Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Sunday Afternoon 12-08-24

Good Afternoon Dinar Recaps,

BRICS NEWS: THE US DOLLAR’S CLOUT IS DECREASING GLOBALLY, SAYS BRICS

BRICS member Russia has commented on the recent 100% tariff threats issued by President-elect Donald Trump for cutting ties with the US dollar. Russian President Vladimir Putin spoke about the threats by poking fun at the American economy and its dwindling power. The clout that the US carried a few decades ago is no longer in existence as developing countries have come far ahead in steering their economy to prosperity.

While their economy is becoming prosperous, BRICS is focusing on boosting their local currency and not the US dollar. The bloc is determined to use local currencies first and keep the US dollar in the backseat of the global economy.

Good Afternoon Dinar Recaps,

BRICS NEWS: THE US DOLLAR’S CLOUT IS DECREASING GLOBALLY, SAYS BRICS

BRICS member Russia has commented on the recent 100% tariff threats issued by President-elect Donald Trump for cutting ties with the US dollar. Russian President Vladimir Putin spoke about the threats by poking fun at the American economy and its dwindling power. The clout that the US carried a few decades ago is no longer in existence as developing countries have come far ahead in steering their economy to prosperity.

While their economy is becoming prosperous, BRICS is focusing on boosting their local currency and not the US dollar. The bloc is determined to use local currencies first and keep the US dollar in the backseat of the global economy.

BRICS: The U.S. Dollar’s Global Influence Is Decreasing

BRICS leader and Russian President Putin explained that after Trump’s presidency, American leaders have done a great deal to undermine the US dollar. The sanctions and weaponization of the USD led to emerging economies ganging up against the White House. “The US dollar’s clout is decreasing globally,” said Putin.

He also said that America’s share in the global economy is shrinking while BRICS is rising. “Given that the US share in the global economy is shrinking, the dollar’s influence on global economic processes is also falling. And as this happens, new tools come to the fore,” he said.

“It’s been four years since the [US] President-elect was in the White House. During this time, the economy has undergone many changes, both globally and in America.

His successors, his political opponents, have done a great deal to undermine the fundamental role of the dollar as a global reserve currency,” Putin summed it up. It now needs to be seen how BRICS will counter Trump’s threat of reducing dependency on the US dollar.

@ Newshounds News™

Source: Watcher Guru\

~~~~~~~~~

YOU WON'T BELIEVE HOW EASY IT IS TO SPREAD CHRISTMAS JOY! | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Bits and Pieces” in Dinarland Sunday Afternoon 12-8-2024

KTFA:

Clare: The House of Representatives postpones its session

12/8/2024

The House of Representatives decided to postpone today's session, Sunday, due to the lack of quorum.

The media department of the council said in a statement received by {Euphrates News} a copy of it, that: "The House of Representatives postponed its session due

to the lack of a legal quorum." LINK

KTFA:

Clare: The House of Representatives postpones its session

12/8/2024

The House of Representatives decided to postpone today's session, Sunday, due to the lack of quorum.

The media department of the council said in a statement received by {Euphrates News} a copy of it, that: "The House of Representatives postponed its session due

to the lack of a legal quorum." LINK

************

Clare: Most notably Trump and Macron.. Nechirvan Barzani meets world leaders in Paris (photos)

12/8/2024

The President of the Kurdistan Region, Nechirvan Barzani, met with leaders and heads of state on the sidelines of participating in the reopening ceremony of "Notre Dame Cathedral" in the French capital, Paris.

According to the photos published by the presidency of the region, the most prominent leaders and chiefs that President Nechirvan Barzani met with are: French President Emmanuel Macron, US President-elect Donald Trump, and American billionaire and businessman Elon Musk.

An official reception ceremony was held in Paris for President Nechirvan Barzani, via an official procession carrying the flag and name of Kurdistan.

In response to an official invitation from French President Emmanuel Macron, Nechirvan Barzani, President of the Kurdistan Region, participated yesterday evening, Saturday, along with a number of world leaders and presidents, in the reopening ceremony of the historic Notre Dame Cathedral in Paris. LINK

************

Clare: Central Bank Governor receives representatives of the Innovation Center at the Dubai International Financial Center

December 08, 2024

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, held a meeting in Baghdad with representatives of the Innovation Center at the Dubai International Financial Center, during which they discussed ways of cooperation in the areas of promoting innovation and entrepreneurship, adopting financial technology, artificial intelligence and advanced infrastructure.

The meeting also reviewed opportunities to support innovation in banking systems and electronic payment solutions, and providing opportunities for emerging companies in these fields to enter Iraqi, regional and global markets.

The meeting addressed the development of training programs to build Iraqi capacities to keep pace with global developments, enhance regulatory cooperation and adopt the best standards in the fields of financial technology and banking technology. The two parties also discussed strengthening partnerships between the financial and banking sector, emerging companies and investors, in addition to interacting with universities and various institutions to support the next generation of Iraqi entrepreneurs.

They expressed their commitment to developing partnerships that contribute to achieving the vision of the Central Bank of Iraq in building a digital economic system and a comprehensive financial system based on technology and innovation.

Central Bank of Iraq

Media Office

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Texas Chase Bank Story] This is a bank story at the next level. It's no longer a scam. It's no longer they don't want to talk to you. It's, we want to talk to you as quickly as possible. MR. DON: Mid-summer...I had a small and seldomly active account...I brought up the subject of the dinar and the fact that I thought it was going to be a significant increase in value...She said, I've heard some chatter about that and I've had a number of customs come in and inquire. I'm not sure what's going on...I asked her, any event that occurs do you expect you would be involved in exchanging? [Post 1 of 2]

Frank26 [Bank Story Continued] She said, well that's what we do. As soon as it appears on my screen we will exchange. That was a couple months ago. This past weekend...my wife got a message on her phone. It was from the assistant manager. She said she wanted us to, 'Get in here and get you an appointment with the wealth manager in preparation for what's coming down the pipe.' FRANK: We're now at the point where it's no longer, 'It's a scam'. That nonsense is over...When are you going to have this meeting? MR. DON: We'll probably schedule for this upcoming week... [Post 2 of 2]

************

BANKRUPT: U.S. Debt Hits Critical Levels as Your Future Is Sold Off

Taylor Kenny: 12-8-2024

he U.S. national debt has skyrocketed to $36 trillion, with $1 trillion added in just 115 days. What does this mean for the next financial crisis? As government spending spirals out of control, the ability to respond to crises diminishes, leaving Americans vulnerable.

In this video, Taylor Kenney dives deep into the growing dangers of national debt, hyperinflation risks, and how to protect yourself with physical gold and silver.

CHAPTERS:

00:00 What $36 Trillion in Debt Means for the U.S.

00:46 Why the Media Avoids the Truth About Debt

02:31 The Illusion of Economic Stability

03:44 The U.S. Debt Crisis: Two Possible Outcomes

04:53 Real-World Consequences for Americans

06:02 How Overspending Affects the Next Generation

07:12 The Risk of a Currency Reset or CBDCs

08:27 Preparing Your Wealth Outside the System

US Admits Collapse of the Dollar as BRICS Introduce New Finance

US Admits Collapse of the Dollar as BRICS Introduce New Finance

Geopolitical Analyst: 12-8-2024

In recent years, the landscape of international finance has been undergoing significant transformation, moving away from traditional systems and exploring innovative alternatives. One of the most groundbreaking initiatives emerging from this shift is BRICS Pay, a payment platform that operates on a decentralized star topology, leveraging dispersed networks to communicate payment information and liquidity.

This novel approach not only enhances the speed and efficiency of payments but also fortifies financial resilience against unilateral actions that can disrupt global economic stability.

US Admits Collapse of the Dollar as BRICS Introduce New Finance

Geopolitical Analyst: 12-8-2024

In recent years, the landscape of international finance has been undergoing significant transformation, moving away from traditional systems and exploring innovative alternatives. One of the most groundbreaking initiatives emerging from this shift is BRICS Pay, a payment platform that operates on a decentralized star topology, leveraging dispersed networks to communicate payment information and liquidity.

This novel approach not only enhances the speed and efficiency of payments but also fortifies financial resilience against unilateral actions that can disrupt global economic stability.

BRICS Pay stands out as a promising alternative to SWIFT, seeking to mitigate potential sanctions and currency volatility that have increasingly characterized the global financial arena. By adopting a decentralized framework, BRICS Pay offers rapid deployment and scalability, making it a highly adaptive solution for the member countries of the BRICS alliance—Brazil, Russia, India, China, and South Africa. The increased focus on inclusivity and transparency aims to foster deeper economic collaboration among BRICS nations and their global partners, ultimately enhancing collective economic power in an increasingly multipolar world.

As of the second quarter of 2024, BRICS countries had significantly bolstered their gold reserves, now totaling approximately 6,200 tons, which accounts for 21.4% of the world’s total reserves. This strategic buildup reflects a broader tendency among countries to diversify from the US dollar and safeguard their economies against external shocks and sanctions.

Russia leads the pack with 2,340 tons (8.1% of global reserves), followed closely by China at 2,260 tons (7.8%). Brazil’s gold reserves have increased nearly threefold, showcasing a successful initiative to strengthen financial defenses in the face of growing global uncertainty.

Nations are increasingly turning away from their dependence on the US dollar in international trade and finance—a process known as de-dollarization. This paradigm shift is driven by various factors, including the desire for economic autonomy, stability, and resilience against US economic sanctions. The dominance of the dollar in global transactions often subjects countries to the vagaries of US monetary policy, which can lead to significant economic instability.

By diversifying their reserves, central banks aim to dispel risk linked to US financial systems and foster greater monetary independence.

Key players like China and Russia are taking significant strides to undermine US economic control by enhancing the use of their respective currencies in international commerce. These nations are establishing regional trade agreements that facilitate local currency transactions, thereby reducing reliance on the dollar.

For instance, a recent agreement between China and Brazil allows for trade in their own currencies, simplifying transactions and minimizing conversion costs.

The movement towards a decentralized payment system and the accumulation of gold reserves are emblematic of the BRICS nations’ commitment to creating a more robust and independent financial architecture. This strategic direction aims not only to cushion the economies of member nations from external pressures but also to pave the way for a multipolar global financial system.

As emerging economies gain traction on the world stage, leveraging their own currencies to bolster financial sovereignty represents a significant shift in international trade dynamics. The rise of BRICS Pay, coupled with nations’ efforts to diversify away from the US dollar, demonstrates a collective resolve to reshape global economic relations and challenge the historical dominance of Western financial institutions.

The introduction of BRICS Pay and the strategic increase in gold reserves signal a pivotal moment in the evolution of global finance. By championing decentralized systems and reducing reliance on the dollar, BRICS nations are taking measured steps towards economic independence, stability, and security.

The aim is clear: to strengthen financial autonomy against geopolitical risks while promoting an inclusive framework conducive to collaboration among emerging markets. As the world moves forward, the success of these initiatives will be closely watched as a potential blueprint for future economic cooperation and resilience on the global stage.

Watch the video below from Geopolitical Analyst for more information.

Iraq Economic News and Points to Ponder Sunday AM 12-8-24

For The Second Week In A Row, Oil Prices Record A Decline Amid Abundant Supplies

Energy Economy | 07/12/2024 Mawazine News – Baghdad The US dollar exchange rates witnessed a rise today, Saturday, in the markets of the capital Baghdad and Erbil, the capital of the Kurdistan Region, with the closure of the country's main stock exchange.

The dollar prices rose with the closing of the Al-Kifah and Al-Harithiya stock exchanges to record 151,250 dinars per 100 dollars, while this morning it recorded 151,000 dinars per 100 dollars.

For The Second Week In A Row, Oil Prices Record A Decline Amid Abundant Supplies

Energy Economy | 07/12/2024 Mawazine News – Baghdad The US dollar exchange rates witnessed a rise today, Saturday, in the markets of the capital Baghdad and Erbil, the capital of the Kurdistan Region, with the closure of the country's main stock exchange.

The dollar prices rose with the closing of the Al-Kifah and Al-Harithiya stock exchanges to record 151,250 dinars per 100 dollars, while this morning it recorded 151,000 dinars per 100 dollars.

}lAs for the selling prices in the field of exchange in the local markets in Baghdad, they rose, as the selling price reached 152,250 dinars per 100 dollars, while the purchase price reached 150,250 dinars per 100 dollars.

In Erbil, the dollar also recorded a rise, as the selling price reached 151,100 dinars per 100 dollars, while the purchase price reached 151,000 dinars per 100 dollars. https://www.mawazin.net/Details.aspx?jimare=257215

For The Second Week In A Row, Oil Prices Record A Decline Amid Abundant Supplies

Energy sw23Economy News - Follow-up Oil prices fell more than 1% on Friday, extending their weekly losses as analysts forecast a supply surplus next year due to weak demand despite OPEC+'s decision to delay production increases and extend deep production cuts until the end of 2026.

Brent crude futures fell 97 cents, or 1.4%, to $71.12 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell $1.10, or 1.6%, to $67.20 a barrel.

Over the course of the week, Brent lost more than 2.5% and WTI fell 1.2%, with prices continuing to decline for the second week in a row.

Prices also fell as the number of oil and gas rigs operating in the United States rose this week, indicating higher production from the world's largest crude oil producer.

OPEC+ on Thursday postponed the start of increasing oil production by three months until April 2025, and extended the period until all cuts are removed by a year to the end of 2026.

The alliance,-` which pumps about half of the world's crude oil production, had planned to start reducing production cuts since October 2020, but slowing global demand, especially in China, and rising production from outside the group, in addition to other factors, prompted the alliance to postpone those plans more than once.

Brent crude traded in a narrow range of $70 to $75 a barrel last month, amid assessments of signs of weak demand in China and rising geopolitical risks in the Middle East.162 views 12/07/2024 - https://economy-news.net/content.php?id=50612

Central Bank Sells More Than $1 Billion In 5 Days

Saturday 07 December 2024 14:49 | Economic Number of readings: 164 Baghdad/ NINA / The total sales of the hard currency of the dollar during the days in which the auction was opened last week exceeded one billion dollars.

The Central Bank sold during the past week and for the 5 days in which the auction was opened one billion and 441 million and 783 thousand and 807 dollars, at a daily average of 288 million and 356 million and 761 dollars, higher than the previous week, which amounted to one billion and 434 million and 982 thousand and 505 dollars.

The highest sales of the dollar were the day before yesterday, Thursday, when sales amounted to 295 million and 719 thousand and 844 dollars, while the lowest sales were on Monday, when sales amounted to 279 million and 257 thousand and 935 dollars.

Foreign remittance sales during the past week amounted to 1 billion, 382 million, 383 thousand, and 807 dollars, an increase of 96% compared to cash sales, which amounted to 59 million, 400 thousand dollars. / https://ninanews.com/Website/News/Details?key=1173330

Financial Supervision Calls For Building Strong And Effective Partnerships Between The Private Sector And Civil Society

Money and business Economy News – Baghdad The Supervision and Inspection Department of the Securities Commission called on Saturday for building strong and effective partnerships between the private sector and civil society. While indicating that volunteer work is an effective tool for enhancing community spirit and developing youth skills, it stressed the endeavor to enhance the partnership between the private sector and promising youth volunteer initiatives.

“Choosing this conference as a platform for cooperation and coordination reflects our deep awareness of the vital role that young people, especially school students, can play in building a brighter future for our beloved country,” said Amir Sabah, Director of Supervision and Inspection at the Securities Commission, during the first coordination conference of the Securities Commission and the School Student Volunteer Team, as followed by “Al-Eqtisad News.”

He added, "Volunteer work is an effective tool to enhance community spirit and develop leadership skills among young people. It is at the heart of our interests. Through this conference, we seek to enhance the partnership between the private sector and these promising volunteer initiatives, in the belief that investing in these young energies is not only a social duty, but a long-term investment in the future of Iraq."

He added, "The role of private companies in this context is not limited to financial support only, but extends to providing expertise and guidance, and opening horizons for these young people to innovate and create," calling on all companies and institutions to "be part of these initiatives, and contribute to achieving their noble goals."

Sabah praised the "exceptional efforts made by the school student volunteer team," noting that they "proved - through their dedication and creativity - that Iraqi youth are capable of giving and inspiring, whenever given the opportunity," calling on everyone to "seize this opportunity to build strong and effective partnerships between the private sector and civil society, in a way that serves the interests of our beloved country."Views 61 12/07/2024 - https://economy-news.net/content.php?id=50630

UNAMI Representative To Security Council: Iraqi Government Has Succeeded In Keeping Iraq Out Of Conflict

2024/12/06 {Politics: Al Furat News} The UN Secretary-General's Representative in Iraq, Mohammed Al Hassan, confirmed during his speech before the UN Security Council that "the Iraqi government succeeded in keeping Iraq away from the conflict," praising its role in enhancing internal stability.

Al-Hassan added that "Iraq, the country of civilizations, is able to overcome crises towards a more stable and bright future," noting the government's success in conducting the population census, saying: "Iraq succeeded in conducting the population census, which is an important process that was followed up with Prime Minister Mohammed Shia al-Sudani."

He pointed to the Iraqi government's efforts to develop the infrastructure, explaining that "Prime Minister Mohammed Shia al-Sudani worked to invest in multiple projects to develop bridges, schools and transportation networks." LINK

Rafidain Bank Restructuring Program.. Justifications And Requirements

Dr. Haitham Hamid Mutlaq Al Mansour

After the Prime Minister stressed during his meeting with representatives of Ernst & Young the importance of developing the work of the government banking sector to enhance the confidence of citizens and local and foreign investors in the government banking sector in particular and the economy in general, the restructuring of Rafidain Bank is the first step towards economic reforms in the banking sector towards restructuring Iraqi government banks such as Rashid, Agricultural and Industrial, in an effort to make them play a financial role that stimulates growth and stability.

Rafidain Bank has witnessed accumulated internal problems inherited from the previous regime and subsequent governments after the change, manifested around banking, credit and administrative policies that have undermined the bank’s credit capacity and limited its banking stability and operational and financial efficiency, as Rafidain Bank still suffers from many fundamental problems at the core of banking work, namely:

The balance sheet of Rafidain Bank suffers from debts owed by it as a result of issuing letters of guarantee and confirming credits in favor of government departments and companies, which, along with the accumulated interest, have exceeded their natural limits.

The bank's credit rating has decreased.

Limited ability to keep up with developments in the banking industry.

The decline in the bank’s ability to meet its obligations according to profitability indicators, capital adequacy indicators, the ratio of equity to total assets and the ratio of equity to total deposits, which indicates the weakness of the bank’s activity in meeting its credit obligations.

Rigidity of banking legislation and failure to build policies for developing banking services through advanced banking technologies.

Hence, it is expected that the restructuring will improve its performance in a way that will rehabilitate it to be able to increase its efficiency in managing its balance sheet and improve its ability to achieve profitability indicators, capital adequacy and resource employment indicators.

By redesigning the bank's organizational structure, creating new departments and merging existing ones with new ones, the bank's tools and objectives can be developed with the aim of improving the performance of the bank's structure in the infrastructure of organization and supervision, solvency and liquidity rules, its lending policy and formulating its relations with other banks on the one hand and government units and others on the other hand.

Therefore, it is possible, on a theoretical level, after the restructuring process, that the bank’s performance will improve and its productivity will increase in the short and long term, and its financial and operational efficiency will be raised, as the cost of banking operations will be reduced and the process of participation in decision-making will move towards what is consistent with banking decentralization. It is expected that the new structure will aim to avoid credit bankruptcy by limiting the accumulation of ineffective balances and avoiding a credit crisis.

But in reality, we see that the restructuring process faces several challenges, the most important of which are the difficulty of attracting and attracting the required sufficient capital, low savings rates, weak capital market, high cost of modern technology and developing related systems, and high cost of training employees in the banking sector.

Therefore, the restructuring program should aim to secure two strategic requirements:

The first requirement: It revolves around the goal of restructuring the operating side with the aim of achieving its financial stability. The goal of restructuring the financial side in a way that restores the bank’s ability to comply with the minimum capital adequacy and other hedging requirements.

The second requirement: It includes two objectives. The first is concerned with restructuring the bank according to an accurate and clear plan for the short, medium and long term in the institutional and operational aspects, in a way that ensures the bank’s harmony with market conditions and customer service and in accordance with the hedging requirements contained in the Banking Law and the Central Bank of Iraq Law, and the requirements of compliance and competition.

As for the second, it is concerned with amending the laws, regulations and instructions that regulate the work of Iraqi banks in a way that qualifies them to work in light of modern banking standards and indicators to keep pace with market requirements and enhance the prospects and requirements of growth and stability in a way that serves the banking reform process 12/07/2024 - https://economy-news.net/content.php?id=50614

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Sunday Morning 12-08-24

Good Morning Dinar Recaps,

COINBASE REVEALS LETTERS WHICH EXPOSES FDIC’S ROLE IN OPERATION CHOKEPOINT 2.0

Coinbase reveals FDIC "pause letters", showing efforts to restrict crypto banking services. Documents support Operation Chokepoint 2.0 claims.

▪️Coinbase obtained FDIC "pause letters" revealing efforts to limit banking access for crypto firms in 2022 through FOIA requests.

Good Morning Dinar Recaps,

COINBASE REVEALS LETTERS WHICH EXPOSES FDIC’S ROLE IN OPERATION CHOKEPOINT 2.0

Coinbase reveals FDIC "pause letters", showing efforts to restrict crypto banking services. Documents support Operation Chokepoint 2.0 claims.

▪️Coinbase obtained FDIC "pause letters" revealing efforts to limit banking access for crypto firms in 2022 through FOIA requests.

▪️FDIC's communications showed deliberate delays and questions aimed at halting crypto-related banking activities, fueling "Operation Chokepoint 2.0."

▪️Crypto industry leaders argue government actions restrict legal crypto businesses' access to banking services.

Coinbase, one of the largest crypto exchanges in the U.S., has made public a series of documents that point to the Federal Deposit Insurance Corporation’s (FDIC) involvement in restricting banking access for crypto companies.

The letters, obtained through a Freedom of Information Act (FOIA) request, suggest that in 2022, the FDIC instructed banks to halt or limit services to crypto businesses.

The exchange’s legal team asserts that these documents provide evidence of a concerted effort by federal agencies to suppress the crypto industry.

Coinbase Exposes FDIC’s ‘Pause Letters’, Proving Role in Crypto Banking Restrictions

Coinbase recently revealed a set of “pause letters” sent by the FDIC to financial institutions in 2022. These letters requested that banks temporarily halt crypto-related activities until further review of compliance and risk factors.

The documents, uncovered through legal action by the exchange, shed light on the FDIC’s efforts to limit the banking services available to crypto businesses.

The “pause letters” explicitly instructed banks to pause any crypto asset-related activities. This signals a proactive stance by regulators to discourage financial institutions from engaging with cryptocurrency industry.

Paul Grewal, Coinbase CLO commented,

“The letters that show Operation Chokepoint 2.0 wasn’t just some crypto conspiracy theory. FDIC is still hiding behind way overbroad redactions. And they still haven’t produced more than a fraction of them.”

Last month, Coinbase CLO Paul Grewal revealed that the FDIC has been actively working to restrict banks from offering crypto services.

Operation Chokepoint 2.0 Allegations and Its Impact on Crypto Firms

The documents made public by Coinbase have rekindled the debate around “Operation Chokepoint 2.0,” a term coined by critics to describe alleged government efforts to stifle the crypto industry. According to the exchange legal team, these letters provide concrete evidence of a coordinated strategy by the FDIC to limit crypto firms.

Crypto executives have long complained about the difficulties of securing banking relationships due to regulatory uncertainty. The letters confirm that federal agencies have been using informal measures to suppress the industry.

However, in recent reports, US Rep. French Hill has vowed to investigate Operation Chokepoint 2.0, which he argues targets industries like crypto through politicized debanking. He has called for transparency in financial oversight and stronger protections for businesses facing unfair regulatory practices.

According to reports, Banks were asked to submit detailed analyses, including risk assessments and income projections, before moving forward with offering crypto services. This level of scrutiny and the subsequent delays were a tactic to stop financial institutions from entering relationships with the crypto sector.

Coinbase has vowed to continue pursuing transparency, despite heavy redactions in the documents released by the FDIC. As Coinbase legal chief Paul Grewal stated, further disclosure will provide additional clarity on the extent of the regulatory actions taken against the industry.

Similarly, John Deaton recently called for the incoming US government to hold accountable those responsible for debanking crypto firms.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

BRICS NEWS: SOUTH AFRICA SAYS BRICS HAS NO PLANS TO CREATE NEW CURRENCY AFTER TRUMP ISSUES WARNING AGAINST DEDOLLARIZATION: REPORT

Reports on a new BRICS currency designed to compete against the US dollar are fundamentally false, according to leaders in South Africa.

In a statement, South Africa’s Department of International Relations and Cooperation (DIRCO) says BRICS is not working on a currency that could be used as an alternative to USD, reports Bloomberg.

According to DIRCO, reports have misinterpreted the intentions of the economic bloc about trade settlements between member nations.

“Recent misreporting has led to the incorrect narrative that BRICS is planning to create a new currency. This is not the case. The discussions within BRICS focus on trading among member countries using their own national currencies.”

In May of last year, reports emerged that BRICS was working on a new currency backed by gold and potentially additional precious metals and assets in a push to abandon the US dollar.

Despite those reports, South Africa is now saying that BRICS has no intention of promoting de-dollarization efforts.

“South Africa supports the increased use of national currencies in international trade and financial transactions to mitigate the impact of foreign exchange fluctuations, rather than focusing on dedollarization. The strengthening of correspondent banking networks and the development of infrastructure for settlements in national currencies could further this aim.”

South Africa’s statements come as President-elect Donald Trump issued an ultimatum against BRICS. Trump says on the social media platform Truth Social that he plans to take severe measures if BRICS creates or backs a dollar alternative.

“The idea that the BRICS Countries are trying to move away from the dollar while we stand by and watch is OVER. We require a commitment from these countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar or, they will face 100% tariffs, and should expect to say goodbye to selling into the wonderful US economy.

They can go find another ‘sucker!’ There is no chance that the BRICS will replace the US dollar in international trade, and any country that tries should wave goodbye to America.”

As a whole, BRICS nations have expressed varying levels of support for a common currency, with leaders in Russia and Brazil firmly behind the idea. South Africa is the most conservative, expressing the need for a cautious approach while emphasizing the importance of the US dollar.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

IMMEDIATE SUPPORT FOR VICTIMS - LISTEN NOW! AUDIO | Youtube

WE ARE ALL VICTIMS OF COMMON LAW CRIMES. Mason explains and gives us a remedy through Victims Support Services.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Sunday AM 12-8-2024

Ariel (@Prolotario1): Are you all Ready? A Legend will be Written

Ariel: Are you all ready?

Do you have your financial & legal teams in place?

Do you have all debts, interest, bills, fees, etc calculated?

Do you all have your foreign currency in accessible places?

Do you have transportation to get to & fro?

Ariel (@Prolotario1): Are you all Ready? A Legend will be Written

Ariel: Are you all ready?

Do you have your financial & legal teams in place?

Do you have all debts, interest, bills, fees, etc calculated?

Do you all have your foreign currency in accessible places?

Do you have transportation to get to & fro?

Because you all are in a turning point for human history that will never happen again.

Many people are waiting for you all to be bamboozled and let down.

Many are waiting for this to fall through the cracks for you and to laugh at your misfortune.

But if you have been studying this investment you know for certain the last laugh will be on this account.

So prepare yourselves. Contact those who you may need to talk to. A legend will be written in the stars. Your legacy will be solidified and you will get to tell people in the future how you came to know about the greatest wealth transfer the world has ever seen.

Tell them Prolotario1 sent you.

Source(s):

https://x.com/Prolotario1/status/1865564070960914798

https://dinarchronicles.com/2024/12/07/ariel-prolotario1-are-you-all-ready-a-legend-will-be-written/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick They're waving the exchange rate right in front of our faces. Everything that they say, do and talk about cannot be at a program rate...The monetary reform is going to get done one way or another...Kurdistan uses the same IQD as Baghdad does...Get along or get left behind...

Frank26 [Iraq boots-on-the-ground report] FIREFLY:

People in the streets are saying Sudani had two years and he is not giving us the purchasing power that he promised us. He made a solemn oath to us and now he's saying not in two weeks, they won't be competed until the early part of 2025. This is unacceptable. FRANK: It's not Sudani that said that. It's this economy idiot and he doesn't represent Sudani.

**************

Andy Schectman Reveals MASSIVE Gold Coverup HAPPENING NOW

CapitalCosm: 12-8-2024

Stock "Wobble" Will PANIC The Fed | Michael Oliver

Liberty and Finance: 12-7-2024

Michael Oliver shares his insights on current market conditions, particularly Bitcoin, the stock market, and precious metals.

He expresses skepticism about Bitcoin's recent surge, suggesting it may be a bubble linked to the NASDAQ, and warns that its momentum may not be sustainable.

Oliver also discusses the strength of the precious metals market, noting that despite recent pullbacks, gold and silver remain stronger than the S&P and NASDAQ year-to-date.

He anticipates that as the stock market weakens, the flow of assets into gold and silver potentially triggering a vertical phase for the metals.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Bitcoin & stock market

5:48 Gold & silver

10:58 Bank stocks

14:55 Move into metals

17:34 Nvidia

20:00 Gold & silver last thoughts

21:17 Momentum Structural Analysis

“Tidbits From TNT” Sunday Morning 12-8-2024

TNT:

Tishwash: Halbousi concludes his visit to Congress and meets with the Foreign Relations Committee

Friday, the head of the Progress Party, Mohammed al-Halbousi, concluded his visit to the US Congress by meeting with Republican Representative and member of the Foreign Relations Committee, Darrell Issa.

The media office of the head of the Progress Party said in a statement received by “Al-Jarida” that “the meeting discussed the strategic partnership between Iraq and the United States of America and ways to develop it in a way that reflects positively on the two friendly peoples and joint cooperation in the fields of energy and gas investment.”

TNT:

Tishwash: Halbousi concludes his visit to Congress and meets with the Foreign Relations Committee

Friday, the head of the Progress Party, Mohammed al-Halbousi, concluded his visit to the US Congress by meeting with Republican Representative and member of the Foreign Relations Committee, Darrell Issa.

The media office of the head of the Progress Party said in a statement received by “Al-Jarida” that “the meeting discussed the strategic partnership between Iraq and the United States of America and ways to develop it in a way that reflects positively on the two friendly peoples and joint cooperation in the fields of energy and gas investment.”

The meeting also discussed the situation in Gaza and Lebanon, efforts to stop the war and put it into practical implementation, as well as the recent developments in Syria and the importance of containing this crisis and affirming the preservation of Syria's security and stability, according to the statement. link

*************

Tishwash: Former Minister Rules Out Trump Imposing Sanctions on Iraqi Oil Production and Marketing

Former Minister of Electricity, Luay Al-Khatib, ruled out US President-elect Trump imposing sanctions on Iraqi oil production and marketing.

Al-Khatib stated in a post on the “X” platform, which was followed by “Jarida”, that “Trump is a man of deals and will use his tools to redraw international relations in a manner consistent with his administration by controlling the movement of the dollar and imposing sanctions and central bank dealings on some institutions, individuals and even regimes that are unfriendly or difficult to deal with with the United States.

He may be stubborn or strict on the issue of granting exceptions to Iraq’s import of Iranian gas and electricity exclusively to restrict the dollar’s access to Tehran, but he will not pressure Iraq, as the second oil producer in OPEC, to limit its production to support global markets in order to push for price instability and rises, especially in light of the sanctions in force on major producers such as Iran, Russia and others.”

He expected, “Perhaps the Trump administration will support American energy companies in the fields of oil, gas, electricity and renewable energy to invest in producing countries, including Iraq, to create an alternative and restore trade balance with an active presence, but with work controls that do not contradict financial dealings between Iraq and the United States and the two countries’ partners in the region.”

He stressed that "Iraq must move wisely and quickly to deal with the Trump administration and work on a proactive plan to win over the elected administration before it takes power so that the country can avoid costly moody scenarios that we faced during our ministerial period with great difficulty and succeeded at that time in containing them to pass exceptions on the gas and electricity files." link

************

Tishwash: Al-Nusairi calls on the media to be patriotic, transparent and supportive of the national economy

Economic and banking advisor Samir Al-Nusairi called for economic media to be national, specialized, accurate, honest and transparent in diagnosing economic problems and imbalances, and to be a real and supportive contributor in proposing solutions and treatments to the supervisory and regulatory government bodies, and not to be a media that is satisfied with directing criticism and accusations without relying on accurate and transparent sources and information.

Al-Nusairi pointed out that the economic analysis of those called analysts or experts should be realistic and committed to reaching accurate information from reliable sources so that the government and its economic institutions can benefit from it for the purposes of diagnosis, treatment and accountability.

Al-Nusairi warned against some non-economic media (or non-specialized media) that have recently promoted and analyzed incorrect news that is tainted with lack of credibility and fallacies in transmitting and analyzing the news according to specific visions, intentionally or unintentionally, that harm the course of economic, financial and banking reform, disrupt the movement of monetary and commodity trading in the local market, and hinder the efforts of the government and the Central Bank in achieving the goals set to achieve the desired reform steps

Stressing that the non-committed media contributes to adding another problem that affects the nerve of the Iraqi economy in addition to the challenges that the country and the region are currently suffering from, which is creating a state of economic instability and fluctuations in the exchange rate of the US dollar against the Iraqi dinar and the rise in the prices of basic and necessary goods and materials such as food and medicine.

He pointed out that it is necessary here for media workers in all its fields and analysts who roam satellite channels and lack experience and intent to realize that specialized economic media has an important and fundamental role in creating economic stability and goes beyond that to contributing to economic reform and enabling and assisting the concerned state agencies and institutions to control economic problems and spread economic culture and avoid failure cases because economic media must be national economic media in word and meaning.

Al-Nusairi explained that media and economy are in a multi-faceted and permanently related partnership, and they are on the same front to face the challenges they face together, and if we assume that the economy can create successful media, then it is certain that the media can also create a successful economy, and this is what results in the success of the media institution if it has specialized economic leaders who are aware of the role of national media.

Iraq's experience in this field is considered modern, as the economy needs support and assistance in promotion, analysis, planning and support in order to deliver a distinguished media message to the audience, whether through the press, television, radio, or modern media and communication channels.

Al-Nusairi concluded by saying: “Therefore, the economic media that can deliver a purposeful message and serve the economy and economic institutions is the one that attracts an important segment of society. It will remain and continue and achieve the strategic goals of supporting the national economy and developing the work of productive, financial and banking institutions.

The economic media must undertake positive participation in the process of development and economic reform by presenting an image of the nature of the future trends of the economy and identifying economic and development activities and events and available energies and encouraging and stimulating the economy and investment.” link

************

Mot: .... ""Mots"" Thought fur da Daze

Mot: ...... and Yet another of ole ""Mots"" marital Tips!!!

Gold, Silver, and the Great Financial Reset

Gold, Silver, and the Great Financial Reset

Kinesis Money: 12-6-2024

In a compelling episode of Live from the Vault, Kinesis Money’s Andrew Maguire joins forces with esteemed economist Dr. Stephen Leeb to uncover the seismic shifts occurring within the global financial landscape.

Their insightful dialogue deftly navigates the accelerating decline of the US dollar’s dominance, the resurgent role of gold in contemporary monetary systems, and the significant moves being made by BRICS nations that are catalyzing a transition towards a multipolar world order.

Gold, Silver, and the Great Financial Reset

Kinesis Money: 12-6-2024

In a compelling episode of Live from the Vault, Kinesis Money’s Andrew Maguire joins forces with esteemed economist Dr. Stephen Leeb to uncover the seismic shifts occurring within the global financial landscape.

Their insightful dialogue deftly navigates the accelerating decline of the US dollar’s dominance, the resurgent role of gold in contemporary monetary systems, and the significant moves being made by BRICS nations that are catalyzing a transition towards a multipolar world order.

At the heart of the discussion lies the growing vulnerability of the US dollar, long held as the world’s primary reserve currency. Maguire and Leeb analyze the multifaceted factors contributing to this decline, including rising inflation, expansive monetary policies, and geopolitical tensions.

The dollar’s entrenched status is increasingly at risk as other nations seek alternatives to mitigate their dependence on the dollar. This realignment is not just a financial shift; it represents a profound transformation in global power dynamics.

Amidst this tumult, gold is resurfacing as a form of monetary security. Maguire and Leeb highlight the critical role that gold plays in the evolving landscape, especially as central banks around the world begin to stockpile the precious metal. This strategic move underscores gold’s timeless allure as a reliable store of value and a hedge against fiat currency failures.

Leeb points out that the historical precedence of gold during economic upheaval has led to renewed interest in its intrinsic value.

As nations grapple with the challenges posed by inflationary pressures and the erosion of trust in fiat currencies, gold is being reconsidered not merely as a commodity, but as a cornerstone of sound monetary policy.

This revitalization of gold could reshape not only individual national economies but also the global financial framework.

The discussion also pivots towards the BRICS nations—Brazil, Russia, India, China, and South Africa—whose collective muscle is creating a new paradigm in international finance. These countries are actively working to establish a multipolar world order that diminishes the spotlight on the US dollar.

The implications of their coordinated efforts are profound, signaling a shift toward diversified currencies and transactions that prioritize regional stability over reliance on a single power.

With initiatives such as the BRICS currency discussions and the promotion of trade in local currencies, these nations aim to create more equitable terms of trade that serve their interests. As Maguire suggests, this transition poses both opportunities and challenges, pushing for a recalibration of how financial systems are viewed and operated globally.

A particularly poignant element of the discussion is the dichotomy between spiritual and material perspectives in global economics. Leeb highlights the importance of recognizing the underlying values that drive economic behavior, suggesting that a purely materialistic approach, often seen in the relentless pursuit of GDP growth, is shortsighted.

The co-hosts argue for a shift towards a more holistic view of economics—one that encompasses not just monetary success but also societal well-being and ethical considerations.

Such insights urge policymakers and individuals alike to rethink their relationship with wealth and prosperity. By fostering a balance between spiritual values and material pursuits, it may be possible to create a more sustainable and equitable financial ecosystem.

As Andrew Maguire and Dr. Stephen Leeb so effectively articulate, the current financial landscape is in flux, marked by the decline of the US dollar’s supremacy, the resurgence of gold as a monetary cornerstone, and the transformative ambitions of BRICS nations.

These changes compel us to reconsider our economic paradigms and the values that underpin them. In navigating these uncharted waters, embracing a more holistic view of economics may well equip us to face the future with resilience and integrity.

The implications of their insights are vast and warrant close attention from anyone interested in the dynamics of global finance, as the winds of change continue to shape our monetary future.

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

Awake-In-3D December 6, 2024

Iraq’s blueprint for a $3.00 IQD revaluation combines re-denomination, gold reserves, and sweeping reforms.

Iraq is setting the stage for a transformative economic shift with a $3.00 IQD revaluation—a move rooted in strategic planning and decisive action. By combining a re-denomination of its currency, leveraging vast gold reserves, and implementing sweeping reforms, Iraq is crafting a blueprint that could reshape its economic future. This article walks you through the steps Iraq is taking, so you can clearly see how this bold strategy is turning a monumental vision into an achievable reality.

This Is How Iraq Will Achieve a $3.00 IQD Revaluation

Awake-In-3D December 6, 2024

Iraq’s blueprint for a $3.00 IQD revaluation combines re-denomination, gold reserves, and sweeping reforms.

Iraq is setting the stage for a transformative economic shift with a $3.00 IQD revaluation—a move rooted in strategic planning and decisive action. By combining a re-denomination of its currency, leveraging vast gold reserves, and implementing sweeping reforms, Iraq is crafting a blueprint that could reshape its economic future. This article walks you through the steps Iraq is taking, so you can clearly see how this bold strategy is turning a monumental vision into an achievable reality.

The Current Iraqi Dinar Landscape

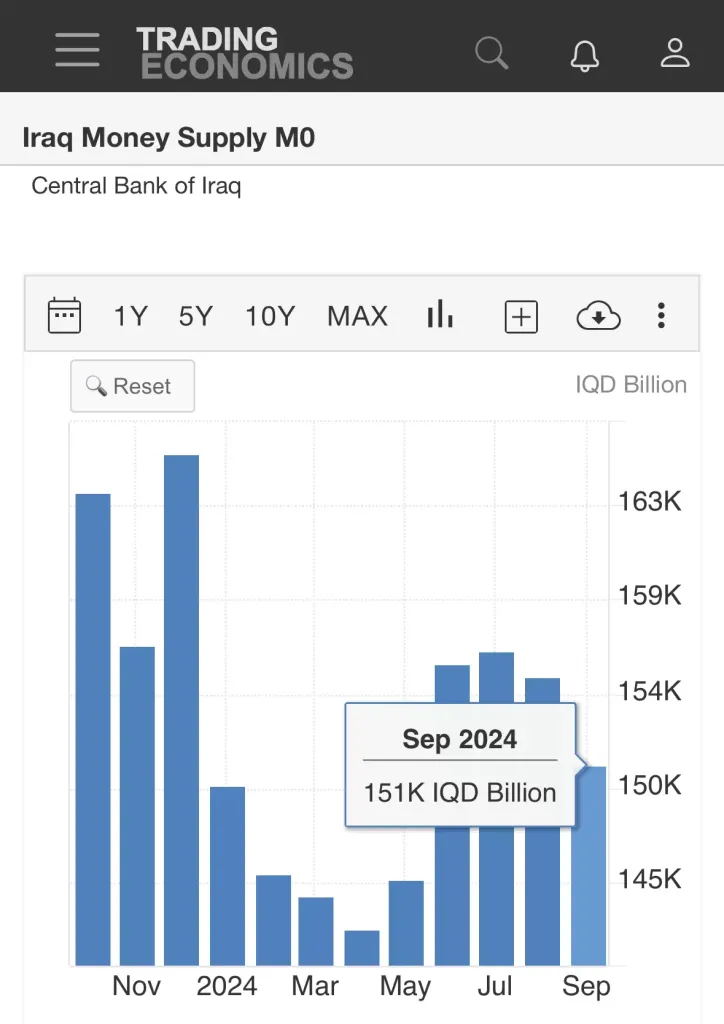

Iraq’s M0 money supply, which measures the total amount of physical currency in circulation, stands at 150,828 billion IQD as of September 2024. To express this figure in trillions, it becomes 150.828 trillion IQD, as one trillion equals 1,000 billion.

Image Source: https://tradingeconomics.com/iraq/money-supply-m0

Additionally, Iraq holds 152.6 metric tons of gold, which equates to approximately 4.9 million troy ounces or 152.6 million grams. At a price of $2,630 per troy ounce, these reserves are valued at around $12.9 billion USD, providing a strong foundation for monetary reform toward a $3.00 IQD.

How a $3.00 IQD Exchange Rate Works

Iraq’s plan to achieve a $3.00 IQD exchange rate relies on two major steps: re-denomination of the currency and backing the new currency with gold reserves. Here’s how these steps would work:

Step 1: Re-denomination

A currency re-denomination means adjusting the value of a currency by removing extra zeros from its face value. For Iraq, this involves removing three zeros from the current IQD notes.

For example:

Today, 1,000 IQD is equal to about $0.76 USD (since 1 IQD is worth roughly $0.00076).

After re-denomination, 1,000 IQD would become 1 new IQD, and that 1 new IQD is targeted to be worth $3.00 USD.

This step simplifies the currency, making it easier for people to use and understand. Instead of needing large numbers (like 1,000 IQD) for small transactions, the new IQD would have a higher value with fewer digits.

Step 2: Backing the New $3.00 IQD with Gold

To support the new value of $3.00 per IQD, Iraq plans to back its currency with its gold reserves. This means each unit of the new IQD would represent a portion of Iraq’s gold. Backing currency with gold provides stability because gold is a tangible, universally valued asset.

Here’s the math behind this:

Iraq’s total money supply after re-denomination would be 150.828 billion new IQD.

To set a value of $3.00 per IQD, the total currency value must equal $452.5 billion USD (calculated as 150.828 billion IQD × $3.00).

Gold is currently valued at $84.58 per gram, so Iraq needs to allocate about 0.0355 grams of gold for every 1 new IQD.

In total, Iraq would need 5.36 metric tons of gold to fully back its new currency at the $3.00 rate. Since Iraq’s reserves are much larger at 152.6 metric tons, the country has more than enough gold to implement this plan.

Why Gold-Backing Matters

By tying the value of the new IQD to gold, Iraq ensures its currency remains stable and valuable. Unlike paper money (fiat currency), which governments can print at will and risk inflation, a gold-backed currency cannot exceed the value of the gold reserves supporting it. This approach boosts confidence in the currency for both Iraqis and international investors.

How a $3.00 IQD Impacts Exports

While a $3.00 IQD delivers many benefits, including increased purchasing power for Iraqi citizens and enhanced international confidence in the currency, it also affects the competitiveness of Iraqi exports.

When a country’s currency strengthens, its goods and services become more expensive for people in other countries. For example, if Iraq exports agricultural products, industrial goods, or locally manufactured items, buyers in other nations need to spend more of their own currency to purchase those items. This higher cost creates challenges in competing with cheaper alternatives from other nations.

For Iraq’s non-oil sectors—such as agriculture, construction materials, and manufacturing—a $3.00 IQD challenges their ability to compete with lower-priced goods from other nations. This slows the development of these industries, which Iraq is keen to grow as part of its economic diversification efforts.

However, Iraq’s primary export—oil—remains unaffected. Oil is priced in USD globally, so its cost doesn’t change regardless of IQD fluctuations. This ensures Iraq’s oil revenue, which makes up the bulk of its economy, remains stable, providing a financial buffer as the country adjusts to a stronger IQD.

A Gold-Backed Currency and Economic Stability

One of the major advantages of a gold-backed currency is its built-in resistance to inflation. Unlike fiat currencies, which can be printed without limit and risk losing value over time, a gold-backed $3.00 IQD derives its value from a tangible asset—gold. This connection to a physical resource ensures monetary stability, as the supply of currency is tied directly to the amount of gold in reserves.

Historically, nations operating on a gold standard experience long periods of price stability, making such a system appealing for Iraq as it restores confidence in its currency.

Economic and Governance Considerations

To sustain the trust of its citizens and international markets, Iraq must address domestic challenges, such as corruption, inefficiency, and political instability. Transparent communication about the redenomination process and its goals is critical in fostering public support and maintaining economic stability.

Iraq has made strides in key areas to support these objectives:

Anti-Corruption Measures

The Iraqi government has intensified efforts to combat corruption, which has long plagued its institutions. The Integrity Commission has launched investigations into high-profile cases, targeting embezzlement and mismanagement of public funds. Recent legislation aims to enhance accountability by streamlining processes for auditing government projects and increasing penalties for financial chaos. These measures are vital for establishing public trust and ensuring that resources are directed toward economic reform.Banking Sector Modernization

Iraq is actively modernizing its banking system to facilitate a stable transition to a stronger IQD. Initiatives include introducing advanced digital banking platforms, improving transparency in financial transactions, and collaborating with international financial institutions for technical assistance. The Central Bank of Iraq (CBI) has also implemented stricter regulations to prevent money laundering and enhance the banking sector’s credibility on the global stage.Political Stability Efforts

Acknowledging the importance of political stability, Iraq’s leaders have focused on fostering unity among its diverse population. Efforts include resolving disputes over revenue sharing between the federal government and the Kurdistan Regional Government (KRG) and strengthening security measures in conflict-prone areas. These steps aim to create a more stable environment conducive to long-term economic growth.Diversification of the Economy

To reduce reliance on oil revenues, Iraq is implementing policies to promote non-oil sectors such as agriculture, manufacturing, and tourism. Programs to provide incentives for small and medium-sized enterprises (SMEs) and attract foreign investors are helping to broaden the economic base. These initiatives are aligned with Iraq’s vision for sustainable development and economic resilience in the face of global market fluctuations.Public Awareness Campaigns

The government has launched public awareness campaigns to educate citizens about the redenomination process and the benefits of a gold-backed $3.00 IQD. These efforts include town hall meetings, media outreach, and collaboration with community leaders to address concerns and misconceptions. By keeping the public informed, Iraq aims to build confidence and minimize resistance to these sweeping monetary changes.

Through these combined efforts, Iraq is positioning itself to implement a strong and sustainable $3.00 IQD exchange rate. Overcoming these challenges is essential to securing the trust of both its citizens and the international community, paving the way for long-term economic stability and growth.

Benefits of a $3.00 IQD

Global Confidence: A gold-backed $3.00 IQD strengthens Iraq’s position in international financial markets and attracts foreign investment.

Increased Purchasing Power: Iraqi citizens benefit from greater purchasing power, making imports more affordable and improving standards of living.

Economic Stability: By tying the IQD to gold, Iraq creates a stable currency, reducing the risk of inflation and promoting long-term trust.

The Bottom Line: A Feasible and Transformative Reform

With gold prices at $2,630 per troy ounce, Iraq’s reserves of 152.6 metric tons are more than sufficient to back a redenominated IQD at $3.00 IQD, requiring only 5.36 metric tons of gold. While this reform is technically feasible and promises significant benefits, Iraq must carefully manage its non-oil export sectors to mitigate the potential downsides of a stronger currency.

If implemented successfully, a $3.00 IQD marks a turning point for Iraq, restoring its currency’s historical strength and securing its place as an economic leader in the region.

=======================================

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Iraq News Highlights and Points to Ponder Saturday Afternoon 12-7-24

Is Iraq Affected Economically By The Current Events In Syria? Al-Sudani’s Advisor Explains

Money and business Economy News – Baghdad The Prime Minister's Advisor for Economic Affairs, Mazhar Mohammed Salih, confirmed the strength of the Iraqi economy, its financial flows and its trade relations, noting that this economy was not affected by the tensions taking place in the Syrian arena.

The Syrian economy is a sanctioned economy by countries such as the United States and some other European countries, and therefore all banking relations (for Iraq) with Syria are basically unavailable," Saleh said.

He explained that "trade with Syria is mostly border trade and consists of simple, natural civilian goods such as agricultural crops or something like that."

Is Iraq Affected Economically By The Current Events In Syria? Al-Sudani’s Advisor Explains

Money and business Economy News – Baghdad The Prime Minister's Advisor for Economic Affairs, Mazhar Mohammed Salih, confirmed the strength of the Iraqi economy, its financial flows and its trade relations, noting that this economy was not affected by the tensions taking place in the Syrian arena.

The Syrian economy is a sanctioned economy by countries such as the United States and some other European countries, and therefore all banking relations (for Iraq) with Syria are basically unavailable," Saleh said.

He explained that "trade with Syria is mostly border trade and consists of simple, natural civilian goods such as agricultural crops or something like that."

Limited" impact on border trade

Regarding the impact of the events in Syria on the exchange rate of the dollar in Iraq, Mazhar Muhammad Salih said that “the current events are in Syria and not in Iraq,” adding that “the problems in Syria may affect some of the simple border trade known, or which is civil or related to the tourism sector, and some simple problems and disturbances may occur, but they are not major disturbances.”

Coinciding with the advance of the Syrian armed opposition forces and their control over Syrian cities, the currency exchange markets in Baghdad witnessed, last Friday evening, a rise in the dollar exchange rate from 1495 dinars to 1510 dinars per dollar.

The Iraqi Prime Minister's advisor for economic affairs pointed out that "the Iraqi economy, by nature, has high cash flows from its oil trade and global trade with large trade sources, while the minor fluctuations that are taking place are nothing but colorful noise."

He explained that "the parallel markets usually benefit from any political event in neighboring countries, for example, to raise the price, and for speculators to benefit, so this is a temporary speculation that leads to very simple price disturbances, and has no relation to the Iraqi economy, and is called information markets, so what is happening in Syria at the present time will not affect the Iraqi economy, and our economy is completely isolated from the Syrian issue."

It is noteworthy that the volume of trade exchange between Iraq and Syria has exceeded the one billion dollar barrier, according to the head of the Iraqi-Syrian Business Council, Hassan Sheikh Zeini.

There are joint committees between the two countries looking for a mechanism for trade exchange away from the dollar, as Syria currently exchanges with the European currency, the euro, and the two countries may use the Russian ruble, the Japanese yen, the Chinese yuan, the Emirati dirham, or other currencies to sustain trade exchange between them, according to Sheikh Zini.

"Iraq is economically fortified"

Saleh stressed that "the country is immune and there is no fear for our trade because it is governed by the central policies of the state," noting that "Iraq obtains its budget from major oil revenues, which strengthen the banks' finances and finance Iraq's foreign trade, not the domestic market," adding that "the parallel market is a completely superficial market and does not indicate anything in reality about the Iraqi economy at the present time."

The Prime Minister's advisor for economic affairs stated that "the parallel market benefits from the neighboring unrest and does not pose any threat to the Iraqi economy and does not represent anything, and we are immune to what is happening in Syria," explaining that "the problems in Syria are not new to it and have existed since 2011, so there is no fear for the Iraqi economy, which is immune and neutral from the problems of others."

Saleh stressed that "our policies are disciplined, so what is happening in Syria does not affect the overall economic situation, and an increase in the exchange rate by one or two dollars could quickly return to its previous state, perhaps through a single statement."

He believed that "Iraq's economic situation is secure, its oil policies are calm, its trade relations with the outside world are going well, and its cash flows from cash revenues are good and beyond reproach, and thus the economic situation is stable."

89 views Added 12/07/2024 https://economy-news.net/content.php?id=50611

Baghdad.. Exchange Rates Record 152 Thousand Dinars Per Hundred Dollars

Money and business Economy News – Baghdad ]The dollar price witnessed a rise with the opening of the Al-Kifah and Al-Harithiya stock exchanges, recording 151,000 dinars for every 100 dollars.

The selling price in exchange shops in local markets in Baghdad was recorded at 152,000 dinars, while the buying price was 150,000 dinars for every 100 dollars. Views 61 Added 12/07/2024 - https://economy-news.net/content.php?id=50613

Morgan Stanley Raises Oil Price Forecast For H2 2025

Economy | Mawazine News – Baghdad Morgan Stanley raised its Brent crude price forecast for the second half of 2025 and said it now expects a smaller surplus in the oil market for the full year after the OPEC+ alliance of oil producers decided to delay and slow plans to increase output. The

bank raised its Brent price forecast for the second half of 2025 to $70 a barrel from $66-$68 a barrel in a December 5 forecast.

The OPEC+ alliance, which groups members of the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, on Thursday delayed the start of oil output increases by three months to April. The group said the cuts would be phased in until September 2026, nine months later than previously planned. https://www.mawazin.net/Details.aspx?jimare=257205

Escalating Events In Syria “Confuse” Iraqi Markets

Posted on2024-12-07 by Sotaliraq For several days, Iraqi markets have been facing a state of confusion due to the closure of the Iraqi-Syrian border against the backdrop of the rapid developments witnessed in the Syrian provinces and the continuous advance of the opposition forces and their control over large areas.

Iraq used to receive dozens of trucks loaded with Syrian export products daily, most notably agricultural products, in addition to household products, textiles, various food industries, oils, detergents and clothing, which now cover part of the needs of the Iraqi market. The

Baghdad government announced last Sunday the complete closure of the western international border adjacent to the Syrian side, considering Iraq's security to be one of the most important priorities, and any threat that could affect the country's territory and sovereignty will be confronted.

Prime Minister Mohammed Shia al-Sudani stressed, during an emergency meeting of the Iraqi National Security Ministerial Council, the importance of tightening the measures taken to secure the international border with Syria.

In turn, Deputy Commander of Joint Operations Qais al-Muhammadawi said in press statements that the Iraqi border is completely closed, noting that the Iraqi forces are committed to the Prime Minister's orders regarding protecting the security and safety of the country's borders.

This caused confusion in the Iraqi local market, which relies on Syrian agricultural and industrial products for many of its imports.

Traders and businessmen demanded the reopening of border crossings for shipments to enter or exit between the two countries, stressing the importance of controlling and securing official border crossings and allowing the entry and exit of goods to avoid the economic damage that this closure will cause.

Economic researcher Ali Al-Amiri said that closing the border could result in tangible economic damage to the Iraqi economy, because economic relations between the two countries depend largely on the exchange of goods and products, especially daily consumer goods, and the cessation of this exchange leads to direct and indirect effects.

Al-Amiri added that Iraq imports a variety of goods from Syria, including agricultural products, such as vegetables and fruits, industrial products and food, and closing the border will lead to a shortage of these products in Iraqi markets, which may raise their prices and increase inflation.

He stated that the border roads between the two countries represent a major land transport corridor, and the movement of trucks will be disrupted, which will negatively affect the transport sector and push shipping companies to look for alternative routes at higher costs, especially since 70% of Syrian exports are agricultural products, the quantities of which exported to Iraq, according to the latest data, amounted to about 350 thousand tons annually.

The economic researcher explained that Syrian products are cheaper compared to their counterparts imported from other countries, and therefore their absence will lead to increased reliance on more expensive imports from other countries, which will worsen the living conditions of the Iraqi citizen.

Al-Amiri pointed out that these effects will consequently be reflected in cash flow and the rise in the value of the dollar against the dinar, due to the increased demand for the dollar and the increased need for foreign currencies to cover imports.

He stressed that the increased need for foreign currencies increases pressure on the exchange rate of the dinar against the dollar, in addition to the increase in transportation costs, as traders are forced to look for alternatives through other ports or land routes, which raises import costs that are usually paid in dollars.

For his part, Majid Muzan, a member of the Federation of Iraqi Chambers of Commerce, said that trade exchange between Iraq and Syria includes various goods, most notably food and semi-finished goods, stressing that Iraq's trade with its surroundings is in the interest of neighboring countries due to the weakness of local industry.

Muzan added that the events taking place in Syria have negatively affected the Iraqi market, and their results have become negative for the local Iraqi economy, because Syria is considered a vital country in the region and possesses the industrial raw materials that Iraq needs.

According to the member of the Federation of Iraqi Chambers of Commerce, Aleppo is considered the capital of trade and industry in the region and a center for the most important manufacturing, paper, craft and plastic industries, stressing that the continuation of events in Syria will push traders to head to alternative markets in neighboring countries represented by Turkey and Iran.

Muzan criticized the weakness of local production and complete reliance on imports from outside Iraq, stressing the importance of developing and supporting local industries and opening industrial projects represented by manufacturing and plastic industries in order to protect the Iraqi economy from being affected by any regional events.

According to an official source in the Syrian regime government earlier, the volume of Syrian exports exceeded the 500 million euro barrier in the first six months of 2024, noting that most of the exports to Iraq are food commodities. Baghdad relies on imports from various countries around the world to meet the needs of local markets.

Iraq ranked first as the largest destination for Syrian exports in 2020, and subsequent data in 2021 showed a significant increase in Syrian exports to Iraq, as the value of exports exceeded 79 million euros in the first seven months of the same year. LINK

Al-Sudani's Advisor: Iraq's Economy Will Not Be Affected By Current Events In Syria

Saturday,07-12-2024,AM 10:21 Taisir Al-Asadi

The Iraqi Prime Minister's Advisor for Economic Affairs, Mazhar Mohammed Salih, confirmed the strength of the Iraqi economy, its financial flows and its trade relations, noting that this economy has not been affected by the tensions taking place in the Syrian arena.

Mazhar Muhammad Salih told Rudaw Media Network, "The Syrian economy is an economy sanctioned by countries, such as the United States and some other European countries, and therefore all banking relations (of Iraq) with Syria are basically unavailable."

He explained that "trade with Syria is mostly border trade and consists of simple, natural civilian goods such as agricultural crops or something like that."

"Limited" impact on border trade

Regarding the impact of the events in Syria on the exchange rate of the dollar in Iraq, Mazhar Muhammad Salih said that “the current events are in Syria and not in Iraq,” adding that “the problems in Syria may affect some of the simple border trade known, or which is civil or related to the tourism sector, and some simple problems and disturbances may occur, but they are not major disturbances.”

Coinciding with the advance of the Syrian armed opposition forces and their control over Syrian cities, the currency exchange markets in Baghdad witnessed, last Friday evening, a rise in the dollar exchange rate from 1495 dinars to 1510 dinars per dollar.

The Iraqi Prime Minister's advisor for economic affairs pointed out that "the Iraqi economy, by nature, has high cash flows from its oil trade and global trade with large trade sources, while the minor fluctuations that are taking place are nothing but colorful noise."

He explained that "the parallel markets usually benefit from any political event in neighboring countries, for example, to raise the price, and for speculators to benefit, so this is a temporary speculation that leads to very simple price disturbances, and has no relation to the Iraqi economy, and is called information markets, so what is happening in Syria at the present time will not affect the Iraqi economy, and our economy is completely isolated from the Syrian issue."

It is noteworthy that the volume of trade exchange between Iraq and Syria has exceeded the one billion dollar barrier, according to the head of the Iraqi-Syrian Business Council, Hassan Sheikh Zeini.

There are joint committees between the two countries looking for a mechanism for trade exchange away from the dollar, as Syria currently exchanges with the European currency, the euro, and the two countries may use the Russian ruble, the Japanese yen, the Chinese yuan, the Emirati dirham, or other currencies to sustain trade exchange between them, according to Sheikh Zini.

"Iraq is economically fortified"

Mazhar Mohammed Saleh stressed that "the country is immune and there is no fear for our trade because it is governed by the central policies of the state," noting that "Iraq obtains its budget from major oil revenues, which strengthen the banks' finances and finance Iraq's foreign trade, not the domestic market," adding that "the parallel market is a completely superficial market and does not indicate anything in reality about the Iraqi economy at the present time."

The Iraqi Prime Minister's advisor for economic affairs stated that "the parallel market benefits from the neighboring unrest and does not pose any threat to the Iraqi economy and does not represent anything, and we are immune to what is happening in Syria," explaining that "the problems in Syria are not new to it and have existed since 2011, so there is no fear for the Iraqi economy, which is immune and neutral from the problems of others."

Mazhar Mohammed Saleh stressed that "our policies are disciplined, so what is happening in Syria does not affect the overall economic situation, and an increase in the exchange rate by one or two dollars could quickly return to its previous state, perhaps through a single statement."

He believed that "Iraq's economic situation is secure, its oil policies are calm, its trade relations with the outside world are going well, and its cash flows from cash revenues are good and beyond reproach, and thus the economic situation is stable." https://non14.net/public/172643

Suze Orman: 3 Things You Should Never Do When Buying Gifts This Holiday Season

Suze Orman: 3 Things You Should Never Do When Buying Gifts This Holiday Season

Gabrielle Olya Sat, December 7, 2024 GOBankingRates