling through the shares of companies listed in it and putting pressure on companies.

Mediation in applying and activating the latest smart systems and phone applications for the daily operations of sales and contracts executed therein, and also encouraging the publication of financial statements of Iraqi companies in international platforms that encourage understanding of the culture of shares of Iraqi companies.

One of the most important economic theories that supports that financial markets can be an effective tool in monetary policy is the Wealth Effec[t] theory, which is summarized and almost consistent...in understanding the dialectic of the Iraqi economy and the stock market economy, and is more consistent with the Iraqi model called the theory.

Wealth effect theory, written by Gregory Mankiw.

Its summary is that the rise in the value of individuals’ financial assets gives them an incentive to withdraw money and re-inject it into purchasing new assets and stocks in order to increase wealth and gives them a feeling of wealth, which prompts them to spend on consumption and develop the national economy.

The bottom line is that all of these theories and studies support the idea that financial markets can be an effective and successful tool in achieving economic stability and promoting growth, especially in emerging markets such as Iraq

If the Iraqi stock market is exploited in the correct way that brings local and international investments, it can help in diversifying The Iraqi economy and creating new opportunities driving economic integration in Iraq, which makes the Iraqi stock market a valuable tool for monetary policies https://mustaqila.com/دور-سوق-العراق-لأوراق-المالية-في

Completion Bonds (Second Issue)

July 23, 2024 :diamonds: demand for trading in national bonds ( Enjaz Bonds / First Issuance the request of the Ministry of Finance, this bank will offer ( Enjaz Bonds / Second Issuance ) on behalf of the aforementioned Ministry for an amount 1,500,000,000,000. (of) high Due to the and at) dinars Iraqi (one trillion and five hundred billion Iraqi dinars) ... For more, click here : https://cbi.iq/static/uploads/up/file-172172636358958.pdf https://cbi.iq/news/view/2620

Next Year: The Opening Of 3 International Airports

The first 07/21/2024 Baghdad: Batoul Al-Hassani

Next year, the Ministry of Transport will open three new international airports within the southern and northern regions of the country.

Director of the Ministry's Media Office, Maytham Al-Safi, explained to Al-Sabah that the ongoing work through local and international companies within the international airports of Holy Karbala, Nasiriyah and Mosul is continuing at an increasing pace and according to the prepared and predetermined timetable for completion.

He revealed coordination with the Imam Hussein Shrine to implement and complete the Karbala International Airport project, which is considered one of the vital projects important to strengthen the aviation infrastructure in the country, as a British company is responsible for its construction at a total cost of $500 million.

The airport is expected to receive six million visitors annually, making it the largest. in the country.

Al-Safi stated that work is underway at Nasiriyah Airport in Dhi Qar Governorate, by two companies, the

first of which is Chinese and is carrying out its construction according to international standards, and the

second of Turkey is supervising the implementation, while the designs of Mosul Airport are being completed by a consulting party, in addition to the continuation of contracting, manufacturing and factory inspections. And training for navigational systems, devices and specialized equipment Consecutively.

He stressed that the three airports will be opened next year, which is expected to contribute significantly to

improving the air transport infrastructure in Iraq, in addition to

strengthening economic and tourism ties with various countries of the world and

opening new international destinations through them. https://alsabaah.iq/99674-.html

Seeds of Wisdom RV and Economic Updates Tuesday Evening 7-23-24

Good Evening Dinar Recaps,

BRICS IS MAKING PREPARATIONS FOR A US DOLLAR COLLAPSE

"According to a Russian IMF representative, BRICS is ready to offer an alternative to the US Dollar amid the currency’s collapse, and the bloc must prepare for such an instance. The alliance, consisting of Russia; India, China; Brazil; South Africa; and supporting nations, has been working to abandon the US Dollar for some time."

"The BRICS bloc is working to develop a new BRICS currency to replace the US dollar, alongside local currencies between nations. In an interview with RIA Novosti published on Friday, Russian IMF rep Alexey Mozhin noted that the shortcomings of the current financial system are becoming more apparent.

Furthermore, he points out that many publications have started to mention BRICS as a group that will offer a successful alternative to the greenback."

Good Evening Dinar Recaps,

BRICS IS MAKING PREPARATIONS FOR A US DOLLAR COLLAPSE

"According to a Russian IMF representative, BRICS is ready to offer an alternative to the US Dollar amid the currency’s collapse, and the bloc must prepare for such an instance. The alliance, consisting of Russia; India, China; Brazil; South Africa; and supporting nations, has been working to abandon the US Dollar for some time."

"The BRICS bloc is working to develop a new BRICS currency to replace the US dollar, alongside local currencies between nations. In an interview with RIA Novosti published on Friday, Russian IMF rep Alexey Mozhin noted that the shortcomings of the current financial system are becoming more apparent.

Furthermore, he points out that many publications have started to mention BRICS as a group that will offer a successful alternative to the greenback."

“Such a proposal is being discussed,” the director told RIA Novosti. “In the event of the collapse of the dollar and the international monetary system, it will be necessary to turn the said BRICS accounting unit into a real currency, backed by exchange goods.”

BRICS CURRENCY TO SERVE AS SUBSTITUTE IF US DOLLAR COLLAPSES

"The BRICS bloc has turned to blockchain technology for its brand-new payment system, according to reports. Indeed, its efforts have sought to build a competing currency built on digital assets."

"The US Dollar is still a ways away from crashing altogether, however, the path is there for BRICS to do damage. The greenback is still the global reserve, but a mounting US Debt has ensured that it won’t remain a fact forever.

"Furthermore, support around the BRICS bloc has grown over the past few years, with more countries likely to receive invites to join in 2024.

With more support in numbers and finances, BRICS could develop a strong contending currency to fight the US dollar."

@ Newshounds News™

Read more: The Republicans Voice

~~~~~~~~~

GOLD, SILVER: India's TAX CUT to Offer a Bullish Boost for the Metals?

"Today, India slashed its import tax on gold and silver, a move that could further boost demand for both precious metals in the world’s second-biggest gold market and support higher prices globally. The move will cut taxes on gold and silver imports by more than half, lowering duties from 15 percent to 6 percent."

"India will also lower the import tax on platinum to 6.4 percent."

"World Gold Council Indian operations CEO Sachin Jain told Reuters the tax cut is “a massive step in the right direction.”

“It will reduce the incentives for smuggling of gold. It will create a level playing field for honest industry stakeholders.”

"Gold was up about $14 in overseas trading after officials announced the tax cut. Even with the high import taxes, Indian gold demand has been strong. Through the first five months of 2024, gold imports into India increased by 26 percent year-on-year, with 230 tons of gold flowing into the country. This is despite record-high prices."

"Indians have historically had an affinity for gold. Indian households own an estimated 25,000 tons of gold, and that likely understates the amount given the large black market in the country. Gold is deeply interwoven into the country’s marriage ceremonies and cultural rituals. Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions."

"Gold isn't considered a luxury in India. Even poor Indians buy gold. According to a 2018 ICE 360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold."

@ Newshounds News™

Read more: Investing

~~~~~~~~~

146 TRILLIONpic

@ Newshounds News™

Read more: https://x.com/SMQKEDQG/status/1780670320522747961

~~~~~~~~~

Warren Buffett Dumps $1.5 Billion Worth Bank of America Shares

Ace investor Warren Buffett’s investment arm Berkshire Hathaway has dumped $1.5 billion worth of Bank of America (BAC) shares. The recent regulatory filings show that the billionaire offloaded 33.9 million Bank of America shares. The BAC stocks were sold at an average price of $43.56 per share. After the sale from Berkshire Hathaway, BAC stocks fell to $42.30 with a decline of 1.40%.

The reduction is significant and has come as a surprise to the US stock market. Warren Buffett is known to hold stocks for the long term and not offload them mid-way. However, despite the sell-off, Warren Buffett is still the second-biggest holder of Bank of America stocks. Berkshire Hathaway holds a 10.8% stake in BAC after falling from the top position to the second due to the sell-off

@ Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

IS TRUMP RIGHT TO WORRY THAT CHINA COULD TAKE OVER CRYPTO?

Does China regret banning Bitcoin mining in 2021? Could it opt back in? Can a single nation even control decentralized assets like BTC?

It’s only recently that Donald Trump has paid any attention to crypto. But now he wants to be the “crypto president,” and he’s raising digital assets as a geopolitical issue.

Asked on July 16 why he’s suddenly embracing the crypto community, he told Bloomberg:

“If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China.”

In the interview, Trump explained how the recent experience with his “Mugshot” NFT Collection “opened my eyes” to cryptocurrencies, saying, “80% of the money [from the NFT sale] was paid in crypto. It was incredible.”

“So we have a good foundation [i.e., crypto]. It’s a baby. It’s an infant right now. But I don’t want to be responsible for allowing another country to take over this sphere,” he added.

His remarks raised several interesting questions — and not just whether China, which banned crypto trading and Bitcoin mining in 2021, is even interested in reentering the crypto trading and mining markets.

It touches on the relationship between governments and the crypto/blockchain sector generally.

To what extent can any single sovereign nation control decentralized and diversified digital assets like Bitcoin and Ethereum.

Is it even possible?

Why China?

China was once a major crypto player. The largest crypto exchanges, such as Binance, were located in China, and as much as 75% of Bitcoin mining took place on the Chinese mainland, according to estimates.

But in 2021, China cracked down on crypto trading and mining, and by July of that year, Bitcoin mining had essentially vanished on the mainland.

Recent developments, however, have raised speculation “that the Chinese government may be warming to cryptocurrency and that Hong Kong may be a testing ground for these efforts,” noted Chainalysis in October.

Indeed, in April 2024, the central government approved the launch of several Bitcoin exchange-traded funds (ETFs) in Hong Kong. Some observers think China wants to make Hong Kong a crypto hub — despite a continued trading ban on the mainland.

China’s Bitcoin ban a “strategic blunder”

“Absolutely,” Daniel Lacalle, chief economist of Tressis, told Cointelegraph.

“Beijing’s 2021 mining crackdown was a strategic blunder,” Emiliano Pagnotta, associate professor of finance at Singapore Management University, told Cointelegraph.