Banking Crisis Update: Estimated $650 Billion in Unrealized Bond Losses : Awake-In-3D

Banking Crisis Update: Estimated $650 Billion in Unrealized Bond Losses

On November 9, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, Fiat Debt System Collapse

According to recent estimates, the 2023 banking crisis looks to be far from resolution.

Major banks are currently facing significant unrealized losses of around $650 billion, as stated by Moody’s.

This latest development in an ongoing banking crisis has arisen due to a bond-market crash and the subsequent Treasury-market rout, which has affected the value of bond holdings held by these banks.

Banking Crisis Update: Estimated $650 Billion in Unrealized Bond Losses

On November 9, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, Fiat Debt System Collapse

According to recent estimates, the 2023 banking crisis looks to be far from resolution.

Major banks are currently facing significant unrealized losses of around $650 billion, as stated by Moody’s.

This latest development in an ongoing banking crisis has arisen due to a bond-market crash and the subsequent Treasury-market rout, which has affected the value of bond holdings held by these banks

Key Facts to Know

US financial institutions had accumulated $650 billion worth of unrealized, paper losses on their portfolios by September 30, according to Moody’s.

Silicon Valley Bank (SVB) collapsed due to crashing bond prices, leading to concerns that similar chaos may affect Wall Street.

The Treasury-market rout has caused bond prices to crash, affecting the share prices of major financial institutions like Bank of America.

10-year Treasury yields recently spiked above 5% for the first time in 16 years.

Bank of America disclosed a potential $130 billion hole in its balance sheet due to the crash in bond prices.

Bank of America’s stock is down 24% over the past year and 14% year-to-date.

Citigroup, JPMorgan Chase, and Wells Fargo have also incurred tens of billions of dollars in unrealized losses.

Larry McDonald, a market veteran, expressed concerns over big banks’ unrealized losses, suggesting that Bank of America could face insolvency if the Fed raises interest rates further.

What’s Happening Today

The impact is not limited to Wall Street, as it has resulted in a decline in share prices for prominent financial institutions, including Bank of America.

The root cause of the bond-market crash can be traced back to concerns over rising interest rates and the long-term sustainability of the United States’ substantial deficit.

Don’t understand bond, treasuries or yields?

I’ve posted a simple explanation in non-financial terms here:

As a result, the value of Treasury bonds, which are used by the government to finance its spending, has experienced a significant decline.

For instance, BlackRock’s iShares 20+ Year Treasury fund, a key indicator of longer-duration debt prices, has plummeted by 48% since April 2020.

Additionally, 10-year Treasury yields, which move inversely to prices, recently reached their highest level in 16 years, surpassing 5%.

Unrealized losses refer to the decline in the value of bond holdings held by banks, which they have chosen to retain rather than sell.

Moody’s data suggests that US financial institutions have accumulated $650 billion of unrealized losses by September 30, a 15% increase from June 30. It is worth noting that these losses are distinct from actual debt and do not represent immediate financial obligations that need to be repaid.

The impact of these unrealized losses is not uniform across banks. Bank of America appears to be the most affected, as it has disclosed a potential $130 billion hole in its balance sheet.

Other major players such as Citigroup, JPMorgan Chase, and Wells Fargo have also reported substantial unrealized losses in the tens of billions, as indicated in their second- and third-quarter earnings reports.

Concern of these unrealized loss figures is now surrounding the major banks, particularly Bank of America, with some market veterans expressing apprehension about the potential insolvency of the bank if the Federal Reserve raises interest rates.

Is it Time for Serious Concern about a Larger Banking Crisis?

Perhaps not … well, not yet anyway

While there is a possibility that the current situation could lead to a mass withdrawal of funds, similar to what occurred earlier this year with Silicon Valley Bank, this has not yet materialized.

In fact, Bank of America has experienced an increase in deposits, with approximately 200,000 new accounts opened in the third quarter.

Additionally, some analysts believe that the worst of the Treasury-market rout may be over, as the Federal Reserve has begun signaling the conclusion of its tightening campaign. Recent weeks have seen a softening of 10-year yields, falling from 5% to 4.6% as of Tuesday.

Do Executives have the Necessary Experience for this Kind of Banking Crisis?

The lack of experience among banking executives with precipitously rising bond yields since before the 2008 Great Financial Crisis poses a significant risk in the banking industry, considering the current banking industry crisis.

In the landscape of rising bond yields, as highlighted above, how many banking execs were around earlier than 15 years ago when the FED lowered interest rates to near zero? Many bankers have only managed their banks in an era of low interest rates.

Given the limited experience of younger banking executives in dealing with precipitously rising bond yields since the 2008 Great Financial Crisis, there is a heightened risk of potential missteps and miscalculations in managing the impact of such scenarios.

Their lack of familiarity with rapidly changing bond market dynamics increases the uncertainty and vulnerability of the banking industry, making it crucial for banks to closely monitor and manage their exposure to bond market risks.

Supporting articles:

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/banking-crisis-update-estimated-650-billion-in-unrealized-bond-losses/.

What are Bonds, Treasuries and Yields? Awake-In-3D

What are Bonds, Treasuries and Yields?

On November 8, 2023 By Awake-In-3D

A Simple Explanation

In recent weeks, the bond market has experienced a significant crash, which is causing concern on Wall Street. This market turmoil is impacting Treasury prices, and 10-year Treasury yields have surged above 5% for the first time in 16 years. But what are bonds, treasuries and yields in simple terms?

To understand the implications of this bond market meltdown, it helps to have basic knowledge of the key concepts.

What are Bonds, Treasuries and Yields?

On November 8, 2023 By Awake-In-3D

A Simple Explanation

In recent weeks, the bond market has experienced a significant crash, which is causing concern on Wall Street. This market turmoil is impacting Treasury prices, and 10-year Treasury yields have surged above 5% for the first time in 16 years. But what are bonds, treasuries and yields in simple terms?

To understand the implications of this bond market meltdown, it helps to have basic knowledge of the key concepts.

What are Bonds?

Bonds are essentially loans, issued by governments or companies when they need to borrow money. When you buy a bond, you are providing a loan and receive regular interest payments, with the loan amount returned to you at a later date. Bonds can also be traded in secondary markets, making them flexible investments.

What are Treasuries?

U.S. government-issued bonds are known as Treasuries, and the 10-year Treasuries serve as a benchmark for the market, influencing the pricing of other loans and investments.

What are Yields?

Bond yields represent the interest-rate returns as a percentage of the initial investment. They move inversely to bond prices, meaning that when yields rise, bond prices (their values) fall.

What’s causing the bond-market meltdown?

Two main factors are driving the recent surge in yields:

Federal Reserve Actions: Over the past 18 months, the Federal Reserve has raised benchmark interest rates substantially, attempting to combat inflation. When interest rates increase, bond prices decrease, as fixed returns become less appealing to investors.

U.S. Government Debt: The U.S. government’s debt has grown significantly over the last two decades, reaching an alarming $33.64 trillion, which far exceeds the country’s GDP. In the past five weeks, the debt has increased by $640 billion, creating an oversupply of bonds and bills that exceeds market demand.

Why does this matter?

Impact on Stocks: The rapid rise in bond yields is detrimental to the stock market. Higher yields make bonds more attractive to investors compared to stocks, leading to a slowdown in equity markets. Some experts are even recommending favoring bonds over equities.

Economic Consequences: Higher bond yields can affect the broader economy and ordinary Americans. When Treasury yields rise, other interest rates, including those for mortgages, personal loans, and credit cards, are likely to increase. This can lead to increased borrowing costs for individuals and companies, potentially resulting in layoffs as firms seek to reduce expenses.

The Key Takeaway

The bond market’s recent turmoil, with 10-year Treasury yields exceeding 5%, is a cause for concern for the entire financial system – which runs on debt and the interest rates tied to debt.

The main drivers are the Federal Reserve’s interest rate increases and the rapidly growing U.S. government debt.

This turmoil has implications for stocks, the broader economy, and the financial well-being of ordinary people, as it can lead to significantly higher interest rates and borrowing costs for everyone.

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Japan’s Financial Implosion Grows in Self-Perpetuating Cycle of Destruction: Awake-In-3D

Japan’s Financial Implosion Grows in Self-Perpetuating Cycle of Destruction

On November 4, 2023 By Awake-In-3D

I continue to monitor the financial Japan’s financial implosion because it is a leading indicator of the fiat system crisis approaching the European Union and the United States.

The precarious balance of national debt, bond yields (cost of debt), and inflation is supremely critical for stability in a fiat debt monetary system.

Japan’s central bank and government have not managed to find an effective balance of the economic factors explained in this article. In fact, they continue to appear helpless in breaking the self-perpetuating cycle leading to Japan’s financial implosion.

Japan’s Financial Implosion Grows in Self-Perpetuating Cycle of Destruction

On November 4, 2023 By Awake-In-3D

I continue to monitor the financial Japan’s financial implosion because it is a leading indicator of the fiat system crisis approaching the European Union and the United States.

The precarious balance of national debt, bond yields (cost of debt), and inflation is supremely critical for stability in a fiat debt monetary system.

Japan’s central bank and government have not managed to find an effective balance of the economic factors explained in this article. In fact, they continue to appear helpless in breaking the self-perpetuating cycle leading to Japan’s financial implosion.

That delicate balance is not going so well these days in Japan and it won’t be long before something’s got to give.

As always, I will update the facts as Japan’s financial implosion continues to unfold and break it down into simple terms as we continue to witness the global fiat currency debt system reaching its logical conclusion.

Japan’s Current Situation

Japan’s high national debt and the pressure of rising interest rates are relentlessly increasing the risk of Japan’s financial implosion.

The falling value of the Japanese yen against the dollar is influenced by ongoing money creation through quantitative easing, intended to support the bond market. However, this approach can lead to inflation and raises concerns about the sustainability of Japan’s debt burden.

THE JAPANESE YEN HAS DEPRECIATED NEARLY 15% AGAINST THE USD THIS YEAR. Source: Yahoo Finance

The Japanese central bank’s control of bond yields (or rather, lack of control) are not effective in attracting bond-buyers (lenders), especially with higher inflation rates.

The BOJ’s self-perpetuating cycle of buying Japanese government bonds to keep rates low is leading to further inflation and a weaker yen. Overall, the situation suggests an ever-growing negative impact on Japan’s economy and the value of the Japanese yen.

Current Economic Facts Facing Japan

Japan has a massive national debt, over 200% of its GDP, amounting to around $9 trillion.

Rising interest rates are putting pressure on Japan’s economy.

The Japanese yen has fallen to its lowest level against the dollar in over 20 years due to ongoing money creation through quantitative easing.

Interest payments on Japan’s debt currently make up a significant portion of government expenditures, and if yields increase to 4%, debt payments would exceed the entire government’s current expenditures.

The Japanese central bank aims to control bond yields, currently targeting 100 basis points (1.00%), but this may not be effective in attracting lenders due to higher inflation.

Inflation in Japan is viewed as a victory by the government and central bank, but it poses a problem given the high level of debt.

The central bank is faced with the dilemma of either allowing yields to rise by stopping bond purchases or continuing to print money and buy bonds to maintain low rates.

The Bank of Japan owns about 45% of the country’s outstanding debt, a significantly higher percentage compared to the Federal Reserve’s ownership of US national debt.

The US has a similar national debt issue and will face increasing interest payments in the near future.

Japan’s Financial Implosion in Simple Terms

The increasing risk of Japan’s financial implosion stem from a combination of factors: its massive national debt, bond yields (interest rates on government bonds), currency strength (the value of the Japanese yen), and inflation.

Japanese Yen Currency Notes

These elements are interconnected and pose a serious problem for Japan’s economy. If not balanced carefully, the potential for a Japanese financial collapse will continue to increase.

Japan has an enormous national debt, which is the amount of money it owes. It is more than twice the size of its entire economy (GDP). This means the country owes a lot of money, and it becomes challenging to manage and repay this debt.

Bond yields play a crucial role. The government issues bonds to borrow money from investors. The yield on these bonds is the interest rate the government pays to lenders. If bond yields rise, it becomes more expensive for the government to borrow money. This puts additional strain on Japan’s finances, as it needs to make larger interest payments on its debt.

The strength of the Japanese currency, the yen, is also important. When the yen is stronger, it means it has a higher value compared to other currencies like the U.S. dollar. A stronger yen can make Japanese exports more expensive, which can hurt the country’s economy. It can also make it harder for Japan to pay off its debt because the revenue from exports may decrease.

Inflation is a factor. Inflation means that prices of goods and services are increasing over time. Japan has had low inflation for a long time, but recently it has been rising. While some inflation is considered healthy, too much can be problematic. If inflation rises significantly, it erodes the value of money, including the money Japan owes as debt. This can make it even harder for Japan to manage its debt burden.

The Self-Perpetuating Cycle

Thus far, Japan’s central bank and government have not managed to find an effective balance of the economic factors explained above. In fact, they continue to appear helpless in breaking the self-perpetuating cycle leading to Japan’s financial implosion.

Rising bond yields increase the cost of borrowing, which strains the government’s finances.

A weaker currency increases the rate of inflation and hampers economic growth making it even more challenging to repay debt.

And if inflation gets out of control, it further weakens the country’s financial stability, requiring even more debt to maintain the appearance of financial stability.

Wash, rinse, repeat…

To avoid a financial collapse, Japan needs to keep bond yields under control, maintain a stable currency, and hold inflation around 1-2%.

None of these are under control today.

Yet then again, this is the way things collapse as the great, global fiat currency debt system runs headlong into its logical conclusion.

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/japans-financial-implosion-grows-in-self-perpetuating-cycle-of-destruction/

Iraq’s 100 Trillion IQD Problem: “Hoarded” Notes Need to be in Banking System: Awake-In-3D

Iraq’s 100 Trillion IQD Problem: “Hoarded” Notes Need to be in Banking System

On November 3, 2023 By Awake-In-3D

In RV/GCR

I found this article interesting. I do not know the position of the author, but it appeared in the Arabic-language news website Al-Sabah. What made it noteworthy for me was that it’s the first time I have seen a statement quantifying Iraq’s 100 Trillion IQD outside of Iraqi banks.

This means there is A LOT of IQD notes stuffed away, or “hoarded”, in Mr. Al-Mutwalli’s own words.

I have got to believe that many within Iraq’s economic and political echelons are fully aware that we all hold substantial amounts of IQD.

Or, do they actually believe that most of Iraq’s 100 Trillion IQD is under the mattresses of everyday Iraqi citizens?

Iraq’s 100 Trillion IQD Problem: “Hoarded” Notes Need to be in Banking System

On November 3, 2023 By Awake-In-3D

In RV/GCR

I found this article interesting. I do not know the position of the author, but it appeared in the Arabic-language news website Al-Sabah. What made it noteworthy for me was that it’s the first time I have seen a statement quantifying Iraq’s 100 Trillion IQD outside of Iraqi banks.

This means there is A LOT of IQD notes stuffed away, or “hoarded”, in Mr. Al-Mutwalli’s own words.

I have got to believe that many within Iraq’s economic and political echelons are fully aware that we all hold substantial amounts of IQD.

Or, do they actually believe that most of Iraq’s 100 Trillion IQD is under the mattresses of everyday Iraqi citizens?

Anyway, I seriously doubt that any of our notes will not end up in Iraqi banks until they revalue their currency. Food for thought.

“Official estimates indicate that 85% of the issued cash mass, which amounts to more than 100 trillion dinars, is outside the banking system…”

Yasser Al-Mutawalli

Now onto the article…

The article discusses the issue of hoarded money, which is cash that is kept outside the banking system in Iraq.

This large amount of money is not being used for development because people do not trust the banks.

The central bank is trying to encourage people to deposit their money in banks by offering incentives. However, the lack of trust in banks is a major challenge. To restore trust, the article suggests the need for a deposit insurance company to guarantee deposits and provide clear and transparent information about its activities.

The fluctuation of the exchange rate also affects trust. Overall, the article highlights the importance of restoring trust in banks to encourage people to deposit their money and stimulate economic development.

Here is the original article…

Hoarded Money and Depositor Incentives

by Yasser Al-Mutawalli

November 1st, 2023

[Translated from original Arabic]

Official estimates indicate that 85% of the issued cash mass, which amounts to more than 100 trillion dinars, is outside the banking system, referred to as hoarded money outside banks. This means that this enormous amount of cash is disabled from performing its role in development. Since banks, through their credit policies, are the driving force behind economic development, their inability to perform this role is hindering our economy from progressing due to the decline in the performance of development banks.

Meanwhile, monetary policy is heading towards stimulating depositors to engage with banks. The recent circular from the central bank urged banks to facilitate procedures and create incentivizing interest rates to attract depositors.

What challenge does this approach face?

The trust factor is the most difficult and fundamental indicator for the success of attracting and mobilizing hoarded funds from the public to deposit them in banks.

Banks worldwide, in all advanced countries, are the primary engine of the economy through their lending policies that contribute to generating benefits for depositors and bank owners by investing funds and achieving profits. They also contribute to implementing projects, thus facilitating the circulation of funds.

However, the Iraqi banks have, honestly and transparently, lost the trust of the public. This is a deep-rooted problem inherited from the actions of some banks due to weak management and the alienation of depositors.

How can we restore trust in light of the new approach?

The public seeks guarantees (insurance policy) to be encouraged to deposit their savings, which requires facilitating deposit and withdrawal operations in an uncomplicated manner. However, the weak banking behavior of some employees and the complexity of instructions in a bureaucratic manner contribute to the public’s reluctance.

The term “insurance policy” refers to the officially designated entity responsible for deposit insurance in the event of the collapse of a specific bank. This is where the role of the deposit insurance company, recently established for this purpose, comes into play.

Here, I have a critical evaluation of the deposit insurance company, with transparency and clarity, stating that its performance is weak, sluggish, and poorly known. It requires the establishment of a regular and influential media unit to continuously market its activities. The company should provide guarantees to depositors by guaranteeing their funds with an official, signed document distributed among all depositors in any bank, holding legal responsibility for deposit insurance. Otherwise, why was it established?

Thus, it can provide partial security that encourages the public to deposit in banks and gradually restore trust.

We cannot ignore the impact of the fluctuation of the exchange rate of the dollar in creating chaos and undermining trust.

However, we are talking about the national currency, which is still strong and there is no problem in depositing and withdrawing it, with the guarantee of the company.

Source: https://alsabaah.iq/86507-.html

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/iraqs-100-trillion-iqd-problem-hoarded-notes-need-to-be-in-banking-system/

Can an Iraqi Dinar RV Reach $3.00+ Matching Kuwait? Here’s What You Need to Know : Awake-In-3D

Can an Iraqi Dinar RV Reach $3.00+ Matching Kuwait? Here’s What You Need to Know

On November 2, 2023 By Awake-In-3D

In RV/GCR

The three strongest currencies in the world are held by Iraq’s neighboring nations – Kuwait, Bahrain and Oman. How does Iraq compare economically and politically against these powerhouse currencies, and can the Iraqi Dinar RV support such valuations?

This is Section 3 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

This section represents the culmination of the 3-section article series which set out to analyze and explain the important factors surrounding a potential revaluation (RV) of the Iraqi Dinar (IQD)

Can an Iraqi Dinar RV Reach $3.00+ Matching Kuwait? Here’s What You Need to Know

On November 2, 2023 By Awake-In-3D

In RV/GCR

The three strongest currencies in the world are held by Iraq’s neighboring nations – Kuwait, Bahrain and Oman. How does Iraq compare economically and politically against these powerhouse currencies, and can the Iraqi Dinar RV support such valuations?

This is Section 3 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

This section represents the culmination of the 3-section article series which set out to analyze and explain the important factors surrounding a potential revaluation (RV) of the Iraqi Dinar (IQD)

Section 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events provided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

Section 2, A Sky High Iraqi Dinar RV Boils Down to This identified and explained every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

Building upon the knowledge acquired regarding key economic indicators in Section 2, we now direct our focus toward a comparison of Iraq’s neighboring countries, distinguished by their robust and stable currencies.

This analysis centers on the examination of the key economic indicators and political stability indices that underpin countries with very strong (high) exchange rate in U.S. Dollar terms. Specifically, the nations of Kuwait, Bahrain, and Oman.

By comparing these nations with Iraq, we will gain valuable insights into the practical determinants that may influence the potential revaluation of the Iraqi Dinar.

3.1 Iraq’s Regional Neighbors with Strong Currency Exchange Rates

Let’s start by establishing a baseline of currency exchange rates within the region.

Kuwait (KWD): 1 KWD = $3.23

Bahrain (BHD): 1 BHD = $2.65

Oman (OMR): 1 OMR = $2.60

Iraq (IQD): 1 IQD = $0.00076 (1310 IQD per 1 USD)

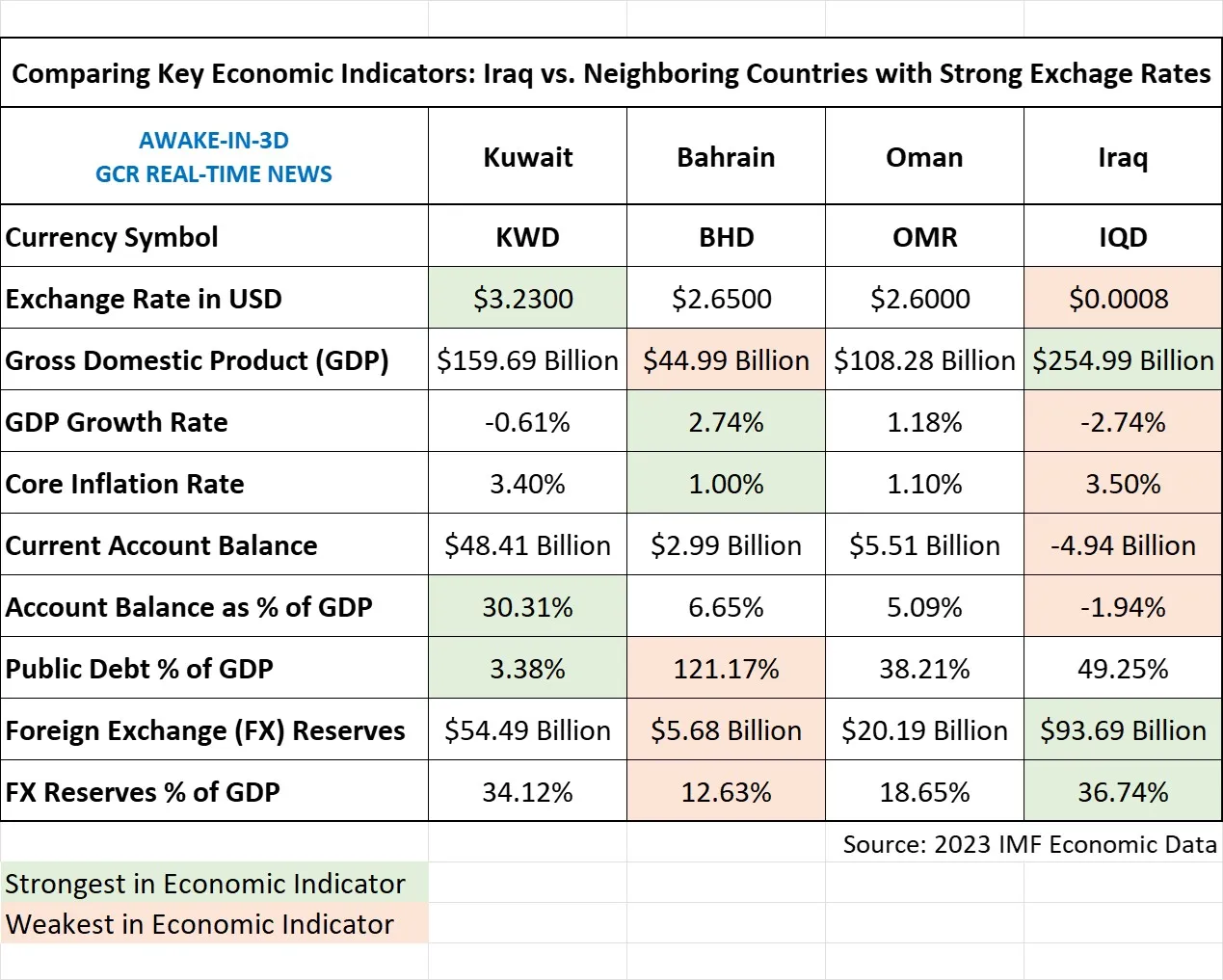

3.2 Key Regional Economic Indicators to Support an Iraqi Dinar RV

The relevance of this comparative analysis lies in the examination of fundamental economic indicators which serve as the bedrock of currency dynamics.

These indicators allow us to assess the currency dynamics and economic environments within Iraq and its regional counterparts.

Here are the key economic indicators we shall scrutinize and compare for each country:

National Gross Domestic Product (GDP)

Economic Growth (GDP Growth Rate)

Core Inflation Rate

Current Account Balance

Public Debt (as a Percentage of GDP)

Foreign Exchange Reserves

The following chart summarizes a direct comparison of these key economic indicators between Iraq, Kuwait, Bahrain and Oman based on the latest 2023 economic data.

Source Data: 2023 IMF Economic Research

3.2.1 What this Economic Comparison Indicates Relative to an Iraqi Dinar RV

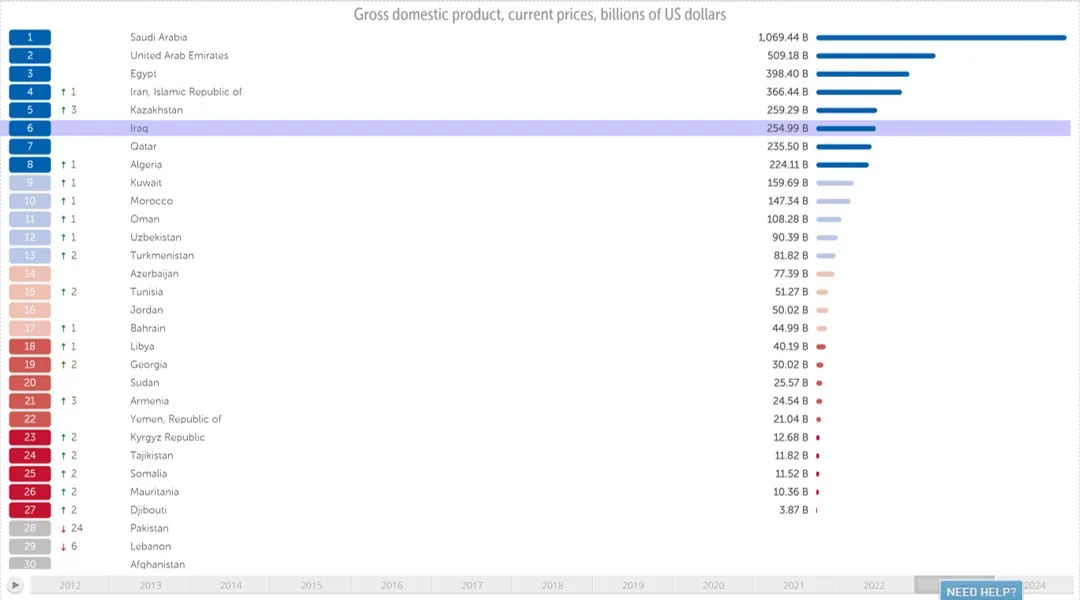

National Gross Domestic Product (GDP):

Iraq has the highest GDP among the mentioned countries at $254.99 billion, indicating the largest economic size in the region.

While Iraq’s GDP is relatively large, its economy is heavily dependent on its competitive strength in oil exports and processing efficiency (production cost per barrel of oil). Given Iraq’s ongoing need for infrastructure efficiency and capacity upgrades, its competitive position is weaker than that of neighboring nations .

Moreover, Iraq’s economy suffers from a broader set of structural issues, including elevated levels of financial and political corruption, which prevents the confidence necessary for significant foreign capital investment.

GDP OF MIDDLE EASTERN REGION. Source: IMF

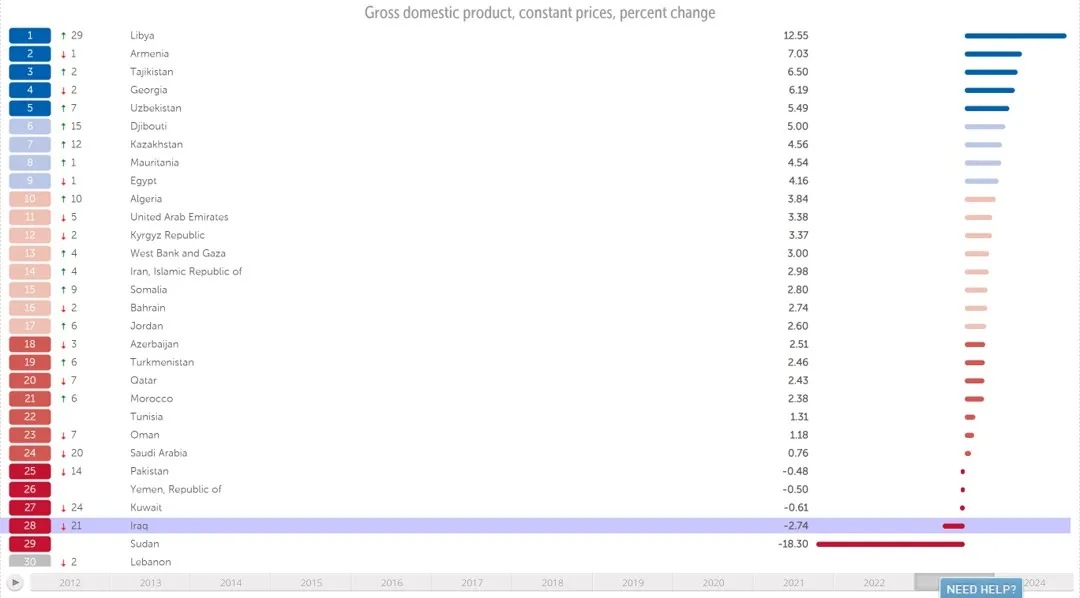

Economic Growth (GDP Growth Rate):

Bahrain leads in economic growth with a GDP growth rate of 2.74%. This positive growth rate signifies a thriving economy.

Oman’s growth rate is 1.18%, indicating a moderately growing economy.

Kuwait has a negative growth rate of -0.61%, suggesting a contraction in its economy.

Iraq’s GDP growth rate is -2.74%, showing a significant economic output decline, which can likely be attributed to ongoing security issues and political instability.

GDP GROWTH RATE OF MIDDLE EASTERN REGION. Source: IMF

Inflation Rates:

Bahrain has a relatively low inflation rate of 1.0%, indicating price stability.

Oman’s inflation rate is also low at 1.1%, contributing to stable purchasing power.

Kuwait’s inflation rate is 3.4%, relatively high compared to its neighbors, which may affect consumer affordability.

Iraq, with an inflation rate of 3.5%, experiences even higher price increases, impacting the living standards of its citizens, which is reflected by Iraq’s contracting GDP above.

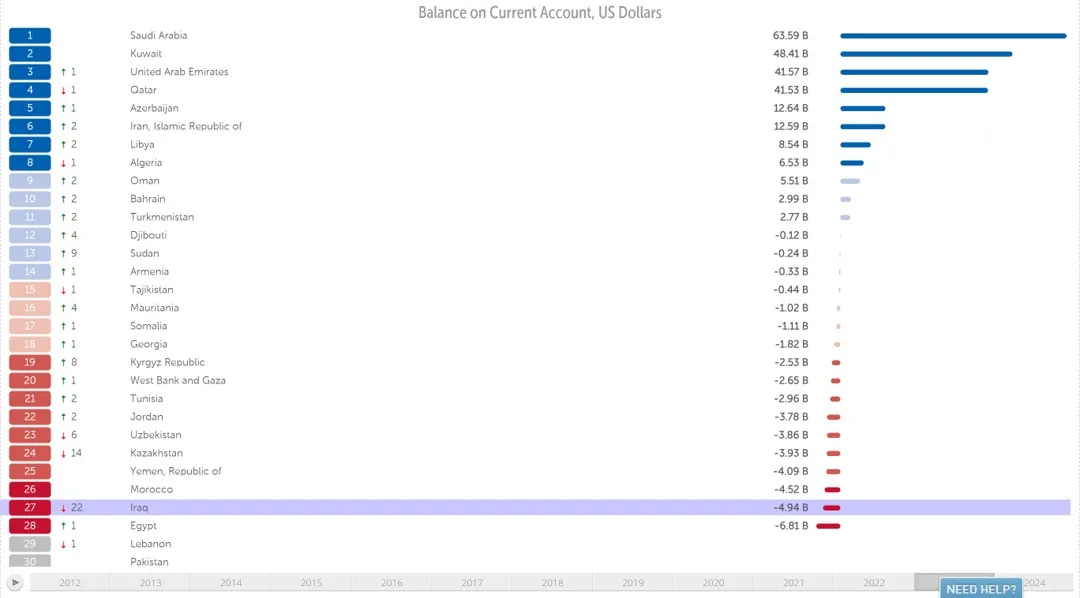

Current Account Balance:

Kuwait maintains a significant surplus with a current account balance of $48.41 billion, reflecting strong international trade.

Oman has a surplus of $5.51 billion, indicating a healthy trade balance.

Bahrain’s surplus is $2.99 billion, showcasing its economic stability.

Iraq, however, has a deficit of -$4.94 billion, implying that it imports more than it exports, which can strain its foreign exchange reserves.

CURRENT TRADE ACCOUNT BALANCE OF MIDDLE EASTERN REGION. Source: IMF

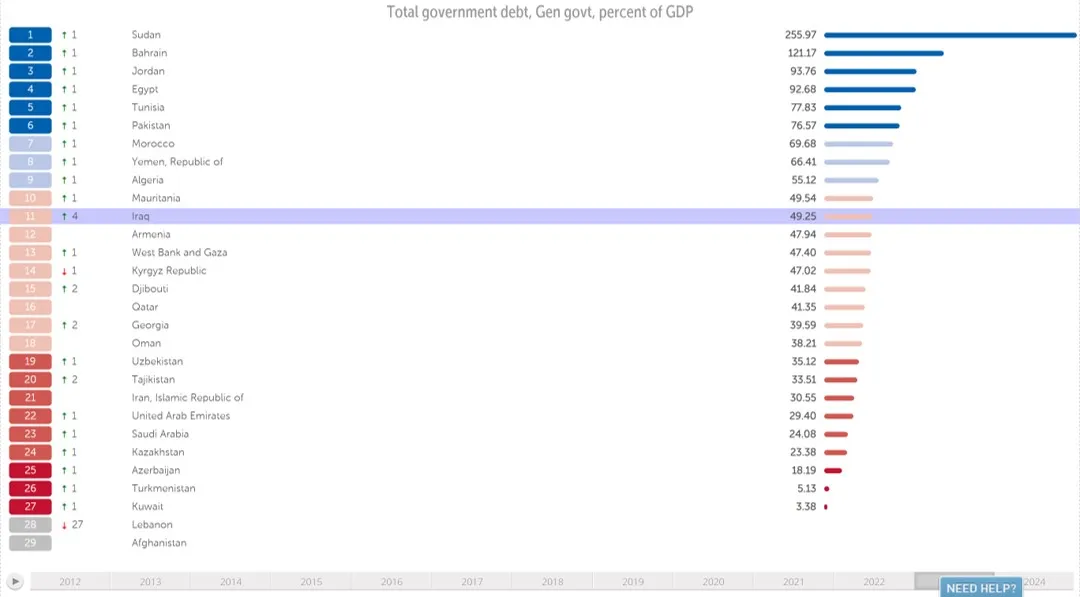

Public Debt (as a Percentage of GDP):

Kuwait’s public debt is relatively low at 3.38% of its GDP, reflecting fiscal responsibility.

Oman’s public debt is 38.21% of its GDP, suggesting a higher debt burden.

Bahrain’s public debt is notably high at 121.17% of GDP, indicating significant fiscal challenges.

Iraq’s public debt is 49.25% of its GDP, which is relatively high and indicates a substantial debt burden.

PUBLIC DEBT OF MIDDLE EASTERN REGION. Source: IMF

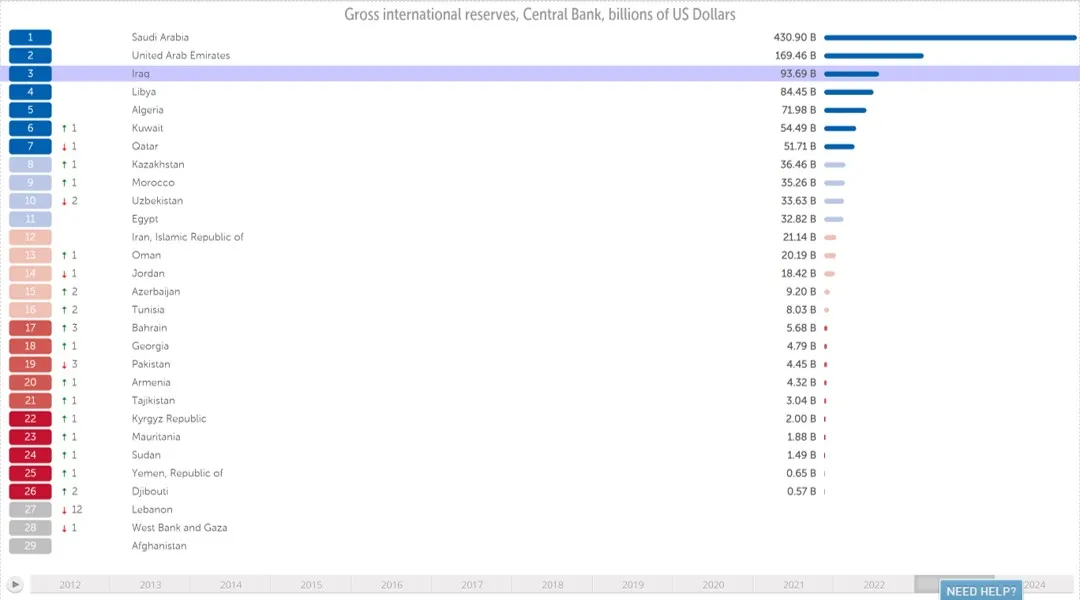

Foreign Exchange Reserves:

Kuwait holds foreign exchange reserves of $54.49 billion, which is substantial and provides stability to its currency.

Oman’s reserves are $20.19 billion, providing a buffer against external economic shocks.

Bahrain’s reserves are $5.68 billion, which, while lower than its neighbors, still contributes to currency stability.

Iraq’s foreign exchange reserves are $93.69 billion at approximately 37% relative to GDP – stronger than any of its neighbors. This would serve well in maintaining a strong currency peg to the U.S. dollar (or a basket of currencies including the USD).

FOREIGN EXCHANGE (FX) OF MIDDLE EASTERN REGION. Source: IMF

The Bottom Line

Iraq faces substantial economic challenges compared to its neighbors with stronger currencies being the weakest in 5 out of 8 key indicators.

These challenges include a negative GDP, economic contraction, higher inflation rates, a trade deficit, and a relatively high public debt burden. Consequently, Iraq’s ability to support an equally high exchange rate as its neighbors is limited by these economic constraints.

However, the weakness around Iraq’s key economic indicators is not so severe as to prevent a significant currency RV in the $2.00-$2.75 range.

Iraq appears to have the basic economic strength to support a currency peg similar to Kuwait, Bahrain and Oman.

So what’s holding Iraq back from Revaluing the IQD with a new currency peg? Perhaps the political stability index can provide an answer.

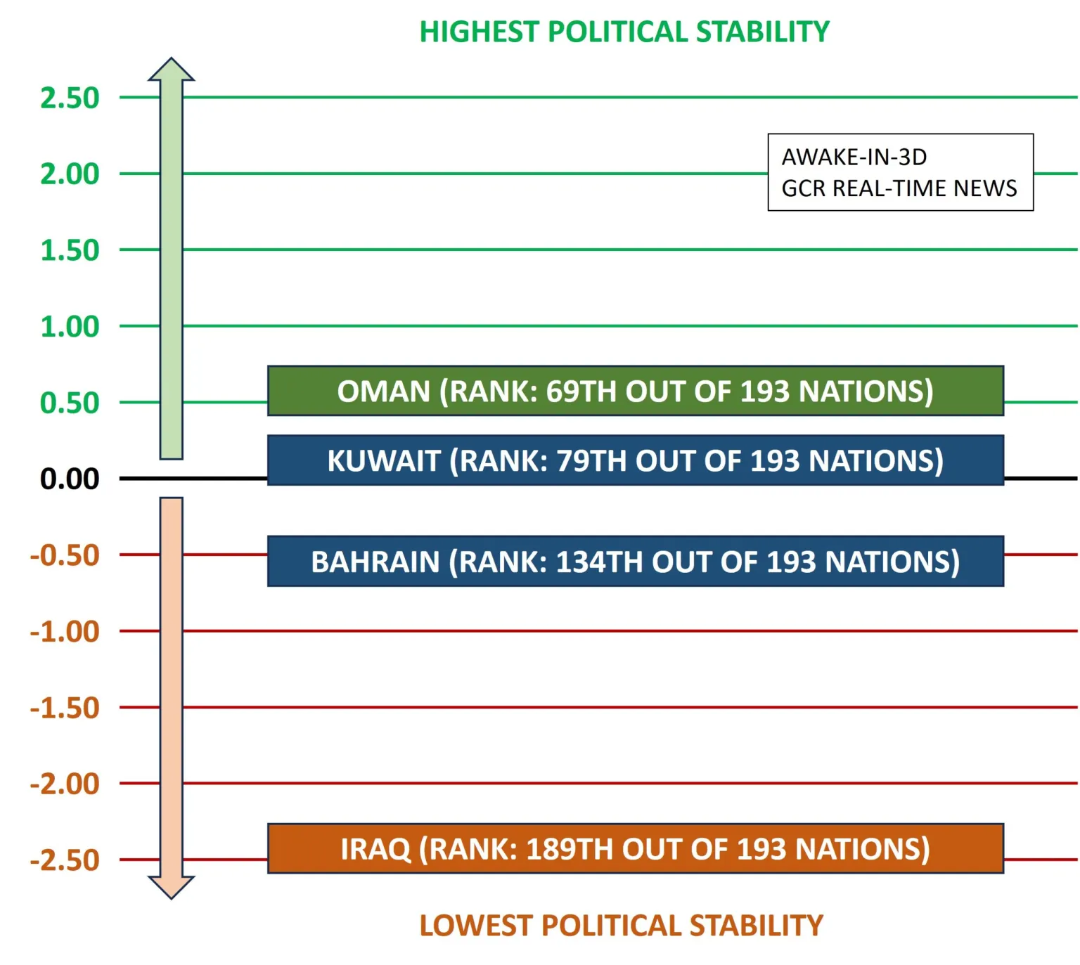

3.3 Political Stability: The Most Significant Challenge Facing an Iraqi Dinar RV

Political stability is a pivotal element in the realm of global economics and currency valuation. Understanding the political stability index is integral to our comparative analysis.

This index measures the perceived likelihood of a country’s government being destabilized or overthrown through unconstitutional or violent means, including politically motivated violence and terrorism.

An index value of 2.5 points indicates a strong and secure political environment, while a value of -2.5 points reflects a weak and insecure setting. The global average index value for 2021, derived from 193 countries, stands at -0.07 points.

Here is how the different countries rank in terms of overall political stability:

Oman: With a commendable index of 0.51, Oman holds the 69th place in the global political stability rankings, signifying a robust and stable political environment.

Kuwait: Kuwait secures the 79th position in global political stability standings with an index of 0.30, indicating a relatively stable political climate.

Bahrain: Bahrain ranks 134th in global political stability standings, albeit with a modestly negative index of -0.51, reflecting specific political challenges.

Iraq: Within this regional context, Iraq stands at the 189th position in political stability rankings out of a total of 193 countries. Iraq’s political stability index stands at -2.4, signifying a significantly weaker and insecure political environment.

Source Data: 2021 TheGlobalEconomy.com

Conclusion

In unison, these comparisons have underscored the interplay of economic indicators and political stability that define the currency dynamics within Iraq and its regional counterparts.

Clearly Iraq has a long way to go in reducing the political and financial corruption that dominates how the international business and foreign exchange markets view Iraq in terms of overall risk vs. reward.

Until the endemic corruption that plagues Iraq is addressed and mitigated, any serious attempts to float or peg a revalued IQD substantially higher will likely fail to achieve the desired results such an RV would yield.

Sources:

IMF Economic Data: https://data.imf.org/?sk=2ab615ea-9fb9-45b2-8d65-a031a6204fea

Political Stability Index: https://www.theglobaleconomy.com/rankings/wb_political_stability/

Section 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events provided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

Section 2, A Sky High Iraqi Dinar RV Boils Down to This identified and explained every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/can-an-iraqi-dinar-rv-reach-3-00-matching-kuwait-heres-what-you-need-to-know/

Central Bank Losses Grow and Bailouts Arrive: Is the Federal Reserve Next? Awake-In-3D

Central Bank Losses Grow and Bailouts Arrive: Is the Federal Reserve Next?

On October 26, 2023 By Awake-In-3D

The global fiat currency debt system is facing an unprecedented financial crisis as central bank losses are significantly increasing month by month. Some are already requiring public bail-outs.

These institutions, which include the U.S. Federal Reserve, are grappling with losses that not only show no sign of relenting, but also pose a substantial risk to the stability of financial systems around the world.

As the financial system grapples with these mounting losses, the Federal Reserve may have immunity (for now).

Central Bank Losses Grow and Bailouts Arrive: Is the Federal Reserve Next?

On October 26, 2023 By Awake-In-3D

The global fiat currency debt system is facing an unprecedented financial crisis as central bank losses are significantly increasing month by month. Some are already requiring public bail-outs.

These institutions, which include the U.S. Federal Reserve, are grappling with losses that not only show no sign of relenting, but also pose a substantial risk to the stability of financial systems around the world.

As the financial system grapples with these mounting losses, the Federal Reserve may have immunity (for now).

Central bank losses continue to escalate, growing from month to month, posing a severe threat to global financial stability. Recent examples are Sweden’s Riksbank and the Bank of England.

The impact of these losses on everyday taxpayers is significant as they may ultimately shoulder the costs of bailouts to cover central bank deficits.

The U.S. Federal Reserve stands apart, thanks to its control over the world’s reserve currency and the use of deferred assets.

Global Central Bank Losses on the Rise

Flag outside of Sweden’s Central Bank building – Sveriges Riksbank

The financial predicament of central banks worldwide is indeed causing global concern, with the following facts highlighting the magnitude of the issue:

Sweden’s Riksbank reported a loss of over SEK 80 billion in 2022 resulting in a negative equity position (insolvency) of SEK -18 billion. It now needs a capital injection of at least SEK 80 billion to restore its equity to the basic level required by the Sveriges Riksbank Act.

The Bank of England, for instance, has already incurred losses estimated at £24 billion from selling bonds as of April 2023, a figure that experts predict could soon soar to a staggering £100 billion.

The U.S. Federal Reserve is not immune to these mounting losses, as it recently breached the $100 billion mark in losses.

In the midst of this financial turmoil, the U.S. Federal Reserve stands apart from the mounting financial problems of other central banks. Unlike its global counterparts, the Federal Reserve possesses a secret weapon.

A Growing Burden on Taxpayers – Bailouts

These central bank losses aren’t confined to the world of finance; they have a tangible impact on everyday people.

The burden of these losses ultimately falls on taxpayers, who may be required to cover the deficits created by these central bank losses.

The potential need for bailouts and the resulting public financial burden is an issue that cannot be ignored.

The Federal Reserve’s Secret Weapon

In the midst of this financial turmoil, the U.S. Federal Reserve stands apart from the mounting financial problems of all other central banks. Unlike its global counterparts, the Federal Reserve possesses a secret weapon.

The Fed is different because of its unique position as the issuer and controller of the world’s reserve currency, the U.S. Dollar.

Right to left: Janet Yellon – US Treasury Secretary and Jerome Powell – Federal Reserve Chairman

This distinctive role affords the Federal Reserve the following unparalleled advantages:

The Federal Reserve’s capacity to print its own currency provides it with the power to meet its debt obligations without the risk of default. This sets it apart from central banks that do not have this privilege.

The Federal Reserve employs a clever strategy involving “deferred assets,” which effectively conceals its losses and maintains normal operations without disruption. This strategy allows the Federal Reserve to maintain its operations indefinitely, even when facing mounting losses.

Can the Federal Reserve Go Bankrupt?

A crucial question arises: Can the U.S. Federal Reserve Bank go bankrupt, just like other central banks facing insurmountable losses? The answer lies in the Federal Reserve’s “unique” position of monetary privilege.

The Federal Reserve’s Special Bankruptcy Shield

The Federal Reserve’s financial stability is underpinned by its unique status as the issuer of the world’s reserve currency and its power to print money to meet its obligations. This affords the Federal Reserve the following key advantages:

Its control over the world’s reserve currency grants it the ability to meet debt obligations without the risk of insolvency, even as central bank losses mount.

The Federal Reserve’s use of “deferred assets” allows it to conceal losses effectively, ensuring its ongoing normal operations without disruption, even in the face of mounting financial challenges.

As the financial system grapples with these mounting losses, the Federal Reserve may have immunity (for now).

However, the broader implications of central bank losses raise questions about the global financial landscape and the role of central banks in the everyday lives of people around the world.

Supporting Articles:

https://www.reuters.com/markets/us/fed-losses-breach-100-billion-interest-costs-rise-2023-09-15/

https://thehill.com/opinion/finance/3955889-the-fed-is-bankrupt/

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/central-bank-losses-grow-and-bailouts-arrive-is-the-federal-reserve-next/

A Sky High Iraqi Dinar RV Boils Down to This: Awake-In-3D

A Sky High Iraqi Dinar RV Boils Down to This

On October 24, 2023 By Awake-In-3D

In RV/GCR

This is Section 2 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

A working knowledge of the economic and political factors that support a currency’s stability and strength is a powerful tool for determining the potential exchange rate within the Iraqi Dinar RV landscape.

This article outlines what you need to know.

Part 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events provided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

A Sky High Iraqi Dinar RV Boils Down to This

On October 24, 2023 By Awake-In-3D

In RV/GCR

This is Section 2 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

A working knowledge of the economic and political factors that support a currency’s stability and strength is a powerful tool for determining the potential exchange rate within the Iraqi Dinar RV landscape.

This article outlines what you need to know.

Part 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events provided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

Coming Soon

Part 3 will bring everything together to analyze and present a comparison between economic and political indicators for Iraq and the three strongest currencies in the world – Kuwait, Oman, and Bahrain.

This section explains the key economic and political stability indicators that are used to generally assess and determine the potential strength and stability of any nation’s currency.

2.1 Key Economic Indicators for Currency Strength and Stability for an Iraqi Dinar RV

While there are many economic indicators that influence currency exchange rates, these are the top five indicators that best serve the scope of this study (keeping it straight forward).

Inflation Rates: Lower inflation rates signify a stable economy, bolstering a currency’s value.

Economic Growth: Indicators like the GDP growth rate are essential in evaluating a country’s economic health. Strong economic growth often results in a robust currency.

Current Account Balance: A surplus in the current account, where a country exports more than it imports, positively supports currency appreciation.

Public Debt: Countries with large public debts are less appealing to foreign investors due to the risk of inflation and default, putting downward pressure on currency value.

Foreign Exchange Reserves: The amount of foreign currency held by a country influences its own currency’s value. Countries with substantial reserves have the ability to better manage and maintain (currency pegs) their currency’s value.

2.2 Understanding Currency Peg Policies

A nation’s monetary policy related to currency pegs ultimately sets the exchange rate. Large economies today, such as the United States and the European Union, allow their currencies float (no peg is used) solely on market forces.

Smaller economies will peg their currencies to other, widely utilized currencies such as the U.S. Dollar, the Euro, or a basket of globally dominant currencies.

When countries engage in international trade, they aim to maintain the stability of their currency. Currency pegging, or fixing, is a method used to achieve this. It involves tying a nation’s currency to another currency, such as the U.S. dollar.

Countries choose to peg their currency to safeguard the competitiveness of their exported goods and services. A weaker currency benefits exports and tourism, as it makes everything more affordable for foreign buyers.

The fluctuation of exchange rates can negatively affect international trade, making currency pegging a viable option for stability.

Many countries, including some that peg their currency to the U.S. dollar, opt for this approach to ensure their goods and services remain competitive.

2.3 Ending the Bretton Woods Agreement Created Fixed vs. Floating Currency Practices (Global Fiat Currencies)

The 1944 Bretton Woods Agreement pegged the U.S. dollar to gold, reducing volatility in international trade relations. As a result, most global nations then pegged their currencies to the U.S. dollar and it became the new world reserve currency.

THE 1944 BRETTON WOODS CONFERENCE WHERE THE US DOLLAR WAS PEGGED TO GOLD AND BECAME THE NEW WORLD RESERVE CURRENCY

However, the Bretton Woods system ended in 1971 when the United States de-pegged the dollar from gold, and the Great Global Fiat Currency System Experiment was born almost overnight.

Since then, countries now decide how their currencies operate in the foreign exchange market – a hard peg or a floating exchange rate.

There are, in essence, two primary types of currency exchange rate policies today: floating and fixed.

5-YEAR CHART: THE US DOLLAR IS A FLOATING CURRENCY RATE – CHANGING VALUE THROUGH MARKET FORCES

Major currencies, like the Japanese yen, euro, and U.S. dollar, are floating currencies, with their values determined by supply and demand in foreign exchange markets. This system is influenced by market forces, signaling economic strength or weakness.

On the other hand, fixed currencies derive their value from being linked to another currency, providing increased stability. Many developing economies use fixed exchange rates to ensure stability in their international trade activities.

5-YEAR CHART: THE IQD IS A FIXED CURRENCY PEGGED TO THE US DOLLAR AND RARELY CHANGES

Iraq employs a fixed exchange rate policy, pegging the IQD to the U.S. Dollar.

2.4 Political Stability Likely the Critical Factor Influencing Potential Iraqi Dinar RV Rate

Countries with greater political stability are more likely to maintain stable currencies with higher exchange rate valuations. Political stability is a key factor in currency valuation and vitally important for a “high-rate” Iraqi Dinar RV.

For a significant currency revaluation to take place, Iraq must address various challenges, including political instability, corruption, and security concerns. Achieving economic stability and implementing necessary reforms are crucial prerequisites for the potential revaluation of the IQD.

2.4.1 The Political Stability Index

The Political Stability Index measures the likelihood that a government will be destabilized or overthrown by unconstitutional or violent means, including politically motivated violence and terrorism. It is based on various indexes from reputable sources such as the Economist Intelligence Unit, the World Economic Forum, and the Political Risk Services.

A Political Stability Index value of 2.5 points indicates a strong, secure political environment in a country. Conversely, a country with a value of (-2.5) points indicate a very weak, insecure political environment. The average index value for 2021, based on 193 countries, was (-0.07) points.

Source: https://www.theglobaleconomy.com/rankings/wb_political_stability/

Conclusion of Section 2

This section has examined essential economic and political stability indicators that influence a country’s currency valuation. Understanding the role of these factors is vital in evaluating an Iraqi Dinar RV exchange rate potential.

In Section 3, we will apply what we’ve learned here and review how Iraq compares to a regional selection of strong, stable currencies, assessing Iraq’s economic and political position in the context of its neighboring countries.

This will reveal a clearer picture of how Iraq stacks up and its ability to set and maintain a much stronger exchange rate for the IQD in an Iraqi Dinar RV.

Part 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events provided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

Coming Soon

Part 3 will bring everything together to analyze and present a comparison between economic and political indicators for Iraq and the three strongest currencies in the world – Kuwait, Oman, and Bahrain.

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-sky-high-iraqi-dinar-rv-boils-down-to-this/

Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events: Awake-In-3D

Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events

On October 23, 2023 By Awake-In-3D

In RV/GCR

This is Section 1 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

Amidst years of speculation, rumors, and expectations surrounding an Iraqi Dinar Revaluation (RV), there exists a base case to be made deserving serious consideration.

Coming Soon

Part 2 will identify and explain every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

Part 3 will bring everything together to analyze and present a comparison between economic and political indicators for Iraq and the three strongest currencies in the world – Kuwait, Oman, and Bahrain.

Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Events

On October 23, 2023 By Awake-In-3D

In RV/GCR

This is Section 1 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

Amidst years of speculation, rumors, and expectations surrounding an Iraqi Dinar Revaluation (RV), there exists a base case to be made deserving serious consideration.

Coming Soon

Part 2 will identify and explain every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

Part 3 will bring everything together to analyze and present a comparison between economic and political indicators for Iraq and the three strongest currencies in the world – Kuwait, Oman, and Bahrain.

However, it is crucial to ground any discussion in the real economic, financial, and political environment surrounding Iraq today.

While the speculative nature of previous claims may not align with economic reality, it is important to acknowledge the continuous improvements witnessed in Iraq’s economic development.

These advancements provide a legitimate rationale in support of considering the eventual revaluation of the Iraqi Dinar.

This report outlines a comprehensive set of factors contributing to this perspective, aiming to provide a thorough analysis of the landscape surrounding the case for an Iraqi Dinar revaluation (RV).

1.1 The Evolution of the Iraqi Dinar

The history of the Iraqi Dinar dates back to its introduction as Iraq’s official currency in 1932. At its inception, the IQD was at par with the British pound, reflecting a stable economy and strong financial position.

However, the subsequent decades witnessed a series of significant events that led to the devaluation of the IQD.

1.1.1 The Impact of Wars on the IQD

The Iran-Iraq war (1980-1988) and the subsequent Gulf War in 1991 had profound effects on Iraq’s economy and its currency.

These prolonged conflicts strained resources, disrupted economic stability, and resulted in the devaluation of the Iraqi Dinar.

See related article: IQD History: CBI Governor Speaks Publicly About Currency RV/RD in 2011

1.1.2 Economic Sanctions and Trade Restrictions

Economic sanctions, imposed by the international community due to various political and security issues, have played a pivotal role in the fluctuations of the Iraqi Dinar’s value.

Sanctions often limited Iraq’s ability to engage in international trade, leading to a decline in foreign currency reserves and contributing to the devaluation of the IQD.

1.2 Popular Reasons Fueling Speculation around an IQD Revaluation

Despite these challenges, speculations about the potential revaluation of the Iraqi Dinar have persisted.

Proponents of an Iraqi Dinar RV often highlight several primary arguments supporting their position.

These include:

1.2.1 Iraq’s Abundant Oil Reserves

Likely the most popular reason supporting expectations of an Iraqi Dinar revaluation is that Iraq possesses one of the world’s largest oil reserves, and the successful exploitation of these resources should significantly boost its economic potential.

This substantial oil wealth is a critical factor in the potential revaluation of the IQD.

SIDEBAR: Oil Credits for the USA?

Many argue that Iraq could support a high exchange rate to the U.S. Dollar because of a much rumored “Oil Credit Agreement” purportedly set up between Iraq and the USA after the Gulf War.

However, there is no conclusive evidence (other than what’s posted on various RV related internet sites) that supports such an agreement actually exists.

The trickle of oil imported from Iraq renders any Oil Credits insignificant. Source: US Energy Information Administration.

Furthermore, if such an Oil Credit Agreement did exist, the fact remains that in 2022:

The USA consumed 19.1 million barrels/day of petroleum

The USA produced 19.99 million barrels/day of petroleum

The USA imported 8.32 million barrels/day of petroleum

The USA only imported an average of 332 thousand barrels/day from Iraq (4% of USA’s total petroleum imports)

Source: US Energy Information Administration (https://www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php)

Source: US Energy Information Administration.

Given that the USA imports such an insignificant amount of petroleum from Iraq, the value of any “Oil Credits” would not support any meaningful role in an Iraqi Dinar RV.

1.2.2 Iraq’s Prospects of Economic Growth

Another popular reason offered in support of an IQD revaluation is Iraq’s potential for continued economic growth.

Underpinned by its oil resources and untapped economic potential, the community of IQD RV’ers has continued to grow over the years with committed interest.

Certainly there is a valid case to be made for a successful Iraqi Dinar revaluation being closely tied to Iraq’s ability to harness its economic potential.

Does Iraq now have a robust economic credentials to support a stable, high-value exchange rate?

A detailed analysis of Iraq’s key economic indicators will be presented in Section 3 of this report (link).

1.2.3 Political Stabilization in Iraq

Finally, Iraq’s purported progress in establishing political stability is another popular argument made in support of a significant currency revaluation.

Iraq’s journey towards political stability has been marred by challenges like corruption, security concerns, and political instability.

Protests in Baghdad over corruption, lack of jobs, and poor services in 2019. Photo: REUTERS/Khalid al-Mousily

As Iraq takes steps towards establishing lasting political stability and independent governance, the probability of a major currency revaluation (RV) would definitely increase.

Yet, has the government of Iraq (GOI) really made significant inroads to political stability?

This subject will be outlined in Section 3 of this report.

1.3 International Agencies and their Effect on Exchange Rates

It’s important to clarify that international agencies, such as the United Nations Security Council (UNSC) and the International Monetary Fund (IMF), do not possess the direct authority to arbitrarily set a country’s currency exchange rate (valuation).

This means that no international agency can mandate that the Iraqi Dinar (IQD) be changed from $3.00 per IQD to $0.0007 per IQD – or visa versa.

IMF members pose for a photograph April 22, 2017 at the IMF Headquarters in Washington, DC. Photo: Getty Images News

Currency exchange rates are primarily shaped by market forces, economic indicators, and the nation’s own financial policies.

While these agencies do not directly dictate exchange rates themselves, they do exert influence through mechanisms such as economic and geopolitical sanctions which may significantly impact a nation’s currency value.

1.4 Executive Orders and Economic Sanctions were a backdrop for an Iraq Dinar Revaluation

In the aftermath of the Gulf War and during the reconstruction of Iraq, a series of Executive Orders were issued to address assets, legal issues, and economic stability.

These Executive Orders collectively aimed to protect Iraqi assets, maintain the stability and security of Iraq, and support post-conflict reconstruction and development. Notably:

1.4.1 Executive Orders Effecting Iraqi Economic Reality

President George W. Bush signs executive orders and directives in the Oval Office on August 27, 2004 . Photo: White House Archives by Paul Morse

Here’s a list of every EO and U.S. Treasury Sanctions related to Iraq.

Executive Order 13303 (May 22, 2003)

Purpose: Protect the Development Fund for Iraq and Iraqi assets from being seized by creditors.

Safeguard the Development Fund for Iraq.

Prohibit attachment or judicial processes against Iraqi assets.

Ensure oil proceeds are used for Iraq’s reconstruction.

Maintain the stability and security of Iraq.

Executive Order 13315 (August 28, 2003)

Purpose: Expand measures to address security threats to Iraq’s stability, security, and reconstruction.

Broaden sanctions against individuals and entities.

Counteract threats to Iraq’s peace and security.

Support economic reconstruction and political reform.

Provide humanitarian aid to the Iraqi people.

Executive Order 13350 (July 29, 2004)

Purpose: Terminate previous national emergencies and modify EOs to address Iraq’s stability and security.

End prior national emergencies.

Modify EOs to counter Iraq’s stability threats.

Protect Iraq’s assets.

Promote reconstruction and development.

Executive Order 13364 (November 29, 2004)

Purpose: Modify protections for the Development Fund for Iraq while recognizing changes in Iraq’s circumstances.

Terminate prohibitions related to the Development Fund.

Balance asset protection with Iraq’s needs.

Address the evolution of Iraq’s financial situation.

Maintain the national emergency declared in EO 13303.

Executive Order 13438 (July 17, 2007)

Purpose: Block the property of individuals and entities that threaten Iraq’s stabilization efforts.

Block assets of those threatening Iraq’s stability.

Prohibit contributions to or from blocked individuals.

Counteract violence undermining peace and reconstruction.

Support Iraq’s economic and political progress.

Executive Order 13668 (May 27, 2014)

Purpose: End immunities granted to the Development Fund for Iraq, considering Iraq’s changing circumstances.

Terminate immunities related to the Development Fund.

Recognize changes in Iraq’s situation.

Balance asset protection with Iraq’s progress.

Maintain the national emergency declared in EO 13303.

1.4.2 Specifics Regarding Executive Order 13303

EO13303 Signed May 22, 2003. Photo: The American Presidency Project

There is much speculation over Executive Order 13303, issued by President George W. Bush in 2003, regarding the revaluation (RV) of the Iraqi Dinar.

Aimed to safeguard the Development Fund for Iraq and protect Iraqi petroleum-related assets, this order prohibited the attachment, judgment, or lien against these assets, aiming to facilitate Iraq’s reconstruction and stability.

Executive Order 13303 has been continuously extended beyond its initial issuance in 2003.

On May 16, 2023, a notice was issued to extend the national emergency with respect to the stabilization of Iraq, originally declared by Executive Order 13303 on May 22, 2003.

The order aimed to prevent obstacles to the orderly reconstruction of Iraq, the restoration of peace and security, and the development of political, administrative, and economic institutions in Iraq.

Executive Order 13303 does not directly mention the Iraqi Dinar currency or address a potential revaluation of the Iraqi Dinar but plays a role in protecting Iraq’s economic interests.

1.4.3 Economic Actions and Sanctions Levied Against Iraq by the U.S. Treasury

There were a number of Actions and Sanctions-related documents issued by the U.S. Treasury against Iraq. Below is a summarized explanation of each document.

OFAC Sets Out Expectations for Compliance with U.S. Sanctions

Establishing the Central Bank of Iraq/Oil Proceeds Receipts Account (May 22, 2003)

This document, issued on May 22, 2003, establishes the Central Bank of Iraq/Oil Proceeds Receipts Account.

The purpose of this account is to receive funds generated from the sale of Iraqi petroleum and petroleum products. It plays a crucial role in managing and allocating the revenue generated from oil sales for the benefit of Iraq.

Establishing the Iraq Stabilization and Insurgency Sanctions Regulations (June 13, 2003)

This document serves as an overview of the Iraq Stabilization and Insurgency Sanctions Regulations (ISISR) and was created around the same period as the ISISR.

It discusses several aspects of the sanctions on Iraq, including exporting to Iraq, financial transactions, prohibitions related to Iraqi cultural property, immunities from attachment, and exemptions for U.S. military forces operating in Iraq. The document provides a broader perspective on the sanctions’ context and application.

The Termination of Iraqi Sanctions and Removal from Chapter V of 31 C.F.R. (September 13, 2010)

What is 31 CFR Chapter V?

Title 31: Chapter V – OFFICE OF FOREIGN ASSETS CONTROL, DEPARTMENT OF THE TREASURY

Title 31 refers to Code of Federal Regulations (CFR) for the U.S. Department of Treasury

Subtitle B refers to Regulations Relating to Money and Finance

Chapter V refers specifically to the Office of Foreign Assets Control under the Department of the Treasury

https://www.ecfr.gov/current/title-31/subtitle-B/chapter-V/part-576

In September 2010, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) marked a significant milestone by formally ending economic sanctions on Iraq. This marked the removal of the Iraqi Sanctions Regulations from 31 C.F.R. Chapter V and introduced the Iraq Stabilization and Insurgency Sanctions Regulations (ISISR).

This transition was in line with several Executive Orders, including Executive Order 13303 (May 22, 2003), Executive Order 13315 (August 28, 2003), Executive Order 13350 (July 29, 2004), Executive Order 13364 (November 29, 2004), and Executive Order 13438 (July 17, 2007).

On September 13, 2010, the ISISR replaced the earlier Iraqi Sanctions Regulations, and as of that date, there were no comprehensive economic sanctions remaining against Iraq.

The ISISR contain the current OFAC restrictions related to Iraq and Iraqi property. As of the date of this document, there were no broad-based sanctions against Iraq. However, specific individuals and entities associated with the former Saddam Hussein regime were subject to prohibitions and asset freezes.

These individuals and entities were determined to have committed or posed a significant risk of committing acts of violence that could threaten the peace, stability of Iraq, the Government of Iraq, or undermine efforts for economic reconstruction, political reform, or humanitarian assistance in Iraq.

On September 13, 2010, the ISISR replaced the earlier Iraqi Sanctions Regulations, and as of that date, there were no comprehensive sanctions against Iraq.

Summary

This section has provided a detailed historical context surrounding the Iraqi Dinar, including its evolution, the impact of wars, the role of economic sanctions, the popular reasons for speculations regarding an Iraqi Dinar revaluation, and the role of international agencies and Executive Orders in currency exchange rates.

Coming Soon

Section 2 will identify and explain every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

Section 3 will bring everything together to analyze and present a comparison between economic and political indicators for Iraq and the three strongest currencies in the world – Kuwait, Oman, and Bahrain.

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/staging-an-iraqi-dinar-revaluation-rv-a-unique-background-of-events/

Liquidation of China’s U.S. Bond Holdings Breaks Record in August: Awake-In-3D

Liquidation of China’s U.S. Bond Holdings Breaks Record in August:

On October 20, 2023 By Awake-In-3D

In GCR Roadmap Events, Fiat Debt System Collapse

China’s ongoing selloff of U.S. Treasury Bonds is a strong indicator of an impending crisis in global fiat currency debt markets.

What may appear to be small ripples in financial markets often foreshadow monumental waves that can reshape the financial landscape. Such is the case with the ongoing selloff of China’s U.S. bond holdings.

This liquidation trend may well be an unequivocal indication of an approaching crisis in U.S. dollar credit and bond markets, hinting at the logical conclusion of the global fiat currency debt system.

“China’s divestment of U.S. Bonds and Equities is more than just a financial transaction; it is a signpost on the roadmap to the collapse of the fiat currency system and the rise of a new asset-backed system via an RV/GCR”

Liquidation of China’s U.S. Bond Holdings Breaks Record in August:

On October 20, 2023 By Awake-In-3D

In GCR Roadmap Events, Fiat Debt System Collapse

China’s ongoing selloff of U.S. Treasury Bonds is a strong indicator of an impending crisis in global fiat currency debt markets.

What may appear to be small ripples in financial markets often foreshadow monumental waves that can reshape the financial landscape. Such is the case with the ongoing selloff of China’s U.S. bond holdings.

This liquidation trend may well be an unequivocal indication of an approaching crisis in U.S. dollar credit and bond markets, hinting at the logical conclusion of the global fiat currency debt system.

“China’s divestment of U.S. Bonds and Equities is more than just a financial transaction; it is a signpost on the roadmap to the collapse of the fiat currency system and the rise of a new asset-backed system via an RV/GCR”

The financial markets have been saturated with discussions about rising yields, with experts offering various explanations for the recent credit/bond market phenomenon. However, we cannot ignore the prominent role played by a significant player on the global stage—China.

China’s consistent and aggressive selloff of U.S. Treasuries, spanning 20 of the past 22 months, is not merely an isolated act but rather a pivotal piece of a broader puzzle.

I view China’s deliberate divestment of U.S. bonds as a compelling indicator of an impending crisis in U.S. dollar credit and bond markets, ultimately hinting at the fate of the global fiat currency debt system.

I further believe we are witnessing the increasing tremors of a seismic shift in the foundations of the global financial system.

Key Facts

China held over $1.1 trillion in U.S. Treasury securities as of September 2021.

Chinese investors liquidated a record-breaking $21.2 billion worth of U.S. bonds and stocks in August 2023.

China’s U.S. bond holdings witnessed a selloff in 20 of the past 22 months, signaling a consistent trend.

Chinese investors also sold a record $5.1 billion of U.S. stocks in August 2023, contributing to the selloff in U.S. securities.

This divestment of U.S. bonds and stocks by China raises concerns about the impact on U.S. credit and bond markets and the global fiat currency financial system.

In recent months, the world has witnessed tumultuous movements in financial markets, particularly in the United States, leading to growing concerns about rising yields and their impact on global economies.

While mainstream pundits debated the causes behind these changes, it has become increasingly clear that one of the major players affecting U.S. bond markets is none other than China’s U.S. bond holdings.

In August, Chinese investors executed the most substantial liquidation of U.S. bonds and stocks in four years, raising questions about their motives and the consequences for the global financial landscape.

The data from the U.S. Treasury reveals a striking trend – China has been actively reducing its holdings of U.S. Treasuries for the past 22 months, with an eye-catching 20 of those months witnessing a consistent selloff.

China’s Selloff of U.S. Securities is part of a global trend

Source: US Treasury Data

While there are various theories to explain rising yields, it appears that China’s aggressive selling of U.S. Treasuries plays a pivotal role in this equation. Foreign central banks have also been involved in this selloff, notably dumping the most Treasuries since the beginning of the year.

However, the situation is more complex than it initially appears, as a broader perspective unveils a more intricate narrative. According to Bloomberg, in August, Chinese investors liquidated substantial amounts of U.S. bonds and stocks. This raises speculation that Beijing may be using these measures to protect its currency, the yuan, as it continues to weaken against the U.S. dollar.

The parallels with Russia’s decision to offload its Treasury holdings in 2018, preempting the weaponization of the U.S. dollar against it, are hard to ignore.

Given China’s territorial ambitions, such as the potential annexation of Taiwan in the future, it is prudent to consider that they might be distancing themselves from U.S. Treasury holdings, anticipating potential financial constraints similar to those faced by Russia.

Analyzing the specifics of China’s U.S. bond holdings liquidation in August, the bulk of the $21.2 billion in sales comprised Treasuries and U.S. equities. Contrary to the belief that China refrained from selling U.S. Treasuries, the data shows that they actively reduced their holdings of these government securities.

This selloff occurred as the onshore yuan experienced a significant depreciation against the U.S. dollar, reaching its lowest point since November 2022.

This led Beijing to instruct state-owned banks to intervene in the currency market to stabilize the yuan’s value, reinforcing the theory that the liquidation was intended to amass U.S. dollar cash reserves for potential intervention operations.

However, this liquidation might be part of a broader strategy to ensure China has access to U.S. dollars when needed to safeguard the yuan.

A similar rationale could apply to the sale of U.S. equities in their portfolio. In August, Chinese investors also sold a record $5.1 billion worth of U.S. stocks, notably around the same time when the S&P index witnessed a significant drop following the Federal Reserve’s final rate hike decision in late July.

The August selloff of U.S. treasury and agency bonds raises questions regarding the demand for U.S. debt, which has traditionally been a cornerstone of the global fiat financial system.

In conclusion, the ongoing liquidation of China’s U.S. bond holdings, particularly in August’s record-breaking selloff, is sending ripples through the global financial markets. While the exact motivations behind this move remain speculative, the possibility that China is preparing for economic contingencies and potential challenges, such as a weakened yuan or geopolitical concerns, cannot be dismissed.

The ongoing crisis in U.S. dollar credit and bond markets poses a fundamental question about the sustainability of the current fiat currency debt system.

In my view, China’s divestment of U.S. Bonds and Equities is more than just a financial transaction; it is a signpost on the roadmap to the collapse of the fiat currency system and the rise of a new asset-backed system via an RV/GCR.

Supporting articles:

Yahoo Finance: https://finance.yahoo.com/news/china-sells-most-us-assets-223331094.html?fr=sycsrp_catchall

Bloomberg News: https://www.bloomberg.com/news/videos/2023-10-20/china-economy-has-bottomed-out-standard-chartered-says-video

BNN Finance: https://bnn.network/finance-nav/chinas-sell-off-of-us-treasury-bonds-a-shift-on-the-global-financial-chessboard/

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/liquidation-of-chinas-u-s-bond-holdings-breaks-record-in-august/

Tracking the Global Shift of Gold as the East Prepares for a Global Currency Reset (GCR): Awake-In-3D

Tracking the Global Shift of Gold as the East Prepares for a Global Currency Reset (GCR)

On October 16, 2023 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

A Golden Eastern Shift is Hitting the Fan of the West

Throughout the on-goings of global finance and geopolitics, a tectonic shift is quietly unfolding. As the global shift of gold continues moving from West to East, it becomes obvious that the world’s economic order is also shifting in preparation for an impending financial system reset.

At its core, this narrative focuses on the discerning movements within the international monetary landscape, hinting at the logical conclusion of the global fiat currency debt system.

“This transference of gold holdings and trade practices is a direct consequence of an inescapable truth: the global fiat currency debt system, which has underpinned the financial structure for decades, is nearing the point of a credit market freeze and collapse.”

Tracking the Global Shift of Gold as the East Prepares for a Global Currency Reset (GCR)

On October 16, 2023 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

A Golden Eastern Shift is Hitting the Fan of the West

Throughout the on-goings of global finance and geopolitics, a tectonic shift is quietly unfolding. As the global shift of gold continues moving from West to East, it becomes obvious that the world’s economic order is also shifting in preparation for an impending financial system reset.

At its core, this narrative focuses on the discerning movements within the international monetary landscape, hinting at the logical conclusion of the global fiat currency debt system.

“This transference of gold holdings and trade practices is a direct consequence of an inescapable truth: the global fiat currency debt system, which has underpinned the financial structure for decades, is nearing the point of a credit market freeze and collapse.”

Regions and countries outside the Western-allied nations are keenly aware that the 50-year-old, but increasingly fragile, global fiat currency experiment is teetering on the brink of a debt-fueled implosion.

This shift underscores a remarkable global preparation for an impending global currency reset (GCR), poised to realign the very fundamentals of the current global financial structure.

The Global Shift of Gold: Key Facts and Figures

Central banks bought a record-breaking 1,136 tons of gold in 2022, the highest in over 70 years.

In the first half of 2023, central banks increased their gold reserves by 378 tons, surpassing the previous half-year record from 2019.

China was the leading purchaser of gold, followed by Singapore, Poland, India, and the Czech Republic.

Central banks outside Western nations significantly contributed to the growing trend of gold purchases.

Gold prices surged in various non-Western currencies in 2023, including a 14.6% increase in Indian rupees, 18.0% in Chinese renminbi, 34.3% in Russian rubles, 22.1% in South African rand, and 114.0% in Turkish lira.