The Implications and Outcomes of an RV/GCR on the World: Awake-In-3D

Awake-In-3D: The Implications and Outcomes of an RV/GCR on the Entire World

The final chapter in the “The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide”

Now, we turn our attention toward gaining a clear view on the potential implications and outcomes of the transformative shift an RV/GCR would have in the global financial landscape.

“On a geopolitical scale, the adoption of a tangible asset-backed currency system will re-calibrate international power dynamics.

Nations with significant reserves of tangible assets will assume greater influence in the global financial arena, challenging the supremacy of traditional economic superpowers.”

Awake-In-3D: The Implications and Outcomes of an RV/GCR on the Entire World

The final chapter in the “The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide”

Now, we turn our attention toward gaining a clear view on the potential implications and outcomes of the transformative shift an RV/GCR would have in the global financial landscape.

“On a geopolitical scale, the adoption of a tangible asset-backed currency system will re-calibrate international power dynamics.

Nations with significant reserves of tangible assets will assume greater influence in the global financial arena, challenging the supremacy of traditional economic superpowers.”

The Implications and Outcomes of an RV/GCR on the World

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Chapter 5 of The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

Now, we turn our attention toward gaining a clear view on the potential implications and outcomes of the transformative shift an RV/GCR would have in the global financial landscape.

In the preceding chapters, we have explored the rationale for a global financial reset and the practical aspects of transitioning to a tangible asset-backed currency system while safeguarding personal freedoms, financial privacy, and individual financial sovereignty.

On a geopolitical scale, the adoption of a tangible asset-backed currency system could re-calibrate international power dynamics. Nations with significant reserves of tangible assets will assume greater influence in the global financial arena, challenging the supremacy of traditional economic superpowers.

5.1 The Potential Benefits of Tangible Asset-Backed Currencies

Transitioning from fiat currencies to tangible asset-backed currencies holds the promise of several significant advantages for both individuals and nations.

These benefits underscore the importance of embracing a new financial paradigm.

5.1.1 Stability and Confidence

One of the primary benefits is enhanced stability and confidence in the financial system. Tangible assets, such as gold, have historically served as reliable stores of value.

By anchoring currencies in such assets, individuals and nations can have greater trust in the value and stability of their money.

Individuals and nations gain greater financial sovereignty in a tangible asset-backed currency system. The reliance on central banks for currency issuance and management diminishes, allowing for more control over financial matters while upholding individual financial privacy.

5.1.2 Protection Against Inflation

Tangible asset-backed currencies provide a hedge against inflation.

Unlike fiat currencies, which can be devalued through excessive printing, the intrinsic worth of tangible assets remains stable. This protection can safeguard the purchasing power of individuals and promote economic stability.

5.1.3 Financial Sovereignty

Individuals and nations gain greater financial sovereignty in a tangible asset-backed currency system.

The reliance on central banks for currency issuance and management diminishes, allowing for more control over financial matters while upholding individual financial privacy.

5.1.4 Equitable Global Trade

The transition promotes equitable global trade by leveling the playing field for nations with varying degrees of tangible assets.

Trade imbalances are reduced as exchange rates more accurately reflect the economic fundamentals of countries. This fosters fairer and more balanced international trade relationships.

5.2 Potential Concerns and Challenges

While the advantages are compelling, the transition to a tangible asset-backed currency system is not without its challenges and potential concerns.

Recognizing and addressing these issues is crucial to the success of this transformative shift.

The RV/GCR must strike the right balance between privacy rights and regulatory frameworks within the decentralized ledger system is essential.

5.2.1 Valuation and Asset Management

Determining the value of tangible assets, especially gold, can be complex and subject to market fluctuations in and RV/GCR landscape.

Ensuring accurate valuation and effective asset management within the Quantum Financial Network System (QFS) is a critical challenge.

5.2.2 Privacy and Oversight

Balancing the need for individual financial privacy with international oversight and accountability is a delicate task.

The RV/GCR must strike the right balance between privacy rights and regulatory frameworks within the decentralized ledger system is essential.

5.3 Conclusion

This chapter has provided insights into the potential benefits, concerns, and challenges associated with transitioning to a tangible asset-backed currency system or the RV/GCR.

On a geopolitical scale, the adoption of a tangible asset-backed currency system could re-calibrate international power dynamics. Nations with significant reserves of tangible assets will assume greater influence in the global financial arena, challenging the supremacy of traditional economic superpowers.

This change could lead to diplomatic realignments, the renegotiation of trade agreements, and a restructuring of international alliances.The geopolitical implications are multifaceted, with the potential to redefine the global economic order.

Final Thoughts on this RV/GCR Thesis: “The End of the Fiat Currency Debt System and the Financial Reset”

In this comprehensive thesis, we have explored the compelling case for a global financial reset and the revaluation of currencies backed by tangible assets.

Our journey has taken us through the inherent flaws and vulnerabilities of the existing fiat currency debt system, highlighting the urgent need for a fundamental shift.

We began by examining the logical conclusion of the fiat currency debt system, revealing unsustainable debt levels, inflationary pressures, market volatility, and central bank interventions. These factors collectively signal the system’s failure and necessitate a fresh approach.

The Global Currency Reset (GCR) emerged as the proposed solution, promising to replace the collapsed fiat currency system.

Underpinning the GCR is the Quantum Financial Network System (QFS), a technological marvel that leverages quantum computing, decentralized ledgers, blockchain technology, smart contracts, quantum encryption, global accessibility, and scalability.

Together, these elements form a financial infrastructure that prioritizes personal freedoms, financial privacy, and individual sovereignty.

Furthermore, we examined the revaluation of currencies (RV) within the GCR framework, emphasizing the need for purchasing power parity among global currencies.

A currency revaluation aims to address trade imbalances, correct unfair exchange rates, spur economic growth and development, and foster international collaboration.

As we embrace the voyage towards a global financial reset, it becomes evident that the QFS stands at the forefront of this transformative endeavor. Its innovative technologies and principles offer a pathway to a more transparent, secure, and efficient financial ecosystem.

The case for a global financial reset and a revaluation of currencies backed by tangible assets is rooted in the necessity to rectify the shortcomings of the existing system.

By embracing technological advancements like the QFS and prioritizing principles of fairness and transparency, we pave the way for a more equitable and prosperous global financial landscape.

An RV/GCR Thesis: The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide

GO TO CHAPTER 1: The Stage is Set for Our RV/GCR

GO TO CHAPTER 2: The Imperative for a Global Financial Reset (GCR)

GO TO CHAPTER 3: A Currency Revaluation (RV) with Tangible Asset Backing

GO TO CHAPTER 4: How Asset-backed Currencies will be Implemented on the QFS

GO TO THE SUPPLEMENT: A Technical Overview of the Quantum Financial Network System (QFS)

GO TO CHAPTER 5: The Implications and Outcomes of the RV/GCR

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-implications-and-outcomes-of-an-rv-gcr-on-the-world/

The QFS: An Overview of the Quantum Financial Network System

The QFS: An Overview of the Quantum Financial Network System

On October 10, 2023 By Awake-In-3D

A Supplement to The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

The Quantum Financial Network System (QFS) stands at the forefront of the proposed global financial reset, offering a quantum leap in financial technology. This sidebar provides a technical glimpse into the QFS, highlighting its core components and functionalities.

The QFS adopts a decentralized ledger system, which is fundamentally different from traditional centralized systems. Instead of relying on a single central authority to maintain and validate transactions, decentralized ledgers distribute this responsibility across a network of nodes.

The QFS: An Overview of the Quantum Financial Network System

On October 10, 2023 By Awake-In-3D

A Supplement to The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

The Quantum Financial Network System (QFS) stands at the forefront of the proposed global financial reset, offering a quantum leap in financial technology. This sidebar provides a technical glimpse into the QFS, highlighting its core components and functionalities.

The QFS adopts a decentralized ledger system, which is fundamentally different from traditional centralized systems. Instead of relying on a single central authority to maintain and validate transactions, decentralized ledgers distribute this responsibility across a network of nodes.

Quantum Computing Technology

At the heart of the QFS lies quantum computing, a groundbreaking technology that harnesses the principles of quantum mechanics.

Unlike classical computers that use binary bits (0s and 1s), quantum computers employ quantum bits or qubits.

This enables quantum computers to process vast amounts of data at unprecedented speeds, making them ideal for complex financial calculations and cryptographic operations.

Related article: Quantum computing networks for finance are real and being used today.

Decentralized Ledger System

The QFS adopts a decentralized ledger system, which is fundamentally different from traditional centralized systems.

Instead of relying on a single central authority to maintain and validate transactions, decentralized ledgers distribute this responsibility across a network of nodes.

This ensures transparency, security, and resilience, as no single entity can control or manipulate the system.

The Quantum Financial Network System represents a technological paradigm shift in the world of finance.

Blockchain Technology

Within the QFS, secure blockchain nodes facilitate transactions and record-keeping.

Blockchain technology ensures the integrity and immutability of financial data by storing information in interconnected blocks, cryptographically linked together.

This prevents fraud, tampering, and unauthorized access while allowing for complete transparency.

Smart Contracts

Smart contracts are self-executing agreements with predefined rules and conditions.

They automate and enforce financial transactions within the QFS, eliminating the need for intermediaries. Smart contracts facilitate trust and efficiency in financial interactions, reducing costs and mitigating risks.

One of the key features of the QFS is its global accessibility. By operating on a decentralized network, the system transcends geographical boundaries and offers financial services to individuals and businesses worldwide.

Quantum Encryption

To safeguard sensitive financial information, the QFS relies on quantum encryption. Unlike classical encryption methods, quantum encryption leverages the principles of quantum entanglement and superposition to create unbreakable codes.

This ensures that financial transactions and data remain confidential and secure.

Global Accessibility

One of the key features of the QFS is its global accessibility.

By operating on a decentralized network, the system transcends geographical boundaries and offers financial services to individuals and businesses worldwide. This inclusivity fosters financial equality and access for all.

Resilience and Scalability

The QFS is designed for resilience and scalability. Its decentralized nature minimizes the risk of system failures or cyberattacks.

Additionally, the use of quantum computing technology ensures that the system can handle growing transaction volumes without compromising speed or security.

In summary, the Quantum Financial Network System represents a technological paradigm shift in the world of finance.

By integrating quantum computing, decentralized ledgers, blockchain technology, smart contracts, quantum encryption, and global accessibility, the QFS aims to create a secure, transparent, and efficient global financial ecosystem for the future.

An RV/GCR Thesis: The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide

GO TO CHAPTER 1: The Stage is Set for Our RV/GCR

GO TO CHAPTER 2: The Imperative for a Global Financial Reset (GCR)

GO TO CHAPTER 3: A Currency Revaluation (RV) with Tangible Asset Backing

GO TO CHAPTER 4: How Asset-backed Currencies will be Implemented on the QFS

GO TO THE SUPPLEMENT: A Technical Overview of the Quantum Financial Network System (QFS)

GO TO CHAPTER 5: The Implications and Outcomes of the RV/GCR

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-qfs-an-overview-of-the-quantum-financial-network-system/

BRICS Lays Groundwork for Alternative Financial System: Insights from the Discreet Valdai Club Meeting

BRICS Lays Groundwork for Alternative Financial System: Insights from the Discreet Valdai Club Meeting

On October 14, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, RV/GCR

The global fiat currency system is approaching a critical crossroads. Behind closed doors at the little-known Valdai Club, the BRICS nations are plotting a path toward financial autonomy, which has received minimal attention from Western media.

BRICS Lays Groundwork for Alternative Financial System: Insights from the Discreet Valdai Club Meeting

On October 14, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, RV/GCR

The global fiat currency system is approaching a critical crossroads. Behind closed doors at the little-known Valdai Club, the BRICS nations are plotting a path toward financial autonomy, which has received minimal attention from Western media.

In this Report:

Insights into the discreet Valdai Club and its significance as a platform for covert discussions on an alternative financial system.

The roles and progress of the New Development Bank (NDB) and Contingent Reserve Agreement (CRA) in BRICS’ financial initiatives.

An understanding of the multipolarity agenda and its implications for reshaping the global financial landscape.

Key challenges, including resistance from BRICS central banks and the technical complexities of establishing an alternative financial system.

The disappointments and sluggish progress experienced by BRICS in their monetary fund, the CRA.

The predicament of the US Dollar as a global reserve currency and its deployment as a geopolitical tool.

The potential for a common BRICS currency and its early foundations.

BRICS’ credibility in the ongoing pursuit of de-dollarization and financial autonomy in the global financial system.

The New BRICS Financial System and Currency: A Work in Progress

The global fiat currency system stands at a critical juncture, with increasing speculation about an impending mini-RV/GCR. Behind the scenes at the Valdai Club, BRICS nations are secretly forging a path toward financial independence.

The Valdai Club: An Exclusive Conclave

The Valdai Club, named after Lake Valdai, has been convening since 2004, providing a haven for global intellectual elites to deliberate on vital geopolitical issues. This discreet club has managed to stay beneath the Western media radar, making it a perfect venue for covert discussions on alternative financial systems.

The New Development Bank (NDB) and Contingent Reserve Agreement (CRA)

Established in 2014, the NDB is aimed at fostering economic cooperation among emerging economies. The CRA, an integral component of the NDB, acts as a financial safety net during turbulent times. Despite their laudable objectives, these initiatives have been bogged down by sluggish progress.

The Multipolarity Agenda

Central to the Valdai Club’s discussions was the notion of ‘Fair Multipolarity.’ BRICS nations are determined to counterbalance Western-dominated institutions such as the IMF and World Bank, advocating for a more equitable global financial system. However, these endeavors face formidable resistance.

BRICS Objectives: Reshaping the Financial Landscape

BRICS countries are striving to diversify their reserve currencies, aiming to reduce their reliance on the US Dollar. Their intention is to shield themselves from potential vulnerabilities stemming from US Dollar-based trade and financial maneuvers.

Key Challenges: Resistance and Technical Complexities

A primary hurdle lies in the resistance encountered from BRICS central banks. The technical intricacies of establishing an alternative financial system, including a new currency, governance structure, and international banking protocols, pose formidable challenges.

Disappointments and Languid Progress

The BRICS’ monetary fund, the CRA, remains largely inactive, restrained by the caution of central banks from BRICS nations. Their struggle to break free from the IMF and their ongoing dependence on the US Dollar continue to hinder progress.

The US Dollar Predicament

The US Dollar’s hegemony as the world reserve currency grants the United States unparalleled influence in global finance. However, its deployment as a geopolitical tool is raising concerns regarding international stability.

Pursuing a Common Currency

The Valdai Club discussions shed light on the concept of a shared BRICS currency, potentially named as the R5 or R5+. This new currency could start as a unit of account, initially based on a basket of BRICS currencies, and subsequently secured by bonds guaranteed by member countries.

BRICS’ Credibility in De-Dollarization

The credibility of BRICS nations in their pursuit of de-dollarization hinges on their capacity to broaden the scope of the CRA, develop a robust common currency, and overcome the internal resistance on their journey toward greater financial independence.

What it All Means

As the global fiat currency system approaches a moment of reckoning, BRICS nations, meeting clandestinely at the Valdai Club, are quietly laying the groundwork for an alternative financial system. These far-reaching plans encompass the NDB, CRA, multipolarity, and de-dollarization, along with the potential for a shared currency. Though rife with challenges, BRICS nations are steadfast in their march toward financial autonomy.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: Introducing the QFS: Implementing an Asset-backed Currency System

Awake-In-3D:

Introducing the QFS: Implementing an Asset-backed Currency System

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Chapter 4 of The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

The preceding chapters have meticulously established the need for a global financial reset and the advantages of transitioning to tangible asset-backed currencies. In this critical chapter, we shift our focus to the practicalities of implementing such a transformative shift on a global scale with the QFS as the centerpiece.

The adoption of tangible asset-backed currencies requires the development of robust valuation mechanisms utilizing advanced technology, including quantum computing. Unlike fiat currencies, which derive their value from arbitrary government declarations, tangible assets have intrinsic worth that must be accurately determined through the Quantum Financial Network System (the QFS).

Awake-In-3D:

Introducing the QFS: Implementing an Asset-backed Currency System

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Chapter 4 of The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

The preceding chapters have meticulously established the need for a global financial reset and the advantages of transitioning to tangible asset-backed currencies. In this critical chapter, we shift our focus to the practicalities of implementing such a transformative shift on a global scale with the QFS as the centerpiece.

The adoption of tangible asset-backed currencies requires the development of robust valuation mechanisms utilizing advanced technology, including quantum computing. Unlike fiat currencies, which derive their value from arbitrary government declarations, tangible assets have intrinsic worth that must be accurately determined through the Quantum Financial Network System (the QFS).

We will explore the challenges, implications, and potential strategies for transitioning from fiat currencies to currencies anchored in tangible assets, all while resolutely aiming to ensure maximum personal freedoms, financial privacy, and individual financial sovereignty.

Before I go further, click the button below to review a comprehensive overview

of the QFS from a technical and practical perspective.

GO TO THE QFS TECHNICAL OVERVIEW HERE

4.1 The Complex Path to Implementation

Transitioning from fiat currencies to tangible asset-backed currencies is a multifaceted endeavor that requires careful consideration of a range of factors.

While the benefits are evident, the path to implementation is laden with complexities. This implementation is purposefully designed to uphold equal opportunity for prosperity among all of humanity.

4.1.1 International Agreements and Collaboration

One of the foremost challenges is securing international agreements and fostering collaboration among nations within the framework of financial sovereignty.

The transition necessitates a coordinated effort to establish a unified framework for currency valuation, asset management, and global financial stability while safeguarding individual freedoms.

The repurposing of multilateral organizations, such as the International Monetary Fund (IMF) and the World Bank, will play pivotal roles in facilitating the transition while respecting financial privacy.

4.2 Establishing Currency Valuation Mechanisms – The QFS

The adoption of tangible asset-backed currencies requires the development of robust valuation mechanisms utilizing advanced technology, including quantum computing.

Unlike fiat currencies, which derive their value from arbitrary government declarations, tangible assets have intrinsic worth that must be accurately determined through the Quantum Financial Network System (the QFS).

4.2.1 Valuing Gold and Other Tangible Assets

Central to this challenge is establishing methods for valuing tangible assets, particularly gold, which is poised to play a pivotal role in the new currency paradigm.

Accurate valuation ensures that currencies maintain stability and confidence within the QFS.

4.3 Safeguarding Against Manipulation

A tangible asset-backed currency system must incorporate safeguards against manipulation and abuse while respecting financial privacy.

Historical instances of governments manipulating gold reserves for political or economic gain serve as cautionary tales.

4.3.1 International Oversight and Accountability

To prevent such manipulation and maintain transparency, international oversight and accountability mechanisms should be put in place.

Transparency in asset management and currency issuance will be vital in maintaining trust and confidence within the decentralized ledger system of the QFS.

4.4 Navigating Economic Disparities

Transitioning to tangible asset-backed currencies, while recognizing individual financial sovereignty, raises concerns about addressing existing economic disparities among nations.

Developed economies with substantial tangible assets may possess inherent advantages, potentially exacerbating global inequality.

Collaborative frameworks between nations, multilateral organizations, and the QFS will be essential in navigating the complexities of the RV/GCR implementation.

4.4.1 Strategies for Mitigation

Mitigating these disparities will require innovative strategies, such as redistributive mechanisms or concessional lending programs, to ensure equal opportunity for prosperity.

A concerted effort to promote equitable access to tangible assets is essential for a fair transition while respecting financial privacy.

4.5 The Role of “Repurposed” Multilateral Organizations

The repurposing of multilateral organizations, such as the International Monetary Fund (IMF) and the World Bank, will play pivotal roles in facilitating the transition while respecting financial privacy. Their financial infrastructure, expertise in global finance, and their mandate to promote stability make them natural partners in this endeavor.

4.5.1 Collaborative Frameworks

Collaborative frameworks between nations, multilateral organizations, and the QFS will be essential in navigating the complexities of implementation.

These entities can provide technical expertise, financial support, and a forum for diplomatic negotiations while upholding individual financial sovereignty and financial privacy.

4.6 Conclusion

Chapter 4 examined the intricate process of implementing tangible asset-backed currencies on a global scale, emphasizing the importance of personal freedoms, financial privacy, and individual financial sovereignty.

While the advantages are evident, the challenges are formidable.

Securing international agreements, developing robust valuation mechanisms utilizing quantum computing (such as the QFS), safeguarding against manipulation within the decentralized ledger system, addressing economic disparities, and leveraging multilateral organizations are all critical components of a successful transition.

The following chapter will outline and present the potential impacts of this transformative shift on global finance and economies, offering insights into the potential benefits and concerns that may arise while respecting financial privacy and individual financial sovereignty.

An RV/GCR Thesis: The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide

GO TO CHAPTER 1: The Stage is Set for Our RV/GCR

GO TO CHAPTER 2: The Imperative for a Global Financial Reset (GCR)

GO TO CHAPTER 3: A Currency Revaluation (RV) with Tangible Asset Backing

GO TO CHAPTER 4: How Asset-backed Currencies will be Implemented on the QFS

GO TO THE SUPPLEMENT: A Technical Overview of the Quantum Financial Network System (QFS)

GO TO CHAPTER 5: The Implications and Outcomes of the RV/GCR

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/introducing-the-qfs-implementing-an-asset-backed-currency-system/

Awake-In-3D: Imagining the Greatest RV/GCR Humanitarian Projects on Earth

Awake-In-3D:

Imagining the Greatest RV/GCR Humanitarian Projects on Earth

On October 13, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Perhaps tomorrow’s “ring of fire” solar eclipse nudged me to contemplate our planet, it’s challenges and the largest humanitarian project I could think of.

So I decided to set my mind free from the daily RV/GCR financial news articles and step outside the box of earthly matters for a while.

I’m sure everyone is familiar with the potential for economic and humanitarian projects that arise from the RV/GCR when the great global fiat currency experiment reaches its logical conclusion.

Like many of you, I’ve spent considerable time evaluating and outlining projects I’d like to do when the RV/GCR kicks into gear.

But then my imagination ran wild on what could be the granddaddy of all economic and humanitarian projects.

So I decided to write about it.

Awake-In-3D:

Imagining the Greatest RV/GCR Humanitarian Projects on Earth

On October 13, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Perhaps tomorrow’s “ring of fire” solar eclipse nudged me to contemplate our planet, it’s challenges and the largest humanitarian project I could think of.

So I decided to set my mind free from the daily RV/GCR financial news articles and step outside the box of earthly matters for a while.

I’m sure everyone is familiar with the potential for economic and humanitarian projects that arise from the RV/GCR when the great global fiat currency experiment reaches its logical conclusion.

Like many of you, I’ve spent considerable time evaluating and outlining projects I’d like to do when the RV/GCR kicks into gear.

But then my imagination ran wild on what could be the granddaddy of all economic and humanitarian projects.

So I decided to write about it.

Space. The Final Frontier for Humanitarian Projects

As we contemplate the possibilities of the global currency reset (GCR) and currency revaluation (RV), it is invigorating to let our minds wander beyond the confines of our earthly existence and explore the greatest hope for collective humanity’s future – the vast realm of space.

These celestial bodies, brimming with water, precious metals, and vital elements, hold the key to ending wars, eradicating hunger, and providing an abundance of multi-generational, high-paying jobs.

This final frontier holds immense promise, offering a multitude of solutions to humanity’s most pressing challenges and food for thought regarding economic and humanitarian projects.

Within our cosmic neighborhood, unimaginable treasures await, presenting us with an opportunity to unite as a global community and set forth on a transformative journey towards the heavens.

Enabling a World of Abundance and Prosperity

Picture a future where the collective consciousness of our global population turns its gaze skyward.

The riches concealed within the local neighborhood of earth’s orbit possess the power to reshape our world.

Take asteroids for instance.

The economic potential of asteroids alone is staggering, with resources valued in quintillions of U.S. dollars.

Quintillions. Think about that for a moment.

These celestial bodies, brimming with water, precious metals, and vital elements, hold the key to ending wars, eradicating hunger, and providing an abundance of multi-generational, high-paying jobs.

Imagine a time when the scarcity that has plagued us for centuries becomes a distant memory.

With limitless resources at our disposal, we can usher in an era of prosperity and fulfillment for all of humanity.

The off-world availability of clean, affordable energy from space alone would revolutionize industries, propelling us towards a thriving, sustainable future.

“Real” Money and Currencies backed by Celestial Resources

Envision a financial system grounded in tangible cosmic resources, a departure from the current fiat-based currencies.

The notion of “real money” backed by the riches of space introduces a paradigm shift that transcends the limitations of any economic system ever undertaken in recorded history.

With an endless supply of resources at our fingertips, scarcity would be replaced by abundance, providing ample opportunities for growth and development.

The economic potential of space mining, forecasted to reach billions of dollars by 2025, paves the way for a new era of prosperity on an unprecedented scale.

From Lack to Abundance: Charting a Shift in Humanity’s Collective Consciousness

As we set our sights on the cosmic horizon, we tap into a wellspring of inspiration and possibility. Our journey into global prosperity for all requires a shift in our collective consciousness, where borders fade and humanity unites in pursuit of a common goal.

The challenges that have long divided us now become catalysts for collaboration and innovation on a global scale. Economic and humanitarian projects that fuel our innate curiosity and thirst for knowledge have the highest potential to elevate our collective consciousness away from a mindset of lack and into a state of abundance.

Within the Near Reaches of Space Lies a Tapestry of Untapped Human Potential

As we contemplate the economic and humanitarian projects in context of the global currency reset (GCR) and currency revaluation (RV), let us not overlook the final frontier of abundance beyond the skies above us.

By harnessing the resources of asteroids and beyond, we can reshape our world, transcending scarcity and ushering in an era of hope and prosperity.

Together, let us dare to dream, embarking on a transformative journey that unlocks the true potential of humanity—a future where the cosmic expanse becomes a wellspring of abundance and fulfillment for all.

Curious to Learn More? Here’s the Facts

The Riches of Asteroids in the Belt

Resources

Asteroids, those rocky remnants from the early days of our solar system, hold a treasure trove of valuable resources within their grasp.

They contain abundant in water, precious metals like platinum, gold, and rare-earth elements, as well as vital minerals such as iron and nickel.

The potential of these resources is immense, offering a solution to our world’s growing demands for sustainable energy, advanced technology, and economic prosperity.

Location

The majority of these asteroids can be found in the asteroid belt, a region located between the orbits of Mars and Jupiter.

This belt is home to millions of asteroids, ranging in size from small boulders to massive bodies spanning hundreds of kilometers.

Additionally, some asteroids have ventured closer to Earth, known as Near-Earth Asteroids (NEAs), presenting even more accessible opportunities for exploration and utilization.

Current Exploration Activities

Several space agencies and private companies have already embarked on missions to explore and mine asteroids.

NASA’s OSIRIS-REx mission successfully retrieved a sample from the asteroid Bennu in 2020, providing valuable insights into the composition and potential resources of these celestial bodies.

SpaceX, in collaboration with NASA, has also announced plans to launch the DART mission (Double Asteroid Redirection Test) in 2022, which aims to redirect and study the binary asteroid system Didymos.

Economic Value

Among the asteroids in the belt, a notable example is the asteroid named Davida. Davida, estimated to be 326 kilometers in diameter, contains vast amounts of water, platinum, and other precious metals.

The economic value of Davida alone, if fully exploited, could be astronomical, potentially reaching trillions or even quadrillions of U.S. dollars.

The potential wealth locked within this one celestial body alone underscores the immense economic potential that asteroids hold.

Supporting articles:

https://www.statista.com/chart/8093/the-colossal-untapped-value-of-asteroids/

https://www.zerohedge.com/technology/colossal-untapped-value-asteroids-0

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/imagining-the-greatest-rv-gcr-humanitarian-projects-on-earth/

Awake-In-3D: The Need for Asset-backed Currencies and a Revaluation (RV)

Awake-In-3D:

The Need for Asset-backed Currencies and a Revaluation (RV)

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Chapter 3 of The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

In the preceding chapters, we elucidated the historical flaws and contemporary vulnerabilities of the fiat currency debt system.

I underscored the urgent need for a comprehensive global financial reset to address unsustainable debt levels, mitigate inflationary pressures, and reduce systemic risks.

In this chapter, I pivot from analysis to prescription, explaining the benefits and structure for a global transition into tangible asset-backed currencies.

Awake-In-3D:

The Need for Asset-backed Currencies and a Revaluation (RV)

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

Chapter 3 of The End of the Fiat Financial System and the Global Financial Reset – A Complete Guide

In the preceding chapters, we elucidated the historical flaws and contemporary vulnerabilities of the fiat currency debt system.

I underscored the urgent need for a comprehensive global financial reset to address unsustainable debt levels, mitigate inflationary pressures, and reduce systemic risks.

In this chapter, I pivot from analysis to prescription, explaining the benefits and structure for a global transition into tangible asset-backed currencies.

3.1 Rethinking Currency Backing

The notion of currencies backed by tangible assets is not novel.

Throughout history, currencies were often anchored to physical commodities such as gold or silver. This backing ensured that currencies held intrinsic value, serving as a reliable store of wealth.

In contrast, modern fiat currencies are divorced from tangible assets, deriving their value from the trust and confidence placed in the issuing governments.

Gold has long been revered as a store of value, resistant to inflationary pressures and government manipulation. Reintroducing gold as a standard for currency valuation provides stability and confidence to the financial system.

3.1.1 The Power of Tangibility

Tangible asset backing for currencies has several distinct advantages. Firstly, it provides a safeguard against uncontrolled monetary expansion.

When currencies are tied to finite resources like gold or precious metals, governments are constrained in their ability to print money recklessly. This limitation curtails the risk of hyperinflation, ensuring the preservation of purchasing power.

3.2 Gold as a Standard

One of the most potent embodiments of tangible asset backing is the return to a gold standard.

Gold has long been revered as a store of value, resistant to inflationary pressures and government manipulation.

Reintroducing gold as a standard for currency valuation provides stability and confidence to the financial system.

3.2.1 Rebuilding Confidence

In an era where trust in fiat currencies has waned, a gold-backed standard can rebuild confidence.

Investors, savers, and nations alike find solace in knowing that their holdings are anchored to a tangible and finite asset. This renewed trust fosters economic stability and enhances global trade.

Strategic resources such as rare minerals, oil, and renewable energy assets can complement gold in backing currencies. These resources possess intrinsic value and serve as pivotal components of modern economies.

3.3 Diversification of Asset Backing

While gold undoubtedly holds a preeminent position among tangible assets, diversification of asset backing presents a compelling case.

By broadening the range of assets supporting currencies, risks associated with fluctuations in a single commodity are mitigated.

3.3.1 Strategic Resources and Renewable Energy

Strategic resources such as rare minerals, oil, and renewable energy assets can complement gold in backing currencies.

These resources possess intrinsic value and serve as pivotal components of modern economies. Inclusion of these assets in the backing of currencies not only enhances stability but also aligns with the imperatives of a sustainable future.

The advantages of such a transition are manifold, from safeguarding against inflationary pressures to rebuilding confidence in the financial system.

3.4 The Practical Implementation

The transition to tangible asset-backed currencies necessitates careful planning and coordination among nations.

Diplomatic negotiations and international agreements will be paramount to ensure a smooth transition and minimize disruptions.

3.4.1 Multilateral Cooperation

Multilateral cooperation is imperative, as nations recognize the shared benefits of anchoring currencies to tangible assets. Collaborative efforts will be vital in establishing a framework for this transformative shift.

3.5 Conclusion

In this chapter, we have outlined the rationale for tangible asset-backed currencies as a reset and revaluation for the global financial system.

The advantages of such a transition are manifold, from safeguarding against inflationary pressures to rebuilding confidence in the financial system.

Gold stands as a symbol of stability and trust, capable of underpinning a new era of economic equilibrium.

The subsequent chapter will delve into the implications and challenges of implementing tangible asset-backed currencies on a global scale, setting the stage for a thorough examination of the way forward.

An RV/GCR Thesis: The End of the Fiat Currency Debt System and the Financial Reset – A Complete Guide

GO TO CHAPTER 1: The Stage is Set for Our RV/GCR

GO TO CHAPTER 2: The Imperative for a Global Financial Reset (GCR)

GO TO CHAPTER 3: A Currency Revaluation (RV) with Tangible Asset Backing

GO TO CHAPTER 4: How Asset-backed Currencies will be Implemented on the QFS

GO TO THE SUPPLEMENT: A Technical Overview of the Quantum Financial Network System (QFS)

GO TO CHAPTER 5: The Implications and Outcomes of the RV/GCR

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-need-for-asset-backed-currencies-and-a-revaluation-rv/

Awake-In-3D: RV/GCR Financial Roundup for October 11th 2023

Awake-In-3D:

RV/GCR Financial Roundup for October 11th 2023

On October 11, 2023 By Awake-In-3D

In GCR Roadmap: Level 1 Events, RV/GCR

The latest financial news report provides a brief analysis of several concerning indicators in the current economic landscape.

Key Economic Facts this week to date:

Default rate on credit card loans from small lenders: 7.51%

Bank credit contraction: Witnessed one of the sharpest declines since 1974

More than 50% of domestic banks tightening lending standards

Awake-In-3D:

RV/GCR Financial Roundup for October 11th 2023

On October 11, 2023 By Awake-In-3D

In GCR Roadmap: Level 1 Events, RV/GCR

The latest financial news report provides a brief analysis of several concerning indicators in the current economic landscape.

Key Economic Facts this week to date:

Default rate on credit card loans from small lenders: 7.51%

Bank credit contraction: Witnessed one of the sharpest declines since 1974

More than 50% of domestic banks tightening lending standards

Contraction in savings as a percentage of national income begins

Excess savings from 2020 now depleted

Credit card debt surpassing $1 trillion

Auto loan interest rates at highest levels since 2008

Auto loan serious delinquency rates at 2008 levels

August PPI inflation revised up from 1.6% to 2.0%

August Core PPI inflation revised up from 2.2% to 2.5%

These indicators shed light on the growing challenges faced by consumers, businesses, and the overall financial system.

When viewed through the lens of the fiat currency debt system, these developments offer further evidence of the logical conclusion of this system.

The report highlights the increasing burden of consumer debt, with default rates on credit card loans reaching levels surpassing previous economic crises.

Coupled with a contraction in bank credit and tightened lending standards, businesses are finding it harder to access the necessary funds for growth and investment.

Additionally, a decline in savings as a percentage of national income and the depletion of excess savings further contribute to the mounting financial pressures faced by individuals and the overall economy.

Furthermore, the report draws attention to the troubling trends in the auto loan market, with interest rates and delinquency rates reaching levels comparable to the 2008 Financial Crisis.

These developments, combined with upward revisions in producer price inflation and the potential challenges faced by the Federal Reserve, paint a concerning picture for the future.

Taken together, these indicators provide further evidence of the inherent flaws and vulnerabilities of the fiat currency debt system.

This system, based on the creation of money as debt and the reliance on credit, has facilitated economic growth but has also led to unsustainable levels of debt and a fragile financial ecosystem.

The report underscores the logical conclusion of this system, as the mounting pressures on consumers, businesses, and the overall economy may ultimately culminate in an economic reset and a revaluation of currencies.

Today’s Financial Summary

1. Consumer Debt Burden

The current scenario indicates that consumers are borrowing beyond their means, as reflected by the sharp spike in default rates on credit card loans.

This level of default rate surpasses previous periods of economic distress, such as the Dot Com bubble, Financial Crisis, and the COVID-19 pandemic.

With credit card interest rates remaining high, consumers will continue to face financial pressure, potentially exacerbating the overall economic situation.

2. Contraction in Bank Credit

The decline in bank credit, which has reached levels comparable to the Financial Crisis, suggests a worrisome trend.

This contraction has historically preceded credit events and economic downturns.

The current rate of decline indicates that a credit event may be imminent, further signaling a potential economic crisis.

3. Restricted Business Lending

More than 50% of domestic banks tightening lending standards at a time when interest rates are already high is a concerning development.

Previous instances of such tightening have consistently led to recessions, making the current situation no exception.

This restricted access to credit for businesses may contribute to an economic downturn.

4. Decline in Savings

The contraction in savings as a percentage of national income, a scenario that has occurred only three times in the past 75 years, is a troubling sign.

Previous contractions coincided with the 2008 Financial Crisis and the 2020 Pandemic, indicating potential economic hardships.

A high-interest rate and high-debt environment pose significant challenges for consumers, pointing towards an impending economic downturn.

5. Depletion of Excess Savings

The depletion of excess savings from 2020, coupled with increasing credit card debt and high-interest rates, puts consumers in a precarious situation.

A personal savings rate as low as 3.9% has not been seen since October 2008, suggesting potential financial distress for individuals.

The combination of these factors may soon lead to consumer-related challenges garnering attention and impacting the broader economy.

6. Auto Loan Troubles

Rising auto loan interest rates, reaching levels not seen since 2008, coupled with a surge in serious delinquency rates, indicate an alarming trend.

The average interest rate on new car loans has nearly doubled in just over a year, resulting in record-high monthly payments for consumers.

As interest rates continue to rise, it is anticipated that auto loan delinquency rates will follow suit, further straining the economy.

7. Inflation Concerns

Recent revisions in August PPI inflation data, with upward revisions in both PPI inflation and Core PPI inflation, are significant indicators.

These revisions hold importance in the coming months, as they highlight potential inflationary pressures.

The Federal Reserve will likely closely monitor these upward data revisions, as they may become a major topic of concern for the central bank.

Wrap Up

Overall, the cumulative impact of these factors suggests an increasingly challenging economic environment.

The high levels of consumer debt, contraction in bank credit, restricted business lending, decline in savings, depletion of excess savings, auto loan troubles, and inflation concerns all contribute to a scenario that aligns with the approaching RV/GCR narrative.

These indicators warrant careful attention as they may serve as precursors to an economic reset and currency revaluation.

Definitions of Terms in this Article (for non-financial readers)

Bank Credit

Bank credit refers to the amount of money that banks provide to borrowers, including individuals, businesses, and other financial institutions. It represents the loans and credit extended by banks to fulfill the funding needs of borrowers.

When individuals or businesses require capital to finance their activities, they approach banks for loans. Banks, being financial intermediaries, have the ability to create credit by accepting deposits from customers and then lending out a portion of those deposits to borrowers. This credit creation process is crucial for stimulating economic growth and facilitating the functioning of various sectors.

Bank credit can take various forms, such as personal loans, mortgages, business loans, credit cards, and lines of credit. These loans may have different terms, interest rates, and repayment schedules, depending on the specific needs of the borrowers and the risk assessment conducted by the bank.

The availability and accessibility of bank credit play a vital role in driving economic activity. When banks are willing to extend credit to businesses, it enables them to invest in expansion, purchase equipment, hire employees, and innovate. Similarly, individuals rely on bank credit for financing major purchases like homes and automobiles or to cover unexpected expenses.

The level of bank credit in an economy is influenced by various factors, including monetary policy set by central banks, interest rates, economic conditions, and regulatory requirements. Changes in bank credit can have significant implications for economic growth, as an expansion of credit can stimulate spending and investment, while a contraction can restrict borrowing and dampen economic activity.

Monitoring bank credit trends is important for understanding the health of the financial system and the overall economy. Sudden contractions in bank credit, as seen during periods like the 2008 Financial Crisis, can lead to liquidity shortages, financial instability, and economic downturns. On the other hand, excessive credit expansion can create asset bubbles and financial imbalances, potentially leading to crises. Therefore, the management and regulation of bank credit are crucial for maintaining stability within the financial system.

PPI

PPI, or Producer Price Index, is an economic indicator that measures the average change over time in the prices received by producers for their goods and services. It provides insight into the cost pressures faced by producers at various stages of the production process.

Unlike the Consumer Price Index (CPI), which measures changes in prices from the perspective of consumers, the PPI focuses on the prices received by producers. It tracks price movements for a wide range of products, including raw materials, intermediate goods, and finished goods.

The PPI is calculated by collecting price data from producers and measuring the percentage change in prices compared to a base period. It takes into account both domestically produced goods and imported goods. The index is often expressed as a percentage change from the previous period or as an annualized rate of change.

The PPI is a valuable tool for economists, policymakers, and businesses as it provides insights into inflationary pressures within the economy. Rising PPI indicates that producers are facing higher input costs, such as raw materials or labor, which can potentially lead to higher prices for consumers down the line. Conversely, a decline in PPI suggests reduced cost pressures, which may eventually translate into lower consumer prices.

By monitoring PPI trends, policymakers can assess the overall health of the economy, identify potential inflationary or deflationary pressures, and make informed decisions regarding monetary policy. Businesses also rely on PPI data to analyze cost trends, adjust pricing strategies, and assess their competitiveness in the market.

It’s important to note that the PPI serves as an early indicator of inflationary pressures and is often used in conjunction with other economic indicators to form a comprehensive understanding of price movements and economic trends.

Overall, the PPI provides valuable information about the pricing dynamics within the production sector of an economy and helps stakeholders make informed decisions based on the observed trends in producer prices.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/rv-gcr-financial-roundup-for-october-11th-2023/

Awake-In-3D: The Gold-backed Zimbabwe ZiG and Our RV/GCR – What You Need to Know

Awake-In-3D:

The Gold-backed Zimbabwe ZiG and Our RV/GCR – What You Need to Know

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, RV/GCR

The New Zimbabwe ZiG Gold-Backed Digital Payments Token

Zimbabwe has recently made headlines in the financial world with the launch of its gold-backed digital token called the Zimbabwe ZiG.

This innovative digital currency, introduced by the Reserve Bank of Zimbabwe (RBZ), is accepted as an official payment method within the country.

The ZiG aims to provide an alternative to traditional fiat currencies and serves as a prime example of the approaching global currency reset (GCR) and the revaluation (RV) of currencies.

Awake-In-3D:

The Gold-backed Zimbabwe ZiG and Our RV/GCR – What You Need to Know

On October 10, 2023 By Awake-In-3D

In GCR Roadmap: Level 2 Events, RV/GCR

The New Zimbabwe ZiG Gold-Backed Digital Payments Token

Zimbabwe has recently made headlines in the financial world with the launch of its gold-backed digital token called the Zimbabwe ZiG.

This innovative digital currency, introduced by the Reserve Bank of Zimbabwe (RBZ), is accepted as an official payment method within the country.

The ZiG aims to provide an alternative to traditional fiat currencies and serves as a prime example of the approaching global currency reset (GCR) and the revaluation (RV) of currencies.

What You Will Learn from this Article:

Introduction to Zimbabwe ZiG: A Gold-Backed Digital Token

The Significance of Zimbabwe ZiG in the Current Financial Landscape

Zimbabwe ZiG as a Catalyst for the Global Currency Reset (GCR)

Currency Revaluation (RV) and the Role of Zimbabwe ZiG

The Implications and Future of Zimbabwe ZiG

The Significance of Zimbabwe ZiG in the Current Financial Landscape

Zimbabwe ZiG holds great significance amidst the ongoing challenges faced by the global financial system.

The token is backed by physical gold reserves held by the RBZ, ensuring its intrinsic value and stability. In a world where fiat currencies are often subject to inflation and volatility, ZiG offers a secure and tangible asset-based option for investors and users alike.

Zimbabwe ZiG as a Catalyst for the Global Currency Reset (GCR)

The launch of Zimbabwe ZiG aligns with the growing calls for a global currency reset (GCR).

The current fiat currency debt system has shown its weaknesses, with rising national debts and increasing inflation rates. ZiG’s introduction signifies a move towards a more sustainable financial system, where currencies are backed by tangible assets, such as gold.

This shift promotes stability and reduces the reliance on traditional fiat currencies, thereby paving the way for a potential global currency reset.

Currency Revaluation (RV) and the Role of Zimbabwe ZiG

As the world experiences economic fluctuations and imbalances, the revaluation (RV) of currencies becomes an imperative step towards restoring stability.

Zimbabwe ZiG, with its gold backing, represents a tangible asset that can serve as a benchmark for the revaluation of currencies.

By providing a reliable and stable alternative, ZiG demonstrates the potential for other currencies to follow suit and undergo revaluation, ensuring a more balanced and sustainable global financial system.

The Implications and Future of Zimbabwe ZiG

The acceptance of Zimbabwe ZiG as a payment method highlights the growing recognition of the importance of asset-backed digital currencies.

The RBZ’s dedication to ensuring transparency through external audits further strengthens the credibility of ZiG. This development opens up new opportunities for investors and individuals seeking a secure and valuable digital currency.

RESERVE BANK OF ZIMBABWE: OFFICIAL PRESS RELEASE ABOUT THE ZiG

Looking ahead, the success and adoption of Zimbabwe ZiG could potentially serve as a catalyst for other nations to explore similar asset-backed digital currencies.

The global financial landscape may witness a significant transformation as more countries embrace the concept of currency revaluation and the adoption of tangible asset-backed tokens.

In conclusion, Zimbabwe ZiG represents a significant step towards a global currency reset and the revaluation of currencies.

As a gold-backed digital token, it offers stability, security, and a tangible asset base that can potentially reshape the financial system. With the ongoing challenges faced by traditional fiat currencies, the emergence of ZiG serves as a beacon of hope for a more sustainable and balanced global economy.

Key Facts and Figures About the Zimbabwe ZiG:

ZiG officially launched as a payment method on October 5, 2023.

The RBZ reported a price of $0.0614 per milligram for ZiG.

One ounce of ZiG has a purchase price of $1,910 U.S. Dollars.

0.1 ounce of ZiG can be purchased for $191.

17.65 kg worth of ZiG was purchased during a token issuance on September 28.

As of today, approximately 350 kg worth of ZiG tokens were sold in total.

The RBZ introduced the gold-backed token project in April 2023.

ZiG tokens can be stored in e-gold wallets or e-gold cards.

The RBZ maintains dedicated ZiG accounts for transactions.

The applicable intermediated money transfer tax (IMTT) for ZiG transactions is half of that for foreign currency transactions.

External auditors validate the availability and adequacy of gold backing ZiG.

Supporting Articles:

COIN TELEGRAPH: Zimbabwe turns gold-backed digital token into payment method

RESERVE BANK OF ZIMBABWE: Press Releases

My primary thesis is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-gold-backed-zimbabwe-zig-and-our-rv-gcr-what-you-need-to-know/

Awake-In-3D: RV/GCR Financial News Roundup for this Week

Awake-In-3D:

RV/GCR Financial News Roundup for this Week

On October 9, 2023 By Awake-In-3D

Highlights this week as we witness the logical conclusion to the global fiat currency debt system leading to Our GCR and RV.

Foreigners hold approximately $18 trillion worth of US assets, of which $7.5 trillion are US Treasury securities.

As the US debt continues to rise and reach $33 trillion, the attractiveness of these IOUs as part of the fiat currency debt system is diminishing.

This highlights the urgent need for a Global Currency Reset (GCR) and the revaluation (RV) of currencies backed by tangible assets.

Awake-In-3D:

RV/GCR Financial News Roundup for this Week

On October 9, 2023 By Awake-In-3D

Highlights this week as we witness the logical conclusion to the global fiat currency debt system leading to Our GCR and RV.

Foreigners hold approximately $18 trillion worth of US assets, of which $7.5 trillion are US Treasury securities.

As the US debt continues to rise and reach $33 trillion, the attractiveness of these IOUs as part of the fiat currency debt system is diminishing.

This highlights the urgent need for a Global Currency Reset (GCR) and the revaluation (RV) of currencies backed by tangible assets.

The median monthly home payment in the US has soared to an all-time high of $2,839, with a significant increase over the past 10 years.

This rise is a direct consequence of the debt-based fiat currency system, which has led to inflation and reduced purchasing power.

The need for a GCR and RV becomes even more evident as the median home payment has become unaffordable for many, reaching unsustainable levels.

The US economy’s proximity to a recession is a clear indication of the inherent flaws in the fiat currency debt system.

The steepening yield curve, historically associated with economic downturns, further emphasizes the urgent need for a GCR and RV to address the structural issues and imbalances within the current financial system.

The US national debt surpassing $33.5 trillion, with a rapid increase in just a few weeks, reveals the fragility of the fiat currency debt system.

Despite optimistic GDP growth forecasts and job creation, the growing debt highlights the underlying weakness and unsustainability of the current system. A GCR and RV would offer an opportunity to reset the financial system and address the unsustainable debt levels.

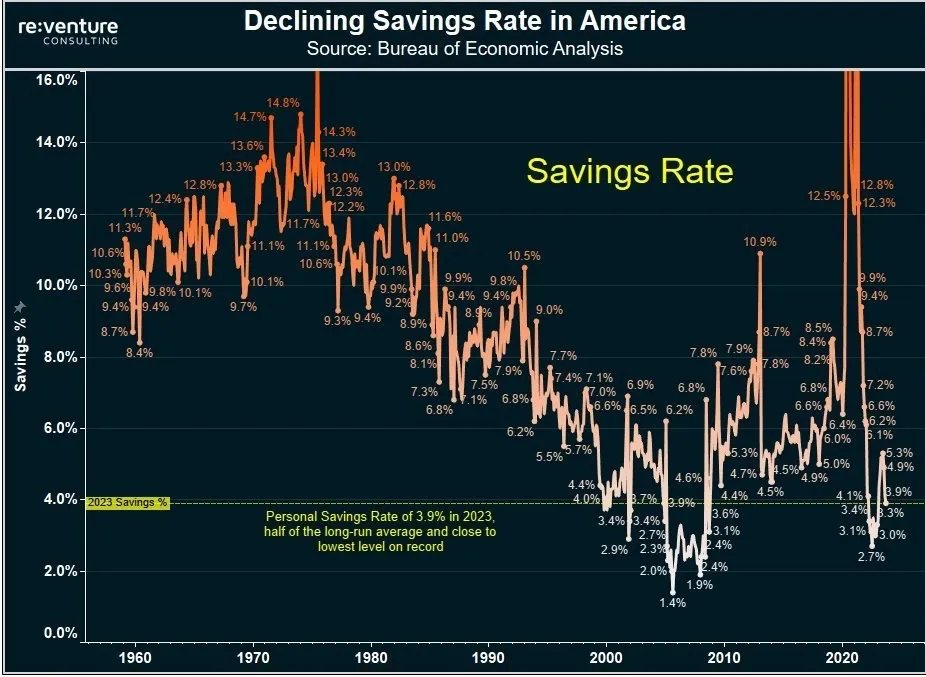

Chart of the Week

Personal savings rates in the US are down to 3.9% which is HALF of the long-run average.

This is also just above the 2008 low of 1.4% which marks the lowest level on record.

Key Financial Events This Week:

Wednesday – September PPI Inflation: This data will further highlight the inflationary pressures and the need for a GCR and RV to address the root causes of inflation within the fiat currency system.

Wednesday – Release of Fed Meeting Minutes: The Federal Reserve’s discussions and actions play a crucial role in shaping the financial system. Any insights into their considerations will be important for understanding the potential for a GCR and RV.

Thursday – September CPI Inflation: This data will provide additional insights into inflation trends and reinforce the need for a GCR and RV to restore stability and mitigate the adverse effects of inflation.

Thursday – OPEC Monthly Report: Monitoring OPEC’s report is vital as it impacts global oil prices, which are closely linked to currency valuations. The potential for a GCR and RV could have implications for oil-dependent economies.

Thursday – Jobless Claims Data: Tracking jobless claims is crucial for assessing the overall health of the economy and its impact on the need for a GCR and RV to stimulate growth and address unemployment.

A total of 12 Fed speaker events scheduled: These events provide an opportunity to understand the perspectives of influential individuals within the financial system. Their insights may shed light on the potential for a GCR and RV and the necessary steps to transition away from the current debt-based fiat currency system.

These news updates and key events reinforce the growing need for a Global Currency Reset and the revaluation of currencies backed by tangible assets as a solution to the inherent flaws and growing unsustainability of the current fiat currency debt system.

My primary belief is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/rv-gcr-financial-news-roundup-for-this-week/

Awake-In-3D: Rationally Explaining the RV/GCR to Friends and Family (Part 3) – Debt Jubilees

Awake-In-3D:

Rationally Explaining the RV/GCR to Friends and Family (Part 3) – Debt Jubilees

On October 7, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

How to Explain Debt Jubilees and the Elimination of Personal and Public Debt

The current fiat debt-based currency system has led to an unsustainable burden of personal and public debt worldwide. To alleviate this economic strain and provide a fresh start, Debt Jubilees can be implemented as part of a comprehensive reset.

In Part 1 of this article series, we learned how to rationally frame the GCR by understanding the driving financial forces behind it.

In Part 2 of the series, we discussed how to reasonably talk about the Currency Revaluation (RV) in context of the challenges and shortcomings of the current fiat debt-based currency system.

Awake-In-3D:

Rationally Explaining the RV/GCR to Friends and Family (Part 3) – Debt Jubilees

On October 7, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

How to Explain Debt Jubilees and the Elimination of Personal and Public Debt

The current fiat debt-based currency system has led to an unsustainable burden of personal and public debt worldwide. To alleviate this economic strain and provide a fresh start, Debt Jubilees can be implemented as part of a comprehensive reset.

In Part 1 of this article series, we learned how to rationally frame the GCR by understanding the driving financial forces behind it.

In Part 2 of the series, we discussed how to reasonably talk about the Currency Revaluation (RV) in context of the challenges and shortcomings of the current fiat debt-based currency system.

Here in Part 3, we will layout a rational case for a Debt Jubilee and the elimination of personal and public debt.

This is a big RV/GCR topic so this article is lengthy. Yet the knowledge is crucial.

What You Will Learn:

Discover what Debt Jubilees are and their historical significance in ancient civilizations.

Explore the mechanics of Debt Jubilees, including debt forgiveness and legal frameworks, and their role in preventing financial crises.

Understand the challenges and feasibility of implementing Debt Jubilees in today’s complex financial systems and political environments.

Examine alternative strategies governments and central banks may use to address mounting debt challenges while maintaining economic stability.

Envision a bold scenario where a Global Currency Reset (GCR) transforms into a modern Debt Jubilee, reshaping the financial landscape and offering debt relief on a global scale.

This powerful measure aims to alleviate the burden of debt, stimulate economic growth, and promote social justice. Drawing upon real-world examples, we will demonstrate how a Debt Jubilee can be a catalyst for a fresh start and a more sustainable financial future.

This measure would involve the comprehensive forgiveness of personal and public debts incurred under the old financial system.

Here are the Key Talking Points for Debt Jubilees

What Are Debt Jubilees?

Imagine a world where your debts could be forgiven, and you could breathe easier without the burden of financial obligations. This concept might seem like a distant dream, but throughout history, societies have embraced the idea of a Debt Jubilee to provide individuals and communities with a financial clean slate.

So, what exactly is a Debt Jubilee? In simple terms, it’s a deliberate and often periodic forgiveness of debt, offering relief to individuals who find themselves trapped under the weight of loans and financial obligations. It’s like hitting “refresh” on your financial life.

But why would societies consider such a radical move?

Debt Jubilees have historically been introduced in response to excessive household debts that threaten economic stability and social harmony. When people accumulate debts they can’t repay, it can lead to the loss of their homes, livelihoods, and even their freedom.

Debt Jubilees, therefore, serve as a solution to prevent these dire consequences and restore balance.

Think of it as a collective sigh of relief for those struggling with debt. In ancient times, rulers recognized the need for such measures to avoid widespread financial turmoil.

Debt Jubilees, often encoded in laws or decrees, provide individuals with a fresh start, allowing them to regain their financial footing and contribute positively to the economy.

Historical Examples of Debt Jubilees

Debt Jubilees Through the Ages: Lessons from History

The concept of a Debt Jubilee isn’t a new one; it’s a practice deeply rooted in the annals of history.

Ancient Civilizations

Going back thousands of years, civilizations such as ancient Babylon, Egypt, and China faced a recurring problem – excessive household debt. Debt, much like it does today, played a crucial role in facilitating trade, paying for labor, and bridging the gap between planting and harvesting seasons.

However, it also had its dark side. Families in these societies sometimes found themselves trapped in a cycle of debt, risking the loss of their land, livelihood, and even their freedom.

To prevent societal collapse, ancient rulers devised the idea of debt forgiveness or amnesty. They recognized that excessive private indebtedness could lead to dire consequences.

For instance, in ancient Israel, debt relief was not just a royal whim; it was enshrined in their laws as a recurring event known as the Jubilee. This event, marked by the sounding of the ram’s horn, brought freedom from the burden of debt and provided individuals with a fresh start.

Solon and Ancient Greece

In ancient Greece, Solon, a lawmaker in the sixth century BC, introduced a partial Debt Jubilee to avoid class conflict.

Solon, (born c. 630 BCE—died c. 560 BCE), Athenian statesman, known as one of the Seven Wise Men of Greece

His measures helped alleviate the financial strain on debtors, preventing a catastrophic social upheaval. Solon’s actions not only contributed to economic stability but also laid the foundations for elements of Greek democracy.

Modern Era

Fast forward to more recent history, and we find examples like the 1930s, where the U.S. government devalued the dollar against gold.

While not a traditional Debt Jubilee, this event illustrates how governments and central banks have utilized financial mechanisms to address economic challenges.

These historical examples emphasize that Debt Jubilees have been a recurring response to the burden of debt on individuals and societies. They show that societies have recognized the need to provide relief to those struggling with debt and to restore economic balance.

The next section shows how Debt Jubilees work and the mechanisms behind them.

How Debt Jubilees Work

Unlocking the Mechanics of Debt Jubilees

Now that we’ve explored the historical precedents of Debt Jubilees, let’s go deeper into how these remarkable mechanisms actually work.

Understanding the inner workings of Debt Jubilees sheds light on their potential benefits and implications for individuals and societies.

1. Debt Forgiveness

At its core, a Debt Jubilee involves the deliberate and systematic forgiveness of certain types of debt. It’s akin to erasing a financial burden, allowing borrowers to start with a clean slate.

This forgiveness can extend to various forms of debt, such as loans, mortgages, and other financial obligations.

2. Legal Framework

In many historical cases, Debt Jubilees were not arbitrary acts but were enshrined in laws and decrees. These legal frameworks ensured that the forgiveness of debt was not left to the whims of rulers but became a structural aspect of the economy.

The ancient Israelites, for instance, codified debt relief into their laws, ensuring it occurred at regular intervals.

3. Timing and Cycles

Debt Jubilees often followed specific timing or cyclical patterns.

For instance, the Israelite Jubilee occurred every fifty years, providing individuals with a predictable opportunity to escape the clutches of debt.

These predetermined cycles helped maintain economic stability and encouraged responsible lending practices.

4. Economic and Social Stability

The primary goal of Debt Jubilees is to promote economic and social stability.

By forgiving debt, individuals who were on the brink of financial ruin can regain their financial footing.

This, in turn, contributes to a healthier economy, as debt-free individuals are more likely to invest, spend, and participate actively in economic activities.

5. Preventing Social Discontent

Debt Jubilees have historically served as a preventative measure against social discontent and upheaval.

Excessive debt burdens, if left unaddressed, can lead to protests, revolts, and political instability.

By forgiving debt, rulers and governments aim to pacify the discontented and maintain order within their societies.

6. Economic Reset

Think of a Debt Jubilee as a reset button for an economy burdened by debt.

It wipes out some of the instabilities and inequalities that have built up over time, offering a fresh start for individuals and communities.

In the next section, we’ll explore whether today’s governments and central banks have the capacity and willingness to declare a Debt Jubilee in the face of mounting debt challenges.

Can Today’s Governments and Central Banks Declare a Debt Jubilee?

Modern Challenges and the Feasibility of Debt Jubilees

As we examine the subject of Debt Jubilees, it’s natural to wonder whether today’s governments and central banks have the capacity and willingness to implement such a bold financial maneuver.