Awake-In-3D: A Fiat Ponzi Scheme Collapse – Time for “System D”

Awake-In-3D:

A Fiat Ponzi Scheme Collapse – Time for “System D”

On September 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Governments, Debt, and the Looming Collapse

In the shadows of global economies, a perilous game is being played—one fueled by unsustainable debt, interventionist policies, and a financial system built on deceit. This is our current world of the Fiat Ponzi Scheme, where governments worldwide are teetering on the edge of self-destruction.

We should all be consciously aware of the key points that expose the fragility of our economic foundations and prepare for the looming collapse that will give birth to Our GCR and historic prosperity.

Awake-In-3D:

A Fiat Ponzi Scheme Collapse – Time for “System D”

On September 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Governments, Debt, and the Looming Collapse

In the shadows of global economies, a perilous game is being played—one fueled by unsustainable debt, interventionist policies, and a financial system built on deceit. This is our current world of the Fiat Ponzi Scheme, where governments worldwide are teetering on the edge of self-destruction.

We should all be consciously aware of the key points that expose the fragility of our economic foundations and prepare for the looming collapse that will give birth to Our GCR and historic prosperity.

Key Aspects of the Fiat Ponzi Scheme

Governments worldwide, including Washington, are on a self-destructive path due to unsustainable debt and interventionist economic policies.

One needs only to study the historical decline of the Roman Empire, burdened with debt and anti prosperity policies, a poignant example of this is today’s Green New Deal in the USA.

In the fiat Ponzi scheme, a constantly depreciating currency, financial deceit and asset value manipulation substitute for sound (asset-backed) money.

Wall Street alone does not have the strength to cause a cataclysmic outcome; it requires the involvement of Washington with its access to a balance sheet running into the tens of trillions.

The central banks and national governments have colluded to fund massive increases in national debt (which just crossed the $33 Trillion level), turning government promises into a gigantic international fiat Ponzi scheme.

Concerns are raised about ultra-high corporate and credit card debt, bank insolvency, and the deep inversion of the spread between two- and ten-year Treasuries.

It is beyond obvious that a massive debt bomb will soon explode, with interest on the U.S. federal debt reaching two trillion dollars annually by the end of next year.

Prosecuting governments for their fiat Ponzi schemes is challenging as most government officials believe in the effectiveness of central banks and the current fiat currency monetary system.

The state monopolizes money, and the introduction of central bank digital currencies (CBDCs) will further control the monetary system.

Florida and Indiana have effectively banned CBDCs as money, and other states may follow suit.

The use of cash, barter, and participation in the “shadow economy” can be strategies to oppose CBDCs and maintain economic independence.

System D* (the shadow economy) is growing faster in many countries than the officially recognized gross domestic product and would be the second-largest economy in the world if considered an independent nation.

The future outcome is undecided, but individuals can influence it by adopting a spirit of adaptability and resourcefulness.

*What is System D?

System D, also known as the “shadow economy” or “informal economy,” refers to a vast network of economic activities that exist outside the official channels of government regulation and oversight.

It encompasses a wide range of informal transactions, including unregistered businesses, cash-based transactions, barter exchanges, and other forms of economic activity that operate outside traditional legal frameworks.

System D typically emerges in response to economic challenges, such as high levels of unemployment, excessive regulations, limited access to formal markets, or a lack of trust in the established financial system.

Participants in the shadow economy often seek alternative means of survival and economic exchange, finding ways to meet their needs and generate income outside the bounds of official regulations and taxation.

It is important to note that the shadow economy can vary significantly in size and characteristics across different countries and regions. Estimates suggest that the size of the shadow economy can be substantial, sometimes rivaling or even surpassing the officially recognized Gross Domestic Product (GDP) of a country.

Fiat Ponzi Scheme Summary

As the cracks in the fiat Ponzi scheme grow wider, it is imperative to recognize the fragility of our economic systems. The unsustainable debt, interventionist policies, and deceitful practices employed by governments worldwide threaten to trigger a catastrophic collapse.

By understanding the key points discussed above, including the fragile foundations of debt and intervention, the substitution of sound money with fiat currency, the role of Wall Street and Washington, the warning signs of debt bombs and inverted curves, and the collusion behind the fiat Ponzi scheme, we can navigate the uncertain future ahead.

It is time to question the status quo and embrace a System D strategy to thrive in a world on the brink of the fiat Ponzi scheme’s unraveling.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-fiat-ponzi-scheme-collapse-time-for-system-d/

Awake-In-3D: Japan’s Yen Crisis Grows and It’s Coming for Us

Awake-In-3D

Japan’s Yen Crisis Grows and It’s Coming for Us

On September 17, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The fiat debt system financial meltdown in Japan is deepening. Japan’s Yen crisis shows us what is coming next for Europe and the United States’ fiat currencies. The Yen collapse is Event Level 10 on my soon-to-be-released RV/GCR Roadmap.

This RV/GCR Roadmap is a definitive 18 Event guide to help you navigate the steps towards the collapse of the Global Fiat Financial System and the introduction of a Financial System Reset and Revaluation scenario.

Yet we have to see the current system reach critical failure, and the Japanese Yen Crisis is a major event to watch. Here’s an update to what’s happening in Japan.

Awake-In-3D:

Japan’s Yen Crisis Grows and It’s Coming for Us

On September 17, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The fiat debt system financial meltdown in Japan is deepening. Japan’s Yen crisis shows us what is coming next for Europe and the United States’ fiat currencies. The Yen collapse is Event Level 10 on my soon-to-be-released RV/GCR Roadmap.

This RV/GCR Roadmap is a definitive 18 Event guide to help you navigate the steps towards the collapse of the Global Fiat Financial System and the introduction of a Financial System Reset and Revaluation scenario.

Yet we have to see the current system reach critical failure, and the Japanese Yen Crisis is a major event to watch. Here’s an update to what’s happening in Japan.

Amidst the glittering skyline of Tokyo, a financial tempest is brewing, and its name is Japan’s Yen Crisis. While it may appear as a distant storm on the horizon, its implications extend far beyond Japan’s borders, reaching the heart of the United States and the global financial landscape.

The Unfolding Events Around Japan’s Yen Crisis

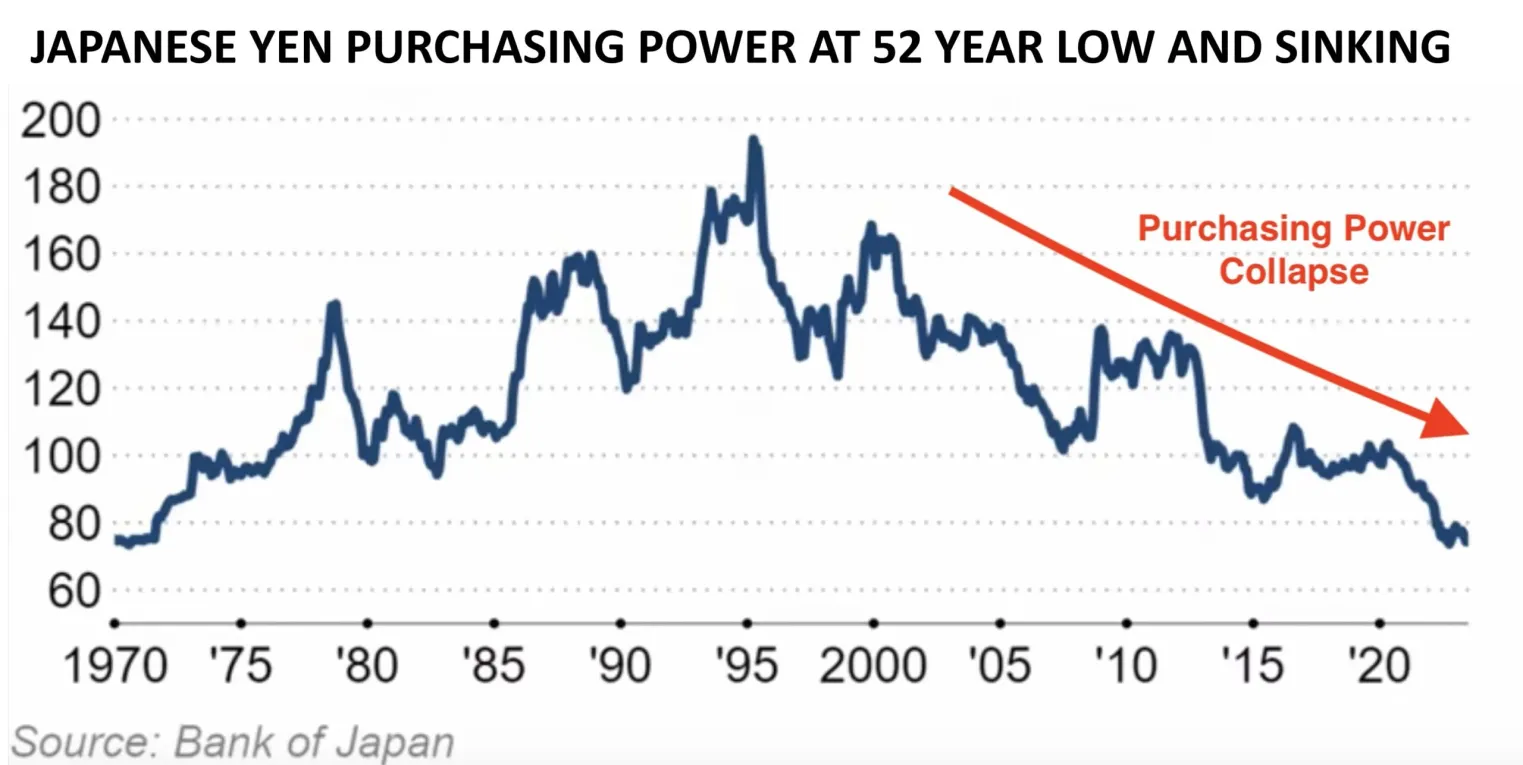

n the epicenter of Tokyo’s bustling streets, Japan’s Yen Crisis looms large. Over the past year, the Japanese Yen has witnessed a precipitous collapse, plummeting by a staggering 11.5 percent against the U.S. Dollar. Japan’s efforts to stem the crisis, including selling off U.S. Dollars, have yielded little success.

What makes this crisis particularly alarming is Japan’s heavy dependence on foreign imports, especially food, fuel, and manufacturing inputs, all priced in U.S. Dollars. Consequently, as the Yen’s value continues to erode, the cost of living in Japan skyrockets.

Updating Japan’s Current Economic Situation

The Japanese Yen has collapsed by over 11.5 percent against the U.S. Dollar in the current year.

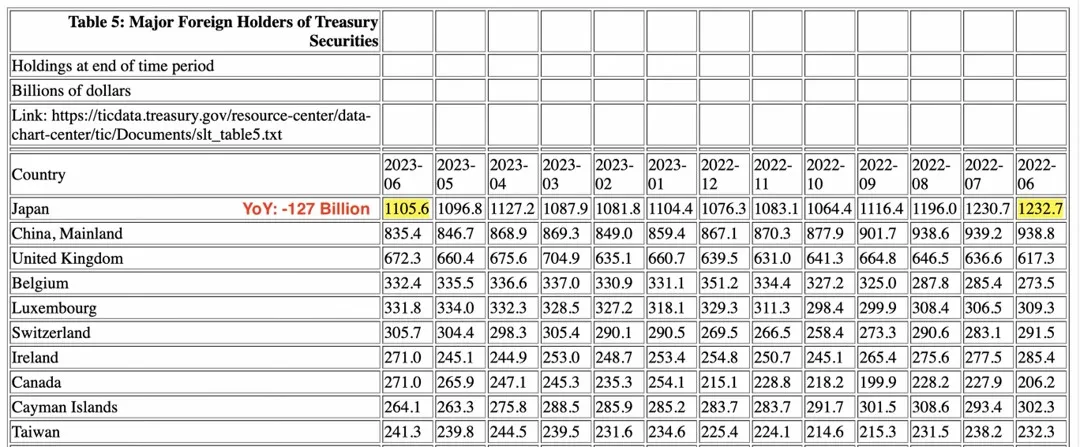

Japan has sold over $127 billion worth of US Treasury bonds.

Japan’s inflation rate reached 3.3 percent for June and July.

The Yen’s buying power has dropped from its peak in 1995 back down to 1970s levels.

Japanese real wages fell for the 16th straight month in July.

The price of gold in Japanese Yen has appreciated by 75 percent since the lows in 2020.

The price of gold has surged by 18 percent since January.

U.S. inflation has gone up from 3.2 percent in July to 3.7 percent in August.

Japan’s current Benchmark rate is still at its 2016 levels of minus 0.1 percent.

Japanese exports fell by 0.3 percent in July.

Japan’s pivot away from U.S. treasuries could lead to higher borrowing costs for the United States.

A significant exodus from the U.S. bond market could occur if Japanese investors shift from U.S. treasuries to Japanese bonds.

Japan’s Yen Crisis Threatens the U.S. Treasury Market

While Japan grapples with its Yen Crisis, the U.S. Treasury market stands as one of its most significant casualties. Japan’s necessity to shed its bonds to bolster the Yen poses a grave threat. Should Japan decide to reverse its money printing strategy, the repercussions for the U.S. bond market could be dire.

This situation distinguishes itself from China’s treasury sell-off, driven more by economic imperatives than strategic motives. Japan’s actions are underscored by its astounding $127 billion in bond sales, surpassing even China’s treasury holdings.

The Bank of Japan’s Dilemma

At the heart of Japan’s Yen crisis is a strategy built on relentless money printing to stimulate its economy. The Bank of Japan (BOJ) actively purchases Japanese government bonds to suppress yields, intervening whenever they approach 0.5 percent.

Unlike the Federal Reserve, Japan appears to have no bounds to its money printing. Regrettably, the Japanese Yen bears the brunt of this approach. Goldman Sachs predicts that should the BOJ persist, the Yen could plunge by another 20 points against the U.S. Dollar, further exacerbating the plight of the Japanese populace.

The Looming U.S. Implosion Risk

Japan’s impending reversal could set off a chain reaction with profound global consequences. As Japan raises interest rates, Japanese investors may pivot from U.S. treasuries to Japanese bonds, triggering substantial currency exchange fluctuations.

This could lead to a mass exodus from the U.S. bond market, resulting in higher borrowing costs for the United States. In turn, this perfect storm might precipitate a banking crisis and a long-anticipated recession.

As Japan’s Yen Crisis continues to grow, the world watches with bated breath. The implications of this crisis extend far beyond Japan’s shores, reaching the United States and beyond.

The BOJ’s impending pivot may well be the event that reshapes the global financial landscape, making it a pivotal moment that brings us significantly closer to a Global Financial Reset and Revaluation.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/japans-yen-crisis-grows-and-its-coming-for-us/

Awake-In-3D: The United States is Racing Towards the Inescapable Death Trap of Debt Default

Awake-In-3D:

The United States is Racing Towards the Inescapable Death Trap of Debt Default

On September 5, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Inevitable Fiat Debt System Collapse is Unstoppable

The United States is hurtling towards an imminent collapse of its financial system, and time is running out. Do not be fooled by the currently rising stock markets, low unemployment, rising GDP, and declining core inflation statistics. All of these economic indicators will dramatically reverse over the coming months. These are the last dance-party moves on the proverbial Titanic as the waters engulf level after level of a sinking ship.

Awake-In-3D:

The United States is Racing Towards the Inescapable Death Trap of Debt Default

On September 5, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Inevitable Fiat Debt System Collapse is Unstoppable

The United States is hurtling towards an imminent collapse of its financial system, and time is running out. Do not be fooled by the currently rising stock markets, low unemployment, rising GDP, and declining core inflation statistics. All of these economic indicators will dramatically reverse over the coming months. These are the last dance-party moves on the proverbial Titanic as the waters engulf level after level of a sinking ship.

Given that our entire global monetary system is based on debt, the only thing to watch is the Bond Markets. As Central Bank interest rates continue to rise, all debt payments become increasingly more difficult to maintain. This includes government sovereign debt (Treasury Bonds), business debt (corporate bonds), commercial real estate debt, home mortgage debt, and credit card debt.

The stakes are high, and the consequences will usher in a total monetary system reset.

The following article is a breakdown of complex information, presented in a bulleted format, to help you better understand the critical situation currently unfolding in real time. It’s important to comprehend the impending crash of the fiat currency debt system and the inescapable death trap of financial death approaching.

Key Events in the USA’s Recent Financial Trajectory

The Fed bailed out the repo markets to the tune of hundreds of billions per week.

The Fed was printing inflationary money quicker than Nolan Ryan’s fastball.

America’s debt costs (interest expenses) skyrocketing into an unsustainable $ trillion/year category.

The U.S. has a $33 trillion bar tab.

Yields on US 10-Year USTs rose, impacting the interest expense on Uncle Sam’s debt.

UST supplies (and hence yields) were climbing at a rate not seen in 55 years.

The United States is hurtling towards an unprecedented debt death trap, analogous to a college frat boy recklessly spending on his rich uncle’s credit card. The nation’s ever-increasing deficit spending, rising interest rates, and mounting debt burdens are setting the stage for an inevitable crash of the fiat currency debt system.

Here is a summary of the dangerous trajectory the United States is on,

Deficit Spending and Rising Debt

The United States’ deficit spending is skyrocketing, akin to a frat boy’s extravagant party lifestyle fueled by unlimited credit.

The short-term benefits of deficit spending are overshadowed by long-term consequences that take time to manifest.

The growing deficits and debt burdens are pushing the nation closer to the edge of a debt default.

Rising Interest Rates and Fiscal Dominance

As GDP rises, the Federal Reserve’s response of hiking interest rates resembles the beer-goggle effect, blinding them to the reality of the situation.

The irony of the Fed’s attempt to combat inflation through rate hikes is that it often results in more inflation, leading to a case of “fiscal dominance.”

Rising rates not only stimulate short-term economic growth but also contribute to skyrocketing interest expenses on the nation’s debt.

The Inevitable Monetary Response

The need to cover mounting deficits by printing trillions of dollars out of thin air becomes increasingly evident.

This excessive money printing, intended to avoid a debt catastrophe, sets the stage for an inflationary spiral.

The tragic predictability of this response mirrors historical failures, akin to Pickett’s failed charge at Gettysburg.

Stagflation Looms Ahead

The likelihood of stagflation, a combination of inflation and stagnant economic growth, is becoming a future certainty.

Rising bond yields and rates will have deflationary effects on risk assets (stocks and foreign currency exchange trading), while Main Street economies struggle to refinance their loans previously acquired at much lower interest rates.

The US Dollar’s Fate and the Bond Market

The USD, like the stern of the Titanic, is on a trajectory from a temporary pause to a rapid descent towards the bottom.

The bond market, with yields acting as approaching shark fins, holds crucial implications for the USA’s fiat system financial stability.

Ignoring these looming dangers in favor of distractions only exacerbates the risks posed by the impending crash.

The United States finds itself hurtling towards an inescapable debt collapse, similar to a frat boy’s reckless spending spree. The combination of deficit spending, rising interest rates, and mounting debt burdens creates a dangerous trajectory. As we race towards an inevitable crash of the fiat currency debt system, it is crucial to acknowledge the severity of the situation and take proactive measures for the events ahead.

Supporting article: https://goldswitzerland.com/rising-gdp-rising-yields-a-major-sign-of-uh-oh/

Related articles:

Our GCR continues to draw ever closer. As the days tick by, the United States government’s financial landscape has been a cause for concern, as its spending patterns have led to an escalating debt crisis.

~~~~~~~~~~

Real-World Warning Signs Today of the Fiat Currency Debt System Collapse – Leading to Our RV/GCR

Amid the alarming trends signaling the impending collapse of the global fiat currency debt system, we look forward to a transformative solution that will revolutionize the financial landscape. My discussions and articles here have illuminated the concept of “Our GCR” as a beacon of hope in these uncertain times. This Asset-Backed Global Currency Reset isn’t just a theoretical concept; it’s beginning to unfold before our eyes.

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-united-states-is-racing-towards-the-inescapable-death-trap-of-debt-default/

Awake-In-3D: Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

Awake-In-3D:

Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

On September 5, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Oil Becomes a Weapon as BRICS and OPEC Flex Dominance Over Global Energy Supply – Expect Inflation to Soar Once Again

In a surprising turn of events, a new alliance formed by BRICS (Brazil, Russia, India, China, and South Africa) and OPEC (Organization of the Petroleum Exporting Countries) is reshaping the global energy landscape.

This alliance, which aims to challenge the dominance of Western economies, has weaponized oil as a means to assert their control over global energy supply resources.

As a result, the world is witnessing a surge in oil prices, raising concerns for Western economies and their inflationary pressures.

Awake-In-3D:

Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

On September 5, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Oil Becomes a Weapon as BRICS and OPEC Flex Dominance Over Global Energy Supply – Expect Inflation to Soar Once Again

In a surprising turn of events, a new alliance formed by BRICS (Brazil, Russia, India, China, and South Africa) and OPEC (Organization of the Petroleum Exporting Countries) is reshaping the global energy landscape.

This alliance, which aims to challenge the dominance of Western economies, has weaponized oil as a means to assert their control over global energy supply resources.

As a result, the world is witnessing a surge in oil prices, raising concerns for Western economies and their inflationary pressures.

The shockwaves began when Saudi Arabia and Russia, two key players in the oil market, announced an unexpected extension of production cuts. Saudi Arabia, in a move that caught markets off guard, declared an extension of the voluntary cut of 1 million barrels per day (b/d) for an additional three months, till the end of December. This decision goes well beyond the initial market expectation of just one more month.

The Saudi press agency SPA emphasized that the voluntary cut would be reviewed monthly, allowing for the possibility of further reductions or increased production as deemed necessary. This extension is aimed at reinforcing the precautionary efforts made by OPEC countries to stabilize the oil market.

Following suit, Russia swiftly announced its commitment to extend its reduction of oil exports until the end of the year. As an added surprise, Russia pledged an additional 300kb/d in voluntary oil cuts, which will remain in effect until December 2023. This measure complements the voluntary reduction previously announced by Russia in April 2023, which will last until December 2024.

Similar to Saudi Arabia, Russia emphasized the monthly review of their production cuts, indicating their willingness to deepen the reductions or increase production based on the global market situation.

The impact of this unexpected alliance and their concerted efforts to manipulate oil supply has been profound. Brent Nov’23, a benchmark for global oil prices, surged above $90 for the first time in 2023.

Meanwhile, WTI Oct’23, the U.S. crude oil benchmark, reached its highest price of the year, shaking the hopes of the Federal Reserve for a decline in headline inflation. These price surges reflect the immense power that the BRICS and OPEC alliance wields over the global energy market.

Analysts and experts view this development as a strategic move by BRICS and OPEC to challenge the dominance of Western economies, particularly the United States.

The weaponization of oil demonstrates their determination to assert control over global energy supply resources and reshape the balance of power. By tightening production cuts and driving up oil prices, BRICS and OPEC seek to exert their dominance and weaken Western economies heavily reliant on energy imports.

This shift in global energy dynamics poses a significant challenge for Western economies, including the United States. President Biden, who recently sold a large portion of the U.S. strategic oil reserves, now faces the daunting task of refilling the Strategic Petroleum Reserve (SPR) amidst soaring oil prices.

With projections indicating that oil prices may reach $100, efforts to stabilize domestic energy supply and mitigate rising inflationary pressures become even more crucial.

As BRICS and OPEC forge ahead with their strategy of weaponizing oil, the financial world watches with a mix of anticipation and concern. The once-unassailable dominance of Western economies over global energy resources is being put to the test.

Whether these new alliances succeed in their pursuit of reshaping the energy landscape remains to be seen, but one thing is clear: oil has become a powerful weapon in their hands, capable of reshaping the balance of power in the global economy.

Supporting article: https://www.zerohedge.com/markets/oil-soars-new-2023-high-after-saudis-russia-surprise-extended-expanded-production-cut

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/global-energy-war-begins-as-brics-opec-force-oil-towards-100-barrel/

Awake-In-3D: Impending Global Fiat Currency Collapse Will Begin with Japan – Here’s Why

Awake-In-3D:

Impending Global Fiat Currency Collapse Will Begin with Japan – Here’s Why

On September 2, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Explaining Japanese Yen Carry Trade and Why it’s a Ticking Time Bomb for the Global Financial Economy

In a world on the edge of economic uncertainty, a looming catastrophe threatens to unravel the global fiat currency debt system. A dangerous scenario around Japanese Yen (JPY) Carry Trades, once a profitable strategy is now a ticking time bomb.

As the doom loop of push-pull tradeoffs between supporting the JPY exchange rate, or keeping government bond (sovereign debt) yields low, continues at the Central Bank of Japan, the inevitable outcome for a government debt default grows closer by the week.

Awake-In-3D:

Impending Global Fiat Currency Collapse Will Begin with Japan – Here’s Why

On September 2, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Explaining Japanese Yen Carry Trade and Why it’s a Ticking Time Bomb for the Global Financial Economy

In a world on the edge of economic uncertainty, a looming catastrophe threatens to unravel the global fiat currency debt system. A dangerous scenario around Japanese Yen (JPY) Carry Trades, once a profitable strategy is now a ticking time bomb.

As the doom loop of push-pull tradeoffs between supporting the JPY exchange rate, or keeping government bond (sovereign debt) yields low, continues at the Central Bank of Japan, the inevitable outcome for a government debt default grows closer by the week.

If the Japanese economy tanks, a financial contagion will likely spread across Asia, Europe, and the United States, bringing with it the collapse of the global financial order.

In a global financial system already grappling with ever-growing economic uncertainties, an impending threat emerges, casting a dark shadow over the global financial system. The JPY Carry Trade, once seen as a foolproof strategy, now reveals its true colors, setting the stage for the worldwide collapse of the fiat currency debt system.

The Allure of the JPY Carry Trade

For years, investors were enticed by the JPY Carry Trade, capitalizing on the extremely low interest rates of the Japanese yen at a mere 0.2%. This approach involved borrowing yen at minimal rates, investing in high-risk assets, and reaping returns ranging from 5% to 10%. It appeared to be a win-win scenario, promising endless profits.

Learn what a Carry Trade is in simple terms here

Unraveling the Illusion

The seemingly infallible JPY Carry Trade is now unraveling, posing detrimental consequences. The first warning signs materialize as Japanese Government Bond (JGB) yields rise. As the value of the yen drops, authorities attempt to defend its foreign exchange price by increasing JGB yields. However, this inadvertently diminishes the incentive for investors to borrow yen.

The Collapse Begins

With diminishing liquidity and waning borrowing incentives, a disastrous chain reaction commences. Foreign capital inflows, once vital for the Japanese economy, experience a sharp decline. The ramifications are dire, as the third-largest global economy plunges into turmoil and eventual debt default.

Pariah Status of the Japanese Yen

The once-reliable yen, previously considered a safe-haven currency, now becomes a pariah on the global stage. Its value spirals out of control, leaving investors and nations in a state of panic. Japan, once an economic powerhouse, now teeters on the edge of an unprecedented default, sending shockwaves throughout the world.

Contagion Spreads to Asia

The contagion swiftly spreads across Asia, with China bearing the brunt of the financial tempest. Economic stability in the region crumbles, as financial markets succumb to insurmountable debt and mass sell-offs.

Eurozone Under Pressure

The crisis engulfs the eurozone, shaking the very core of European finance. Country after country will fall into chaos under the relentless onslaught, further threatening the stability of the global financial order.

Impact on the United States

Finally, the contagion reaches the United States, the epitome of fiat currency and global economic power. The nation, once considered immune to external turmoil, finds itself ensnared in an inescapable web of financial crisis. The ripple effects of the collapse of the fiat currency debt system leave no stone unturned, shattering the illusion of debt system invincibility worldwide.

Conclusion

As the world teeters on the brink of financial Armageddon, it serves as a stark reminder that even seemingly infallible systems are not immune to collapse. The JPY Carry Trade, once celebrated for its profit potential, now stands as a testament to the fragility of the global economy and the catalyst for a Global Financial Reset.

Will the world unite around this cataclysmic disaster and implement our Gold-backed GCR? Or will the central banksters and elitists push onwards to introduce their version of a financial reset based on CBDCs backed by Carbon Credits?

Only time will tell.

Related Articles:

A Tale of Two Financial Doom Loops – Japan Leads and the USA Follows

In an era of mounting financial challenges and escalating risks to global economies, the need for a stable and sustainable monetary system becomes increasingly evident. When we closely examine the economic landscapes of both the USA and Japan, the pressing need for a transformative approach becomes apparent. Spiraling debt levels, surging inflation, and the vulnerability of fiat currencies call for a viable alternative – Our Gold-backed RV/GCR.

~~~~~~~~~~~~~~~

Japan’s Catastrophic Debt and the Inevitable Collapse of the Yen Fiat Currency

The Japanese Yen could be the first fiat currency to collapse and trigger a worldwide financial crash due to the country’s unsustainable debt problem, coupled with a lack of effective economic reforms and a dependency on aggressive, and failing, monetary policies. Given Japan’s position as the third-largest economy globally and its extensive international financial linkages, the collapse of the Japanese Yen could have significant contagion effects on other major economies. The inter-connectedness of the global financial system could amplify the impact of a Japanese Yen collapse, potentially triggering a worldwide financial crash.

~~~~~~~~~~

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/impending-global-fiat-currency-collapse-will-begin-with-japan-heres-why/

Awake-In-3D: BRICS Alliance Forging Ahead with a Global Financial Revolution

Awake-In-3D:

BRICS Alliance Forging Ahead with a Global Financial Revolution

On August 24, 2023 By Awake-In-3D

As the 2023 BRICS Summit concludes, is there a new currency on the horizon?

Envision what a world without the dominance of the U.S. dollar might look like. Imagine a new currency taking center stage, a currency formed by the combined efforts of Brazil, Russia, India, China, and South Africa, the BRICS nations. While it may not be happening as fast as we would like, it certainly appears to be moving forward.

Awake-In-3D:

BRICS Alliance Forging Ahead with a Global Financial Revolution

On August 24, 2023 By Awake-In-3D

As the 2023 BRICS Summit concludes, is there a new currency on the horizon?

Envision what a world without the dominance of the U.S. dollar might look like. Imagine a new currency taking center stage, a currency formed by the combined efforts of Brazil, Russia, India, China, and South Africa, the BRICS nations. While it may not be happening as fast as we would like, it certainly appears to be moving forward.

Key Points

A revolutionary financial proposal from the BRICS summit

The push for a more sophisticated payment system

Russia’s alternative to SWIFT

Could a common currency for BRICS soon be a reality?

A New Financial Era Beckons

At the recent BRICS summit in Johannesburg, a game-changing idea was proposed. The leaders of the BRICS nations are considering a break from the U.S. dollar, in favor of local currency usage in trade and financial transactions.

Li Kexin, Director-General of the Department of International Economic Affairs of the Foreign Ministry of China said, “BRICS members should study local currency cooperation payment tools and platforms, and promote local currency settlement.”

Russia’s SWIFT Alternative

Russia, in response to being cut-off from the SWIFT messaging system due to western sanctions, has already created its own alternative. An alternative payment system is not just a Russian idea, but a promising area, according to Indian Foreign Secretary Vinay Kwatra.

Techniques for Implementing BRICS Payment System

Strengthening cross-border payment cooperation

Promoting local currency settlement

Setting up alternative international payment systems

Unfolding Events to Watch

Russia: Despite being cut-off from SWIFT, they created their own alternative system, proving self-sufficiency is possible.

China: They are pushing for local currency settlement in global transactions, reducing reliance on the U.S. dollar.

Brazil: The call for a common BRICS currency for trade and investment between members, a bold move that could reshape global financial dynamics.

We Are Witnessing an Unfolding Financial Revolution

This development could reshape the global financial landscape. This is not just about a new currency, it’s about a shift in financial power and monetary system dynamics, a new era that could spark global awareness of a stable, sovereign non-fiat financial system offering fairness and increased prosperity for all of humanity.

…Leading to Our GCR Alternative.

Supporting Article: https://www.reuters.com/world/brics-nations-should-strengthen-cooperation-cross-border-payment-china-2023-08-24/

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/brics-alliance-forging-ahead-with-a-global-financial-revolution/

Awake-In-3D: Buckle Up World! We’re in for a Banking Bloodbath

Awake-In-3D:

Buckle Up World! We’re in for a Banking Bloodbath

On August 24, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Not a doomsday prophecy, but a heads-up for a financial challenge like we’ve never seen.

There’s a white-knuckle ride developing in the banking world. Thanks to our government’s love for spending like a drunken sailor, we’re moving headlong towards a financial free-fall. This isn’t some half-baked theory, it’s a red alert from a highly successful, $254 million hedge fund leader.

I foresee an energy crisis, entwined in a banking crisis, swallowed by a fiscal and monetary crisis.

Awake-In-3D:

Buckle Up World! We’re in for a Banking Bloodbath

On August 24, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Not a doomsday prophecy, but a heads-up for a financial challenge like we’ve never seen.

There’s a white-knuckle ride developing in the banking world. Thanks to our government’s love for spending like a drunken sailor, we’re moving headlong towards a financial free-fall. This isn’t some half-baked theory, it’s a red alert from a highly successful, $254 million hedge fund leader.

I foresee an energy crisis, entwined in a banking crisis, swallowed by a fiscal and monetary crisis.

Harris Kupperman, CEO Praetorian Capital Management

Why should you care?

This is a serious warning from Harris Kupperman, the big cheese of Praetorian Capital Management. His investment fund skyrocketed over 658% net of fees from its inception in 2019 through to Q2’s end. Now that’s a track record that screams ‘listen up’!

“I foresee an energy crisis, entwined in a banking crisis, swallowed by a fiscal and monetary crisis. This will birth epic opportunities, laced with risk and seismic volatility,” he prophesizes.

The Three-Headed Monster

Here’s the point: Kupperman predicts a fiscal crisis thanks to our government’s spending spree, a banking crisis because our financial institutions are up the creek without a paddle, and an energy crisis because energy demand is outrunning supply.

He forecasts the 10-year US Treasury’s yield will rocket to 6% in the next year, which, in his words, “annihilates a lot of things in terms of businesses.”

These looming crises will shake up our financial world like a snow globe.

Contributing articles: https://www.businessinsider.com/economy-outlook-banking-crisis-energy-uranium-oil-prices-investing-kupperman-2023-8

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/buckle-up-world-were-in-for-a-banking-bloodbath/

Awake-In-3D: Get Ready for China’s Epic Property Meltdown

Awake-In-3D:

Get Ready for China’s Epic Property Meltdown

On August 24, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

China’s “Lehman Moment”? Maybe.

Ever thought about China’s property market going belly up? Picture this: the world’s number two economy is teetering on the edge of its very own “Lehman moment”.

Awake-In-3D:

Get Ready for China’s Epic Property Meltdown

On August 24, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

China’s “Lehman Moment”? Maybe.

Ever thought about China’s property market going belly up? Picture this: the world’s number two economy is teetering on the edge of its very own “Lehman moment”.

What’s Happening Now:

China’s property market disaster.

The “Lehman moment” – why you should be concerned.

Beijing’s desperate scramble to keep the ship afloat.

China’s Property Crisis: It’s Worse Than You Think

China’s real estate sector is a ticking time bomb. China Evergrande Group, a big-shot developer, is drowning in losses – a staggering 812 billion yuan (US$112 billion) for 2021 and 2022. And it’s not the only one. Country Garden, another property behemoth, is flirting with a bond default.

For once I agree with something the seriously flawed, fiat money economist John Maynard Keynes once quipped, “When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” Couldn’t have put it better myself.

Lehman Moment: It’s Not Just a Possibility, It’s a Promise

“Lehman moment” – a domino effect of financial catastrophes triggered when one company’s mess becomes everyone’s nightmare. While some may think that a full-blown Lehman moment is unlikely in China, the property sector’s mounting troubles are about to give Beijing a reality check.

Possible Short Term Band-Aids to Survive the Impending Meltdown

Policy Intervention: Beijing might pull some tricks to steady the property market and dodge a crash.

Debt Restructuring: Companies could beg their creditors to avoid default and rejig their debts.

Bondholder Bailouts: The government could play the hero and bail out bondholders to avoid mass hysteria.

Asian Crisis Contagion Management – Been There, Done That

2008 Financial Crisis: Central banks worldwide went all guns blazing with monetary policy measures to fight the crisis. This will only increase inflation rates to epic proportions.

1997 Asian Financial Crisis: Governments did some soul searching, enacted reforms and groveled to the IMF to restore stability. Hopefully, they won’t end up at the IMF’s doorstep.

Contributing article: https://www.scmp.com/economy/china-economy/article/3231900/chinas-property-crisis-plagues-its-economy-and-financial-system-lehman-moment-looming

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/get-ready-for-chinas-epic-property-meltdown/

Awake-In-3D: Look Who’s Officially Joining the Developing Big Boys’ Club!

Awake-In-3D:

Look Who’s Officially Joining the Developing Big Boys’ Club!

On August 24, 2023 By Awake-In-3D

Saudi Arabia, the oil-slicked Cinderella, just got a golden ticket to the economic Oscars. Imagine being a regular Joe, then getting invited to a secret society where Elon Musk and Jeff Bezos discuss world domination over whiskey. That’s Saudi Arabia right now.

The BRICS group – the economic Avengers, if you will – just extended a hand to Saudi Arabia. Now, they’re not just rubbing shoulders with Brazil, Russia, India, China, and South Africa, but also the United Arab Emirates, Iran, Egypt, and Argentina.

Awake-In-3D:

Look Who’s Officially Joining the Developing Big Boys’ Club!

On August 24, 2023 By Awake-In-3D

Saudi Arabia, the oil-slicked Cinderella, just got a golden ticket to the economic Oscars. Imagine being a regular Joe, then getting invited to a secret society where Elon Musk and Jeff Bezos discuss world domination over whiskey. That’s Saudi Arabia right now.

The BRICS group – the economic Avengers, if you will – just extended a hand to Saudi Arabia. Now, they’re not just rubbing shoulders with Brazil, Russia, India, China, and South Africa, but also the United Arab Emirates, Iran, Egypt, and Argentina.

Why should you care?

Imagine if Pepsi and Coca-Cola decided to merge. That’s the kind of seismic shift we’re talking about. Saudi Arabia might just ditch its BFF, the United States, for this new, shiny alliance. It’s like Batman ditching Robin for the Justice League.

But there’s a twist: PetroDollar at Stake?

China, the persistent Romeo, wants Saudi Arabia to price its oil in Renminbi, not dollars. It’s a high stakes love triangle, with Saudi playing hard-to-get, and the US and China fighting for its heart.

This isn’t just about oil, it’s a global power play. Saudi Arabia joining BRICS could be its Rocky Balboa moment, catapulting it to global stardom.

Will Saudi play both sides or pick a team? Who knows? But one thing’s for sure, the world is watching, popcorn in hand.

BRICS and Saudi Arabia: A Power Play You Can’t Ignore

Saudi Arabia, the energy juggernaut, is cozying up to the BRICS nations (Brazil, Russia, India, China, South Africa). It’s like a colossal jigsaw puzzle, and the pieces? They’re falling into place. The result? A goldmine of developmental and economic opportunities.

Saudi Foreign Minister, Prince Faisal bin Farhan, used the BRICS summit as his soapbox. Picture a quarterback, laying down a daring game plan in the final quarter. Bold move, don’t you think?

And Saudi Arabia, the heart of the energy sector, is not backing down. They’re pumping life into the global energy markets, and they’re not about to let go of the reins.

So, what’s brewing? Expect new alliances, amplified cooperation, and a skyrocketing relationship between these powerhouses. It’s like watching a caterpillar morph into a butterfly – a breathtaking transformation is in the pipeline!

Stay glued for more updates on this global power play.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/look-whos-officially-joining-the-developing-big-boys-club/

Awake-In-3D: Calls for Gold-backed Dollar on the Rise Across USA

Awake-In-3D:

Calls for Gold-backed Dollar on the Rise Across USA

On August 23, 2023 By Awake-In-3D

Our GCR, as an alternative currency system, is gaining public awareness.

Amidst mounting concerns over inflation and the waning influence of the U.S. dollar in international trade, lawmakers on both the federal and state levels are championing gold and precious metals as a remedy.

With growing discussions about the potential loss of the dollar’s status as the global reserve currency, proponents of a gold-backed U.S. dollar are making a compelling case for returning to the economic stability of the past.

Awake-In-3D:

Calls for Gold-backed Dollar on the Rise Across USA

On August 23, 2023 By Awake-In-3D

Our GCR, as an alternative currency system, is gaining public awareness.

Amidst mounting concerns over inflation and the waning influence of the U.S. dollar in international trade, lawmakers on both the federal and state levels are championing gold and precious metals as a remedy.

With growing discussions about the potential loss of the dollar’s status as the global reserve currency, proponents of a gold-backed U.S. dollar are making a compelling case for returning to the economic stability of the past.

Key Takeaways from this Article

Amount of new debt added under the current administration: $5 trillion.

Growing concerns over escalating debt, inflation, and global efforts to displace the dollar.

Fitch’s downgrade of U.S. debt and declining purchasing power underscore need for monetary reform. A weakening U.S. dollar prompt discussions on returning to a gold-backed dollar.

Lawmakers advocate for gold and precious metals to stabilize the economy and protect U.S. interests. The Gold Standard Restoration Act (H.R. 2435) proposes redefining the dollar with fixed gold weight, exchanging paper currency for gold.

Texas Gold Depository promotes intrastate gold trade for economic stability. Increasing states recognize gold and silver as legal tender, facilitating trade and eliminating barriers.

Non-Western central banks buying gold in record quantities.

China and other nations challenge dollar’s dominance, prompting reconsideration of precious metals’ role.

The call for a return to the gold standard is gaining traction through diverse initiatives, ranging from congressional bills advocating for the dollar’s connection to gold to state-level efforts facilitating the use of precious metals in commerce. The implications are far-reaching, and even private-sector players are advocating for a return to the gold standard as protection against looming economic crises.

Lawmakers at both state and federal levels underscored the urgency of reestablishing gold as a foundation for the U.S. dollar. U.S. Rep. Alex Mooney’s (R-W.Va.) Gold Standard Restoration Act (H.R. 2435) is a notable example, proposing a redefinition of the dollar based on a fixed gold weight and mandating the exchange of paper currency for gold. Mooney argues that the U.S.’s staggering $32 trillion debt and unrestrained spending necessitate a return to a tangible standard.

While the path forward remains uncertain, the growing momentum behind the call for a gold-backed dollar is hard to ignore.

Mr. Mooney emphasized, “Returning to the gold standard would bolster domestic and international confidence in the U.S. dollar because its value would be tied to something of actual worth, not just the ‘full faith and credit’ of the U.S. government.” He added that this move would preserve the dollar’s global reserve status.

Texas Representative Mark Dorazio, a Republican, is advocating for intrastate trade in gold through the Texas Gold Depository. Dorazio contends that history’s endurance of gold’s value over millennia positions it as a reliable standard. He stated, “It is the go-to in economic crisis and instability—everyone knows you go to gold.” Dorazio’s proposal not only offers economic stability but also presents an opportunity for the state to generate revenue.

Ron Paul, a prominent advocate for the gold standard and sound money, concurs. Paul highlights the stability and inherent value of gold, which digital currencies lack. He asserts, “Gold and silver became money spontaneously thousands of years ago, and metals have worked well.” Paul’s perspective aligns with a growing number of states that are legally recognizing gold and silver as tender, facilitating trade by eliminating sales taxes and other obstacles.

As the U.S. faces escalating debt, inflation, and global efforts to replace the dollar, interest in precious metals is surging. Fitch’s recent downgrade of U.S. debt and the erosion of purchasing power worldwide underscore the urgency for monetary reform. With China and other countries actively challenging the dollar’s dominance, the return to a gold-backed dollar emerges as a potential solution.

Economists point out that for thousands of years, gold and precious metals have served as reliable mediums of exchange due to their durability, portability, scarcity, and intrinsic value. Until 1971, the U.S. dollar was officially backed by gold. However, policy shifts over the years led to the dollar’s detachment from gold. Now, lawmakers are acknowledging the critical need for a stable foundation in the face of economic and monetary turmoil.

Efforts to return to the gold standard are fueled by concerns over the dollar’s stability, the loss of trust in the government, and the potential displacement of the dollar in international trade. The urgency of legislation like the Gold Standard Restoration Act highlights the catastrophic effects of severing the dollar’s link to gold, including extreme spending and inflation.

Mr. Mooney underscores that restoring the gold standard is not merely an economic necessity but also a safeguard against geopolitical challenges. He emphasizes the vulnerability of the dollar to international competition due to its unstable value resulting from borrowing and money printing.

While the path forward remains uncertain, the growing momentum behind the call for a gold-backed dollar is hard to ignore. As experts and lawmakers reevaluate the role of precious metals in securing economic stability, the idea of returning to a gold standard gains traction as a safeguard against inflation, economic instability, and the potential loss of the dollar’s global reserve status.

Supporting Article: Epoch Times – Efforts to Protect US Intensify Amid Global Shift From Dollar

You might also like:

Florida, Indiana Ban CBDCs: Gold As Money A State’s Right

Florida and Indiana have introduced a ban on the use of central bank digital currency (CBDC) as a form of money within their respective states. The legislation explicitly excludes CBDCs from the definition of money, aiming to protect consumers and businesses from what some perceive as a potential threat to economic freedom and security.

The Importance of the Gold Standard in Economic Freedom

The gold standard plays a crucial role in economic freedom and stability. It serves as a reliable medium of exchange, store of value, and protector of property rights. The abandonment of the gold standard allows for excessive deficit spending and wealth confiscation.

Texas Takes the Lead: A Golden Future for Sovereign Digital Currency

Could Texas (not Reno) be the actual location of the New Republic Sovereign US Treasury? Texas, the Lone Star State, is poised to revolutionize the world of finance with its groundbreaking proposal for a state-run digital currency.

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/calls-for-gold-backed-dollar-on-the-rise-across-usa/

Awake-In-3D: BRICS Summit – No Gold-backed Currency Will Be Announced

Awake-In-3D:

BRICS Summit – No Gold-backed Currency Will Be Announced

On August 22, 2023 By Awake-In-3D

BRICS is certainly exploring an asset/gold-backed common currency monetary system to divorce it’s allied members from US Dollar and fiat currency dependency.

However, all of the prognosticators claiming that BRICS will “announce” a new common currency this week will be severely disappointed.

The truth is, the BRICS Alliance is far from ready to execute such a bold plan. The most we can hope for is that several new member nations will be accepted into BRICS+ block. They will potentially announce an expanded intent to conduct cross-border trade in their local currencies as well.

Awake-In-3D:

BRICS Summit – No Gold-backed Currency Will Be Announced

On August 22, 2023 By Awake-In-3D

BRICS is certainly exploring an asset/gold-backed common currency monetary system to divorce it’s allied members from US Dollar and fiat currency dependency.

However, all of the prognosticators claiming that BRICS will “announce” a new common currency this week will be severely disappointed.

The truth is, the BRICS Alliance is far from ready to execute such a bold plan. The most we can hope for is that several new member nations will be accepted into BRICS+ block. They will potentially announce an expanded intent to conduct cross-border trade in their local currencies as well.

What will be significant is the inclusion of Saudi Arabia, Venezuela and Iran into the BRICS+ block. This would tip the scales in favor of BRICS regarding control of the majority of global natural resources.

The distribution of global natural resources has long played a pivotal role in shaping geopolitical dynamics and economic influence on the world stage. Historically, key Western nations have held significant sway over the availability and control of crucial resources. However, a potential shift in this balance is on the horizon, driven by the prospects of new entrants joining the BRICS alliance. This article explores how the inclusion of “potential BRICS nations” – Saudi Arabia, Venezuela, and Iran – into the BRICS alliance could lead to a notable redistribution of global natural resource power.

The BRICS Alliance: A Natural Resource Powerhouse

The BRICS alliance, comprising Brazil, Russia, India, China, and South Africa, has emerged as a formidable economic and geopolitical force. With their combined economic strength, population, and resource endowments, BRICS nations have already disrupted the established global order. Russia, for instance, holds the world’s largest proven natural gas reserves and significant reserves of gold and oil. China dominates in rare earth metals and coal reserves, while Brazil boasts substantial reserves of iron, gold, and hydroelectric power potential.

Potential BRICS+ Nations

As of today, Saudi Arabia, Venezuela, and Iran stand as potential BRICS alliance members holding vast natural resource endowments. Saudi Arabia is a leading exporter of oil and holds significant reserves of copper, silver, and sulfur. Venezuela, despite its economic challenges, possesses vast oil reserves and valuable resources like iron ore and natural gas. Iran, another resource-rich nation, ranks as a key player in global crude oil and natural gas production, while also holding reserves of copper, zinc, and sulfur.

Significant Global Resource Redistribution

The inclusion of Saudi Arabia, Venezuela, and Iran into the BRICS alliance could drastically alter the balance of global natural resource distribution. Currently, key Western nations such as the United States, Canada, and Australia hold substantial reserves of resources like coal, oil, natural gas, gold, and uranium. However, the potential BRICS nations collectively possess a staggering estimated value of $76 trillion in natural resources. This influx of resource-rich nations could reshape the global resource landscape.

Implications for Geopolitics and Economy

The shift of resource power from Western nations to the BRICS alliance would not only influence geopolitical dynamics but also impact global economic strategies. The increased resource clout of the BRICS alliance could strengthen their bargaining position in international trade negotiations, bolstering their economic independence and influence. Additionally, the alignment of resource-rich nations could potentially reduce their reliance on traditional Western markets and currencies, fostering new economic alliances and trade partnerships.

The global balance of natural resources is poised for a seismic shift as potential BRICS nations eye membership in the alliance. The inclusion of Saudi Arabia, Venezuela, and Iran as potential BRICS alliance members has the potential to significantly reshape the balance of global natural resource power.

Reference Data (from 2021 statistics): The Top-10 Nations with the highest value in natural resources

Top 10 Nations (not currently BRICS members) Natural Resources

United States:

Estimated Value of Natural Resources: $45 trillion

Resources: Timber, coal, copper, gold, oil, natural gas, lead, molybdenum, phosphates, rare earth elements, uranium, bauxite, iron, mercury, nickel, potash, silver, tungsten, zinc, petroleum, arable land

Saudi Arabia:

Estimated Value of Natural Resources: $34.4 trillion

Resources: Oil, copper, feldspar, phosphate, silver, sulfur, tungsten, zinc

Canada:

Estimated Value of Natural Resources: $33.2 trillion

Resources: Oil, industrial minerals (gypsum, limestone, rock salt, potash), energy minerals (coal, uranium), copper, lead, nickel, zinc, gold, platinum, silver, natural gas

Australia:

Estimated Value of Natural Resources: $19.9 trillion

Resources: Coal, timber, copper, iron ore, gold, uranium, oil, natural gas, alumina, nickel, rare earth elements, mineral sands, lead, zinc, diamonds

Iran:

Estimated Value of Natural Resources: $27.3 trillion

Resources: Crude oil, natural gas, coal, chromium, copper, iron ore, lead, manganese, zinc, sulfur, arable land

Iraq:

Estimated Value of Natural Resources: $15.9 trillion

Resources: Petroleum, natural gas, phosphates, sulfur

Venezuela:

Estimated Value of Natural Resources: $14.3 trillion

Resources: Iron, natural gas, oil, iron ore, gold, bauxite, hydropower, diamonds

Top-10 Nations (Currently BRICS Members) Natural Resources

Russia:

Estimated Value of Natural Resources: $75 trillion

Resources: Coal, oil, natural gas, gold, timber, rare earth metals, industrial diamonds

China:

Estimated Value of Natural Resources: $23 trillion

Resources: Coal, rare earth metals, timber, arable land, rice, oil, natural gas, metals (gold, aluminum), minerals

Brazil:

Estimated Value of Natural Resources: $21.8 trillion

Resources: Gold, iron, oil, uranium, bauxite, platinum, copper, tin, timber, hydroelectric power

Summary of BRICS Nation Resources Value (2021)

Russia: $75 trillion

China: $23 trillion

Brazil: $21.8 trillion

Total for BRICS Nations: $119.8 trillion

Summary of Potential New BRICS Member Natural Resources Value

Saudi Arabia: $34.4 trillion

Venezuela: $14.3 trillion

Iran: $27.3 trillion

Total for Potential BRICS+ Nations: $76 trillion

Non-BRICS Nations Resources:

United States: $45 trillion

Canada: $33.2 trillion

Australia: $19.9 trillion

Total for Developed Nations: $98.1 trillion

Top-10 Natural Resource Nation: What About IRAQ?

Iraq: $15.9 trillion

THE ORPHAN CHILD caught in the crosshairs between the West and BRICS…

Bottom Line

If Saudi Arabia, Venezuela and Iran are granted membership in the BRICS Alliance, 7 out of the Top-10 nations would represent a BRICS control of over $195 Trillion in global natural resources compared to the Western Top-10 nations only controlling $98 Trillion in natural resources.

A global game-changer indeed…

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/brics-summit-no-gold-backed-currency-will-be-announced/