BRICS Initiates Chinese Yuan’s Rise: JP Morgan Says Potential End for the US Dollar

BRICS Initiates Chinese Yuan’s Rise: JP Morgan Says Potential End for the US Dollar

On January 7, 2024 By Awake-In-3D

In RV/GCR

The BRICS alliance continues making financial waves as JP Morgan hints at a significant geopolitical currency shift. The Chinese Yuan’s rise, gaining momentum, emerges as a plausible alternative to the once-dominant US Dollar.

BRICS De-Dollarization Plans Has Potential

In a steady turn of events throughout 2023, BRICS has strategically revealed its de-dollarization plans, openly aiming to diminish the U.S. dollar’s hegemony.

The alliance’s commitment to promoting local currencies has set the stage for a profound transformation in the global financial landscape.

BRICS Initiates Chinese Yuan’s Rise: JP Morgan Says Potential End for the US Dollar

On January 7, 2024 By Awake-In-3D

In RV/GCR

The BRICS alliance continues making financial waves as JP Morgan hints at a significant geopolitical currency shift. The Chinese Yuan’s rise, gaining momentum, emerges as a plausible alternative to the once-dominant US Dollar.

BRICS De-Dollarization Plans Has Potential

In a steady turn of events throughout 2023, BRICS has strategically revealed its de-dollarization plans, openly aiming to diminish the U.S. dollar’s hegemony.

The alliance’s commitment to promoting local currencies has set the stage for a profound transformation in the global financial landscape.

JP Morgan Analysts: Yuan’s Rise as a Game-Changer

JP Morgan, a financial services Goliath, has weighed in on the matter, highlighting China’s Yuan as a potential game-changer in the quest to dethrone the US Dollar.

Alexander Wise, a strategic researcher at JP Morgan, emphasized the Chinese Yuan’s rise taking a central role in the global economic shift.

Wise elaborated, stating, “With China’s growth centrality in global commerce, one might naturally expect the renminbi to assume a greater role in the global economy over time.”

To solidify its position, China is strategically implementing measures such as relaxing capital controls, opening markets, and promoting market liquidity.

BRICS’ Decisive Moves: Data Speaks Louder than Words

The BRICS alliance has not merely expressed intentions but has taken tangible steps towards reducing the US dollar’s significance.

Noteworthy data reveals that 25% of Russia’s non-China trade was settled in the Yuan, showcasing a tangible shift in trade dynamics.

Additionally, a colossal $7 billion currency swap agreement between China and Saudi Arabia amplifies the potential acceleration of the Yuan’s ascent.

Implications for the Dollar’s Future

As the Yuan gains traction, the US Dollar faces the prospect of a gradual decline in its international standing.

The combination of BRICS’ strategic initiatives and JP Morgan’s analysis positions the Yuan as a formidable contender, challenging the once-unquestioned dominance of the US Dollar.

In a landscape marked by continuous financial transformations, the rise of the Yuan signifies a potential turning point in the Great Global Fiat Debt Currency System, aligning with the ongoing narrative of a global financial reset.

The question now lingers: Can the Yuan truly emerge as the harbinger of change, signaling the logical conclusion of the existing fiat currency order?

Contributing article: https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/brics-initiates-chinese-yuans-rise-jp-morgan-says-potential-end-for-the-us-dollar/

When Will U.S. Federal Debt Collapse into Bankruptcy? Awake-In-3D

When Will U.S. Federal Debt Collapse into Bankruptcy?

On January 7, 2024 By Awake-In-3D

In the reality of the relentless ascent of U.S. federal debt, a tipping point threatens to push the government into financial insolvency.

Given the complex nature of this impending crisis within the context of a Global Financial Reset (GFR) and Global Currency Reset (GCR), is it possible to determine exactly when the U.S. federal government debt becomes undeniably unsustainable?

When Will U.S. Federal Debt Collapse into Bankruptcy?

On January 7, 2024 By Awake-In-3D

In the reality of the relentless ascent of U.S. federal debt, a tipping point threatens to push the government into financial insolvency.

Given the complex nature of this impending crisis within the context of a Global Financial Reset (GFR) and Global Currency Reset (GCR), is it possible to determine exactly when the U.S. federal government debt becomes undeniably unsustainable?

Factors Driving the Surge of U.S. Federal Debt

The debt-GDP ratio has been steadily rising since the late 2000s, fueled by major policy shifts responding to events like the Great Recession, the Tax Cuts and Jobs Act of 2017, and the recent Covid-19 stimulus.

These factors contribute to a financial landscape echoing a global economic reset and currency shift—a narrative central to the GFR/GCR scenario.

Essentially, as the government borrows more money, it must pay higher interest rates to lenders. This dynamic creates a risky situation.

If markets foresee continuous debt growth, they demand even higher interest rates, setting off a dangerous cycle that can threaten the government’s ability to borrow and spend.

This echoes the challenges foreseen in the GFR/GCR thesis.

Challenges in Predicting a U.S. Federal Debt Crisis

Predicting when the crisis will hit is no easy feat.

Financial models face challenges due to their complexity and the unpredictability of future events—complexities akin to the uncertainties surrounding the fate of the current financial system.

Attempts to forecast when the debt will bankrupt the U.S. Federal Government involve wandering through a maze of intricate financial variables within the GFR/GCR framework.

The answer is, it’s nearly impossible to forecast a time-frame for a debt collapse. If anyone says they have a date, they certainly don’t know.

What to Watch For

As the debt relentlessly climbs higher, keep an eye on key indicators.

The debt-GDP ratio reaching critical levels around 130% or more, continuous policy changes to manage the increasing debt, and rising interest rates demanded by financial markets (to manage the debt default risk) are critical signs to watch for.

These indicators provide insights into the evolving financial landscape and potential shifts in the global economic order, aligning with the prophesied changes in the GFR/GCR narrative.

The Bottom Line

Federal Debt is different than total Public Debt (which is over $34 Trillion as of today).

As of September 30, 2023, the federal debt stood at a staggering $26.3 trillion, nearly 98 percent of projected GDP.

The United States stands on a cliff, looking over the edge into the peril of escalating federal debt within the context of a shifting financial and geopolitical (BRICS) landscape.

Understanding the complexities of when federal debt becomes unsustainable requires discerning observation of policy shifts, market dynamics, and the nuances of economic forecasting—a journey poised on the brink of an uncertain fiscal future within the narrative of the GFR/GCR.

https://ai3d.blog/when-will-u-s-federal-debt-will-collapse-into-bankruptcy/

The Global Financial Reset and America’s Debt Insolvency: Awake-In-3D

The Global Financial Reset and America’s Debt Insolvency

On January 6, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

In the unfolding tragedy of America’s debt-based financial turmoil, the escalating national debt, surpassing $34 trillion on December 29th (2023), serves as a compelling precursor to the imminent Global Financial Reset (GFR).

As the U.S. hurtles towards insolvency, the RV/GCR thesis gains further validation, emphasizing the necessity of a new financial system grounded in tangible assets like gold, oil, and energy.

The real issue lies in a government spending problem, not a revenue shortfall. This echoes the core argument of the Global Currency Reset (GCR) thesis — the need for a fundamental reset of financial structures.

Alarming Debt Trends and the Global Financial Reset

The current national debt, soaring to nearly 100% of the Gross Domestic Product (GDP), echoes the key tenets of the Great Global Fiat Debt Currency System Experiment reaching its logical conclusion.

The trajectory projecting a staggering 125%% debt-to-GDP ratio by 2030 reinforces the urgency for a paradigm shift, aligning with the principles of the impending Global Financial Reset.

Unprecedented government spending increased the national Debt to GDP ratio to surpass the record level seen during WW2. Source: Statista

Autopilot to a Financial Shift

The autopilot nature of the U.S. government’s spending trajectory, particularly the surge in mandatory spending to 71% of federal outlays, underscores the inherent flaws of the fiat financial system.

In the context of the RV/GCR narrative, this dysfunctional trajectory reinforces the need for a reset anchored in hard assets, disentangling from the unsustainable debt load inherent in the current fiat system.

Government Spending Problem: A Catalyst for a Global Financial Reset

While Washington grapples with the consequences of skyrocketing deficits, the real issue lies in a spending problem, not a revenue shortfall. This echoes the core argument of the Global Currency Reset (GCR) thesis — the need for a fundamental reset of financial structures.

The distraction caused by out-of-control discretionary spending veils the imperative to address mandatory spending reduction and align the nation’s fiscal policies with the “sound money” principles of the impending GFR.

Tackling the Third Rail with Global Implications

Confronting the sacred cows of American politics, namely Social Security and Medicare, is not just a domestic policy challenge but a global economic necessity.

The accusations of economic catastrophe from many lawmakers reflect the entrenched resistance to systemic spending change, hindering the transition towards our envisioned global financial and currency reset infrastructure.

The Global Time Bomb

As the U.S. approaches fiscal calamity, the imperative for the Global Financial Reset becomes clearer.

Social Security and Medicare’s trust funds on borrowed time serve as a global time bomb, demanding urgent intervention not just for America but for the health and prosperity of the international financial system itself.

The deafening political posturing obscures the fact that the impending explosion of this global time bomb could be the catalyst for the transformative shift envisioned in our RV/GCR outlook.

The clock is ticking, and the urgency for a Global Financial Reset has never been more evident.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-global-financial-reset-and-americas-debt-insolvency/

Housing Market Entering Crash Cycle: What You Need to Know: Awake-In-3D

Housing Market Entering Crash Cycle: What You Need to Know

On January 4, 2024 By Awake-In-3D

The U.S. residential real estate market is now facing a significant downturn, and here’s why you should pay attention. This is in addition to the ongoing scenario playing out in commercial real estate crisis.

Recent data reveals a sudden increase in the number of new homes for sale, and home builders are selling off their inventory, raising concerns about a possible crash.

This means that the ‘active inventory’ of homes on the market is spiking upwards.

Housing Market Entering Crash Cycle: What You Need to Know

On January 4, 2024 By Awake-In-3D

The U.S. residential real estate market is now facing a significant downturn, and here’s why you should pay attention. This is in addition to the ongoing scenario playing out in commercial real estate crisis.

Recent data reveals a sudden increase in the number of new homes for sale, and home builders are selling off their inventory, raising concerns about a possible crash.

This means that the ‘active inventory’ of homes on the market is spiking upwards.

More Homes on the Market – What Does It Mean?

In November 2023, around 590,000 new homes were sold, but that’s a 12.2% drop from October. The price of these homes fell to $434,000, which is 12.5% less than what it was a year ago.

Now, at the end of November, there were 451,000 new homes up for sale – that’s a lot! In fact, it’s enough to meet the demand for about 9.2 months, which is a big deal and signals huge problems developing in the residential real estate market.

Builders are Selling More – Is That a Problem?

Yes, it is.

Home builders, who usually build and sell houses, have suddenly started selling more houses than before. This wasn’t expected, and it could be a sign that they are worried about the market.

They used to keep some houses to control prices, but now they’re liquidating them quickly, and that’s not normal.

History Tells Us This is a Big Problem

Whenever we’ve seen lots of new homes in the market like this in the past, it often coincided with significant economic troubles. So, this history lesson tells us that we might be in for a tough time in the housing market.

Why Prices are Dropping and Where

The price of these new homes has fallen, especially in places like California. In some areas, prices have dropped by 15% or more! This is happening because there are too many homes available compared to people who are looking to buy a home.

What About Mortgage Rates?

Mortgage rates, or how much it costs to borrow money to buy a home, are also important.

Right now, rates are at 6.5%, which is not too high, but it’s not too low either. In the meantime, new mortgage applications are at record lows not seen in decades.

This means that home sellers will begin dropping prices like never before. It tends to happen slowly at first, then all of a sudden as sellers capitulate and become desperate to sell their homes.

What Does This Mean for You?

If you’re thinking about buying or selling a home, this situation could impact you. Prices might continue to drop, and it might be harder to sell a house.

On the other hand, if you’re looking to buy, it could be a good time to find a more affordable home.

The real estate market is going through some big changes, and it’s essential to be aware of them. Keep an eye on the news and any updates about the housing market in your area. If you’re planning to make a move in the real estate world, understanding these changes can help you make smarter decisions.

Supporting Data

Historical Context

Historical patterns show that elevated levels of new homes in the market, as seen in November, tend to coincide with severe recessions.

National Level

Active listings reached a three-year high at 752,000 in November 2023.

New single-family home sales in November were at a seasonally adjusted annual rate of 590,000.

U.S. Census Bureau’s November 2023 Data

Median sales price for the 590,000 new homes sold was $434,000.

Number of new houses for sale at the end of November was 451,000, indicating a 9.2 months supply.

California

Statewide, a spike in new homes hit the market in November.

Prices in various counties, including San Francisco, San Mateo, Alameda, Butte, Contra Costa, experienced significant drops, contributing to six of the largest price drops in the state.

The entire state of California has a lack of active listings, contributing to the broader issue of an active listing shortage nationwide.

Texas

Active listings in Texas surpassed 2019 levels, with Austin having 5,800 active listings as of the end of November.

Williamson County, Texas, experienced a peak-to-trough price drop of 16%, putting it in the crash territory.

New York

New York County, New York, saw the largest peak-to-trough price drop at 22%.

Pennsylvania

Cambria County, Pennsylvania, witnessed a peak-to-trough price drop of 14%.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/housing-market-entering-crash-cycle-what-you-need-to-know/

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here: Awake-In-3D

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here

On January 3, 2024 By Awake-In-3D

Buckle up GCR-Land… If the first few days of 2024’s financial events are any indication of the rest of the year, it’s going to be game over.

The onset of 2024 has seen a significant downturn in the global financial markets, marking the worst start in decades. Here’s a detailed breakdown of the key events impacting the financial landscape and why each is a cause for concern:

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here

On January 3, 2024 By Awake-In-3D

Buckle up GCR-Land… If the first few days of 2024’s financial events are any indication of the rest of the year, it’s going to be game over.

The onset of 2024 has seen a significant downturn in the global financial markets, marking the worst start in decades. Here’s a detailed breakdown of the key events impacting the financial landscape and why each is a cause for concern:

1. Stocks and Bonds Suffer Largest Rout in Decades

Stocks and bonds experienced their most significant global decline to start the year since 1999. This decline was also marked by the largest daily drop in global capitalization since December 2022.

The simultaneous decline in both stocks and bonds marks the most substantial global drop to start the year since 1999. This indicates widespread investor unease and can be a sign of underlying economic instability.

2. Dollar Soars

The value of the dollar has not fallen at the start of a calendar year since 2012, but its start in 2024 represents the most substantial rally since 1997.

While a strong dollar can be beneficial in some contexts, its significant rally suggests a flight to safety and could indicate a lack of confidence in other assets and currencies, potentially signaling global economic uncertainty.

3. Weak Economic Data Persists

The manufacturing sector has been in contraction for the 15th consecutive month, indicating ongoing economic challenges. Additionally, signs of strain are emerging in the labor market.

Continued contraction in the manufacturing sector for the 15th consecutive month, along with labor market strains, indicates prolonged economic challenges, potentially leading to reduced consumer spending and business investment.

4. FOMC Minutes Less Dovish

The Federal Open Market Committee’s (FOMC) recent meeting minutes were less accommodating than expected, leading to reduced likelihood of a rate cut in March.

The Federal Reserve’s less accommodative stance, as indicated in the FOMC meeting minutes, suggests a potential shift in monetary policy. This could signal higher interest rates and reduced market support, impacting borrowing costs and economic growth.

5. Stocks Fail to Rebound

Stocks have shown no signs of recovery, risking the end of a nine-week winning streak, with significant losses in small caps and the tech-heavy Nasdaq index.

The lack of a stock market rebound threatens to end a nine-week winning streak, indicating a potential loss of investor confidence and market stability, which can further impact consumer sentiment and business investment.

6. Treasury Yields Tumble

Yields on government bonds experienced a significant decline, with the 10-year Treasury yield briefly testing above 4.00% before quickly retracting.

A significant decline in government bond yields can indicate a flight to safety and a lack of confidence in other investment opportunities, potentially signaling concerns about future economic performance.

7. Crypto Volatility

Cryptocurrencies experienced a flash-crash, with Bitcoin plunging 7% before rebounding, while Ethereum remained in negative territory for the year.

The volatility in cryptocurrency markets, especially the significant flash-crash in Bitcoin and Ethereum, raises questions about the stability and maturity of these alternative assets, impacting investor confidence and broader market sentiment.

8. Oil Prices Surge

Oil prices surged higher due to escalating violence in the Middle East, impacting global markets.

Rising oil prices due to escalating Middle East violence can lead to increased production costs and consumer prices, potentially impacting global economic growth and market stability.

9. Gold Weakens

The value of gold declined as the dollar strengthened, affecting the precious metal’s market performance.

The decline in gold prices, often seen as a safe-haven asset, alongside a strengthening dollar, could reflect reduced concerns about economic uncertainty, potentially impacting investor risk perceptions and market stability.

10. European Selling Pressure

There are indications of significant selling pressure from European markets, raising questions about the potential impact on global equities.

Significant selling pressure from European markets can signal broader concerns about global economic conditions, potentially leading to increased market volatility and reduced investor confidence.

Fasten Your Seat Belt!

These events collectively mark a challenging and turbulent start to the year for global financial markets, impacting various asset classes and raising serious concerns among investors and analysts about the overall health of the global financial system.

Yet readers of GCR Real-Time News already know what this is all about.

Supporting article: https://www.zerohedge.com/markets/global-bonds-stocks-suffer-biggest-rout-start-year-1999

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/from-stocks-and-bonds-to-cryptos-and-gold-perfect-rv-gcr-storm-24-already-here/

10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026: Awake-In-3D

10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026

On January 2, 2024 By Awake-In-3D

Based on careful analysis and historical patterns, the following factors indicate a potential for significant increases in gold prices versus fiat currencies over the next few years.

1. Today’s Gold Bull Market Trajectory

The current bull market for gold, which began in 2015, suggests that the price could increase by 1,435% over the proceeding 11 years (from 2015), pointing to a potential value of fiat $10,000-$15,000 per Troy ounce by the end of 2026.

10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026

On January 2, 2024 By Awake-In-3D

Based on careful analysis and historical patterns, the following factors indicate a potential for significant increases in gold prices versus fiat currencies over the next few years.

1. Today’s Gold Bull Market Trajectory

The current bull market for gold, which began in 2015, suggests that the price could increase by 1,435% over the proceeding 11 years (from 2015), pointing to a potential value of fiat $10,000-$15,000 per Troy ounce by the end of 2026.

The current gold bull market began in 2015 and projected to continue through 2026. Chart Source: Blue Hill Research

2. Historical Gold Bull Markets Comparison

When comparing the current gold market to past trends, a strong similarity is seen, indicating the likelihood of significant price increases.

3. Moderated Gold Bull Market Assumptions

The analysis takes a balanced approach, looking at average gains and time frames from past bull markets to give a realistic view of what might happen in the future.

4. Mathematical Progression

Simple math shows that as the price of gold goes up, each additional fiat $1,000 increase becomes easier in percentage terms, which could lead to prices surpassing fiat $15,000.

5. Projected Annualized Gains

By looking at the average gains from previous bull markets, a steady increase in gold’s value over time is historically significant and anticipated.

6. Decreasing Percentage Increase

As gold prices rise, the percentage increase for each $1,000 gain becomes smaller, making it more achievable to reach higher prices.

As the price of gold goes up, the percentage increase for each additional $1,000 gain becomes smaller. For example, if the price goes from $2,000 to $3,000, it’s a 50% increase.

However, if it goes from $3,000 to $4,000, it’s only a 33.33% increase. This means that as gold prices rise, it becomes easier for the price to make larger jumps.

The decreasing percentage increase makes it more achievable for gold prices to reach higher levels as they continue to rise.

7. Market Behavior and Analysis

A detailed study of past market behavior and comparison with previous bull markets gives confidence in predicting that gold’s price could exceed fiat $10,000 per ounce by 2026.

8. Potential for Exceeding Projections

The model for projecting the fiat $15,000 price is flexible, allowing for the possibility of actual gains surpassing expectations, meaning gold could potentially be worth even more.

9. Support from Supply and Demand

While less detailed, the basic principles of supply and demand support the overall idea that gold prices will increase, potentially surpassing fiat $10,000 per ounce.

10. Plausibility Scenario

Based on historical analysis and mathematical findings, it seems likely that the price of gold could reach fiat $15,000 per ounce within the next 36 months, reinforcing the potential of surpassing fiat $10,000 by 2026.

Looking ahead, these reasons provide a strong, plausible foundation for a logical increase in gold’s value above fiat $10,000 per ounce by 2026.

This insight can help everyone understand the potential future trajectory of gold’s value against fiat currencies.

Add in the current geopolitical power shifts continuing throughout 2024 and beyond, and the deteriorating financial system we see unfolding today and the case for fiat $10,000+ gold becomes even more probable.

Supporting articles:

NOTE: THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE FINANCIAL ADVISE. READERS ARE ADVISED TO CONSULT WITH PROFESSIONALS BEFORE MAKING FINANCIAL DECISIONS.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/10-reasons-for-gold-surpassing-10000-fiat-dollars-by-2026/

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

On January 2, 2024 By Awake-In-3D

As we step into a new year, the ghost of the 2008 global monetary crisis still looms large over the fiat financial system.

More than fifteen years have passed, yet the financial earthquake that shook the world in 2008 was never fixed. It was merely “papered over” setting the stage for a grand, catastrophic finale that will bring down the great global fiat currency debt system experiment which began in 1971 (when the United States ended it’s peg to gold).

The 2008 crisis wasn’t just another financial downturn; it represented a seismic shift that transcended the confines of specific assets or sectors.

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

On January 2, 2024 By Awake-In-3D

As we step into a new year, the ghost of the 2008 global monetary crisis still looms large over the fiat financial system.

More than fifteen years have passed, yet the financial earthquake that shook the world in 2008 was never fixed. It was merely “papered over” setting the stage for a grand, catastrophic finale that will bring down the great global fiat currency debt system experiment which began in 1971 (when the United States ended it’s peg to gold).

The 2008 crisis wasn’t just another financial downturn; it represented a seismic shift that transcended the confines of specific assets or sectors.

Unlike an asset bubble like the 2000 dot-com crisis, which primarily affected specific industries, the 2008 meltdown was a global monetary catastrophe.

It went beyond the devaluation of a few assets; even fundamentally sound assets had to be repriced lower due to a severe shortage of cash to purchase them. This scarcity of funds led to a worldwide liquidity crisis, impacting the circulation of money throughout the international financial system.

What made the 2008 crisis different was its global character. The crisis extended beyond the United States, affecting the global financial landscape through the Eurodollar market.

The Eurodollar market, despite its name, is not about Europe; it involves the circulation of US dollars outside the United States and played a pivotal role in the crisis. The shortage of dollars in this international market had a far-reaching impact, leading to a liquidity crisis that affected the worldwide circulation of money.

European banks were ensnared in this dollar shortage, resulting in a tidal wave of fund outflows, which went beyond bad loans and represented a struggle for liquidity in the global financial system.

Fast forward to 2024, and the aftershocks of 2008 are still being felt.

The government-induced economic shockwaves of the COVID-19 pandemic have only served to exacerbate the existing challenges stemming from the 2008 crisis.

Central banks continue to grapple with the long-term repercussions, with discussions and actions indicating ongoing concerns about a return to the gloomy aftermath of the crisis.

These actions are not just economic adjustments; they reflect a persistent worry about the prolonged impact of the crisis on the global economy.

To the non-financial reader, it’s crucial to recognize that the 2008 global monetary crisis isn’t just a historical event—it’s an ongoing issue with profound implications for the stability and functioning of the global financial system.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

2024 May Finally Be Our RV/GCR Year : Awake-In-3D

2024 May Finally Be Our RV/GCR Year

On January 1, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

BRICS Alliance is overtaking the global Oil, Gold, Energy and Financial System landscape and their Gold/Asset-backed Trade Currency will decimate the Fiat Currency Financial System

In the rapidly evolving geopolitical landscape of global trade and finance, 2024 is proving to be a pivotal year marked by significant shifts in energy, currency usage, and financial alliances.

At the center of these transformations lies the rapidly growing and influential consortium known as BRICS, comprising Brazil, Russia, India, China, and South Africa.

2024 May Finally Be Our RV/GCR Year

On January 1, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

BRICS Alliance is overtaking the global Oil, Gold, Energy and Financial System landscape and their Gold/Asset-backed Trade Currency will decimate the Fiat Currency Financial System

In the rapidly evolving geopolitical landscape of global trade and finance, 2024 is proving to be a pivotal year marked by significant shifts in energy, currency usage, and financial alliances.

At the center of these transformations lies the rapidly growing and influential consortium known as BRICS, comprising Brazil, Russia, India, China, and South Africa.

However, when we zoom out and take a closer look at how global oil, energy, and gold producing countries are also folding into the BRICS Alliance, it becomes clear that the Western Alliance, led by the United States and Europe is facing an existential threat that will likely replace the dominance of the US Dollar and the global fiat currency system once and for all.

If successful, this new gold/asset based trade currency would likely decimate the global fiat currency system and initiate a substantial revaluation of currencies (RV) in the Forex market. The USD and Euro would become essentially useless against the vast BRICS+ Alliance.

As BRICS continues to expand, the impact of its control over global energy, gold, and GDP will reshape the geopolitical and financial world order this year.

Furthermore, if BRICS+, combined with OPEC and the SCO (Shanghai Cooperation Organization) all agree to utilize an asset-backed, common trade currency, an RV (revaluation) of global currencies will occur unlike anything seen in financial and economic history.

Breaking Down New 2024 Geopolitical Alliances – Iraq is in the Neutral Camp

BRICS is the heart of what I call the East-South Alliance. Six new countries will join today (January 1st, 2024) and fourteen additional countries (marked with an * in the table below) have formally applied to join this year.

By looking at a combination of the existing BRICS, their new members and applicants, the OPEC Oil Alliance, and members of the SCO (Shanghai Cooperation Organization), the amount of Oil, other Energy resources (Natural Gas, Coal, etc.), Gold mining production, and combined GDP, the big picture comes fully into focus.

The West Alliance is relative to Oil, Other Energy and Gold production consisting the the USA, some European nations, Canada, Australia, etc.

The Neutral Nations (non-allied with West or South-East) are Oil/Energy/Gold producing nations sitting on the fence. Yet all of the Neutral countries are affiliated with OPEC at one level of participation or another.

Most notably, this includes Iraq and Mexico.

OPEC (Organization of Petroleum Exporting Countries). SCO (Shanghai Cooperation Organization). NDB (BRICS New Development Bank).

Global Oil/Energy Trade and US Dollar Currency Shifts

The traditional dominance of the US dollar in global trade is being challenged as Russia and China forge an ever-closer energy trade relationship, notably bypassing the use of the dollar.

As BRICS expands, their East-South Alliance will control 55% of global oil production

In tandem, there is a growing trend towards local currency usage in trade transactions, a move that is gaining traction among countries worldwide.

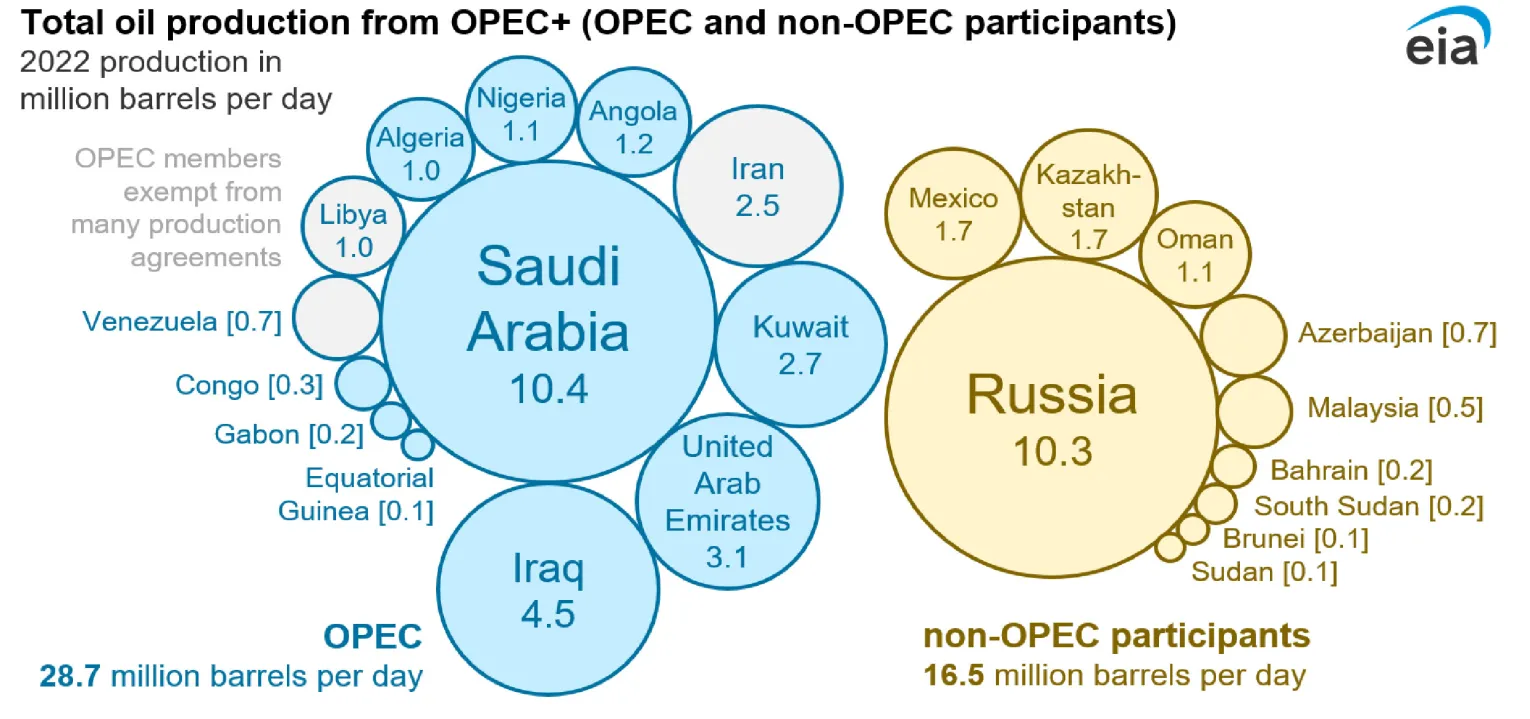

The growing BRICS Alliance will include 9 OPEC member nations in 2024. Image source: US Energy Information Administration

China, in particular, is spearheading this shift by encouraging Gulf nations, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, to utilize the Shanghai Petroleum and Natural Gas Exchange for yuan-based oil and gas trade settlement.

The BRICS+ East-South Alliance will control 64% of all LNG, Coal, etc. Energy resources. (Mtoe = Million Tons Oil Equivalent)

Moreover, as BRICS expands with the inclusion of Saudi Arabia and the United Arab Emirates, the use of local currencies in trade is expected to surge.

This aligns with China’s call for greater emphasis on local currency cooperation payment tools and platforms, signaling a pivotal moment in the diversification of global trade settlement mechanisms.

The Role of Precious Metals and a New BRICS’ Trade Currency

The potential development of a new trading currency, likely backed by precious metals and base metals, is gaining traction.

If successful, this new gold/asset based trade currency would likely decimate the global fiat currency system creating a revaluation of currencies (RV) in the Forex markets. The USD and Euro would be essentially useless.

The BRICS+ East-South Alliance is set to control 56% of total Gold Mining and Production in 2024

This shift is supported by Saudi Arabia’s strategic investment in global mining assets, particularly in minerals like copper, as part of its Vision 2030 to diversify the economy.

With an estimated mineral endowment worth $1.3 trillion, Saudi Arabia’s potential establishment of gold refineries and its strong ties with China, the largest producer of gold, position the nation as a key player in this evolving landscape.

The recent agreement between China and Saudi Arabia to set up a currency swap line worth around $7 billion further underscores the growing financial ties between these influential nations.

As central bank digital currencies rise in prominence and the development of domestic mining resources by BRICS member countries advances, 2024 is poised to be a transformative year, marking a shift in the global monetary system.

Financial Realignment and the Petrodollar’s Decline

The long-standing connection between the dollar and global energy markets, rooted in historical agreements dating back to the mid-20th century, is facing unprecedented challenges.

The reinvestment of petrodollars into US assets, particularly Treasury bonds, is undergoing a transformation as nations increasingly divest from their US treasuries in favor of alternative assets like gold.

The freezing of around $300 billion of sovereign Russian assets by the United States and its allies in 2022 has further accelerated this trend.

The BRICS+ East-South Alliance will dominate 56% of global GDP. More than enough economic power to launch a new, gold-backed trade currency to challenge the US dollar and the Euro in 2024.

Notably, there has been a significant increase in oil transactions settled in currencies other than the dollar, marking a departure from the traditional petrodollar system.

With Saudi Arabia’s and the UAE’s entry into BRICS and with strategic initiatives to diversify their economy beyond oil, there is a clear signal that the influence of the petrodollar will certainly diminish in the coming years.

Bottom Line

While we wait for IRAQ to jump off the fence and official pick a side in the new global alliance landscape, global currencies are undergoing increasing strain, and the traditional petrodollar system faces serious challenges.

The rise of BRICS is reshaping the global energy, gold, and financial landscape in 2024.

The consortium’s influence, combined with strategic initiatives by key players like China and Saudi Arabia, is signaling a fundamental realignment in global trade and finance.

The year 2024 is positioned to be a turning point, ushering in new dynamics that will have far-reaching implications for the future of international trade, currencies and finance.

Supporting References

BRICS Membership: https://www.msn.com/en-us/money/markets/breaking-14-more-countries-lined-up-to-join-brics/ar-AA1lzggd

OPEC vs. OPEC+ Nations: https://www.eia.gov/todayinenergy/detail.php?id=56420

Global Oil Production: https://tradingeconomics.com/country-list/crude-oil-production

Global Gold Production: https://www.gold.org/goldhub/data/gold-production-by-country

Global Economic Data: https://www.imf.org/external/datamapper/datasets

Global LNG Production: https://yearbook.enerdata.net/natural-gas/world-natural-gas-production-statistics.html

Total Global Energy Industry Production: https://yearbook.enerdata.net/total-energy/world-energy-production.html

AIIB: https://www.aiib.org/en/about-aiib/governance/members-of-bank/index.html

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/is-2024-finally-our-rv-gcr-year-it-certainly-looks-promising/

The Year of the Black Swan: Two Significant Financial Events to Watch in Q1 2024: Awake-In-3D

The Year of the Black Swan: Two Significant Financial Events to Watch in Q1 2024

On December 28, 2023 By Awake-In-3D

In Fiat Debt System Collapse, CBDCs and Digital Finance

What Is a Black Swan Event?

A black swan event is an extremely rare and unpredictable occurrence that has significant and widespread consequences.

It is characterized by being an unexpected outlier, having a high impact, and then being “rationally” explained after the fact.

The term originated from the belief that all swans were white until the discovery of a black swan in 17th century England.

The Year of the Black Swan: Two Significant Financial Events to Watch in Q1 2024

On December 28, 2023 By Awake-In-3D

In Fiat Debt System Collapse, CBDCs and Digital Finance

What Is a Black Swan Event?

A black swan event is an extremely rare and unpredictable occurrence that has significant and widespread consequences.

It is characterized by being an unexpected outlier, having a high impact, and then being “rationally” explained after the fact.

The term originated from the belief that all swans were white until the discovery of a black swan in 17th century England.

Examples of black swan events include the 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic. These events are difficult to predict and often have a profound effect on various aspects of society, such as politics, business, and financial markets.

While black swan events are typically associated with negative outcomes, they can also have positive effects, like the rapid rise of the internet.

Black Swan #1: Expiration of BTFP (emergency bank liquidity program) March 12th 2024

The expiration of the Bank Term Funding Program (BTFP) by the Federal Reserve on March 12th, 2024 holds significant potential as a strategic “Black Swan” event.

The decision to let the BTFP expire, despite ongoing bank reliance, is considered surprising and could lead to a major banking crisis.

Consequences include a decline in bank loans, impacting economic activity and reducing persistent inflation. Big banks stand to benefit by acquiring distressed banks, consolidating the financial landscape.

The strategic motive behind this potential Black Swan event is suggested to be the implementation of a U.S. Central Bank Digital Currency (CBDC).

The relationship between big banks and the Federal Reserve is a financial country club, and a planned banking crisis would create ideal conditions for quick CBDC legislation, small/medium bank consolidation, and the elimination of regional bank competition.

Read more about this event here:

Black Swan: Why US Banks Could Crash on March 12th 2024

By connecting the dots of a chain of events the potential for a major Banking Black Swan Event comes into view.

Black Swan #2: The Bitcoin Halving March/April 2024

The 2024 Bitcoin Halving is a potentially significant “Black Swan” event in the context of its impact on the Bitcoin network and its implications for the global fiat financial system.

Occurring approximately every four years, the halving is emphasized for its role in preventing inflation and maintaining the scarcity of bitcoins. Unlike fiat currencies which are significantly susceptible to manipulation through unlimited printing, the halving model ensures a controlled supply.

The reduction in block rewards during halving events leads to a predictable and diminishing inflation rate, safeguarding against the erosion of purchasing power seen with traditional fiat currencies.

The article below highlights the unique market-driven mechanism of Bitcoin’s price influenced by scarcity, in contrast to fiat currencies affected by external factors.

Historical data from previous halvings in 2012, 2016, and 2020 illustrate the event’s impact on Bitcoin’s supply, inflation rate, and price dynamics.

The upcoming 2024 Bitcoin Halving is anticipated to continue this trend, with varied expert predictions for its potential impact on Bitcoin’s price, emphasizing the event’s significance in the cryptocurrency world.

Understanding Bitcoin Halving is portrayed as crucial for those interested in cryptocurrencies and their potential influence on the global financial landscape.

Read more here:

The 2024 Bitcoin Halving: What You Should Know and Why It’s Important

Bitcoin Halving offers a thought-provoking alternative to fiat currencies and central banking. The limited inflation and price-value model merits consideration.

The 2024 Bitcoin Halving: What You Should Know and Why It’s Important

Bitcoin Halving offers a thought-provoking alternative to fiat currencies and central banking. The limited inflation and price-value model merits consideration.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-year-of-the-black-swan-two-significant-financial-events-to-watch-in-q1-2024/

Something Big is Coming at the Fiat Financial System and Smart-Money Folks Know It : Awake-In-3D

Something Big is Coming at the Fiat Financial System and Smart-Money Folks Know It

On December 28, 2023 By Awake-In-3D

In Fiat Debt System Collapse, Uncategorized

London Gold Price Soars to All-Time High as 2023 Comes to a Close

As a telltale testimony to the crumbling state of the global financial system, the London Gold Price has shattered all previous records, marking an unprecedented milestone as the year draws to a close.

The price of the precious metal has experienced a meteoric rise throughout 2023, solidifying its status as a solid and secure asset in a time of out-of-control central banking insanity.

Since the beginning of this year, the gold market has witnessed a staggering surge.

Something Big is Coming at the Fiat Financial System and Smart-Money Folks Know It

On December 28, 2023 By Awake-In-3D

In Fiat Debt System Collapse, Uncategorized

London Gold Price Soars to All-Time High as 2023 Comes to a Close

As a telltale testimony to the crumbling state of the global financial system, the London Gold Price has shattered all previous records, marking an unprecedented milestone as the year draws to a close.

The price of the precious metal has experienced a meteoric rise throughout 2023, solidifying its status as a solid and secure asset in a time of out-of-control central banking insanity.

Since the beginning of this year, the gold market has witnessed a staggering surge.

Pic 2

12-Month Gold Cash for Delivery (CFD) Price

On January 3, the price of gold opened at $1835.05, and today it stands at an impressive gain of $232.10, representing a remarkable increase of 12.65%.

Spanning the course of the 21st century, the price of gold has witnessed a remarkable growth trajectory, surging by an astounding 633.7%.

Comparing the price at the dawn of the century, which stood at $282.05 on January 4, 2000, the current record-breaking value showcases the enduring value and significance of gold for a coming, global asset-backed system.

Ruth Crowell, the CEO of the LBMA, expressed her conviction in gold’s unparalleled role as a store of value, particularly during times of economic and geopolitical crisis. Crowell emphasized the unwavering enthusiasm with which smart-money investors worldwide have turned to gold amidst growing financial uncertainties and unprecedented volatility.

Indeed, gold has proven itself as the safe haven of choice, offering stability and reassurance in times of market unpredictability.

As the curtain falls on 2023, the LBMA London Gold Price stands as undisputed evidence to the unwavering and enduring legacy of gold.

Its remarkable surge throughout the year reaffirms gold’s position as a reliable and sought-after store of value in a self destructing fiat currency financial landscape.

RV/GCR University 2: Iraq’s Dollar Crisis and Lack of Confidence in the IQD: Awake-In-3D

RV/GCR University 2: Iraq’s Dollar Crisis and Lack of Confidence in the IQD

On December 12, 2023 By Awake-In-3D

In RV/GCR

A Pragmatic Analysis of an Iraqi Dinar RV in Today’s Global Financial Landscape

This multi-part article series discusses the following subjects:

Part 1: Iraq’s Dollar Crisis and Lack of Confidence in the IQD

Part 2: The Current IQD Peg and Iraq’s Financial Constraints

Part 3: Iraq’s Pivot Towards BRICS and Geopolitical Shift

Part 4: Challenges Facing Iraq for an “Independent” RV at $3.00+ per IQD

Part 5: A Gold-Backed PetroYuan as an IQD RV Solution

Part 6: Why Saudi Arabia’s Recent Geopolitical Pivot Matters to Our RV/GCR

Part 7: BRICS Alliance and its Potential Gold/Asset-Backed Common Trade Currency

Part 8: A Pragmatic and Realistic Base Case for a Meaningful RV/GCR

RV/GCR University 2: Iraq’s Dollar Crisis and Lack of Confidence in the IQD

On December 12, 2023 By Awake-In-3D

In RV/GCR

A Pragmatic Analysis of an Iraqi Dinar RV in Today’s Global Financial Landscape

This multi-part article series discusses the following subjects:

Part 1: Iraq’s Dollar Crisis and Lack of Confidence in the IQD

Part 2: The Current IQD Peg and Iraq’s Financial Constraints

Part 3: Iraq’s Pivot Towards BRICS and Geopolitical Shift

Part 4: Challenges Facing Iraq for an “Independent” RV at $3.00+ per IQD

Part 5: A Gold-Backed PetroYuan as an IQD RV Solution

Part 6: Why Saudi Arabia’s Recent Geopolitical Pivot Matters to Our RV/GCR

Part 7: BRICS Alliance and its Potential Gold/Asset-Backed Common Trade Currency

Part 8: A Pragmatic and Realistic Base Case for a Meaningful RV/GCR

Part 1: Iraq’s Dollar Crisis and Lack of Confidence in the IQD

PREMISE: Iraq, once a robust economic force with a currency $3.00 per IQD, now contends with a self-induced dollar crisis, evident in a pervasive lack of trust in the Iraqi Dinar (IQD).

The widespread reliance on the US dollar for daily transactions reflects a profound mistrust ingrained in Iraq’s political and economic landscape, exacerbated by government corruption, political instability, and the constant threat of terrorism.

The Central Bank of Iraq (CBI) and the Government of Iraq (GOI) have pegged the IQD at 1310 IQD/USD, pursuing a cautious route towards financial stability. However, the potential to re-peg the IQD at a higher rate, such as $1.00/IQD, encounters formidable obstacles rooted in existing instability and insecurity, posing a risk of economic chaos.

In a strategic shift away for the USA/Western alliance, Iraq turns towards the BRICS alliance, particularly fostering close economic ties with China and Russia, signaling a pursuit of stability and economic revitalization.

This re-calibration within BRICS, coupled with geopolitical shifts in global energy dynamics, provides Iraq a transformative prospect to break free from the conventional PetroDollar system and forge a new economic currency structure.

These significant geopolitical currents warrant a detailed analysis of Iraq’s economic challenges and, more critically, a realistic forward path for a significant RV of the Iraqi Dinar.

Iraq, once a thriving economic powerhouse, now grapples with a self-induced dollar crisis.

The Iraqi Dinar (IQD) finds itself on shaky ground, lacking the confidence of both citizens and institutions alike. In the daily transactions of Iraqi citizens, the prevalent use of dollars for everyday essentials reflects a pervasive mistrust in the national currency.

Iraqi banks further contribute to the dollarization phenomenon, driven by the reluctance of foreign businesses to engage in transactions using the Iraqi Dinar.

Iraq finds itself caught in a paradox – it has the potential to re-peg the IQD at a higher rate, but the existing issues of instability and insecurity act as insurmountable barriers. The increased US dollar reserves needed to support a high peg rate at this time would equate to financial suicide.

This crisis of confidence in the IQD is not arbitrary; it is deeply rooted in the political and economic landscape of Iraq.

Government corruption, political instability, and the persistent threat of terrorist activities within and around the country’s borders have created an environment where trust in the national currency is eroding.

The Central Bank of Iraq (CBI) and the Government of Iraq (GOI) attempt to maintain a semblance of stability by pegging the IQD at 1310 IQD/USD. However, this peg is not without reason; it is a cautious response to the challenges that a higher peg rate would bring.

Iraq finds itself caught in a paradox – it has the potential to re-peg the IQD at a higher rate, say $1.00/IQD, but the existing issues of instability and insecurity act as insurmountable barriers.

The increased US dollar reserves needed to support such a peg rate at this time would equate to financial suicide for Iraq.

The amplified instability and the deep-rooted no-confidence crisis would render such a currency RV attempt economically unsustainable at this time.

In response to these challenges, Iraq is pivoting away from its traditional alliances and turning towards the BRICS alliance, with a specific focus on bolstering strong economic ties with China and Russia.

A recent article highlighting Iraq’s strategic shift towards BRICS underscores the nation’s quest for stability and economic rejuvenation. In contrast to the perceived lack of interest or capability from the USA/Western alliance, China and Russia are seen as partners with a personal stake and the ability to help Iraq stabilize its economy – and a practical scenario for a significant RV.

An impending alignment of Iraq with BRICS raises questions about the future dynamics of the global energy markets, particularly in oil and gas.

The collaboration of Russia, Saudi Arabia, Iran, and potentially Iraq within BRICS is positioned to reshape the supply dynamics of global oil and gas.

As these nations assert dominance, the traditional PetroDollar system is expected to diminish rapidly. Iraq, finding itself at the crossroads, could emerge with the potential to embrace a new economic currency structure, breaking away from the reliance on the US dollar and the Euro.

Part 2 of this article series coming soon…

READ: Iraq is not in the same situation as Kuwait was in the 1991 Kuwaiti Dinar currency series upgrade.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/rv-gcr-university-2-iraqs-dollar-crisis-and-lack-of-confidence-in-the-iqd/