.Money Can Kind Of Buy Happiness After All

.Money Can Kind Of Buy Happiness After All

By Kelsey Piper Sep 23, 2019, 8:00am EDT

It turns out money can kind of buy happiness after all

A new paper argues that, actually, winning the lottery totally does make you happy.

Does winning the lottery even make you happier? For a long time, researchers said no. Research hadn’t found any conclusive evidence that people who won large sums of money were happier afterward. There was even some evidence they were worse off.

This fact became widely known, partially because it’s so appealing to many people. It’s nice to think that life satisfaction isn’t just about how much money you have, that other things matter more, that we can’t solve all our problems with a sudden infusion of cash.

Money Can Kind Of Buy Happiness After All

By Kelsey Piper Sep 23, 2019, 8:00am EDT

It turns out money can kind of buy happiness after all

A new paper argues that, actually, winning the lottery totally does make you happy.

Does winning the lottery even make you happier? For a long time, researchers said no. Research hadn’t found any conclusive evidence that people who won large sums of money were happier afterward. There was even some evidence they were worse off.

This fact became widely known, partially because it’s so appealing to many people. It’s nice to think that life satisfaction isn’t just about how much money you have, that other things matter more, that we can’t solve all our problems with a sudden infusion of cash.

But there’s a problem with that research: It’s probably wrong. At least, that’s what is argued by economists Andrew J. Oswald and Rainer Winkelmann at the University of Warwick in the new academic book The Economics of Happiness.

Their chapter in the book makes the case that past research about the lottery was badly designed, which is why it found the counterintuitive conclusion that lottery winnings don’t make us happy, instead of the much more boring truth: They totally do.

Economists have good reason — beyond just curiosity — to care whether lottery winners are happier than the rest of us. Lottery winners represent a great chance to explore whether increases in income make people happier.

We know that there’s a well-established association between higher income and happiness, but it can be tricky to say for sure that it’s the higher income that causes happiness.

Maybe happier people earn more money, or depressed people tend to earn very little money, or people with some general quality of life successfulness will be both happy and rich.

Lottery winners are selected at random, so they can help answer this question for us: Does money cause happiness?

Here’s what we know about the effects of lottery winnings

The first paper to take a serious look at the happiness of lottery winnings was a 1978 paper by Philip Brickman and colleagues, titled “Lottery winners and accident victims: Is happiness relative?”

To continue reading, please go to the original article at

https://www.vox.com/future-perfect/2019/9/23/20870762/money-can-buy-happiness-lottery

.How Much Money Do You Need To Feel Wealthy?

.How Much Money Do You Need To Feel Wealthy?

By RETIREBYFORTY

Last time, I asked – Can YOU become a millionaire? Incredibly, 95% of voters picked yes. That’s awesome, I love it! It really isn’t that hard to become a millionaire in the U.S. if you make at least a median household income of $60,000/year. You just have to commit to saving and you’ll get there.

The point of the previous post was for you to pick yes. Unfortunately, a million dollars doesn’t go as far as it used to. Most people don’t even consider a million dollars wealthy anymore. So how much money do you need to feel wealthy? Let’s check it out.

*This post was originally written in 2013. I’ve updated and expanded it with the latest info. I hope you enjoy this one.

How much money do you need to feel wealthy?

$3 million+ (28%, 555 Votes)

$5 million+ (26%, 529 Votes)

$10 million+ (29%, 579 Votes)

$100 million!!! (7%, 147 Votes)

2-3 times what you have now (3%, 69 Votes)

Total Voters: 2,007

How Much Money Do You Need To Feel Wealthy?

By RETIREBYFORTY

Last time, I asked – Can YOU become a millionaire? Incredibly, 95% of voters picked yes. That’s awesome, I love it! It really isn’t that hard to become a millionaire in the U.S. if you make at least a median household income of $60,000/year. You just have to commit to saving and you’ll get there.

The point of the previous post was for you to pick yes. Unfortunately, a million dollars doesn’t go as far as it used to. Most people don’t even consider a million dollars wealthy anymore. So how much money do you need to feel wealthy? Let’s check it out.

*This post was originally written in 2013. I’ve updated and expanded it with the latest info. I hope you enjoy this one.

How much money do you need to feel wealthy?

$3 million+ (28%, 555 Votes)

$5 million+ (26%, 529 Votes)

$10 million+ (29%, 579 Votes)

$100 million!!! (7%, 147 Votes)

2-3 times what you have now (3%, 69 Votes)

Total Voters: 2,007

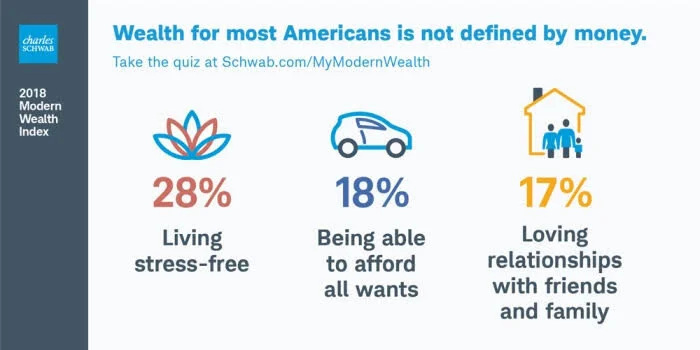

Wealth Isn’t All About Money

Of course, wealth isn’t all about money. Health, relationships, freedom, and happiness are all integral parts of wealth. Money won’t make you feel wealthy if you’re missing some of these. When asked about wealth in Charles Schwab’s 2018 Modern Wealth Index survey, two of the top three answers weren’t related to money.

Wealth Not All About Money

Those things are more difficult to measure, though because they are all subjective. We all have different definitions of happiness. My happiness doesn’t necessarily match yours.

In fact, I think the pursuit of happiness is misguided. We can’t measure those other things, so we’ll just focus on the money today. It’s way easier to figure out net worth than happiness.

When asked to focus on just the money, respondents said it takes $2.4 million to be considered wealthy.

I Don’t Feel Wealthy

Really, $2.4 million? That seems a tad low to me. Our net worth is over that line and I don’t feel rich at all. The problem is the survey is meant to be representative of the US population.

That means most of those surveyed are not millionaires. $2.4 million sounds like a lot of money to regular people, but millionaires don’t consider that wealthy.

Being wealthy is actually a moving target. It turns out most people need twice or more of their current net worth to feel wealthy. If someone is worth $5 million, they would say wealthy means $10 million. That’s pretty funny, isn’t it?

The 2x wealth corollary is pretty much spot on for me. When I wrote this in 2013, our net worth was about $1.5 million. I thought we’d feel wealthy when our net worth reaches $3 million.

Today, I think $3 million is merely comfortable, not wealthy. Like I said, it’s a moving target. However, I’m pretty sure I’ll feel wealthy when we hit $5 million…

UBS Wealth Study

To back up my $5 million = wealthy theory, here is a wealth study from UBS in 2013. It’s a bit older, but investors agreed that wealth isn’t just about having a certain amount of money.

The majority of investors define wealth as having no financial constraints on what they do. But when asked to assign a dollar amount to being wealthy, they say it takes $5 million.

This study targeted investors so the results skewed a bit higher. Investors surveyed were older than 25 years old and have at least $250,000 in investable assets; half have at least $1 million in investable assets. This group is doing a lot better than the average American household.

To continue reading, please go to the original article at

.Can You Become A Millionaire?

.Can You Become A Millionaire?

By RETIREBYFORTY

Recently, I saw a question on Twitter – Can anyone become a millionaire? My gut instinct said yes. I was sure anyone can become a millionaire if they just save and invest consistently. Inflation alone will make the millionaire status much easier to attain in 30 years.

Everyone will make a lot more money so it shouldn’t be that hard. That was my reply. However, there were a few dissenting opinions. I didn’t have any research to back it up so I didn’t argue and let it go.

Today, we’ll take a closer look and see if anyone can really become a millionaire. First, we’ll crank some numbers and then look at the psychological side of this question.

Median income

Let’s look at the average case first to see if they have a chance to become a millionaire. We’ll call our average family the Joneses. The median household income in the US is about $60,000 per year. Median household income means that half of the population makes more than this and half makes less. It’s the middle line.

That’s how much the Joneses make. If the Joneses save and invest consistently, can they become millionaires?

Can You Become A Millionaire?

By RETIREBYFORTY

Recently, I saw a question on Twitter – Can anyone become a millionaire? My gut instinct said yes. I was sure anyone can become a millionaire if they just save and invest consistently. Inflation alone will make the millionaire status much easier to attain in 30 years.

Everyone will make a lot more money so it shouldn’t be that hard. That was my reply. However, there were a few dissenting opinions. I didn’t have any research to back it up so I didn’t argue and let it go.

Today, we’ll take a closer look and see if anyone can really become a millionaire. First, we’ll crank some numbers and then look at the psychological side of this question.

Median income

Let’s look at the average case first to see if they have a chance to become a millionaire. We’ll call our average family the Joneses. The median household income in the US is about $60,000 per year. Median household income means that half of the population makes more than this and half makes less. It’s the middle line.

That’s how much the Joneses make. If the Joneses save and invest consistently, can they become millionaires?

Here are my assumptions

The Joneses will receive a 3% raise every year. This really isn’t much. It’s barely beating inflation, which is around 2%. I assume the Joneses will keep their saving rate steady. When they get any annual raises, they’ll save a bit more.

They’ll invest in the stock market and generate 8% return every year.

I’ll graph it out. We’ll see how long it’ll take the Joneses to reach millionaire status with different saving rates.

Ha! It is as I suspected. The Joneses can become millionaires in 31 years if they religiously save 10% of their income. The more they save, the faster they’ll become a millionaire.

Saving Rate Millionaire in

10% 31 years

20% 23 years

30% 20 years

40% 17 years

50% 15 years

From this table, it looks to me like anyone who makes median income AND is under 30 can easily become a millionaire. Saving 10% really isn’t that difficult at that level of income.

Of course, I recommend saving much more than that in order to achieve financial independence in a reasonable timeframe. You really should aim to save 50% of your income.

To continue reading, please go to the original article at

.Cheapest U.S. Cities for Early Retirement 2019

.Cheapest U.S. Cities for Early Retirement 2019

By Stacy Rapacon, Online Editor Kiplinger| July 4, 2019

Early retirement can be more than just a daydream for those long Tuesday afternoons at work. With some smart planning, you can make leaving the workforce early a reality. You just have to keep in mind the unique challenges facing early retirees.

First of all, entering retirement at a relatively younger age means needing to stretch your nest egg further (hopefully). One way to do that is to find the right retirement destination for you. That's because where you live makes a big impact on your budget. After all, settling down in a place where the cost of living is below the national average means your retirement savings pack in more purchasing power.

With that in mind, we pinpointed 50 great places in the U.S. for early retirees—one in each state—focusing on living costs, median incomes and poverty rates for residents ages 45 to 64, as well as local tax environments and labor markets (just in case you want a second act to stretch your retirement savings further).

Of our 50 picks, these 31 destinations offer particularly low living costs, which heightens the chances of your money lasting through your extra-long retirement and beyond. The list is ordered alphabetically by state.

Cheapest U.S. Cities for Early Retirement 2019

By Stacy Rapacon, Online Editor Kiplinger| July 4, 2019

Early retirement can be more than just a daydream for those long Tuesday afternoons at work. With some smart planning, you can make leaving the workforce early a reality. You just have to keep in mind the unique challenges facing early retirees.

First of all, entering retirement at a relatively younger age means needing to stretch your nest egg further (hopefully). One way to do that is to find the right retirement destination for you. That's because where you live makes a big impact on your budget. After all, settling down in a place where the cost of living is below the national average means your retirement savings pack in more purchasing power.

With that in mind, we pinpointed 50 great places in the U.S. for early retirees—one in each state—focusing on living costs, median incomes and poverty rates for residents ages 45 to 64, as well as local tax environments and labor markets (just in case you want a second act to stretch your retirement savings further).

Of our 50 picks, these 31 destinations offer particularly low living costs, which heightens the chances of your money lasting through your extra-long retirement and beyond. The list is ordered alphabetically by state.

Huntsville, Ala.

Total Population: 444,908

Share Of Population, Age 45 To 64: 27.8% (U.S.: 26.1%)

Retired Cost Of Living: 5.4% Below The National Average

Median Income, Age 45 To 64: $77,266 (U.S.: $69,909)

State's Retiree Tax Picture: Tax Friendly

As one of the 10 Cheapest States Where You'll Want to Retire, the Heart of Dixie boasts many great spots for affordable living. And Huntsville, in northern Alabama, is one of the best. It offers all the low-cost, low-tax advantages as the rest of the state, but adds more generous household incomes.

Home to NASA's Marshall Space Flight Center, the Redstone Arsenal and the Huntsville campus of the University of Alabama, the city offers a robust economy and a highly educated population.

You can also find plenty of cultural attractions, from a sculpture trail to a symphony orchestra, as well as opportunities for outdoor recreation (think bass fishing). In fact, Alabama at-large offers many of Florida's popular retirement attractions—warm weather, nice beaches and plenty of golf—all at a typically lower price.

To continue reading, please go to the original article at

.Crypto-Fiat Currency is a Disaster for Your Privacy

Crypto-Fiat Currency is a Disaster for Your Privacy

By Chris Lowe, Editor, Inner Circle Sep 12, 2019, 8:08 am EDT

We’re not the first to worry about financial privacy in a digital world

Imagine a new type of cash…

Unlike the kind you carry in your wallet, it exists only in digital form.

There’s no more need for ATMs. Tip jars are a thing of the past. Even vending machines are digital.

Every time you spend money, it’s through a digital app. And it’s recorded in a government database.

Crypto-Fiat Currency is a Disaster for Your Privacy

By Chris Lowe, Editor, Inner Circle Sep 12, 2019, 8:08 am EDT

We’re not the first to worry about financial privacy in a digital world

Imagine a new type of cash…

Unlike the kind you carry in your wallet, it exists only in digital form.

There’s no more need for ATMs. Tip jars are a thing of the past. Even vending machines are digital.

Every time you spend money, it’s through a digital app. And it’s recorded in a government database.

The feds collect and store details on every transaction you make. They also know exactly where you are in the world every time you buy something.

In today’s dispatch, I (Chris) will show you why this scenario is already becoming a reality around the world… and why it’s a disaster if you value your liberty.

Then tomorrow, we’ll look at why it’s coming to America… and what you can do about it.

We’re not the first to worry about financial privacy in a digital world…

A pioneering computer scientist called Paul Armer sounded the alarm on this back in the 1970s.

In the 1950s and 1960s, Armer headed the computer science departments at the RAND Corporation think tank and at Stanford University.

Then, in 1975, he issued a chilling warning about what would happen to our privacy if governments ditched physical cash and moved to a purely digital money system.

In an article titled “Computer Technology and Surveillance,” Armer said such a system would become a powerful surveillance tool for the state.

This wasn’t lost on the KGB….

In 1971, Russia’s secret police tasked a group of advisors to devise a plan.

KGB higher-ups wanted to figure out how to create a surveillance system that would keep track of everyone inside the U.S.S.R. without them knowing about it.

The computer scientists’ proposed solution was to get rid of physical cash and replace it with digital currency transactions. As Armer wrote…

To continue reading, please go to the original article at

https://investorplace.com/2019/09/crypto-fiat-currency-is-a-disaster-for-your-privacy-lrg/

.How the Feds Can Finally Win Their War on Cash

.How the Feds Can Finally Win Their War on Cash

By Chris Lowe November 28, 2018

Say goodbye to the dollars in your wallet… Why governments hate cash and cryptos… Last chance to join Bill, Doug, and Mark in tonight’s special broadcast… In the mailbag: “Your freedom ends as soon as it crosses into mine”…

We’re living in a Surveillance Society…

When we left off yesterday, we were discussing the Surveillance Society – the Deep State’s attempt to monitor, record, and process everything you say and do.

Every search you make on Google… every page you like on Facebook… every purchase you make with a credit or debit card… every song you listen to on iTunes… every show you watch on Netflix… every email you send… every phone call you make – your digital activity is being watched and tracked around the clock.

How the Feds Can Finally Win Their War on Cash

By Chris Lowe November 28, 2018

Say goodbye to the dollars in your wallet… Why governments hate cash and cryptos… Last chance to join Bill, Doug, and Mark in tonight’s special broadcast… In the mailbag: “Your freedom ends as soon as it crosses into mine”…

We’re living in a Surveillance Society…

When we left off yesterday, we were discussing the Surveillance Society – the Deep State’s attempt to monitor, record, and process everything you say and do.

Every search you make on Google… every page you like on Facebook… every purchase you make with a credit or debit card… every song you listen to on iTunes… every show you watch on Netflix… every email you send… every phone call you make – your digital activity is being watched and tracked around the clock.

There are also hundreds of millions of cameras and microphones in smartphones, laptops, and “smart devices” such as Amazon’s Echo, Google Home, or Facebook’s Portal.

And with the new advances in facial recognition we’ve been telling you about… odds are you’ll show up on one of America’s 30 million CCTV cameras. (That’s one for roughly every 11 citizens.)

The U.S. Surveillance Society is already formidable. And it’s about to get even more formidable… as the feds come after the last refuge of financial privacy – cash.

Before we get to that, a final reminder about tonight’s special broadcast…

Tonight at 8 p.m. ET, we’re hosting an evening with Bill Bonner, Doug Casey, and Mark Ford.

It’s a rare chance to hear these three legendary newsletter men and self-made millionaires share their secrets about business, investing, and life that I (Chris) think you’re going to love.

You will also have the opportunity to “partner” with Bill, Doug, and Mark on a new venture they’ve been keeping under wraps until now.

Now, back to why the feds want to kill cash…

Cash is a remnant of the analog age. That makes it a safe haven from digital snooping.

Take a stack of $50 bills from under your mattress… buy something with them… and the feds can’t easily track you.

To continue reading, please go to the original article at

https://www.legacyresearch.com/the-daily-cut/how-the-feds-can-finally-win-their-war-on-cash/

.Your Savings Are at Risk in the Cashless World That’s Coming

Your Savings Are at Risk in the Cashless World That’s Coming

Chris Lowe Investor Place September 13, 2019

They’re Coming For Your Money – Every Last Cent…

That may sound like a weird, tinfoil-hat type of thing to say.

But it’s what’s at stake in the War on Cash.

As we’ve been showing you, governments are planning to seize control of your wealth by getting rid of banknotes and coins.

That means no more Ben Franklins. No more nickels and dimes. Nothing but electronic 1s and 0s in a government database.

Your Savings Are at Risk in the Cashless World That’s Coming

Chris Lowe Investor Place September 13, 2019

They’re Coming For Your Money – Every Last Cent…

That may sound like a weird, tinfoil-hat type of thing to say.

But it’s what’s at stake in the War on Cash.

As we’ve been showing you, governments are planning to seize control of your wealth by getting rid of banknotes and coins.

That means no more Ben Franklins. No more nickels and dimes. Nothing but electronic 1s and 0s in a government database.

In a purely digital-currency world… the feds will be able to track, monitor, and record all your financial transactions.

Worse, your savings will be subject to whatever crazy policies central bankers come up with to cope with the next financial crisis… with little chance of escape.

Think of this as a “digital slaughterhouse”…

It’s a term I (Chris) borrowed from currency expert Jim Rickards. As he put it…

When pigs are going to be slaughtered, they are first herded into pens for the convenience of the slaughterhouse. When savers are going to be slaughtered, they are herded into digital accounts from which there is no escape.

As I showed you yesterday, this is a trend already in motion.

https://investorplace.com/2019/09/crypto-fiat-currency-is-a-disaster-for-your-privacy-lrg/

China plans to roll out a fully digital version of its currency in November. Canada, Britain, Norway, and Sweden are also looking into purely digital versions of their national currencies.

Today, I’ll show you why these countries are creating a roadmap that other governments – including in the U.S. – will follow.

https://finance.yahoo.com/news/savings-risk-cashless-world-coming-144512361.html

.Laurentian Bank Will Not Accept Rolled Change For Deposit

Laurentian Bank Will Not Accept Rolled Change For Deposit

Montreal man has $800 in rolled change, but his bank won't deposit the money

Lauren McCallum, Verity Stevenson 2 days ago

Julien Perrotte brings rolled change to his bank each year. But now, Laurentian Bank says it will not deposit the coins into his account.

Julien Perrotte stood in front of the representative at his local bank last week, unsure he properly understood what she was telling him.

He was carrying about $800 worth of coins, sorted and rolled, that he had collected over the past year. But she said Laurentian Bank wouldn't deposit them.

"I'm like, 'It doesn't make sense,'" Perrotte told CBC News.

Laurentian Bank Will Not Accept Rolled Change For Deposit

Montreal man has $800 in rolled change, but his bank won't deposit the money

Lauren McCallum, Verity Stevenson 2 days ago

Julien Perrotte brings rolled change to his bank each year. But now, Laurentian Bank says it will not deposit the coins into his account.

Julien Perrotte stood in front of the representative at his local bank last week, unsure he properly understood what she was telling him.

He was carrying about $800 worth of coins, sorted and rolled, that he had collected over the past year. But she said Laurentian Bank wouldn't deposit them.

"I'm like, 'It doesn't make sense,'" Perrotte told CBC News.

The woman told him he could exchange the coins for bills at local grocery stores, corner stores and pharmacies because "they love coins."

But Perrotte, who works as an independent insurance claims adjuster, says he doesn't have time to shop around for a small business to take his change — especially when it's a service he expects to receive from his bank.

He called Laurentian Bank's customer service line to see if there was any other way the bank would take his hundreds of loonies and toonies.

He was told it was a new policy at the bank not to accept coins.

"Pretty much, I was exasperated," said Perrotte, who has been a member of Laurentian Bank for 15 years.

"It's so absurd.… Everyone has coins, that's for sure. Poor people, rich people."

The other option Perrotte considered was to exchange the coins at a Coinstar machine, which are at some grocery stores and malls, but the machines charge about 12 per cent in fees for the service.

"So I would lose like 80 bucks just to try to get rid of money. And my bank doesn't want my money!" Perrotte said.

Some bank branches going cashless

As Perrotte points out, the Royal Canadian Mint is still producing coins as legal tender. But he now wonders who is ensuring that banks will take them.

He's worried other banks will follow Laurentian's lead.

In a response to a request for comment from CBC News, Royal Canadian Mint spokesperson Alex Reeves said the Crown corporation's mandate is limited to manufacturing and distributing Canadian currency.

To continue reading, please go to the original article at

.Going Cashless Looks More and More Like a Capitalist Scam

Going Cashless Looks More and More Like a Capitalist Scam

By Ankita RaoMar 22 2019

Lawmakers argue bans on cashless stores could protect tens of millions of Americans without access to credit cards.

When Bluestone Lane decided to go cashless, the people running the coffee franchise were thinking of efficiency.

“Cash takes time,” said Andy Stone, vice president of brand marketing and events at the company, which was inspired by cafe culture in Australia. “In New York, nobody wants to be waiting in line.” There’s also the counting of cash, the moving and transferring of it in actual trucks, which can be vulnerable to theft.

And, Stone noted, the transparency question. “Whatever comes into the system, comes into the system. It’s better for society if we pay more taxes.”

Going Cashless Looks More and More Like a Capitalist Scam

By Ankita RaoMar 22 2019

Lawmakers argue bans on cashless stores could protect tens of millions of Americans without access to credit cards.

When Bluestone Lane decided to go cashless, the people running the coffee franchise were thinking of efficiency.

“Cash takes time,” said Andy Stone, vice president of brand marketing and events at the company, which was inspired by cafe culture in Australia. “In New York, nobody wants to be waiting in line.” There’s also the counting of cash, the moving and transferring of it in actual trucks, which can be vulnerable to theft.

And, Stone noted, the transparency question. “Whatever comes into the system, comes into the system. It’s better for society if we pay more taxes.”

Bluestone is far from the only business allowing solely plastic or digital payments in a country where, a Federal Reserve report last fall estimated, credit and debit cards were used in 48 percent of consumer transactions in 2017.

But in the past several months, local and state governments have moved to resist this trend, citing concerns that a cashless economy could discriminate against the roughly 6.5 percent of US households—disproportionately young, low-income people of color—without bank accounts, and hike up the cost of goods to account for credit card fees.

In early March, Philadelphia became the first major US city to ban cashless businesses. A couple of weeks later, the state of New Jersey followed suit, becoming the second state to ban virtually all cashless businesses after Massachusetts, which has had a policy in place since the 1970s.

Now cities like New York, Washington, DC, and San Francisco are considering similar moves. The regulations reflect a national push to fight back against corporations and tech firms critics say are only serving to widen already-yawning economic disparities.

“This should be the law of the land,” said Paul Moriarty, the New Jersey assemblyman who led his state’s successful push to ban cashless enterprises, "just as the US dollar is legal tender and is supposed to be accepted for all debts.” Moriarty’s legislation garnered almost unanimous support in a state that includes Newark, one of the most underbanked cities in the country.

But it’s not only low-income families he’s accounting for. Moriarty also pointed out that going cashless could allow businesses, and customers, to be exploited or juiced by financial institutions. Visa, it should be noted, has been offering restaurants $10,000 to go cashless.

To continue reading, please go to the original article at

https://www.vice.com/en_us/article/kzm4yv/cashless-businesses-discrimination

.Forrrest Fenn's 5 Million Dollar Hidden Treasure

.Forrrest Fenn’s 5 Million Dollar Hidden Treasure

By Julia Glum June 17, 2019

Everyday Money & Hidden Treasure

There's a Treasure Chest Worth Millions Hidden Somewhere in the Rocky Mountains. These Searchers Are Dedicating Their Lives and Savings to Finding It

Forrrest Fenn’s 5 Million Dollar Hidden Treasure

By Julia Glum June 17, 2019

Everyday Money & Hidden Treasure

There's a Treasure Chest Worth Millions Hidden Somewhere in the Rocky Mountains. These Searchers Are Dedicating Their Lives and Savings to Finding It

When Cynthia Meachum lost her job in 2015, it was the best day of her life. To hear the 65-year-old tell it, she got the bad news, waved off her boss’s apologies and nearly skipped away.

“I wanted to do cartwheels,” she says.

Meachum had been close to retiring from her gig as a field service engineer in the semiconductor industry anyway. Getting laid off meant she could fully throw herself into her true passion: finding Forrest Fenn’s hidden treasure, worth millions.

She already had the “war room,” a converted library in her Rio Rancho, New Mexico, home where the walls are papered with giant maps of Yellowstone National Park and nearby forests. She had the resources, including manuals on fly fishing in Montana, the domain chasingfennstreasure.com, and connections to an international community of searchers.

Cynthia Meachum in the "war room" of her home in Rio Rancho, NM, May 29, 2019. Photograph by Sarina Finkelstein.

Now — finally — she had the time.

“As soon as I walked out of that conference room, the first person I called was my spouse,” Meachum says. “And the second person I told was Forrest Fenn.”

It was, after all, not something she could really talk about at the water cooler. The elements of the Fenn treasure hunt sound like something out of a fairy tale: nine clues in a poem written by an elderly collector; a chest of jewels concealed somewhere in the Rocky Mountains; a bounty so valuable people have died looking for it.

To continue reading, please go to the original article at

.Why Don’t Americans Save?

.Why Don’t Americans Save?

From Get Rich Slowly By J.D. Roth — updated on 07 November 2018

A new report from the Center for Financial Services Innovation says that only 28% of Americans are financially healthy. And it reinforces something we already knew: The U.S. saving rate sucks. Americans don't save.

The U.S. Financial Health Pulse divides people into three tiers of financial health.

Financially healthy people (28% of the U.S., 70 million people) are “spending saving, borrowing, and planning in a way that will allow them to be resilient and pursue opportunities over time.”

Financially coping people (55%, 138 million) are “struggling with some, but not necessarily all, aspects of their financial lives.”

Financially vulnerable people (17%, 42 million) are “struggling with all, or nearly all, aspects of their financial lives.”

Why Don’t Americans Save?

From Get Rich Slowly By J.D. Roth — updated on 07 November 2018

A new report from the Center for Financial Services Innovation says that only 28% of Americans are financially healthy. And it reinforces something we already knew: The U.S. saving rate sucks. Americans don't save.

The U.S. Financial Health Pulse divides people into three tiers of financial health.

Financially healthy people (28% of the U.S., 70 million people) are “spending saving, borrowing, and planning in a way that will allow them to be resilient and pursue opportunities over time.”

Financially coping people (55%, 138 million) are “struggling with some, but not necessarily all, aspects of their financial lives.”

Financially vulnerable people (17%, 42 million) are “struggling with all, or nearly all, aspects of their financial lives.”

Financial Health Of Americans

The full report is huge — it's an 80-page PDF! — and filled with data based on survey responses from 5000 people. The document does a great job of presenting the info, separating it into four major sections (spend, save, borrow, plan), then comparing how people in each financial health tier differ in their approaches.

Here, for instance, are the results for the survey question about saving rate:

Saving rate among Americans

In the nearly thirteen years I've been writing Get Rich Slowly, I've seen reports like this over and over and over again. It's a constant refrain: American's don't save. But why don't they save?

To continue reading, please go to the original article at

![190617-forrest-fenn-featured-image[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1568682963875-JSGXCWU9DU3H2VA7V8OZ/190617-forrest-fenn-featured-image%5B1%5D.jpg)

![30811508277_fcd0b26106_c[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1568606241779-Y12IIWFPH3HZ7CP0OITU/30811508277_fcd0b26106_c%5B1%5D.jpg)

![43933915090_4d1fe55e08_c[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1568606309387-O0L6OVIP5U4ZYCXZ0PJN/43933915090_4d1fe55e08_c%5B1%5D.jpg)