Seeds of Wisdom RV and Economic Updates Monday Morning 9-30-24

Good Morning Dinar Recaps,

CHINA-RUSSIA CRYPTO PACT: A NEW THREAT TO US DOMINANCE?

The China-Russia crypto pact is worrying some experts. It could challenge the US’s dominance and bring some new security risks to the cryptocurrency market. Global stability could be at stake as tensions grow around the world.

Navigating Security Risks and Cryptocurrency Market Dynamics and Growing Peril of Chinese-Russian Cooperation

Good Morning Dinar Recaps,

CHINA-RUSSIA CRYPTO PACT: A NEW THREAT TO US DOMINANCE?

The China-Russia crypto pact is worrying some experts. It could challenge the US’s dominance and bring some new security risks to the cryptocurrency market. Global stability could be at stake as tensions grow around the world.

Navigating Security Risks and Cryptocurrency Market Dynamics and Growing Peril of Chinese-Russian Cooperation

Frederick Kempe, CEO of the Atlantic Council, highlighted key issues at the UN General Assembly. He stated:

“Two dark clouds hung over the United Nations General Assembly this week in New York. The first was the growing peril of Chinese-Russian common cause. The second was uncertainty about whether US leadership will rise to the challenge after the November elections.” This reflects the influence of the China-Russia crypto pact as well.

The US has sanctioned over 300 Chinese firms recently, but China’s behavior hasn’t changed. In Russia’s Dagestan region, crypto miners are going underground. Local Prime Minister Abdulmuslimov noted:

“The owners of illegal cryptocurrency mining installations are coming up with new methods of ‘circumventing’ the law – they install mining farms underground,” influenced by the China-Russia crypto pact.

Global Security Implications

Former Secretary of State Condoleezza Rice sees our era as more dangerous than the Cold War. Kempe reported her concerns about “the gathering global threats running up against the perils of what she called ‘the four horsemen of the Apocalypse—populism, nativism, isolationism, and protectionism.'” Such concerns are exacerbated by the China-Russia crypto pact.

Cryptocurrency Regulation in Russia

Russia will enforce new crypto mining laws from November 1, 2024. The finance ministry will keep a list of approved crypto-mining companies. The influence of the China-Russia crypto pact is expected to be a significant factor in these new laws.

US Response and Future Outlook

The US plans to keep pressuring China for supporting Russia. Nicholas Burns, US ambassador to China, stated:

“We’re not going to stand by as China significantly helps Russia strengthen [not only] its armaments potential, but also its defense industrial base.” The crypto pact further complicates this stance.

The China-Russia crypto pact is a big challenge to US dominance. As cryptocurrency markets grow, global politics are changing. This could reshape how money moves around the world.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

FORMER CHINESE FINANCE MINISTER URGES STUDY OF CRYPTOCURRENCY MARKETS

Former Chinese finance minister Zhu Guangyao calls for closer study of cryptocurrencies, citing global developments and potential economic importance.

▪️Former Chinese finance minister calls for closer study of crypto

▪️Cites Trump’s campaign remarks as reason for Beijing to pay attention

▪️Acknowledges risks but calls crypto crucial to digital economy

▪️Notes SEC approval of Bitcoin and Ethereum ETFs

▪️Contrasts mainland China’s caution with Hong Kong’s crypto embrace

Zhu Guangyao, China’s former minister of finance, has called on Beijing to pay closer attention to the cryptocurrency markets.

Speaking at a summit hosted by Tsinghua University, Zhu emphasized the need for the Chinese government to study recent international changes and policy adjustments in the crypto space.

The former minister’s remarks come in light of comments made by Republican presidential candidate Donald Trump on the U.S. campaign trail.

At the Bitcoin Conference in Nashville this July, Trump stated that the United States must fully embrace the crypto industry, warning that “China will do it” if America doesn’t take the lead.

Zhu highlighted Trump’s comparison of the crypto industry to the steel industry of a century ago, noting the candidate’s prediction that cryptocurrency might one day overtake gold.

This high-profile endorsement of crypto by a major U.S. political figure seems to have caught the attention of Chinese officials.

While acknowledging the potential of cryptocurrencies, Zhu also stressed the importance of recognizing the risks associated with them.

He stated that crypto “has negative impacts, and we must fully recognize its risks and the harm it poses to capital markets.” However, he balanced this caution by describing cryptocurrency as “a crucial aspect of digital economy development.”

The former finance minister also pointed to recent developments in the United States financial sector as a reason for China to reassess its stance on crypto.

Specifically, he mentioned the Securities and Exchange Commission’s (SEC) approval of bitcoin (BTC) and ether (ETH) exchange-traded funds (ETFs), despite initial opposition from the regulatory body.

This call for a closer examination of cryptocurrencies marks a potential shift in thinking among some Chinese officials. Mainland China has maintained a cautious approach to cryptocurrencies, with strict regulations in place.

However, Hong Kong, which operates under a semi-autonomous system of government and market regulations, has taken a more welcoming stance towards the crypto industry.

Hong Kong has recently listed bitcoin and ether ETFs, signaling a more open approach to cryptocurrency investments. Additionally, some members of Hong Kong’s mini-legislature have actively courted crypto businesses to set up operations in the city.

This divergence in approach between mainland China and Hong Kong highlights the complex landscape of cryptocurrency regulation in the region.

Zhu’s comments suggest that some Chinese officials may be reconsidering the country’s stance on cryptocurrencies in light of global developments.

The former finance minister’s call for further study indicates a recognition that the crypto industry is becoming an increasingly important part of the global financial landscape.

@ Newshounds News™

Source: Blockonomi

~~~~~~~~~

RIPPLE & INDIA, PARTNER UP- $500T MARKET

Zach Humphries Tells us "Massive XRP news as Ripple & India, partner up- $500T Market. The oil industry is changing, and XRP is revolutionizing it." He states in the video that "Ripple is integrating XRP into Oil trading and cross border transactions using Saudi Arabia Banks."

@ Newshounds News™

Source: Twitter X

~~~~~~~~~

DIGITAL FUSION SUMMIT UNITES FAMILY OFFICES AND INSTITUTIONAL INVESTORS TO EXPLORE DIGITAL ASSET OPPORTUNITIES IN DALLAS

Dallas, United States, Texas, September 28th, 2024, Chainwire

Event Highlights Strategies for Integrating Digital Assets into Traditional Finance Portfolios

On September 19th, the Digital Fusion Summit convened at the W Hotel - Victory in Dallas, Texas, bringing together family offices, institutional investors, and high-net-worth individuals for an exclusive event focused on the burgeoning digital asset class.

Hosted on the 33rd Floor Altitude Center, the summit provided a premier platform for education, networking, and strategic discussions at the intersection of traditional finance and digital assets.

Co-hosted by industry leaders Jake Claver and Max Avery of Digital Ascension Group and Syndicately, alongside Jordan M. Hutchinson, President and Managing Partner of Black Ocean Capital & Jest Events, and supported by team members Eric Ascione and Jedidiah Wick, the summit assembled experts to delve into opportunities, challenges, and investment strategies surrounding digital assets.

The event featured a series of panels and discussions addressing critical aspects of the digital asset landscape, including blockchain technology, cryptocurrency adoption, asset tokenization, and fintech innovations.

"What Digital Assets Really Mean for Family Offices: Strategy, Adoption, and Investment Opportunities"—This panel, moderated by Ray Fuentes, explored how family offices can develop effective strategies and assess value propositions in the digital asset space.

Panelists included thought leaders such as Jake Claver, Matthew Snider, Erin Friez, and Rustin Diehl, who shared insights on successful investment cases and adoption strategies within blockchain and cryptocurrency markets.

"Professional Service Providers for Digital Assets: Ensuring Security and Compliance"—Moderated by Rachel Wolfson, this discussion focused on the evolution of custody solutions, best practices for digital asset security, and navigating regulatory considerations in the cryptocurrency sphere.

Panelists Eric Ervin, Joe Medioli, and John Wingate offered valuable perspectives on the role of institutional custody in driving widespread adoption of digital assets.

"Fintech Companies Providing Liquidity to Private Investments: Opportunities and Challenges"—This panel, led by Ray Fuentes, delved into the potential of tokenizing real assets, legal considerations in asset tokenization, and successful case studies.

Industry specialists Lee Mosbacker IV, Connor McLaughlin, Jake Claver, and John Wingate shared their expertise on navigating early-stage investments in digital assets and the tokenization process, highlighting how fintech innovations are reshaping liquidity in private markets.

"Legal Innovations in Blockchain"—Rachel Wolfson moderated this discussion with legal experts Rick Tapia, Rustin Diehl, and Erin Friez to explore the evolving legal frameworks shaping the blockchain and cryptocurrency sectors. The panel examined intellectual property rights, compliance issues, and the impact of regulatory changes on the deployment of blockchain technology and digital assets.

The summit also featured keynote speeches from Joe Medioli of Anchorage Digital and Lee Mosbacker IV of Cyrannus, providing deeper insights into institutional digital asset services and the importance of liquidity in private markets. Their presentations underscored the critical role of secure, compliant, and efficient digital asset solutions in the financial industry's future.

Sponsors Cyrannus, Anchorage Digital, and Securitize for Advisors played a pivotal role in making the summit possible, demonstrating their commitment to advancing the digital asset ecosystem and supporting the integration of blockchain technology into mainstream finance.

The Digital Fusion Summit successfully bridged the gap between traditional finance and the digital asset landscape, offering attendees a comprehensive view of the opportunities and challenges in this rapidly evolving sector.

As digital assets, blockchain, and cryptocurrency continue to gain traction among institutional investors and family offices, events like this are crucial for fostering education, collaboration, and growth within the industry.

The success of this inaugural Digital Fusion Summit sets the stage for future events aimed at uniting traditional finance with the burgeoning world of digital assets. For those interested in attending upcoming events or learning more about opportunities in the digital asset space, the team at Digital Ascension Group welcomes inquiries.

To stay informed about future events and explore how your family office or institution can navigate the world of digital assets, please visit www.digitalfamilyoffice.io.

The team at Digital Ascension Group looks forward to fostering more insightful discussions and valuable networking opportunities in the digital asset sector.

@ Newshounds News™

Source: Investing News

~~~~~~~~~

🌍 Dive Deeper into The Constitution: Fascinating Facts You Need to Know | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 9-29-24

Good Afternoon Dinar Recaps,

XRP VS. TRADITIONAL BANKING SOLUTIONS: WHY BANKS ARE TAKING NOTICE OF RIPPLE

▪️The role of XRP as a bridge currency in global finance is gaining traction.

▪️Top Analyst uncovers key factors that can drive XRP’s adoption.

XRP, the cryptocurrency associated with Ripple Labs Inc., is often described as a bridge currency that can be integrated with the traditional banking sector. At the moment, there are heightened discussions on why banks should use XRP for payments.

Good Afternoon Dinar Recaps,

XRP VS. TRADITIONAL BANKING SOLUTIONS: WHY BANKS ARE TAKING NOTICE OF RIPPLE

▪️The role of XRP as a bridge currency in global finance is gaining traction.

▪️Top Analyst uncovers key factors that can drive XRP’s adoption.

XRP, the cryptocurrency associated with Ripple Labs Inc., is often described as a bridge currency that can be integrated with the traditional banking sector. At the moment, there are heightened discussions on why banks should use XRP for payments.

Why Banks Are Taking Notice of Ripple

In an X post, crypto investor and analyst CryptoTank highlighted several reasons banks would use XRP instead of other digital tokens or a Central Bank Digital Currency (CBDC).

First, the analyst pointed out that the traditional banking sector is competitive. He noted that smaller banks compete with larger banks like JPMorgan for market share and customers.

Therefore, he claims banks will be uninterested in accepting each other’s digital token or CBDC since doing so will give bigger rivals a competitive advantage. The analyst added that the smaller banks’ agreement could give bigger banks total control of how the tokens will be issued and used.

Essentially, the analyst opined that the bigger banks could eventually exert tough conditions that might put smaller ones out of business.

J.P. Morgan or B of A, or any other competitor. If they agreed to that the the Big bank could set the terms and control how that token is issued, used, etc to the smaller banks. Essentially able to put them out of business if they wanted to. Which of course they do…

— CryptoTank (@Tank2033js) September 24, 2024

CryptoTank’s second point hinges on liquidity. He emphasized how banks are desperate to get liquidity that is easily accessible, cheap, and with low to zero friction. He noted that the SWIFT network, developed as a payment solution for financial institutions, is still far behind in technology. The analyst stated that the network is slow, costly, and has friction, thus limiting its use by traditional banks.

CryptoTank highlighted that the fundamental idea behind the new financial system and the digital age is the seamless transfer of value. He added that the BRICS alliance was created by countries seeking freedom from the traditional banking system. According to the analyst, the United States and the United Kingdom have had authority over sanctions, which often caused financial harm to them.

Documents from the BIS, IMF, and WEF claim a neutral bridge currency is needed to provide a seamless transfer of value globally. This would avoid friction and failed transactions and allow banks to free up Nostro Vostro accounts.

Comparing XRP to XLM as a Solution to Financial Freedom

Many think Stellar’s XLM could be used for seamless value transfer instead of XRP. CryptoTank, however, pointed out that XLM was created for peer-to-peer smaller transactions and banking the unbanked globally and not as a bridge currency.

On the other hand, he noted that XRP is not a utility token. The analyst describes XRP as a token created specifically for transferring huge amounts of value at a low cost, high speed, and without friction.

The analyst highlighted how Ripple uses XRP as a bridge asset to move value for its On-Demand Liquidity (ODL). As noted in an earlier CNF post, wealth advisor Mickle claims demand for XRP among market makers will increase as global ODL transactions expand.

CryptoTank highlights Ripple’s partnership with the BIS, IMF, WEF, and central banks, further strengthening XRP’s case as the appropriate bridge currency.

“Sitting at the head tables with the Global leaders of Finance and Banking. Crafting the rules, regulations, and how the new system will work…It doesn’t take a genius to see where this is going,” CryptoTank emphasized.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

GOLDMAN SACHS FORECASTS WEAKER DOLLAR AS FED BEGINS INTEREST RATE REVERSAL: REPORT

Banking giant Goldman Sachs is forecasting a weaker US dollar following the interest rate reversal from the Federal Reserve.

In a new note to investors covered by Bloomberg, Goldman strategists say a gradual weakening of the greenback is expected now that lower rates have lessened the dollar’s appeal.

The bank said the Fed’s recent cut of 50 basis points (bps) showed a willingness to respond aggressively to a potential economic downturn, justifying expectations of relative weakness for the dollar against other major currencies including the euro, pound and yen.

Goldman is now predicting upward moves in the euro and the pound against the dollar, predicting $1.15 for EUR/USD, a 2.67% boost, and $1.40 for GBP/USD, a 4.47% rally from current prices.

Says the Goldman strategists,

“This balance should entail a weaker dollar over time, but we still expect that to be a gradual and uneven process. We also still believe the dollar’s high valuation will not be eroded quickly or easily, but the bar has been lowered a bit…

Support for sterling is coming both from its risk beta as well as solid growth momentum and a patient BOE. Markets have priced out US recession risk, benefiting risky assets and pro-cyclical currencies like sterling.”

Goldman’s call for a weaker dollar differs from the forecast from German banking titan Deutsche Bank, who believes that a potential Donald Trump presidency will ultimately boost the dollar relative to other currencies.

“We think pricing for the Fed is too dovish and that the market is underpricing the dollar positive risks around a Trump victory, so we like buying the USD.”

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

XRP RECOGNIZED BY SWIFT AS A BRIDGE CURRENCY FOR 11,000+ BANKS

▪️XRP was recognised as a bridge currency by SWIFT, an interbank messaging platform that connects over 11,000 banks globally and facilitates $150 trillion in transfers annually.

▪️While the two were initially viewed as rivals, they work even better together, with SWIFT bringing legacy finance connections while XRP provides the tech.

Years ago, XRP was viewed as the ultimate solution that would wipe off traditional cross-border rails, with SWIFT being put on notice. However, crypto has matured since then, and its enthusiasts have recognized that it’s easier to integrate with established players than to fight them, Now, XRP is seen as complementary to SWIFT rather than a whole new solution.

SWIFT has also warmed up to XRP, and in a partnership with blockchain consortium R3 that extends back over five years, the interbank messaging platform mentioned XRP as one of the options for a bridge currency between its participants.

SWIFT is the world’s most popular interbank messaging protocol, connecting over 11,000 global banks, ranging from multinational behemoths like JPMorgan and Bank of China to local union banks. In its most recent published figures, it revealed that it was recording 45 million transfers daily, resulting in $150 trillion worth of value transfers facilitated annually.

As XRP enthusiasts noted on social media, this recognition is important for XRP.

XRP for Global Fund Transfers

Today, sending an email or a chat message is instant and cheap. However, sending a financial message remains cumbersome, very costly and extremely slow. Most banks take three to five working days to deliver the funds, leading to the joke that it’s easier to take a flight and deliver the cash in hand rather than send it via SWIFT.

Since crypto launched, this has been one of the sectors it’s targeted. XRP has been one of the leaders in this revolution owing to its very low fees and fast transactions. While it has seen some traction, including integrating with several banks globally, it has yet to land its key moment.

Despite the integrations, Ripple is still pushing to completely overhaul the system. As we reported, CEO Brad Garlinghouse revealed recently he’s still focused on “trying to let value move the way information moves today.”

However, it doesn’t happen overnight, he noted. Being a payment network that handles people’s money, XRP and the interlinked systems are moving systematically slowly to ensure they are compliant with every financial regulation and avoid the walls caving in on the leaders as they have for former kingpins like Binance founder Changpeng Zhao and FTX founder Sam Bankman-Fried, who prioritised speed over compliance.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

THE SILVER PRICE NARRATIVE HAS BEGUN...

💰 Silver, dubbed the "money of the people," is projected for 50% gains in 2024, potentially reaching $1 per ounce due to its diverse uses beyond gold.

📈 In the past 11 months, silver has outperformed gold by 61%, with analysts predicting a potential surge to $50 an ounce within 100 days if it breaks above $32.

🗓 2024 has been officially named the "year of the metals" by GSC commodity intelligence, marking the beginning of the "silver narrative" expected to continue into 2025.

The Economic Ninja encourages everyone to own at least 2 ounces of silver, calling it the "investment of the century" due to anticipated truth revelations.

🚀 Predictions suggest silver prices will reach all-time highs in 2025, with some analysts offering even more bullish forecasts for the precious metal's future value.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~

XRP NEWS: TOP RIPPLE EXECUTIVES TO ATTEND FEDERAL RESERVE BANK’S 8TH ANNUAL FINTECH CONFERENCE

▪️Ripple’s Brad Garlinghouse and Chris Larsen have been reported to appear at the upcoming annual Fintech conference hosted by the Federal Reserve Bank of Philadelphia.

▪️Before this, Ripple’s flagship event – the Swell conference, would be hosted with several industry key players expected to discuss the future of the crypto industry.

The price of XRP surged 4% daily after reports emerged that Ripple executives Brad Garlinghouse and Chris Larsen would make a groundbreaking appearance at the annual fintech conference.

According to details, the upcoming event would be the eighth edition hosted by the Federal Reserve Bank of Philadelphia from October 22 to October 23. Based on the information available on the host’s website, this year’s conference would feature notable fintech professionals and researchers speaking on various topics, including real-world asset tokenization, banking-as-a-service, tokenized deposits, and the potential role of fintech in shaping the future of finance.

In addition to the Ripple executives, the list of expected speakers at the event includes Coinbase lawyer Paul Grewal, and the head of the Crypto Council for Innovation Sheila Warren.

The Swell Conference by Ripple

From October 15-16, Ripple will also host its annual flagship event, the Swell Conference. According to the blockchain company, this event will be attended by more than 40 countries, over 600 attendees, and more than 50 speakers.

Based on the document we have, some of the featured speakers would include Ripple’s Brad Garlinghouse, superintendent at the New York State Department of Financial Services Adrienne Harris, former chair of the FDIC and founding chair of the Systemic Risk Council Sheila Bair, global head of blockchain and digital assets at BBVA Francisco Maroto, and Chief Security Officer at Coinbase Philip Martin.

According to reports, the conference would discuss several topics to reveal how financial institutions and businesses leverage crypto in blockchain technology.

Court Case Still Hanging

Currently, the entire crypto industry is waiting for the appeal decision by the US Securities and Exchange Commission (SEC) as the October 7 deadline is fast approaching. According to a former SEC lawyer, the Commission would likely appeal the ruling on the programmatic sales of XRP by Judge Analisa Torres as we reported. However, Ripple’s Chief Legal Officer Stuart Alderoty believes that the conflict has ended.

Attorney Jeremy Hogan commented on this and advised the Commission to consider its “mandate of investors’ protection” in its decision-making.

Of course, they think the opinion is wrong – they were on the losing side. What the SEC should be thinking of right now is whether an appeal furthers its mandate of investor protection and capital formation. Why isn’t that top of mind? More evidence the SEC has lost the plot.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

🌍 7 CONFUSING CRYPTO TERMS (ALMOST) NOBODY UNDERSTANDS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Sunday Morning 9-29-24

Good Morning Dinar Recaps,

SEC TAKES STEPS TO APPEAL JUDGE TORRES’ RULING ON XRP

▪️The SEC is preparing to appeal Judge Torres' ruling on XRP.

▪️Experts share mixed views on the outcome of the potential appeal.

▪️XRP's price is trending upward, reflecting increased investor interest.

Good Morning Dinar Recaps,

SEC TAKES STEPS TO APPEAL JUDGE TORRES’ RULING ON XRP

▪️The SEC is preparing to appeal Judge Torres' ruling on XRP.

▪️Experts share mixed views on the outcome of the potential appeal.

▪️XRP's price is trending upward, reflecting increased investor interest.

The U.S. Securities and Exchange Commission (SEC) is moving to appeal Judge Torres’ summary judgment on XRP in the Ripple case. Pro-XRP attorney John Deaton and other legal experts are assessing the likelihood of the SEC’s appeal and its potential ramifications.

Intent to Appeal by the SEC

Recently, the possibility of the SEC filing an appeal has increased. A former SEC attorney stated to Fox Business journalist Eleanor Terrett that the agency would likely challenge Judge Analisa Torres’ July 2023 ruling.

Legal Critiques and Expert Opinions

John Deaton, working pro bono for 75,000 XRP holders, noted that judges have criticized the SEC’s adherence to the law. He pointed out that under Gary Gensler’s leadership, the SEC might still pursue an appeal, which could waste taxpayer money.

“I don’t believe an appeals court will rule that Judge Torres erred in applying the third criterion. Judge Torres’ decision was based on very specific facts. The SEC did not rely on any expert testimony regarding XRP holders (which was ultimately excluded), but the judge did.”

Deaton added that even if the Second Circuit judges determined that Judge Torres erred in applying the third criterion, the case would return to her, where the SEC would likely lose again, as the district court would conclude that the SEC failed to establish a ‘joint venture.’

The Only Way to Win the Case

Fred Rispoli agreed with Deaton, stating that it would be very challenging for the SEC to alter Torres’ ruling. Rispoli expressed that the SEC’s chances of winning depend on the preferences of three randomly selected judges reviewing the case.

“If the SEC selects three SEC-friendly judges (rare but possible), it could win.”

Rispoli and other attorneys anticipate a last-minute appeal from the SEC. If the SEC does not appeal, it would be a significant victory for Ripple and the XRP community, allowing them to argue that all secondary sales do not constitute an investment contract.

There is a rising trend in XRP’s price, which has seen a 2% increase in the last 24 hours, currently trading at $0.602. The recorded low and high levels are $0.585 and $0.610, respectively. Additionally, trading volume has surged by 21% in the last day, indicating growing investor interest. XRP price analysis suggests a target price of $2.

These developments in the legal process could significantly impact the future of XRP in the cryptocurrency market and the SEC’s regulatory role. Investors and market observers are closely monitoring how court decisions and potential appeals might affect the value of cryptocurrency assets.

@ Newshounds News™

Source: CoinTurk

~~~~~~~~~

CARDANO TURNS 7: A LOOK BACK AT KEY MILESTONES AND THE ROAD AHEAD

On Friday, the Cardano blockchain marked its seventh anniversary, solidifying its position as one of the most recognized protocols in the cryptocurrency market. Currently, Cardano’s native token, ADA, ranks eleventh among cryptocurrencies, boasting a market capitalization of approximately $14 billion.

Input Output Global (IOG), the development company behind Cardano, celebrated this milestone on social media, highlighting significant achievements since its inception by co-founder Charles Hoskinson, who also played a key role in the creation of the Ethereum blockchain.

Cardano’s Architectural Evolution Over Seven Years

In a commemorative video, IOG shared notable statistics reflecting Cardano’s growth and development. The blockchain has facilitated over 95 million transactions, showcasing its usage and adoption through the years.

Additionally, more than 74,000 Plutus scripts have been executed, which are essential for the effective deployment of smart contracts on the platform.

Cardano has also witnessed significant community engagement, with the creation of 1.3 million delegated wallets and the publication of 226 research papers. Furthermore, approximately 1,373 projects have been launched on the blockchain, also showcasing the community usage.

The Catalyst funding program, which has undergone 12 funding rounds, has played a crucial role in advancing the Cardano ecosystem. This initiative has supported over 1,800 funded ideas, fostering upgrades and further developments within the protocol.

However, the last seven years have also seen significant transformations in Cardano’s architecture. The transition from the Shelley era to the Alonzo hard fork marked a pivotal shift.

Moves Toward Decentralized Decision-Making

The Shelley era, which began in 2020, focused on decentralization and enhancing network security through the introduction of the Ouroboros upgrades. These upgrades improved stake pool operations and ADA delegation, encouraging staking rewards for users.

The Alonzo hard fork, implemented in 2021, enabled smart contract functionalities on Cardano, significantly increasing the block size and enhancing script memory unit parameters. This advancement allowed developers to create decentralized applications (dApps) that leverage Cardano’s capabilities.

Further enhancements came with the Vasil and Chang upgrades, the latter being the first hard fork of the Voltaire era, the protocol’s final era. The Vasil upgrade, released in 2022, introduced new features, including Plutus script upgrades to reduce transaction costs and the implementation of diffusion pipelining for faster block propagation.

The recent Chang upgrade is being rolled out in two phases, introducing on-chain governance to the network. The first phase, which implements governance features through CIP-1694, sets the foundation for decentralized voting and governance actions.

The second phase will introduce additional governance functionalities, including delegated representative participation and treasury withdrawals, further empowering the community.

Next Steps In The Voltaire Era

Looking ahead, the second part of the Voltaire era will replace the initial genesis keys, which have been key in managing the network since its inception, with ongoing support from stake pool operators (SPOs) and increased involvement from delegated representatives (DReps) and the Constitutional Committee (CC).

The next steps toward achieving decentralized governance involve ensuring that stake pool nodes meet the required thresholds for operation and that decentralized applications (DApps) are nearing completion.

The final transition to the Voltaire era will occur with the last use of the Genesis keys, which will trigger a hard fork and cement Cardano’s status as a self-sustaining blockchain. However, further announcements of subsequent upgrades and their respective dates remain undisclosed.

@ Newshounds News™

Source: Bitcoinist

~~~~~~~~~

7 CONFUSING CRYPTO TERMS (ALMOST) NOBODY UNDERSTANDS

The crypto world is full of technical terms, some of which are so difficult that almost no one understands them.

Getting to grips with cryptocurrency isn’t easy. Even after you’ve got your head around Bitcoin and Ethereum and the difference between proof-of-work and proof-of-stake, there’s still a whole new world of terminology to learn and understand.

But even among fairly hardened cryptonians, there are still terms that are difficult to understand. Here are the seven terms that almost nobody in blockchain understands as fully or as deeply as they’d like.

Blobs

In the 1958 movie starring Steve McQueen, and its 1988 remake, The Blob is an amoeba-like jello monster that terrorizes the inhabitants of a small town, growing larger and redder as it consumes them.

In crypto, most especially Ethereum, blobs (Binary Large Objects) are substantial chunks of data not required by Ethereum’s electronic virtual machine (EVM). Blob data is held onchain for around 20-90 days and then deleted.

The result is a more cost-effective and scalable blockchain. As part of Ethereum’s Dencum update, blobs are often discussed in parallel to the next term on this list.

Blobs may also refer to chunks of data held on decentralized storage systems such as IPFS or Filecoin. These blobs are encrypted and stored across multiple nodes.

Finally, blobs can also refer to transaction blobs on Monero, which is the binary data of a transaction before it is broadcast to the network. Being that Monero is a privacy chain these blobs are structured in a way to maintain anonymity.

And that’s a whole lot of blobs.

Rollups

Rollups are a way of processing transactions on layer-2 protocols, freeing up valuable space on the base layer. A rollup folds transaction upon transaction on the layer-2 level, sometimes dozens of times over, then rolls them together before sending the data back to layer-1.

There are two main types of rollups, optimistic and zero-knowledge (ZK) proofs.

Optimistic rollups is a fairly clear term. It means the rollup operates on an “optimistic” approach, assuming a transaction is valid unless proven wrong by a validator. They only check the validity of a transaction if there’s a dispute.

ZK rollups prove a transaction without revealing any of the transaction data. Hence, “zero-knowledge.”

ZK-rollups offer instant finality because the cryptographic proof guarantees the data is valid.

In many ways a rollup is to your standard blockchain transaction what a Calzone is to a regular pizza slice. By rolling it over, you can fit more in.

Byzantine Fault Tolerance

It’s one of the classic blockchain terms and a key feature of the technology, but for most people, it’s something they spend absolutely no time thinking about.

The Byzantine Generals problem was a theoretical exercise that describes the difficulty of decentralized parties arriving at a consensus without a trusted centralized entity. Namely, it grappled with the possibility for bad actors to produce false information to produce a poor outcome in a given scenario.

Specifically, generals with no direct communication must attack Byzantium simultaneously to be victorious. If one of the generals retreats, or signals they will attack but then retreats, the battle will be a rout; worse than a coordinated retreat between all generals.

Satoshi Nakamoto solved the Byzantine Generals problem for Bitcoin by using a proof-of-work consensus mechanism. The significant amount of time and effort in creating a block is costly for the creator, thus giving them the incentive to produce accurate information.

A Byzantine fault is an error in a decentralized computing system that would show a different error or result to different actors, as in the Byzantine Generals problem.

Therefore, Byzantine fault tolerance is the resilience of that computing system to producing such a fault.

We hope this wasn't too Byzantine an explanation.

Proto-danksharding

Sharding is a means of partitioning a ledger into smaller pieces called shards.

But proto-danksharding is one of the most opaque terms to enter the lexicon of the crypto world. The term just isn’t particularly instructive. Is proto short for prototype? Is this the same dank of your favorite meme folder? Both may be fairly reasonable assumptions, but both are wrong.

First proposed by Protolambda and Dankrad Feist, the creators who lent their names to the idea, proto-danksharding is a transaction type that accepts the aforementioned blobs. The blob-utilizing solution is designed to overcome Ethereum’s longstanding issues with high gas fees and low transaction throughput.

The blobs are used by layer-2 rollups to bundle transactions and submit them to the Ethereum base layer without overwhelming it.

But if proto-danksharding seems like a confusing and mysterious turn of phrase, you can instead choose to use the far more instructive name for the process; EIP-4844.

On second thoughts, the term proto-danksharding isn’t all that bad.

DVT — Distributed validator technology

Most people in cryptocurrency are already familiar with the validators that approve transactions in proof-of-stake consensus models.

DVT takes that concept and decentralizes the process across multiple validators. As described by Lido, DVT “functions as a system that operates similarly to a multisignature (multisig) setup for running a validator.”

This they call “simple DVT” though what’s simple about it remains a mystery.

Ultimately, DVT utilizes multiple operators instead of depending on a single operator, enhancing resilience and mitigating single points of failure.

Dynamic resharding

Dynamic resharding is not your grandmother’s old shards. Dynamic resharding is a relatively new term that Near Protocol’s marketing team has dubbed “the holy grail of sharding,” but it also creates a new lexicon that isn’t immediately understandable.

Building upon the concept of blockchain shards, resharding occurs when the network adjusts the number of shards depending on the load.

An overloaded shard can become two shards, while two underutilized shards can become one.

Nonce

Nonce is one of those terms most people come across during their early days of cryptocurrency discovery and then completely forget about, like the individual names of a large group of people you’ve just met at a party.

In the Bitcoin blockchain, the nonce is the number used in the block header, which is then cryptographically hashed. It is the number guessed through trial and error to decide which miner produces the next blockchain.

Nonce generation makes the mining process more fair and transparent. It takes lots of computation power and energy to do and in some cases, miners may have to adjust the nonce multiple times before solving a block.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

China pressed to speed up crypto policy as US takes Bitcoin ETF lead

▪️Former Finance Minister urges China to rethink crypto policy.

▪️China's allowance of Hong Kong ETF investments signals cautious steps toward crypto.

At a 2024 economic forum in Beijing, former Finance Minister Zhu Guangyao urged China to rethink its crypto approach amid accelerating US policies.

He acknowledged the risks but stressed the importance of staying updated on global shifts, stating, “We must fully recognise its risks and the harm it poses to capital markets, but we must study the latest international changes and policy adjustments because it is a crucial aspect of digital economy development.”

Zhu noted that the US has made significant policy changes this year, including the approval of 11 Bitcoin ETFs.

He even quoted former President Donald Trump, who has been advocating for embracing crypto to prevent China from taking the lead in the sector.

Trump’s opponent, Kamala Harris, has also recently adopted a stance on clear-cut and progressive crypto regulations.

This call for a policy shift echoes comments from Tron founder Justin Sun, who urged China to reconsider its stance on crypto following Trump’s endorsement of Bitcoin.

Sun tweeted in July, “China also needs to step up... US policies have warmed. China should make further progress.”

While China maintains a cautious stance, it has taken small steps towards becoming more open to crypto.

Chinese investors can still purchase crypto through Hong Kong-based firms, and in April, three Bitcoin ETFs were launched in Hong Kong.

@ Newshounds News™

Source: DI News

~~~~~~~~~

🌍 Old System Plows to New QFS Drones Planting Good Seeds. | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 9-28-24

Good Afternoon Dinar Recaps,

RIPPLE ADVANCES STABLECOIN INITIATIVE, ISSUES ANOTHER 350K RLUSD

Ripple mints 350,000 RLUSD to enhance testing on XRP Ledger and Ethereum, aiming for regulatory approval and improved ecosystem integration.

▪️Ripple mints 350,000 RLUSD stablecoins in 24 hours on XRPL and Ethereum.

▪️RLUSD stablecoin undergoes private beta testing for security and efficiency.

▪️XRP Ledger enhancements improve RLUSD's security and efficiency in beta testing.

Good Afternoon Dinar Recaps,

RIPPLE ADVANCES STABLECOIN INITIATIVE, ISSUES ANOTHER 350K RLUSD

Ripple mints 350,000 RLUSD to enhance testing on XRP Ledger and Ethereum, aiming for regulatory approval and improved ecosystem integration.

▪️Ripple mints 350,000 RLUSD stablecoins in 24 hours on XRPL and Ethereum.

▪️RLUSD stablecoin undergoes private beta testing for security and efficiency.

▪️XRP Ledger enhancements improve RLUSD's security and efficiency in beta testing.

Ripple has expanded its stablecoin operations by minting an additional 350,000 units of its RLUSD stablecoin within a span of 24 hours. This activity was carried out in two separate transactions, one consisting of 300,000 RLUSD and the other 50,000 RLUSD. The process was monitored by the Ripple stablecoin tracker, a community-driven XRP Ledger account that tracks the issuance and redemption of these stablecoins.

Ripple Sets Pace with Massive 350K RLUSD Stablecoin Mint

According to the Ripple stablecoin tracker, the recent minting marks a significant step in the testing phase for RLUSD. The issuance occurred through two separate transactions, one for 300,000 RLUSD and another for 50,000 RLUSD. This testing phase is crucial for ensuring the RLUSD meets the highest standards of security, efficiency, and reliability before its full-scale launch.

The minting demonstrates Ripple’s commitment to advancing its stablecoin offerings and enhances the liquidity and functionality of the RLUSD. Most recently, the XRP company reported issuing a record 485 RLUSD stablecoins, its largest single batch yet.

The private beta testing of the RLUSD aims to streamline the integration process across different blockchain platforms. This phase is vital for gaining regulatory approvals and for ensuring that the RLUSD can operate across various blockchain environments.

XRPL Upgrades Enhance Stablecoin Efficacy

The recent enhancements in the XRP Ledger are also pivotal to the optimal functioning of the RLUSD. Two major amendments, fixEmptyDID and fixPreviousTxnID, were activated on the XRPL mainnet, improving the ledger’s efficiency.

These updates will boost the stability and reliability of Ripple’s stablecoin operations. Concurrently, these will impact RLUSD’s performance and its integration within the broader ecosystem.

These technical upgrades facilitate a more robust framework for Ripple’s stablecoin initiatives. This will make the infrastructure supporting RLUSD align with the latest blockchain innovations.

In addition, the legal environment surrounding digital currencies remains a significant aspect of Ripple’s operational strategy. Recent developments in the Ripple vs. SEC case have brought to light the challenges faced by blockchain enterprises.

Insights from legal experts suggest that the SEC’s potential appeal against a favorable ruling for Ripple in the XRP lawsuit may have limited success.

XRP price reacted positively to the recent mint of RLUSD, surging to $0.622. The increase reflects a 5.44% gain over the last 24 hours, accompanied by a 60% rise in trading volume. However, recent CoinGape analysis have hinted at a potential 25% crash on on XRP price if SEC appeals before the October 7 deadline.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

NEW HOME SALES DECLINE IN AUGUST, YET YEAR-OVER-YEAR GROWTH REMAINS STRONG

▪️U.S. new home sales hit 716,000 in August 2024, exceeding the forecast of 699,000 but marking a 4.7% drop from July's figures.

▪️Year-over-year, new home sales jumped 9.8% compared to August 2023, signaling sustained housing market strength.

▪️August inventory climbed to 467,000 units, representing a 7.8-month supply, hinting at potential downward pressure on prices.

▪️Despite year-over-year gains, rising inventory and slower sales indicate a slightly bearish short-term housing outlook.

New Home Sales Fall in August, But Year-Over-Year Growth Persists

New residential home sales in the U.S. declined in August 2024, coming in below both the previous month’s figures and market expectations. However, despite this monthly dip, year-over-year data reveals a significant rise in activity.

Sales of New Homes Exceed Expectations in August

New single-family home sales in August 2024 came in at a seasonally adjusted annual rate of 716,000 units. This is a 4.7% decrease from the revised July figure of 751,000.

However, it exceeded economists’ forecast of 699,000 units, suggesting demand remains robust despite the monthly drop. Additionally, August 2024 sales showed a significant 9.8% increase compared to August 2023’s 652,000 units, highlighting continued year-over-year growth.

Home Prices Show Mixed Trends

The data also revealed mixed signals in home prices. The median sales price for new homes in August was $420,600. While this figure suggests the majority of home sales were occurring at relatively high price points, the average sales price jumped significantly higher, reaching $492,700. The gap between median and average prices highlights that a portion of the market consists of high-end sales, skewing the average price upward.

Inventory and Supply

At the end of August 2024, there were approximately 467,000 new homes on the market, representing a 7.8-month supply at the current sales pace. This indicates a relatively balanced market in terms of supply and demand, as a six-month supply is generally considered healthy. However, with sales slowing from the prior month, it suggests a potential buildup of inventory that could pressure future pricing if demand doesn’t rebound.

Market Forecast: Slightly Bearish Outlook

Given the month-over-month decline and higher-than-expected inventory levels, the outlook for the new home sales market leans bearish in the short term. The 4.7% drop from July, coupled with the rising inventory, suggests some cooling off in demand, which could impact pricing and sales volume in the coming months. However, the solid year-over-year growth hints that the market’s longer-term trend remains positive.

@ Newshounds News™

Source: FX Empire

~~~~~~~~~

$1,100,000,000,000 POURS INTO US BANKS AMID HIGH INTEREST RATES AS JPMORGAN CHASE, BANK OF AMERICA PAY PITTANCE TO DEPOSITORS: REPORT

US banks have reportedly raked in more than $1 trillion after two and a half years of the Fed’s “higher for longer” interest rate policy.

Data from the Federal Deposit Insurance Corporation (FDIC) shows the high interest rate regime allowed thousands of US banks to reap higher yields on their deposits at the Fed, reports the Financial Times.

And although a number of analysts and market observers thought the banks would pass on a significant portion of the higher interest rates to their customers, that didn’t happen.

In the second quarter of 2024 when the Fed was paying banks 5.5% in interest on deposits, savers were getting an average annual rate of 2.2%, according to regulatory data that includes accounts that do not pay any interest.

At JPMorgan Chase, savers received an annual interest rate of just 1.5% while Bank of America depositors collected 1.7% in interest per year.

With low interest for depositors, banks gained $1.1 trillion in additional revenue, about 66.67% of what the Fed paid in interest during the last two and a half years. Meanwhile, savers received only $600 billion.

When the Fed lowered interest rates this month, some banking giants were quick to further reduce the interest paid to wealthy depositors, with JPMorgan and Citi announcing 50 bps cuts in line with the Fed’s own actions.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

ETHENA ANNOUNCES USTB STABLECOIN BACKED BY BLACKROCK'S BUIDL

Reserves for UStb will be invested in BUIDL, which in turn holds U.S. dollars, U.S. Treasury bills, and repurchase agreements.

▪️Ethena has announced a new stablecoin that invests its reserves in Blackrock's real-world asset fund called BUIDL.

▪️The team said UStb can support its synthetic stablecoin USDe during tough market conditions by allowing Ethena’s governance to close USDe hedging positions and reallocate assets to UStb.

Ethena announced today that it's developing a new stablecoin called UStb, which invests its reserves in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

Its the second stablecoin from Ethena, as earlier this year it launched USDe, a synthetic stablecoin that derives its value from the cash-and-carry trade, an arbitrage strategy between an asset and its derivative to maintain its $1 peg.

In a blog post, the team explained that UStb will be a "wholly independent product" with a different risk profile compared to USDe.

The team also wrote that UStb helps USDe manage risk during tough markets by allowing Ethena's governance to reallocate backing assets to UStb when needed.

USDe has brought about some concern from industry stakeholders who say that while the trade is safe, volatility in the markets – which crypto is known for – can quickly cause it to unwind.

In a thread on X, the team addressed some of these concerns, pointing out that while USDe has remained stable despite recent bearish conditions, it can dynamically adjust its backing between basis positions and liquid stable products and may incorporate UStb during periods of weak funding rates if needed.

Ethena said in the post that UStb will be listed on centralized exchanges like Bybit, Bitget, and any future exchanges that Ethena partners with, where USDe is already used as margin collateral.

More details on UStb will be available in the coming weeks, Ethena said.

@ Newshounds News™

Source: CoinDesk

~~~~~~~~~

🌍 JIM SAID WHAT? ROCKS IN HEAD OR FACTS? | Youtube

Jim discusses historical information on our Constitution and rights and how we got to where we are today. Must hear this information.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Saturday Morning 9-28-24

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

To create their model, the economists used the 2022 ECB Study on Payment Attitudes of Consumers in the EU (SPACE). Given it was post COVID, it showed changes in payment behaviors such as an increase in usage of mobile payments for person-to-person payments which rose from 3% in 2019 to 10% in 2022.

Unsurprisingly, they found consumers prefer to stick to familiar methods, such as cards and cash. Switching incurs a significant adoption cost, in terms of money, time and effort.

Three steps to make adoption worthwhile

One avenue to make the switching costs worthwhile is to design the CBDC to combine the relative advantages of both cards (usability) and cash (controlling usage and privacy). The model showed this could increase adoption by 80% and usage by 140%.

A second strategy is to communicate these benefits effectively. While this had some benefit, the impact was smaller compared to the design choices.

Thirdly, the economists highlight the importance of surfing network effects. We believe this implies there could be different strategies for different jurisdictions. In some regions P2P payments might be more popular, so this could be the area to push. In other jurisdictions there may be more potential for Point of Sale payments (PoS). For example, the SPACE survey showed usage of mobile payments at PoS at 10% in the Netherlands versus 1% in Slovenia.

They argue that regions more eager to adopt new payment technologies will be more open to CBDC. That makes sense. However, we see a counterargument that if users adopt new payment technologies they could perceive less need for a CBDC.

The economists also highlight the role of legislation in ensuring distribution, such as obliging banks, and requiring merchants to accept the digital euro at PoS.

Other digital euro reports

Meanwhile, in other digital euro news, during August an NEBR paper explored the impact of a potential digital euro on banks, European payment providers and US payment providers.

It found upbeat press mentions of a digital euro coincided with positive stock price movements for European payment firms and negative ones for American firms. There was no impact on banks.

Another report was published by the Veblen Institute and Positive Money, two organizations that are critical of banks. They highlight that there’s an option for the ECB and national central banks to sidestep private payment providers and go direct to consumers.

We confirm that legally the central banks and governments are also ‘payment service providers’ (PSPs), and it is PSPs that will provide wallet services for the digital euro, per draft legislation.

The IMF recently published a report on CBDCs exploring how to encourage adoption by consumers and merchants.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

COULD ROBINHOOD AND REVOLUT FIND STABLECOIN SUCCESS WHERE PAYPAL STUMBLED?

If Robinhood and Revolut do make a run at launching a stablecoin, as reported, can they each avoid the same fate as PayPal's PYUSD?

Fintech heavyweights Robinhood, a U.S. investing app, and Revolut, a crypto-friendly neobank based in London, are considering launching their own stablecoins, unnamed sources told Bloomberg this week.

The giants are eyeing the stablecoin market at a time when Tether (USDT), with its $119 billion market capitalization, accounts for roughly 68% of the $173.5 billion category.

With Europe offering clearer regulatory frameworks, the fintech giants could bring a new wave of competition. However, the question remains: Can they break through Tether's dominance, or will they struggle like other giants before them?

Although neither company has officially confirmed their plans, both companies are considering stablecoin issuance, according to a report on September 26.

Fred Schebesta, founder of Finder.com, sees the potential for Robinhood and Revolut but acknowledged the challenge.

“Revolut and Robinhood definitely have a shot at making a dent in USDT’s dominance, but it's going to take a lot of integration to get there,” he said. “USDT has a deep-rooted presence in the market, and people, for some reason, still place an unusual amount of trust in it.”

He said PayPal's stablecoin demonstrates that “even big players aren’t gaining much traction yet,” but added that Robinhood and Revolut have a chance to try a different approach.

“Their platforms are more integrated with retail investors,” Schebesta said, “and if they can leverage those ecosystems properly, they might find an edge that PayPal hasn't tapped into yet.”

Pav Hundal, a market analyst at Australian crypto exchange Swyftx, agrees that scale will be crucial.

“Stablecoins are a game of scale, or relative scale if you have a niche offering,” he told Decrypt. “Robinhood and Revolut possess scale in abundance and clearly have some level of conviction that they can leverage their huge global networks to take a slice of Tether’s market.”

The two companies also have one major advantage, he added: Both companies are already regulated in many jurisdictions around the world. “But for now, Tether exists on an entirely different plane of existence to its competitor,” Hundal said.

PayPal isn’t alone in its struggles with PYUSD. Even giants like JPMorgan Chase, Meta (Facebook), and Binance have attempted to conquer the stablecoin world—each meeting their own unique challenges and limitations.

JPM Coin found its place within internal banking but failed to penetrate wider retail or DeFi markets. Meta’s Diem, once heralded as the “future of money,” crumbled under regulatory pressures, never seeing the light of day.

Binance's BUSD has grown, but even it remains a distant competitor to Tether, unable to topple the giant.

Tether’s entrenched position as the crypto exchanges’ primary trading pair sets a high bar for liquidity that new entrants must match. The stablecoin market's deep liquidity pools, network effects, and established trust create high barriers for new entrants.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

XRP LEDGER IMPLEMENTS TWO MAJOR UPDATES TO BOOST ECOSYSTEM FUNCTIONALITY

▪️XRP Ledger announces two updates that enhance its functionality.

▪️Ripple’s stablecoin RLUSD may benefit from these new updates.

▪️Continued blockchain advancements support Ripple's ecosystem growth.

The XRP Ledger (XRPL) has announced two significant updates following a recent modification.

These developments have attracted attention, particularly due to rising expectations surrounding the potential launch of Ripple’s stablecoin, RLUSD. Consequently, there is curiosity about how these updates will impact the stablecoin’s functionality and the overall ecosystem.

XRP Ledger Executes Two Major Updates

According to an XRPScan report, the XRP Ledger implemented two important updates named “fixEmptyDID” and “fixPreviousTxnID” last Friday. Both updates received support from 31 validators, surpassing the 28/35 threshold.

The first update aims to prevent the creation of empty DID ledger entries that previously occupied unnecessary space. With this change, any transaction attempting to create such entries will result in an error. This endeavor is expected to enhance ledger efficiency without interfering with existing processes.

Will Ripple’s Stablecoin RLUSD Be Affected?

Ripple $0.620272 has begun beta testing its stablecoin on both the XRPL and Ethereum $2,675 networks. Recently, Ripple released two batches of the RLUSD stablecoin, each containing 485 RLUSD. These developments have intensified speculation regarding how the recent updates on XRPL will influence the operation of the stablecoin.

Ripple President Monica Long confirmed that RLUSD would be launched this year if it receives U.S. approval.

Long expressed expectations that the stablecoin would serve broader areas compared to Ripple’s native cryptocurrency, XRP. She also noted that decentralized exchanges (DEX) on the XRPL could benefit from the stablecoin’s efficiency, while XRP would be utilized for smaller cryptocurrency transactions.

These statements suggest that the recent XRPL updates could empower both RLUSD and the XRP ecosystem, offering more functionality and flexibility across multiple applications.

In a period marked by continuous advancements in blockchain technology, such technical updates within the XRP Ledger may contribute to strengthening the Ripple ecosystem and enhancing investor confidence.

@ Newshounds News™

Source: CoinTurk

~~~~~~~~~

IS THE US DEBT CLOCK ACCURATE? LET'S PEEK | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Evening 9-27-24

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

In comments to Bloomberg today, SEC Chair Gary Gensler discussed BNY Mellon’s crypto custody structure. He suggested that the model used for Bitcoin and Ether ETFs could be applied to other digital assets.

While the current approval applies only to Bitcoin and Ether ETFs, Gensler noted that the custody structure is not limited to specific crypto assets.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was, it didn’t matter what the crypto was.” said Gensler.

BNY Mellon now has the flexibility to extend its custody services to other digital assets if it chooses. Gensler emphasized that the “non-objection” is based on the structure itself, not the type of crypto asset, allowing other banks to adopt the same model for crypto custody.

The approval hinges on BNY’s use of individual crypto wallets, ensuring that customer assets are protected and segregated from the bank’s own assets in the event of insolvency. This wallet structure was developed in consultation with the SEC’s Office of Chief Accountant, leading to the agency’s “non-objection” decision.

This approval guarantees that the bank’s approach complies with regulatory requirements, preventing customer assets from being at risk during bankruptcy, a key issue that has plagued crypto platforms like Celsius, FTX, and Voyager.

The crypto custody market, estimated to be worth $300 million and growing by 30% annually, represents a lucrative opportunity for financial institutions.

With non-bank providers typically charging much higher fees for digital asset custody compared to traditional assets, banks like BNY Mellon are well-positioned to capitalize on this growing demand by offering more secure and regulated solutions.

@ Newshounds News™

Source: CryptoBriefing

~~~~~~~~~

@ Newshounds News™

Live Call: https://t.me/+CpYhls2JLGc5YWRh

~~~~~~~~~

BIG Silver Price and coin news

The Economic Ninja

(9/26/2024)

🚀 Silver surged to a 12-year high in 2022, gaining 37% since January 2023, driven by expectations of Fed rate cuts and increased demand in renewable energy, electronics, and electric vehicles.

💡 The global renewable energy market is projected to grow from $1.14 trillion in 2023 to $5.62 trillion by 2025, with a 17.3% annual growth rate, boosting silver's industrial applications.

🔬 Silver has more patents tied to it than any other metal, used in everyday items like water filters, cell phones, and solar panels, with companies indifferent to price fluctuations due to the small amounts needed in production.

📈 The Federal Reserve's pivot towards easier monetary policy, potential future rate cuts, and China's economic boost efforts have supported silver's price gains.

💼 Silver is considered a tangible, real investment that can be vaulted, contrasting with the stock market's perceived "vaporware" nature, with recommendations to invest in the cheapest possible silver coins.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

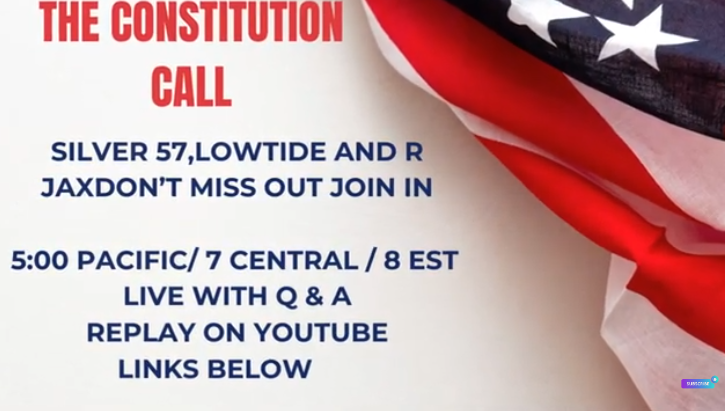

Join Us for the Constitution Call Tonight - You Won't Want to Miss It! Seeds of Wisdom Team | Youtube

@ Newshounds News™

Visit, Like and Subscribe to Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Evening 9-26-24

Good Evening Dinar Recaps,

IRAQ BOOSTS GOLD RESERVES TO OVER 145 TONS

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

ERBIL (Kurdistan24) - Iraq has significantly increased its gold reserves over the past three years, acquiring approximately 52 tons of the precious metal. The majority of these purchases occurred in 2022, accounting for 65% of the total acquired gold.

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

Good Evening Dinar Recaps,

IRAQ BOOSTS GOLD RESERVES TO OVER 145 TONS

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

ERBIL (Kurdistan24) - Iraq has significantly increased its gold reserves over the past three years, acquiring approximately 52 tons of the precious metal. The majority of these purchases occurred in 2022, accounting for 65% of the total acquired gold.

Data from the World Gold Council reveals that Iraq purchased a total of 51.9 tons of gold between 2022 and September of this year.

The breakdown shows a significant purchase of 33.9 tons in 2022, followed by 12.3 tons in 2023, and 5.7 tons so far this year. Notably, there were substantial purchases of 3.1 tons in February and 2.6 tons in May of this year.

This strategic accumulation of gold aligns with a global trend among central banks seeking to diversify their reserves and hedge against economic uncertainties.

Gold Prices in Iraq Soar

The increased demand for gold has also driven up its price in Iraq across all carats. Currently, one gram of gold is priced as follows:

- 24 carat gold: 108.652 dinars (equivalent to 83 US dollars – based on the official exchange rate by the Iraqi government.)

- 22 carat gold: 99.598 dinars (equivalent to 76 US dollars – based on the official exchange rate by the Iraqi government.)

- 21 carat gold: 95.071 dinars (equivalent to 72 US dollars – based on the official exchange rate by the Iraqi government.)

- 18 carat gold: 81.489 dinars (equivalent to 62 US dollars – based on the official exchange rate by the Iraqi government.)

Iraq's Global Ranking

According to the World Gold Council's latest data for June, Iraq's gold reserves have now reached 145.7 tons, a notable increase from 142.6 tons in May.

This increase has solidified Iraq's position as a significant holder of gold reserves globally. While the country has dropped one place to 31st in the World Gold Council's ranking of the 100 countries with the largest gold reserves, its holdings represent a substantial 9.8% of its total reserves.

The United States, Germany, and Italy continue to hold the top three positions in terms of gold reserves, while Suriname ranks at the bottom of the list.

@ Newshounds News™

Source: Kurdistan24

~~~~~~~~~

US SANCTIONS RUSSIAN CRYPTO PLATFORMS FOR MONEY LAUNDERING TIES

Two crypto exchanges and two individuals have been sanctioned for ties to underground finance.

The United States government has taken action against two Russians and two cryptocurrency exchanges tied to alleged illicit Russian finance. The departments of the Treasury, Justice and State were involved, along with an assortment of overseas law enforcement agencies.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) identified PM2BTC, a Russian cryptocurrency exchange, and Sergey Ivanov, who is associated with that exchange, as being of “primary money laundering concern.” At the same time, Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned Ivanov and another crypto exchange, Cryptex.

Crypto exchanges to the underworld

PM2BTC is alleged to process the proceeds of ransomware attacks and other illicit activities. Half of its activities are linked to illegal operations, according to FinCen.

According to Chainalysis, PM2BTC shares wallet infrastructure with UAPS (Universal Anonymous Payment System), an underground payment processing system.

Cryptex is registered in St. Vincent and the Grenadines but advertises in Russian. According to the Treasury:

“Cryptex is also associated with over $720 million in transactions to services frequently used by Russia-based ransomware actors and cybercriminals, including fraud shops, mixing services, exchanges lacking KYC programs, and OFAC-designated virtual currency exchange Garantex.”

The Treasury Department acknowledged the US Secret Service Cyber Investigative Section, the Netherlands Police and the Dutch Fiscal Intelligence and Investigation Service for seizing web domains and infrastructure associated with PM2BTC, Cryptex and Ivanov. Chainalysis said that it and Tether also contributed to the effort.

Links to “carding”

In documents unsealed in the District Court of Eastern Virginia, Ivanov was charged with one count of conspiracy to commit and aid and abet bank fraud in connection with websites that engage in “carding,” or trading in stolen credit card information.

Timur Shakhmametov was charged with one count of conspiracy to commit and aid and abet bank fraud, one count of conspiracy to commit access device fraud, and one count of conspiracy to commit money laundering in connection with the same operations.

The State Department is offering a reward of up to $10 million for information leading to the arrest and/or conviction of Ivanov or Shakhmametov.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BRICS NEWS: 40% GOLD AND 60% LOCAL—IS THERE ROOM FOR BITCOIN, XRP, AND OTHER CRYPTOS?

▪️The BRICS currency, which is reported to be in development, is said to be backed by 40% gold and 60% local currencies.

▪️The currency is disclosed to be apolitical and would be outside the “circumference” of the SWIFT payment network.

The much anticipated BRICS currency, which would be the principal driving force at the heart of the de-dollarization strategy, could be on the table at the upcoming summit in October.

According to experts, this kind of development could largely erode a significant portion of the US dollar dominance as several other developing countries show their willingness to join the alliance.

Even before that, details of the expected BRICS currency have started leaking as reports establish that the potential currency could be based on a “basket” of 40% gold reserves and 60% BRICS sovereign nation currencies.

According to the details, the regional currencies that could be involved are the Chinese yuan, Russian ruble, and Indian rupee. Interestingly, this report aligns with the alleged outcome of a recent meeting between Russian President Vladimir Putin and the Head of the BRICS New Development Bank (NDB).

In our review of a publication by a Russian news platform, it was discovered that shareholders directed the NDB to prioritize the new digital currency to facilitate trade and avoid Russian sanctions.

Some Exclusive Details Around the BRICS Currency

According to the report, Russia is facing limitations as its trade volume among certain members remains one-sided. A typical example is Russia’s possession of excessive rupees received in exchange for energy, such as oil and gas, with India.

In this case, backing the BRICS currency with gold and local currency could provide enough stability and take care of the exchange rate fluctuations. Conversely to the US dollar, the BRICS currency would be apolitical and transactional and operate externally from the SWIFT payment network.

According to reports, the West can only distract this arrangement by sanctioning currencies such as the Chinese RMB and the Indian Rupee. Unfortunately, this could negatively impact the Western economy as the trade between these two countries and the US and EU amounted to around $1.56 trillion last year.

According to experts, an attempt to impose sanctions could cause serious inflation and recession in the West. Meanwhile, the NDB shareholders include Brazil, India, China, and South Africa, and Bangladesh, Egypt, the UAE, and Uruguay have joined them. More than 30 other countries have expressed interest in joining the alliance.

Amid the ongoing developments, enthusiasts have highly recommended Bitcoin, XRP, and other cryptos for consideration for their democratic qualities. Already, countries like El Salvador have declared Bitcoin a legal tender and the process could be keenly studied by the BRICS nations. However, no official announcement on this possibility has ever been made.

Commenting on the impact of these developments, the founder and CEO of Zang Enterprises, Lynette Zang, recently disclosed in a CNF report that the US Dollar’s dominance has reduced to 3% and could dwindle to zero in 2025.

I believe with all my heart and everything that I know that we’ve already begun the transition to hyperinflation. We’re going to see more borrowing, more money printing, and more inflation because they have not killed that beast that they created and continue to create. It’ll become very obvious in 2025.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

SEC CHAIR GENSLER PLUGS CHANGES TO EXCHANGE DEFINITION THAT WORRIES CRYPTO

Gary Gensler reminded a conference on Treasury bonds about a proposed rule change that would impact DeFi, too.

The United States Securities and Exchange Commission will continue to pursue changes to the definition of “exchange” and alternative trading systems, Chair Gary Gensler told attendees of the US Treasury Market Conference on Sept. 26.

Gensler was speaking about issues that affect the efficiency and resilience of the US Treasury bond market, but that proposal has been heavily criticized in the digital asset space.

Defining dealers to include more market players

One of the measures the SEC has taken to buttress the Treasury market was a change to the definition of a “dealer” that was meant to clarify the role of market participants such as principal-trading firms, which might use algorithmic and high-frequency trading strategies.

The changes, proposed in 2022, were criticized at the time by pro-crypto politicians for the spillover effect they would have on digital asset trading. Nonetheless, they were adopted in February.

What makes an alternative trader?